UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F/A

There are no changes to the body of the 20-F, the only purpose of this amendment is to add the XBRL files for the financial statment.

[ ] REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12 (g) OF THE SECURITIES EXCHANGE ACT OF 1934

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2012

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

[ ] SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission File Number 001-35201

Zodiac Exploration Inc.

(Exact Name of Registrant as Specified in Its Charter)

ALBERTA, CANADA

(Jurisdiction of Incorporation or Organization)

Suite 400 – 1324 17th Avenue

Calgary, Alberta

T2T 5S8

(Address of Principal Executive Offices)

Peter Haverson

Interim President and Chief Executive Officer

Zodiac Exploration Inc.

Suite 400 – 1324 17th Avenue

Calgary, Alberta

T2T 5S8

Telephone: 403-450-7896

Fax: 403-444-7855

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Common Shares, without Par Value

(Title of Class)

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: 359,635,408

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [X]

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP [X]

International Financial Reporting Standards as issued by the International Accounting Standards

Board [ ] Other [ ]

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the Company has elected to follow.

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

| | |

| TABLE OF CONTENTS |

| |

| ITEM 1 - Identity of Directors, Senior Management and Advisers | 13 |

| A. | Directors and Senior Management | 13 |

| B. | Advisers | 13 |

| |

| ITEM 2 - OFFER STATISTICS AND EXPECTED TIMETABLE | 13 |

| |

| ITEM 3 - KEY INFORMATION | 13 |

| A. | Selected Financial Data | 13 |

| B. | Capitalization and Indebtedness | 16 |

| C. | Reasons for the Offer and Use of Proceeds | 16 |

| D. | Risk Factors | 16 |

| |

| ITEM 4 - INFORMATION ON THE CORPORATION | 26 |

| A. | History and Development of the Corporation | 26 |

| B. | Business Overview | 31 |

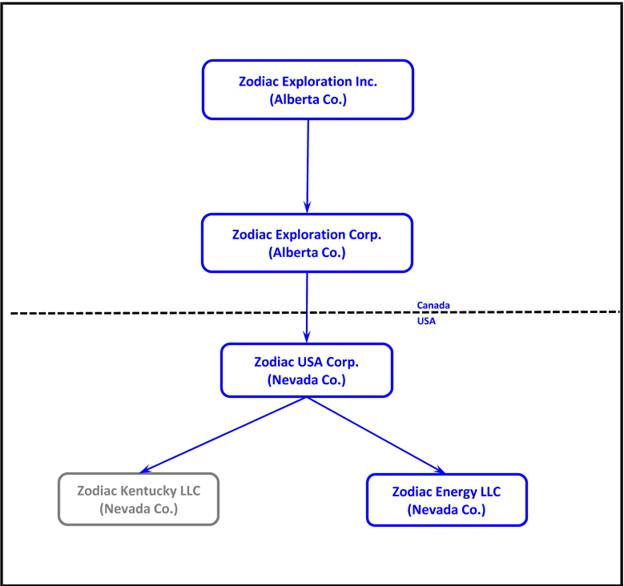

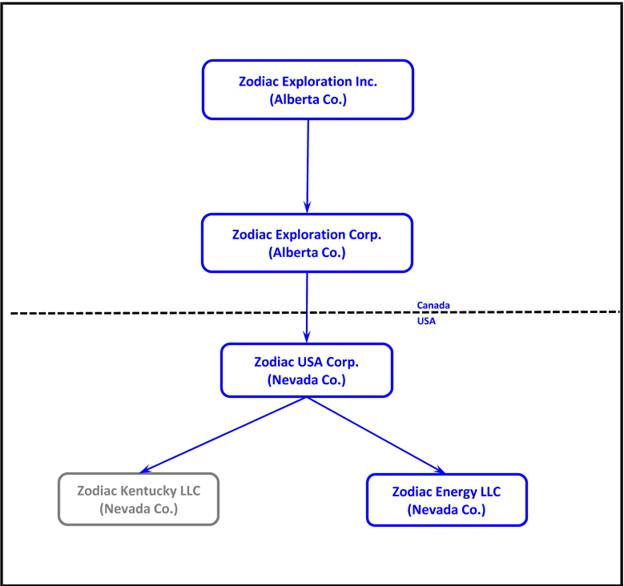

| C. | Organizational Structure | 35 |

| D. | Property, Plant and Equipment | 36 |

| ITEM 4A - UNRESOLVED STAFF COMMENTS | 40 |

| |

| ITEM 5 - OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 40 |

| A. | Operating Results | 43 |

| B. | Liquidity and Capital Resources | 46 |

| C. | Research and Development, Patents and License, etc | 46 |

| D. | Trend Information | 46 |

| E. | Off Balance Sheet Arrangements | 46 |

| F. | Tabular Disclosure of Contractual Obligations | 46 |

| |

| ITEM 6 - DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 46 |

| A. | Directors and Senior Management | 46 |

| B. | Executive Compensation | 48 |

| C. | Board Practices | 48 |

| D. | Employees | 56 |

| E. | Share Ownership | 56 |

| |

| ITEM 7 - MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 57 |

| A. | Major Shareholders | 57 |

| B. | Related Party Transactions | 58 |

| C. | Interests of Experts and Counsel | 58 |

| |

| ITEM 8 - FINANCIAL STATEMENTS | 58 |

| A. | Consolidated Statements and Other Financial Information | 58 |

| B. | Significant Changes | 59 |

| |

| ITEM 9 - THE OFFERING AND LISTING | 59 |

| A. | Offering and Listing Details | 59 |

| B. | Plan of Distribution | 60 |

| C. | Markets | 60 |

| D. | Selling Shareholders | 60 |

| E. | Dilution | 60 |

| F. | Expenses of the Issue | 60 |

| | |

| ITEM 10 - ADDITIONAL INFORMATION | 60 |

| A. | Share Capital | 60 |

| B. | Articles of Incorporation and Bylaws | 60 |

| C. | Material Contracts | 62 |

| | |

|

| |

| D. | Exchange Controls | 62 |

| E. | Taxation | 63 |

| F. | Dividends and Paying Agents | 71 |

| G. | Statement by Experts | 71 |

| H. | Documents on Display | 72 |

| I. | Subsidiary Information | 72 |

| | |

| ITEM 11 - QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 72 |

| | |

| ITEM 12 - DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 73 |

| | |

| ITEM 13 - DEFAULTS, DIVIDEND ARREARS AND DELINQUENCIES | 72 |

| | |

| ITEM 14 - MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF | |

| PROCEEDS | 73 |

| | |

| ITEM 15 - CONTROLS AND PROCEDURES | 73 |

| | |

| ITEM 16A - AUDIT COMMITTEE FINANCIAL EXPERT | 74 |

| | |

| ITEM 16B - CODE OF ETHICS | 74 |

| | |

| ITEM 16C - PRINCIPAL ACCOUNTANT FEES AND SERVICES | 74 |

| | |

| ITEM 16D - EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 75 |

| | |

| ITEM 16E - PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | 75 |

| | |

| ITEM 16F - CHANGE IN REGISTRANT'S CERTIFYING ACCOUNTANT | 75 |

| | |

| ITEM 16G - CORPORATE GOVERNANCE | 75 |

| | |

| ITEM 16H - MINE SAFETY DISCLOSURE | 75 |

| | |

| ITEM 17 - FINANCIAL STATEMENTS | 75 |

| | |

| ITEM 18 - FINANCIAL STATEMENTS | 76 |

| | |

| ITEM 19 - EXHIBITS | 76 |

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 20-F ("Annual Report") and the exhibits attached hereto contain "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities legislation. Certain statements and information in this document may constitute forward-looking statements or forward-looking information (collectively, "forward-looking statements") which involve substantial known and unknown risks and uncertainties. Forward-looking statements are statements that are not historical fact and are generally identified by words such as "believes", "anticipates", expects", "estimates", "pending", "intends", "plans" or similar words suggesting future outcomes. These statements and information are only predictions and actual events or results may differ materially. Although we believe that the expectations reflected in the forward-looking statements and information are reasonable, it cannot guarantee future results, levels of activity, performance or achievement since such expectations are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause our actual results to differ materially from those expressed or implied in any forward-looking statements and information made by, or on behalf of, us.

In particular, forward-looking statements included in this Annual Report include, but are not limited to:

| · | planned exploration activity including both expected drilling and geological and geophysical related activities; |

| · | future crude oil, natural gas or natural gas liquids prices; |

| · | future sources of funding for our capital program; |

| · | government or other regulatory consent for exploration, development or acquisition activities; |

| · | future capital expenditures and their allocation to exploration and development activities; |

| · | future asset acquisitions or dispositions; |

| · | development plans or capacity expansions; |

| · | future sources of liquidity, cash flows and their uses; |

| · | future drilling of new wells; |

| · | ultimate recoverability of current and long-term assets; |

| · | ultimate recoverability of reserves or resources; |

| · | expected operating costs; |

| · | future foreign currency exchange rates; |

| · | future market interest rates; |

| · | future expenditures and future allowances relating to environmental matters; |

| · | dates by which certain areas will be developed; and |

| · | changes in any of the foregoing. |

In addition, statements relating to "resources" are forward-looking statements, as they involve the implied assessment, based on estimates and assumptions that the reserves and resources described exist in the quantities predicted or estimated, and can be profitably produced in the future.

By their nature, forward-looking statements and information involve assumptions, inherent risks and uncertainties, many of which are difficult to predict, and are usually beyond the control of management, that could cause actual results to be materially different from those expressed by these forward-looking statements and information. Risks and uncertainties include, but are not limited to, volatility in market prices for crude oil and natural gas; industry conditions; volatility of commodity prices; currency fluctuation; imprecision of resource estimates; liabilities inherent in crude oil and natural gas operations; environmental risks; incorrect assessments of the value of acquisitions and exploration and development programs; competition from other producers; the lack of availability of qualified personnel or management; changes in income tax laws or changes in property tax laws relating to the oil and gas industry; hazards such as fire, explosion, blowouts, cratering, and spills, each of which could result in substantial damage to wells, production facilities, other property and the environment or in personal injury; stock market volatility; ability to access sufficient capital from internal and external sources and other risks identified in this Annual Report under the heading "Risk Factors".

Cautionary Note to U.S. Investors CONCERNING OIL and Gas Production, Reserves AND RESOURCES

As an Alberta corporation, we are subject to certain rules and regulations issued by Canadian Securities Administrators. We file our annual information form (the "AIF") with the Alberta Securities Commissions via the System for Electronic Document Analysis and Retrieval ("SEDAR"). Under the filing requirements for an AIF, we are required to provide detailed information regarding our operations and oil and gas reserve estimates, if any. Further, we may describe our properties utilizing terminology such as "attributed reserves" that are permitted by Canadian securities regulations, but are not recognized by the SEC. Additionally, the SEC prohibits disclosure of oil and gas resources, whereas Canadian issuers may voluntarily disclose oil and gas resources. "Resources" (unless otherwise defined or reported under a separate sub-category of resources) generally refers to a quantity of petroleum that is estimated to exist originally in naturally occurring accumulations and includes the quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations, prior to production, plus those estimated quantities in accumulations yet to be discovered. Resources are different than, and should not be construed as, reserves.

Our management and directors are required to prepare information with respect to our oil and gas activities in accordance with applicable securities regulatory requirements in Canada under Canadian National Instrument 51 101 –Standards of Disclosure for Oil and Gas Activities ("NI 51-101"). This information would include reserves data, which are estimates of proved reserves and probable reserves and related future net revenue. However, as at November 27, 2012 we determined that none of our properties contained "proven" or "probable" oil and gas reserves.

We may, in the future, incorporate information with respect to production, reserves and resources which is either not generally included or prohibited under SEC rules and practices in the United States. We would follow the Canadian practice of reporting gross production and reserve volumes; and may follow the United States practice of separately reporting these volumes on a net basis (after the deduction of royalties and similar payments). The Canadian practice of estimating reserves uses forecast pricing and costs in such estimates. However, we may also separately estimate its reserves using prices and costs held constant at the effective date of the reserve report in accordance with the Canadian reserve reporting requirements. These latter requirements may be similar to the average constant pricing reserve methodology utilized in the United States.

The SEC has adopted revisions to its oil and gas reporting rules that, effective as of January 1, 2010, among other things, modified the standards to establish proved reserves and permit disclosure of probable and possible reserves under certain circumstances. However, it is likely that significant differences will remain between the reserve categories and reserve reporting generally under Canadian and U.S. securities laws and rules.

The primary differences between the Canadian requirements and the US standards are that:

| (a) | NI 51-101 requires disclosure of gross and net reserves using forecast prices, whereas the SEC rules require the disclosure of net reserves estimated using a historical 12-month average price; |

| (b) | NI 51-101 requires the disclosure of the net present value of future net revenue attributable to all of the disclosed reserves categories, estimated using forecast prices and costs, before and after deducting future income tax expenses, calculated without discount and using discount rates of 5%, 10%, 15% and 20%, whereas the SEC rules require disclosure of the present value of future net cash flows attributable to proved reserves only, estimated using a constant price (the historical 12-month average price) and a 10% discount rate; |

| (c) | NI 51-101 requires a one year reconciliation of gross proved reserves, gross probable reserves and gross proved plus probable reserves, based on forecast prices and costs, for various product types, whereas the SEC rules require a three-year reconciliation of net proved reserves, based on constant prices and costs, for less specific product types; |

| (d) | NI 51-101 requires reserves to show a hurdle rate of return, whereas the SEC rules require reserves to be cash flow positive on an undiscounted basis; and |

| (e) | NI 51-101 permits voluntary disclosure of resources. |

Status as an Emerging Growth Company

Recently the United States Congress passed the Jumpstart Our Business Startups Act of 2012 (the "JOBS Act"), which provides for certain exemptions from various reporting requirements applicable to public companies that are reporting companies but not "emerging growth companies." We are an "emerging growth company" as defined in section 3(a) of the Exchange Act (as amended by the JOBS Act, enacted on April 5, 2012), and we will continue to qualify as an "emerging growth company" until the earliest to occur of: (a) the last day of the fiscal year during which we had total annual gross revenues of US$1,000,000,000 (as such amount is indexed for inflation every 5 years by the SEC) or more; (b) the last day of our fiscal year following the fifth anniversary of the date of the first sale of common equity securities pursuant to an effective registration statement under the Securities Act; (c) the date on which we have, during the previous 3-year period, issued more than US$1,000,000,000 in non-convertible debt; or (d) the date on which we are deemed to be a "large accelerated filer", as defined in Exchange Act Rule 12b-2. Therefore, we expect to continue to be an emerging growth company for the foreseeable future.

Generally, a registrant that registers any class of its securities under section 12 of the Exchange Act is required to include in the second and all subsequent annual reports filed by it under the Exchange Act, a management report on internal control over financial reporting and, subject to an exemption available to registrants that are neither an "accelerated filer" or a "larger accelerated filer" (as those terms are defined in Exchange Act Rule 12b-2), an auditor attestation report on management's assessment of internal control over financial reporting. However, for so long as we continue to qualify as an emerging growth company, we will be exempt from the requirement to include an auditor attestation report in its annual reports filed under the Exchange Act, even if we were to qualify as an "accelerated filer" or a "larger accelerated filer". In addition, section 103(a)(3) of the Sarbanes-Oxley Act of 2002 has been amended by the JOBS Act to provide that, among other things, auditors of an emerging growth company are exempt from the rules of the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the registrant (auditor discussion and analysis).

Currency

All references to dollar amounts are expressed in (000s) and the lawful currency of Canada, unless otherwise specifically stated. Per share amounts are expressed in Canadian dollars.

Foreign Private Issuer Filings

As a foreign private issuer registered under section 12(b) of theSecurities Exchange Act of 1934 (the "Exchange Act"), we are subject to section 13 of the Exchange Act, and we are required to file Annual Reports on Form 20-F and Reports of Foreign Private Issuer on Form 6-K with the SEC. However, we are exempt from the proxy rules under section 14 of the Exchange Act, and the short-swing profit rules under section 16 of the Exchange Act.

ABBREVIATIONS

| Oil and Natural Gas Liquids | Natural Gas |

| | | | |

| bbl | barrel | bcf | billion cubic feet |

| bbls | barrels | GJ | gigajoule |

| bbls/d | barrels of oil per day | GJ/d | gigajoules per day |

| bopd | barrels of production per day | kpa | kilopascals |

| e3m3 | thousand cubic metres | Mcf | thousand cubic feet |

| e3m3/d | thousands cubic metres per day | Mcf/d | thousand cubic feet per day |

| Mbbls | thousand barrels | MMcf | million cubic feet |

| MMbbls | million barrels | MMcf/d | million cubic feet per day |

| mstb | thousand stock tank barrels of oil | MMbtu | million British Thermal Units |

| NGLs | natural gas liquids (consisting of any one or more of propane, butane and condensate) | m3 psi | cubic metres pounds per square inch |

| | | | |

| | | | |

| Other |

| |

| API | an indication of the specific gravity of crude oil measured on the API gravity scale. Liquid petroleum with a specified gravity of 28° API or higher is generally referred to as light crude oil. |

| Bcfge | billion cubic feet of gas equivalent. |

| BOE | barrel of oil equivalent, using the conversion factor of six (6) Mcf of natural gas being equivalent to one bbl of oil. The conversion factor used to convert natural gas to oil equivalent is not necessarily based upon either energy or price equivalents at this time. |

| BOE/d | barrel of oil equivalent per day. |

| km | kilometres |

| MBOE | thousand barrels of oil equivalent. |

| Mcfge | thousand cubic feet of gas equivalent. |

| MMBOE | million barrels of oil equivalent. |

| WTI | West Texas Intermediate, the reference price paid in U.S. dollars, at Cushing, Oklahoma for crude oil of standard grade. |

BOEs and Mcfges may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl and a Mcfge conversion ratio of 1 bbl: 6 Mcf is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

CONVERSION

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

| To Convert From | To | Multiply By |

| Mcf | cubic metres | 28.174 |

| cubic metres | cubic feet | 35.494 |

| bbls | cubic metres | 0.159 |

| cubic metres | bbls oil | 6.290 |

| feet | metres | 0.305 |

| metres | feet | 3.281 |

| miles | kilometres | 1.609 |

| kilometres | miles | 0.621 |

| acres | hectares | 0.400 |

| hectares | acres | 2.500 |

GLOSSARY OF TERMS

Note: All references in this Annual Report to the terms "we", "our", "us", "the Corporation" and "Zodiac" refer to Zodiac Exploration Inc., as defined below.

In this Annual Report, unless the context otherwise requires, the following words and phrases shall have the meanings set forth below:

"ABCA" means theBusiness Corporations Act (Alberta), as amended, including all regulations promulgated thereunder;

"Aera" means Aera Energy LLC;

"Aera Farmout Agreement" means the definitive farmout agreement between the Corporation and Aera whereby Aera acquired the right to earn a 50% interest in the Aera Farmout Lands;

"Aera Farmout Lands" means the approximate 19,600 net acres of Zodiac lands located in Kings County, California subject to the Aera Farmout Agreement;

"affiliate" means a company that is affiliated with another company as described below:

A company is an "affiliate" of another company if:

(a) one of them is the subsidiary of the other, or

(b) each of them is controlled by the same Person.

A company is "controlled" by a Person if:

| (a) | voting securities of the company are held, other than by way of security only, by or for the benefit of that Person, and |

| (b) | the voting securities, if voted, entitle the Person to elect a majority of the directors of the company. |

A Person beneficially owns securities that are beneficially owned by:

| (a) | a company controlled by that Person, or |

| (b) | an affiliate of that Person or an affiliate of any company controlled by that Person; |

"AcquisitionCo" means 1543081 Alberta Ltd., a corporation incorporated pursuant to the ABCA;

"Arrangement" means the arrangement involving Peninsula, Zodiac PrivateCo and AcquisitionCo pursuant to and in accordance with the Arrangement Agreement and Plan of Arrangement;

"Arrangement Agreement" means the Arrangement Agreement dated as of August 18, 2010 among Peninsula, Zodiac and AcquisitionCo, a copy of which is available under the Corporation's SEDAR profile at www.sedar.com;

"Bayswater" means Bayswater Exploration & Production, LLC;

"BCBCA" means theBusiness Corporations Act (British Columbia), as amended, including all regulations promulgated thereunder;

"Common Shares" means the voting common shares in the capital of the Corporation;

"company" unless specifically indicated otherwise, means a corporation, incorporated association or organization, body corporate, partnership, trust, association or other entity other than an individual;

"Exchange" means the TSX Venture Exchange Inc.;

"Final Exchange Bulletin" means the bulletin issued by the Exchange following closing of the Arrangement which evidenced the final acceptance by the Exchange of the Arrangement;

"Gross Acres" means the total acres contained in the land described in the lease or other conveyance.

"insider" if used in relation to an issuer, means:

| (a) | a director or senior officer of the issuer, |

| (b) | a director or senior officer of the issuer that is an insider or subsidiary of the issuer, |

| (c) | a Person that beneficially owns or controls, directly or indirectly, voting shares carrying more than 10% of the voting rights attached to all outstanding voting shares of the issuer, or |

| (d) | the issuer itself if it holds any of its own securities; |

"Jaguar Farmout Lands" means the lands subject to the Jaguar Farmout Agreement;

"Jaguar Farmout Agreement" means the farmout agreement dated effective May 27, 2009 between Zodiac PrivateCo and Bayswater;

"Jaguar Pooling Agreement" means the pooling agreement among Zodiac Corp., Vintage and Bayswater;

"Joint Information Circular" means the joint information circular of Peninsula and Zodiac PrivateCo dated August 27, 2010 a copy of which is available under the Corporation's SEDAR profile at www.sedar.com;

"Net Acres" means the gross acres multiplied by the mineral interest;

"NI 51-101" means National Instrument 51-101 –Standards of Disclosure for Oil and Gas Activities;

"Olympia" means Olympia Trust Company;

"Panther Acquisition Agreement" means the acquisition agreement dated November 3, 2010 between Zodiac and Bayswater;

"Panther Assets" means the approximately 21,500 acres of land located in Kings and Kern Counties in California as set out in the Panther Acquisition Agreement;

"Peninsula" means Peninsula Resources Ltd., a corporation incorporated pursuant to the BCBCA and continued under the ABCA as Zodiac;

"Peninsula Barbados" means Peninsula Resources Barbados Ltd., a corporation incorporated under the laws of Barbados and a wholly-owned subsidiary of Zodiac;

"Peninsula Warrants" means the warrants to purchase Common Shares issued by the Corporation prior to the Arrangement, exercisable at a price of $0.125 per Common Share until April 21, 2011;

"Person" means an individual or company;

"Plan of Arrangement" means the plan of arrangement attached as Schedule "C" to the Joint Information Circular;

"SEDAR" means the System for Electronic Document Analysis and Retrieval of the Canadian Securities Administrators, accessible at www.sedar.com;

"Stock Option Plan" means the stock option plan of the Corporation;

"Tearlach Barbados" means Tearlach Resource (Barbados) Limited, a corporation incorporated under the laws of Barbados;

"Triangle" means Triangle Petroleum Corporation, a corporation incorporated under the laws of the State of Nevada, USA;

"USGS" means United States Geological Survey;

"Vintage" means Vintage Production California LLC, a wholly-owned subsidiary of Occidental Petroleum Corp.;

"Zodiac" or the "Corporation" means Zodiac Exploration Inc., a corporation continued pursuant to the ABCA;

"Zodiac Board" or "Board" means the board of directors of Zodiac;

"Zodiac Corp." means Zodiac Exploration Corp., a corporation amalgamated under the ABCA and being the corporation resulting from the amalgamation of Zodiac PrivateCo and AcquisitionCo;

"Zodiac Energy" means Zodiac Energy LLC, a limited liability corporation incorporated under the laws of the State of Nevada, USA;

"Zodiac Kentucky" means Zodiac Kentucky LLC, a limited liability corporation incorporated under the laws of the State of Nevada, USA;

"Zodiac Options" means stock options to acquire Common Shares granted pursuant to the Stock Option Plan;

"Zodiac Performance Warrants" means the performance warrants to purchase, in the aggregate, 10,150,000 Common Shares, exercisable at a price of $0.207 per Common Share until April 6, 2015;

"Zodiac PrivateCo" means Zodiac Exploration Corp., a corporation incorporated pursuant to the ABCA;

"Zodiac Series I Warrants" means the warrants to purchase 45,675,000 Common Shares, which were exercisable at a price of $1.035 per Common Share until February 10, 2012;

"Zodiac Series II Warrants" means the warrants to purchase 27,037,061 Common Shares, exercisable at a price of $0.414 per Common Share until March 17, 2015 (as to 13,883,242 Zodiac Series II Warrants), April 1, 2015 (as to 12,121,661 Zodiac Series II Warrants) and April 9, 2015 (as to 1,032,158 Zodiac Series II Warrants);

"Zodiac USA" means Zodiac USA Corp., a corporation incorporated under the laws of the State of Nevada, USA; and

Certain other terms used herein but not defined herein are defined in NI 51-101 and, unless the context otherwise requires, shall have the same meanings herein as in NI 51-101.

ITEM 1 - Identity of Directors, Senior Management and Advisers

A. Directors and Senior Management

Not Applicable.

B. Advisers

Not Applicable.

ITEM 2 - OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3 - KEY INFORMATION

A. Selected Financial Data

We were formed as a result of the Reverse Takeover ("RTO") structured under the Plan of Arrangement completed on September 28, 2010, in which Peninsula Resources Ltd. ("Peninsula") acquired all of the outstanding shares of Zodiac Exploration Corp. in a share for share exchange (the "Transaction"). The Transaction entailed the amalgamation of Zodiac Exploration Corp. with 1543081 Alberta Ltd. (subsequently named Zodiac Exploration Corp.), a wholly owned subsidiary of Peninsula. Upon completion of the Transaction, Peninsula changed its name to Zodiac Exploration Inc. For more information see "Item 4 – Information on the Corporation – History and Development of the Corporation".

For financial reporting purposes, the Transaction was accounted for as an RTO that did not constitute a business combination, with Zodiac Exploration Corp. identified as the RTO acquirer and Peninsula the reverse takeover acquiree. The consolidated financial statements are those of Zodiac with the RTO accounted for as a capital transaction. The comparative information presented, including all information presented prior to September 28, 2010, is that of Zodiac Exploration Corp. as it has been deemed the continuing entity post RTO. Zodiac is principally engaged in the acquisition, exploration and development of oil and gas properties in the San Joaquin Basin in California. To date, we have had only incidental oil and gas revenues included as an offset to capital expenditures and we are still considered to be in the development stage as defined by the Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") 915.

We have consolidated in our accounts the accounts of: Zodiac Exploration Corp.; Peninsula Barbados; and Zodiac USA Corp. ("Zodiac USA"), including Zodiac Kentucky LLC ("Zodiac Kentucky") and Zodiac Energy LLC ("Zodiac Energy"). Peninsula Resources (Barbados) Limited was established by Peninsula Resources Ltd. prior to the RTO and is inactive. Zodiac Exploration Corp. (formerly 1543081 Alberta Ltd.) was the amalgamation vehicle for the RTO. Zodiac Kentucky and Zodiac Energy were established to carry on oil and gas exploration and development activities in the states of Kentucky and California, respectively. Both Zodiac Kentucky and Zodiac Energy are limited liability corporations, established under the laws of the state of Nevada and wholly owned by Zodiac USA. Zodiac Kentucky is inactive and no longer registered to operate in Kentucky.

At September 30, 2012, we have not yet achieved profitable operations, have accumulated a deficit of $46,012 (September 30, 2011 $18,381) since our inception, and expect to incur further losses in the development of our business, which is typical of an oil and gas exploration company in the early stages of development. As at September 30, 2012, we have a cash balance of $20,381 (September 30, 2011 $40,532) generated primarily from financings completed in the fiscal years ended September 30, 2011 and 2010.

We changed our fiscal year from December 31 to September 30, effective September 30, 2010. As a result, the figures in the consolidated statement of loss and deficit, and consolidated statement of cash flows are for the twelve months ended September 30, 2012 and 2011, and for the nine months ended September 30, 2010. The consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States ("US GAAP"), are expressed in Canadian dollars and reflect the significant accounting policies as stated in the our audited financial statements for the year ended September 30, 2012.

The consolidated financial statements include the assets, liabilities and results of operations, after the elimination of intercompany transactions and balances, of us and our subsidiaries, all of which are wholly-owned.

For each of the financial periods presented, the information in the tables was extracted from our more detailed audited financial statements.

The selected financial data should be read in conjunction with Item 5, "Operating and Financial Review and Prospects" and in conjunction with our consolidated financial statements and the notes thereto contained elsewhere in this Annual Report.

The following is a summary of certain selected financial information for our five most recently completed fiscal years (in Canadian dollars, except number of shares):

| | Zodiac Exploration Inc.(1) | Zodiac Exploration Corp. |

(Expressed in Canadian $000's expect per share amounts and number of shares) | 12 months ended September 30, 2012 | 12 months ended September 30, 2011 | 9 months ended September 30, 2010 | 12 months ended December 31, 2009 | Inception (June 12, 2008) to December 31, 2008 |

| | $ | $ | $ | $ | $ |

| Operations: | | | | | |

| | Revenues | 194 | 215 | 42 | 21 | 133 |

| | Net loss | -27,631 | -13,761 | -2,591 | -1,767 | -262 |

| | Basic and diluted loss per share | -0.08 | -0.04 | -0.02 | -0.02 | -0.01 |

| Balance sheet: | | | | | |

| | Total Assets | 76,180 | 109198 | 80,108 | 17202 | 17147 |

| | Net Assets | 74577 | 101823 | 77769 | 16362 | 17069 |

| | Share Capital | 114541 | 114424 | 74742 | 12912 | 12090 |

| | Number of Shares | 359,635,408 | 359,248,741 | 317,583,611 | 83,302,515 | 79,895,015 |

| | Deficit | 46,012 | 18,381 | 4,620 | 2,029 | 262 |

Note:

| (1) | The financial year end of Zodiac was changed to September 30 in connection with the completion of the Plan of Arrangement. |

Exchange Rates

Since June 1, 1970, the Government of Canada adopted a floating exchange rate to determine the value of the Canadian dollar as compared to the U.S. dollar. On January 18, 2013, the exchange rate in effect for Canadian dollars exchanged for US dollars, expressed in terms of Canadian dollars was $1.0063. This exchange rate is based on the noon buying rates of the Bank of Canada, as obtained from the website www.bankofcanada.ca.

For the past five fiscal years ended September 30, 2012, and for the six month period between August 31, 2012 and January 31, 2013, the following exchange rates were in effect for Canadian dollars exchanged for US dollars, calculated in the same manner as above:

Period | | Average (Close) |

| Year ended December 31, 2008(1) | $ | 0.8965 |

| Year ended December 31, 2009 | $ | 0.8757 |

| Year ended September 30, 2010(2) | $ | 0.9656 |

| Year ended September 30, 2011 | $ | 1.0134 |

| Year ended September 30, 2012 | $ | 0.9927 |

Period | | Low | | High |

| Month ended July 31, 2012 | $ | 0.9755 | $ | 0.9956 |

| Month ended August 31, 2012 | $ | 0.9916 | $ | 1.0116 |

| Month ended September 30, 2012 | $ | 1.0082 | $ | 1.0289 |

| Month ended October 31, 2012 | $ | 0.9986 | $ | 1.0207 |

| Month ended November 30, 2012 | $ | 0.9943 | $ | 1.0061 |

| Month ended December 31, 2012 | $ | 1.0028 | $ | 1.0146 |

| January 1, 2013 to January 18, 2012 | $ | 1.0053 | $ | 1.0157 |

Notes:

| (1) | This number represents the average exchange rate from inception as at June 12, 2008 to December 31, 2008. |

| (2) | This number represents the average exchange rate for the 9 months ended September 30, 2010 as a result of the Corporation's change in fiscal year to September 30 effective as at September 30, 2010. |

B. Capitalization and Indebtedness

Not Applicable.

C. Reasons for the Offer and Use of Proceeds

Not Applicable.

D. Risk Factors

An investment in our Common Shares involves a high degree of risk and should be considered speculative. You should carefully consider the following risks set out below and other information before investing in our Common Shares. If any event arising from these risks occurs, our business, prospects, financial condition, results of operations or cash flows could be adversely affected, the trading price of our Common Shares could decline and all or part of any investment may be lost.

Our operations are highly speculative due to the high-risk nature of our business, which include the acquisition, financing, exploration and development of oil and gas properties. The risks and uncertainties set out below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem immaterial, may also impair our operations. If any of the risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our Common Shares could decline and investors could lose part or all of their investment. Our business is subject to significant risks and past performance is no guarantee of future performance.

Additional Financing, Farmouts and Joint Ventures

Zodiac's future exploration, development and acquisition plans will require additional financing and/or the farming out of additional portions of Zodiac's holdings to joint venture partners. The ability of Zodiac to arrange financing or complete successful farmouts will depend in part upon the business performance of Zodiac as well as the capital market conditions. An inability to raise additional financing could limit growth prospects in the short run or may even require Zodiac to dispose of properties to continue operations under circumstances of declining energy prices, disappointing exploration results, or economic or political dislocation in foreign countries. Alternatively, even if financing is available, there can be no assurance that Zodiac will be successful in its efforts to arrange additional financing on terms satisfactory to Zodiac. This may be further complicated by the limited market liquidity for shares of smaller companies, restricting access to some institutional investors. If additional financing is raised by the issuance of securities from treasury of Zodiac, control of Zodiac may change and shareholders may suffer dilution.

Zodiac may seek to enter into additional joint venture or farmout agreements in order to finance the continued development of the properties. The ability of Zodiac to enter into such farmout arrangements will also depend on the business performance of Zodiac, the macro economic factors that impact the oil and gas industry and the

perceived value of Zodiac's assets. There can be no assurance that Zodiac will be successful in its efforts to arrange a farmout agreement on terms satisfactory to Zodiac.

Alternatively, Zodiac may be required to fund its ongoing operations, capital expenditures or transactions to acquire assets or the shares of other companies through debt financing which may increase Zodiac's debt levels above industry standards. Periodic fluctuations in energy prices may affect lending policies of banks.

Resource Estimates

There are numerous uncertainties inherent in estimating quantities of resources, including many factors beyond the control of Zodiac. The contingent and prospective resource information in respect of the petroleum and natural gas holdings and exploration prospects disclosed by the Corporation from time to time represent estimates only. Estimates of resources depend in large part upon the reliability of available geological and engineering data and require certain assumptions to be made in order to assign resource volumes. Geological and engineering data are used to determine the probability that a reservoir of oil and/or natural gas exists at a particular location, and whether, and to what extent, such hydrocarbons are recoverable from the reservoir. Accordingly, the ultimate resources discovered by Zodiac may be significantly less than the total estimates calculated by management of Zodiac and/or its independent engineers which may have a material adverse effect on Zodiac's business, financial condition results of operations and the value of the Common Shares.

Reserves, contingent resources and prospective resources involve different risks associated with achieving commerciality. To be classified as reserves, estimated recoverable quantities must be associated with a project that has demonstrated commercial viability. In estimating reserves, the chance of commerciality is effectively 100%. In the case of contingent resources, the chance of commerciality is equal to the chance that an accumulation will be commercially developed. For prospective resources, the chance of commerciality will be the product of the chance that a project will result in the discovery of petroleum and the chance that an accumulation will be commercially developed. There is no guarantee that the contingent and prospective resources attributed by Zodiac and/or its independent engineers to the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, including the Jaguar Prospect, from time to time, will become commercially viable.

Addition of Reserves and Resources

Zodiac currently has no reserves. Zodiac's future crude oil and natural gas reserves, production, and cash flows to be derived from any future reserves realized by Zodiac are highly dependent on Zodiac successfully discovering and developing or acquiring new reserves and resources. The addition of new reserves and resources will depend not only on Zodiac's ability to explore and develop the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, including the Jaguar Prospect, or any other properties it may have from time to time, but also, in the case of reserves, on its ability to select and acquire suitable producing properties or prospects. There can be no assurance that Zodiac's exploration, development or acquisition efforts will result in the discovery and development of commercial accumulations of oil and natural gas.

Exploration Risks

The exploration of the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, involves a high degree of risk that no production will be obtained or that the production obtained will be insufficient to recover drilling and completion costs. The costs of seismic operations and drilling, completing and operating wells are uncertain to a degree. Cost overruns can adversely affect the economics of Zodiac's exploration programs and projects. In addition, Zodiac's seismic operations and drilling plans may be curtailed, delayed or cancelled as a result of numerous factors, including, among others, equipment failures, weather or adverse climate conditions, shortages or delays in obtaining qualified personnel, shortages or delays in the delivery of or access to equipment, necessary governmental, regulatory or other third party approvals and compliance with regulatory requirements.

Stage of Development

An investment in Zodiac is subject to certain risks related to the nature of Zodiac's business and the early stage of development of Zodiac's oil and gas business. There are numerous factors which may affect the success of Zodiac's business which are beyond Zodiac's control including local, national and international economic and political conditions. Zodiac's business involves a high degree of risk which a combination of experience, knowledge and careful evaluation may not overcome. Accordingly, there can therefore be no assurance that Zodiac's business will be successful or profitable or that commercial quantities of crude oil and natural gas will be discovered by Zodiac.

Zodiac may be subject to growth-related risks, capacity constraints and pressure on its internal systems and controls, particularly given the early stage of its development. The ability of Zodiac to manage growth effectively will require it to continue to implement and improve its operational and financial systems and to expand, train and manage its employee base. The inability of Zodiac to deal with this growth could have a material adverse effect on its business, operations and prospects.

Uncertainty of Cost Estimates

Due to the nature of Zodiac's business and the early stage of development of Zodiac's oil and gas business, Zodiac is unable to estimate costs, including infrastructure improvement costs, transportation costs, seismic and drilling costs and production costs for its exploration and development plans, with complete accuracy. The inability of Zodiac to estimate these costs could affect the commerciality of the resources and reserves discovered in the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, including the Jaguar Prospect, or any other properties Zodiac may have from time to time, the economic viability of Zodiac's product and the ability of Zodiac to transport its product to market.

Limited Operating and Financial History

Zodiac has not received any commercial revenue to date from the exploration activities on its properties and Zodiac has only incurred losses since its incorporation. In addition, Zodiac has not found that development activity is warranted on any of its properties.

Zodiac's business plan requires significant expenditure, particularly capital expenditure, during the exploration phase. Zodiac will be subject to all the risks associated with establishing new oil and gas operations, including the timing and cost of the construction of infrastructure and facilities, the availability and cost of skilled labour and equipment, the need to obtain necessary environmental or other governmental approvals and permits, and the availability of funds to finance construction and development activities. Current cash positions may not be sufficient to cover the costs of Zodiac's drilling and exploration program and, accordingly, additional financing or joint venture partners may be required to conduct these activities. The inability to obtain future financing or find future joint venture partners could materially affect Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Any future profitability from Zodiac's business will depend upon the successful development of the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, including the Jaguar Prospect or any other properties Zodiac may acquire from time to time. There can be no assurance that Zodiac can achieve profitability in the future. Revenues, other than interest on unused funds, may not occur for some time, if at all. The timing and extent of any revenues is variable and uncertain and, accordingly, Zodiac is unable to predict when, if at all, profitability will be achieved.

Negative Cash Flows

To date, Zodiac has experienced negative operating cash flow and has not recorded any revenues from oil and gas operations. Zodiac does not have any commercial production and has no history of earnings or cash flow from operations. There can be no assurance that significant additional losses will not occur in the near future or that Zodiac will be profitable in the future. In the event of a commercial discovery, Zodiac's operating expenses and capital expenditures will likely increase as needed consultants, personnel and equipment associated with advancing

exploration, development and potentially commercial production are added. The amounts and timing of such expenditures will depend on the progress of Zodiac's exploration and development plans, the results of consultants' analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners, the acquisition of additional properties and other factors, many of which are not under the control of Zodiac. Zodiac expects to continue to incur losses unless and until such time as it enters into commercial production from one or more of the properties that it may have and generates sufficient revenues to fund continuing operations. The development of any properties Zodiac may have will require the commitment of substantial resources to conduct Zodiac's exploration and development plans. There can be no assurance that Zodiac will generate any revenues or achieve profitability or that the underlying assumed costs and expenses of Zodiac's exploration and development plans will prove to be accurate. Historically, the only source of funds available to Zodiac has been through the sale of equity. There is no guarantee that Zodiac will be able to sell equity or debt securities in the future. If Zodiac does not have sufficient capital for its operations, this could result in delay or indefinite postponement of further exploration or development of any properties Zodiac may have, which could have a material adverse effect on Zodiac's business, financial condition results of operations, and the value of the Common Shares.

Reliance on Operators

To the extent that Zodiac will not be the operator of its properties, it will be dependent upon other guarantors or third parties' operations for the timing of such activities and will be largely unable to control the activities of such operators. The failure of such operators and their contractors to properly perform their obligations would have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Crude Oil and Natural Gas Development

No reserves have been assigned in connection with Zodiac's oil and gas properties. The future value of Zodiac is therefore dependent on the success of Zodiac's activities which are directed toward the exploration and development of properties Zodiac may have. Zodiac has a plan to explore and develop the petroleum and natural gas holdings and exploration prospects in the San Joaquin Basin, California, which it may not be able to carry out. Zodiac's plans are contingent on the success of its work program. There is no certainty of the success of Zodiac's exploration and development plan or that Zodiac will be able to carry out its plan as contemplated or even to complete its plan. Additionally, Zodiac's current exploration and development plan could change depending on the results of its exploration and development work program.

Exploration and development of crude oil and natural gas reserves is speculative and involves a significant degree of risk. There is no guarantee that exploration or appraisal of the properties Zodiac has will lead to a commercial discovery or, if there is commercial discovery, that Zodiac will be able to realize such reserves as intended. Few properties that are explored are ultimately developed into new reserves. If at any stage Zodiac is precluded from pursuing its exploration or development plan, or such plan is otherwise not continued, Zodiac's business, financial condition, results of operations, and the value of the Common Shares could be materially adversely affected.

Crude oil and natural gas exploration involves a high degree of risk and there is no assurance that expenditures made on future exploration or development activities by Zodiac will result in discoveries of crude oil, condensate or natural gas that are commercially or economically viable. Zodiac may face shortages of and increasing costs for seismic crews and equipment, drilling and completion equipment, services (including transportation for equipment and crews) and personnel. Shortages of, or increasing costs for, experienced seismic and drilling crews and oil field equipment and services could restrict Zodiac's ability to conduct seismic operations, drill and complete wells and conduct other operations which it may currently have planned, and the timing of any such operations. Any delay in the drilling or completion of new wells or significant increase in drilling and or completion costs could reduce Zodiac's revenues and cash available for operations.

Furthermore, it is difficult to project the costs of executing any seismic program and any exploratory drilling program due to the inherent uncertainties of available logistical arrangements, including transportation, drilling in unknown formations, the costs associated with encountering various drilling conditions such as overpressured zones and tools lost in the hole, and changes in drilling plans and locations as a result of prior exploratory wells or

additional seismic data and interpretations thereof. Furthermore, drilling operations may be delayed or cancelled as a result of other factors, including encountering unexpected formations or pressures, premature declines of reservoir pressures, potential environmental damage, adverse weather conditions, concession problems, lost circulation of drilling fluids, facility or equipment malfunctions, unexpected operational events, blow-outs, fires, ruptures and spills, all of which could result in personal injuries, loss of life and damage to property of Zodiac and others.

Environmental Regulation and Risks

The crude oil and natural gas industry is subject to environmental regulations in the jurisdictions in which it operates, namely in the United States and Canada. Environmental regulations place restrictions and prohibitions on emissions of various substances produced concurrently with crude oil and natural gas and can impact on the selection of drilling sites and facility locations, potentially resulting in increased capital expenditures. Zodiac may be responsible for abandonment and site restoration costs. Zodiac is of the view that its abandonment and restoration obligations can be satisfied out of general corporate funds as such obligations become due. As of the date hereof, Zodiac has not reserved any funds for future site restoration costs.

Extensive national, state and local environmental laws and regulations affect nearly all of the operations of Zodiac. These laws and regulations set various standards regulating certain aspects of health and environmental quality, provide for penalties and other liabilities for the violation of such standards, establish in certain circumstances obligations to remediate current and former facilities and locations where operations are or were conducted, and require environmental reviews and approvals prior to the commencement of any operations. In addition, special provisions may be appropriate or required in environmentally sensitive areas of operation, including the use of newer technologies to mitigate the impact of Zodiac's oil and gas activities on such environmentally sensitive areas. There can be no assurance that Zodiac will not incur substantial financial obligations in connection with environmental compliance.

Failure to comply with these laws and regulations may trigger a variety of administrative, civil and criminal enforcement measures, including the assessment of monetary penalties, the imposition of remedial requirements, and the issuance of orders enjoining future operations.

Significant liability could be imposed on Zodiac for damages, clean up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of properties purchased by Zodiac or non-compliance with environmental laws or regulations. Such liability could have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares. Moreover, Zodiac cannot predict what environmental legislation or regulations will be enacted in the future or how existing or future laws or regulations will be administered or enforced. Compliance with more stringent laws or regulations, or more vigorous enforcement policies of any regulatory authority, could in the future require material expenditures by Zodiac for the installation and operation of systems and equipment for remedial measures, any or all of which may have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Other Regulations

Zodiac's operations are regulated extensively. Environmental and other governmental laws and regulations have increased the costs to operate the business and conduct the operations. Under these laws and regulations, Zodiac could also be liable for personal injuries, property damage and other damages. Failure to comply with these laws and regulations may result in the suspension or termination of operations and subject Zodiac to administrative, civil and criminal penalties. Moreover, public interest in environmental protection has increased in recent years, and environmental and other organizations or groups have opposed, with some success, certain drilling projects.

Zodiac's operations require numerous permits and authorisations under various laws and regulations, including environmental and health and safety laws and regulations. These authorisations and permits are subject to revocation, renewal or modification and can require operational changes, which may involve significant costs, to limit impacts or potential impacts on the environment and/or health and safety. A violation of these authorisation or permit conditions or other legal or regulatory requirements could result in substantial fines, criminal sanctions, permit revocations, injunctions and/or refinery shutdowns. In addition, major modifications of operations could

require revisions to Zodiac's existing permits and authorizations, or expensive upgrades to the existing pollution control equipment, which could have a material adverse effect on Zodiac's business, financial condition results of operations, and the value of the Common Shares.

Availability of Equipment, Logistical Support and Qualified Personnel

Oil and natural gas exploration and development activities are dependent on the availability of seismic, drilling, completion and related equipment and qualified personnel in the particular areas where such activities will be conducted. All operations, including seismic, drilling and completion operations, are also heavily dependent on the availability of limited logistical support and services, including transportation by helicopter, railcar, and trucks. Demand for such limited equipment and qualified personnel may affect the availability of such equipment and qualified personnel to Zodiac and may delay Zodiac's exploration and development activities. In addition, the costs of employing qualified personnel and transporting equipment may be very high due to the immature nature of the California unconventional resource industry and the challenges of transporting personnel and equipment there from other parts of North America. The need to hire or retain qualified personnel from outside the areas in which Zodiac operates to provide services to Zodiac in connection with its exploration and development activities in the areas in which Zodiac operates will further exacerbate costs. There is no guarantee that Zodiac will have available to it all the personnel and equipment required to implement or carry on its work program.

Seasonal Weather Conditions

Zodiac's operations will be adversely affected by seasonal weather conditions. The ability to effectively continue exploration and development activities and to transport equipment, personnel and carry out production operations may be adversely impacted by weather conditions. Adverse weather conditions may impact the timing and costs of Zodiac's plans.

Volatility of Crude Oil and Gas Prices and Markets

Assuming Zodiac's properties realize production or Zodiac acquires production, Zodiac's financial condition, operating results and future growth will be dependent on the prevailing prices for its hydrocarbons. Specifically, Zodiac's earnings and cash flows from operations will depend on the margin above fixed and variable expenses it is able to sell its raw products. Historically, the markets for crude oil and natural gas have been volatile and such markets are likely to continue to be volatile in the future. Any substantial decline in the prices of crude oil and natural gas could have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares. Additionally, in the event that Zodiac should develop or acquire any producing wells, the economics of producing may change as a result of lower prices, which could result in a suspension of production from some wells by Zodiac. No assurance can be given that crude oil and natural gas prices will be sustained at levels which will enable Zodiac to operate profitably.

Title Matters

There is no guarantee that an unforeseen defect in title, changes in laws or change in their interpretation or political events will not arise to defeat or impair the claim of Zodiac to its properties which could have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Expiration of Licences and Leases

Zodiac's properties are held in the form of licences and leases and working interests in licences and leases. If the Corporation or the holder of the licence or lease fails to meet the specific requirement of a licence or lease, the licence or lease may terminate or expire. There can be no assurance that any of the obligations required to maintain each licence or lease will be met. The termination or expiration of the Corporation's licences or leases or the working interests relating to a licence or lease may have a material adverse effect on the Corporation's business, financial condition or the value of the Common Shares.

Key Personnel

Zodiac's success depends in large part on the ability of its executive management team, particularly to deal effectively with complex risks and relationships and execute Zodiac's business development plan. The members of the management team contribute to Zodiac's ability to obtain, generate and manage opportunities. Zodiac's prospects also depend upon the continued service of its senior technical employees and consultants and its ability to hire service providers to assist it in implementing its exploration and development plans. There may be a limited number of service providers who provide transportation, including seismic services and drilling and other oilfield services to the oil and gas industries and a high demand for the services offered by these service providers. Zodiac may further experience delays or interruptions in its exploration and development plans due to its inability to engage service providers to provide the transportation, seismic and drilling services it requires to carry out its work programs. There is also no guarantee that Zodiac will be able to retain its service providers. Additionally, their relationships with governmental agencies can be critical factors in Zodiac's success. There can be no assurance that Zodiac's present key personnel and directors will remain with Zodiac or that Zodiac will be able to retain its service providers. The departure of any such key person, director or service provider may materially affect Zodiac's business, financial condition, results of operations, and the value of the Common Shares. A shortage of skilled labour may make it difficult for Zodiac to maintain labour productivity, and competitive costs could adversely affect its profitability.

Fluctuations in Foreign Currency Exchange Rates

Most of Zodiac's operations are located in the United States and operating and capital costs are generally incurred in Canadian and U.S. dollars. Fluctuations in the Canadian dollar and U.S. dollar exchange rate may cause a negative impact on revenue and costs and could have a material adverse effect on Zodiac's capital programs, business strategy, financial condition, results of operations, and the value of the Common Shares.

To the extent that Zodiac is required to hold currency positions in U.S. dollars, there is a risk from foreign exchange fluctuations. If the exchange rate of the U.S. dollar fluctuates substantially, or the rate of inflation in the U.S. materially increases, historic financial statements of Zodiac may not accurately reflect the Canadian dollar value of its assets or operations.

Such foreign exchange risk could materially adversely affect Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Risks of Foreign Operations

Zodiac is subject to political, economic, and other uncertainties, including, but not limited to changes in energy policies or the personnel administering them, currency fluctuations, exchange controls, and royalty and tax increases. Zodiac's operations may also be adversely affected by laws and policies of the United States and Canada affecting foreign trade, taxation and investment. In the event of a dispute arising in connection with Zodiac's operations in the countries in which it operates, Zodiac may be subject to the exclusive jurisdiction of United States' courts or may not be successful in subjecting foreign persons to the jurisdictions of the courts of Canada or enforcing Canadian judgments in such other jurisdictions. Accordingly, Zodiac's exploration, development and production activities in United States and Canada could be substantially affected by factors beyond Zodiac's control, any of which could have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Zodiac's business, financial condition, results of operations, and the value of the Common Shares could also be materially adversely affected by changes in government policies and legislation or social instability and other factors which are not within the control of Zodiac including, among other things, the risks of terrorism, civil strikes, and the development and abandonment of fields.

Foreign Subsidiaries

Zodiac conducts the majority of its operations through wholly-owned subsidiaries. Zodiac will be dependent on the cash flows of such subsidiaries to meet its obligations. The ability of such subsidiaries to make payments to Zodiac may be constrained by certain factors including the level of taxation, in the countries in which they operate.

Legal System

Zodiac is incorporated under the laws of Alberta; however, Zodiac carries on all of its material operations in California. Accordingly, Zodiac is subject to the legal systems and regulatory requirements of both jurisdictions with a variety of requirements and implications for shareholders of Zodiac.

Competition

The crude oil and natural gas industry is intensely competitive and Zodiac competes with other companies which possess greater technical and financial resources, including access to seismic equipment, drilling equipment, completion equipment, transportation equipment and personnel. Many of these competitors not only explore for and produce crude oil and natural gas but also carry on refining operations and market petroleum and other products on an international basis. Because of their geographic diversity, larger and more complex assets, integrated operations and greater resources, some of these competitors may be better able to compete on the basis of price and to bear the economic risks which exist in the energy industry. Further, Zodiac's ability to implement its business strategy will be dependent upon its ability to evaluate and select suitable opportunities and consummate transactions in a highly competitive environment. Crude oil and natural gas production operations are also subject to all the risks typically associated with such operations, including premature decline of reservoirs and invasion of water into producing formations.

Technological advancements in the oil and gas industry are common and rapid and competitors with greater technical and financial resources than Zodiac will be in a better position to take advantage of them. Competition could either force Zodiac to implement new technologies at a substantial cost or leave Zodiac at a competitive disadvantage due to the utilization of sub-optimal technologies.

Insurance

Oil and natural gas exploration, development and production operations are subject to all the risks and hazards typically associated with such operations, including fire, explosion, blowouts, cratering, sour gas releases, and spills, each of which could result in substantial damage to oil and natural gas wells, production facilities, other property and the environment or in personal injury. Although Zodiac has obtained insurance in accordance with industry standards to address certain of these risks, insurance may not be sufficient to cover the full extent of potential liabilities. In addition, risks may not in all circumstances be insurable or, in certain circumstances, Zodiac may elect not to obtain insurance to deal with specific risks due to the high premiums associated with such insurance or for other reasons. The payment of such uninsured liabilities would reduce the funds available to Zodiac. The occurrence of a significant event against which Zodiac is not fully insured, or the insolvency of the insurer of such event, could have a material adverse effect on Zodiac's business, financial condition, results of operations, and the value of the Common Shares.

Zodiac may be subject to certain events beyond its control which may have a material adverse effect on Zodiac's business, results of operation, financial condition, or the value of the Common Shares.

Zodiac's projects may be adversely affected by uninsurable risks outside the control of Zodiac including labour unrest, civil disorder, war, acts of terrorism, subversive activities or sabotage, fires, floods, explosions or other catastrophes, epidemics or quarantine restrictions.

Conflicts of Interest

Certain of the directors and officers of Zodiac are also directors, officers and or shareholders of other oil and gas companies involved in natural resource exploration and development, which may in the future be involved in transactions with Zodiac, and conflicts of interest may arise between their duties as officers and directors of Zodiac and as officers and directors of such other companies.

Public Market Risk

There can be no assurance that an active trading market in Zodiac's securities will be sustained. The market price for Zodiac's securities could be subject to wide fluctuations. Factors such as commodity prices, government regulation, interest rates, share price movements of Zodiac's peer companies and competitors, as well as overall market movements, may have a significant impact on the market price of the securities of Zodiac. The stock market has from time to time experienced extreme price and volume fluctuations, particularly in the oil and gas sector, which have often been unrelated to the operating performance of particular companies.

Recent Global Financial Conditions

Over the past few years, global financial conditions have been subject to increased volatility and numerous financial institutions have either gone into bankruptcy or have had to be rescued by governmental authorities. In addition, access to public financing has been negatively impacted by both sub-prime mortgages and the liquidity crisis affecting the asset-backed commercial paper market. These factors may impact the ability of Zodiac to obtain equity or debt financing in the future and, if obtained, on terms favourable to Zodiac. If these increased levels of volatility and market turmoil continue, Zodiac's operations could be negatively impacted and the value and the price the Common Shares could be adversely affected.

As a Foreign Private Issuer, our Shareholders May Have Less Complete and Timely Data

Zodiac is a "foreign private issuer" as defined in Rule 3b-4 under the Exchange Act. Our equity securities are exempt from Sections 14(a), 14(b), 14(c), 14(f) and 16 of the Exchange Act pursuant to Rule 3a12-3 of the Exchange Act. Therefore, we are not required to file a Schedule 14A proxy statement in relation to the annual meeting of shareholders. The submission of proxy and annual meeting of shareholder information on Form 6-K may result in shareholders having less complete and timely information in connection with shareholder actions. The exemption from Section 16 rules regarding reports of beneficial ownership and purchases and sales of Common Shares by insiders and restrictions on insider trading in our securities may result in shareholders having less data and there being fewer restrictions on insiders' activities in our securities.

We are a Foreign Corporation and our Directors and Officers are Outside of the United States, Which May Make Enforcement of Civil Liabilities Difficult

Zodiac is governed under the laws of the Province of Alberta, Canada. All of our directors and officers are residents of Canada, and some of our assets are located outside of the United States. Consequently, it may be difficult for United States investors to effect service of process within the United States upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under the Exchange Act.

The Corporation MAY BE A "Passive Foreign Investor Corporation" ("PFIC") Which May Have Adverse Federal Income Tax Consequences for U.S. Shareholders

If the Corporation is classified as a passive foreign investment company ("PFIC") under the meaning of Section 1297 of the Internal Revenue Code of 1986, as amended (the "Code") for any year during a U.S. shareholder's holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, or any so-called "excess distribution" received on its Common Shares, as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective "qualified electing fund" election ("QEF Election") or a "mark-to-market" election with respect to the Common Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of the Corporation's net capital gain and ordinary earnings for any year in which the Corporation is a PFIC, whether or not the Corporation distributes any amounts to its shareholders. However, U.S. shareholders should be aware that there can be no assurance that the Corporation will satisfy record keeping requirements that apply to a qualified electing fund, or that the Corporation will supply U.S. shareholders with information that such U.S. shareholders require to report under the QEF Election rules, in the event that the Corporation is a PFIC and a U.S. shareholder wishes to make a QEF Election. Thus, U.S. shareholders may not be able to make, if required, a QEF Election with respect to their Common Shares. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common Shares over the taxpayer's basis therein. This paragraph is qualified in its entirety by the discussion below under the heading "Certain United States Federal Income Tax Consequences." Each U.S. shareholder should consult its own tax advisors regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares.

Broker-Dealers May Be Discouraged From Effecting Transactions In Our Common Shares Because They are Considered a Penny Stock and are Subject To The Penny Stock Rules