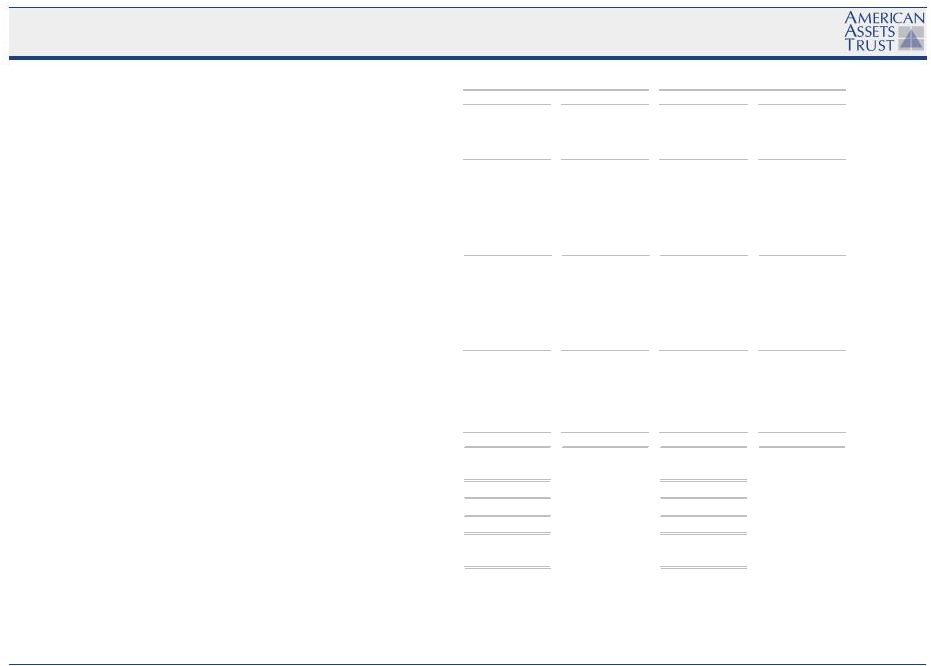

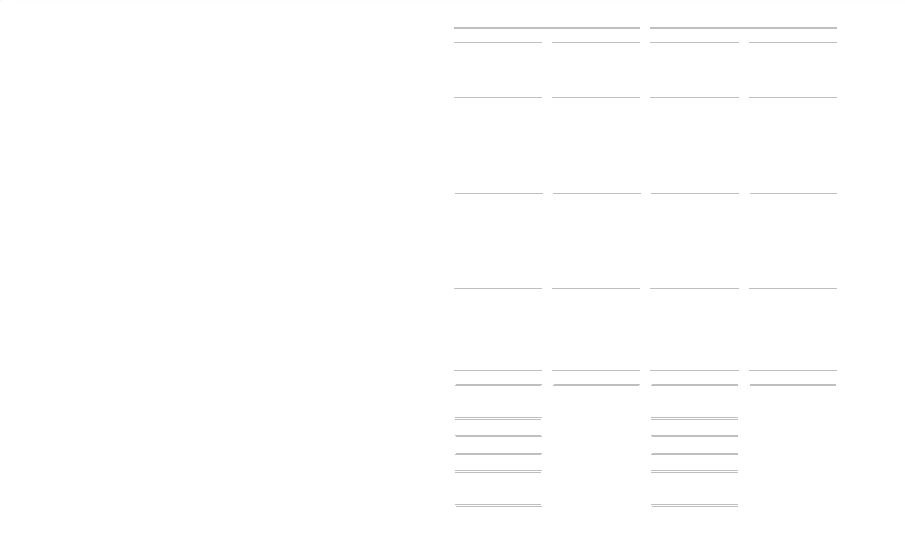

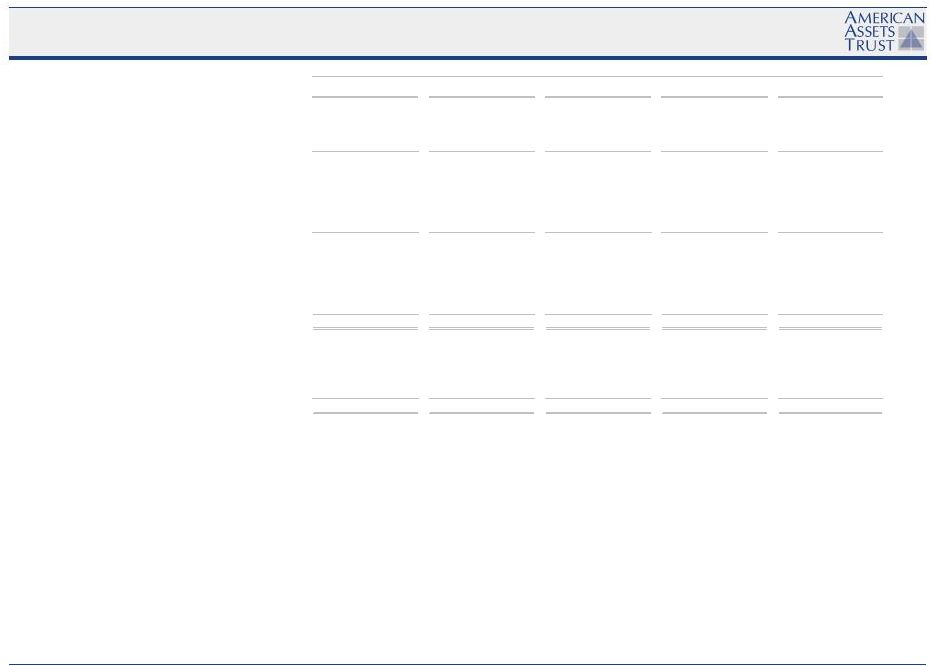

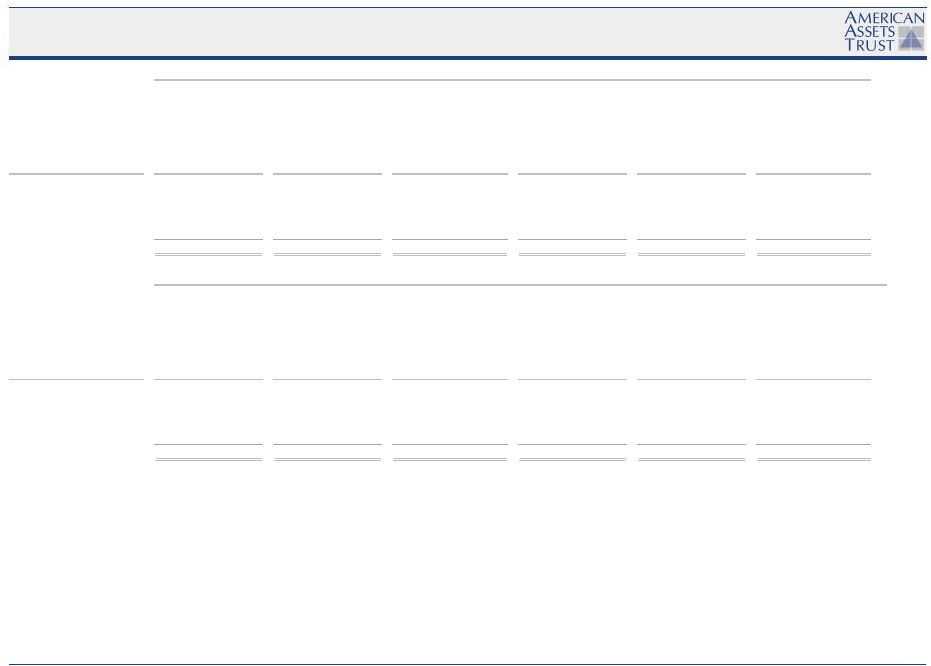

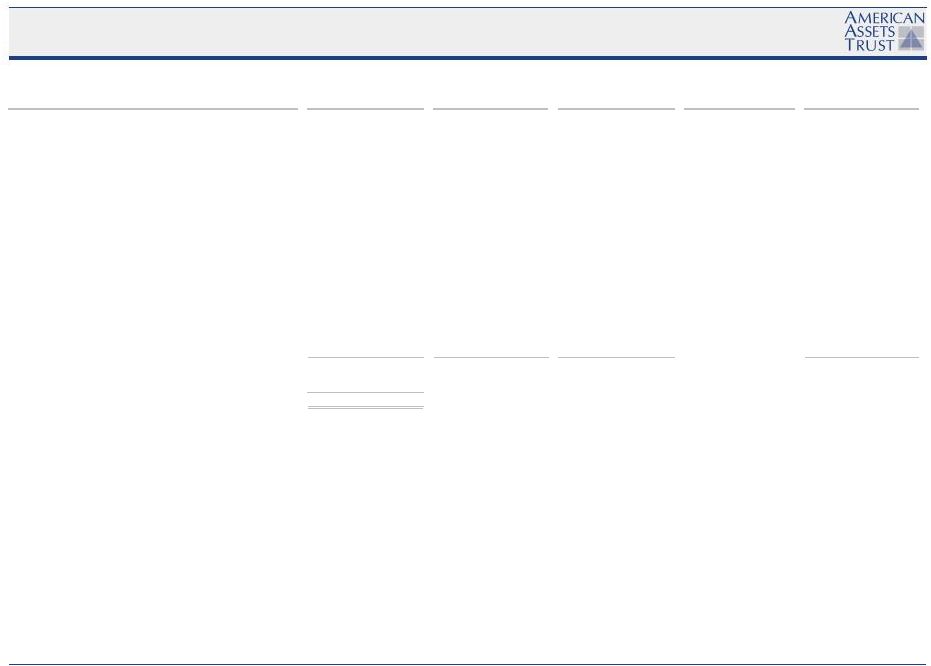

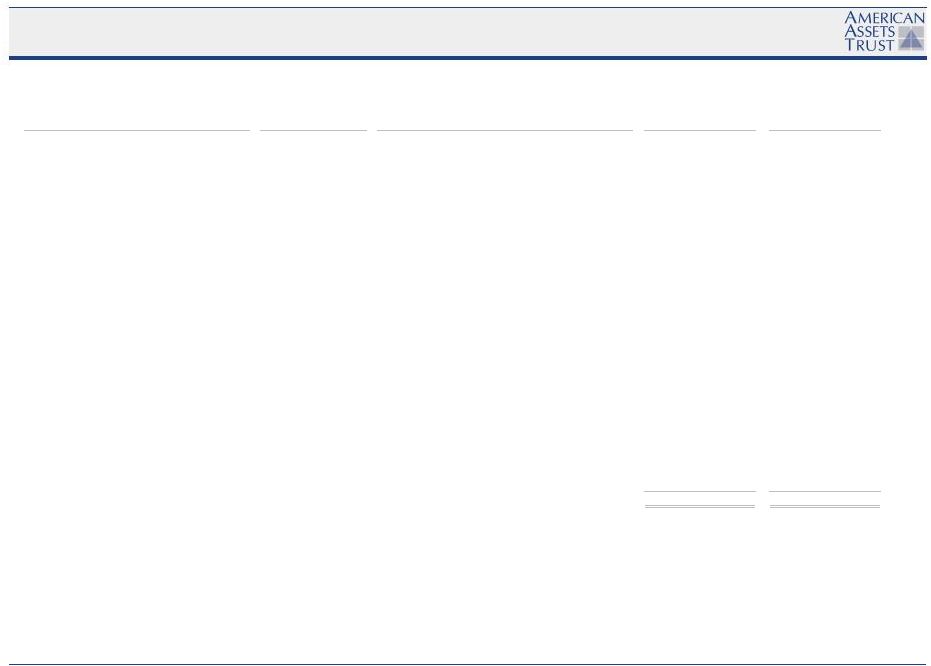

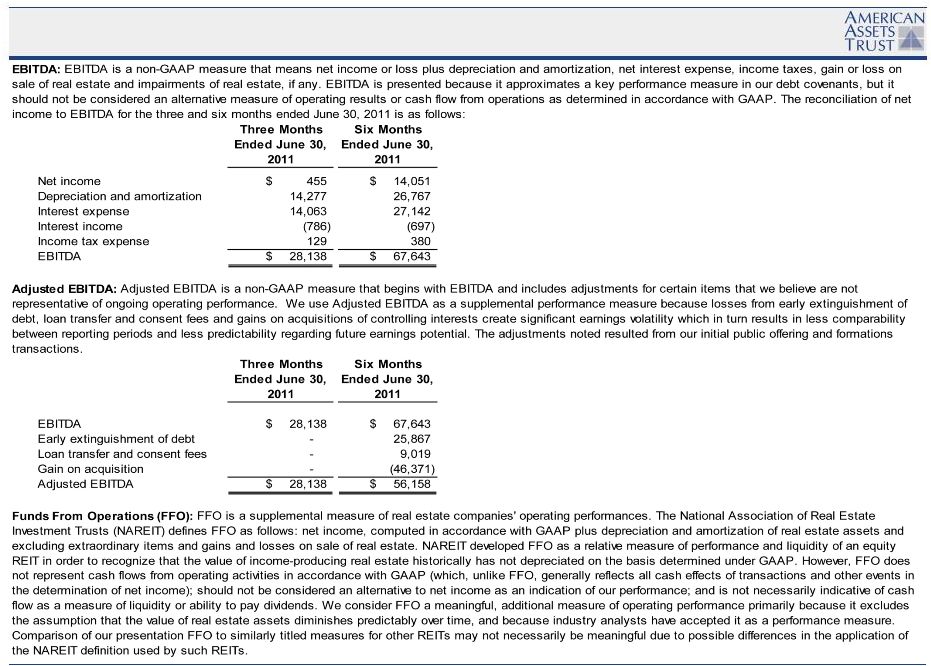

Second Quarter 2011 Supplemental Information Page 22 PROPERTY REPORT As of June 30, 2011 Net Number Rentable Year Built/ of Square Location Renovated Buildings Feet (1) Retail Properties Carmel Country Plaza San Diego, CA 1991 9 77,813 100.0 % $ 3,515,846 $ 45.18 Sharp Healthcare, Frazee Industries Inc. Carmel Mountain Plaza (7) San Diego, CA 1994 13 520,228 82.9 8,686,016 20.14 Sears Sports Authority, Reading Cinemas South Bay Marketplace (7) San Diego, CA 1997 9 132,873 100.0 2,067,796 15.56 Office Depot Inc., Ross Dress for Less Rancho Carmel Plaza San Diego, CA 1993 3 30,421 74.5 713,589 31.47 Oggi's Pizza & Brewing Co., Sprint PCS Assets Lomas Santa Fe Plaza Solana Beach, CA 1972/1997 9 209,569 97.6 5,257,257 25.71 Vons, Ross Dress for Less Del Monte Center (7) Monterey, CA 1967/1984/2006 16 674,224 97.2 8,789,864 13.41 Macy's, KLA Monterey Century Theatres, Macy's Furniture Gallery The Shops at Kalakaua Honolulu, HI 1971/2006 3 11,671 100.0 1,535,028 131.52 Whalers General Store, Diesel U.S.A. Inc. Waikele Center Waipahu, HI 1993/2008 9 538,024 90.9 17,014,540 34.81 Old Navy, Officemax Alamo Quarry Market (7) San Antonio, TX 1997/1999 16 589,479 98.9 11,808,839 20.26 Regal Cinemas Bed Bath & Beyond, Whole Foods Market Subtotal/Weighted Average Retail Portfolio 87 2,784,302 93.7 % $ 59,388,775 $ 22.77 Office Properties Torrey Reserve Campus San Diego, CA 1996-2000 9 456,801 93.1 % $ 14,795,889 $ 34.78 Valencia Corporate Center Santa Clarita, CA 1999-2007 3 194,268 80.9 4,493,083 28.58 160 King Street San Francisco, CA 2002 1 167,986 95.2 5,467,207 34.18 Subtotal/Weighted Average Office Portfolio 13 819,055 90.7 % $ 24,756,179 $ 33.34 Total/Weighted Average Retail and Office Portfolio 100 3,603,357 93.0 % $ 84,144,954 $ 25.11 Number Year Built/ of Location Renovated Buildings Units Loma Palisades San Diego, CA 1958/2001-2008 80 548 100.0 % $ 10,392,072 $ 1,580 Imperial Beach Gardens Imperial Beach, CA 1959/2008-present 26 160 96.9 2,674,296 1,437 Mariner's Point Imperial Beach, CA 1986 8 88 98.9 1,173,900 1,124 Santa Fe Park RV Resort (8) San Diego, CA 1971/2007-2008 1 126 88.0 968,388 728 Total/Weighted Average Multifamily Portfolio 115 922 97.7 % $ 15,208,656 $ 1,407 Net Number Rentable Year Built/ of Square Location Renovated Buildings Feet (1) Retail Property Solana Beach Towne Centre Solana Beach, CA 1973/2000/2004 12 246,730 97.7 % $ 5,306,176 $ 22.01 Dixieline Probuild, Marshalls Office Properties Solana Beach Corporate Centre Solana Beach, CA 1982/2005 4 211,971 84.1 $ 5,691,424 $ 31.94 The Landmark at One Market (9) San Francisco, CA 1917/2000 1 421,934 100.0 18,289,232 43.35 First & Main Portland, OR 2010 1 363,763 96.5 10,548,509 30.04 Subtotal/Weighted Average Office Portfolio 6 997,668 95.4 % $ 34,529,165 $ 36.30 Total/Weighted Average Retail and Office Portfolio 18 1,244,398 95.8 % $ 39,835,341 $ 33.41 Lowe's, Kmart, Sports Authority, Foodland Super Martket Square Foot (4) Property Leased (2) Base Rent (3) Leased Unit (4) Non - Same Store Retail and Office Portfolios Same - Store Multifamily Portfolio Average Monthly Percentage Annualized Base Rent per Same - Store Retail and Office Portfolios Annualized Base Rent Retail Anchor Tenant(s) (5) Other Principal Retail Tenants (6) Percentage Annualized per Leased Property Leased (2) Base Rent (3) Square Foot (4) Annualized Base Rent Property Retail Anchor Tenant(s) (5) Other Principal Retail Tenants (6) Percentage Annualized per Leased Leased (2) Base Rent (3) |