- EU Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

enCore Energy (EU) 8-KOther Events

Filed: 16 Jan 25, 7:00am

Exhibit 96.1

Dewey Burdock Project

South Dakota, USA

S-K 1300 Technical Report Summary

Effective Date: October 8, 2024

Report Date: January 6, 2025

Prepared for enCore Energy Corporation by:

Table of Contents

| 1.0 | EXECUTIVE SUMMARY | 1 | ||

| 1.1 | Property Description and Ownership | 1 | ||

| 1.2 | Geology and Mineralization | 1 | ||

| 1.3 | Exploration Status | 2 | ||

| 1.4 | Development and Operations | 2 | ||

| 1.5 | Mineral Resource Estimates | 3 | ||

| 1.6 | Mineral Reserve Estimates | 3 | ||

| 1.7 | Summary Capital and Operating Cost Estimates | 3 | ||

| 1.8 | Permitting Requirements | 4 | ||

| 1.9 | Conclusions and Recommendations | 4 | ||

| 2.0 | INTRODUCTION | 6 | ||

| 2.1 | Registrant | 6 | ||

| 2.2 | Terms of Reference and Purpose | 6 | ||

| 2.3 | Information and Data Sources | 6 | ||

| 2.4 | QP Site Inspection | 6 | ||

| 3.0 | PROPERTY DESCRIPTION | 7 | ||

| 3.1 | Description and Location | 7 | ||

| 3.2 | Mineral Titles | 7 | ||

| 3.3 | Mineral Rights | 7 | ||

| 3.4 | Encumbrances | 8 | ||

| 3.4.1 | Legacy Issues | 8 | ||

| 3.4.2 | Permitting and Licensing | 8 | ||

| 3.5 | Other Significant Factors and Risks | 9 | ||

| 4.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 13 | ||

| 4.1 | Topography, Elevation and Vegetation | 13 | ||

| 4.2 | Access | 13 | ||

| 4.3 | Climate | 14 | ||

| 4.4 | Infrastructure | 15 | ||

| i | REPORT DATE: JANUARY 6, 2025 |

| 5.0 | HISTORY | 16 | |||

| 5.1 | Ownership | 16 | |||

| 5.2 | Historic Mineral Resource Estimates | 17 | |||

| 5.3 | Historic Production | 18 | |||

| 6.0 | GEOLOGICAL SETTING, MINERALIZATION AND DEPOSIT | 19 | |||

| 6.1 | Regional Geology | 19 | |||

| 6.2 | Local and Project Geology | 20 | |||

| 6.3 | Significant Mineralized Zones | 22 | |||

| 6.3.1 | Mineralization | 22 | |||

| 6.4 | Relevant Geologic Controls | 22 | |||

| 6.5 | Deposit Type | 23 | |||

| 7.0 | EXPLORATION | 25 | |||

| 7.1 | Drilling | 25 | |||

| 7.2 | Drilling Type and Procedures | 25 | |||

| 7.3 | Past Exploration | 25 | |||

| 7.4 | Accuracy and Reliability | 28 | |||

| 7.5 | Hydrogeology | 29 | |||

| 7.5.1 | Hydraulic Properties of the Inyan Kara | 29 | |||

| 7.5.1.1 | Dewey | 29 | |||

| 7.5.1.2 | Burdock | 30 | |||

| 7.5.2 | Hydrogeologic Considerations for ISR Mining | 32 | |||

| 7.5.3 | Hydrogeologic Considerations for ISR Mining Impact to Groundwater System | 33 | |||

| 7.5.4 | Groundwater Chemistry | 34 | |||

| 7.5.5 | Assessment of Dewey Burdock Project Hydrogeology | 35 | |||

| 8.0 | SAMPLE PREPARATION, ANALYSIS AND SECURITY | 36 | |||

| 8.1 | Sample Methods | 36 | |||

| 8.1.1 | Downhole Geophysical Data | 36 | |||

| 8.1.2 | Drill Cuttings | 36 | |||

| 8.1.3 | Core Samples | 36 | |||

| 8.2 | Laboratory Analysis | 37 | |||

| 8.3 | Opinion on Adequacy | 37 | |||

| 9.0 | DATA VERIFICATION | 38 | |||

| 9.1 | Data Confirmation | 38 | |||

| 9.2 | Limitations | 38 | |||

| 9.3 | Data Adequacy | 38 | |||

| 10.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 39 | |||

| 10.1 | Procedures | 39 | |||

| 10.2 | Evaluation | 39 | |||

| 10.2.1 | Ambient Bottle Roll Tests | 39 | |||

| 10.3 | Results | 40 | |||

| 10.4 | Additional Testing | 41 | |||

| ii | REPORT DATE: JANUARY 6, 2025 |

| 11.0 | MINERAL RESOURCE ESTIMATES | 42 | ||

| 11.1 | Key Assumptions, Parameters and Methods | 42 | ||

| 11.1.1 | Key Assumptions | 42 | ||

| 11.1.2 | Key Parameters | 42 | ||

| 11.1.3 | Key Methods | 42 | ||

| 11.2 | Resource Classification | 43 | ||

| 11.2.1 | Measured Mineral Resources | 43 | ||

| 11.2.2 | Indicated Mineral Resources | 43 | ||

| 11.2.3 | Inferred Mineral Resources | 43 | ||

| 11.3 | Mineral Resource Estimates | 44 | ||

| 11.4 | Material Affects to Mineral Resources | 44 | ||

| 12.0 | MINERAL RESERVE ESTIMATES | 44 | ||

| 13.0 | MINING METHODS | 45 | ||

| 13.1 | Mine Designs and Plans | 45 | ||

| 13.1.1 | Patterns, Wellfields and Mine Units | 45 | ||

| 13.1.2 | Monitoring Wells | 45 | ||

| 13.1.3 | Wellfield Surface Piping System and Header Houses | 46 | ||

| 13.1.4 | Wellfield Production | 46 | ||

| 13.1.5 | Production Rates and Expected Mine Life | 46 | ||

| 13.2 | Mine Development | 48 | ||

| 13.3 | Mining Fleet and Machinery | 48 | ||

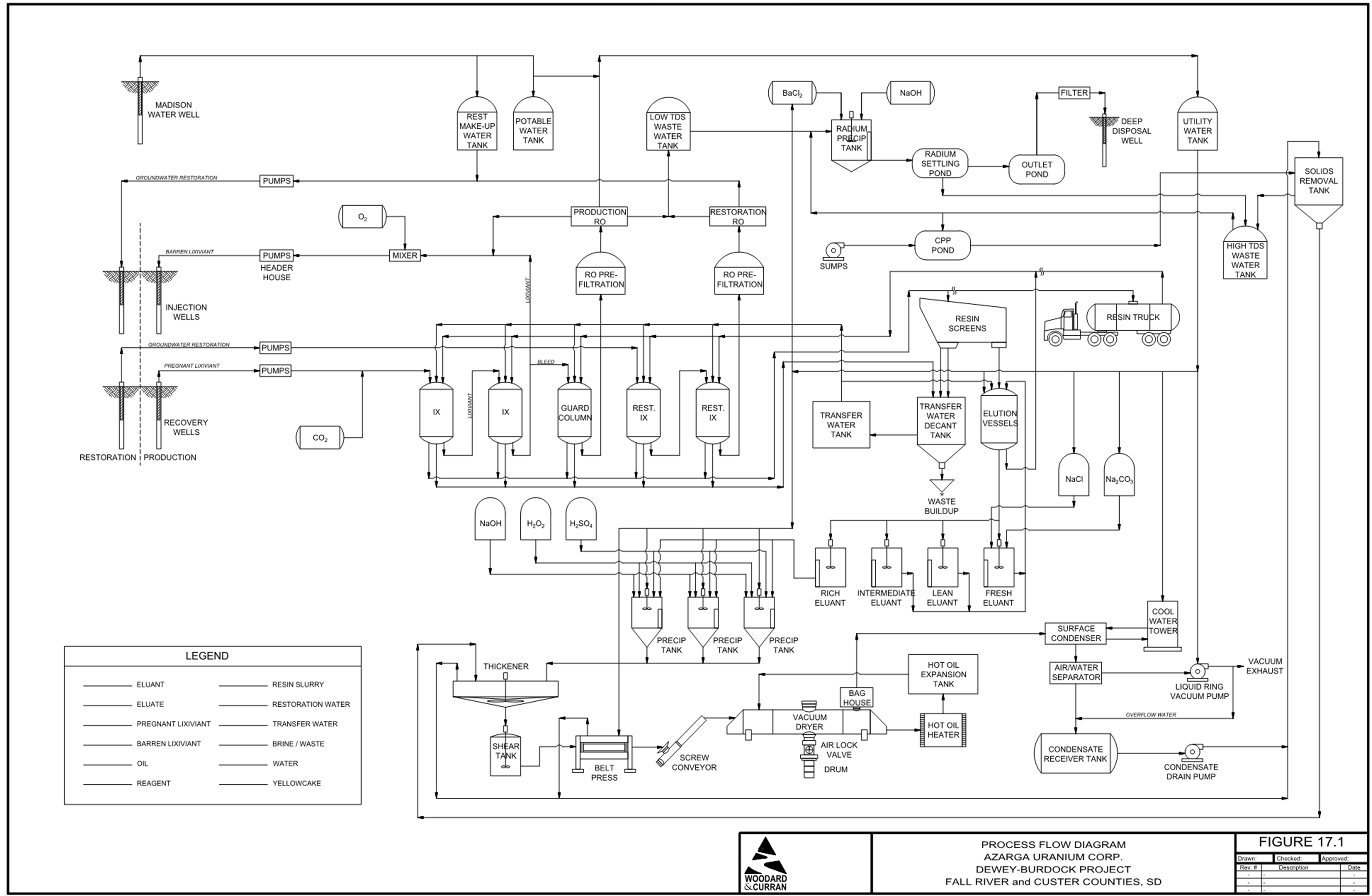

| 14.0 | PROCESS AND RECOVERY METHODS | 50 | ||

| 14.1 | Processing Facilities | 50 | ||

| 14.2 | Process Flow | 50 | ||

| 14.2.1 | Ion Exchange | 50 | ||

| 14.2.2 | Production Bleed | 50 | ||

| 14.2.3 | Elution Circuit | 50 | ||

| 14.2.4 | Precipitation Circuit | 54 | ||

| 14.2.5 | Product Filtering, Drying and Packaging | 54 | ||

| 14.3 | Water Balance | 54 | ||

| 14.4 | Liquid Waste Disposal | 54 | ||

| 14.5 | Solid Waste Disposal | 55 | ||

| 14.6 | Energy, Water and Process Material Requirements | 55 | ||

| 14.6.1 | Energy Requirements | 55 | ||

| 14.6.2 | Water Requirements | 55 | ||

| 15.0 | INFRASTRUCTURE | 56 | ||

| 15.1 | Utilities | 56 | ||

| 15.1.1 | Electrical Power | 56 | ||

| 15.1.2 | Domestic and Utility Water Wells | 56 | ||

| 15.1.3 | Sanitary Sewer | 56 | ||

| 15.2 | Transportation | 56 | ||

| 15.2.1 | Railway | 56 | ||

| 15.2.2 | Roads | 56 | ||

| 15.3 | Buildings | 58 | ||

| 15.3.1 | Central Processing Plant & Satellite | 58 | ||

| 15.3.2 | Office | 58 | ||

| 15.3.3 | Warehouse | 59 | ||

| 15.3.4 | Maintenance Shop | 59 | ||

| 15.3.5 | Wellfield Construction Shop | 59 | ||

| 15.3.6 | Diesel and Gasoline Storage | 59 | ||

| 15.3.7 | Laboratory | 59 | ||

| 15.3.8 | Surface Impoundments | 59 | ||

| 15.3.9 | Radium Settling Pond | 60 | ||

| 15.3.10 | Outlet Pond | 60 | ||

| 15.3.11 | CPP Pond | 60 | ||

| 15.3.12 | Surge Pond | 60 | ||

| 15.3.13 | Spare Settling Pond | 60 | ||

| 16.0 | MARKET STUDIES | 61 | ||

| 16.1 | Uranium Market | 61 | ||

| 16.2 | Uranium Price Projection | 61 | ||

| 16.3 | Contracts | 61 | ||

| iii | REPORT DATE: JANUARY 6, 2025 |

| 17.0 | ENVIRONMENTAL STUDIES, PERMITTING, AND PLANS, NEGOTIATIONS, OR AGREEMENTS WITH LOCAL INDIVIDUALS OR GROUPS | 62 | |||

| 17.1 | Environmental Studies | 62 | |||

| 17.1.1 | Potential Wellfield Impacts | 62 | |||

| 17.1.2 | Potential Soil Impacts | 63 | |||

| 17.1.3 | Potential Impacts from Shipping Resin, Yellowcake and 11.e.(2) Materials | 64 | |||

| 17.1.3.1 | Ion Exchange Resin Shipment | 64 | |||

| 17.1.3.2 | Yellowcake Shipment | 65 | |||

| 17.1.3.3 | 11.e.(2) Shipment | 65 | |||

| 17.2 | Socioeconomic Studies and Issues | 65 | |||

| 17.3 | Permitting Requirements and Status | 66 | |||

| 17.4 | Community Affairs | 67 | |||

| 17.5 | Project Closure | 68 | |||

| 17.5.1 | Byproduct Disposal | 68 | |||

| 17.5.2 | Well Abandonment and Groundwater Restoration | 68 | |||

| 17.5.3 | Demolition and Removal of Infrastructure | 68 | |||

| 17.5.4 | Reclamation | 69 | |||

| 17.6 | Financial Assurance | 69 | |||

| 17.7 | Adequacy of Mitigation Plans | 69 | |||

| 18.0 | CAPITAL AND OPERATING COSTS | 70 | |||

| 18.1 | Capital Cost Estimates | 70 | |||

| 18.2 | Operating Cost Estimates | 75 | |||

| 18.3 | Cost Accuracy | 75 | |||

| 19.0 | ECONOMIC ANALYSIS | 80 | |||

| 19.1 | Economic analysis | 80 | |||

| 19.2 | Taxes, Royalties and Other Interests | 87 | |||

| 19.2.1 | Federal Income Tax | 87 | |||

| 19.2.2 | State Income Tax | 87 | |||

| 19.2.3 | Production Taxes | 87 | |||

| 19.2.4 | Royalties | 87 | |||

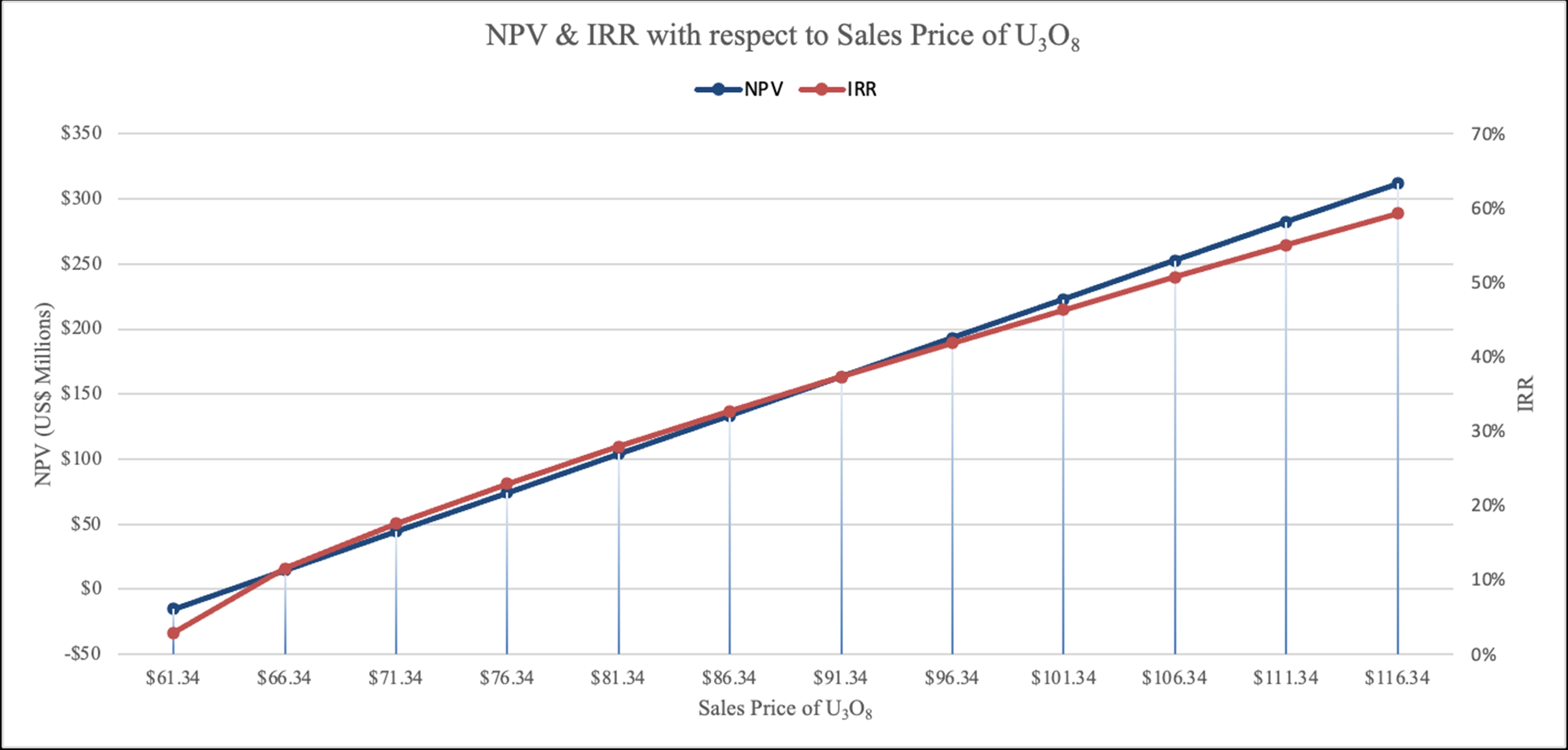

| 19.3 | Sensitivity Analysis | 88 | |||

| 19.3.1 | NPV and IRR v. Variable Capital and Operating Cost | 89 | |||

| 20.0 | ADJACENT PROPERTIES | 90 | |||

| 21.0 | OTHER RELEVANT DATA AND INFORMATION | 91 | |||

| 21.1 | Other Relevant Items | 91 | |||

| 22.0 | INTERPRETATION AND CONCLUSIONS | 92 | |||

| 22.1 | Risk Assessment | 92 | |||

| 22.2 | Uranium Recovery and Processing | 92 | |||

| 22.2.1 | Permitting and Licensing Delays | 93 | |||

| 22.3 | Social and/or Political | 94 | |||

| 23.0 | RECOMMENDATIONS | 95 | |||

| 24.0 | REFERENCES | 96 | |||

| 25.0 | RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT | 98 | |||

| 26.0 | DATE, SIGNATURE AND CERTIFICATION | 99 | |||

| iv | REPORT DATE: JANUARY 6, 2025 |

Tables

| Table 1.1: | Mineral Resources Summary | 3 |

| Table 7.1: | Results of Fall River Formation Core Holes | 28 |

| Table 7.2: | Results of Lakota Formation Core Holes | 28 |

| Table 7.3: | Dewey Production Area Water Level Data (MSL) | 30 |

| Table 7.4: | Burdock Production Area Water Level Data (MSL) | 32 |

| Table 7.5: | Hydro-stratigraphic unit Property Summary for the Dewey Burdock Project | 32 |

| Table 7.6: | Groundwater Chemistry for Fall River and Chilson Formations | 35 |

| Table 10.1: | Uranium and Vanadium Dissolutions Based on Solids Assays | 40 |

| Table 10.2: | Uranium Dissolutions Based on Leachate and Residue Assays | 41 |

| Table 10.3: | Vanadium Dissolutions Based on Head and Leachate Assays | 41 |

| Table 11.1: | Summary of Mineral Resource Estimates | 44 |

| Table 17.1: | Permitting Status | 67 |

| Table 18.1: | Capital Cost Components | 71 |

| Table 18.2: | Capital Cost Forecast by Year | 72 |

| Table 18.3: | Operating Cost Components | 76 |

| Table 18.4: | Operating Cost Forecast by Year | 77 |

| Table 19.1: | Economic Analysis Forecast by Year with Exclusion of Federal Income Tax | 81 |

| Table 19.2: | Economic Analysis Forecast by Year with Inclusion of Federal Income Tax | 84 |

| Table 25.0: | Other Experts | 98 |

| Table 25.1: | Referenced Sections | 98 |

| v | REPORT DATE: JANUARY 6, 2025 |

Figures

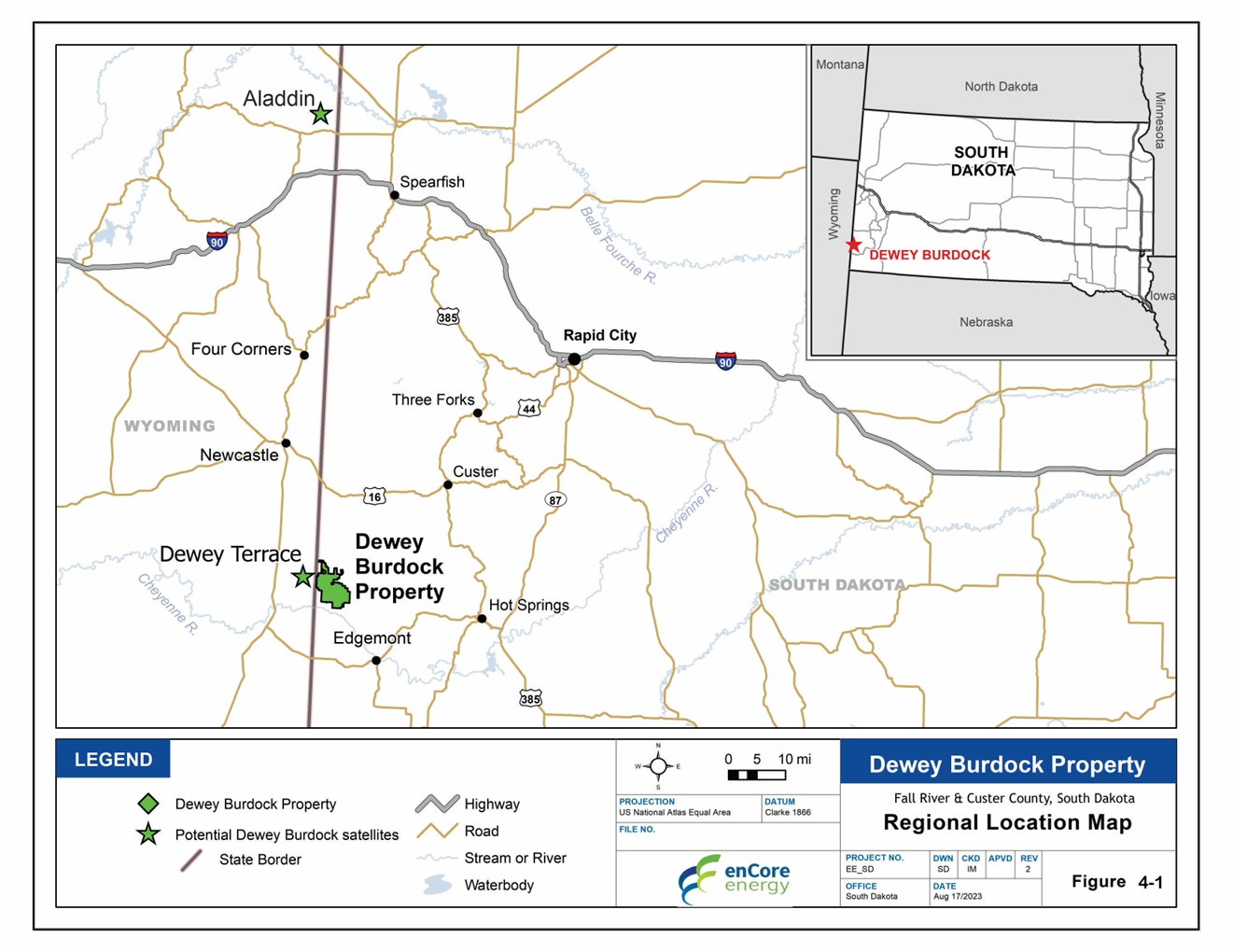

| Figure 3.1: | Project Location Map | 10 |

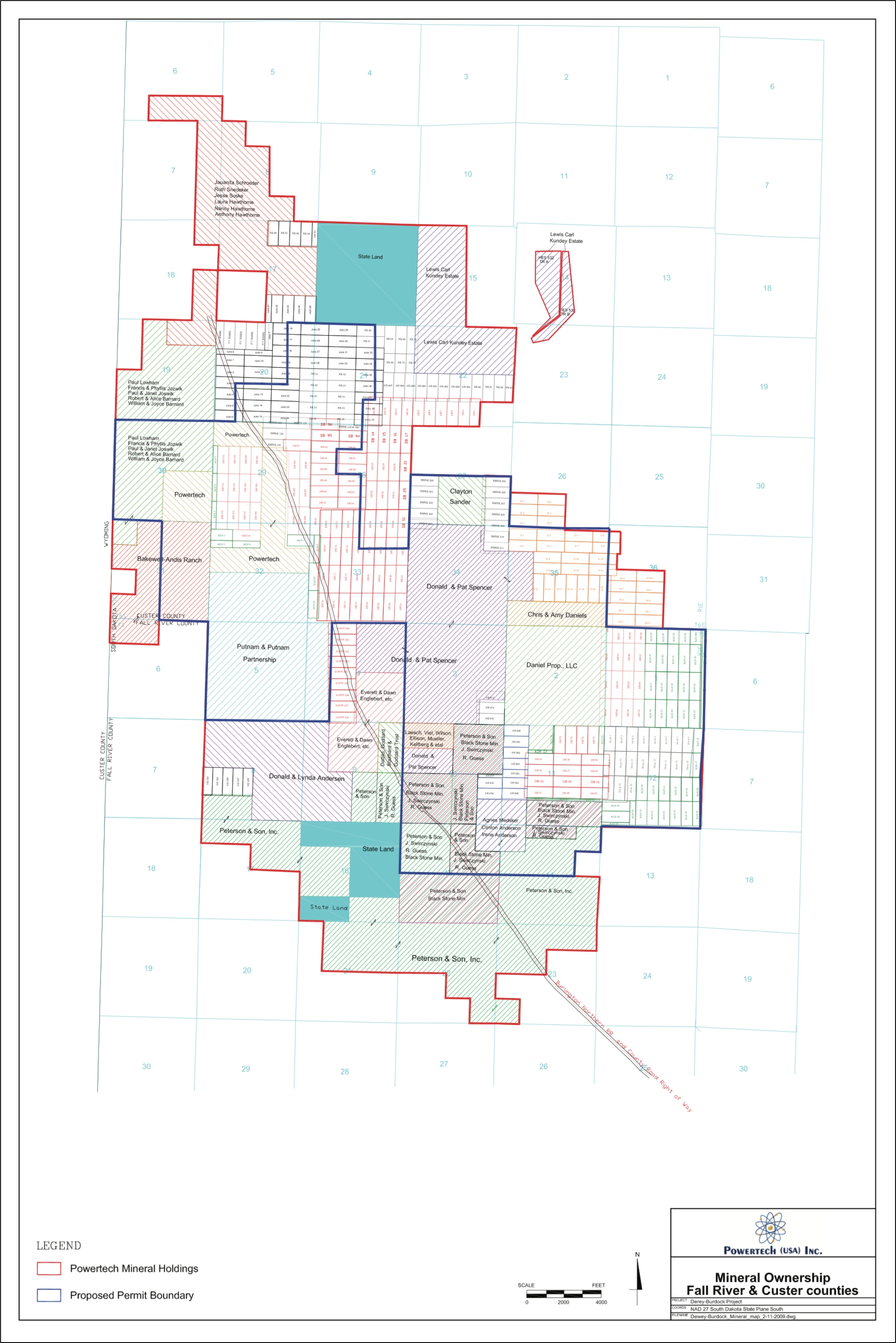

| Figure 3.2: | Dewey Burdock Mineral Ownership | 11 |

| Figure 3.3: | Surface Use Agreements | 12 |

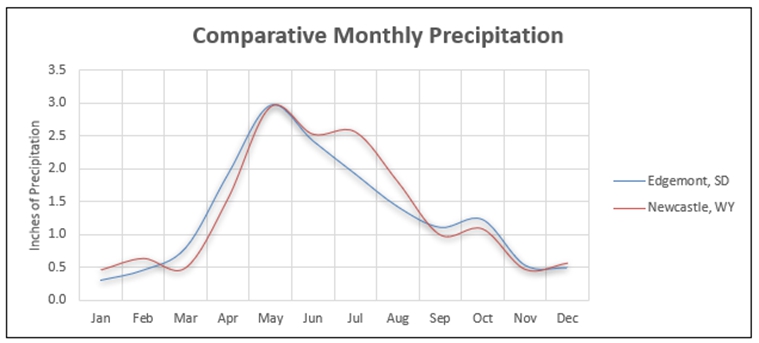

| Figure 4.1: | Average Monthly Precipitation (2009 – 2022) | 15 |

| Figure 6.1 | Stratigraphic Column | 20 |

| Figure 6.2: | Cross-section A – A’ | 21 |

| Figure 6.3: | Typical Roll Front Deposit | 24 |

| Figure 7.1. | Drill Hole Locations | 26 |

| Figure 13.1: | Production Forecast Model | 47 |

| Figure 13.2: | Dewey Burdock Mine | 49 |

| Figure 14.1: | Process Flow Diagram | 51 |

| Figure 14.2: | CPP Facility General Arrangement | 52 |

| Figure 14.3: | Satellite Facility General Arrangement | 53 |

| Figure 15.1: | Project Infrastructure | 57 |

| Figure 19.1: | NPV & IRR v. Uranium Price | 88 |

| Figure 19.2: | NPV v. Variable Capital and Operating Cost | 89 |

| Figure 19.3: | IRR v. Variable Capital and Operating Cost | 90 |

| vi | REPORT DATE: JANUARY 6, 2025 |

| Units of Measure and Abbreviations | |

| Avg | Average |

| ° | Degrees |

| ft | Feet |

| F | Fahrenheit |

| g/L | Grams per liter |

| GT | Mineralization Grade times (x) Mineralization Thickness |

| gpm | Gallons per minute |

| kWh | Kilo Watt Hour |

| Lbs | Pounds |

| M | Million |

| Ma | One Million Years |

| mg/l | Milligrams per liter |

| Mi | Mile |

| ml | Milliliter |

| MBTUH | Million British Thermal Units per Hour |

| U3O8 | Chemical formula used to express natural form of uranium |

| eU3O8 | Radiometric equivalent U3O8 measured by a calibrated total gamma downhole probe |

| pCi/L | Picocuries per liter of air |

| pH | Potential of hydrogen |

| ppm | Parts per Million |

| % | Percent |

| +/- | Plus, or Minus |

| USD | United States Dollar |

| vii | REPORT DATE: JANUARY 6, 2025 |

| Definitions and Abbreviations | |

| Azarga | Azarga Uranium |

| BLM | Bureau of Land Management |

| BNSF | Burlington Northern Santa Fe Railroad |

| CIM | Canadian Institute of Mining |

| D&D | Decontamination and Decommissioning |

| DANR | South Dakota Department of Agriculture and Natural Resources |

| Denver Uranium | Denver Uranium Company |

| DDW | Deep Disposal Well |

| EAB | Environmental Appeals Board |

| ELI | Energy Laboratories Incorporated |

| enCore | enCore Energy Corporation |

| Energy Fuels | Energy Fuels Nuclear Company |

| Energy Metals | Energy Metals Corporation |

| EPA | Environmental Protection Agency |

| IRR | Internal Rate of Return |

| ISR | In Situ Recovery |

| IX | Ion Exchange |

| LLC | Limited Liability Company |

| LOM | Life of Mine |

| MCL | Maximum Contaminant Level |

| MSL | Mean Sea Level |

| MBTUH | Million British Thermal Units per Hour |

| NI 43-101 | National Instrument 43-101 – Standards of Disclosure for Mineral Projects |

| NI 43-101F1 | Form 43-101 Technical Report Table of Contents |

| NGO | Non-Government Organization |

| NPV | Net Present Value |

| NRC | Nuclear Regulatory Commission |

| Petrotek | Petrotek Engineering Corporation |

| Project | Dewey Burdock ISR Project |

| PV | Pore volume |

| QEMSCAN | Quantitative evaluation of minerals by scanning electron microscopy |

| QP | Qualified Person |

| RBS&A | Robert Bob Smith and Associates |

| RO | Reverse Osmosis |

| Rough Stock | Rough Stock Mining Services |

| S-K 1300 | United States Securities and Exchange Commission disclosure requirements for mineral resources or mineral reserves, S-K 1300 Technical Report Summary |

| Susquehanna | Susquehanna Western Corporation |

| TVA | Tennessee Valley Authority |

| U | Uranium |

| US | United States |

| USDW | Underground Source of Drinking Water |

| USGS | United States Geological Survey |

| WMB | South Dakota Water Management Board |

| V | Vanadium |

| 11.e.(2) | Tailings or wastes produced by the extraction or concentration of uranium from processed ore |

| viii | REPORT DATE: JANUARY 6, 2025 |

1.0 EXECUTIVE SUMMARY

1.1 Property Description and Ownership

The Project is an advanced-stage uranium exploration project located in southwest South Dakota and forms part of the northwestern extension of the Edgemont Uranium Mining District about 13 miles north-northwest of Edgemont. The Project is wholly owned by enCore.

enCore controls over 16,000 acres in the area, of which over 10,500 acres are within the Project’s permit boundary. Mineral title is controlled by federal mining claims and private lease agreements.

The project is within an area of low population density characterized by an agriculture-based economy with little other types of commercial and industrial activity. The Project is expected to bring a significant economic benefit to the local area in terms of tax revenue, new jobs, and commercial activity supporting the project. Previously, a uranium mill was in the town of Edgemont from 1956 to 1972, and a renewal of uranium production is expected to be a locally favorable form of economic development. Regionally, there are individuals and other organizations that oppose the project, though typically not in the immediate Edgemont area.

1.2 Geology and Mineralization

The Edgemont Uranium District is located on the southwest side of the Black Hills Uplift. The Black Hills Uplift is a Laramide Age structure forming a northwest trending dome about 125 miles long x 60 miles wide located in southwestern South Dakota and northeastern Wyoming. The uplift has deformed all rocks in age from Cambrian to latest Cretaceous. Subsequent erosion has exposed these rock units dipping outward in successive elliptical outcrops surrounding the central Precambrian granite core. Differential weathering has resulted in present day topography of concentric ellipsoids of valleys under softer rocks and ridges held up by more competent units.

The Cretaceous sediments contain uranium roll front deposits in the more porous and permeable sands within the Inyan Kara Group, Lakota and Fall River Formations. The entire Inyan Kara Group consists of basal fluvial sediments grading into near marine sandstones, silts and clays deposited along the ancestral Black Hills Uplift. The sandstones are continuous along the entire western flank of the uplift and dip about 3° to the southwest in the Project area.

The Lakota and Fall River Formations were deposited by northward flowing stream systems. Sediments are characterized by point bar and traverse bar deposition, in meandering fluvial systems. Sand units fine upward with numerous cut-and-fill indicative of channel migration depositing silt and clay upon older sand and additional channel sands overly older silts and clays. The Fall River sands are noticeably thinner with marine sediments superimposed directly on the fluvial sands.

The depositional characteristics of the Lakota and Fall River Formations results in stratigraphic heterogeneity within the sands. Because of this heterogeneity, uranium mineralization occurs as multiple sinuous roll fronts, instead of one large front as is observed in more homogeneous sands. Individual roll fronts are continuous and generally trend along strike but may or may not overlap. Individual roll fronts average about 8 feet thick and 30 feet wide. Where overlapping the deposit can be tens of feet thick and hundreds of feet wide. The strike length of individual roll fronts is variable but often on the order of thousands of feet, where the total strike length of the deposit is miles. Depth to mineralization is variable and ranges from about 180 to 920 feet.

| 1 | REPORT DATE: JANUARY 6, 2025 |

1.3 Exploration Status

Exploration started in the Edgemont Uranium District in the early 1950’s. Since that time numerous companies have explored on or around the Project. To date over 6,000 holes have been drilled on the property. The most recent exploration was conducted by Powertech in 2007 and 2008. Since enCore’s acquisition of the Project in 2021 no exploration has been conducted.

1.4 Development and Operations

In Azarga’s 2019 technical report, the Project was planned to operate with a satellite facility and toll-mill processing at a competitor’s plant. To de-risk the project, enCore has elected to proceed with construction of a CPP to recover and process uranium, followed by construction of a satellite.

enCore will mine uranium using ISR. An alkaline leach system of bicarbonate and oxygen will be used for extraction. The fundamental ISR production unit will be the pattern which is comprised of a recovery well and associated injection wells. Patterns will be grouped into wellfields of 20-30 recovery wells and their associated injection wells. Wellfields function as the fundamental operating unit for distribution of the alkaline leach system. Wellfields will be grouped into Mine Units. Mine Units represent a collection of wellfields for which baseline data, monitoring requirements, restoration criteria and development of a Wellfield Hydrologic Data Package, that will be submitted to regulatory authorities for mining approval.

enCore is advancing pre-construction activities to achieve a commercial operation in the second half of 2028. Permitting and licensing actions are ongoing, and forecasted completion is Q3 2026. Engineering is anticipated to commence in late 2025 or early 2026. Construction will start on the Burdock CPP in early 2027. Also in 2027, enCore will install the first Burdock mine unit monitor wells, conduct hydrologic testing, baseline sampling, and preparation of the hydrologic data package. Starting in late 2027 or early 2028, wellfield construction will start in the first Mine Unit.

Pursuant to start of commercial operations, construction will start on the Dewey Satellite and first Dewey mine unit. Construction is forecasted to take one year with the start of commercial operations in the second half of 2029.

| 2 | REPORT DATE: JANUARY 6, 2025 |

1.5 Mineral Resource Estimates

A summary of the Project’s mineral resources is provided in Table 1.1.

Table 1.1: Mineral Resources Summary

| ISR Resources | Measured | Indicated | M & I | Inferred | ||||||||||||

| Lbs (U3O8) | 14,285,988 | 2,836,159 | 17,122,147 | 712,624 | ||||||||||||

| Tons | 5,419,779 | 1,968,443 | 7,388,222 | 645,546 | ||||||||||||

| Avg. GT | 0.73 | 0.41 | 0.66 | 0.32 | ||||||||||||

| Avg. Grade (% U3O8) | 0.13 | % | 0.07 | % | 0.12 | % | 0.06 | % | ||||||||

| Avg. Thickness (ft) | 5.56 | 5.74 | 5.65 | 5.87 | ||||||||||||

Notes:

| 1. | enCore reports mineral reserves and mineral resources separately. Reported mineral resources do not include mineral reserves. |

| 2. | The geological model used is based on geological interpretations on section and plan derived from surface drillhole information. |

| 3. | Mineral resources have been estimated using a minimum grade-thickness cut-off of 0.20 ft% U3O8. |

| 4. | Mineral resources are estimated based on the use of ISR for mineral extraction. |

| 5. | Inferred mineral resources are estimated with a level of sampling sufficient to determine geological continuity but less confidence in grade and geological interpretation such that inferred resources cannot be converted to mineral reserves. |

1.6 Mineral Reserve Estimates

No mineral reserves are defined for the Project.

1.7 Summary Capital and Operating Cost Estimates

Estimated capital costs are $264.2 M and includes $2.2 M for pre-construction permitting and licensing costs, $178.0 M for wellfield development, $84.0 M for the CPP, Satellite and associated infrastructure.

Capital is heavily weighted from 2027 through 2029 with completion of permitting and licensing and start-up costs for construction of the Burdock CPP, Dewey Satellite, initial Dewey and Burdock wellfields, and associated infrastructure. Capital costs during this period are estimated at $105.0 M.

Operating costs are estimated to be $23.81 per pound of U3O8. The basis for operating costs is planned development, production sequence, production quantity, and past production experience. Operating costs include plant and wellfield operations, product transaction, administrative support, decontamination and decommissioning, and restoration.

Taxes, royalties, and other interests are applicable to production and revenue. Total Federal income tax is estimated at $113.4 M for a cost per pound U3O8 of $8.04. The state of South Dakota does not impose a corporate income tax, but uranium sales revenue is subject to a state combined severance and conservation tax of 4.74% for a total production tax burden of $54.4 M for a cost per pound U3O8 of $3.85. Property taxes will also be realized based on property value as discussed in Section 22.2.3, in the amount of $16.2 M or $1.15 per pound of U3O8. The project is subject to a cumulative 5.8% surface and mineral royalty at an average LOM sales price of $86.34 per pound U3O8 for $70.9 M or $5.03 per pound.

| 3 | REPORT DATE: JANUARY 6, 2025 |

The economic analysis assumes that 80% of the mineral resources are recoverable. The pre-tax net cash flow incorporates estimated sales revenue from recoverable uranium, less costs for surface and mineral royalties, severance and conservation tax, property tax, plant and wellfield operations, product transaction, administrative support, D&D, restoration, and pre-construction capital. The after-tax analysis includes the above information plus amortized development costs, depreciated plant and wellfield capital costs, existing and forecasted operating losses to estimate federal income tax.

Less Federal Tax, the Projects cash flow is estimated at $476.8 M or $52.56 per pound U3O8.Using an 8% discount rate, the Projects NPV is $180.1 M with an IRR of 39% (Table 22.1). The Projects after tax cash flow is estimated at $363.4 M for a cost per pound U3O8 of $60.60. Using an 8.0% discount rate, the Projects NPV is $133.6 M with an IRR of 33% (Table 22.2).

Commercial operations are forecasted to start Q3 2028, and the estimated project payback is 2032.

1.8 Permitting Requirements

Permitting and licensing actions are ongoing, and forecasted completion is Q3 2026. The most significant permits and licenses required to operate the Project are (1) the Source and Byproduct Materials License, which was issued by NRC April of 2014; (2) the Large Scale Mine Permit, to be issued by the South Dakota DENR; and (3) UIC Class III and V wells (injection and/or deep disposal), and aquifer exemption, all three were issued in November 2020 by the EPA, but are currently under appeal.

The land within the Project boundary includes mining claims on private and federal lands. Access to these lands is controlled with leases held by enCore or by public access. Thus, a BLM Plan of Operations and associated Environmental Assessment which will reference the already completed Environmental Impact Statement previously finalized by NRC with BLM as a cooperating agency will be completed. The status of the various federal and state permits and licenses are summarized in Table 17.1. Prior to the start of mining (the injection of lixiviant), enCore will obtain all the following necessary permits, licenses, and approvals required by the NRC, DENR and EPA.

1.9 Conclusions and Recommendations

Based on the quality and quantity of geologic data, stringent adherence to geologic evaluation procedures and thorough geological interpretative work, mineralogical and hydrological testing, deposit modeling and resource estimation methods, production forecasting detail, high degree of design and pre-engineering, quality and substantial quantity of detailed cost inputs, cost estimates, and comprehensive economic analysis, the QP responsible for this report considers that the current mineral resource estimates are relevant and reliable.

As with any pre-development mining property there are risks to the Project. Key risks are with respect to uranium recovery, liquid waste disposal, permitting and licensing delays, and social and political opposition. Based on the technical and scientific work of previous operators and their own development plans, enCore is actively working to mitigate risk to ensure a profitable and successful project.

| 4 | REPORT DATE: JANUARY 6, 2025 |

To further de-risk technical and scientific aspects, enCore staff and SOLA have reviewed the technical and scientific work completed by previous operators. Previous metallurgical and hydrologic studies were done in accordance with industry standard procedures, and the results indicate the geological conditions are suitable for ISR mine development. SOLA has also revised the Project LOM production forecast using a more reliable and predictive model.

Regarding liquid waste disposal, enCore has previous operators engineering studies for DDW’s and surface impoundments. These studies have been used to develop a liquid waste management plan utilizing surface impoundments and subsurface injection of treated effluents through permitted Class V injection wells.

enCore has an ongoing community affairs program to address social and political misunderstandings with education and community relations. enCore maintains routine contacts with landowners, local communities and businesses, and the public.

There is opposition to the Project by environmental NGO’s, tribal governments, and individuals though typically not in the Edgemont area. This has created increased regulatory efforts and logistics for accommodating public involvement. There has already been extensive public involvement including public hearings and public comment on the project for the NRC license and draft EPA permits, as well as challenges and litigation of issued approvals. Hearings for State of South Dakota permits begun in 2013 but were suspended pending completion of federal licenses. To successfully permit and license the Project, enCore is working proactively with State and Federal regulatory agencies and have internal staff and outside support dedicated to this effort.

It is recommended enCore continue pre-construction activities to achieve start of commercial operations in 2028 to include:

| ● | Finalize state and federal permitting and licensing work obtaining necessary permits and licenses required to operate Project. This work will consist of pre-operations inspections, regulatory fees, and fees associated with contestations. Pre-construction remaining permitting and licensing work is estimated to cost $2.2 M. |

| ● | Since enCore has not conducted drilling on the Project, it is recommended that as part of their 2025 program, confirmation holes are drilled to verify some of the historic drilling data. It is also recommended that a coring program be conducted to better assess deposit mineralogy, confirm secular equilibrium, measure U/V ratios in leach solutions, and determine the best approach to handling U and V separation. Confirmation drilling and coring are estimated to cost $0.2 M. Conducting a drilling program is not contingent on receipt of major permits and licenses. |

| ● | Commence engineering in Q3 2026, for the Burdock CPP, office facility, warehouse, maintenance shop, construction shop, Dewey satellite and liquid waste disposal facilities. Engineering services are estimated at 8% of plant development costs or $6.7 M. To advance engineering is not contingent on receipt of permits and licenses. |

| 5 | REPORT DATE: JANUARY 6, 2025 |

2.0 INTRODUCTION

2.1 Registrant

This report was prepared by SOLA Project Servicers LLC., for the registrant, enCore Energy Corporation.

enCore was incorporated in 2009 under the previous name of Tigris Uranium Corporation and is engaged in the identification, acquisition, exploration, development and operation of uranium properties in the United States. enCore is incorporated British Columbia, Canada. The company’s principal executive offices are located at 101 N. Shoreline Blvd. Suite 450, Corpus Christi, Texas 78401. enCore’s portfolio includes uranium mineral properties in Texas, South Dakota, Wyoming and New Mexico.

2.2 Terms of Reference and Purpose

This report was prepared to disclose mineral resources, updated development plans and the results of an economic analysis.

The technical and scientific information in this report reflects material changes in enCore’s mineral project development plans, which are material in the company’s affairs. The report has an effective date of October 8, 2024, and has been prepared in accordance with the guidelines set forth under SEC Subpart 229.1300 – Disclosure by Registrants Engaged in Mining Operations.

2.3 Information and Data Sources

The report has been prepared with internal enCore Project technical and financial information, as well as data prepared by others. Documents, files and information provided by the registrant used to prepare this report are listed in Section 24.0 REFERENCES and Section 25.0 RELIANCE ON INFORMATION PROVIDED BY THE REGISTRANT.

2.4 QP Site Inspection

Stuart Bryan Soliz is the QP responsible for the content of this report. He visited the Project on January 30th, 2024. The purpose of the visit was to inspect the site and to meet with the enCore team to review the details of material changes.

| 6 | REPORT DATE: JANUARY 6, 2025 |

3.0 PROPERTY DESCRIPTION

3.1 Description and Location

The Project is in southwest South Dakota and forms part of the northwestern extension of the Edgemont Uranium Mining District. The project area is in Townships 6 and 7 South, Range 1 East, of the Black Hills Prime Meridian approximately 13 miles north-northwest of Edgemont. The county line dividing Custer and Fall River counties, South Dakota, lies at the confluence of Townships 6 and 7 South (Figure 3.1 Project Location Map). The company holds approximately 16,962 acres of mineral rights in the area. The permitted area encompasses approximately 10,580 acres of mostly private land and 240 acres under the control of the BLM.

3.2 Mineral Titles

Mineral titles are comprised of federal claims, private minerals and private surface rights within the permit boundary and surrounding areas. Access and mineral rights are currently held by a combination of private surface use agreements, access and mining lease agreements, purchase agreements and federal mineral claims.

The name or number of each title, mineral right, lease, or option under which enCore have the right to hold or operate the property are shown on Figures 3.2 and 3.3; however, lease terms are not disclosed in this report due to confidentiality and competitive leasing conditions. Mineral title is a matter of public record that can be obtained at the Custer and Fall River County Register’s Offices.

enCore controls federal unpatented lode mining claims. Title to mining claims is subject to rights of pedis possession against all third-party claimants if the claims are maintained. Mining Claims do not have an expiration date and affidavits are filed with the BLM and recorded with the Custer and Fall River County Register’s Offices attesting to the payment of BLM annual maintenance fees.

3.3 Mineral Rights

Leases have been acquired from various landowners with several levels of payments and obligations. Where enCore will develop mineral resources, both surface and minerals are leased or controlled by unpatented mineral claims. Furthermore, enCore controls all surface and mineral rights within the permit boundary. Most leases and purchase agreements are maintained through annual payments. Several leases are subject to an annual payment that is based on uranium spot price at payment due date. Claims are held by annual payments to the BLM.

Royalty agreements have been established with mineral and surface owners. Furthermore, surface owners are paid an annual rental to hold the surface on behalf of enCore. Additionally, the agreements also provide for additional charges to the surface owner to cover surface damages and for reduction of husbandry grazing during field operations.

| 7 | REPORT DATE: JANUARY 6, 2025 |

3.4 Encumbrances

3.4.1 Legacy Issues

On the east side of the Project there are shallow un-reclaimed open pits from legacy surface uranium mining operations. Existing surface disturbance related to these pits are the responsibility of previous operators and existing landowners. Mineralization does exist below these surface pits, but at this time enCore has no intention to pursue development options due to potential liabilities associated with the pits.

3.4.2 Permitting and Licensing

The Project is the first uranium ISR facility to submit permit applications in the State of South Dakota. As such, there is inherent risk in a new permitting process, regulatory unfamiliarity with ISR methods, and an untested review period. The amount of time required for regulatory review of all permits associated with the commissioning of an ISR facility is highly variable and directly affects project economics. It is assumed enCore will have all permits necessary to construct in 2027. The timeframe to obtain licenses and permits is expected to be impacted by environmental NGO’s and public contestation of both state and federal permits and licenses. Time for contested cases has been accounted for in the project development schedule.

The Project has drawn attention from environmental NGO’s, tribal governments, and individuals in the public. enCore is managing this risk through the State and Federal permitting processes. Extensive efforts by the regulatory agencies have proceeded to near completion of all major permitting and licensing actions.

The NRC license (SUA 1600) was issued in 2014, challenged and appealed, is now in good standing and in timely renewal. The EPA issued the Class III and Class V Area Underground Injection Control (UIC) permits and Aquifer Exemption in 2020. The Class III and Class V UIC permits, and Aquifer Exemption were challenged by the OST and are under appeal.

The EAB heard oral arguments on the Class III and Class V UIC permits in March 2024. In September, the EAB issued its ruling on the OST appeal finding:

| ● | The EAB 2023 decision denying OST claims and finding that EPA complied with the National Historic Preservation ACT (NHPA) Section 106, |

| ● | Denied OST claims and found that EPA complied with NHPA Section 110, |

| ● | Denied OST claims that EPA failed to comply with the National Environmental Protection Act (NEPA), |

| ● | Reserved judgment on other OST claims until EPA expands the administrative record adding documents, considers those additional materials, responds to related comments, takes further appropriate action in reissuing the permit decisions; and, |

| 8 | REPORT DATE: JANUARY 6, 2025 |

| ● | The EAB remanded the reserved issues to EPA and specified that any appeals challenging the reissued permit decisions will be limited to the issues reserved in the remand and any modifications to the permits made as a result of the remand. |

The EAB decisions regarding EPA compliance with NHPA and NAPA were favorable rulings and consistent with the 2023 D.C. Circuit Court of Appeals rulings where similar appeals were made by the OST against the NRC Source Material License.

Regarding the portion of the ruling remanded back to the EPA Region 8, it is anticipated that this will be an exercise to formally complete the administrative record. Once the administrative record is complete and the permit decision reissued, the EAB will consider any additional materials and respond to related comments. It is also anticipated that the OST will appeal the reissued permit, but the EAB will rule in favor of the EPA and enCore with minimal impact to the overall project schedule. If the EAB does find merit in the appealed reissued permit, there could be an impact to the project schedule.

A ruling on the issuance of the Aquifer Exemption is currently under appeal to the 8th Circuit Court of Appeals and will rule upon once the EAB issues final ruling on the Class III and Class V UIC permits.

In South Dakota, enCore is advancing work on the major state permits needed to operate the Project. The State Engineer had previously recommended approval of the Inyan Kara (#2686-2) and Madison (#2685-2) Water Rights. The next step to advance water rights will be the resumption of the Department of Agriculture and Natural Resources (DANR) Water Management Board hearings. Efforts are also advancing on the DANR Groundwater Discharge Plan and Large-Scale Permit to Mine approvals. The DANR has recommended conditional approval of the Groundwater Discharge Plan and Large-Scale Permit to Mine, pending completion of all federal challenges of the Class III, Class V and Aquifer Exemption.

3.5 Other Significant Factors and Risks

There are no other significant factors or risks that may affect access, title or the right or ability to perform work on the property that have not been addressed elsewhere in this report.

| 9 | REPORT DATE: JANUARY 6, 2025 |

Figure 3.1: Project Location Map

| 10 | REPORT DATE: JANUARY 6, 2025 |

Figure 3.2: Dewey Burdock Mineral Ownership

| 11 | REPORT DATE: JANUARY 6, 2025 |

Figure 3.3: Surface Use Agreements

| 12 | REPORT DATE: JANUARY 6, 2025 |

4.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY

4.1 Topography, Elevation and Vegetation

The Project is located at the extreme southwest corner of the Black Hills Uplift. Terrain is thus, in part, undulating to moderately incised at the south and west. The eastern and northern areas are further into the Uplift and are cut by narrow canyons draining the higher hills. Significant drainages are few, with only four or five canyons in the area. These canyons are cut less than 1,000 feet in width between the ridges. Slopes may be gentle or steep depending upon the underlying rock type. Sandstones may form cliffs up to 30 to 45 feet in height that will extend for only hundreds of feet in length.

There is only about 300 feet of elevation change across the Project. The south and west side are at a lower elevation of about 3,600 feet above mean sea level. The highest elevation is at near 3,900 feet above mean sea level in the northeast.

Three major vegetation regions are noted: grassland, ponderosa pine and desert shrub. Grassland vegetation is dominated by buffalo grass, blue grama grass and western wheatgrass. Ponderosa pine occurs with Rocky Mountain juniper. Shrubs are composed of big sagebrush and black greasewood.

Cultivated crops are limited to and consist of flood irrigated hay land. Less than 5% of the Project includes cultivated farming. Most of the vegetation is given over to cattle. A minor portion of the Project covered by stands of ponderosa pine has been selectively logged for pulpwood. Timber is not a significant industry in the area.

4.2 Access

The nearest population center to the Project is Edgemont, South Dakota (population 900) located on US Highway 18, 14 miles east from the Wyoming-South Dakota state line. Fall River County Road 6463 extends northwestward from Edgemont to the abandoned community of Burdock located in the southern portion of the Project, about 16 miles from Edgemont. This road is two-lane and all-weather gravel and continues north from Burdock to the Fall River-Custer County line where it becomes Custer County Road 769. 769 continues to the hamlet of Dewey, a total distance of about 23 miles from Edgemont. The road closely follows the tracks of the BNSF between Edgemont and Newcastle, Wyoming. Dewey is about 2 miles from the northwest corner of the Project.

An unnamed unimproved public access road into the Black Hills National Forest intersects Fall River County Road 6463 4.3 miles southeast of Burdock and extends northward about 4 miles, allowing access to the east side of the Project. About 0.9 miles northwest from Burdock, an unimproved public access road to the west from Fall River County Road 6463 allows access to the western portion of the Project. Private ranch roads intersecting Fall River County Road 6463 and Custer County Road 769 allow access to all other portions of the Project.

| 13 | REPORT DATE: JANUARY 6, 2025 |

As discussed in Section 3.0, Project access is granted by private surface leases, or public access on federal lands. There are no significant limitations to surface access and usage rights that will affect the company’s ability to conduct exploration, development or operations. Since waste rock and tailings will not be generated there is no requirement for surface mine waste disposal and no requirement for acquiring surface rights for on-site disposal. All 11.e.(2) designated waste will be disposed of at an off-site licensed facility, all non 11.e.(2) waste will be disposed of at a local licensed landfill and liquid wastes will be disposed of using licensed lined impoundments and treated liquid effluents will be injected into a subsurface aquifer using permitted Class V injection wells.

4.3 Climate

The general climate of the project area is semi-arid continental or steppe with a dry winter season. Low precipitation, high evaporation rates, low relative humidity and moderate mean temperatures with significant diurnal and seasonal variations characterize the area. The higher Black Hills to the northeast of the project seem to generally moderate temperature extremes especially during winter months. The local climate is not expected to have any adverse impacts to construction or operations. Similar projects have been constructed and operated for decades in neighboring Nebraska and Wyoming. Blizzards and extreme cold during the winter months can cause temporary access restrictions but are typically short lived and have rarely been a significant impedance.

The annual mean temperature in this area of South Dakota is 46°F. The low mean temperature of 20°F occurs in January. The mean high temperature of 74°F occurs in July. The Project averages 198 day/year of below freezing temperatures. Below freezing temperatures generally do not occur after mid-May or before late September.

The average precipitation at the Project is 15 inches. The wettest month is May when rainfall amounts to 3 inches and the driest months are January and December yielding 0.5 inch each month, usually as snow. The average annual snowfall is 37 inches (Figure 4.1).

| 14 | REPORT DATE: JANUARY 6, 2025 |

Figure 4.1: Average Monthly Precipitation (2009 – 2022)

4.4 Infrastructure

The Project is well supported by nearby towns and services. Major power lines are located across the Project and can be accessed for electrical service. The BNSF railroad crosses the Project, and a major railroad siding occurs at Edgemont and may be used for shipment of materials and equipment, if necessary.

Human resources will be employed from nearby population centers. The local communities of Edgemont, Custer and Hot Springs offer sources for labor, housing, offices and basic supplies. It is enCore’s plan to utilize local resources when and where possible supporting the local economy.

Regarding site infrastructure, leases are written to have maximum flexibility for emplacement of tanks, out buildings, storage areas and pipelines. Most of the topography is relatively low lying and undulating and is conducive to development and operations.

The project site has no mining facilities or buildings. The only site equipment related to mining include a weather monitoring station, radiological monitoring stations, and monitor wells. All are accessible by dirt roads.

| 15 | REPORT DATE: JANUARY 6, 2025 |

5.0 HISTORY

5.1 Ownership

Property ownership is often represented by split estate where separate parties own the rights to a surface parcel and the minerals beneath that parcel are owned by a different entity. Historically, when surface real estate was sold, property owners often retained mineral ownership resulting in the above-mentioned spilt estate. Other properties are split estate that were homesteaded under the 1916 Homestead Act granting homesteader surface ownership and the mineral rights were reserved by the U.S. Government.

Uranium minerals were discovered in the vicinity of the Project as early as 1952 and were soon mined by small mining companies using open pit, adit, or shallow underground mines. These mining companies leased the mineral rights from mineral or other claim owners. By the late 1950’s, these deposits came under the control of Susquehanna who had purchased the process mill located in Edgemont. Susquehanna mined most of the known, shallow uranium deposits before closure of the mill in 1972.

During the uranium boom of the 1970s, several companies returned to the Project area, acquired leases and began exploration for deeper deposits. During this period, exploration companies such as Wyoming Mineral, Homestake Mining Company, Federal Resources and Susquehanna discovered deeper uranium roll-front type uranium mineralization. In 1978, TVA purchased Susquehanna’s interest in the Edgemont Uranium Mining District, including the Edgemont mill. TVA made Dewey Burdock its main exploration target and developed enough reserves to warrant mine plans that included an underground mine shaft at both the Burdock and Dewey sites and a new uranium mill that was planned to be located near Burdock. TVA’s plans ended when the price of uranium dropped in the early 1980’s. Eventually, TVA dropped their leases and mining claims.

In 1994, Energy Fuels acquired the properties with an interest in exploration and development of the roll-front deposits. By 2000, Energy Fuels relinquished their land position in the Project.

In 2005, Denver Uranium acquired federal claims and private mineral leases covering 11,180 acres and private surface rights covering 11,520 acres in the Project area. This acreage created a contiguous land position of both surface and mineral rights covering most of the discovered and delineated uranium in this district.

On February 21, 2006, Powertech and Denver Uranium entered into a binding Agreement of Purchase and Sale for the Project assets.

On October 29, 2014, Powertech merged with Azarga Resources Limited forming Azarga Uranium. To further consolidate project resources, Azarga entered into a binding property purchase agreement with Energy Metals on November 18, 2005, whereby Azarga acquired a 100% interest in 119 mineral claims covering approximately 2,300 acres.

In 2021, Azarga and enCore entered into an agreement whereby enCore was to purchase Azarga. In September of 2021, the acquisition was finalized with enCore acquiring multiple assets in various stages of development including the advanced stage Dewey Burdock Project.

| 16 | REPORT DATE: JANUARY 6, 2025 |

5.2 Historic Mineral Resource Estimates

There are no historical mineral resource and mineral reserve estimates within the meaning of NI-43-101 to report; however, historical mineral resources were estimated for TVA by Silver King in 1981, as part of an underground mine feasibility study. Silver King classified resources as identified resources and mineable reserves. Resources were classified based drill density, and categories used are other than categories set out in NI 43-101, Sections 1.2 and 1.3.

Estimation parameters that Silver King used were minimum thickness of 6 feet with a minimum average grade of 0.20% U3O8. As with subsequent evaluations, geological interpretation methods were done on section and plan from surface drillhole information. The study concluded that 5.0 M lbs could be mined by underground methods from a total calculated resource of about 8.0 M lbs.

In 1985, Silver King estimated Project in place identified resources of 10 M lbs. Average grade and tonnage were not specified. Within these in-place pounds, Silver King also estimated underground mineable reserves of approximately 5.0 M lbs, based on a run of mine total of 1,250,000 tons averaging 0.20% U3O8.

As part of the feasibility study, TVA and Silver King conducted several leach studies designed for a conventional milling circuit. Uranium recovery averaged over 99% and mineralization was not refractory. Copies of the same drillhole assay maps were available to RBS&A in 1991 (ref., Smith, 1993 and 1994).

In 1991, RBS&A evaluated the Project to determine if ISR was a viable development approach.

Estimation parameters that RBS&A used were minimum thickness of 6 feet with a minimum average grade of 0.05% U3O8 and thickness with a grade-thickness product of 0.50. RBS&A geological interpretation methods were done on section and plan from surface drillhole information.

RBS&A used a grade-thickness contour method to model the deposit estimating 8.1 M lbs, contained in 1,928,000 tons or rock with an average grade of 0.21% eU3O8.

Powertech purchased all RBS&A data in 2006. These records include documentation of the method of calculation and interpretation.

In 2015, with the merger of Powertech and Azarga, the company reported mineral resources for the Project of 8.5 M lbs of measured and indicated resources, and 3.5 M lbs of Inferred. The average grade and thickness reported for measured and indicated resources was 0.25% eU3O8and 5.2 feet. Inferred resources average grade was 0.05% eU3O8with an average thickness of 4.2 feet.

In 2018, Rough Stock was retained by Azarga and their wholly owned subsidiary Powertech, to prepare an independent resource estimate for the Project (ref., Rough Stock 2018). Rough Stock reported mineral resources for the Project of 16.9 M lbs of measured and indicated resources, and 0.8 M lbs of Inferred. The average grade and thickness reported for measured and indicated resources was 0.11% eU3O8and 5.6 feet. Inferred resources average grade was 0.05% eU3O8with an average thickness of 5.9 feet.

| 17 | REPORT DATE: JANUARY 6, 2025 |

In 2019, Azarga completed an internal mineral resources evaluation which serves as the basis for the Projects current mineral resource estimates. The individual that completed the 2019 evaluation is still with the Project and employed by enCore. Details of this evaluation are discussed in Section 12. MINERAL RESOURCE ESTIMATES.

5.3 Historic Production

Uranium was first produced as early as 1954 by a local group, Triangle Mining, a subsidiary of Edgemont Mining Company. Early commercial production entailed a single, shallow open pit and driving of an adit from both sides of an exposed ridge mining a narrow orebody, on the Burdock side of the project.

Susquehanna acquired the Project in about 1960 and discovered with shallow drilling, sufficient mineralization in the Fall River formation to warrant mining in five or six pits less than 100 feet deep. Susquehanna controlled the mill in Edgemont, which allowed some tolerances to mine low-grade ore that other mining companies could not afford. Susquehanna also had a milling contract with Homestake Mining Company buying ore from the Hauber Mine in northeast Wyoming. If Susquehanna had the Hauber ore to run through the Edgemont mill, the company could afford to mine low-grade ores from the Burdock pits. When the Hauber Mine was depleted and Homestake ceased ore shipments to Edgemont, Susquehanna closed their mining operations at Burdock and elsewhere in the Black Hills.

No actual production records are known for the Susquehanna mines, but it’s estimated that about 200,000 lbs of U3O8was produced.

| 18 | REPORT DATE: JANUARY 6, 2025 |

6.0 GEOLOGICAL SETTING, MINERALIZATION AND DEPOSIT

6.1 Regional Geology

The Black Hills Uplift is a Laramide Age structure forming a northwest trending dome about 125 miles long x 60 miles wide located in southwestern South Dakota and northeastern Wyoming. The uplift has deformed all rocks in age from Cambrian to latest Cretaceous. Subsequent erosion has exposed these rock units dipping outward in successive elliptical outcrops surrounding the central Precambrian granite core. Differential weathering has resulted in present day topography of concentric ellipsoids of valleys under softer rocks and ridges held up by more competent units.

The Cretaceous sediments contain uranium roll front deposits in the more porous and permeable sands within the Inyan Kara Group Lakota and Fall River Formations. These Formations are equivalent to the Cloverly Formation in western Wyoming, the Lakota Formation in western Minnesota, and the Dakota Formation in the Colorado Plateau. The entire Inyan Kara Group consists of basal fluvial sediments grading into near marine sandstones, silts and clays deposited along the ancestral Black Hills Uplift. The sandstones are continuous along the western flank of the Uplift. The Inyan Kara Group unconformably overlies the Jurassic Morrison formation, characterized as a flood plain deposit and terrestrial clay unit. Overlying the Inyan Kara are later early Cretaceous marine shales composed of the Skull Creek, Mowry, and Belle Fourche formations and referred to as the Graneros Group. Post uplift, the entire truncated set of formations was unconformably overlain by the Tertiary White River Formation. The White River consisted of several thousand feet of volcanic ash laden sediments that have since been eroded.

The Inyan Kara is typical of units formed as first incursion of a transgressive sea. The basal fluvial units’ grade into marine units as the ocean inundates a stable land surface. The basal units of the Lakota rest in scours cut into the underlying Morrison shale and display the depositional nature associated with mega-channel systems crossing a broad, flat coastal plain. Between channel sands are thin deposits of overbank and flood plain silts and clays.

Crevasse splays are common and abruptly terminate into inter-channel clays. The upper-most unit of the Lakota Formation is a widespread clay unit generally easily identified on electric logs by a characteristic “shoulder” on the resistivity curve. This unit is known as the Fuson Member. The basal unit of the Fall River Formation is a widespread, thick channel sand deposited in a middle deltaic environment that is evidenced by low-grade coals in its upper portion. Younger Fall River sand units are progressively thinner, less widespread; contain more silt and contain considerably more carbon, denoting a lower deltaic environment of deposition. There is little or no evidence of scouring of the contact between Fall River and the overlying marine Skull Creek. Inundation must have been rapid since within less than 20 feet of sedimentation, rock character goes from middle deltaic, marginal marine to deep marine environment with no evidence of beach deposits or offshore bar systems.

The overall structure of the Black Hills Uplift is relatively simple in that the structure is domal and rock units dip outward away from the central core. Regionally across the Black Hills, subsequent and attendant local doming caused by local intrusions disrupts the general dip of the units. Tensional stress creates fault zones with considerable displacement from one side of the zone to the other. This is often a distance of three or four miles. The Dewey fault zone, a few miles to the north, is a zone of major displacement. The faulting drops the uranium host units several hundred feet and truncates the oxidation reduction contact that formed the Project mineralization. However, detailed geologic and hydrogeologic investigations indicate no evidence of faulting within the permit area.

| 19 | REPORT DATE: JANUARY 6, 2025 |

6.2 Local and Project Geology

The Lakota Formation was deposited by a northward flowing stream system. Sediments consist of point bar and transverse bar deposition. The stream channel systems are typical of meandering fluvial deposition. Sand units fine upward and numerous cut-and-fill sandstones are indicative of channel migration depositing silt and clay upon older sand and additional channel sands overlay older silts and clays. Uranium mineralization occurs in several stratigraphically different sands within the Lakota.

Similar channel deposition occurred during Fall River time, but the channel sands are noticeably thinner with marine sediments immediately superimposed on the fluvial sands. The major sand unit in the basal Fall River is mineralized. On the Dewey side of the property, this mineralization is below the water table; however, on the Burdock mineralization is at or above the water table and is not considered economically viable by ISR.

The lithologic units of the Lakota and Fall River Formations dip about 3° to the southwest off the flank of the Black Hills Uplift. This structure controls present day groundwater hydrogeologic conditions.

The Projects geology is illustrated in stratigraphic column, Figure 6.1, and Figure 6.2 cross-section A – A’.

Figure 6.1 Stratigraphic Column

| 20 | REPORT DATE: JANUARY 6, 2025 |

Figure 6.2: Cross-section A – A’

| 21 | REPORT DATE: JANUARY 6, 2025 |

6.3 Significant Mineralized Zones

6.3.1 Mineralization

Historical TVA reports indicate that uranium minerals are all of +4 valence state and deposited from epigenetic solutions. Sandstone permeability controlled the migration of these epigenetic solutions and deposit formation. The deposit is characterized by numerous roll fronts in the overall deposit. Deposits with multiple roll fronts form because of heterogeneity within the host sands and changes in groundwater oxidation/reduction potential. The deposits are continuous for thousands of feet and in some instances several miles. Individual roll fronts range in thickness from 5 to 12 feet thick and 10 to 50 feet wide. Where roll fronts overlap or nearly overlap vertically, total deposit thickness can be tens of feet thick and hundreds of feet wide. Grade along the length of the roll fronts is highly variable ranging from below detectable up to tenths of a % eU3O8.

6.4 Relevant Geologic Controls

The primary geologic controls for development of the Project’s deposit are:

| ● | The White River Formation uranium source, |

| ● | The permeable sandstones within the Lakota and Fall River Formation, |

| ● | Groundwater and formation geochemical conditions suitable for uranium transport |

| ● | Reductant source (hydrocarbons or carbonaceous materials) within the sandstones to interact with uranium bearing groundwater modifying oxidation/reduction potential of geochemical conditions and precipitation of uranium. |

| 22 | REPORT DATE: JANUARY 6, 2025 |

6.5 Deposit Type

The Project’s deposit type is sandstone hosted uranium roll-fronts. The deposit is characterized by numerous vertically stacked roll-fronts controlled by stratigraphic heterogeneity and variability in groundwater oxidation-reduction potential. Individual roll-fronts are a few tens of feet wide, 5 to 10 feet thick, and often thousands of feet long. Collectively, roll-fronts result in an overall roll-front deposit that is up to a few hundred feet wide, 50 to 75 feet thick and continuous for miles in length.

The uranium deposits in the southern Black Hills region are characteristic of the Rocky Mountain and Intermontane Basin uranium province, United States (ref., Finch, 1996). The uranium province is essentially defined by the extent of the Laramide uplifts and basins.

Roll-front sandstone uranium deposits formed in the continental fluvial basins developed between uplifts. These uranium deposits were formed by oxidizing uranium-bearing groundwater that entered the host sandstone from the edges of the basins. Two possible sources of the uranium were (1) uraniferous Precambrian granite that provided sediment for the host sandstone and (2) overlying Tertiary age (Oligocene) volcanic ash sediments. Major uranium deposits occur as sandstone deposits in Cretaceous and Tertiary age basin sediments. Cluster size and grades for the sandstone deposits range from 500 to 20,000t U3O8, at typical grades of 0.04 to 0.23% U3O8.

The tectono-stratigraphic setting for roll-front uranium ores is in arkosic and fluvial sandstone formations deposited in small basins. Host rocks are continental fluvial and near-shore sandstone. The principal ages of the host rocks are Early Cretaceous (144–97Ma), Eocene (52–36Ma), and Oligocene (36–24Ma), with epochs of mineralization at 70Ma, 35–26Ma, and 3Ma.

Ore mineralogy consists of uraninite, pitchblende and coffinite with associated vanadium in some deposits. Typical alteration in the roll-front sandstone deposit includes oxidation of iron minerals up-dip from the front and reduction of iron minerals down-dip along advancing redox interface boundaries (Figure 6.3).

| 23 | REPORT DATE: JANUARY 6, 2025 |

Figure 6.3: Typical Roll Front Deposit

(ref., Powertech, 2009)

| 24 | REPORT DATE: JANUARY 6, 2025 |

7.0 EXPLORATION

7.1 Drilling

No exploration work has been conducted by or on behalf of enCore since acquisition of the Project. Since Project inception, over 6,300 holes have been drilled on the property by previous operators and the nature and extent of that information is discussed in the following. See Figure 7.1, plan view map of the property showing locations of all drill holes.

7.2 Drilling Type and Procedures

Drilling has been conducted by surface drilling vertical holes. Holes are drilled using direct mud rotary drilling system, where drilling fluid is pumped through the drill pipe, drill bit ports, and back to surface between the pipe and borehole wall. Drilling fluid is typically a mix of clean water and industrial materials added to the water to lift cuttings, stabilize hole to prevent sidewall caving and sloughing, and to clean and lubricate the drilling system.

Hole depth is determined by depth of the deepest stratigraphic unit to be investigated. Hole diameter is determined by drill bit and pipe diameter used.

Drill holes are sampled by collection of drill cuttings, downhole geophysics and core. Cuttings are typically collected every 5 feet and assessed for lithology and color. If core is collected, a coring tool is used to drill and sample lithological material without comprising its natural condition. Holes are also logged for downhole geophysical characteristics to assess lithology type, stratigraphic and structural geologic features, and mineralization location and quality. The collar or surface location of each drill hole is surveyed for azimuth and bearing, and since mineralized stratigraphic horizons are nearly horizontal and drill holes are nearly vertical, mineralization’s true thickness is represented in geophysical and core data.

Initial Project exploration was wide spaced drilling at miles or thousands of feet between drill holes. With increasing geologic knowledge and confidence, closer spaced drilling was conducted on drilling densities of 250 x 500, 100 x 250 and 100 x 100 feet.

7.3 Past Exploration

Exploration in the vicinity of the Project began in 1952 following discovery of uranium minerals in Craven Canyon in the Edgemont District. Early efforts by the US Atomic Energy Commission and the USGS determined the Lakota and Fall River formations were potential uranium host formations.

Early ranchers and prospectors made the first uranium discovery in outcrops of the Fall River formation. Prospectors leased their holdings to local uranium mining companies who first drilled shallow exploration holes with wagon drills and hand-held Geiger probes. Sufficient uranium was discovered to warrant mine development by adit and shallow decline. Susquehanna drilled the first deep holes (600 ft) discovering unoxidized uranium roll-front deposits in the Lakota formation.

| 25 | REPORT DATE: JANUARY 6, 2025 |

Figure 7.1. Drill Hole Locations

| 26 | REPORT DATE: JANUARY 6, 2025 |

After acquisition of the Project by TVA in 1978, its contractor, Silver King Mine, evaluated previous exploration data and began its own exploration program. Exploration and development drilling continued until 1986. When TVA allowed its leases to expire, approximately 6,000 holes had been drilled on the Project.

TVA conducted downhole petrophysical analysis using a downhole suite consisting of gamma, self-potential and resistivity measurement, to evaluate uranium and lithologic characteristics.

TVA drilled approximately 64 core holes on the Burdock to determine deposit uranium equilibrium conditions. Results did show that mineralization is in equilibrium and that gamma logging provides an accurate measurement of in-situ uranium grade.

TVA completed an extensive development drilling program and hydrologic study, and in 1981 finalized a feasibility study anticipating underground mine development. The mine was planned with five shafts, three on the Burdock deposit and two on the Dewey. Forecasted mine production was 750 tons/day with a mining cutoff grade of 6.0 ft of 0.20% eU3O8. Total LOM estimated production was 5.0 M lbs U3O8. Later studies evaluated constructing a processing mill on site that would also process other ores mined in the Edgemont District.

Between 1982 and 1986 TVA performed assessment drilling that was required to hold lode mining claims. This effort ended in 1988, and claims and leases were allowed to expire.

In 1992, Energy Fuels acquired Project leases and drillhole information. Energy Fuels intended to develop an ISR mine and retained RBS&A as an independent consultant to evaluate the Project. Energy Fuels did no exploration or development drilling and in 2000, International Uranium Corporation, the successor to Energy Fuels, dropped their Project holdings.

Previous operator, Powertech, conducted the most recent drilling on the Project drilling 91 holes between 2007 and 2008. Depths ranged from 185 to 761 feet. Core was collected in 10 holes and 12 were completed as water wells. Core was collected for metallurgical and leach testing, and wells were installed to perform pump testing. Holes were drilled in areas away from known mineral resources, but where mineralization had been intersected. In 56 of the holes, mineralization was intersected with grades more than 0.05% eU3O8.

Drilling confirmed the location of mineralization and reinforced confidence in the resource model. While higher uranium grades were not encountered, results did justify future closer spaced drilling.

Powertech did collect core from 10 of the 91 holes. 10 feet-long by 4 inches in diameter core barrel was used. A total of 407 feet of core was recovered. Samples were collected from within four separate areas with defined mineral resources. Coring was planned to intersect various parts of deposits obtaining samples for chemical analyses and for metallurgical testing.

Six holes were cored in the Fall River Formation and four holes were cored in the Lakota Formation. Table 7.1 and Table 7.2 present a listing of the uranium values in these core holes, as determined by down-hole radiometric logging for the Fall River and Lakota Formations, respectively.

| 27 | REPORT DATE: JANUARY 6, 2025 |

Table 7.1: Results of Fall River Formation Core Holes

| Core Hole Number | Depth (ft) | Mineralization | GT | Highest ½ ft Interval | ||||

| DB 07-29-1C | 579.5 | 12.5’ of 0.150% eU3O8 | 1.88 | 0.944% eU3O8 | ||||

| DB 07-32_1C | 589.5 | 5.0’ of 0.208% eU3O8 | 1.88 | 0.774% eU3O8 | ||||

| DB 07-32-2C | 582.5 | 16.0’ of 0.159% eU3O8 | 2.54 | 0.902% eU3O8 | ||||

| DB 07-32-3C | - | No Mineralized Sand Rec Recovered | - | - | ||||

| DB 07-32-4C | 559.0 | 13.0’ of 0.367% eU3O8 | 4.77 | 1.331% eU3O8 | ||||

| DB 08-32-9C | 585.5 | 10.5’ of 0.045% eU3O8 | 0.47 | 0.076% eU3O8 |

Table 7.2: Results of Lakota Formation Core Holes

| Core Hole Number | Depth (ft) | Mineralization | GT | Highest ½ ft Interval | ||||

| DB 07-11-4C | 432.5 | 6.0’ of 0.037% eU3O8 | 0.22 | 0.056% eU3O8 | ||||

| DB 07-11-11C | 429.5 | 7.0’ of 0.056% eU3O8 | 0.40 | 0.061% eU3O8 | ||||

| DB 07-11-14C | 415.0 | 9.0’ of 0.052% eU3O8 | 0.47 | 0.126% eU3O8 | ||||

| DB 07-11-16C | 409.0 | 3.5’ of 0.031% eU3O8 | 0.17 | 0.041% eU3O8 |

Overall core recovery, despite poor hole conditions in DB 07-32-3C, was greater than 90%.

Laboratory analyses were performed on select core samples to determine the permeability and porosity of the mineralized sands, and the overlying and underlying clays.

Analyses of the sandstone samples showed horizontal permeabilities ranging from 449 to 3207 millidarcies. Horizontal permeabilities within this range are indicative of flow rates conducive for successful mine operations. Analyses of overlying and underlying confining unit core samples showed low vertical permeabilities ranging from 0.007 to 0.697 millidarcies. Low vertical permeabilities were expected from confining unit samples and bolster confidence that overlying and underlying shales will ensure production fluid confinement to the production zone sand.

Powertech did complete 12 of the 91 drills holes as wells in both Fall River and Lakota sands. Wells were used in conjunction with existing wells for collection of water quality sampling and hydrostatic pump tests. Groundwater quality and hydrology data are available for public review in the permit applications submitted to the NRC and the State of South Dakota.

7.4 Accuracy and Reliability

Past drilling practices were conducted in accordance with industry standard procedures and the most recent drilling conducted by Powertech, confirmed historical drill results in previously intersected mineralization for thickness, grade and location. The QP of this report is knowledgeable of the 2007 and 2008 work and technical participants who were responsible for the work.

It is the opinion of this QP that there are no drilling, sampling or recovery factors that materially affect the accuracy and reliability of results; however, the QP does provide additional opinion in Section 9.0 DATA VERIFICATION and Section 23.0 RECOMMENDATIONS.

| 28 | REPORT DATE: JANUARY 6, 2025 |

7.5 Hydrogeology

Substantial work has been done by previous companies to characterize the hydrogeology of the sandstone hosted uranium deposits, with respect specifically to:

| ● | Permeability of the mineralized horizon, |

| ● | Hydrologic confinement of the mineralized horizon; and, |

| ● | Ability to return groundwater within the mined area to original baseline quality and usage. |

Because of the amount and importance of hydrogeology to ISR development of sandstone hosted uranium systems, considerable technical detail is provided.

Within the Project area the uppermost hydro-stratigraphic unit and the production hydro-stratigraphic unit are both the Inyan Kara, the underlying hydro-stratigraphic unit is the Unkpapa Formation (or Sundance if the Unkpapa is not present). There is no overlying hydro-stratigraphic unit within the project area other than minor localized alluvial hydro-stratigraphic units.

7.5.1 Hydraulic Properties of the Inyan Kara

Hydraulic information presented is based on results of work completed by Powertech and TVA. Powertech completed groundwater sampling, piezometric surface mapping, and individual hydro-stratigraphic tests within both the Dewey and Burdock project area in 2007-2009. TVA completed three hydro-stratigraphic tests. One test was conducted just north of the Dewey project area in 1982, and two tests were performed within the Burdock in 1979 (ref., Powertech, 2013a and 2013b).

Powertech installed monitor and pumping wells, conducted hydro-stratigraphic testing, groundwater sampling, and developed regional and wellfield scale groundwater models.

The following section discusses the results of hydro-stratigraphic and geotechnical tests.

7.5.1.1 Dewey

Two hydro-stratigraphic test programs were completed within or just outside of Dewey, by TVA in 1982 (ref., Powertech, 2013a) and Powertech in 2008 (ref., Powertech, 2013c).

The TVA test consisted of pumping the Lakota Formation for 11 days at an average rate of 495 gpm from a screened interval 75 feet in length. The results of the test yielded:

| ● | Transmissivity average of 590 ft2/day; and |

| ● | Storativity of approximately 0.0001 (dimensionless). |

TVA recorded a hydraulic response in the Fall River through the intervening Fuson Member late in the hydro-stratigraphic unit test (3,000 to 10,000 minutes). TVA calculated the vertical hydraulic conductivity of the Fuson Member to be 0.0002 ft/day using the Neuman-Witherspoon ratio method (ref., Neuman and Witherspoon, 1972).

| 29 | REPORT DATE: JANUARY 6, 2025 |

TVA observed a barrier boundary, or a decrease in transmissivity due to lithologic changes or lithologic changes with distance from the site. A possible geologic feature corresponding to a barrier was noted to be the Dewey Fault Zone, located approximately 1.5 miles north of the test site, where the Lakota and Fall River Formations are structurally offset.

Powertech’s 2008 test consisted of pumping in the Fall River Formation for 74 hours at an average rate of 30.2 gpm from a screened interval 15 feet in length. The results of the test yielded:

| ● | Ten determinations of transmissivity ranging from 180 to 330 ft2/day, with the median value of 255 ft2/day; and |

| ● | Five determinations of storativity ranged from 0.000023 to 0.0002 with a median value of 0.000046. |

Powertech recorded a delayed response in the upper Fall River Formation which indicates lateral and vertical anisotropy due to interbedded shales in the formation. No flow was observed through the Fuson Member between the Fall River and the Lakota.

In addition to the 2008 hydro-stratigraphic test, Powertech collected core from the Fall River Formation, the same stratigraphic unit that was hydro-stratigraphically tested. Laboratory measurements of horizontal and vertical hydraulic conductivity, from the core, measured:

| ● | Horizontal hydraulic conductivity was 6.1 ft/day; and |

| ● | Horizontal to vertical hydraulic conductivity ratio of 4.5:1. |

Core was also collected for confining units above the Fall River (Skull Creek Shale), and between the Fall River and Lakota (Fuson Shale). Laboratory measurements of horizontal and vertical to hydraulic conductivity on these hydro-stratigraphic units measured:

| ● | Skull Creek Shale: average vertical hydraulic conductivity of 0.000015 ft/day; and |

| ● | Fuson Shale: average vertical hydraulic conductivity of 0.000018 ft/day. |

Water level data collected by Powertech from a nest of vertical wells, at Dewey, indicated that the Unkpapa, Lakota, and Fall River hydro-stratigraphic units are confined and locally hydraulically isolated. Generalized water level data for the Lower Fall River Sandstone that hosts uranium mineralization in the Dewey project area are detailed in Table 7.3.

Table 7.3: Dewey Production Area Water Level Data (MSL)

| Hydro-Stratigraphic Unit | Top Elevation (ft) | Bottom Elevation (ft) | Static Water Elevation (ft) | Available Drawdown (ft) | ||||||||||||

| Lower Fall River | 3,151 | 3,011 | 3,642 | 491 | ||||||||||||

7.5.1.2 Burdock

Three hydro-stratigraphic tests were completed at Burdock. Two tests were completed by TVA in 1979 (ref., Powertech, 2013b), and a third by Powertech in 2008 (ref., Powertech, 2013c).

| 30 | REPORT DATE: JANUARY 6, 2025 |