Q2 2017 conference call Invitae: Genetics from downstream to mainstream Exhibit 99.1

Safe harbor statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the company's expectations regarding second quarter and expected full-year 2017 results; future uses of the company’s cash, its cash burn and its expectation to be cash-flow positive by the end of 2018; the company’s belief regarding the success of its business model, business strategy and momentum in its business; the drivers of growth in its business and momentum in future revenue; the company’s expectations regarding reimbursement; the benefits and attributes of the company’s tests; that research continues to point to the broader utility of genetic information and precision of the company’s services; the potential benefits and synergies from completed and proposed acquisitions, including the positive impact on gross profit and gross margin due to the Good Start acquisition; statements relating to completion of the proposed acquisition of CombiMatrix; future product offerings and growth potential; and the company’s business strategy, including its acquisition growth strategy, and its beliefs regarding the ways in which completed and proposed acquisitions will contribute to that strategy. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: risks and uncertainties associated with the parties’ ability to satisfy the conditions precedent to the consummation of the proposed transaction with CombiMatrix, including stockholder approval of and the ability to consummate the proposed merger, the ability of Invitae to conduct the warrant exchange offer, and the participation by CombiMatrix Series F warrant holders of the 90% minimum participation; the occurrence of any event that could give rise to the termination of the merger agreement with CombiMatrix; legal proceedings that may be instituted against the parties following announcement of the proposed acquisition of CombiMatrix; disruptions of current plans and operations caused by completed or pending acquisitions; unanticipated difficulties or expenditures relating to completed or proposed transactions; the risk that expected benefits, synergies and growth prospects resulting from completed or proposed transactions may not be achieved in a timely manner, or at all; the risk that the businesses of CombiMatrix and/or Good Start may not be successfully integrated with the company’s business following the respective closings; potential difficulties in employee retention as a result of completed or pending transactions; the reaction of customers and potential customers, payers, partners and competitors to the announcement of the proposed merger; the company’s failure to manage growth effectively; the company's history of losses; the company's ability to compete; the company's need to scale its infrastructure in advance of demand for its tests and to increase demand for its tests; the company's ability to develop and commercialize new tests and expand into new markets; the risk that the company may not obtain or maintain sufficient levels of reimbursement for its tests; the company's ability to raise additional capital on acceptable terms; risks associated with the company's ability to use rapidly changing genetic data to interpret test results accurately, consistently, and quickly; risks associated with the company's limited experience with respect to acquisitions; the risk that the contemplated acquisition of CombiMatrix will not be completed, will be completed on different terms or will not yield some or all of the intended benefits; security breaches, loss of data and other disruptions; laws and regulations applicable to the company's business; and the other risks set forth in the company's filings with the Securities and Exchange Commission, including the risks set forth in the company's Quarterly Report on Form 10-Q for the quarter ended March 31, 2017. These forward-looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements.

Safe harbor statement (cont.) Additional Information and Where You Can Find It In connection with the CombiMatrix Merger, the Company and CombiMatrix intend to file relevant materials with the SEC, including (a) a registration statement on Form S-4 that will contain a proxy statement/prospectus for CombiMatrix to solicit stockholder approval of the CombiMatrix Merger and (b) a registration statement on Form S-4 that will contain offer documents for the Company to conduct the Warrant Exchange Offer. Investors and securityholders of the Company and CombiMatrix are urged to read these materials when they become available because they will contain important information about the Company and CombiMatrix as well as the CombiMatrix Merger and the Warrant Exchange Offer. The proxy statement/prospectus and the offering documents and other relevant materials (when they become available), and any other documents filed by the Company or CombiMatrix with the SEC, may be obtained free of charge at the SEC web site at www.sec.gov. In addition, investors and securityholders may obtain free copies of the documents (i) filed with the SEC by the Company, by directing a written request to: Invitae Corporation, 1400 16th Street, San Francisco, California 94103, Attention: Investor Relations or (ii) filed with the SEC by CombiMatrix, by directing a written request to: CombiMatrix Corporation, 310 Goddard, Suite 150, Irvine, California 92618, Attention: Investor Relations. Investors and securityholders are urged to read the proxy statement/prospectus, the offering documents and the other relevant materials when they become available before making any voting or investment decision with respect to the CombiMatrix Merger or the Warrant Exchange Offer. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities in connection with the Merger shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The Company and CombiMatrix and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of CombiMatrix in connection with the CombiMatrix Merger. Information regarding the special interests of these directors and executive officers in the CombiMatrix Merger will be included in the proxy statement/prospectus referred to above. Additional information regarding the Company’s directors and executive officers is also included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 and the proxy statement for the Company’s 2017 annual meeting of stockholders. Additional information regarding CombiMatrix’s directors and executive officers is also included in CombiMatrix’s Annual Report on Form 10-K for the year ended December 31, 2016 and the proxy statement for CombiMatrix’s 2017 annual meeting of stockholders. These documents are available free of charge at the SEC’s web site (www.sec.gov) and from Investor Relations at the Company or CombiMatrix at the addresses set forth above. NOTE: Invitae and the Invitae logo are trademarks of Invitae Corporation. All other trademarks and service marks are the property of their respective owners.

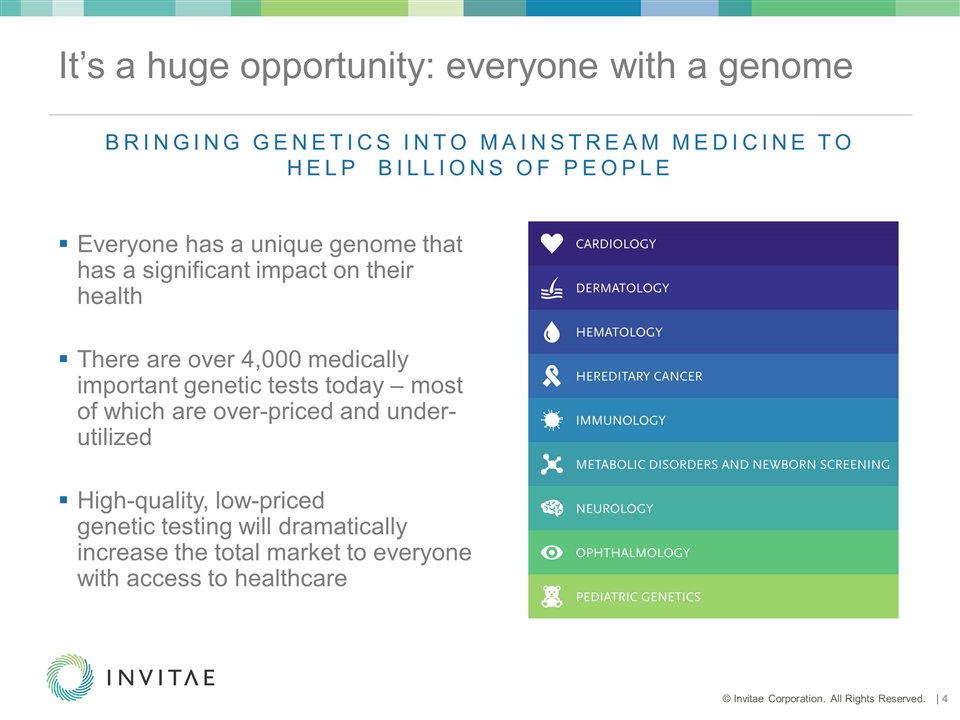

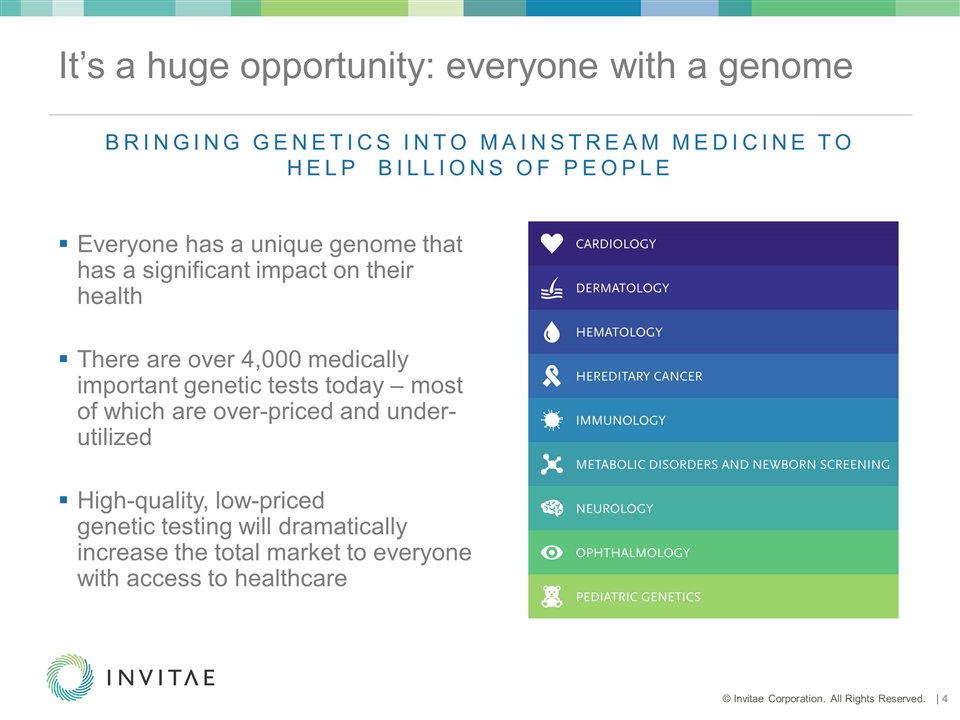

It’s a huge opportunity: everyone with a genome Everyone has a unique genome that has a significant impact on their health There are over 4,000 medically important genetic tests today – most of which are over-priced and under-utilized High-quality, low-priced genetic testing will dramatically increase the total market to everyone with access to healthcare Bringing genetics into mainstream medicine to help billions of people

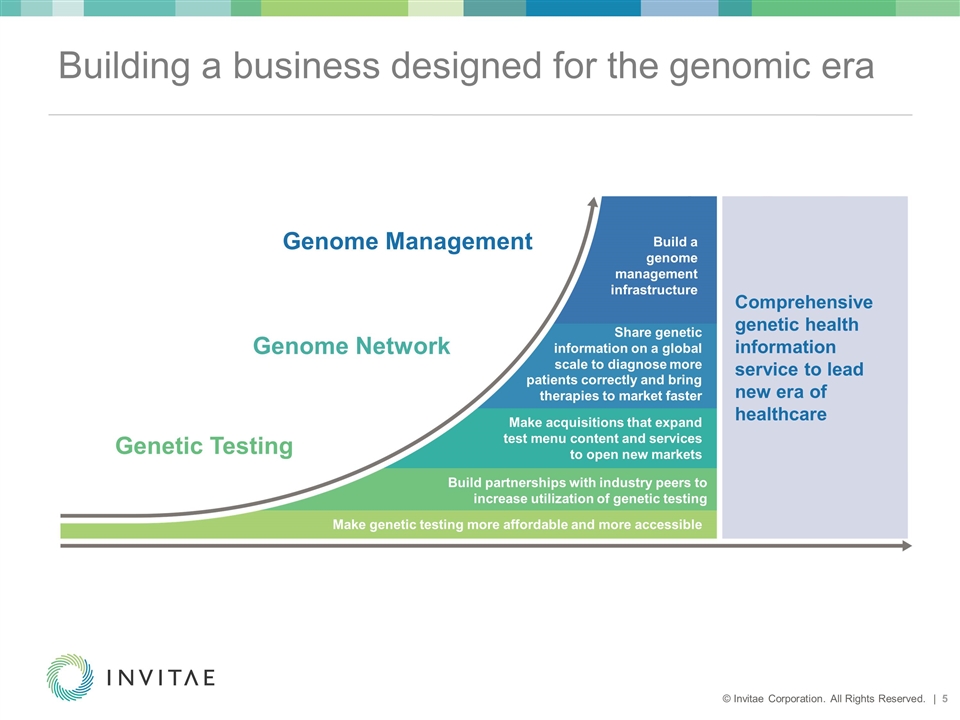

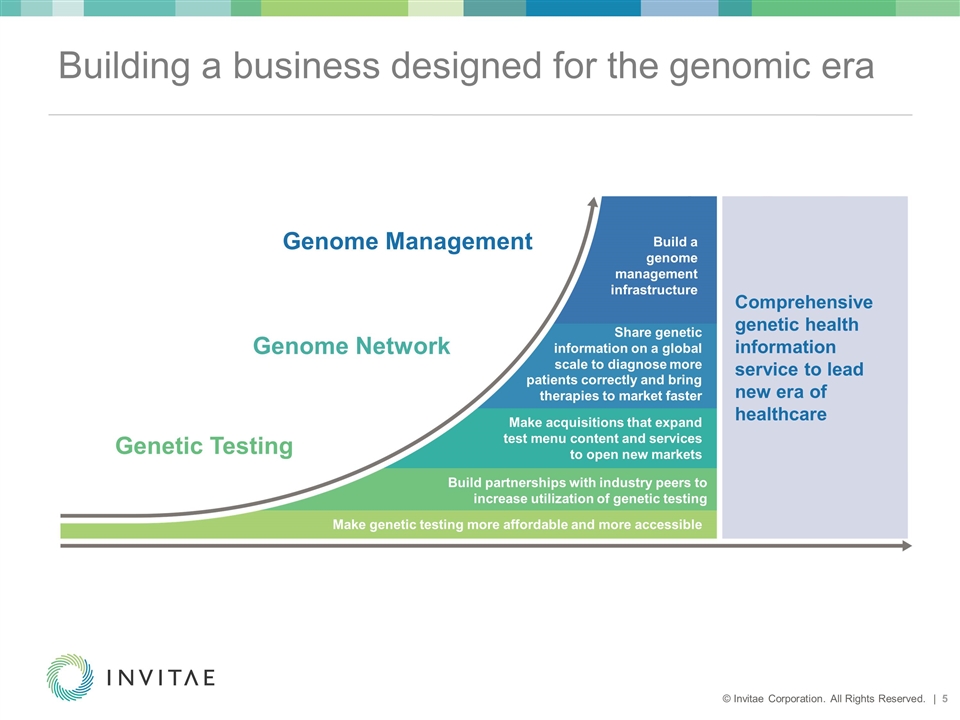

Building a business designed for the genomic era Comprehensive genetic health information service to lead new era of healthcare Build a genome management infrastructure Make genetic testing more affordable and more accessible Build partnerships with industry peers to increase utilization of genetic testing Share genetic information on a global scale to diagnose more Genome Network Genetic Testing Genome Management Make acquisitions that expand test menu content and services to open new markets patients correctly and bring therapies to market faster

Recipe for success: build/partner/buy Build industry leading platform that is Cost-effective Scalable Content and feature rich Proven in complex and competitive market Identify industry partners that can Increase awareness, utility and utilization of Invitae menu Augment content and capabilities Expand existing market or channels Seek select acquisition candidates that can Expand our infrastructure and services capabilities Enhance our position in an existing market or provide an entry point into a new market Offer tests capable of being delivered in a cost-effective, scalable manner Contribute positively to cash flow after 2-3 quarters * *Pending acquisition, subject to closing conditions.

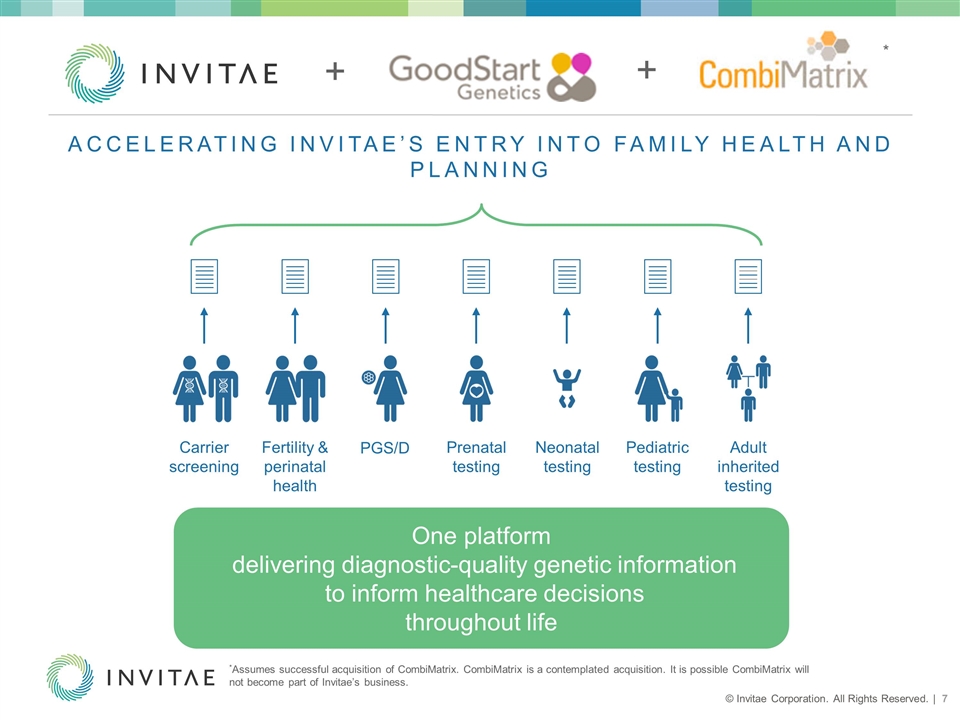

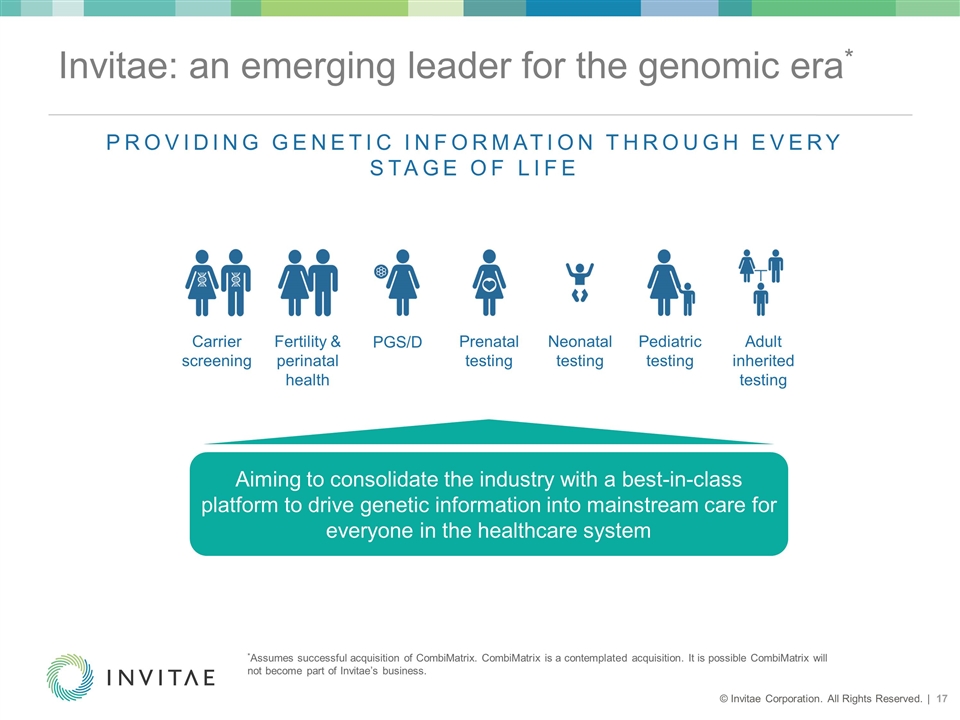

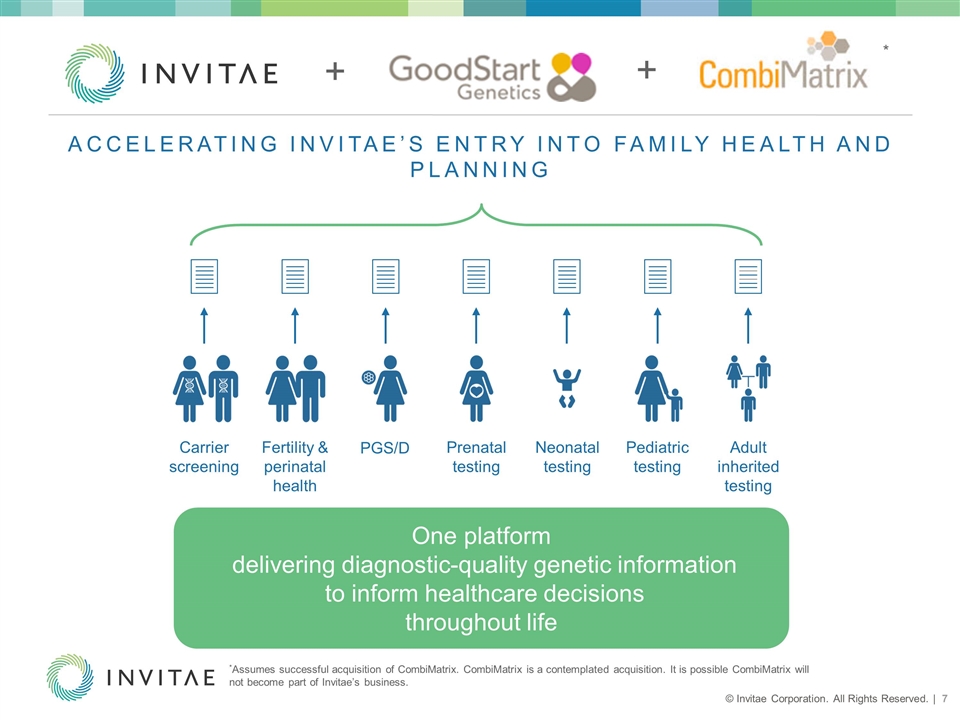

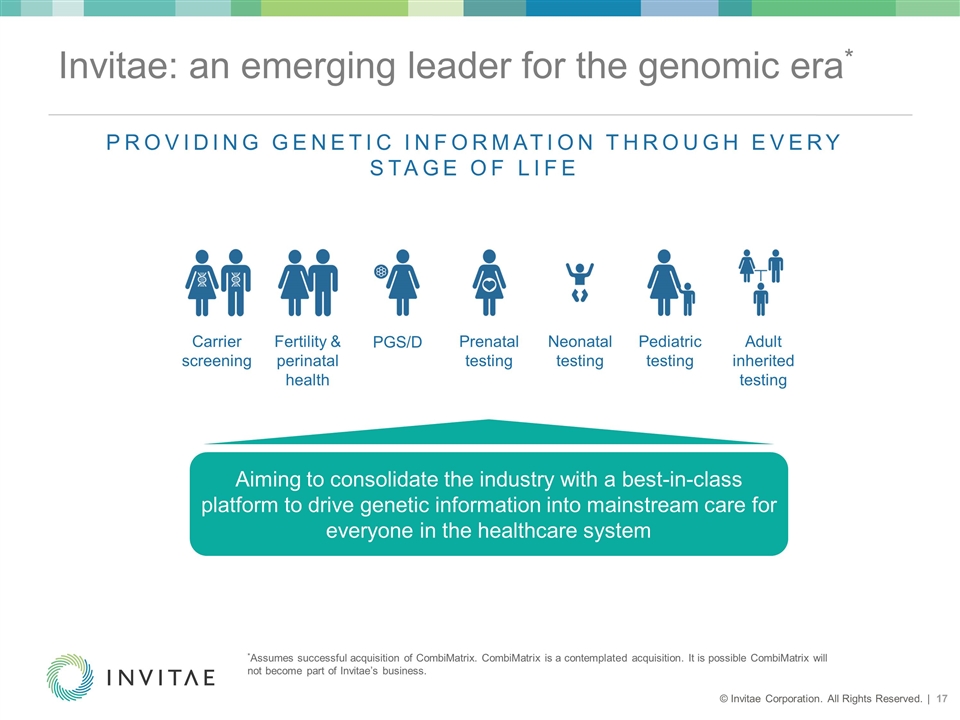

Accelerating Invitae’s entry into Family Health and Planning Adult inherited testing Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening One platform delivering diagnostic-quality genetic information to inform healthcare decisions throughout life + + * *Assumes successful acquisition of CombiMatrix. CombiMatrix is a contemplated acquisition. It is possible CombiMatrix will not become part of Invitae’s business.

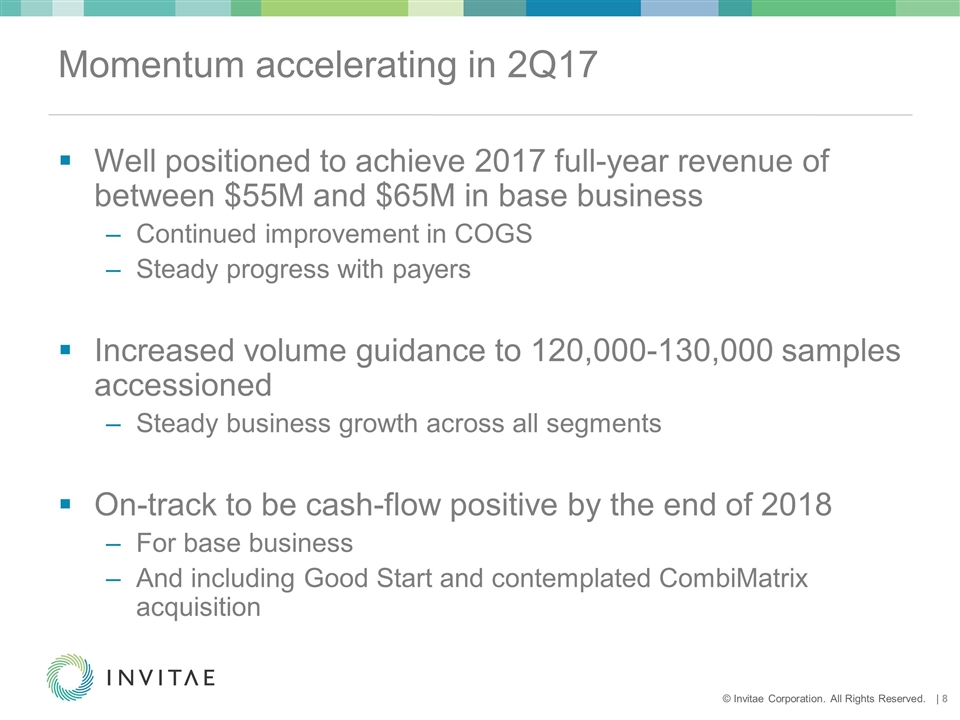

Momentum accelerating in 2Q17 Well positioned to achieve 2017 full-year revenue of between $55M and $65M in base business Continued improvement in COGS Steady progress with payers Increased volume guidance to 120,000-130,000 samples accessioned Steady business growth across all segments On-track to be cash-flow positive by the end of 2018 For base business And including Good Start and contemplated CombiMatrix acquisition

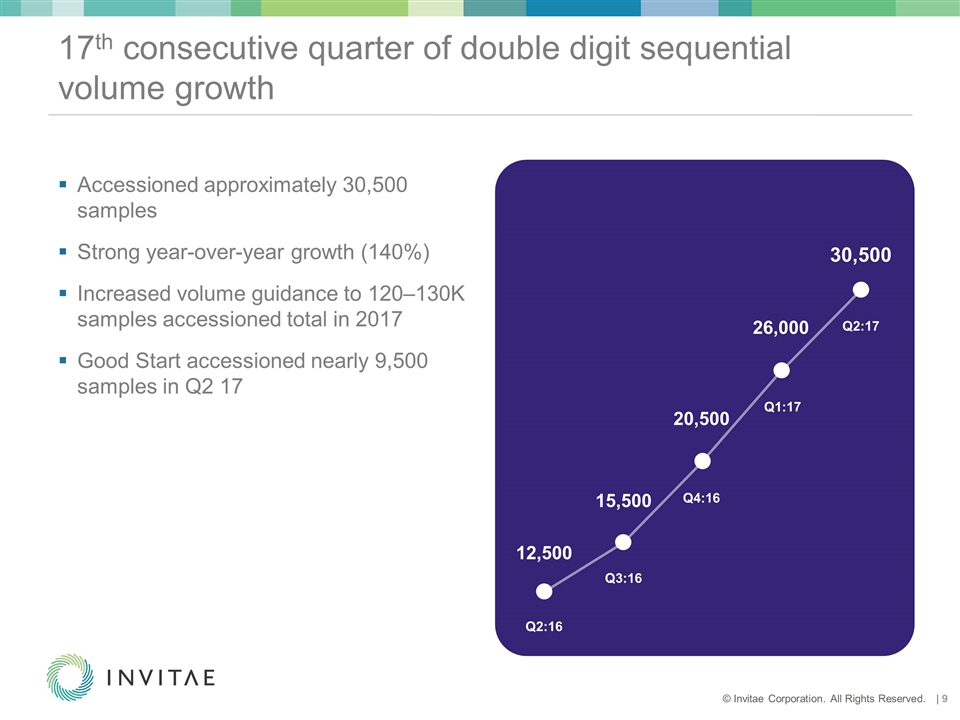

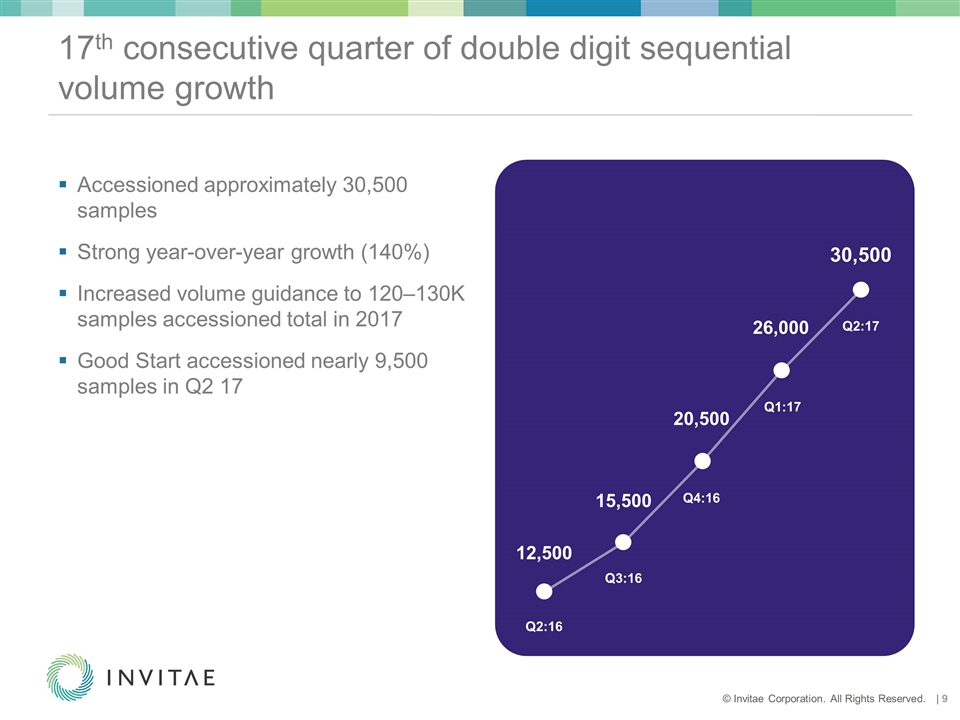

17th consecutive quarter of double digit sequential volume growth Accessioned approximately 30,500 samples Strong year-over-year growth (140%) Increased volume guidance to 120–130K samples accessioned total in 2017 Good Start accessioned nearly 9,500 samples in Q2 17 Q2:16 12,500 Q2:17 30,500 Q1:17 26,000 Q4:16 20,500 Q3:16 15,500

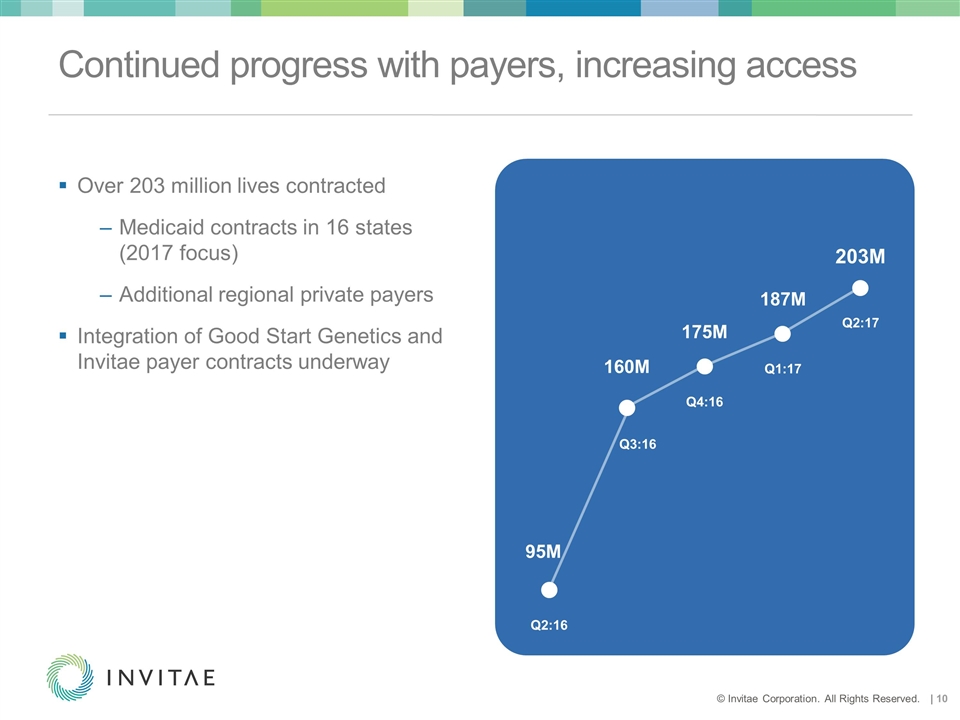

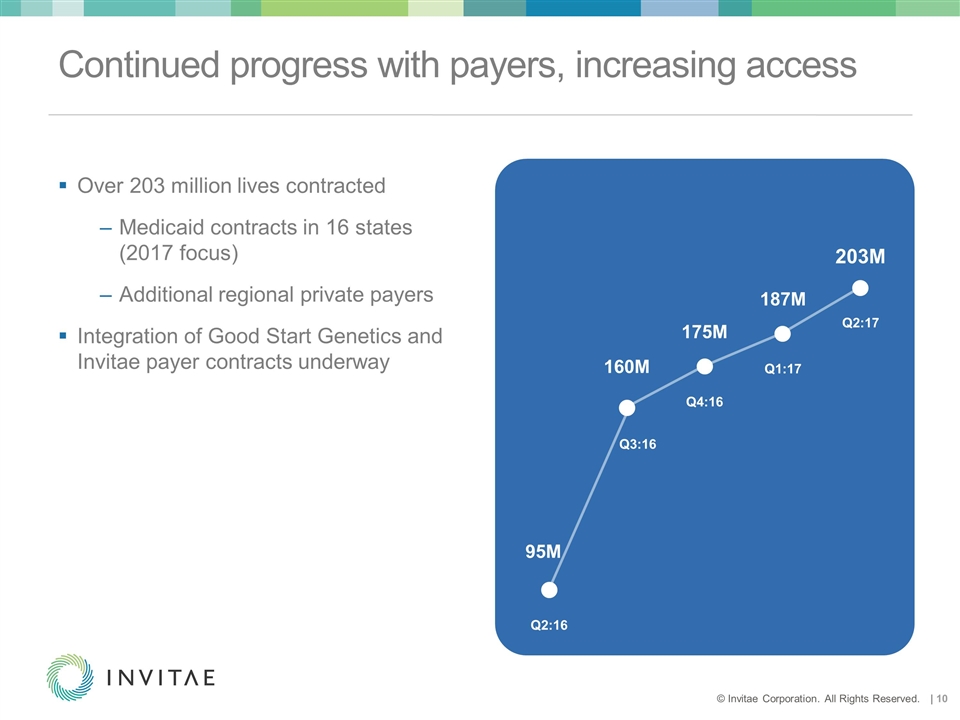

Continued progress with payers, increasing access Over 203 million lives contracted Medicaid contracts in 16 states (2017 focus) Additional regional private payers Integration of Good Start Genetics and Invitae payer contracts underway Q2:16 95M Q2:17 203M Q3:16 160M Q4:16 175M Q1:17 187M

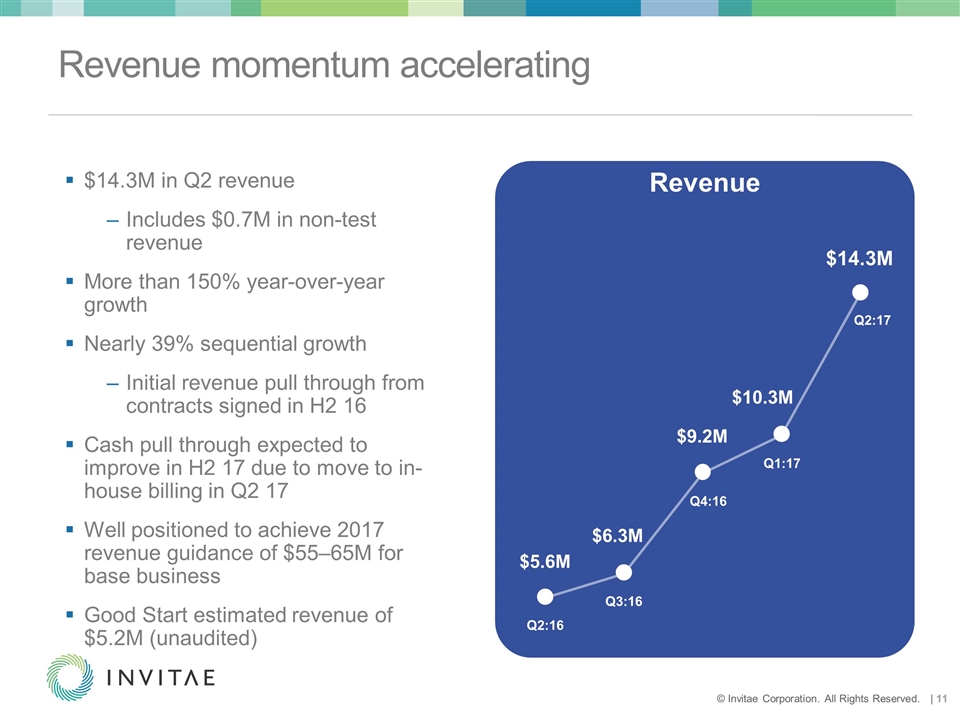

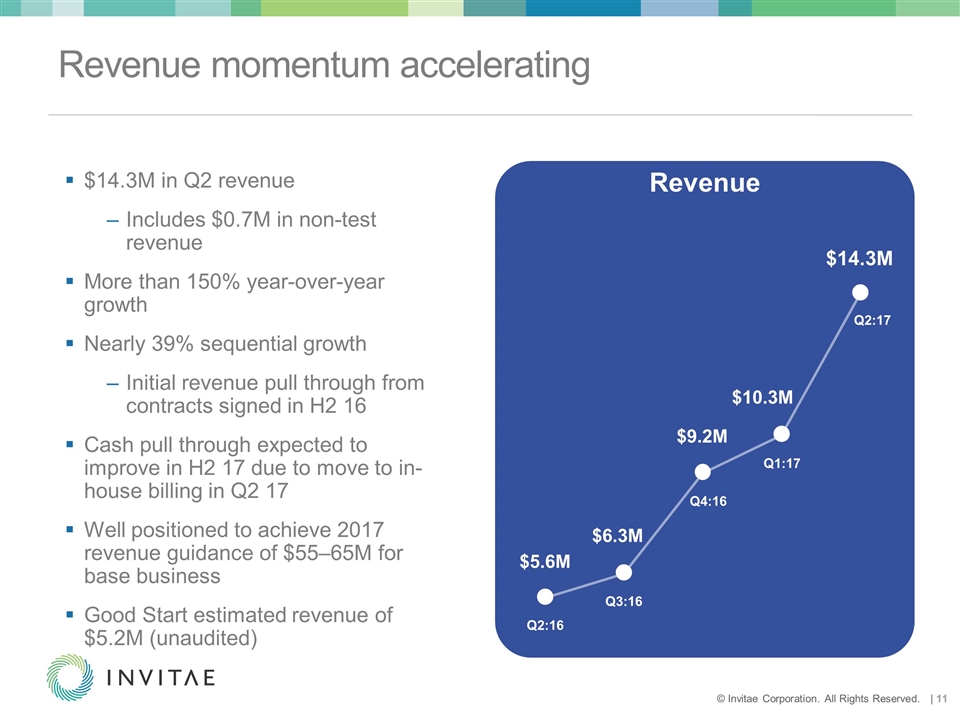

Revenue momentum accelerating $14.3M in Q2 revenue Includes $0.7M in non-test revenue More than 150% year-over-year growth Nearly 39% sequential growth Initial revenue pull through from contracts signed in H2 16 Cash pull through expected to improve in H2 17 due to move to in-house billing in Q2 17 Well positioned to achieve 2017 revenue guidance of $55–65M for base business Good Start estimated revenue of $5.2M (unaudited) Revenue Q2:16 $5.6M Q2:17 $14.3M Q3:16 $6.3M Q4:16 $9.2M Q1:17 $10.3M

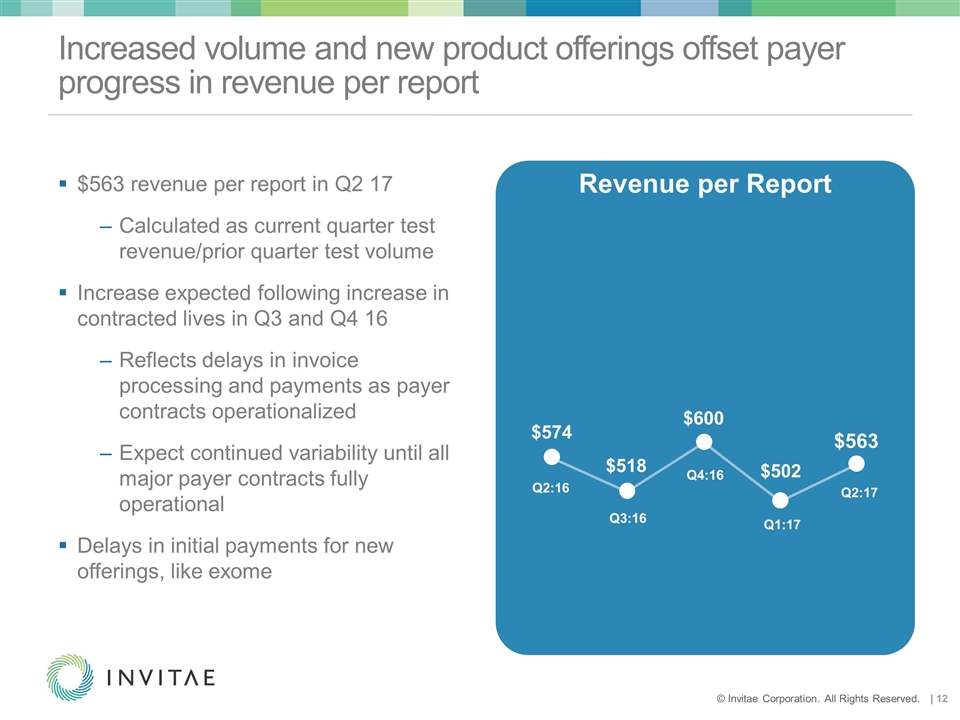

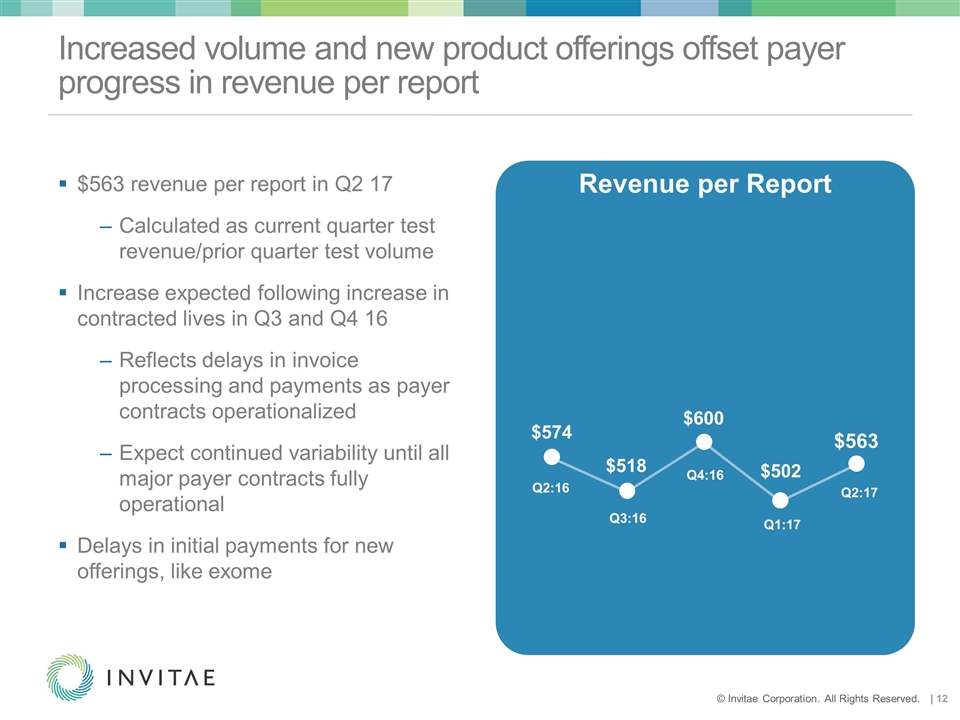

Increased volume and new product offerings offset payer progress in revenue per report $563 revenue per report in Q2 17 Calculated as current quarter test revenue/prior quarter test volume Increase expected following increase in contracted lives in Q3 and Q4 16 Reflects delays in invoice processing and payments as payer contracts operationalized Expect continued variability until all major payer contracts fully operational Delays in initial payments for new offerings, like exome Q3:16 Q4:16 Q1:17 $502 Q2:16 $574 $518 Revenue per Report $600 Q2:17 $563

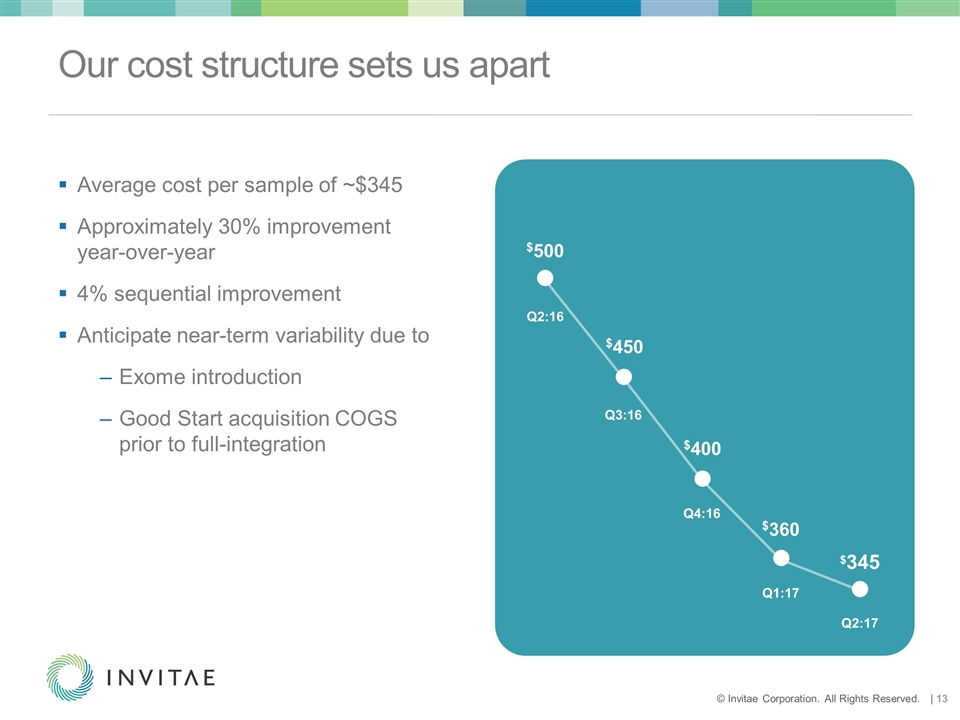

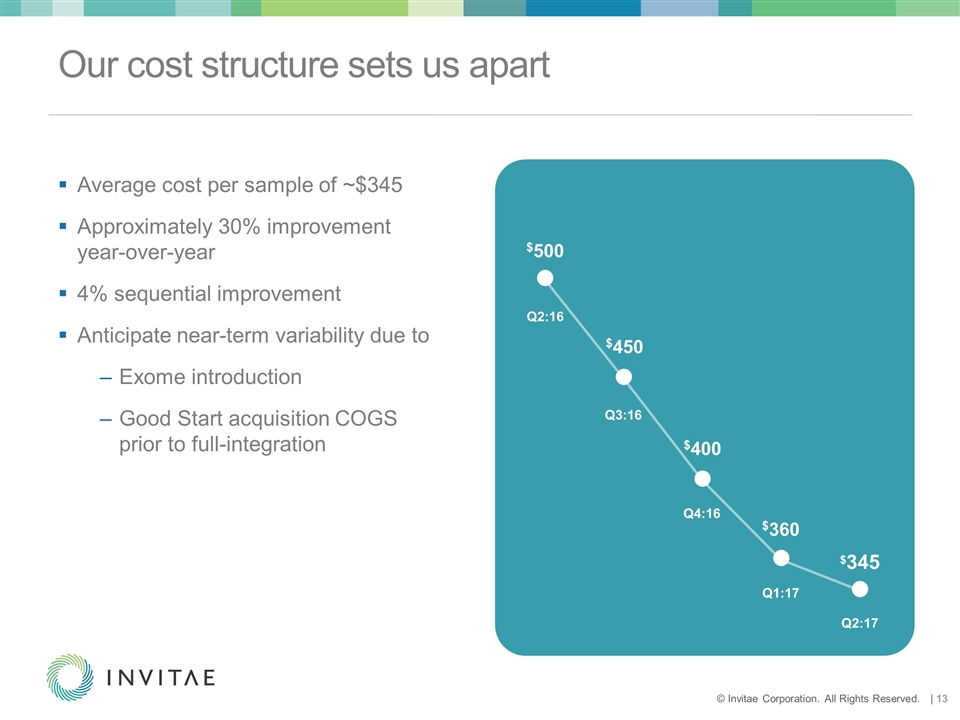

Our cost structure sets us apart Average cost per sample of ~$345 Approximately 30% improvement year-over-year 4% sequential improvement Anticipate near-term variability due to Exome introduction Good Start acquisition COGS prior to full-integration Q2:16 $500 Q3:16 Q2:17 $345 Q4:16 $400 $450 Q1:17 $360

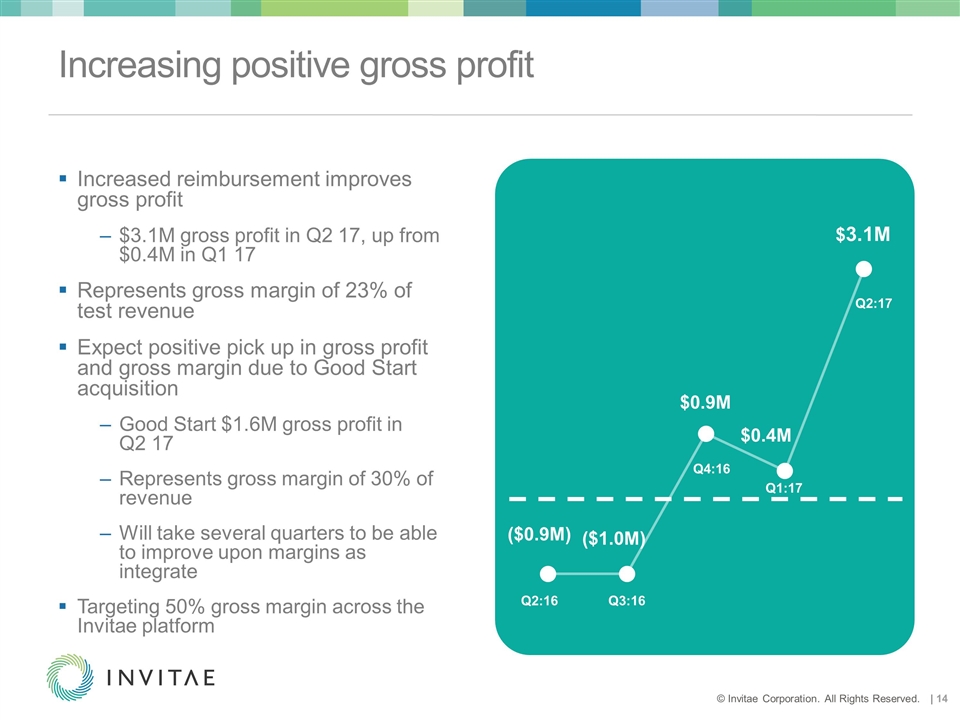

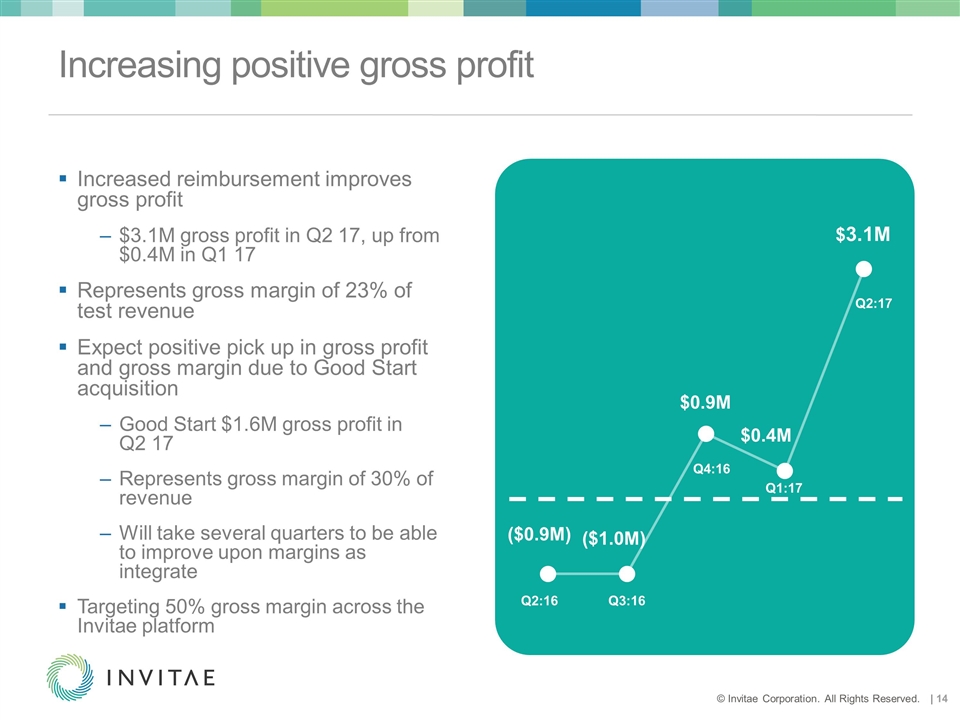

Increasing positive gross profit Increased reimbursement improves gross profit $3.1M gross profit in Q2 17, up from $0.4M in Q1 17 Represents gross margin of 23% of test revenue Expect positive pick up in gross profit and gross margin due to Good Start acquisition Good Start $1.6M gross profit in Q2 17 Represents gross margin of 30% of revenue Will take several quarters to be able to improve upon margins as integrate Targeting 50% gross margin across the Invitae platform Q2:16 ($0.9M) Q3:16 ($1.0M) Q4:16 $0.9M Q2:17 $3.1M Q1:17 $0.4M

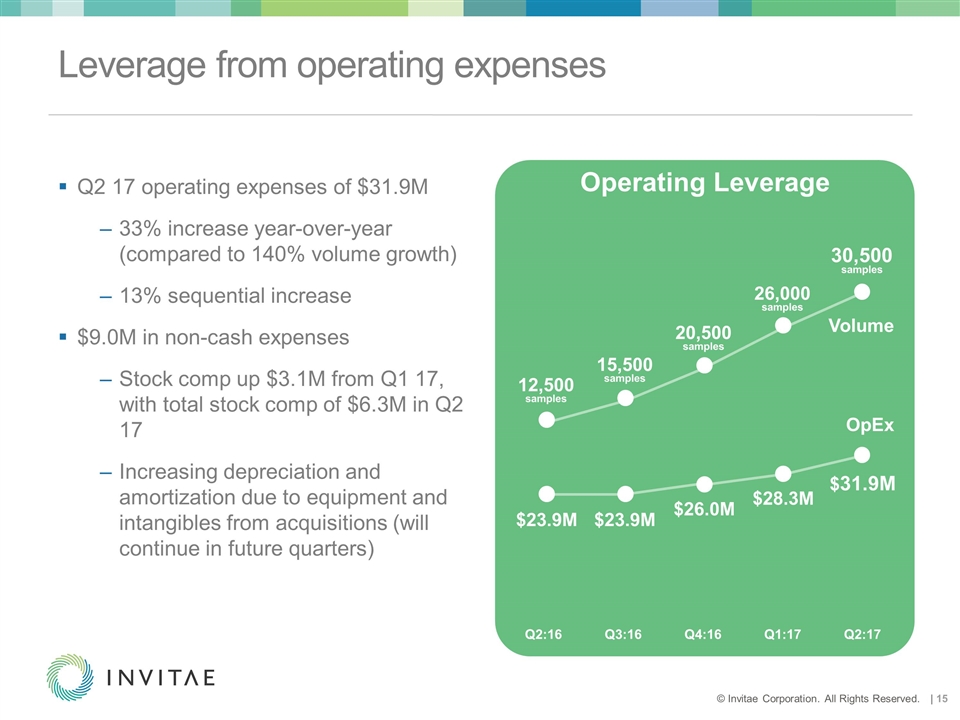

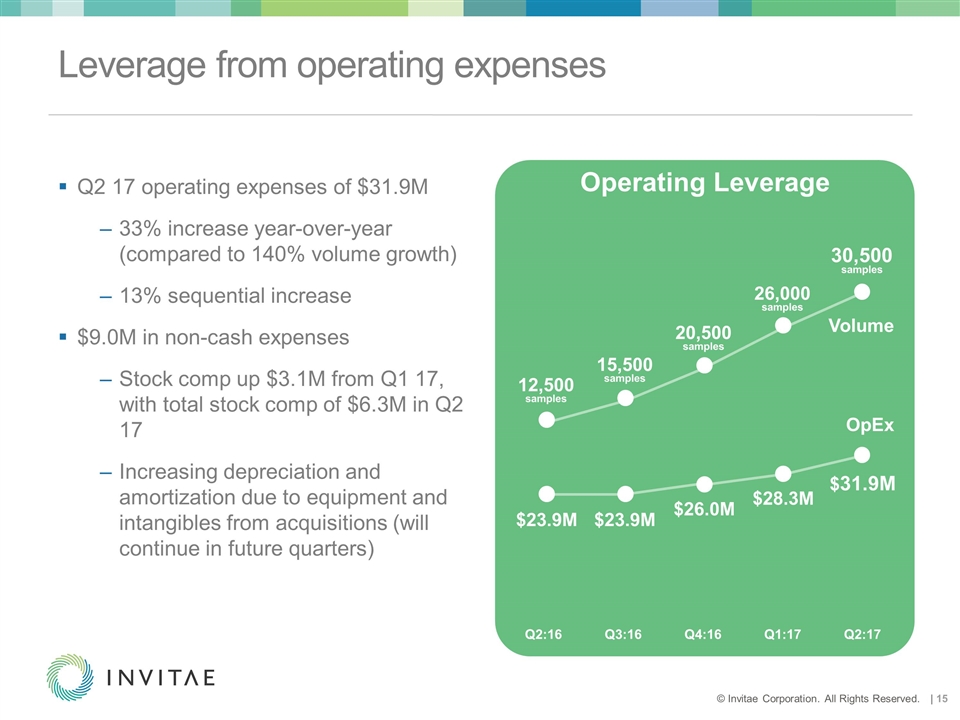

Leverage from operating expenses Q2 17 operating expenses of $31.9M 33% increase year-over-year (compared to 140% volume growth) 13% sequential increase $9.0M in non-cash expenses Stock comp up $3.1M from Q1 17, with total stock comp of $6.3M in Q2 17 Increasing depreciation and amortization due to equipment and intangibles from acquisitions (will continue in future quarters) Q2:16 $23.9M Q3:16 $23.9M Q4:16 $26.0M Operating Leverage Q2:17 $31.9M 12,500 samples 30,500 samples 15,500 samples 20,500 samples 26,000 samples Q1:17 $28.3M OpEx Volume

Strong cash position supports continued execution Ended Q2 17 with $80.4M in cash Additional $20.0M debt draw down available $21.1M cash burn in Q2 17 Compared to $23.4M in Q1 17 Expenses from moving SF headquarters and lab completed in H1 17 and move to in-house billing in Q2 17 Expect decreased Q3 17 burn associated with base business, but overall burn expected to increase due to acquisition expenses Closed $73.5M private placement in August 2017 Estimated net proceeds of $68.8M Continue tracking toward cash flow positive by end of 2018 Including Good Start acquisition and contemplated CombiMatrix acquisition

Invitae: an emerging leader for the genomic era* PROVIDING GENETIC INFORMATION THROUGH EVERY STAGE OF LIFE Aiming to consolidate the industry with a best-in-class platform to drive genetic information into mainstream care for everyone in the healthcare system *Assumes successful acquisition of CombiMatrix. CombiMatrix is a contemplated acquisition. It is possible CombiMatrix will not become part of Invitae’s business. Fertility & perinatal health PGS/D Prenatal testing Neonatal testing Pediatric testing Carrier screening Adult inherited testing

Q&A: General discussion