| Philips Pension Fund |

| |

Philips Centre, Guildford Business Park. Guildford. Surrey GU2 8XH |

12 February 2013

PPTL Investment Limited

15 Atholl Crescent

Edinburgh

EH3 8HA

Dear Sirs,

PPTL Investment LP

Amendments to the Amended and Restated Limited Partnership Agreement among the General Partner and the Limited Partner relating to the Partnership dated 29th October 2010 ("Partnership Agreement")

| 1.1 | This letter agreement is supplemental to the Partnership Agreement and its purpose is to record and give legal effect to certain changes which PPTL Investment Limited and Philips Pension Trustees Limited ("the Parties") agree to make to the Partnership Agreement with effect from today's date. |

| 1.2 | The Parties agree that the terms set out in this letter constitute probative agreement to the proposed alterations to the Partnership Agreement as required under clause 13.3 of the Partnership Agreement. |

| 2.1 | Words and expressions defined in the Partnership Agreement (as amended by this letter agreement) shall bear the same meanings where used in this letter agreement. |

| 2.2 | The Parties agree that the following words and expressions shall be inserted in the appropriate alphabetical place as new definitions in the Partnership Agreement: |

"Early Sale Date" means the later of (i) the first business day on which a sale becomes possible in terms of the legal, contractual and regulatory requirements applicable to the Partnership as the holder of shares and (ii) the earliest date thereafter on which it is possible to dispose of them on an orderly basis;

"Initial Period" means the period commencing on the date of this letter agreement and ending on 30th June 2016;

"S&P Agreement" means the Amendment and Restatement Agreement for the sale and purchase of shares in NXP Semiconductors N.V. dated 7 September 2010 as amended and supplemented on 29 October 2010 and as further amended by a letter dated January 2013;

"Strike Price" means the minimum average price per share specified in Schedule A to that certain agreement, dated November 28, 2012, between the Partnership and J.P. Morgan Securities LLC, In respect of shares comprised In the Contractual Transfer;

"Sales Plan" means a trading plan established by PPTL Investment LP for selling NXP shares under Rule 10b5-1(c) of the Securities Exchange Act of 1934, as amended, in the United States;

"Surplus" has the meaning given to that term in the S&P Agreement except that (for the avoidance of doubt) for the purposes of Clause 2.4.3.1(b)(ii) it may be calculated as at any date or dates between the Early Sale Date and the end of the Initial Period.

| 3 | Amendment to Clause 2.4.3.1 of the Partnership Agreement |

| 3.1 | Subject to clause 3.2 of this letter agreement, Clause 2.4.3.1 of the Partnership Agreement shall be deleted and the following new clause 2.4.3.1 inserted in its place: |

"2.4.3.1 during the Initial Period:

| | (a) | subject always to sub-paragraph (b) below, the Partnership shall not sell any shares if the Partnership determines in its absolute discretion that it would be in the Partnership's best interests to retain them; |

| | (b) | the Partnership shall sell the shares on the Early Sale Date (or on any later date or dates during the Initial Period) if any of the following circumstances apply: |

| | (i) | the sales are made at a price equal to or greater than the Strike Price (which condition shall for the avoidance of doubt in relation to any block trade on a single trading day be deemed satisfied if the sales are made pursuant to an Instruction or Sales Plan which does not permit trades unless, among other things, the average price per share achieved on any block trade on a single trading day is equal to or greater than the Strike Price); |

| | (ii) | the funding level of the Philips Pension Fund (as advised to the General Partner by the Trustees of the Philips Pension Fund) approximates to or exceeds a level which would make it possible for the Philips Pension Fund to buy out its benefit liabilities in full with an appropriate insurance company and to wind up the Philips Pension Fund in an orderly and correct manner, paying the associated expenses and charges. For these purposes, the General Partner may at its discretion regard the funding position of the Philips Pension Fund as having approximated to or exceeded the level set out in the foregoing sentence if it is advised by the Trustees of the Philips Pension Fund that, (assuming a value of the shares equal to the proposed sale price) there is a Surplus; or |

| | (iii) the General Partner has consulted an appropriate executive or representative of Koninklijke Philips Electronics N.V. about the proposed sale and, after considering the outcome of that consultation and other matters such as analysts' opinions, market activity including secondary offerings relating to the shares, the level of volatility in the publicly quoted price, and such other factors as it considers relevant, the General Partner determines in its absolute discretion that each of (A), (B) and (C) below are satisfied, where: |

| | (A) | is that NXP shares are more likely than not to trade at a publicly quoted price which is, at all times during the Reasonably Foreseeable Future, below the Strike Price; |

| | (B) | is that, if (A) does apply: EITHER: the reason for it applying is (or is predominantly) a factor which is specific to NXP rather than a general trend in the market prices of US quoted equities, OR: in the opinion of the General Partner there is no realistic likelihood of market prices of US quoted securities increasing such that (A) would no longer apply within the Reasonably Foreseeable Future; and |

| | (C) | is that the price which the General Partner will obtain for the shares by executing the proposed sale is likely to be the best price which is likely to be obtained for the shares in the Reasonably Foreseeable Future and accordingly that not executing the proposed sale at that price and time may expose those with an interest in the Partnership's obtaining the best price possible for those shares to unreasonable downside risks having regard to their nature and purpose as investors. |

For these purposes, the "Reasonably Foreseeable Future" means such time horizon as the General Partner considers reasonable to adopt from time to time having regard to (among other factors) the nature and duration of the expected future retirement benefits payable under the Philips Pension Fund at any time, provided that that time horizon shall always extend at least to the end of the Initial Period."

| 3.2 | At the end of the Initial Period (as so defined) the amendment in Clause 3.1 of this letter agreement will cease to have effect and clause 2.4.3.1 of the Partnership Agreement will revert to the form it took immediately before this letter agreement took effect. No action taken in reliance upon the terms of Clause 2.4.3.1 as temporarily amended (and during the period of the temporary amendment) will be invalidated by that reversion. |

| 3.3 | In all other respects the Partnership Agreement remains unaltered. |

4 | Conflict between this letter and the Partnership Agreement |

| 4.1 | In the event of any conflict between the terms of this letter and the Partnership Agreement, the terms of this letter shall prevail. |

| 5.1 | This agreement shall be governed by and construed In accordance with the laws of Scotland. |

| 5.2 | Each of the Parties submits to the non-exclusive jurisdiction of the Court of Session in Scotland. |

Please sign and date the enclosed copy of this letter where Indicated and return it to us to signify your acceptance of and binding agreement to its terms.

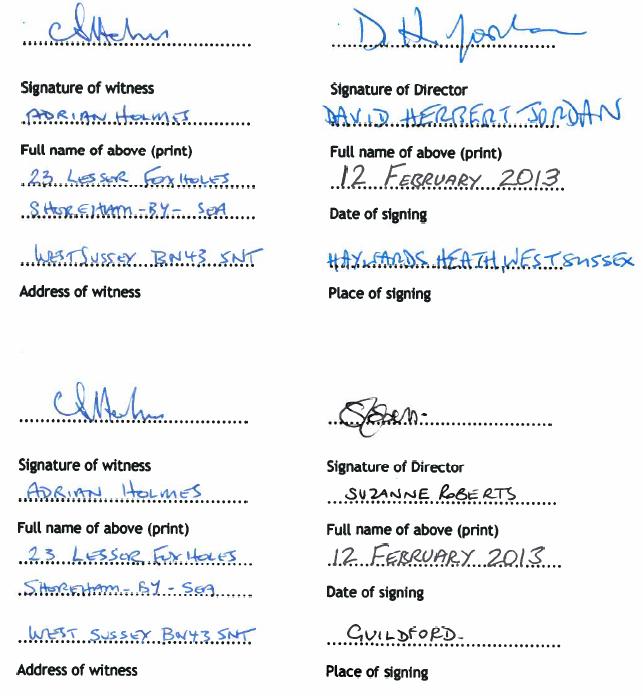

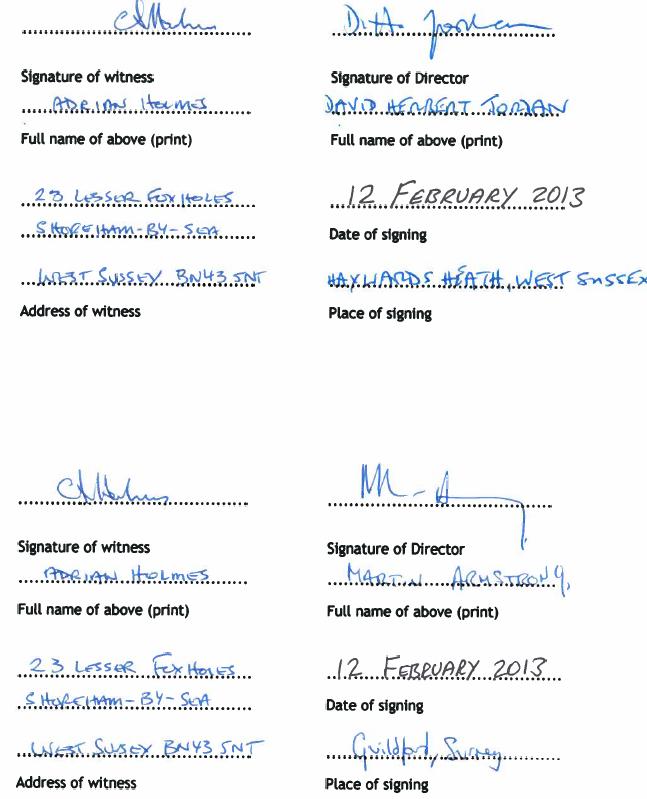

For and on behalf of Philips Pension Trustees Limited