Corporate Update July 18, 2022 Exhibit 99.2

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the expected impact, benefits, parameters, details and timing of the company’s strategic business realignment or various aspects thereof; the company’s beliefs regarding the potential of its business, and its business priorities; the company’s preliminary financial results for the quarter ended June 30, 2022 and the first half of 2022; the company’s future financial and operating results, including estimated annual cost savings, cash runway, guidance for 2022 and beyond, and the drivers of future financial results; the company’s beliefs regarding what is necessary to succeed in the industry; the company’s focus for the remainder of 2022, and its expectations regarding future operating cash flows; and the company’s expectations regarding its genome management platform and the benefits thereof. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to: actual results for the quarter ended June 30, 2022; the ability of the company to successfully execute its strategic business realignment and achieve the intended benefits thereof on the expected timeframe or at all; unforeseen or greater than expected costs associated with the strategic business realignment; the risk that the disruption that may result from the realignment may harm the company’s business, market share or its relationship with customers or potential customers; the company’s beliefs regarding the impact of COVID-19 on the company, and the effectiveness of the efforts it has taken or may take in the future in response thereto; the impact of inflation and the current economic environment on the company’s business; the company's ability to grow its business in a cost-efficient manner; the company's history of losses; the company’s ability to maintain important customer relationships; the company’s ability to compete; the company's failure to manage growth effectively; the company's need to scale its infrastructure in advance of demand for its tests and to increase demand for its tests; the risk that the company may not obtain or maintain sufficient levels of reimbursement for its tests; the company’s ability to obtain regulatory approval for its tests; the applicability of clinical results to actual outcomes; risks associated with litigation; the company's ability to use rapidly changing genetic data to interpret test results accurately and consistently; the applicability of clinical research results to actual outcomes; the timing of product launches and/or approvals; the success of collaborations; laws and regulations applicable to the company's business; and the other risks set forth in the reports filed by the company with the SEC, including its Quarterly Report on Form 10-Q for the quarter ended March 31, 2022. These forward- looking statements speak only as of the date hereof, and Invitae Corporation disclaims any obligation to update these forward-looking statements. Safe Harbor Statement

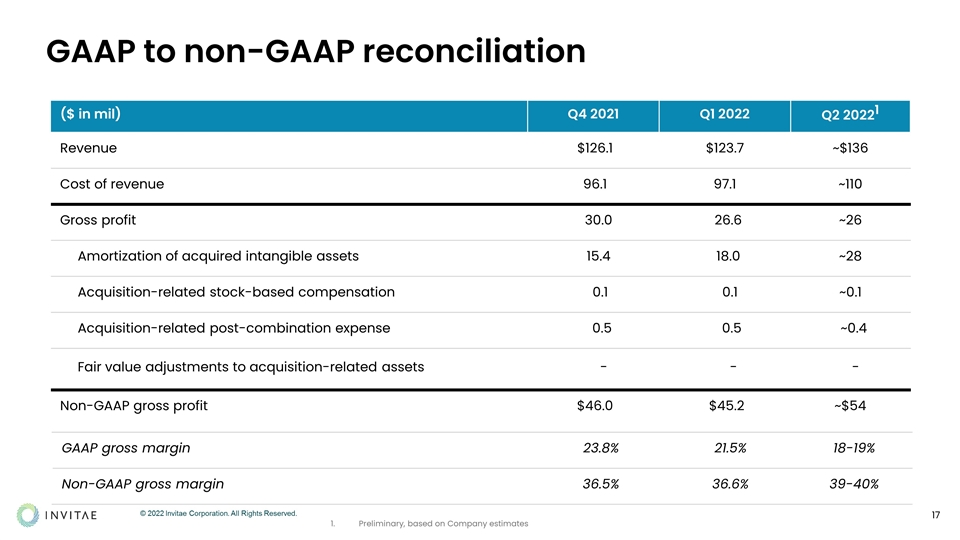

Preliminary second quarter results To supplement Invitae's consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States (GAAP), the company is providing several preliminary non-GAAP measures, including non-GAAP gross profit and non-GAAP gross margin, as well as non-GAAP cash burn. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly-titled measures presented by other companies. Management believes these non-GAAP financial measures are useful to investors in evaluating the company's ongoing operating results and trends. Management is excluding from some or all of its non-GAAP operating results (1) amortization of acquired intangible assets, (2) acquisition-related stock-based compensation, and (3) post-combination expense related to the acceleration of equity grants or bonus payments in connection with acquisitions. These non-GAAP financial measures are limited in value because they exclude certain items that may have a material impact on the company’s reported financial results. Management accounts for this limitation by analyzing results on a GAAP basis as well as a non-GAAP basis and also by providing GAAP measures in the company's public disclosures. Cash burn excludes changes in investments. Management believes cash burn is a liquidity measure that provides useful information to management and investors about the amount of cash consumed by the operations of the business. A limitation of using this non-GAAP measure is that cash burn does not represent the total change in cash, cash equivalents and restricted cash for the period because it excludes cash provided by or used for other operating, investing or financing activities. Management accounts for this limitation by providing information about the company's operating, investing and financing activities in the statements of cash flows in the consolidated financial statements in the company's most recent Quarterly Report on Form 10-Q and Annual Report on Form 10-K and by presenting net cash provided by (used in) operating, investing and financing activities as well as the net increase or decrease in cash, cash equivalents and restricted cash in its reconciliation of cash burn. In addition, other companies, including companies in the same industry, may not use the same non-GAAP measures or may calculate these metrics in a different manner than management or may use other financial measures to evaluate their performance, all of which could reduce the usefulness of these non-GAAP measures as comparative measures. Because of these limitations, the company's non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the non-GAAP reconciliations provided in the tables presented. Invitae has not completed preparation of its financial statements for the second quarter. The preliminary results presented in this presentation are based on current expectations and are subject to change. Actual results may differ materially from those disclosed in this presentation. Non-GAAP financial measurements

Agenda Leadership Transition Organizational Update Financial Outlook Business Outlook

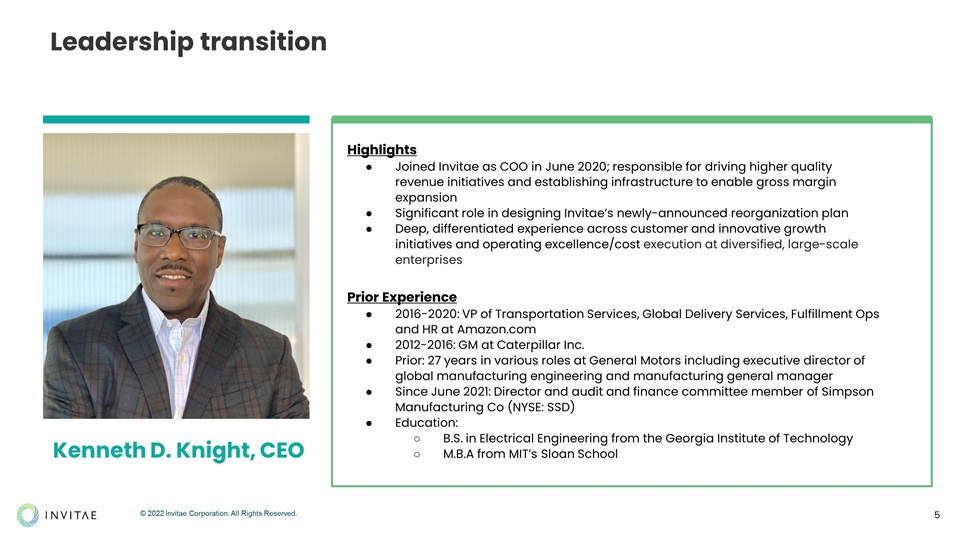

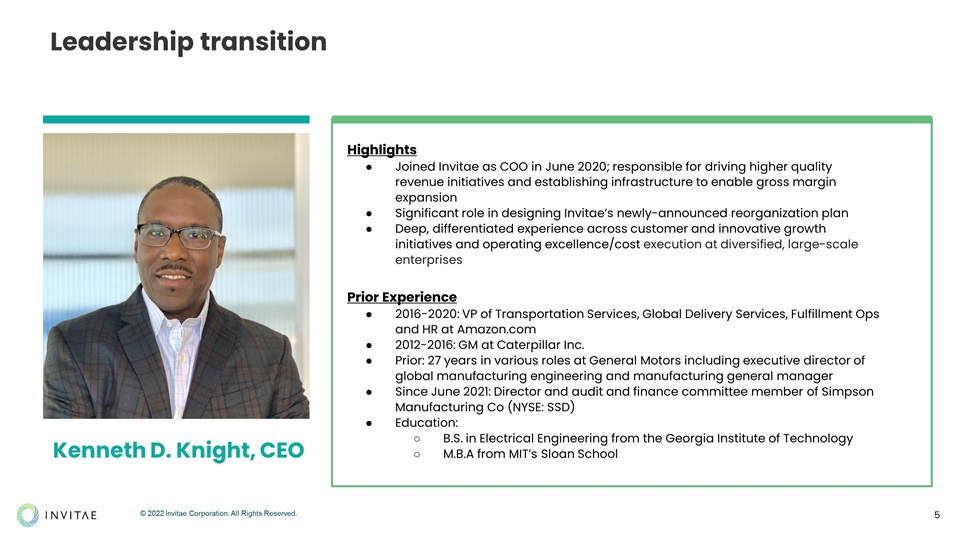

Leadership transition Prior Experience 2016-2020: VP of Transportation Services, Global Delivery Services, Fulfillment Ops and HR at Amazon.com 2012-2016: GM at Caterpillar Inc. Prior: 27 years in various roles at General Motors including executive director of global manufacturing engineering and manufacturing general manager Since June 2021: Director and audit and finance committee member of Simpson Manufacturing Co (NYSE: SSD) Education: B.S. in Electrical Engineering from the Georgia Institute of Technology M.B.A from MIT’s Sloan School Highlights Joined Invitae as COO in June 2020; responsible for driving higher quality revenue initiatives and establishing infrastructure to enable gross margin expansion Significant role in designing Invitae’s newly-announced reorganization plan Deep, differentiated experience across customer and innovative growth initiatives and operating excellence/cost execution at diversified, large-scale enterprises Kenneth D. Knight, CEO

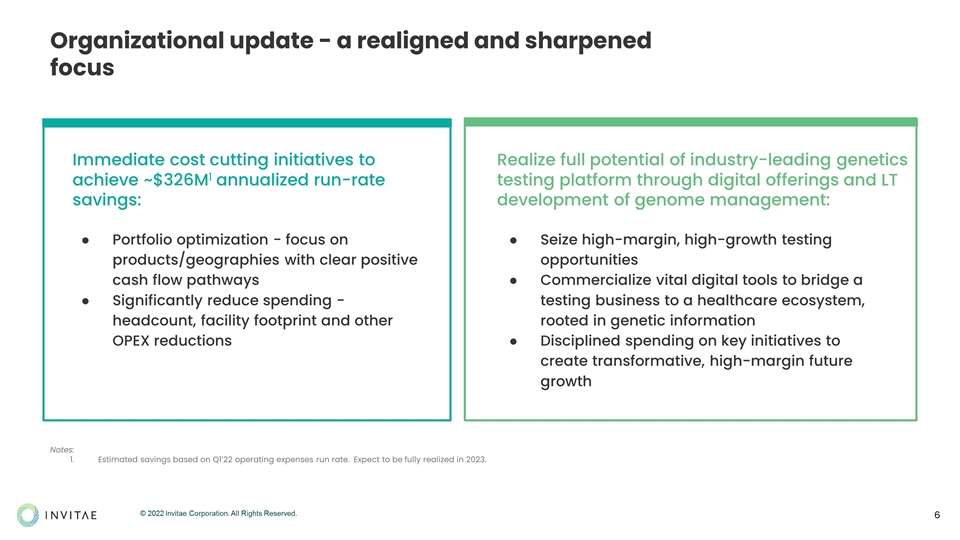

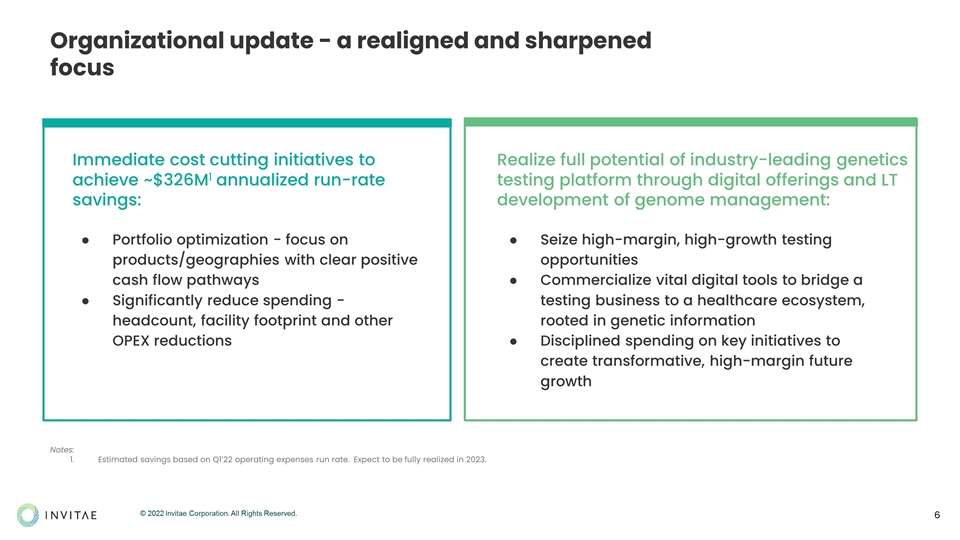

Organizational update - a realigned and sharpened focus Immediate cost cutting initiatives to achieve ~$326M1 annualized run-rate savings: Seize high-margin, high-growth testing opportunities Commercialize vital digital tools to bridge a testing business to a healthcare ecosystem, rooted in genetic information Disciplined spending on key initiatives to create transformative, high-margin future growth Realize full potential of industry-leading genetics testing platform through digital offerings and LT development of genome management: Portfolio optimization - focus on products/geographies with clear positive cash flow pathways Significantly reduce spending - headcount, facility footprint and other OPEX reductions Notes: Estimated savings based on Q1’22 operating expenses run rate. Expect to be fully realized in 2023.

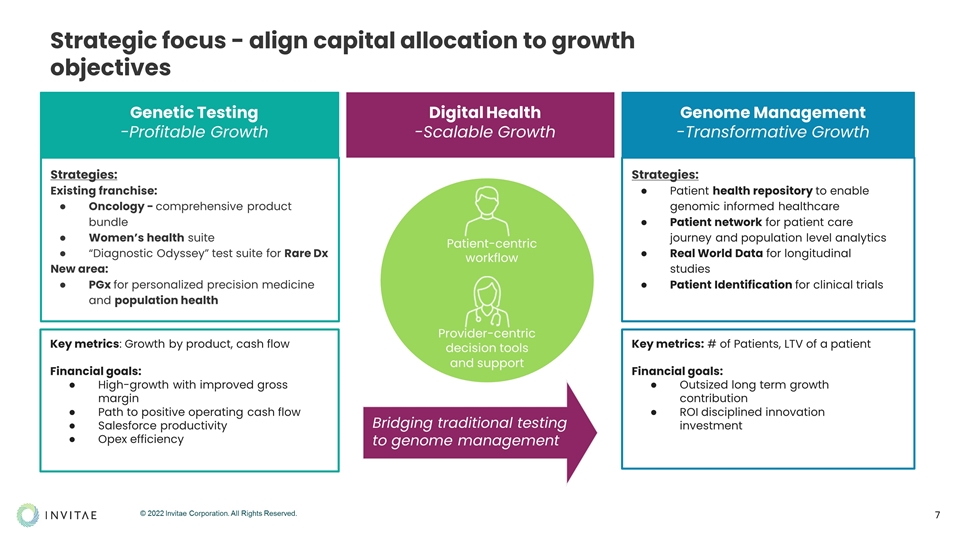

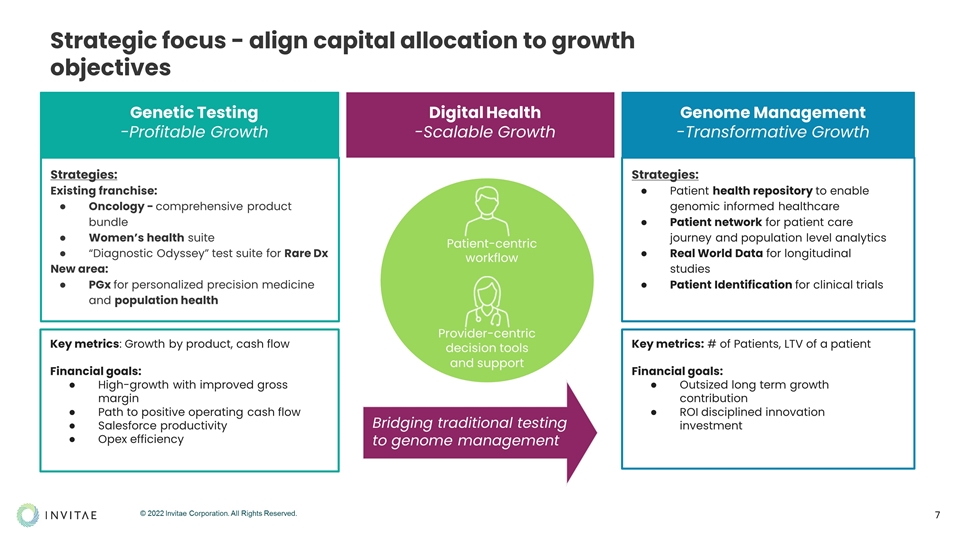

Strategies: Existing franchise: Oncology - comprehensive product bundle Women’s health suite “Diagnostic Odyssey” test suite for Rare Dx New area: PGx for personalized precision medicine and population health Genetic Testing -Profitable Growth Genome Management -Transformative Growth Key metrics: Growth by product, cash flow Financial goals: High-growth with improved gross margin Path to positive operating cash flow Salesforce productivity Opex efficiency Key metrics: # of Patients, LTV of a patient Financial goals: Outsized long term growth contribution ROI disciplined innovation investment Strategies: Patient health repository to enable genomic informed healthcare Patient network for patient care journey and population level analytics Real World Data for longitudinal studies Patient Identification for clinical trials Patient-centric workflow Bridging traditional testing to genome management Digital Health -Scalable Growth Provider-centric decision tools and support Strategic focus - align capital allocation to growth objectives

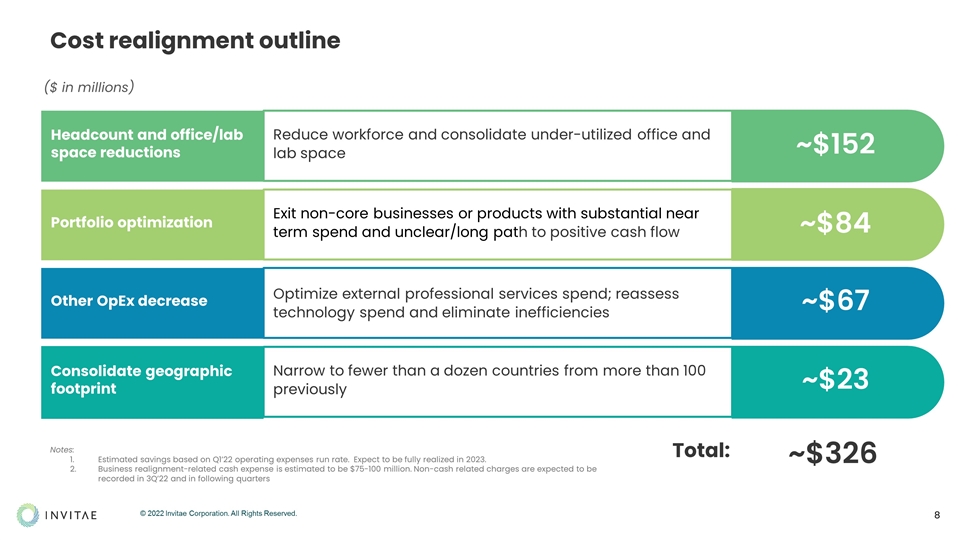

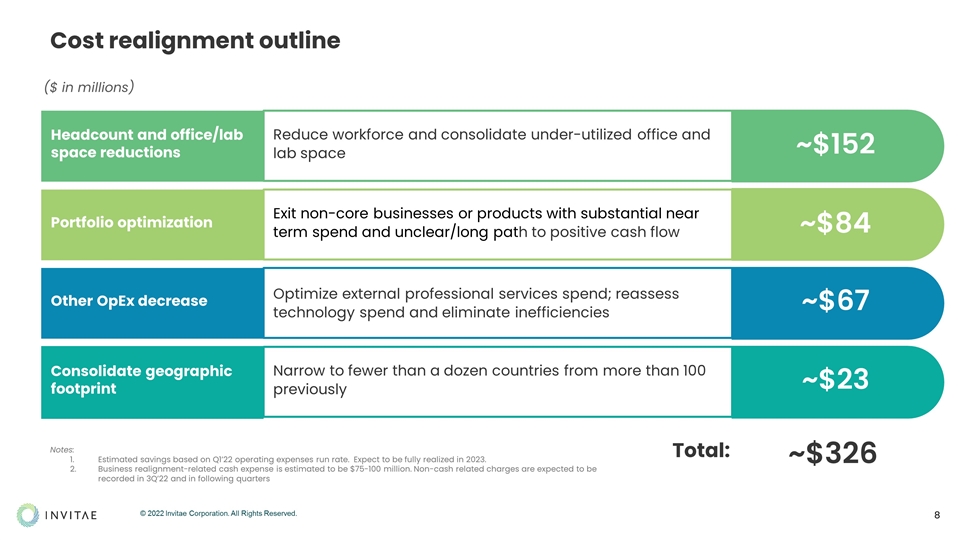

($ in millions) Consolidate geographic footprint Narrow to fewer than a dozen countries from more than 100 previously ~$23 Portfolio optimization Exit non-core businesses or products with substantial near term spend and unclear/long path to positive cash flow ~$84 Headcount and office/lab space reductions Reduce workforce and consolidate under-utilized office and lab space ~$152 Other OpEx decrease Optimize external professional services spend; reassess technology spend and eliminate inefficiencies ~$67 ~$326 Total: Notes: Estimated savings based on Q1’22 operating expenses run rate. Expect to be fully realized in 2023. Business realignment-related cash expense is estimated to be $75-100 million. Non-cash related charges are expected to be recorded in 3Q’22 and in following quarters Cost realignment outline

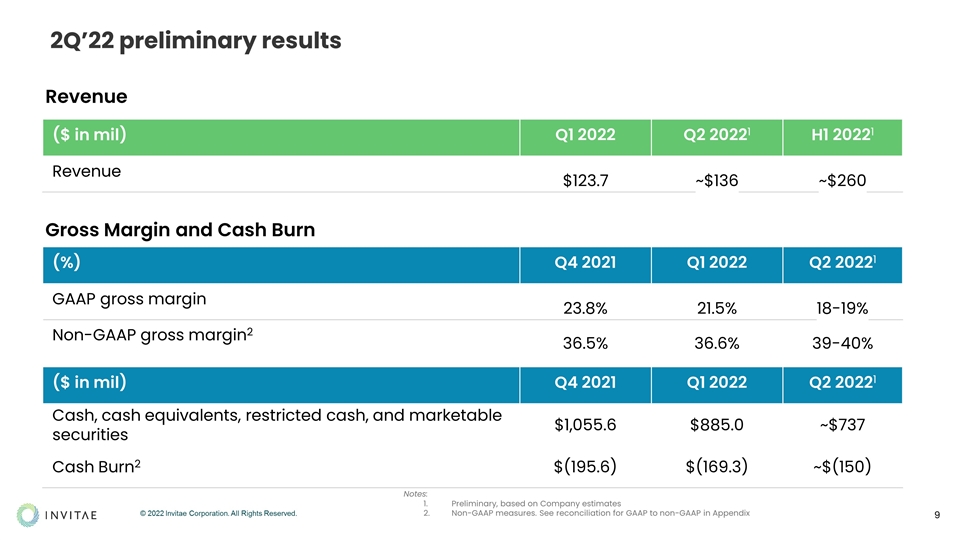

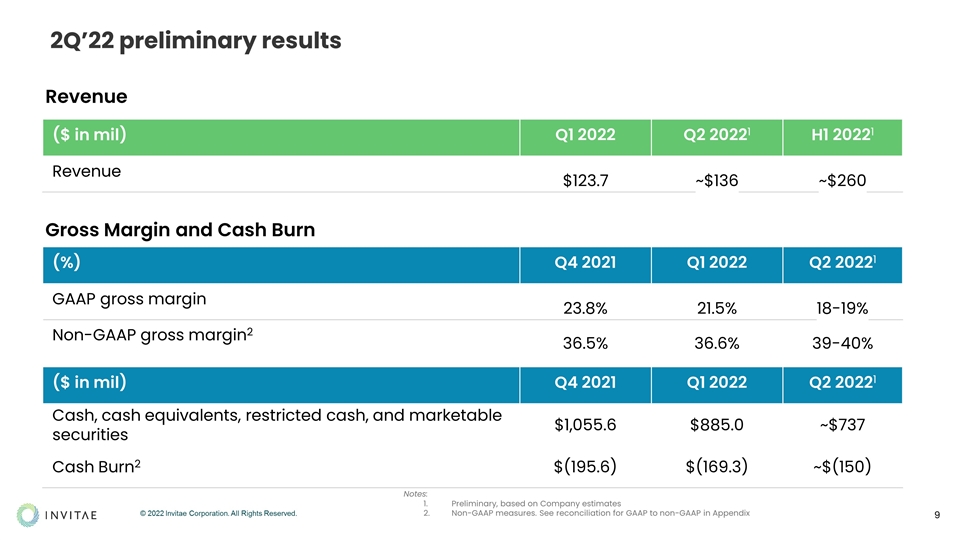

2Q’22 preliminary results ($ in mil) Q1 2022 Q2 20221 H1 20221 Revenue $123.7 ~$136 ~$260 (%) Q4 2021 Q1 2022 Q2 20221 GAAP gross margin 23.8% 21.5% 18-19% Non-GAAP gross margin2 36.5% 36.6% 39-40% ($ in mil) Q4 2021 Q1 2022 Q2 20221 Cash, cash equivalents, restricted cash, and marketable securities $1,055.6 $885.0 ~$737 Cash Burn2 $(195.6) $(169.3) ~$(150) Revenue Gross Margin and Cash Burn Notes: Preliminary, based on Company estimates Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Appendix

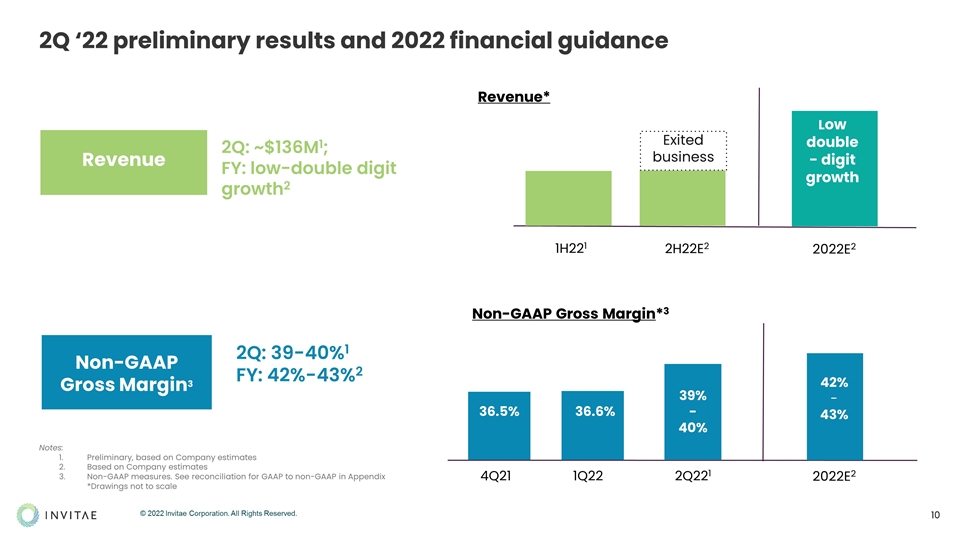

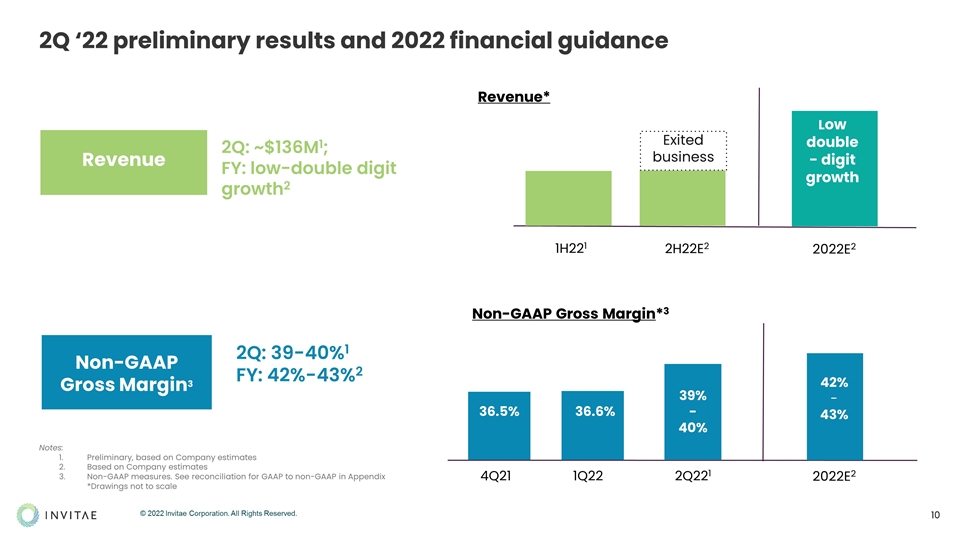

2Q ‘22 preliminary results and 2022 financial guidance Revenue Non-GAAP Gross Margin3 2Q: ~$136M1; FY: low-double digit growth2 2Q: 39-40%1 FY: 42%-43%2 1H221 2H22E2 Exited business 2022E2 Low double- digit growth Revenue* Non-GAAP Gross Margin*3 Notes: Preliminary, based on Company estimates Based on Company estimates Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Appendix *Drawings not to scale 1Q22 2Q221 4Q21 36.5% 2022E2 36.6% 39% - 40% 42% - 43%

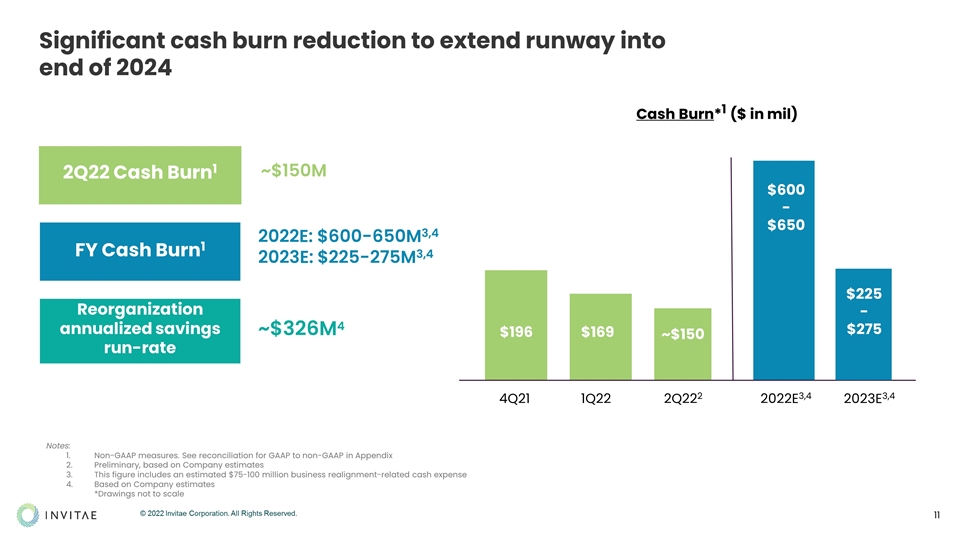

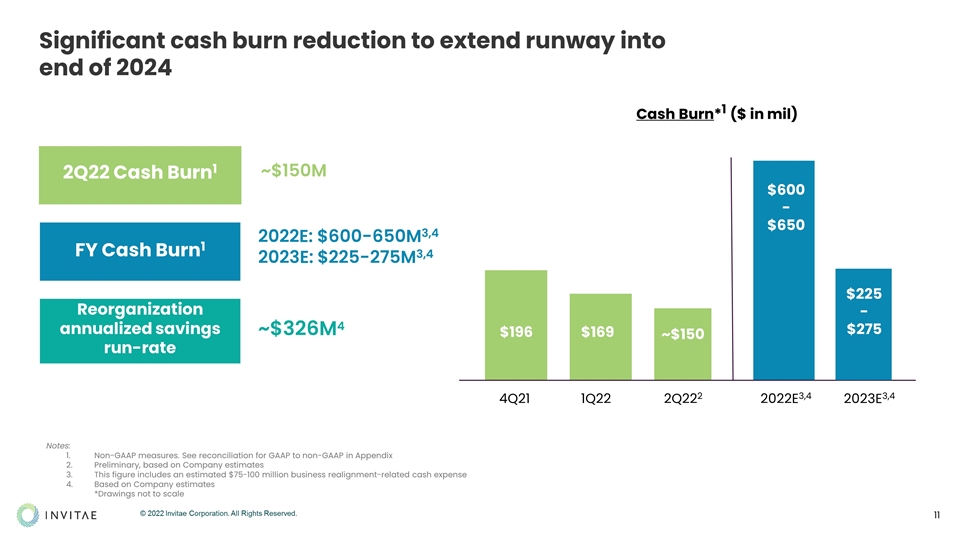

Significant cash burn reduction to extend runway into end of 2024 2Q22 Cash Burn1 FY Cash Burn1 Reorganization annualized savings run-rate ~$326M4 ~$150M 2022E: $600-650M3,4 2023E: $225-275M3,4 Notes: Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Appendix Preliminary, based on Company estimates This figure includes an estimated $75-100 million business realignment-related cash expense Based on Company estimates *Drawings not to scale 1Q22 2Q222 2023E3,4 $600 - $650 $225- $275 2022E3,4 $169 ~$150 Cash Burn*1 ($ in mil) 4Q21 $196

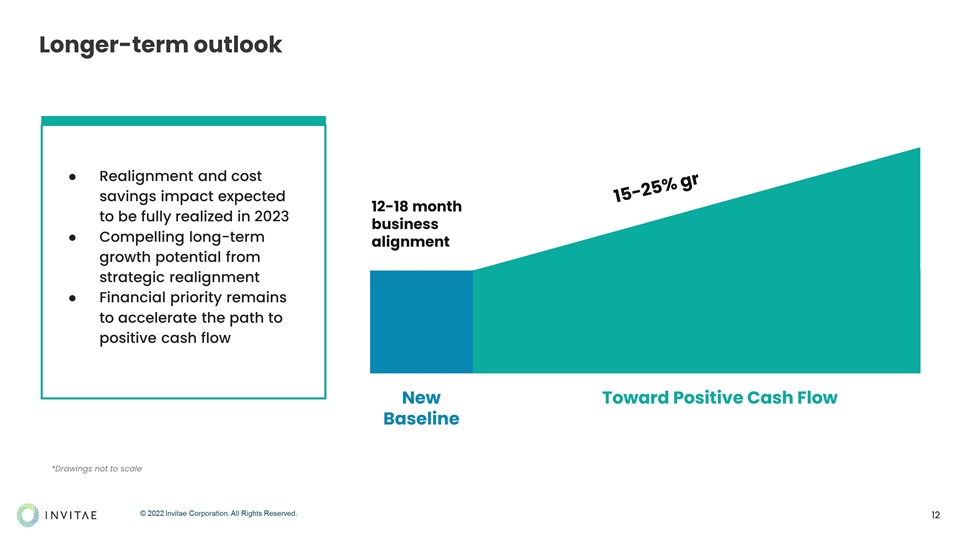

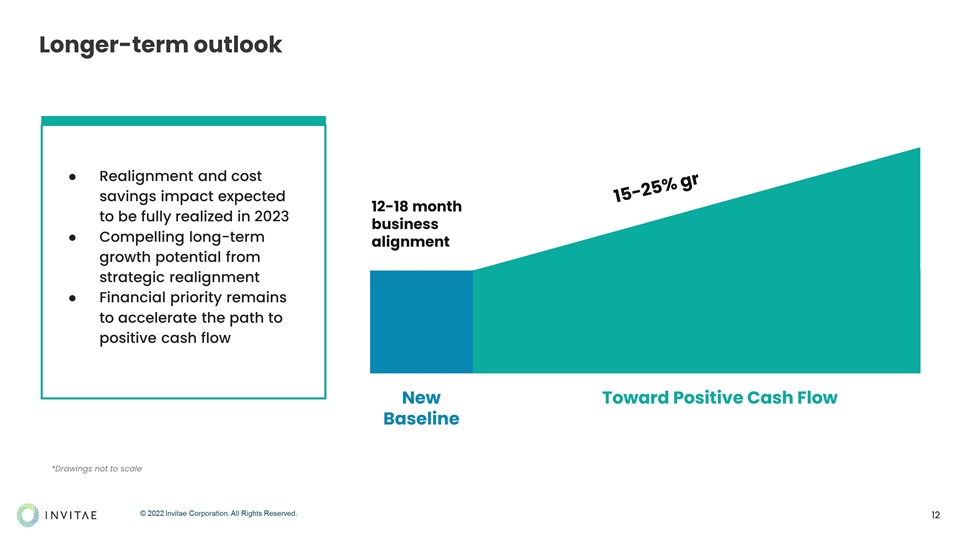

Longer-term outlook *Drawings not to scale 12-18 month business alignment New Baseline Toward Positive Cash Flow 15-25% gr Realignment and cost savings impact expected to be fully realized in 2023 Compelling long-term growth potential from strategic realignment Financial priority remains to accelerate the path to positive cash flow

Key takeaways Leadership team to execute growth with operational excellence Established, market leading genomic testing platform Strategic and operational realignment to match costs with profitable growth Cost saving initiatives expected to eliminate ~$326M by 2023 to extend runway significantly Maintaining differentiated vision to lead Invitae into genome management era

Q&A

Thank you.

Appendix

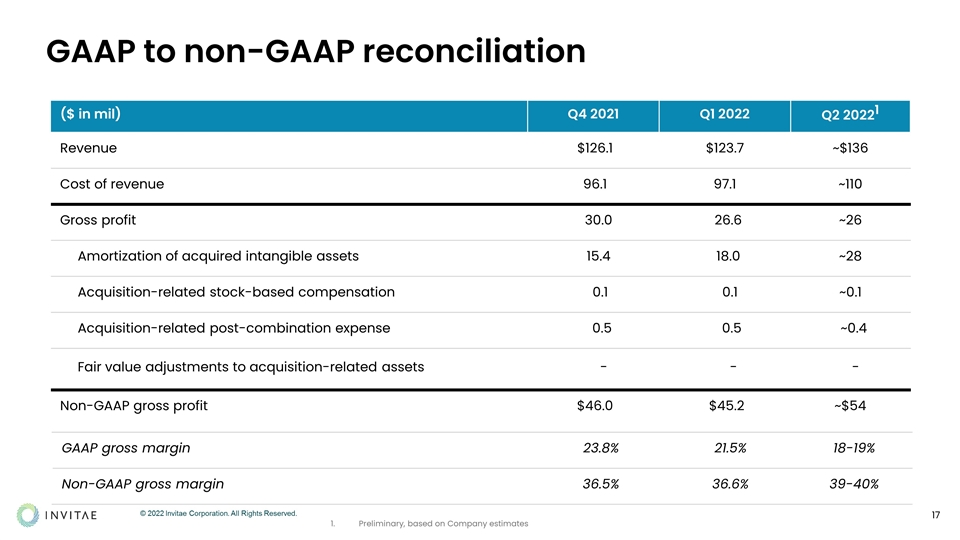

($ in mil) Q4 2021 Q1 2022 Q2 20221 Revenue $126.1 $123.7 ~$136 Cost of revenue 96.1 97.1 ~110 Gross profit 30.0 26.6 ~26 Amortization of acquired intangible assets 15.4 18.0 ~28 Acquisition-related stock-based compensation 0.1 0.1 ~0.1 Acquisition-related post-combination expense 0.5 0.5 ~0.4 Fair value adjustments to acquisition-related assets - - - Non-GAAP gross profit $46.0 $45.2 ~$54 GAAP to non-GAAP reconciliation 1. Based on Company Estimates GAAP gross margin 23.8% 21.5% 18-19% Non-GAAP gross margin 36.5% 36.6% 39-40% Preliminary, based on Company estimates

Cash, cash equivalents, restricted cash and marketable securities totaled ~$737 million at June 30, 2022 Approximately $150 million Cash Burn is estimated for Q2 2022 ($ in mil) Q4 2021 Q1 2022 Net cash used in operating activities $(175.9) $(147.5) Net cash used in investing activities 170.5 (449.5) Net cash used in financing activities 7.0 (920.0) Net decrease in cash, cash equivalents and restricted cash 1.6 (597.9) Adjustments: Net changes in investments (197.3) 428.6 Cash burn $(195.6) $(169.3) GAAP to non-GAAP reconciliation