Exhibit 99.2

0 Acquisition of American Realty Capital – Retail Centers of America

1 Important Information Risk Factors The proposed acquisition and issuance of our common stock involves a high degree of risk. See the section entitled “Risk Factors” in our most recent Annual Report on Form 10 - K and the other reports we file with the Securities and Exchange Commission ("SEC") for a discussion of the risks which should be considered in connection with American Finance Trust, Inc . (“AFIN” or the “Company”) and the discussion of Risk Factors at the end of this presentation. Forward - Looking Statements This presentation may contain forward - looking statements. You can identify forward - looking statements by the use of forward - looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . The forward - looking statements involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Please review the end of this presentation and the Company’s most recent Annual Report on Form 10 - K for a more complete list of risk factors, as well as a discussion of forward - looking statements and other details .

2 Important Information Additional Information About the Proposed Transaction and Where to Find It This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitati on of any vote or approval. In connection with the proposed transaction, AFIN and American Realty Capital — Retail Centers of America, Inc. (“RCA”) intend to file relevant materials with the SEC, including a joint proxy statement on Schedule 14A. BOTH AFIN AND RCA STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors may obtain free copies of the proxy statement and other relevant documents filed by AFIN and RCA with the SEC (if and when they become available) through the website maintained by the SEC at www.sec.gov. Copies of the documents filed by AFIN and RCA with the SEC are also available free of charge on AFIN’s website at www.americanfinancetrust.com and copies of the documents filed by RCA with the SEC are available free of charge on RCA’s website at www.retailcentersofamerica.com. AFIN and RCA and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from both companies’ stockholders in respect of the proposed transaction. Information regarding AFIN’s directors and executive officers can be found in AFIN’s definitive proxy statement filed with the SEC on April 29, 2016. Information regard ing RCA’s directors and executive officers can be found in RCA’s definitive proxy statement filed with the SEC on April 29, 2016. Additional information regarding the interests of potential participants will be included in the joint proxy statement and ot her relevant documents filed with the SEC in connection with the proposed transaction if and when they become available. These documents are available free of charge on the SEC’s website and from AFIN and RCA, as applicable, using the sources indicated above.

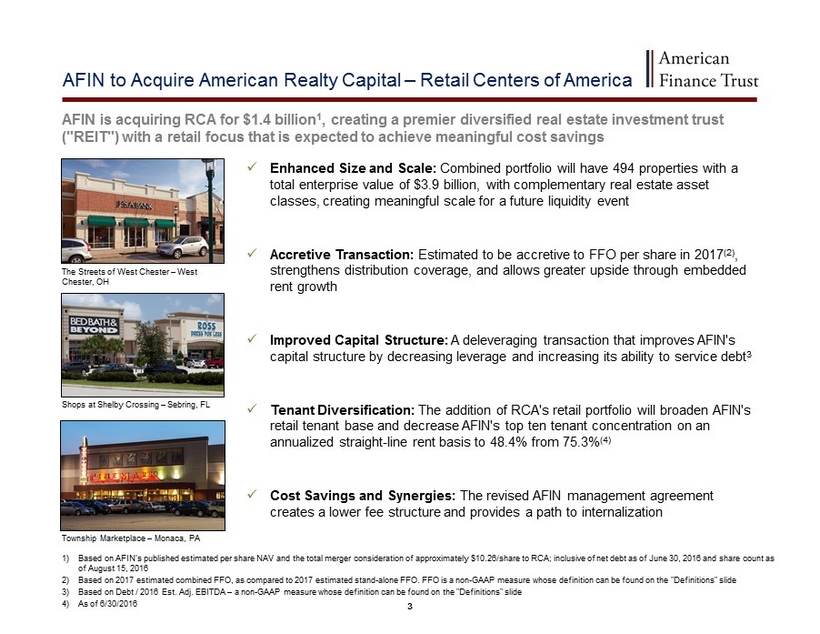

3 AFIN to Acquire American Realty Capital – Retail Centers of America AFIN is acquiring RCA for $1.4 billion 1 , creating a premier diversified real estate investment trust ("REIT") with a retail focus that is expected to achieve meaningful cost savings x Enhanced Size and Scale: Combined portfolio will have 494 properties with a total enterprise value of $3.9 billion, with complementary real estate asset classes, creating meaningful scale for a future liquidity event x Accretive Transaction: Estimated to be accretive to FFO per share in 2017 (2) , s trengthens distribution coverage, and allows greater upside through embedded rent growth x Improved Capital Structure: A deleveraging transaction that improves AFIN's capital structure by decreasing leverage and increasing its ability to service debt 3 x Tenant Diversification: The addition of RCA's retail portfolio will broaden AFIN's retail tenant base and decrease AFIN's top ten tenant concentration on an annualized straight - line rent basis to 48.4% from 75.3% (4) x Cost Savings and Synergies: The revised AFIN management agreement creates a lower fee structure and provides a path to internalization The Streets of West Chester – West Chester, OH Shops at Shelby Crossing – Sebring, FL Township Marketplace – Monaca, PA 1) Based on AFIN's published estimated per share NAV and the total merger consideration of approximately $10.26/share to RCA; inclusive of net debt as of June 30, 2016 and share count as of August 15, 2016 2) Based on 2017 estimated combined FFO, as compared to 2017 estimated stand - alone FFO. FFO is a non - GAAP measure whose definition can be found on the "Definitions" slide 3 ) Based on Debt / 2016 Est. Adj. EBITDA – a non - GAAP measure whose definition can be found on the "Definitions" slide 4 ) As of 6/30/2016

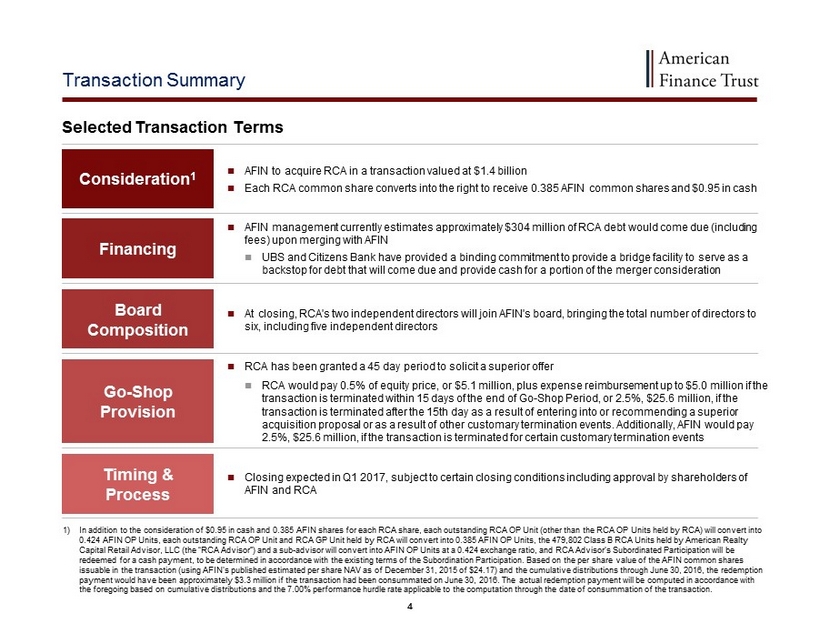

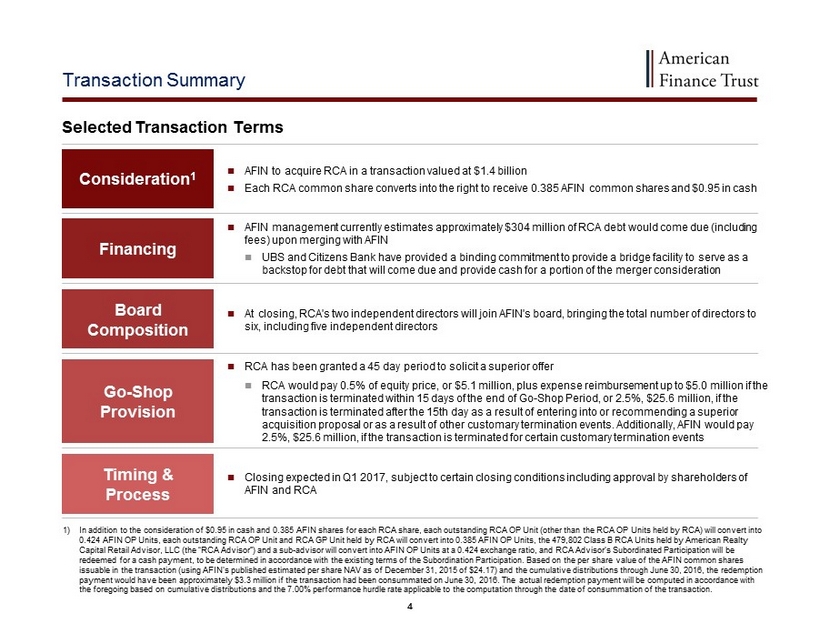

4 Transaction Summary Consideration 1 Financing Go - Shop Provision Board Composition Timing & Process AFIN to acquire RCA in a transaction valued at $1.4 billion Each RCA common share converts into the right to receive 0.385 AFIN common shares and $0.95 in cash AFIN management currently estimates approximately $304 million of RCA debt would come due (including fees) upon merging with AFIN UBS and Citizens Bank have provided a binding commitment to provide a bridge facility to serve as a backstop for debt that will come due and provide cash for a portion of the merger consideration RCA has been granted a 45 day period to solicit a superior offer RCA would pay 0.5% of equity price, or $5.1 million, plus expense reimbursement up to $5.0 million if the transaction is terminated within 15 days of the end of Go - Shop Period, or 2.5%, $25.6 million, if the transaction is terminated after the 15th day as a result of entering into or recommending a superior acquisition proposal or as a result of other customary termination events. Additionally, AFIN would pay 2.5%, $25.6 million, if the transaction is terminated for certain customary termination events At closing, RCA's two independent directors will join AFIN's board, bringing the total number of directors to six, including five independent directors Closing expected in Q1 2017, subject to certain closing conditions including approval by shareholders of AFIN and RCA Selected Transaction Terms 1) In addition to the consideration of $0.95 in cash and 0.385 AFIN shares for each RCA share, each outstanding RCA OP Unit (oth er than the RCA OP Units held by RCA) will convert into 0.424 AFIN OP Units, each outstanding RCA OP Unit and RCA GP Unit held by RCA will convert into 0.385 AFIN OP Units, the 479, 802 Class B RCA Units held by American Realty Capital Retail Advisor, LLC (the “RCA Advisor”) and a sub - advisor will convert into AFIN OP Units at a 0.424 exchange ratio, and RCA Advisor’s Subordinated Participation will be redeemed for a cash payment, to be determined in accordance with the existing terms of the Subordination Participation. Based on the per share value of the AFIN common shares issuable in the transaction (using AFIN's published estimated per share NAV as of December 31, 2015 of $24.17) and the cumula tiv e distributions through June 30, 2016, the redemption payment would have been approximately $3.3 million if the transaction had been consummated on June 30, 2016. The actual redem pti on payment will be computed in accordance with the foregoing based on cumulative distributions and the 7.00% performance hurdle rate applicable to the computation through the date of consummation of the transaction.

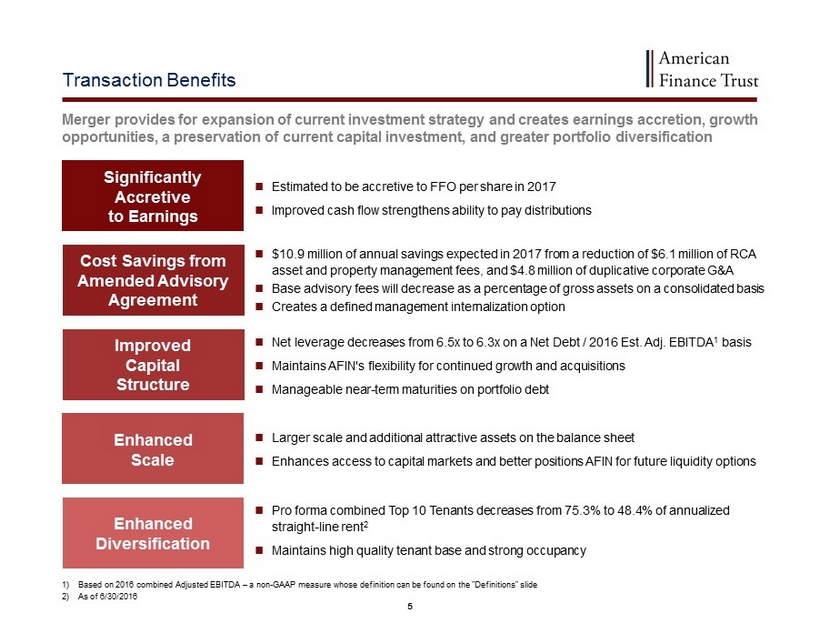

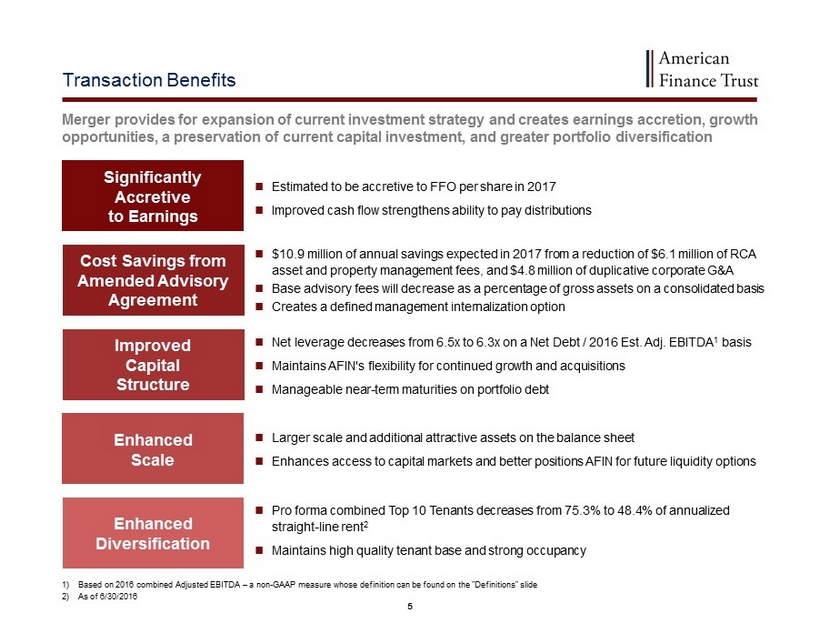

5 Transaction Benefits Merger provides for expansion of current investment strategy and creates earnings accretion, growth opportunities , a preservation of current capital investment, and greater portfolio diversification Estimated to be accretive to FFO per share in 2017 Improved cash flow strengthens ability to pay distributions $10.9 million of annual savings expected in 2017 from a reduction of $6.1 million of RCA asset and property management fees, and $4.8 million of duplicative corporate G&A Base advisory fees will decrease as a percentage of gross assets on a consolidated basis Creates a defined management internalization option Net leverage decreases from 6.5x to 6.3x on a Net Debt / 2016 Est. Adj. EBITDA 1 basis Maintains AFIN's flexibility for continued growth and acquisitions Manageable near - term maturities on portfolio debt Larger scale and additional attractive assets on the balance sheet Enhances access to capital markets and better p ositions AFIN for future liquidity options Pro forma combined Top 10 Tenants decreases from 75.3% to 48.4% of annualized straight - line rent 2 Maintains high quality tenant base and strong occupancy Significantly Accretive to Earnings Enhanced Scale Enhanced Diversification Cost Savings from Amended Advisory Agreement Improved Capital Structure 1) Based on 2016 combined Adjusted EBITDA – a non - GAAP measure whose definition can be found on the "Definitions" slide 2) As of 6/30/2016

6 Transaction Overview (Portfolio details a s of 6/30/2016; shares as of 8/15/2016) Pro Forma Combined Company Enterprise Value ($ billions) (1) 2.5 1.4 3.9 Equity Value ($ billions) (1) 1.6 1.0 2.5 No. of Properties 459 35 494 Total Rentable Square Feet (millions) 13.3 7.5 20.8 2016 Est. Adj. EBITDA ($ millions) (2) 136.5 74.3 221.5 No. of States (3) 37 16 39 Top 10 Tenants (% of Annualized Straight - line Rent) 75.3% 28.3% 48.4% Net Debt / 2016 Est. Adj. EBITDA (2) 6.5x 5.2x 6.3x 1) Based on AFIN's published estimated per share NAV as of December 31, 2015 and the total merger consideration of approximately $1 0.26/share to RCA, calculated based on AFIN's published estimated per share NAV as of December 31, 2015 and the value of the cash consideration. Pro Forma Combined Company value includes transaction adjustments 2 ) Per Company Management estimates for AFIN and RCA, respectively. Includes estimated G&A synergies of $4.7 million, consisting of estimated reductions in expenses for audit , tax, accounting, legal, and other professional services. Also includes estimated reduction of RCA asset and property management fees of $6.0 million in year 1; base managem ent fee under the new AFIN advisory agreement will increase in subsequent years 3 ) Including Washington, DC 3 3

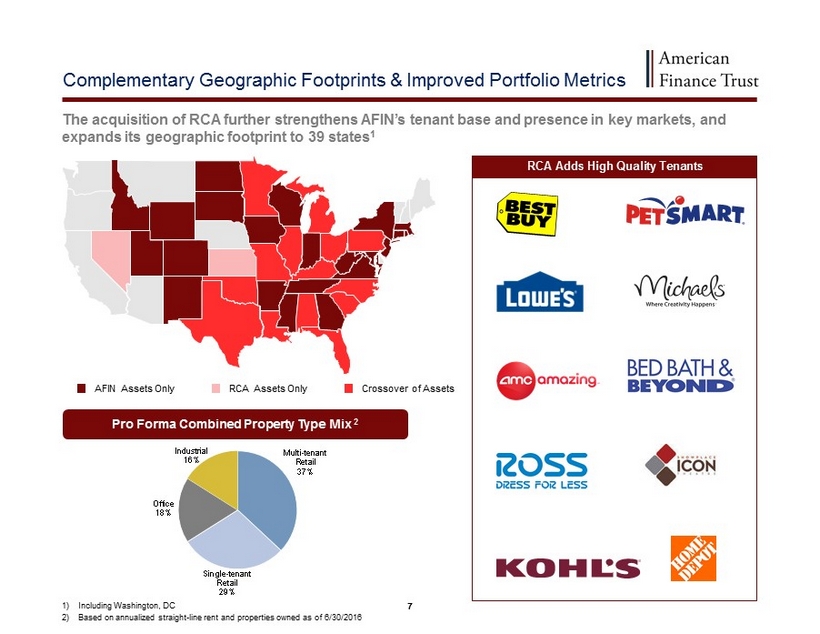

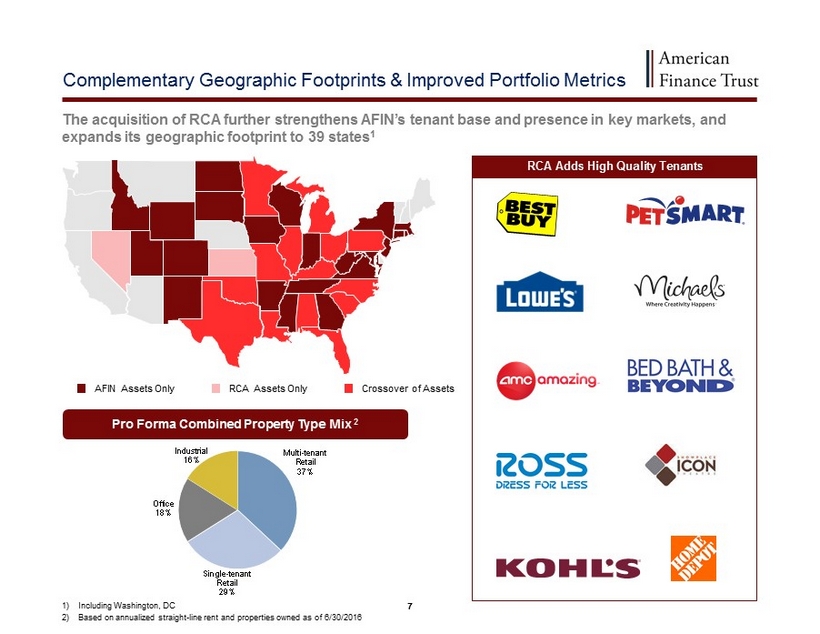

7 Multi - tenant Retail 37% Single - tenant Retail 29% Office 18% Industrial 16% Complementary Geographic Footprints & Improved Portfolio Metrics AFIN Assets Only RCA Assets Only Crossover of Assets The acquisition of RCA further strengthens AFIN’s tenant base and presence in key markets, and expands its geographic footprint to 39 states 1 RCA Adds High Quality Tenants Pro Forma Combined Property Type Mix 2 1) Including Washington, DC 2) Based on annualized straight - line rent and properties owned as of 6/30/2016

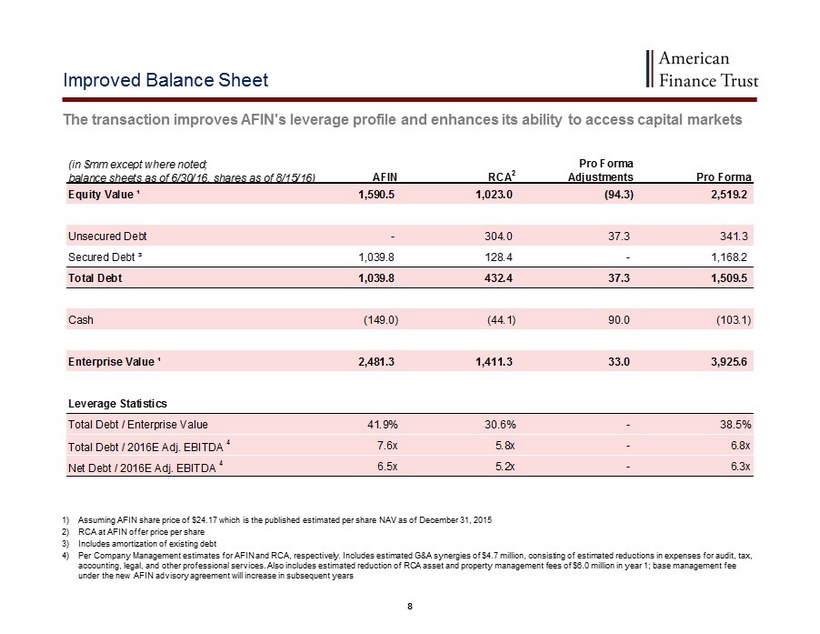

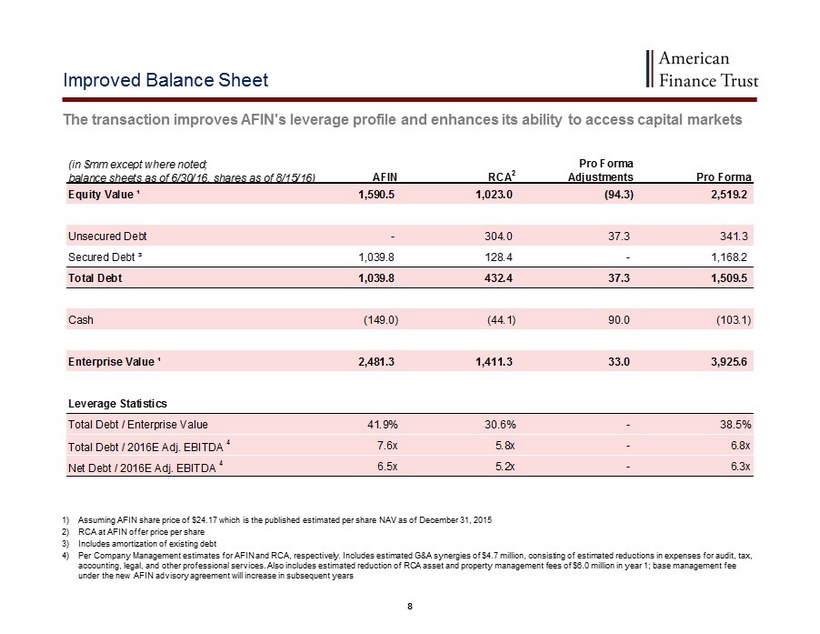

8 Improved Balance Sheet The transaction improves AFIN's leverage profile and enhances its ability to access capital markets 1) Assuming AFIN share price of $24.17 which is the published estimated per share NAV as of December 31, 2015 2) RCA at AFIN offer price per share 3) Includes amortization of existing debt 4 ) Per Company Management estimates for AFIN and RCA, respectively. Includes estimated G&A synergies of $ 4.7 million, consisting of estimated reductions in expenses for audit, tax, accounting, legal, and other professional services. Also includes estimated reduction of RCA asset and property management fe es of $ 6.0 million in year 1; base management fee under the new AFIN advisory agreement will increase in subsequent years (in $mm except where noted; balance sheets as of 6/30/16, shares as of 8/15/16) AFIN RCA 2 Pro Forma Adjustments Pro Forma Equity Value ¹ 1,590.5 1,023.0 (94.3) 2,519.2 Unsecured Debt - 304.0 37.3 341.3 Secured Debt ³ 1,039.8 128.4 - 1,168.2 Total Debt 1,039.8 432.4 37.3 1,509.5 Cash (149.0) (44.1) 90.0 (103.1) Enterprise Value ¹ 2,481.3 1,411.3 33.0 3,925.6 Leverage Statistics Total Debt / Enterprise Value 41.9% 30.6% - 38.5% Total Debt / 2016E Adj. EBITDA 4 7.6x 5.8x - 6.8x Net Debt / 2016E Adj. EBITDA 4 6.5x 5.2x - 6.3x

9 49% 45% 43% 39% 38% 38% 37% 35% 33% 25% 23% 22% 21% 0% 10% 20% 30% 40% 50% 60% SIR LXP GNL WPC AFIN VER SRC GPT STOR ADC GRP O NNN Pro Forma Leverage Profile AFIN's pro forma balance sheet and credit metrics position the company for continued growth (Net Debt + Preferred) / 2016 Est. Adj. EBITDA Debt / Enterprise Value Manageable near - term debt maturities and ample near - term liquidity provide AFIN with a favorable and flexible capital structure Maintains AFIN's flexibility for continued growth and acquisitions Debt metrics align AFIN with public market peers for better positioning towards potential liquidity 7.1x 6.9x 6.8x 6.5x 6.3x 6.1x 6.1x 5.7x 5.7x 5.4x 5.2x 5.2x 2.1x 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x 6.0x 7.0x 8.0x VER SIR GNL LXP AFIN SRC STOR NNN WPC O ADC GPT GRP

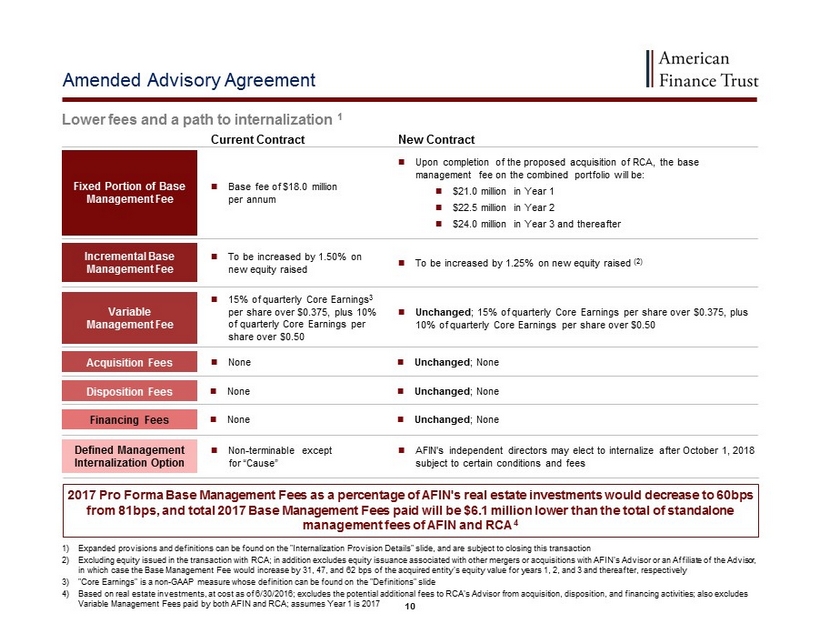

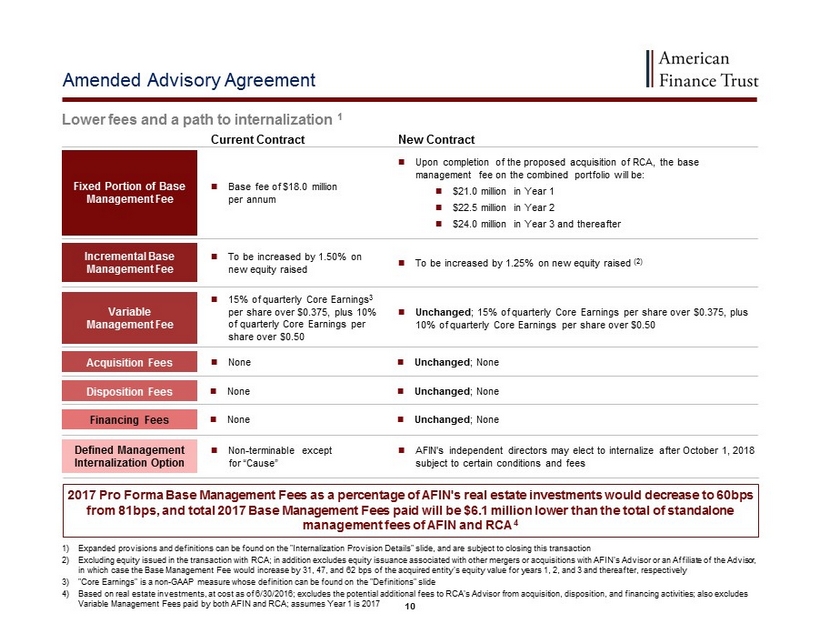

10 Amended Advisory Agreement Lower fees and a path to internalization 1 Fixed Portion of Base Management Fee Incremental Base Management Fee Defined Management Internalization Option Base fee of $18.0 million per annum To be increased by 1.50% on new equity raised Non - terminable except for “Cause” Current Contract Upon completion of the proposed acquisition of RCA, the base management fee on the combined portfolio will be: $21.0 million in Year 1 $22.5 million in Year 2 $24.0 million in Year 3 and thereafter To be increased by 1.25 % on new equity raised (2) AFIN's independent directors may elect to internalize after October 1, 2018 subject to certain conditions and fees New Contract 1) Expanded provisions and definitions can be found on the "Internalization Provision Details" slide, and are subject to closing this transaction 2) Excluding equity issued in the transaction with RCA; in addition excludes equity issuance associated with other mergers or acquisitions with AFIN's Advisor or an Affiliate of the Advisor, in which case the Base Management Fee would increase by 31, 47, and 62 bps of the acquired entity's equity value for years 1, 2, and 3 and thereafter, respectively 3) "Core Earnings" is a non - GAAP measure whose definition can be found on the "Definitions" slide 4) Based on real estate investments, at cost as of 6/30/2016; excludes the potential additional fees to RCA's Advisor from acqui sition, disposition, and financing activities; also excludes Variable Management Fees paid by both AFIN and RCA; assumes Year 1 is 2017 Variable Management Fee 15% of quarterly Core Earnings 3 per share over $ 0.375, plus 10% of quarterly Core Earnings per share over $0.50 Unchanged ; 15% of quarterly Core Earnings per share over $0.375, plus 10% of quarterly Core Earnings per share over $0.50 Acquisition Fees None Unchanged ; None Disposition Fees None Unchanged ; None Financing Fees None Unchanged ; None 2017 Pro Forma Base Management Fees as a percentage of AFIN's real estate investments would decrease to 60bps from 81bps, and total 2017 Base Management Fees paid will be $6.1 million lower than the total of standalone management fees of AFIN and RCA 4

11 Internalization Provision Details Management Internalization Option AFIN, acting by a two - thirds (2/3) vote of the independent directors, may elect to internalize subject to the following conditions: nine (9) months prior written notice of election (ii) effective date of notice no earlier than January 1, 2018 (iii) Internalization Fee equal to $15.0 million plus: (i) 4.5x of “Subject Fees” if the internalization occurs on or prior to December 31, 2028; or (ii) 3.5x of “Subject Fees” if the internalization occurs on or after January 1, 2029 plus 1.00% of (x) the purchase price of each acquisition or merger that occurs after the notice date occurs and prior to the internalization and (y) amount of new equity raised by AFIN and its subsidiaries after the end of fiscal quarter in which the notice date occurs and prior to the internalization “Subject Fees” means (i) (x) the actual Base Management Fee and Variable Management Fees payable for the fiscal quarter in which the Notice Date occurs multiplied by (y) four (4) plus (ii) without duplication, the annual increase in the Base Management Fee resulting from the amount of new equity raised by AFIN or its subsidiaries within the fiscal quarter in which the Notice Date occurs

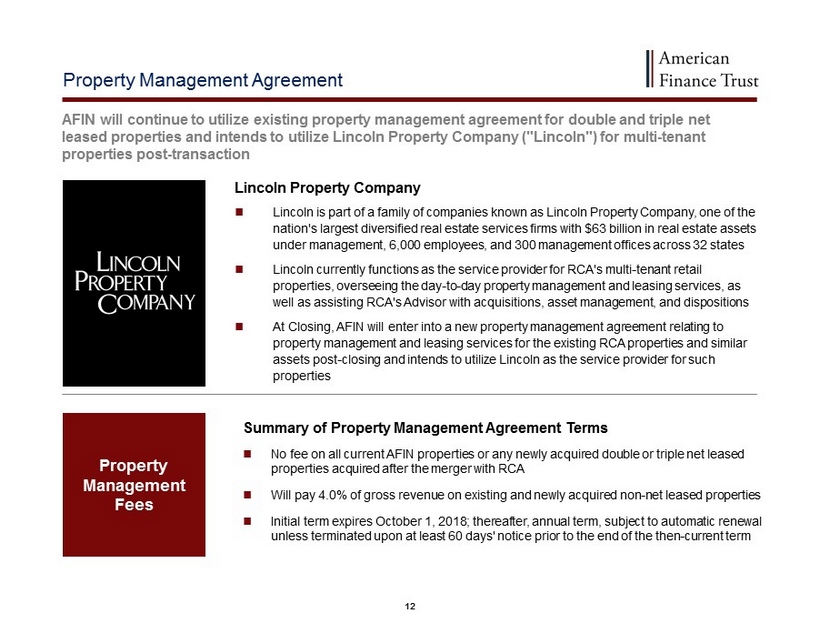

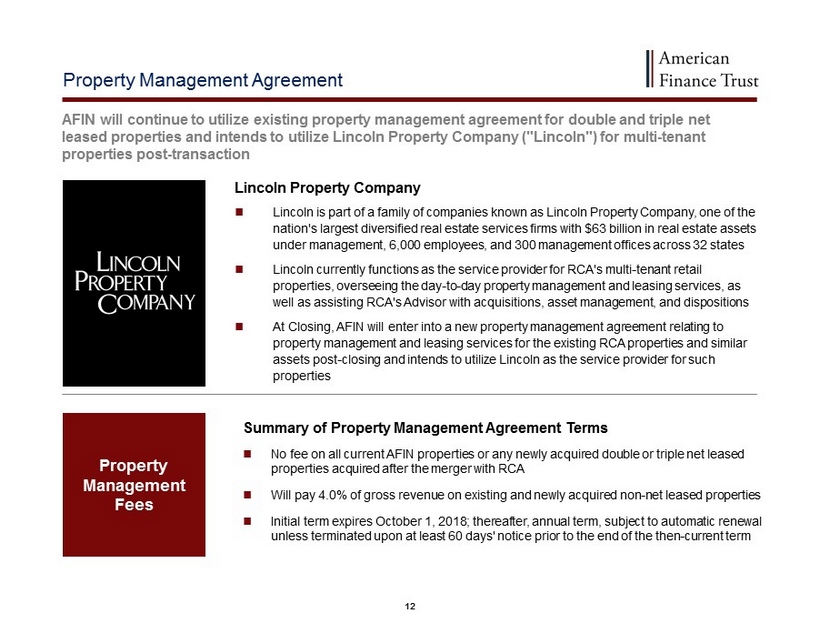

12 Property Management Agreement AFIN will continue to utilize existing property management agreement for double and triple net leased properties and intends to utilize Lincoln Property Company ("Lincoln") for multi - tenant properties post - transaction Property Management Fees Summary of Property Management Agreement Terms No fee on all current AFIN properties or any newly acquired double or triple net leased properties acquired after the merger with RCA Will pay 4.0% of gross revenue on existing and newly acquired non - net leased properties Initial term expires October 1, 2018; thereafter, annual term, subject to automatic renewal unless terminated upon at least 60 days' notice prior to the end of the then - current term Lincoln Property Company Lincoln is part of a family of companies known as Lincoln Property Company, one of the nation's largest diversified real estate services firms with $63 billion in real estate assets under management, 6,000 employees, and 300 management offices across 32 states Lincoln currently functions as the service provider for RCA's multi - tenant retail properties, overseeing the day - to - day property management and leasing services, as well as assisting RCA's Advisor with acquisitions, asset management, and dispositions At Closing, AFIN will enter into a new property management agreement relating to property management and leasing services for the existing RCA properties and similar assets post - closing and intends to utilize Lincoln as the service provider for such properties

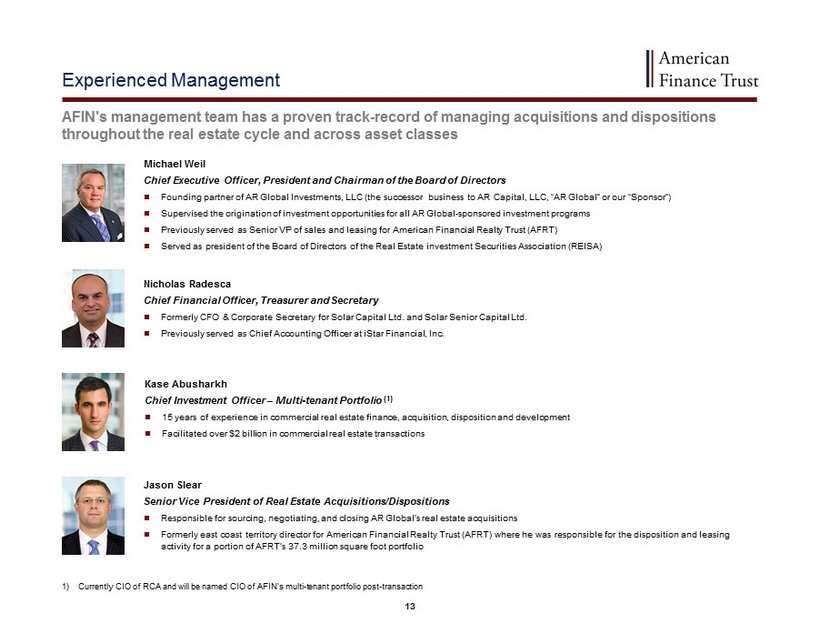

13 Experienced Management AFIN's management team has a proven track - record of managing acquisitions and dispositions throughout the real estate cycle and across asset classes Michael W eil Chief Executive Officer, President and Chairman of the Board of Directors Founding partner of AR Global Investments , LLC (the successor business to AR Capital, LLC, “AR Global” or our “Sponsor”) Supervised the origination of investment opportunities for all AR Global - sponsored investment programs Previously served as Senior VP of sales and leasing for American Financial Realty Trust (AFRT) Served as president of the Board of Directors of the Real Estate investment Securities Association (REISA) Nicholas Radesca Chief Financial Officer, Treasurer and Secretary Formerly CFO & Corporate Secretary for Solar Capital Ltd. and Solar Senior Capital Ltd. Previously served as Chief Accounting Officer at iStar Financial, Inc. Jason Slear Senior Vice President of Real Estate Acquisitions/Dispositions Responsible for sourcing, negotiating, and closing AR Global's real estate acquisitions Formerly east coast territory director for American Financial Realty Trust (AFRT) where he was responsible for the dispositio n a nd leasing activity for a portion of AFRT’s 37.3 million square foot portfolio Kase Abusharkh Chief Investment Officer – Multi - tenant Portfolio (1) 15 years of experience in commercial real estate finance, acquisition, disposition and development Facilitated over $2 billion in commercial real estate transactions 1) Currently CIO of RCA and will be named CIO of AFIN's multi - tenant portfolio post - transaction

14 Projections This presentation includes estimated projections of future operating results. These projections were not prepared in accordance with published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants for preparation and presentation of financial projections. This information is not fact and should not be relied upo n as being necessarily indicative of future results; the projections were prepared in good faith by management and are based on numerous assumptions that may prove to be wrong. Important factors that may affect actual results and cause the projections to not be achieved include, but are not limited to, risks and uncertainties relating to the company and other factors describ ed in the “Risk Factors” section of AFIN’s Annual Report on Form 10 - K filed with the SEC on March 16, 2016, AFIN’s Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 11, 2016, respectively, in the “Risk Factors” section of RCA’s Annual Report on Form 10 - K filed with the SEC on March 11, 2016, RCA’s Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 12, 2016, respectively, in AFIN’s and RCA’s future filings with the SEC. The projections also reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contai ned in the estimates. Accordingly, there can be no assurance that the estimates will be realized. This presentation also contains estimates and information concerning our industry, including market position, market size, an d growth rates of the markets in which we participate, that are based on industry publications and reports. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and reports . The industry in which we operate is subject to a high degree of uncertainty and risk due to variety of factors, including tho se described in the “Risk Factors” section of the Company’s Annual Report on Form 10 - K filed with the SEC on March 16, 2016, the Quarterly Reports on Form 10 - Q filed for the quarters ended March 31, 2016 and June 30, 2016 filed on May 13, 2016 and August 11, 2016, respectively, and in future filings with the SEC. These and other factors could cause results to differ materially from those expressed in these publications and reports.

15 Risk Factors Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2015 and our Quarterly Reports on Form 10 - Q filed from time to time. The following are some of the risks and uncertainties relating to us and the proposed transaction, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward - looking statements: All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Fi nance Advisors, LLC (our “Advisor”) or other entities under common control with AR Global. As a result, our executive officers, our Advisor and its af fil iates face conflicts of interest, including significant conflicts created by our Advisor’s compensation arrangements with us and other investment pro gra ms advised by affiliates of our Sponsor and conflicts in allocating time among these entities and us, which could negatively impact our ope rat ing results. Although we previously announced our intention to list our shares of common stock on the New York Stock Exchange and the merger is conditioned on our shares of common stock being authorized for listing, the merger agreement does not require that our common stock be listed upon closing and there can be no assurance that our shares of common stock will be listed. No public market currently exists, or may ever exis t, for shares of our common stock and our shares are, and may continue to be, illiquid. We depend on tenants for our rental revenue and, accordingly, our rental revenue is dependent upon the success and economic v iab ility of our tenants. Our tenants may not achieve our rental rate incentives and our expenses could be greater, which may impact our results of operations. The merger and related transactions are subject to certain conditions, including approval by stockholders of AFIN and RCA. Failure to complete the merger could negatively impact the value of AFIN common stock, and the future business and financial results of AFIN. The pendency of the merger could adversely affect the business and operations of AFIN and RCA. If the merger is not consummated by April 21, 2017, either AFIN or RCA may terminate the merger agreement. RCA is engaged in the business of owning and operating retail properties, including power centers and lifestyle centers , and this business has different risks than our current business which primarily consists of owning net leased real estate, including shorter lease ter ms, greater exposure to downturns in the retail market, dependence on the success and economic viability of anchor tenants and competition from alter nat ive retail channels such as internet shopping .

16 Risk Factors We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100% of our distributions, and, as such, we may be forced to source distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees. There is no assurance that our Advisor will waive reimbursement of expenses or fees. We may be unable to pay or maintain cash distributions at the current rate or increase distributions over time. We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates. We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America. We may fail to continue to qualify to be treated as a real estate investment trust for U.S. federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and our cash available for distributions. We may be deemed by regulators to be an investment company under the Investment Company Act of 1940, as amended (the “Investment Company Act”), and thus subject to regulation under the Investment Company Act.

17 Risk Factors Certain statements made in this presentation are “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect the expectations of AFIN and RCA regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the Agreement and Plan of Merger (the “Merger Agreement”) between AFIN and RCA, among others, will be consummated, the new combined company’s plans, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to the combined company, including regarding future dividends and market valuations, and other statements that are not historical facts. The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain regulatory approvals for the transaction and the approval by AFIN’s and RCA’s stockholders of the transactions contemplated in the Merger Agreement; market volatility; unexpected costs or unexpected liabilities that may arise from the transaction, whether or not consummated; the inability to retain key personnel; continuation or deterioration of current market conditions; future regulatory or legislative actions that could adversely affect the companies; and the business plans of the tenants of the respective parties. Additional factors that may affect future results are contained in AFIN’s and RCA’s filings with the SEC, which are available at the SEC’s website at www.sec.gov. AFIN and RCA disclaim any obligation to update and revise statements contained in these materials based on new information or otherwise.

18 Definitions Funds from Operations (FFO) We define FFO, a non - GAAP measure, consistent with the standards set forth in the White Paper on FFO approved by the Board of Gover nors of NAREIT, as revised in February 2004 (the "White Paper"). The White Paper defines FFO as net income or loss computed in accordance with GAAP, but ex clu ding gains or losses from sales of property and real estate related impairments, plus real estate related depreciation and amortization, and after adjustments f or unconsolidated partnerships and joint ventures . We believe that the use of FFO provides a more complete understanding of our performance to investors and to management, and, wh en compared year over year, reflects the impact on our operations from trends in occupancy rates, rental rates, operating costs, general and admini str ative expenses, and interest costs, which may not be immediately apparent from net income . Not all REITs, including publicly registered, non - listed REITs, calculate FFO the same way. Accordingly, comparisons with other REITs, including publicly registered, non - listed REITs, may not be meaningful. Furthermore, FFO is not indicative of cash flow available to fund cash needs and should not be considered as an alternative to net income (loss) or income (loss) from continuing operations as determined under GAAP as an indication of our performance, as an alternative to cash flows from operations, as an indication of our liquidity, or indicative of funds available to fund our ca sh needs including our ability to make distributions to our stockholders. FFO should be reviewed in conjunction with other GAAP measurements as an indication of our performance. FFO should not be construed to be more relevant or accurate than the current GAAP methodology in calculating net income or in its applicability in evaluating our operating performance. The methods utilized to evaluate the performance of a publicly registered, non - listed REIT under GAAP should be con strued as more relevant measures of operational performance and considered more prominently than the non - GAAP measures, FFO, and the adjustments to GAAP in calculating FFO. Neither the SEC, NAREIT, the IPA nor any other regulatory body or industry trade group has passed judgment on the acceptabili ty of the adjustments that we use to calculate FFO. In the future, NAREIT, the IPA or another industry trade group may publish updates to the White Paper or the Practice Guideli nes or the SEC or another regulatory body could standardize the allowable adjustments across the publicly registered, non - listed REIT industry, an d we would have to adjust our calculation and characterization of FFO accordingly. Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA ) We believe that adjusted earnings before interest, taxes, depreciation and amortization ("Adjusted EBITDA") is an appropriate me asure of our ability to incur and service debt. We define Adjusted EBITDA as net income or loss computed in accordance with GAAP, but excluding gains or losses fr om sales of real estate investments , real estate related impairments and mark - to - market adjustments included in net income (including gains or losses i ncurred on assets held for sale), plus interest, real estate related depreciation and amortization, adjustments for unconsolidated partnerships and joint ventu res and acquisition and transaction related expense. Adjusted EBITDA should not be considered as an alternative to cash flows from operating activities, as a mea sur e of our liquidity or as an alternative to net income as an indicator of our operating activities. Other REITs may calculate Adjusted EBITDA differently and our calculation should not be compared to that of other REITs . Core Earnings Core Earnings means the net income (loss), computed in accordance with GAAP, excluding ( i ) non - cash equity compensation expense, (ii) the Variable Management Fee, (iii) acquisition and transaction related fees and expenses, (iv) financing related fees and expenses, (v) de pre ciation and amortization, (vi) realized gains and losses on the sale of assets, (vii) any unrealized gains or losses or other non - cash items that are included in net income (loss) for the applicable reporting period, regardless of whether such items are included in other comprehensive income or loss, or in net i nco me, (viii) one - time events pursuant to changes in GAAP and certain non - cash charges, (ix) impairment losses on real estate related investments and other th an temporary impairment of securities, (x) amortization of deferred financing costs, (xi) amortization of tenant inducements, (xii) amortization of stra igh t - line rent, (xiii) amortization of market lease intangibles, (xiv) provision for loan losses and (xv) other non - recurring revenue and expenses, in each case after discuss ions between AFIN's Advisor and its Independent Directors and approved by a majority of AFIN's Independent Directors .

For account information , including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com Shareholders may access their accounts at www.ar - global.com AmericanFinanceTrust.com