Exhibit 99.3

Pre-Reverse Takeover Pro Forma Consolidated Balance Sheet

Sustainable Projects Group Inc.

September 30, 2022

Unaudited

| Cons SPG | Lithium | Pro Forma | Pro Forma | |||||||||||||||||

| Sep 30 | Sep 30 | Adjusting | Consolidated | |||||||||||||||||

| 2022 | 2022 | Entries | Sep 30 2022 | |||||||||||||||||

| As at | ||||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| Current Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 21,675 | $ | 35 | $ | 21,710 | ||||||||||||||

| Other receivables | - | 1,299 | 1,299 | |||||||||||||||||

| Inventory - | 3,939 | - | 3,939 | |||||||||||||||||

| Prepaid expenses | 2,036 | 105 | 2,141 | |||||||||||||||||

| 27,650 | 1,439 | 29,089 | ||||||||||||||||||

| Office Equipment | 1,042 | - | 1,042 | |||||||||||||||||

| Intangible assets | 71,468 | - | 71,468 | |||||||||||||||||

| Goodwill | 156,752 | - | 9,729,562 | (a) | 9,886,314 | |||||||||||||||

| TOTAL ASSETS | $ | 256,912 | $ | 1,439 | $ | 9,987,913 | ||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||||||||||||||

| LIABILITIES | ||||||||||||||||||||

| CURRENT LIABILITIES: | ||||||||||||||||||||

| Accounts payable and accrued liabilities | $ | 143,671 | $ | 3,929 | $ | 147,600 | ||||||||||||||

| Amount due to directors | 116,684 | - | 116,684 | |||||||||||||||||

| Convertible Note | 125,000 | - | (125,000 | ) | (b) | - | ||||||||||||||

| Interest payable | 18,705 | - | (12,425 | ) | (b) | 6,280 | ||||||||||||||

| TOTAL CURRENT LIABILITIES | 404,060 | 3,929 | 270,564 | |||||||||||||||||

| NON-CURRENT LIABILITIES | ||||||||||||||||||||

| Notes payable | $ | 50,000 | $ | - | $ | 50,000 | ||||||||||||||

| TOTAL NON-CURRENT LIABILITIES | 50,000 | - | 50,000 | |||||||||||||||||

| TOTAL LIABILITIES | $ | 454,060 | $ | 3,929 | $ | 320,564 | ||||||||||||||

| Commitments and Contingencies | $ | - | $ | - | $ | - | ||||||||||||||

| STOCKHOLDERS’ EQUITY | ||||||||||||||||||||

| Common Stock Par Value: $0.0001 Authorized 500,000,000 shares Common Stock Issued: 8,725,877 | $ | 872 | $ | 7,940 | 19,907 | (a),(b) | $ | 28,719 | ||||||||||||

| Additional Paid in Capital | 3,112,131 | - | 9,632,413 | (a),(b) | 11,744,544 | |||||||||||||||

| Accumulated Deficit | (3,310,151 | ) | (9,995 | ) | 1,214,667 | (b) | (2,105,479 | ) | ||||||||||||

| Accumulated other comprehensive income (loss) | - | (435 | ) | (435 | ) | |||||||||||||||

| TOTAL STOCKHOLDERS’ EQUITY | (197,148 | ) | (2,490 | ) | 9,667,349 | |||||||||||||||

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 256,912 | $ | 1,439 | 19,459,124 | $ | 9,987,913 | |||||||||||||

Pre-Reverse Takeover Pro Forma Statement of Operations

Sustainable Projects Group Inc.

For the Nine Months Ended September 30, 2022

Unaudited

| Lithium | Pro Forma | Final | ||||||||||||||

| Sep 30 2022 | Adjustments | Sep 30 2022 | ||||||||||||||

| Revenues | $ | - | $ | - | ||||||||||||

| Gross Revenues | - | - | ||||||||||||||

| Cost of Goods Sold | - | - | ||||||||||||||

| Gross Margin | ||||||||||||||||

| Operating Expenses | ||||||||||||||||

| Administrative and other operating expenses | $ | 1,520 | - | $ | 1,520 | |||||||||||

| Depreciation | - | - | ||||||||||||||

| Financing fees | - | 2,089,204 | (b) | 2,089,204 | ||||||||||||

| Management fees | 4,285 | - | 4,285 | |||||||||||||

| Professional fees | 2,715 | - | 2,715 | |||||||||||||

| 8,520 | 2,089,204 | 2,097,724 | ||||||||||||||

| Net loss/gain and comprehensive loss/gain | $ | (8,520 | ) | (2,089,204 | ) | $ | (2,097,724 | ) | ||||||||

| Net loss and comprehensive loss Translation | (167 | ) | (167 | ) | ||||||||||||

| Net Gain/loss and comprehensive loss allocated to shareholders | $ | (8,687 | ) | (2,089,204 | ) | $ | (2,097,891 | ) | ||||||||

Sustainable Projects Group Inc.

Notes to the Unaudited Consolidated Pre-Reverse Takeover Pro Forma Financial Statements

For the Nine Months Ended September 30, 2022

Unaudited

Note 1 – Description of Transaction and the Basis of Presentation

The unaudited pre-reverse takeover pro forma consolidated balance sheet combines the consolidated historical balance sheet of Sustainable Projects Group, Inc. (the “Company”) and the historical balance sheet of Lithium Harvest ApS at September 30 2022, giving effect to a Letter of Intent (“LOI”) dated November 12, 2022 in which Sustainable Projects Group Inc. acquires Lithium Harvest, ApS, (“Subsidiary”) a Denmark corporation. Under the terms of the LOI the Company is to issue 206,667,233 common stock of the Company to the shareholders of Lithium Harvest ApS . In accordance with US generally accepted account principles (“US GAAP”), the transaction has been calculated using $0.0311 per share, the stock price of the Company, at September 30, 2022, which provided a fair value of the purchase of $6,427,351. As the share issuance represents a change of control, and as the Company is a business, the transaction is accounted for as a reverse merger as described below. The Company, as the legal acquirer, becomes the accounting acquiree and Lithium Harvest, the legal acquiree, becomes the accounting acquirer.

The pre-reverse takeover pro forma consolidated balance sheet presented herein reflects the effects of the Reverse Merger, (collectively the “Transactions”) as if they had been completed on September 30, 2022. The following unaudited pro forma statement of operations was the historical statement of operations of Lithium Harvest ApS for the nine months ended September 30, 2022, after giving effect to the Pro Forma Adjustments, noted below. The historical financial information has been adjusted to give effect to pro forma events that are directly attributable to the Transactions and factually supportable.

The following information should be read in conjunction with the pre-reverse takeover pro forma consolidated financial statements.

| ● | Accompanying notes to the unaudited pre-reverse takeover pro forma consolidated financial statements | |

| ● | Separate historical financial statements of Sustainable Projects Group, Inc. for the nine months ended September 30, 2022 as filed in its quarterly report on Form 10-Q with the Securities and Exchange Commission | |

| ● | Separate historical financial statements of Lithium Harvest ApS for the nine months ended September 30, 2022 included herewith |

The unaudited pre-reverse takeover pro forma consolidated financial statements are presented for informational purposes only. The pro forma information is not necessarily indicative of what the financial position or results of operations actually would have been had the Transactions been completed at the dates indicated. In addition, the unaudited pre-reverse takeover pro forma consolidated financial statements do not purport to project the future financial position or operating results of the combined company.

The unaudited pre-reverse takeover pro forma consolidated financial statements were prepared using the reverse acquisition application method of accounting as described in ASC 805-40, with Lithium Harvest ApS treated as the acquiror for accounting and financial reporting purposes. Accordingly, the unaudited pre-reverse takeover pro forma consolidated financial statements are presented as a continuation of Lithium Harvest ApS financial statements with an adjustment to reflect the issued equity capital of the former Sustainable Projects Group Inc., the legal parent, including the equity issued by the Company to effect the business combination.

Note 2 – Pro Forma Adjustments

There were no inter-company balances and transactions between Sustainable Projects Group Inc. and Lithium Harvest ApS as of the dates and for the periods of these pre-reverse takeover pro form as combined financial statements.

The pre-reverse takeover pro forma adjustments included in the unaudited pro forma consolidated financial statements are as follows:

| (a) | Although the LOI stated a share price of $0.39, these pro forma financial statements have been presented using the price per share of $0.0311, which was the market price of the shares as September 30, 2022. This price will need to be adjusted to the fair value at the time of a definitive agreement, should the parties finalized the transaction. The calculation below is based on the September 30, 2022 price per share of $0.0311: |

206,667,233 x $0.0311 per share = $6,427,351

| Shares to be issued to Lithium Harvest | ||||||||

| $ | $ | |||||||

| Common shares | 20,667 | |||||||

| Additional Paid In Capital | 6,406,684 | |||||||

| Equity of Lithium | 7,940 | |||||||

| Goodwill | 9,729,562 | |||||||

| Accumulated deficit SPG | 3,310,151 | |||||||

| (b) | Pursuant to the loan agreement with Kestrel Flight Fund LLC., the outstanding principal of $125,000 plus accrued interest thereof may be converted to common shares of the Company to an amount equal to 25% of the fully diluted capitalization of the Company on a post money basis. As such, the pre-reverse takeover transaction was calculated using the below formula and using the stock price of $0.0311 per share valuation. The total number of shares to be issued to Kestrel Flight Fund LLC will be 71,797,703 shares. |

71,797,703 x $0.0311 per share = $2,232,909

| Conversion of loans to shares equating to 25% of fully diluted | ||||||||

| $ | $ | |||||||

| Common shares | 7,780 | |||||||

| Additional Paid In Capital | 2,225,729 | |||||||

| Convertible loan | 125,000 | |||||||

| Interest payable | 12,425 | |||||||

| Finance charge | 2,095,484 | |||||||

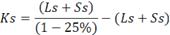

The formula used to calculate the number of shares to be issued to Kestrel Flight Fund LLC was:

Ks = Kestrel conversion shares

Ls = Lithium Harvest ApS shares

Ss = Sustainable Projects Group shares