- NVTAQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Invitae (NVTAQ) PRE 14APreliminary proxy

Filed: 3 Apr 23, 4:31pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

INVITAE CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required |

| Fee paid previously with preliminary materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

Invitae Corporation 1400 16th Street |

April 17, 2023

To our stockholders,

2022 was transformative for Invitae, and we passed several milestones along the way. We finished the year having served over 3.6 million patients in total since our founding. Additionally, information from over 2.3 million patients has been made available for sharing, in support of our core tenets that patients own their data and that data is more valuable when shared. From a customer standpoint, we wrapped up 2022 with over 20,000 health systems, institutions, clinics, and providers actively ordering from us. We are more and more focused on how we provide value for customers who share our vision to bring accessible and affordable genetic information into healthcare. Finally, our full year 2022 revenue crossed the $500 million threshold for the first time. These milestones are important, and come with them an acknowledgement of the privilege we have to be of service to so many. Invitaens believe in our mission, care deeply for the health outcomes of patients, and also embrace our fundamental responsibility to deliver long–term value for our stockholders.

In 2022, we also delivered a major strategic realignment, executed to reshape Invitae and set us on a path to operational excellence, profitable growth, cash preservation, and focused investment in support of our most promising opportunities. We are pleased that the major initiatives under our strategic realignment are now largely completed. These changes have unlocked improved margins and reduced cash consumption, and were done with swift execution and courage by our dedicated and committed teams.

The transformation does not end there. Already in 2023 we have taken steps to put the company on a more solid financial footing by addressing our short term debt maturities, including the repayment of our senior term loan in full.

Our mission — to bring comprehensive genetic information into mainstream medicine to improve healthcare for billions of people — has not changed. I’d like to thank our many stockholders, investors, customers, patients, and employees for their continued support of our mission, and for their belief and confidence in the important work that we are doing at Invitae. We are now moving forward, with a refined focus and strategy to deliver sustainable growth as we go about reaching our long-term goals.

And, speaking of the long-term, value is created by our ability to extend our market leadership position in comprehensive genetic testing while building a powerful platform using variant interpretation and clinical insights, followed by new products in oncology care, pharmacogenomics, and an emerging data business. By integrating and connecting our portfolio of products and services, we are evolving from a one-patient, one-test business model to one where each patient interaction provides multiple opportunities to deliver solutions — for them, their families and others in the ecosystem. This multiplying value proposition can translate directly to better patient outcomes, greater innovation, higher revenue, higher profitability, higher growth, and stronger returns. We are uniquely positioned to do this, not simply because we think it makes sense, but also because patients will demand it.

Our goals for 2023 are to continue to expand the ways we serve patients and customers, to further unlock profitable growth, to strengthen our infrastructure, to invest in our most promising future bets and clinical evidence, and to do these while managing our cash. We will balance our focus on growth with an emphasis on long-term profitability and capital management to scale our business.

Finally, I can’t talk about the efforts of Invitae without highlighting the impact of the talented, versatile, and hard–working employees who are Invitaens. It’s not easy going through a major realignment, and I am proud of how we finished 2022 with a determination and grit that were impressive to witness. I am honored to be a part of this group, and I am optimistic about Invitae’s future. We are grateful to our customers and patients for their business and for their trust, and to our stockholders for their support. We look forward to reporting our continued success for many years to come.

INVITAE CORPORATION • 2023 Proxy Statement 1

You are cordially invited to attend the 2023 Annual Meeting of Stockholders of Invitae Corporation, which will be held at 4:00 p.m., Pacific Time, on Monday, June 5, 2023. The Annual Meeting will be a completely virtual meeting of stockholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/NVTA2023 and using the 16-digit control number included in your proxy materials.

The formal notice of the Annual Meeting and the Proxy Statement have been made a part of this invitation.

Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. After reading the Proxy Statement, please promptly vote. Your shares cannot be voted unless you vote by Internet or telephone, vote as instructed by your broker, or vote your shares electronically at the Annual Meeting.

We look forward to seeing you at the meeting.

Together in health,

Kenneth D. Knight Chief Executive Officer

Invitae Corporation |

INVITAE CORPORATION • 2023 Proxy Statement 2

To Be Held on Monday,

June 5, 2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on June 5, 2023.

The Proxy Statement and Annual Report are available at www.proxyvote.com |

To our stockholders:

Invitae Corporation will hold its 2023 Annual Meeting of Stockholders at 4:00 p.m., Pacific Time, on Monday, June 5, 2023. The Annual Meeting will be a completely virtual meeting of stockholders conducted via live audio webcast. You will be able to attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/NVTA2023 and using the 16-digit control number included in your proxy materials.

We are holding this Annual Meeting:

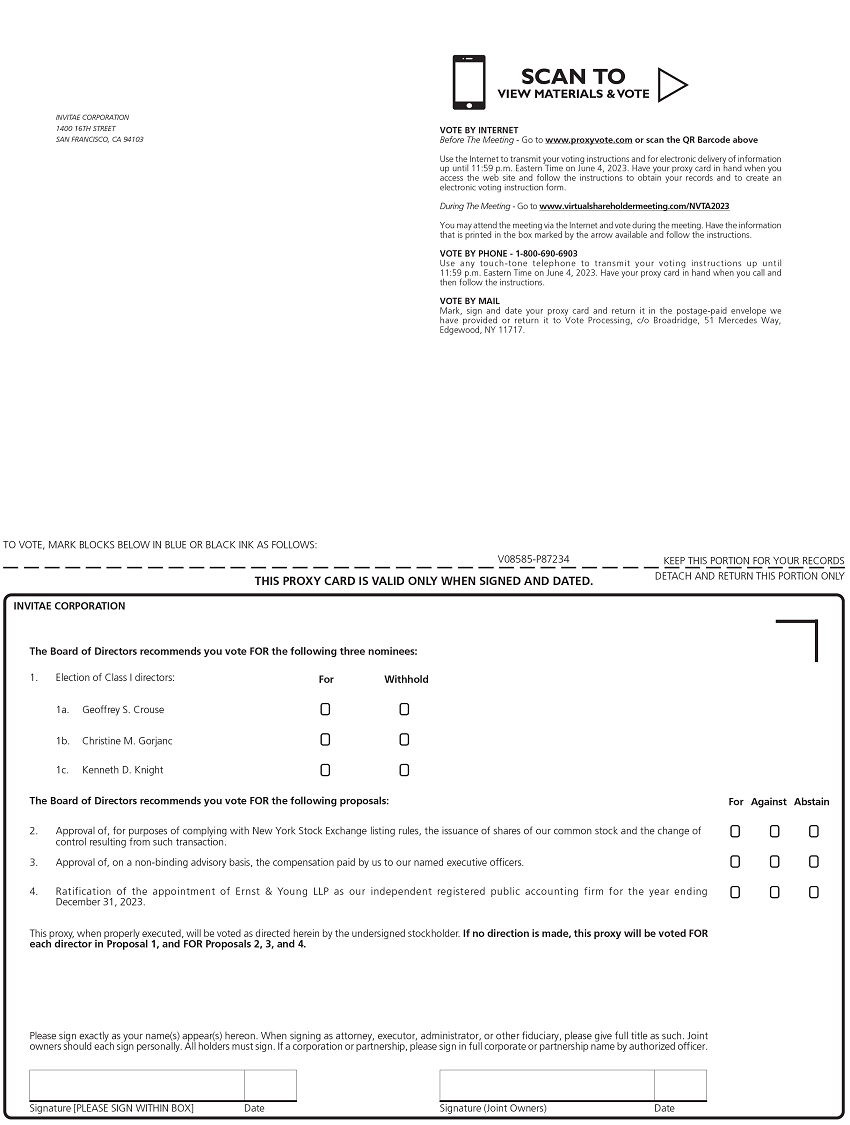

| • | to elect three Class I directors to serve until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified; |

| • | to approve, for purposes of complying with New York Stock Exchange (“NYSE”) listing rules, the issuance of shares of our common stock and the change of control resulting from such transaction (collectively, the “NYSE Proposal”); |

| • | to approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers as disclosed in the attached Proxy Statement; |

| • | to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2023; and |

| • | to transact such other business as may properly come before the Annual Meeting and any adjournments or postponements of the Annual Meeting. |

Stockholders of record at the close of business on April 10, 2023 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements of the Annual Meeting.

It is important that your shares be represented at the Annual Meeting. Whether or not you expect to attend the virtual Annual Meeting, please vote at your earliest convenience by following the instructions in the Notice of Internet Availability of Proxy Materials you received in the mail. Please review the detailed instructions on pages 50 to 54 regarding your voting options.

By Order of the Board of Directors,

Thomas R. Brida General Counsel, Chief Compliance Officer and Secretary San Francisco, California April 17, 2023 |

INVITAE CORPORATION • 2023 Proxy Statement 3

Table of Contents

INVITAE CORPORATION • 2023 Proxy Statement 4

Invitae Corporation 1400 16th Street San Francisco, California 94103 |

This Proxy Statement is being furnished to you in connection with the solicitation by the board of directors of Invitae Corporation, a Delaware corporation (“we,” “us,” “our,” “Invitae” or the “Company”), of proxies in the accompanying form to be used at the Annual Meeting of Stockholders of the Company to be held virtually on Monday, June 5, 2023 at 4:00 p.m., Pacific Time, and any adjournments or postponements thereof (the “Annual Meeting”).

The Notice of Internet Availability of Proxy Materials (the “Notice”) is being mailed to stockholders on or about April 17, 2023.

Please promptly vote by Internet or telephone, or by following the instructions provided by your broker, bank or nominee, so that your shares can be represented at the Annual Meeting.

| YOU MAY VOTE IN ONE OF THE FOLLOWING WAYS: |

INTERNET |

TELEPHONE |

MAIL |

AT THE VIRTUAL MEETING |

INVITAE CORPORATION • 2023 Proxy Statement 5

Our amended and restated bylaws (“Bylaws”) provide that our board of directors shall consist of such number of directors as the board of directors may from time to time determine. Our board of directors currently consists of eight directors. The authorized number of directors may be changed by resolution of our board of directors. Vacancies on our board of directors can be filled by resolution of our board. Our board of directors is divided into three classes, each serving staggered, three-year terms:

| • | Our Class I directors are Geoffrey S. Crouse, Christine M. Gorjanc and Kenneth D. Knight, and their terms will expire at the Annual Meeting; |

| • | Our Class II directors are Kimber D. Lockhart, Chitra Nayak and William H. Osborne, and their terms will expire at the 2024 annual meeting of stockholders; and |

| • | Our Class III directors are Eric Aguiar and Randal W. Scott, and their terms will expire at 2025 annual meeting of stockholders. |

Three Class I directors will be elected at the Annual Meeting to serve until the annual meeting of stockholders to be held in 2026 or until their successors are duly elected and qualified, with the other classes of directors continuing to serve for the remainder of their respective terms. The nominees receiving the highest number of affirmative votes will be elected as the Class I directors. The nominating and governance committee of the board has recommended, and our board of directors has designated, Geoffrey S. Crouse, Christine M. Gorjanc and Kenneth D. Knight as the nominees for Class I director to serve until the 2026 annual meeting of stockholders, and each has indicated to us that they will be able to serve. If any of the nominees are unable or decline to serve as a director at the time of the Annual Meeting, an event that we do not currently anticipate, proxies will be voted for any nominees designated by our board of directors, taking into account any recommendations of the nominating and governance committee, to fill such vacancy.

Certain biographical information and other information regarding the Class I nominees and the other members of our board of directors as of April 1, 2023 are set forth below:

| • | Director Independence. 7 of the 8 individuals currently serving as directors are independent within the meaning of the listing standards of the New York Stock Exchange. | |

| • | Director Diversity. 50% of our directors identify as a minority and 3 of 8 of our directors identify as female. | |

| • | Director Tenure. 50% of our directors have more than 5 years of tenure. The average tenure of our directors is approximately 5.4 years. | |

| • | Director Age. The average age of our directors is approximately 58 years. | |

| • | Director Skills. Our directors have diverse experiences and perspectives in areas that we believe are critical to the success of our business and to the creation of sustainable stockholder value, as described in the table below. |

INVITAE CORPORATION • 2023 Proxy Statement 6

The following table presents independence, tenure, skills, diversity attributes, age and committee assignments for our directors.

| Aguiar | Crouse | Gorjanc | Knight | Lockhart | Nayak | Osborne | Scott | |||||||||||

| Director Class | III | I | I | I | II | II | II | III | ||||||||||

| Independence |  |  |  |  |  |  |  | 88% | ||||||||||

| Tenure | ||||||||||||||||||

| Invitae board tenure (consecutive years) | 12 | 11 | 7 | 0 | 2 | 4 | 0 | 0 | 4.5 | |||||||||

| Invitae board tenure (total years) | 12 | 11 | 7 | 0 | 2 | 4 | 0 | 7 | 5.4 | |||||||||

| Skills | ||||||||||||||||||

| senior executive leadership |  |  |  |  |  |  |  |  | 100% | |||||||||

| finance and accounting expertise |  |  |  | 38% | ||||||||||||||

| biotechnology / medical |  |  |  |  |  | 63% | ||||||||||||

| growth / operations |  |  |  |  |  |  |  |  | 100% | |||||||||

| sales and marketing |  |  |  | 38% | ||||||||||||||

| technology |  |  |  |  |  |  | 75% | |||||||||||

| cybersecurity / data privacy |  | 13% | ||||||||||||||||

| business development / M&A |  |  |  |  |  | 63% | ||||||||||||

| executive compensation and human capital management |  |  |  |  |  | 63% | ||||||||||||

| global expertise |  |  |  |  |  |  |  | 75% | ||||||||||

| corporate governance |  |  |  | 25% | ||||||||||||||

| risk oversight |  |  |  | 38% | ||||||||||||||

| public company board service |  |  |  |  |  |  |  | 88% | ||||||||||

| environmental sustainability |  | 13% | ||||||||||||||||

| Diversity | ||||||||||||||||||

| Gender Diversity |  |  |  | 38% | ||||||||||||||

| Racial/Ethnic Diversity |  |  |  |  | 50% | |||||||||||||

| Age | 61 | 52 | 66 | 62 | 36 | 59 | 63 | 65 | 58 | |||||||||

| Committees | ||||||||||||||||||

= Member; = Member;  = Chair = Chair | ||||||||||||||||||

| Audit |  |  |  |  | ||||||||||||||

| Compensation |  |  |  | |||||||||||||||

| Nominating and Governance |  |  |  |

INVITAE CORPORATION • 2023 Proxy Statement 7

Age: 52

INDEPENDENT

Committees: • Audit • Compensation (Chair)

| GEOFFREY S. CROUSE

Since July 2017, Mr. Crouse has served as Chief Executive Officer of Candela Corporation, a non-surgical aesthetic device company. From December 2015 to July 2017, Mr. Crouse was a consultant for private equity evaluating investment opportunities. Mr. Crouse served as Chief Executive Officer of Cord Blood Registry, a company that stores stem cells from umbilical blood and tissues, from September 2012 to August 2015 when it was sold to AMAG Pharmaceuticals, and served as Executive Vice President of AMAG until December 2015. From April 2011 through September 2012, Mr. Crouse was a consultant for private equity evaluating investment opportunities. He previously served as Chief Operating Officer at Immucor, Inc., an in vitro diagnostics company, from August 2009 to April 2011. Prior to Immucor, he served as Vice President of the life sciences business at Millipore Corporation, a provider of technologies, tools and services for the life sciences industry, from 2006 to 2009. Prior to that, he worked at Roche, a pharmaceuticals and diagnostics company, where he held various roles from 2003 to 2006. Mr. Crouse holds a BA in English and Japanese from Boston College and an MBA and Masters of Public Health from the University of California, Berkeley. We believe that Mr. Crouse is qualified to serve on our board of directors due to his extensive experience in the life sciences industry and his management and financial experience with life sciences companies. |

Age: 66

INDEPENDENT

Committees: • Audit (Chair) • Compensation

| CHRISTINE M. GORJANC

Ms. Gorjanc is an experienced financial executive with expertise gained through service as a chief financial officer as well as working in multinational public companies. Ms. Gorjanc served as the Chief Financial Officer of Arlo Technologies, Inc. (NYSE: Arlo), a home automation company, from August 2018 to June 2020. She previously served as the Chief Financial Officer of Netgear, Inc. (Nasdaq: NTGR), a provider of networking products and services, from January 2008 to August 2018, where she also served as Chief Accounting Officer from December 2006 to January 2008 and Vice President, Finance from November 2005 to December 2006. From September 1996 through November 2005, Ms. Gorjanc served as Vice President, Controller, Treasurer and Assistant Secretary for Aspect Communications Corporation, a provider of workforce and customer management solutions. From October 1988 through September 1996, she served as the Manager of Tax for Tandem Computers, Inc., a provider of fault-tolerant computer systems. Prior to that, Ms. Gorjanc served in management positions at Xidex Corporation, a manufacturer of storage devices, and spent eight years in public accounting with a number of public accounting firms. Ms. Gorjanc joined the board of Shapeways Holdings, Inc., a leader in the fast-growing digital manufacturing industry, in March 2023. Since May 2019, Ms. Gorjanc has served as a director of Juniper Networks, Inc. (NYSE: JNPR), a leader in secure AI driven networks, and from March 2021 to October 2022, Ms. Gorjanc served as a director of Zymergen Inc. (Nasdaq: ZY), a biotechnology company. Ms. Gorjanc holds a BA in accounting from the University of Texas at El Paso and an MS in taxation from Golden Gate University. In April 2022, Ms. Gorjanc achieved NACD Directorship Certified status (National Association of Corporate Directors). We believe that Ms. Gorjanc is qualified to serve on our board of directors due to her extensive experience in the technology industry and her management and financial experience.

|

Age: 62 DirectorSince: 2022 | KENNETH D. KNIGHT

Mr. Knight has served as our Chief Executive Officer since July 2022 and as our Chief Operating Officer from June 2020 to July 2022. Prior to joining the Company, Mr. Knight most recently served as vice president of transportation services at Amazon. com, Inc. (Nasdaq: AMZN), a multinational and diversified technology company, from December 2019 to June 2020, and as Vice President of Amazon’s Global Delivery Services, Fulfillment Operations and Human Resources from April 2016 to December 2019. Prior to his time at Amazon, from 2012 to March 2016, Mr. Knight served as General Manager of Material Handling and Underground Business Division at Caterpillar Inc., a manufacturer of machinery and equipment. Prior to that, Mr. Knight served in various capacities at General Motors Company (NYSE: GM), a vehicle manufacturer, for 27 years, including as Executive Director of Global Manufacturing Engineering and as Manufacturing General Manager. Since June 2021, Mr. Knight has served as a director and a member of the audit and finance committee of Simpson Manufacturing Co., Inc. (NYSE: SSD), a construction product manufacturer. Mr. Knight holds a BS in Electrical Engineering from the Georgia Institute of Technology and an MBA from the Massachusetts Institute of Technology. We believe that Mr. Knight’s business experience and his understanding of our business given his current role as Chief Executive Officer qualify him to serve on our board of directors.

|

| THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE CLASS I NOMINEES SET FORTH ABOVE AS DIRECTORS OF THE COMPANY. |

INVITAE CORPORATION • 2023 Proxy Statement 8

Age: 61 Lead Independent

INDEPENDENT

Committees: • Compensation • Nominating and Governance (Chair) | ERIC AGUIAR, MD

Since January 2016, Dr. Aguiar has been a partner at Aisling Capital, an investment firm specializing in products, technologies, and global businesses that advance health. Prior to Aisling Capital, from October 2007 to December 2015, he was a partner at Thomas, McNerney & Partners, a healthcare venture capital and growth equity firm. From 2001 to 2007, Dr. Aguiar was a Managing Director of HealthCare Ventures, a healthcare focused venture capital firm. Dr. Aguiar was Chief Executive Officer and a director of Genovo, Inc., a biopharmaceutical company focused on gene delivery and gene regulation, from 1998 to 2000. Since December 2020, he has served as a director of Biomea Fusion (Nasdaq: BMEA), Inc., a preclinical-stage biopharmaceutical company. Since 2019, he has served as a director of BridgeBio Pharma, Inc. (Nasdaq: BBIO), a commercial-stage biopharmaceutical company. Dr. Aguiar previously served as a director of Eidos Therapeutics, Inc. (formerly Nasdaq: EIDX) in addition to Biohaven Pharmaceutical Holding Company Ltd. (NYSE: BHVN) and Amarin Pharmaceuticals (Nasdaq: AMRN), each a public biopharmaceutical company, as well as on the boards of directors of numerous private companies including companies in the life sciences industry. Since September 2021, Dr. Aguiar has served as a director of Garuda Therapeutics, a company focused on developing blood stem cell therapies. He is a member of the Council on Foreign Relations. Dr. Aguiar received an MD with honors from Harvard Medical School and a BA in Arts and Sciences from Cornell University. Dr. Aguiar was also a Luce Fellow and is a Chartered Financial Analyst. We believe that Dr. Aguiar is qualified to serve on our board of directors due to his extensive experience in the life sciences field, his experience on various public company boards, and his management and financial experience with life sciences companies. |

Age 36

INDEPENDENT

Committees: • Audit • Nominating and Governance | KIMBER D. LOCKHART

Ms. Lockhart currently serves on the boards of private and public companies, including as a director of Beam Technologies Inc., a digital-first provider of employee benefits for businesses, since July 2019. Previously, Ms. Lockhart served in various capacities at 1Life Healthcare, Inc., dba One Medical (Nasdaq: ONEM), a membership-based primary care platform, including as advisor from July 2021 to December 2021, Chief Technology Officer from March 2015 to June 2021, and Vice President of Engineering from April 2014 to March 2015. Ms. Lockhart holds a BS in Computer Science from Stanford University. We believe that Ms. Lockhart is an experienced technology leader and has scaled technology platforms to support rapid business growth and is therefore qualified to serve on our board of directors. |

Age 59

INDEPENDENT

Committees: • Nominating and Governance

| CHITRA NAYAK

Ms. Nayak serves as the ESG lead of our board of directors and is a public and private company board director for several businesses and an advisor to technology startups and venture firms 1414 Ventures & Plum Alley. From January 2019 to May 2021, she served as an adjunct faculty member at California State University’s MBA program. Ms. Nayak served as the Chief Operating Officer of Comfy, Inc., a real-estate technology company in the machine learning and IoT space, from February 2017 to June 2018, when it was acquired by Siemens, and prior to that, the Chief Operating Officer of Funding Circle Ltd., an online peer-to-peer lending marketplace, from February 2015 to May 2016. Prior to joining Funding Circle, Ms. Nayak worked at Salesforce, Inc., a cloud computing company, for eight years, serving in a variety of roles including Chief Operating Officer of Platform from February 2013 to January 2015, Senior Vice President of Global Sales Development from February 2008 to January 2013 and Vice President of Marketing Strategy & Operations from February 2007 to January 2008. From 2004 to 2006, Ms. Nayak served as Vice President, Membership Products for California State Automobile Association, a provider of automobile insurance. From 1999 to 2003, Ms. Nayak served as Vice President, Strategy & Operations of Charles Schwab Corporation, an investment and brokerage firm. Prior to that, Ms. Nayak spent six years with the Boston Consulting Group and four years with a number of environmental engineering consulting firms. Since March 2021, Ms. Nayak has served as a director of Infosys Limited (NYSE: INFY), an information technology company, and as a director of Forward Air Corporation (Nasdaq: FWRD). From November 2020 until its acquisition by TELUS Corporation in September 2022, she served as a director of LifeWorks Inc. (XTSE: LWRK). Ms. Nayak has served on the boards of directors of Intercom, a messaging platform company, since January 2020, and UrbanFootprint, a social impact data platform company, since March 2021. Ms. Nayak holds a BS in Engineering from the Indian Institute of Technology, an MS in Environmental Engineering from Cornell University, and an MBA from Harvard Business School (with honors). We believe that Ms. Nayak is qualified to serve on our board of directors due to her substantial experience scaling companies through high-growth phases as well as her background in operations and go-to-market strategies for complex businesses. |

INVITAE CORPORATION • 2023 Proxy Statement 9

Age: 63

INDEPENDENT

Committees: • Audit

| WILLIAM H. OSBORNE

Mr. Osborne most recently served as Senior Vice President of Operations and Total Quality for Boeing Defense, Space & Security (BDS) at The Boeing Company (NYSE: BA), an aerospace company, from May 2020 to October 2022, and as Boeing’s Senior Vice President, Enterprise Operations, from May 2018 until April 2020. Prior to that, Mr. Osborne served in various capacities at Navistar, Inc., a producer of commercial and military trucks, including as Senior Vice President of Global Manufacturing and Quality from August 2013 to August 2018, as Senior Vice President of Custom Products from May 2011 to August 2013, and as Corporate Director from September 2009 to April 2012. Prior to his time at Navistar, from September 2008 to October 2010, Mr. Osborne served as President and Chief Executive Officer of Federal Signal Corporation (NYSE: FSS), a manufacturer of emergency vehicle equipment. Mr. Osborne has served on the board of directors at Quaker Chemical Corporation (NYSE: KWR), a chemical company, since December 2016. Mr. Osborne also serves on the board of directors of Armstrong World Industries, Inc. (NYSE: AWI), a designer and manufacturer of walls and ceilings, since July 2022. Mr. Osborne holds a BS in Mechanical Engineering from Kettering University, an MS in Engineering from Wayne State University, and an MBA from University of Chicago. We believe that Mr. Osborne is qualified to serve on our board of directors due to his considerable track record of operational leadership. |

Age: 65

Chair of the Board

INDEPENDENT | RANDAL W. SCOTT, PHD

Dr. Scott is a Co-Founder of the Company and served as Chair of the Board and Chief Executive Officer from 2012 to 2017 and Executive Chairman from 2017 to 2019. Prior to Invitae, Dr. Scott cofounded Genomic Health, Inc. (Nasdaq: GHDX), a genomic-based diagnostic testing company, where he served as the chairman and chief executive officer from 2000 to 2009 and the executive chairman from 2009 to 2012. Dr. Scott serves as a director and as a member of the audit committee of BridgeBio Pharma, Inc. (Nasdaq: BBIO), a commercial-stage biopharmaceutical company, and as a director, chair of the audit committee and member of the nominating and corporate governance committee of Talis Biomedical Corporation (Nasdaq: TLIS), a molecular diagnostic company. He also serves on the boards of directors of and/or as an advisor to several private companies in the life sciences/biotech industry. Dr. Scott holds a BS in Chemistry from Emporia State University and a PhD in Biochemistry from the University of Kansas. We believe that Dr. Scott is qualified to serve on our board of directors due to his years of experience in the life sciences industry and his extensive executive leadership, management and board experience at public companies, and as our former Chief Executive Officer. |

Our board of directors nominates directors whose term is scheduled to expire at the next annual meeting of stockholders and elects new directors to fill vacancies when they arise. Our nominating and governance committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the board for nomination or election.

Our board of directors strives to find directors who are experienced and dedicated individuals with diverse backgrounds, perspectives and skills. Our Corporate Governance Guidelines contain membership criteria that call for candidates to be selected for their character, judgment, diversity of backgrounds, age, gender, ethnicity and professional experience, business acumen and ability to act on behalf of all stockholders. In addition, we expect each director to be committed to enhancing stockholder value and to have sufficient time to effectively carry out his or her duties as a director. Our nominating and governance committee also seeks to ensure that a majority of our directors are independent under the rules of the New York Stock Exchange (the “NYSE”) and that one or more of our directors is an “audit committee financial expert” under the rules of the Securities and Exchange Commission (the “SEC”).

The nominating and governance committee believes it appropriate for our Chief Executive Officer (“CEO”) to participate as a member of our board of directors.

Prior to our annual meeting of stockholders, our nominating and governance committee identifies director nominees first by evaluating the current directors whose terms will expire at the annual meeting and who are willing to continue in service. The candidates are evaluated based on the criteria described above, the candidate’s prior service as a director, and the needs of the board of directors for any particular talents and experience. If a director no longer wishes to continue in service, if the nominating and governance committee decides not to renominate a director, or if a vacancy is created on the board of directors because of a resignation or an increase in the size of the board or other event, then the committee will consider whether to replace the director or to decrease the size of the board. If the decision is to replace a director, the nominating and

INVITAE CORPORATION • 2023 Proxy Statement 10

governance committee will consider various candidates for board membership, including those suggested by committee members, by other board members, a director search firm engaged by the committee or our stockholders. Prospective nominees are evaluated by the nominating and governance committee based on the membership criteria described above and set forth in our Corporate Governance Guidelines. The nominating and governance committee will consider candidates recommended by stockholders. A stockholder who wishes to suggest a prospective nominee for our board of directors should notify the Secretary of the Company or any member of the nominating and governance committee in writing with any supporting material the stockholder considers appropriate.

Our board of directors determined that Eric Aguiar, Geoffrey S. Crouse, Christine M. Gorjanc, Kimber D. Lockhart, Chitra Nayak, William H. Osborne and Randal W. Scott are “independent directors” as defined under the rules of the NYSE. There are no family relationships among any of our directors or executive officers.

The members of our compensation committee during 2022 were Geoffrey S. Crouse, Eric Aguiar and Christine M. Gorjanc. No member of our compensation committee in 2022 was at any time during 2022 or at any other time an officer or employee of ours. None of our executive officers currently serve, or has served during the last completed fiscal year, on the compensation committee or board of directors of any other entity that has one or more executive officers serving as a member of our board of directors or compensation committee.

Our board of directors held twenty meetings during 2022. Each director attended at least 75% of the aggregate meetings held by our board of directors and the committees on which such director served. We do not have a policy that requires the attendance of directors at our annual meetings of stockholders. Five of our directors attended the 2022 annual meeting of stockholders.

During meetings of our board of directors, our independent directors meet in an executive session without management or management directors present. The purpose of these executive sessions is to promote open and candid discussion among the non-management directors. Our board of directors welcomes questions or comments about our Company and our operations. If you wish to communicate with our board of directors, including our independent directors, you may send your communication in writing to: Secretary, Invitae Corporation, 1400 16th Street, San Francisco, California 94103. You must include your name and address in the written communication and indicate whether you are a stockholder or interested party. The Secretary will review any communication received from a stockholder or interested party, and all material communications will be forwarded to the appropriate director or directors or committee of our board of directors based on the subject matter.

We have established an audit committee, compensation committee and nominating and governance committee, each of which operate under a charter that has been approved by our board of directors. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees complies with the applicable requirements of, the Sarbanes-Oxley Act, and the current rules and regulations of the SEC and the NYSE. We intend to comply with future requirements as they become applicable to us. Each committee has the composition and responsibilities described below.

INVITAE CORPORATION • 2023 Proxy Statement 11

MEMBERS: • Christine M. Gorjanc (Chair) • Geoffrey S. Crouse • Kimber D. Lockhart • William H. Osborne

NUMBER OF MEETINGS IN 2022: 7

| FUNCTIONS: Our audit committee assists our board of directors in fulfilling its legal and fiduciary obligations in matters involving our accounting, auditing, financial reporting, internal control, internal audit, risk and cybersecurity oversight and legal compliance functions, and is directly responsible for the approval of the services performed by our independent registered public accounting firm and reviewing of their reports regarding our accounting practices and systems of internal accounting control. Our audit committee also oversees the audit efforts of our independent registered public accounting firm and takes actions as it deems necessary to satisfy itself that such firm is independent of management. Our audit committee is also responsible for monitoring the integrity of our consolidated financial statements and our compliance with legal and regulatory requirements as they relate to financial statements or accounting matters. Our board of directors has determined that each of Ms. Gorjanc and Mr. Crouse is an audit committee financial expert, as defined by the rules promulgated by the SEC, and has the requisite financial sophistication as defined under the applicable rules and regulations of the NYSE. |

MEMBERS: • Geoffrey S. Crouse (Chair) • Eric Aguiar, MD • Christine M. Gorjanc

NUMBER OF MEETINGS

| FUNCTIONS: Our compensation committee assists our board of directors in meeting its responsibilities with regard to oversight and determination of executive compensation and assesses whether our compensation structure establishes appropriate incentives for officers and employees. Our compensation committee reviews and makes recommendations to our board of directors with respect to our major compensation plans, policies and programs. In addition, our compensation committee reviews and makes recommendations for approval by the independent members of our board of directors regarding the compensation for our executive officers, establishes and modifies the terms and conditions of employment of our executive officers and administers our stock option plans. The compensation committee has the authority, in its sole discretion, to select, retain, or obtain the advice of, any adviser to assist in the performance of its duties, but only after taking into consideration all factors relevant to the adviser’s independence from management.

Our board of directors has established a Special Stock Incentive Plan Committee, the members of which are our Chief Executive Officer, our Chief Financial Officer or Chief Accounting Officer, and our Chief Talent Officer. The Special Stock Incentive Plan Committee has been delegated the authority to make awards or grants under our 2015 Stock Incentive Plan (the “2015 Stock Plan”) (including shares, options, or restricted stock units) to employees (including new employees), other than to any member of our board of directors and individuals designated by our board of directors as “Section 16 officers.” |

MEMBERS: • Eric Aguiar, MD (Chair) • Kimber D. Lockhart • Chitra Nayak

NUMBER OF MEETINGS

| FUNCTIONS: Our nominating and governance committee is responsible for making recommendations to our board of directors regarding candidates for directorships and the size and composition of the board of directors. In addition, our nominating and governance committee is responsible for overseeing our Corporate Governance Guidelines, and reporting and making recommendations to the board of directors concerning corporate governance matters. Our nominating and governance committee also reviews the overall adequacy of our Corporate Social Responsibility and Environmental, Social and Governance strategy, initiatives and policies, including communications with employees, investors and other stakeholders. For ESG matters, Ms. Nayak serves as the liaison between our nominating and governance committee and our management team.

|

INVITAE CORPORATION • 2023 Proxy Statement 12

Our board of directors continuously evaluates its leadership structure, taking into account the evolving needs of the business and the interests of our stockholders. Our board of directors currently believes that it is in the best interests of the Company and its stockholders to separate the Chair of the Board and Chief Executive Officer roles and for our Chair to be independent. Since July 2022, Dr. Scott has served as our independent Chair of the Board. Our board of directors believes that our current structure, with an independent Chair, gives our board of directors a strong leadership and corporate governance structure that best serves the needs of the Company and its stockholders.

The Chair of the Board:

| • | presides at all meetings of our board of directors, and has the authority to call non-employee director sessions and independent director sessions; |

| • | approves board meeting agenda items and schedules; |

| • | helps facilitate communication between senior management and the independent directors; |

| • | works with committee chairs to oversee coordinated coverage of board responsibilities; |

| • | serves as an advisor to the Chief Executive Officer; |

| • | presides over all meetings of stockholders; and |

| • | participates and provides leadership on Chief Executive Officer performance evaluation and succession planning. |

Our lead independent director works with the Chair of the Board and our Chief Executive Officer on the board meeting agenda items and schedules, and serves in place of the Chair of the Board in the Chair’s absence.

Our board of directors is responsible for overseeing the overall risk management process at the Company. The responsibility for managing risk rests with executive management while the audit committees and our board of directors as a whole participate in the oversight process. Our board of directors’ risk oversight process builds upon management’s risk assessment and mitigation processes, which include reviews of long-term strategic and operational planning, executive development and evaluation, regulatory and legal compliance, environmental, social and governance initiatives, cybersecurity, COVID-19, financial reporting, internal risk management and internal controls.

Our Bylaws provide that if a majority of the votes cast for a director are marked “against” or “withheld” in an uncontested election, the director must promptly tender his or her irrevocable resignation for our board of directors’ consideration. In addition, our Corporate Governance Guidelines provide that the board shall nominate or elect as a director only persons who agree to tender, promptly following his or her election or re-election to the board, an irrevocable resignation that will be effective upon (i) the failure of the candidate to receive the required vote at the next annual meeting at which he or she faces re-election and (ii) the acceptance by the board of such resignation.

Our Bylaws provide a proxy access provision stating that stockholders who meet the requirements set forth in our Bylaws may under certain circumstances include a specified number of director nominees in our proxy materials. Under the provision, eligible stockholders, or a group of up to 20 stockholders, owning at least 3% of our outstanding shares of common stock continuously for at least three years, may nominate and include in our annual meeting proxy materials a limited number of director nominees constituting up to the greater of (i) two directors or (ii) 20% of the board (rounded down to the nearest whole number), subject to certain limitations and provided that the stockholders and nominees satisfy the requirements specified in our Bylaws.

INVITAE CORPORATION • 2023 Proxy Statement 13

Our purpose and values guide our aim to improve healthcare for all, uphold our social responsibility, exercise environmental stewardship and govern with trust and transparency throughout our business.

Our board of directors, as a whole and through its standing committees, works with our senior executive leadership team to oversee ESG issues. Our business functions drive management accountability for a range of ESG areas designed to maximize our impacts, drive better business performance and create long-term value for our stakeholders. While the entire board engages in corporate ESG matters, the nominating and governance committee, per its charter, has oversight responsibility for our company-wide corporate social responsibility (“CSR”) and ESG strategy, initiatives and policies. Chitra Nayak serves on the nominating and governance committee and acts as the liaison between our board and management on these matters.

Our CEO appointed our chief sustainability officer to oversee our day-to-day sustainability program and lead our ESG efforts including the ESG steering committee. This committee is composed of senior cross-functional leaders from medical affairs, human resources, finance, legal, facilities and others to champion our ESG program and guide our multiyear efforts to improve ESG capabilities across our business.

Additional information about our ESG activities is in our ESG Report. Although not incorporated by reference into this Proxy Statement, our ESG Report is available at our website at www.invitae.com/social-responsibility.

Our ESG approach reflects the passion in our work to reach more patients, support our clinicians, and lead in the advancement of the science of genetics. We developed core tenets to represent the principles that direct our actions, guide our decision-making across all levels of the organization, and form the foundation of our sustainability efforts.

| 1. | Healthcare for all: We spearhead the mission to bring comprehensive genetic information into mainstream medicine to improve healthcare for people worldwide. | |

| 2. | Social Responsibility: We implement programs that instill ethical practices and increase diversity, equity and inclusion among employees, patients, suppliers and partners throughout our value chain. | |

| 3. | Environmental Stewardship: We work to minimize our environmental impact and reduce our emissions footprint. | |

| 4. | Governance: We ensure that our governance structure and policies implement ethical, transparent and accountable business practices to ensure corporate performance and value. |

We understand that engaging with our internal and external stakeholders is critical for our long-term business success. We proactively engage them in continuous dialogue regarding our business and sustainability efforts through open discussion, collaboration and transparent disclosure. We apply stakeholders’ valued perspectives to inform, prioritize and continually improve our ESG strategy and advance our social and environmental initiatives.

We provide affordable testing, integrated health information, digital solutions and data services to shape genomic medicine and support patients through all stages of life. As a result, we believe healthcare relies less on trial and error and more on fact-based analysis of biology and medical risks using genomic information.

| • | Our 2022 efforts included a focus on improving patient outcomes and the science of genetics, broadening access through affordability, expanding to underserved populations, and driving access through patient advocacy. |

| • | We released a Data Use Transparency and Impact Report which detailed how Invitae uses de-identified patient data to help advance precision medicine research. Invitae is leading the industry by publishing this report about using de-identified data for secondary research. We believe we provide a transparent view into how we manage de-identified patient data responsibly and how we use it to promote patient advocacy, further scientific research, and advance patient outcomes to produce positive healthcare impacts for individuals and society. |

| • | We tirelessly advocate for expanded access to genetic testing. We believe our efforts resulted in policies and professional clinical guidelines that qualify more patients and their families for genetic testing. We joined other clinical experts pushing for the advancement of universal germline testing. |

Our commitment to our people and communities is intrinsically linked to our overall mission to improve people’s healthcare. We are dedicated to fostering a culture of diversity, equity and inclusion to positively impact our people and business.

Our relationships with our employees and the stakeholders in our value chain fall within our social responsibility. For our employees, we strive to create an innovative and supportive workplace. We also aim to uphold the value of our core ESG tenets via our safety protocols, quality management systems and vendor compliance requirements.

In 2022, we strengthened our programs in an effort to ensure equitable representation, engagement and advancement of all employees.

| • | Our diversity, equity, and inclusion mission is to engage, develop and retain talent by fostering community, providing education and support and advancing inclusive research and health equity globally. We have a dedicated team focused on driving this effort. |

| • | As of December 31, 2022, approximately 56.3% of our U.S. workforce is White, 20.5% Asian, 9.3% Hispanic or Latino, 5.2% Black or African American, 4.0% two or more races, 0.2% Native Hawaiian or Pacific Islander, 0.1% American Indian or Alaska Native and 4.4% not known based on our payroll system and individual self-identification. On our management team, 21% are people who identify as a minority. |

| • | Our workforce is approximately 61% female, and our management team is 29% female. |

INVITAE CORPORATION • 2023 Proxy Statement 14

| • | Invitae believes that employee engagement is directly connected to purpose, and through our employee resource groups, or ERGs, we foster those connections and meaningful work relationships. Our ERGs are committed to community, learning, and service. In 2022, we launched a new group “Differently Abled” focused on supporting people with different abilities. Our eight previously established groups include: InvitASIANS, BlackGenX, LatinX, Genetic Counseling at Invitae, Peer Soul Support Team, Rainbow Connection, Vets-in-Genetics, Women in HealthCare. |

| • | We maintained ongoing employee engagement through quarterly team surveys and monthly pulse surveys. |

| • | We strengthened our governance framework with the adoption of a Supplier Code of Conduct and Human Rights Policy. |

Sustainability is part of our DNA, and our environmental stewardship is a serious endeavor. We recognize climate change has a direct impact on human health and well-being. We work to examine and minimize our environmental impact and decrease our emissions footprint. Our efforts include integrating energy-efficient technologies and advancing eco-friendly products.

| • | Since 2019, our team has tracked energy use, water consumption and waste data to eventually achieve carbon neutrality. We continue to operationalize data collection for Scope 1 and Scope 2 emissions and ready ourselves for forthcoming regulatory reporting requirements inclusive of Scope 3. |

| • | Since the establishment of our Green Ambassadors Program (GAP) in 2021, we have continued to operationalize our environmental sustainability-related practices. The role of GAP is to advance our environmental sustainability programs (including carbon tracking) and encourage the use of best practices across sites. |

| • | We realize our effectiveness in executing our objectives begins with understanding our environmental impact and carbon footprint. As a result, we engaged a third-party expert to complete an in-depth analysis of our 2020, 2021 and 2022 emissions, water use and waste data. We continue to build on an established baseline to facilitate ongoing measurement, management and reporting. This foundation better positions us to improve internal tracking systems, launch eco-friendly initiatives, and set science-based targets to reduce our environmental footprint over time. |

Governance plays a critical role in driving our ESG goals. Our board leadership — combined with how we manage risk, implement ethics compliance, and ensure privacy and data security — is crucial for our long-term success. Our board continuously evaluates its leadership structure and considers the evolving needs of the business and interests of our stockholders.

| • | Our board of directors reflects diversity in experience, skills, race, ethnicity, age and gender. As of January 26, 2023 with the addition of a new board member, 37.5% of our board members identify as female and 50% as a minority. 88% of our directors are independent under the rules of the NYSE. |

| • | We have ethics and compliance policies and programs, including a Code of Business Conduct and Ethics that applies to each of our directors, officers and employees, and training on these policies, with compliance tracked and overseen by our Chief Compliance Officer. |

| • | In January 2022, we adopted a Supplier Code of Conduct, which details our expectations for our suppliers and their subcontractors to comply with applicable laws and to operate their businesses in an ethical and sustainable manner. |

| • | We concurrently instituted a Human Rights Policy, which outlines the fundamental rights, freedoms and standards of treatment to which we believe all people are entitled. These rights include respect for labor rights, treating all people with dignity and respect, enabling a healthy and safe work environment, promoting ethical behavior and respecting privacy. We recognize that we are part of the communities in which we operate, and as part of our mission, we believe respect for human rights is integral to our business. |

| • | Four Invitae core laboratories (San Francisco, Irvine, Metropark and Sydney, Australia) achieved accreditation by the International Organization for Standardization (ISO) for Clinical Laboratories ISO 15189. This distinction validates our dedication to continuous quality improvement for patients and ability to operate a resilient laboratory organization. |

| • | Invitae has a robust privacy and data security program. Invitae’s Data Use Committee focuses on data usage and sharing activities with a lens on privacy and regulatory compliance based on the Health Insurance Portability and Accountability Act of 1996 (HIPAA), the Clinical Laboratory Improvement Amendments of 1988 (CLIA), the General Data Protection Regulation (GDPR), the Common Rule and other such domestic and foreign rules. As part of risk oversight, our board oversees patient privacy and data security and receives a quarterly update from our security team and our general counsel. |

| • | Ensuring that people own and control their genetic data has been one of our core principles from inception. We are committed to the privacy and security of all protected health information (PHI) we create, receive, use, disclose and transmit. We allow users to access, rectify and delete certain of their data on our platform. |

| • | Our privacy practices are explained within our HIPAA Notice of Privacy Practices and Privacy Policy on our privacy website available at www.invitae.com/privacy. As a provider of clinical genetic testing services, we are a covered entity subject to the HIPAA Privacy Rule, Security Rule and Breach Notification Rule. Our privacy and security compliance program is subject to inspection by the secretary of Health & Human Services and the Office for Civil Rights for complaint investigation and monitoring of our compliance with these three rules. Our privacy and security compliance program is regularly reviewed and updated to respond to emerging risks. |

| • | We have instituted business continuity planning and risk management processes to understand and manage risks related to our operations, both physical and those related to IT. These efforts are led by our IT and operations teams. We have developed a formal Invitae business continuity plan based on an enterprise-wide assessment to identify critical business areas and processes that have the potential, if disrupted, to significantly impact overall business operations, reputation and quality. This plan was finalized in 2022 and will be reviewed annually to ensure that all risks are identified and mitigated effectively. |

INVITAE CORPORATION • 2023 Proxy Statement 15

It is our policy that all employees, officers and directors must avoid any activity that is or has the appearance of conflicting with the interests of the Company. This policy is included in our Code of Business Conduct and Ethics as discussed below. Additionally, we conduct a review of all related party transactions for potential conflict of interest situations on an ongoing basis and all such transactions relating to executive officers and directors must be approved by our audit committee, as discussed below.

Our board of directors has adopted written Corporate Governance Guidelines to ensure that the board will have the necessary authority and practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices the board intends to follow with respect to board composition and selection, board meetings and involvement of senior management, Chief Executive Officer performance evaluations and succession planning, and board committees and compensation. The nominating and governance committee assists our board of directors in implementing and adhering to the Corporate Governance Guidelines. The Corporate Governance Guidelines are reviewed at least annually by the nominating and governance committee, and changes are recommended to our board of directors as warranted.

We believe that our corporate governance initiatives comply with the Sarbanes-Oxley Act and the rules and regulations of the SEC adopted thereunder. In addition, we believe our corporate governance initiatives comply with the rules of the NYSE. Our board of directors will continue to evaluate our corporate governance principles and policies.

Our board of directors has adopted a Code of Business Conduct and Ethics that applies to each of our directors, officers and employees. The code addresses various topics, including:

| • | compliance with laws, rules and regulations; |

| • | interacting with healthcare professionals; |

| • | quality of products and services; |

| • | privacy and data security; |

| • | prohibiting bribery and corrupt payments; |

| • | transfers of value; |

| • | fair dealing; |

| • | environmental stewardship; |

| • | safe and healthy workplace; |

| • | open and respectful workplace; |

| • | policy against retaliation; |

| • | confidentiality; |

| • | insider trading; |

| • | communicating on behalf of the Company; |

| • | conflicts of interest; |

| • | corporate opportunities; |

| • | protection and proper use of company assets; and |

| • | record keeping. |

Our board of directors has also adopted a Code of Ethics for Senior Financial Officers applicable to our Chief Executive Officer and Chief Financial Officer as well as other key management employees addressing ethical behavior, compliance with law and reporting of material information. The Code of Business Conduct and Ethics and the Code of Ethics for Senior Financial Officers can only be amended by the approval of a majority of our board of directors. Any waiver to the Code of Business Conduct and Ethics for an executive officer or director or any waiver of the Code of Ethics for Senior Financial Officers may only be granted by our board of directors or a committee thereof and must be timely disclosed as required by applicable law. We have implemented whistleblower procedures that establish formal protocols for receiving and handling complaints from employees. Any concerns regarding accounting or auditing matters reported under these procedures will be communicated promptly to our audit committee.

To date, there have been no waivers under our Code of Business Conduct and Ethics or Code of Ethics for Senior Financial Officers. We intend to disclose future amendments to certain provisions of these codes or waivers of such codes granted to executive officers and directors on our website at ir.invitae.com within four business days following the date of such amendment or waiver.

Our Corporate Governance Guidelines, Code of Business Conduct and Ethics, Code of Ethics for Senior Financial Officers, charters for each of the audit, compensation and nominating and governance committees and other corporate governance documents, are posted on the investor relations section of our website at ir.invitae.com under the heading “Leadership —Governance documents.” In addition, stockholders may obtain a printed copy of these documents by writing to Secretary, Invitae Corporation, 1400 16th Street, San Francisco, California 94103.

INVITAE CORPORATION • 2023 Proxy Statement 16

In addition to the compensation arrangements of our directors and named executive officers discussed elsewhere in this Proxy Statement or disclosed below, there were no transactions since January 1, 2022 to which we have been or will be a party, and in which the amount involved exceeded or will exceed $120,000 and in which any of our directors, executive officers, beneficial holders of more than 5% of our capital stock, or entities affiliated with, or immediate family members of, any of the foregoing, had or will have a direct or indirect material interest.

In 2021, the Company invested $1,000,000 in Series B Preferred Stock of Genomic Life, Inc., a company focused on accelerating access to affordable and engaging genomics-based, proactive health solutions, for which Dr. Scott serves on the board of directors (including as executive co-chair) and is a significant stockholder.

We have entered into indemnification agreements with our directors and executive officers. These agreements require us to indemnify these individuals to the fullest extent permitted under Delaware law against liabilities that may arise by reason of their service to us, and to advance expenses incurred as a result of any proceeding against them as to which they could be indemnified.

We have adopted a written policy that our executive officers, directors, holders of more than 5% of any class of our voting securities, and any member of the immediate family of and any entity affiliated with any of the foregoing persons, are not permitted to enter into a related party transaction with us without the review and approval of our audit committee in accordance with such policy. Any request for us to enter into a transaction with an executive officer, director, principal stockholder, or any of their immediate family members or affiliates, in which the amount involved exceeds $120,000 must be presented to our audit committee for review, consideration and approval. In approving or rejecting any such proposal, our audit committee will approve only those transactions it determines are fair to and in the best interests of the Company, after considering the relevant facts and circumstances available and deemed relevant to our audit committee, including, but not limited to, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction.

INVITAE CORPORATION • 2023 Proxy Statement 17

Our director compensation is based on the recommendation of our independent compensation consultant as to what is market competitive and did not change for 2022. The following table shows certain information with respect to the compensation of our non-employee directors during the fiscal year ended December 31, 2022, including the compensation paid to Dr. George in the role of a non-employee director:

| Name | Fees earned or paid in cash ($) | Stock awards ($) | Option awards ($) | (1) | All other compensation ($) | Total ($) | |||||

| Eric Aguiar, MD | 106,019 | 226,548 | 76,030 | – | 408,597 | ||||||

| Geoffrey S. Crouse | 75,000 | 167,562 | 56,150 | – | 298,712 | ||||||

| Christine M. Gorjanc | 77,500 | 167,562 | 56,150 | – | 301,212 | ||||||

| Kimber D. Lockhart | 65,000 | 167,562 | 56,150 | – | 288,712 | ||||||

| Chitra Nayak | 55,000 | 167,562 | 56,150 | – | 278,712 | ||||||

| Randal W. Scott, PhD | 50,000 | 153,330 | 53,005 | – | 256,335 | ||||||

| Sean E. George, PhD(2) | 22,690 | 45,743 | 8,462 | – | 76,895 |

| (1) | Amounts represent the aggregate fair value of the option awards computed as of the grant date of each award in accordance with Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 718 (“ASC 718”) for financial reporting purposes, rather than amounts paid to or realized by the named individual. See the notes to our consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2022 for a discussion of assumptions made in determining the grant date fair value and compensation expense of our stock options. There can be no assurance that option awards will be exercised (in which case no value will be realized by the individual) or that the value on exercise will approximate the fair value as computed in accordance with ASC 718. |

| The following table sets forth the aggregate number of shares of common stock underlying stock and option awards outstanding on December 31, 2022: |

| Name | Number of shares | |

| Eric Aguiar, MD | 91,100 | |

| Geoffrey S. Crouse | 125,100 | |

| Christine M. Gorjanc | 127,600 | |

| Kimber D. Lockhart | 70,600 | |

| Chitra Nayak | 100,100 | |

| Randal W. Scott, PhD | 80,805 | |

| Sean E. George, PhD | 52,784 |

| (2) | For his service on the Board following his transition from the CEO role through December 31, 2022, Dr. George received the following: (i) an RSU grant for 16,050 shares of common stock which vested in full on December 15, 2022, (ii) a nonqualified stock option for 8,050 shares of common stock, with an exercise price of $2.85 per, the closing stock price of our common stock on July 15, 2022, which also vested n full on December 15, 2022 and will remain exercisable until June 15, 2023 or, if earlier, any noncompliance by Dr. George with his obligations under the Transition and Separation Agreement, which was executed by Dr. George and the Company on July 17, 2022; and (iii) cash compensation of $12,500 per calendar quarter. The stock options are valued at $1.0512 per share, reflecting a grant date stock price of $2.85 and a Black-Scholes value of 36.88%. |

INVITAE CORPORATION • 2023 Proxy Statement 18

We reimburse our non-employee directors for their reasonable out-of-pocket costs and travel expenses in connection with their attendance at board and committee meetings. Employee directors do not receive any compensation for service as a member of our board of directors.

Each non-employee director is entitled to receive annual cash compensation for their service on our board of directors, payable quarterly in arrears. Annual compensation is pro-rated for non-employee directors with less than 12 months of service. Unpaid retainers are payable in full for the current fiscal year in the event of a change in control of our Company during that fiscal year. The annual retainer for service on our board of directors was $50,000.

Each non-employee director who joins our board of directors receives a fixed dollar value of $400,000 of stock, 75% of which is in the form of restricted stock units (“RSUs”), with one quarter of the RSUs vesting on each of the first four anniversaries of the director’s appointment, subject to the director’s continuous service as a member of our board of directors, and 25% of which is in the form of stock options using the Black-Scholes option-pricing model, with one quarter of the shares subject to the option vesting on the first anniversary of the director’s appointment or election to our board of directors and 1/48th of the shares subject to the option vesting on a monthly basis over the following three years, subject to the director’s continuous service as a member of our board of directors. The exercise price of the options will be the fair market value on the date of grant. If still vesting, the RSUs and the options will accelerate in full upon a change in control of our Company.

Each non-employee director with at least 12 months of continuous service as of the date of each annual meeting of our stockholders is entitled to receive an annual award of a fixed dollar value of $200,000 of stock, 75% of which is in the form of RSUs vesting the following year and 25% of which is in the form of stock options using the Black-Scholes option-pricing model, vesting on a monthly basis over the following year. Directors with less than 12 months of continuous service as of such annual meeting are also entitled to receive such an award, but with the dollar value pro-rated to reflect their applicable portion of a full year of service. The exercise price of the options will be the fair market value on the date of grant. If still vesting, the RSUs and the options will accelerate in full upon a change in control of our Company.

The Chair of the Board receives an annual fee of $50,000 in cash and an annual equity grant with a fixed dollar value of $150,000, which is in the form of stock options using the Black-Scholes option-pricing model, vesting on a monthly basis over the following year. If still vesting, the options will accelerate in full upon a change in control of our Company. The lead independent director receives an annual fee of $25,000 in cash. In addition, Dr. Aguiar’s unvested equity granted with respect to his service as Chair of the Board continues to vest so long as he remains the lead independent director. The chair of the audit committee receives an annual fee of $20,000 and the non-chair members of the audit committee receive an annual fee of $10,000. The chair of the compensation committee receives an annual fee of $15,000 and the non-chair members of the compensation committee receive an annual fee of $7,500. The chair of the nominating and governance committee receives an annual fee of $10,000 and the non-chair members of the nominating and governance committee receive an annual fee of $5,000.

INVITAE CORPORATION • 2023 Proxy Statement 19

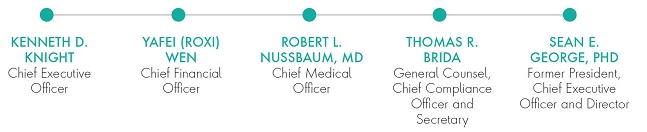

The names of our executive officers and their ages as of April 1, 2023 are as follows:

| Name | Age | Position | ||

| Kenneth D. Knight | 62 | Chief Executive Officer | ||

| Yafei (Roxi) Wen | 50 | Chief Financial Officer | ||

| Thomas R. Brida | 52 | General Counsel, Chief Compliance Officer and Secretary | ||

| Robert L. Nussbaum, MD | 73 | Chief Medical Officer |

Certain biographical information of our executive officers, excluding that of Mr. Knight, are set forth below:

Yafei (Roxi) Wen has served as our Chief Financial Officer since June 2021. Prior to joining Invitae, from February 2019 to June 2021, she served as the Chief Financial Officer at Mozilla Corporation, an open-source software company, overseeing finance and accounting, mergers and acquisitions, business development, data and analytics, information technology and engineering operations, workplace resources and sustainability. Prior to that, Ms. Wen served as the Chief Financial Officer at Elo Touch Solutions, a touch screen systems and components company, from April 2014 to February 2019, and General Electric Critical Power, an electronics power technology company, from 2008 to 2013, following experience driving capital market and business finance efforts as finance manager at Medtronic, a leading medical technology company, from 2002 to 2008. Ms. Wen holds a Bachelor of Economics from Xiamen University, is a CFA charterholder and has an MBA from the University of Minnesota.

Thomas R. Brida has served as our General Counsel since January 2017, our Chief Compliance Officer since February 2019, and our Secretary since May 2019. Mr. Brida also served as our Deputy General Counsel from January 2016 to January 2017.

Prior to joining Invitae, he was Associate General Counsel at Bio-Rad Laboratories, a life science research and clinical diagnostics manufacturer, from January 2004 to January 2016. Mr. Brida holds a BA from Stanford University and a JD from the University of California, Berkeley School of Law.

Robert L. Nussbaum, MD has served as our Chief Medical Officer since August 2015. From April 2006 to August 2015, he was chief of the Division of Genomic Medicine at UCSF Health where he also held leadership roles in the Cancer Genetics and Prevention Program beginning in January 2009 and the Program in Cardiovascular Genetics beginning in July 2007. From April 2006 to August 2015, he served as a member of the UCSF Institute for Human Genetics. Prior to joining UCSF Health, Dr. Nussbaum was chief of the Genetic Disease Research Branch of the National Human Genome Research Institute, one of the National Institutes of Health, from 1994 to 2006. He is a member of the National Academy of Medicine and a fellow at the American Academy of Arts and Sciences. Dr. Nussbaum is a board-certified internist and medical geneticist who holds a BS in Applied Mathematics from Harvard College and an MD from Harvard Medical School in the Harvard-MIT joint program in Health Sciences and Technology. He completed his residency in internal medicine at Barnes-Jewish Hospital and a fellowship in medical genetics at the Baylor College of Medicine.

Robert F. Werner has served as our Chief Accounting and Principal Accounting Officer since May 2020. Prior to that, Mr. Werner served as our Corporate Controller from September 2017 to May 2020. Prior to joining Invitae, from February 2015 to September 2017, Mr. Werner served as Vice President of Finance and Corporate Controller of Proteus Digital Health, Inc., a digital medicine pharmaceuticals company. Prior to that, Mr. Werner served as Corporate Controller and Principal Accounting Officer of CardioDx, Inc., a molecular diagnostics company, from March 2012 to February 2015. Mr. Werner is a Certified Public Accountant in California and started his career at Ernst & Young LLP. Mr. Werner holds a BS in Accounting and a Master of Accountancy in Professional Accounting from Brigham Young University’s Marriott School of Management.

INVITAE CORPORATION • 2023 Proxy Statement 20

Table of Contents

This section explains how our executive compensation program is designed and operates with respect to our named executive officers listed in the Summary Compensation Table below. Our named executive officers consist of individuals who served, during 2022, as our principal executive officer, our principal financial officer and the two most highly compensated executive officers (other than the principal executive officer and principal financial officer) who were serving as executive officers at the end of 2022. The named executive officers in 2022 were:

INVITAE CORPORATION • 2023 Proxy Statement 21

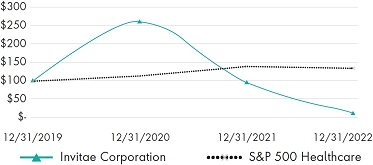

We believe we can build long-term stockholder value by executing on our mission to bring comprehensive genetic information into mainstream medicine to improve healthcare for billions of people. Our strategy for long-term, profitable growth centers on seven key drivers of our business, which we believe work in conjunction to create a flywheel effect extending our leadership position in the new market we are building. Our executive compensation program takes into account the dynamic growth of our business and our focused execution on our core business model. Our executive compensation philosophy is focused on real pay delivery through the achievement of performance targets, which ultimately drives total stockholder return (“TSR”) and aligns our named executive officers with long-term stockholders.

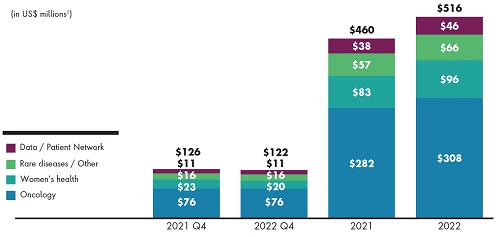

In 2022, we announced a strategic realignment plan to stabilize our portfolio, focus on profitable growth and reduce cash burn. Our results in 2022 reflect the execution of these priorities. Looking into 2023, we will continue to work towards enabling an integrated, connected portfolio, generating profitable growth, and investing in our most promising future bets and clinical evidence. We will balance our focus on growth with an emphasis on long-term profitability and capital management to scale our business.

The following presents certain non-GAAP financial measures. A reconciliation to GAAP is presented in Annex A.

| Revenue breakdown – Q4 and FY’22 | |

| |

| Note: | |

| * | May not sum due to rounding Drawings not to scale. |

INVITAE CORPORATION • 2023 Proxy Statement 22

| Cash burn1 trend2 | |

| |

| 1. | Ongoing cash burn includes cash, cash equivalents, marketable securities, and restricted cash and excludes certain items. |

| 2. | Non-GAAP measures. See reconciliation for GAAP to non-GAAP in Annex A. |

| 3. | Cash items in Q3 ’22 outflow of $43.2 million related to restructuring-related cash payments and acquisition-related payments. |

| 4. | Cash items in Q4 ’22 outflow of $9.3 million related to realignment, $0.1 million acquisition-related payments, and an inflow of $44.5 million related to the selected assets sale of the RUO kitted solutions. |

| * | May not sum due to rounding. Drawings not to scale. |

| Portfolio growth | |

| |

| * | New Product Vitality is revenue from products launched or acquired in the previous three years divided by total revenue. |

INVITAE CORPORATION • 2023 Proxy Statement 23

On July 16, 2022, Mr. Knight succeeded Dr. George as CEO and Dr. George entered into a Transition and Separation Agreement summarized in the “Transition and Separation Agreement” section below. Dr. George did not receive an equity grant for 2022. He received cash severance and a COBRA payment pursuant to his Change in Control Agreement and, subject to satisfaction of certain restrictive covenants, a pro rata, 69.9% of target cash bonus payment of $582,637. Mr. Knight’s compensation as CEO for 2022 is summarized in the below table and, demonstrating the pay for performance nature of our program, his year-end value is significantly less than the grant value. See our Pay for Performance Table below.

| 2022 | 2021 | ||||

| CEO Total Direct Compensation | |||||

| Base Salary | $750,000 | $500,000 | |||

| Reported Earned Bonus | $786,875 | – | |||

| Option | As of 12/31/2022 | As of grant date | |||

| Number of Options | 1,000,000 | 1,000,000 | 69,500 | ||

| Value | $1,490,000(1) | $1,962,800(2) | $1,560,991(3) | ||

| RSU | As of 12/31/2022 | As of grant date | |||

| Number of RSUs | 225,000 | 225,000 | 134,200 | ||

| Value | $418,500(1) | $1,588,500(2) | $4,683,580(3) | ||

| PRSU | – | As of date earned | As of grant date | ||

| Number of PRSUs | – | 44,117 | 59,700 | ||

| Value | – | $320,289(4) | $2,083,530(3) | ||

| As of 12/31/2022 | As of grant date | As of date earned | As of grant date | ||

| TOTAL VALUE | $3,445,375(5) | $5,088,175 | $7,064,860(6) | $8,828,101 | |