UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No._)

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

SUNSHINE FINANCIAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| 1) | Amount previously paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

SUNSHINE FINANCIAL, INC.

April 24, 2013

Dear Fellow Stockholder:

On behalf of the Board of Directors and management of Sunshine Financial, Inc., we cordially invite you to attend the annual meeting of Sunshine Financial, Inc. stockholders. The meeting will be held at 10:00 a.m., local time, on May 22, 2013, at our executive offices located at 1400 East Park Avenue, Tallahassee, Florida. The annual meeting will include management’s report to you on our fiscal year 2012 financial and operating performance.

The matters expected to be acted upon at the meeting are described in the accompanying notice of annual meeting of stockholders and proxy statement. An important aspect of the annual meeting process is the annual stockholder vote on corporate business items. I urge you to exercise your rights as a stockholder to vote and participate in this process.

We encourage you to attend the meeting in person. Whether or not you plan to attend, please complete, sign and date the enclosed proxy card and return it in the accompanying postpaid return envelope or vote electronically via the Internet or telephone. See “How do I vote?” in the proxy statement for more details. Your prompt response will save us additional expense in soliciting proxies and will ensure that your shares are represented at the meeting. Returning the proxy or voting electronically does NOT deprive you of your right to attend the meeting and to vote your shares in person for matters being acted upon at the meeting.

On behalf of your Board of Directors and management, I want to thank you for your attention to this important matter and express my appreciation for your confidence and support.

Very truly yours,

/s/ Louis O. Davis, Jr.

Louis O. Davis, Jr.

President and Chief Executive Officer

SUNSHINE FINANCIAL, INC.

1400 East Park Avenue

Tallahassee, Florida 32301

(850) 219-7200

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 22, 2013

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of Sunshine Financial, Inc. will be held at our executive offices located at 1400 East Park Avenue, Tallahassee, Florida, on May 22, 2013, at 10:00 a.m., local time.

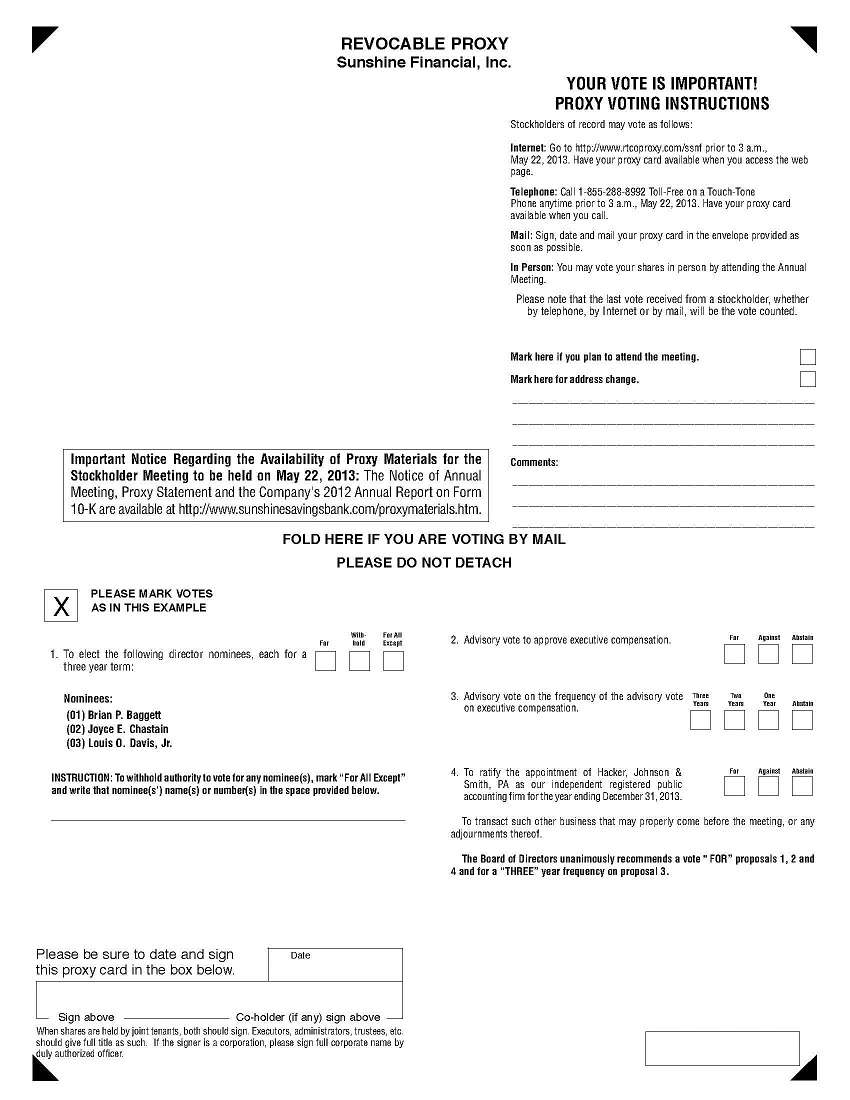

At the annual meeting, stockholders of Sunshine Financial will be asked to consider and vote upon:

(1) (2) | The election of three directors, each of whom shall be elected for a term of three years; An advisory (non-binding) vote on executive compensation; |

| (3) | An advisory (non-binding) vote on whether an advisory vote on executive compensation should be held every one year, every two years or every three years; and |

| (4) | Ratification of the appointment of Hacker, Johnson & Smith, PA as the Company’s independent registered public accounting firm for the year ending December 31, 2013. |

Your Board of Directors recommends that you vote “FOR” each of the foregoing proposals.

Stockholders also will transact any other business that may properly come before the annual meeting and any adjournments thereof. As of the date of this proxy statement, we are not aware of any other business to come before the annual meeting.

The Board of Directors has fixed the close of business on March 28, 2013, as the record date for the annual meeting. This means that stockholders of record at the close of business on that date are entitled to receive notice of and to vote at the annual meeting and any adjournments thereof.

The Annual Report on Form 10-K, which is not a part of the proxy soliciting materials, accompanies this notice of annual meeting of stockholders, proxy statement and form of proxy, which is first being mailed to stockholders on or about April 24, 2013.

It is important that your shares be represented and voted at the annual meeting. You can vote your shares by completing and returning the enclosed proxy card. Registered stockholders, that is, stockholders who hold their stock in their own name, can also vote their shares over the Internet or by telephone. If Internet or telephone voting is available to you, voting instructions are printed on the proxy card sent to you. Regardless of the number of shares you own, your vote is very important. Please act today.

Thank you for your continued interest and support.

By Order of the Board of Directors

/s/ Brian P. Baggett

Brian P. Baggett

Corporate Secretary

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 22, 2013: This Notice of Annual Meeting of Stockholders, the attached proxy statement and the Company’s 2012 Annual Report on Form 10-K are available at http://www.sunshinesavingsbank.com/proxymaterials.htm. |

SUNSHINE FINANCIAL, INC.

1400 East Park Avenue

Tallahassee, Florida 32301

(850) 219-7200

____________________

PROXY STATEMENT

____________________

ANNUAL MEETING OF STOCKHOLDERS

To be held on May 22, 2013

____________________

INTRODUCTION

The Sunshine Financial, Inc. Board of Directors is using this proxy statement to solicit proxies from the holders of common stock of Sunshine Financial, Inc. for use at Sunshine Financial, Inc.’s annual meeting of stockholders and any adjournments thereof. The notice of annual meeting of stockholders, this proxy statement and the enclosed form of proxy are first being mailed to our stockholders on or about April 24, 2013. References to Sunshine Financial, the Company, we, us and our, refer to Sunshine Financial, Inc., and as the context requires, Sunshine Savings Bank. Sunshine Savings Bank is the wholly-owned subsidiary of Sunshine Financial.

INFORMATION ABOUT THE ANNUAL MEETING

What is the date, time and place of the annual meeting?

Our annual meeting will be held as follows:

Date: | May 22, 2013 |

Time: | 10:00 a.m., local time |

Place: | Executive Offices of Sunshine Financial |

| 1400 East Park Avenue | |

| Tallahassee, Florida |

What matters will be considered at the annual meeting?

At the annual meeting, stockholders will be asked to vote on the following proposals:

| Proposal 1-- | Election of three directors of the Company; | |

| Proposal 2 -- | An advisory (non-binding) vote on executive compensation; | |

| Proposal 3 -- | An advisory (non-binding) vote on whether an advisory vote on executive compensation should be held every one year, every two years or every three years; and | |

| Proposal 4 -- | Ratification of the appointment of Hacker, Johnson & Smith, PA as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. |

Stockholders also will transact any other business that may properly come before the meeting. Members of our management team will be present at the meeting to respond to appropriate questions from stockholders.

How does the Board of Directors recommend that I vote?

The Board of Directors recommends that you vote:

| • | FOR the election of the director nominees named in this proxy statement; |

| • | FOR the advisory vote on executive compensation; |

| • | FOR THREE YEARS on the frequency of the advisory vote on executive compensation; and |

| • | FOR the ratification of the appointment of Hacker, Johnson & Smith, PA as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. |

Who is entitled to vote?

The Board of Directors has fixed the close of business on March 28, 2013, as the record date for the annual meeting. Only stockholders of record of Sunshine Financial common stock on that date are entitled to receive notice of and to vote at the annual meeting and any adjournments thereof. Each stockholder of record on March 28, 2013, will be entitled to one vote for each share of Sunshine Financial common stock held. On March 28, 2013, there were 1,234,454 shares of Sunshine Financial common stock issued and outstanding and entitled to vote at the annual meeting.

What if my shares are held in “street name” by a broker, bank or other nominee?

If you are the beneficial owner of shares held in “street name” by a broker, bank or other nominee, your nominee, as the record holder of the shares, is required to vote the shares in accordance with your instructions. If you do not give instructions to your nominee, your nominee may nevertheless vote the shares with respect to “discretionary” items, but will not be permitted to vote your shares with respect to “non-discretionary” items, pursuant to current industry practice.

How will shares of common stock held in Sunshine Financial’s Employee Stock Ownership Plan be voted?

We maintain an employee stock ownership plan which beneficially owned approximately 8.0% of the Company’s common stock as of the record date. Employees of the Company and Sunshine Savings Bank participate in the employee stock ownership plan. Each participant may instruct the trustee of the plan how to vote the shares of common stock allocated to his or her account under the employee stock ownership plan. If a participant properly executes the voting instruction card distributed by the trustee, the trustee will vote the participant’s shares in accordance with the instructions. Where properly executed voting instruction cards are returned to the trustee with no specific instruction as to how to vote at the annual meeting, the trustee will vote the shares “FOR” the election of the director nominees named in this proxy statement, “FOR the advisory vote on executive compensation, “FOR THREE YEARS” on the frequency of the advisory vote on executive compensation and “FOR” the ratification of the appointment of Hacker, Johnson & Smith, PA. In the event the participant fails to give timely voting instructions to the trustee with respect to the voting of the common stock that is allocated to his or her employee stock ownership plan account, and in the case of shares held in the employee stock ownership plan but not allocated to any participant’s account, the trustee will vote such shares in the same proportion as directed by the participants who directed the trustee as to the manner of voting their allocated shares in the employee stock ownership plan with respect to each proposal.

2

How many shares must be present to hold the meeting?

A quorum must be present at the meeting for any business to be conducted. The presence at the meeting, in person or by proxy, of the holders of one-third of the shares of Sunshine Financial common stock outstanding on the record date will constitute a quorum. Abstentions and broker “non-votes” will be included in determining the presence of a quorum at the annual meeting.

What if a quorum is not present at the meeting?

If a quorum is not present at the scheduled time of the meeting, a majority of the stockholders present or represented by proxy may adjourn the meeting until a quorum is present. The time and place of the adjourned meeting will be announced at the time the adjournment is taken, and no other notice will be given. An adjournment will have no effect on the business that may be conducted at the meeting.

How do I vote?

1. You may vote by mail. If you properly complete and sign the accompanying proxy card and return it in the enclosed envelope, it will be voted in accordance with your instructions.

2. You may vote by telephone. If you are a registered stockholder, that is, if you hold your stock in your own name, you may vote by telephone by following the instructions included with the proxy card. If you vote by telephone, you do not have to mail in your proxy card.

3. You may vote on the internet. If you are a registered stockholder, that is, if you hold your stock in your own name, you may vote on the Internet by following the instructions included with the proxy card. If you vote on the Internet, you do not have to mail in your proxy card.

4. You may vote in person at the meeting. If you plan to attend the annual meeting and wish to vote in person, we will give you a ballot at the annual meeting. However, if your shares are held in the name of your broker, bank or other nominee, you will need to obtain a proxy form from the institution that holds your shares indicating that you were the beneficial owner of Sunshine Financial common stock on March 28, 2013, the record date for voting at the annual meeting.

Can I vote by telephone or on the Internet if I am not a registered stockholder?

If your shares are held in “street name” by a broker or other nominee, you should check the voting form used by that firm to determine whether you will be able to vote by telephone or on the Internet.

Can I change my vote after I submit my proxy?

If you are a registered stockholder, you may revoke your proxy and change your vote at any time before the polls close at the meeting by:

| • | signing another proxy with a later date; |

| • | voting by telephone or on the Internet – your latest telephone or Internet vote will be counted; |

| • | giving written notice of the revocation of your proxy to the Secretary of the Company prior to the annual meeting; or |

| • | voting in person at the annual meeting. |

If you have instructed a broker, bank or other nominee to vote your shares, you must follow directions received from your nominee to change those instructions.

3

What if I do not specify how my shares are to be voted?

If you submit an executed proxy but do not indicate any voting instructions, your shares will be voted:

| • | FOR the election of the director nominees to the Company’s Board of Directors; |

| • | FOR the advisory vote on executive compensation; |

| • | FOR THREE YEARS on the advisory vote on the frequency of the advisory vote on executive compensation; and |

| • | FOR the ratification of the appointment of Hacker, Johnson & Smith, PA as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013. |

Will any other business be conducted at the annual meeting?

The Board of Directors knows of no other business that will be conducted at the meeting. If any other proposal properly comes before the stockholders for a vote at the meeting, however, the proxy holders will vote your shares in accordance with their best judgment.

How many votes are required to approve the proposals?

Directors are elected by a plurality of the votes cast, which means that the director nominees who receive the highest number of votes for the positions to be filled will be elected. The advisory vote on executive compensation and the ratification of the appointment of Hacker, Johnson & Smith, PA each requires the affirmative vote of a majority of the votes cast on the matter. With respect to the advisory vote on the frequency of the advisory vote on executive compensation, the choice receiving the greatest number of votes – one year, two years or three years – will be the frequency that stockholders will be deemed to have approved.

How will withheld votes and abstentions be treated?

If you withhold authority to vote for one or more director nominees or if you abstain from voting on any of the other proposals, your shares will be included for purposes of determining whether a quorum is present at the meeting. Abstentions will not be counted in determining the number of shares necessary for approval of the advisory votes on executive compensation and on the frequency of the advisory vote on executive compensation, or for the ratification of the appointment of the Company’s independent auditors and will, therefore, reduce the absolute number, but not the percentage, of the affirmative votes required for the approval of each of these proposals.

How will broker non-votes be treated?

Shares treated as broker non-votes on one or more proposals will be included for purposes of calculating the presence of a quorum. Otherwise, shares represented by broker non-votes will be treated as shares not entitled to vote on a proposal. Consequently, any broker non-votes will have the following effects:

| Proposal 1. | Broker non-votes will have no effect on the election of directors. | |

| Proposals 2, 3 and 4. | Broker non-votes will not be counted in determining the number of shares necessary for approval of the advisory votes on executive compensation and on the frequency of the advisory vote on executive compensation, or for the ratification of the appointment of the Company’s independent auditors and will, therefore, reduce the absolute number, but not the percentage, of the affirmative votes required for the approval of each of these proposals. |

4

STOCK OWNERSHIP OF SUNSHINE FINANCIAL, INC.

COMMON STOCK

Stock Ownership of Directors and Executive Officers

The following table presents information regarding the beneficial ownership of Sunshine Financial common stock as of March 28, 2013, by:

| · | those persons or entities (or group of affiliated persons or entities) known by management to beneficially own more than five percent of the outstanding common stock of Sunshine Financial; |

| · | each director and director nominee of Sunshine Financial; |

| · | each named executive officer of Sunshine Financial set forth in the “Summary Compensation Table” herein; and |

| · | all of the executive officers and directors of Sunshine Financial as a group. |

The persons named in this table have sole voting and dispositive power for all shares of common stock shown as beneficially owned by them, except as indicated in the footnotes to this table. The address of each beneficial owner named in the table, except where otherwise indicated, is the same address as Sunshine Financial. An asterisk (*) in the table indicates that an individual beneficially owns less than one percent of the outstanding common stock of Sunshine Financial. As of March 28, 2013, there were 1,234,454 shares of Sunshine Financial common stock outstanding.

Amount and Nature of Common Stock Beneficially Owned | ||||||||

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class | ||||||

| Beneficial Owners of More Than 5% | ||||||||

Stilwell Value Partners II, L.P., Stilwell Value Partners VII, L.P. Stilwell Partners, L.P. and Joseph Stilwell(1) 111 Broadway, 12th Floor New York, NY 10006 | 120,600 | 9.8 | % | |||||

| Sunshine Financial Employee Stock Ownership Plan | 98,591 | 7.9 | % | |||||

Sandler O’Neill Asset Management, LLC and Terry Maltese(2) 780 Third Avenue, 30th Floor New York, NY 10017 | 96,284 | 7.8 | % | |||||

Wellington Management Company, LLP(3) 280 Congress Street Boston, MA 02210 | 85,300 | 6.9 | % | |||||

Farley Capital II L.P, Stephen Farley LLC and Stephen L. Farley(4) 800 Third Avenue, Suite 2305 New York, New York 10022 | 80,810 | 6.6 | % | |||||

5

Amount and Nature of Common Stock Beneficially Owned | ||||||||

| Name of Beneficial Owner | Number of Shares Beneficially Owned | Percent of Class | ||||||

Ithan Creek Master Investors (Cayman) LP(5) Wellington Hedge Management, LLC 280 Congress Street Boston, MA 02210 | 70,800 | 5.7 | % | |||||

| Directors, Director Nominees and Executive Officers | ||||||||

Benjamin F. Betts Chairman of the Board | 4,500 | * | ||||||

Louis O. Davis, Jr. Director/President and Chief Executive Officer | 16,074 | (6) | 1.3 | % | ||||

Brian P. Baggett Director/Executive Vice President | 7,299 | (7) | * | |||||

Robert K. Bacon Director/Director Nominee | --- | * | ||||||

Joyce E. Chastain Director | 100 | * | ||||||

Patrick E. Lyons Director | 100 | * | ||||||

Doris K. Richter Director | 1,000 | * | ||||||

Fred G. Shelfer, Jr. Director/Director Nominee | --- | * | ||||||

Scott A. Swain Senior Vice President/Chief Financial Officer | 5,713 | (8) | * | |||||

All directors, director nominees and executive officers of Sunshine Financial as a group (9 persons) | 35,786 | (9) | 2.9 | % | ||||

| (1) | As reported in the Schedule 13D/A filed with the SEC on March 25, 2013, jointly by Stilwell Value Partners II, L.P., Stilwell Value Partners VII, L.P., Stilwell Partners, L.P., Stilwell Value LLC and Joseph Stilwell (collectively, the “Stilwell Group”), The Stilwell Group reported having shared voting and dispositive power with respect to all 120,600 shares. |

| (2) | As reported in the Schedule 13G/A filed with the SEC on February 14, 2013, by Sandler O’Neill Asset Management LLC (“SOAM”) and Terry Maltese, Managing Member of SOAM. SOAM reported shared voting and dispositive power with respect to 70,000 shares; and Mr. Maltese reported sole voting and dispositive power with respect to 26,284 shares and, as the Managing Member of SOAM, shared voting and dispositive power with respect to 70,000 shares. |

| (3) | As reported in the Schedule 13G filed with the SEC on February 14, 2012, by Wellington Management Company, LLP, which reported shared voting and dispositive power with respect to all shares beneficially owned. |

| (4) | As reported in the Schedule 13G/A filed with the SEC on February 14, 2013 by Farley Capital II L.P., Stephen Farley LLC and Stephen L. Farley, each reported shared voting and dispositive power with respect to 80,810 shares. Farley Associates II LLC and Labrador Partners L.P. each reported shared voting and dispositive power with respect to 49,072 shares and FA Newfoundland LLC and Newfoundland Partners L.P each reported shared voting and dispositive power with respect to 16,832 shares. |

6

| (5) | As reported in the Schedule 13G/A filed February 14, 2012, by Wellington Hedge Management, LLC (“Wellington”), in its capacity as the sole general partner of Ithan Creek Master Investors (Cayman) L.P. (“ICMI”), the record owner of the shares. Wellington and ICMI reported having shared voting and dispositive power with respect to all 63,700 shares. |

| (6) | Includes 1,619 shares allocated to Mr. Davis in the Employee Stock Ownership Plan. |

| (7) | Includes 5,467 shares held in Mr. Baggett’s 401(k) account and 1,307 shares allocated to Mr. Baggett in the Employee Stock Ownership Plan. |

| (8) | Includes 963 shares allocated to Mr. Swain in the Employee Stock Ownership Plan. |

| (9) | Includes shares held by directors and executive officers directly, in retirement accounts, in a fiduciary capacity or by certain affiliated entities or members of the named individuals’ families, with respect to which shares the named individuals and group may be deemed to have sole or shared voting and/or dispositive powers. |

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Board of Directors consists of eight members. Approximately one-third of the directors are elected annually to serve for a three-year period or until their respective successors are elected and qualified.

The table below sets forth information regarding our Board of Directors, including their age, position with Sunshine Financial and term of office. The “Director Since” column includes service on the Board of Directors of Sunshine Savings Bank (and its predecessor) as well as service on Sunshine Financial’s Board of Directors.

The Board of Directors selects nominees for election as directors, based on the recommendation of the Nominating Committee. Brian P. Baggett, Joyce E. Chastain and Louis O. Davis, Jr. have been nominated for election to the Board of Directors for a three year term. Each nominee has consented to being named in this proxy statement and has agreed to serve if elected. If a nominee is unable to stand for election, the Board of Directors may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the proxy holders will vote your shares for the substitute nominee, unless you have withheld authority. At this time, we are not aware of any reason why a nominee might be unable to serve if elected. Except as disclosed in this proxy statement, there are no arrangements or understandings between any nominee and any other person pursuant to which such nominee was selected. The Board of Directors recommends you vote “FOR” each of management’s director nominees.

| Name | Age(1) | Position(s) Held | Director Since | Term Expires | ||||

| Director Nominees | ||||||||

| Brian P. Baggett | 49 | Director and Executive Vice President | 2007 | 2016 | ||||

| Joyce E. Chastain | 59 | Director | 2012 | 2016 | ||||

| Louis O. Davis, Jr. | 66 | Director, President and CEO | 2007 | 2016 | ||||

| Continuing Directors | ||||||||

| Robert K. Bacon | 58 | Director | 2012 | 2015 | ||||

| Fred G. Shelfer, Jr | 65 | Director | 2012 | 2015 | ||||

| Benjamin F. Betts, Jr. | 71 | Chairman of the Board | 2008 | 2014 | ||||

| Patrick E. Lyons | 48 | Director | 1997 | 2014 | ||||

| Doris K. Richter | 66 | Director | 2002 | 2014 | ||||

_______________________________

(1) As of December 31, 2012.

7

Business Experience and Qualification of Directors

The business experience of each director for at least the past five years is set forth below. The biographies also contain information regarding the person’s experience, qualifications, attributes or skills that caused the Nominating Committee and the board of directors to determine that the person should serve as a director. Unless otherwise indicated, directors and executive officers have held their positions for the past five years.

Brian P. Baggett. Mr. Baggett serves as the Executive Vice President and Corporate Secretary of Sunshine Financial, positions he has held since its formation in 2010. Mr. Baggett serves as the Executive Vice President and Chief Lending Officer of Sunshine Savings Bank, positions he has held since its formation in 2007. He has been employed Sunshine Savings Bank, including its predecessor organization, for the last 20 years, and with Sunshine Financial since its incorporation in 2010. His current responsibilities include overseeing the lending department and bank administration. He has overseen all major areas of Sunshine Savings Bank.

Mr. Baggett’s affiliation with Sunshine Savings for over 20 years has provided him with strong leadership and managerial skills, as well as an in-depth knowledge and understanding of our history, operations and customer base.

Joyce E. Chastain. Ms. Chastain has served as the Human Resources Consultant for Mainline Information Systems of Tallahassee, Florida since 2004, an IBM reseller with 750 employees in 50 states. Ms. Chastain also is the owner of Chastain Consulting which provides human resource and personnel management services to local companies in the north Florida and south Georgia areas. Since 2009, she has been a member of the Executive Board of the HR Florida State Council, a non-profit accrediting association of human resource professionals.

Ms. Chastain’s career knowledge and experience in human resource issues, includes negotiating compensation plans, benefit plans and dealing with state and federal labor laws. Her expertise will provide a considerable benefit to our Board in labor and employment issues.

Louis O. Davis, Jr. Mr. Davis serves as the President and Chief Executive Officer of Sunshine Financial, a position he has held since its formation in 2010. Mr. Davis also serves as the President and Chief Executive Officer of Sunshine Savings Bank (including its predecessor entity), a position he has held since 2005. He has over 30 years of experience managing thrifts in Florida, including serving as President and Chief Executive Officer of First Bank of Florida and its publicly-traded holding company, First Palm Beach Bancorp. Mr. Davis also held senior management positions with First Federal of the Palm Beaches, a mutual thrift in West Palm Beach, Florida.

Mr. Davis’ over 30 years of banking experience, as well as his experience in running a public company, have provided him with strong leadership and managerial skills, as well as a deep understanding of the financial industry, capital markets and the Florida marketplace, all which position him well to serve as our President and Chief Executive Officer.

Robert K. Bacon. Mr. Bacon is the President and Chief Executive Officer of the Earl Bacon Agency, Inc., one of North Florida’s oldest and largest independent insurance agencies, and where he has worked since 1981. He is a graduate of the Florida State University with a Bachelor’s Degree in Accounting. In addition, Mr. Bacon is a Certified Public Accountant and has earned the following designations: Personal Financial Specialist, Chartered Property Casualty Underwriter and Certified Public Pension Trustee. Mr. Bacon holds multiple insurances licenses in the State of Florida and a FINRA Series-7 Securities license. He previously served as an advisory director for a large regional bank. He has also been an organizer and founding director of a local community bank and chaired its Audit Committee. In addition, Mr. Bacon

8

served ten years on the audit committee for the City of Tallahassee and six years on the audit committee for the Leon County Government.

Mr. Bacon’s extensive and varied knowledge of accounting, insurance and investing provides the Board with experience and expertise in areas that directly influence the future profitability of the Company. His first hand knowledge of, and thirty year involvement in, the local business community will provide important guidance and direction to our Company.

Fred G. Shelfer, Jr. Mr. Shelfer has been the President and CEO of Goodwill Industries - Big Bend, Inc., since 2004, a 501(c)3 nonprofit organization with a mission to provide job training, education, and employment to people with disabilities and other barriers to employment. Previously he has held Florida real estate brokerage and insurance licenses and was the developer of several multifamily housing and golf course communities in the Tallahassee area. He currently is an investor in several commercial shopping centers in Tallahassee. Mr. Shelfer received a BA from Emory University in Atlanta.

Mr. Shelfer’s first hand knowledge of local building codes and commercial development activities provides significant oversight capability for our future participation in commercial and residential lending activities.

Benjamin F. Betts, Jr. Mr. Betts is the Chairman of the Board of Directors of Sunshine Financial and Sunshine Savings Bank. Mr. Betts is a Certified Public Accountant. He is currently a partner in the Tallahassee, Florida office of the regional Certified Public Accounting firm of Carr, Riggs & Ingram, LLC.

Mr. Betts was originally nominated as a director because of his accounting expertise and experience. Mr. Betts’ expertise also qualifies him as a financial expert, which was the basis of his selection as chairman of the Audit Committee.

Patrick E. Lyons. Mr. Lyons is a law enforcement officer for the Leon County Sheriff's Office. He has held that position since 1998. He has also been a Certified General Contractor in the State of Florida since 2008. Prior to that, Mr. Lyons was employed by Sunshine State Credit Union for 12 years.

Mr. Lyons’ 24 years of service with Sunshine Savings Bank, and its predecessor, Sunshine State Credit Union, first as an employee and then as a director, gives him an in-depth knowledge and understanding of our history, operations and customer base. In addition, as a law enforcement officer, Mr. Lyon’s has developed strong interpersonal skills and extensive experience in the area of security, which he draws upon for his service on our board.

Doris K. Richter. Mrs. Richter is President and owner of VIP Travel and Tours, Inc., a full-service travel agency located in Tallahassee, Florida. Mrs. Richter has been with VIP Travel and Tours, Inc. since 1991. Mrs. Richter’s 8 years of service as a director of Sunshine Savings Bank and its predecessor, Sunshine State Credit Union, provide her with a strong knowledge and understanding of the institution’s business, history and market area. Mrs. Richter’s 19 years of running a successful business has provided her with strong leadership, management and administrative skills which are valuable to our organization.

9

CORPORATE GOVERNANCE

Director Independence

The Board of Directors of Sunshine Financial has determined that all of its directors, with the exception of Louis O. Davis, Jr. and Brian P. Baggett, each of whom is a current officer of the Company, are “independent directors,” as that term is defined by the applicable listing standards of the Nasdaq Marketplace Rules and by the Securities and Exchange Commission. These independent directors are Robert K. Bacon, Benjamin F. Betts, Jr., Joyce E. Chastain, Patrick K. Lyons, Doris K. Richter and Fred G. Shelfer, Jr. The Board of Directors has made a subjective determination as to each independent director that no relationships exist that, in the opinion of the Board, would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director. In making these determinations, the directors reviewed and discussed information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to the Company and its management.

Board Leadership Structure

The Board of Directors has placed the responsibilities of Chairman with an independent nonexecutive member of the Board which we believe provides better accountability between the Board and our management team. We believe it is beneficial to have an independent Chairman whose sole responsibility to us is leading our Board members as they provide leadership to our executive team. Our Chairman is responsible for providing leadership to the Board and facilitating communication among the directors; setting the Board meeting agendas in consultation with the President and CEO; and presiding at Board meetings and executive sessions. This delineation of duties allows the President and CEO to focus his attention on managing the day-to-day business of the Company. We believe this structure provides strong leadership for our Board, while positioning our President and CEO as the leader of the Company in the eyes of our customers, employees and other stakeholders.

Board Role in Risk Oversight

As part of its overall responsibility to oversee the management, business and strategy of our company, one of the primary responsibilities of our Board of Directors is to oversee the amounts and types of risk taken by management in executing the corporate strategy, and to monitor our risk experience against the policies and procedures set to control those risks. The Board’s risk oversight function is carried out through its approval of various policies and procedures, such as our lending and investment polices; ratification or approval of investments and loans exceeding certain thresholds; and regular review of risk elements such as interest rate risk exposure, liquidity and problem assets. Some oversight functions are delegated to committees of the Board, with such committees regularly reporting to the full board the results of their oversight activities. For example, the Audit Committee is responsible for oversight of the independent auditors and meets directly with the auditors at various times during the course of the year.

Board Meetings and Committees

The Board of Directors of Sunshine Financial generally meets quarterly and the Board of Directors of Sunshine Savings Bank, its wholly-owned operating subsidiary, generally meets monthly. During 2012, the Sunshine Financial Board held five meetings and the Sunshine Savings Bank Board held 14 meetings. During 2012, no director during the period that he or she served attended less than 75% of the Sunshine Financial Board meetings, Sunshine Savings Bank Board meetings and any committees thereof on which he or she served.

10

We have standing Executive, Audit, Compensation and Nominating Committees. During 2012, the Executive Committee was comprised of Directors Betts, Davis and Shelfer. The Audit Committee was comprised of Directors Betts (Chair), Bacon, Lyons and Richter. The Compensation Committee was comprised of Directors Chastain (Chair), Bacon, Lyons and Shelfer. The Nominating Committee was comprised of Directors Richter (Chair), Betts and Shelfer.

Executive Committee. The Executive Committee acts on behalf of the entire board in between regularly scheduled meetings. This Committee met two times in 2012.

Audit Committee. The Audit Committee operates under a formal written charter adopted by the Board of Directors. The Audit Committee is appointed by the Board of Directors to provide assistance to the Board in fulfilling its oversight responsibility relating to the integrity of our consolidated financial statements and the financial reporting processes, the systems of internal accounting and financial controls, compliance with legal and regulatory requirements, the annual independent audit of our consolidated financial statements, the independent auditors’ qualifications and independence, the performance of our internal audit function and independent auditors and any other areas of potential financial risk to Sunshine Financial specified by its Board of Directors. The Audit Committee also is responsible for the appointment, retention and oversight of our independent auditors, including pre-approval of all audit and non-audit services to be performed by the independent auditors, and for the review and approval, on an ongoing basis, of all related party transactions for potential conflict of interest situations. The Audit Committee Report appears on page 17 of this proxy statement.

All members of the Audit Committee (i) are independent as defined under Rule 4200 (a)(15) of the Nasdaq Marketplace Rules; (ii) meet the criteria for independence set forth in SEC Rule 10A-3(b)(1); (iii) have not participated in the preparation of the financial statements of Sunshine Financial or any of its current subsidiaries at any time during the past three years; and (iv) are able to read and understand fundamental financial statements, including our balance sheet, income statement, and cash flow statement. The Board of Directors has determined that Director Betts is an “audit committee financial expert” as defined in Item 407(e) of Regulation S-K of the Securities and Exchange Commission and that all of the Audit Committee members meet the financial literacy requirements under the Nasdaq listing standards. The Audit Committee is scheduled to meet at least quarterly and on an as-needed basis. The Audit Committee met eight times during 2012. The Audit Committee of Sunshine Financial also serves as the audit committee of Sunshine Savings Bank.

Compensation Committee. The Compensation Committee operates under a formal written charter adopted by the Board of Directors. The Company’s Compensation Committee and the Bank’s Compensation Committee, which have identical membership, are collectively responsible for determining compensation to be paid to the Bank’s officers and employees, which are based on the recommendation of supervisors, including the President and Chief Executive Officer. Officers Davis and Baggett are not present during voting or deliberations concerning their compensation. All members of the Compensation Committee are independent as defined under the Nasdaq Marketplace Rules. During 2012, the Compensation Committee held nine meetings.

Nominating Committee. The Nominating Committee operates under a formal written charter adopted by the Board of Directors. The Nominating Committee is responsible for identifying individuals qualified to serve as board members and recommending to the Board of Directors the director nominees for election or appointment to the Board of Directors. Final approval of director nominees is determined by the full Board, based on the recommendation of the Nominating Committee.

The Nominating Committee recommends candidates (including incumbents) for election and appointment to the Board of Directors, subject to the provisions set forth in the Company’s articles of incorporation, bylaws and charter, based on the following criteria: business experience, education, integrity and

11

reputation, independence, conflicts of interest, diversity, age, number of other directorships and commitments (including charitable obligations), tenure on the Board, attendance at Board and committee meetings, stock ownership, specialized knowledge (such as an understanding of banking, accounting, marketing, finance, regulation and public policy) and a commitment to the Company’s communities and shared values, as well as overall experience in the context of the needs of the Board as a whole. Nominations from stockholders will be considered and evaluated using the same criteria as all other nominations.

Nominations, other than those made by the Board of Directors after its review of the recommendations of the Nominating Committee, must be made pursuant to timely notice in writing to the Corporate Secretary as set forth in the Company’s bylaws. In general, to be timely, a stockholder’s notice must be received by the Company not less than 90 days nor more than 120 days prior to the date of the scheduled annual meeting; however, if less than 100 days’ notice of the date of the scheduled annual meeting is given by the Company, the stockholder has until the close of business on the tenth day following the day on which notice of the date of the scheduled annual meeting was made. In addition to meeting the applicable deadline, nominations must be accompanied by certain information specified in the Company’s bylaws.

The foregoing description is a summary of the Company’s nominating process. Any stockholder wishing to propose a director candidate to the Company should review and must comply in full with the procedures set forth in the Company’s articles of incorporation and bylaws, and Maryland law.

All members of the Nominating Committee are independent as defined in the Nasdaq Marketplace Rules. The Company’s Nominating Committee met once during 2012.

Committee Charters. The full responsibilities of the Audit, Compensation and Nominating Committees are set forth in their charters, which are posted in the “Investor Relations” section under the “About Us” heading on our website at www.sunshinesavingsbank.com.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics which applies to all of our directors, officers and employees, including directors, officers and employees of our subsidiaries and affiliates. Our Code of Business Conduct and Ethics is posted in the “Investor Relations” section under the “About Us” heading on our website at www.sunshinesavingsbank.com.

Stockholder Communications with Directors

Stockholders may communicate directly with the Board of Directors, or any individual Board member, by sending written communications to the Company, addressed to the Chairman of the Board or such individual Board member.

Board Member Attendance at Annual Stockholder Meetings

Although the Company does not have a formal policy regarding director attendance at annual stockholder meetings, directors are expected to attend these meetings absent extenuating circumstances. All of our directors were in attendance at last year’s annual stockholder meeting.

12

COMPENSATION OF EXECUTIVE OFFICERS

Summary Compensation Table

The following table sets forth information concerning the annual compensation for services provided to us during the periods indicated by our Chief Executive Officer and our two other most highly compensated executive officers. We refer to the individuals listed in the table below as the named executive officers.

Name and Principal Position | Year | Salary | Bonus | Stock Awards | Option Awards(1) | All Other Compensation | Total | ||||||||||||||||||

| Louis O. Davis, Jr. | 2012 | $ | 204,700 | $ | 355 | --- | $ | 27,500 | $ | 13,657 | (3) | $ | 246,212 | ||||||||||||

| President and Chief | 2011 | 197,512 | 355 | --- | --- | 9,701 | 207,568 | ||||||||||||||||||

| Executive Officer | |||||||||||||||||||||||||

| Brian P. Baggett | 2012 | $ | 162,052 | $ | 355 | --- | $ | 37,600 | $ | 16,562 | (3) | $ | 216,569 | ||||||||||||

| Executive Vice President | 2011 | 163,753 | (2) | 355 | --- | --- | 13,786 | 177,894 | |||||||||||||||||

| Scott A. Swain | 2012 | $ | 120,000 | $ | 355 | --- | $ | 37,600 | $ | 12,347 | (3) | $ | 170,302 | ||||||||||||

| Chief Financial Officer | 2011 | 119,745 | (2) | 355 | --- | --- | 10,215 | 130,315 | |||||||||||||||||

| (1) | The amounts in this column are calculated using the grant date fair values of the awards under ASC Topic 718, based on the fair value of the stock option awards, as estimated using the Black-Scholes option-pricing model. The assumptions used in the calculation of these amounts are included in Note 15 of the Notes to Consolidated Financial Statements contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012 filed with the SEC. |

| (2) | Includes $3,332 and $2,914 paid to Messrs. Baggett and Swain for unused vacation/ sick leave during 2010 paid in 2011. |

| (3) | The amounts represented for the year ended December 31, 2012, consist of the following (no executive officer received personal benefits or perquisites exceeding $10,000 in the aggregate): |

| Form of Compensation | Louis O. Davis, Jr. | Brian P. Baggett | Scott A. Swain | |||||||||

| 401(k) matching contribution | $ | --- | $ | 8,103 | $ | 6,026 | ||||||

| Life insurance premiums | 3,782 | 638 | 525 | |||||||||

| Employee stock ownership plan allocation | 9,875 | 7,821 | 5,796 | |||||||||

| Total | $ | 13,657 | $ | 16,562 | $ | 12,347 | ||||||

Outstanding Equity Awards at December 31, 2012

The following table sets forth information for each named executive officer concerning stock options and restricted stock held at December 31, 2012.

| Options Awards | Stock Awards | ||||||||||||||||||||

| Name | Number of Securities Underlying Unexercised Options | Option Exercise Price | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested | Market Value of Shares or Units of Stock That Have Not Vested | ||||||||||||||||

| Exercisable | Unexercisable | ||||||||||||||||||||

| Louis O. Davis, Jr. | --- | 10,000 | (1) | $ | 10.75 | 12/10/2022 | --- | --- | |||||||||||||

| Brian P. Baggett | --- | 10,000 | (2) | $ | 10.75 | 12/10/2022 | --- | --- | |||||||||||||

Scott A. Swain | --- | 10,000 | (2) | $ | 10.75 | 12/10/2022 | --- | --- | |||||||||||||

| (1) Non-qualified stock option; vests in full on December 31, 2013. |

| (2) Non-qualified stock option; vests in full on December 10, 2017. |

13

Employment Agreements. Effective January 1, 2008, Sunshine Savings Bank entered into an employment agreement with Mr. Davis, which has a three-year term with continuing annual extensions, subject to approval by the Board of Directors. Under the terms of this agreement, Mr. Davis’ minimum base salary is $178,000. The amount of annual base salary is reviewed by the Compensation Committee each year. The employment agreement also provides for the payment of club fees; life insurance; fully paid health, dental and long-term disability insurance; participation in any retirement plans; and participation in any other executive compensation plan. Mr. Davis also is entitled to expense reimbursement, professional and educational dues, expenses for programs related to Sunshine Savings Bank operations, including travel costs.

Under the employment agreement, if Mr. Davis’ employment is terminated for any reason other than cause, death, or disability, or if Mr. Davis terminates his employment for good reason, he will be entitled to his salary for the remaining term of the agreement and continued eligibility under the health benefit programs for executive officers. The employment agreement includes an agreement not to compete with Sunshine Savings Bank and Sunshine Financial in the delivery of financial services for a period of one year following termination of employment. The value of compensation and benefits payable under the agreement is capped so as to prevent imposition of the golden parachute tax under Section 280G of the Internal Revenue Code.

Change of Control Agreements. In April 2011, Sunshine Financial entered into change in control agreements with each of the named executive officers. The change in control agreements provide for a severance payment in the event of a termination of employment within six months preceding or 24 months following a change in control of Sunshine Financial or Sunshine Savings Bank. The value of the severance benefits under Mr. Davis’ change in control agreement is 2.99 times his then current salary. The value of the severance benefits under Messrs. Baggett’s and Swain’s change in control agreements is 24 months of their then current salary. Assuming that a change in control had occurred at December 31, 2012, Messrs. Davis, Baggett and Swain would be entitled to a payment of approximately $612,100, $324,100 and $240,000, respectively. The agreements provide that severance and other payments that are subject to a change in control will be reduced as much as necessary to ensure that no amounts payable to the executive will be considered excess parachute payments.

| COMPENSATION OF DIRECTORS |

Non-Employee Director Compensation

The following table provides compensation information for each non-employee member of the board of directors of Sunshine Savings Bank during the year ended December 31, 2012. Non-employee directors were not awarded any options or restricted stock during the year ended December 31, 2012.

Name | Fees Earned or Paid in Cash | |||

| Robert K. Bacon | $ | 9,100 | ||

| Benjamin F. Betts, Jr. | 10,100 | |||

| Joyce E. Chastain | 7,850 | |||

| Doris K. Richter | 8,050 | |||

| Patrick E. Lyons | 9,100 | |||

| Fred G. Shelfer, Jr. | 8,500 | |||

Non-employee directors of Sunshine Savings Bank receive compensation for their service on the board of directors of the Bank. In setting their compensation, the Board of Directors considers the significant amount of time and level of skill required for director service. Director compensation is reviewed

14

annually by the Compensation Committee, which makes recommendations for approval by the Board of Directors. Currently, each non-employee board member receives $500 for each board meeting, except the chairman who receives $600 per board meeting attended. In addition, each non-employee board committee members receive $150 for each committee meeting attended. Directors who are Sunshine Savings Bank employees receive no extra pay for services as directors.

Directors are provided or reimbursed for travel and lodging and other customary out-of-pocket expenses incurred in attending out-of-town board and committee meetings, industry conferences and continuing education seminars.

Directors are not paid for services on the Board of Directors of Sunshine Financial. We may if we believe it is necessary to attract or retain qualified directors or if it is otherwise beneficial to Sunshine Financial, adopt a policy of paying directors for service on the Sunshine Financial Board.

PROPOSAL II

ADVISORY VOTE ON EXECUTIVE COMPENSATION

Under the Dodd-Frank Act, we are including in this proxy statement and will present at the annual meeting a non-binding stockholder vote to approve the compensation of our executives, as described in the proxy statement pursuant to the compensation disclosure rules of the SEC. This proposal, commonly known as a “say on pay” vote, gives stockholders the opportunity to endorse or not endorse the compensation of the Company’s executives as disclosed in this proxy statement. This proposal will be presented at the annual meeting as a resolution in substantially the following form:

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in the Company’s proxy statement for the annual meeting pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion, is hereby APPROVED.

This vote will not be binding on the Company’s Board of Directors and may not be construed as overruling a decision by the Board or creating or implying any change to the fiduciary duties of the Board. Nor will it affect any compensation previously paid or awarded to any executive. The Compensation Committee and the Board may, however, take into account the outcome of the vote when considering future executive compensation arrangements.

The Board of Directors recommends that you vote “FOR” the non-binding resolution to approve the compensation of our named executive officers.

PROPOSAL III

ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE

ON EXECUTIVE COMPENSATION

The Dodd-Frank Act requires that we include a “say on pay” vote in our annual meeting proxy statement at least once every three years, and that at least once every six years we hold a non-binding, advisory vote on the frequency of future say-on-pay votes, with stockholders having the choice of every year, every two years or every three years. This is the first year that we are subject to this requirement. Accordingly, we are seeking a stockholder vote regarding whether the advisory vote on executive compensation (Proposal II) should occur every one, two or three years.

15

The Board of Directors asks that you support a frequency of every three years for future advisory votes on executive compensation. Setting an advisory vote every three years will be the most effective timeframe for the Company to respond to stockholder feedback and provide us with sufficient time to engage with stockholders to understand and respond to the vote results.

Stockholders have the opportunity to choose among four options (holding the advisory vote on executive compensation every year, every two years, every three years or abstaining) and, therefore, stockholders will not be voting to approve or disapprove the Board’s recommendation.

The advisory vote on this proposal is not binding on the Company or the Board of Directors and cannot be construed as overruling any decision made by the Board of Directors. However, the Board of Directors of the Company will review the results on the advisory vote and take it into consideration when making future decisions regarding the frequency of future advisory votes on executive compensation.

The Board of Directors recommends that you vote for a “say on pay” frequency of every “THREE YEARS.”

PROPOSAL IV

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee has renewed its arrangement with Hacker, Johnson & Smith, PA to be its independent auditors for the year ending December 31, 2013, subject to ratification of that appointment by Sunshine Financial’s stockholders at the annual meeting. In making its determination to renew its arrangement with Hacker, Johnson & Smith, PA as the Company’s independent auditors for the 2013 fiscal year, the Audit Committee considered the non-audit services that the independent auditors provided during the 2012 fiscal year and determined that the provision of these services is compatible with and does not impair the auditors’ independence. The Audit Committee pre-approves all audit and non-audit services performed by the independent auditors. A representative of Hacker, Johnson & Smith, PA is expected to attend the meeting to respond to appropriate questions and will have an opportunity to make a statement if he or she so desires.

Your ratification of the Audit Committee’s selection of Hacker, Johnson & Smith, PA is not necessary because the Audit Committee has responsibility for selection of our independent registered public accounting firm. However, the Audit Committee will take your vote on this proposal into consideration when selecting our independent registered public accounting firm. The Audit Committee, in its discretion, may direct the appointment of a different independent accounting firm at any time during the year, if it determines that such a change would be in the best interest of Sunshine Financial and its stockholders.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of Hacker, Johnson & Smith, PA as Sunshine Financial’s independent registered public accounting firm for the year ending December 31, 2013.

16

Independent Auditing Firm Fees

Hacker, Johnson & Smith, PA was the Company’s principal auditor for fiscal 2012 and 2011. The aggregate fees billed to the Company by Hacker, Johnson & Smith, PA and its affiliates for the years ended December 31, 2012 and 2011 were as follows:

| Year Ended December 31, | ||||||||

| 2012 | 2011 | |||||||

Audit Fees(1) | $ | 60,000 | $ | 71,000 | ||||

| Audit Related Fees | --- | --- | ||||||

Tax Fees(2) | 7,000 | 5,000 | ||||||

| All Other Fees | --- | --- | ||||||

| (1) Includes $10,000 of fees during 2011 related to our mutual to stock conversion which was completed in April 2011. |

| (2) Fees related to the preparation and filing of our annual tax filings. |

| Pre-Approval of Audit and Non-Audit Services |

Pursuant to the terms of its charter, the Audit Committee is responsible for the appointment, compensation, retention and oversight of the work of the independent auditors. The Audit Committee must pre-approve the engagement letters and the fees to be paid to the independent auditors for all audit and permissible non-audit services to be provided by the independent auditors and consider the possible effect that any non-audit services could have on the independence of the auditors. The Audit Committee may establish pre-approval policies and procedures, as permitted by applicable law and SEC regulations and consistent with its charter for the engagement of the independent auditors to render permissible non-audit services to the Company, provided that any pre-approvals delegated to one or more members of the committee are reported to the committee at its next scheduled meeting. At this time, the Audit Committee has not adopted any pre-approval policies.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

The Audit Committee has reviewed and discussed the audited financial statements of Sunshine Financial for the year ended December 31, 2012 with management. The Audit Committee has discussed with Hacker, Johnson & Smith, PA, the independent auditors for Sunshine Financial, the matters required in Statement on Auditing Standards No. 114, The Auditor’s Communication With Those Charged With Governance.

The Audit Committee also has received the written disclosures and the letter from Hacker, Johnson & Smith, PA, required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, disclosing the matters that, in the auditors' judgment, may reasonably be thought to bear on the auditors' independence from Sunshine Financial, and has discussed with the auditors their independence from Sunshine Financial.

17

Based on the Audit Committee’s review and discussions referred to above, the Audit Committee recommended to the Board of Directors that Sunshine Financial’s 2012 audited financial statements be included in Sunshine Financial’s Annual Report on Form 10-K for the year ended December 31, 2012, for filing with the SEC.

Submitted by the Audit Committee of Sunshine Financial’s Board of Directors:

| Benjamin F. Betts, Jr. (Chair) | Robert K. Bacon | |

| Doris K. Richter | Patrick Lyons |

LOANS AND RELATED TRANSACTIONS

WITH EXECUTIVE OFFICERS AND DIRECTORS

Sunshine Savings Bank may engage in a transaction or series of transactions with our directors, executive officers and certain persons related to them. These transactions are subject to the review and approval of the Board of Directors of Sunshine Savings Bank. During the year ended December 31, 2012, there were no transactions of this nature, the amount of which exceeded $120,000. All future material affiliated transactions and loans, and any forgiveness of these loans, must be approved by a majority of our independent directors who do not have an interest in the transaction and who have access, at our expense, to our legal counsel or independent legal counsel.

Sunshine Savings Bank has followed a policy of granting loans to officers and directors, which fully complies with all applicable federal regulations. Loans to directors and executive officers are made in the ordinary course of business and on the same terms and conditions, including interest rates and collateral, as those of comparable transactions with persons not related to Sunshine Savings Bank prevailing at the time, in accordance with our underwriting guidelines, and do not involve more than the normal risk of collectability or present other unfavorable features. All loans to directors and executive officers and their related persons totaled approximately $34,300 at December 31, 2012, and were performing in accordance with their terms at that date.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires Sunshine Financial’s directors and executive officers, and persons who own more than 10% of Sunshine Financial’s common stock to report their initial ownership of Sunshine Financial’s common stock and any subsequent changes in that ownership to the SEC. Specific due dates for these reports have been established by the SEC and Sunshine Financial is required to disclose in this proxy statement any late filings or failures to file.

Sunshine Financial believes, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required during the year ended December 31, 2012, that all Section 16(a) filing requirements applicable to our executive officers, directors and greater than 10% beneficial owners were complied with during 2012, except for the inadvertent late filing of a (i) Form 3 report for each of Directors Bacon, Chastain and Shelfer on March 9, 2012, with respect to their appoint to the Company’s Board of Directors effective January 1, 2012, and (ii) Form 4 report by each of Messrs. Davis and Baggett on December 18, 2012, and by Mr. Swain on December 19, 2012, which reported an option grant to purchase 10,000 shares of Company common stock made to each of them on December 10, 2012.

18

STOCKHOLDER PROPOSALS

In order to be eligible for inclusion in the Company’s proxy materials for next year’s annual meeting of stockholders, any stockholder proposal to take action at the meeting must be received at the Company’s executive office at 1400 East Park Avenue, Tallahassee, Florida 32301 no later than December 25, 2013. All stockholder proposals submitted for inclusion in the Company’s proxy materials will be subject to the requirements of the proxy rules adopted under the Securities Exchange Act of 1934, as amended, and, as with any stockholder proposal (regardless of whether included in the Company’s proxy materials), the Company’s charter and bylaws.

In addition to the deadline and other requirements referred to above for submitting a stockholder proposal to be included in the Company’s proxy materials for its next annual meeting of stockholders, the Company’s bylaws require a separate notification to be made in order for a stockholder proposal to be eligible for presentation at the meeting, regardless of whether the proposal is included in the Company’s proxy materials for the meeting. In order to be eligible for presentation at the Company’s next annual meeting of stockholders, written notice of a stockholder proposal containing the information specified in Article I, Section 6 of the Company’s bylaws must be received by the Secretary of the Company not earlier than the close of business on January 22, 2014 and not later than the close of business on February 21, 2014. If, however, the date of the next annual meeting is before May 2, 2014 or after July 21, 2014, the notice of the stockholder proposal must instead be received by the Company’s Secretary not earlier than the close of business on the 120th day prior to the date of the next annual meeting and not later than the close of business on the later of the 90th day before the date of the next annual meeting or the tenth day following the first to occur of the day on which notice of the date of the next annual meeting is mailed or otherwise transmitted or the day on which public announcement of the date of the next annual meeting is first made by the Company.

OTHER MATTERS

We are not aware of any business to come before the annual meeting other than the matters described above in this proxy statement. However, if any other matters should properly come before the meeting, it is intended that holders of the proxies will act in accordance with their best judgment.

ADDITIONAL INFORMATION

Sunshine Financial will pay the costs of soliciting proxies. Proxies may be solicited by certain officers and employees of the Company personally or by written communication, telephone, facsimile or other means, for which they will receive no compensation in addition to their normal compensation. The Company has engaged Regan & Associates, Inc. to assist in the solicitation of proxies and to provide related advice and informational support for a service fee and the reimbursement of customary disbursements, which are not expected to exceed $3,000 in the aggregate. The Company will also reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of common stock.

19