SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| þ | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

| Eureka Financial Corp. | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| N/A | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| þ | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

N/A | |||

| ||||

| (2) | Aggregate number of securities to which transactions applies:

N/A | |||

| ||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

N/A | |||

| ||||

| (4) | Proposed maximum aggregate value of transaction:

N/A | |||

| ||||

| (5) | Total fee paid: | |||

| N/A | ||||

| ||||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

N/A | |||

| ||||

| (2) | Form, Schedule or Registration Statement No.:

N/A | |||

| ||||

| (3) | Filing Party:

N/A | |||

| ||||

| (4) | Date Filed:

N/A | |||

| ||||

[LETTERHEAD OF EUREKA FINANCIAL CORP.]

December 28, 2012

Dear Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Eureka Financial Corp. (the “Company”). The meeting will be held at the Hilton Garden Inn Pittsburgh—University Place, located at 3454 Forbes Avenue, Pittsburgh, Pennsylvania on Monday, January 28, 2013 at 3:00 p.m., local time.

The notice of annual meeting and proxy statement appearing on the following pages describe the formal business to be transacted at the meeting. Directors and officers of the Company, as well as a representative of S.R. Snodgrass, A.C., the Company’s independent registered public accounting firm, will be present to respond to appropriate questions from stockholders.

It is important that your shares are represented at the meeting, whether or not you attend the meeting in person and regardless of the number of shares you own. To make sure your shares are represented, we urge you to vote via the Internet, by telephone or by promptly completing and mailing the enclosed proxy card.

We look forward to seeing you at the meeting.

Sincerely,

/s/ Edward F. Seserko

Edward F. Seserko

President and Chief Executive Officer

EUREKA FINANCIAL CORP.

3455 Forbes Avenue

Pittsburgh, Pennsylvania

(412) 681-8400

NOTICE OF 2013 ANNUAL MEETING OF STOCKHOLDERS

TIME AND DATE | 3:00 p.m., local time, on Monday, January 28, 2013 | |

PLACE | Hilton Garden Inn Pittsburgh—University Place 3454 Forbes Avenue Pittsburgh, Pennsylvania | |

ITEMS OF BUSINESS | (1) The election of two directors for a term of three years; | |

(2) The ratification of the appointment of S.R. Snodgrass, A.C. as our independent registered public accounting firm for the fiscal year ending September 30, 2013; | ||

(3) An advisory vote on the compensation of our named executive officers as disclosed in this proxy statement; | ||

(4) An advisory vote on the frequency of the advisory vote on the compensation of our named executive officers; and | ||

(5) The transaction of such other business as may properly come before the meeting and any adjournment or postponement of the meeting. | ||

RECORD DATE | To vote, you must have been a stockholder at the close of business on December 7, 2012. | |

PROXY VOTING | It is important that your shares be voted at the meeting. You can vote your shares via the Internet, by telephone or by completing and returning the proxy card or voting instruction form sent to you. You can revoke a proxy at any time before its exercise at the meeting by following the instructions in the proxy statement. | |

| By Order of the Board of Directors, | ||

/s/ Barbara A. Rota Barbara A. Rota Corporate Secretary | ||

Pittsburgh, Pennsylvania

December 28, 2012

EUREKA FINANCIAL CORP.

PROXY STATEMENT

GENERAL INFORMATION

We are providing this proxy statement to you in connection with the solicitation of proxies by the Board of Directors of Eureka Financial Corp. for the 2013 annual meeting of stockholders and for any adjournment or postponement of the meeting. In this proxy statement, we may also refer to Eureka Financial Corp. as the “Company,” “we,” “our” or “us.”

Eureka Financial Corp. is the holding company for Eureka Bank. In this proxy statement, we may also refer to Eureka Bank as the “Bank.”

We are holding the 2013 annual meeting of stockholders at the Hilton Garden Inn Pittsburgh—University Place, 3454 Forbes Avenue, Pittsburgh, Pennsylvania on Monday, January 28, 2013 at 3:00 p.m., local time.

We intend to mail this proxy statement and the enclosed proxy card to stockholders of record beginning on or about December 28, 2012.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDERS’ MEETING TO BE HELD ON JANUARY 28, 2013

This proxy statement, including the accompanying proxy card, and the Company’s Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, are available athttp://www.eub.ilstk.com.

INFORMATION ABOUT VOTING

Who Can Vote at the Meeting

You are entitled to vote your shares of Eureka Financial Corp. common stock that you owned as of December 7, 2012, the record date for the annual meeting. As of the close of business on December 7, 2012, 1,317,897 shares of Eureka Financial Corp. common stock were outstanding. Each share of common stock has one vote.

The Company’s articles of incorporation provide that record holders of the Company’s common stock who beneficially own, either directly or indirectly, in excess of 10% of the Company’s outstanding shares are not entitled to any vote with respect to those shares held in excess of the 10% limit.

Ownership of Shares; Attending the Meeting

You may own shares of Eureka Financial Corp. in one or more of the following ways:

| • | Directly in your name as the stockholder of record; |

| • | Indirectly through a broker, bank or other holder of record in “street name”; |

1

| • | Indirectly through the Eureka Bank Employee Stock Ownership Plan; or |

| • | Indirectly through the Eureka Bank Retirement Savings Plan. |

If your shares are registered directly in your name, you are the holder of record of these shares and we are sending these proxy materials directly to you. As the holder of record, you have the right to give your proxy to us or to vote in person at the meeting.

If you hold your shares in street name, your broker, bank or other holder of record is sending these proxy materials to you. As the beneficial owner, you have the right to direct your broker, bank or other holder of record how to vote by filling out a voting instruction form that accompanies your proxy materials. Your broker, bank or other holder of record may allow you to provide voting instructions by telephone or by the Internet. Please see the instruction form provided by your broker, bank or other holder of record that accompanies this proxy statement. If you hold your shares in street name, you will need proof of ownership to be admitted to the meeting. A recent brokerage statement or a letter from a bank or broker are examples of proof of ownership. If you want to vote your shares of Eureka Financial Corp. common stock held in street name in person at the meeting, you must obtain a written proxy in your name from the broker, bank or other nominee who is the holder of record of your shares.

If you own shares of Company common stock indirectly through the Eureka Bank Employee Stock Ownership Plan or the Eureka Bank Retirement Savings Plan, see“Participants in the ESOP or the 401(k) Plan” for voting information.

Quorum and Vote Required

Quorum. We will have a quorum and will be able to conduct the business of the annual meeting if the holders of a majority of the outstanding shares of common stock entitled to vote are present at the meeting, either in person or by proxy.

Vote Required for Proposals.At this year’s annual meeting, stockholders will elect two directors for a term of three years. In voting on the election of directors, you may vote in favor of the nominees, withhold votes as to the nominees or withhold votes as to either nominee. There is no cumulative voting for the election of directors. Directors must be elected by a plurality of the votes cast at the annual meeting. This means that the nominees receiving the greatest number of votes will be elected.

In voting on the ratification of the appointment of S.R. Snodgrass as the Company’s independent registered public accounting firm and on the advisory resolution to approve the compensation of the Company’s named executive officers, you may vote in favor of each proposal, against each proposal or abstain from voting. To be approved, each proposal requires the affirmative vote of a majority of the votes cast at the annual meeting. The results of the vote on the compensation of the named executive officers are not binding on the Board of Directors.

In voting on the frequency of the stockholder vote to approve the compensation of the named executive officers, you may vote for a frequency of one, two, or three years or abstain from voting. This matter will be determined by a plurality of the votes cast at the annual meeting. The results of this vote are not binding on the Board of Directors.

2

Routine and Non-Routine Proposals. Applicable stock exchange rules determine whether proposals presented at stockholder meetings are routine or non-routine. If a proposal is routine, a broker or other entity holding shares for an owner in street name may vote on the proposal without receiving voting instructions from the owner. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the owner has provided voting instructions. A broker non-vote occurs when a broker or other entity does not have discretion to vote on a particular proposal and the broker or other entity has not received voting instructions from the beneficial owner. The election of directors and the two advisory proposals regarding the compensation of the Company’s named executive officers are non-routine proposals. The proposal to ratify the appointment of S.R. Snodgrass as the Company’s independent registered public accounting firm is a routine proposal.

How We Count Votes.If you return valid proxy instructions or attend the meeting in person, we will count your shares to determine whether there is quorum, even if you abstain from voting. Broker non-votes also will be counted to determine the existence of a quorum.

In the election of directors, votes that are withheld and broker non-votes will have no effect on the outcome of the election.

In counting votes on the ratification of the appointment of the independent registered public accounting firm and the two advisory proposals regarding the compensation of the Company’s named executive officers, abstentions and broker non-votes will have no effect on the outcome of the proposal.

Voting by Proxy

The Company’s Board of Directors is sending you this proxy statement to request that you allow your shares of Company common stock to be represented at the annual meeting by the persons named in the enclosed proxy card. All shares of Company common stock represented at the meeting by properly executed and dated proxies will be voted according to the instructions indicated on the proxy card. If you sign, date and return a proxy card without giving voting instructions, your shares will be voted as recommended by the Company’s Board of Directors. The Board of Directors recommends that you vote:

| • | “FOR”the election of each of the nominees for director; |

| • | “FOR”the ratification of the appointment of S.R. Snodgrass as the Company’s independent registered public accounting firm; |

| • | “FOR”the approval of the compensation of the Company’s named executive officers as disclosed in this proxy statement; and |

| • | To hold the advisory vote to approve the compensation of the Company’s named executive officers every year. |

If any matters not described in this proxy statement are properly presented at the annual meeting, the persons named in the proxy card will use their judgment to determine how to vote your shares. This includes a motion to adjourn or postpone the annual meeting to solicit additional proxies. If the annual meeting is postponed or adjourned, your shares of Company common stock may be voted by the persons named in the proxy card on the new meeting date, provided that the new meeting occurs within 30 days of the annual meeting and you have not revoked your proxy. The Company does not currently know of any other matters to be presented at the meeting.

You may revoke your proxy at any time before the vote is taken at the meeting. To revoke your proxy, you must either advise the Corporate Secretary of the Company in writing before your shares have been voted at the annual meeting, deliver a later-dated and properly executed proxy or attend the meeting and vote your shares in person. Attendance at the annual meeting will not in itself constitute revocation of your proxy.

3

Instead of voting by mailing a proxy card, registered stockholders can vote their shares of Company common stock via the Internet or by telephone. The Internet and telephone voting procedures are designed to authenticate stockholders’ identities, allow stockholders to cast their vote and confirm that their vote has been recorded properly. Specific instructions for Internet and telephone voting are set forth on the proxy card. The deadline for voting via the Internet or by telephone is 11:59 p.m., Central time, on Saturday, January 26, 2013.

Participants in the ESOP or the 401(k) Plan

If you participate in the Eureka Bank Employee Stock Ownership Plan (the “ESOP”) or if you invest in Company common stock through the Eureka Financial Corp. Stock Fund in the Eureka Bank Retirement Savings Plan (the “401(k) Plan”), you will receive a voting instruction form for each plan that reflects all of the shares you may direct the trustees to vote on your behalf under the plan. Under the terms of the ESOP, all allocated shares of Company common stock held by the ESOP are voted by the ESOP trustees, as directed by plan participants. All unallocated shares of Company common stock held by the ESOP and allocated shares for which no timely voting instructions are received are voted by the ESOP trustees in the same proportion as shares for which the trustees have received timely voting instructions, subject to the exercise of the trustees’ fiduciary duties. Under the terms of the 401(k) Plan, a participant may direct the stock fund trustees of the 401(k) Plan how to vote the shares in the Eureka Financial Corp. Stock Fund credited to his or her account. The stock fund trustees will vote all shares for which timely voting instructions are not received in the same proportion as shares for which the trustees received voting instructions. The deadline for returning your voting instruction forms is January 18, 2013.

CORPORATE GOVERNANCE

Director Independence

Although the Company’s common stock is quoted on the Over-the-Counter Bulletin Board and is not listed on a national securities exchange, we believe that sound management and oversight is in the best interests of the Company and its stockholders. Accordingly, all of our directors are independent under the current listing standards of the Nasdaq Stock Market, except for Mr. Seserko, who is President and Chief Executive Officer of the Company and the Bank.

Board Leadership Structure and Board’s Role in Risk Oversight

The Board of Directors of the Company has determined that the separation of the offices of Chairman of the Board and President and Chief Executive Officer enhance board independence and oversight. Moreover, the separation of the positions of the Chairman of the Board and President and Chief Executive Officer allow the President and Chief Executive Officer to focus on his responsibilities of running the Company, enhancing stockholder value and expanding and strengthening our franchise while allowing the Chairman of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management. Consistent with this determination, Mark B. Devlin serves as Chairman of the Board of the Company and Edward F. Seserko serves as President and Chief Executive Officer of the Company.

4

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including credit, interest rate, liquidity, operational, strategic and reputation risks. Management is responsible for the day-to-day management of risks we face, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. In its risk oversight role, the Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. Senior management attends the Board meetings and is available to address any questions or concerns raised by the Board on risk management and any other matters. The Chairman of the Board and independent members of the Board work together to provide strong, independent oversight of our management and affairs through our standing committees and, when necessary, special meetings of independent directors.

Corporate Governance Policy

The Board of Directors has adopted a corporate governance policy to govern certain activities, including: the duties and responsibilities of directors; the composition, responsibilities and operations of the Board of Directors; the establishment and operation of Board committees; succession planning; convening executive sessions of independent directors; the Board of Directors’ interaction with management and third parties; and the evaluation of the performance of the Board of Directors and of the President and Chief Executive Officer.

Committees of the Board of Directors

The following table identifies our standing committees and their members. All members of each committee are independent in accordance with the listing requirements of the Nasdaq Stock Market. Each committee operates under a written charter that is approved by the Board of Directors and that governs its composition, responsibilities and operation. Each committee reviews and reassesses the adequacy of its charter at least annually. The charters of all three committees are available in the Investor Relations section of our website (www.eurekabancorp.com).

Director | Audit Committee | Compensation Committee | Nominating and Governance Committee | |||||||||

Mark B. Devlin | X | X | ||||||||||

Robert J. Malone | X | X | X | |||||||||

Paul M. Matvey | X | * | X | * | ||||||||

Dennis P. McManus | X | X | * | |||||||||

William F. Ryan | X | X | ||||||||||

Edward F. Seserko | ||||||||||||

Number of Meetings in 2012. | 2 | 1 | 1 | |||||||||

| * | Denotes Chairperson |

Audit Committee. The Audit Committee is responsible for providing oversight relating to our consolidated financial statements and financial reporting process, systems of internal accounting and financial controls, internal audit function, annual independent audit and the compliance programs established by management and the Board. The Audit Committee is also responsible for engaging the Company’s independent registered public accounting firm and monitoring its conduct and independence. The Company’s Board of Directors has determined that Paul M. Matvey qualifies as an audit committee financial expert under the rules of the Securities and Exchange Commission.

5

Compensation Committee. The Compensation Committee approves the compensation objectives for the Company and the Bank, establishes the compensation for the Company’s and Bank’s senior management and conducts the performance review of the President and Chief Executive Officer. The Compensation Committee reviews all components of compensation, including salaries, bonuses, benefit and equity plans and various employee benefit matters. Decisions by the Compensation Committee with respect to the compensation of executive officers are approved by the full Board of Directors. The Committee also assists the Board of Directors in evaluating potential candidates for executive positions.

Nominating and Governance Committee. The Nominating and Governance Committee assists the Board of Directors in: (1) identifying individuals qualified to become Board members, consistent with criteria approved by the Board; (2) recommending to the Board the director nominees for the next annual meeting; (3) implementing policies and practices relating to corporate governance; (4) leading the Board in its annual review of the Board’s performance; and (5) recommending director nominees for each committee.

Minimum Qualifications for Director Nominees.The Nominating and Governance Committee has adopted a set of criteria that it considers when it selects individuals to be nominated for election to the Board of Directors. A candidate must meet the eligibility requirements set forth in the Company’s Bylaws, which include a requirement that the candidate not have been subject to certain criminal or regulatory actions. A candidate also must meet any qualification requirements set forth in any Board of Directors or committee governing documents.

If a candidate is deemed eligible for election to the Board of Directors, the Nominating and Governance Committee will then evaluate the following criteria in selecting nominees:

| • | contributions to the range of talent, skill and expertise of the Board of Directors; |

| • | financial, regulatory and business experience, knowledge of the banking and financial service industries, familiarity with the operations of public companies and ability to read and understand financial statements; |

| • | familiarity with the Company’s market area and participation in and ties to local businesses and local civic, charitable and religious organizations; |

| • | personal and professional integrity, honesty and reputation; |

| • | the ability to represent the best interests of the stockholders of the Company and the best interests of the institution; |

| • | the ability to devote sufficient time and energy to the performance of his or her duties; |

| • | independence as that term is defined under applicable Securities and Exchange Commission and stock exchange listing criteria; and |

| • | current equity holdings in the Company. |

The Nominating and Governance Committee also will consider any other factors it deems relevant, including diversity, competition, size of the Board of Directors and regulatory disclosure obligations.

6

With respect to nominating an existing director for re-election to the Board of Directors, the Nominating and Governance Committee will consider and review an existing director’s attendance and performance at Board meetings and at meetings of committees on which he or she serves; length of Board service; experience, skills and contributions; and independence.

Director Nomination Process.The process that the Nominating and Governance Committee follows to identify and evaluate individuals to be nominated for election to the Board of Directors is as follows:

For purposes of identifying nominees for the Board of Directors, the Nominating and Governance Committee relies on personal contacts of the committee members and other members of the Board of Directors, as well as its knowledge of members of the communities served by the Bank. The Nominating and Governance Committee will also consider director candidates recommended by stockholders according to the policy and procedures set forth below. The Nominating and Governance Committee has not previously used an independent search firm to identify nominees.

In evaluating potential nominees, the Nominating and Governance Committee determines whether the candidate is eligible and qualified for service on the Board of Directors by evaluating the candidate under the criteria set forth above. If such individual fulfills these criteria, the Nominating and Governance Committee will conduct a check of the individual’s background and interview the candidate to further assess the qualities of the prospective nominee and the contributions he or she would make to the Board.

Considerations of Recommendations by Stockholders.The policy of the Nominating and Governance Committee is to consider director candidates recommended by stockholders who appear to be qualified to serve on the Company’s Board of Directors. The Nominating and Governance Committee may choose not to consider an unsolicited recommendation if no vacancy exists on the Board of Directors and the Nominating and Governance Committee does not perceive a need to increase the size of the Board of Directors. To avoid the unnecessary use of the Nominating and Governance Committee’s resources, the Nominating and Governance Committee will consider only those director candidates recommended in accordance with the procedures set forth below.

Procedures to be Followed by Stockholders. To submit a recommendation of a director candidate to the Nominating and Governance Committee, a stockholder should submit the following information in writing, addressed to the Chairman of the Nominating and Governance Committee, care of the Corporate Secretary, at the main office of the Company:

| 1. | The name of the person recommended as a director candidate; |

| 2. | All information relating to such person that is required to be disclosed in solicitations of proxies for election of directors pursuant to Regulation 14A under the Securities Exchange Act of 1934; |

| 3. | The written consent of the person being recommended as a director candidate to being named in the proxy statement as a nominee and to serving as a director if elected; |

| 4. | As to the stockholder making the recommendation, the name and address of such stockholder as they appear on the Company’s books; provided, however, that if the stockholder is not a registered holder of the Company’s common stock, the stockholder should submit his or her name and address along with a current written statement from the record holder of the shares that reflects ownership of the Company’s common stock; and |

7

| 5. | A statement disclosing whether such stockholder is acting with or on behalf of any other person and, if applicable, the identity of such person. |

For a director candidate to be considered for nomination at the Company’s annual meeting of stockholders, the recommendation must be received by the Nominating and Governance Committee at least 120 calendar days before the date the Company’s proxy statement was released to stockholders in connection with the previous year’s annual meeting, advanced by one year.

Board and Committee Meetings

During the fiscal year ended September 30, 2012, the Board of Directors of the Company held eleven meetings. No director attended fewer than 75% of the total meetings of the Company’s Board of Directors and the respective committees on which such director served during fiscal 2012.

Director Attendance at the Annual Meeting of Stockholders

The Board of Directors encourages each director to attend the Company’s annual meeting of stockholders. Each of the Company’s directors attended the Company’s 2012 annual meeting of stockholders.

Code of Ethics and Business Conduct

The Company has adopted a code of ethics and business conduct that applies to all of the Company’s and the Bank’s directors, officers and employees. A copy of the code of ethics and business conduct is available to stockholders in the Investor Relations portion of our website (www.eureka bancorp.com).

REPORT OF THE AUDIT COMMITTEE

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal controls and financial reporting process on behalf of the Board of Directors.

In this context, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed pursuant to U.S. Auditing Standards No. 380 (The Auditor’s Communication With Those Charged With Governance), including the quality, and not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

8

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board and has discussed with the independent registered public accounting firm the firm’s independence from the Company and its management. In concluding that the registered public accounting firm is independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the firm were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for their audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of their examination, their evaluation of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm who, in its report, express an opinion on the conformity of the Company’s consolidated financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s consolidated financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s consolidated financial statements has been carried out in accordance with generally accepted auditing standards or that the Company’s independent registered public accounting firm is “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee has recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2012 for filing with the Securities and Exchange Commission. The Audit Committee also has approved, subject to stockholder ratification, the selection of the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2013.

Audit Committee of the Board of Directors of

Eureka Financial Corp.

Paul M. Matvey, Chairman

Mark B. Devlin

Robert J. Malone

9

DIRECTOR COMPENSATION

The following table provides information regarding the compensation received by individuals who served as non-employee directors of the Company and the Bank during fiscal 2012. The table excludes perquisites, which did not exceed $10,000 in the aggregate for any director.

| Fees Earned or Paid in Cash | Stock Awards (1) | Option Awards (2) | All Other Compensation | Total | ||||||||||||||||

Mark B. Devlin | $ | 23,100 | $ | 23,271 | $ | 5,116 | $ | — | $ | 51,487 | ||||||||||

Robert J. Malone | 24,650 | 23,271 | 5,116 | 5,644 | (3) | 58,681 | ||||||||||||||

Paul M. Matvey | 20,125 | 23,271 | 5,116 | — | 48,512 | |||||||||||||||

Dennis P. McManus | 20,750 | 23,271 | 5,116 | — | 49,137 | |||||||||||||||

William F. Ryan | 23,250 | 23,271 | 5,116 | — | 51,637 | |||||||||||||||

| (1) | Reflects the grant date fair value calculated in accordance with FASB ASC Topic 718 on restricted stock awards based upon the Company’s stock price of $15.24 as of May 21, 2012, the date of grant. When shares become vested and are distributed from the trust in which they are held, the recipient will also receive an amount equal to accumulated cash and stock dividends (if any) paid with respect thereto, plus earnings thereon. At September 30, 2012, the aggregate number of unvested restricted stock award shares held in trust was 1,527 for each director listed above. |

| (2) | Reflects the compensation expense to be recorded in accordance with FASB ASC Topic 718 on stock option awards based upon a fair value of $1.34 for each option using the Black-Scholes option pricing model. For information on the assumptions used to compute fair value, see note 9 to the notes to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2012. The actual value, if any, realized by a director from any option will depend on the extent to which the market value of the common stock exceeds the exercise price of the option on the date the option is exercised. Accordingly, there is no assurance that the value realized by a director will be at or near the value estimated above. The aggregate outstanding stock options at September 30, 2012 was 3,818 for each director listed above. |

| (3) | Represents health insurance benefit payments. |

Cash Retainer and Meeting Fees for Non-Employee Directors. The following table sets forth the applicable retainers and fees that will be paid to our non-employee directors for their service on our Board of Directors during the year ending September 30, 2013.

Annual retainer | $ | 18,300 | ||

Additional annual retainer: | ||||

Chairman of the Board | 1,500 | |||

Attendance fees: | ||||

Per Executive Committee meeting | 425 | |||

Per Loan, Compensation and CRA Committee meeting | 275 | |||

Per Audit Committee meeting | 275 | |||

Per Audit Committee meeting (Committee Chairman) | 425 |

10

STOCK OWNERSHIP

The following table provides information as of December 7, 2012 about the persons known to the Company to be the beneficial owners of more than 5% of the Company’s outstanding common stock. A person may be considered to beneficially own any shares of common stock over which he or she has, directly or indirectly, sole or shared voting or investment power.

Name and Address | Number of Shares Owned | Percent of Common Stock Outstanding (1) | ||||||

Stilwell Value Partners, L.P. Stilwell Partners, L.P. Stilwell Value LLC Joseph Stilwell 111 Broadway, 12th Floor New York, New York 10006 | 125,000 | (2) | 9.48 | % | ||||

Sandler O’Neill Asset Management, LLC SOAM Holdings, LLC Terry Maltese 150 East 52nd Street, 30th Floor New York, New York 10022 | 82,800 | (3) | 6.28 | |||||

Edward F. Seserko 3455 Forbes Avenue Pittsburgh, Pennsylvania 15213 | 77,903 | (4) | 5.91 | |||||

Gary B. Pepper 3455 Forbes Avenue Pittsburgh, Pennsylvania 15213 | 66,888 | (4) | 5.08 | |||||

| (1) | Based on 1,317,897shares of the Company’s common stock outstanding and entitled to vote as of December 7, 2012. |

| (2) | Based on a Schedule 13D/A filed with the Securities and Exchange Commission on March 30, 2011. |

| (3) | Based on a Schedule 13G filed with the Securities and Exchange Commission on February 14, 2012. |

| (4) | See the table on the following page for additional information regarding Mr. Seserko’s and Mr. Pepper’s beneficial ownership of Company common stock. |

11

The following table provides information about the shares of Company common stock that may be considered to be owned by each director of the Company, by the executive officers and by all directors and executive officers of the Company as a group as of December 7, 2012. A person may be considered to own any shares of common stock over which he has, directly or indirectly, sole or shared voting or investment power. Unless otherwise indicated, each of the named individuals has sole voting and investment power with respect to the shares shown.

Name | Number of Shares Owned (1) | Percent of Common Stock Outstanding (2) | ||||||

Directors: | ||||||||

Mark B. Devlin | 46,725 | (3) | 3.55 | % | ||||

Robert J. Malone | 16,755 | 1.27 | ||||||

Paul M. Matvey | 19,363 | 1.47 | ||||||

Dennis P. McManus | 16,863 | 1.28 | ||||||

William F. Ryan | 26,663 | 2.02 | ||||||

Edward F. Seserko | 77,903 | (4) | 5.91 | |||||

Executive Officers Who Are Not Directors: | ||||||||

Gary B. Pepper | 66,888 | (5) | 5.08 | |||||

All Directors and Executive Officers as a Group (7 persons) | 271,160 | 20.58 | % | |||||

| (1) | Includes shares of unvested restricted stock held under the Eureka Financial Corp. 2012 Equity Incentive Plan as follows: Messrs. Devlin, Malone, Matvey, McManus and Ryan—1,527 shares each; Mr. Seserko—7,636 shares; and Mr. Pepper—4,582 shares. Shares of restricted stock vest in five equal annual installments beginning on the first anniversary of the date of grant, which was May 21, 2012. |

| (2) | Based on 1,317,897 shares of the Company’s common stock outstanding and entitled to vote as of December 7, 2012. |

| (3) | Includes 22,000 shares held through an individual retirement account. |

| (4) | Includes 5,000 shares held through an individual retirement account, 18,400 shares held under the Eureka Bank Retirement Savings Plan and 1,092 shares held under the Eureka Bank Employee Stock Ownership Plan. |

| (5) | Includes 12,150 shares held through an individual retirement account, 3,600 shares held as custodian for Mr. Pepper’s children, 10,780 shares held under the Eureka Bank Retirement Savings Plan and 832 shares held under the Eureka Bank Employee Stock Ownership Plan. |

ITEMS OF BUSINESS TO BE VOTED ON BY STOCKHOLDERS

Item 1 — Election of Directors

The Company’s Board of Directors consists of six members. At the annual meeting of stockholders Robert J. Malone and William F. Ryan will each be nominated to serve for a term of three years and until their respective successors have been duly elected and qualified. Both of the nominees are currently directors of the Company and the Bank.

Unless you indicate on the proxy card that your shares should not be voted for certain nominees, the Board of Directors intends that the proxies solicited by it will be voted for the election of each of the Board’s nominees. If any nominee is unable to serve, the persons named in the proxy card would vote your shares to approve the election of any substitute proposed by the Board of Directors. At this time, we know of no reason why any nominee might be unable to serve.

The Board of Directors recommends that stockholders vote “FOR” the election of Messrs. Malone and Ryan as directors of the Company.

12

Information regarding the directors is provided below. Unless otherwise stated, each person has held his or her current occupation for the last five years. Ages presented are as of September 30, 2012. The starting year of service as director relates to service on the Board of Directors of the Bank.

Board Nominees for Terms Ending in 2013

Robert J. Maloneis retired and was the former owner and Chief Executive Officer of Fidelity Insurance Agency, Inc. in Pittsburgh, Pennsylvania. He served as the Chairman of the Board of Directors of the Company and the Bank until 2012. Age 86. Director since 1961.

Mr. Malone’s insurance background provides the Board of Directors with substantial management and leadership experience with respect to an industry that complements the financial services provided by the Bank.

William F. Ryanis Chairman and Chief Executive Officer of Point Spring & Driveshaft Co., a transportation-related business in Pittsburgh, Pennsylvania. Age 59. Director since 1997.

Mr. Ryan’s background offers the Board of Directors substantial small company management experience, specifically within the market in which the Bank conducts its business, and provides the board with valuable insight regarding the local business and consumer environment. In addition, Mr. Ryan offers the board significant business experience from a setting outside of the financial services industry.

Directors with Terms Ending in 2014

Dennis P. McManusis the Government Affairs Director for the Greater Pittsburgh Community Food Bank and is also an adjunct faculty member at the University of Pittsburgh. Age 57. Director since 1997.

Mr. McManus’ strong ties to the community, through his work with the Greater Pittsburgh Community Food Bank and involvement in civic organizations, provides the board with valuable insight regarding the local business and consumer environment.

Edward F. Seserkois President and Chief Executive Officer of the Company and the Bank. Mr. Seserko has been employed by the Bank since 1976 and has served in various positions with the Bank since that time. Age 60. Director since 1986.

Mr. Seserko’s extensive experience in the local banking industry and involvement in business and civic organizations in the communities in which the Bank serves affords the board valuable insight regarding the business and operations of the Bank. Mr. Seserko’s knowledge of all aspects of the Company’s and the Bank’s business and history, combined with his success and strategic vision, position him well to continue to serve as our President and Chief Executive Officer.

Directors with Terms Ending in 2015

Mark B. Devlinis the owner of T.B. Devlin Funeral Home in Pittsburgh, Pennsylvania. . Mr. Devlin serves as Chairman of the Board of Directors of the Company and the Bank. Age 61. Director since 1992.

13

Mr. Devlin’s background offers the Board of Directors substantial small company management experience, specifically within the market in which the Bank conducts its business, and offers the board significant business experience from a setting outside of the financial services industry.

Paul M. Matveyis a certified public accountant and a stockholder of Schneider Downs Co., Inc., a public accounting firm headquartered in Pittsburgh, Pennsylvania. Age 59. Director since 1994.

As a certified public accountant, Mr. Matvey provides the Board of Directors with substantial experience regarding accounting and financial matters.

Item 2 — Ratification of the Independent Registered Public Accounting Firm

The Audit Committee of the Board of Directors has appointed S.R. Snodgrass to serve as the Company’s independent registered public accounting firm for the 2013 fiscal year, subject to ratification by stockholders. A representative of S.R. Snodgrass is expected to be present at the annual meeting to respond to appropriate questions from stockholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accounting firm is not approved by a majority of the shares cast at the annual meeting, the Audit Committee of the Board of Directors may consider other independent registered public accounting firms.

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of S.R. Snodgrass as the Company’s independent registered public accounting firm for the 2013 fiscal year.

Audit Fees.The following table sets forth the fees billed to the Company by S.R. Snodgrass for the fiscal years ended September 30, 2012 and 2011. As discussed in greater detail below, on June 1, 2011, the Company dismissed ParenteBeard LLC and engaged S.R. Snodgrass as its independent registered public accounting firm.

| 2012 | 2011 | |||||||

Audit fees (1) | $ | 53,743 | $ | 17,517 | ||||

Audit related fees | — | — | ||||||

Tax fees (2) | 22,788 | 2,015 | ||||||

All other fees | — | — | ||||||

| (1) | Includes fees for the audit of the consolidated financial statements and review of the interim financial information contained in the quarterly reports on Form 10-Q and other regulatory reporting. In addition, this category includes fees for services associated with SEC registration statements or other documents filed in connection with securities offerings including comfort letters, consents and assistance with the review of documents filed with the SEC. |

| (3) | Includes fees for tax compliance services including preparation of original and amended federal and state income tax returns, preparation of personal property tax returns and tax payment and planning advice. |

Change in Independent Registered Public Accounting Firm.On June 1, 2011, the Company dismissed ParenteBeard LLC, which had previously served as independent auditors for the Company. The decision to dismiss ParenteBeard LLC was approved by the Audit Committee of the Board of Directors.

14

The audit reports of ParenteBeard LLC on the consolidated financial statements of the Company for the years ended September 30, 2010 and 2009 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During the fiscal years ended September 30, 2010 and 2009 and through the subsequent interim period preceding the date of ParenteBeard LLC’s dismissal, there were: (1) no disagreements between the Company and ParenteBeard LLC on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of ParenteBeard LLC would have caused them to make reference thereto in their reports on the Company’s financial statements for such years, and (2) no reportable events within the meaning set forth in Item 304(a)(1)(v) of Regulation S-K.

On June 1, 2011, the Audit Committee of the Board of Directors engaged S.R. Snodgrass as the Company’s independent registered public accounting firm. During the fiscal years ended September 30, 2010 and 2009 and the subsequent interim period preceding the engagement of S.R. Snodgrass, the Company did not consult with S.R. Snodgrass regarding: (1) the application of accounting principles to a specified transaction, either completed or proposed; (2) the type of audit opinion that might be rendered on the Company’s financial statements, and S.R. Snodgrass did not provide any written report or oral advice that S.R. Snodgrass concluded was an important factor considered by the Company in reaching a decision as to any such accounting, auditing or financial reporting issue; or (3) any matter that was either the subject of a disagreement with S.R. Snodgrass on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure or the subject of a reportable event.

Pre-Approval of Services by the Independent Registered Public Accounting Firm.The Company’s Audit Committee has adopted a policy for approval of audit and permitted non-audit services by the Company’s independent registered public accounting firm. The Audit Committee will consider annually and approve the provision of audit services by the independent registered public accounting firm and, if appropriate, approve the provision of certain defined audit and non-audit services. The Audit Committee also will consider on a case-by-case basis and, if appropriate, approve specific engagements.

Any proposed specific engagement may be presented to the Audit Committee for consideration at its next regular meeting or, if earlier consideration is required, to the Audit Committee or one or more of its members. The member or members to whom such authority is delegated shall report any specific approval of services at its next regular meeting. The Audit Committee will regularly review summary reports detailing all services being provided to the Company by its independent registered public accounting firm.

During the year ended September 30, 2012, all of the audit related fees, tax fees and all other fees set forth above were approved by the Audit Committee.

Item 3 — Advisory Vote on Executive Compensation

As required by federal securities laws, the Board of Directors is providing the Company’s stockholders with an opportunity to provide an advisory vote on the compensation of our named executive officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and the related narrative discussion contained in this proxy statement.

This proposal, commonly known as a “say-on-pay” proposal, gives the Company’s stockholders the opportunity to endorse or not endorse the Company’s executive pay program and policies through the following resolution:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and related narrative discussion contained in the 2012 proxy statement is hereby approved.”

15

This advisory vote on the compensation of our named executive officers is not binding on us, our Board or the Compensation Committee. However, our Board and the Compensation Committee will review and consider the outcome of this advisory vote when making future compensation decisions for our named executive officers.

The Board of Directors recommends that stockholders vote “FOR” the compensation paid to the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and related narrative discussion contained in this proxy statement.

Item 4 — Advisory Vote on the Frequency of the Stockholder Vote to Approve Executive Compensation

As required by federal securities laws, the Board of Directors is providing the Company’s stockholders with an opportunity to provide an advisory vote on the frequency of the advisory vote on the compensation of the Company’s named executive officers. We are asking stockholders whether the advisory vote should occur every year, every two years or every three years.

The Board of Directors has considered the frequency of the advisory vote on the compensation of the Company’s named executive officers that it should recommend. After considering the benefits and consequences of each option for the frequency of submitting the advisory vote on the compensation of the Company’s named executive officers to stockholders, the Board recommends submitting the advisory vote on the compensation of the Company’s named executive officers to stockholders annually.

The Board of Directors believes an annual advisory vote on the compensation of the Company’s named executive officers will allow the Board to obtain information on stockholders’ views of the compensation of the Company’s named executive officers on a more consistent basis. In addition, the Board believes an annual advisory vote on the compensation of the Company’s named executive officers will provide the Board of Directors and the Compensation Committee with frequent input from stockholders on the Company’s compensation programs for its named executive officers. Finally, the Board believes an annual advisory vote on the compensation of the Company’s named executive officers aligns more closely with the Company’s objective to engage in regular dialogue with its stockholders on corporate governance matters, including the Company’s executive compensation philosophy, policies and programs.

This advisory vote on the frequency of the vote on the compensation of our named executive officers is not binding on us, our Board or the Compensation Committee. However, our Board and the Compensation Committee will review and consider the outcome of this advisory vote when making future compensation decisions for our named executive officers.

The Board of Directors recommends that stockholders vote to hold the advisory vote on the compensation of the Company’s named executive officers every year.

16

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides information concerning total compensation earned or paid to Edward F. Seserko, our President and Chief Executive Officer, and Gary B. Pepper, our Executive Vice President and Chief Financial Officer, during the fiscal years ended September 30, 2012 and 2011. No other employee received total compensation exceeding $100,000 during the 2012 or 2011 fiscal years. Messrs. Seserko and Pepper are sometimes referred to in this proxy statement as “named executive officers.”

Name and Principal Position | Year | Salary | Bonus | Stock Awards (1) | Stock Options (2) | All Other Compensation (3) | Total | |||||||||||||||||||||

Edward F. Seserko | 2012 | $ | 143,000 | $ | 35,000 | $ | 116,373 | $ | 25,582 | $ | 29,211 | $ | 349,166 | |||||||||||||||

President and Chief Executive Officer | 2011 | 140,000 | 25,000 | — | — | 29,449 | 194,449 | |||||||||||||||||||||

Gary B. Pepper | 2012 | 104,250 | 32,000 | 69,830 | 15,348 | 8,721 | 230,149 | |||||||||||||||||||||

Executive Vice President and Chief Financial Officer | 2011 | 101,400 | 18,000 | — | — | 8,536 | 127,936 | |||||||||||||||||||||

| (1) | Reflects the grant date fair value calculated in accordance with FASB ASC Topic 718 on restricted stock awards based upon the Company’s stock price of $15.24 as of May 21, 2012, the date of grant. When shares become vested and are distributed from the trust in which they are held, the recipient will also receive an amount equal to accumulated cash and stock dividends (if any) paid with respect thereto, plus earnings thereon. |

| (2) | Reflects the compensation expense to be recorded in accordance with FASB ASC Topic 718 on stock option awards based upon a fair value of $1.34 for each option using the Black-Scholes option pricing model. For information on the assumptions used to compute fair value, see note 9 to the notes to the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2012. The actual value, if any, realized by a named executive officer from any option will depend on the extent to which the market value of the common stock exceeds the exercise price of the option on the date the option is exercised. Accordingly, there is no assurance that the value realized by the named executive officer will be at or near the value estimated above. |

| (3) | Details of the amounts reported in the “All Other Compensation” column for 2012 are provided in the table below. |

| Mr. Seserko | Mr. Pepper | |||||||

Employer contributions to 401(k) plan | $ | 8,535 | $ | 6,221 | ||||

Supplemental executive retirement plan benefit | 6,800 | 2,500 | ||||||

Perquisites | 13,876 | (a) | — | (b) | ||||

| (a) | Includes the value of Mr. Seserko’s use of a company-owned automobile and country club dues. |

| (b) | Did not exceed $10,000. |

Employment Agreements

The Company and the Bank maintain employment agreements with Messrs. Seserko and Pepper. Under the agreements, the current base salaries for Messrs. Seserko and Pepper are $143,000 and $104,250, respectively. We may increase the amount of the base salaries under the agreements from time to time and will review the salaries of the executives not less than annually. We may also pay discretionary bonuses to each of the executives. In addition to cash compensation, the executives participate in all standard benefit plans and programs we sponsor for employees or other executive officers.

17

Under the agreements, if we terminate an executive’s employment for “just cause,” as that term is defined in the agreements, the executive will not receive any compensation for any period after his termination date. If we terminate an executive’s employment without just cause, we will continue to pay the executive the salary he would have earned for the greater of (1) the then remaining term of the employment agreement or (2) 12 months.

If we, or our successor, terminate an executive’s employment during the term of his employment agreement following a change in control or within a period of 24 months following a change in control, the executive will receive a severance benefit equal to 2.99 times the executive’s average taxable income for the five taxable years preceding the change in control. The executive will receive the benefit in 36 equal, monthly installments. We will also pay this benefit to the executive if he voluntarily terminates his employment during the term of his employment agreement following a change in control or within 12 months following the change in control if (1) he must relocate his residence or employment location by more than 35 miles, (2) he must report to a someone other than our Board of Directors, (3) we fail to maintain his base salary or benefits, (4) we assign him duties or responsibilities other than those normally associated with his position, (5) we diminish or reduce his responsibilities or authority or (6) in the case of Mr. Seserko, he is not re-elected to our Board of Directors.

If an executive dies while the agreement is in effect, we will provide the executive’s estate with the compensation due to the executive through the last day of the calendar month in which the executive dies. If an executive becomes disabled, we will continue to provide him with 100% of the compensation and benefits owed under the employment agreement for the lesser of (1) the remaining term of the agreement or (2) 12 months. If more than 12 months remain on the term of the employment agreement at the time the executive becomes disabled, we will also provide him with 65% of his compensation and benefits for the term of the agreement remaining after the 12-month period.

Deferred Compensation Plan

The Bank maintains deferred compensation agreements with each of Messrs. Seserko and Pepper. Under the agreements, if an executive dies while employed with the Bank, we will pay his beneficiary a single lump sum benefit scheduled under the agreement (the “Death Benefit”). At their current ages, the agreements provide for a Death Benefit of $300,000 for Mr. Seserko and $130,000 for Mr. Pepper.

Under the agreements, if Messrs. Seserko and Pepper terminate employment after attaining age 65, we will pay them a retirement benefit of $500,000 and $300,000, respectively (the “Normal Retirement Benefit”). We will also pay the executives a reduced benefit if they terminate employment before attaining age 65, but after attaining age 60 (the “Early Retirement Benefit”). In the case of Mr. Seserko, the Early Retirement Benefit ranges from $400,000 to $480,000, depending on his age at the time of his termination of employment. In the case of Mr. Pepper, the Early Retirement Benefit ranges from $181,000 to $268,000, depending on his age at the time of his termination of employment. The executives would receive the Normal Retirement Benefit or the Early Retirement Benefit in ten equal annual installments.

Under the deferred compensation agreements, we will also pay the executives a benefit if we terminate their employment other than for “cause” (as defined in the agreements) or if they terminate employment due to a permanent disability (the “Other Termination Benefit”). At their current ages, we would pay Messrs. Seserko and Pepper an Other Termination Benefit of $168,000 and $63,000, respectively. The maximum Other Termination Benefit payable to Messrs. Seserko and Pepper equal $188,000 and $138,000, respectively, depending on their age at the time the benefit becomes payable. The executives would receive the Other Termination Benefits in ten equal annual installments.

18

Under the agreements, we also have the discretion to credit the executives’ Death Benefit, Normal Retirement Benefit, Early Retirement Benefit and/or Other Termination Benefit with additional amounts from time to time and we may make this determination based on the Bank’s or the executive’s performance.

Outstanding Equity Awards at Fiscal Year End

The following table provides information concerning unexercised options and unvested restricted stock awards for each named executive officer as of September 30, 2012.

Name | Number of Securities Underlying Unexercised Options Exercisable | Number of Securities Underlying Unexercised Options Unexercisable (1) | Option Exercise Price | Option Expiration Date | Number of Shares of Restricted Stock That Have Not Vested (2) | Market Value of Shares of Restricted Stock That Have Not Vested (3) | ||||||||||||||||||

Edward F. Seserko | — | 19,091 | $ | 15.24 | 05/21/2022 | 7,636 | $ | 120,267 | ||||||||||||||||

Gary B. Pepper | — | 11,454 | 15.24 | 05/21/2022 | 4,582 | 72,166 | ||||||||||||||||||

| (1) | Options vest in five equal annual installments beginning one year from the date of grant, which was May 21, 2012. |

| (2) | Restricted stock awards vest in five equal annual installments beginning one year from the date of grant. |

| (3) | Based upon the Company’s closing stock price of $15.75 on September 30, 2012. |

OTHER INFORMATION RELATING TO

DIRECTORS AND EXECUTIVE OFFICERS

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers and directors, and persons who own more than 10% of any registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission. These individuals are required by regulation to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of the reports it has received and written representations provided to the Company from the individuals required to file the reports, the Company believes that each of its executive officers and directors has complied with applicable reporting requirements for transactions in Company common stock during the year ended September 30, 2012.

Transactions with Related Persons

The Sarbanes-Oxley Act of 2002 generally prohibits loans by the Company to its executive officers and directors. However, the Sarbanes-Oxley Act contains a specific exemption from such prohibition for loans by the Bank to its executive officers and directors in compliance with federal banking regulations. Federal regulations require that all loans or extensions of credit to executive officers and directors of insured financial institutions must be made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and must not involve more than the normal risk of repayment or present other unfavorable features. The Bank is therefore prohibited from making any new loans or extensions of credit to executive officers and directors at different rates or terms than those offered to the general public. Notwithstanding this rule, federal regulations permit the Bank to make loans to executive officers and directors at reduced interest rates if the loan is made under a benefit program generally available to all other employees and does not give preference to any executive officer or director over any other employee, although the Bank does not currently have such a program in place. All outstanding loans made by the Bank to its directors and executive officers, and members of their immediate families, were made in the ordinary course of business, were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank, and did not involve more than the normal risk of collectibility or present other unfavorable features.

19

Pursuant to the Company’s Audit Committee charter, the Audit Committee will periodically review, no less frequently than quarterly, a summary of the Company’s transactions with directors and executive officers of the Company and with firms that employ directors, as well as any other related person transactions, to recommend to the disinterested members of the Board of Directors that the transactions are fair, reasonable and within Company policy and should be ratified and approved. Also, in accordance with banking regulations and its policy, the Board of Directors will review all loans made to a director or executive officer in an amount that, when aggregated with the amount of all other loans to such person and his or her related interests, exceed the greater of $25,000 or 5% of the Company’s capital and surplus (up to a maximum of $500,000) and such loans must be approved in advance by a majority of the disinterested members of the Board of Directors. Additionally, pursuant to the Company’s Code of Ethics and Business Conduct, all executive officers and directors of the Company must disclose any existing or potential conflicts of interest to the President and Chief Executive Officer of the Company. Such potential conflicts of interest include, but are not limited to, the following: (1) the Company conducting business with or competing against an organization in which a family member of an executive officer or director has an ownership or employment interest and (2) the ownership of more than 5% of the outstanding securities or 5% of total assets of any business entity that does business with or is in competition with the Company.

SUBMISSION OF BUSINESS PROPOSALS AND STOCKHOLDER NOMINATIONS

The Company must receive proposals that stockholders seek to include in the proxy statement for the Company’s next annual meeting no later than August 30, 2012. If next year’s annual meeting is held on a date that is more than 30 calendar days from January 28, 2014, a stockholder proposal must be received by a reasonable time before the Company begins to print and mail its proxy solicitation materials for such annual meeting. Any stockholder proposals will be subject to the requirements of the proxy rules adopted by the Securities and Exchange Commission.

The Company’s Bylaws provide that, for a stockholder to make nominations for the election of directors or proposals for business to be brought before the annual meeting, a stockholder must deliver notice of such nomination and/or proposals to the Company’s Secretary not less than 90 days before the date of the annual meeting. However, if less than 100 days’ notice or prior public disclosure of the annual meeting is given to stockholders, such notice must be delivered not later than the close of business on the tenth day following the day on which notice of the annual meeting was mailed to stockholders or public disclosure of the meeting date was made. A copy of the Bylaws may be obtained from the Company.

STOCKHOLDER COMMUNICATIONS

The Company encourages stockholder communications to the Board of Directors and/or individual directors. All communications from stockholders should be addressed to Eureka Financial Corp., 3455 Forbes Avenue, Pittsburgh, Pennsylvania 15213. Communications to the Board of Directors should be sent to the attention of Barbara A. Rota, Corporate Secretary. Communications to individual directors should be sent to such director at the Company’s address. Stockholders who wish to communicate with a committee of the Board of Directors should send their communications to the attention of the Chairman of the particular committee, with a copy to Dennis P. McManus, the Chairman of the Nominating and Governance Committee. It is in the discretion of the Nominating and Governance Governance Committee as to whether a communication sent to the full Board should be brought before the full Board.

20

MISCELLANEOUS

The Company will pay the cost of this proxy solicitation. The Company will reimburse brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to the beneficial owners of the Company. Additionally, directors, officers and other employees of the Company may solicit proxies personally or by telephone. None of these persons will receive additional compensation for these activities.

The Company’s Annual Report on Form 10-K has been included with this proxy statement. Any stockholder who has not received a copy of the Annual Report on Form 10-K may obtain a copy by writing to the Corporate Secretary of the Company. The Annual Report is not to be treated as part of the proxy solicitation material or as having been incorporated by reference into this proxy statement.

If you and others who share your address own your shares in “street name,” your broker or other holder of record may be sending only one annual report and proxy statement to your address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, if a stockholder residing at such an address wishes to receive a separate annual report or proxy statement in the future, he or she should contact the broker or other holder of record. If you own your shares in “street name” and are receiving multiple copies of our annual report and proxy statement, you can request householding by contacting your broker or other holder of record.

Whether or not you plan to attend the annual meeting, please vote by marking, signing, dating and promptly returning the enclosed proxy card in the enclosed envelope.

| By Order of the Board of Directors, |

| /s/ Barbara A. Rota |

| Barbara A. Rota |

| Corporate Secretary |

Pittsburgh, Pennsylvania

December 28, 2012

21

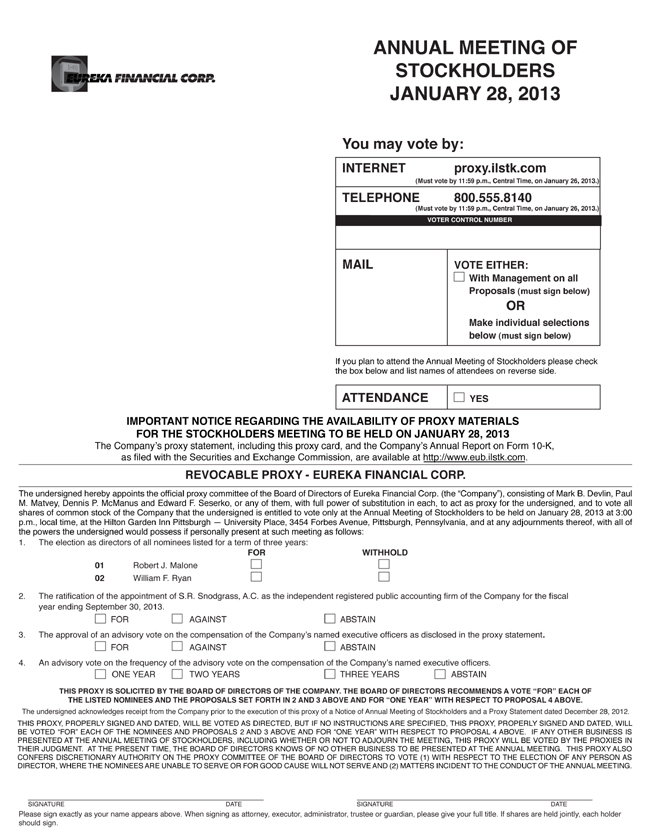

ANNUAL MEETING OF STOCKHOLDERS JANUARY 28, 2013You may vote by:INTERNET proxy.ilstk.com(Must vote by 11:59 p.m., Central Time, on January 26, 2013.) TELEPHONE 800.555.8140(Must vote by 11:59 p.m., Central Time, on January 26, 2013.)VOTER CONTROL NUMBERMAIL VOTE EITHER: With Management on all Proposals OR (must sign below) Make individual selections below (must sign below)If you plan to attend the Annual Meeting of Stockholders please check the box below and list names of attendees on reverse side. ATTENDANCE YES IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS The Company’s FOR THE proxy STOCKHOLDERS statement, including MEETING this proxy card, TO and BE HELD the Company’s ON ANUARY Annual Report 28, 2013 on Form 10-K, as filed with the Securities and Exchange Commission, are available at http://www.eub.ilstk.com.REVOCABLE PROXY—EUREKA FINANCIAL CORP. The undersigned hereby appoints the official proxy committee of the Board of Directors of Eureka Financial Corp. (the “Company”), consisting of Mark B. Devlin, Paul M. Matvey, Dennis P. McManus and Edward F. Seserko, or any of them, with full power of substitution in each, to act as proxy for the undersigned, and to vote all shares of common stock of the Company that the undersigned is entitled to vote only at the Annual Meeting of Stockholders to be held on January 28, 2013 at 3:00 p.m., local time, at the Hilton Garden Inn Pittsburgh — University Place, 3454 Forbes Avenue, Pittsburgh, Pennsylvania, and at any adjournments thereof, with all of 1. the powers The election the undersigned as directors would of all possess nominees if personally listed for a present term of at three such years: meeting as follows: FOR WITHHOLD 01 Robert J. Malone 02 William F. Ryan 2. year TheratificationoftheappointmentofS. ending September 30, 2013.R.Snodgrass,A.C.astheindependentregisteredpublicaccountingfirmoftheCompanyforthefiscal FOR AGAINST ABSTAIN 3. TheapprovalofanadvisoryvoteonthecompensationoftheCompany’snamedexecutiveofficersasdisclosedintheproxystatement. FOR AGAINST ABSTAIN 4. AnadvisoryvoteonthefrequencyoftheadvisoryvoteonthecompensationoftheCompany’snamedexecutiveofficers. ONE YEAR TWO YEARS THREE YEARS ABSTAIN THIS THE PROXY LISTED IS NOMINEES SOLICITED AND BY THE BOARD PROPOSALS OF DIRECTORS SET FORTH OF IN THE 2 AND COMPANY. 3 ABOVE THE AND BOARD FOR “ONE OF DIRECTORS YEAR” WITH RECOMMENDS RESPECT TO A PROPOSAL VOTE “FOR” 4 ABOVE. EACH OF The undersigned acknowledges receipt from the Company prior to the execution of this proxy of a Notice of Annual Meeting of Stockholders and a Proxy Statement dated December 28, 2012. BE THIS VOTED PROXY, “FOR” PROPERLY EACH OF SIGNED THE NOMINEES AND DATED, AND WILL PROPOSALS BE VOTED 2 AS AND DIRECTED, 3 ABOVE BUT AND IF FOR NO INSTRUCTIONS “ONE YEAR” WITH ARE RESPECT SPECIFIED, TO THIS PROPOSAL PROXY, 4 PROPERLY ABOVE. IF SIGNED ANY OTHER AND BUSINESS DATED, WILL IS THEIR PRESENTED JUDGMENT. AT THE AT ANNUAL THE PRESENT MEETING TIME, OF STOCKHOLDERS, THE BOARD OF DIRECTORS INCLUDING KNOWS WHETHER OF NO OR OTHER NOT TO BUSINESS ADJOURN TO THE BE MEETING, PRESENTED THIS AT PROXY THE ANNUAL WILL BE MEETING. VOTED BY THIS THE PROXY PROXIES ALSO IN DIRECTOR, CONFERS DISCRETIONARY WHERE THE NOMINEES AUTHORITY ARE UNABLE ON THE TO PROXY SERVE COMMITTEE OR FOR GOOD OF THE CAUSE BOARD WILL OF NOT DIRECTORS SERVE AND TO (2) VOTE MATTERS (1) WITH INCIDENT RESPECT TO THE TO CONDUCT THE ELECTION OF THE OF ANNUAL ANY PERSON MEETING. AS SIGNATURE DATE SIGNATURE DATE should Please sign. sign exactly as your name appears above. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. If shares are held jointly, each holder

PLEASE LIST NAMES OF PERSONS ATTENDING

[Eureka Financial Corp. Letterhead]

Dear ESOP Participant:

On behalf of the Board of Directors of Eureka Financial Corp. (the “Company”), I am forwarding to you the attachedyellow vote authorization form so that you may convey your voting instructions to Edward F. Seserko and Gary B. Pepper, the trustees for the Eureka Bank Employee Stock Ownership Plan (“ESOP”), on the proposals presented at the Annual Meeting of Stockholders of the Company to be held on January 28, 2013. Also enclosed is a Notice and Proxy Statement for the Company’s Annual Meeting of Stockholders and an Annual Report to Stockholders of the Company.

As an ESOP participant, you are entitled to instruct the ESOP Trustees how to vote the shares of Company common stock allocated to your account as of December 7, 2012, the record date for the 2013 Annual Meeting of Stockholders. To direct the ESOP Trustees how to vote the shares of Company common stock allocated to your ESOP account, please complete, sign and submit the enclosedyellowvote authorization form in the postage paid envelope provided with this letter,no later than January 18, 2013. The unallocated shares of Company common stock held in the ESOP Trust and the shares for which timely instructions are not received, will be voted by the ESOP Trustees in a manner calculated to most accurately reflect the instructions the ESOP Trustees receive from participants regarding the shares of common stock allocated to their accounts, subject its fiduciary duties.

Your vote will be tabulated by Kilpatrick Townsend & Stockton LLP and will not be revealed, directly or indirectly, to any employee or director of the Company or Eureka Bank.

Sincerely,

/s/ Edward F. Seserko

Edward F. Seserko

President and Chief Executive Officer

Name:

Shares:

VOTE AUTHORIZATION FORM

I understand that Edward F. Seserko and Gary B. Pepper, the ESOP Trustees, are the holders of record of all shares of Eureka Financial Corp. (the “Company”) common stock allocated to me under the ESOP. I understand that my voting instructions are solicited on behalf of the Company’s Board of Directors for the Annual Meeting of Stockholders to be held on January 28, 2013.

Accordingly, you are to vote my shares as follows (please check one):

| 1. | The election as directors of all nominees listed for a term of three years: |

| FOR | WITHHOLD | |||

| Robert J. Malone | ¨ | ¨ | ||

| William F. Ryan | ¨ | ¨ | ||

| 2. | The ratification of the appointment of S.R. Snodgrass, A.C. as the independent registered public accounting firm of the Company for the fiscal year ending September 30, 2013. |

| ¨ FOR | ¨ AGAINST | ¨ ABSTAIN |