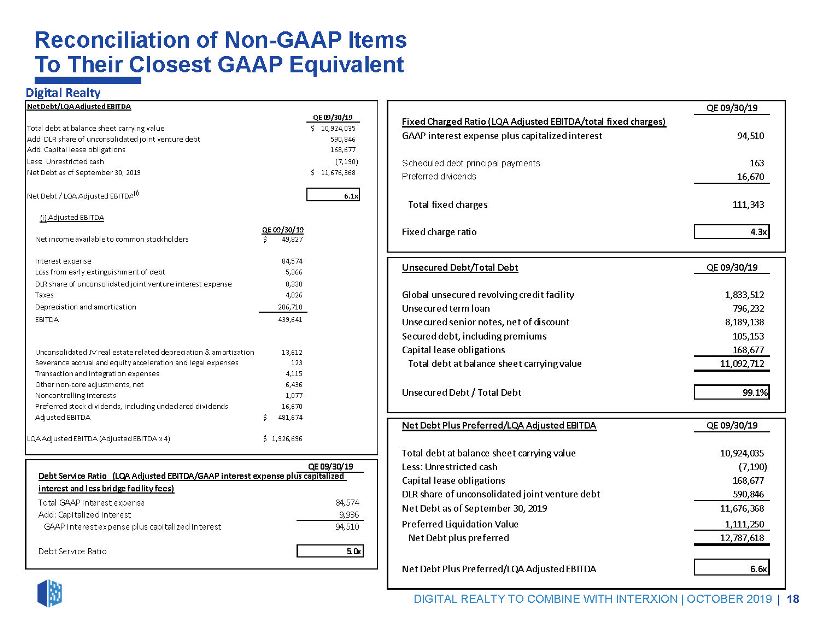

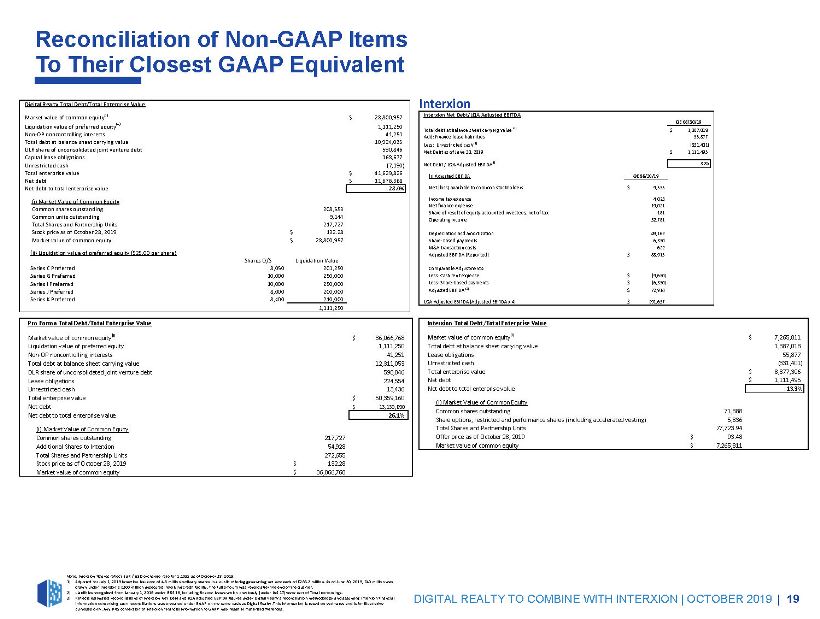

Reconciliation ofNon-GAAP Items To Their Closest GAAP Equivalent

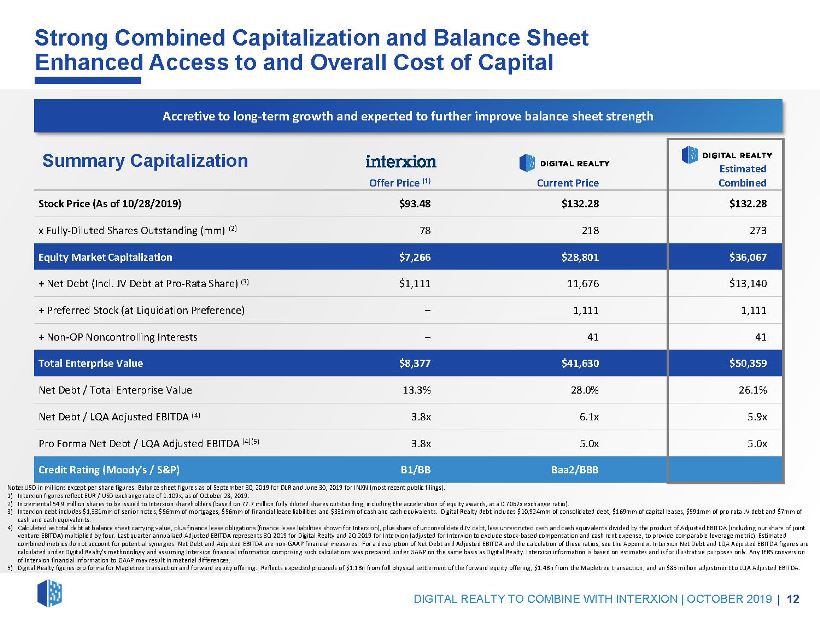

Digital Realty Total Debt/Total Enterprise Value

Market value of common equity(i)

$28,800,957

Liquidation value of preferred equity(ii) 1,111,250

Non-OP noncontrolling interests

41,251

Total debt at balance sheet carrying value

10,924,035

DLR share of unconsolidated joint venture debt

590,846

Capital lease obligations

168,677

Unrestricted cash

(7,190)

Total enterprise value

$41,629,826

Net debt

$11,676,368

Net debt to total enterprise value

28.0%

(i) Market Value of Common Equity

Common shares outstanding

208,583

Common units outstanding

9,144

Total Shares and Partnership Units

217,727 Stock price as of October 28, 2019

$132.28

Market value of common equity

$ 28,800,957

(ii) Liquidation value of preferred equity ($

25.00 per share)

Shares O/S

Liquidation Value

Series C Preferred

8,050

201,250

Series G Preferred

10,000

250,000

Series I Preferred

10,000

250,000

Series J Preferred

8,000

200,000

Series K Preferred

8,400

210,000

1,111,250

Pro Forma Total Debt/Total Enterprise Value

Market value of common equity(i)

$36,066,768

Liquidation value of preferred equity

1,111,250

Non-OP noncontrolling interests

41,251

Total debt at balance sheet carrying value

12,311,053

DLR share of unconsolidated joint venture debt

590,846

Lease obligations

224,554

Unrestricted cash

13,436

Total enterprise value

$50,359,160

Net debt

$13,139,890

Net debt to total enterprise value

26.1%

(i) Market Value of Common Equity

Common shares outstanding

217,727

Additional Shares to Interxion

54,928

Total Shares and Partnership Units

272,655

Stock price as of October 28, 2019

$ 132.28

Market value of common equity

$ 36,066,768

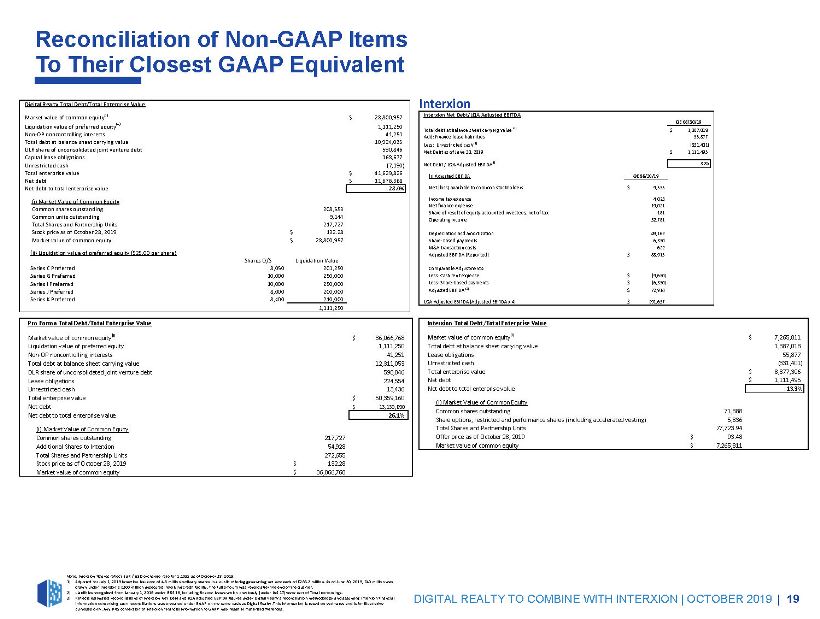

Interxion

Interxion Net Debt/LQA Adjusted EBITDA

QE 06/30/19

Total debt at balance sheet carrying value (1)

$1,387,018

Add: Finance lease liabilities

55,877

Less: Unrestricted cash (1)

(331,401)

Net Debt as of June 30, 2019

$1,111,495

Net Debt / LQA Adjusted EBITDA(i)

3.8x

(i) Adjusted EBITDA

QE 06/30/19

Net (loss) available to common stockholders

$9,555

Income tax expense

4,023

Net finance expense

19,021

Share of result of equity-accounted investees, net of tax

181

Operating income

32,781

Depreciation and amortization

49,162

Share-based payments

6,350

M&A transaction costs

622

Adjusted EBITDA (Reported)

$88,915

Interxion Total Debt/Total Enterprise Value

Market value of common equity(i)

$7,265,811

Total debt at balance sheet carrying value

1,387,018

Lease obligations

55,877

Unrestricted cash

(331,401)

Total enterprise value

$8,377,306

Net debt

$1,111,495

Net debt to total enterprise value

13.3%

(i) Market Value of Common Equity

Common shares outstanding

71,888

Share options, restricted and performance shares (including accelerated vesting)

5,836

Total Shares and Partnership Units

77,723.94

Offer price as of October 28, 2019

$ 93.48

Market value of common equity

$ 7,265,811

Comparable Adjustments:

Less: Cash rent expense

$(9,650)

Less: Share-based payments

$(6,350)

Adjusted EBITDA (2)

$72,914

LQA Adjusted EBITDA (Adjusted EBITDA x 4)

$291,657

Note: Interxion figures reflect EUR / USD exchange rate for 1.109x, as of October 28, 2019.

1) Adjusted for July 1, 2019 Interxion issuance of 4.6 million ordinary shares in a public offering generating net proceeds of €283.2 million. As of June 30, 2019, €40 million was drawn under Interxion’s €300 million unsecured revolving credit facility. The full amount was repaid after the end of the quarter.

2) Liabilities recognized from January 1, 2019 under IFRS 16, including finance leases which previously (under IAS 17) were part of Total borrowings.

3) Reflects estimated reconciliations of Interxion Net Debt and LQA Adjusted EBITDA figures under Digital Realty’s reconciliation methodology and assuming Interxion financial information comprising such reconciliations was prepared under GAAP on the same basis as Digital Realty. This information is based on estimates and is for illustrative purposes only. Any IFRS conversion of Interxion financial information to GAAP may result in material differences.

DIGITAL REALTY TO COMBINE WITH INTERXION | OCTOBER 2019 | 19