Exhibit 99.2

Management’s Discussion & Analysis

For the six months ended

June 30, 2024

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Introduction

Set out below is management’s assessment and analysis of the results of operations and financial condition of enCore Energy Corp. and its subsidiaries (“enCore”, or the “Company”) for the three and six months ended June 30, 2024. The following information is prepared as of June 30, 2024, and should be read in conjunction with the unaudited condensed consolidated interim financial statements for the six months ended June 30, 2024 and 2023, and the accompanying notes thereto, as well as Management’s Discussion and Analysis for the year ended December 31, 2023, as contained in our Form 40-F Annual Report for 2023, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”). All dollar figures included in this management’s discussion and analysis (“MD&A”) are quoted in United States Dollars unless otherwise indicated. Additional information related to the Company is available on SEDAR+ at www.sedarplus.ca.

Our Business: America’s Clean Energy Company™

Business Operations Update

The Company is focused on producing uranium in the United States and delivering that uranium to customers. The Company currently utilizes only the proven In-Situ Recovery technology (ISR) to provide necessary fuel for the generation of clean, reliable, and carbon-free nuclear energy.

enCore owns 3 of the 11 licensed and constructed Central ISR Uranium Processing Plants (CPPs) in the United States.1 All of its existing facilities are located in the business-friendly, energy-centric State of Texas. Our plants are designed and permitted to process uranium from a mix of satellite plants and primary sources within South Texas. In addition, the Company has several key mineral resource projects in other jurisdictions within the United States. Our NI43-101 compliant resources are listed below:

| Total measured and indicated Mineral Resources | 74.42 million lbs U3O8 |

| Total inferred Mineral Resources | 26.47 million lbs U3O8 |

Although the United States is the world’s largest consumer of uranium and largest producer of nuclear energy, it remains dependent on imported uranium. Due to the current geopolitical environment, the Company expects increasing demand for domestically produced uranium as US utilities transition to domestic supply following the recent ban of Russian supplies. enCore’s strategy is to leverage its uranium production to drive value for its shareholders and be a United States preferred supplier. With current and future sales contracts with nuclear utilities, enCore’s product will fuel clean, reliable and carbon-free electricity generation. Used for nuclear energy, uranium is an important green energy fuel source. Unlike most fossil fuels, the cost of nuclear fuel (uranium) constitutes only a small portion of total power generating costs.

With a diverse portfolio of uranium projects, enCore is prioritizing projects that will utilize ISR technology to produce uranium. ISR, when compared to conventional open pit or underground mining, requires less capital and operating expenditures with a shorter lead time to extraction and a reduced impact on the environment, including minimizing groundwater use. The historic worker safety record in the ISR segment of the mining industry is significantly better than that of conventional underground and open pit uranium mining and milling.

enCore’s production strategy over the next 3 years is centered around two of its fully licensed Texas CPPs; Rosita and Alta Mesa. The CPPs located at the Rosita and Kingsville Dome projects are designed for, and fully capable of, processing feed resin from relocatable satellite ion-exchange (IX) plants employed at various deposits within a 100-mile radius of each plant.

enCore has a significant economic opportunity in the changing and growing uranium market and nuclear energy industry. Its strong technical team forms the basis for its strength with extensive expertise in ISR operations, reclamation, permitting and exploration. The Company has a broad set of uranium assets that provide a growing production pipeline that includes current and near-term production in Texas followed by pipeline projects in South Dakota and Wyoming with longer term production planned from enCore’s extensive resources in New Mexico. The Company enjoys access to a large collection of proprietary databases of United States assets. This gives the Company access to exclusive benefits from historic exploration, development and production data generated over almost 100 years by several major companies including Union Carbide, W.R. Grace, UV Industries, Getty Oil, Uranium Resources Inc. Powertech (USA) Inc., Ucolo Exploration Co., and others.

| 1 | Domestic Uranium Production Report First-Quarter 2024, Energy Information Administration, May 2024 |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

To support the Company’s development plans, enCore’s uranium sales strategy provides a base level of projected income from sales contracts while preserving significant ability to realize opportunities when strong short-term market fundamentals are present. This strategy ensures that the Company will have committed sales to support the capital necessary for construction of new projects while maintaining flexibility to be opportunistic as market conditions continue to change. In February 2024, the Company signed its fifth and sixth supply agreements with two separate US nuclear utilities, and in May 2024, the Company signed its seventh supply agreement. enCore’s sales contracts typically retain exposure to spot pricing while including minimum floor and maximum ceiling prices, some of which are adjusted upwards periodically for inflation. Minimum floor prices are set at levels that provide the Company a comfortable margin over its expected costs of operations in Texas while still allowing the Company to participate in anticipated escalations of the price of uranium. Combined, the Company has 4.5 million lbs U3O8 in committed uranium sales contracts from 2024 to 2033. Three of our current contracts provide optionality to add an additional 1.65 million lbs U3O8 to 2032. The Company will continue to assess opportunities to secure future sales agreements that will support its continued project and production growth strategies. The Company is committed to honoring all sales commitments. To meet delivery obligations during the year as production increased, the company occasionally purchased U3O8 in the open market to fill those contractual obligations.

The Rosita Central Processing Plant was the starting point for enCore’s Texas production strategy. In Q1 2024, the Company announced it had commenced uranium production at Rosita from the Rosita Extension wellfield, PAA-5. Rosita is located approximately 60 miles from Corpus Christi, Texas and has an 800,000-pound U3O8 per year production capacity. Newly modernized and refurbished in 2023, the Rosita Plant will act as the central processing site for the Rosita South, Upper Spring Creek, and Butler Ranch Uranium Projects.

In February 2023, the Company acquired 100% of the Alta Mesa Project from Energy Fuels, Inc. for $120 million. enCore’s fully licensed Alta Mesa ISR Uranium CPP is located approximately 100 miles southeast of Corpus Christi, TX, and has a production capacity of 1.5 million lbs U3O8 per year through its ion exchange system located at the plant. The facility has IX elution, precipitation, drying, and packaging capacity for 2.0 million lbs U3O8 per year. This capacity is designed to accept direct production feed to the IX columns in the plant and concurrently accept loaded resin from satellite locations. The Alta Mesa Project includes existing and near-term production areas, including the fully permitted and authorized production areas 6 & 7. The project also has 9 additional mineral resource areas described in the “Our Assets” section of Management’s Discussion and Analysis for the year ended December 31, 2023. In total, the project encompasses mineral leases on 200,000 acres of private land. In February 2024, the Company sold a 30% interest in the Alta Mesa project to Boss Energy Limited for $60 million. The injection of capital to the Company from its the sale of a 30% interest in the Alta Mesa Project will allow the Company to accelerate future production levels in South Texas, Wyoming and South Dakota.

In June 2024, the company announced the successful startup of production at the Alta Mesa Uranium Central Processing Plant (“CPP”) and Wellfield (“Alta Mesa Project”). With the restart of the previously producing Alta Mesa Project, enCore Energy is now the only uranium producer in the United States with multiple production facilities in operation. The initial ramp up will be a progressive process to advance and continually increase uranium production via direct feed to the CPP. enCore is anticipating its first shipment of yellowcake (uranium) from the Alta Mesa Project to occur in approximately 60 to 90 days from date of startup of production.

The Kingsville Dome Central ISR Uranium Processing Plant (Kingsville Dome CPP) is currently maintained and available to increase production capacity as additional satellite plants and production wellfields are brought into production. This facility, similar in size and design to the Rosita facility, has a capacity of 800,000 lbs U3O8 per year.

Notably, the advanced stage Dewey-Burdock Uranium Project (Dewey-Burdock) in South Dakota has demonstrated ISR resources, including a 2019 Preliminary Economic Assessment (PEA) citing robust economics. The Company is in the process of reviewing and updating the PEA to reflect current economics and planning. The project has its source material license from the US Nuclear Regulatory Commission (NRC) and its underground injection permits and aquifer exemption from the US Environmental Protection Agency (EPA). In 2023, the Company announced that the NRC approval was considered final when appeals of the license approval were exhausted following a successful outcome from the Circuit Court of Appeals for the District of Columbia. The underground injection permits were appealed to the EPA’s Environmental Appeals Board and the aquifer exemption was appealed to the 8th Circuit Court of Appeals. Based on the successful outcome for the company of the appeal of the NRC license, we believe we will also be successful in the appeals of the EPA’s underground injection permits and the aquifer exemption.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

The Company has commenced the initial permitting work to advance the Gas Hills Uranium Project (Gas Hills) as an ISR uranium recovery operation located in central Wyoming, approximately 60 miles west of Casper, WY. Gas Hills has a current resource and robust economics as described in a 2021 PEA. It is ideally located in the historic Gas Hills Uranium Mining District, a brownfield area of extensive previous mining. The Company has Dewey-Burdock and Gas Hills as its mid-term production assets within the planned production pipeline.

The Company’s New Mexico assets represent a major, long-term asset in our planned production pipeline. enCore holds a dominant position in the historic Grants Uranium District in New Mexico through its control of mineral rights over approximately 500 square miles containing significant uranium resources in several different deposits. The Company is committed to the significant work necessary to overcome legacy issues related to historic uranium mining and milling in New Mexico and its effect on indigenous and local communities. The Company is executing an engagement strategy with local communities to educate one another and work together to realize economic and social benefits of collectively exploiting these significant resources in an environmentally superior way, unlocking the value of the assets to all parties’ benefit. In addition to these more advanced projects, the Company has significant mineral holdings in Wyoming, Arizona, Utah, and Colorado.

enCore has a clear pathway to production across the western United States and is focusing its expansion efforts within jurisdictions with well-established regulatory environments for the development of ISR uranium projects. Both Texas and Wyoming are NRC Agreement states, whereby the Nuclear Regulatory Commission has ceded its regulatory authority to the individual state regulators. This streamlined and mature regulatory process is a demonstrable benefit to the uranium industry within these jurisdictions. The Company is leveraging the near-term production assets in South Texas to support the South Dakota-based Dewey-Burdock and Wyoming-based Gas Hills projects for mid-term production opportunities with advanced projects and established resources. enCore’s significant New Mexico uranium resource endowment provides long-term opportunities and the ability to establish mutually beneficial relationships with indigenous and local communities. The Company also supports communities with local hiring and capital spending in the localities where it works.

ESG Principles

The long-term success of enCore requires the integration of sustainability into all aspects of its business. Leading environmental, social and governance performance is strongly correlated to strong financial performance and the creation of long-term value for enCore’s shareholders and other stakeholders. This includes striving to meet the highest standards, contributing toward sustainable development, and serving as responsible natural resource stewards for the purpose of making positive and lasting impacts on the communities where we operate. enCore is responsible to its shareholders, governments, and community stakeholders as the Company’s projects are advanced, and we consider appropriate best practices and innovative methods to meet and exceed these standards where practical, within our financial means.

Please refer to Management’s Discussion and Analysis for the year ended December 31, 2023, as contained in our Form 40-F Annual Report for 2023 on www.sedarplus.ca or on the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system at www.sec.gov/edgar.

Corporate Highlights for Second Quarter 2024

In April 2024, the Company:

| ● | Announced that it had suspended its ATM Program with a remaining balance of approximately $18.7 million of common shares available for sale. |

| ● | Announced that it had published its 2023 Annual Report, that is available on the enCore Energy website at htps://encoreuranium.com/investors/annual-report/. The Annual Report outlines enCore’s business plan, the corporate objectives for 2024 and evaluates the Company’s success in meeting its 2023 objectives. |

In May 2024, the Company:

| ● | Announced the appointment of Ms. Kristi Caplan as Corporate Secretary. |

| ● | Entered into its seventh uranium sales agreement. |

In June 2024, the Company:

| ● | Announced the successful startup of production at the Alta Mesa Uranium Central Processing Plant (“CPP”) and Wellfield (“Alta Mesa Project”). |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Highlights Subsequent to June 30, 2024

| ● | On July 9, 2024 the Company announced that enCore Energy joined the Texas Nuclear Alliance (TNA). Through this partnership, the company is the first uranium producer to join the TNA, which is the only industry association in Texas dedicated to the advancement of nuclear technology in the state. |

Our Assets

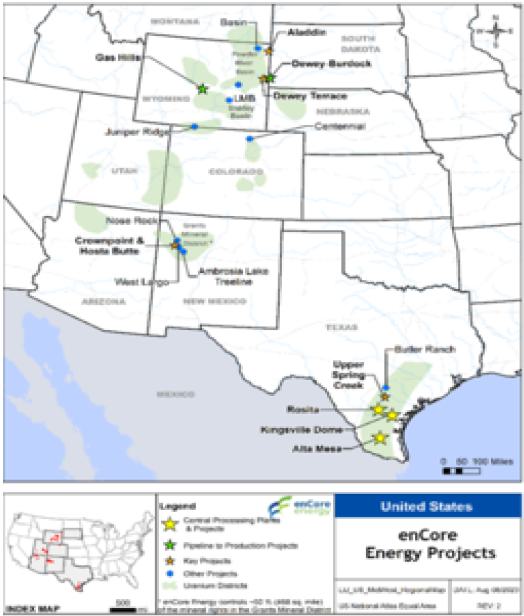

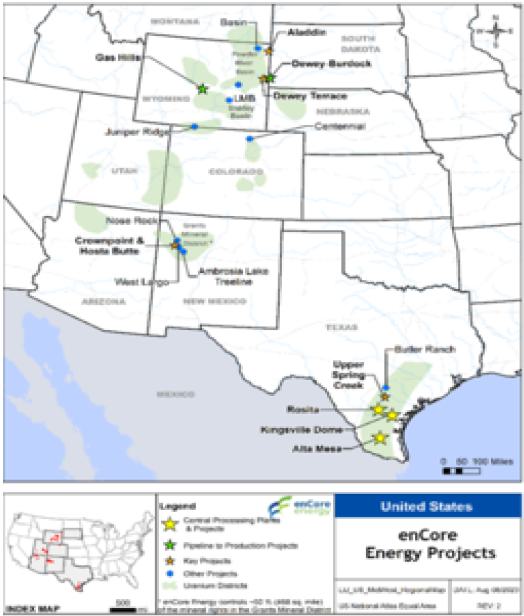

The Company has properties across the Western United States. Approximate locations are shown in Figure 1.

Figure 1: Locations of enCore Energy Corp. Projects.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Texas

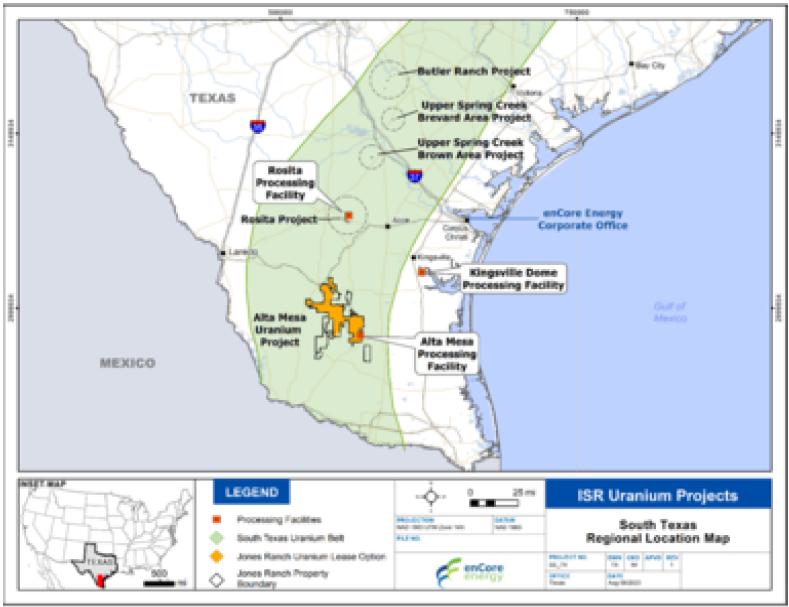

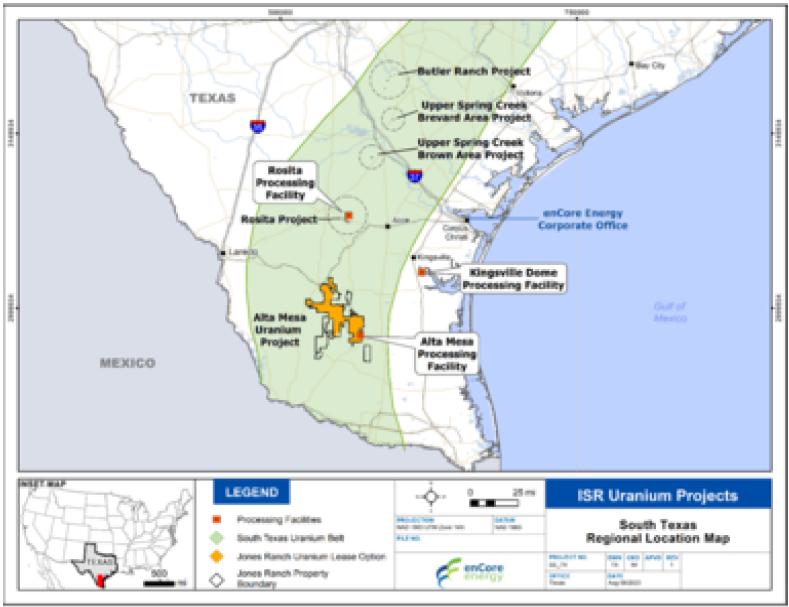

The Company has three licensed and constructed uranium production facilities along with several mineral properties that are owned in fee or leased from private owners. The Figure 2 below describes the location of the uranium production facilities and the production project areas.

Figure 2: enCore Energy Corp. properties in South Texas.

The Kingsville Dome project is located in Kleberg County, Texas. It is a licensed and constructed past operating production facility that is currently maintained in a standby state. The project area consists of mineral properties that are leased by the Company or owned in fee by the Company. The Central Processing Plant is located on land owned by the Company.

The Rosita Project is located in Duval County, Texas. It is a licensed and constructed past operating production facility that is currently operating and producing uranium from the nearby Rosita Extension wellfield. The project area consists of mineral properties that are leased by the Company or owned in fee by the Company. The Central Processing Plant is located on land owned by the Company. The Rosita project also includes the Rosita South Development Area within the project boundary.

The Upper Spring Creek Project consists of two project areas, Brown and Brevard, located in Live Oak and Bee counties in Texas, respectively. The project will be developed and operated as a satellite wellfield operation to be processed at the Rosita Central Processing Plant.

The Butler Ranch Exploration project is located in Karnes County, Texas. The Butler Ranch project will be developed as a satellite wellfield to the Rosita Central Processing Plant.

The Alta Mesa Project consists of 200,000 acres of leased private mineral properties located in Brooks and Jim Hogg Counties, Texas. The Company announced on June 13, 2024, that it had started uranium production operation at the Alta Mesa CPP and wellfield located on Production Area 7 (PAA7). In February 2024, the Company entered into a joint venture with Boss Energy, Ltd. to develop and advance the project. The Company retains ownership of 70% of the project and Boss Energy holds 30%. The Mesteña Grande Exploration project is a portion of the Alta Mesa Project, and it will be developed as multiple satellite wellfields to feed the Alta Mesa Central Processing Plant. The January 2023 N.I. 43-101 Technical Report Summary for the Alta Mesa Uranium Project, Brooks and Jim Hogg Counties, Texas, USA can be found on the Company’s website at https://encoreuranium.com/wp-content/uploads/2023/02/TechReport.pdf.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Wyoming

The Gas Hills Project is located in Fremont and Natrona Counties, Wyoming. The August 2021 NI 43-101 Technical Report and Preliminary Economic Assessment Gas Hills Uranium Project in Fremont and Natrona Counties, Wyoming, USA can be found on the Company’s website at https://encoreuranium.com/wp-content/uploads/2022/08/Gas-Hills.pdf.

The Dewey Terrace Exploration project is located in Weston and Niobrara Counties, Wyoming. The project is adjacent to the Company’s NRC licensed Dewey-Burdock Project along the Wyoming-South Dakota state line.

The Aladdin Exploration project is located in Weston County, Wyoming.

The Juniper Ridge Project is located in southern Sweetwater County, Wyoming, near the state line with Colorado.

South Dakota

The Dewey-Burdock Project is an in-situ recovery uranium project located near Edgemont, South Dakota. The December 2020 NI 43-101 Technical Report and Preliminary Economic Assessment of the Dewey-Burdock Uranium ISR Project South Dakota, USA, can be found on the Company’s website at https://encoreuranium.com/wp-content/uploads/2022/02/Azarga-Amended-Technical-Report-Compiled.pdf.

Arizona

The Company owns or controls several Arizona State mineral leases and unpatented federal lode mining claims covering acreage in northern Arizona Strip district.

Colorado

The Centennial Uranium Project is located in northeastern Colorado.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

New Mexico

The Company has several uranium mineral holdings and project areas in New Mexico.

The Nose Rock Project is located in McKinley County, New Mexico.

The Treeline project is located in McKinley and Cibola Counties, Grants Uranium District, New Mexico.

The Crownpoint-Hosta Butte Uranium Project: the Company owns a 100% interest in the McKinley County properties and a 60 - 100% interest in the adjacent Crownpoint and Hosta Butte properties, all of which are located in McKinley County, New Mexico. The Company holds a 60% interest in a portion of a certain section at Crownpoint. The Company owns a 100% interest in the rest of the Crownpoint and Hosta Butte project area, subject to a 3% gross profit royalty on uranium produced. The 2022 N.I. 43-101 compliant technical report can be found on the Company’s website at https://encoreuranium.com/wp-content/uploads/2022/03/05.-CPHB-Technical-Report.pdf.

The West Largo Project is near the Grants Mineral Belt in McKinley County, New Mexico.

The Company holds several sections of mineral properties in an area located primarily in McKinley County and Cibola County in northwestern New Mexico. These mineral properties are part of the former railroad checkerboard holdings that the company has acquired over the last several years.

Utah

The Ticaboo project consists of three portions of a claim block located in Garfield County, Utah with low grade uranium ore stockpiles. The Company has a federal Plan of Operation and State of Utah approval for processing of the assets.

The Company owns various mining claims throughout southern Utah, including Emery, Garfield, and San Juan Counties. All of these are in relative proximity to the White Mesa Mill in Blanding County, Utah.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Results of Operations:

Three Months Ended June 30, 2024 Compared to Three Months Ended June 30, 2023

The following table summarizes the results of operations for the three months ended June 30, 2024 and 2023:

| | | Three Months Ended

June 30, | | | | | | | |

| | | 2024

$ | | | 2023

$ | | | Increase

(Decrease) | | | Percent

Change | |

| Revenue | | | 5,319,563 | | | | - | | | | 5,319,563 | | | | 100 | % |

| Cost of goods sold | | | (8,322,298 | ) | | | - | | | | (8,322,298 | ) | | | 100 | % |

| Operating expenses, excluding stock option expense | | | (5,147,412 | ) | | | (5,869,884 | ) | | | 722,472 | | | | (12 | )% |

| Stock option expense | | | (1,211,662 | ) | | | (1,143,656 | ) | | | (68,006 | ) | | | 6 | % |

| Interest income | | | 908,754 | | | | 7,984 | | | | 900,770 | | | | 11282 | % |

| Interest expense | | | (452,430 | ) | | | (1,200,000 | ) | | | 747,570 | | | | (62 | )% |

| Foreign exchange gain (loss) | | | 1,591,561 | | | | (882,750 | ) | | | 2,474,311 | | | | (280 | )% |

| Gain on divestment of mineral interests | | | - | | | | 2,056,638 | | | | (2,056,638 | ) | | | (100 | )% |

| (Loss) on marketable securities | | | (1,395,512 | ) | | | (1,344,596 | ) | | | (50,916 | ) | | | 4 | % |

| Gain (loss) on sale of asset | | | - | | | | 858,500 | | | | (858,500 | ) | | | (100 | )% |

| Net Income (loss) | | | (8,709,436 | ) | | | (7,517,764 | ) | | | (1,191,672 | ) | | | 16 | % |

| Basic and diluted earnings (loss) per share1 | | | (0.05 | ) | | | (0.06 | ) | | | 0.01 | | | | (19 | )% |

The following table sets forth selected operating data and financial metrics for uranium sales for the three months ended June 30, 2024 and 2023.

| | | Three Months Ended | | | Increase | | | Percent | |

| | | 2024 | | | 2023 | | | (Decrease) | | | Change | |

| Volumes Sold (lbs) | | | 90,000 | | | | - | | | | 90,000 | | | | nm | |

| Realized Sales Price ($/lb) | | | 59.11 | | | | - | | | | 59.11 | | | | nm | |

| Costs applicable to revenues ($/lb) | | | 85.47 | | | | - | | | | 85.47 | | | | nm | |

| ● | Revenue from uranium for the three months ended June 30, 2024 was $5,319,563 due to the completed sale of 90,000 pounds of our inventories to major U.S. nuclear utilities at a realized sales price of $59.11 per pound of uranium which includes the contractual sales price less sales related costs such as transfer fees . There were no revenues from uranium for the three months ended June 30, 2023. |

| ● | Costs applicable to uranium were $7,692,253 for the three months ended June 30, 2024 related to the completed sale of 90,000 pounds of our inventories at a weighted average cost of $85.47 per pound. The company’s weighted average cost components include cost of purchased uranium and uranium from production. For the three months ended June 30, 2024 the company reported an additional amount of $630,044 for costs related to the sale of 20,000 pounds of inventory in Q1 2024. There were no costs applicable to uranium concentrates for the three months ended June 30, 2023. |

| ● | Operating expenses for the three months ended June 30, 2024, were $5,147,412 as compared to $5,869,884 for the three months ended June 30, 2023. This reduction is primarily due to a reclassification of Q1 2024 depletion costs to inventory in the amount of $1,578,418, largely offset by higher costs that primarily reflect the growth and increased activity levels the Company experienced in 2024. |

| ● | Losses recognized on the fair value of marketable securities remained fairly constant at $1,395,512 for the three months ended June 30, 2024 compared to a loss of $1,344,596 for the three months ended June 30, 2023. This is due to losses in Nuclear Fuels largely offset by gains in other investments. |

| ● | Interest expense for the three months ended June 30, 2024 and June 30, 2023, was $452,430 and $1,200,000, respectively. This reduction is attributable to the Company’s debt pay down of $40,000,000 in 2023 and conversion of the $60,000,000 convertible promissory note in February 2024, partially offset by interest expense on the uranium loan in 2024. |

| ● | Foreign exchange gain for the three months ended June 30, 2024, was $1,591,561 compared to a loss of $882,750 for the three months ended June 30, 2023. This change reflects the increase in assets and liabilities as well as the impact of foreign exchange fluctuations on the Company’s Canadian Dollar denominated financial assets and liabilities. |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Six Months Ended June 30, 2024 Compared to Six Months Ended June 30, 2023

The following table summarizes the results of operations for the six months ended June 30, 2024 and 2023:

| | | Six Months Ended

June 30, | | | | | | | |

| | | 2024

$ | | | 2023

$ | | | Increase

(Decrease) | | | Percent

Change | |

| Revenue | | | 35,714,263 | | | | - | | | | 35,714,263 | | | | 100 | % |

| Cost of goods sold | | | (36,374,585 | ) | | | - | | | | (36,374,585 | ) | | | 100 | % |

| Operating expenses, excluding stock option expense | | | (13,788,663 | ) | | | (12,737,087 | ) | | | (1,051,576 | ) | | | 8 | % |

| Stock option expense | | | (2,321,950 | ) | | | (2,010,139 | ) | | | (311,811 | ) | | | 16 | % |

| Interest income | | | 1,324,020 | | | | 328,259 | | | | 995,761 | | | | 303 | % |

| Interest expense | | | (858,997 | ) | | | (1,800,000 | ) | | | 941,003 | | | | (52 | )% |

| Foreign exchange gain (loss) | | | 4,255,028 | | | | (886,691 | ) | | | 5,141,719 | | | | (580 | )% |

| Gain on divestment of mineral interests | | | 24,240 | | | | 2,080,878 | | | | (2,056,638 | ) | | | (99 | )% |

| Gain (loss) on marketable securities | | | (1,961,110 | ) | | | (1,926,317 | ) | | | (34,793 | ) | | | 2 | % |

| Gain (loss) on sale of asset | | | (18,028 | ) | | | 1,959,000 | | | | (1,977,028 | ) | | | 100 | % |

| Net Income (loss) | | | (14,005,782 | ) | | | (14,992,097 | ) | | | 986,315 | | | | (7 | )% |

| Basic and diluted earnings (loss) per share | | | (0.05 | ) | | | (0.11 | ) | | | - | | | | - | % |

The following table sets forth selected operating data and financial metrics for uranium sales for the six months ended June 30, 2024 and 2023.

| | | Six Months Ended | | | Increase | | | Percent | |

| | | 2024 | | | 2023 | | | (Decrease) | | | Change | |

| Volumes Sold (lbs) | | | 410,000 | | | | - | | | | 410,000 | | | | nm | |

| Realized Sales Price ($/lb) | | | 87.11 | | | | - | | | | 87.11 | | | | nm | |

| Costs applicable to revenues ($/lb) | | | 88.72 | | | | - | | | | 88.72 | | | | nm | |

| ● | Revenue from uranium for the six months ended June 30, 2024 was $35,714,263 due to the completed sale of 410,000 pounds of our inventories to major U.S. nuclear utilities at a realized sales price of $87.11 per pound of uranium which includes the contractual sales price less sales related costs such as transfer fees . There were no revenues from uranium for the six months ended June 30, 2023. |

| ● | Costs applicable to uranium were $36,374,585 for the six months ended June 30, 2024 related to the completed sale of 410,000 pounds of our inventories at a weighted average cost of 88.72 per pound. The company’s weighted average cost components include cost of purchased uranium and uranium from production. There were no costs applicable to uranium concentrates for the six months ended June 30, 2023. |

| ● | Operating expenses for the six months ended June 30, 2024, were $13,788,663 as compared to $12,737,087 for the six months ended June 30, 2023. This increase primarily reflects the growth and increased activity levels the Company experienced in 2024. |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

| ● | Losses recognized on the fair value of marketable securities for the six months ended June 30, 2024, were $1,961,110 compared to a loss of $1,926,317 for the six months ended June 30, 2023. This is due to losses in Nuclear Fuels largely offset by gains in other investments. |

| ● | Interest expense for the six months ended June 30, 2024 and June 30, 2023, was $858,997 and $1,800,000, respectively. This reduction is attributable to the Company’s debt pay down of $40,000,000 in 2023 and conversion of the $60,000,000 convertible promissory note in February 2024, partially offset by interest expense on the uranium loan in 2024. |

| ● | Foreign exchange gain for the six months ended June 30, 2024, was $4,255,028 compared to a loss of $886,691 for the six months ended June 30, 2023. This change reflects the increase in assets and liabilities as well as the impact of foreign exchange fluctuations on the Company’s Canadian Dollar denominated financial assets and liabilities. |

Liquidity and Capital Resources

As at June 30, 2024, the Company had cash and cash equivalents of $55,749,522 (December 31, 2023 - $7,493,424) and working capital of 89,010,869 (December 31, 2023 - $19,045,294).

On February 26, 2024, pursuant to the terms of a Master Transaction Agreement dated December 5,2023, Boss Energy acquired a 30% equity interest in a new limited liability company (the “JV Company”) that was formed to hold the Alta Mesa project, in exchange for a payment to enCore of $60 million. enCore holds 70% equity in the JV Company. Upon closing of the Transaction, the parties entered into a joint venture agreement (the “JV Agreement”) which will govern the JV Company. Pursuant to the JV Agreement, enCore will act as manager of the JV Company and will be entitled to a management fee. The JV Company will distribute uranium from production at Alta Mesa on a pro rata basis according to enCore and Boss Energy’s ownership interests. In the event a party’s interest falls below 10%, the other party shall have a right to either acquire that interest, or elect to have the interest converted into a 1% production royalty at Alta Mesa.

Concurrently with the establishment of the JV Company, the parties entered into a uranium loan agreement providing for up to 200,000 pounds of uranium to be lent by Boss Energy to enCore. The loan will bear interest of 9% and be repayable in12 months. Under the agreement enCore may prepay the loan in full or part after six months and would be subject to a prepayment fee of $200,000. Both the prepayment and the prepayment fee can be paid in cash or uranium at the election of Boss Energy.

Boss Energy also acquired 2,564,102 common shares of enCore at a price of $3.90 per share for total proceeds to enCore of $10 million. The share price was fixed under the Master Transaction Agreement dated December 5, 2023 with the common shares subject to a four-month statutory hold period that expired on June 27, 2024.

Finally, the parties also entered into a strategic collaboration agreement for the joint collaboration and research to develop the Company’s PFN technology, to be financed equally by each party.

Management estimates that it has adequate working capital to fund planned activities for the next year. The Company’s long-term continued operations are dependent on its ability to monetize assets, raise funding from loans or equity financings, deliver uranium into sales at a price above cost, or through other financing arrangements. There is no assurance that future financing activities will be successful.

From January 1 through June 30, 2024, the Company issued:

| ● | 6,872,143 common shares pursuant to the conversion of the outstanding balance on its convertible note by its holder. |

| ● | 7,467,735 shares for warrants exercised for gross proceeds of $22,270,297. |

| ● | 1,936,867 shares for stock options exercised for gross proceeds of $2,929,532. |

| ● | 495,765 shares for its At-The-Market (ATM) program for gross proceeds of $2,008,261. |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Contractual Purchase Obligations

| | | Payments Due by Period | |

| Type of Obligation | | Total | | | Less than

1 year | | | 1-3 years | | | 4-5 years | | | After

5 years | |

| Finance Lease Obligations | | $ | 422,525 | | | $ | 136,898 | | | $ | 230,400 | | | $ | 55,227 | | | | | |

| Purchase Obligations1 | | | 9,200,000 | | | | 9,200,000 | | | | - | | | | - | | | | - | |

| Other Obligations2 | | | 1,518,418 | | | | 1,483,418 | | | | 35,000 | | | | - | | | | - | |

| Total Contractual Obligations | | $ | 11,140,943 | | | $ | 10,820,316 | | | $ | 265,400 | | | $ | 55,227 | | | $ | - | |

| 1 | “Purchase Obligation” means an agreement to purchase goods or services that is enforceable and legally binding |

| 2 | “Other Obligations” means other financial liabilities reflected on your company’s statement of financial position. |

Transactions with Related Parties

Key management personnel and compensation

Related parties include key management of the Company and any entities controlled by these individuals as well as other entities providing key management services to the Company. Key management personnel consist of directors and senior management including the Executive Chairman, Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, and Chief Legal Officer.

The amounts paid to key management or entities providing similar services are as follows:

| | | | | June 30,

2024

$ | | | June 30,

2023

$ | |

| Consulting | | (1) | | $ | 150,000 | | | $ | 75,641 | |

| Directors’ fees | | (2) | | | 153,000 | | | | 60,500 | |

| Staff costs | | | | | 919,832 | | | | 1,961,422 | |

| Stock option expense | | | | | 1,589,276 | | | | 1,571,089 | |

| Total key management compensation | | | | $ | 2,812,108 | | | $ | 3,668,652 | |

| (1) | During the six months ended June 30, 2024, the Company incurred communications & community engagement consulting fees of $150,000 (June 30, 2023 - $75,641) according to a contract with 5 Spot Corporation in 2024 and Tintina Holdings, Ltd., in 2023. In July 2023, the Tintina Holdings, Ltd contract was reassigned to 5 Spot Corporation, a new Company owned by the spouse of the Company’s Executive Chairman. |

| (2) | Directors’ Fees are included in staff costs on the consolidated statements of loss and comprehensive loss. |

During the six months ended June 30, 2024, the Company granted 2,010,000 (June 30, 2023 – 2,075,000) options to key management, with a fair value of $5,519,254 (June 30, 2023 – $3,179,305).

As of June 30, 2024, and December 31, 2023, the following amounts were owing to related parties:

| | | | | June 30,

2024

$ | | | December 31,

2023

$ | |

| 5 Spot Corp | | Consulting services | | | 28,859 | | | | 12,000 | |

| Hovan Ventures LLC | | Consulting services | | | — | | | | 7,000 | |

| Officers and Board members | | Accrued compensation | | | 75,878 | | | | 2,501,594 | |

| | | | | | 104,737 | | | | 2,520,594 | |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Financial Instruments and financial risk management

Please refer to the December 31, 2023, consolidated financial statements on www.sedarplus.ca or on the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system at www.sec.gov/edgar.

In January 2024, the Company subscribed to a unit offering with Nuclear Fuels Inc. whereby the Company acquired 1,716,260 units at a price of C$0.60 per unit for gross consideration of C$1,029,756. Each unit is comprised of one common share and one-half of one share purchase warrant, with each whole warrant being exercisable into an additional common share at a price of C$0.80 for a period of 3 years, expiring January 24, 2027.

Off Balance Sheet Arrangements

At June 30, 2024, the Company had no material off-balance sheet arrangements such as guarantee contracts, contingent interest in assets transferred to an entity, derivative instruments obligations or any obligations that trigger financing, liquidity, market or credit risk to the Company.

Accounting Policies and Critical Accounting Estimates and Judgements:

For a complete summary of all of our material accounting policies refer to Note 2: Material Accounting Policy Information of the Notes to the consolidated financial statements, Consolidated Financial Statements and Management’s Discussion and Analysis for the year ended December 31, 2023, in our Annual Report on Form 40-F for 2023 on www.sedarplus.ca or on the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system at www.sec.gov/edgar.

Other MD&A Requirements

Additional disclosure of the Company’s technical reports, material change reports, news releases and other information can be obtained on SEDAR+ at www.sedarplus.ca or on the SEC’s EDGAR system at www.sec.gov/edgar.

Contingencies

There are no contingent liabilities that have not been disclosed herein.

Proposed Transactions

There are no proposed transactions that have not been disclosed herein.

Risk Factors and Uncertainties

There have been no material changes from the risk factors disclosed in Management’s Discussion and Analysis of our Annual Report on Form 40-F for the year ended December 31, 2023.

Industry Update and Outlook

In May 2024, the World Nuclear Association reported, globally, there are currently 440 operable reactors and 60 reactors under construction. Many nations that have deployed nuclear power are appreciating its clean energy and energy security benefits, reaffirming their commitment, and developing plans to support existing reactor units while reviewing and developing policies to encourage more nuclear capacity. Several non-nuclear countries continue to emerge as candidates for new nuclear capacity. In the European Union (EU), specific nuclear energy projects have been identified for inclusion under its sustainable financing taxonomy and are therefore eligible for access to low-cost financing. In some countries where phase-out policies were previously in place, there have been policy reversals and potential reactor life extensions with public opinion polls showing growing support. In the U.S., several utilities have announced life extensions and power uprates of existing, operating reactors because of government policy changes that are directly supporting nuclear power. With several reactor construction projects recently approved and many more planned around the world, demand for uranium fuel continues to increase.

Ongoing geopolitical events continuing in 2024, the global focus on the climate crisis, and energy security concerns all continued to provide tailwinds to the nuclear energy industry while further highlighting supply and demand challenges. Driven by a tightened uranium market and growing security of supply concerns, uranium prices reached levels not seen since 2008. Significantly, the continuing Russian invasion of Ukraine is impacting global nuclear supply chains including the ability to reliably deliver enriched uranium from Russia to the United States, and to reliably deliver uranium produced in Kazakhstan to western uranium markets.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

The Company believes that these recent events are resulting in a geopolitical realignment of uranium markets. Nuclear energy is seen as a key source of clean, secure, and affordable energy. Currently, according to the World Nuclear Association, Russia supplies approximately 5% of uranium concentrates globally, 38% of conversion capacity, and 46% of enrichment capacity. In May 2024, H.R. 1042 was signed into law banning the imports of Russian enriched uranium into the United States, effective August 11, 2024, subject to waivers granted for supply for distressed reactors and the national interest, and the ban is fully in effect on January 1, 2028. The Russian import ban is accelerating the realignment that has been occurring as the result of highlighted security of supply risk with a growing primary supply gap and shrinking secondary supplies. At the same time, there has been a significant increase in the focus on the origin of supply. To address these risks, utilities continue to evaluate their nuclear fuel supply chains. Nuclear utility contracting to secure their long-term requirements for conversion and enrichment services we saw in 2023 has continued into 2024. Higher prices across the fuel cycle and annual contracting activity that is getting closer to the rate required to replace what is consumed annually indicate that utilities are returning their focus to secure the uranium necessary to feed those services. The Company expects continued competition among utilities to secure long-term contracts for uranium products and services with proven producers who demonstrate strong environmental, social and governance (ESG) performance and from assets in geopolitically attractive jurisdictions on terms that will ensure the availability of reliable supply to satisfy demand.

Over the last decade, the uranium industry has seen underinvestment in new production capacity, and because of persistent low uranium prices, many producers, including the lowest cost producers, made decisions to leave uranium in the ground or idled capacity to preserve long-term value of their resources. Unplanned supply disruptions related to the COVID-19 pandemic also disrupted uranium mining and processing activities. Despite the increase in prices across most segments of the fuel cycle there has been no material increase in global production due to increased costs, inflationary pressures and uncertainty regarding the continuing and changing geopolitical conditions. The World Nuclear Association’s 2023 Nuclear Fuel Report highlights that nuclear powers contributes of 10 percent of the global electricity demand, accounts for 25 percent of low carbon electricity production, and is expected to play a growing role in future energy supply in a low-carbon economy. Notably, geopolitical instability has led to increased interest in nuclear power for energy security. Three scenarios for nuclear generating capacity are presented in the report, and referred to as Lower, Reference, and Higher Scenarios. In the Reference Scenario (informed by government & utility targets), total nuclear capacity is expected to increase to 444 GWe by 2030 and 686 GWe by 2040, including 35 GWe of generic small modular reactor (SMR) capacity. In the Lower Scenario, nuclear capacity is projected to reach 409 GWe by 2030 and 487 GWe by 2040. In the Upper Scenario, the figures show a higher increase with 490 GWe nuclear capacity by 2030 and 931 GWe by 2040. The report notes that primary production from uranium mines, conversion, and enrichment plants continue to supply the majority of the demand from nuclear reactors. Secondary supply is projected to have a gradually diminishing role in the market, decreasing from the current level of 11-14 percent of global reactor uranium requirements to 4-11 percent by 2040, depending on the scenario.

United States Government Policy

| ● | The Prohibiting Russian Uranium Imports Act (H.R. 1042) will go into effect 90 days after being signed by President Joseph Biden on May 13, 2024 and allows for temporary waivers under certain circumstances. However, any waiver must terminate by January 1, 2028, and the ban remains in effect until December 31, 2040. |

| ● | On June 18, 2024, the U.S. Senate passed the Accelerating Deployment of Versatile, Advanced Nuclear for Clean Energy (ADVANCE) Act to accelerate the deployment of nuclear energy capacity, including by accelerating the licensing and creating new incentives for advanced nuclear reactor technologies, among them small modular reactors. The Senate introduced the ADVANCE Act in March 2023, and the House of Representatives passed the Fire Grants and Safety Act, which contains the ADVANCE Act, on May 8, 2024. President Joseph Biden signed the Act into law on July 9, 2024. |

| ● | On June 23, 2024, the U.S. Department of Energy released a Request for Proposals (RFP) to supply Low Enriched Uranium (LEU). The purpose of this acquisition is to ensure that, in the event of a supply disruption in the nuclear fuel market, a commercial domestic capacity is available. To accomplish this, DOE intends to acquire LEU from new domestic enrichment capacity to support the commercial availability of LEU for U.S. commercial nuclear energy companies. For this acquisition, all LEU acquired by DOE through this contract shall be enriched and stored in the continental United States, and the RFP places a preference on existing US permitted facilities, and it provides a second preference on new US permitted facilities. The value of the RFP is US$3.7 billion and it is authorized under the Nuclear Fuel Security Act contained within the 2024 National Defense Authorization Act that was signed into law in April 2024. |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Global Market Developments

| ● | G7 ministers vowed to strengthen energy security and keep the goal of limiting global warming to 1.5 °C within reach by taking actions to achieve the ambitious energy goals set at the COP28 climate summit in Dubai last December. The ministers also reaffirmed the commitment of the G7 leaders “to reduce dependence on Russian supplies of civilian goods, including by promoting a diversified fuel supply chain that is not influenced by Russia and also intend to assist countries seeking to diversify their supplies.” |

| ● | Japan’s Nuclear Regulation Authority (NRA) has approved the extended operation of Units 3 and 4 (830 MWe PWRs) at Kansai Electric Power Co.’s Takahama Nuclear Power Plant in Fukui prefecture for another 20 years. Japan’s Nuclear Regulation Authority approved the plans to insert fuel rods in Unit 7 (1,315 MWe BWR) at Tokyo Electric Power Co.’s (TEPCO) Kashiwazaki-Kariwa Nuclear Power Plant in Niigata prefecture. A Japanese court has rejected a lawsuit seeking to block the restart of Chugoku Electric’s Shimane Unit 2 (789 MWe BWR) due to safety concerns, dismissing the plaintiffs’ claim that evacuation plans in the event of a natural disaster are inadequate. |

| ● | Korea Hydro & Nuclear Power (KHNP) announced Unit 2 (1,340 MWe APR) at the Shin-Hanul Nuclear Power Plant in South Korea has entered commercial operation following a seven-month commissioning process, Unit 2 is the second of two APR-1400 reactors at the site, where another two are planned for construction as Shin Hanul Units 3 and 4. |

| ● | India is planning to achieve a goal of building 100 GW of nuclear power capacity by 2047. Currently, India’s total nuclear power capacity is nearly 7 GW with another 5.4 GW under construction. Today, the country has 22 operating commercial nuclear reactors, which contributed about 3 percent of the electricity supply in 2022, according to the International Atomic Energy Agency. |

US Market Events

| ● | Georgia Power, a subsidiary of Southern Co., declared on April 29 that Plant Vogtle Unit 4 (1,117 MWe PWR) has entered commercial operation in the US state of Georgia. |

| ● | PSEG subsidiary PSEG Nuclear notified the US Nuclear Regulatory Commission (NRC) of its intent to seek subsequent license renewals for Salem Units 1 and 2 (1,169 & 1,158 MWe PWRs) and the single unit (1,172 MWe BWR) Hope Creek Generating Station, which collectively produce nearly one-half of New Jersey’s electricity and 85 percent of the state’s carbon-free generation. |

| ● | Constellation, which operates the largest commercial reactor fleet in the USA, has filed a subsequent license renewal (SLR) application with the US Nuclear Regulatory Commission (NRC) for its Dresden Clean Energy Center in the state of Illinois. Dresden is currently licensed to operate through 2029 for Unit 2 (894 MWe BWR) and 2031 for Unit 3 (879 MWe BWR). |

| ● | The US Energy Information Administration reported production of uranium concentrate (U3O8) for the first quarter ended March 31, 2024, totaled 82,533 pounds U3O8, compared to 2,511 pounds U3O8 in Q1 2023. |

| ● | TerraPower has initiated the start of construction for the NatriumTM reactor demonstration project, marking the first advanced reactor project to move from design into construction. Upon completion, the Natrium demonstration plant, featuring a 345 MWe sodium-cooled reactor with a molten salt-based energy storage system, will be a fully functioning commercial power plant. |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Cautionary Notes Regarding Forward-Looking Statements

This MD&A contains statements that, to the extent that they are not historical fact, may constitute “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and United States securities legislation, respectively. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “project”, “estimates”, “forecasts”, “intends”, “anticipates”, “believes” or variations (including negative variations) of such words and phrases, or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements may include, but are not limited to, statements with respect to:

| ● | the Company’s future financial and operational performance; |

| ● | the sufficiency of the Company’s current working capital, anticipated cash flow or its ability to raise necessary funds; |

| ● | the anticipated amount and timing of work programs; |

| ● | our expectations with respect to future exchange rates; |

| ● | the estimated cost of and availability of funding necessary for sustaining capital; |

| ● | forecast capital and non-operating spending; |

| ● | the Company’s plans and expectations for its property, exploration, development, and production; |

| ● | the use of available funds; |

| ● | expectations regarding the process for and receipt of regulatory approvals, permits and licenses under governmental and other applicable regulatory regimes, including U.S. government policies towards domestic uranium supply; |

| ● | expectations about future uranium market prices, production costs and global uranium supply and demand; |

| ● | expectations regarding holding physical uranium for long-term investment; |

| ● | the establishment of mineral resources on any of the Company’s current or future mineral properties (other than the Company’s properties that currently have established mineral resource estimates); |

| ● | future royalty and tax payments and rates; |

| ● | expectations regarding possible impacts of litigation and regulatory actions; and |

| ● | the completion of reclamation activities at former mine or extraction sites. |

Such forward-looking statements reflect the Company’s current views with respect to future events, based on information currently available to the Company and are subject to and involve certain known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed in or implied by such forward-looking statements. The forward-looking statements in this MD&A are based on material assumptions, including the following:

| ● | the Company budget, including expected levels of exploration, evaluation, development, production and operational activities and costs, as well as assumptions regarding market conditions and other factors upon which we have based the Company’s income and expenditure expectations; |

| ● | assumptions regarding the timing and use of the Company’s cash resources; |

| ● | the Company’s ability to, and the means by which the Company can, raise additional capital to advance other exploration objectives; |

| ● | the Company’s operations and key suppliers, employees, contractors and subcontractors will be available to continue operations; |

| ● | the Company’s ability to obtain all necessary regulatory approvals, permits, and licenses for the Company’s planned activities under governmental and other applicable regulatory regimes; |

| ● | the Company’s expectations for the demand and supply of uranium, the outlook for long-term contracting, changes in regulations, public perception of nuclear power, and the construction of new and ongoing operation of existing nuclear power plants; |

| ● | the Company’s expectations regarding spot and long-term prices and realized prices for uranium; |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

| ● | the Company’s expectations that the Company’s holdings of physical uranium will be helpful in securing project financing and/or in securing long- term uranium supply agreements in the future; |

| ● | the Company’s expectations regarding tax rates, currency exchange rates, and interest rates; |

| ● | the Company’s decommissioning and reclamation obligations and the status and ongoing maintenance of agreements with third parties with respect thereto; |

| ● | the Company’s mineral resource estimates, and the assumptions upon which they are based; |

| ● | the Company’s employees’ and contractors’, ability to comply with current and future environmental, safety and other regulatory requirements and to obtain and maintain required regulatory approvals; and |

| ● | the Company’s operations are not significantly disrupted by political instability, nationalization, terrorism, sabotage, pandemics, social or political activism, breakdown, natural disasters, governmental actions, litigation or arbitration proceedings, equipment or infrastructure failure, labor shortages, transportation disruptions, or other development or exploration risks. |

The risks, uncertainties, assumptions and other factors that could cause actual results to differ materially from any future results expressed in or implied by the forward-looking statements in this MD&A include, but are not limited to, the following factors:

| ● | exploration and development risks; |

| ● | changes in commodity prices; |

| ● | access to skilled mining personnel; |

| ● | results of exploration and development activities; |

| ● | availability of supplies, timeliness of government approvals and unanticipated environmental impacts on operations; |

| ● | risks posed by the economic and political environments in which the Company operates and intends to operate; |

| ● | the potential for losses arising from the expansion of operations into new markets; |

| ● | assumptions regarding market trends and expected demand and desires for the Company’s products and proposed products; |

| ● | reliance on industry manufacturers, suppliers and others; |

| ● | the failure to adequately protect intellectual property; |

| ● | the failure to adequately manage future growth; |

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

| ● | adverse market conditions; and |

| ● | the failure to satisfy ongoing regulatory requirements. |

In addition, the risks, assumptions, and other factors set out herein (including under Risk Factors and Uncertainties) and in the Company’s public filings, including its most recent Annual Information Form, could cause actual results to differ materially from any future results expressed in or implied by the forward-looking statements in this MD&A. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. These risks, uncertainties, assumptions and other factors should be considered carefully, and prospective investors and readers should not place undue reliance on the forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and the Company undertakes no obligation to update any forward-looking statement or information or statements to reflect information, events, results, circumstances or otherwise after the date on which such statement is made or to reflect the occurrence of unanticipated events, except as required by applicable laws. New factors emerge from time to time, and it is not possible for management to predict all of such factors and to assess in advance the impact of each such fact on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements or information.

All of the forward-looking statements contained in this MD&A are qualified by the foregoing cautionary statements.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED MINERAL RESOURCES: The Company reports mineral resources on its projects according to Canadian standards, which differ from the requirements of U.S. securities laws. As a result, the Company reports the mineral resources of the projects it has an interest in according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The requirements of NI 43-101 and the CIM Standards differ from the requirements of the SEC that are applicable to domestic United States reporting companies under subpart 1300 of Regulation S-K (“S-K 1300”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). As an issuer that prepares and files its reports with the SEC pursuant to the multi-jurisdictional disclosure system of the Exchange Act, the Company is not subject to the requirements of S-K 1300. Any mineral resources reported by the Company in accordance with NI 43-101 and CIM Standards may not qualify as such under or differ from those prepared in accordance with S-K 1300. Accordingly, information included in this MD&A concerning descriptions of mineralization and estimates of mineral resources under Canadian standards may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements of S-K 1300.

| enCore Energy Corp. |

| Management’s Discussion and Analysis |

| For the six months ended June 30, 2024 and 2023 |

Outstanding Share Data

Issued share capital: 181,732,963 common shares

| a) | Outstanding stock options: |

| Expiry Date | | Outstanding

Options | | | Average

Exercise Price

C$ | |

| October 2024 | | | 66,666 | | | | 5.76 | |

| May 2025 | | | 640,499 | | | | 0.65 | |

| September 2025 | | | 475,000 | | | | 1.35 | |

| October 2025 | | | 5,000 | | | | 1.20 | |

| January 2026 | | | 53,333 | | | | 2.82 | |

| February 2026 | | | 86,667 | | | | 6.02 | |

| May 2026 | | | 182,292 | | | | 3.89 | |

| December 2026 | | | 65,000 | | | | 5.30 | |

| January 2027 | | | 16,667 | | | | 5.01 | |

| February 2027 | | | 2,120,833 | | | | 4.20 | |

| May 2027 | | | 83,333 | | | | 4.32 | |

| June 2027 | | | 166,667 | | | | 3.75 | |

| November 2027 | | | 133,334 | | | | 3.65 | |

| December 2027 | | | 50,000 | | | | 3.30 | |

| January 2028 | | | 25,000 | | | | 3.38 | |

| February 2028 | | | 44,681 | | | | 3.10 | |

| April 2028 | | | 67,000 | | | | 2.61 | |

| May 2028 | | | 2,014,250 | | | | 2.79 | |

| June 2028 | | | 60,000 | | | | 3.10 | |

| October 2028 | | | 35,000 | | | | 4.24 | |

| January 2029 | | | 125,000 | | | | 6.25 | |

| February 2029 | | | 185,000 | | | | 6.04 | |

| March 2029 | | | 40,000 | | | | 5.37 | |

| April 2029 | | | 37,000 | | | | 6.20 | |

| May 2029 | | | 100,000 | | | | 6.25 | |

| June 2029 | | | 2,242,000 | | | | 5.65 | |

| | | | 9,120,222 | | | | | |

| b) | Outstanding share purchase warrants: |

| Expiry Date | | Outstanding

Warrants | | | Exercise

Price

C$ | |

| May 2025 | | | 56,444 | | | | 3.251 | |

| February 2026 | | | 21,191,890 | | | | 3.806 | |

| | | | 21,248,334 | | | | | |

| c) | Convertible Promissory note: |

A portion of the consideration paid to Energy Fuels, Inc in the Company’s acquisition of the Alta Mesa Project was a $60,000,000 secured vendor take-back convertible promissory note. The Promissory Note had a two-year term and bore interest at 8% per annum.

During the year ended December 31, 2023, the Company paid $40,000,000 of the principal balance off, reducing the outstanding principal balance at that date to $20,000,000. In February 2024, the balance was converted by issuance of 6,872,143 common shares to the debt holder eliminating the debt.

19