Washington, D.C. 20549

Abigail J. Murray

RiverNorth Opportunities Fund, Inc.

| Performance Overview | 2 |

| Statement of Investments | 6 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statement of Changes in Net Assets | 10 |

| Financial Highlights | 11 |

| Notes to Financial Statements | 12 |

| Dividend Reinvestment Plan | 19 |

| Approval of Investment Advisory and Sub-Advisory Agreements | 21 |

| Additional Information | 24 |

INVESTMENT OBJECTIVE

RiverNorth Opportunities Fund, Inc.’s (the “Fund”) investment objective is total return consisting of capital appreciation and current income.

PERFORMANCE OVERVIEW

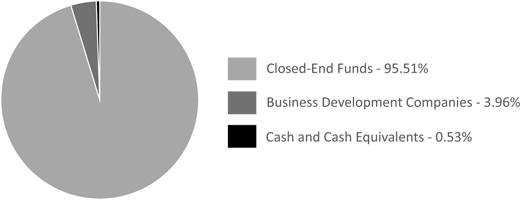

After starting out with 100% cash immediately following the Fund’s initial public offering (“IPO”) in December, 2015, we have fully deployed the Fund’s strategy as of April 30, 2016. There was significant discount widening among closed-end funds (CEFs) during the first half of the period, which provided the Fund the opportunity to put cash to work at what we found to be attractive valuations. Closed-end fund discounts were 7.9%, on average, on the Fund’s first day of trading, widened out to 10.3% on January 20, 2016, and ended the period at 5.2%. As of April 30, 2016, the weighted average discount of the CEFs in the Fund’s portfolio was 12.2%.

As of April 30, 2016, the Fund’s portfolio was approximately 55% fixed income, 35% equity, 7% hybrid, and 3% cash on an unlevered basis. Among the fixed income holdings, the largest allocations were to multi-sector bond CEFs and bank loan CEFs, while the largest allocation among the equity portion was to U.S. general equity CEFs.

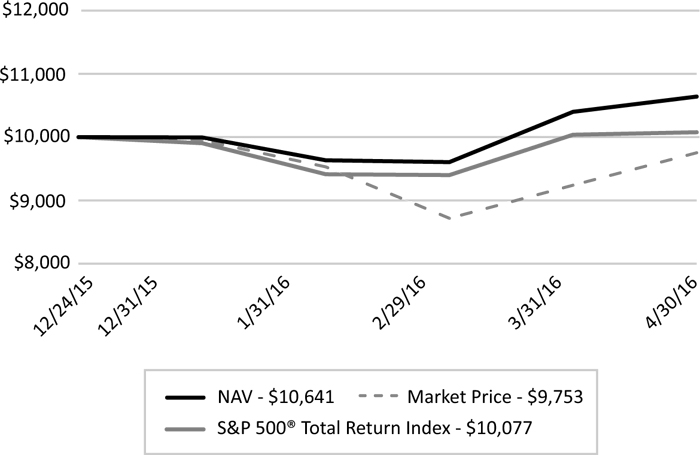

PERFORMANCE as of April 30, 2016

| | CUMULATIVE |

TOTAL RETURNS(1) | Since Inception(2) |

RiverNorth Opportunities Fund, Inc. - NAV(3) | 6.41% |

RiverNorth Opportunities Fund, Inc. - Market Price(4) | -2.47% |

S&P 500® Total Return Index | 0.77% |

| (1) | Total returns assume reinvestment of all distributions. |

| (2) | The Fund commenced operations on December 24, 2015. |

| (3) | Performance returns are net of management fees and other Fund expenses. |

| (4) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

Performance data quoted represents past performance, which is not a guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and investment return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling (855)830-1222 or by visiting www.rivernorthcef.com. Total return measures net investment income and capital gain or loss from portfolio investments. All performance shown assumes reinvestment of dividends and capital gains distributions.

Total annual expense ratio as a percentage of net assets attributable to common shares excluding interest expense: 2.98%.

The Fund is a closed-end fund and does not continuously issue shares for sale as open-end mutual funds do. Since the initial public offering, the Fund now trades only in the secondary market. Investors wishing to buy or sell shares need to place orders through an intermediary or broker and additional charges or commissions will apply. The share price of a closed-end fund is based on the market’s value.

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | April 30, 2016 (Unaudited) |

S&P 500® Total Return Index – A market value weighted index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. This index is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. This index reflects the effects of dividend reinvestment.

Indices are unmanaged; their returns do not reflect any fees, expenses, or sales charges.

An investor cannot invest directly in an index.

ALPS Advisors, Inc. is the investment adviser to the Fund.

RiverNorth Capital Management, LLC is the investment sub-adviser to the Fund. RiverNorth Capital Management, LLC is not affiliated with ALPS Advisors, Inc. or any of its affiliates.

Secondary market support provided to the Fund by ALPS Fund Services, Inc.’s affiliate, ALPS Portfolio Solutions Distributor, Inc., a FINRA member.

Semi-Annual Report | April 30, 2016 | 3 |

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | April 30, 2016 (Unaudited) |

GROWTH OF A HYPOTHETICAL $10,000 INVESTMENT

The graph below illustrates the growth of a hypothetical $10,000 investment assuming the purchase of common shares at the closing market price (NYSE: RIV) of $20.00 on December 24, 2015 (the date of commencement of operations), and tracking its progress through April 30, 2016.

Past performance does not guarantee future results. Performance will fluctuate with changes in market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

ASSET ALLOCATION as of April 30, 2016^

| ^ | Holdings are subject to change. |

Percentages are based on total investments of the Fund.

| RiverNorth Opportunities Fund, Inc. | Performance Overview |

| | April 30, 2016 (Unaudited) |

TOP TEN HOLDINGS as of April 30, 2016

| | % of Total Investments |

| Royce Value Trust, Inc. | 6.51% |

| Clough Global Opportunities Fund | 5.01% |

| PIMCO Dynamic Credit Income Fund | 4.89% |

| BlackRock Multi-Sector Income Trust | 4.08% |

| Zweig Fund, Inc. | 4.00% |

| Virtus Total Return Fund | 3.85% |

| Ares Dynamic Credit Allocation Fund, Inc. | 3.41% |

| Alpine Total Dynamic Dividend Fund | 3.09% |

| Brookfield Global Listed Infrastructure Income Fund, Inc. | 3.04% |

| Invesco Senior Income Trust | 3.00% |

| | 40.88% |

Holdings are subject to change.

Semi-Annual Report | April 30, 2016 | 5 |

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

| | April 30, 2016 (Unaudited) |

| Description | | Shares | | | Value (Note 2) | |

| CLOSED-END FUNDS (95.42%) | |

| Adams Diversified Equity Fund, Inc. | | | 100,666 | | | $ | 1,273,425 | |

| Advent Claymore Convertible Securities and Income Fund | | | 138,793 | | | | 1,938,938 | |

| Advent Claymore Convertible Securities and Income Fund II | | | 323,570 | | | | 1,811,992 | |

| Advent/Claymore Enhanced Growth & Income Fund | | | 106,666 | | | | 900,261 | |

| AllianzGI Diversified Income & Convertible Fund | | | 53,693 | | | | 956,272 | |

| AllianzGI NFJ Dividend Interest & Premium Strategy Fund | | | 167,044 | | | | 2,084,709 | |

| Alpine Total Dynamic Dividend Fund | | | 309,050 | | | | 2,339,509 | |

| Apollo Senior Floating Rate Fund, Inc. | | | 46,651 | | | | 734,753 | |

| Ares Dynamic Credit Allocation Fund, Inc. | | | 187,030 | | | | 2,577,273 | |

| Avenue Income Credit Strategies Fund | | | 36,800 | | | | 427,616 | |

| BlackRock Debt Strategies Fund, Inc. | | | 480,030 | | | | 1,684,905 | |

| BlackRock Multi-Sector Income Trust | | | 190,962 | | | | 3,084,036 | |

| Blackstone/GSO Long-Short Credit Income Fund | | | 70,626 | | | | 989,470 | |

| Blackstone/GSO Strategic Credit Fund | | | 140,084 | | | | 1,949,969 | |

| Brookfield Global Listed Infrastructure Income Fund, Inc. | | | 189,284 | | | | 2,297,909 | |

| Brookfield Mortgage Opportunity Income Fund, Inc. | | | 118,994 | | | | 1,775,390 | |

| Calamos Convertible Opportunities and Income Fund | | | 54,940 | | | | 530,171 | |

| Calamos Global Dynamic Income Fund | | | 273,732 | | | | 1,951,709 | |

| Clough Global Allocation Fund | | | 24,981 | | | | 292,278 | |

| Clough Global Equity Fund | | | 22,556 | | | | 244,281 | |

| Clough Global Opportunities Fund | | | 399,909 | | | | 3,787,138 | |

| Deutsche Global High Income Fund, Inc. | | | 3,300 | | | | 26,499 | |

| Deutsche High Income Opportunities Fund, Inc. | | | 200 | | | | 2,710 | |

| Deutsche Multi-Market Income Trust | | | 64,545 | | | | 532,496 | |

| Deutsche Strategic Income Trust | | | 4,635 | | | | 53,117 | |

| Eaton Vance Floating-Rate Income Trust | | | 104,748 | | | | 1,379,531 | |

| Eaton Vance Limited Duration Income Fund | | | 164,208 | | | | 2,193,819 | |

| Eaton Vance Short Duration Diversified Income Fund | | | 52,080 | | | | 704,642 | |

| First Trust Aberdeen Global Opportunity Income Fund | | | 21,180 | | | | 234,886 | |

| Franklin Limited Duration Income Trust | | | 101,033 | | | | 1,174,003 | |

| General American Investors Co., Inc. | | | 59,112 | | | | 1,856,117 | |

| Guggenheim Enhanced Equity Income Fund | | | 7,423 | | | | 55,227 | |

| Invesco Senior Income Trust | | | 556,158 | | | | 2,269,125 | |

| KKR Income Opportunities Fund | | | 5,938 | | | | 87,407 | |

| Legg Mason BW Global Income Opportunities Fund, Inc. | | | 67,550 | | | | 847,077 | |

| LMP Capital and Income Fund, Inc. | | | 69,206 | | | | 878,916 | |

| MFS Intermediate High Income Fund | | | 75,632 | | | | 184,542 | |

| Neuberger Berman Real Estate Securities Income Fund, Inc. | | | 151,882 | | | | 779,155 | |

| NexPoint Credit Strategies Fund | | | 21,619 | | | | 423,300 | |

| Nuveen Credit Strategies Income Fund | | | 193,602 | | | | 1,535,264 | |

| Nuveen Global Equity Income Fund | | | 44,402 | | | | 499,523 | |

| Nuveen Global High Income Fund | | | 50,343 | | | | 717,388 | |

| Nuveen Senior Income Fund | | | 179,988 | | | | 1,085,328 | |

| Pacholder High Yield Fund, Inc. | | | 54,101 | | | | 368,428 | |

| RiverNorth Opportunities Fund, Inc. | Statement of Investments |

| | April 30, 2016 (Unaudited) |

| Description | | Shares | | | Value (Note 2) | |

| PIMCO Dynamic Credit Income Fund | | | 202,216 | | | $ | 3,694,486 | |

| Prudential Global Short Duration High Yield Fund, Inc. | | | 106,605 | | | | 1,591,613 | |

| Royce Value Trust, Inc. | | | 409,557 | | | | 4,918,781 | |

| Sprott Focus Trust, Inc. | | | 111,172 | | | | 717,059 | |

| Tri-Continental Corp. | | | 1,715 | | | | 34,729 | |

| Virtus Total Return Fund | | | 682,693 | | | | 2,908,272 | |

| Voya Emerging Markets High Income Dividend Equity Fund | | | 35,264 | | | | 266,948 | |

| Voya Prime Rate Trust | | | 91,436 | | | | 461,752 | |

| Wells Fargo Advantage Multi-Sector Income Fund | | | 36,788 | | | | 462,425 | |

| Western Asset Emerging Markets Income Fund, Inc. | | | 82,507 | | | | 870,449 | |

| Zweig Fund, Inc. | | | 233,626 | | | | 3,020,785 | |

| Zweig Total Return Fund, Inc. | | | 141,472 | | | | 1,737,276 | |

| | | | | | | | | |

| TOTAL CLOSED-END FUNDS | | | | | |

| (Cost $69,789,861) | | | | 72,205,079 | |

| | | | | | | | | |

| BUSINESS DEVELOPMENT COMPANIES (3.95%) | |

American Capital Ltd.(a) | | | 73,200 | | | | 1,156,560 | |

| MVC Capital, Inc. | | | 52,503 | | | | 390,097 | |

| OHA Investment Corp. | | | 509,686 | | | | 1,442,412 | |

| | | | | | | | | |

| TOTAL BUSINESS DEVELOPMENT COMPANIES | | | | | |

| (Cost $3,020,774) | | | | 2,989,069 | |

| | | 7-Day Yield | | | Shares | | | Value (Note 2) | |

| SHORT TERM INVESTMENTS (0.53%) | |

| State Street Institutional Treasury Money Market Fund | | | 0.161 | % | | | 402,416 | | | | 402,416 | |

| | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | |

| (Cost $402,416) | | | | | | | | | | | 402,416 | |

| | | | | | | | | | | | | |

| TOTAL INVESTMENTS (99.90%) | | | | | |

| (Cost $73,213,051) | | | | | | | $ | 75,596,564 | |

| | | | | | | | | | | | | |

| Other Assets In Excess Of Liabilities (0.10%) | | | | | | | | 75,518 | |

| NET ASSETS (100.00%) | | | $ | 75,672,082 | |

(a) | Non-income producing security. |

See Notes to Financial Statements

| ASSETS: | | | |

| Investments, at value | | $ | 75,596,564 | |

| Receivable for investments sold | | | 1,849,549 | |

| Dividends receivable | | | 89,243 | |

| Prepaid and other assets | | | 126 | |

| Total Assets | | | 77,535,482 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 1,741,224 | |

| Payable to adviser | | | 61,283 | |

| Payable to administrator | | | 10,128 | |

| Payable to transfer agent | | | 5,821 | |

| Payable for trustee fees | | | 1,059 | |

| Other payables | | | 43,885 | |

| Total Liabilities | | | 1,863,400 | |

| Net Assets | | $ | 75,672,082 | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 72,699,801 | |

| Undistributed net investment income | | | 713,617 | |

| Accumulated net realized loss on investments | | | (124,849 | ) |

| Net unrealized appreciation on investments | | | 2,383,513 | |

| Net Assets | | $ | 75,672,082 | |

| | | | | |

| PRICING OF SHARES: | | | | |

| Net Assets | | $ | 75,672,082 | |

| Shares of common stock outstanding (37,500,000 of shares authorized, at $0.0001 par value per share) | | | 3,755,155 | |

| Net asset value per share | | $ | 20.15 | |

| | | | | |

| Cost of Investments | | $ | 73,213,051 | |

See Notes to Financial Statements

| RiverNorth Opportunities Fund, Inc. | Statement of Operations |

| For the Period December 24, 2015 (Commencement) to April 30, 2016 (Unaudited) |

| INVESTMENT INCOME: | |

| Dividends | | $ | 2,824,211 | |

| Total Investment Income | | | 2,824,211 | |

| | | | | |

| EXPENSES: | |

| Investment advisory fees | | | 252,113 | |

| Administration fees | | | 38,759 | |

| Transfer agent fees | | | 9,194 | |

| Audit fees | | | 9,892 | |

| Legal fees | | | 21,147 | |

| Custodian fees | | | 3,524 | |

| Trustee fees | | | 31,000 | |

| Printing fees | | | 8,505 | |

| Insurance fees | | | 15,708 | |

| Other | | | 12,156 | |

| Total Expenses | | | 401,998 | |

| Net Investment Income | | | 2,422,213 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | (124,849 | ) |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Investments | | | 2,383,513 | |

| Net Realized and Unrealized Gain on Investments | | | 2,258,664 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 4,680,877 | |

See Notes to Financial Statements

Semi-Annual Report | April 30, 2016 | 9 |

| RiverNorth Opportunities Fund, Inc. | |

| Statement of Changes in Net Assets | |

| | | For the Period December 24, 2015 (Commencement of Operations) to April 30, 2016 (Unaudited) | |

| | | | |

| OPERATIONS: | | | |

| Net investment income | | $ | 2,422,213 | |

| Net realized loss on investments | | | (124,849 | ) |

| Net change in unrealized appreciation on investments | | | 2,383,513 | |

| Net increase in net assets resulting from operations | | | 4,680,877 | |

| | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | |

| From net investment income | | | (1,708,596 | ) |

| Net decrease in net assets from distributions to shareholders | | | (1,708,596 | ) |

| | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | |

| Proceeds from sales of shares, net of offering costs | | | 72,599,794 | |

| Net increase in net assets from capital share transactions | | | 72,599,794 | |

| | | | | |

| Net Increase in Net Assets | | | 75,572,075 | |

| | | | | |

| NET ASSETS: | |

| Beginning of period | | | 100,007 | |

| End of period (including undistributed net investment income of $713,617) | | $ | 75,672,082 | |

See Notes to Financial Statements

| RiverNorth Opportunities Fund, Inc. | Financial Highlights |

| For a share outstanding throughout the period presented. |

| | | For the Period December 24, 2015 (Commencement of Operations) to April 30, 2016 (Unaudited) | |

| | | | |

| Net asset value - beginning of period | | $ | 19.40 | |

| Income/(loss) from investment operations: | | | | |

Net investment income(a) | | | 0.65 | |

| Net realized and unrealized gain on investments | | | 0.60 | |

| Total income from investment operations | | | 1.25 | |

| | | | | |

| Less distributions to shareholders: | | | | |

| From net investment income | | | (0.46 | ) |

| Total distributions | | | (0.46 | ) |

| | | | | |

| Capital share transactions: | | | | |

| Common share offering costs charged to paid-in capital | | | (0.04 | ) |

| Total capital share transactions | | | (0.04 | ) |

| | | | | |

| Net increase in net asset value | | | 0.75 | |

| Net asset value - end of period | | $ | 20.15 | |

| Market price - end of period | | $ | 19.04 | |

| | | | | |

Total Return(b) | | | 6.41 | % |

Total Return - Market Price(b) | | | (2.47 | %) |

| | | | | |

| Supplemental Data: | | | | |

| Net assets, end of period (in thousands) | | $ | 75,672 | |

| Ratios to Average Net Assets: | | | | |

| Total expenses | | | 1.59 | %(c) |

| Net investment income | | | 9.61 | %(c) |

| Portfolio turnover rate | | | 32 | %(d) |

(a) | Calculated using average shares throughout the period. |

(b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. For purposes of this calculation, dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment returns do not reflect brokerage commissions, if any. Periods less than one year are not annualized. |

(c) | Annualized. |

(d) | Not annualized. |

See Notes to Financial Statements

Semi-Annual Report | April 30, 2016 | 11 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

1. ORGANIZATION

RiverNorth Opportunities Fund, Inc. (the “Fund”) is a Maryland corporation registered as a diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund commenced operations on December 24, 2015. Prior to that date, the Fund had no operations other than matters relating to its organization and the sale and issuance of 5,155 common shares of beneficial interest in the Fund (“Common Shares”) to ALPS Advisors, Inc. (“AAI”) at a price of $19.40 per share, net of 3.00% sales load. AAI agreed to pay all of the Fund’s organizational expenses and certain offering expenses. The Fund’s investment objective is total return consisting of capital appreciation and current income.

The Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy and opportunistically investing under normal circumstances in closed-end funds and exchange-traded funds (“ETFs” and collectively, “Underlying Funds”). Underlying Funds also may include business development companies (“BDCs”). All Underlying Funds will be registered under the Securities Act of 1933, as amended (the “Securities Act”). The Fund will incur higher and additional expenses when it invests in Underlying Funds. There is also the risk that the Fund may suffer losses due to the investment practices or operations of the Underlying Funds. To the extent that the Fund invests in one or more Underlying Funds that concentrate in a particular industry, the Fund would be vulnerable to factors affecting that industry and the concentrating Underlying Funds’ performance, and that of the Fund, may be more volatile than Underlying Funds that do not concentrate. In addition, one Underlying Fund may purchase a security that another Underlying Fund is selling.

2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates: The preparation of the financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements during the period reported. Management believes the estimates and security valuations are appropriate; however, actual results may differ from those estimates, and the security valuations reflected in the financial statements may differ from the value the Fund ultimately realizes upon sale of the securities. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946. The financial statements have been prepared as of the close of the New York Stock Exchange (“NYSE”) on April 30, 2016.

Portfolio Valuation: The net asset value per Common Share of the Fund is determined daily, on each day that the NYSE is open for trading, as of the close of regular trading on the NYSE (normally 4:00 p.m. New York time). The Fund’s net asset value per Common Share is calculated by dividing the value of the Fund’s total assets, less its liabilities by the number of shares outstanding.

The Board of Directors (the “Board”) has established the following procedures for valuation of the Fund’s assets under normal market conditions. Marketable securities listed on foreign or U.S. securities exchanges generally are valued at closing sale prices or, if there were no sales, at the mean between the closing bid and ask prices on the exchange where such securities are primarily

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

traded. If the independent primary or secondary pricing service is unable to provide a price for a security, if the price provided by the independent primary or secondary pricing service is deemed unreliable, or if events occurring after the close of the market for a security but before the time as of which the Fund values its Common Shares would materially affect net asset value, such security will be valued at its fair value as determined in good faith under procedures approved by the Board.

When applicable, fair value of an investment is determined by the Fund’s Fair Valuation Committee as a designee of the Board. In fair valuing the Fund’s investments, consideration is given to several factors, which may include, among others, the following: the fundamental business data relating to the issuer, borrower, or counterparty; an evaluation of the forces which influence the market in which the investments are purchased and sold; the type, size and cost of the investment; the information as to any transactions in or offers for the investment; the price and extent of public trading in similar securities (or equity securities) of the issuer, or comparable companies; the coupon payments, yield data/cash flow data; the quality, value and saleability of collateral, if any, securing the investment; the business prospects of the issuer, borrower, or counterparty, as applicable, including any ability to obtain money or resources from a parent or affiliate and an assessment of the issuer’s, borrower’s, or counterparty’s management; the prospects for the industry of the issuer, borrower, or counterparty, as applicable, and multiples (of earnings and/or cash flow) being paid for similar businesses in that industry; one or more independent broker quotes for the sale price of the portfolio security; and other relevant factors.

Securities Transactions and Investment Income: Investment security transactions are accounted for on a trade date basis. Dividend income is recorded on the ex-dividend date. Realized gains and losses from securities transactions and unrealized appreciation and depreciation of securities are determined using the first-in/first-out cost basis method for both financial reporting and tax purposes.

Fair Value Measurements: The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

Semi-Annual Report | April 30, 2016 | 13 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 | – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 | – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 | – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2016:

| Investments in Securities at Value | | Level 1 - Quoted Prices | | | Level 2 - Other Significant Observable Inputs | | | Level 3 - Significant Unobservable Inputs | | | Total | |

| Closed-End Funds | | $ | 72,205,079 | | | $ | – | | | $ | – | | | $ | 72,205,079 | |

| Business Development Companies | | | 2,989,069 | | | | – | | | | – | | | | 2,989,069 | |

| Short Term Investments | | | 402,416 | | | | – | | | | – | | | | 402,416 | |

| Total | | $ | 75,596,564 | | | $ | – | | | $ | – | | | $ | 75,596,564 | |

The Fund recognizes transfers between levels as of the end of the period. For the period ended April 30, 2016, the Fund did not have any significant transfers between Level 1 and Level 2 securities. The Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value.

3. INVESTMENT ADVISORY AND OTHER AGREEMENTS

AAI serves as the Fund’s investment adviser pursuant to an Investment Advisory Agreement with the Fund. As compensation for its services to the Fund, AAI receives an annual investment advisory fee of 1.00% based on the Fund’s average daily Managed Assets (as defined below). Pursuant to an Investment Sub-Advisory Agreement, AAI has retained RiverNorth Capital Management LLC (‘‘RiverNorth’’) as the Fund’s sub-adviser and will pay RiverNorth an annual fee of 0.85% based on the Fund’s average daily Managed Assets.

ALPS Fund Services, Inc. (‘‘AFS’’), an affiliate of AAI, serves as administrator to the Fund. Under an Administration, Bookkeeping and Pricing Services Agreement, AFS is responsible for calculating the net asset values, providing additional fund accounting and tax services, and providing fund

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

administration and compliance-related services to the Fund. AFS is entitled to receive a monthly fee, accrued daily based on the Fund’s average Managed Assets, as defined below, plus reimbursement for certain out-of-pocket expenses.

DST Systems, Inc. (‘‘DST’’), the parent company of AAI and AFS, serves as the Transfer Agent to the Fund. Under the Transfer Agency Agreement, DST is responsible for maintaining all shareholder records of the Fund. DST is entitled to receive an annual minimum fee of $22,500 plus out-of-pocket expenses.

The Fund pays no salaries or compensation to any of its interested Directors or its Officers. For their services, the four independent Directors of the Fund receive an annual retainer in the amount of $17,000, an additional $2,000 for attending each meeting of the Board and $1,000 for attending a special meeting of the Board. The independent Directors are also reimbursed for all reasonable out-of-pocket expenses relating to attendance at meetings of the Board.

A Director and certain Officers of the Fund are also officers of AAI.

Managed Assets: For these purposes, the term Managed Assets is defined as the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be outstanding), calculated as of 4:00 p.m. Eastern time on such day or as of such other time or times as the Board may determine in accordance with the provisions of applicable law and of the declaration and bylaws of the Fund and with resolutions of the Board of Directors as from time to time in force.

The Fund may use leverage through borrowings or the issuance of preferred stock, in an aggregate amount of up to 15% of the Fund’s Managed Assets immediately after such borrowings or issuance. The underlying funds that the Fund invests in may also use leverage; provided, however, it is the intention of the Fund that the Fund’s direct use of leverage and the Fund’s overall exposure to leverage utilized by all the underlying funds will not exceed 33 1/3% of the Fund’s Managed Assets. The sub-adviser will assess whether or not to engage in leverage based on its assessment of conditions in the debt and credit markets. Leverage, if used, is expected to take the form of a borrowing or the issuance of preferred stock, although the Fund currently anticipates that leverage will initially be obtained through the use of bank borrowings or other similar term loans.

4. DISTRIBUTIONS

The Fund intends to distribute to Common Shareholders regular monthly cash distributions of its net investment income. In addition, the Fund intends to distribute its net realized capital gains, if any, at least annually. At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return capital, in addition to current net investment income. Any distribution that is treated as a return of capital generally will reduce a shareholder’s basis in his or her shares, which may increase the capital gain or reduce the capital loss realized upon the sale of such shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain, assuming the shares are held as capital assets.

Semi-Annual Report | April 30, 2016 | 15 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

In addition to regular monthly distributions, for the first year following the completion of the Fund’s initial public offering, the Fund intends to pay quarterly distributions (each, a “Contingent Quarterly Special Distribution”) to Common Shareholders if the conditions described below have been met (the “Contingent Quarterly Special Distribution Program”). The date on which the amount of the Contingent Quarterly Special Distribution will be measured (each, a “Quarterly Special Distribution Measurement Date”) for the first Contingent Quarterly Special Distribution was March 15, 2016 and subsequent Quarterly Special Distribution Measurement Dates will occur every three months thereafter (a “Quarterly Special Distribution Period”) on the 15th day of each such month (or, if such date is not a business day, on the first business day thereafter) during the one-year period following the completion of this offering. The aggregate amount payable for each Quarterly Special Distribution Period is expected to be equal to 50% of the amount by which the net asset value of the Fund as of the applicable Quarterly Special Distribution Measurement Date (the “Measurement NAV”) exceeds the net asset value of the Fund as of the most recent prior Quarterly Special Distribution Measurement Date for which a Contingent Quarterly Special Distribution was paid (the “Benchmark NAV”). The calculation of the Measurement NAV and the Benchmark NAV will be appropriately adjusted to reflect distributions paid or to be paid by the Fund. For purposes of calculating the Measurement NAV, the Fund will subtract from the net asset value as of the Quarterly Special Distribution Measurement Date the amount of any regular monthly distribution not reflected in the net asset value on such date but which is declared prior to or simultaneous with the declaration of the Contingent Quarterly Special Distribution during that month. In addition, for purposes of calculating the Benchmark NAV, the Fund will subtract from the NAV as of the Quarterly Special Distribution Measurement Date for the applicable prior Quarterly Special Distribution Period the amounts of any Contingent Quarterly Special Distribution and regular monthly distribution that had not been reflected in the net asset value as of such date but were declared by the end of the month in which such Quarterly Special Distribution Measurement Date occurred. For the purposes of the first Contingent Quarterly Special Distribution, the Benchmark NAV was $19.36 per Common Share. There can be no assurance that the net asset value of the Fund will increase or any Contingent Quarterly Special Distribution will be made by the Fund. The Board will review the Contingent Quarterly Special Distribution Program from time to time and may determine to modify, suspend or cancel the program.

Subsequent to April 30, 2016, the Fund paid the following distributions:

| Ex-Date | Record Date | Payable Date | Rate (per share) |

| May 12, 2016 | May 16, 2016 | May 26, 2016 | $0.140 |

| June 16, 2016 | June 20, 2016 | June 30, 2016 | $0.140 |

The Fund’s authorized capital stock consists of 37,500,000 shares of common stock, $0.0001 par value per share, all of which is initially classified as Common Shares. Under the rules of the NYSE applicable to listed companies, the Fund is required to hold an annual meeting of stockholders in each year.

Under the Fund’s Charter, the Board is authorized to classify and reclassify any unissued shares of stock into other classes or series of stock and authorize the issuance of shares of stock without obtaining stockholder approval. Also, the Fund’s Board, with the approval of a majority of the

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

entire Board, but without any action by the stockholders of the Fund, may amend the Fund’s Charter from time to time to increase or decrease the aggregate number of shares of stock of the Fund or the number of shares of stock of any class or series that the Fund has authority to issue.

The Fund issued 3,755,155 Common Shares in its initial public offering on December 23, 2016. These Common Shares were issued at $20.00 per share before the underwriting discount of $0.60 per share. Offering costs of $150,206 (representing $0.04 per Common Share) were offset against proceeds of the offerings and have been charged to paid-in capital of the Common Shares. AAI agreed to pay those offering costs of the Fund (other than the sales load) that exceeded $0.04 per Common Share.

Additional shares of the Fund may be issued under certain circumstances pursuant to the Fund’s Automatic Dividend Reinvestment Plan, as defined within the Fund’s organizational documents. Additional information concerning the Automatic Dividend Reinvestment Plan is included within this report.

6. PORTFOLIO INFORMATION

Purchases and Sales of Securities: For the period ended April 30, 2016, the cost of purchases and proceeds from sales of securities, excluding short‐term obligations, were $90,603,711 and $17,668,226, respectively.

7. TAXES

Classification of Distributions: Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund.

The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year‐end and are not available for the period ended April 30, 2016.

Semi-Annual Report | April 30, 2016 | 17 |

| RiverNorth Opportunities Fund, Inc. | Notes to Financial Statements |

| April 30, 2016 (Unaudited) |

Tax Basis of Investments: Net unrealized appreciation/(depreciation) of investments based on federal tax cost as of April 30, 2016, were as follows:

| Cost of investments for income tax purposes | | $ | 73,213,051 | |

| Gross appreciation on investments (excess of value over tax cost) | | $ | 2,932,453 | |

| Gross depreciation on investments (excess of tax cost over value) | | | (548,940 | ) |

| Net unrealized appreciation on investments | | $ | 2,383,513 | |

Federal Income Tax Status: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its investment company taxable net income and realized gain, not offset by capital loss carryforwards, if any, to its shareholders. No provision for federal income taxes has been made. During the period, the Fund paid an excise tax of $216 as required under Internal Revenue Code §4982, primarily due to the timing of income inclusions from Passive Foreign Investment Companies (“PFICs”) held by the Fund. As of April 30, 2016, $2 of the $216 excise tax paid was included on the Statement of Operations.

As of and during the period ended April 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return. The Fund’s commencement date was December 23, 2015; therefore, no tax returns have been filed as of the date of this report.

| RiverNorth Opportunities Fund, Inc. | Dividend Reinvestment Plan |

| April 30, 2016 (Unaudited) |

RiverNorth Opportunities Fund, Inc. (the “Fund”) has a dividend reinvestment plan commonly referred to as an “opt-out” plan. Unless the registered owner of the Fund’s common stock (the “Common Shares”) elects to receive cash by contacting DST Systems, Inc. (the “Plan Administrator”), all dividends declared on Common Shares will be automatically reinvested by the Plan Administrator for shareholders in the Fund’s Automatic Dividend Reinvestment Plan (the “Plan”), in additional Common Shares. Common Shareholders who elect not to participate in the Plan will receive all dividends and other distributions in cash paid by check mailed directly to the shareholder of record (or, if the Common Shares are held in street or other nominee name, then to such nominee) by the Plan Administrator as dividend disbursing agent. Participation in the Plan is completely voluntary and may be terminated or resumed at any time without penalty by notice if received and processed by the Plan Administrator prior to the dividend record date; otherwise such termination or resumption will be effective with respect to any subsequently declared dividend or other distribution. Such notice will be effective with respect to a particular dividend or other distribution (together, a “Dividend”). Some brokers may automatically elect to receive cash on behalf of Common Shareholders and may re-invest that cash in additional Common Shares.

Whenever the Fund declares a Dividend payable in cash, non-participants in the Plan will receive cash and participants in the Plan will receive the equivalent in Common Shares. The Common Shares will be acquired by the Plan Administrator for the participants’ accounts, depending upon the circumstances described below, either (i) through receipt of additional unissued but authorized Common Shares from the Fund (“Newly Issued Common Shares”) or (ii) by purchase of outstanding Common Shares on the open market (“Open-Market Purchases”) on the New York Stock Exchange (“NYSE”) or elsewhere. If, on the payment date for any Dividend, the closing market price plus estimated brokerage commissions per Common Share is equal to or greater than the net asset value per Common Share, the Plan Administrator will invest the Dividend amount in Newly Issued Common Shares on behalf of the participants. The number of Newly Issued Common Shares to be credited to each participant’s account will be determined by dividing the dollar amount of the Dividend by the Fund’s net asset value per Common Share on the payment date. If, on the payment date for any Dividend, the net asset value per Common Share is greater than the closing market value plus estimated brokerage commissions (i.e., the Fund’s Common Shares are trading at a discount), the Plan Administrator will invest the Dividend amount in Common Shares acquired on behalf of the participants in Open-Market Purchases.

In the event of a market discount on the payment date for any Dividend, the Plan Administrator will have until the last business day before the next date on which the Common Shares trade on an “ex-dividend” basis or 30 days after the payment date for such Dividend, whichever is sooner (the “Last Purchase Date”), to invest the Dividend amount in Common Shares acquired in Open-Market Purchases. It is contemplated that the Fund will pay monthly income Dividends. If, before the Plan Administrator has completed its Open-Market Purchases, the market price per Common Share exceeds the net asset value per Common Share, the average per Common Share purchase price paid by the Plan Administrator may exceed the net asset value of the Common Shares, resulting in the acquisition of fewer Common Shares than if the Dividend had been paid in Newly Issued Common Shares on the Dividend payment date. Because of the foregoing difficulty with respect to Open-Market Purchases, the Plan provides that if the Plan Administrator is unable to invest the full Dividend amount in Open-Market Purchases during the purchase period or if the market discount shifts to a market premium during the purchase period, the Plan Administrator may cease making Open-Market Purchases and may invest the uninvested portion of the Dividend amount in Newly

Semi-Annual Report | April 30, 2016 | 19 |

| RiverNorth Opportunities Fund, Inc. | Dividend Reinvestment Plan |

| April 30, 2016 (Unaudited) |

Issued Common Shares at the net asset value per Common Share at the close of business on the Last Purchase Date.

The Plan Administrator maintains all shareholders’ accounts in the Plan and furnishes written confirmation of all transactions in the accounts, including information needed by shareholders for tax records. Common Shares in the account of each Plan participant will be held by the Plan Administrator on behalf of the Plan participant, and each shareholder proxy will include those shares purchased or received pursuant to the Plan. The Plan Administrator will forward all proxy solicitation materials to participants and vote proxies for shares held under the Plan in accordance with the instructions of the participants.

Beneficial owners of Common Shares who hold their Common Shares in the name of a broker or nominee should contact the broker or nominee to determine whether and how they may participate in the Plan. In the case of Common Shareholders such as banks, brokers or nominees which hold shares for others who are the beneficial owners, the Plan Administrator will administer the Plan on the basis of the number of Common Shares certified from time to time by the record shareholder’s name and held for the account of beneficial owners who participate in the Plan.

There will be no brokerage charges with respect to Common Shares issued directly by the Fund. However, each participant will pay a pro rata share of brokerage commissions incurred in connection with Open-Market Purchases. The automatic reinvestment of Dividends will not relieve participants of any federal, state or local income tax that may be payable (or required to be withheld) on such Dividends. Participants that request a sale of Common Shares through the Plan Administrator are subject to brokerage commissions.

The Fund reserves the right to amend or terminate the Plan. There is no direct service charge to participants with regard to purchases in the Plan; however, the Fund reserves the right to amend the Plan to include a service charge payable by the participants.

All correspondence or questions concerning the Plan should be directed to the Plan Administrator at Mail Stop: RiverNorth Opp, 430 West 7th Street, Kansas City, MO 64105-1407.

| RiverNorth Opportunities Fund, Inc. | Approval of Investment Advisory and Sub-Advisory Agreements |

| April 30, 2016 (Unaudited) |

At the November 20, 2015 meeting (“Meeting”) of the Board of Directors (the “Board”) of RiverNorth Opportunities Fund, Inc. (the “Fund”), the Board, including those Directors who are not “interested persons” of the Fund (the “Independent Directors”), as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), approved ALPS Advisors, Inc. (the “Adviser”) and RiverNorth Capital Management, LLC, (the “Sub-Adviser”) to serve as the Fund’s investment adviser and sub-adviser, respectively, and approved the investment advisory agreement between the Adviser and the Fund, and the sub-advisory agreement between Sub-Adviser and the Adviser with respect to the Fund (collectively, the “Advisory Agreements”), upon the terms and conditions set forth therein. In connection with considering the approval of each of the Advisory Agreements, the Independent Directors met in executive session with independent counsel, who provided assistance and advice.

The Board considered factors including: (i) the nature, extent and quality of the services to be provided by the Adviser and Sub-Adviser and the personnel providing those services; (ii) the costs of the services to be provided and profits to be realized by the Adviser and its affiliates and, separately, the Sub-Adviser and its affiliates, from their relationships with the Fund; (iii) comparisons of services rendered to and fees to be paid by the Fund with the services provided by and the fees paid to other investment advisers and sub-advisers or the services provided to and the fees paid by other clients, if any, of the Adviser and Sub-Adviser; (iv) the extent to which economies of scale could be realized by the Adviser and Sub-Adviser; and (v) any benefits to be derived by the Adviser and the Sub-Adviser from their relationships with the Fund, such as soft-dollar arrangements or other so-called “fall-out benefits.” Although not meant to be all-inclusive, the following discussion summarizes the factors considered and conclusions reached by the Directors in the executive session and at the Meeting in determining to approve the Advisory Agreements.

Nature, extent, and quality of services. In examining the nature, extent and quality of the investment advisory services to be provided by the Adviser, the Directors considered the qualifications, experience and capability of the Adviser’s management and other personnel and the extent of care and conscientiousness with which the Adviser will perform its duties. In this regard, the Directors considered, among other matters the process by which the Adviser would perform oversight of the Fund, including initial and ongoing due diligence regarding product viability, product structure, resources, personnel, technology, performance, compliance, and oversight of the Sub-Adviser and other service providers of the Fund.

With respect to the nature, extent and quality of the investment advisory services to be provided by the Sub-Adviser, the Directors considered the Sub-Adviser’s investment management process it proposed to use in managing the assets of the Fund, including the experience and capability of the Sub-Adviser’s management and other personnel responsible for the portfolio management of the Fund and compliance with the Fund’s investment policies and restrictions. The Directors also considered the favorable assessment provided by the Adviser as to the nature and quality of the services provided by the Sub-Adviser and the ability of the Sub-Adviser to fulfill its contractual obligations.

Semi-Annual Report | April 30, 2016 | 21 |

| RiverNorth Opportunities Fund, Inc. | Approval of Investment Advisory and Sub-Advisory Agreements |

| April 30, 2016 (Unaudited) |

Based on the totality of the information considered, the Directors concluded that the Fund was likely to benefit from the nature, extent and quality of the Adviser’s and the Sub-Adviser’s services, and that the Adviser and the Sub-Adviser have the ability to provide these services based on their respective experience, operations and current resources.

Investment performance of the Fund, the Adviser, and the Sub-Adviser. Although the Fund, having commenced operations but not launched, did not have performance history, the Directors reviewed information provided by the Sub-Adviser concerning the performance of other funds and accounts utilizing similar investment strategies to those that would be employed for the Fund.

Costs of services and profits realized, and comparison with other advisory contracts. The Board considered the fees payable under the Advisory Agreements. The Board reviewed the information compiled by an independent source comparing the Fund’s contractual management fee rate (at common asset levels based on the Fund’s projected assets) and actual management fee rate (which includes the effect of any fee waivers) as a percentage of net assets on a leveraged and unleveraged basis—these fee rates include advisory and subadvisory and administrative service fees—to other funds in its Lipper expense group. The Board also considered the fees paid to the administrator, which is an affiliate of the Adviser. Based on the data provided on management fee rates, the Board noted that the Fund’s proposed fees were acceptable based on the services to be provided.

The Directors also considered that the fee to be paid to the Sub-Adviser would be paid out of the fees paid to the Adviser and that no separate fee for sub-advisory services would be charged to the Fund. The Directors also considered the fees charged by the Sub-Adviser to other accounts managed using a similar strategy, including an open-end mutual fund. The Directors also considered the Adviser’s conclusion that the compensation payable to the Sub- Adviser is reasonable, appropriate and fair in light of the nature and quality of the services to be provided to the Fund.

The Board reviewed the materials it received from the Adviser regarding its projected revenues and expenses in connection with the services provided to the Fund. The Directors also reviewed the estimated profitability information provided by the Sub-Adviser.

Economies of scale. With respect to whether economies of scale are realized by the Adviser and the Sub-Adviser and whether management fee levels reflect these economies of scale for the benefit of Fund investors, the Board considered the proposed level of management fees to be charged and fee structure and concluded that the proposed fee structure was appropriate at this time.

Indirect benefits. The Board considered whether there were any “fall-out” or ancillary benefits that may accrue to the Adviser or Sub-Adviser or their affiliates as a result of their relationships with the Fund. The Directors considered that both the Adviser and Sub-Adviser noted their belief that they would not experience any “fall-out” benefits except, in the case of the Sub-Adviser, that it might have future opportunities to sub-advise closed-end funds as a result of managing the Fund. The Board concluded that the benefits accruing to the Adviser and the Sub-Adviser by virtue of their relationships to the Fund appeared to be reasonable.

| RiverNorth Opportunities Fund, Inc. | Approval of Investment Advisory and Sub-Advisory Agreements |

| April 30, 2016 (Unaudited) |

After evaluation of the performance, fee and expense information and the profitability, ancillary benefits and other considerations as described above, and in light of the nature, extent and quality of services to be provided by the Adviser and the Sub-Adviser, the Board concluded that the level of fees to be paid to each of the Adviser and the Sub-Adviser is reasonable.

In summary, based on the various considerations discussed above, the Board determined that approval of each of the Advisory Agreements was in the best interests of the Fund.

Semi-Annual Report | April 30, 2016 | 23 |

| RiverNorth Opportunities Fund, Inc. | Additional Information |

| April 30, 2016 (Unaudited) |

PORTFOLIO HOLDINGS

The Fund files a complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N–Q within 60 days after the end of the period. Copies of the Fund’s Form N–Q are available without a charge, upon request, by contacting the Fund at 1–855–830–1222 and on the SEC’s website at http://www.sec.gov. You may also review and copy Form N–Q at the SEC’s Public Reference Room in Washington, D.C. For more information about the operation of the Public Reference Room, please call the SEC at 1–800–SEC–0330.

PROXY VOTING

A description of the Fund’s proxy voting policies and procedures is available (1) without charge, upon request, by calling 1-855-830-1222, (2) on the Fund’s website located at http://www.rivernorthcef.com, or (3) on the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the twelve-month period ended June 30th is available on the SEC’s website at http://www.sec.gov.

SECTION 19(A) NOTICES

The following table sets forth the estimated amount of the sources of distribution for purposes of Section 19 of the Investment Company Act of 1940, as amended, and the related rules adopted there under. A Fund estimates the following percentages, of the total distribution amount per share, attributable to (i) current and prior fiscal year net investment income, (ii) net realized short‐term capital gain, (iii) net realized long‐term capital gain and (iv) return of capital or other capital source as a percentage of the total distribution amount. These percentages are disclosed for the fiscal year‐to‐date cumulative distribution amount per share for the Fund. The amounts and sources of distributions reported in these 19(a) notices are only estimates and not for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of the calendar year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099‐DIV for the calendar year that will tell you how to report these distributions for federal income tax purposes.

Per Share Cumulative Distributions for the period ended April 30, 2016* | | Percentage of the Total Cumulative Distributions for the period ended April 30, 2016* |

| Net Investment Income | Net Realized Capital Gains | Return of Capital | Total Per Share | | Net Investment Income | Net Realized Capital Gains | Return of Capital | Total Per Share |

| $ 0.4550 | $ 0.0000 | $ 0.0000 | $ 0.4550 | | 100.00% | 0.00% | 0.00% | 100.00% |

| * | The Fund commenced operations on December 24, 2015. |

| RiverNorth Opportunities Fund, Inc. | Additional Information |

| April 30, 2016 (Unaudited) |

DATA PRIVACY POLICIES AND PROCEDURES

Policy Statement: The Fund has in effect the following policy with respect to nonpublic personal information about its customers:

| · | Only such information received from customers, through application forms or otherwise, and information about customers’ Fund transactions will be collected. |

| · | None of such information about customers (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). |

| · | Policies and procedures (including physical, electronic and procedural safeguards) are in place and designed to protect the confidentiality and properly disposal of such information. |

| · | The Fund does not currently obtain consumer information. If the Fund were to obtain consumer information at any time in the future, it would employ appropriate procedural safeguards that comply with federal standards to protect against unauthorized access to and properly dispose of consumer information. |

For more information about the Fund’s privacy policies call (855) 830-1222.

CUSTODIAN AND TRANSFER AGENT

State Street Bank and Trust Company, located at State Street Financial Center, One Lincoln Street, Boston, MA 02111, serves as the Fund’s custodian and will maintain custody of the securities and cash of the Fund.

DST Systems, Inc., located at 333 West 11th Street, 5th Floor, Kansas City, Missouri 64105, serves as the Fund’s transfer agent and registrar.

LEGAL COUNSEL

Dechert LLP, New York, New York, serves as legal counsel to the Trust.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen Fund Audit Services, Ltd. is the independent registered public accounting firm for the Fund.

Semi-Annual Report | April 30, 2016 | 25 |

Page Intentionally Left Blank

Page Intentionally Left Blank