V E R I T E X Sandler O’Neill + Partners, L.P. West Coast Financial Services Conference March 7, 2017

2 Safe Harbor Statement ABOUT VERITEX HOLDINGS, INC. Headquartered in Dallas, Texas, Veritex Holdings, Inc. (“VBTX”, “Veritex” or the “Company”) is a bank holding company that conducts banking activities through its wholly-owned subsidiary, Veritex Community Bank, with locations throughout the Dallas metropolitan area. Veritex Community Bank is a Texas state chartered bank regulated by the Texas Department of Banking and the Board of Governors of the Federal Reserve System. For more information, visit www.veritexbank.com. NO OFFER OR SOLICITATION This communication does not constitute an offer to sell, a solicitation of an offer to sell, the solicitation or an offer to buy any securities or a solicitation of any vote or approval. There will be no sale of securities in any jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirement of Section 10 of the Securities Act of 1933, as amended. ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT In connection with the proposed merger of Veritex and Sovereign Bancshares, Inc. (“Sovereign”) Veritex filed with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 that includes a joint proxy statement of Veritex and Sovereign and a prospectus of Veritex, and will file other relevant documents concerning the proposed transaction. WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S-4, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, THE JOINT PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S-4 AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT VERITEX, SOVEREIGN AND THE PROPOSED MERGER. The joint proxy statement/prospectus has or will be sent to the shareholders of each institution seeking the required shareholder approvals. Investors and security holders may obtain free copies of the registration statement on Form S-4 and the related joint proxy statement/prospectus, as well as other documents filed with the SEC by Veritex through the web site maintained by the SEC at www.sec.gov. Documents filed with the SEC by Veritex will also be available free of charge by directing a written request to Veritex Holdings, Inc., 8214 Westchester Drive, Suite 400, Dallas, Texas 75225 Attn: Investor Relations. Veritex’s telephone number is (972) 349-6200. NON-GAAP FINANCIAL MEASURES Veritex reports its results in accordance with United States generally accepted accounting principles (“GAAP”). However, management believes that certain non-GAAP performance measures used in managing the business may provide meaningful information about underlying trends in its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, Veritex’s reported results prepared in accordance with GAAP. Please see Reconciliation of Non-GAAP Measures at the end of this presentation for a reconciliation to the nearest GAAP financial measure. PARTICIPANTS IN THE TRANSACTION Veritex, Sovereign and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the respective shareholders of Veritex and Sovereign in connection with the proposed transaction. Certain information regarding the interests of these participants and a description of their direct and indirect interests, by security holdings or otherwise, are included in the joint proxy statement/prospectus regarding the proposed transaction. Additional information about Veritex and its directors and officers may be found in the definitive proxy statement of Veritex relating to its 2016 Annual Meeting of Stockholders filed with the SEC on April 7, 2016. The definitive proxy statement can be obtained free of charge from the sources described above.

3 Forward Looking Statements “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release may contain certain forward-looking statements within the meaning of the securities laws that are based on various facts and derived utilizing important assumptions, current expectations, estimates and projections about Veritex and its subsidiaries. Forward-looking statements include information regarding Veritex’s future financial performance, business and growth strategy, projected plans and objectives, and related transactions, integration of the acquired businesses, ability to recognize anticipated operational efficiencies, and other projections based on macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “anticipates,” “intends,” “projects,” “estimates,” “plans” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could” are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing. Further, certain factors that could affect Veritex’s future results and cause actual results to differ materially from those expressed in the forward-looking statements include, but are not limited to whether Veritex can: successfully implement its growth strategy, including identifying acquisition targets and consummating suitable acquisitions; continue to sustain internal growth rate; provide competitive products and services that appeal to its customers and target market; continue to have access to debt and equity capital markets; and achieve its performance goals. For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Special Cautionary Notice Regarding Forward-Looking Statements” and “Item 1A. Risk Factors” in Veritex’s Annual Report on Form 10-K filed with the SEC on March 15, 2016 and any updates to those risk factors set forth in Veritex’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Veritex’s underlying assumptions prove to be incorrect, actual results may differ materially from what Veritex anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Veritex does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for us to predict those events or how they may affect us. In addition, Veritex cannot assess the impact of each factor on Veritex’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward- looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Veritex or persons acting on Veritex’s behalf may issue. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

4 Headquartered in Dallas, Texas Established in 2010 Twelve locations within one of the fastest growing metropolitan areas in the U.S. Strong core deposit mix and commercial lending focus Significant organic growth profile complemented by disciplined M&A Franchise FootprintOverview Veritex – “Truth in Texas Banking” Financial Highlights Source: SNL Financial and Company documents; financial data as of 12/31/16. VBTX (11) (Dollars in Millions) Total Assets $ 1,408 Tangible Common Equity $ 210 ROAA (MRQ) 0.97% NPAs/ Assets 0.17% VBTX (12)

Successful Organic Growth and M&A Strategy Source: SNL Financial and Company documents Unaudited 5 $524,127 $664,971 $802,286 $1,408,350 $2,485,535 $181,800 $220,100 $121,417 0.03% 0.31% 0.58% 0.73% 0.98% 1.06% 2010 2011 2012 2013 2014 2015 2016 Combined 2016 Total Assets at Year End Assets Acquired During the Year ROAA $197,949 $437,820 $1,039,600 (Dollars in Thousands) Pending Completed $40 million Initial Public Offering and grew $137 million organically Founded Veritex Holdings & acquired $182 million asset Professional Bank Acquired $166 million asset Fidelity Bank and $54 million asset Bank of Las Colinas Grew $86 million organically exceeding $500 million in assets Grew $141 million organically Acquired $121 million asset IBT Bancorp, Inc. exceeded $1 billion in assets Grew $369 million or 35% in 2016

6 Combined Texas Footprint Announced Acquisition of Sovereign Bancshares VBTX (11) Sovereign (10) D/FW Metroplex VBTX (11) Sovereign (7) Source: SNL Financial and Company documents as of 12/31/16. Note: Market share rank based on FDIC data as of 6/30/16. Combined figures for Veritex and Sovereign as of 12/31/16. Combined Franchise Offices: 21 Assets: $2.5 Billion Loans: $1.9 Billion Deposits: $2.0 Billion Compelling transaction between two established Dallas-based banks Increases deposit market share rank to #17 in D/FW metroplex Addition of two Sovereign insiders to VBTX board of directors Financially attractive with double digit EPS accretion and limited TBVPS dilution VBTX (12) Sovereign (9) VBTX (12) Sovereign (6)

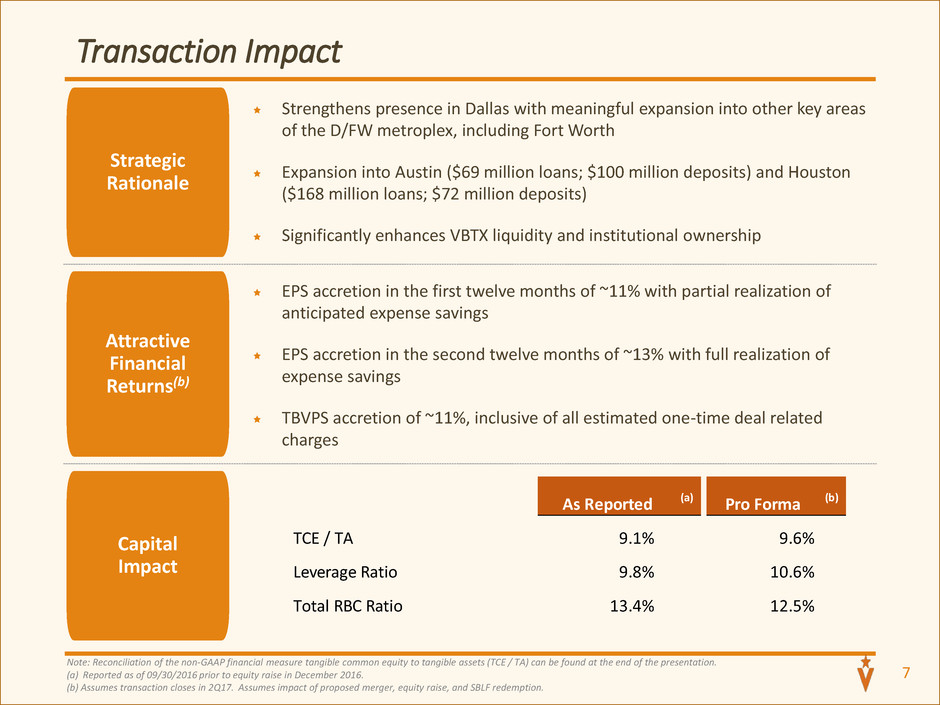

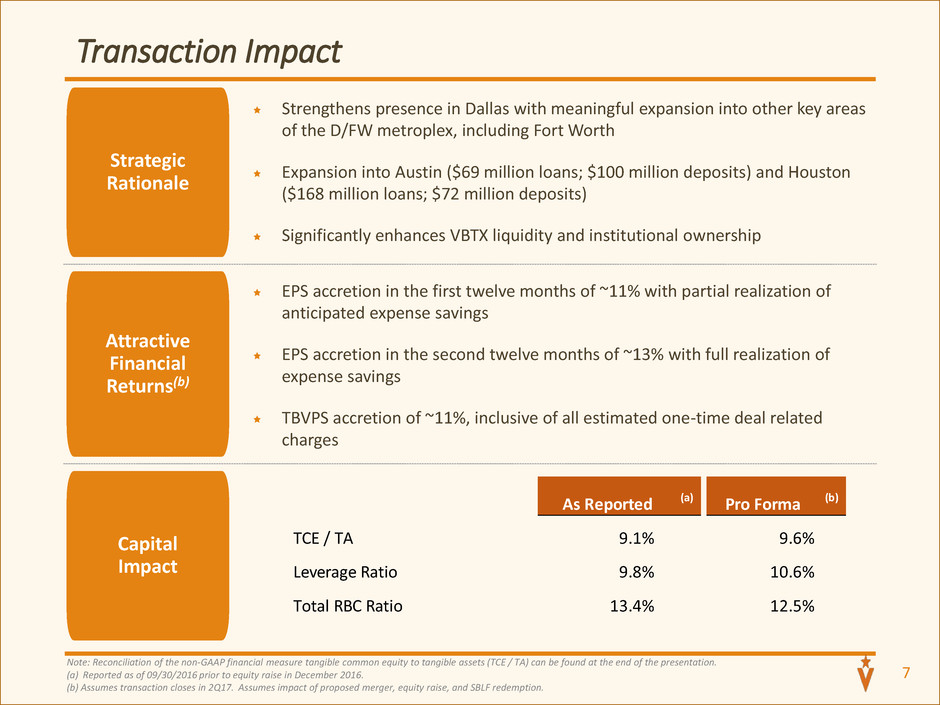

7 Transaction Impact Strategic Rationale Attractive Financial Returns(b) Capital Impact Strengthens presence in Dallas with meaningful expansion into other key areas of the D/FW metroplex, including Fort Worth Expansion into Austin ($69 million loans; $100 million deposits) and Houston ($168 million loans; $72 million deposits) Significantly enhances VBTX liquidity and institutional ownership Note: Reconciliation of the non-GAAP financial measure tangible common equity to tangible assets (TCE / TA) can be found at the end of the presentation. (a) Reported as of 09/30/2016 prior to equity raise in December 2016. (b) Assumes transaction closes in 2Q17. Assumes impact of proposed merger, equity raise, and SBLF redemption. EPS accretion in the first twelve months of ~11% with partial realization of anticipated expense savings EPS accretion in the second twelve months of ~13% with full realization of expense savings TBVPS accretion of ~11%, inclusive of all estimated one-time deal related charges As Reported (a) Pro Forma (b) TCE / TA 9.1% 9.6% Leverage Ratio 9.8% 10.6% Total RBC Ratio 13.4% 12.5%

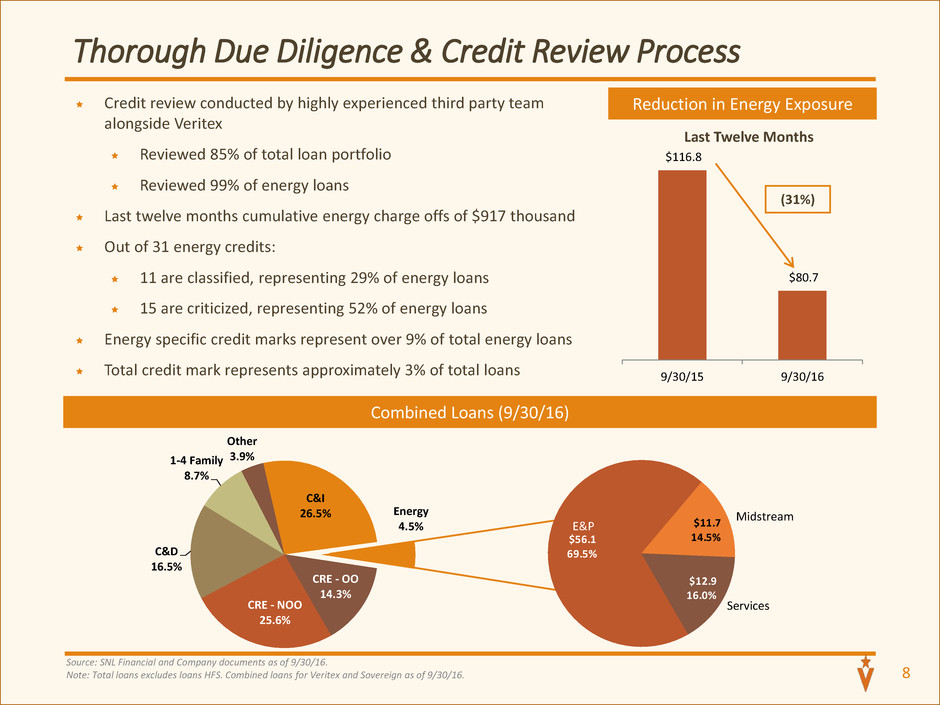

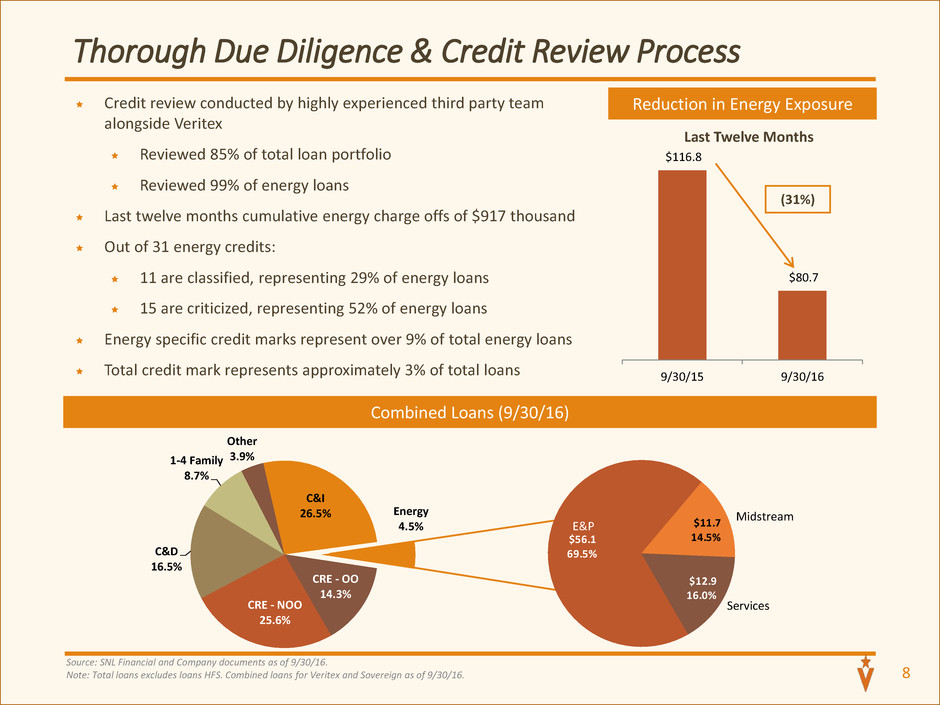

$116.8 $80.7 9/30/15 9/30/16 8 Thorough Due Diligence & Credit Review Process Combined Loans (9/30/16) Credit review conducted by highly experienced third party team alongside Veritex Reviewed 85% of total loan portfolio Reviewed 99% of energy loans Last twelve months cumulative energy charge offs of $917 thousand Out of 31 energy credits: 11 are classified, representing 29% of energy loans 15 are criticized, representing 52% of energy loans Energy specific credit marks represent over 9% of total energy loans Total credit mark represents approximately 3% of total loans Reduction in Energy Exposure (31%) Last Twelve Months Source: SNL Financial and Company documents as of 9/30/16. Note: Total loans excludes loans HFS. Combined loans for Veritex and Sovereign as of 9/30/16. C&I 26.5% Energy 4.5% CRE - OO 14.3% CRE - NOO 25.6% C&D 16.5% 1-4 Family 8.7% Other 3.9% Midstream Services $56.1 69.5% $11.7 14.5% $12.9 16.0% E&P

Experienced Leadership 9 Executive Management C. Malcolm Holland, III Chairman of the Board, Chief Executive Officer 35 years of banking experience, all in the Dallas metropolitan area Former CEO of Texas region for Colonial Bank, which grew from $625 million to $1.6 billion Former President of First Mercantile Bank William C. Murphy Vice Chairman 45 years of banking experience Former Chairman or CEO of several Dallas community banks Has led 25 financial institution transactions Noreen E. Skelly Chief Financial Officer 30 years of banking experience Former CFO of Highlands Bancshares, Inc. Former SVP and Retail line of business chief finance officer for Comerica and LaSalle Banks Jeff Kesler Chief Lending Officer 16 years of banking experience Former president of Dallas and Austin markets for Colonial Bank Clay Riebe Chief Credit Officer 30 years of banking experience Former Chief Lending Officer of American Momentum Bank Former market president of Citibank’s Bryan/College Station markets LaVonda Renfro Chief Retail Officer 32 years of banking experience Former Retail Executive of Colonial Bank/BB&T Former Senior Vice President, District Manager for Bank of America’s Austin and San Antonio markets Angela Harper Chief Risk Officer 25 years of banking experience Former Senior Vice President, Credit Administration Officer and Risk Management Officer for the Texas Region of Colonial Bank

Commitment to Delivering Shareholder Value Source: SNL Financial and Company documents; information as of and for the year ended unless otherwise noted. Note: Reconciliation of the non-GAAP financial measure tangible book value per share can be found at the end of the presentation. Loans & Deposits 10 Tangible Book Value per Share Return on Average Assets Efficiency Ratio (Dollars in Millions, Except Per Share) 0.03% 0.31% 0.58% 0.75% 0.98% 1.06% 2011 2012 2013 2014 2015 2016 92.2% 78.0% 69.8% 66.5% 60.8% 55.5% 2011 2012 2013 2014 2015 2016 $298 $398 $495 $603 $821 $992 $365 $448 $574 $639 $868 $1,120 2011 2012 2013 2014 2015 2016 Total Loans Total Deposits $5.28 $5.77 $6.46 $8.96 $9.59 $13.81 2011 2012 2013 2014 2015 2016

Veritex Plan for 2017 11 Focus on seamless integration of the Sovereign acquisition Maintain strong underwriting standards and excellent credit quality Continue strong pace of organic growth in loans and EPS Add experienced bankers to enhance our growth profile Seek accretive acquisitions that strengthen our presence in new and existing markets We are committed to the significant ongoing expansion of Veritex and expect the robust pace of our growth and momentum to continue

12 Reconciliation of Non-GAAP Measures The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance including tangible book value per common share and tangible common equity to tangible assets. The Company has included in this presentation information related to these non-GAAP financial measures for the applicable periods presented. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the table below. (Dollars in Thousands, Except Per Share) Source: Company documents. 2011 2012 2013 2014 2015 2016 Total Stockholders' Equity 58,676$ 61,860$ 66,239$ 113,312$ 132,046$ 238,888$ Preferred Stock (8,000) (8,000) (8,000) (8,000) - - Common Equity 50,676 53,860 58,239 105,312 132,046 238,888 Goodwill (19,148) (19,148) (19,148) (19,148) (26,865) (26,865) Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181) Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 209,842 Common Shares Outstanding 5,554 5,694 5,805 9,471 10,712 15,195 Tangible Book Value per Share 5.28$ 5.77$ 6.46$ 8.96$ 9.59$ 13.81$ Total Assets 437,820$ 524,127$ 664,971$ 802,286$ 1,039,600$ 1,408,350$ G odwill (19,148) (19,148) (19,148) (19,148) (26,865) (26,865) Intangible Assets (2,183) (1,875) (1,567) (1,261) (2,410) (2,181) Tangible Assets 416,489 503,104 644,256 781,877 1,010,325 1,379,304 Tangible Common Equity 29,345 32,837 37,524 84,903 102,771 209,842 TCE / TA 7.0% 6.5% 5.8% 10.9% 10.2% 15.2% As of December 31,

13