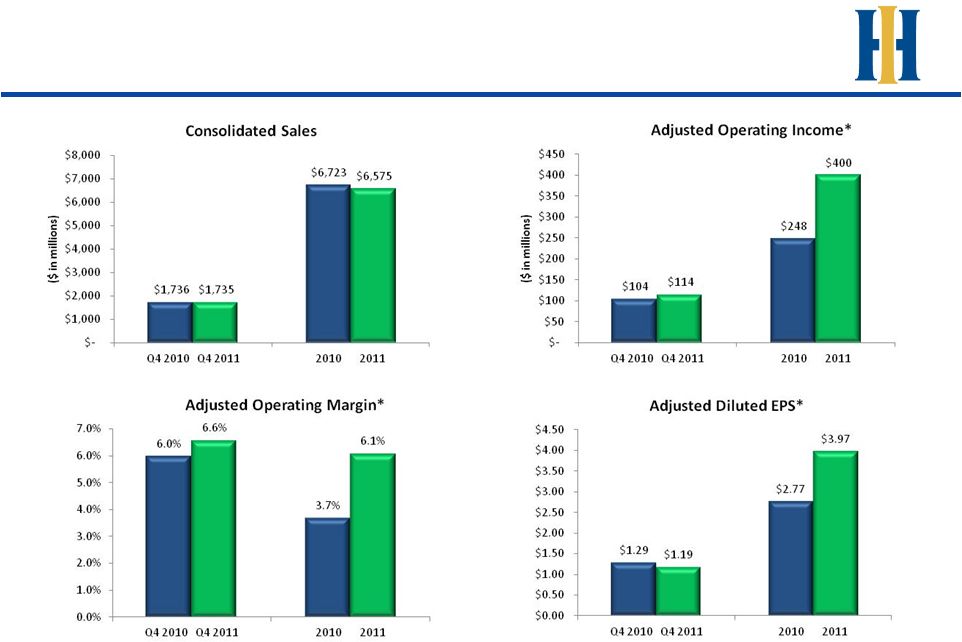

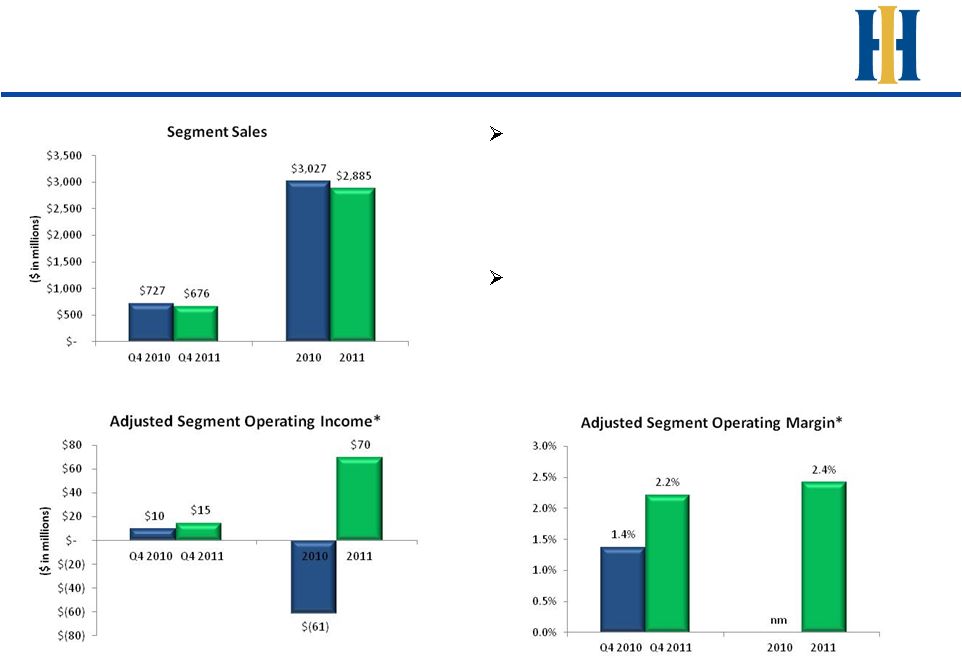

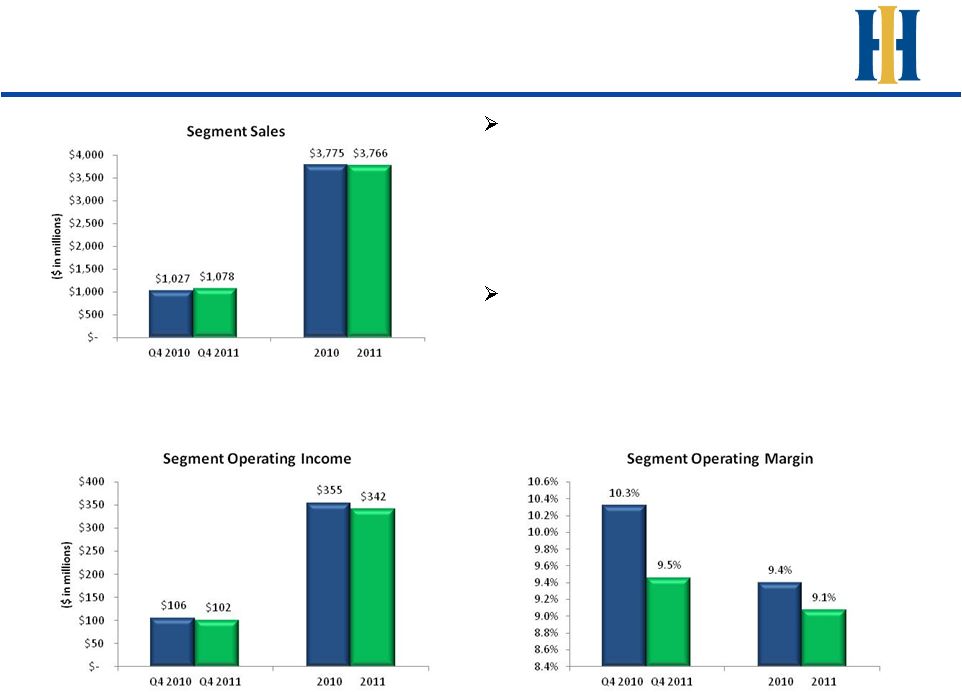

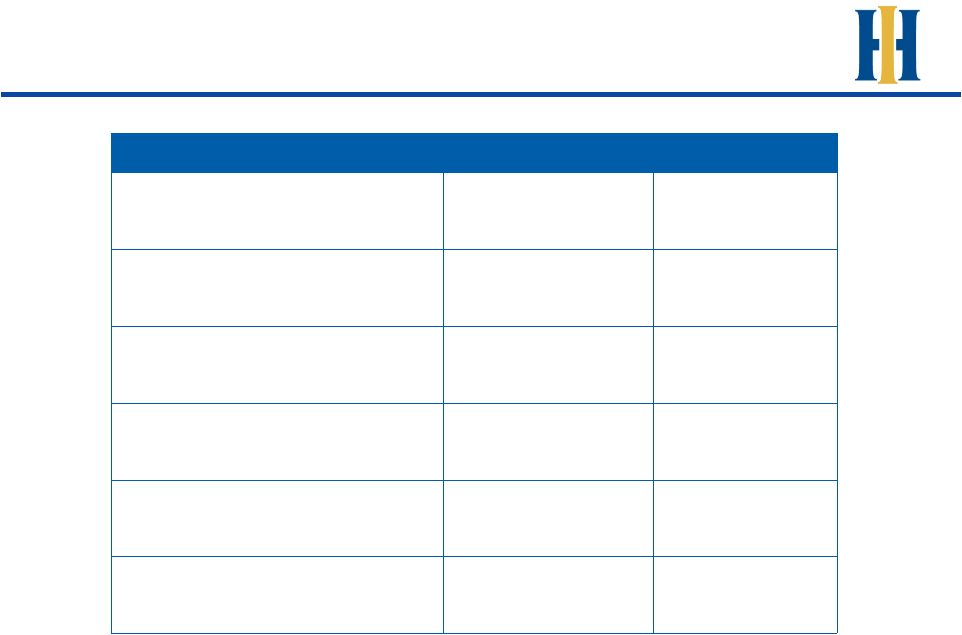

Reconciliation of Non-GAAP Measure – Adjusted Figures 12 (1) Adjusted diluted average common shares outstanding is a non-GAAP measure defined as weighted average common shares outstanding plus the dilutive effect of stock options and stock awards. This measure has been provided for consistency and comparability of the 2011 results with earnings per share from prior periods. (2) Adjusted diluted EPS is a non-GAAPmeasure defined as earnings per share before the per share 2011 goodwill impairmentcharge impact. Adjusted diluted EPS has been provided forconsistencyand comparability of theresults with results of operations from prior periods. (3) Per share amounts are based on basic weighted average shares outstanding, as use of dilutive securities (ie. stock options and stock awards) would result in a lesser per share loss for 2011. Three Months Ended Year Ended December 31 December 31 $ in millions 2011 2010 2011 2010 Sales and Service Revenues Ingalls 676 $ 727 $ 2,885 $ 3,027 $ Newport News 1,078 1,027 $ 3,766 3,775 $ Intersegment eliminations (19) (18) (76) (79) Total sales and service revenues 1,735 $ 1,736 $ 6,575 $ 6,723 $ Adjusted Operating Income (Loss) Ingalls 25 $ 10 $ (220) $ (61) $ Adjustment for goodwill impairment (10) - 290 - Adjusted Ingalls 15 10 70 (61) As a % of sales 2.2% 1.4% 2.4% -2.0% Newport News 102 106 342 355 Total Adjusted Segment Operating Income (Loss) 117 116 412 294 As a % of sales 6.7% 6.7% 6.3% 4.4% Non-segment factors affecting adjusted operating income Net pension and post-retirement benefits adjustment (4) (15) (13) (49) Deferred state income taxes 1 3 1 3 Total adjusted operating income (loss) 114 $ 104 $ 400 $ 248 $ As a % of sales 6.6% 6.0% 6.1% 3.7% Non-operating factors affecting adjusted net income Interest expense (29) (10) (104) (40) Federal income taxes (26) (29) (100) (71) Other, Net - (2) - (2) Total adjusted net earnings (loss) 59 $ 63 $ 196 $ 135 $ Per Share Amounts Weighted average common shares outstanding 48.9 48.8 48.8 48.8 Dilutive effect of stock options and stock awards 0.8 - 0.6 - Adjusted diluted average common shares outstanding (1) 49.7 48.8 49.4 48.8 Earnings Per Share (EPS) Calculations Adjusted net earnings from above 59 $ 63 $ 196 $ 135 $ Adjusted diluted average common shares outstanding (1) 49.7 48.8 49.4 48.8 Adjusted diluted earnings per share (2) 1.19 $ 1.29 $ 3.97 $ 2.77 $ Reported net income (loss) 69 $ (94) $ Weighted average common shares outstanding (3) 48.9 48.8 Basic earnings (loss) per share 1.41 $ (1.93) $ Diluted average common shares outstanding 49.7 48.8 Diluted earnings (loss) per share 1.39 $ (1.93) $ |