Exhibit 99.1

2 nd Quarter 2016 Webinar Series

Second Quarter 2016 Investor Presentation Platform Advisor To Investment Programs

IMPORTANT INFORMATION American Realty Capital – Retail Centers of America 3 Risk Factors Investing in our common stock involves a high degree of risk . See the section entitled “Risk Factors” in the Annual Report on Form 10 - K for a discussion of the risks which should be considered in connection with American Realty Capital – Retail Centers of America, Inc . (“ARC – RCA” or the “Company”) . Forward - Looking Statements This presentation may contain forward - looking statements . You can identify forward - looking statements by the use of forward - looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases . Please review the end of this presentation and the Company’s Annual Report on Form 10 - K for the year ended December 31, 2015 and Quarterly Reports on Form 10 - Q for the quarters ended March 31, 2016 and June 30, 2016 for a more complete list of risk factors, as well as a discussion of forward - looking statements and other offering details.

American Realty Capital – Retail Centers of America 4 Our primary investment objectives are: • Preserve and protect capital; • Provide attractive and stable cash distributions; and • Increase the value of assets in order to generate capital appreciation. INVESTMENT OBJECTIVES

American Realty Capital – Retail Centers of America 5 Acquire Large Retail Assets Diversify by Tenant and Geography Obtain Lease Terms of 5 Years or Greater Buy Assets at Least 80% Leased at Time of Purchase Buy at Discount to Replacement Cost ARC - RCA owns anchored, stabilized core retail properties for investment purposes, including power centers and lifestyle centers, which are located in the United States and were at least 80.0% leased at the time of acquisition. We have acquired properties, which we believe were valued at a substantial discount to replacement cost using current market rents and with significant potential for appreciation. The ARC - RCA portfolio has been constructed with an exit in mind, through listing on a national exchange, acquisition by another real estate investment trust (“REIT”) or other type of strategic alternative. ACQUISITION STRATEGY

American Realty Capital – Retail Centers of America 6 Real Estate Investments, at Cost : $1.28 Billion Number of Properties: 35 Rentable Square Feet: 7.5 Million Percentage Leased: 93.1% Weighted Avg. Remaining Lease Term: 5.3 years Based on rentable square feet Data as of June 30, 2016 89% 11% Power Center Lifestyle Center PORTFOLIO UPDATE

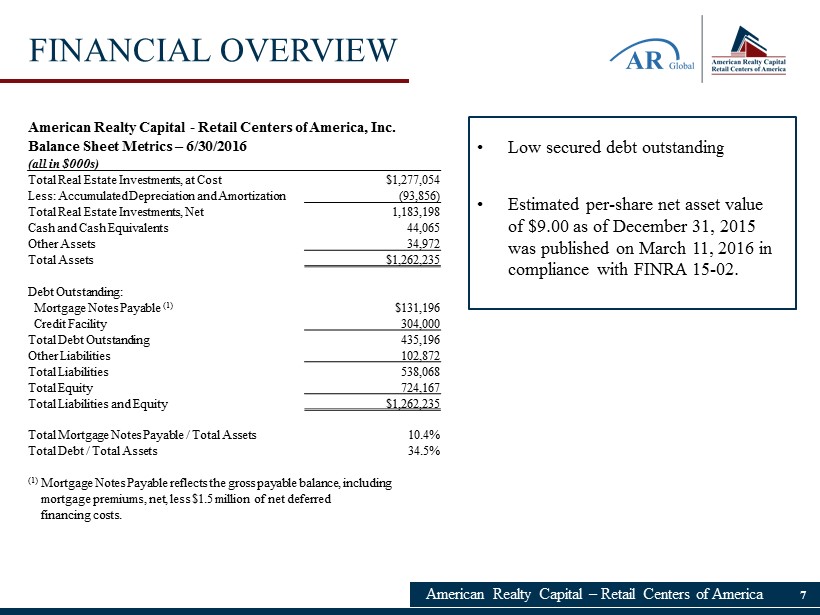

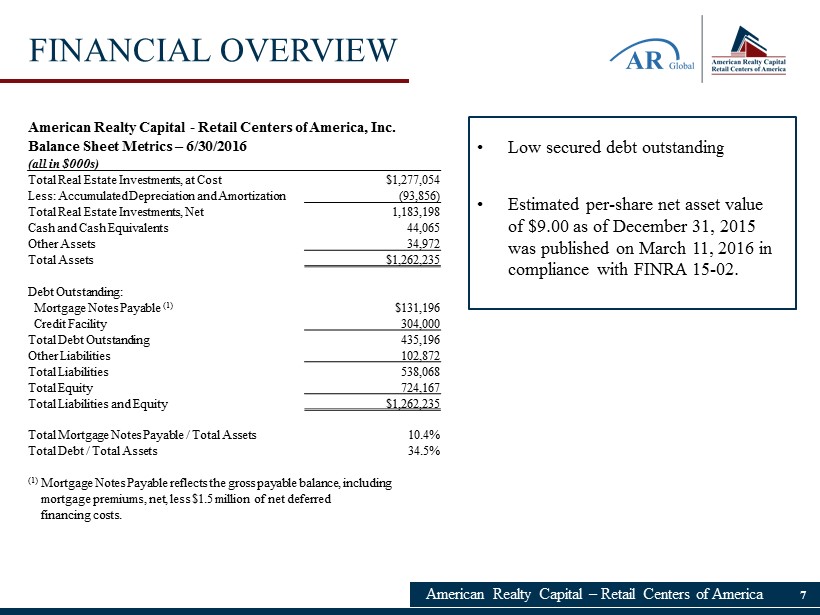

American Realty Capital – Retail Centers of America 7 • Low secured debt outstanding • Estimated per - share net asset value of $9.00 as of December 31, 2015 was published on March 11, 2016 in compliance with FINRA 15 - 02. American Realty Capital - Retail Centers of America, Inc. Balance Sheet Metrics – 6/30/2016 (all in $000s) Total Real Estate Investments, at Cost $1,277,054 Less: Accumulated Depreciation and Amortization (93,856) Total Real Estate Investments, Net 1,183,198 Cash and Cash Equivalents 44,065 Other Assets 34,972 Total Assets $1,262,235 Debt Outstanding: Mortgage Notes Payable (1) $131,196 Credit Facility 304,000 Total Debt Outstanding 435,196 Other Liabilities 102,872 Total Liabilities 538,068 Total Equity 724,167 Total Liabilities and Equity $1,262,235 Total Mortgage Notes Payable / Total Assets 10.4% Total Debt / Total Assets 34.5% (1) Mortgage Notes Payable reflects the gross payable balance, including mortgage premiums, net, less $1.5 million of net deferred financing costs. FINANCIAL OVERVIEW

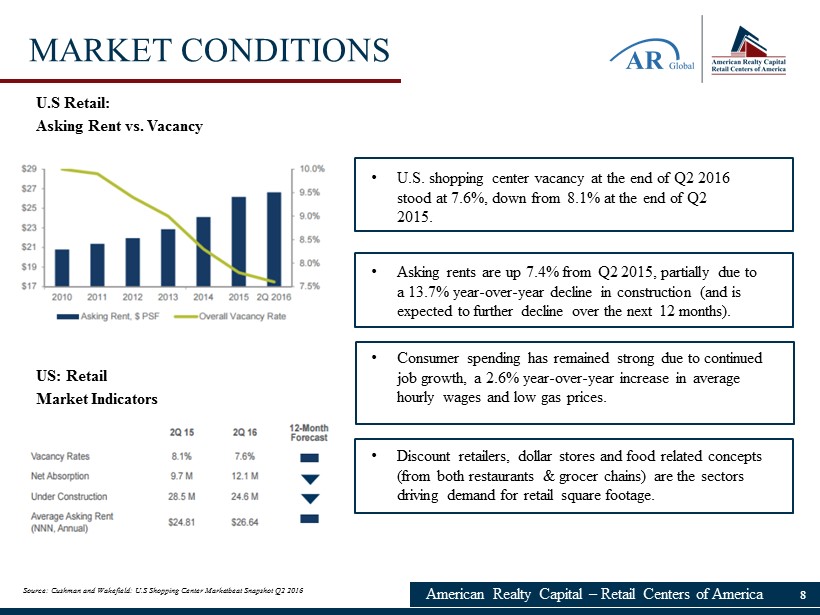

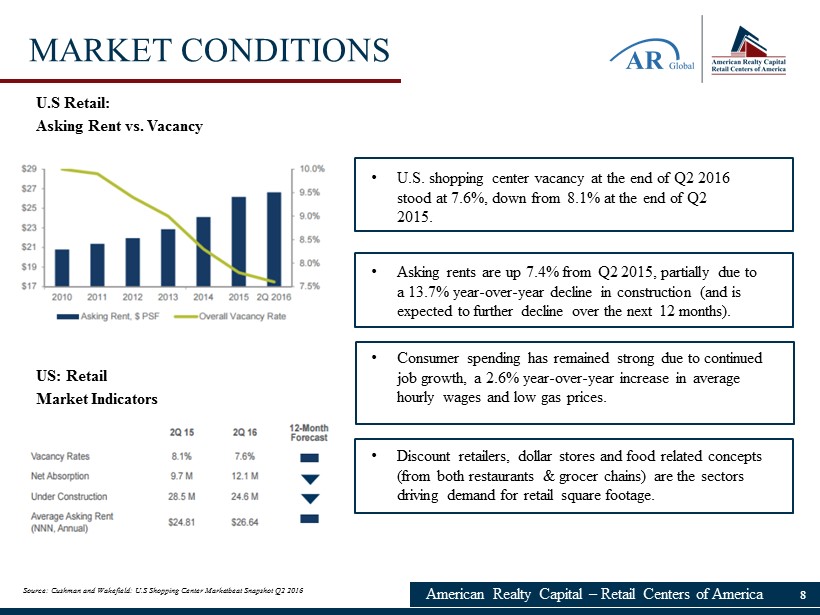

American Realty Capital – Retail Centers of America 8 • U.S. shopping center vacancy at the end of Q2 2016 stood at 7.6%, down from 8.1% at the end of Q2 2015. • Asking rents are up 7.4% from Q2 2015, partially due to a 13.7% year - over - year decline in construction (and is expected to further decline over the next 12 months). • Consumer spending has remained strong due to continued job growth, a 2.6% year - over - year increase in average hourly wages and low gas prices. U.S Retail: Asking Rent vs. Vacancy US: Retail Market Indicators Source: Cushman and Wakefield: U.S Shopping Center Marketbeat Snapshot Q2 2016 MARKET CONDITIONS • Discount retailers, dollar stores and food related concepts (from both restaurants & grocer chains) are the sectors driving demand for retail square footage.

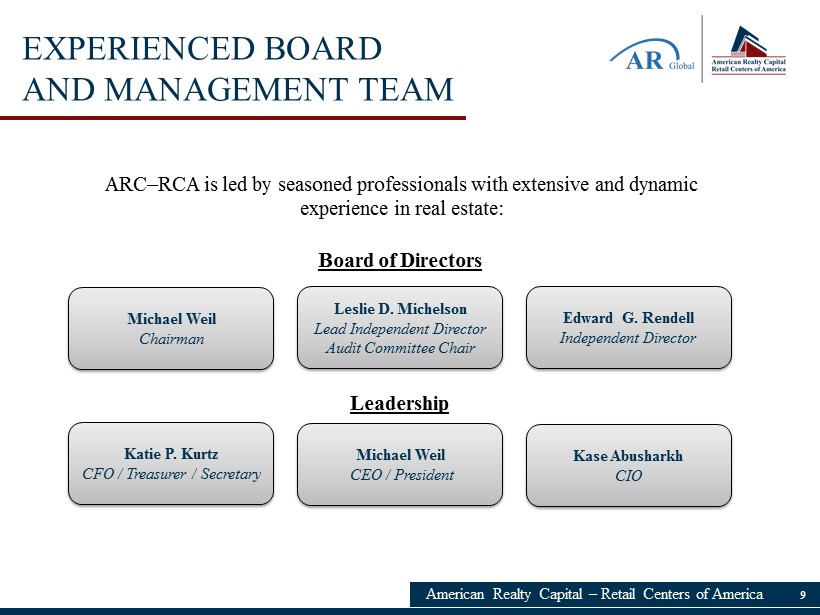

EXPERIENCED BOARD AND MANAGEMENT TEAM American Realty Capital – Retail Centers of America 9 Katie P. Kurtz CFO / Treasurer / Secretary Michael Weil CEO / President Kase Abusharkh CIO ARC – RCA is led by seasoned professionals with extensive and dynamic experience in real estate: Leslie D. Michelson Lead Independent Director Audit Committee Chair Edward G. Rendell Independent Director Michael Weil Chairman Board of Directors Leadership

American Realty Capital – Retail Centers of America 10 ◙ Founded in 1965 ◙ Among Largest Private Diversified Real Estate Firms in U.S. ◙ Full Service – development, sales, advisory and property management ◙ $63 Billion Real Estate Assets Under Management ◙ Properties located in more than 200 U.S. cities and 10 countries throughout Europe ◙ 6,000 Employees ◙ 40 Administrative Offices in U.S./Europe ◙ 300 Management Offices in 32 States Access to Lincoln Property Company* through Service Provider * Lincoln Retail REIT Services, LLC, a Delaware limited liability company (“Lincoln Retail”), was organized specifically to p rov ide real estate services to ARC – RCA on behalf of the Advisor. Lincoln Retail has agreed to engage the services of its affiliates as necessary, to maintain an adequate number of ski lled and licensed employees, in addition to all systems, equipment and software needed to carry out the services for which it has been engaged, exclusively for the benefit of ARC – RCA. Per the ex clusive services agreement, Lincoln Retail is responsible for the services that it has undertaken to provide and its affiliates are not contractually bound to provide it with assistance. Li ncoln Property Company does not function as ARC – RCA’s service provider. LINCOLN PROPERTY COMPANY

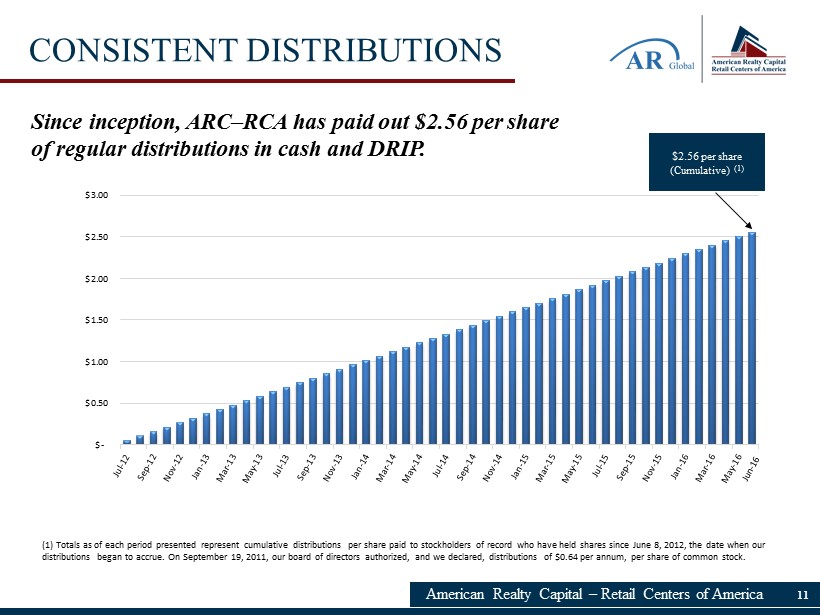

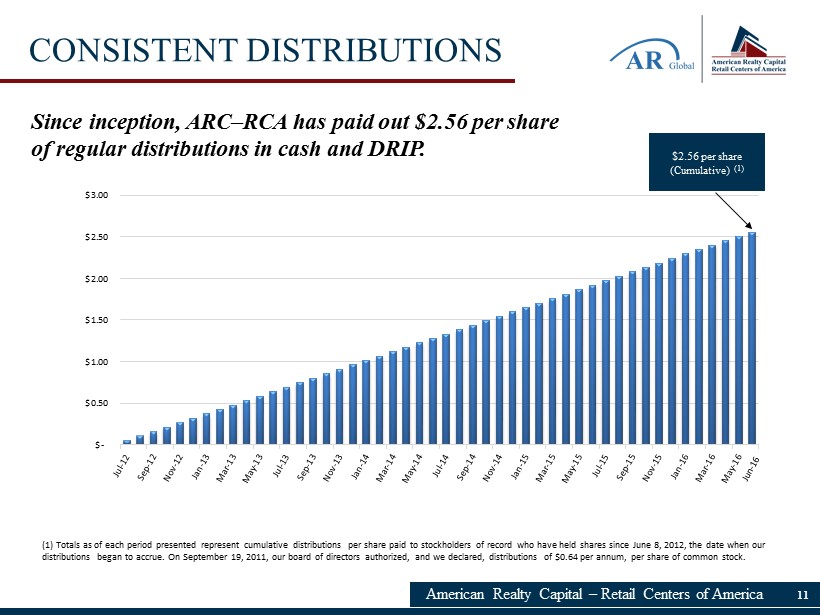

$- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 American Realty Capital – Retail Centers of America 11 Since inception, ARC – RCA has paid out $2.56 per share of regular distributions in cash and DRIP. CONSISTENT DISTRIBUTIONS $2.56 per share (Cumulative) (1) (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have h eld shares since June 8, 2012, the date when our distributions began to accrue. On September 19, 2011, our board of directors authorized, and we declared, distributions of $0 .64 per annum, per share of common stock.

American Realty Capital – Retail Centers of America 12 • On August 30 , 2016 , in consideration of an unsolicited proposal from American Finance Trust, Inc . (“AFIN”), an entity sponsored by AR Global Investments, LLC (“AR Global” or the “Parent of our Sponsor”), the parent of our sponsor, American Realty Capital IV, LLC (our “Sponsor”), relating to a potential strategic transaction with AFIN, the Company determined to suspend the Company’s distribution reinvestment plan (the “DRIP”) . The final issuance of common stock pursuant to the DRIP occurred in connection with the distribution paid on August 1 , 2016 . • On September 6 , 2016 , the Company and its operating partnership, American Realty Capital Retail Operating Partnership, L . P . (the “OP”), entered into an Agreement and Plan of Merger with AFIN, American Finance Operating Partnership, L . P . (the “AFIN OP”) and Genie Acquisition, LLC, a wholly owned subsidiary of AFIN (the “Merger Sub”), providing for the merger of the Company with the Merger Sub and the OP with the AFIN OP (together, the “Mergers”) . • On September 6 , 2016 , in contemplation of the Mergers, the Company’s board of directors determined to suspend the Company’s share repurchase program effective as of September 8 , 2016 . SUPPLEMENTAL INFORMATION

Our potential risks and uncertainties are presented in the section titled “Item 1A. Risk Factors” disclosed in our Annual Report on Form 10 - K for the year ended December 31, 2015 and updated in Quarterly Reports on Form 10 - Q from time to time. The following are some of the risks and uncertainties, although not all risks and uncertainties, that could cause our actual results to differ materially from those presented in our forward looking statements: • All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in American Re alty Capital Advisor, LLC (our “Advisor”), or other entities affiliated with AR Global. As a result, our executive officers, our A dvi sor and its affiliates face conflicts of interest, including conflicts created by our Advisor's and its affiliates' compensation arr angements with us and other investment programs advised by affiliates of the Parent of our Sponsor and conflicts in allocating time amo ng these investment programs and us, which could negatively impact our operating results. • Lincoln Retail and its affiliates have to allocate time between providing real estate - related services to our Advisor and other programs and activities in which they are presently involved or may be involved in the future. • The merger with AFIN is subject to certain conditions, including approval by stockholders of ARC - RCA and AFIN, and there is no assurance that the merger will be completed. • Failure to complete the merger could negatively impact the value of ARC - RCA common stock, and the future business and financial results of ARC - RCA. • We depend on tenants for revenue and, accordingly, our revenue is dependent upon the success and economic viability of our tenants. • Our tenants may not achieve the rental rate incentives in their lease agreements with us, which may impact our results of operations . • Increases in interest rates could increase the amount of our interest payments associated with our credit facility and limit our ability to pay distributions . American Realty Capital – Retail Centers of America 13 RISK FACTORS

• We are permitted to pay distributions of unlimited amounts from any source . There are no established limits on the amount of borrowings that we may use to fund distribution payments . • We have not generated, and in the future may not generate, operating cash flows sufficient to cover 100 % of our distributions, and, as such, to maintain the level of distributions, we may need to fund some portion of distributions from borrowings, which may be at unfavorable rates, or depend on our Advisor to waive reimbursement of certain expenses or fees . There is no assurance that our Advisor will waive reimbursement of expenses or fees . • We may be unable to maintain cash distributions at the current rate or increase distributions over time . • We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates . • No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid . • We are subject to risks associated with any dislocation or liquidity disruptions that may exist or occur in the credit markets of the United States of America . • We may fail to continue to qualify to be treated as a REIT for U . S . federal income tax purposes, which would result in higher taxes, may adversely affect our operations and would reduce the value of an investment in our common stock and the cash available for distributions . • We may be deemed to be an investment company under the Investment Company Act of 1940 , as amended (the "Investment Company Act"), and thus be subject to regulation under the Investment Company Act . American Realty Capital – Retail Centers of America 14 RISK FACTORS

▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com www.RetailCentersofAmerica.com