Exhibit 99.1

united financial bancorp, inc.

Create Your Balance

united financial

bancorp, inc.

NASDAQ Global Select Market: UBNK FourthQuarter 2014

Forward Looking Statements

This Presentation contains forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties. These risks and uncertainties could cause our results to differ materially from those set forth in such forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. Words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “estimates,” “targeted” and similar expressions, and future or conditional verbs, such as “will,” “would,” “should,” “could” or “may” are intended to identify forward-looking statements but are not the only means to identify these statements. Forward-looking statements involve risks and uncertainties. Actual conditions, events or results may differ materially from those contemplated by a forward-looking statement. Factors that could cause this difference — many of which are beyond our control — include without limitation the following: Any forward-looking statements made by or on behalf of us in this Presentation speak only as of the date of this Presentation. We do not undertake to update forward-looking statements to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. The reader should; however, consult any further disclosures of a forward-looking nature we may make in future filings.

With regard to presentations compared to peer institutions, the peer companies include: BHLB, BRKL, CBU, CUBI, DCOM, FCF, FFIC, IBCP, NPBC, NBTB, NWBI, PFS, STBA, STL, TMP, and TRST. The data presented in this presentation relating to the peer companies is based on the calendar year. Data for peers is sourced from SNL Financial LLC.

NON-GAAP FINANCIAL MEASURES

This presentation references non-GAAP financial measures incorporating tangible equity and related measures, and operating earnings excluding non-recurring costs. These measures are commonly used by investors in evaluating financial condition. GAAP earnings are lower than core earnings primarily due to non-recurring conversion, balance sheet restructuring and cost cutting initiative related expenses. Reconciliations are in earnings releases at www.unitedfinancialinc.com.

united financial

bancorp, inc.

NASDAQ: UBNK 2

Corporate Contacts

William H. W. Crawford, IV

Chief Executive Officer

Eric R. Newell, CFA

Executive Vice President, Chief Financial Officer

David C. Paulson

Executive Vice President, Head of Wholesale Banking

Brandon C. Lorey

Executive Vice President, Head of Consumer Lending

Investor Information:

Marliese L. Shaw

Executive Vice President, Corporate Secretary/Investor Relations Officer

860-291-3622 or mshaw@bankatunited.com

united financial

bancorp, inc.

NASDAQ: UBNK 3

Table of Contents

Page | ||

Management Team | 5 | |

Branch Franchise | 6 | |

Balance Sheet Trends | 7 | |

Balance Sheet Summary | 8 | |

Deposit Market Share | 10 | |

How United Creates Value | 11 | |

2015 Priorities | 12 | |

Appendix | 14 |

united financial

bancorp, inc.

NASDAQ: UBNK 4

Management Team

Name | Title/Function | Years in Industry / Years at United | Prior Experience | |||

William H.W. Crawford | Chief Executive Officer | 26/3 | Wells Fargo Bank, Wachovia Bank | |||

Marino J. Santarelli | Chief Operating Officer | 41/3 | Wells Fargo Bank, Wachovia Bank | |||

Dena M. Hall | Western MA Regional President | 17/9 | Woronoco Savings Bank | |||

Craig W. Hurty | Chief Human Resource Officer | 30/0 | Aetna, PacifiCare Health Systems | |||

Mark A. Kucia | Chief Credit Officer | 27/9 | Liberty Bank, Mechanics Bank, BayBank | |||

Brandon C. Lorey | Head of Consumer Lending | 24/2 | H&R Block Bank, Chevy Chase Federal Savings Bank | |||

Eric R. Newell | Chief Financial Officer | 11/3 | FDIC, Fitch Ratings, Alliance Bernstein | |||

David C. Paulson | Head of Wholesale Banking | 29/1 | Santander, Wells Fargo, Wachovia | |||

Betsy Wynnick | Chief Risk Officer | 22/2 | NewAlliance Bank, Webster Bank |

united financial

bancorp, inc.

NASDAQ: UBNK 5

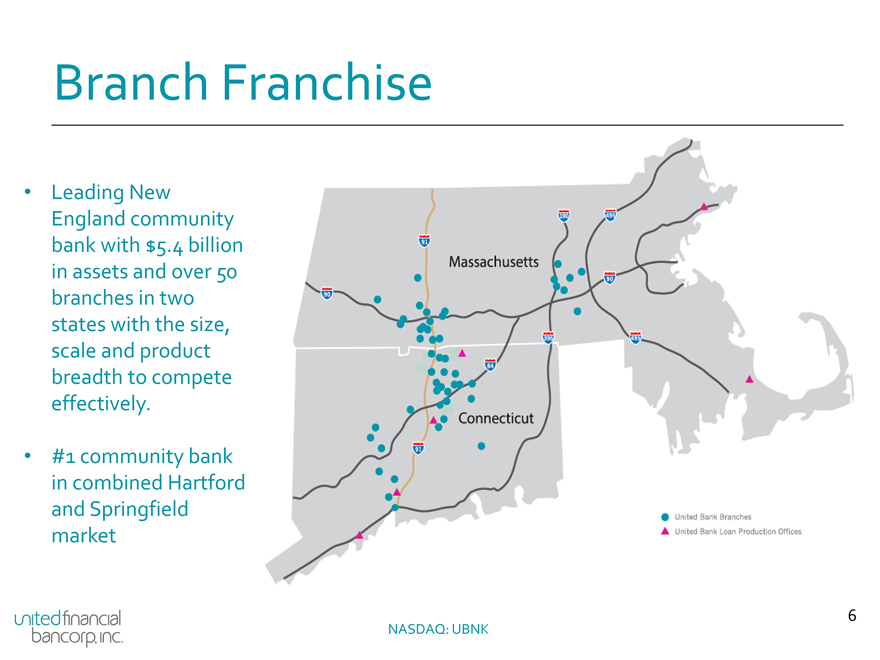

Branch Franchise

Leading New England community bank with $5.4 billion in assets and over 50 branches in two states with the size, scale and product breadth to compete effectively.

#1 community bank in combined Hartford and Springfield market

Massachusetts

Connecticut

United Bank Branches

United Bank Loan Production Offices

united financial

bancorp, inc.

NASDAQ: UBNK 6

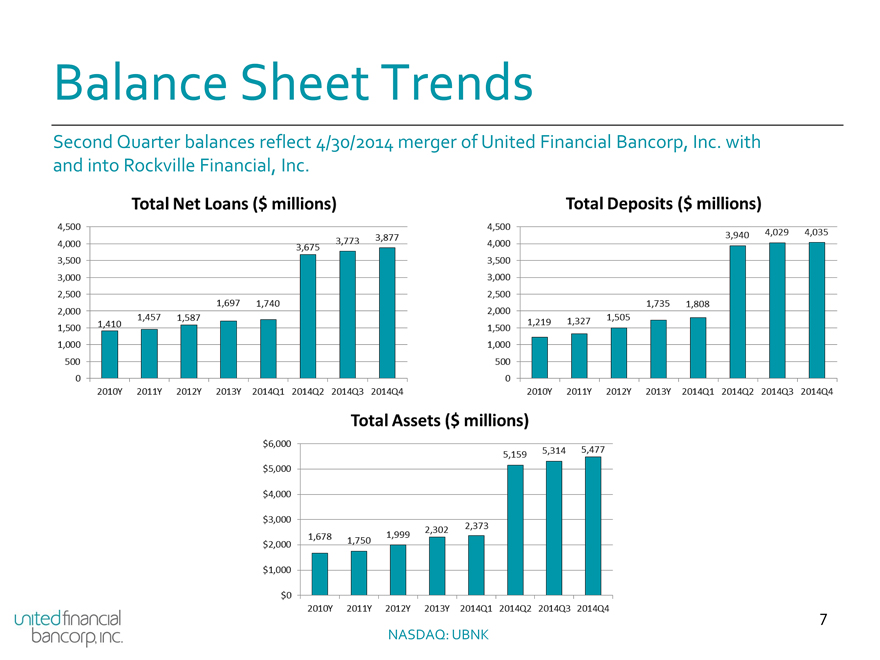

Balance Sheet Trends

Second Quarter balances reflect 4/30/2014 merger of United Financial Bancorp, Inc. with and into Rockville Financial, Inc.

Total Net Loans ($ millions)

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

1,410 1,457 1,587 1,697 1,740 3,675 3,773 3,877

2010Y 2011Y 2012Y 2013Y 2014Q1 2014Q2 2014Q3 2014Q4

Total Deposits ($ millions)

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

0

1,219 1,327 1,505 1,735 1,808 3,940 4,029 4,035

2010Y 2011Y 2012Y 2013Y 2014Q1 2014Q2 2014Q3 2014Q4

Total Assets ($ millions)

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

1,678 1,750 1,999 2,302 2,373 5,159 5,314 5,477

2010Y 2011Y 2012Y 2013Y 2014Q1 2014Q2 2014Q3 2014Q4

united financial

bancorp, inc.

NASDAQ: UBNK 7

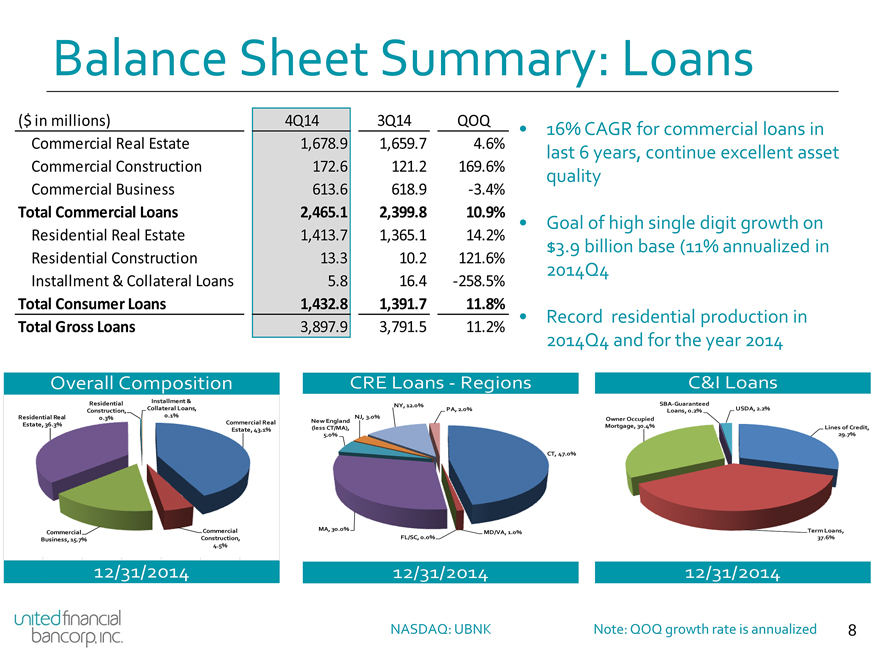

Balance Sheet Summary: Loans

($ in millions) 4Q14 3Q14 QOQ

Commercial Real Estate 1,678.9 1,659.7 4.6%

Commercial Construction 172.6 121.2 169.6%

Commercial Business 613.6 618.9 -3.4%

Total Commercial Loans 2,465.1 2,399.8 10.9%

Residential Real Estate 1,413.7 1,365.1 14.2%

Residential Construction 13.3 10.2 121.6%

Installment & Collateral Loans 5.8 16.4 -258.5%

Total Consumer Loans 1,432.8 1,391.7 11.8%

Total Gross Loans 3,897.9 3,791.5 11.2%

16% CAGR for commercial loans in last 6 years, continue excellent asset quality

Goal of high single digit growth on $3.9 billion base (11% annualized in 2014Q4

Record residential production in 2014Q4 and for the year 2014

Overall Composition

Residential Real Estate, 36.3%

Residential Construction, 0.3%

Installment & Collateral Loans, 0.1%

Commercial Real Estate, 43.1%

Commercial Business, 15.7%

Commercial Construction, 4.5%

12/31/2014

CRE Loans - Regions

New England (less CT/MA), 5.0%

NJ, 3.0%

NY, 12.0%

PA, 2.0%

CT, 47.0%

MA, 30.0%

FL/SC, 0.0%

MD/VA, 1.0%

12/31/2014

C&I Loans

Owner Occupied Mortgage, 30.4%

SBA-Guaranteed Loans, 0.2%

USDA, 2.2%

Lines of Credit, 29.7%

Term Loans, 37.6%

12/31/2014

united financial

bancorp, inc.

NASDAQ: UBNK

Note: QOQ growth rate is annualized

8

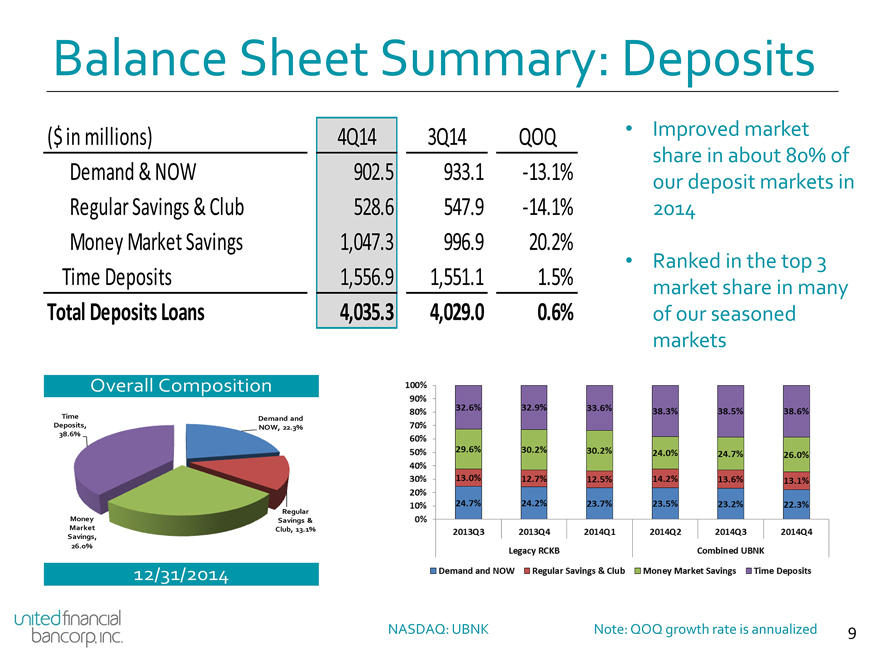

Balance Sheet Summary: Deposits

($ in millions) 4Q14 3Q14 QOQ

Demand & NOW 902.5 933.1 -13.1%

Regular Savings & Club 528.6 547.9 -14.1%

Money Market Savings 1,047.3 996.9 20.2%

Time Deposits 1,556.9 1,551.1 1.5%

Total Deposits Loans 4,035.3 4,029.0 0.6%

Improved market share in about 80% of our deposit markets in 2014

Ranked in the top 3 market share in many of our seasoned markets

Overall Composition

Time Deposits, 38.6%

Demand and NOW, 22.3%

Money Market Savings, 26.0%

Regular Savings & Club, 13.1%

12/31/2014

100%

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

32.6% 32.9% 33.6% 38.3% 38.5% 38.6%

29.6% 30.2% 30.2% 24.0% 24.7% 26.0%

13.0% 12.7% 12.5% 14.2% 13.6% 13.1%

24.7% 24.2% 23.7% 23.5% 23.2% 22.3%

2013Q3 2013Q4 2014Q1 2014Q2 2014Q3 2014Q4

Legacy RCKB

Combined UBNK

Demand and NOW

Regular Savings & Club

Money Market Savings

Time Deposits

united financial

bancorp, inc.

NASDAQ: UBNK

Note: QOQ growth rate is annualized

9

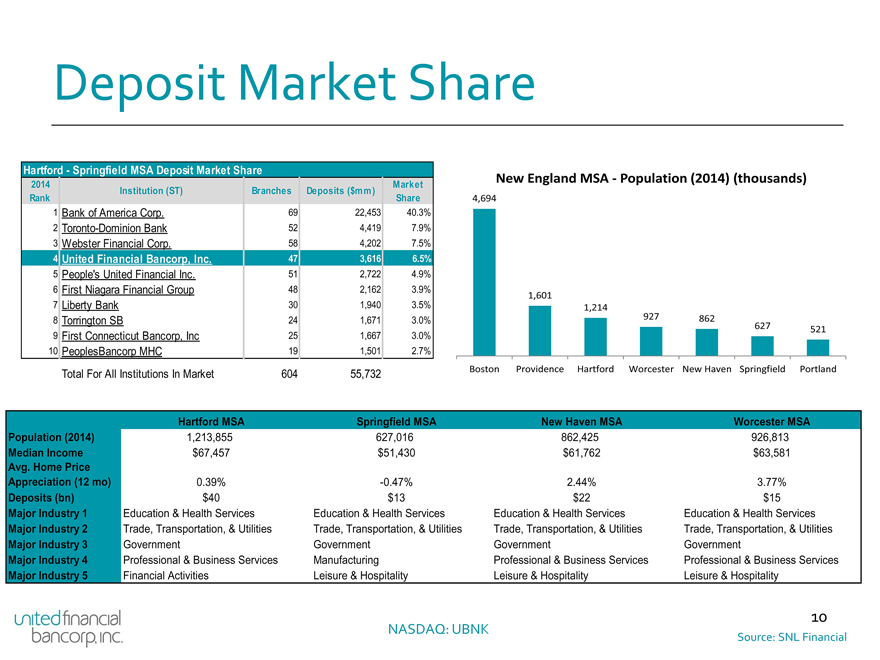

Deposit Market Share

Hartford—Springfield MSA Deposit Market Share

2014 Rank

Institution (ST)

Branches

Deposits ($mm)

Market Share

1 Bank of America Corp. 69 22,453 40.3%

2 Toronto-Dominion Bank 52 4,419 7.9%

3 Webster Financial Corp. 58 4,202 7.5%

4 United Financial Bancorp, Inc. 47 3,616 6.5%

5 People’s United Financial Inc. 51 2,722 4.9%

6 First Niagara Financial Group 48 2,162 3.9%

7 Liberty Bank 30 1,940 3.5%

8 Torrington SB 24 1,671 3.0%

9 First Connecticut Bancorp, Inc 25 1,667 3.0%

10 PeoplesBancorp MHC 19 1,501 2.7%

Total For All Institutions In Market 604 55,732

New England MSA—Population (2014) (thousands)

4,694

1,601

1,214

927 862

627 521

Boston Providence Hartford Worcester New Haven Springfield Portland

Hartford MSA

Springfield MSA

New Haven MSA

Worcester MSA

Population (2014) 1,213,855 627,016 862,425 926,813

Median Income $67,457 $51,430 $61,762 $63,581

Avg. Home Price

Appreciation (12 mo) 0.39% -0.47% 2.44% 3.77%

Deposits (bn) $40 $13 $22 $15

Major Industry 1 Education & Health Services Education & Health Services Education & Health Services Education & Health Services

Major Industry 2 Trade, Transportation, & Utilities Trade, Transportation, & Utilities Trade, Transportation, & Utilities Trade, Transportation, & Utilities

Major Industry 3 Government Government Government Government

Major Industry 4 Professional & Business Services Manufacturing Professional & Business Services Professional & Business Services

Major Industry 5 Financial Activities Leisure & Hospitality Leisure & Hospitality Leisure & Hospitality

united financial

bancorp, inc.

NASDAQ: UBNK 10

Source: SNL Financial

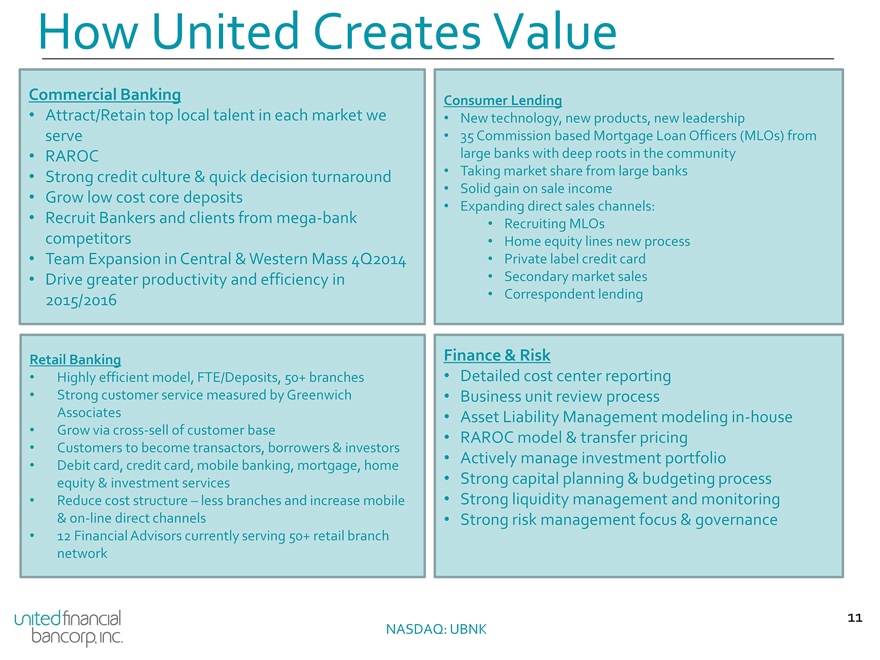

How United Creates Value

Commercial Banking

Attract/Retain top local talent in each market we serve

RAROC

Strong credit culture & quick decision turnaround

Grow low cost core deposits

Recruit Bankers and clients from mega-bank competitors

Team Expansion in Central & Western Mass 4Q2014

Drive greater productivity and efficiency in 2015/2016

Consumer Lending

New technology, new products, new leadership

35 Commission based Mortgage Loan Officers (MLOs) from large banks with deep roots in the community

Taking market share from large banks

Solid gain on sale income

Expanding direct sales channels:

Recruiting MLOs

Home equity lines new process

Private label credit card

Secondary market sales

Correspondent lending

Retail Banking

Highly efficient model, FTE/Deposits, 50+ branches

Strong customer service measured by Greenwich Associates

Grow via cross-sell of customer base

Customers to become transactors, borrowers & investors

Debit card, credit card, mobile banking, mortgage, home equity & investment services

Reduce cost structure – less branches and increase mobile & on-line direct channels

12 Financial Advisors currently serving 50+ retail branch network

Finance & Risk

Detailed cost center reporting

Business unit review process

Asset Liability Management modeling in-house

RAROC model & transfer pricing

Actively manage investment portfolio

Strong capital planning & budgeting process

Strong liquidity management and monitoring

Strong risk management focus & governance

united financial

bancorp, inc.

NASDAQ: UBNK 11

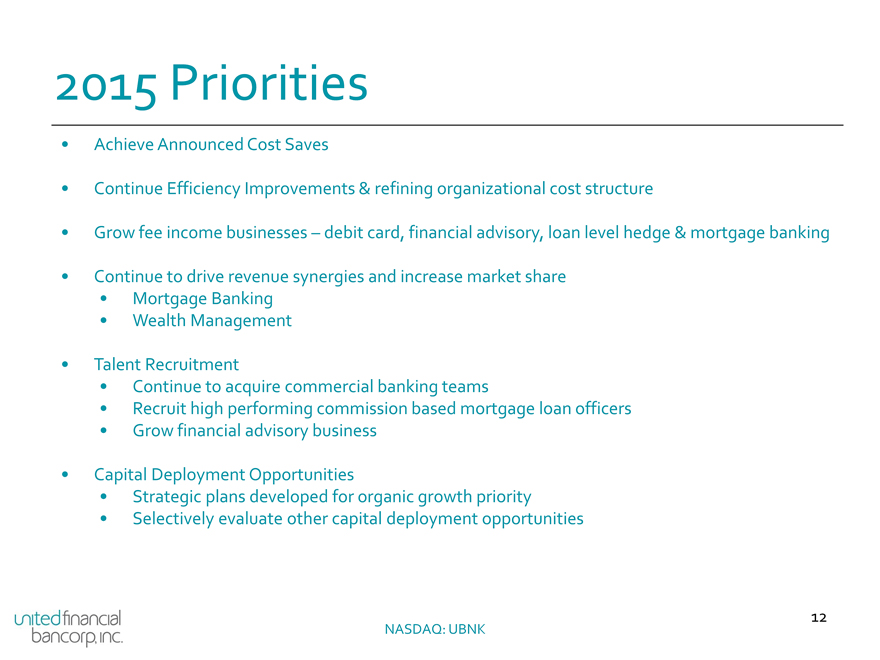

2015 Priorities

Achieve Announced Cost Saves

Continue Efficiency Improvements & refining organizational cost structure

Grow fee income businesses – debit card, financial advisory, loan level hedge & mortgage banking

Continue to drive revenue synergies and increase market share

Mortgage Banking

Wealth Management

Talent Recruitment

Continue to acquire commercial banking teams

Recruit high performing commission based mortgage loan officers

Grow financial advisory business

Capital Deployment Opportunities

Strategic plans developed for organic growth priority

Selectively evaluate other capital deployment opportunities

united financial bancorp, inc.

NASDAQ: UBNK 12

2015 Priorities (cont.)

2015: Operating Run Rate Goals

Financial Performance Metric

Targets

NIE / Average Assets

<2.00%

Return on Tangible Common Equity

~10.0%

Efficiency

~57%

2015 Operating Budget: Continue to evaluate cost saving opportunities throughout entire enterprise as we develop 2015 & 2016 operating budgets. Opportunities will be enhanced by critical analysis of cost center expense reporting

united financial bancorp, inc.

NASDAQ: UBNK 13

APPENDIX

united financial bancorp, inc.

NASDAQ: UBNK 14

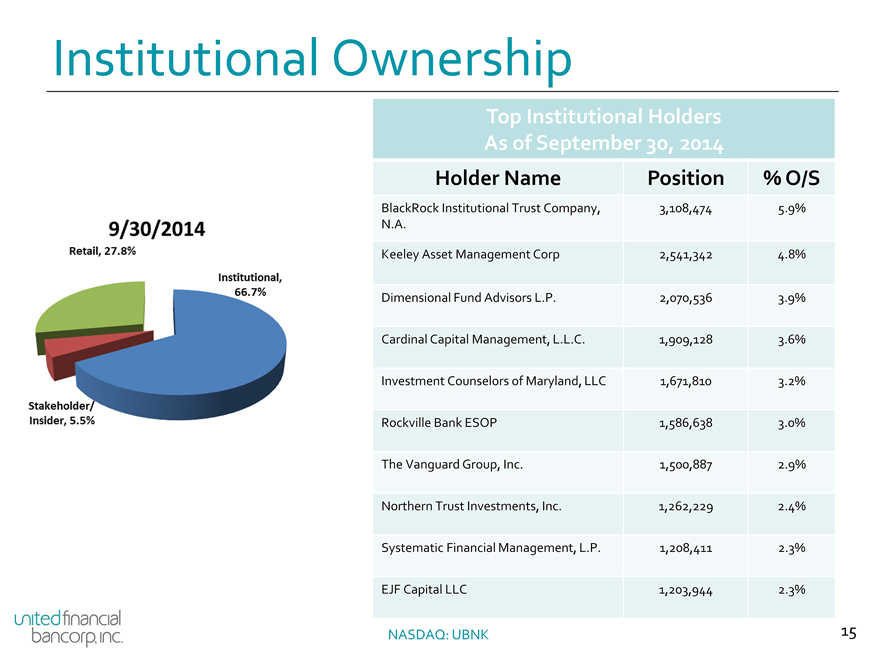

Institutional Ownership

9/30/2014

Retail, 27.8%

Institutional 66.7%

Stakeholder/Insider, 5.5%

Top Institutional Holders As of September 30, 2014

Holder Name Position % O/S

BlackRock Institutional Trust Company, N.A. 3,108,474 5.9%

Keeley Asset Management Corp 2,541,342 4.8%

Dimensional Fund Advisors L.P. 2,070,536 3.9%

Cardinal Capital Management, L.L.C. 1,909,128 3.6%

Investment Counselors of Maryland, LLC 1,671,810 3.2%

Rockville Bank ESOP 1,586,638 3.0%

The Vanguard Group, Inc. 1,500,887 2.9%

Northern Trust Investments, Inc. 1,262,229 2.4%

Systematic Financial Management, L.P. 1,208,411 2.3%

EJF Capital LLC 1,203,944 2.3%

united financial

bancorp, inc.

NASDAQ: UBNK

15

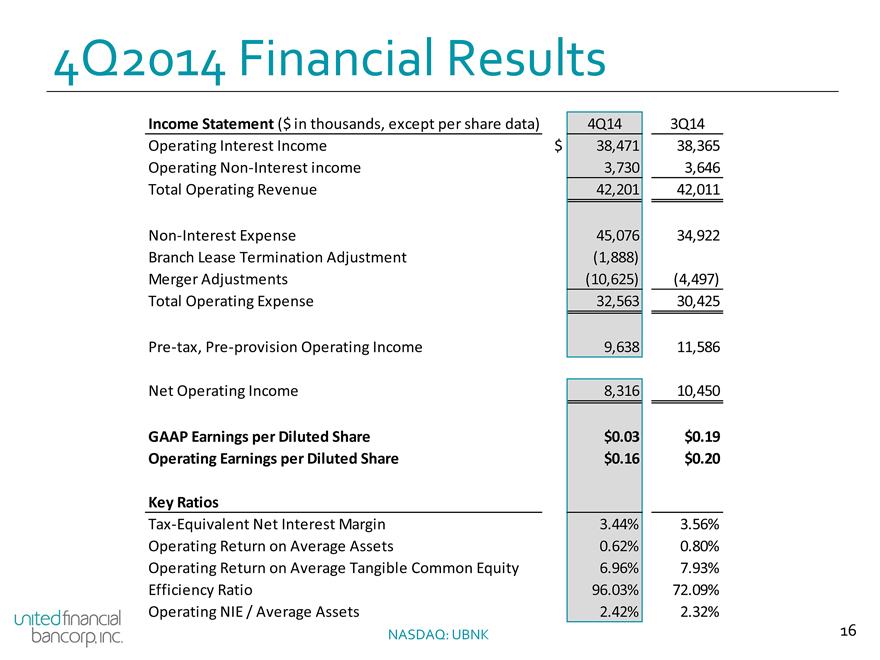

4Q2014 Financial Results

Income Statement ($ in thousands, except per share data) 4Q14 3Q14

Operating Interest Income $38,471 38,365

Operating Non-Interest income 3,730 3,646

Total Operating Revenue 42,201 42,011

Non-Interest Expense 45,076 34,922

Branch Lease Termination Adjustment (1,888)

Merger Adjustments (10,625) (4,497)

Total Operating Expense 32,563 30,425

Pre-tax, Pre-provision Operating Income 9,638 11,586

Net Operating Income 8,316 10,450

GAAP Earnings per Diluted Share $0.03 $0.19

Operating Earnings per Diluted Share $0.16 $0.20

Key Ratios

Tax-Equivalent Net Interest Margin 3.44% 3.56%

Operating Return on Average Assets 0.62% 0.80%

Operating Return on Average Tangible Common Equity 6.96% 7.93%

Efficiency Ratio 96.03% 72.09%

Operating NIE / Average Assets 2.42% 2.32%

united financial

bancorp, inc.

NASDAQ: UBNK

16

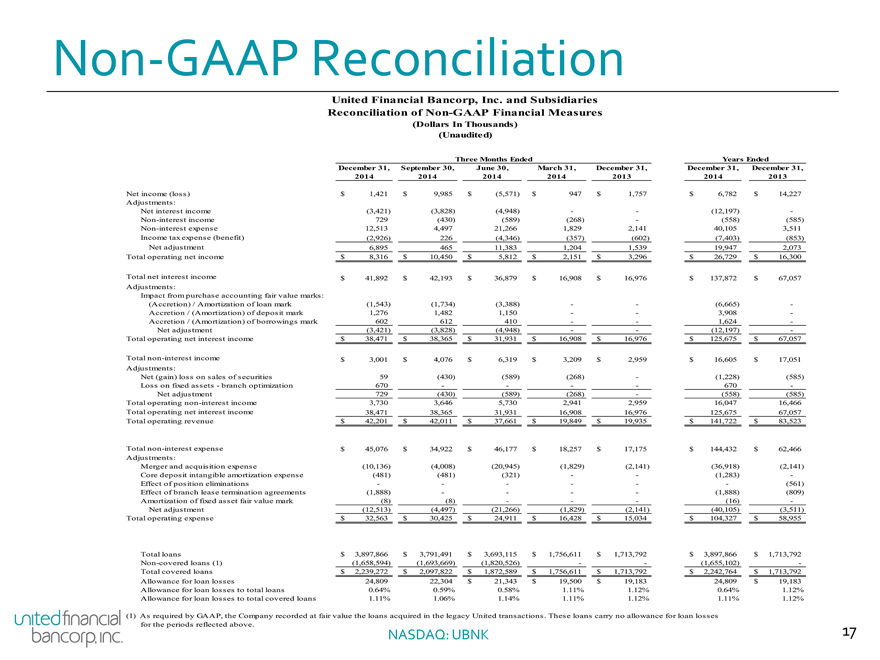

Non-GAAP Reconciliation

United Financial Bancorp, Inc. and Subsidiaries

Reconciliation of Non-GAAP Financial Measures

(Dollars In Thousands)

(Unaudited)

Three Months Ended

Years Ended

Net income (loss)

Adjustments:

Net interest income

Non-interest income

Non-interest expense

Income tax expense (benefit)

Net adjustment

Total operating net income

Total net interest income

Adjustments:

Impact from purchase accounting fair value marks:

(Accretion) / Amortization of loan mark

Accretion / (Amortization) of deposit mark

Accretion / (Amortization) of borrowings mark

Net adjustment

Total operating net interest income

Total non-interest income

Adjustments:

Net (gain) loss on sales of securities

Loss on fixed assets - branch optimization

Net adjustment

Total operating non-interest income

Total operating net interest income

Total operating revenue

Total non-interest expense

Adjustments:

Merger and acquisition expense

Core deposit intangible amortization expense

Effect of position eliminations

Effect of branch lease termination agreements

Amortization of fixed asset fair value mark

Net adjustment

Total operating expense

Total loans

Non-covered loans (1)

Total covered loans

Allowance for loan losses

Allowance for loan losses to total loans

Allowance for loan losses to total covered loans

December 31, 2014

$1,421

(3,421)

729

12,513

(2,926)

6,895

$8,316

$41,892

(1,543)

1,276

602

(3,421)

$38,471

$3,001

59

670

729

3,730

38,471

$42,201

$45,076

(10,136)

(481)

-

(1,888)

(8)

(12,513)

$32,563

$3,897,866

(1,658,594)

$2,239,272

24,809

0.64%

1.11%

September 30, 2014

$9,985

(3,828)

(430)

4,497

226

465

$10,450

$42,193

(1,734)

1,482

612

(3,828)

$38,365

$4,076

(430)

-

(430)

3,646

38,365

$42,011

$34,922

(4,008)

(481)

-

-

(8)

(4,497)

$30,425

$3,791,491

(1,693,669)

$2,097,822

22,304

0.59%

1.06%

June 30, 2014

$(5,571)

(4,948)

(589)

21,266

(4,346)

11,383

$5,812

$36,879

(3,388)

1,150

410

(4,948)

$31,931

$6,319

(589)

-

(589)

5,730

31,931

$37,661

$46,177

(20,945)

(321)

-

-

-

(21,266)

$24,911

$3,693,115

(1,820,526)

$1,872,589

$21,343

0.58%

1.14%

March 31, 2014

$947

-

(268)

1,829

(357)

1,204

$2,151

$16,908

-

-

-

-

$16,908

$3,209

(268)

-

(268)

2,941

16,908

$19,849

$18,257

(1,829)

-

-

-

-

(1,829)

$16,428

$1,756,611

-

$1,756,611

$19,500

1.11%

1.11%

December 31, 2013

$1,757

-

-

2,141

(602)

1,539

$3,296

$16,976

-

-

-

-

$16,976

$2,959

-

-

-

2,959

16,976

$19,935

$17,175

(2,141)

-

-

-

-

(2,141)

$15,034

$1,713,792

-

$1,713,792

$19,183

1.12%

1.12%

December 31, 2014

$6,782

(12,197)

(558)

40,105

(7,403)

19,947

$26,729

$137,872

(6,665)

3,908

1,624

(12,197)

$125,675

$16,605

(1,228)

670

(558)

16,047

125,675

$141,722

$144,432

(36,918)

(1,283)

-

(1,888)

(16)

(40,105)

$104,327

$3,897,866

(1,655,102)

$2,242,764

24,809

0.64%

1.11%

December 31, 2013

$14,227

-

(585)

3,511

(853)

2,073

$16,300

$67,057

-

-

-

-

$67,057

$17,051

(585)

-

(585)

16,466

67,057

$83,523

$62,466

(2,141)

-

(561)

(809)

-

(3,511)

$58,955

$1,713,792

-

$1,713,792

$19,183

1.12%

1.12%

(1) As required by GAAP, the Company recorded at fair value the loans acquired in the legacy United transactions. These loans carry no allowance for loan losses for the periods reflected above.

united financial

bancorp, inc.

NASDAQ: UBNK 17

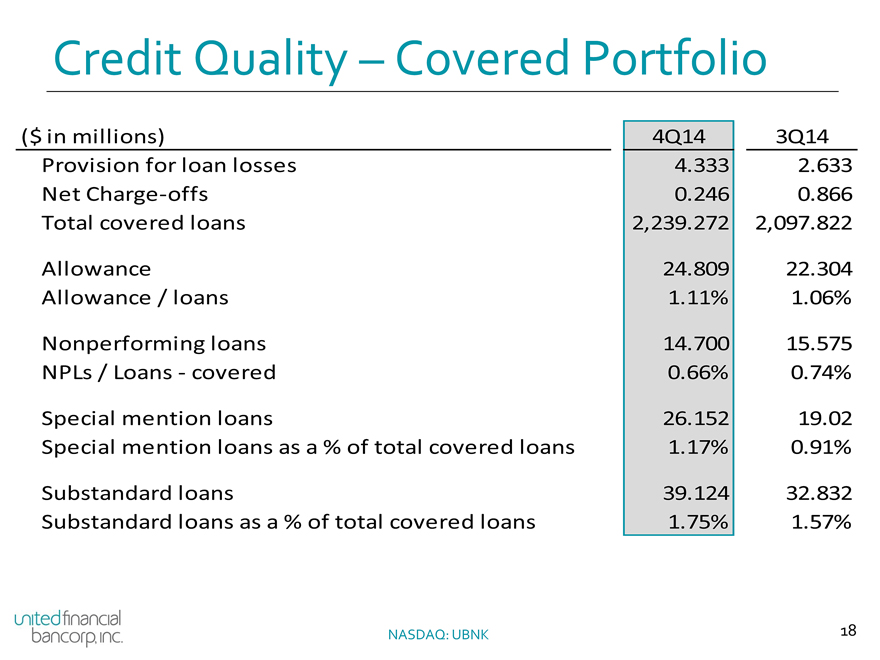

Credit Quality - Covered Portfolio

($ in millions)

Provision for loan losses

Net Charge-offs

Total covered loans

Allowance

Allowance / loans

Nonperforming loans

NPLs / Loans - covered

Special mention loans

Special mention loans as a % of total covered loans

Substandard loans

Substandard loans as a % of total covered loans

4Q14

4.333

0.246

2,239.272

24.809

1.11%

14.700

0.66%

26.152

1.17%

39.124

1.75%

3Q14

2.633

0.866

2,097.822

22.304

1.06%

15.575

0.74%

19.02

0.91%

32.832

1.57%

united financial

bancorp, inc.

NASDAQ: UBNK 18

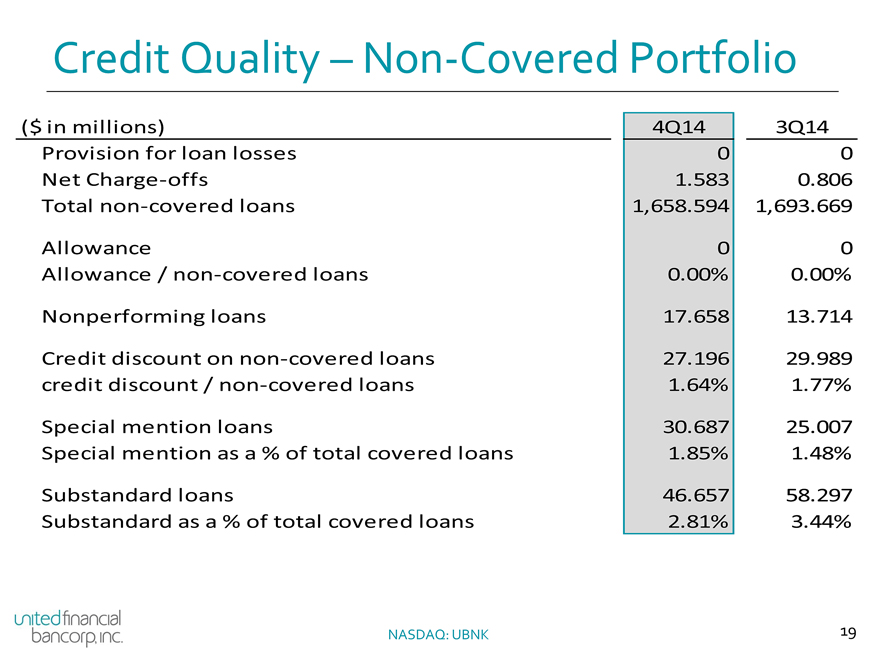

Credit Quality – Non-Covered Portfolio

($ in millions) 4Q14 3Q14

Provision for loan losses 0 0

Net Charge-offs 1.583 0.806

Total non-covered loans 1,658.594 1,693.669

Allowance 0 0

Allowance / non-covered loans 0.00% 0.00%

Nonperforming loans 17.658 13.714

Credit discount on non-covered loans 27.196 29.989

credit discount / non-covered loans 1.64% 1.77%

Special mention loans 30.687 25.007

Special mention as a % of total covered loans 1.85% 1.48%

Substandard loans 46.657 58.297

Substandard as a % of total covered loans 2.81% 3.44%

united financial

bancorp, inc.

NASDAQ: UBNK 19

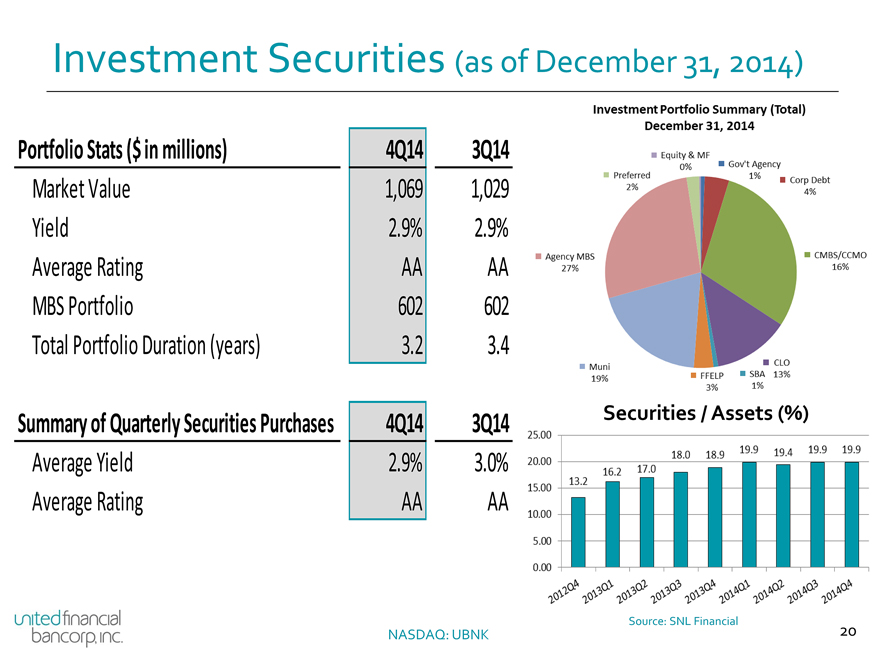

Investment Securities (as of December 31, 2014)

Portfolio Stats ($ in millions) 4Q14 3Q14

Market Value 1,069 1,029

Yield 2.9% 2.9%

Average Rating AA AA

MBS Portfolio 602 602

Total Portfolio Duration (years) 3.2 3.4

Summary of Quarterly Securities Purchases 4Q14 3Q14

Average Yield 2.9% 3.0%

Average Rating AA AA

Investment Portfolio Summary (Total)

December 31, 2014

Agency MBS 27%

Preferred 2%

Equity & MF 0%

Gov’t Agency 1%

Corp Debt 4%

CMBS/CCMO 16%

Muni 19%

FFELP 3%

SBA 1%

CLO 13%

Securities / Assets (%)

25.00

20.00

15.00

10.00

5.00

0.00

13.2 16.2 17.0 18.0 18.9 19.9 19.4 19.9 19.9

2012Q4 2013Q1 2013Q2 2013Q3 2013Q4 2014Q1 2014Q2 2014Q3 2014Q4

Source: SNL Financial

united financial

bancorp, inc.

NASDAQ: UBNK 20

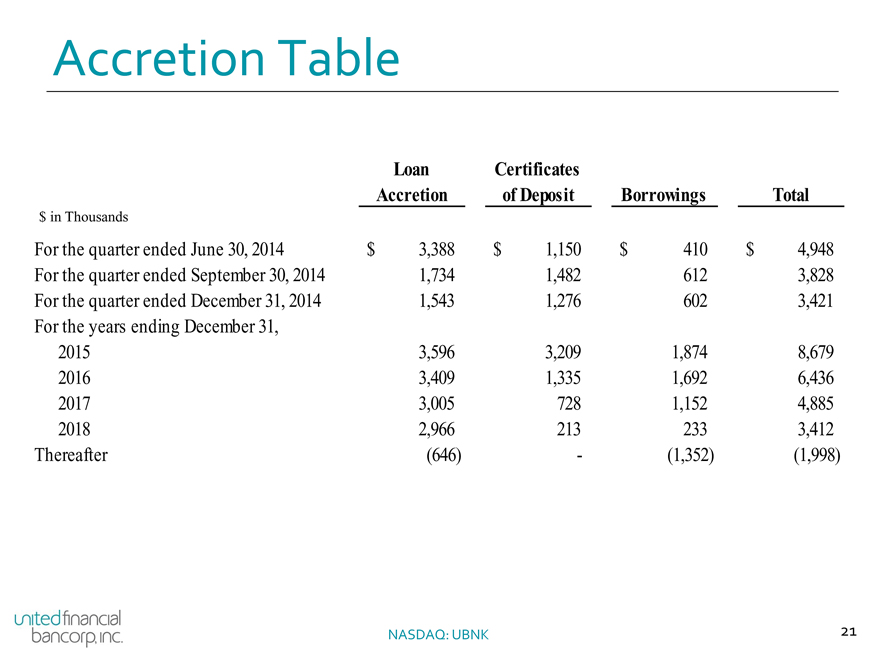

Accretion Table

Loan Accretion Certificates of Deposit Borrowings Total

$ in Thousands

For the quarter ended June 30, 2014 $3,388 $1,150 $410 $4,948

For the quarter ended September 30, 2014 1,734 1,482 612 3,828

For the quarter ended December 31, 2014 1,543 1,276 602 3,421

For the years ending December 31,

2015 3,596 3,209 1,874 8,679

2016 3,409 1,335 1,692 6,436

2017 3,005 728 1,152 4,885

2018 2,966 213 233 3,412

Thereafter (646) - (1,352) (1,998)

united financial

bancorp, inc.

NASDAQ: UBNK 21