UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 |

AMENDMENT NO. 1 TO FORM S-1 |

| REGISTRATION STATEMENT |

| UNDER |

| THE SECURITIES ACT OF 1933 |

ANPULO FOOD, INC.

(Exact name of registrant as specified in its charter)

| British Virgin Islands | | | | |

| (State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer Identification |

| incorporation) | | Classification Code Number) | | Number) |

Hangkong Road, Xiangfeng Town,

Laifeng County, Hubei 445700, China

+86 (718) 628 8576

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Copies of communications to:

Gregg E. Jaclin, Esq.

Szaferman, Lakind, Blumstein & Blader, P.C.

101 Grovers Mill Road, Suite 200,

Lawrenceville, NJ 08648

Tel: (609) 275 0400

Fax: (609) 557 0969

Andrew Swapp, Esq.

Codan Trust Company (B.V.I.) Ltd.

Commerce House, Wickhams Cay 1,

P.O. Box 3140, Road Town,

Tortola, British Virgin Islands, VG 1110

+1 (284)852 1141

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer (Do not check if a smaller reporting company) | ¨ | Smaller reporting company | x |

Calculation of Registration Fee

| Title of Each Class of Securities to be Registered | | Amount to be Registered (1) | | | Proposed Maximum Offering Price Per Share | | | Proposed Maximum Aggregate Offering Price | | | Amount of Registration Fee (2) | |

| Ordinary Shares, par value $0.001 per share | | | 15,500,000 | | | $ | 0.20 | | | $ | 3,100,000 | | | $ | 399.28 | |

(1) In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of additional ordinary shares that may be issued and resold resulting from share splits, share dividends or similar transactions.

(2) Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a). The proposed maximum offering price per share is based on the last effective private sale price for the ordinary shares of the registrant as there is currently no public market price for the registrant’s ordinary shares. The last private sales price is further determined by the price at which the common stock of registrant’s sole operating entity and wholly-owned subsidiary (“Anpulo HK”) was sold in a shares-for-debt transaction occurred on October 21, 2013, prior to the share exchange transaction where the common stock of Anpulo HK were subsequently exchanged for the registrant’s ordinary shares. On October 21, 2013, Mr. Wenping Luo, the then shareholder of Anpulo HK transferred 280 shares of the common stock of Anpulo HK that he owned to six creditors in exchange for the cancellation of $5.6 million of debt that owed by Mr. Luo. These creditors subsequently exchanged each share of the common stock of Anpulo HK for 100,000 ordinary shares of the Company in the share exchange occurred on October 30, 2013. The last private sale price for the common stock of Anpulo HK in the shares-for-debt transaction was $20,000 per share and following the share exchange, the last effective private sale price for the registrant’s ordinary share was $0.2 per ordinary share.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the securities act or until the registration statement shall become effective on such date as the commission, acting pursuant to such section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION | |

Anpulo Food, Inc.

15,500,000 Ordinary shares

This prospectus relates to the resale by the selling shareholders named in this prospectus of up to 15,500,000 ordinary shares, par value $0.001 per share.

Our ordinary shares are presently not traded on any market or securities exchange and there is currently no public trading market for our shares. We intend to apply for quotation of our ordinary shares on the Over the Counter Bulletin Board (the “OTC Bulletin Board”). There can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority (“FINRA”), nor can there be any assurance that such an application for quotation will be approved. In the absence of a trading market or an active trading market, investors may be unable to liquidate their investment or make any profit from the investment. There can be no assurance that an active trading market will develop, or if an active market does develop, that it will continue.

The selling shareholders will offer and sell our ordinary shares at $0.20 per share until a public market emerges for our ordinary shares and, thereafter, at prevailing market prices.

We will not receive any of the proceeds from the sale of the ordinary shares by the selling shareholders. We have agreed to pay all of the registration expenses incurred in connection with the registration of the ordinary shares, but we will not pay any of the selling commissions, brokerage fees and related expenses.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and as such, may elect to comply with certain reduced public company reporting requirements for future filings. However, we have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b), and this election is irrevocable. Please refer to more discussions under “Prospectus Summary” beginning on page 4 and “Risk Factors” beginning on page 9 of how and when we may lose emerging growth company status and the various exemptions that are available to us.

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 9 to read about factors you should consider before investing in our ordinary shares.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is: January 2, 2014

| | PAGE |

| 4 |

| 9 |

| 29 |

| 30 |

| 30 |

| 30 |

| 34 |

| 35 |

| 41 |

| 54 |

| 54 |

| 54 |

| 55 |

| 66 |

| 72 |

| 73 |

| 74 |

| 76 |

| 76 |

| 76 |

| | |

| F-1 |

You should rely only on the information contained in this prospectus that we authorize to be distributed to you. We have not authorized any other person to provide you with information different from that contained in this prospectus that we authorize to be distributed to you. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of our ordinary shares.

Third Party Data

This prospectus contains estimates and other information concerning our industry, which are based on industry publications, surveys and forecasts, including those generated by us. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. Please contact us if you have any specific questions. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.”

This summary highlights select information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our ordinary shares. You should carefully read the entire prospectus, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and the “Financial Statements,” before making an investment decision.

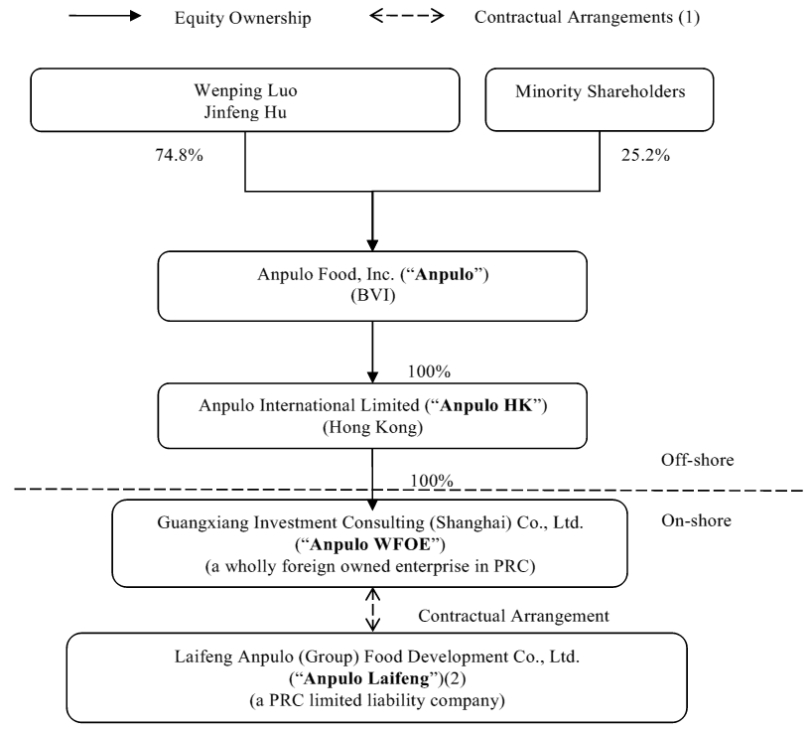

In this prospectus, the terms “Anpulo,” “Company,” “we,” “us,” and “our,” refer to Anpulo Food, Inc., and its wholly-owned subsidiary Anpulo International Limited, a holding company formed in Hong Kong (“Anpulo HK”), Anpulo HK’s wholly-owned subsidiary Guangxiang Investment Consulting Co., Ltd., a limited liability company located in Shanghai, China (“Anpulo WFOE”), and our variable interest entity Laifeng Anpulo (Group) Food Development Co., Ltd. (“Anpulo Laifeng”).

Overview

We process, distribute and market pork and cured pork products in the People’s Republic of China, (the “PRC” or “China”). We do not raise hogs, but instead purchase live hogs from pig farms or individual farmers in Laifeng county and its neighboring area in China for slaughtering, processing and curing. As of September 30, 2013, our product line included over 183 unique meat products, including chilled pork, frozen pork and prepared meats. We sell all of our products under our “Anpulo” and “Linghaotuzhu” brand names.

Our value-added pork and cured pork products are targeting China’s middle and high income class. Our products are marketed domestically to supermarkets, warehouse club stores, foodservice distributors, restaurant operators, and non-commercial establishments, such as schools, hotel chains, healthcare facilities, army bases and other food processors. As of September 30, 2013, our wholesale customers included eight fast food companies, 16 processing factories and 51 school cafeterias, factory canteens, hotels, army bases, hospitals and government departments. As of such date, we also retail through 66 supermarket counter locations and 38 third-party owned and operated specialty boutique stores.

We currently have one processing plant in China, located in Laifeng County, Enshi Tujia and Miao Prefecture, Hubei province. Our total production capacity for chilled pork and frozen pork is approximately 85 metric tons per eight-hour day, or approximately 30,000 metric tons on an annual basis. In addition, we have production capacity for prepared meats of approximately 14 metric tons per eight-hour day, or approximately 5,000 metric tons on an annual basis.

We have a video monitored logistics system that integrates transportation and warehouse management. As of September 30, 2013, we had over 12 temperature-controlled trucks to handle our transportation needs and the capacity for our two temperature adjustable warehouses totaled approximately 5,230 cubic meters.

In 2012 and 2011, we had approximately $18.12 million and $15.08 million in sales, respectively, and $0.23 million and $0.11 million in net income, respectively. For the nine months ended September 30, 2013, we had approximately $13.56 million in sales and approximately $0.71 million in net loss.

Our History and Corporate Structure

Prior to October 30, 2013, we were organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation. From our inception on July 30, 2010 to October 30, 2013, we did not generate any revenue and we accumulated no significant assets as we explored a possible business combination. We entered into our current line of business on October 30, 2013 by acquiring Anpulo HK, its wholly-owned subsidiary Anpulo WFOE and the variable interest entity Anpulo Laifeng.

We do not directly own our business operation in China. We conduct our business operations through our variable interest entity, Anpulo Laifeng, which we control by a series of contractual arrangements. The following chart demonstrates our current corporate structure:

| (1) | Contractual arrangements including an Entrusted Management Agreement, Exclusive Option Agreement, Shareholders’ Voting Proxy Agreement and Pledge of Equity Interest Agreement. For a description of these agreements, see “Corporate Structure— Contractual Arrangements with Anpulo and Anpulo’s Shareholders.” |

| | |

| (2) | The shareholders of Anpulo Laifeng are Wenping Luo (95%) and Jinfeng Hu (5%). |

Equity Pledge Registration

We are currently in the process of registering with SAIC local branch the equity pledge for all of the shares of Anpulo Laifeng provided by the equity pledge agreement. We expect to complete such registration no later than June 2014. Before the registration is completed, the equity pledge is not deemed to have been established, and therefore Anpulo WFOE is considered as an unsecured creditor and is not entitled to enjoy a first priority in equity interest. In this case, if the shareholders of Anpulo Laifeng default on the contractual agreements or if Anpulo Laifeng bankrupts, we will lose a substantial portion of our equity interest in Anpulo Laifeng to any then existing secured creditors. As a result, our financial interest in Anpulo Laifeng could be comprised and our financial position could be materially and adversely affected. For more discussions of the consequence for failing to register the equity pledge, please see the section titled “Risk Factors” beginning on page 9.

Our Industry

The meat industry in China is characterized by fragmentation, sanitation and hygiene issues, as well as social demographic trends. According to the Earth Policy Institute, more than a quarter of all the meat produced worldwide is now eaten in China. Half the world’s pigs, about 476 million of them are said to reside in China. According to November 2013 report of the United States Department of Agriculture (“USDA”), since 2010 the pork market in China has become the largest national market in the world, accounting over half of global production and consumption. Production in China has consistently expanded over the past several years and is forecast at another record 54.7 million tons in 2014, according to USDA. China became a net importer of pork in 2008. It has imported approximately 400,000 tons of pork per year in recent years. This compares with global pork trade of less than seven million, according to Rabobank and Earth Policy Institute. According to USDA November 2013 report, China pork imports are expected to grow to a record 775,000 tons, yet still only account for just over 1 percent of China consumption.

Competitions

The production and sale of meat and food products in China are highly competitive. Our pork products compete with several large and small regional pork processors. The principal competitive elements are price, product safety and quality, brand identification, breadth and depth of product offerings, availability of products, customer service and credit terms. Our competitive strategy is to increase and sustain consumer demand and loyalty by raising safe and healthy food awareness and educating customers of our premium pork products in our marketing activities, increase brand recognition, and build support for our pricing policies. Please see “Description of Business- Competition.”

Competitive Strengths

We believe that the following competitive strengths enable us to compete effectively in the meat products market in Hubei, China:

| | o | Our “Anpulo” and “Linghaotuzhu” brand products are sold at premium prices to middle and high income market in China. Because hogs from our region are fed by local farmers with mountain grown herbs, fruits and crops, which are free from drug, hormone and heavy metals residues, we are able to price our pork products at a premium, approximately 20% to 50% higher than similar pork products. |

| | o | Our geographic location offers lower cost labors and abundant hog supply. Our production and processing plant is located in Laifeng county, Enshi Tujia and Miao Autonomous Prefecture, which we believe that provides lower cost labors than that is available for many of our competitors. Laifeng county, and its neighboring counties, are rich in pig farming, which provides us reliable sources to grow and expand. |

| | o | The “Anpulo” brand name, to our belief, is well recognized throughout our target markets in Hubei Province, China. The brand identification differentiates us from many unorganized and low-end meat product suppliers, and therefore lends us support in developing customer base and implementing our pricing strategy. |

For more discussion regarding our competitive strengths, please see “Description of Business-Competitive Strengths.”

Our Growth Strategy

Our long-term business strategy is to establish our Company as a leading provider of premium pork and pork products in China. Our short-term objectives are to capitalize on current market opportunities and build on our competitive strengths to increase our market presence and enhance our position as a regional leader in the premium pork markets. The key elements of our growth strategy include the following:

| | o | Continue the strategy of offering premium product at premium price. We apply different pricing strategy than our competitors, targeting health conscious consumers who are willing to pay premium price for safe, high quality pork products. We believe that food safety is a top concern of Chinese consumers who purchase meat products. Therefore, we expect that our products by giving consumers the comfort and security of safe and health food will remain marketable at extra cost. To distinguish our pork products from the rest, we plan to continue to sell our pork products at prices approximately 20% to 50% higher than the products of the same category. |

| | o | Increase our market presence in Wuhan City, Chongqing city and Hunan province. As of September 30, 2013, we operated sales offices in Laifeng County and Wuhan City and had one warehouse in each of two cities. When our financial position permits, we plan to increase our market presence by continue adding more supermarket counters in Wuhan City. We are also strategizing to seek expansion opportunities in neighboring provinces. Laifeng county is located in the southwest part of Hubei province and it’s also in the junction of Hubei province, Hunan province and the municipality Chongqing city. As of September 30, 2013, we sell our products to 14 specialty retail stores in Chongqing city and Hunan province and had no supermarket counter in these two provinces. We believe our Laifeng location will enable us to continue service the three provinces and municipality and expand our presence there. |

| | o | Expand our product lines. As of September 30, 2013, our product lines included over 183 types of pork and cured pork products, and we had over 30 new products under development. At such day, we were unable to ascertain the timeframe by which the development can be completed. In addition to in-house product development, we plan to seek collaboration with outside academic and research force to optimize and expand our product lines. |

| | o | Enhance our brand awareness. We believe that we can best achieve sustainable growth through further raising awareness of our brand names “Anpulo” and “Linghaotuzhu”. We plan to build our brand by focusing on educating consumers of our pork products, participate in holidays and special occasion promotions, and showcase our variety of pork products through our retail channels including our supermarket counters and third-party owned and operated boutique type, specialty retail stores. We believe that our retail channels will create additional brand awareness that will benefit our wholesale customers. |

| | o | Improve our warehouse capability. Our temperature adjustable warehouse capability, although totals approximately 5,230 cubic meters, falls short of the amount of products that our slaughterhouse could produce in its full capacity. As a result, we are currently utilizing less than one third of our production capacity at our slaughterhouse. We regard our logistics capabilities as a key to our growth strategy. We intend to construct new warehouse facilities with walk-in coolers and freezers if and when we are able to secure additional funding for the construction projects. |

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

We could remain as an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period. Please see “Risk Factors” beginning on page 9 for various risks associated with investing in an emerging growth company like us.

Enforceability of Civil Liabilities Against Our Assets and Management in China

Our operations are conducted and our assets are located within China. In addition, all of our directors and all of our senior management personnel reside in China, where substantially all of their assets are located. You may experience difficulties in effecting service of process upon us, our directors or our senior management as it may not be possible to effect such service of process outside China. In addition, China does not have treaties with the United States and many other countries providing for reciprocal recognition and enforcement of court judgments. Therefore, recognition and enforcement in China of judgments of a court in the United States or certain other jurisdictions may be difficult or impossible.

Corporate Information

Our principal executive offices are located at Hangkong Road, Xiangfeng Town, Laifeng County, Hubei 445700, China and our telephone number is (86) 718 628 7598. Our website is www.anpulo.cn. No information available on or through our website is incorporated into this prospectus supplement, the accompanying prospectus or the registration statement of which it forms a part.

The Offering

| Ordinary shares offered by selling security holders | | 15,500,000 ordinary shares |

| | | |

| Ordinary shares outstanding before the offering | | 123,000,000 ordinary shares |

| | | |

| Ordinary shares outstanding after the offering | | 123,000,000 ordinary shares |

| | | |

| Use of proceeds | | We are not selling any ordinary shares covered by this prospectus, and, as a result, will not receive any proceeds from this offering. |

| | | |

| Risk Factors | | See “Risk Factors” beginning on page 9 and other information included in this prospectus for a discussion of the risks you should carefully consider before making a decision to invest in our ordinary shares. |

Risks Relating to Our Financial Conditions and Capital Requirements

We will require additional capital resource to meet our ongoing obligations and anticipated operations for the next twelve months.

Our cash reserves are not sufficient to meet our ongoing obligations and anticipated operations for the next twelve month period. As a result, we will need to seek additional funding in the near future. We currently do not have a specific plan of how we will obtain such funding; however, we anticipate that additional funding will be in the form of equity financing from the sale of shares of our common stock or renewing our current obligations with loaners. We may also seek to obtain short-term loans from our directors or unrelated parties. If we raise additional capital through the issuance of equity, the percentage ownership of our company held by existing shareholders will be reduced and those shareholders may experience significant dilution. In addition, new securities may contain certain rights, preferences or privileges that are senior to those of our common stock. If we seek to raise additional capital through the issuance of debt or its equivalents, which will be more difficult for us for our high debt-to-assets ratio described in more details below, the incurrence of indebtedness, will result in increased interest expense and, may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt, expending capital, or declaring dividends, or which impose financial covenants on us that impede our ability to manage our operations.

If we are unable to obtain additional financing, we may be required to reduce the scope of our business development activities, which could harm our business plans, financial condition and operating results. If we are unable to operate at a reduced scale, we may not be able to continue. If we ceased operations, it is likely that all of our investors would lose their investment.

Risks Relating To Our Business

We have over $14 million debt due in the next three years and a high debt-to-assets ratio.

We have over $14 million in debt obligations due in the next three years. We have historically carried large debt and have been able to meet our debt obligations. However, if we fail to secure additional financing for the next twelve month period, or if we fail to obtain further financing or start to generate sufficient cash from operations a year from now and beyond, we could default on our debts when they become due. As a result, we may face serious adverse consequences, including acceleration of debts and penalty for defaults, and eventually bankruptcy.

In addition, our debt to assets ratio is 76% as a result of carrying large debts. Our assets are highly leveraged among the comparable companies. We anticipate that it will be generally difficult for us to obtain additional loans. If we cannot alternatively secure equity financing at acceptable terms, as previously discussed we will have to scale down or even cease our operations.

We may be unable to anticipate changes in consumer preferences for processed meat products, which may result in decreased demand for our products.

Our continued success in the processed meat products market is in large part dependent on our ability to anticipate and develop products that appeal to the changing tastes, dietary habits and preferences of our customers. If we are not able to anticipate and identify new consumer trends and develop new products accordingly, demand for our products may decline and our operating results may be adversely affected. In addition, we may incur significant costs relating to developing and marketing new products or expanding our existing product lines in reaction to what we perceive to be a consumer preference or demand. Such development or marketing may not result in the level of market acceptance, volume of sales or profitability anticipated.

If the chilled and frozen pork market in China does not grow as we expect, our results of operations and financial condition may be adversely affected.

We believe chilled and frozen pork products have strong growth potential in China and, accordingly, we have continuously increased our sales of chilled and frozen pork. If the chilled and frozen pork market in China does not grow as we expect, our business may be harmed, we may need to adjust our growth strategy and our results of operations may be adversely affected.

We require various licenses and permits to operate our business, and the loss of, failure to renew or failure to obtain any or all of these licenses and permits could require us to suspend some or all of our production or distribution operations.

In accordance with PRC laws and regulations, we are required to maintain various licenses and permits in order to operate our business, including, without limitation, a slaughtering permit for our chilled and frozen pork production facility, a permit for production of industrial products for our processed meat production facilities, and permits for distribution of our pork products. We are required to comply with applicable hygiene and food safety standards in relation to our production and distribution processes. Our premises and transportation vehicles are subject to regular inspections by the regulatory authorities for compliance with applicable regulations. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production or distribution operations, which could disrupt our operations and adversely affect our revenues and profitability.

The loss of senior management or key research and development personnel or our inability to recruit additional personnel may harm our business.

We are highly dependent on our senior management to manage our business and operations and our key research and development personnel for the development of new processing technologies and food products and the enhancement of our existing products. In particular, we rely substantially on our founder, Chairman and Chief Executive Officer, Mr. Wenping Luo to manage our operations. We also depend on our key research personnel for the development of new products and manufacturing methods, on our key information technology and logistics personnel for the production, storage and shipment of our products and on our key marketing and sales personnel, engineers and other personnel with technical and industry knowledge to transport, market and sell our products. We do not maintain key man life insurance on any of our senior management or key personnel. The loss of any one of them, in particular Mr. Luo, would have a material adverse effect on our business and operations. Competition for senior management and our other key personnel is intense and the pool of suitable candidates is limited. We may be unable to locate a suitable replacement for any senior management or key personnel that we lose. In addition, if any member of our senior management or key personnel joins a competitor or forms a competing company, they may compete with us for customers, business partners and other key professionals and staff members of our company. Although each of our senior management and key personnel has signed a confidentiality and non-competition agreement in connection with his employment with us, we may not be able to successfully enforce these provisions in the event of a dispute between us and any member of our senior management or key personnel.

We compete for qualified personnel with other food processing companies, food retailers, logistics companies and research institutions. Intense competition for these personnel could cause our compensation costs to increase significantly, which could have a material adverse effect on our results of operations. Our future success and ability to grow our business will depend in part on the continued service of these individuals and our ability to identify, hire and retain additional qualified personnel. If we are unable to attract and retain qualified employees, we may be unable to meet our business and financial goals.

Our growth strategy may prove to be disruptive and divert management resources, which could adversely affect our existing businesses.

Over the last three years, we increased our retail locations from 68 to 156, including specialty retail stores and “Anpulo” supermarket counter locations. Our growth strategy includes the continued expansion of our retail locations. In addition, we intend to expand our network of sales offices and warehouses to additional cities in China. The implementation of such strategy may involve large transactions and present financial, managerial and operational challenges, including diversion of management attention from existing businesses, difficulty with integrating personnel and financial and other systems, increased expenses, including compensation expenses resulting from newly hired employees, assumption of unknown liabilities and potential disputes. We also could experience financial or other setbacks if any of our growth strategies incur problems of which we are not presently aware.

We may require financing in the future and our operations could be curtailed if we are unable to obtain required additional financing when needed.

We may need to obtain debt or equity financing to fund future capital expenditures. Additional equity may result in dilution to the holders of our outstanding shares. Additional debt financing may include conditions that would restrict our freedom to operate our business, such as conditions that:

| | ● | limit our ability to pay dividends or require us to seek consent for the payment of dividends; |

| | | |

| | ● | increase our vulnerability to general adverse economic and industry conditions; |

| | | |

| | ● | require us to dedicate a portion of our cash flow from operations to payments on our debt, thereby reducing the availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and |

| | | |

| | ● | limit our flexibility in planning for, or reacting to, changes in our business and our industry. |

We cannot guarantee that we will be able to obtain any additional financing on terms that are acceptable to us, or at all.

If the global economy experiences another downturn or crisis, potential disruptions in the capital and credit markets may adversely affect our business, including the availability and cost of short-term funds for liquidity requirements, our ability to meet short-term and long-term commitments and our ability to grow our business; each could adversely affect our results of operations, cash flows and financial condition.

The global economy has recently experienced a significant contraction, with an almost unprecedented lack of availability of business and consumer credit. We rely on the credit markets, particularly for short-term borrowings from banks in China, as well as the capital markets, to meet our financial commitments and short-term liquidity needs if internal funds are not available from our operations. Disruptions in the credit and capital markets, as have been experienced since mid-2008, could adversely affect our ability to draw on our short-term bank facilities. Our access to funds under these credit facilities is dependent on the ability of the banks that are parties to those facilities to meet their funding commitments, which may be dependent on governmental economic policies in China. Those banks may not be able to meet their funding commitments to us if they experience shortages of capital and liquidity or if they experience excessive volumes of borrowing requests from us and other borrowers within a short period of time.

Long-term disruptions in the credit and capital markets, similar to those that have been experienced since mid-2008, could result from uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions and could adversely affect our access to liquidity needed for our business. Any disruption could require us to take measures to conserve cash until the markets stabilize or until alternative credit arrangements or other funding for our business needs can be arranged. Such measures could include deferring capital expenditures, and reducing or eliminating discretionary uses of cash.

Continued market disruptions could cause broader economic downturns, which may lead to lower demand for our products and increased incidence of customers' inability to pay their accounts. Further, bankruptcies or similar events by customers may cause us to incur bad debt expense at levels higher than historically experienced. These events would adversely affect our results of operations, cash flows and financial position.

Our operations are cash intensive and our business could be adversely affected if we fail to maintain sufficient levels of working capital.

We expend a significant amount of cash in our operations, principally to fund our raw material procurement. Our suppliers, in particular, suppliers of hogs, typically require payment in full upon delivery. In turn, we typically require our customers of chilled and frozen pork to make payment in full on delivery, although we offer some of our long-standing customers’ credit terms. We generally fund most of our working capital requirements out of cash flow generated from operations. If we fail to generate sufficient revenues from our sales, or if we experience difficulties collecting our accounts receivable, we may not have sufficient cash flow to fund our operating costs and our profitability could be adversely affected.

We may be unable to maintain our profitability in the face of a consolidating retail environment in China.

We sell substantial amounts of our products to supermarkets and large retailers. The supermarket and food retail industry in China has been, and is expected to continue, undergoing a trend of development and consolidation. As the retail food trade continues to consolidate and our retail customers grow larger and become more sophisticated, they may demand lower pricing and increased promotional programs. Furthermore, larger customers may be better able to operate on reduced inventories and potentially develop or increase their focus on private label products. If we fail to maintain a good relationship with our large retail customers, or maintain a wide offering of quality products, or if we lower our prices or increase promotional support of our products in response to pressure from our customers and are unable to increase the volume of our products sold, our profitability could decline.

Our operating results may fluctuate from period to period and if we fail to meet market expectations for a particular period.

Our operating results have fluctuated from period to period and are likely to continue to fluctuate as a result of a wide range of factors, including seasonal variations in live hog supply and processed meat products consumption. For example, demand for our products in general is relatively high before the Chinese New Year in January or February each year and lower thereafter. Our production and sales of chilled and frozen pork are generally lower in the summer due to a lower supply of live hogs, as well as a slight drop in meat consumption during the hot summer months. Interim reports may not be indicative of our performance for the year or our future performance, and period-to-period comparisons may not be meaningful due to a number of reasons beyond our control. We cannot assure you that our operating results will meet the expectations of market analysts or our investors.

We derive virtually all of our revenues from sales in China and a general economic downturn, a recession or a sudden disruption in business conditions in China could have a material adverse effect on our business and financial condition.

Consumer spending is generally affected by a number of factors, including general economic conditions, the level of unemployment, inflation, interest rates, energy costs, gasoline prices and consumer confidence generally, all of which are beyond our control. Consumer purchases of discretionary items tend to decline during recessionary periods, when disposable income is lower, and may impact sales of our products. In addition, sudden disruption in business conditions as a result of a terrorist attack, retaliation and the threat of further attacks or retaliation, war, adverse weather conditions and climate changes or other natural disasters, pandemic situations or large scale power outages can have a short or, sometimes, long-term impact on consumer spending.

All of our revenues are generated from sales in China. We anticipate that revenues from sales of our products in China will continue to represent a substantial proportion of our total revenues in the near future. A downturn in the economy in China, any recession or a sudden disruption of business conditions in China's economy could, among other things, adversely affect consumer buying power and discourage consumption of our products, which in turn would have a material adverse effect on our business, financial condition and results of operations.

We utilize our exclusive network of independently operated specialty retail stores and supermarket brand counters to sell a significant portion of our products and maintain our brand image, and should they perform poorly, our revenues and brand image could be materially and adversely affected.

In addition to our sales to wholesale customers, we sell our products through specialty retail stores owned and operated by resellers of our products with whom we have arrangements to sell our product under the Anpulo brand name, and supermarket counters where we hire our own employees to operate and manage them. All of these retail outlets exclusively sell our pork products and display the “Anpulo” logo on the outside of the stores. For the years ended December 31, 2012 and 2011, these retail outlets accounted for approximately 67% and 69%, respectively, of our total revenue. Any significant deterioration in the sales performance of our retail outlets could adversely affect our financial results. In addition, any sanitation, hygiene or food quality problems that might arise from the retail outlets could adversely affect our brand image and lead to a loss of sales.

We rely on the performance of our large retailers and mass merchant customers for the success of our sales, and should they perform poorly or give priority to our competitors’ products, our sales performance and branding image could be materially and adversely affected.

In addition to our retail sales channel, we sell our products to supermarkets and large retailers, which in turn sell the products to end consumers. Any significant deterioration in the sales performance of our wholesale customers could adversely affect the performance of our products. Furthermore, our wholesale customers also carry products that directly compete with our products for retail space and consumer purchases. There is a risk that our wholesale customers may give higher priority to products of, or form alliances with, our competitors. If our wholesale customers do not continue to purchase our products, or provide our products with similar levels of promotional support, our sales performance and brand imaging could be adversely affected.

The loss of any of our significant customers could reduce our revenues and our profitability.

Our key customers are principally wholesalers and distributors, supermarkets and large retailers in China. For the years ended December 31, 2012 and 2011, Wuhan Zhongbai Chain Warehouse Supermarket Co., Ltd. accounted for 21% and 27% of our sales, respectively. If we lose Wuhan Zhongbai Chain Warehouse Supermarket Co., Ltd. as a customer or any customer who becomes to account for a major portion of our sales, the loss of a significant portion of our sales to them could have an adverse effect on our business, financial condition and results of operations. Any extended discontinuance of sales to this customer could, if not replaced, have a material impact on our operations.

We may experience difficulties in maintaining long-term relationships with customers who do not currently have a contract with us, which will harm our ability to maintain a steady sales level.

Some of our customers purchase our products through spot orders without contracts. These customers would incur almost no immediate economic cost if they abandon their business relationship with our Company and place orders with other meat product suppliers. Therefore, there can be no assurance that we will maintain or improve the relationships with these customers, or that we will be able to continue to supply these customers at current levels or at all. If we cannot maintain long-term relationships with these customers, a loss of order volumes from them, or a significant reduction in their purchase orders could have a material adverse effect on our business, financial condition and results of operations.

If our pork products become contaminated, we may be subject to product liability claims and product recalls.

Pork products may be subject to contamination by disease producing organisms. These organisms are generally found in the environment and as a result, regardless of the manufacturing practices employed, there is a risk that they could be present in our processed pork products as a result of food processing. Once contaminated products have been shipped for distribution, illness and death may result if the organisms are not eliminated at the further processing, foodservice or consumer level. Even an inadvertent shipment of contaminated products is a violation of law and may lead to increased risk of exposure to product liability claims, product recalls and increased scrutiny by regulatory agencies and may have a material adverse effect on our business, reputation, prospects, results of operations and financial condition.

Regulatory enforcement crackdowns on food processing companies in China could increase our compliance costs and reduce our profitability.

We believe we are in compliance in all material respects with all applicable regulatory requirements of China and all local jurisdictions in which we operate. However, the PRC government authorities have taken certain measures to maintain China's food market in good order and to improve the integrity of China's food industry, such as enforcing full compliance with industry standards and closing certain food processing companies in China that did not meet regulatory standards. While the closing of competing meat processing plants that do not meet regulatory standards could increase our revenues in the long term, we may also experience increased regulatory compliance costs that could reduce our profitability.

Our failure to comply with increasingly stringent environmental regulations and related litigation could result in significant penalties, damages and adverse publicity for our business.

Our operations and properties are subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment and the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. In addition, under PRC environmental regulations, we are required to obtain an approval on environmental impact assessment before the construction of our production facilities, and we are further required to undergo environmental protection examinations and obtain acceptance approval from the relevant governmental authorities after we complete the installation of our manufacturing equipment and before we commence commercial production. Failure to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity.

We have incurred, and will continue to incur, significant capital and operating expenditures to comply with these laws and regulations. We cannot assure you that additional environmental issues will not require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

Our largest shareholder has significant influence over our management and affairs and could exercise this influence against your best interests.

As of October 30, 2013, Mr. Wenping Luo, our founder, Chairman and Chief Executive Officer and our largest shareholder, along with his wife, beneficially owned approximately 74.8% of our outstanding common shares, and our other executive officers and directors collectively beneficially owned an additional 0.16% of our outstanding common shares. As a result, pursuant to our memorandum of association and articles of association and applicable laws and regulations, our controlling shareholder and our other executive officers and directors are able to exercise significant influence over our company, including, but not limited to, any shareholder approvals for the election of our directors and, indirectly, the selection of our senior management, the amount of dividend payments, if any, our annual budget, increases or decreases in our share capital, new securities issuance, mergers and acquisitions and any amendments to our memorandum of association and articles of association. Furthermore, this concentration of ownership may delay or prevent a change of control or discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which could decrease the market price of our shares.

The lack of public company experience of our management team could adversely impact our ability to comply with the reporting requirements of U.S. securities laws.

Our management, including our President, Chief Executive Officer, Chief Financial Officer and our directors, has never been responsible for managing a publicly traded company with active operational activities and has no trainings or experience in maintaining books and records and preparing financial statements in accordance with U.S. GAAP. Our management’s lack of public company experience could impair our ability to comply with federal securities laws and make required disclosures on a timely basis including those imposed by Sarbanes-Oxley Act of 2002. Our management may not be able to implement programs and policies in an effective and timely manner that adequately respond to such increased legal, regulatory compliance and reporting requirements, including establishing and maintaining internal controls over financial reporting. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our ability to comply with the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) which is necessary to maintain our public company status. If we were to fail to fulfill those obligations, our ability to continue as a U.S. public company would be in jeopardy in which event you could lose your entire investment in our company.

If we fail to develop and maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud; as a result, current and potential shareholders could lose confidence in our financial reports, which could harm our business and the trading price of our common shares.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. Section 404 of the Sarbanes-Oxley Act of 2002 requires us to evaluate and report on our internal controls over financial reporting and have our independent registered public accounting firm annually attest to our evaluation, as well as issue their own opinion on our internal controls over financial reporting. We cannot be certain that the measures we have undertaken to comply with Section 404 will ensure that we will maintain adequate controls over our financial processes and reporting in the future. Furthermore, if we are able to rapidly grow our business, the internal controls that we will need will become more complex, and significantly more resources will be required to ensure our internal controls remain effective. Failure to implement required controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. If we or our auditors discover a material weakness in our internal controls, the disclosure of that fact, even if the weakness is quickly remedied, could diminish investors' confidence in our financial statements and harm our share price. In addition, non-compliance with Section 404 could subject us to a variety of administrative sanctions, including the suspension of trading, ineligibility for listing on one of the national securities exchanges and the inability of registered broker-dealers to make a market in our common shares, which could reduce our share price.

Any disruptions to our processing facility may materially and adversely affect our business, financial condition and results of operations.

The loss of our sole hog processing facility could adversely affect our business. Any of our processing facility, equipment or installed production lines could suspend or cease operations unexpectedly due to a number of events or circumstances, including problems with our electricity or water supply, equipment failures, regulatory noncompliance, labor disruptions, fires, floods, earthquakes, acts of war or other catastrophes. While we seek to operate our facility in compliance with all applicable rules and regulations and take measures to minimize the risks of disruption at our facility, a material disruption at our processing facility could prevent us from meeting customer demand, reduce our sales and/or negatively impact our business, financial condition and results of operations.

Our classified board structure may prevent a change in our control.

Our board of directors is divided into three classes of directors. The current terms of the directors expire in 2014, 2015 and 2016. Directors of each class are chosen for three-year terms upon the expiration of their current terms, and each year one class of directors is elected by the shareholders. The staggered terms of our directors may reduce the possibility of a tender offer or an attempt at a change in control, even though a tender offer or change in control might be in the best interest of our shareholders.

We may not pay dividends.

We have not previously paid any cash dividends, and we do not anticipate paying any dividends on our common shares. We cannot assure you that our operations will continue to result in sufficient revenues to enable us to operate at profitable levels or to generate positive cash flows. Furthermore, there is no assurance our Board of Directors will declare dividends even if we are profitable. Dividend policy is subject to the discretion of our Board of Directors and will depend on, among other things, our earnings, financial condition, capital requirements and other factors. If we determine to pay dividends on any of our common shares in the future, we will be dependent, in large part, on receipt of funds from Anpulo Laifeng. See “Dividend Policy.”

Risks Relating To Our Industry

An outbreak of A/H1N1 influenza (commonly referred to as “swine flu”) or other diseases could adversely affect our business, results of operations and financial condition.

A spread of A/H1N1 influenza such as that which occurred in 2009 and 2010, or any outbreak of other epidemics in China affecting animals or humans might result in material disruptions to our operations, material disruptions to the operations of our customers or suppliers, a decline in the supermarket or food retail industry or slowdown in economic growth in China and surrounding regions, any of which could have a material adverse effect on our operations and sales revenue. Negative association of the A/H1N1 flu with hogs and pork products, since it is commonly referred to by laypersons as “swine flu”, could have a negative impact on sales of pork products. Moreover, our facilities and products may be affected by A/H1N1 flu or similar diseases in the future, or that the market for pork products in China may decline as a result of fear of such an outbreak. If either case should occur, our business, results of operations and financial condition would be adversely and materially affected.

The hog slaughtering and processed meat industries in China are subject to extensive government regulation, which is still evolving and could adversely affect our ability to sell products in China or increase our production costs.

The hog slaughtering and processed meat industries in China are heavily regulated by a number of governmental agencies, including primarily the Ministry of Agriculture, the Ministry of Commerce, the Ministry of Health, the General Administration of Quality Supervision, Inspection and Quarantine and the State Environmental Protection Administration. These regulatory bodies have broad discretion and authority to regulate many aspects of the hog slaughtering and processed meat industries in China, including, without limitation, setting hygiene standards for production and quality standards for processed meat products. In addition, the hog slaughtering and processed meat products regulatory framework in China is still in the process of being developed. If the relevant regulatory authorities set standards with which we are unable to comply or which increase our production costs and hence our prices so as to render our products non-competitive, our ability to sell products in China may be limited.

The hog slaughtering and processed meat industries in China may face increasing competition from both domestic and foreign companies, as well as increasing industry consolidation, which may affect our market share and profit margin.

The hog slaughtering and processed meat industries in China are highly competitive. Our processed meat products are targeted at mid- to high-end consumers, a market in which we face increasing competition, from both domestic and foreign suppliers. See “Description Business-Competition”. In addition, the evolving government regulations in relation to the hog slaughtering industry has driven a trend of consolidation through the industry, with smaller operators unable to meet the increasing costs of regulatory compliance and therefore at a competitive disadvantage. We believe that our ability to maintain our market share and grow our operations within this landscape of changing and increasing competition is largely dependent upon our ability to distinguish our products and services.

Our current or potential competitors may develop products of a comparable or superior quality to ours, or adapt more quickly than we do to evolving consumer preferences or market trends. In addition, our competitors in the raw meat market may merge or form alliances to achieve a scale of operations or sales network which would make it difficult for us to compete. Increased competition may also lead to price wars, counterfeit products or negative brand advertising, all of which may adversely affect our market share and profit margin. In an effort to expand market share or enter into new markets, some of our competitors have used, and we expect they will continue to use, aggressive pricing strategies, greater incentives and subsidies for distributors, retailers and customers. If their efforts are successful, our market share and profit margin may be adversely affected. Furthermore, consolidation among industry participants in China may potentially result in stronger domestic competitors better able to compete as end-to-end suppliers as well as competitors more specialized in particular areas and geographic markets. We may not be able to compete effectively with our current or potential competitors, and our inability to compete successfully against competitors could result in lost customers, loss of market share and reduced operating margins, which would adversely impact our results of operations.

The outbreak of animal diseases or other epidemics could adversely affect our operations.

An occurrence of serious animal diseases, such as foot-and-mouth disease, or any outbreak of other epidemics in China affecting animals or humans might result in material disruptions to our operations, material disruptions to the operations of our customers or suppliers, a decline in the supermarket or food retail industry or slowdown in economic growth in China and surrounding regions, any of which could have a material adverse effect on our operations and turnover. In 2006, there was an outbreak of streptococcus suis in hogs, principally in Sichuan province, PRC, with a large number of cases of human infection following contact with diseased hogs. There also were unrelated reports of diseased hogs in Guangdong province, PRC. Our procurement and production facilities are located in Henan province, PRC and were not affected by the streptococcus suis infection. In 2010, there were reports of an outbreak of foot-and-mouth disease in several provinces in China, such as Guangdong, Gansu, Jiangxi, Xinjiang and Tibet, and tens of thousands of hogs were culled after such disease outbreak in 2010. In addition, in 2010 and 2011, there have been reports of outbreaks of foot-and-mouth disease in countries and regions near China, such as in Japan and South Korea. Such outbreaks could spread to China. There can be no assurance that our facilities or products will not be affected by an outbreak of this disease or similar ones in the future, or that the market for pork products in China will not decline as a result of fear of disease. In either case, our business, results of operations and financial condition would be adversely and materially affected.

Consumer concerns regarding the safety and quality of food products or health concerns could adversely affect sales of our products.

Our sales performance could be adversely affected if consumers lose confidence in the safety and quality of our products. Consumers in China are increasingly conscious of food safety and nutrition. Consumer concerns about, for example, the safety of pork products, or the safety of food additives used in processed meat products, could discourage them from buying certain products and cause our results of operations to suffer. Specifically in 2011, there was some negative publicity regarding the quality and safety of some of our competitors’ meat products. While we believe that we maintain an advanced system for quality assurance and control, our operations may be impacted by the deteriorating reputation of the food industry in China due to recent food safety scandals.

We may be subject to substantial liability should the consumption of any of our products cause personal injury or illness and, unlike most food processing companies in the United States, we do not maintain product liability insurance to cover our potential liabilities.

The sale of food products for human consumption involves an inherent risk of injury to consumers. Such injuries may result from tampering by unauthorized third parties or product contamination or degeneration, including the presence of foreign contaminants, chemical substances or other agents or residues during the various stages of the procurement and production process. The PRC Food Safety Law which became effective on June 1, 2009 enhances the supervision and examination of governmental authorities over food production and provides that no exemption from such inspections and examinations shall be permitted. While we are subject to governmental inspections and regulations, we cannot assure you that consumption of our products will not cause a health-related illness in the future, or that we will not be subject to claims or lawsuits relating to such matters.

Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. Unlike most food processing companies in the United States, but in line with industry practice in China, we do not maintain product liability insurance. Furthermore, our products could potentially suffer from product tampering, contamination or degeneration or be mislabeled or otherwise damaged. Under certain circumstances, we may be required to recall products. Even if a situation does not necessitate a product recall, we cannot assure you that product liability claims will not be asserted against us as a result. A product liability judgment against us or a product recall could have a material adverse effect on our revenues, profitability and business reputation.

Our product and company name may be subject to counterfeiting and/or imitation, which could have an adverse effect upon our reputation and brand image, as well as lead to higher administrative costs.

We regard brand positioning as the core of our competitive strategy, and intend to position our “Anpulo” and “Linghaotuzhu” brand to create the perception and image of health, nutrition, freshness and quality in the minds of our customers. There have been frequent occurrences of counterfeiting and imitation of products in China in the past. We cannot guarantee that counterfeiting or imitation of our products will not occur in the future or that we will be able to detect it and deal with it effectively. Any occurrence of counterfeiting or imitation could negatively affect our corporate and brand image, particularly if the counterfeit or imitation products cause sickness, injury or death to consumers. In addition, counterfeit or imitation products could result in a reduction in our market share, a loss of revenues or an increase in our administrative expenses in respect of detection or prosecution.

Failure to adequately protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights may be costly.

We have registered our “Anpulo” and “Linhaotuzhu” as trademarks in China for the product categories for which they are currently used. However, there can be no assurance that additional applications, if any, we make to register such mark, or any other trade name or trademark we may seek to register, will be approved and/or that the right to the use of any such trademarks outside of their respective current areas of usage will not be claimed by others. We also own the rights to two domain names that we use in connection with the operation of our business. We believe that such trademarks and domain names provide us with the opportunity to enhance our marketing efforts for our products. Failure to protect our intellectual property rights may undermine our marketing efforts and result in harm to our reputation and the growth of our business.

PRC intellectual property-related laws and their implementation are still under development. Accordingly, intellectual property rights in China may not be as effective as in the United States or many other countries. Litigation may be necessary to enforce our intellectual property rights and the outcome of any such litigation may not be in our favor. Given the relative unpredictability of China's legal system and potential difficulties enforcing a court judgment in China, there is no guarantee that we would be able to halt the unauthorized use of our intellectual property through litigation in a timely manner or at all. Furthermore, any such litigation may be costly and may divert management attention away from our business and cause us to expend significant resources. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, prospects and reputation. We have no insurance coverage against litigation costs so we would be forced to bear all litigation costs if we cannot recover them from other parties. All of the foregoing factors could harm our business and financial condition.

We are an “emerging growth company” under the jobs act and any decision on our part to comply with certain reduced disclosure requirements applicable to “emerging growth companies” could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and, for as long as we continue to be an “emerging growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we have elected to opt out of the extended transition period for complying with the revised accounting standards.

Our status as an “emerging growth company” under the jobs act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company,” we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our reports are not as transparent as other companies in our industry. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

Risks Relating To Conducting Business in China

Substantially all of our assets and operations are located in China, and substantially all of our revenue is sourced from China. Accordingly, our results of operations and financial position are subject to a significant degree to economic, political and legal developments in China, including the following risks:

Changes in the political and economic policies of the PRC government, including those that are intended to address the rising inflation rates in China, could have a material adverse effect on our operations.

Our business operations may be adversely affected by the political and economic environment in China. China has operated as a socialist state since 1949 and is controlled by the Communist Party of China. As such, the economy of China differs from the economies of most developed countries in many respects, including, but not limited to:

| ● | structure | ● | capital re-investment |

| ● | government involvement | ● | allocation of resources |

| ● | level of development | ● | control of foreign exchange |

| ● | growth rate | ● | rate of inflation |

In recent years, however, the government has introduced measures aimed at creating a "socialist market economy" and policies have been implemented to allow business enterprises greater autonomy in their operations. Nonetheless, a substantial portion of productive assets in China is still owned by the PRC government. Changes in the political leadership of China may have a significant effect on laws and policies related to the current economic reforms program, other policies affecting business and the general political, economic and social environment in China, including the introduction of measures to control inflation, changes in the rate or method of taxation, the imposition of additional restrictions on currency conversion and remittances abroad, and foreign investment. Moreover, economic reforms and growth in China have been more successful in certain provinces in China than in others, and the continuation or increases of such disparities could affect the political or social stability in China.

Although we believe the economic reform and the macroeconomic measures adopted by the Chinese government have had a positive effect on the economic development in China, the future direction of these economic reforms is uncertain and the uncertainty may decrease the attractiveness of our company as an investment, which may in turn materially adversely affect the price at which our shares trade.

Furthermore, in recent years the Chinese economy has experienced periods of rapid expansion and highly fluctuating rates of inflation. These factors have led to the adoption by the PRC government, from time to time, of various measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may cause the PRC government to impose controls on credit and/or prices, or to take other actions, which could result in a slowdown in economic activity in China, adversely affect the market demand for our products or increase the financing costs of our Company. In addition, if prices for our products increase at a rate that is insufficient to compensate for the rise in the cost of hogs and other supplies due to inflation, and we are unable to mitigate these inflation increases through customer pricing, our profitability may be reduced and our growth prospects may be negatively impacted.

If we do not complete remigration of equity pledge with SAIC local branch, we will not have priority in the equity interest of Anpulo Laifeng if Anpulo Laifeng shareholders default on other contractual agreements, Shareholders’ Voting Proxy Agreement, Exclusive Option Agreement and Entrusted Management Agreement.