2Q 2019 Earnings Conference Call NYSE: INXN 7 August 2019 Exhibit 99.2

This document includes forward-looking statements. All statements other than statements of historical fact included in this document regarding our business, financial condition, results of operations and certain of our plans, objectives, assumptions, projections, expectations or beliefs with respect to these items and statements regarding other future events or prospects, are forward-looking statements. These statements include, without limitation, those concerning: our strategy and our ability to achieve it; expectations regarding sales, profitability and growth; plans for the construction of new data centres; our possible or assumed future results of operations; research and development, capital expenditure and investment plans; adequacy of capital; and financing plans. The words “aim", “may", “will", “expect", “anticipate", “believe", “future", “continue", “help", “estimate", “plan", “schedule", “intend", “should", “shall” or the negative or other variations thereof as well as other statements regarding matters that are not historical fact, are or may constitute forward-looking statements. In addition, this document includes forward-looking statements relating to our potential exposure to various types of market risks, such as foreign exchange rate risk, interest rate risks and other risks related to financial assets and liabilities. We have based these forward-looking statements on our management’s current view with respect to future events and financial performance. These views reflect the best judgment of our management but involve a number of risks and uncertainties which could cause actual results to differ materially from those predicted in our forward-looking statements and from past results, performance or achievements. Although we believe that the estimates reflected in the forward-looking statements are reasonable, such estimates may prove to be incorrect. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, among other things: operating expenses cannot be easily reduced in the short term; inability to utilise the capacity of newly planned data centres and data centre expansions; significant competition; cost and supply of electrical power; data centre industry over-capacity; performance under service level agreements; and delays in remediating the material weakness in internal control over financial reporting and/or making disclosure controls and procedure effective. All forward-looking statements included in this document are based on information available to us on the date of this document. The Company undertakes no obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained throughout this document. This document contains references to certain non-IFRS financial measures, such as Adjusted EBITDA, Adjusted EBTIDA margin, Adjusted EBITDA excluding the impact of IFRS 16, Adjusted EBITDA margin excluding the impact of IFRS 16, Recurring revenue, Revenue on a constant currency basis, Adjusted net income, Adjusted diluted earnings per share and Cash generated from operations. For definitions of these measures and a reconciliation of these measures to the nearest IFRS measure, please refer to the appendix and the tables attached to our 2Q19 press release. Certain financial and other information presented in this document has not been audited or reviewed by our independent auditors. Certain numerical, financial data, other amounts and percentages in this document may not sum due to rounding. In addition, certain figures in this document have been rounded to the nearest whole number. Disclaimer

Strategic & Operational Highlights David Ruberg – Chief Executive Officer

Financial Execution Total revenue up 14% Y/Y Recurring revenue up 14% Y/Y Adjusted EBITDA up 26% Y/Y, 13% excluding IFRS 16 Adjusted EBITDA margin increased 490 bps Y/Y to 50.6% Decreased 60 bps Y/Y to 45.1% excluding IFRS 16 Capital expenditure of €123 million including intangibles €283 million in net proceeds raised from equity offering Transaction closed in July Operational Execution Added 6,500 sqm of new equipped space Opened a new data centre in Madrid Opened expansions in Dusseldorf, London, Marseille, Paris, Stockholm and Vienna Installed 2,600 sqm of revenue generating space Utilisation rate of 79% Announced new data centre in Stockholm (STO6) and expansions in Frankfurt (FRA15) and Marseille (MRS3) Acquired PAR7 data centre land Option to purchase adjacent property of 68,000 sqm with access to 50 MW of available power 2Q 2019 Performance Healthy Demand Across European Footprint

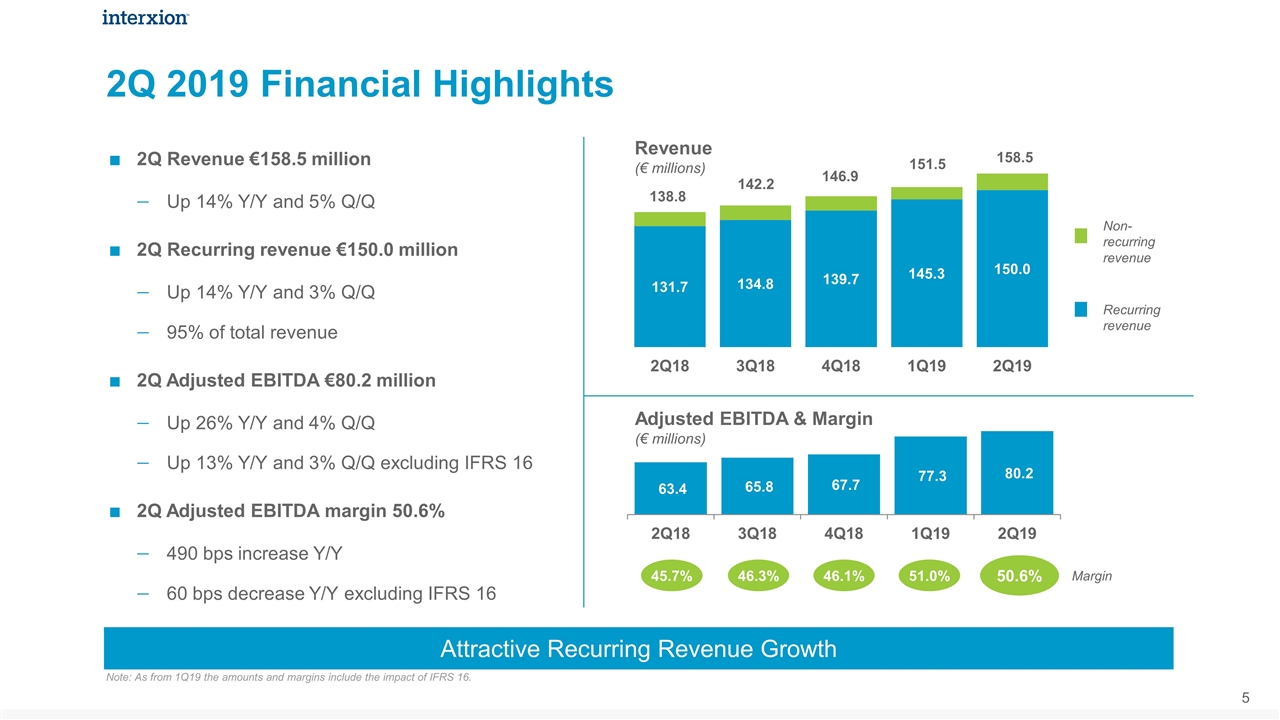

2Q Revenue €158.5 million Up 14% Y/Y and 5% Q/Q 2Q Recurring revenue €150.0 million Up 14% Y/Y and 3% Q/Q 95% of total revenue 2Q Adjusted EBITDA €80.2 million Up 26% Y/Y and 4% Q/Q Up 13% Y/Y and 3% Q/Q excluding IFRS 16 2Q Adjusted EBITDA margin 50.6% 490 bps increase Y/Y 60 bps decrease Y/Y excluding IFRS 16 2Q 2019 Financial Highlights Adjusted EBITDA & Margin (€ millions) 46.3% 50.6% Margin 45.7% Attractive Recurring Revenue Growth 46.1% 51.0% Revenue (€ millions) Non- recurring revenue Recurring revenue 138.8 142.2 146.9 151.5 158.5 Note: As from 1Q19 the amounts and margins include the impact of IFRS 16.

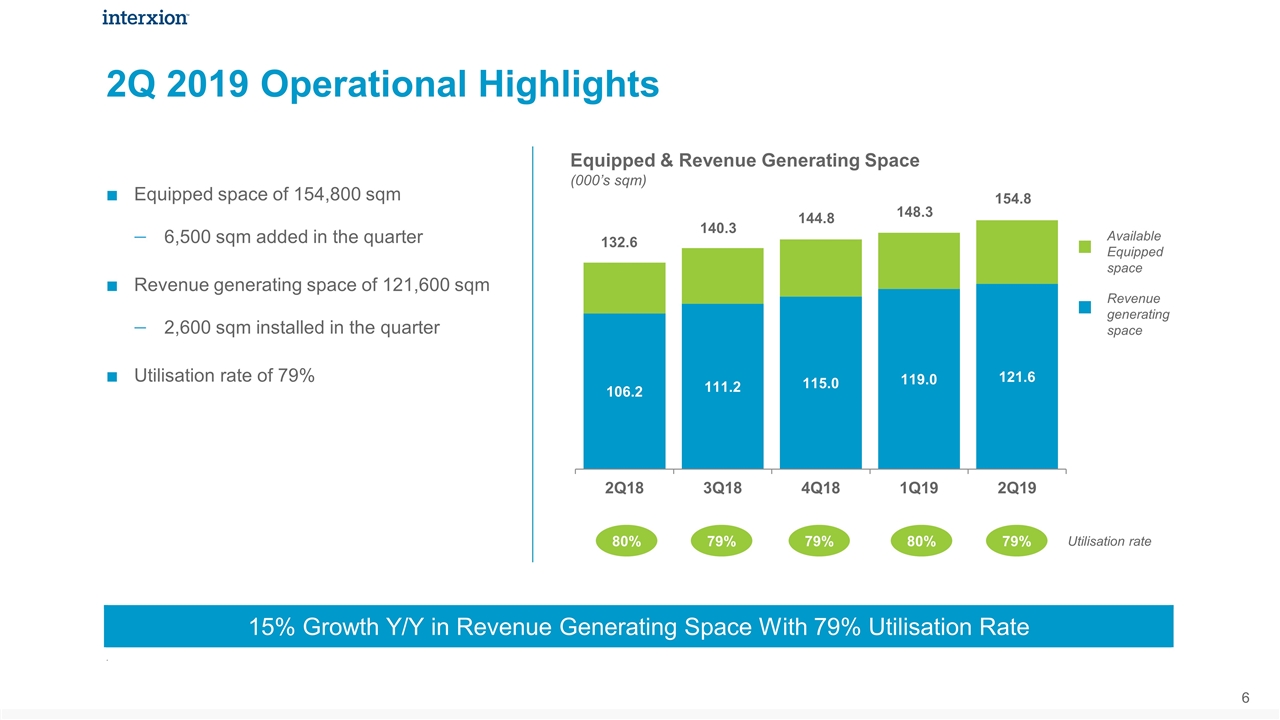

Equipped space of 154,800 sqm 6,500 sqm added in the quarter Revenue generating space of 121,600 sqm 2,600 sqm installed in the quarter Utilisation rate of 79% 2Q 2019 Operational Highlights Equipped & Revenue Generating Space (000’s sqm) Available Equipped space Revenue generating space 79% 80% Utilisation rate 79% 132.6 15% Growth Y/Y in Revenue Generating Space With 79% Utilisation Rate 140.3 80% . 144.8 148.3 154.8 79%

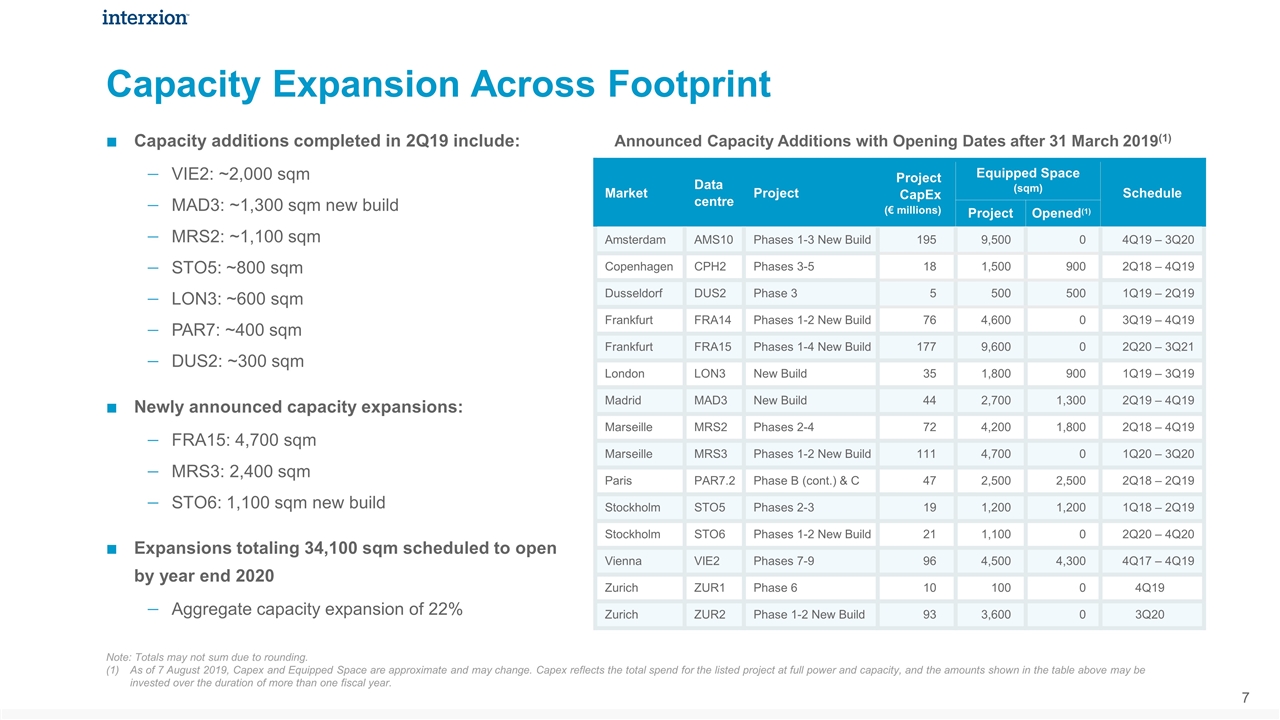

Capacity Expansion Across Footprint Note: Totals may not sum due to rounding. As of 7 August 2019, Capex and Equipped Space are approximate and may change. Capex reflects the total spend for the listed project at full power and capacity, and the amounts shown in the table above may be invested over the duration of more than one fiscal year. Announced Capacity Additions with Opening Dates after 31 March 2019(1) Market Data centre Project Project CapEx (€ millions) Equipped Space (sqm) Schedule Project Opened(1) Amsterdam AMS10 Phases 1-3 New Build 195 9,500 0 4Q19 – 3Q20 Copenhagen CPH2 Phases 3-5 18 1,500 900 2Q18 – 4Q19 Dusseldorf DUS2 Phase 3 5 500 500 1Q19 – 2Q19 Frankfurt FRA14 Phases 1-2 New Build 76 4,600 0 3Q19 – 4Q19 Frankfurt FRA15 Phases 1-4 New Build 177 9,600 0 2Q20 – 3Q21 London LON3 New Build 35 1,800 900 1Q19 – 3Q19 Madrid MAD3 New Build 44 2,700 1,300 2Q19 – 4Q19 Marseille MRS2 Phases 2-4 72 4,200 1,800 2Q18 – 4Q19 Marseille MRS3 Phases 1-2 New Build 111 4,700 0 1Q20 – 3Q20 Paris PAR7.2 Phase B (cont.) & C 47 2,500 2,500 2Q18 – 2Q19 Stockholm STO5 Phases 2-3 19 1,200 1,200 1Q18 – 2Q19 Stockholm STO6 Phases 1-2 New Build 21 1,100 0 2Q20 – 4Q20 Vienna VIE2 Phases 7-9 96 4,500 4,300 4Q17 – 4Q19 Zurich ZUR1 Phase 6 10 100 0 4Q19 Zurich ZUR2 Phase 1-2 New Build 93 3,600 0 3Q20 Capacity additions completed in 2Q19 include: VIE2: ~2,000 sqm MAD3: ~1,300 sqm new build MRS2: ~1,100 sqm STO5: ~800 sqm LON3: ~600 sqm PAR7: ~400 sqm DUS2: ~300 sqm Newly announced capacity expansions: FRA15: 4,700 sqm MRS3: 2,400 sqm STO6: 1,100 sqm new build Expansions totaling 34,100 sqm scheduled to open by year end 2020 Aggregate capacity expansion of 22%

40% 30% 30% Communities of Interest Deliver Significant Customer Value Connectivity Platforms Enterprises

Financial Highlights John Doherty – Chief Financial Officer

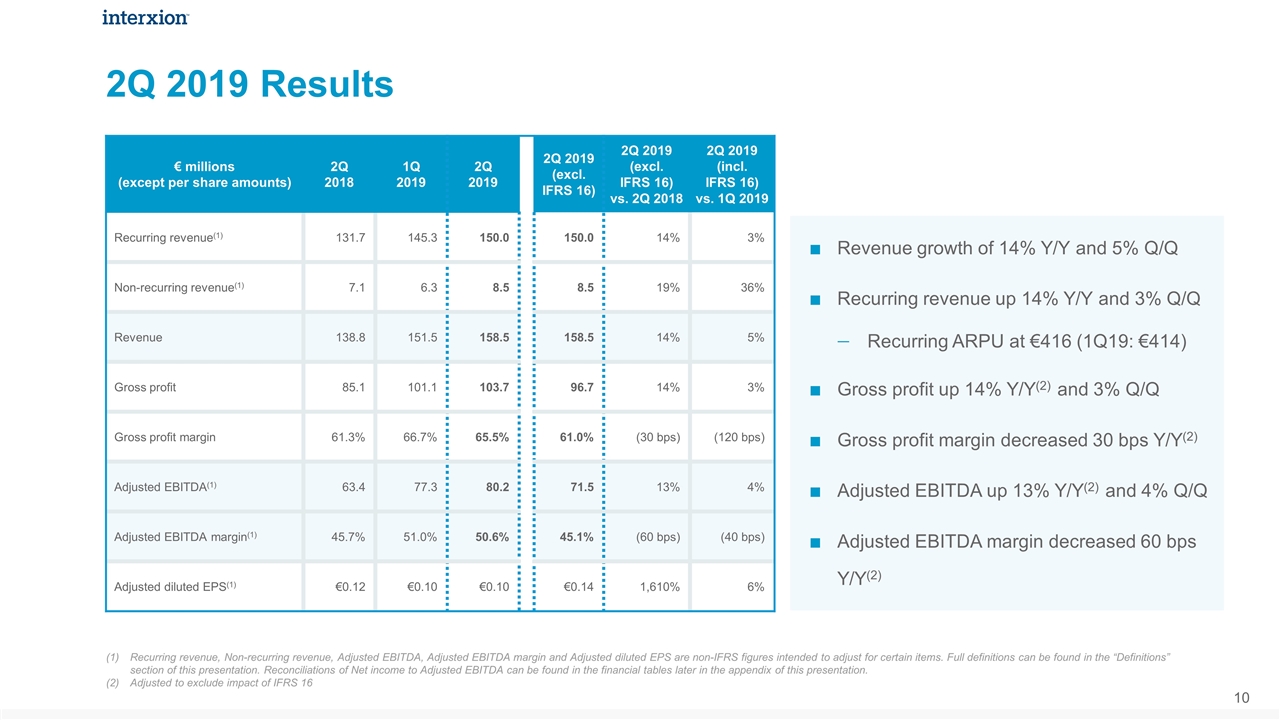

Recurring revenue, Non-recurring revenue, Adjusted EBITDA, Adjusted EBITDA margin and Adjusted diluted EPS are non-IFRS figures intended to adjust for certain items. Full definitions can be found in the “Definitions” section of this presentation. Reconciliations of Net income to Adjusted EBITDA can be found in the financial tables later in the appendix of this presentation. Adjusted to exclude impact of IFRS 16 € millions (except per share amounts) 2Q 2018 1Q 2019 2Q 2019 2Q 2019 (excl. IFRS 16) 2Q 2019 (excl. IFRS 16) vs. 2Q 2018 2Q 2019 (incl. IFRS 16) vs. 1Q 2019 Recurring revenue(1) 131.7 145.3 150.0 150.0 14% 3% Non-recurring revenue(1) 7.1 6.3 8.5 8.5 19% 36% Revenue 138.8 151.5 158.5 158.5 14% 5% Gross profit 85.1 101.1 103.7 96.7 14% 3% Gross profit margin 61.3% 66.7% 65.5% 61.0% (30 bps) (120 bps) Adjusted EBITDA(1) 63.4 77.3 80.2 71.5 13% 4% Adjusted EBITDA margin(1) 45.7% 51.0% 50.6% 45.1% (60 bps) (40 bps) Adjusted diluted EPS(1) €0.12 €0.10 €0.10 €0.14 1,610% 6% Revenue growth of 14% Y/Y and 5% Q/Q Recurring revenue up 14% Y/Y and 3% Q/Q Recurring ARPU at €416 (1Q19: €414) Gross profit up 14% Y/Y(2) and 3% Q/Q Gross profit margin decreased 30 bps Y/Y(2) Adjusted EBITDA up 13% Y/Y(2) and 4% Q/Q Adjusted EBITDA margin decreased 60 bps Y/Y(2) 2Q 2019 Results

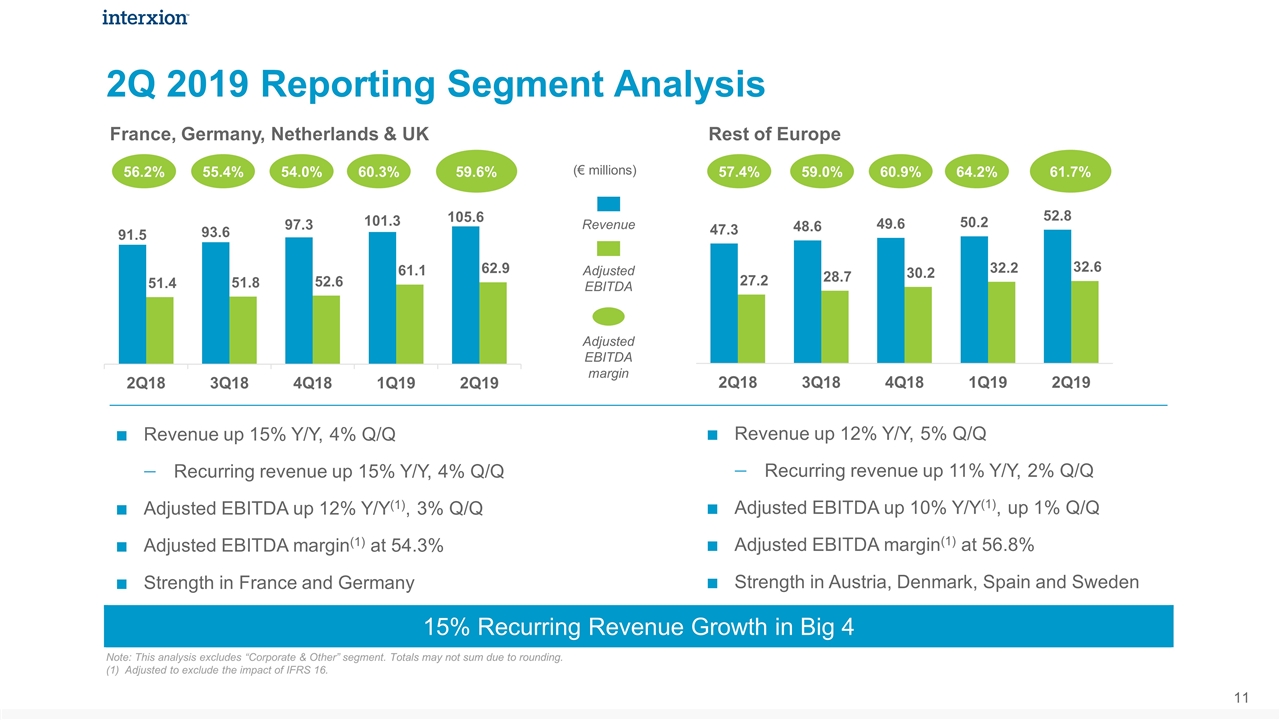

2Q 2019 Reporting Segment Analysis Revenue up 12% Y/Y, 5% Q/Q Recurring revenue up 11% Y/Y, 2% Q/Q Adjusted EBITDA up 10% Y/Y(1), up 1% Q/Q Adjusted EBITDA margin(1) at 56.8% Strength in Austria, Denmark, Spain and Sweden Note: This analysis excludes “Corporate & Other” segment. Totals may not sum due to rounding. (1) Adjusted to exclude the impact of IFRS 16. Revenue up 15% Y/Y, 4% Q/Q Recurring revenue up 15% Y/Y, 4% Q/Q Adjusted EBITDA up 12% Y/Y(1), 3% Q/Q Adjusted EBITDA margin(1) at 54.3% Strength in France and Germany Revenue Adjusted EBITDA Adjusted EBITDA margin (€ millions) 56.2% 55.4% 54.0% 57.4% 59.0% 60.9% France, Germany, Netherlands & UK 60.3% 64.2% 59.6% 61.7% Rest of Europe 15% Recurring Revenue Growth in Big 4

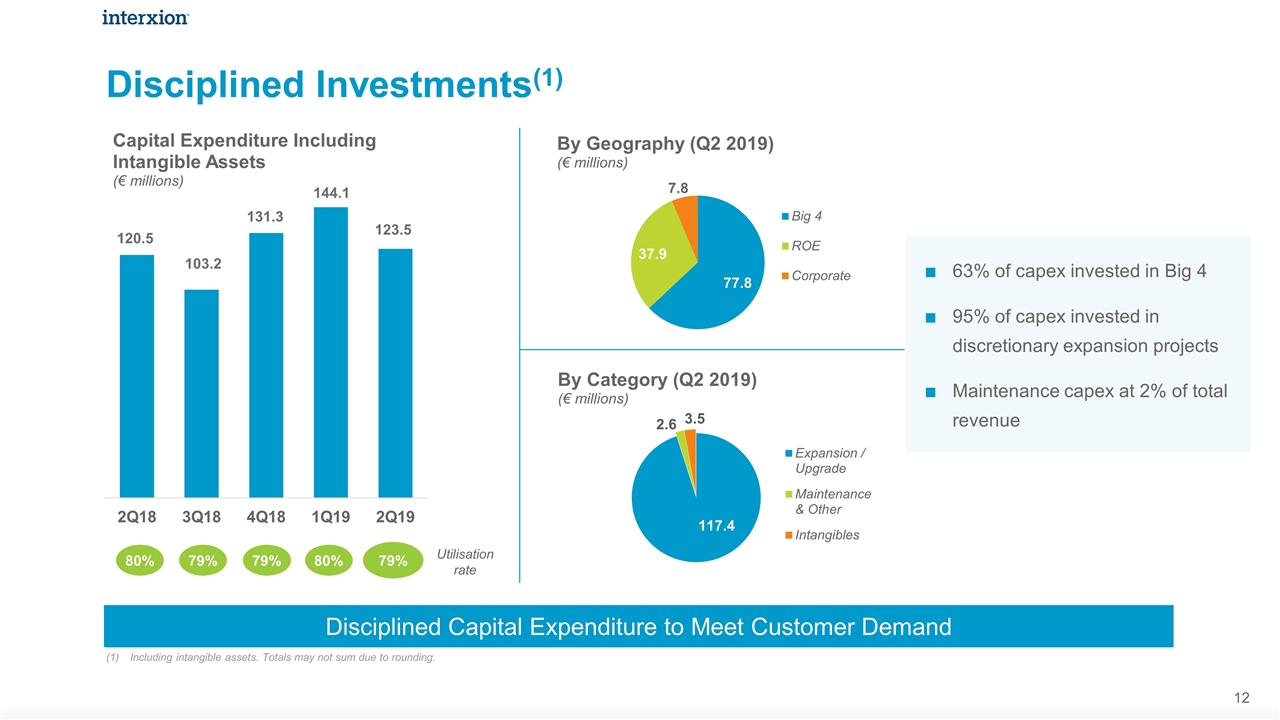

Disciplined Investments(1) 79% 79% 80% Utilisation rate 80% Disciplined Capital Expenditure to Meet Customer Demand 63% of capex invested in Big 4 95% of capex invested in discretionary expansion projects Maintenance capex at 2% of total revenue Including intangible assets. Totals may not sum due to rounding. 79%

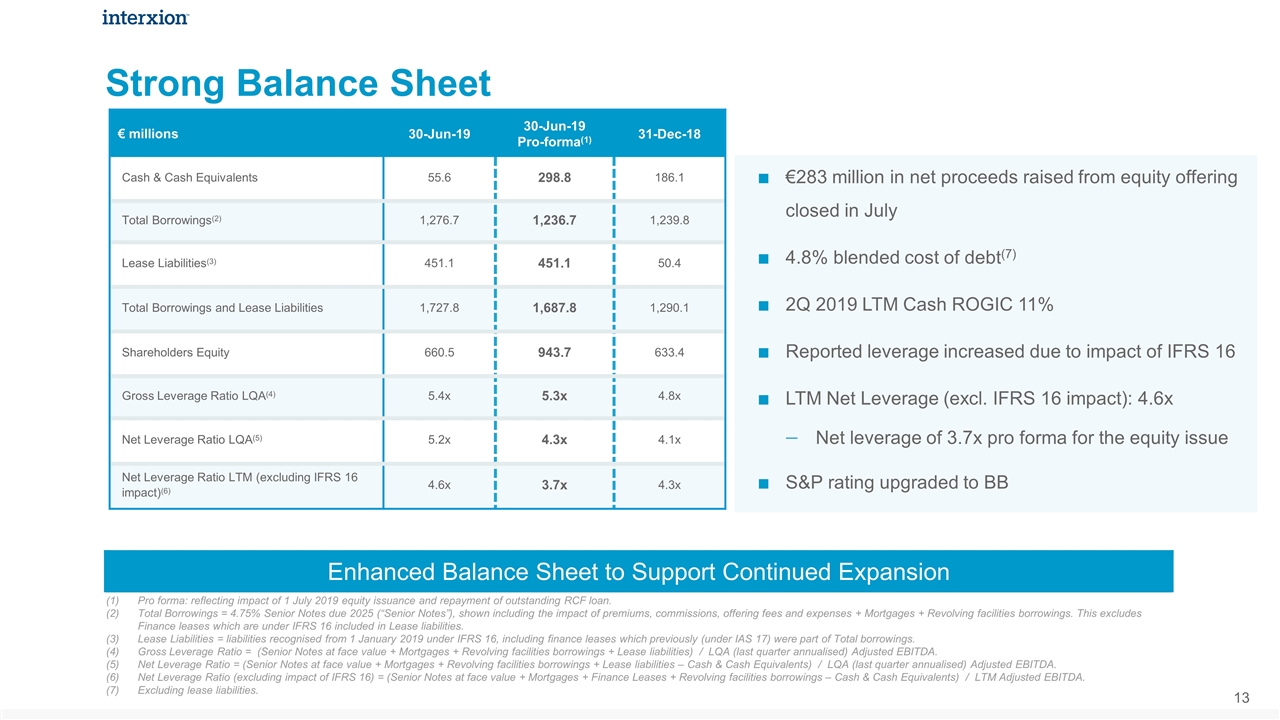

€283 million in net proceeds raised from equity offering closed in July 4.8% blended cost of debt(7) 2Q 2019 LTM Cash ROGIC 11% Reported leverage increased due to impact of IFRS 16 LTM Net Leverage (excl. IFRS 16 impact): 4.6x Net leverage of 3.7x pro forma for the equity issue S&P rating upgraded to BB Strong Balance Sheet Pro forma: reflecting impact of 1 July 2019 equity issuance and repayment of outstanding RCF loan. Total Borrowings = 4.75% Senior Notes due 2025 (“Senior Notes”), shown including the impact of premiums, commissions, offering fees and expenses + Mortgages + Revolving facilities borrowings. This excludes Finance leases which are under IFRS 16 included in Lease liabilities. Lease Liabilities = liabilities recognised from 1 January 2019 under IFRS 16, including finance leases which previously (under IAS 17) were part of Total borrowings. Gross Leverage Ratio = (Senior Notes at face value + Mortgages + Revolving facilities borrowings + Lease liabilities) / LQA (last quarter annualised) Adjusted EBITDA. Net Leverage Ratio = (Senior Notes at face value + Mortgages + Revolving facilities borrowings + Lease liabilities – Cash & Cash Equivalents) / LQA (last quarter annualised) Adjusted EBITDA. Net Leverage Ratio (excluding impact of IFRS 16) = (Senior Notes at face value + Mortgages + Finance Leases + Revolving facilities borrowings – Cash & Cash Equivalents) / LTM Adjusted EBITDA. Excluding lease liabilities. € millions 30-Jun-19 30-Jun-19 Pro-forma(1) 31-Dec-18 Cash & Cash Equivalents 55.6 298.8 186.1 Total Borrowings(2) 1,276.7 1,236.7 1,239.8 Lease Liabilities(3) 451.1 451.1 50.4 Total Borrowings and Lease Liabilities 1,727.8 1,687.8 1,290.1 Shareholders Equity 660.5 943.7 633.4 Gross Leverage Ratio LQA(4) 5.4x 5.3x 4.8x Net Leverage Ratio LQA(5) 5.2x 4.3x 4.1x Net Leverage Ratio LTM (excluding IFRS 16 impact)(6) 4.6x 3.7x 4.3x Enhanced Balance Sheet to Support Continued Expansion

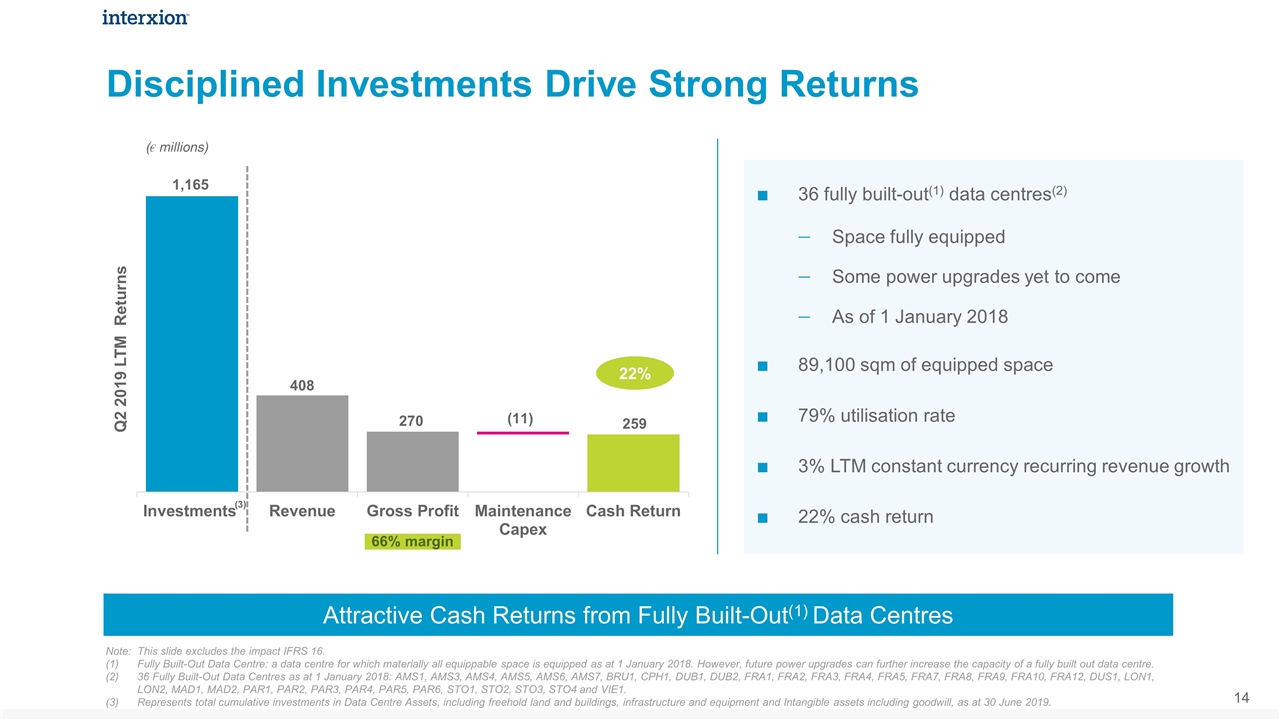

36 fully built-out(1) data centres(2) Space fully equipped Some power upgrades yet to come As of 1 January 2018 89,100 sqm of equipped space 79% utilisation rate 3% LTM constant currency recurring revenue growth 22% cash return Disciplined Investments Drive Strong Returns Q2 2019 LTM Returns (€ millions) Note: This slide excludes the impact IFRS 16. Fully Built-Out Data Centre: a data centre for which materially all equippable space is equipped as at 1 January 2018. However, future power upgrades can further increase the capacity of a fully built out data centre. 36 Fully Built-Out Data Centres as at 1 January 2018: AMS1, AMS3, AMS4, AMS5, AMS6, AMS7, BRU1, CPH1, DUB1, DUB2, FRA1, FRA2, FRA3, FRA4, FRA5, FRA7, FRA8, FRA9, FRA10, FRA12, DUS1, LON1, LON2, MAD1, MAD2, PAR1, PAR2, PAR3, PAR4, PAR5, PAR6, STO1, STO2, STO3, STO4 and VIE1. Represents total cumulative investments in Data Centre Assets, including freehold land and buildings, infrastructure and equipment and Intangible assets including goodwill, as at 30 June 2019. Attractive Cash Returns from Fully Built-Out(1) Data Centres

Business Commentary Outlook & Concluding Remarks David Ruberg – Chief Executive Officer

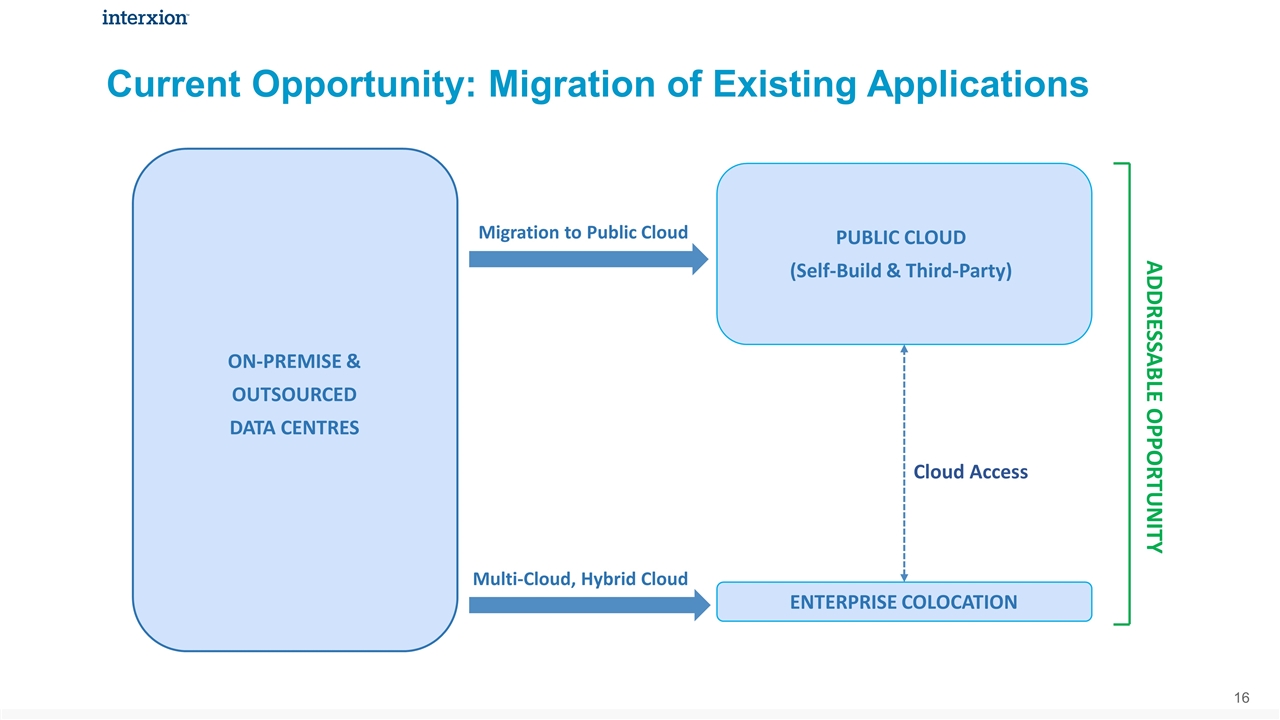

Current Opportunity: Migration of Existing Applications ON-PREMISE & OUTSOURCED DATA CENTRES PUBLIC CLOUD (Self-Build & Third-Party) ENTERPRISE COLOCATION Migration to Public Cloud Multi-Cloud, Hybrid Cloud Cloud Access ADDRESSABLE OPPORTUNITY

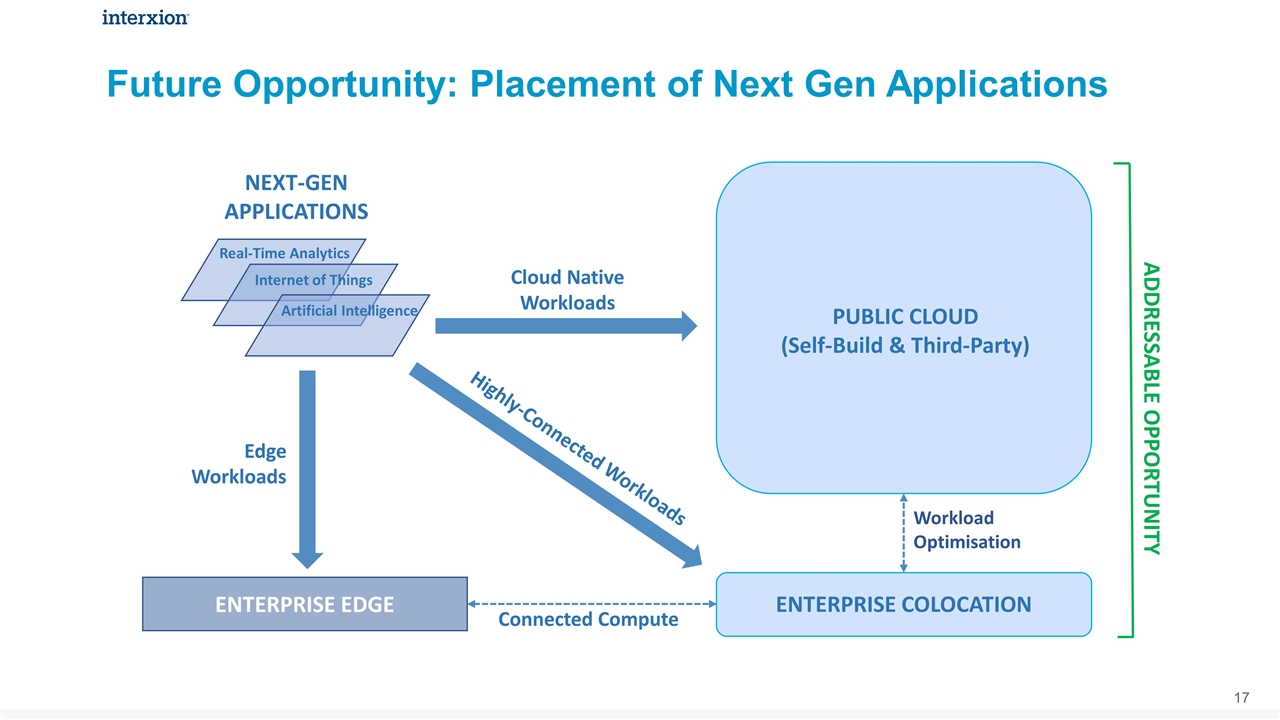

Future Opportunity: Placement of Next Gen Applications PUBLIC CLOUD (Self-Build & Third-Party) ENTERPRISE COLOCATION ADDRESSABLE OPPORTUNITY Edge Workloads Workload Optimisation NEXT-GEN APPLICATIONS ENTERPRISE EDGE Highly-Connected Workloads Cloud Native Workloads Connected Compute Real-Time Analytics Internet of Things Artificial Intelligence

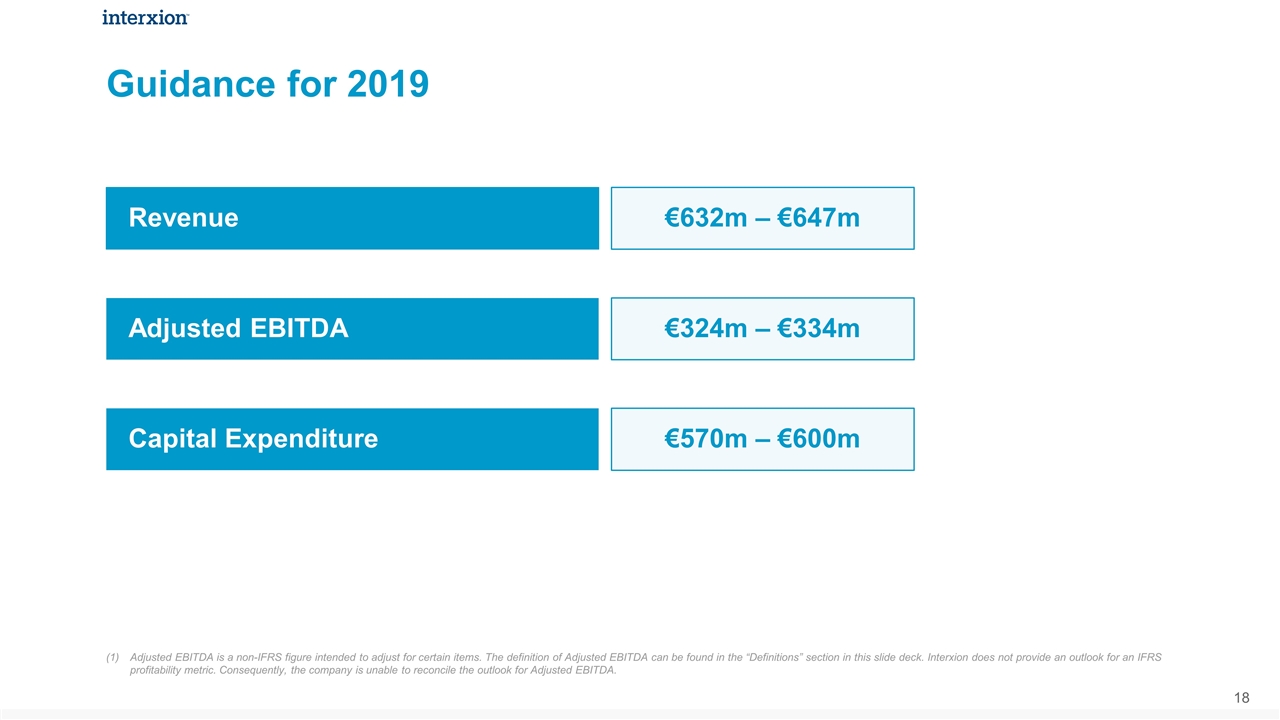

Guidance for 2019 Adjusted EBITDA is a non-IFRS figure intended to adjust for certain items. The definition of Adjusted EBITDA can be found in the “Definitions” section in this slide deck. Interxion does not provide an outlook for an IFRS profitability metric. Consequently, the company is unable to reconcile the outlook for Adjusted EBITDA. Revenue Adjusted EBITDA Capital Expenditure €632m – €647m €324m – €334m €570m – €600m

Questions & Answers

Appendix

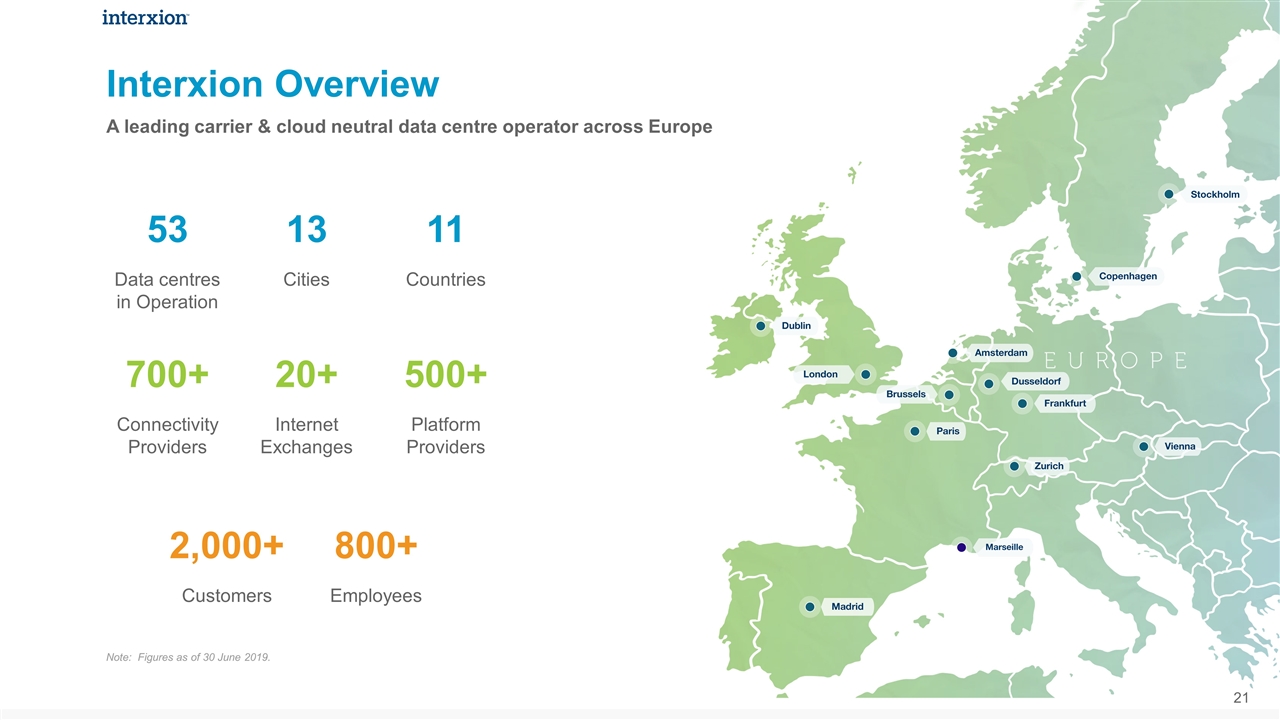

A leading carrier & cloud neutral data centre operator across Europe Interxion Overview 53 Data centres in Operation 13 Cities 11 Countries 700+ Connectivity Providers 20+ Internet Exchanges 500+ Platform Providers 2,000+ Customers 800+ Employees Note: Figures as of 30 June 2019.

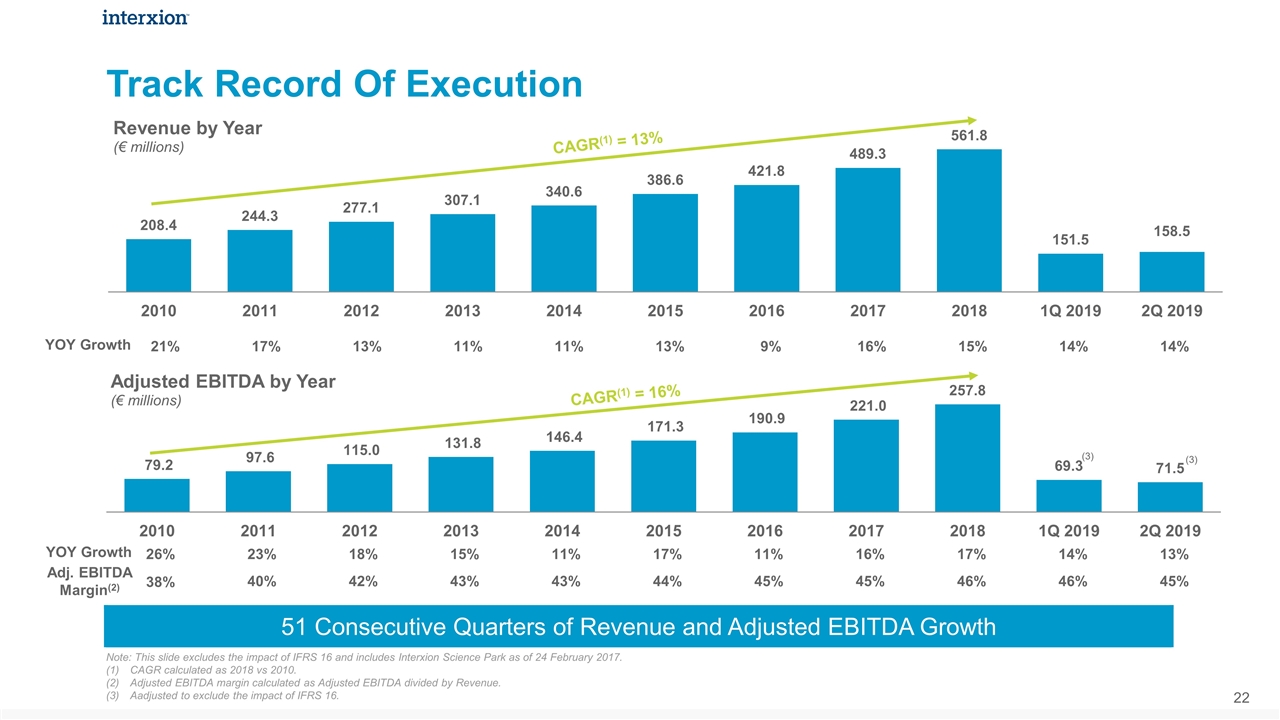

Track Record Of Execution Note: This slide excludes the impact of IFRS 16 and includes Interxion Science Park as of 24 February 2017. CAGR calculated as 2018 vs 2010. Adjusted EBITDA margin calculated as Adjusted EBITDA divided by Revenue. Aadjusted to exclude the impact of IFRS 16. CAGR(1) = 13% CAGR(1) = 16% 38% 40% 42% 43% 43% 44% 45% 45% 46% 46% 45% 21% 17% 13% 11% 11% 13% 9% 16% 15% 14% 14% 51 Consecutive Quarters of Revenue and Adjusted EBITDA Growth YOY Growth 26% 23% 18% 15% 11% 17% 11% 16% 17% 14% 13% Adj. EBITDA Margin(2) YOY Growth (3) (3)

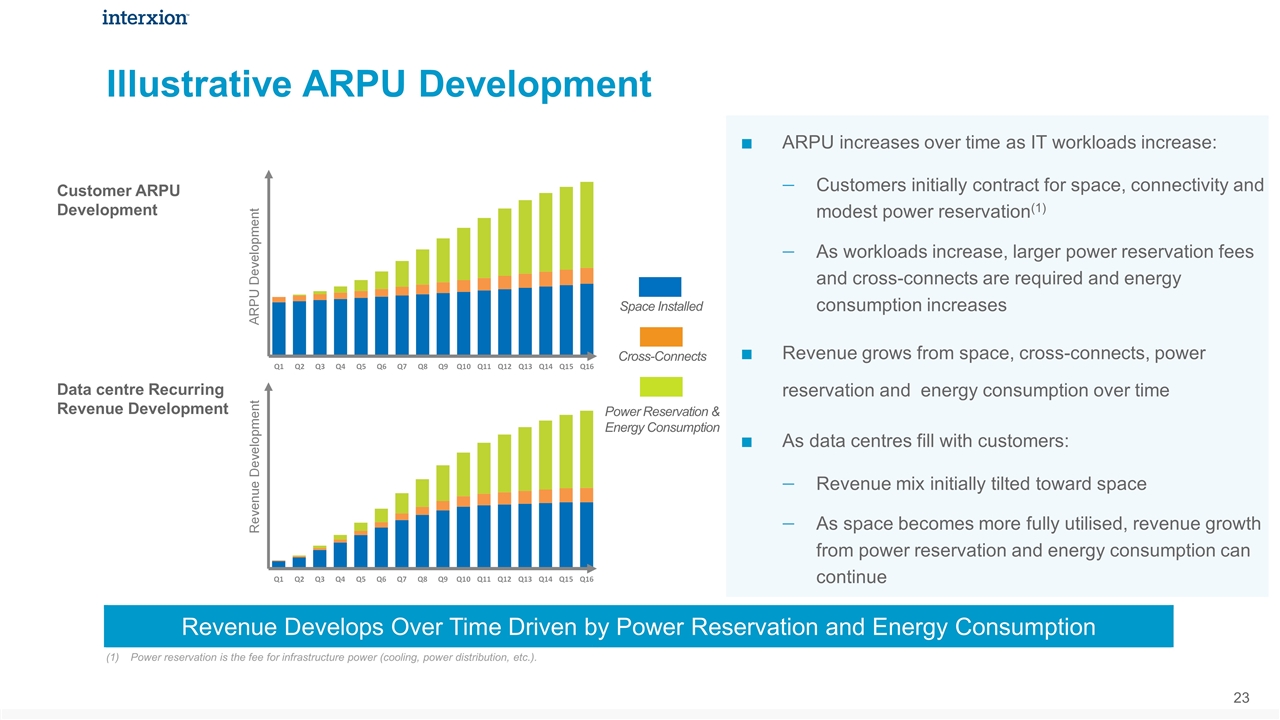

ARPU increases over time as IT workloads increase: Customers initially contract for space, connectivity and modest power reservation(1) As workloads increase, larger power reservation fees and cross-connects are required and energy consumption increases Revenue grows from space, cross-connects, power reservation and energy consumption over time As data centres fill with customers: Revenue mix initially tilted toward space As space becomes more fully utilised, revenue growth from power reservation and energy consumption can continue Revenue Develops Over Time Driven by Power Reservation and Energy Consumption Illustrative ARPU Development Power reservation is the fee for infrastructure power (cooling, power distribution, etc.). Customer ARPU Development Data centre Recurring Revenue Development Power Reservation & Energy Consumption Cross-Connects Space Installed

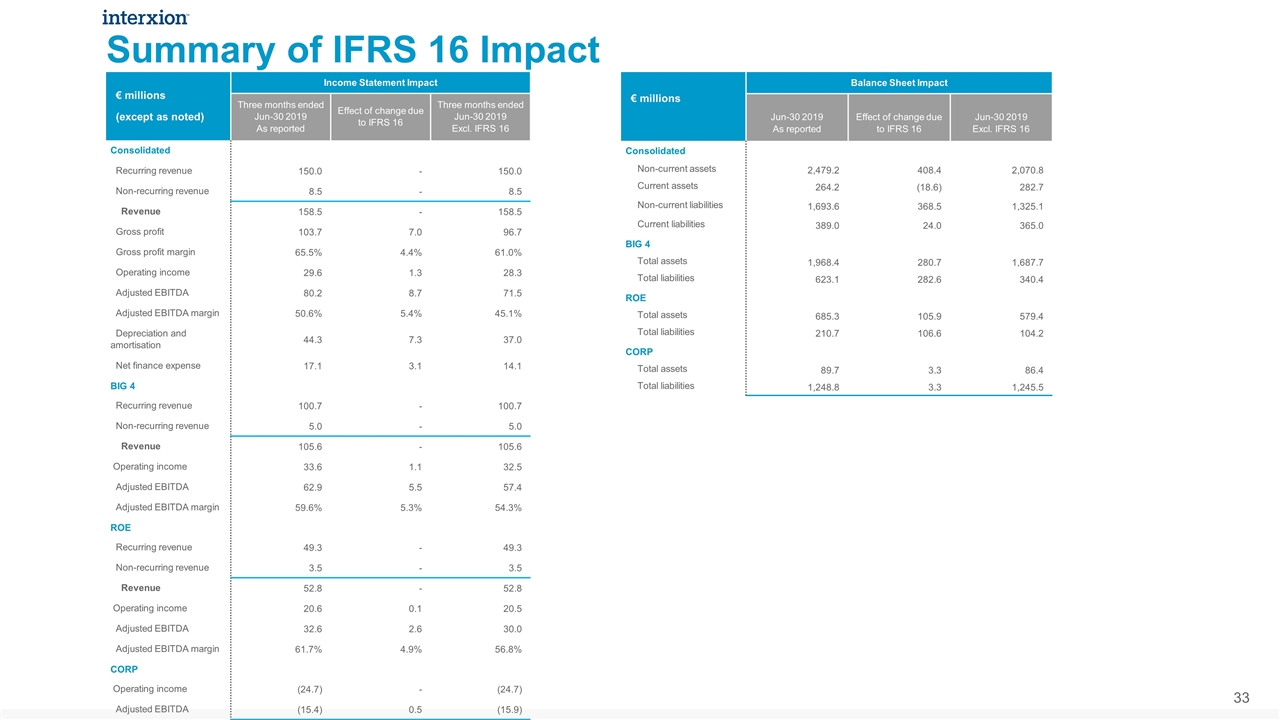

IFRS 16 – Lease Accounting Metric Significant Considerations Impact Revenue Certain components of revenue are recognised as lease revenue. Negligible impact on revenue metrics Adjusted EBITDA Properties and other assets leased under operating lease agreements are recognised as right of use assets and lease liabilities, reducing rent expense and increasing interest expense and depreciation charges. 540 bps increase to Adjusted EBITDA margin in 2Q 2019 Leverage Recognising right of use assets and lease liabilities for data centres leased under operating leases increases the level of reported third party debt resulting in an increase in reported gross and net leverage. Impact as at 30 June 2019: Gross leverage (LQA):+0.8x Net leverage (LQA):+0.8x IFRS 16 adopted 1 January 2019 Operating leases and financial leases are now treated the same IFRS 16 does not impact Interxion’s financial covenant reporting on debt or revolving credit facilities More comparable with our U.S. peer group

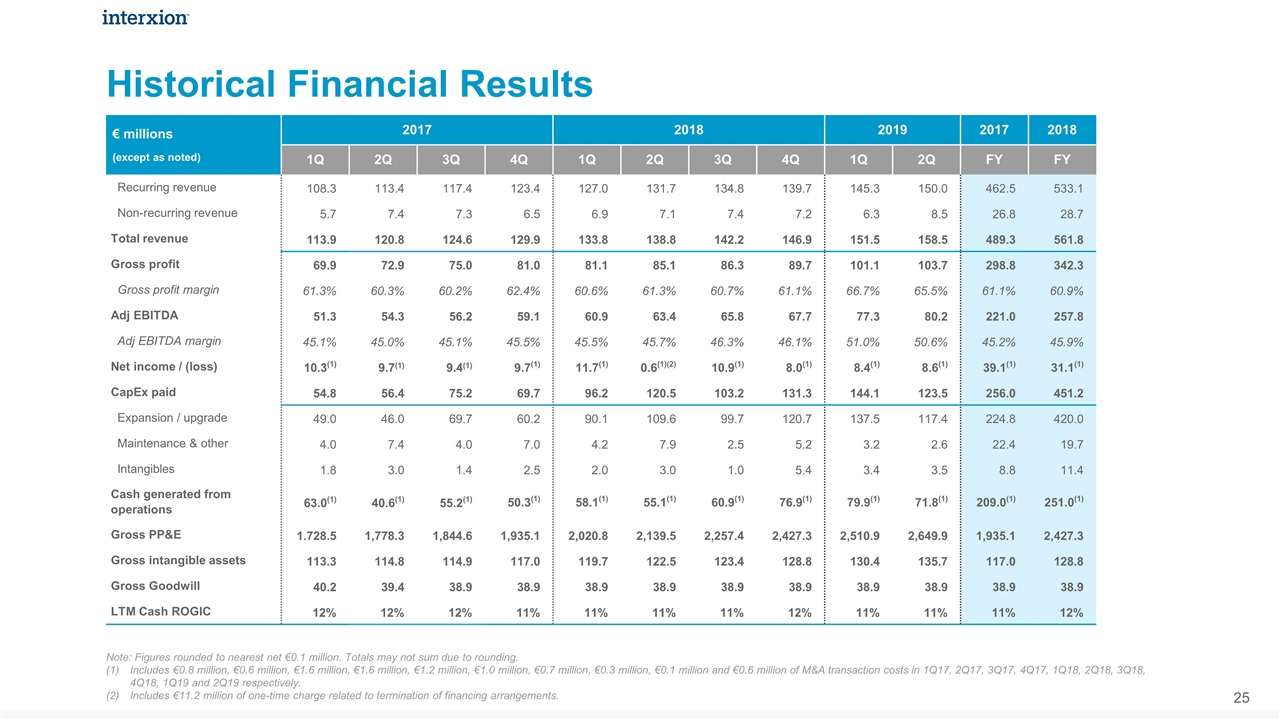

Historical Financial Results Note: Figures rounded to nearest net €0.1 million. Totals may not sum due to rounding. Includes €0.8 million, €0.6 million, €1.6 million, €1.6 million, €1.2 million, €1.0 million, €0.7 million, €0.3 million, €0.1 million and €0.6 million of M&A transaction costs in 1Q17, 2Q17, 3Q17, 4Q17, 1Q18, 2Q18, 3Q18, 4Q18, 1Q19 and 2Q19 respectively. Includes €11.2 million of one-time charge related to termination of financing arrangements. € millions (except as noted) 2017 2018 2019 2017 2018 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q FY FY Recurring revenue 108.3 113.4 117.4 123.4 127.0 131.7 134.8 139.7 145.3 150.0 462.5 533.1 Non-recurring revenue 5.7 7.4 7.3 6.5 6.9 7.1 7.4 7.2 6.3 8.5 26.8 28.7 Total revenue 113.9 120.8 124.6 129.9 133.8 138.8 142.2 146.9 151.5 158.5 489.3 561.8 Gross profit 69.9 72.9 75.0 81.0 81.1 85.1 86.3 89.7 101.1 103.7 298.8 342.3 Gross profit margin 61.3% 60.3% 60.2% 62.4% 60.6% 61.3% 60.7% 61.1% 66.7% 65.5% 61.1% 60.9% Adj EBITDA 51.3 54.3 56.2 59.1 60.9 63.4 65.8 67.7 77.3 80.2 221.0 257.8 Adj EBITDA margin 45.1% 45.0% 45.1% 45.5% 45.5% 45.7% 46.3% 46.1% 51.0% 50.6% 45.2% 45.9% Net income / (loss) 10.3(1) 9.7(1) 9.4(1) 9.7(1) 11.7(1) 0.6(1)(2) 10.9(1) 8.0(1) 8.4(1) 8.6(1) 39.1(1) 31.1(1) CapEx paid 54.8 56.4 75.2 69.7 96.2 120.5 103.2 131.3 144.1 123.5 256.0 451.2 Expansion / upgrade 49.0 46.0 69.7 60.2 90.1 109.6 99.7 120.7 137.5 117.4 224.8 420.0 Maintenance & other 4.0 7.4 4.0 7.0 4.2 7.9 2.5 5.2 3.2 2.6 22.4 19.7 Intangibles 1.8 3.0 1.4 2.5 2.0 3.0 1.0 5.4 3.4 3.5 8.8 11.4 Cash generated from operations 63.0(1) 40.6(1) 55.2(1) 50.3(1) 58.1(1) 55.1(1) 60.9(1) 76.9(1) 79.9(1) 71.8(1) 209.0(1) 251.0(1) Gross PP&E 1.728.5 1,778.3 1,844.6 1,935.1 2,020.8 2,139.5 2,257.4 2,427.3 2,510.9 2,649.9 1,935.1 2,427.3 Gross intangible assets 113.3 114.8 114.9 117.0 119.7 122.5 123.4 128.8 130.4 135.7 117.0 128.8 Gross Goodwill 40.2 39.4 38.9 38.9 38.9 38.9 38.9 38.9 38.9 38.9 38.9 38.9 LTM Cash ROGIC 12% 12% 12% 11% 11% 11% 11% 12% 11% 11% 11% 12%

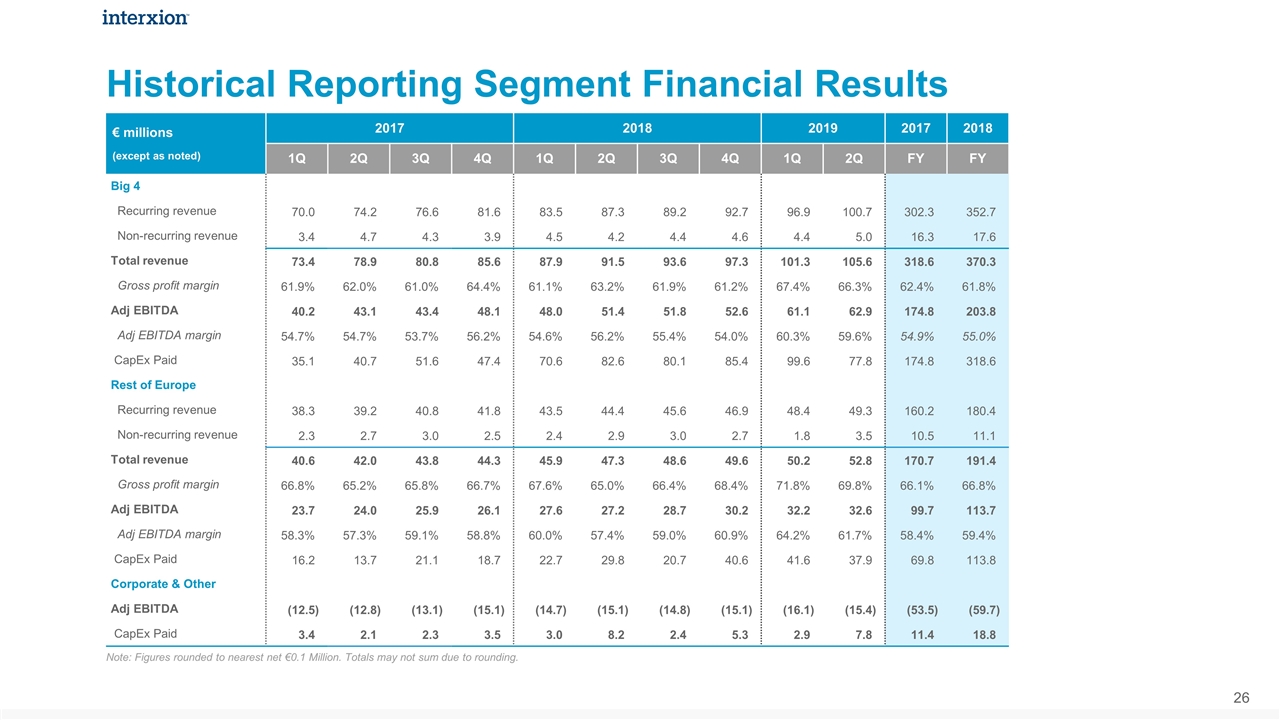

Historical Reporting Segment Financial Results Note: Figures rounded to nearest net €0.1 Million. Totals may not sum due to rounding. € millions (except as noted) 2017 2018 2019 2017 2018 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q FY FY Big 4 Recurring revenue 70.0 74.2 76.6 81.6 83.5 87.3 89.2 92.7 96.9 100.7 302.3 352.7 Non-recurring revenue 3.4 4.7 4.3 3.9 4.5 4.2 4.4 4.6 4.4 5.0 16.3 17.6 Total revenue 73.4 78.9 80.8 85.6 87.9 91.5 93.6 97.3 101.3 105.6 318.6 370.3 Gross profit margin 61.9% 62.0% 61.0% 64.4% 61.1% 63.2% 61.9% 61.2% 67.4% 66.3% 62.4% 61.8% Adj EBITDA 40.2 43.1 43.4 48.1 48.0 51.4 51.8 52.6 61.1 62.9 174.8 203.8 Adj EBITDA margin 54.7% 54.7% 53.7% 56.2% 54.6% 56.2% 55.4% 54.0% 60.3% 59.6% 54.9% 55.0% CapEx Paid 35.1 40.7 51.6 47.4 70.6 82.6 80.1 85.4 99.6 77.8 174.8 318.6 Rest of Europe Recurring revenue 38.3 39.2 40.8 41.8 43.5 44.4 45.6 46.9 48.4 49.3 160.2 180.4 Non-recurring revenue 2.3 2.7 3.0 2.5 2.4 2.9 3.0 2.7 1.8 3.5 10.5 11.1 Total revenue 40.6 42.0 43.8 44.3 45.9 47.3 48.6 49.6 50.2 52.8 170.7 191.4 Gross profit margin 66.8% 65.2% 65.8% 66.7% 67.6% 65.0% 66.4% 68.4% 71.8% 69.8% 66.1% 66.8% Adj EBITDA 23.7 24.0 25.9 26.1 27.6 27.2 28.7 30.2 32.2 32.6 99.7 113.7 Adj EBITDA margin 58.3% 57.3% 59.1% 58.8% 60.0% 57.4% 59.0% 60.9% 64.2% 61.7% 58.4% 59.4% CapEx Paid 16.2 13.7 21.1 18.7 22.7 29.8 20.7 40.6 41.6 37.9 69.8 113.8 Corporate & Other Adj EBITDA (12.5) (12.8) (13.1) (15.1) (14.7) (15.1) (14.8) (15.1) (16.1) (15.4) (53.5) (59.7) CapEx Paid 3.4 2.1 2.3 3.5 3.0 8.2 2.4 5.3 2.9 7.8 11.4 18.8

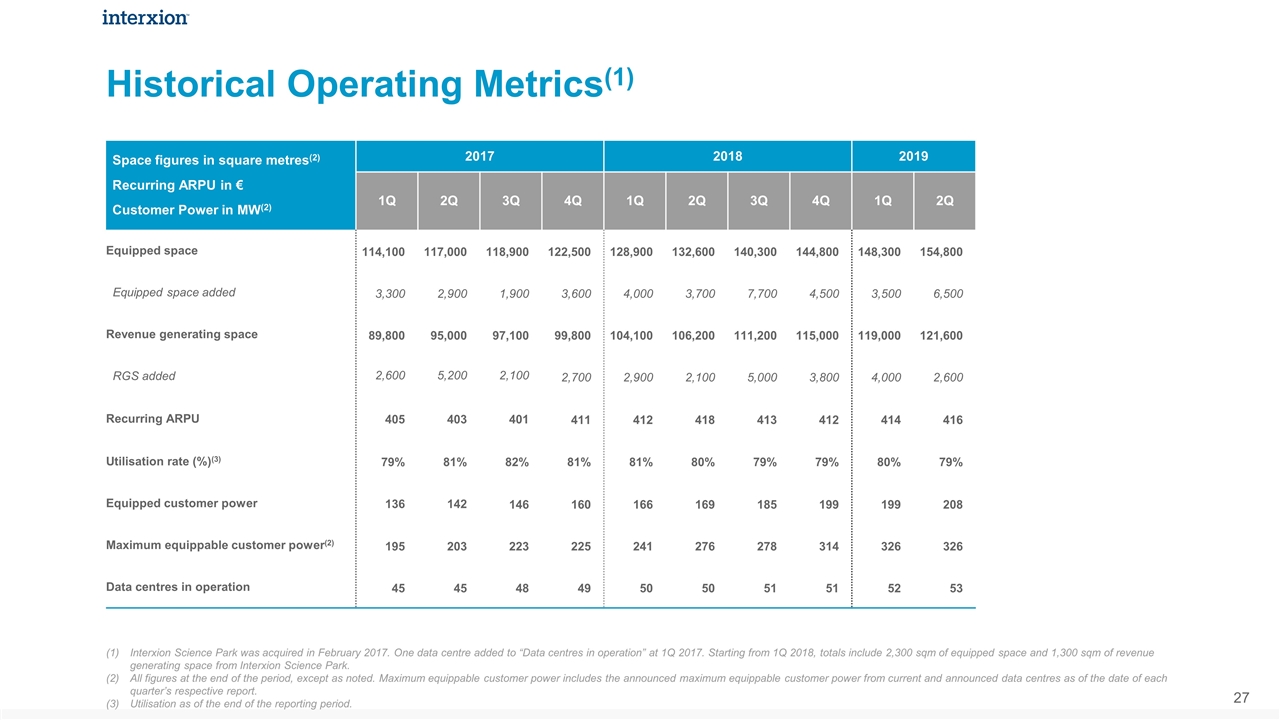

Historical Operating Metrics(1) Interxion Science Park was acquired in February 2017. One data centre added to “Data centres in operation” at 1Q 2017. Starting from 1Q 2018, totals include 2,300 sqm of equipped space and 1,300 sqm of revenue generating space from Interxion Science Park. All figures at the end of the period, except as noted. Maximum equippable customer power includes the announced maximum equippable customer power from current and announced data centres as of the date of each quarter’s respective report. Utilisation as of the end of the reporting period. Space figures in square metres(2) Recurring ARPU in € Customer Power in MW(2) 2017 2018 2019 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q Equipped space 114,100 117,000 118,900 122,500 128,900 132,600 140,300 144,800 148,300 154,800 Equipped space added 3,300 2,900 1,900 3,600 4,000 3,700 7,700 4,500 3,500 6,500 Revenue generating space 89,800 95,000 97,100 99,800 104,100 106,200 111,200 115,000 119,000 121,600 RGS added 2,600 5,200 2,100 2,700 2,900 2,100 5,000 3,800 4,000 2,600 Recurring ARPU 405 403 401 411 412 418 413 412 414 416 Utilisation rate (%)(3) 79% 81% 82% 81% 81% 80% 79% 79% 80% 79% Equipped customer power 136 142 146 160 166 169 185 199 199 208 Maximum equippable customer power(2) 195 203 223 225 241 276 278 314 326 326 Data centres in operation 45 45 48 49 50 50 51 51 52 53

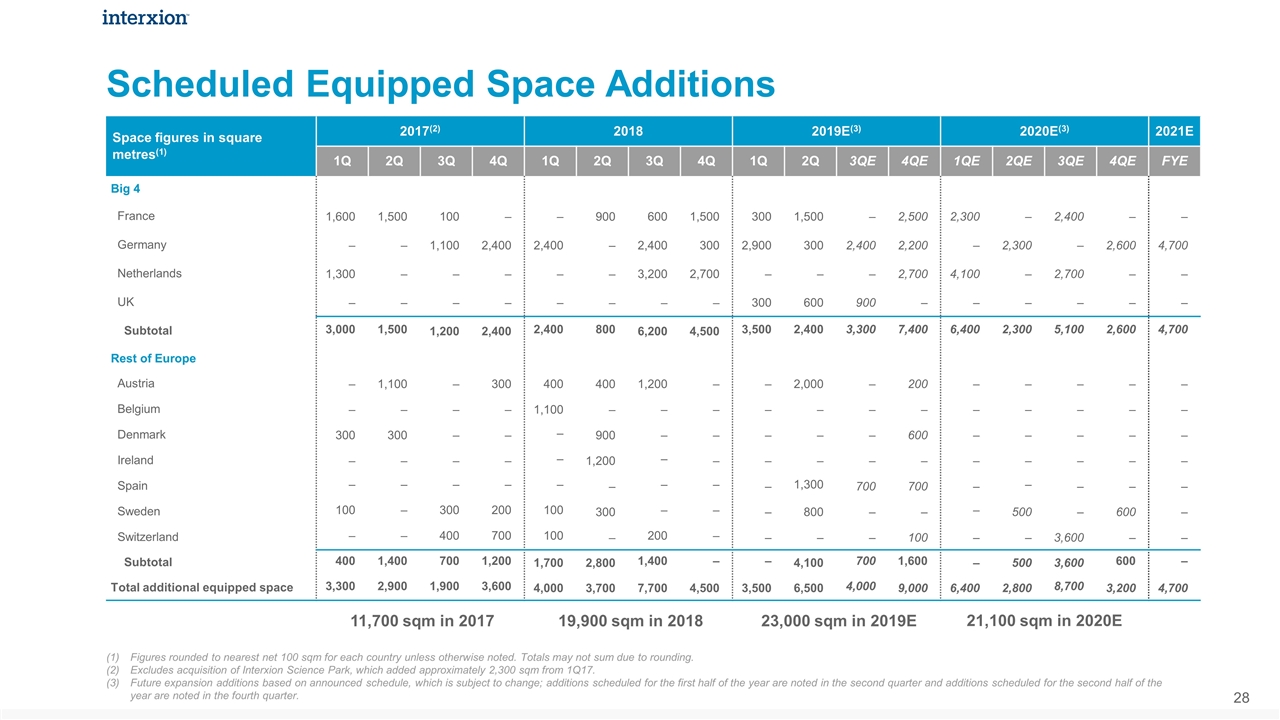

Scheduled Equipped Space Additions Figures rounded to nearest net 100 sqm for each country unless otherwise noted. Totals may not sum due to rounding. Excludes acquisition of Interxion Science Park, which added approximately 2,300 sqm from 1Q17. Future expansion additions based on announced schedule, which is subject to change; additions scheduled for the first half of the year are noted in the second quarter and additions scheduled for the second half of the year are noted in the fourth quarter. Space figures in square metres(1) 2017(2) 2018 2019E(3) 2020E(3) 2021E 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3QE 4QE 1QE 2QE 3QE 4QE FYE Big 4 France 1,600 1,500 100 ‒ ‒ 900 600 1,500 300 1,500 ‒ 2,500 2,300 ‒ 2,400 ‒ ‒ Germany ‒ ‒ 1,100 2,400 2,400 ‒ 2,400 300 2,900 300 2,400 2,200 ‒ 2,300 ‒ 2,600 4,700 Netherlands 1,300 ‒ ‒ ‒ ‒ ‒ 3,200 2,700 ‒ ‒ ‒ 2,700 4,100 ‒ 2,700 ‒ ‒ UK ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 300 600 900 ‒ ‒ ‒ ‒ ‒ ‒ Subtotal 3,000 1,500 1,200 2,400 2,400 800 6,200 4,500 3,500 2,400 3,300 7,400 6,400 2,300 5,100 2,600 4,700 Rest of Europe Austria ‒ 1,100 ‒ 300 400 400 1,200 ‒ ‒ 2,000 ‒ 200 ‒ ‒ ‒ ‒ ‒ Belgium ‒ ‒ ‒ ‒ 1,100 ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ Denmark 300 300 ‒ ‒ ‒ 900 ‒ ‒ ‒ ‒ ‒ 600 ‒ ‒ ‒ ‒ ‒ Ireland ‒ ‒ ‒ ‒ ‒ 1,200 ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ Spain ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1,300 700 700 ‒ ‒ ‒ ‒ ‒ Sweden 100 ‒ 300 200 100 300 ‒ ‒ ‒ 800 ‒ ‒ ‒ 500 ‒ 600 ‒ Switzerland ‒ ‒ 400 700 100 ‒ 200 ‒ ‒ ‒ ‒ 100 ‒ ‒ 3,600 ‒ ‒ Subtotal 400 1,400 700 1,200 1,700 2,800 1,400 ‒ ‒ 4,100 700 1,600 ‒ 500 3,600 600 ‒ Total additional equipped space 3,300 2,900 1,900 3,600 4,000 3,700 7,700 4,500 3,500 6,500 4,000 9,000 6,400 2,800 8,700 3,200 4,700 23,000 sqm in 2019E 19,900 sqm in 2018 11,700 sqm in 2017 21,100 sqm in 2020E

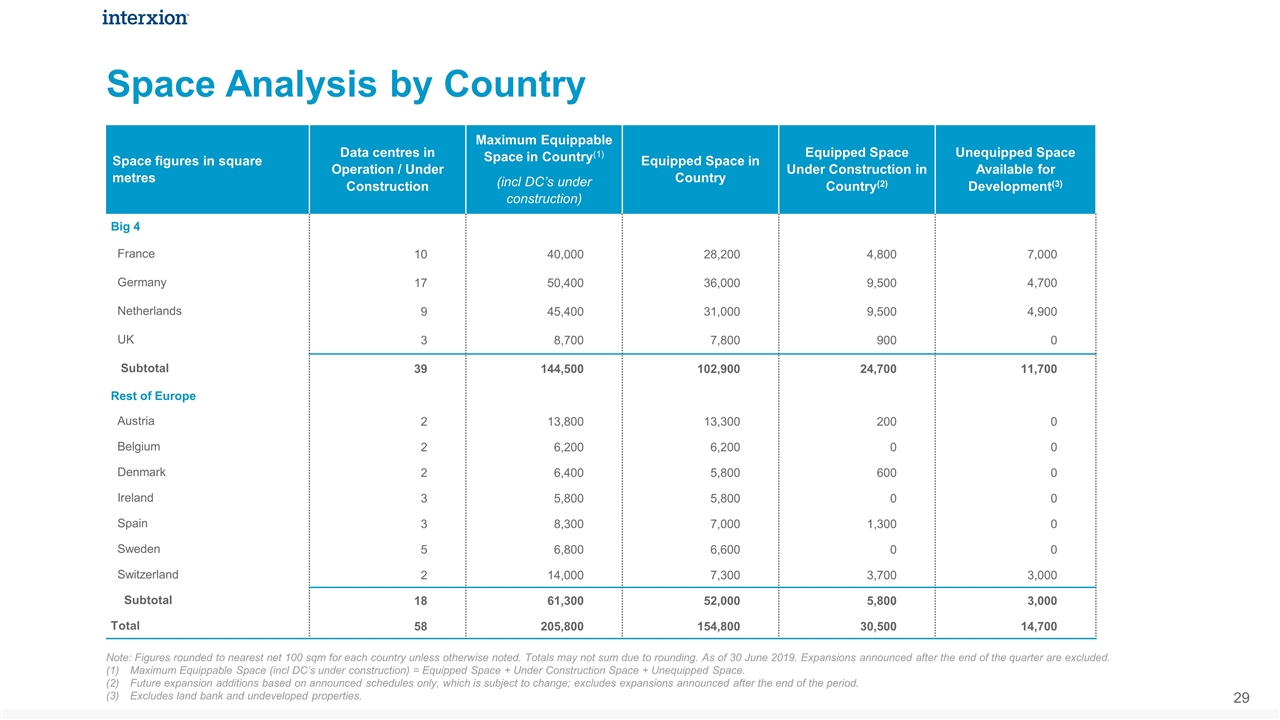

Space Analysis by Country Note: Figures rounded to nearest net 100 sqm for each country unless otherwise noted. Totals may not sum due to rounding. As of 30 June 2019. Expansions announced after the end of the quarter are excluded. Maximum Equippable Space (incl DC’s under construction) = Equipped Space + Under Construction Space + Unequipped Space. Future expansion additions based on announced schedules only, which is subject to change; excludes expansions announced after the end of the period. Excludes land bank and undeveloped properties. Space figures in square metres Data centres in Operation / Under Construction Maximum Equippable Space in Country(1) (incl DC’s under construction) Equipped Space in Country Equipped Space Under Construction in Country(2) Unequipped Space Available for Development(3) Big 4 France 10 40,000 28,200 4,800 7,000 Germany 17 50,400 36,000 9,500 4,700 Netherlands 9 45,400 31,000 9,500 4,900 UK 3 8,700 7,800 900 0 Subtotal 39 144,500 102,900 24,700 11,700 Rest of Europe Austria 2 13,800 13,300 200 0 Belgium 2 6,200 6,200 0 0 Denmark 2 6,400 5,800 600 0 Ireland 3 5,800 5,800 0 0 Spain 3 8,300 7,000 1,300 0 Sweden 5 6,800 6,600 0 0 Switzerland 2 14,000 7,300 3,700 3,000 Subtotal 18 61,300 52,000 5,800 3,000 Total 58 205,800 154,800 30,500 14,700

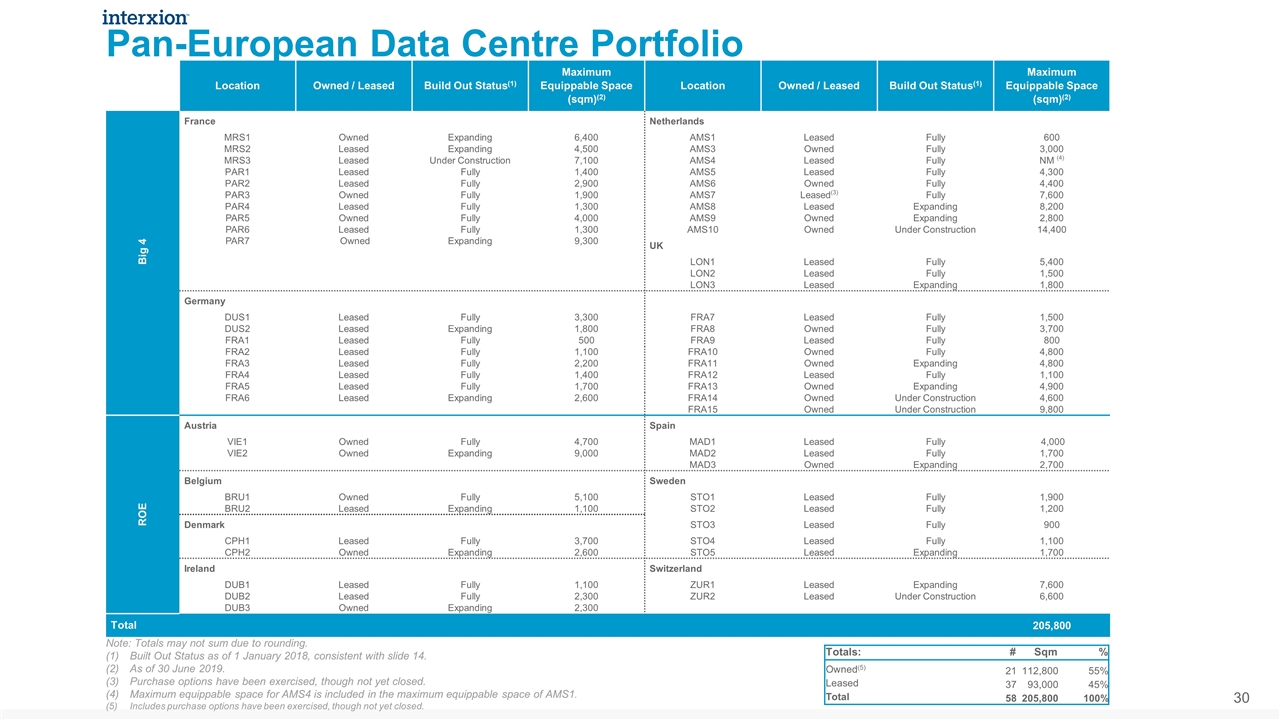

Pan-European Data Centre Portfolio 18 Location Owned / Leased Build Out Status(1) Maximum Equippable Space (sqm)(2) Location Owned / Leased Build Out Status(1) Maximum Equippable Space (sqm)(2) Big 4 France Netherlands MRS1 Owned Expanding 6,400 AMS1 Leased Fully 600 MRS2 Leased Expanding 4,500 AMS3 Owned Fully 3,000 MRS3 Leased Under Construction 7,100 AMS4 Leased Fully NM (4) PAR1 Leased Fully 1,400 AMS5 Leased Fully 4,300 PAR2 Leased Fully 2,900 AMS6 Owned Fully 4,400 PAR3 Owned Fully 1,900 AMS7 Leased(3) Fully 7,600 PAR4 Leased Fully 1,300 AMS8 Leased Expanding 8,200 PAR5 Owned Fully 4,000 AMS9 Owned Expanding 2,800 PAR6 Leased Fully 1,300 AMS10 Owned Under Construction 14,400 PAR7 Owned Expanding 9,300 UK LON1 Leased Fully 5,400 LON2 Leased Fully 1,500 LON3 Leased Expanding 1,800 Germany DUS1 Leased Fully 3,300 FRA7 Leased Fully 1,500 DUS2 Leased Expanding 1,800 FRA8 Owned Fully 3,700 FRA1 Leased Fully 500 FRA9 Leased Fully 800 FRA2 Leased Fully 1,100 FRA10 Owned Fully 4,800 FRA3 Leased Fully 2,200 FRA11 Owned Expanding 4,800 FRA4 Leased Fully 1,400 FRA12 Leased Fully 1,100 FRA5 Leased Fully 1,700 FRA13 Owned Expanding 4,900 FRA6 Leased Expanding 2,600 FRA14 Owned Under Construction 4,600 FRA15 Owned Under Construction 9,800 ROE Austria Spain VIE1 Owned Fully 4,700 MAD1 Leased Fully 4,000 VIE2 Owned Expanding 9,000 MAD2 Leased Fully 1,700 MAD3 Owned Expanding 2,700 Belgium Sweden BRU1 Owned Fully 5,100 STO1 Leased Fully 1,900 BRU2 Leased Expanding 1,100 STO2 Leased Fully 1,200 Denmark STO3 Leased Fully 900 CPH1 Leased Fully 3,700 STO4 Leased Fully 1,100 CPH2 Owned Expanding 2,600 STO5 Leased Expanding 1,700 Ireland Switzerland DUB1 Leased Fully 1,100 ZUR1 Leased Expanding 7,600 DUB2 Leased Fully 2,300 ZUR2 Leased Under Construction 6,600 DUB3 Owned Expanding 2,300 Total 205,800 Note: Totals may not sum due to rounding. Built Out Status as of 1 January 2018, consistent with slide 14. As of 30 June 2019. Purchase options have been exercised, though not yet closed. Maximum equippable space for AMS4 is included in the maximum equippable space of AMS1. Includes purchase options have been exercised, though not yet closed. Totals: # Sqm % Owned(5) 21 112,800 55% Leased 37 93,000 45% Total 58 205,800 100%

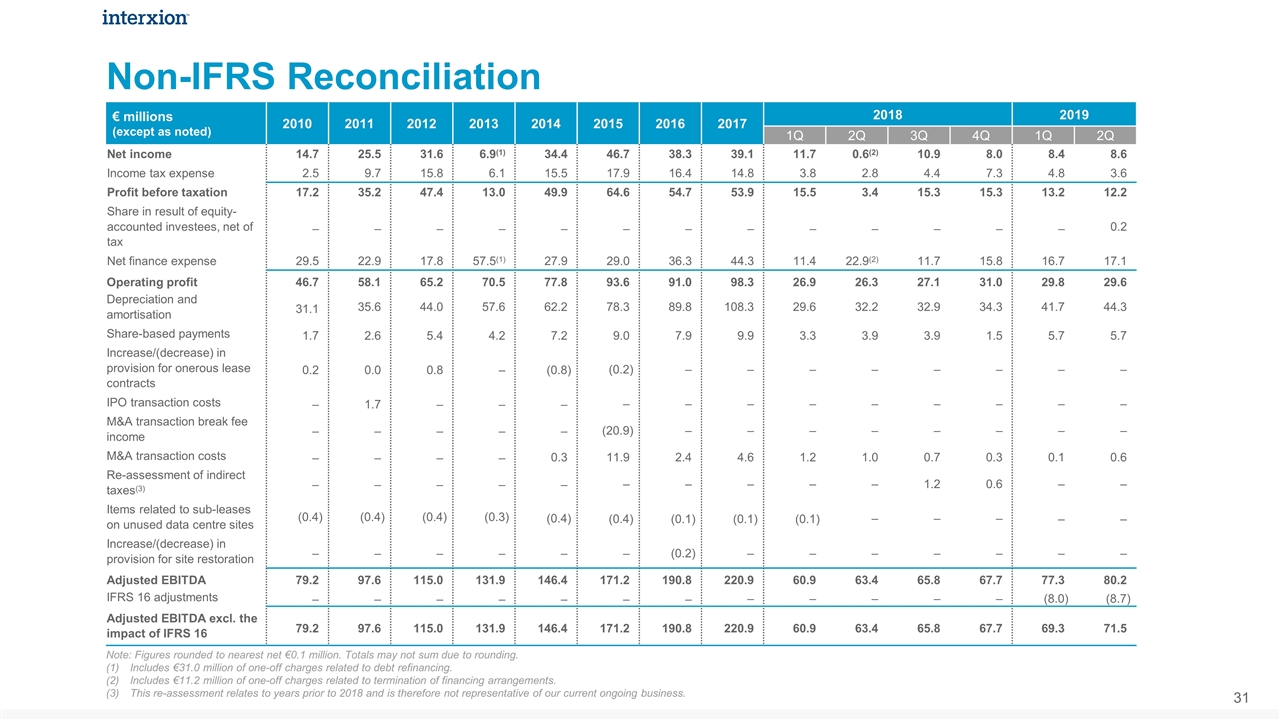

Non-IFRS Reconciliation Note: Figures rounded to nearest net €0.1 million. Totals may not sum due to rounding. Includes €31.0 million of one-off charges related to debt refinancing. Includes €11.2 million of one-off charges related to termination of financing arrangements. This re-assessment relates to years prior to 2018 and is therefore not representative of our current ongoing business. € millions (except as noted) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 1Q 2Q 3Q 4Q 1Q 2Q Net income 14.7 25.5 31.6 6.9(1) 34.4 46.7 38.3 39.1 11.7 0.6(2) 10.9 8.0 8.4 8.6 Income tax expense 2.5 9.7 15.8 6.1 15.5 17.9 16.4 14.8 3.8 2.8 4.4 7.3 4.8 3.6 Profit before taxation 17.2 35.2 47.4 13.0 49.9 64.6 54.7 53.9 15.5 3.4 15.3 15.3 13.2 12.2 Share in result of equity-accounted investees, net of tax ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 0.2 Net finance expense 29.5 22.9 17.8 57.5(1) 27.9 29.0 36.3 44.3 11.4 22.9(2) 11.7 15.8 16.7 17.1 Operating profit 46.7 58.1 65.2 70.5 77.8 93.6 91.0 98.3 26.9 26.3 27.1 31.0 29.8 29.6 Depreciation and amortisation 31.1 35.6 44.0 57.6 62.2 78.3 89.8 108.3 29.6 32.2 32.9 34.3 41.7 44.3 Share-based payments 1.7 2.6 5.4 4.2 7.2 9.0 7.9 9.9 3.3 3.9 3.9 1.5 5.7 5.7 Increase/(decrease) in provision for onerous lease contracts 0.2 0.0 0.8 ‒ (0.8) (0.2) ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ IPO transaction costs ‒ 1.7 ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ M&A transaction break fee income ‒ ‒ ‒ ‒ ‒ (20.9) ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ M&A transaction costs ‒ ‒ ‒ ‒ 0.3 11.9 2.4 4.6 1.2 1.0 0.7 0.3 0.1 0.6 Re-assessment of indirect taxes(3) ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ 1.2 0.6 ‒ ‒ Items related to sub-leases on unused data centre sites (0.4) (0.4) (0.4) (0.3) (0.4) (0.4) (0.1) (0.1) (0.1) ‒ ‒ ‒ ‒ ‒ Increase/(decrease) in provision for site restoration ‒ ‒ ‒ ‒ ‒ ‒ (0.2) ‒ ‒ ‒ ‒ ‒ ‒ ‒ Adjusted EBITDA 79.2 97.6 115.0 131.9 146.4 171.2 190.8 220.9 60.9 63.4 65.8 67.7 77.3 80.2 IFRS 16 adjustments ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ (8.0) (8.7) Adjusted EBITDA excl. the impact of IFRS 16 79.2 97.6 115.0 131.9 146.4 171.2 190.8 220.9 60.9 63.4 65.8 67.7 69.3 71.5

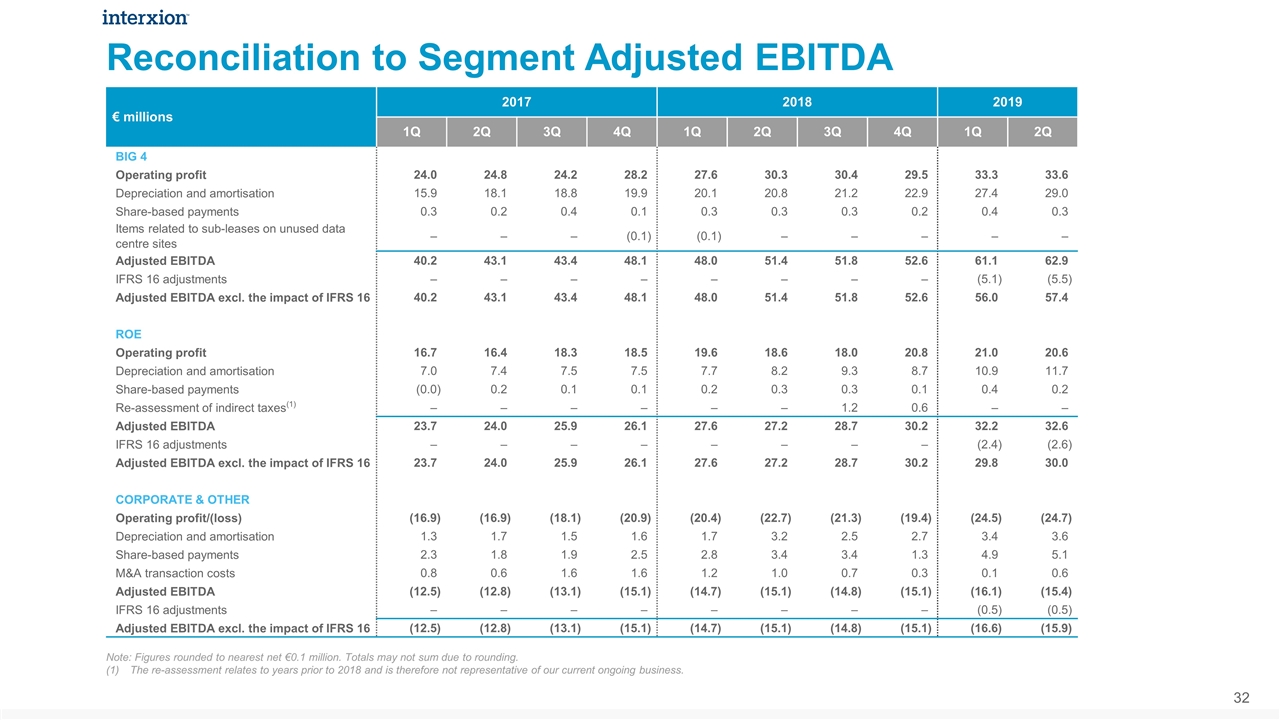

Reconciliation to Segment Adjusted EBITDA Note: Figures rounded to nearest net €0.1 million. Totals may not sum due to rounding. The re-assessment relates to years prior to 2018 and is therefore not representative of our current ongoing business. € millions 2017 2018 2019 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q BIG 4 Operating profit 24.0 24.8 24.2 28.2 27.6 30.3 30.4 29.5 33.3 33.6 Depreciation and amortisation 15.9 18.1 18.8 19.9 20.1 20.8 21.2 22.9 27.4 29.0 Share-based payments 0.3 0.2 0.4 0.1 0.3 0.3 0.3 0.2 0.4 0.3 Items related to sub-leases on unused data centre sites ‒ ‒ ‒ (0.1) (0.1) ‒ ‒ ‒ ‒ ‒ Adjusted EBITDA 40.2 43.1 43.4 48.1 48.0 51.4 51.8 52.6 61.1 62.9 IFRS 16 adjustments ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ (5.1) (5.5) Adjusted EBITDA excl. the impact of IFRS 16 40.2 43.1 43.4 48.1 48.0 51.4 51.8 52.6 56.0 57.4 ROE Operating profit 16.7 16.4 18.3 18.5 19.6 18.6 18.0 20.8 21.0 20.6 Depreciation and amortisation 7.0 7.4 7.5 7.5 7.7 8.2 9.3 8.7 10.9 11.7 Share-based payments (0.0) 0.2 0.1 0.1 0.2 0.3 0.3 0.1 0.4 0.2 Re-assessment of indirect taxes(1) ‒ ‒ ‒ ‒ ‒ ‒ 1.2 0.6 ‒ ‒ Adjusted EBITDA 23.7 24.0 25.9 26.1 27.6 27.2 28.7 30.2 32.2 32.6 IFRS 16 adjustments ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ (2.4) (2.6) Adjusted EBITDA excl. the impact of IFRS 16 23.7 24.0 25.9 26.1 27.6 27.2 28.7 30.2 29.8 30.0 CORPORATE & OTHER Operating profit/(loss) (16.9) (16.9) (18.1) (20.9) (20.4) (22.7) (21.3) (19.4) (24.5) (24.7) Depreciation and amortisation 1.3 1.7 1.5 1.6 1.7 3.2 2.5 2.7 3.4 3.6 Share-based payments 2.3 1.8 1.9 2.5 2.8 3.4 3.4 1.3 4.9 5.1 M&A transaction costs 0.8 0.6 1.6 1.6 1.2 1.0 0.7 0.3 0.1 0.6 Adjusted EBITDA (12.5) (12.8) (13.1) (15.1) (14.7) (15.1) (14.8) (15.1) (16.1) (15.4) IFRS 16 adjustments ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒ (0.5) (0.5) Adjusted EBITDA excl. the impact of IFRS 16 (12.5) (12.8) (13.1) (15.1) (14.7) (15.1) (14.8) (15.1) (16.6) (15.9)

Summary of IFRS 16 Impact € millions (except as noted) Income Statement Impact Three months ended Jun-30 2019 As reported Effect of change due to IFRS 16 Three months ended Jun-30 2019 Excl. IFRS 16 Consolidated Recurring revenue 150.0 - 150.0 Non-recurring revenue 8.5 - 8.5 Revenue 158.5 - 158.5 Gross profit 103.7 7.0 96.7 Gross profit margin 65.5% 4.4% 61.0% Operating income 29.6 1.3 28.3 Adjusted EBITDA 80.2 8.7 71.5 Adjusted EBITDA margin 50.6% 5.4% 45.1% Depreciation and amortisation 44.3 7.3 37.0 Net finance expense 17.1 3.1 14.1 BIG 4 Recurring revenue 100.7 - 100.7 Non-recurring revenue 5.0 - 5.0 Revenue 105.6 - 105.6 Operating income 33.6 1.1 32.5 Adjusted EBITDA 62.9 5.5 57.4 Adjusted EBITDA margin 59.6% 5.3% 54.3% ROE Recurring revenue 49.3 - 49.3 Non-recurring revenue 3.5 - 3.5 Revenue 52.8 - 52.8 Operating income 20.6 0.1 20.5 Adjusted EBITDA 32.6 2.6 30.0 Adjusted EBITDA margin 61.7% 4.9% 56.8% CORP Operating income (24.7) - (24.7) Adjusted EBITDA (15.4) 0.5 (15.9) € millions Balance Sheet Impact Jun-30 2019 As reported Effect of change due to IFRS 16 Jun-30 2019 Excl. IFRS 16 Consolidated Non-current assets 2,479.2 408.4 2,070.8 Current assets 264.2 (18.6) 282.7 Non-current liabilities 1,693.6 368.5 1,325.1 Current liabilities 389.0 24.0 365.0 BIG 4 Total assets 1,968.4 280.7 1,687.7 Total liabilities 623.1 282.6 340.4 ROE Total assets 685.3 105.9 579.4 Total liabilities 210.7 106.6 104.2 CORP Total assets 89.7 3.3 86.4 Total liabilities 1,248.8 3.3 1,245.5

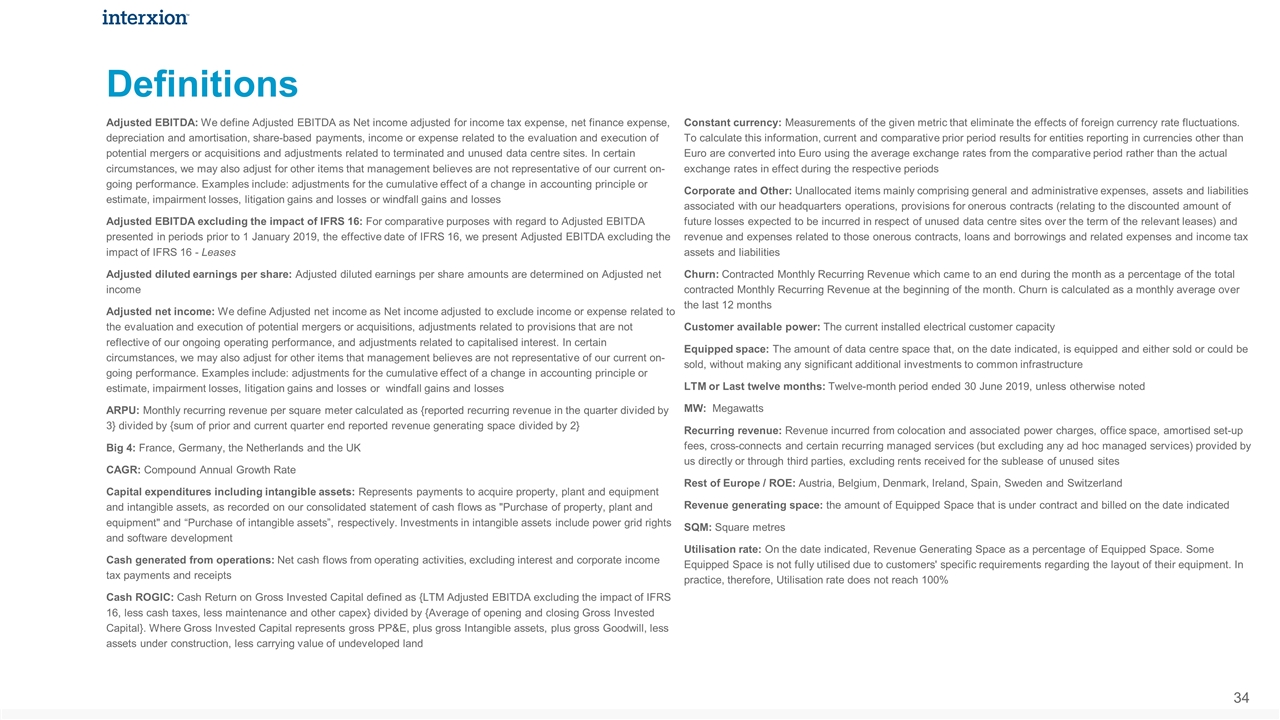

Adjusted EBITDA: We define Adjusted EBITDA as Net income adjusted for income tax expense, net finance expense, depreciation and amortisation, share-based payments, income or expense related to the evaluation and execution of potential mergers or acquisitions and adjustments related to terminated and unused data centre sites. In certain circumstances, we may also adjust for other items that management believes are not representative of our current on-going performance. Examples include: adjustments for the cumulative effect of a change in accounting principle or estimate, impairment losses, litigation gains and losses or windfall gains and losses Adjusted EBITDA excluding the impact of IFRS 16: For comparative purposes with regard to Adjusted EBITDA presented in periods prior to 1 January 2019, the effective date of IFRS 16, we present Adjusted EBITDA excluding the impact of IFRS 16 - Leases Adjusted diluted earnings per share: Adjusted diluted earnings per share amounts are determined on Adjusted net income Adjusted net income: We define Adjusted net income as Net income adjusted to exclude income or expense related to the evaluation and execution of potential mergers or acquisitions, adjustments related to provisions that are not reflective of our ongoing operating performance, and adjustments related to capitalised interest. In certain circumstances, we may also adjust for other items that management believes are not representative of our current on-going performance. Examples include: adjustments for the cumulative effect of a change in accounting principle or estimate, impairment losses, litigation gains and losses or windfall gains and losses ARPU: Monthly recurring revenue per square meter calculated as {reported recurring revenue in the quarter divided by 3} divided by {sum of prior and current quarter end reported revenue generating space divided by 2} Big 4: France, Germany, the Netherlands and the UK CAGR: Compound Annual Growth Rate Capital expenditures including intangible assets: Represents payments to acquire property, plant and equipment and intangible assets, as recorded on our consolidated statement of cash flows as "Purchase of property, plant and equipment" and “Purchase of intangible assets”, respectively. Investments in intangible assets include power grid rights and software development Cash generated from operations: Net cash flows from operating activities, excluding interest and corporate income tax payments and receipts Cash ROGIC: Cash Return on Gross Invested Capital defined as {LTM Adjusted EBITDA excluding the impact of IFRS 16, less cash taxes, less maintenance and other capex} divided by {Average of opening and closing Gross Invested Capital}. Where Gross Invested Capital represents gross PP&E, plus gross Intangible assets, plus gross Goodwill, less assets under construction, less carrying value of undeveloped land Definitions Constant currency: Measurements of the given metric that eliminate the effects of foreign currency rate fluctuations. To calculate this information, current and comparative prior period results for entities reporting in currencies other than Euro are converted into Euro using the average exchange rates from the comparative period rather than the actual exchange rates in effect during the respective periods Corporate and Other: Unallocated items mainly comprising general and administrative expenses, assets and liabilities associated with our headquarters operations, provisions for onerous contracts (relating to the discounted amount of future losses expected to be incurred in respect of unused data centre sites over the term of the relevant leases) and revenue and expenses related to those onerous contracts, loans and borrowings and related expenses and income tax assets and liabilities Churn: Contracted Monthly Recurring Revenue which came to an end during the month as a percentage of the total contracted Monthly Recurring Revenue at the beginning of the month. Churn is calculated as a monthly average over the last 12 months Customer available power: The current installed electrical customer capacity Equipped space: The amount of data centre space that, on the date indicated, is equipped and either sold or could be sold, without making any significant additional investments to common infrastructure LTM or Last twelve months: Twelve-month period ended 30 June 2019, unless otherwise noted MW: Megawatts Recurring revenue: Revenue incurred from colocation and associated power charges, office space, amortised set-up fees, cross-connects and certain recurring managed services (but excluding any ad hoc managed services) provided by us directly or through third parties, excluding rents received for the sublease of unused sites Rest of Europe / ROE: Austria, Belgium, Denmark, Ireland, Spain, Sweden and Switzerland Revenue generating space: the amount of Equipped Space that is under contract and billed on the date indicated SQM: Square metres Utilisation rate: On the date indicated, Revenue Generating Space as a percentage of Equipped Space. Some Equipped Space is not fully utilised due to customers' specific requirements regarding the layout of their equipment. In practice, therefore, Utilisation rate does not reach 100%

Interxion Leadership David Ruberg, Chief Executive Officer John Doherty, Chief Financial Officer Giuliano Di Vitantonio, Chief Marketing & Strategy Officer Jan-Pieter Anten, SVP, Human Resources Jaap Camman, SVP, Legal Adriaan Oosthoek, SVP, IT & Operations Support Sell-Side Analyst Coverage Bank of America Merrill Lynch, Michael Funk Berenberg, Nate Crossett Citi, Mike Rollins Cowen, Colby Synesael Credit Suisse, Sami Badri Guggenheim, Rob Gutman Oppenheimer, Tim Horan Raymond James, Frank Louthan RBC Capital Markets, Jon Atkin Stifel, Erik Rasmussen Sun Trust Robinson Humphrey, Greg Miller Wells Fargo, Jennifer Fritzsche William Blair, Jim Breen Investor Relations Jim Huseby, VP, Investor Relations T: +1 813 644 9399 E: ir@interxion.com