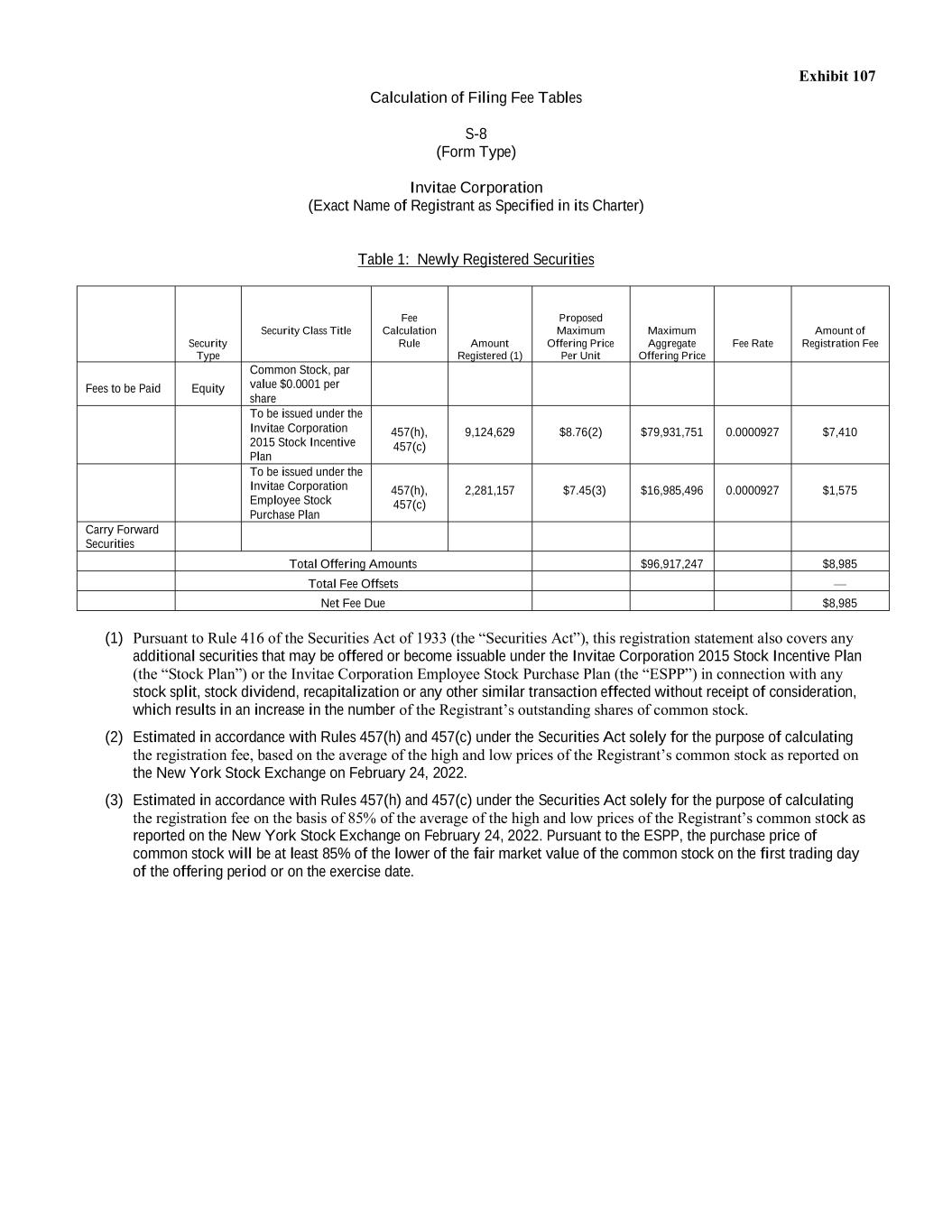

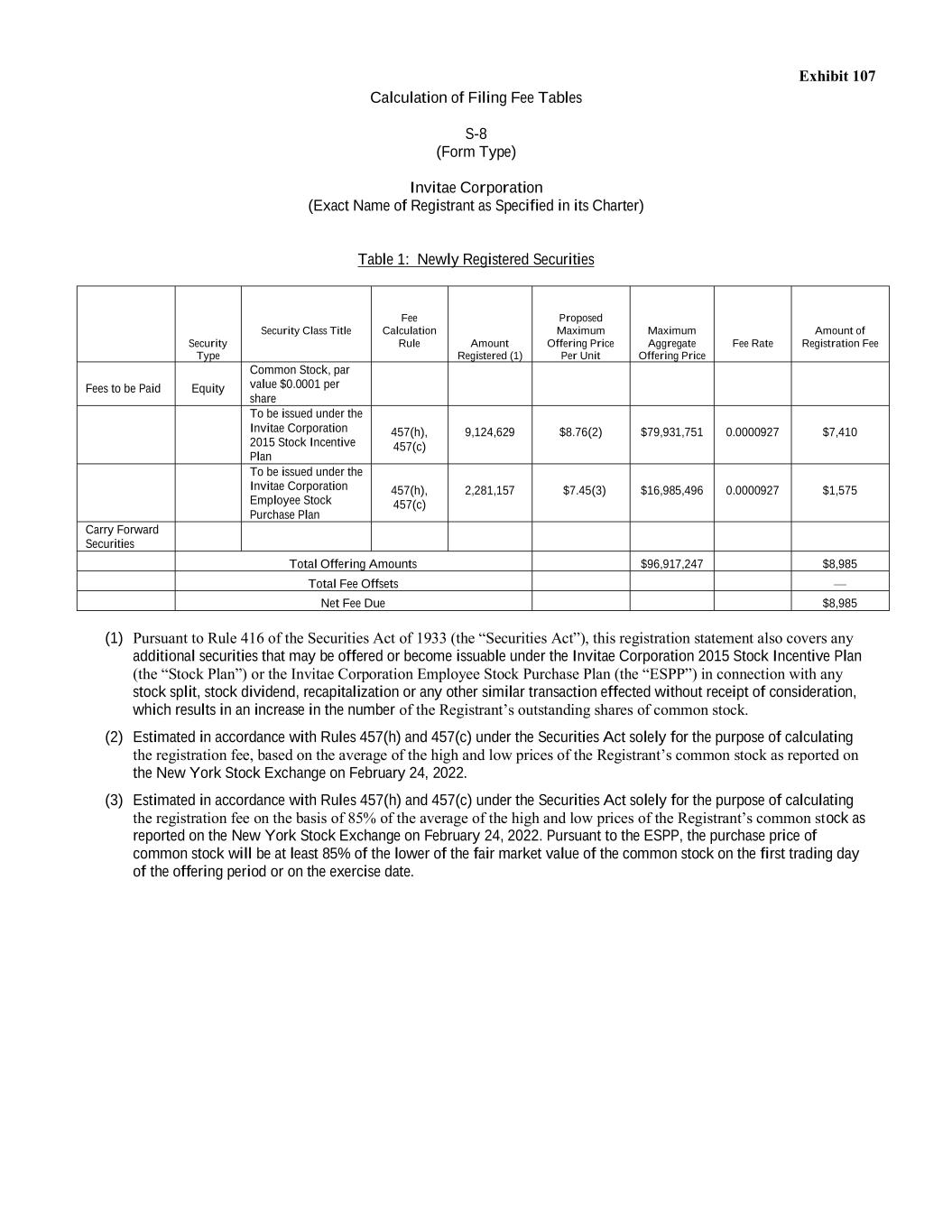

Exhibit 107 Calculation of Filing Fee Tables S-8 (Form Type) Invitae Corporation (Exact Name of Registrant as Specified in its Charter) Table 1: Newly Registered Securities Security Type Security Class Title Fee Calculation Rule Amount Registered (1) Proposed Maximum Offering Price Per Unit Maximum Aggregate Offering Price Fee Rate Amount of Registration Fee Fees to be Paid Equity Common Stock, par value $0.0001 per share To be issued under the Invitae Corporation 2015 Stock Incentive Plan 457(h), 457(c) 9,124,629 $8.76(2) $79,931,751 0.0000927 $7,410 To be issued under the Invitae Corporation Employee Stock Purchase Plan 457(h), 457(c) 2,281,157 $7.45(3) $16,985,496 0.0000927 $1,575 Carry Forward Securities Total Offering Amounts $96,917,247 $8,985 Total Fee Offsets — Net Fee Due $8,985 (1) Pursuant to Rule 416 of the Securities Act of 1933 (the “Securities Act”), this registration statement also covers any additional securities that may be offered or become issuable under the Invitae Corporation 2015 Stock Incentive Plan (the “Stock Plan”) or the Invitae Corporation Employee Stock Purchase Plan (the “ESPP”) in connection with any stock split, stock dividend, recapitalization or any other similar transaction effected without receipt of consideration, which results in an increase in the number of the Registrant’s outstanding shares of common stock. (2) Estimated in accordance with Rules 457(h) and 457(c) under the Securities Act solely for the purpose of calculating the registration fee, based on the average of the high and low prices of the Registrant’s common stock as reported on the New York Stock Exchange on February 24, 2022. (3) Estimated in accordance with Rules 457(h) and 457(c) under the Securities Act solely for the purpose of calculating the registration fee on the basis of 85% of the average of the high and low prices of the Registrant’s common stock as reported on the New York Stock Exchange on February 24, 2022. Pursuant to the ESPP, the purchase price of common stock will be at least 85% of the lower of the fair market value of the common stock on the first trading day of the offering period or on the exercise date.