| Registration No. 333- |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SUNSHINE FINANCIAL, INC.

and

SUNSHINE SAVINGS BANK 401(k) PROFIT SHARING PLAN

(Exact name of registrant as specified in its charter)

Maryland | 6035 | Applied For | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

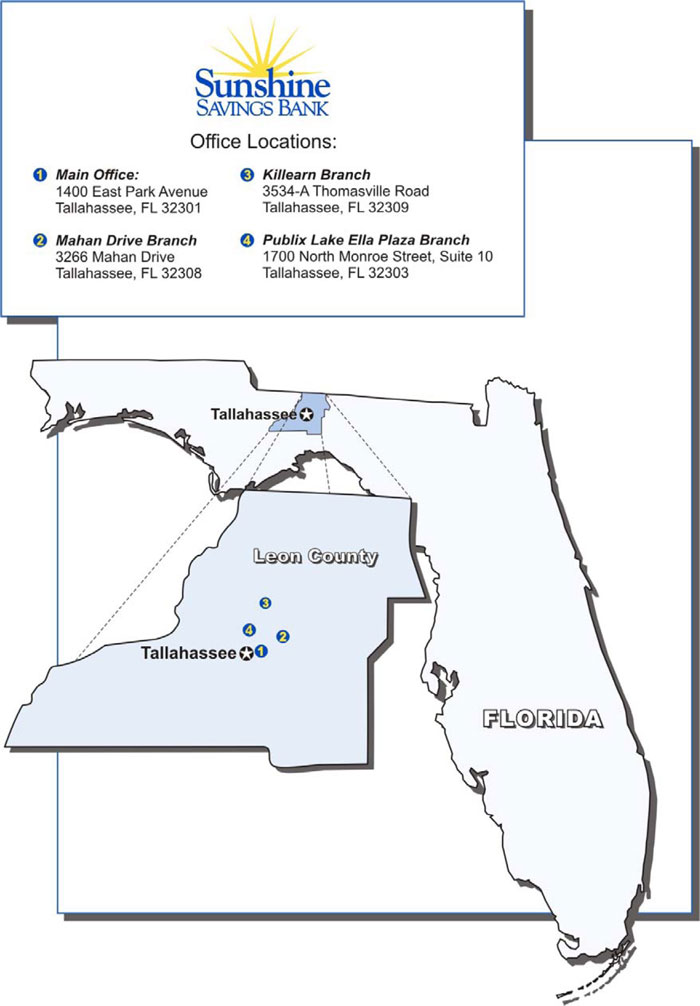

1400 East Park Avenue, Tallahassee, Florida 32301; (850) 488-3993

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Louis O. Davis, Jr., President and CEO

Sunshine Savings Bank

1400 East Park Avenue, Tallahassee, Florida 32301; (850) 219-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael S. Sadow, P.C. Dave M. Muchnikoff, P.C. Silver, Freedman & Taff, L.L.P. 3299 K Street, N.W., Suite 100 Washington, D.C. 20007 (202) 295-4500 | James C. Stewart, Esq. Malizia Spidi & Fisch, PC 1227 25th Street, N.W. Suite 200 West Washington, D.C. 20037 (202) 434-4660 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement

becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

| Common Stock, par value $.01 per share | 1,388,625 | $ 10.00 | $13,886,250(1) | $990.09 |

| 401(k) Plan Participant Interests | 319,662 (2) | --- | --- | (3) |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | In addition, pursuant to Rule 416(c) under the Securities Act, this registration statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described herein. |

| (3) | The securities of Sunshine Financial, Inc. to be purchased by the Sunshine Savings Bank 401(k) Plan are included in the amount shown for common stock. Accordingly, no separate fee is required for the participation interests. In accordance with Rule 457(h) of the Securities Act, as amended, the registration fee has been calculated on the basis of the number of shares of common stock that may be purchased with the current assets of such Plan. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS SUPPLEMENT

Interests in

SUNSHINE SAVINGS BANK 401(K) PLAN

Offering of Participation Interests in up to 319,662 Shares of

SUNSHINE FINANCIAL, INC.

Common Stock

In connection with the conversion of Sunshine Savings MHC from the mutual to the stock form of organization, Sunshine Financial, Inc. is allowing participants in the Sunshine Savings Bank 401(k) Plan (the “401(k) Plan”) to invest all or a portion of their accounts in participation interests in the common stock of Sunshine Financial, Inc. Based upon the value of the 401(k) Plan assets at June 30, 2010, Sunshine Financial, Inc. has registered a number of participation interests through the 401(k) Plan in order to enable the trustee to purchase up to 319,662 shares of Sunshine Financial, Inc. common stock, at the purchase price of $10 per share. This prospectus supplement relates to the initial election of 401(k) Plan particip ants to direct the trustee of the 401(k) Plan to invest all or a portion of their 401(k) Plan accounts in the Sunshine Financial, Inc. Employer Stock Fund (“Employer Stock Fund”) at the time of the stock offering. This prospectus supplement relates solely to the election of a participant to direct the purchase of Sunshine Financial common stock in the conversion and stock offering and not to any future purchases under the 401(k) Plan or otherwise.

The prospectus of Sunshine Financial, Inc., dated ________ __, 2010, accompanies this prospectus supplement. It contains detailed information regarding the conversion and offering of Sunshine Financial, Inc. common stock and the financial condition, results of operations and business of Sunshine Savings Bank. This prospectus supplement provides information regarding the 401(k) Plan. You should read this prospectus supplement together with the prospectus and keep both for future reference.

For a discussion of risks that you should consider, see the “Risk Factors” section of the prospectus.

The interests in the 401(k) Plan and the offering of Sunshine Financial, Inc. common stock have not have not been approved or disapproved by the Securities and Exchange Commission, the Federal Deposit Insurance Corporation, the Office of Thrift Supervision, or any state securities commission or agency, nor have these agencies passed upon the accuracy or adequacy of this prospectus supplement. Any representation to the contrary is a criminal offense.

The securities offered in this prospectus supplement and in the prospectus are not deposits or accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

This prospectus supplement contains information you should consider when making your investment decision. You should rely only on the information provided in this prospectus supplement and the related prospectus. Sunshine Financial, Inc. has not authorized anyone else to provide you with different information. Sunshine Financial, Inc. is not making an offer of its common stock in any state where an offer is not permitted. The information in this prospectus supplement is accurate only as of the date of this prospectus supplement, regardless of the time of delivery of this prospectus supplement or any sale of Sunshine Financial, Inc. common stock.

The date of this prospectus supplement is ______________, 2010.

TABLE OF CONTENTS

| Page | ||||

| THE OFFERING | 1 | |||

| Election to Purchase Sunshine Financial Common Stock in the Reorganization | 1 | |||

| Securities Offered | 2 | |||

| Method of Directing Transfer | 2 | |||

| Time for Directing Transfer | 2 | |||

| Irrevocability of Transfer Direction | 2 | |||

| No Subsequent Elections | 3 | |||

| Purchase of Sunshine Financial Common Stock B Employer Stock Fund | 3 | |||

| Nature of a Participant’s Interest in Sunshine Financial Common Stock | 3 | |||

| Voting and Tender Rights of Sunshine Financial Common Stock | 3 | |||

| DESCRIPTION OF THE 401(k) PLAN | 3 | |||

| Introduction | 3 | |||

| Eligibility and Participation | 4 | |||

| Contributions Under the 401(k) Plan | 4 | |||

| Limitations on Contributions | 5 | |||

| Investment of Contributions | 6 | |||

| Financial Data | 9 | |||

| Administration of the 401(k) Plan | 11 | |||

| Benefits Under the 401(k) Plan | 11 | |||

| Withdrawals and Distributions from the 401(k) Plan | 11 | |||

| Reports to 401(k) Plan Participants | 12 | |||

| Amendment and Termination | 12 | |||

| Federal Income Tax Consequences | 12 | |||

| ERISA and Other Qualification | 13 | |||

| Restrictions on Resale | 13 | |||

| Securities and Exchange Commission Reporting and Short-Swing Profit Liability | 14 | |||

| LEGAL OPINIONS | 14 | |||

| INVESTMENT ELECTION FORM | A-1 | |||

i

THE OFFERING

Election to Purchase Sunshine Financial Common Stock in the Reorganization

In connection with the conversion of and stock offering, you may elect to transfer all or part of your account balances in the 401(k) Plan to the Employer Stock Fund to be used to purchase the common stock issued in the stock offering. The trustee of the 401(k) Plan will purchase common stock of Sunshine Financial, Inc. (“Sunshine Financial”) in accordance with your directions. However, such directions are subject to purchase limitations in the Plan of Conversion and Reorganization of Sunshine Savings MHC. Funds in the 401(k) Plan that you do not want to be used to purchase Sunshine Financial common stock will remain invested in accordance with your investment instructions in effect at the time.

The shares of common stock are being offered at $10 per share in a subscription offering and community offering. In the subscription offering, the shares are being offered in the following descending order of priority:

Subscription offering: |

(1) | To depositors of Sunshine Savings Bank with deposit account(s) totaling $50 or more as of the close of business on June 30, 2009. |

(2) | Second, to Sunshine Savings Bank’s tax-qualified plans, including the employee stock ownership plan and the 401(k) Plan. |

(3) | Third, to depositors of Sunshine Savings Bank with deposit account(s) totaling $50 or more on deposit as of the close of business on September 30, 2010. |

(4) | Fourth, to depositors of Sunshine Savings Bank as of the close of business on ________ __, 2010. |

If not all shares are subscribed for in the subscription offering, our shares will be offered in a community offering to residents of the Leon County, Florida, and the counties contiguous to Leon County, Florida.

If you fall into subscription categories (1), (3), or (4), you have subscription rights to purchase shares of Sunshine Financial common stock in the subscription offering. You will separately receive offering materials in the mail, including a Stock Order Form. If you wish to purchase stock outside of the 401(k) Plan, you must complete and submit the Stock Order Form and payment to the Stock Information Center. Instead of placing an order outside of the 401(k) Plan through a Stock Order Form, as a 401(k) Plan participant, you may place an order to purchase shares of common stock of Sunshine Financial through the 401(k) Plan, in the manner described below under “Method of Directing Transfer.”

In the event the stock offering is oversubscribed, i.e. there are more orders for shares of common stock than shares available for sale in the stock offering, and the trustee is unable to use the full amount allocated by you to purchase shares of common stock in the stock offering, the amount that cannot be invested in the Employer Stock Fund, and any interest earned, will be reallocated on a pro-rata basis among your other 401(k) Plan fund investments. If you elect to have 100% of your current 401(k) Plan funds transferred into the Employer Stock Fund and the offering is oversubscribed, the amount that is not invested in the Employer Stock Fund will be in vested in the money market account, pending your reinvestment in another fund of your choice.

If you choose not to direct the investment of your account balances towards the purchase of any shares in the stock offering, your account balances will remain in the investment funds of the Plan as previously directed by you.

All elections to purchase participation interests in the Employer Stock Fund in the stock offering and any questions about this prospectus supplement should be addressed to Jill Higgins, Director of Human Resources, telephone number: (850) 219-7304; fax (850)___-____; or by e-mail at jhiggins@sunshine savings bank.com.

1

Securities Offered

The securities offered in connection with this prospectus supplement are participation interests in the Employer Stock Fund, which is being established under the 401(k) Plan in connection with the stock offering. The participation interests represent your indirect ownership of Sunshine Financial common stock. At the purchase price of $10 per share, the 401(k) Plan may acquire up to 319,622 shares of Sunshine Financial common stock in the stock offering, based on the fair market value of the Plan’s assets as of June 30, 2010. Only employees of Sunshine Savings Bank may become participants in the 401(k) Plan. Your investment in the shares of common stock of Sunshine Financial in the stock offering through the Employer St ock Fund is subject to the purchase priorities contained in the Plan of Conversion and Reorganization of Sunshine Savings MHC.

Information relating to the 401(k) Plan is contained in this prospectus supplement and information relating to Sunshine Financial, the reorganization and stock offering, and the financial condition, results of operations and business of Sunshine Savings Bank is contained in the prospectus delivered with this prospectus supplement. The address of our principal executive office is 1400 East Park Avenue, Tallahassee, Florida 32301, and our telephone number will be (850) 219-7200.

Method of Directing Transfer

Included with this prospectus supplement is an Investment Election Form. If you wish to direct some or all of your beneficial interest in the assets of the 401(k) Plan into the Employer Stock Fund to purchase Sunshine Financial common stock in the stock offering, you should indicate that decision by completing and submitting the election form. If you do not wish to make an election at this time you do not need to take any action. Please note the following stipulations concerning this election:

• You can direct all or a portion of your current account balance to the Employer Stock Fund.

• Your election is subject to a minimum purchase of 25 shares which equates to $250.00.

• Your election is subject to a maximum purchase of 45,000 shares which equates to $450,000.

• The election period is expected to open ___________ __, 2010 and close ________ __, 2010.

| • | You will continue to have the ability to transfer amounts not in the Employer Stock Fund among all the other investment funds on a daily basis. The amount transferred to the Employer Stock Fund needs to be segregated and held until the offering closes. Therefore, this money is not available for distributions, loans or withdrawals until the transaction is completed which is after the closing of the stock offering. |

Time for Directing Transfer

You must make your election and return your Election Form to Jill Higgins, Director of Human Resources, Sunshine Savings Bank, 1400 East Park Avenue, Tallahassee, Florida 32301, to be received by no later than __:__ p.m. Eastern time on ______ __, 2010, unless extended. You may return your Election Form by U.S. mail, interoffice mail or by faxing it to (850) ___-_____, so long as it is returned by the time specified.

Irrevocability of Transfer Direction

Once received in proper form, your executed Investment Election Form may not be modified, amended or revoked without our consent unless the stock offering has not been completed by ____________, 2010. See also “Investment of Contributions - Sunshine Financial Common Stock Investment Election Procedures” below.

2

No Subsequent Election

After the offering, you will continue to be able to direct the investment of past balances and current contributions among the investment options available under the 401(k) Plan, excluding the Employer Stock Fund (the percentage invested in any option must be a whole percent). The offering is your only opportunity to allocate funds in your 401(k) Plan account to the Employer Stock Fund. The allocation of your interest in the various investment options offered under the 401(k) Plan may be changed daily. After the offering, you may transfer funds from the Employer Stock Fund to other investment options in the 401(k) Plan. Special restrictions may apply to transfers directed to or from the Employer Stock Fund by those par ticipants who are our executive officers and principal stockholders and are subject to the provisions of Section 16(b) of the Securities Exchange Act of 1934, as amended. In particular, executive officers of Sunshine Financial and Sunshine Savings Bank will not be able to transfer their initial investment out of the Employer Stock Fund for a period of one year following consummation of the offering.

Purchase of Sunshine Financial Common Stock B Employer Stock Fund

Shares of Sunshine Financial common stock purchased through the 401(k) Plan will be held as part of the Employer Stock Fund. The 401(k) Plan trustee requires that Employer Stock Fund units consist of both shares of Sunshine Financial common stock and cash. Accordingly, funds transferred to the Employer Stock Fund for the purchase of Sunshine Financial common stock in the stock offering will be used by the trustee to purchase both shares of the common stock and cash. Units of the Employer Stock Fund will be valued in the offering at $10.00 per unit. Of this amount, it is anticipated that $____ of a unit will be used to acquire Sunshine Financial common stock, and that $_____ of the unit will be used to acquire cas h, through an interest in a money market account. However, the portion of a unit that may be invested in cash may range from $_____ to $_____ with the balance being used to acquire Sunshine Financial common stock. All other persons who purchase our common stock in the stock offering outside of the 401(k) Plan may acquire the common stock without having to acquire the related cash interest and will pay $10.00 per share for Sunshine Financial common stock.

Nature of a Participant’s Interest in Sunshine Financial Common Stock

Sunshine Financial common stock will be held in the name of the 401(k) Plan trustee as part of the Employer Stock Fund, in its capacity as 401(k) Plan trustee. Because the 401(k) Plan actually purchases the Employer Stock Fund units, you will acquire a “participation interest” in the Employer Stock Fund units (and the underlying shares of Sunshine Financial common stock and cash) and not own the units (and shares and cash) directly. The trustee will maintain individual accounts reflecting each participant’s individual interest in the Employer Stock Fund.

Voting and Tender Rights of Sunshine Financial Common Stock

The plan administrator generally will exercise voting rights attributable to all of the Sunshine Financial common stock held by the Employer Stock Fund. With respect to matters involving tender offers for Sunshine Financial, the plan administrator will vote shares allocated to participants in the 401(k) Plan as directed by participants with interests in the Employer Stock Fund. The trustee will provide to you voting instruction rights reflecting your proportional interest in the Employer Stock Fund. The number of shares of common stock held in the Employer Stock Fund that the trustee votes in the affirmative and negative on each matter will be proportionate to the voting instructions given by the participants. Where no voting or tender offer instructions are given by the participant, the shares shall be voted or tendered in the manner directed by the plan administrator.

DESCRIPTION OF THE 401(k) PLAN

Introduction

The 401(k) Plan was adopted by Sunshine Financial and is now formally named the “Sunshine Savings Bank 401(k) Plan.” The 401(k) Plan is a combination of the Sunshine Savings Bank Money Purchase Plan (which was previously converted into a profit sharing plan and merged into the 401(k) Plan) and the Sunshine Savings Bank 401(k) Plan. This profit sharing plan contains a cash-or-deferred feature described at Section 401(k) of the Internal Revenue Code of 1986, as amended, to encourage employee savings and to allow eligible employees to supplement their income upon retirement.

Reference to Full Text of 401(k) Plan. The following statements are summaries of certain provisions of the 401(k) Plan. They are not meant to be a complete description of these provisions and are qualified in their entirety by the full text of the 401(k) Plan. Copies of the 401(k) Plan are available to all employees. You should submit your request to the plan administrator, Sunshine Savings Bank, 1400 East Park Avenue, Tallahassee, Florida 32301. We encourage you to read carefully the full text of the 401(k) Plan to understand your rights and obli gations under the 401(k) Plan.

3

Tax and Securities Laws. Participants should consult with legal counsel regarding the tax and securities laws implications of participation in the 401(k) Plan. Any officers or beneficial owners of more than 10% of the outstanding shares of common stock should consider the applicability of Sections 16(a) and 16(b) of the Securities Exchange Act of 1934, as amended, to his or her participation in the 401(k) Plan. See “Securities and Exchange Commission Reporting and Short Swing Profit Liability” on page 11 of this prospectus supplement.

Eligibility and Participation

All employees of Sunshine Financial, Sunshine Savings Bank or a subsidiary (other than union employees who are excluded from participation, nonresident aliens without U.S. source income, leased employees and on-call employees) may participate in the Plan as of the January 1 or July 1 next following the completion of 6 months of service or attaining age 18, whichever occurs later. As of December 31, 2009, there were approximately 80 employees eligible to participate in the cash or deferred portion of the 401(k) Plan, and 59 employees had elected to participate.

Contributions Under the 401(k) Plan

401(k) Contributions. The 401(k) Plan permits you to defer receipt of up to 100% of your annual compensation, not to exceed $16,500 (for 2010), and to have that compensation contributed to the 401(k) Plan on your behalf. Generally, the 401(k) Plan describes a participant’s annual compensation as total compensation while the employee is a participant, taking into account pre-tax deferrals and excluding fringe benefits. However, no more than $245,000 of compensation may be taken into account for purposes of determining 401(k) contributions (and matching and p rofit sharing contributions) for 2010. You may modify the rate of your future 401(k) contributions by filing a new deferral agreement with the plan administrator. Modifications to your rate of 401(k) contributions take effect as soon as practicable following when you make your revised deferral election. Suspension of your 401(k) contributions will be effective as of the next payroll period.

Catch-Up 401(k) Contributions. The 401(k) Plan permits each participant who has attained age 50 to defer up to an additional $5,500 (for 2010) into the 401(k) Plan. Catch-up 401(k) contributions are not subject to any limitations other than the $5,500 dollar limitation.

Matching Contributions. The 401(k) Plan currently provides for matching contributions to the 401(k) Plan. The annual matching contribution rate or amount for any plan year is determined by Sunshine Financial (and may be zero). To be eligible for a matching contribution in any plan year, you must, in addition to making a 401(k) contribution, be actively employed with Sunshine Financial, Sunshine Savings Bank or an affiliated entity on the last day of the plan year, and have been credited with at least 1,000 hours of service during the plan year. If you retire on or after your normal retirement age (age 65), die or become disabled during the plan year, you will be allocated a matching contribution for that plan year (if one is declared), regardless of not being employed on the last day of the plan year or being credited with at least 1,000 hours of service during that plan year. Depending on the rate or amount of matching contributions determined by Sunshine Financial, not all of your 401(k) contributions may be matched (and none will be matched if no matching contribution is declared for the plan year).

Profit Sharing Contributions. The 401(k) Plan currently permits Sunshine Financial to make discretionary profit sharing contributions to the 401(k) Plan. To be eligible for a profit sharing contribution in any year, you must be actively employed with Sunshine Financial, Sunshine Savings Bank or an affiliated entity on the last day of the plan year, and have completed at least 1,000 hours of service during the plan year. You will be eligible to share in any discretionary profit sharing contributions regardless of the amount of service you are credited with during the pl an year, and regardless of whether you are employed by Sunshine Financial, Sunshine Savings Bank or an affiliated entity on the last day of the plan year. In any plan year in which a profit sharing contribution is made and in which you are eligible to receive an allocation, an allocation on a pro rata basis based on the total eligible compensation of participants who are eligible to be allocated a profit sharing contribution.

4

Rollover Contributions. You may also rollover or directly transfer accounts from another qualified plan or an individual retirement account (“IRA”), provided the rollover or direct transfer complies with applicable law. If you want to make a rollover contribution or direct transfer, you should contact the plan administrator.

Limitations on Contributions

Limitations on 401(k) Contributions. Although the 401(k) Plan allows you to defer receipt of up to 100% of your compensation each year as a 401(k) contribution, federal law limits your total 401(k) contributions under the 401(k) Plan, and any similar plans, to $16,500 for 2010. This annual limitation may increase in future years to reflect increases in the cost of living. 401(k) contributions in excess of this limitation are considered excess deferrals, and will be included in an affected participant’s gross income for federal income tax purposes in the year the 401(k) cont ribution is made. In addition, any excess deferral will again be subject to federal income tax when distributed by the 401(k) Plan to the participant, unless the excess deferral, adjusted for any income or loss attributable to the excess deferral, is distributed to the participant not later than the first April 15th following the close of the taxable year in which the excess deferral is made. Any income on the excess deferral that is distributed not later than such date shall be treated, for federal income tax purposes, as earned and received by the participant in the taxable year in which the distribution is made.

Limitations on Annual Additions and Benefits. Pursuant to the requirements of the Internal Revenue Code, the 401(k) Plan provides that the total amount of all contributions and forfeitures (annual additions) allocated on behalf of a participant during any plan year may not exceed the lesser of 100% of the participant’s compensation for the plan year, or $49,000 (for 2010). The $49,000 limit will be increased from time to time to reflect increases in the cost of living. Annual additions for this purpose generally include 401(k) deferrals, matching contributions an d profit sharing contributions to this or any other qualified plan sponsored by Sunshine Savings Bank or an affiliated entity. Annual additions do not include rollover contributions.

Limitation on 401(k) and Matching Contributions for Highly Compensated Employees. Sections 401(k) and 401(m) of the Internal Revenue Code limit the amount of 401(k) contributions and matching contributions that may be made to the 401(k) Plan in any plan year on behalf of highly compensated employees (defined below) in relation to the amount of 401(k) contributions and matching contributions made by or on behalf of all other employees eligible to participate in the 401(k) Plan. Specifically, the percentage of 401(k) contributions made on behalf of a participant who is a highly com pensated employee shall be limited so that the average actual deferral percentage for the group of highly compensated employees for the current plan year does not exceed the greater of (i) the average actual deferral percentage for the group of eligible employees who are non-highly compensated employees for the prior plan year multiplied by 1.25, or (ii) the average actual deferral percentage for the group of eligible employees who are non-highly compensated employees for the prior plan year, multiplied by two (2); provided that the difference in the average actual deferral percentage for eligible non-highly compensated employees does not exceed 2%. Similar discrimination rules apply to matching contributions. The discrimination rules do not apply to 401(k) catch-up contributions.

In general, a highly compensated employee includes any employee who was a 5% owner of the employer at any time during the year or preceding year, or had compensation for the preceding year in excess of $110,000. This dollar amount may be adjusted to reflect increases in the cost of living.

401(k) contributions allocated to highly compensated employees that exceed the average deferral percentage limitation in any plan year are referred to as excess contributions. In order to prevent the disqualification of the 401(k) Plan, any excess contributions, together with income or losses attributable to those excess contributions, may be distributed to the highly compensated employees before the close of the following plan year. Matching contributions that relate to the returned deferral contributions will be forfeited (if not vested) or distributed (if vested) at the same time as the excess contributions are returned. Regarding matching contributions that do not satisfy the limitation tests described above, in order to prev ent the disqualification of the 401(k) Plan, any excess matching contributions, together with any income or losses related to those excess matching contributions, may be distributed to the highly compensated employees before the close of the following plan year. Excess matching contributions, plus income or losses allocable thereto, will be forfeited (if not vested) or distributed (if vested). There are specific rules for determining which highly compensated employees will be affected by the excess contribution and excess matching contribution return rules, and the amount of excess contributions and excess matching contributions that must be returned to the affected employees. The employer will be subject to a 10% excise tax on any excess contributions and excess matching contributions unless the excess contributions and excess matching contributions, together with any income or losses attributable thereto, are distributed before the close of the first 22 months followin g the plan year to which the excess contributions and excess matching contributions relate.

5

Deduction Limits. Matching and profit sharing contributions are subject to and limited by Internal Revenue Code deduction rules. Contributions will not be made to the extent they would be considered nondeductible. 401(k) contributions are neither subject to nor limited by the Internal Revenue Code deduction rules.

Top-Heavy Plan Requirements. If for any plan year the 401(k) Plan is a top-heavy plan, then minimum contributions may be required to be made to the 401(k) Plan on behalf of non-key employees. Contributions otherwise being made under the Plan may apply to satisfy these requirements.

In general, the 401(k) Plan will be regarded as a “top-heavy plan” for any plan year if, as of the last day of the preceding plan year, the aggregate balance of the accounts of participants who are key employees exceeds 60% of the aggregate balance of the accounts of all participants. Key employees generally include any employee who, at any time during the plan year, is (1) an employee of Sunshine Financial or its subsidiaries having annual compensation in excess of $160,000 (adjusted in the future for cost of living increases), who also is in an officer in an administrative or policy-making capacity, (2) a 5% owner of Sunshine Financial (i.e., owns directly or indirectly more than 5% of the stock of Sunshine Financial, or stock possessing more than 5% of the total combined voting power of all stock of Sunshine Financial), or (3) a 1% owner of Sunshine Financial having annual compensation in excess of $150,000.

Investment of Contributions

Investment Options. All amounts credited to participants’ accounts under the 401(k) Plan are held in trust. The trust is administered by trustees appointed by Sunshine Financial’s Board of Directors.

You must instruct the trustee as to how funds held in your account are to be invested. In addition to the Employer Stock Fund, which will consist of shares of Sunshine Financial common stock and cash, participants may elect to instruct the trustee to invest such funds in any or all of the following investment options:

| X | Federated Capital Preservation Fund - The Fund seeks stability of principal and high current income. The Fund invests primarily in stable value products, including guaranteed investment contracts (GICs) and synthetic GICs issued by major insurance companies and money market instruments. |

X | PIMCO Total Return Fund - The Fund seeks maximum total return, consistent with preservation of capital and prudent investment management. The Fund normally invests primarily in a diversified portfolio of fixed income instruments of varying maturities, which may be represented by forwards or derivatives such as options, futures contracts or swap agreements. |

X | Vanguard Intermediate Term Bond Index Fund - The Fund seeks to track the performance of the Barclays Capital U.S. 5-10 Year Government/Credit Float Adjusted Index, a market-weighted bond index with an intermediate-term dollar-weighted average maturity. The Fund invests by sampling the Index, holding a range of securities that, in the aggregate, approximate the full Index. |

X | American Funds American High Income Trust - The Fund seeks a high level of current income and, secondarily, capital appreciation. The Fund invests primarily in higher yielding and generally lower quality debt securities. The Fund may also invest in equity securities that provide an opportunity for income and/or capital appreciation. |

X | American Funds American Balanced Fund - The Fund seeks conservation of capital, current income and long-term growth of capital and income. The Fund invests in a broad range of securities, including stocks and bonds. The Fund also invests in securities issued or guaranteed by the U.S. government. |

6

X | DFA U.S. Large Cap Value Fund - The Fund seeks conservation of capital, current income and long-term growth of capital and income. The Fund invests in a broad range of securities, including stocks and bonds. The Fund also invests in securities issued or guaranteed by the U.S. government. |

X | Eaton Vance Large-Cap Value Fund - The Fund seeks total return. The Fund currently invests in Large-Cap Value Portfolio, a separate registered investment company with the same objective. The Fund normally invests primarily in dividend-paying value stocks of large-cap companies. It may invest in convertible debt securities (including securities rated below investment-grade). |

X | MFS Value Fund - The Fund seeks capital appreciation. The Fund normally invests primarily in equity securities of companies that are believed to be undervalued compared to their perceived worth. The Fund may invest in companies of any size, generally focusing on companies with large capitalizations. |

X | Vanguard 500 Index Fund - The Fund seeks to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance. The Fund invests all, or substantially all, of its assets in the stocks that make up the Index, holding each stock in approximately the same proportion as its weighting in the Index. |

X | American Funds Growth Fund of America - The Fund seeks growth of capital. The Fund invests primarily in attractively valued common stocks of companies that appear to offer superior opportunities for growth of capital. |

X | Columbia Mid Cap Value Fund - The Fund seeks long-term capital appreciation. The Fund normally invests primarily in equity securities of mid-cap U.S. companies believed to be undervalued and have the potential for long-term growth. The Fund may invest up to 20% of total assets in foreign securities. The Fund also may invest in real estate investment trusts. |

X | Vanguard Mid Capitalization Fund - The Fund seeks to track the performance of the MSCI US Mid Cap 450 Index, a broadly diversified index of stocks of medium-size U.S. companies. The Fund invests all, or substantially all, of its assets in the stocks that make up the Index, holding each stock in approximately the same proportion as its weighting in the Index. |

X | Columbia Acorn Fund - The Fund seeks long-term capital appreciation. The Fund normally invests a majority of its assets in common stock of small- and mid-sized U.S. companies, but also may invest a portion of its assets in foreign companies in developed and emerging markets. |

X | DFA U.S. Small Cap Value Fund - The Fund seeks long-term capital appreciation. The Fund invests all of its assets in a Master Fund that purchases value stocks of U.S. small capitalization companies. |

X | Vanguard Small Cap Index Fund - The Fund seeks to track the performance of the MSCI US Small Cap 1750 Index, a broadly diversified index of stocks of smaller U.S. companies. The Fund invests all, or substantially all, of its assets in the stocks that make up the Index, holding each stock in approximately the same proportion as its weighting in the Index. |

X | JPMorgan Small Cap Growth Fund - The Fund seeks long-term capital growth primarily by investing in a portfolio of equity securities of small-capitalization and emerging growth companies. The Fund invests mainly in small-cap companies with market capitalizations equal to those within the universe of the Russell 2000 Growth Index stocks at the time of purchase. |

X | American Funds Capital World Growth and Income Fund - The Fund seeks long-term growth of capital while providing current income. The Fund invests primarily in common stocks of well-established companies located around the world, including developing countries, many of which have the potential to pay dividends. |

7

X | DFA International Small Cap Value Fund - The Fund seeks long-term capital appreciation. The Fund invests in value stocks of small non-U.S. companies using a market capitalization weighted approach in each applicable country. |

X | DFA International Value Fund - The Fund seeks long-term capital appreciation. The Fund invests all of its assets in a Master Fund that purchases value stocks of large non-U.S. companies. |

X | American Funds EuroPacific Growth Fund - The Fund seeks long-term growth of capital. The Fund normally invests primarily in growth-oriented, equity-type securities of issuers located in Europe and the Pacific Basin. The Fund may also hold cash, money market instruments and fixed-income securities. |

X | DFA Emerging Markets Value Fund - The Fund seeks long-term capital appreciation. The Fund invests in emerging market equity securities that are deemed to be value stocks at the time of purchase. |

X | Cohen & Steers Realty Shares - The Fund seeks total return. The Fund invests primarily, and normally substantially all of its total assets, in common stocks and other equity securities issued by real estate companies. The Fund may invest a small percentage in foreign issuers. |

X | T. Rowe Price Retirement 2010 Fund - The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The Fund invests in a diversified portfolio of T. Rowe Price stock and bond funds, the allocation of which will change over time in relation to its target retirement date. |

X | T. Rowe Price Retirement 2020 Fund - The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The Fund invests in a diversified portfolio of T. Rowe Price stock and bond funds, the allocation of which will change over time in relation to its target retirement date. |

X | T. Rowe Price Retirement 2030 Fund - The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The Fund invests in a diversified portfolio of T. Rowe Price stock and bond funds, the allocation of which will change over time in relation to its target retirement date |

X | T. Rowe Price Retirement 2040 Fund - The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The Fund invests in a diversified portfolio of T. Rowe Price stock and bond funds, the allocation of which will change over time in relation to its target retirement date. |

X | T. Rowe Price Retirement 2050 Fund - The Fund seeks the highest total return over time consistent with an emphasis on both capital growth and income. The Fund invests in a diversified portfolio of T. Rowe Price stock and bond funds, the allocation of which will change over time in relation to its target retirement date. |

For further descriptions of these investment options, you may request a prospectus for each of the investment options from the plan administrator. If no investment direction is given, all contributions to a participant’s account will be invested in an age-appropriate T. Rowe Price Retirement Fund (2010, 2020, 2030, 2040 or 2050).

8

The investment in Sunshine Financial common stock (through the Employer Stock Fund) involves certain risks. No assurance can be given that units in the Employer Stock Fund purchased pursuant to the 401(k) Plan will thereafter be able to be sold at a price equal to or in excess of the purchase price. See also “Risk Factors” in the prospectus.

Sunshine Financial Common Stock Investment Election Procedures. You may instruct the trustee to purchase Sunshine Financial common stock by redirecting funds from your existing 401(k) Plan investments into the Employer Stock Fund by filing a completed Investment Election Form with the plan administrator on or prior to the election deadline. The amount of funds redirected into the Employer Stock Fund must be allocated in whole dollar increments from investment options containing your 401(k) Plan funds. When you instruct the trustee to redirect the funds in your existing accounts into the Employer Stock Fund in order to purchase units in the Employer Stock Fund, the trustee will liquidate funds from the appropriate investment option(s) and apply such redirected funds as requested, in order to effect the new allocation. Approximately ___% of the elected funds used to acquire units in the Employer Stock Fund will be invested in Sunshine Financial common stock and the remaining __% will be invested in a money market account.

For example, you may fund an election to purchase $1,000 worth of the Employer Stock Fund by redirecting the aggregate purchase price of $1,000 for the shares from the following investment options (provided the necessary funds are available in such investment options): (i) $100 from the Federated Capital Preservation Fund; (ii) $300 from the Vanguard 500 Index; and (iii) $600 from the Columbia Acorn Fund. In such case, the trustee would liquidate the amount instructed from each of the selected accounts and the $1,000 will be used to acquire 100 Employer Stock Fund units (that is, approximately ___ shares of Sunshine Financial common stock and $__ in cash through a money market account investment). If your instructions cannot be fulfilled because you do not have the required funds in one or more of the investment options t o purchase the units in the Employer Stock Fund subscribed for, you will be required to file a revised Investment Election Form with the plan administrator by the election deadline. Once received in proper form, an executed election form may not be modified, amended or rescinded without our consent unless the stock offering has not been completed by __________, 2010.

Adjusting Your Investment Strategy. Until changed in accordance with the terms of the 401(k) Plan, future allocations of your contributions among the various investment options would remain unaffected by the election to purchase units in the Employer Stock Fund through the 401(k) Plan in the stock offering. You may modify a prior investment allocation election or request the transfer of funds to another investment vehicle by telephone at (800) 795-2697 or on the Internet at www.alerusretirementsolutions.com. Modifications and fund transfers relating to the Employer Stock Fund will be permitted on a daily basis, except that additional Employer Stock Fund investments are not allowed, and except further, as limited for certain 401(k) Plan participants as previously indicated.

Valuation of Accounts. The 401(k) Plan uses a unit system for valuing each investment fund. Under this system, your share in any investment fund is represented by units. The unit value is determined as of the close of business each regular business day. The total dollar value of your share in any investment fund as of any valuation date is determined by multiplying the number of units held by you by the unit value of the fund on that date. The sum of the values of the funds you select represents the total value of your 401(k) Plan account.

Financial Data

Employer Contributions. For the plan year ended December 31, 2009, we made a profit sharing contribution of approximately $157,160, and a matching contribution of $70,092 to the 401(k) Plan. Also for the plan year ended December 31, 2009, participants made 401(k) contributions in the amount of $130,893.

If we adopt other stock-based benefit plans, such as a stock option plan or a restricted stock plan, or if contributions are made to the employee stock ownership plan, which was formed as part of the reorganization and stock offering, to repay a loan used by it to acquire Sunshine Financial common stock, then we may decide to reduce our discretionary matching contributions or profit sharing contribution under the 401(k) Plan, in order to reduce overall expenses. If we adopt a restricted stock plan, the plan would not be submitted for stockholder approval for at least six months following completion of the reorganization.

Performance of Sunshine Financial Common Stock. It is expected that the Sunshine Financial common stock will be listed on the Over-the-Counter Bulletin Board of the Nasdaq system. As of the date of this prospectus supplement, no shares of Sunshine Financial common stock have been issued or are outstanding and there is no established market for our common stock. Accordingly, there is no record of the historical performance of Sunshine Financial common stock.

9

Performance of Investment Options. The following table provides performance data with respect to the investment options available under the 401(k) Plan, based on information provided to Sunshine Financial by Alerus Retirement Solutions.

The information set forth below with respect to the investment options has been reproduced from materials supplied by Alerus Retirement Solutions, which administers the 401(k) Plan and is responsible for providing investment alternatives under the 401(k) Plan other than the Employer Stock Fund. Sunshine Financial and Sunshine Savings Bank take no responsibility for the accuracy of such information.

Additional information regarding the investment options may be available from Alerus Retirement Solutions or Sunshine Financial. Participants should review any available additional information regarding these investments before making an investment decision under the 401(k) Plan.

The total percentage return for the prior three years is provided for each of the following funds.

NET INVESTMENT PERFORMANCE | ||||||||||||

For the Year Ended December 31, | ||||||||||||

2009 | 2008 | 2007 | ||||||||||

| Federal Capital Preservation Fund | 4.06 | % | 4.40 | % | 4.44 | % | ||||||

PIMCO Total Return Fund | 9.07 | % | 3.99 | % | 2.89 | % | ||||||

Vanguard Intermediate Term Bond Index Fund | 7.61 | % | 3.91 | % | 1.75 | % | ||||||

American Funds American High Income Trust | 1.78 | % | 12.45 | % | 3.86 | % | ||||||

American Funds American Balanced Fund | 6.86 | % | 12.08 | % | 3.38 | % | ||||||

DFA U.S. Large Cap Value Fund | -2.76 | % | 20.18 | % | 10.24 | % | ||||||

Eaton Vance Large Cap Value Fund | 9.99 | % | 18.81 | % | 11.47 | % | ||||||

MFS Value Fund | 20.82 | % | -32.65 | % | 7.99 | % | ||||||

Vanguard 500 Index Fund | 5.39 | % | 15.64 | % | 4.77 | % | ||||||

American Funds Growth Fund of America | 11.26 | % | 11.24 | % | 14.53 | % | ||||||

Columbia Mid Cap Value Fund | 7.65 | % | 17.09 | % | 15.27 | % | ||||||

Vanguard Mid Capitalization Fund | 6.02 | % | 13.60 | % | 13.93 | % | ||||||

Columbia Acorn Fund | 7.69 | % | 14.45 | % | 13.11 | % | ||||||

DFA U.S. Small Cap Value Fund | -10.75 | % | 21.55 | % | 7.79 | % | ||||||

Vanguard Small Cap Index Fund | 1.16 | % | 15.66 | % | 7.36 | % | ||||||

JP Morgan Small Cap Growth Fund | 12.34 | % | 16.01 | % | 6.38 | % | ||||||

American Funds Capital World Growth and Income Fund | 17.78 | % | 22.59 | % | 15.00 | % | ||||||

DFA International Small Cap Value Fund | 2.95 | % | 28.39 | % | 23.23 | % | ||||||

DFA International Value Fund | 10.24 | % | 34.15 | % | 15.27 | % | ||||||

American Funds EuroPacific Growth Fund | 19.20 | % | 22.20 | % | 21.40 | % | ||||||

DFA Emerging Markets Value Fund | 45.64 | % | 37.93 | % | 30.81 | % | ||||||

Cohen & Steers Realty Shares | -19.19 | % | 37.13 | % | 14.88 | % | ||||||

T. Rowe Price Retirement 2010 Fund | 6.42 | % | 12.52 | % | 6.05 | % | ||||||

T. Rowe Price Retirement 2020 Fund | 6.52 | % | 14.37 | % | 6.91 | % | ||||||

T. Rowe Price Retirement 2030 Fund | 6.58 | % | 15.88 | % | 7.87 | % | ||||||

T. Rowe Price Retirement 2040 Fund | 6.53 | % | 15.99 | % | 7.83 | % | ||||||

T. Rowe Price Retirement 2050 Fund | 6.62 | % | n/a | n/a | ||||||||

10

Each participant should note that past performance is not necessarily an indicator of future results.

Administration of the 401(k) Plan

Trustees. The trustee is appointed by the Board of Directors of Sunshine Financial to serve at its pleasure. Currently, the 401(k) Plan Trustee is First Bankers Trust Services, Inc. This entity also serves as the trustees of the Employer Stock Fund.

The trustee receives and holds the contributions to the 401(k) Plan in trust and distributes them to participants and beneficiaries in accordance with the provisions of the 401(k) Plan. The trustee is responsible for following participant directions, effectuating the investment of the assets of the trust in the Employer Stock Fund and the other investment options.

Benefits Under the 401(k) Plan

Plan Benefits. Your 401(k) Plan benefit is based on the value of the vested portion of your 401(k) Plan accounts as of the valuation date next preceding the date of distribution to you.

Vesting. You will always have a fully vested (nonforfeitable) interest in your 401(k) contribution account and rollover account. Your matching contribution account and profit sharing contribution account will become fully vested after completion of 3 years of service. Prior to the completion of this vesting requirement, you will not have a vested interest in your matching contribution account and profit sharing contribution account. Generally, a year of service is a plan year (January 1 to December 31) during which you perform at least 1,000 hours of service for Sunshine Savings Bank or an affiliated employer (and in some cases a former employer that was acquired by Sunshine Financial or its predecessor). You also will become 1 00% vested in your matching contribution account and profit sharing contribution account if you are actively employed on your normal retirement date (age 65), death or disability.

Withdrawals and Distributions from the 401(k) Plan

Withdrawals Prior to Termination of Employment. You may elect to receive an in-service distribution from your rollover account at any time. You may also receive an in-service distribution of all or part of your 401(k) deferrals if you experience a hardship. Whether a hardship has occurred in determined in accordance with Internal Revenue Service rules. Loans are also permitted from your 401(k) Plan accounts, subject to the loan administration policies then in effect and qualified plan loan limitation rules in the Internal Revenue Code.

Distribution Upon Retirement or Disability. Upon your retirement or disability, you may elect to receive your 401(k) Plan benefits in a lump sum payment, in substantially equal installments over a specified number of years not to exceed your life expectancy. That portion of your 401(k) Plan benefit that was attributable to the Money Purchase Pension Plan will be distributed to you in the form of a qualified joint and survivor annuity, unless you elect otherwise and your spouse properly and timely consents to your election. A qualified joint and survivor annuity is a monthly annuity for your life, with a monthly payment continuing for the life of your surviving spouse in an amount equal to 50 or 75 percent of the amount of your monthly payment.

Distribution Upon Death. If you die prior to your benefits being paid from the 401(k) Plan, your benefits will be paid to your surviving spouse or other properly designated beneficiary. If you are married when you die, your death benefit that is attributable to the Money Purchase Pension Plan will be paid as an annuity over the life of your surviving spouse, unless you elect to waive that form of benefit, and he or she consents to that election. The balance of the death benefit, plus the remaining portion of the death benefit that is not paid in the form of an annuity, will be paid as either a lump sum payment or in substantially equal installment payments over a period not exceeding the life your beneficiary, as elected by your beneficiary.

11

Distribution Upon Termination for any Other Reason. If you terminate your employment for any reason other than retirement, disability or death and your vested 401(k) Plan account balances exceed $5,000, your distribution will be made on your normal retirement date, unless you request an earlier or later distribution date. Your vested 401(k) Plan accounts will be distributed in the same manner as if you retired or became disabled, as described above. If your vested account balances do not exceed $5,000, your 401(k) Plan benefit will be distributed to you as soon as administratively practicable in a lump sum following your termination of employment.

Form of Distribution. Distributions from the 401(k) Plan will generally be in the form of cash.

Nonalienation of Benefits. Except with respect to federal income tax withholding and as provided with respect to a qualified domestic relations order, benefits payable under the 401(k) Plan shall not be subject in any manner to anticipation, alienation, sale, transfer, assignment, pledge, encumbrance, charge, garnishment, execution, or levy of any kind, either voluntary or involuntary, and any attempt to anticipate, alienate, sell, transfer, assign, pledge, encumber, charge or otherwise dispose of any rights to benefits payable under the 401(k) Plan shall be void.

Reports to 401(k) Plan Participants

As soon as practicable after the end of each calendar quarter, the plan administrator will furnish to each participant a statement showing (i) balances in the participant’s accounts as of the end of that period, (ii) the amount of contributions allocated to his or her accounts for that period, and (iii) the number of units in each of the investment funds and the value thereof. Participants may also access information regarding their 401(k) Plan Accounts by using internet access made available by Alerus Retirement Services, the plan investment manager.

Amendment and Termination

We intend to continue to participate in the 401(k) Plan. Nevertheless, we may amend or terminate the 401(k) Plan at any time. If the 401(k) Plan is terminated in whole or in part, then, regardless of other provisions in the 401(k) Plan, each participant affected by the termination shall become fully vested in all of his or her accounts.

Federal Income Tax Consequences

The following is a brief summary of the material federal income tax aspects of the 401(k) Plan. You should not rely on this summary as a complete or definitive description of the material federal income tax consequences relating to the 401(k) Plan. Statutory provisions change, as do their interpretations, and their application may vary in individual circumstances. Finally, the consequences under applicable state and local income tax laws may not be the same as under the federal income tax laws. Please consult your tax advisor with respect to any distribution from the 401(k) Plan and transactions involving the 401(k) Plan.

As a “tax-qualified retirement plan,” the Internal Revenue Code affords the 401(k) Plan special tax treatment, including:

$ | the sponsoring employer is allowed an immediate tax deduction for the amount contributed to the 401(k) Plan each year; |

$ | participants pay no current income tax on amounts contributed by the employer on their behalf; and |

$ | earnings of the 401(k) Plan are tax-deferred, thereby permitting the tax-free accumulation of income and gains on investments. |

We will administer the 401(k) Plan to comply with the requirements of the Internal Revenue Code as of the applicable effective date of any change in the law.

Taxation of Distributions. Generally, 401(k) Plan distributions are taxable as ordinary income for federal income tax purposes. States may also impose income taxes on 401(k) Plan distributions.

12

Rollovers and Direct Transfers to Another Qualified Plan or to an IRA; Mandatory Tax Withholding. Except as discussed below, you may roll over virtually all distributions from the 401(k) Plan to another tax-favored plan or to an standard IRA without regard to whether the distribution is a lump sum distribution or a partial distribution. You have the right to elect to have the trustee transfer all or any portion of an “eligible rollover distribution” directly to another qualified retirement plan (subject to the provisions of the recipient qualified plan) or to an IRA. If you transfer the eligible rollover distribution to a Roth IRA (which permits nondeductible contributions but does not subject the IRA income to taxes if the distribution is a “qualified distribution”, or the minimum required distribution rules), then you must include the value of the distribution in current taxable income. If you do not elect to have an “eligible rollover distribution” transferred directly to another qualified plan or to an IRA, the distribution will be subject to a mandatory federal withholding tax equal to 20% of the taxable distribution. Your state may also impose tax withholding on your taxable distribution. An “eligible rollover distribution” means any amount distributed from the 401(k) Plan except: (1) a distribution that is (a) one of a series of substantially equal periodic payments (not less frequently than annually) made for your life (or life expectancy) or the joint lives of you and your designated beneficiary or (b) for a specified period of ten years or more; (2) any amount required to be distributed under the minimum distribution rules; and (3) any other distributions excepte d under applicable federal law.

Ten-Year Averaging Rules. Under a special grandfather rule, if you have completed at least five years of participation in the 401(k) Plan before the taxable year in which the distribution is made, and you turned age 50 by 1986, you may elect to have your lump sum distribution taxed using a “ten-year averaging” rule. The election of the special averaging rule applies only to one lump sum distribution you or your beneficiary receive, provided such amount is received on or after you attain age 592 and you elect to have any other lump sum distribution from a qualified plan received in the same taxable year taxed under the ten-year averaging rule or receive a lump sum distribution on account of your death.

Additional Tax on Early Distributions. A participant who receives a distribution from the 401(k) Plan prior to attaining age 592 will be subject to an additional income tax equal to 10% of the amount of the distribution. The 10% additional income tax will not apply, however, in certain cases, including (but not limited) to distributions rolled over or directly transferred into an IRA or another qualified plan, or the distribution is (i) made to a beneficiary (or to the estate of a participant) on or after the death of the participant, (ii) attributable to the participant’s being disabled within the meaning of Section 72(m)(7) of the Internal Revenue Code, (iii) part of a series of substantially equal periodic payments (not less frequently than annually) made for the life (or life expectancy) of the participant or the joint lives (or joint life expectancies) of the participant and his beneficiary, (iv) made to the participant after separation from service under the 401(k) Plan after attainment of age 55, (v) made to pay medical expenses to the extent deductible for federal income tax purposes, (vi) pursuant to a qualified domestic relations order or (vii) made to effect the distribution of excess contributions or excess deferrals.

This is a brief description of federal income tax aspects of the 401(k) Plan which are of general application under the Internal Revenue Code. It is not intended to be a complete or definitive description of the federal income tax consequences of participating in or receiving distributions from the 401(k) Plan. Accordingly, you are urged to consult a tax advisor concerning the federal, state and local tax consequences that may be particular to you of participating in and receiving distributions from the 401(k) Plan.

ERISA and Other Qualification

The 401(k) Plan is subject to certain provisions of the Employee Retirement Income Security Act of 1974, the primary federal law governing retirement plans, and is intended to be a qualified retirement plan under the Internal Revenue Code.

Restrictions on Resale

Any person receiving shares of Sunshine Financial common stock under the 401(k) Plan who is an “affiliate” of Sunshine Financial as the term “affiliate” is used in Rules 144 and 405 under the Securities Act of 1933 (e.g., directors, officers and significant stockholders of Sunshine Financial) may re-offer or resell such shares only pursuant to a registration statement or, assuming the availability thereof, pursuant to Rule 144 or some other exemption from the registration requirements of the Securities Act of 1933. Any person who may be an “affiliate” of Sunshine Financial may wish to consult with counsel before transferring any Sunshine Financial common stock owned by him or her. In addition, participants are advised to consult with counsel as to the applicability of Section 16 o f the Securities Exchange Act of 1934 which may restrict the sale of Sunshine Financial common stock acquired under the 401(k) Plan, or other sales of Sunshine Financial common stock.

13

Securities and Exchange Commission Reporting and Short-Swing Profit Liability

Section 16 of the Securities Exchange Act of 1934 imposes reporting and liability requirements on officers, directors and persons beneficially owning more than 10% of public companies such as Sunshine Financial. Section 16(a) of the Securities Exchange Act of 1934 requires the filing of reports of beneficial ownership. Within ten days of becoming a person subject to the reporting requirements of Section 16(a), a Form 3 reporting initial beneficial ownership must be filed with the Securities and Exchange Commission. Certain changes in beneficial ownership, such as purchases, sales and participation in savings and retirement plans must be reported on a Form 4 within two business days of when a change occurs. Certain other changes in beneficial ownership, such as gifts and inheritances, may be rep orted on a Form 4 or annually on a Form 5 within 45 days after the close of our fiscal year. Participation in the Employer Stock Fund of the 401(k) Plan by our officers, directors and persons beneficially owning more than 10% of the outstanding Sunshine Financial common stock must be reported to the Securities and Exchange Commission at least annually on a Form 4 or Form 5 by such individuals.

Section 16(b) of the Securities Exchange Act of 1934 provides for the recovery by us of any profits realized by an officer, director or any person beneficially owning more than 10% of the Sunshine Financial common stock resulting from the purchase and sale or sale and purchase of Sunshine Financial common stock within any six-month period. The Securities and Exchange Commission rules provide an exemption from the profit recovery provisions of Section 16(b) for certain transactions within an employee benefit plan, such as the 401(k) Plan, provided certain requirements are met. If you are subject to Section 16, you should consult with counsel regarding the applicability of Section 16 to specific transactions involving the 401(k) Plan.

LEGAL OPINIONS

The validity of the issuance of Sunshine Financial common stock will be passed upon by Silver, Freedman & Taff, LLP, Washington, DC, which firm acted as special counsel for Sunshine Financial and Sunshine Savings Bank in connection with the conversion and stock offering.

14

INVESTMENT ELECTION FORM

PARTICIPANT ELECTION TO INVEST IN

SUNSHINE FINANCIAL, INC. COMMON STOCK

(“EMPLOYER STOCK FUND”)

Sunshine Savings Bank 401(k) Plan

If you would like to participate in the stock offering using amounts currently in your account in the Sunshine Savings Bank 401(k) Plan, please complete this form and return it to Jill Higgins, 1400 East Park Avenue, Tallahassee, Florida, 32301, by no later than __:__ _.m., Eastern time, on_________________, 2010.

Participant’s Name (Please Print): | ||||

Address: _______ | ||||

Street | City | State | Zip Code | |

Social Security Number: _____________________

1. Background Information

Sunshine Financial, Inc. (“Sunshine Financial”) will be issuing shares of common stock, par value $0.01 per share, to certain eligible depositors of Sunshine Savings Bank and the public in connection with the conversion of Sunshine Savings MHC from the mutual to the stock form of organization.

Participants in the Sunshine Savings Bank 401(k) Plan (the “401(k) Plan”) are being given a one-time opportunity to direct the trustee of the 401(k) Plan to purchase Sunshine Financial common stock in the offering with amounts currently in their 401(k) Plan account by acquiring units of the Employer Stock Fund, an investment fund under the 401(k) Plan comprised of Sunshine Financial common stock and cash. (Employees who would like to purchase shares of Sunshine Financial common stock in the offering with funds other than amounts currently in their 401(k) Plan account may do so by completing the order form that accompanies the prospectus.) Units of the Employer Stock Fund will be valued in the stock offering at $10.00 per unit. Between ___% and ___% of the amounts used to acquire units in the E mployer Stock Fund will be invested in Sunshine Financial common stock and the remaining __% to __% will be invested in cash. Assuming that __% percent of a unit will be invested in cash, approximately $_____ of each unit will be used to acquire Sunshine Financial common stock, and $____ of each unit will be used to acquire cash, through an interest in a money market account.

Because it is actually the 401(k) Plan that purchases the Sunshine Financial common stock, participants would acquire a “participation interest” (expressed as units of the Employer Stock Fund) in the shares and cash and would not own the shares and cash directly.

Prior to making a decision to direct the trustee to purchase units in the Employer Stock Fund, we strongly urge you to carefully review the prospectus and the prospectus supplement that accompany this Investment Election Form. Your decision to direct the transfer of amounts credited to your account balances to the Employer Stock Fund in order to purchase shares of Sunshine Financial common stock in connection with the stock offering is irrevocable. Notwithstanding this irrevocability, participants may transfer out some or all of their units in the Employer Stock Fund, if any, and into one or more of the 401(k) Plan’s other investment funds at such times as are provided for under the 401(k) Plan’s rules for such transfers.

Investing in any stock entails some risks and we encourage you to discuss your investment decision with your investment advisor before completing this form. Neither the trustee, nor the plan administrator, nor any employee of Sunshine Financial or Sunshine Savings Bank is authorized to make any representations about this investment. You should not rely on any information other than information contained in the prospectus and the prospectus supplement in making your investment decision.

Any shares purchased by the 401(k) Plan based on your election will be subject to the conditions and restrictions otherwise applicable to Sunshine Financial common stock purchased directly by you in the stock offering. These restrictions are described in the prospectus and the prospectus supplement.

A-1

2. Investment Elections

If you would like to participate in the stock offering with amounts currently in your 401(k) Plan account, please complete the table below, indicating what amount of each of your current funds you would like to transfer into the Employer Stock Fund. If the trustee is unable to use the total amount that you elect in the box below to have transferred into the Employer Stock Fund to purchase Sunshine Financial common stock and cash due to an oversubscription in the stock offering, the amount that is not invested in the Employer Stock Fund will be reallocated on a pro-rata basis among your other 401(k) Plan fund investments. If you elect in the box below to have 100% of your current 401(k) Plan funds transferred into the Employer Stock Fund and the offering is oversubscribed, the amount that is not invested in the Emplo yer Stock Fund will be invested in the money market account, pending your reinvestment in another fund of your choice.

Indicate the amount to be transferred from one or more of the following funds into the Employer Stock Fund:

| Amount | From Fund |

$____________.00 | Federated Capital Preservation Fund |

$____________.00 | PIMCO Total Return Fund |

$____________.00 | Vanguard Intermediate Term Bond Index Fund |

$____________.00 | American Funds American High Income Trust |

$____________.00 | American Funds American Balanced Fund |

$____________.00 | DFA U.S. Large Cap Value Fund |

$____________.00 | Eaton Vance Large Cap Value Fund |

$____________.00 | MFS Value Fund |

$____________.00 | Vanguard 500 Index Fund |

$____________.00 | American Funds Growth Fund of America |

$____________.00 | Columbia Mid Cap Value Fund |

$____________.00 | Vanguard Mid Capitalization Fund |

$____________.00 | Columbia Acorn Fund |

$____________.00 | DFA U.S. Small Cap Value Fund |

$____________.00 | Vanguard Small Cap Index Fund |

$____________.00 | JP Morgan Small Cap Growth Fund |

$____________.00 | American Funds Capital World Growth and Income Fund |

$____________.00 | DFA International Small Cap Value Fund |

$____________.00 | DFA International Value Fund |

$____________.00 | American Funds EuroPacific Growth Fund |

$____________.00 | DFA Emerging Markets Value Fund |

$____________.00 | Cohen & Steers Realty Shares |

$____________.00 | T. Rowe Price Retirement 2010 Fund |

$____________.00 | T. Rowe Price Retirement 2020 Fund |

$____________.00 | T. Rowe Price Retirement 2030 Fund |

$____________.00 | T. Rowe Price Retirement 2040 Fund |

$____________.00 | T. Rowe Price Retirement 2050 Fund |

A-2

Note: If you do not complete this election, you will not participate in the offering by using your 401(k) Plan funds.

3. Purchaser Information. The ability of participants in the Plan to purchase common stock in the stock offering and to direct their current account balances into the Employer Stock Fund may be based upon the participant’s status as an eligible account holder, supplemental eligible account holder or other member. Please indicate your status.

| A. | [_] Eligible Account Holder - Check here if you were a depositor with $50.00 or more on deposit with Sunshine Savings Bank as of June 30, 2009. |

| B. | [_] Supplemental Eligible Account Holder - Check here if you were a depositor (other than a director or officer of Sunshine Savings Bank) with $50.00 or more on deposit with Sunshine Savings Bank as of _____________, 2010, but are not an eligible account holder. |

| C. | [_] Other Member - Check here if you were a depositor of, or borrower from, Sunshine Savings Bank as of ___________________, 2010, but are not an eligible account holder or supplemental eligible account holder. |

| Account Title (Names on Accounts) | Account Number | |||

4. Participant Signature and Acknowledgment - Required

By signing this investment election form, I authorize and direct the plan administrator and trustee to carry out my instructions. I acknowledge that I have been provided with and have received a copy of the prospectus and prospectus supplement relating to the issuance of Sunshine Financial common stock that accompany this investment election form. I am aware of the risks involved in investing in Sunshine Financial common stock and understand that the trustee, plan administrator and any employee of Sunshine Financial or Sunshine Savings Bank are not responsible for my choice of investment. I understand that my failure to sign this acknowledgment will make this investment election form null and void.

I ACKNOWLEDGE THAT THE SHARES OF COMMON STOCK, $.01 PAR VALUE PER SHARE, OF SUNSHINE FINANCIAL, INC. ARE NOT DEPOSITS OR AN ACCOUNT AND ARE NOT FEDERALLY INSURED OR GUARANTEED BY SUNSHINE FINANCIAL, SUNSHINE SAVINGS BANK OR BY THE FEDERAL GOVERNMENT.

If anyone asserts that the shares of Sunshine Financial common stock are federally insured or guarantee, or are as safe as an insured deposit, I should call the Office of Thrift Supervision (OTS) Consumer Response Center at (800) 842-6929.

Participant’s Signature: ________________________________________________________ Date Signed: __________________________

This form must be completed and returned to Jill Higgins,

1400 East Park Avenue

Tallahassee, Florida 32301

by no later than

__:__ _.m., Eastern time, on_________________, 2010.

A-3

PROSPECTUS

SUNSHINE FINANCIAL, INC.

(Proposed Holding Company for Sunshine Savings Bank)

Up to 1,207,500 Shares of Common Stock

Sunshine Financial, Inc., a newly formed Maryland corporation, is offering up to 1,207,500 shares of common stock for sale to the public at $10.00 per share in connection with the conversion and reorganization of Sunshine Savings Bank from the mutual holding company form of organization. When the conversion and reorganization is completed, all of the outstanding common stock of Sunshine Savings Bank will be owned by the newly formed Sunshine Financial, Inc., and all of the outstanding common stock of Sunshine Financial, Inc. will be owned by public shareholders.

The shares are being offered for sale on a best efforts basis. The shares are first being offered in a subscription offering to current and former depositors of Sunshine Savings Bank as of the eligibility dates, with aggregate account balances of at least $50.00, and tax-qualified employee benefit plans of Sunshine Savings Bank as described in this prospectus. Shares not purchased in the subscription offering will simultaneously be offered to the general public in a community offering, with a preference given to the communities served by Sunshine Savings Bank. We also may offer for sale shares of common stock not purchased in the subscription offering or community offering through a syndicated community offering managed by Keefe, Bruyette & Woods, Inc.

We must sell a minimum of 892,500 shares in order to complete the offering. Keefe, Bruyette & Woods, Inc. will use its best efforts to assist us in selling our common stock, but is not obligated to purchase any of the common stock that is being offered for sale. Subscribers will not pay any commissions to purchase shares of common stock in the offering.