Use these links to rapidly review the document

TABLE OF CONTENTS

CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on February 11, 2011

Registration No. 333-171534

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5 TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Zuoan Fashion Limited

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant's name into English)

| | | | |

Cayman Islands

(State or Other Jurisdiction of

Incorporation or Organization) | | 2320

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Rooms 213 to 215, Block 8

No. 1150 Luochuan Middle Road

Shanghai 200072, China

(86) 21-5653-5557

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Name of Agent for Service

CT Corporation System

111 Eighth Avenue, 13th Floor

New York, New York 10011

(212) 604-1666

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

| | |

James C. Lin, Esq.

Davis Polk & Wardwell LLP

c/o 18th Floor, The Hong Kong Club Building

3A Chater Road

Hong Kong

(852) 2533-3300 | | David Roberts, Esq.

O'Melveny & Myers LLP

37/F, Yin Tai Centre Office Tower

No. 2 Jianguomenwai Avenue, Chaoyang District

Beijing 100022, China

(86) 10-6563-4200 |

Approximate date of commencement of proposed sale to the public:As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

CALCULATION OF REGISTRATION FEE

| | | | | | | | |

| | | | | | | | |

| |

Title of each class

of securities to be registered

| | Amount to be

Registered

| | Proposed Maximum

Offering Price Per

Share(3)

| | Proposed maximum

aggregate offering price(3)

| | Amount of

registration fee

|

|---|

| |

Ordinary shares, par value US$0.00025 per share(1)(2) | | 27,600,000 | | US$1.75 | | US$48,300,000 | | US$5,607.63(4) |

|

- (1)

- American depositary shares issuable upon deposit of the ordinary shares registered hereby will be registered pursuant to a separate registration statement on Form F-6 (Registration No. 333-171669). Each American depositary share represents four ordinary shares.

- (2)

- Includes ordinary shares represented by American depositary shares initially offered and sold outside the United States that may be resold from time to time in the United States either as part of their distribution or within 40 days after the later of the effective date of this registration statement and the date the shares are first bona fide offered to the public. These ordinary shares are not being registered for the purposes of sales outside the United States. Also includes ordinary shares represented by American depositary shares that are issuable upon the exercise of the underwriters' over-allotment option to purchase additional shares.

- (3)

- Estimated solely for the purpose of computing the amount of registration fee in accordance with Rule 457(a) under the Securities Act of 1933, as amended.

- (4)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | |

| PRELIMINARY PROSPECTUS (Subject to Completion) | | Dated February 11, 2011 |

| |

Zuoan Fashion Limited

6,000,000 American Depositary Shares

Representing 24,000,000 Ordinary Shares

This is an initial public offering of our American depositary shares, or ADSs. We are offering 6,000,000 ADSs. Each ADS represents four ordinary shares, par value $0.00025 per share. The ADSs are evidenced by American depositary receipts, or ADRs.

Prior to this offering, there has been no public market for our ADSs or our ordinary shares. We expect that the initial public offering price will be US$7.00 per ADS. Our ADSs have been approved for listing on the New York Stock Exchange, or NYSE, under the symbol "ZA."

Our business and an investment in our ADSs involve significant risks. These risks are described under the caption "Risk Factors" beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | |

| | Per ADS | | Total | |

|---|

Public offering price | | US$ | | | US$ | | |

Underwriting discount | | US$ | | | US$ | | |

Proceeds, before expenses, to us | | US$ | | | US$ | | |

The underwriters may also purchase up to an additional 900,000 ADSs from the selling shareholders at the public offering price, less the underwriting discount, within 30 days from the date of this prospectus to cover overallotments. We will not receive any proceeds from the sale of ADSs by the selling shareholders.

Four unaffiliated investors have indicated to the underwriters and us their interest in subscribing for an aggregate of up to 3,000,000 ADSs offered in this offering, representing up to 50% of the total ADSs offered by us.

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on , 2011.

| | |

| RBC Capital Markets | | Samsung Securities (Asia) Limited |

, 2011

Table of Contents

TABLE OF CONTENTS

| | |

| | Page |

|---|

Prospectus Summary | | 1 |

The Offering | | 5 |

Summary Consolidated Financial and Operating Data | | 7 |

Risk Factors | | 9 |

Special Note Regarding Forward-Looking Statements | | 30 |

Corporate Structure | | 31 |

Use of Proceeds | | 32 |

Dividend Policy | | 33 |

Capitalization | | 34 |

Dilution | | 35 |

Exchange Rate Information | | 37 |

Enforceability of Civil Liabilities | | 38 |

Selected Consolidated Financial and Operating Data | | 39 |

Management's Discussion and Analysis of Financial Condition and Results of Operations | | 41 |

Our Industry | | 67 |

Our Business | | 71 |

Regulation | | 89 |

Management | | 94 |

Principal and Selling Shareholders | | 101 |

Related Party Transactions | | 103 |

Description of Share Capital | | 106 |

Description of American Depositary Shares | | 115 |

Shares Eligible for Future Sale | | 125 |

Taxation | | 127 |

Underwriting | | 132 |

Expenses Relating to This Offering | | 138 |

Legal Matters | | 139 |

Experts | | 139 |

Where You Can Find Additional Information | | 140 |

You should rely only on the information contained in this prospectus or in any related free writing prospectus filed with the Securities and Exchange Commission, or the SEC. We have not, and the selling shareholders and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the selling shareholders and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus or any related free writing prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

We have not taken any action to permit a public offering of the ADSs outside the United States or to permit the possession or distribution of this prospectus outside the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about and observe any restrictions relating to the offering of the ADSs and the distribution of this prospectus outside of the United States.

i

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information appearing elsewhere in this prospectus. This summary may not contain all of the information you should consider before investing in our ADSs. You should carefully read this prospectus, including our financial statements and related notes appearing elsewhere in this prospectus, and the registration statement of which this prospectus is a part in their entirety before investing in our ADSs, especially the risks of investing in our ADSs, which we discuss under "Risk Factors." This prospectus contains statistical data extracted from two reports which we commissioned Frost & Sullivan, an independent market research firm, to prepare for the purpose of providing information on China's menswear market. The reports, publicly issued in March 2010 and in August 2010, are entitled "China Menswear Market Study, 2009" and "China Consumers' Environmental Protection Awareness Survey, 2010," respectively, and are referred to as the Frost & Sullivan Report and Frost & Sullivan Survey, respectively, in this prospectus. "We," "us," "our company," "our" and "Zuoan" refer to Zuoan Fashion Limited, a Cayman Islands company, and its predecessor entities and subsidiaries.

Overview

We are a leading design-driven fashion casual menswear company in China. According to the Frost & Sullivan Report, sales of our "Zuoan" branded products ranked second in China's fashion casual menswear market, with a 5.4% market share, in terms of retail sales in 2009. Our products are designed in-house and sold under our Zuoan brand, which means "left bank" in Chinese, referring to the Left Bank district of Paris and embodying our design philosophy of "fashionable elegance." We offer a wide range of products, including men's casual apparel, footwear and lifestyle accessories, primarily targeting urban males between the ages of 20 and 40 who prefer stylish clothing that represents a sophisticated lifestyle.

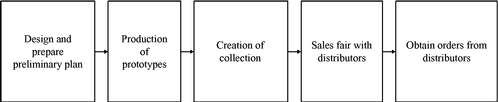

Our design team is led by Mr. James Jinshan Hong, or Mr. James Hong, our chairman and chief executive officer. Mr. James Hong is recognized as one of China's top designers with more than 15 years of industry experience. He was nominated one of the "Top Three Fashion Designers" by the China Fashion Association in November 2009 and one of "China's Top 10 Fashion Designers" by the China Fashion Association for two consecutive years in 2006 and 2007. Our marketing strategy focuses on promoting an overall brand image that embodies a lifestyle of "fashionable elegance," rather than individual products. Unlike many of our competitors, we do not rely on large-scale, blanket television advertising, but instead adopt a targeted multi-channel marketing strategy through our sponsorship of selective public events and activities, participation in major fashion shows and exhibitions and national advertising through television, internet, billboards, magazines and newspapers. We outsource the production of most of our products to selected contract manufacturers. For our most exclusive and fashion-forward products, we produce them in our own secure production facility in Jinjiang City, Fujian Province to retain maximum control over quality and prevent unauthorized disclosure of our new collection before its scheduled release.

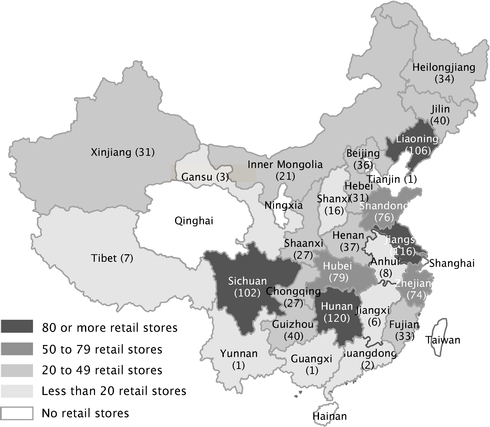

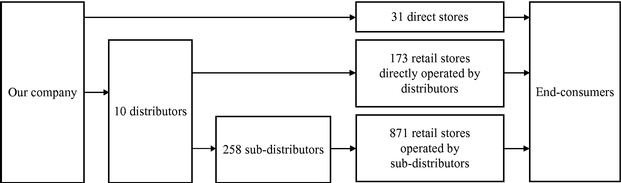

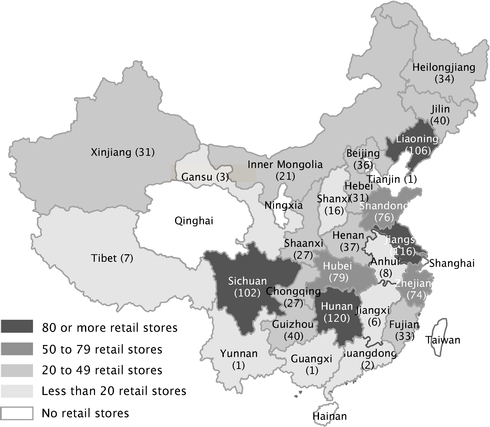

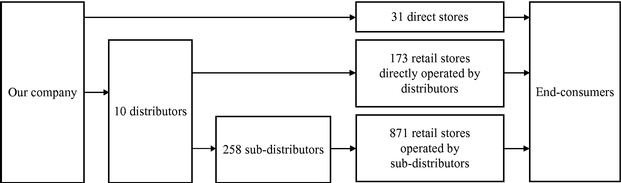

We sell our products through an extensive distribution network covering 27 of China's 32 provinces and centrally administered municipalities, as well as through our direct stores. Our products are primarily sold to customers through retail stores operated by our distributors and their sub-distributors. As of September 30, 2010, we appointed 10 distributors which, directly or through their sub-distributors, operated 1,044 retail stores across China. All of the retail stores are operated under our Zuoan brand and are required to sell only our products. As part of our expansion strategy, in April 2009, we started building up our direct stores in selected cities where we already have an established presence and believe that there is potential for additional growth. As of September 30, 2010, we had 31 direct stores in seven provinces and centrally administered municipalities in China.

To further promote our brand and improve the performance of Zuoan retail stores, since early 2010 we have adopted a strategy of opening flagship stores, both distributor-operated and directly

1

Table of Contents

operated, at prime locations in major cities in China. These flagship stores are significantly larger than most of our existing stores and sell the complete line of our collections. Our distributors have opened seven flagship stores in Henan, Jiangxi, Jilin and Liaoning Provinces. In line with our flagship store strategy, in January 2011, we transferred all of our direct stores, which were located in department stores or shopping malls, to our distributors and intend to open our new directly operated flagship stores at prime commercial areas.

Our business has grown rapidly in recent years. Our revenues increased from RMB434.5 million in 2007 to RMB598.3 million in 2008 and RMB693.1 million (US$103.6 million) in 2009, representing a CAGR of 26.3% from 2007 to 2009. Our profit after taxation increased from RMB91.4 million in 2007 to RMB132.7 million in 2008 and RMB153.9 million (US$23.0 million) in 2009, representing a CAGR of 29.8% from 2007 to 2009. For the nine months ended September 30, 2010, we achieved revenues of RMB613.9 million (US$91.8 million) and profit after taxation of RMB127.7 million (US$19.1 million) compared to revenues of RMB489.7 million and profit after taxation of RMB115.4 million for the nine months ended September 30, 2009.

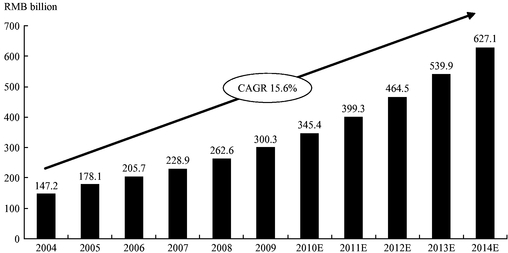

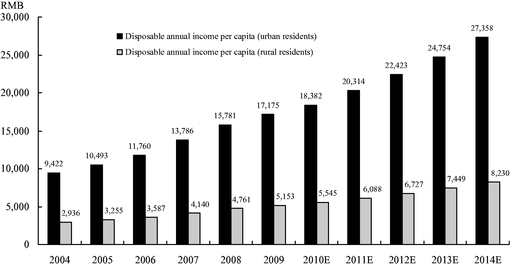

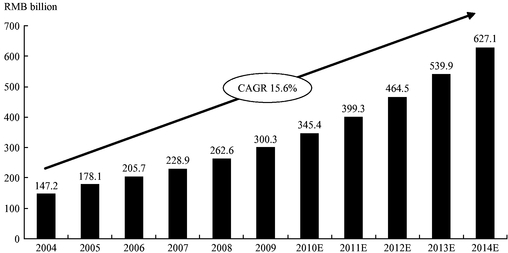

Industry Background

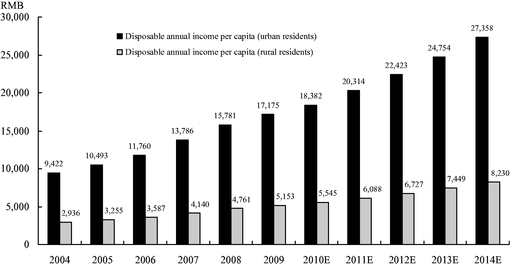

China is one of the largest and fastest-growing menswear markets in the world, driven primarily by a rapidly growing economy and increasing disposable income of consumers. According to the Frost & Sullivan Report, total retail sales of menswear in China increased from RMB147.2 billion in 2004 to RMB300.3 billion (US$44.9 billion) in 2009 and are estimated to reach RMB627.1 billion in 2014, representing a 10-year CAGR of 15.8%.

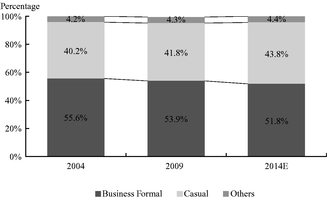

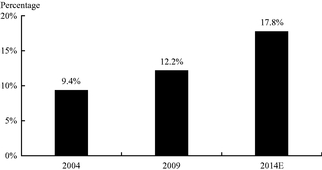

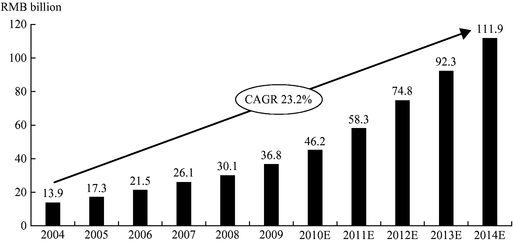

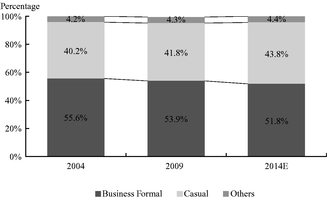

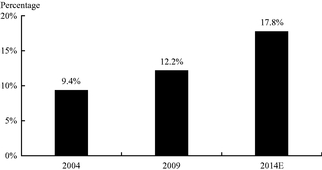

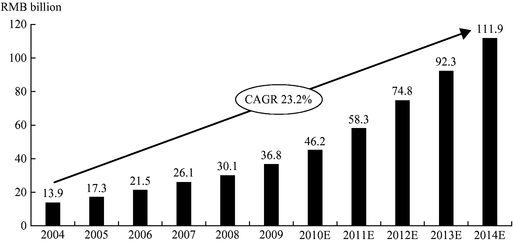

Along with increased purchasing power, male consumers in China are becoming more conscious of and sensitive to the branding, design and quality of menswear. As a result, fashion casual menswear, a sub-sector of casual menswear, has become increasingly popular in China because it caters to consumers who desire variety and fashion that highlight an individual's personality while participating in recreational, social or leisure activities. According to the Frost & Sullivan Report, total retail sales of fashion casual menswear in China grew from RMB13.9 billion in 2004 to RMB36.8 billion (US$5.5 billion) in 2009. Frost & Sullivan estimates that total retail sales of fashion casual menswear will grow to RMB111.9 billion by 2014, representing a 10-year CAGR of 23.2%, and account for 40.7% of the casual menswear market in China.

The fashion casual menswear market in China is relatively fragmented, with more than 500 fashion casual menswear providers, according to the Frost & Sullivan Report. Among them, only a small number of providers have in-house design capabilities that enable them to provide branded fashion casual menswear products and to retain leading market positions.

Our Competitive Strengths

We believe that the following strengths differentiate us from our competitors:

- •

- Strong focus on design and product innovation;

- •

- Established and leading designer brand for fashion casual menswear in China;

- •

- Creative multi-channel brand marketing strategies;

- •

- Extensive and well-managed nationwide distribution network; and

- •

- Socially conscious corporate culture supported by experienced management team.

2

Table of Contents

Our Strategies

We intend to further strengthen our position as a leading fashion casual menswear brand in China by pursuing the following strategies:

- •

- Open additional retail and flagship stores across China;

- •

- Continue to raise the profile of our Zuoan brand through enhanced advertising and promotional activities;

- •

- Expand and build upon our design and product development capabilities; and

- •

- Expand and diversify our product offerings.

Summary of Risk Factors

Investing in our ADSs involves a high degree of risk. You should consider carefully the risks and uncertainties summarized below, the risks described under "Risk Factors," beginning on page 9, and the other information contained in this prospectus before you decide whether to purchase our ADSs.

- •

- Our dependence on our Zuoan brand and our ability to promote our brand based on consumer preference or demand;

- •

- Our reliance on a small number of distributors for the sale of our products and independent third-party contract manufacturers for the production of a significant portion of our products;

- •

- Our control over the ultimate retail sales by our distributors and exposure to the credit risks of our distributors;

- •

- Competition in the fashion casual menswear industry;

- •

- Our compliance with a complex set of laws, rules and regulations governing our business in China; and

- •

- Our ability to manage our growth effectively and efficiently.

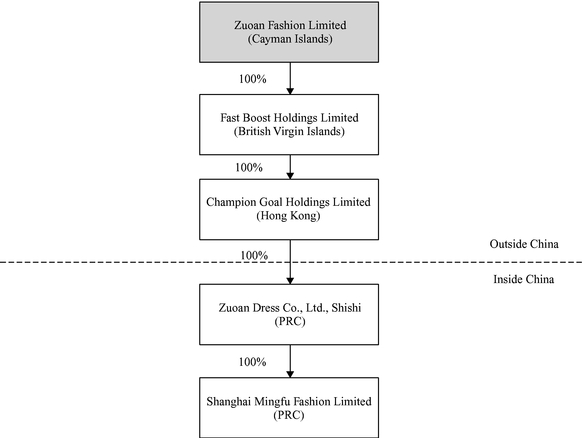

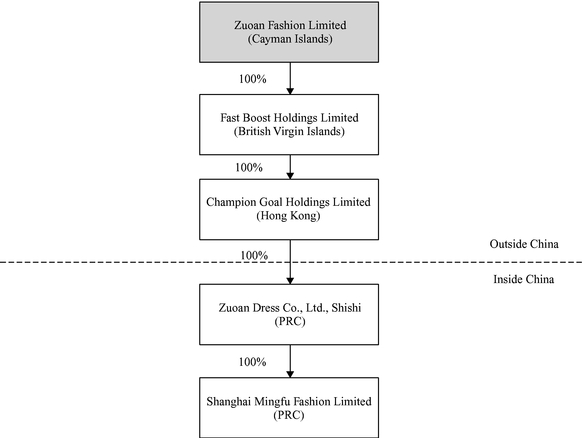

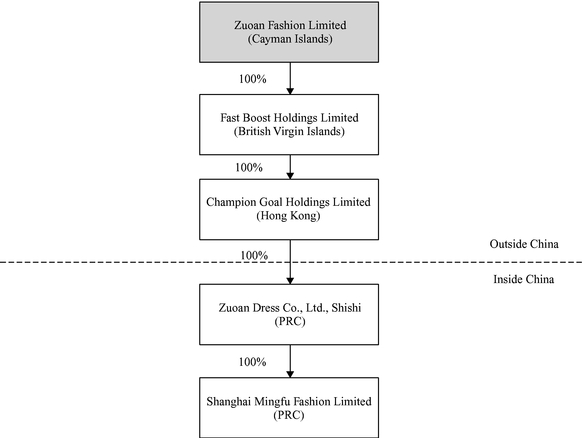

Corporate Structure and History

We commenced our garment manufacturing operations in June 1999. Our Zuoan trademark was originally registered in 2001 by Fujian Aidu Industry and Trading Co., Ltd., a company wholly owned by the family of Mr. James Hong, our founder. In April 2002, Zuoan Dress Co., Ltd., Shishi, or Shishi Zuoan, was incorporated and commenced operations as a foreign-invested enterprise. The then sole shareholder of Shishi Zuoan was Ms. Siu Fong Or, wife of Mr. James Hong and a Hong Kong resident. Shishi Zuoan subsequently migrated to our current business as a designer and seller of fashion casual menswear.

In February 2008, we set up a holding company structure by establishing Fast Boost Holdings Limited, or Fast Boost, in the British Virgin Islands. Fast Boost established a wholly owned subsidiary, Champion Goal Holdings Limited, or Champion Goal, in July 2008 in Hong Kong. Champion Goal then acquired all the equity interests in Shishi Zuoan in September 2008.

We incorporated Zuoan Fashion Limited, or Zuoan Cayman, in connection with this offering in August 2010. On October 5, 2010, Fast Boost became the wholly owned subsidiary of Zuoan Cayman through a share exchange through which Zuoan Cayman acquired all of the issued and outstanding shares of Fast Boost, and issued ordinary shares to the shareholders of Fast Boost. Upon completion of the share exchange, Zuoan Cayman became our ultimate holding company.

3

Table of Contents

In August 2010, Shishi Zuoan incorporated a wholly owned subsidiary, Shanghai Mingfu Fashion Limited, or Shanghai Mingfu, in Shanghai. After its incorporation, we relocated our headquarters and design and product development team to Shanghai.

The following diagram illustrates our corporate structure, the place of formation and the ownership interests of our subsidiaries as of the date of this prospectus:

Corporate Information

Our principal executive offices are located at Rooms 213 to 215, Block 8, No. 1150 Luochuan Middle Road, Shanghai, China. Our telephone number at this address is +86 21-5653-5557. Our registered office in the Cayman Islands is located at the offices of Cricket Square, Hutchins Drive, P.O. Box 2681, Grand Cayman, KY1-1111, Cayman Islands. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, 13th Floor, New York, New York 10011.

Investors should contact us for any inquiries through the address and telephone number of our principal executive offices. Our website is http://www.zuoancn.com. The information contained on our website does not constitute a part of this prospectus.

4

Table of Contents

THE OFFERING

| | | |

| Total ADSs offered: | | |

| |

by us |

|

6,000,000 ADSs |

Total |

|

6,000,000 ADSs |

Price per ADS |

|

We currently estimate that the initial public offering price will be US$7.00 per ADS. |

Overallotment option |

|

The selling shareholders have granted the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase an additional 900,000 ADSs to cover overallotments. |

ADSs |

|

Each ADS represents four ordinary shares. The depositary will hold the shares underlying your ADSs and you will have rights as provided in the deposit agreement. |

|

|

We do not expect to pay dividends in the foreseeable future. If, however, we declare dividends on our ordinary shares, the depositary will pay you the cash dividends and other distributions it receives on our ordinary shares, after deducting its fees and expenses in accordance with the terms set forth in the deposit agreement. |

|

|

You may surrender your ADSs to the depositary to be cancelled in exchange for ordinary shares. The depositary will charge you fees for any cancellation. |

|

|

We may amend or terminate the deposit agreement without your consent. If you continue to hold your ADSs, you agree to be bound by the deposit agreement as amended. |

|

|

To better understand the terms of the ADSs, you should carefully read the "Description of American Depositary Shares" section of this prospectus. You should also read the deposit agreement, which is filed as an exhibit to the registration statement that includes this prospectus. |

ADSs outstanding immediately after this offering |

|

6,000,000 ADSs (or 6,900,000 ADSs if the underwriters exercise the overallotment option in full). |

Ordinary shares outstanding immediately after this offering |

|

110,722,500 ordinary shares. |

Use of proceeds |

|

We intend to use the net proceeds we receive from this offering primarily for the following purposes: |

| | • approximately 35% to expand our network of directly operated flagship stores in China; |

| | • approximately 35% to support our distributors in opening new Zuoan retail stores; |

5

Table of Contents

| | |

| | • approximately 24% to establish a logistics center in Shishi for the purpose of stocking our finished products; and |

| | • the remaining amount to fund working capital and for other general corporate purposes. |

|

|

See "Use of Proceeds" for more information. |

|

|

We will not receive any of the proceeds from the sale of ADSs by the selling shareholders. |

Listing |

|

Our ADSs have been approved for listing on the NYSE. Our ordinary shares will not be listed on any exchange or quoted for trading on any over-the-counter trading system. |

Proposed NYSE symbol |

|

"ZA" |

Depositary |

|

Deutsche Bank Trust Company Americas |

Lock-up |

|

We, our directors and executive officers, and all of our existing shareholders have agreed with the underwriters for a period of 180 days after the date of this prospectus not to sell, transfer or otherwise dispose of, and not to announce an intention to sell, transfer or otherwise dispose of any ADSs, ordinary shares or similar securities. |

|

|

In addition, four unaffiliated investors have indicated to the underwriters and us their interest in subscribing for an aggregate of up to 3,000,000 ADSs offered in this offering, representing up to 50% of the total ADSs offered by us. Each of these investors has agreed with the underwriters that, to the extent such investor purchases any ADSs in this offering, such investor will not, directly or indirectly, transfer or dispose of any of such ADSs for a period of 180 days after the first day our ADSs are traded on the NYSE. |

|

|

See "Underwriting" for more information. |

Risk factors |

|

See "Risk Factors" and other information included in this prospectus for a discussion of risks you should carefully consider before investing in the ADSs. |

Unless otherwise indicated, the number of ordinary shares that will be outstanding immediately after this offering:

- •

- assumes the conversion of all outstanding amounts on the 2008 convertible loan and 2010 convertible loan into 6,722,500 ordinary shares, which conversion will occur prior to the completion of this offering; and

- •

- assumes that the underwriters do not exercise their overallotment option to purchase additional ADSs.

6

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OPERATING DATA

The following summary consolidated financial data for the periods and as of the dates indicated are qualified by reference to, and should be read in conjunction with, our consolidated financial statements and related notes and "Management's Discussion and Analysis of Financial Condition and Results of Operations," both of which are included elsewhere in this prospectus.

The summary consolidated statements of comprehensive income data and summary consolidated statements of cash flow data for the years ended December 31, 2007, 2008 and 2009 and the nine months ended September 30, 2010 and the summary consolidated statements of financial position data as of December 31, 2007, 2008 and 2009 and September 30, 2010 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of comprehensive income data and summary consolidated statements of cash flow data for the nine months ended September 30, 2009 have been derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus and have been prepared on the same basis as our audited consolidated financial statements. Our consolidated financial statements are prepared in accordance with International Financial Reporting Standards, or IFRS, issued by the International Accounting Standards Board, or IASB.

Unless otherwise indicated, all historical share and per-share data contained in this prospectus has been restated to give retroactive effect to a 4,000-for-1 share split effected in December 2010.

The results for the nine months ended September 30, 2010 may not be indicative of our results for the full year ending December 31, 2010. Our historical results for any prior period do not necessarily indicate our results to be expected for any future period.

Consolidated Statements of Comprehensive Income Data:

| | | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, | | For the Nine Months Ended September 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2009 | | 2010 | |

|---|

| | RMB

| | RMB

| | RMB

| | US$

| | RMB

(unaudited)

| | RMB

| | US$

| |

|---|

| | (in thousands, except for per share and per ADS data)

| |

|---|

Revenues | | | 434,472 | | | 598,344 | | | 693,089 | | | 103,593 | | | 489,693 | | | 613,878 | | | 91,754 | |

Cost of sales | | | (262,281 | ) | | (355,640 | ) | | (411,165 | ) | | (61,455 | ) | | (293,561 | ) | | (360,790 | ) | | (53,926 | ) |

| | | | | | | | | | | | | | | | |

Gross profit | | | 172,191 | | | 242,704 | | | 281,924 | | | 42,138 | | | 196,132 | | | 253,088 | | | 37,828 | |

Other income | | | 381 | | | 1,783 | | | 898 | | | 134 | | | 381 | | | 606 | | | 91 | |

Selling and distribution expenses | | | (32,954 | ) | | (49,666 | ) | | (53,373 | ) | | (7,977 | ) | | (28,012 | ) | | (44,217 | ) | | (6,609 | ) |

Administrative expenses | | | (12,700 | ) | | (18,572 | ) | | (22,176 | ) | | (3,315 | ) | | (13,631 | ) | | (27,885 | ) | | (4,168 | ) |

Finance costs | | | (230 | ) | | (360 | ) | | (1,018 | ) | | (152 | ) | | (690 | ) | | (6,063 | ) | | (906 | ) |

| | | | | | | | | | | | | | | | |

Profit before taxation | | | 126,688 | | | 175,889 | | | 206,255 | | | 30,828 | | | 154,180 | | | 175,529 | | | 26,236 | |

Income tax expense | | | (35,277 | ) | | (43,206 | ) | | (52,357 | ) | | (7,826 | ) | | (38,824 | ) | | (47,846 | ) | | (7,151 | ) |

| | | | | | | | | | | | | | | | |

Profit after taxation | | | 91,411 | | | 132,683 | | | 153,898 | | | 23,002 | | | 115,356 | | | 127,683 | | | 19,084 | |

| | | | | | | | | | | | | | | | |

Earnings per ordinary share | | | | | | | | | | | | | | | | | | | | | | |

| | Basic and diluted | | | 1.14 | | | 1.66 | | | 1.92 | | | 0.29 | | | 1.44 | | | 1.60 | | | 0.24 | |

Earnings per ADS | | | | | | | | | | | | | | | | | | | | | | |

| | Basic and diluted | | | 4.57 | | | 6.63 | | | 7.69 | | | 1.15 | | | 5.77 | | | 6.38 | | | 0.95 | |

Pro forma earnings per ordinary share, diluted (unaudited) | | | | | | | | | 1.85 | | | 0.28 | | | 1.39 | | | 1.53 | | | 0.23 | |

7

Table of Contents

Consolidated Statements of Financial Position Data:

| | | | | | | | | | | | | | | | | | | |

| | As of December 31, | | As of September 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2010 | |

|---|

| | RMB

| | RMB

| | RMB

| | US$

| | RMB

| | US$

| |

|---|

| | (in thousands)

| |

|---|

Non-current assets | | | | | | | | | | | | | | | | | | | |

Property, plant and equipment | | | 2,983 | | | 2,559 | | | 2,043 | | | 305 | | | 2,895 | | | 433 | |

Deferred offering cost | | | — | | | — | | | — | | | — | | | 4,362 | | | 652 | |

| | | | | | | | | | | | | | |

Total non-current assets | | | 2,983 | | | 2,559 | | | 2,043 | | | 305 | | | 7,257 | | | 1,085 | |

Current assets | | | | | | | | | | | | | | | | | | | |

Inventories | | | 50,554 | | | 8,319 | | | 17,409 | | | 2,602 | | | 25,876 | | | 3,868 | |

Trade and other receivables | | | 103,127 | | | 142,066 | | | 215,454 | | | 32,203 | | | 314,597 | | | 47,021 | |

Prepayments | | | 22,600 | | | — | | | 2,409 | | | 360 | | | 1,800 | | | 269 | |

Fixed deposits—pledged | | | — | | | 5,905 | | | 2,175 | | | 325 | | | 775 | | | 116 | |

Cash and cash equivalents | | | 23,642 | | | 70,625 | | | 141,569 | | | 21,160 | | | 238,483 | | | 35,645 | |

| | | | | | | | | | | | | | |

Total current assets | | | 199,923 | | | 226,915 | | | 379,016 | | | 56,650 | | | 581,531 | | | 86,919 | |

Total assets | | | 202,906 | | | 229,474 | | | 381,059 | | | 56,955 | | | 588,788 | | | 88,004 | |

Total current liabilities | | | 78,261 | | | 104,198 | | | 101,912 | | | 15,232 | | | 181,172 | | | 27,079 | |

| | | | | | | | | | | | | | |

Net assets | | | 124,645 | | | 125,276 | | | 279,147 | | | 41,723 | | | 407,616 | | | 60,925 | |

| | | | | | | | | | | | | | |

Consolidated Statements of Cash Flow Data:

| | | | | | | | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, | | For the Nine Months Ended September 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2009 | | 2010 | |

|---|

| | RMB

| | RMB

| | RMB

| | US$

| | RMB

(unaudited)

| | RMB

| | US$

| |

|---|

| | (in thousands)

| |

|---|

Net cash generated from operating activities | | | 53,245 | | | 174,782 | | | 41,272 | | | 6,169 | | | 2,731 | | | 46,426 | | | 6,939 | |

Net cash generated from/(used in) investing activities | | | (391 | ) | | (284 | ) | | 233 | | | 35 | | | 303 | | | (718 | ) | | (107 | ) |

Net cash generated from/(used in) financing activities | | | (55,000 | ) | | (127,515 | ) | | 29,439 | | | 4,400 | | | 31,265 | | | 51,206 | | | 7,654 | |

Cash and cash equivalents at period end | | | 23,642 | | | 70,625 | | | 141,569 | | | 21,160 | | | 104,924 | | | 238,483 | | | 35,645 | |

Selected Operating Data:(1)

| | | | | | | | | | | | | | | | |

| | For the Year Ended December 31, | | For the Nine Months Ended September 30, | |

|---|

| | 2007 | | 2008 | | 2009 | | 2009 | | 2010 | |

|---|

Revenues (in thousands of RMB) | | | 434,472 | | | 598,344 | | | 693,089 | | | 489,693 | | | 613,878 | |

Units sold (in thousands) | | | 3,503 | | | 4,723 | | | 5,325 | | | 4,141 | | | 5,108 | |

Average selling price (RMB per unit(2)) | | | 124 | | | 127 | | | 130 | | | 118 | | | 120 | |

Cost of sales (in thousands of RMB) | | | 262,281 | | | 355,640 | | | 411,165 | | | 293,561 | | | 360,790 | |

Unit cost (RMB per unit) | | | 75 | | | 75 | | | 77 | | | 71 | | | 71 | |

Gross margin (%) | | | 39.6 | | | 40.6 | | | 40.7 | | | 40.1 | | | 41.2 | |

- (1)

- Units sold and average selling price as used in this prospectus represent the number of units and average selling price of items that we have sold to our distributors and sold to end-consumers in our direct stores, and do not include units sold at retail by our distributors or the average selling price of those units.

- (2)

- A "unit" as used in this prospectus refers to a single item of our products, which may be a coat, a jacket, a tie, a pair of shoes or socks, a pair of pants or any other menswear item. The average selling price for a given period represents revenues divided by the units sold for that period.

8

Table of Contents

RISK FACTORS

Investing in our ADSs involves a high degree of risk. You should carefully consider the risks described below with all of the other information included in this prospectus before deciding to invest in our ADSs. If any of the following risks actually occur, they may materially harm our business, financial condition, results of operations and prospects. In this event, the market price of our ADSs could decline, and you could lose some or all of your investment.

Risks Related to Our Business

We are dependent on our Zuoan brand, and failure to successfully promote our brand may materially and adversely affect our business and results of operations.

Brand image is a key factor in consumer purchasing decisions for menswear products. We are committed to building our Zuoan brand through the introduction of stylish and quality designs as well as through our promotional activities. We derive substantially all of our revenues from sales of our Zuoan products in China, and our success depends on market perception and acceptance of the Zuoan brand and the "fashionable elegance" culture, lifestyle and images associated with the brand. We have limited control over our distributors that we rely upon to sell our products, which may limit our ability to ensure a consistent brand image. See "—Risks Related to Our Business—We have limited control over the ultimate retail sales by our distributors, their sub-distributors and the retail stores which they operate and our business may be negatively affected if our distributors or their sub-distributors fail to comply with our retail policies and brand management." If we are unable to successfully promote and maintain our Zuoan brand, our business and results of operations may be materially and adversely affected. Any negative publicity or disputes in China regarding our Zuoan brand, our products, our company, our management, our sponsored organizations or individuals, or our distributors or sub-distributors could materially and adversely affect public perception of our Zuoan brand, which in turn could materially and adversely affect our business and results of operations.

Our success largely depends on our ability to identify, anticipate and influence the fashion preferences of our consumers and deliver products in a timely manner to meet changing market demands. Our target market of consumers comprises urban males between the ages of 20 and 40 with moderate-to-high levels of disposable income. Our business is particularly sensitive to their fashion preferences, which cannot be predicted with certainty and are subject to rapid change. Sales of our products will be adversely affected if we fail to identify, anticipate and respond effectively to changing consumer preferences and fashion trends. If this occurs, we and our distributors and sub-distributors may be forced to rely on markdowns or promotional sales to dispose of excess, slow-moving inventory. In a distressed economic and retail environment, many of our competitors may engage in aggressive promotional activities, making it all the more important to react appropriately to changing consumer preferences and fashion trends. Failure to do so could adversely affect the level of acceptance of our products, our brand image and our relationship with our distributors, and therefore have a material adverse effect on our financial condition or results of operations.

As part of our strategy, we plan to expand our product offerings for each of our product lines. The development of new products requires us to allocate significant operational and financial resources. We cannot assure you that we will have the requisite resources and expertise to undertake such product development efforts. If our efforts are unsuccessful, our brand image could be damaged, and our financial condition and results of operations could be adversely affected.

9

Table of Contents

We sell the substantial majority of our products in China through our distributors, who in turn sell our products to consumers through retail stores directly operated by them or by their sub-distributors. As of September 30, 2010, we had 31 direct stores as compared to 1,044 retail stores operated by our distributors and their sub-distributors. Sales to our top three distributors accounted for 50.1%, 48.2%, 46.8% and 45.6% of our revenues in 2007, 2008, 2009 and the nine months ended September 30, 2010, respectively. Our distributors are not contractually obligated to purchase minimum quantities of our products or to work with us on an exclusive basis. Our dependence on distributors increases their bargaining power with us and the need for us to maintain good relationships with them. To the extent that any distributor ceases to cooperate with us for any reason and we are not able to find a suitable replacement in a timely manner, we may lose significant business. To the extent that our large distributors significantly reduce their purchases from us due to the deterioration of their financial position or other reasons, our sales would be materially and adversely affected. In addition, we may have to offer volume-based discounts or more favorable credit terms to our distributors in the future, which may lower our operating profit. As we rely to a large extent on our distributors for the sale of our products, our future growth will also depend on the performance of our distributors and their ability to expand their business and sales networks. In addition, any consolidation, restructuring, reorganization or other ownership change in our distributors may have a material adverse effect on our sales.

We generally enter into agreements with our distributors for a term of three years. There is no assurance that we will be able to renew our distribution agreements or renew such agreements on terms that are favorable to us. In addition, there is no assurance that one or more of our major distributors will not breach their distribution agreements or fail to comply with their obligations thereunder. In such event or events, our results of operations may be materially and adversely affected.

We have limited control over our distributors, their sub-distributors and the retail stores that they operate, and our business may be negatively affected if our distributors or their sub-distributors fail to comply with our retail policies and brand management.

We collaborate with our distributors and sub-distributors to implement our retail and brand management policies in the retail stores which they operate. See "Our Business—Our Zuoan Brand." As of September 30, 2010, 1,044 of a total of 1,075 Zuoan stores were operated by our distributors or their sub-distributors. We rely on agreements with our distributors to impose our retail policies on the stores operated by such distributors and their sub-distributors. We do not own any interest in any of our distributors, their sub-distributors or the retail stores they operate. The distribution agreements we typically enter into with our distributors do not allow us to be involved in the daily operating, financing or other activities of the distributors, except that our distributors need to comply with our brand management policies and pricing and store management guidelines. In addition, we do not have direct contractual relationships with the sub-distributors, and we rely on our distributors to oversee these sub-distributors. As a result, we have limited control over ultimate retail sales by our distributors, their sub-distributors and the retail stores that they operate. If our distributors or their sub-distributors fail to comply with our retail policies, we may not be able to effectively manage our sales network or maintain a uniform brand image, which may negatively impact how our brand is perceived by consumers. In addition, if our distributors fail to meet our retail targets either because they are unable to open a sufficient number of new retail stores or are otherwise unsuccessful in selling our products, our results of operations may be materially and adversely affected. Although we have the right to impose penalties, suspend supplies of our products, or replace any of our distributors for breach of retail policies, we may be unable to find replacement distributors in a timely manner. As a result, our business and results of operations may be materially and adversely affected.

10

Table of Contents

Our financial performance in a given period may not be fully indicative of the sales performance of our distributors and sub-distributors or the market reception of our products.

We sell our products to our distributors upon their orders and recognize revenue upfront based on the contract amount regardless of the actual sales performance of the distributors. Consequently, our financial performance and results of operations may not be fully indicative of the sales performance of our distributors and sub-distributors or the market reception of our products. Although we obtain sales and operational data from our distributors from time to time, we cannot assure you that such data are accurate. In addition, we do not have an enterprise resource planning system, or ERP system, to receive real-time sales data from our distributors, sub-distributors and the retail stores operated by them. As a result, we may not be able to effectively monitor and control excess inventory buildup. See "Our Business—Sales—Our Distributors." Our distributors, their sub-distributors, and the retail stores which they operate may, for various reasons, experience difficulties in selling our products. Our distributor may close the retail store operated by a sub-distributor and repurchase the products if that retail store experiences extreme difficulties in selling our products. However, we cannot assure you that our distributors and their sub-distributors will not resort to liquidating their excess inventory through aggressive discounts in the future, thereby having an adverse effect on the value and reputation of our brand.

We have grown rapidly over recent years. The number of retail stores operated by our distributors or their sub-distributors increased from 843 as of December 31, 2007 to 861 as of December 31, 2008, to 978 as of December 31, 2009 and to 1,044 as of September 30, 2010. We intend to continue to expand our network of retail stores, and we rely to a large extent on our distributors and their sub-distributors for such expansion. Previously, we coordinated with our distributors to establish annual targets for the number of new retail stores, and our distributors have met such targets. However, there is no assurance that our distributors will meet our expansion targets in the future. We also intend to open new direct stores as flagship stores, which will place significant strain on our managerial, operational and financial resources. In addition, we may not be able to secure desirable locations for our flagship stores on economically viable terms. We plan to introduce a new generation layout and design for Zuoan retail stores and flagship stores, and we will need to bear the costs of such upgrades. In connection with our expansion plans, we may also need to establish information systems across our flagship store distribution network. We cannot assure you that our personnel, systems, procedures and controls will be adequate to implement our business plans or support our future growth. Additionally, we may not be able to obtain sufficient funds to finance our expansion plans. If our expansion efforts are unsuccessful or our management systems insufficient, our financial condition and results of operations could be materially and adversely affected.

We generally provide credit terms of up to 90 days to our distributors. As of September 30, 2010, we have not experienced any significant difficulty in collections or made any provision for bad or doubtful debts. However, our sales going forward may rely more heavily on credit, and we may be unable to collect these accounts receivable in full or at all. Failure by our distributors to pay us in a timely manner or at all could have a material adverse effect on our financial condition and results of operations.

The PRC market for fashion casual menswear products is highly competitive. We compete with various domestic brands with similar business models and target markets. We also compete with a growing number of international brands trying to expand their market share in China to take advantage of rising consumer spending on fashion casual menswear. In addition, certain business formal menswear

11

Table of Contents

brands have been seeking to expand into fashion casual menswear market and if they are successful, it may intensify the competition in the fashion casual menswear market that we engage in.

Our products compete on the basis of brand image, design and concept, product mix, quality, price, customer service and the breadth of our retail network. Some of our competitors may have greater financial, management, human resources, distribution, development, marketing or other resources or better brand recognition than we do. We face a variety of competitive challenges, including:

- •

- strong brand recognition of many of our competitors;

- •

- relatively low entry barriers to the menswear industry;

- •

- competitive pricing strategies of our competitors;

- •

- established relationships between our competitors and their distributors;

- •

- expansion by existing competitors;

- •

- innovative sales methods adopted by our competitors; and

- •

- better product designs from or better branding efforts of our competitors.

We cannot assure you that we will be able to continue to successfully compete with other domestic or international brands. Failure to do so could have a material adverse effect on our business and results of operations.

Our business is affected by seasonal trends. Generally, the third and fourth quarters, during which our fall/winter collections are sold, account for a higher portion of our annual revenues than the first and second quarters because our fall/winter collections are generally priced higher than our spring/summer collections and consist of more types of products. The sales in our direct stores are also affected by local spending behavior, which are typically affected by seasonal shopping patterns during major Chinese holidays. As a result, comparisons of sales and operating results between different periods within a single fiscal year, or between different periods in different fiscal years, are not necessarily meaningful and cannot be relied on as indicators of our performance. In addition, since we operate largely on a seasonal cycle, if our raw material suppliers or contract manufacturers fail to deliver on a timely basis for any reason, sales for the season and our results of operations could be materially and adversely affected.

Our business is also susceptible to extreme or unexpected changes in weather conditions. For example, extended periods of unusually warm temperatures during the winter season or cool weather during the summer season could render a portion of our inventory incompatible with such unusual weather conditions. These extreme or unusual weather conditions could have a material adverse effect on our results of operations.

We rely on independent third-party contract manufacturers for the production of a significant portion of our products and any material disruption to the supply of the products from such manufacturers would materially and adversely affect our results of operations.

We outsource the production of a significant portion of our products to third-party contract manufacturers. Contract manufacturing costs represented 85.5%, 90.7%, 91.6% and 93.8% of our total cost of sales in 2007, 2008, 2009 and the nine months ended September 30, 2010, respectively. In addition, most of our outsourced products are produced by a small number of contract manufacturers. In 2009 and the nine months ended September 30, 2010, contract manufacturing costs attributable to our top five contract manufacturers represented 37.5% and 44.2%, respectively, with contract manufacturing costs attributable to our largest contract manufacturer accounting for 10.1% and 12.7%, respectively, of our total cost of sales. As a result, our continued success is tied to our timely receipt of

12

Table of Contents

quality finished products from our contract manufacturers, especially our major contract manufacturers, which may be affected by various factors, including those beyond our control, such as production failures, labor strikes, riots, public disorders and other similar events. A contract manufacturer's failure to ship orders in a timely manner or meet our quality standards could negatively impact our ability to fulfill our sales orders and result in the cancellation of orders or price reductions, which in turn could damage our relationships with our distributors. We cannot assure you that we will not face material disruptions to the supply of products from our contract manufacturers in the future. In the event of such disruptions, especially disruptions with respect to our major contract manufacturers, we may not be able to find suitable alternative contract manufacturers on a timely basis or offset such disruptions by increasing production at our own production facilities. Our financial condition or results of operations may be adversely affected.

Our results of operations may be adversely affected by an increase in the cost of raw materials or labor costs for our in-house production and outsourced contract manufacturing.

We price our products based on each item's production costs and a targeted product margin, while also taking into account other important factors, such as the price ranges offered by comparable fashion casual menswear companies, our market position and consumer spending power. Cost of raw materials, such as fabrics and accessories, and labor costs constitute important components in the production costs for both our in-house production and outsourced contract manufacturing. We do not maintain long-term contracts with our raw material suppliers or contract manufacturers, and prices that we pay for such materials and outsourced products may increase due to increased raw material or labor costs as a result of greater industry demand or supply shortages. If we are unable to reduce the costs of our own or outsourced production, or pass on such increase in the cost of raw materials, labor or outsourced products to our customers, our profitability may be materially and adversely affected.

Any significant damage to our sole production facility or our primary warehousing facility could have a material adverse effect on our results of operations.

We have only one production facility located in Fujian, China. We produce our most exclusive and fashion-forward products at this facility in order to retain maximum control of quality and prevent unauthorized disclosure of our new collection before its scheduled release. In addition, we have only one primary warehousing facility located in Fujian, China, in which we store substantially all of our finished products procured from third-party contract manufacturers. Our ability to meet the market demands of, and our contractual obligations to, our distributors for our in-house produced or outsourced products depend on efficient, proper and uninterrupted operations at our production facility or warehousing facility. Power failures or disruptions, the breakdown, failure or substandard performance of equipment, and the destruction of buildings and other facilities due to fire or natural disasters such as hurricanes, severe winter storms, flood, droughts or earthquakes would severely affect our ability to continue our operations. In the event of such disruptions, we may not be able to find suitable alternatives on a timely basis and at reasonable cost, which could have a material adverse effect on our business and results of operations.

The success of our business depends on our product designs and other proprietary information. Our standard employment agreements for members of our product design and development team and our executive officers contains confidentiality provisions. We typically limit access to our new season collections to a small number of distributors prior to our sales fair. In addition, we produce our most exclusive and fashion-forward products at our own production facility instead of outsourcing to our contract manufacturers in order to ensure maximum confidentiality. However, there is no assurance that our measures to maintain confidentiality will be effective and there will be no unauthorized disclosure of our proprietary information. Any breach of confidentiality may adversely affect our business and results of operations.

13

Table of Contents

We face possible infringement of our trademarks and other intellectual property rights and counterfeiting of our products.

We believe our trademarks and other intellectual property rights are important to our success and competitive position and recognize the importance of registering the trademarks related to our Zuoan brand for protection against infringement. As of September 30, 2010, we had 23 registered trademarks in China in the classes relevant to our business. See "Our Business—Intellectual Property." We are not aware of any material violations or infringements of our trademarks and intellectual property rights. However, third parties may in the future attempt to challenge the ownership and/or validity of our intellectual property rights. In addition, our business is subject to the risk of third parties counterfeiting our Zuoan brand products or otherwise infringing our intellectual property rights. Such unauthorized use of our brand in counterfeit products could not only result in potential revenue loss, but also an adverse impact to our brand equity and perceptions of our products quality. We may not always be successful in securing protection for our intellectual property rights, in preventing the production and sale of counterfeit products and preventing other infringements of our intellectual property rights. Protections offered by PRC intellectual property laws and the enforcement of these protections may not be as effective as in some other countries. We may need to resort to litigation in the future to enforce our intellectual property rights. Any such litigation could result in substantial costs and a diversion of our resources. Our failure to protect and enforce our intellectual property rights could have a material adverse impact on our reputation, business and results of operations.

During the course of our operations, we may design products that include elements that may inadvertently infringe third-party copyright and other intellectual property rights, as a result of which other parties may initiate litigation or other proceedings against us. It is also possible that third parties may seek to initiate proceedings against us for infringement of their intellectual property rights through the use of our trademarks. Responding to and defending these proceedings may require substantial costs and diversion of resources, and the result of these proceedings may be uncertain. Our reputation may also be adversely affected.

Our success depends on our ability to retain our senior management team and our ability to attract and retain additional management, design talent and other qualified personnel.

Many of our senior management team have been with us for over five years. Their talent, effort, experience and leadership are critical to the success of our business. In particular, the leadership of Mr. James Hong, our chairman and chief executive officer, in the design, marketing and operational areas of our business has been a critical element of our success since the inception of our company. The loss of services of Mr. James Hong or any negative market or industry perception with respect to him could have a material adverse effect on our business. In addition, Mr. Chaoshen Wang, our chief operating officer, and other members of our senior management also have substantial experience and expertise in our business and have made significant contributions to our growth and success. The unexpected loss of services of one or more of these individuals could also have a material adverse effect on us. We have entered into three-year contracts, including non-compete undertakings, with all of our executive officers and senior management. However, there can be no assurance that such contracts will not be terminated or breached, nor can there be assurance that the contracts will be enforceable. In addition, we are not protected by any key-man or similar life insurance covering Mr. James Hong and other members of senior management.

Our success also depends upon the continued service of our design and sales personnel and our ability to continue to attract, retain and motivate such personnel. There is intense competition to recruit competent personnel with expertise in China's menswear industry. We may also need to offer better compensation and other benefits in order to attract and retain these personnel in the future, and

14

Table of Contents

we cannot assure you that we will have the resources to meet our staffing needs. These difficulties could limit our development capacity or reduce our operating efficiency and product quality, which could reduce our profitability and limit our ability to grow.

In the course of preparing our consolidated financial statements for the years ended December 31, 2007, 2008 and 2009 and the nine months ended September 30, 2010, several significant deficiencies in our internal control over financial reporting were noted. We expect to incur extra costs in implementing measures to address such deficiencies. If we fail to maintain an effective system of internal control over financial reporting, our ability to accurately and timely report our financial results or prevent fraud may be adversely affected. As a result, investor confidence and the trading price of our ADSs may be adversely impacted.

Upon the completion of this offering, we will become a public company in the United States subject to the Sarbanes-Oxley Act of 2002. Section 404 of the Sarbanes-Oxley Act of 2002, or Section 404, will require that we include a report of management on our internal control over financial reporting in our annual report on Form 20-F beginning with our annual report for the fiscal year ending December 31, 2011. In addition, our independent registered public accounting firm must report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm may still decline to attest to the effectiveness of our internal control over financial reporting or may issue a report that is qualified if it is not satisfied with our internal control or the level at which our control is documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. In addition, our reporting obligations as a public company may place a significant strain on our management, operational and financial resources and systems for the foreseeable future.

Prior to this offering, we have been a private company with limited accounting personnel and other resources with which to address our internal controls and procedures. Our independent registered public accounting firm has not conducted an audit of our internal control over financial reporting. However, in connection with the audits of our consolidated financial statements for the years ended December 31, 2007, 2008 and 2009 and the nine months ended September 30, 2010, our independent registered public accounting firm identified several "significant deficiencies" in our internal control over financial reporting, as defined in the standards established by the Public Company Accounting Oversight Board (United States). The significant deficiencies identified related to (i) the control procedures relating to payroll, a significant portion of which is currently paid in cash, and (ii) our approval policies, limits and procedures regarding petty cash reimbursements. In response, we have implemented procedures to ensure that we maintain a minimum amount of petty cash and all reimbursements are supported by documents approved in accordance with our internal payment approval policies and limits. We are also in the process of implementing a number of measures to address the deficiencies relating to payroll, including: (i) establishing employee individual bank accounts for all employees other than factory workers for payment of salaries through direct deposit; and (ii) establishing policies and procedures to prevent misappropriation relating to payment of salaries in cash to factory workers. We are working to implement these measures, although we cannot assure you that our efforts to remedy these significant deficiencies will be successful.

During the course of documenting and testing our internal control procedures in order to satisfy the requirements of Section 404, we may identify other deficiencies in our internal control over financial reporting. In addition, if we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. If we fail to achieve and maintain an effective internal

15

Table of Contents

control environment, we could suffer material misstatements in our financial statements and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial information. This could harm our operating results and lead to a decline in the trading price of our ADSs. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to potential delisting from the NYSE, regulatory investigations and civil or criminal sanctions.

We began operating direct stores in April 2009. The revenue generated by our direct stores was 2.8% and 3.8% of our total revenues in 2009 and the nine months ended September 30, 2010, respectively. We intend to lease or acquire retail space in prime shopping areas for our directly operated flagship stores. Given the scarcity of prime locations and the relatively high rental rates in major cities in China, we may be unable to obtain retail space on commercially acceptable terms for our direct stores in the future, nor can we assure you that we will be able to renew our existing lease agreements upon expiry on terms and conditions acceptable to us or at all. If any of these situations occur, we may not be able to find alternative premises located in areas that offer similar retail environments, and our competitors may move into such retail spaces previously occupied by us. As a result, our operating costs may increase, which may lead to a decline in our profitability and adversely affect our results of operations.

We may be exposed to product liability or personal injury claims, which may materially and adversely affect our reputation and business.

As of September 30, 2010, all of our products were sold in China. We may be exposed to product liability claims, such as excessive pH values in our products, that may be harmful to consumers. As a result, we may have to expend significant financial and managerial resources to defend against such claims. We believe that such product liability claim risks will increase as legal concepts in product liability claims begin to develop and mature in China. We currently outsource the manufacturing of most of our products, and may not have effective or sufficient control over the quality of those products. We cannot give any assurance that our reputation, business, financial condition, results of operations and prospects will not be materially and adversely affected by a successful product liability claim against us. We may incur significant costs and expenses to defend against such claims or enter into settlement agreements. We may be fined or sanctioned and our reputation and brand may be negatively impacted, which could materially and adversely affect our reputation, business, prospects, financial condition and results of operations.

We face various risks in connection with our businesses and may lack adequate insurance coverage or may not have the relevant insurance coverage. We maintain insurance coverage for our equipment, raw materials and inventory. However, as is typical in China, we do not maintain product liability insurance, business interruption insurance or third-party liability insurance against claims for property damage, personal injury and environmental liabilities. If we incur substantial losses or liabilities and our insurance coverage is unavailable or inadequate to cover such losses or liabilities, our financial condition and results of operations may be materially and adversely affected.

Deterioration in general economic and financial conditions could decrease consumer demand for our products, which may have a material adverse effect on our business, results of operations and liquidity.

Consumer purchases of discretionary items, including our products, generally decline during recessionary periods and other periods where disposable income is adversely affected. Our performance is subject to factors that affect the general economy in China, including worldwide economic conditions,

16

Table of Contents

individual income levels, interest rates, currency exchange rates, recession, inflation, deflation, political uncertainty, taxation, stock market performance, unemployment level, general consumer confidence, consumer debt and other macroeconomic factors. The combination of these factors may cause consumer spending to deteriorate significantly, which may result in consumers purchasing products from lower priced competitors or to defer purchases of fashion apparel products altogether. For instance, although we sustained our growth in 2008, our growth rate was not as high as projected due to the negative impact of the global economic downturn on general market demand. Economic uncertainty could also have a material adverse effect on the market demand for our products, sales and results of operations.

We face risks related to severe weather conditions, natural disasters, health epidemics and other similar events, any of which could adversely affect our business.

Our business could be disrupted or otherwise adversely affected by severe weather conditions, such as snowstorms or typhoons, natural disasters, such as earthquakes, health epidemics, such as an outbreak of avian influenza or severe acute respiratory syndrome, and other similar events. The occurrence of any such event could significantly change the living and consumption patterns of the people in the affected area. Our business and production activities, contract manufacturers, and distributors and sub-distributors may also be disrupted. In particular, a lower consumption level or reduced traffic in the affected area may decrease sales at our direct stores and the retail stores operated by our distributors and sub-distributors, which in turn may lead to reduced orders from our distributors. Such changes and disruptions could adversely affect our business, results of operations and financial condition.

Risks Related to Doing Business in China

Adverse changes in the economic and political policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could adversely affect our business.

We conduct substantially all our business operations in China. Accordingly, our results of operations, financial condition and prospects are significantly dependent on economic and political developments in China. China's economy differs from the economies of developed countries in many aspects, including the level of development, growth rate and degree of government control over foreign exchange and allocation of resources. While China's economy has experienced significant growth in the past 30 years, the growth has been uneven across different regions and periods and among various economic sectors in China. We cannot assure you that China's economy will continue to grow, or that if there is growth, such growth will be steady and uniform, or that if there is a slowdown, such slowdown will not have a negative effect on our business and results of operations.

The PRC government exercises significant control over China's economic growth through the allocation of resources, control over payment of foreign currency-denominated obligations, implementation of monetary policy, and preferential treatment to particular industries or companies. Certain measures adopted by the PRC government may restrict loans to certain industries, such as changes in statutory deposit reserve ratio and lending guidelines for commercial banks by the People's Bank of China, or PBOC. These current and future government actions could materially affect our liquidity, access to capital, and ability to operate our business.

In response to the global financial crisis and economic downturn in 2008, the PRC government adopted various measures aimed at expanding credit and stimulating economic growth, such as decreasing the PBOC statutory deposit reserve ratio and lowering benchmark interest rates. However, since January 2010, the PBOC has begun to increase the statutory reserve ratio in response to rapid domestic growth, which may have a negative impact on the stability of China's economy. It is unclear whether the PRC economic policies will be effective in sustaining stable economic growth in the future.

17

Table of Contents

Any slowdown in the economic growth of China could lead to reduced demand for our products, which could materially and adversely affect our business, financial condition and results of operations.

Uncertainties presented by the PRC legal system could limit the legal protections available to us and to our investors, which may have a material adverse effect on our business and results of operations.

Our operations in China are governed by PRC laws and regulations. Our PRC subsidiaries are foreign-invested enterprises and are subject to laws and regulations applicable to foreign investment in China. China has a civil law legal system based on written statutes. Unlike the common law system, previous court decisions in China may be cited for reference but have limited precedential value. Although the overall effect of legislation over the past 30 years has significantly enhanced the protections afforded to various forms of foreign investments in China, China has not developed a fully integrated legal system and recently enacted laws and regulations may not sufficiently cover all aspects of economic activities. In particular, because these laws and regulations are relatively new, and because of the limited volume of published decisions and their non-binding nature, the interpretation and enforcement of these laws and regulations involve uncertainties. Such uncertainties may limit the legal protections available to us and to other foreign investors, including you as an investor.

In addition, the PRC legal system is based in part on government policies and certain internal rules, some of which are not published on a timely basis or at all and which may have retroactive effect. As a result, we may not be aware of our violation of these policies and internal rules until some time after the violation. Also, any administrative or court proceedings may be protracted, resulting in substantial costs and diversion of resources and management attention if we seek to enforce our legal rights through administrative or court proceedings. Moreover, compared to more developed legal systems, the PRC administrative and court authorities have significantly wider discretion in interpreting and implementing statutory and contractual provisions. As a result, it may be more difficult to evaluate the outcomes of the administrative and judicial proceedings as well as the level of legal protections we are entitled to. These uncertainties may impede our ability to enforce our contracts, which could in turn materially and adversely affect our business and operations.

Government control over currency conversion may limit our ability to issue dividends to our shareholders in foreign currencies, and may therefore adversely affect the value of your investment.

The PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. We receive all of our revenues in Renminbi. Under our current corporate structure, our Cayman Islands holding company may rely on dividend payments from our PRC subsidiaries to fund any cash and financing requirements we may have. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. Therefore, our PRC subsidiaries are able to pay dividends in foreign currencies to us without prior approval from SAFE by complying with certain procedural requirements. But approval from or registration with appropriate government authorities is required where Renminbi are to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans denominated in foreign currencies. The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currencies to satisfy our foreign currency demands, we may not be able to pay dividends in foreign currencies to our shareholders, including holders of our ADSs.

18

Table of Contents

Substantially all of the revenues and costs of our PRC subsidiaries are denominated in Renminbi. The net proceeds from this offering will be denominated in U.S. dollars. Fluctuations in the U.S. dollar-Renminbi exchange rate will affect the relative value of these proceeds in Renminbi terms. Fluctuations in the exchange rate will also affect the relative value in Renminbi terms of earnings from and the value of any U.S. dollar-denominated investments we make in the future.