ZODIAC EXPLORATION INC.

MANAGEMENT’S DISCUSSION & ANALYSIS

The following is Management’s Discussion and Analysis (“MD&A”) of the performance, financial condition and future prospects of Zodiac Exploration Inc. (“Zodiac” or “the Company”). This document should be read in conjunction with the audited annual consolidated financial statements of the Company for the year ended September 30, 2011 and September 30, 2012, and notes thereto. With its head office based in Calgary, Alberta, Canada, Zodiac is primarily engaged in the exploration for, and development of, oil and gas interests in California, USA. Common shares of the Company are listed on the TSX-Venture under the symbol “ZEX”.

The financial information in this MD&A is derived from the Company’s audited consolidated financial statements. All amounts are expressed in Canadian $000’s unless otherwise indicated and prepared in accordance with US generally accepted accounting principles (“US GAAP”).

Additional information about Zodiac and its business activities is available on SEDAR at http://www.sedar.com and at http://www.zodiacexploration.ca

Forward Looking Statements

Certain information contained herein may constitute forward-looking statements under applicable securities laws. Forward-looking statements look into the future and provide an opinion as to the effect of certain events and trends on the business. Forward-looking statements are based on the estimates and opinions of the Company’s management at the time the statements were made. Readers are cautioned not to place undue reliance on these statements as the Company’s actual results, performance or achievements may differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements if known or unknown risks, uncertainties or other factors affect the Company’s business, or if the Company’s estimates or assumptions prove inaccurate. Therefore, the Company cannot provide any assurance that forward-looking statements will materialize.

The Company assumes no obligation to update forward-looking statements should circumstances or management’s estimates change.

The material assumptions that were applied in making the forward-looking statements in this MD&A include: execution of the Company’s existing plans for each of its projects, which may change due to changes in the views of the Company or if new information arises which makes it prudent to change such plans; and execution of the Company’s plans to seek out additional opportunities in the natural resource sector, which are dependent in part on global economic conditions and upon the prices of commodities and natural resources.

Readers are urged to carefully review and consider the various disclosures made by us in this report and in our other reports filed with the Securities and Exchange Commission.

Highlights

During the year ended September 30, 2012, Zodiac:

| - | Initiated a successful search for joint venture partners to further develop Zodiac’s extensive inventory of land. |

| - | Continued to develop its land base which currently sits at approximately 86,000 net acres. |

| - | Ended the year with $20.4 million in cash and $20.4 million in working capital. |

| - | Drilled, completed and tested its second exploratory well, the 1-10 well with a 2,647 foot horizontal wellbore in the Upper Kreyenhagen formation in Kings County, California. The horizontal wellbore was placed at an average vertical depth of 14,551 feet. The following summarizes the 1-10 well results:. |

| | o | The Company performed a ten stage completion operation on the well using a water based fluid and a ball drop system. Equipment limitations during the stimulation and testing phases, led to less than expected results. In spite of this, the well flowed with no artificial lift. |

| | o | Analysis of the flowing pressures and data from a very brief shut-in during the month of January 2012 indicated possible damage to the reservoir and hydraulic fractures with very limited effectiveness. The Company then performed a small acid stimulation that had a negligible impact. |

| | o | In late April 2012, the Company shut-in the well to perform an extended build up test to further evaluate the reservoir and possible remedial actions to improve well results. The mineral lease upon which the 1-10 horizontal well was drilled contained continuous drilling obligations that required Zodiac to spud a new well by June 4, 2012. |

| | o | Given the capital required to spud a new well, and the relatively minor acreage position associated with the lease, the Company decided not to proceed with the continuous drilling commitments. Accordingly, an impairment writedown of $23.2 million was recognized in the quarter. |

Subsequent to year end

| - | Subsequent to year end the Company signed a definitive farmout agreement with Aera Energy LLC, a large California operator, whereby Aera has acquired the right to earn a 50% interest in approximately 19,600 net acres of Zodiac lands located in Kings County, California. Highlights of the agreement are: |

| | o | Under the terms of the Farmout Agreement, Aera will pay 100% of the cost of two vertical wells and two horizontal wells to be drilled on or adjacent to the Farmout Lands. The agreement is comprised of two Phases: |

| | o | The initial Phase 1 earning wells (one horizontal and one vertical) will be drilled on the northern portion of the Farmout Lands. Aera will drill a vertical test well to an estimated depth of 14,800 feet to the Monterey and Kreyenhagen formations. |

| | o | The initial Phase 2 earning wells (one horizontal and one vertical) will be drilled on adjacent lands, which are controlled by Aera. |

| | o | Zodiac will retain a carried working interest of 12.5 % (before payout) and 25% (after payout) in the earning wells. |

| | o | Upon Aera’s fulfillment of its earning obligations under each Phase of the Farmout Agreement, Zodiac will have the right to retain either a 50% working interest or a 3% gross overriding royalty in the Farmout Lands. |

| | | |

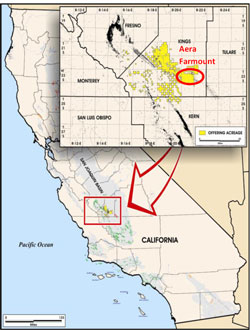

| - | | Zodiac continues to engage in discussion with additional, potential joint venture partners on its other lands located in California. Zodiac controls approximately 90,000 net acres in Kings County, prior to any earning by Aera under the Farmout Agreement. |

Zodiac’s operations are focused in the San Joaquin Basin principally Kings County, California.

Fig 1: Zodiac Acreage in Kings County

Summary of Operations

4-9 and 1-10 Wells

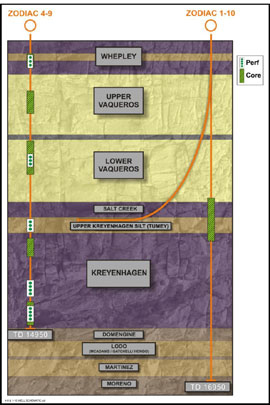

On December 25, 2010, the Company spud its initial evaluation well the 4-9 well - in the Jaguar prospect area. The well reached a total depth of 14,950 feet in the Kreyenhagen formation and a 7 inch production liner was set on March 18, 2011. In November of 2011 the Company spud its second evaluation well one mile east of the 4-9 well. In many of these large resource type plays, the initial wells in the ‘learning curve’ often do not result in commercial producing wells but rather they provide the information needed for further development. This is the case here. The 4-9 well is shut-in. The 1-10 well and the lease associated with this well have been turned back to the lessor as it has not as yet been proven to be capable of commercial production. The scientific and drilling/completion data and learnings gained from these wells have nevertheless been substantial. This has allowed the Company to successfully enter into one material farmout agreement with Aera Energy LLC, and to continue to engage in other farmout negotiations to further develop its land base.

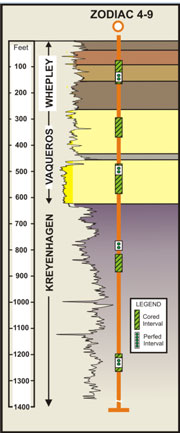

The 4-9 well was the first deep well in the Kings County area in the past 25 years and it provided the Company with a comprehensive data set over several prospective light oil targets within the Monterey, Allison/Whepley, Vaqueros and Tumey/Kreyenhagen Formations. The drilling operations included the collection of 417 feet of core and an extensive suite of modern well logs over these prospective geological horizons.

Fig 2: 4-9 Core and Test intervals

Kreyenhagen Formation

The Kreyenhagen formation is one of the primary source rocks in the San Joaquin Basin and these source rocks have been estimated by the United States Geological Service (“USGS”) to have generated over 100 Billion barrels of crude oil.1 USGS PP 1713

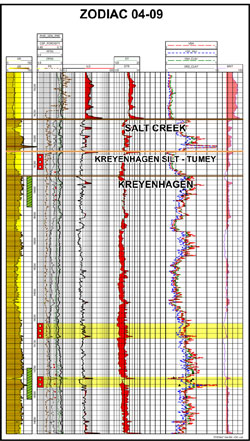

The 4-9 well reached total depth after intersecting 650 feet of Kreyenhagen silts and organic source shales. In the area of the wellbore, the Kreyenhagen formation is approximately 800 feet thick and reaches thicknesses exceeding 1,500 feet further south on Zodiac acreage.

Zodiac completed and tested a 30 foot silty interval in the upper part of the Kreyenhagen, known as the Tumey Formation. This upper interval flowed 29° API oil at an average rate of 24 barrels per day (“bbls/day”) over a nine day flow test period. The pressure transient analysis (“PTA”) indicated significant formation damage. The well test analysis demonstrated that a rate of 120 bbls per day could be achieved by removing the formation damage. The extrapolated reservoir pressure from the PTA was 12,900 pound per square inch (“psia”) which equates to a pressure gradient of approximately 0.9 psi per foot. The reservoir permeability calculated from the PTA was 0.85 mD.

The Company believes the formation damage observed in the 4-9 well can be addressed by optimizing the drilling and completion procedures in future wells. Porosity and permeability values derived from the well log and core analyses indicated effective siltstone porosity ranging between 10% and 13%, with permeability ranging between 0.4 and 3.0 millidarcies.

Fig: 3 : Kreyenhagen Silt (Tumey Fm)

The production testing, the coring and the log analyses have shown that the Kreyenhagen formation has similarities to the Bakken in that organic rich shales are feeding oil into siltier units.

The major difference between the Bakken and the Kreyenhagen interval is the thickness. The Kreyenhagen is approximately 800 to 1,500 feet thick across Zodiac’s land base while the Bakken ranges from 40 to 100 feet.

Detailed geologic mapping of the Upper

Kreyenhagen or ‘Tumey” Formation indicates that this zone is present on at least 100 net sections of Zodiac acreage. Based on preliminary internal estimates from petrophysical logs and core data, management estimates that this could comprise a significant resource addition to Zodiac’s portfolio as the Kreyenhagen formation was not included in the resource assessment conducted by Sproule (US) Limited (a summary is available within the September 1, 2010 Management Information Circular on SEDAR). The Kreyenhagen formation, which has a thickness of approximately 800 feet in this location. Several prospective lower zones in the Kreyenhagen have been identified and have not yet been tested. The total thickness of the Kreyenhagen formation ranges from approximately 800 to 1,500 feet throughout

Zodiac’s acreage. The Company anticipates that with continued wellbore design refinements, horizontal drilling should have widespread application in the Kreyenhagen and in the development of other plays that comprise Zodiac’s portfolio.

Lower Vaqueros Formation

The Company performed a completion over a 30 foot interval in the Lower Vaqueros formation. Following this operation, the zone flowed water at an average rate of 57 bbls/day over a 19 day period. The chemistry and the salinities of the water recovered during the flow period do not match regional Vaqueros water properties. The Company believes the water could have originated from interference from the 1-9 offset well which was injected with 5,000 bbls of kill fluid during well control operations.

Given the proximity of the 4-9 wellbore to the 1-9 wellbore and the fractured nature of the rock, there is more than one possible source for the water produced during the production test over the Lower Vaqueros.

This test does not negate the Vaqueros formation as a target. The entire Vaqueros formation is over 650 feet thick, with the first test comprising 30 feet within the lowermost 200 feet of the Vaqueros formation. Oil-bearing sandstones above the tested zone have been identified in core and on well logs in both the 4-9 and 1-10 wells but down-hole equipment limitations did not allow the Company to test these zones in the 4-9 well. Further testing will be required to fully evaluate this formation.

Allison/Whepley Formation

A 30 foot interval was completed in the Allison/Whepley formation. This zone flowed 33° API oil at a stabilized an average rate of 13 bbls/day over a 9 day flow period. The well was then shut-in and the pressure transient analysis indicated significant formation damage. A reservoir pressure of 11,100 psia was extrapolated from the PTA and this equates to a gradient of 0.8 psi per foot.

The test results achieved in the Allison/Whepley formation were very encouraging to the Company, particularly as the interval completed was mostly shale rather than a siltstone or sandstone sequence inter-bedded in the shale. Optimal perforation placement was not achieved due to poor cement bond over the primary target. Over 50 feet of potential siltstone reservoir remains to be adequately tested in future operations. The Company is confident it can overcome the damage issues by optimizing the drilling and completion procedures in future wells

Jaguar Prospect Earning Obligation

The Company has now completed its earning obligation on the Jaguar prospect as required under the Zodiac/Bayswater farm-in agreement effective May 27, 2009.

1-10 Well

The Company’s second well was drilled one mile east of the 4-9 location and was spud on June 16, 2011. The 1-10 well consisted of a vertical pilot hole with a lateral section drilled in the Upper Kreyenhagen zone which tested oil in the 4-9 well.

The vertical pilot hole reached total depth of 16,950 feet, on August 28, 2011, in the Cretaceous Moreno formation.

Deeper Potential

The 1-10 well, originally targeted to a total vertical depth of 15,240 feet, was deepened to test additional zones of interest including the Cretaceous Moreno formation, a significant source rock interval in this area, according to the USGS. The well reached total depth at 16,950 feet on August 28, 2011, after intersecting sandstone, siltstone, and shale sections below the Kreyenhagen formation with high background gas readings and associated increases in C1-C5 on mud logs, and oil shows. The Company encountered significant hydrocarbon response and pressures that exceeded 14,000 psi in the lowermost 250 feet of the wellbore, which required mud weight to be increased to 16.4 ppg prior to stopping drilling. Subsequent analysis conducted by the Company has confirmed that the Moreno formation in this area is in an oil generation phase.

Horizontal Completion

After the lower section was successfully logged it was plugged back to the Whepley formation. A 2,647 foot horizontal wellbore was then drilled into the Upper Kreyenhagen (Tumey Fm) at an average depth approximately 14,550 feet. This operation was completed in October 2011.

The Salt Creek, Tumey and a portion of the Upper Kreyenhagen formations were cored in the 1-10 well with a total of 110 feet recovered. Thorough analysis of the logging and coring data gathered to date in the 1-10 and 4-9 wells over this horizon indicates the presence of significant oil stained natural fractures (observed in magnetic resonance images and confirmed visually in core and detailed petrographic analysis), high silica content and high brittleness.

In late December, 2011, the 1-10 horizontal well was stimulated using a water based gelled fluid with a multi stage completion system (ball drop system, 10 stages). Despite surface and down hole equipment limitations during the stimulation and testing phases, the well flowed oil at a rate of 126 barrels per day to 60 barrels per day of 29 degree API oil.

Analysis of the flowing pressures and data from a very brief shut-in during the month of January 2012 indicated possible damage to the reservoir and hydraulic fractures with very limited effectiveness. Management believes these issues could have resulted from completion fluid issues or downhole obstruction generated by the inability to restrict the flow rate during the initial cleanup phase. It is likely that this less than optimal result was due primarily to equipment failure during a critical phase of the completion operations.

The Company then attempted to clean out the well bore using a coiled tubing unit but was unable to reach beyond the build section due to equipment limitations. In order to investigate downhole issues such as potential obstruction or formation damage, the Company performed a small acid stimulation that had a negligible impact. The well was subsequently opened to flow with oil averaging 50 barrels per day over the first 72 hours at a flowing pressure of 1150 psi. The Company subsequently conducted flow and buildup testing and analysis over several weeks while continuing to identify and recommend several completion strategies with its partners. The well was shut-in pending discussions with partners as to next steps.

Fig 4: 4-9 and 1-10 Wellbores

1-10 Writedown

In late April 2012, the Company shut-in the well to perform an extended build up test to further evaluate the reservoir and possible remedial actions to improve well results as the well had not yet achieved commercial production. The mineral lease upon which the 1-10 horizontal well was drilled contains continuous drilling obligations that required Zodiac to spud a new well by June 4, 2012. Given the capital required to spud a new well, and the relatively minor acreage position associated with the well, the Company prudently decided not to proceed with the continuous drilling commitments in the lease. Surface equipment was removed from the well site and the lease was returned to the lessor. Accordingly, an impairment writedown of $23.2 million was recognized in the third quarter. Extensive and ongoing efforts by the Company throughout the quarter to negotiate with the Lessor for an extension to the lease (without spudding another well) were unsuccessful. This lease comprised approximately 3 % of the Company’s total net acreage position.

Land Holdings

Excluding the land associated with the 1-10 well, The Company continued to add to its land base in 2012. This partially offset the loss of the land associated with the 1-10 well. At year end the Company is maintaining a total land base of approximately 86,000 net acres.

| | Land Holdings | Acres | Sections | |

| | Gross | 132,000 | 206 | |

| | Net | 86,000 | 134 | |

| | Net Revenue Interest | 69,000 | 108 | |

| | | | | |

Note: Net Revenue Interest is shown after payout and includes all overriding royalty interests

Net lands include lands associated with earning requirements in two prospects Hawk(gross 7,000 net 3,900) and Panther (gross 21,500 net 16,000).

Strategy and Outlook

Zodiac plans to continue its process to identify additional joint venture (“JV”) partners to assist the Company in assessing and ultimately exploiting the potential within its acquired land base. That process is currently on-going.

The Company expects to develop a systematic plan to both achieve commerciality and further appraise the array of resource and conventional plays on its land base. The pace at which this is executed will depend on the resources that the Company has at its disposal.

Corporate History and Background

Zodiac is in the pre-production stages of its oil and gas exploration and development program on its land holdings in California, USA (San Joaquin Valley, California). The Company holds varying working interests in approximately 105,000 net acres in the San Joaquin Basin in California. The primary target formations in the Jaguar prospect area are characterized as naturally fractured, low permeability sandstone, siltstone and shale contained in the Whepley, Vaqueros and Kreyenhagen formations. Management believes that this acreage position contains a major accumulation of light oil and further believes that through the application of established oilfield drilling, completion and production technologies and methodologies that Zodiac will be able to ultimately prove the commercial productivity of these lands.

On August 19, 2010, Zodiac Exploration Corp. (“Old Zodiac”) entered into an Arrangement Agreement with Peninsula Resources Ltd. (“Peninsula”), and a wholly-owned subsidiary of Peninsula, 1543081 Alberta Ltd., to effect a reverse takeover transaction (“RTO”). Under the Agreement, Old Zodiac amalgamated with 1543081 Alberta Ltd (the continuing corporate entity post-amalgamation was named Zodiac Exploration Corp.). Peninsula was renamed Zodiac Exploration Inc. (TSX-V:ZEX). This transaction was successfully completed on September 28, 2010 and shares of ZEX began trading on October 6, 2010.

Upon completion of the RTO, Old Zodiac shareholders exchanged their shares in Old Zodiac for shares in Zodiac Exploration Inc. on a 1:1.45 basis. Pre-existing warrants, performance warrants and stock options of Old Zodiac remain outstanding until they are exercised, expired, forfeited, or cancelled. Upon exercise of the warrants, performance warrants, or options they will be exchanged at the 1:1.45 ratio for Zodiac Exploration Inc. shares.

SELECTED ANNUAL FINANCIAL INFORMATION

At September 30, 2012, the Company has not yet achieved profitable operations, has accumulated a deficit of $46,111 (twelve months ended September 30, 2011 - $18,381 and nine months ended September 30, 2010 - $4,620) since inception and expects to incur further losses in the development of its business, which is typical of an oil and gas exploration company in the early stages of development. As at September 30, 2012, the Company’s cash balance was $20,381 (September 30, 2011 - $40,532, September 30 ,2010 - $58,445) primarily resulting from warrant exercises during the year ended September 30, 2011 and financings completed in the nine month period ended September 30, 2010.

To date, the Company has no oil and gas revenues and is considered to be in the development stage as defined by the Financial Accounting Standards Board (“FASB”) Accounting Standard’s Codification (“ASC”) 915.

SELECTED ANNUAL FINANCIAL INFORMATION

| | | FINANCIAL HIGHLIGHTS | |

| | | 12 months ended | | | 12 months ended | | | 9 months ended | |

| | | September 30, | | | September 30, | | | September 30, | |

| | | 2012 | | | 2011 | | | 2010 | |

| Interest income | | $ | 194 | | | $ | 215 | | | $ | 42 | |

| Total assets | | | 76,180 | | | | 109,198 | | | | 80,108 | |

| Cash flows used in operating activities | | | (4,032 | ) | | | (3,785 | ) | | | (1,666 | ) |

| Net loss | | | (27,631 | ) | | | (13,761 | ) | | | (2,591 | ) |

| Per share (basic and diluted) | | | (0.08 | ) | | | (0.04 | ) | | | (0.02 | ) |

| Capital expenditures | | | 13,548 | | | | 46,402 | | | | 5,319 | |

| General & administrative expenses | | | 3,629 | | | | 3,824 | | | | 1,876 | |

| | | | | | | | | | | | | |

Interest income was generated from interest received on cash held in bank deposits and term deposits obtained throughout the period.

Total assets at September 30, 2012 were $76,180 (September 30, 2011 - $109,198, September 30, 2010 - $80,108). The significant decrease in assets in 2012 was primarily the result of an impairment writedown on the Company’s property, plant and equipment assets related to the 1-10 well. The build-up of assets in the year ended September 30, 2011 was the result of drilling the 4-9 well and beginning the 1-10 well. Assets are comprised mainly of cash of $20,381 and property, plant and equipment of $54,465.

During the twelve months ended September 30, 2012, funds used in operating activities increased to $4,032, from usage of $3,785 during the twelve months ended September 30, 2011 and $1,666 during the nine months ended September 30, 2010. This increase in 2012 and 2011 compared with 2009 is due to the effect of twelve months of operation as well as the increase in G&A expense resulting from the drilling of the above 2 wells and in 2012 from the initiation of a process to find joint venture partners to continue the development of the Company’s lands. The change from 2011 to 2012 in not significant.

The net loss for the twelve months ended September 30, 2012 was $27,631 or $(0.08) per share, compared to a loss of $13,761 or $(0.04) per share for the twelve months ended September 30, 2011, and a loss of $2,591 or $(0.02) per share for the nine months ended September 30, 2010. Weighted average share calculations have been restated for comparative periods in accordance with reverse takeover accounting guidance. The net loss incurred in 2012 was primarily the result of a $23.2 million impairment writedown related to the 1-10 well and associated lease in California. The loss in 2011 was primarily the result of the $8.5 million impairment writedown related to the Company’s Nova Scotia properties. For the twelve months ended September 30, 2012, Zodiac expensed $3,629 in general and administrative expenses (twelve months ended September 30, 2011 - $3,824 and nine months ended September 30, 2010 - $1,876), net of capitalized G&A of $107 (twelve months ended September 30, 2011 - $1,510 and nine months ended September 30, 2010 - $738). The amounts capitalized are directly related to the Company’s drilling, geological and geophysical capital programs.

Zodiac uses the Canadian dollar as its functional and reporting currency. The Company’s US operations are considered integrated. Accordingly, the Company uses the temporal method of accounting for the foreign currency transactions of its US subsidiaries. It is anticipated that, as US operations comprise a progressively larger proportion of the Company’s balance sheet and operations, adoption of the US dollar as its reporting currency may occur.

ANNUAL RESULTS OF OPERATIONS

| | | RESULTS OF OPERATIONS | |

| | | 12 months ended | | | 12 months ended | | | 9 months ended | |

| | | September 30, 2012 | | | September 30, 2011 | | | September 30, 2010 | |

| Interest income | | $ | 194 | | | $ | 215 | | | $ | 42 | |

| General and administrative expenses | | | 3,629 | | | | 3,824 | | | | 1,876 | |

| Foreign exchange (gain)/loss | | | 195 | | | | 64 | | | | (115 | ) |

| Stock based compensation | | | 499 | | | | 1,546 | | | | 814 | |

| Depletion, depreciation and accretion | | | 340 | | | | 45 | | | | 33 | |

| Asset impairment charge | | | 23,162 | | | | 8,497 | | | | 25 | |

| Net loss | | | 27,631 | | | | 13,761 | | | | 2,591 | |

| | | | | | | | | | | | | |

During the year, the Company recognized $73 (twelve months ended September 30, 2011 - $265 and nine months ended September 30, 2010 - $489) of performance warrant compensation expense (included in stock-based compensation) resulting from the issuance of 10,150,000 performance warrants to officers of the Company during the year ended September 30, 2011. During the current year, 2,900,000 performance warrants held by a former officer were cancelled. As at December 31, 2010, all performance warrants had vested.

Depreciation and accretion (“D&A”) expenses during the period ended September 30, 2012, September 30, 2011 and September 30, 2010 equaled $340, $45, and $33, respectively. These expenses relate to depreciation on fixed assets and accretion on the asset retirement obligation (“ARO”). As the Company’s petroleum and natural gas assets have not yet commenced production, no depletion has been recorded.

CAPITAL EXPENDITURES

The Company’s intention is to fund the acquisition of mineral and surface rights, the initiation of exploration activities including acquisition of seismic data, and the drilling, completion and tie-in of oil and gas wells through equity issues, operating cash flow and eventually borrowing base loans. A summary of the

Company’s Property, Plant and Equipment additions to date are summarized below:

| | | | | | | | | | |

| | | September | | | September | | | September | |

| | | | 30, 2012 | | | | 30, 2011 | | | | 30, 2010 | |

Beginning Property, Plant and Equipment balance | | $ | 64,477 | | | $ | 21,037 | | | $ | 15,722 | |

| Land and lease rentals additions | | | 3,830 | | | | 13,487 | | | | 1,846 | |

| Geology and seismic additions | | | 73 | | | | 2,167 | | | | 1,298 | |

| Drilling and completions additions | | | 9,425 | | | | 36,104 | | | | 2,221 | |

| Asset retirement obligation additions | | | (177 | ) | | | 163 | | | | (12 | ) |

| Other fixed assets additions | | | 24 | | | | 36 | | | | 12 | |

| Accumulated depreciation | | | (23,162 | ) | | | (8,472 | ) | | | (49 | ) |

| Depreciation and accretion | | | (28 | ) | | | (45 | ) | | | | |

| Total | | | 54,465 | | | | 64,477 | | | | 21,037 | |

Since its inception, the Company’s Property, Plant and Equipment additions have been $54,465, net of depreciation and impairments (September 30, 2011 - $64,477, September 30, 2010 - $21,037).

During the year the Company’s capital focus was on finishing the drilling and completion of the 1-10 well. The Company performed a ten stage completion operation on the well using a water based fluid and a ball drop system. Despite equipment limitations during the stimulation and testing phases, the well flowed with no artificial lift. However, analysis of the flowing pressures and data from a very brief shut-in during the month of January 2012 indicated possible damage to the reservoir and hydraulic fractures with very limited effectiveness. In an attempt to offset the damage, the Company performed a small acid stimulation that had a negligible impact. In late April 2012, the Company shut-in the well to perform an extended build up test to further evaluate the reservoir and possible remedial actions to improve well results. The mineral lease upon which the 1-10 horizontal well was drilled contained continuous drilling obligations that required Zodiac to spud a new well by June 4, 2012. It was determined that additional expenditures on this lease and wellbore would not be in the Company’s best interest and accordingly, an impairment writedown of $23.2 million was recognized.

In 2011 the Company’s primary focus was the drilling of the 4-9 well and and initiation of the 1-10 well in the San Joaquin Basin along with the acquisition of the Panther prospect (discussed above). Throughout the period discussed above there has been constant acquisition of additional lands in the Company’s operational area of focus in the San Joaquin basin, lease rental costs to maintain our rights in our land holdings, and acquisition of additional 3-D seismic data.

The Company’s initial entry into California occurred on June 8, 2009, when the Company acquired the rights, through farm-in, to drill for petroleum and natural gas on approximately 19,700 gross acres (15,750 net) (the “Jaguar Prospect”), of principally contiguous land in the San Joaquin Basin in California (“California Transaction”). The Company paid US$2,500 (CDN $2,800), issued 2 million Zodiac common shares, committed to pay 100% of a seismic program and drill the initial well on the Jaguar prospect, and agreed to pay 100% of the land lease rentals until the initial well is drilled to earn an 80% interest in these lands. The California Transaction also had a secondary component, the Hawk prospect, which is characterized as a conventional prospect. The Company received an option to drill and pay for 100% of the first exploratory well on the Hawk prospect (to be spud by May 31, 2013) to earn an 80% interest in an approximate additional 7,000 gross acres (3,900 net). All of the lands are entirely freehold lands and have varying royalty requirements, which average approximately 20%. These lands are also subject to an overriding royalty interest on production of 2.5% before payout and 4% after payout.

With the completion of the drilling of the 4-9 well on the Jaguar prospect the Company has satisfied its earning requirements on the Jaguar prospect.

During 2012 reclamation activities were underway in relation to its interests in Nova Scotia. During the year ended September 30, 2011, the Company had minimal activities in the Windsor Basin in Nova Scotia. The Company took a full impairment charge of $8.5 million on its Nova Scotia assets upon assessing certain factors including (among others): intent to drill by the operator of the Windsor Basin project; remaining lease term; geological and geophysical evaluations; and drilling results. Given that the operator was no longer allocating meaningful resources to continued evaluation, lack of proved reserves attributable to the property and no success to date in finding a joint venture partner to fund a drilling program the Company felt that a full impairment charge was both reasonable and warranted.

LIQUIDITY & CAPITAL RESOURCES

As of September 30, 2012 the Company had positive working capital of $20,420 (September 30, 2011 - $37,731, September 30, 2010 - $56,913). The Company had $20,381 in cash, generated through equity financings in 2010 and warrant exercises in 2011. In 2012 the Company initiated a process to find joint venture partners to continue the development of its California assets. Subsequent to year end the Company signed a definitive farmout agreement with a large California operator whereby the operator has acquired the right to earn a 50% interest in approximately 19,600 net acres of Zodiac lands located in Kings County, California. Under the terms of the Farmout Agreement, the operator will pay 100% of the cost of two vertical wells and two horizontal wells to be drilled on or adjacent to the Farmout Lands. As a result, the Company does not anticipate spending its own capital resources on drilling in the next fiscal year. Therefore, its capital resource requirements will be much reduced in 2013. As a result, management believes that through existing cash it will have adequate funding to support the Company’s capital expenditure programs to the end of its 2013 fiscal year and beyond. Zodiac’s revenue is comprised entirely of interest earned on cash and cash equivalent balances and short-term investments. Zodiac invests the short-term investments with a major Canadian financial institution. Zodiac has no outstanding bank debt or other interest-bearing indebtedness as at September 30, 2012.

The Company spud its initial evaluation well on December 25, 2010 and as of the date of this MD&A has completed and tested it. This well has satisfied the Company’s obligations to earn its interest in the Jaguar prospect as previously described above. In order for the Company to earn its working interest in the Hawk and Panther prospects, it will need to spud a well on the Hawk prospect by May 31, 2013; one well in Panther by January 1, 2013 and a second well in Panther by January 1, 2014. The company is continuing its search for Joint venture partners and will attempt to meet these requirements through a farm out arrangement rather than through the spending of its own capital resources.

The Company holds an operating lease agreement for office space in Calgary, Alberta commencing on March 1, 2012 and ending on February 28, 2017. The annual average basic rent obligation is $110, payable in monthly instalments of $9. In addition to the basic rent, additional rent is payable monthly, and includes the Company’s proportionate share of all operating costs and taxes.

The Company held an operating lease agreement for the lease of office space in Bakersfield, California commencing July 1, 2010 and ending on September 30, 2012. The annual basic rent obligation is US$37 per annum, payable in monthly instalments of US$3. In addition to the basic rent, additional rent is payable monthly, and includes the Company’s proportionate share of all operating costs and taxes. During the year, the Company signed a new five year lease, beginning July 1, 2012, for the Bakersfield, California office space. The annual average basic rent obligation will be US$77 per annum, payable in average monthly instalments of USD$6. As with the prior lease, additional rent will be payable monthly, which will include the Company’s proportionate share of all operating costs and taxes.

Zodiac assesses its financing requirements and its ability to access equity or debt markets on an ongoing basis. This assessment considers: the stage and success of the Company’s evaluation activities to date; the continued participation of the Company’s partners in evaluation activities; and financial market conditions.

The Company’s intent is to fund the acquisition of mineral and surface rights, the initiation of exploration activities including acquisition of seismic data, and the drilling, completion and tie-in of oil and gas wells through equity issues and farm-out agreements and eventually operating cash flow and borrowing base loans.

Zodiac will continue to maintain financial flexibility and monitor its financing requirements along with its ability to access the equity markets. It is possible that future economic events and global conditions may result in further volatility in the financial markets which could negatively impact Zodiac’s ability to access equity or debt markets in the future. Any inability to access equity or debt markets for sufficient capital, at acceptable terms, and within required timeframes, could have a material adverse effect on Zodiac’s financial condition, results of operations and prospects. Further discussion of these risks may be found in the “Business Risks and Uncertainties” section of this MD&A.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

The discussion and analysis of our financial condition and results of operations are based upon the consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the Unites States of America. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, related disclosure of contingent assets and liabilities and oil and gas properties. Certain accounting policies involve judgments and uncertainties to such an extent that there is reasonable likelihood that materially different amounts could have been reported under different conditions, or if different assumptions had been used. We evaluate our estimates and assumptions on a regular basis. We base our estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates and assumptions used in preparation of our financial statements. Below, we have provided expanded discussion of our more significant accounting policies, estimates and judgments for our financial statements. We believe these accounting policies reflect the more significant estimates and assumptions used in preparation of the financial statements.

The Company views the following estimates as critical:

Income Tax

Income taxes are accounted for using the liability method of income tax allocation. Under the liability method, future income tax assets and liabilities are recorded to recognize future income tax inflows and outflows arising from the settlement or recovery of assets and liabilities at their carrying values. Future income tax assets are also recognized for the benefits from tax losses and deductions that cannot be identified with particular assets or liabilities, provided those benefits are more likely than not to be realized. Future income tax assets and liabilities are determined based on the substantively enacted tax laws and rates that are anticipated to apply in the period of realization.

Oil and Gas Properties

The Company follows the full cost method of accounting whereby all costs related to the acquisition are initially capitalized. Costs capitalized include land acquisition costs, geological and geophysical expenditures, lease rentals on undeveloped properties, costs of drilling productive and non-productive wells, together with overhead and interest directly related to exploration and development activities, and lease and well equipment.

Costs capitalized are to be depleted and amortized on a cost centre basis using the unit-of-production method based on estimated proved petroleum and natural gas reserves before royalties as determined by independent engineers. In determining its depletion base, the Company includes estimated future capital costs to be incurred in developing proved reserves and excludes the cost of significant unproved properties until it is determined whether proved reserves are attributable to the unproved properties or impairment has occurred. Unproved properties are evaluated separately for impairment based on management’s assessment of future drilling and exploration activities. The Company’s decision to withhold costs from amortization and the timing of the transfer of those costs into the depreciating asset base involve significant judgment and may be subject to changes over time based on several factors, including drilling plans, availability of capital, project economics and results of drilling on adjacent acreage. During the period there has been nil production, and a depletion expense was not recognized.

Costs capitalized are periodically assessed for impairment after considering geological data and other information. A loss is recognized at the time of impairment by providing an impairment allowance.

As at September 30, 2012, the Company had oil and gas properties with a net book value of $54,398 (September 30, 2011 - $64,406, September 30, 2010 - $20,973) included in Property, Plant and Equipment on the balance sheet. During the year ended September 30, 2011, management considered whether events occurred or conditions existed, as at period end, that would indicate that net carrying amounts would not be recoverable from estimated future cash flows. Management has determined that, other than those amounts already claimed, there was no additional asset impairment as at September 30, 2012.

Future Development and Abandonment Costs

The Company recognizes the fair value of an asset retirement obligation (“ARO”) in the period in which a well or related asset is drilled, constructed or acquired and when a reasonable estimate of the fair value can be made. The fair value of the estimated ARO is recorded as a long-term liability, and equals the present value of estimated future cash flows, discounted using a risk-free interest rate adjusted for the Company’s credit standing. The liability accretes until the date of expected settlement of the retirement obligations or the asset is sold and is recorded as an accretion expense. Asset retirement costs are capitalized as part of the carrying value of the related assets. The capitalized amount is amortized to earnings on a basis consistent with depreciation and depletion of the underlying assets. Actual restoration expenditures are charged to the accumulated obligation as incurred. Any settlements are charged to income in the period of settlement. Holding all other factors constant, if our estimate of future abandonment and development costs is revised upward, earnings would decrease due to higher depletion, depreciation & accretion expense. Conversely, should these estimates be revised downwards, earnings would increase.

The Company develops estimates of these costs on a location by location basis, and as these costs typically extend many years into the future, estimating these future costs is difficult and requires management to make judgments that are subject to future revisions based upon numerous factors, including changing technology and the political and regulatory environment. We review our assumptions and estimates of future development and future abandonment costs on an annual basis.

Revenue Recognition

Revenue from the sale of petroleum and natural gas is recorded on a gross basis when title passes to an external party and is recognized based on volumes delivered to customers at contractual delivery points and when the significant risks and rewards of ownership have been transferred to the buyer and collectability is reasonably assured.

As at September 30, 2012, the Company has not recognized revenue from the sale of petroleum and natural gas as production has not yet occurred, other than incidental production from testing net against capital costs.

The Company records compensation expense in the consolidated financial statements for stock options granted to employees, consultants and directors using the fair value method. Fair values are determined using the Black-Scholes option pricing model, which is sensitive to the estimate of stock price volatility and the options’ expected life.

Financial Instruments

The fair values of financial instruments, which include cash and cash equivalents, other receivables, accounts payable and accrued liabilities approximate their carrying values due to the relatively short maturity of these instruments.

RECENT ACCOUNTING PRONOUNCEMENTS

The Company successfully completed efforts to raise additional equity capital in conjunction with the plan to combine with Peninsula (note 4). Post RTO, U.S. based investors form a substantial minority of the Company’s shareholder base. Should trading of the Company’s shares shift the balance to majority ownership by U.S. investors, it was anticipated, given the Company’s focus on the properties located in California, that the Company will eventually become a Domestic Issuer from a Securities Exchange Commission ("SEC") perspective. As a result, the Company would then be obligated to prepare and file U.S. GAAP based financial statements and regulatory filings to comply with U.S. regulations and the Company could avail itself of the option to use its U.S. GAAP statements for all financial disclosure requirements both in Canada and the U.S. Alternatively, should shareholdings shift towards a greater allocation to Canadian and international investors or stay static, International Financial Reporting Standards (“IFRS”) would have needed to be adopted for the fiscal year beginning October 1, 2011. In order to eliminate the uncertainty regarding an inevitable accounting conversion, to either IFRS or U.S. GAAP, the Company filed a form 40 F registration statement with the SEC during the quarter ended June 30, 2011. The Company intends to continue to avail itself of the option to use its U.S. GAAP statements for all financial disclosure requirements both in Canada and the U.S. which it began doing for fiscal 2011.

The following recently issued accounting developments have been applied or may impact the Company in future periods.

Comprehensive Income - In June of 2011, the FASB issued Accounting Standards Update No. 2011-05: Comprehensive Income (Topic 220): Presentation of Comprehensive Income (ASU 2011-05). ASU 2011-05 provides that an entity that reports items of other comprehensive income has the option to present comprehensive income in either one continuous financial statement or two consecutive financial statements. ASU 2011-05 is effective for annual period beginning after December 15, 2011. We do not anticipate the implementation to have an impact on the Company's financial position or results of operations.

Fair Value Measurements - In May of 2011, the FASB issued Accounting Standards Update No. 2011-04: Fair Value Measurement (Topic 820): Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs (ASU 2011-04). ASU 2011-04 clarifies application of fair value measurement and disclosure requirements and is effective for annual periods beginning after December 15, 2011. We are currently evaluating the provisions of ASU 2011-04 and assessing the impact, if any, it may have on our financial position and results of operations.

OFF BALANCE SHEET ARRANGEMENTS

The Company has not entered into any off-balance sheet arrangements such as guarantee contracts, contingent interests in assets transferred to unconsolidated entities, derivative financial obligations, or with respect to any obligation under a variable interest equity arrangement.

OUTSTANDING SHARE DATA

Authorized capital:

Unlimited number of common shares with voting rights.

Unlimited number of preferred shares, issuable in series.

Issued and outstanding:

- 359,635,408 common shares as at September 30, 2012.

Warrants outstanding:

- 24,445,706 with an exercise price of $0.414. 12,325,008 expire on March 17, 2015, 11,088,539 expire on April 1, 2015 and 1,032,159 expire on April 9, 2015.

BUSINESS RISKS AND UNCERTAINTIES

The Company is subject to various risks and uncertainties, including, but not limited to, those listed below:

Oil and Gas Exploration and Development

The oil and gas industry is extremely competitive in all aspects including the acquisition of oil and gas interests, the marketing of oil and natural gas, and acquiring or gaining access to necessary drilling equipment, services and supplies. Zodiac competes with numerous other companies in the search for and acquisition of prospective oil and gas plays.

Zodiac is subject to all risks and hazards inherent in the business involved in the exploration for, and the acquisition, development, production and marketing of oil and natural gas. Many of these inherent risks cannot be compensated for, even with the combination of experience, knowledge and careful planning of an experienced technical team. The risks and hazards typically associated with oil and gas operations include equipment failure, fire, explosion, blowouts, sour gas releases, pipeline ruptures and oil spills, each of which could result in substantial damage to oil and gas wells, production facilities, other property, the environment or personal injury.

Capital Requirements

To finance future operations, Zodiac may require financing from external sources including, but not limited to, issuance of common or preferred shares, issuance of debt or implementation of working interest farm-out agreements. There can be no assurance that such financing will be offered on acceptable terms or that it will be available at all to the Company. If additional financing is raised through the issuance of equity or convertible debt securities, control of the Company may change and the interests of shareholders in the net assets of Zodiac may be diluted. If unable to secure financing on acceptable terms, Zodiac may have to cancel or postpone certain of its planned exploration and development activities which may ultimately lead to Zodiac’s inability to fulfill the minimum work obligations under various farm-in agreements and potentially to the forfeiture of existing land holdings. Availability of capital will also directly impact the Company’s ability to take advantage of additional farm-in and acquisition opportunities.

Operations

Zodiac’s largest land position relates to the oil and gas projects located in Kings County, California, USA, which is currently its primary focus. Uncertainties include, but are not limited to: a change in the general regulatory environment; a change in environmental protection policies; or a change in taxation policies.

These uncertainties, all of which are beyond the Company’s control, could have a material adverse effect on Zodiac’s business, prospects and results of operations. Zodiac will require licenses or permits from various governmental authorities to carry out future exploration, development and production activities. There can be no assurance that Zodiac will be able to obtain all necessary licenses and permits when required.

Uncertainty of Title

Although Zodiac conducts a thorough title review prior to acquiring additional acreage in its areas of interest, such reviews do not guarantee that an unforeseen defect in the chain of title will not arise that may call into question Zodiac’s interest in its land holdings. Any uncertainty with respect to one or more of Zodiac’s leasehold interests could have a material adverse effect on the Company’s business, prospects and results of operations.

Foreign Operations

Zodiac operates in the United States and consequently, if legal disputes arise related to oil and gas leases acquired by Zodiac, these disputes would likely be subject to the jurisdiction of courts other than those of Canada.

Operational Uncertainties

In carrying out its planned exploration program, Zodiac is subject to various risks including, but not limited to: the availability of equipment, manpower and supplies; the effects of weather on drilling and production; and operating in an environmentally responsible fashion.

The Company mitigates these business risks by: working with qualified operators and/or operating the majority of properties to control the amount and timing of capital expenditures; restricting operations to areas where locations are accessible, operating and capital costs are reasonable and on-stream times are shorter; drilling wells in areas with multiple high deliverability zone potential; striving to maintain cost-effective operations; using current technology to maximize production and recoveries and reduce operating costs and environmental impacts; and maintaining memberships in industry organizations.

Dependence on Management

The Company strongly depends on the technical and business expertise of its management team and there is little possibility that this dependence will decrease in the near term. The unexpected loss of any member of the management team may have a material adverse impact on the operations of the Company.

DATE

This MD&A is dated November 27, 2012