HII Q2 2022 Earnings August 4, 2022 Chris Kastner President and Chief Executive Officer Tom Stiehle Executive Vice President and Chief Financial Officer Exhibit 99.2

Cautionary Statement Regarding Forward-looking Statements Statements in this presentation, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by words such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue," and similar words or phrases or the negative of these words or phrases. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by these forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable when made, we cannot guarantee future results, levels of activity, performance, or achievements. There are a number of important factors that could cause our actual results to differ materially from the results anticipated by our forward-looking statements, which include, but are not limited to: changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, and changes in customer short-range and long-range plans); our ability to estimate our future contract costs, including increases in costs due to inflation, and perform our contracts effectively; changes in procurement processes and government regulations and our ability to comply with such requirements; our ability to deliver our products and services at an affordable life cycle cost and compete within our markets; natural and environmental disasters and political instability; our ability to execute our strategic plan, including with respect to share repurchases, dividends, capital expenditures, and strategic acquisitions; adverse economic conditions in the United States and globally; health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic, and the impacts of vaccination mandates on our workforce; disruptions impacting the global supply, including those attributable to the ongoing COVID-19 pandemic and the ongoing conflict between Russia and Ukraine; our ability to effectively integrate the operations of Alion Science and Technology into our business; changes in key estimates and assumptions regarding our pension and retiree health care costs; security threats, including cyber security threats, and related disruptions; and other risk factors discussed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business, and we undertake no obligation to update any forward-looking statements. You should not place undue reliance on any forward-looking statements that we may make. This presentation also contains non-GAAP financial measures. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. 2

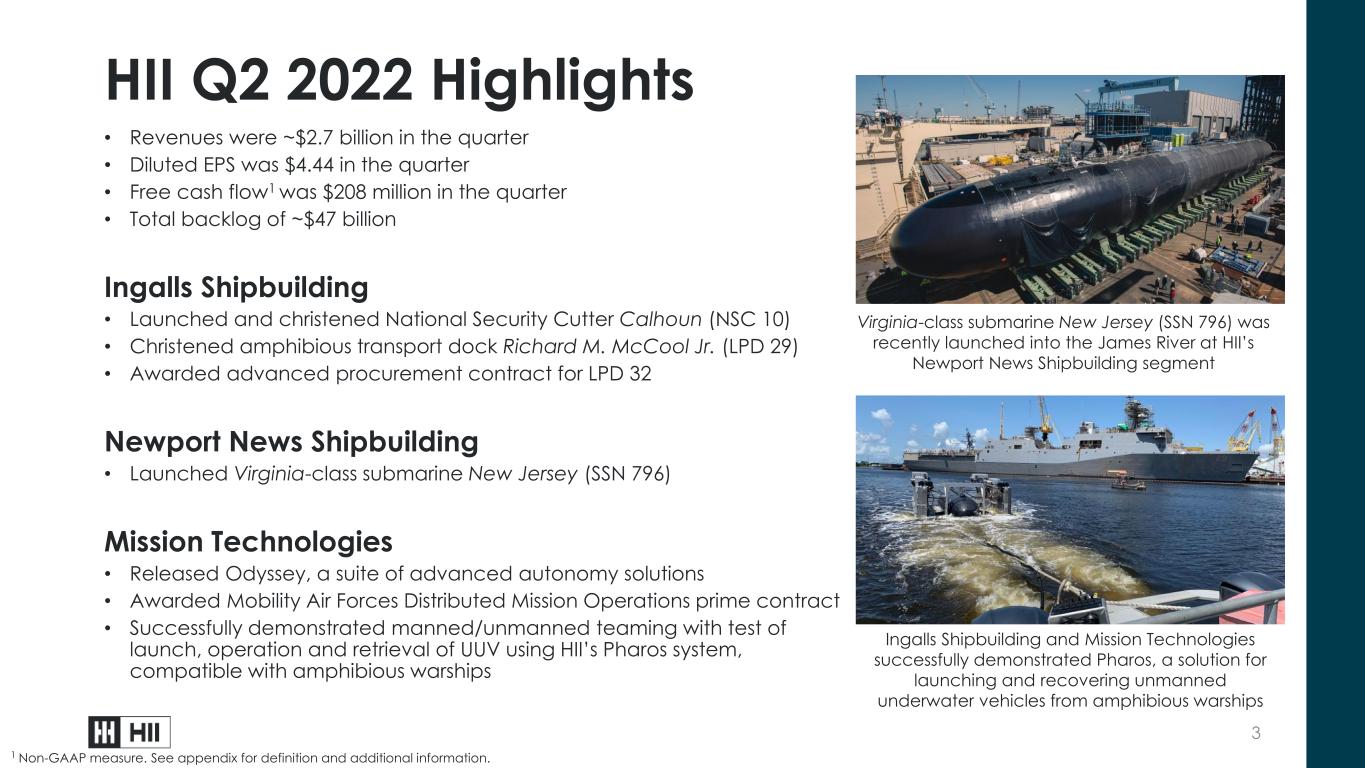

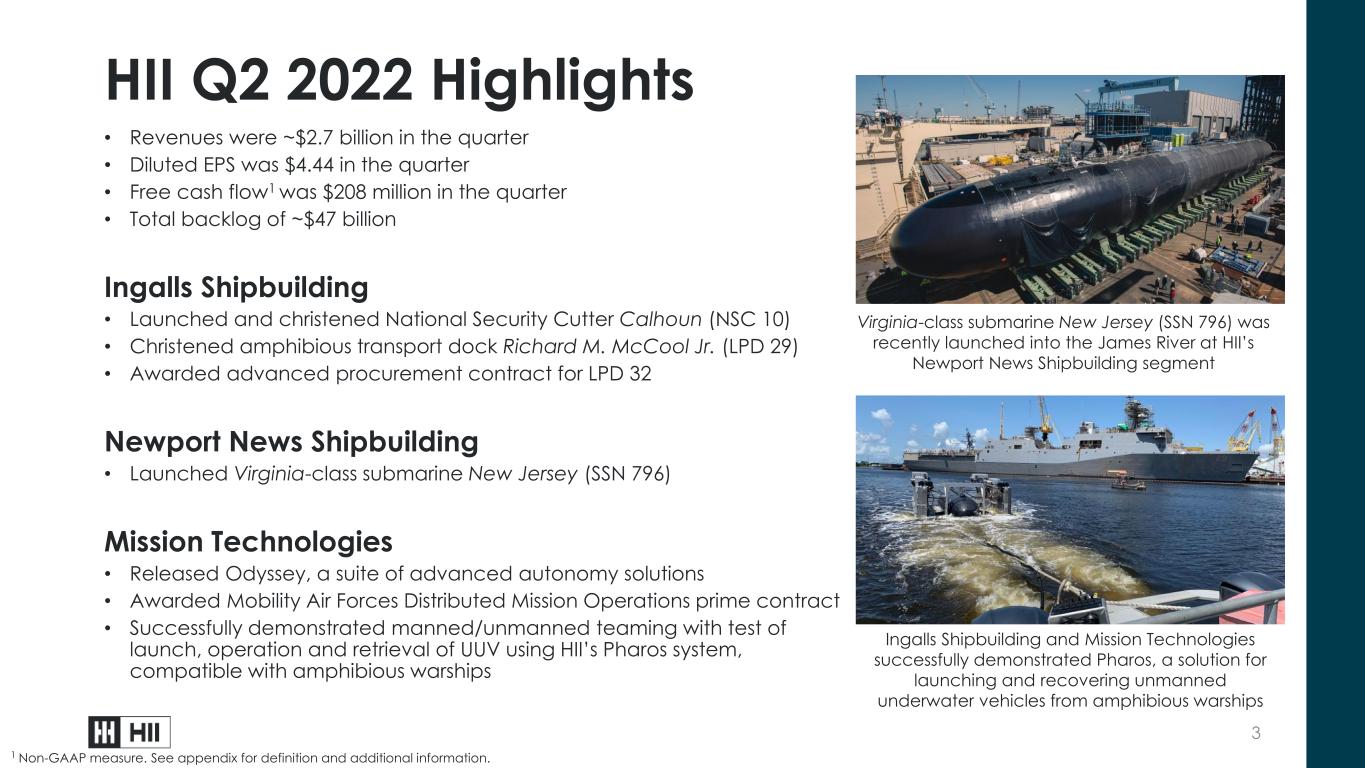

3 HII Q2 2022 Highlights • Revenues were ~$2.7 billion in the quarter • Diluted EPS was $4.44 in the quarter • Free cash flow1 was $208 million in the quarter • Total backlog of ~$47 billion Ingalls Shipbuilding • Launched and christened National Security Cutter Calhoun (NSC 10) • Christened amphibious transport dock Richard M. McCool Jr. (LPD 29) • Awarded advanced procurement contract for LPD 32 Newport News Shipbuilding • Launched Virginia-class submarine New Jersey (SSN 796) Mission Technologies • Released Odyssey, a suite of advanced autonomy solutions • Awarded Mobility Air Forces Distributed Mission Operations prime contract • Successfully demonstrated manned/unmanned teaming with test of launch, operation and retrieval of UUV using HII’s Pharos system, compatible with amphibious warships Virginia-class submarine New Jersey (SSN 796) was recently launched into the James River at HII’s Newport News Shipbuilding segment Ingalls Shipbuilding and Mission Technologies successfully demonstrated Pharos, a solution for launching and recovering unmanned underwater vehicles from amphibious warships 1 Non-GAAP measure. See appendix for definition and additional information.

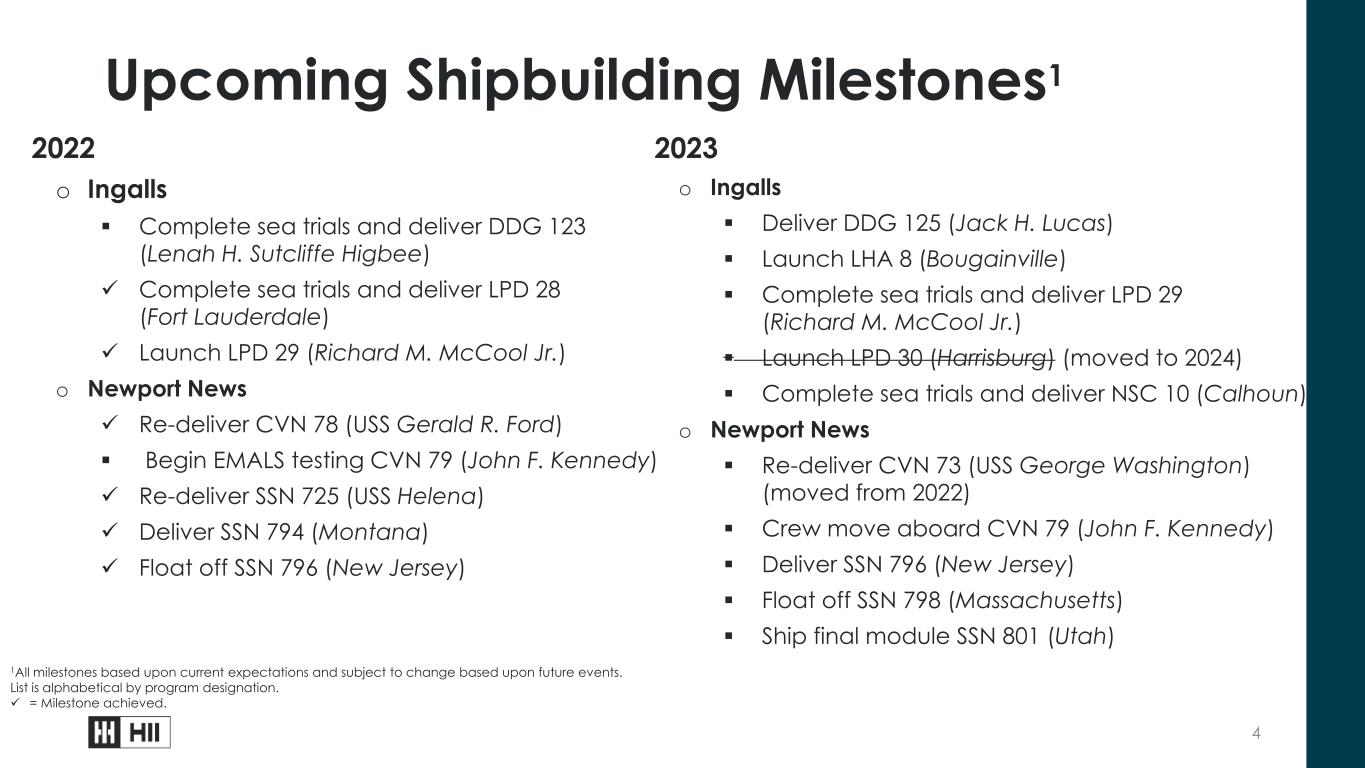

4 Upcoming Shipbuilding Milestones1 2022 o Ingalls Complete sea trials and deliver DDG 123 (Lenah H. Sutcliffe Higbee) Complete sea trials and deliver LPD 28 (Fort Lauderdale) Launch LPD 29 (Richard M. McCool Jr.) o Newport News Re-deliver CVN 78 (USS Gerald R. Ford) Begin EMALS testing CVN 79 (John F. Kennedy) Re-deliver SSN 725 (USS Helena) Deliver SSN 794 (Montana) Float off SSN 796 (New Jersey) 2023 o Ingalls Deliver DDG 125 (Jack H. Lucas) Launch LHA 8 (Bougainville) Complete sea trials and deliver LPD 29 (Richard M. McCool Jr.) Launch LPD 30 (Harrisburg) (moved to 2024) Complete sea trials and deliver NSC 10 (Calhoun) o Newport News Re-deliver CVN 73 (USS George Washington) (moved from 2022) Crew move aboard CVN 79 (John F. Kennedy) Deliver SSN 796 (New Jersey) Float off SSN 798 (Massachusetts) Ship final module SSN 801 (Utah) 1All milestones based upon current expectations and subject to change based upon future events. List is alphabetical by program designation. = Milestone achieved.

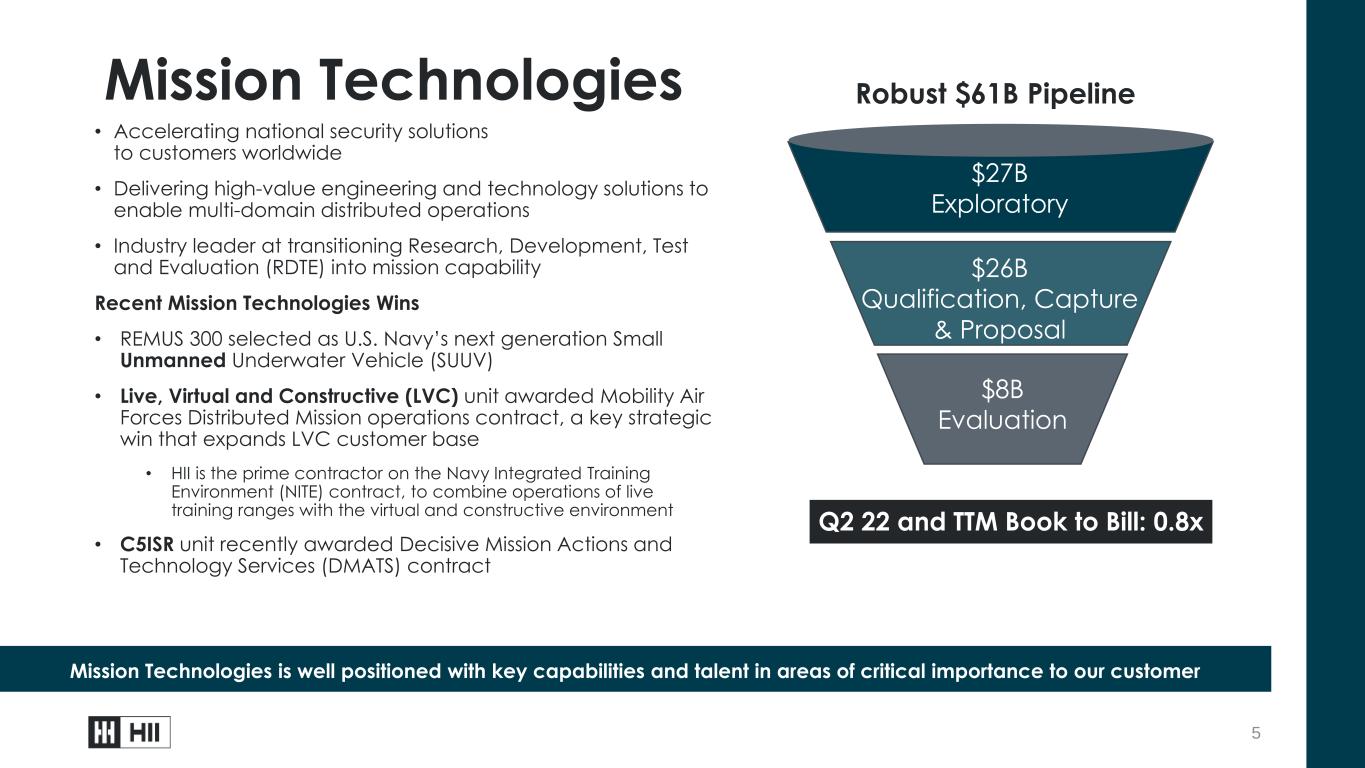

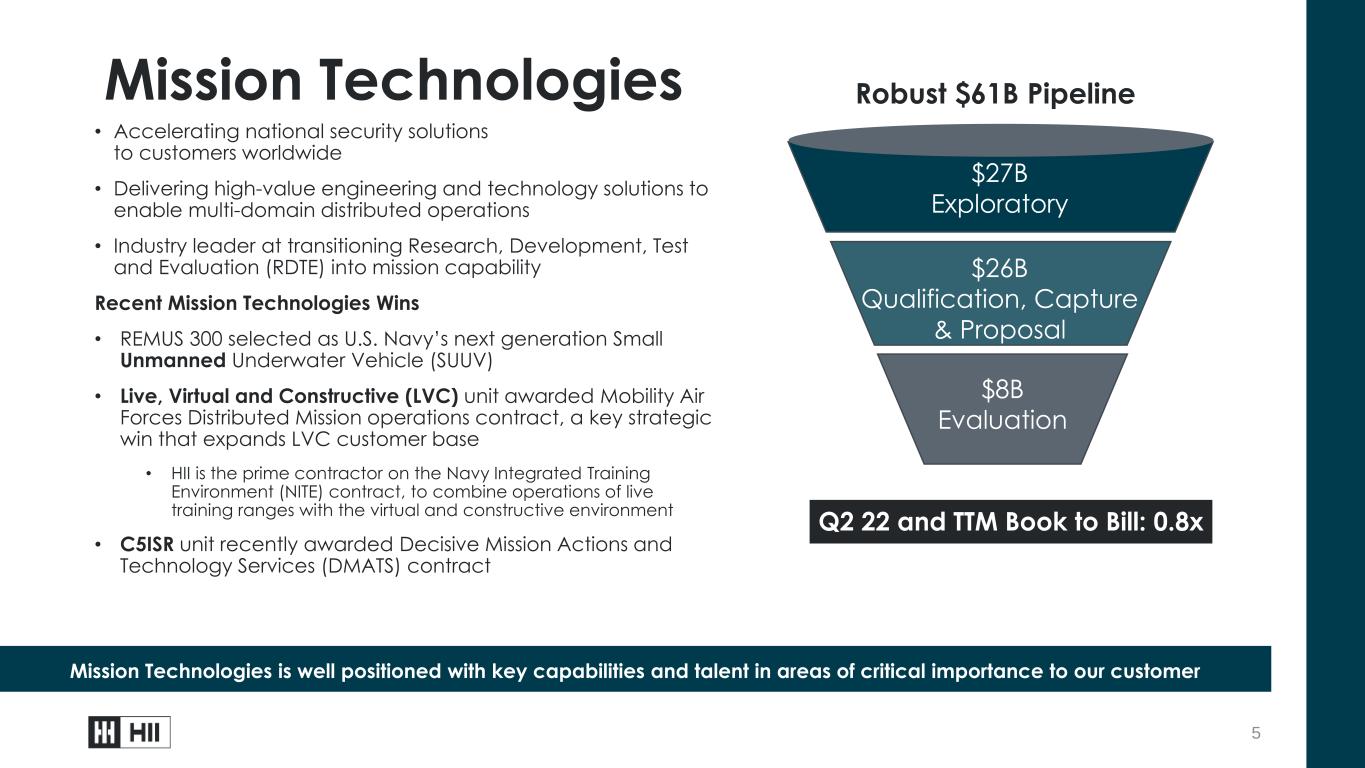

• Accelerating national security solutions to customers worldwide • Delivering high-value engineering and technology solutions to enable multi-domain distributed operations • Industry leader at transitioning Research, Development, Test and Evaluation (RDTE) into mission capability Recent Mission Technologies Wins • REMUS 300 selected as U.S. Navy’s next generation Small Unmanned Underwater Vehicle (SUUV) • Live, Virtual and Constructive (LVC) unit awarded Mobility Air Forces Distributed Mission operations contract, a key strategic win that expands LVC customer base • HII is the prime contractor on the Navy Integrated Training Environment (NITE) contract, to combine operations of live training ranges with the virtual and constructive environment • C5ISR unit recently awarded Decisive Mission Actions and Technology Services (DMATS) contract 5 Mission Technologies is well positioned with key capabilities and talent in areas of critical importance to our customer Mission Technologies Q2 22 and TTM Book to Bill: 0.8x Robust $61B Pipeline $27B Exploratory $26B Qualification, Capture & Proposal $8B Evaluation

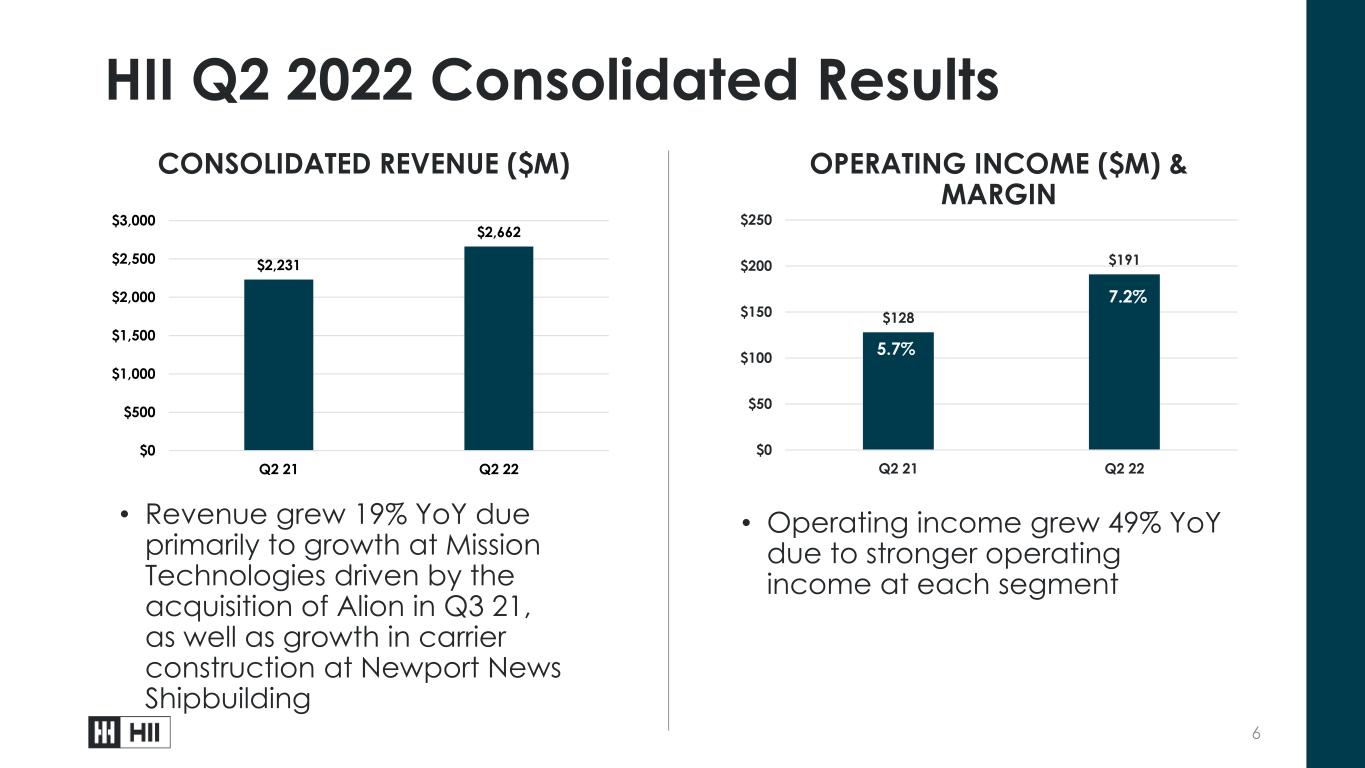

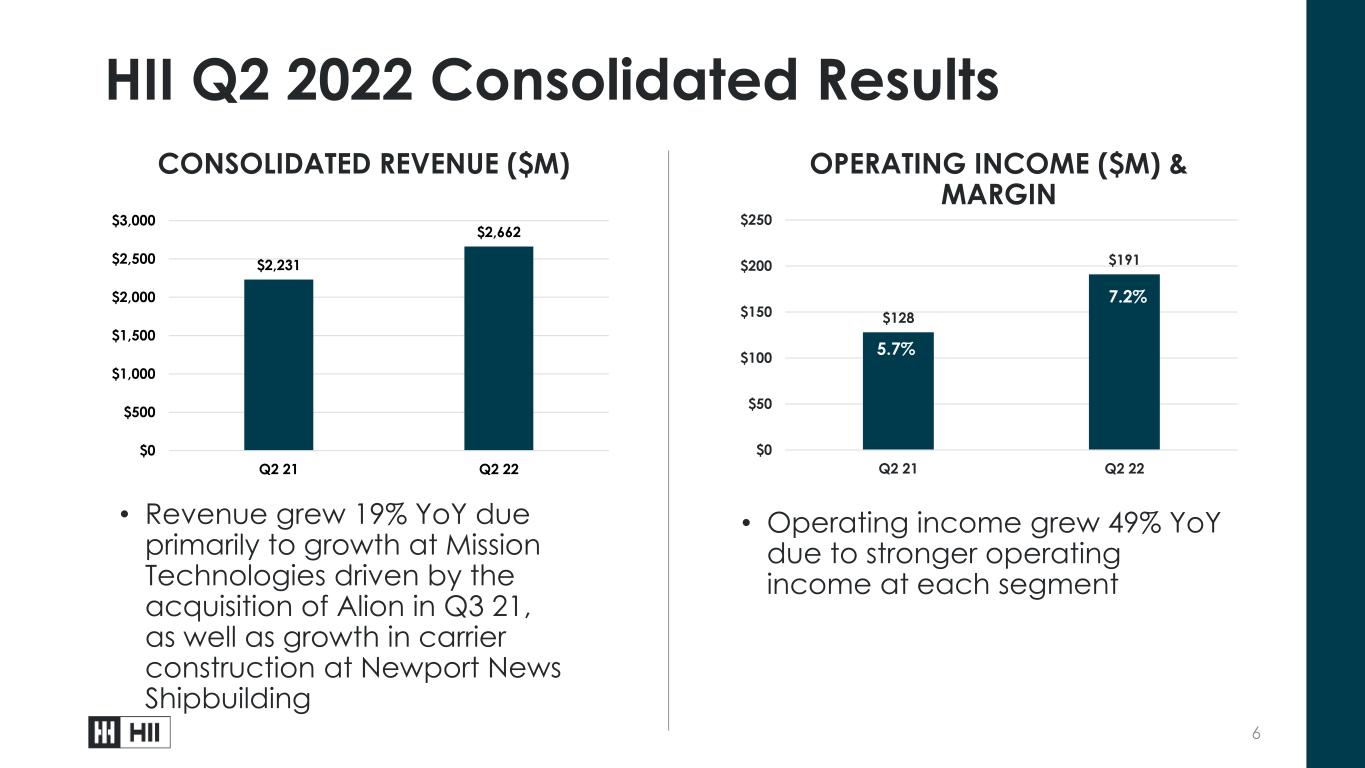

6 HII Q2 2022 Consolidated Results • Revenue grew 19% YoY due primarily to growth at Mission Technologies driven by the acquisition of Alion in Q3 21, as well as growth in carrier construction at Newport News Shipbuilding • Operating income grew 49% YoY due to stronger operating income at each segment $2,231 $2,662 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q2 21 Q2 22 CONSOLIDATED REVENUE ($M) OPERATING INCOME ($M) & MARGIN $128 $191 $0 $50 $100 $150 $200 $250 Q2 21 Q2 22 5.7% 7.2%

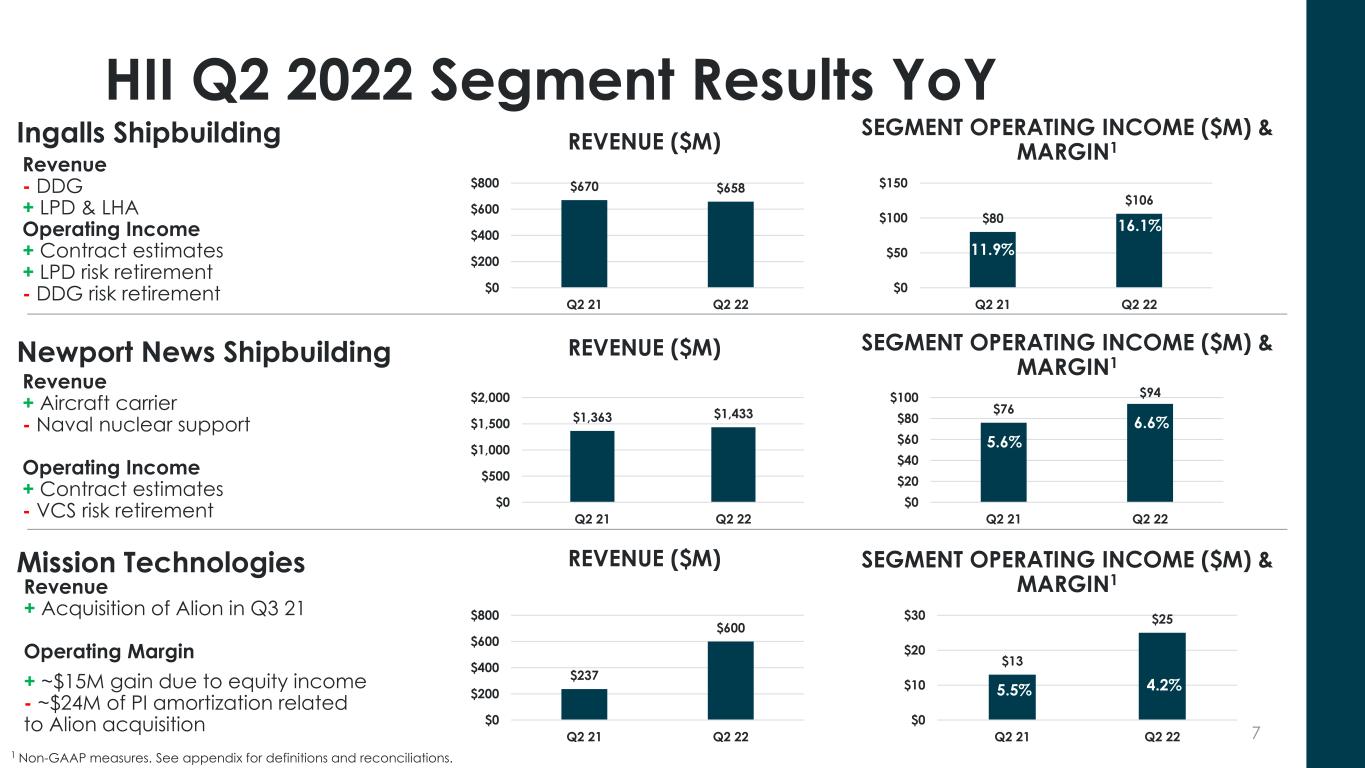

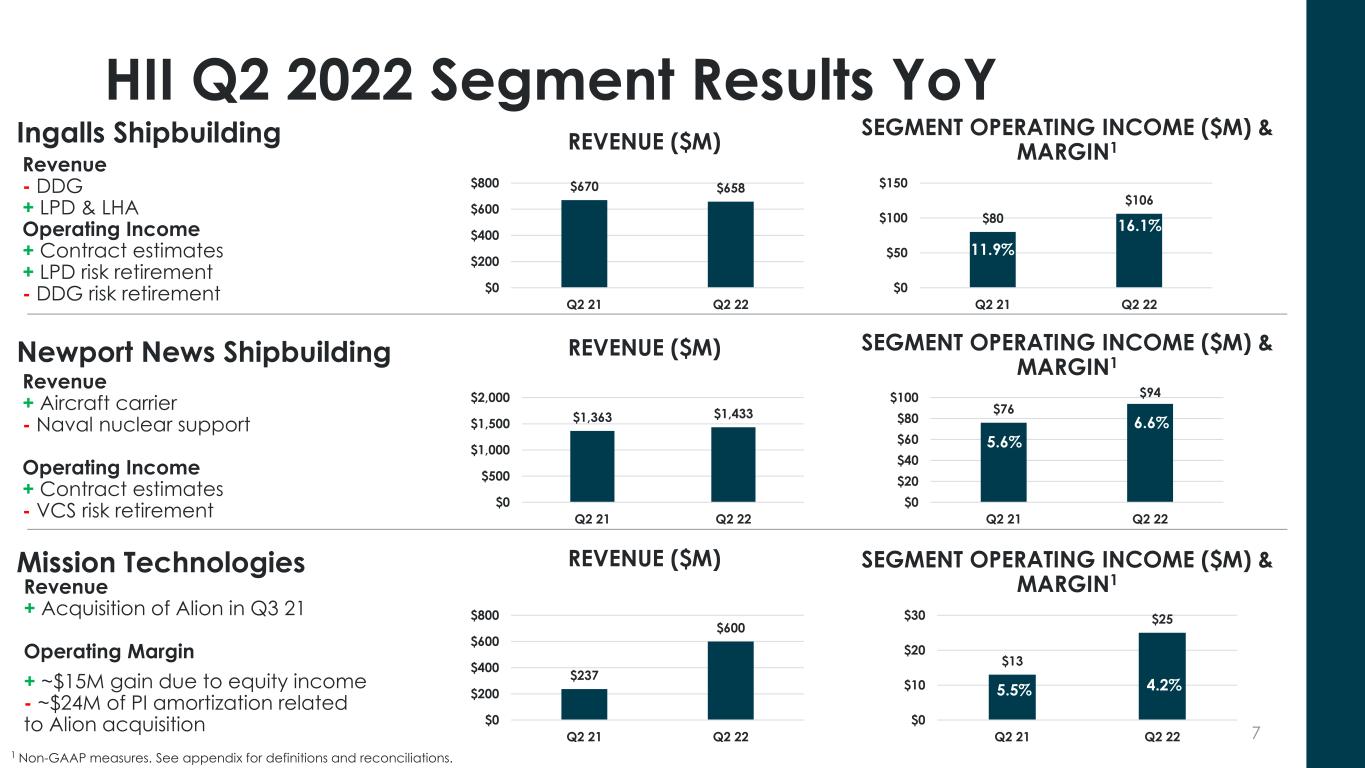

7 HII Q2 2022 Segment Results YoY Revenue - DDG + LPD & LHA Operating Income + Contract estimates + LPD risk retirement - DDG risk retirement Newport News Shipbuilding Ingalls Shipbuilding Mission Technologies REVENUE ($M) SEGMENT OPERATING INCOME ($M) & MARGIN1 REVENUE ($M) Revenue + Aircraft carrier - Naval nuclear support Operating Income + Contract estimates - VCS risk retirement REVENUE ($M) Revenue + Acquisition of Alion in Q3 21 Operating Margin + ~$15M gain due to equity income - ~$24M of PI amortization related to Alion acquisition $670 $658 $0 $200 $400 $600 $800 Q2 21 Q2 22 $1,363 $1,433 $0 $500 $1,000 $1,500 $2,000 Q2 21 Q2 22 $237 $600 $0 $200 $400 $600 $800 Q2 21 Q2 22 $80 $106 $0 $50 $100 $150 Q2 21 Q2 22 $76 $94 $0 $20 $40 $60 $80 $100 Q2 21 Q2 22 $13 $25 $0 $10 $20 $30 Q2 21 Q2 22 1 Non-GAAP measures. See appendix for definitions and reconciliations. 11.9% 16.1% 5.6% 6.6% 5.5% 4.2% SEGMENT OPERATING INCOME ($M) & MARGIN1 SEGMENT OPERATING INCOME ($M) & MARGIN1

$46 $47 $21 $17 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q2 21 Q2 22 Dividends Share Repurchases (at cost) $96 $267 ($73) ($59) $23 $208 ($100) ($50) $0 $50 $100 $150 $200 $250 $300 Cash from Ops. CAPEX Free Cash Flow 8 HII Q2 2022 Capital Deployment • Cash balance of $375 million and liquidity of $1.9 billion at quarter-end • Capital expenditures were 2.2% of revenues • Cash contributions to pension and other postretirement benefit plans were $11 million • $64 million distributed to shareholders in the quarter • Repurchased 80 thousand shares at a cost of $17 million • Paid dividends of $47 million Q2 21 Q2 22 CASH FLOW GENERATION ($M) SHAREHOLDER DISTRIBUTIONS ($M) TOTAL $67 TOTAL $64 1 Non-GAAP measure. See appendix for definition and reconciliation. 1

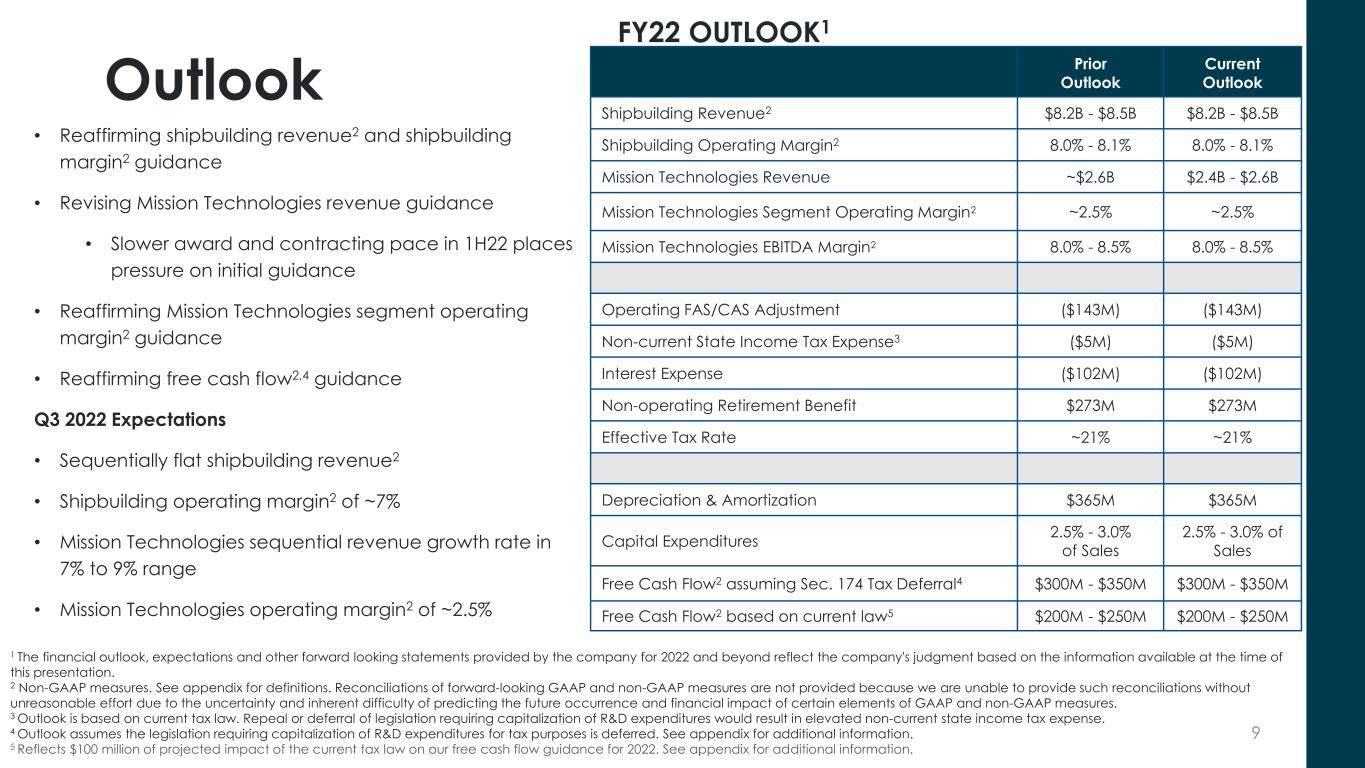

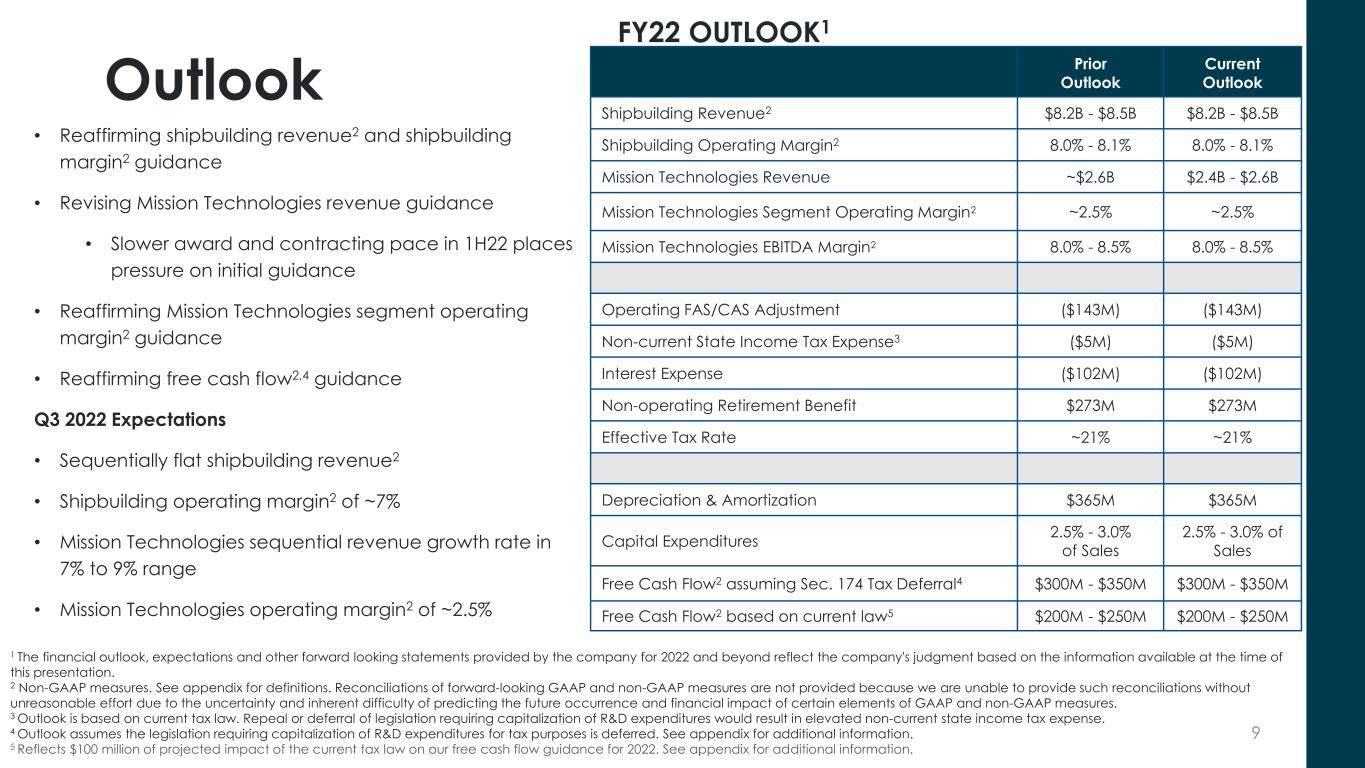

9 Outlook Prior Outlook Current Outlook Shipbuilding Revenue2 $8.2B - $8.5B $8.2B - $8.5B Shipbuilding Operating Margin2 8.0% - 8.1% 8.0% - 8.1% Mission Technologies Revenue ~$2.6B $2.4B - $2.6B Mission Technologies Segment Operating Margin2 ~2.5% ~2.5% Mission Technologies EBITDA Margin2 8.0% - 8.5% 8.0% - 8.5% Operating FAS/CAS Adjustment ($143M) ($143M) Non-current State Income Tax Expense3 ($5M) ($5M) Interest Expense ($102M) ($102M) Non-operating Retirement Benefit $273M $273M Effective Tax Rate ~21% ~21% Depreciation & Amortization $365M $365M Capital Expenditures 2.5% - 3.0% of Sales 2.5% - 3.0% of Sales Free Cash Flow2 assuming Sec. 174 Tax Deferral4 $300M - $350M $300M - $350M Free Cash Flow2 based on current law5 $200M - $250M $200M - $250M FY22 OUTLOOK1 • Reaffirming shipbuilding revenue2 and shipbuilding margin2 guidance • Revising Mission Technologies revenue guidance • Slower award and contracting pace in 1H22 places pressure on initial guidance • Reaffirming Mission Technologies segment operating margin2 guidance • Reaffirming free cash flow2,4 guidance Q3 2022 Expectations • Sequentially flat shipbuilding revenue2 • Shipbuilding operating margin2 of ~7% • Mission Technologies sequential revenue growth rate in 7% to 9% range • Mission Technologies operating margin2 of ~2.5% 1 The financial outlook, expectations and other forward looking statements provided by the company for 2022 and beyond reflect the company's judgment based on the information available at the time of this presentation. 2 Non-GAAP measures. See appendix for definitions. Reconciliations of forward-looking GAAP and non-GAAP measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the future occurrence and financial impact of certain elements of GAAP and non-GAAP measures. 3 Outlook is based on current tax law. Repeal or deferral of legislation requiring capitalization of R&D expenditures would result in elevated non-current state income tax expense. 4 Outlook assumes the legislation requiring capitalization of R&D expenditures for tax purposes is deferred. See appendix for additional information. 5 Reflects $100 million of projected impact of the current tax law on our free cash flow guidance for 2022. See appendix for additional information.

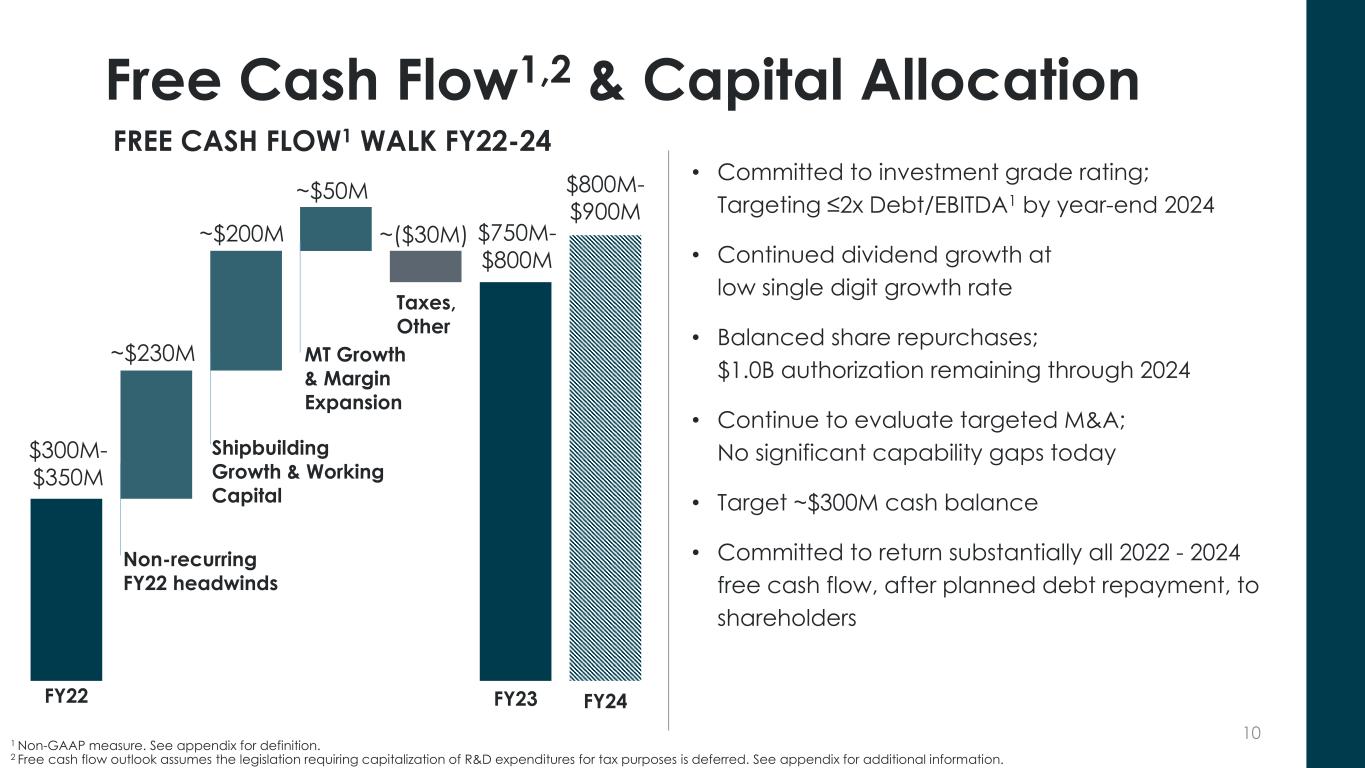

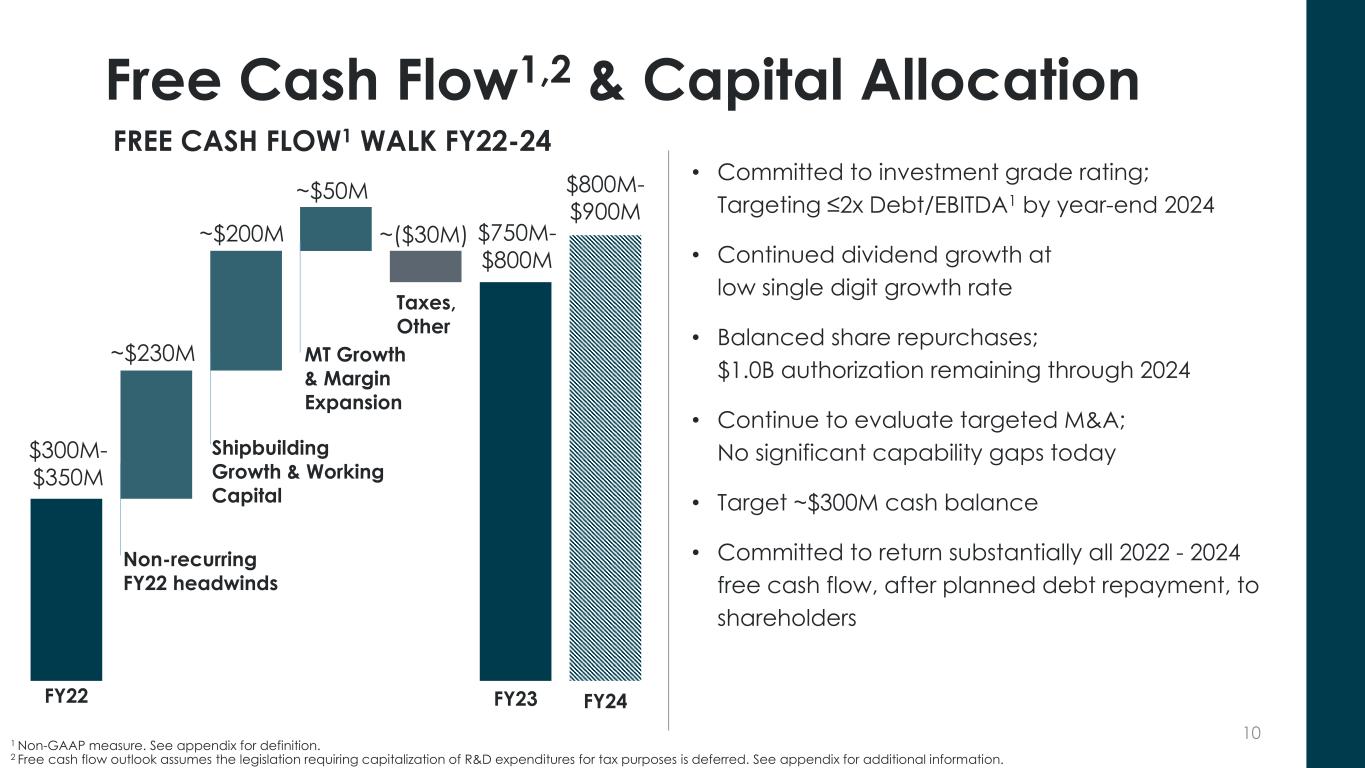

10 Free Cash Flow1,2 & Capital Allocation FY22 $300M- $350M FY23 $750M- $800M ~$230M Non-recurring FY22 headwinds Shipbuilding Growth & Working Capital MT Growth & Margin Expansion ~$200M ~$50M ~($30M) Taxes, Other FY24 $800M- $900M • Committed to investment grade rating; Targeting ≤2x Debt/EBITDA1 by year-end 2024 • Continued dividend growth at low single digit growth rate • Balanced share repurchases; $1.0B authorization remaining through 2024 • Continue to evaluate targeted M&A; No significant capability gaps today • Target ~$300M cash balance • Committed to return substantially all 2022 - 2024 free cash flow, after planned debt repayment, to shareholders 1 Non-GAAP measure. See appendix for definition. 2 Free cash flow outlook assumes the legislation requiring capitalization of R&D expenditures for tax purposes is deferred. See appendix for additional information. FREE CASH FLOW1 WALK FY22-24

INVESTMENT THESIS POSITIONED FOR SUCCESS; EXECUTION FOCUSED Historic backlog and positioning provide strong visibility Consistent long-term shipbuilding growth profile Reshaped Mission Technologies portfolio to address evolving customer needs in high growth markets 11 Nearing sustainable free cash flow inflection point Commitment to return substantially all free cash flow, after planned debt repayment, to shareholders 2022 - 2024

Appendix 12

Non-GAAP Information 13 We make reference to “segment operating income,” “segment operating margin,” “shipbuilding revenue,” “shipbuilding operating margin,” “Mission Technologies EBITDA margin,” “Debt/EBITDA” and “free cash flow.” We internally manage our operations by reference to segment operating income and segment operating margin, which are not recognized measures under GAAP. When analyzing our operating performance, investors should use segment operating income and segment operating margin in addition to, and not as alternatives for, operating income and operating margin or any other performance measure presented in accordance with GAAP. They are measures that we use to evaluate our core operating performance. We believe that segment operating income and segment operating margin reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. We believe these measures are used by investors and are a useful indicator to measure our performance. Because not all companies use identical calculations, our presentation of segment operating income and segment operating margin may not be comparable to similarly titled measures of other companies. Shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin are not measures recognized under GAAP. They are measures that we use to evaluate our core operating performance. We believe that shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin reflect additional ways of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. When analyzing our operating performance, investors should use shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin in addition to, and not as alternatives for, operating income and operating margin or any other performance measure presented in accordance with GAAP. We believe these measures are used by investors and are a useful indicator to measure our performance. Free cash flow is not a measure recognized under GAAP. Free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, net earnings as a measure of our performance or net cash provided or used by operating activities as a measure of our liquidity. We believe free cash flow is an important measure for our investors because it provides them insight into our current and period-to-period performance and our ability to generate cash from continuing operations. We also use free cash flow as a key operating metric in assessing the performance of our business and as a key performance measure in evaluating management performance and determining incentive compensation. Free cash flow may not be comparable to similarly titled measures of other companies. A provision of the Tax Cuts and Jobs Act of 2017 went into effect on Jan. 1, 2022 that requires companies to capitalize and amortize research and development costs over five years rather than deducting such costs in the year incurred for tax purposes. Unless the provision is deferred, modified, or repealed, we currently estimate that this change could have a $100 million impact on our free cash flow guidance for 2022, which currently assumes the legislation will be deferred, modified or repealed. Unless the provision is deferred, modified, or repealed, we currently estimate that this change could have a $250 million impact on our free cash flow guidance for 2022 through 2024, which currently assumes the legislation will be deferred, modified or repealed. The Debt/EBITDA ratio is not a measure recognized under GAAP. We believe the Debt/EBITDA ratio is useful to management, investors and other users of our financial information in evaluating the total amount of leverage in our capital structure. Reconciliations of forward-looking GAAP and non-GAAP measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the future occurrence and financial impact of certain elements of GAAP and non-GAAP measures.

Non-GAAP Measures Definitions 14 Debt/EBITDA is defined as gross debt divided by net earnings before interest expense, income taxes, depreciation and amortization. Segment operating income is defined as operating income for the relevant segment(s) before the Operating FAS/CAS Adjustment and non-current state income taxes. Segment operating margin is defined as segment operating income as a percentage of sales and service revenues. Shipbuilding revenue is defined as the combined sales and service revenues from our Newport News Shipbuilding segment and Ingalls Shipbuilding segment. Shipbuilding operating margin is defined as the combined segment operating income of our Newport News Shipbuilding segment and Ingalls Shipbuilding segment as a percentage of shipbuilding revenue. Mission Technologies EBITDA margin is defined as Mission Technologies segment operating income before interest expense, income taxes, depreciation, and amortization as a percentage of Mission Technologies revenues. Free cash flow is defined as net cash provided by (used in) operating activities less capital expenditures net of related grant proceeds. Operating FAS/CAS Adjustment is defined as the difference between the service cost component of our pension and other postretirement expense determined in accordance with GAAP (FAS) and our pension and other postretirement expense under U.S. Cost Accounting Standards (CAS). Non-current state income taxes are defined as deferred state income taxes, which reflect the change in deferred state tax assets and liabilities and the tax expense or benefit associated with changes in state uncertain tax positions in the relevant period. These amounts are recorded within operating income. Current period state income tax expense is charged to contract costs and included in cost of sales and service revenues in segment operating income. We present financial measures adjusted for the Operating FAS/CAS Adjustment and non-current state income taxes to reflect the company’s performance based upon the pension costs and state tax expense charged to our contracts under CAS. We use these adjusted measures as internal measures of operating performance and for performance-based compensation decisions.

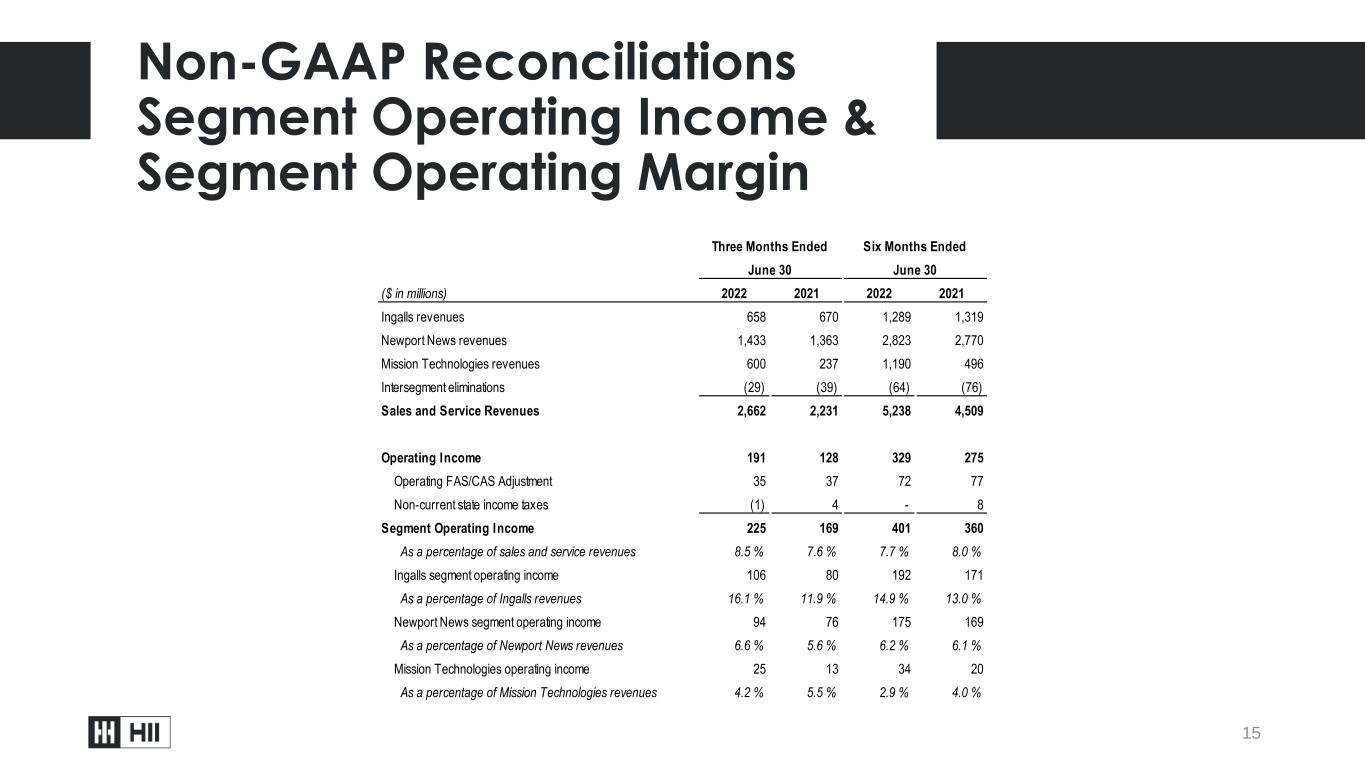

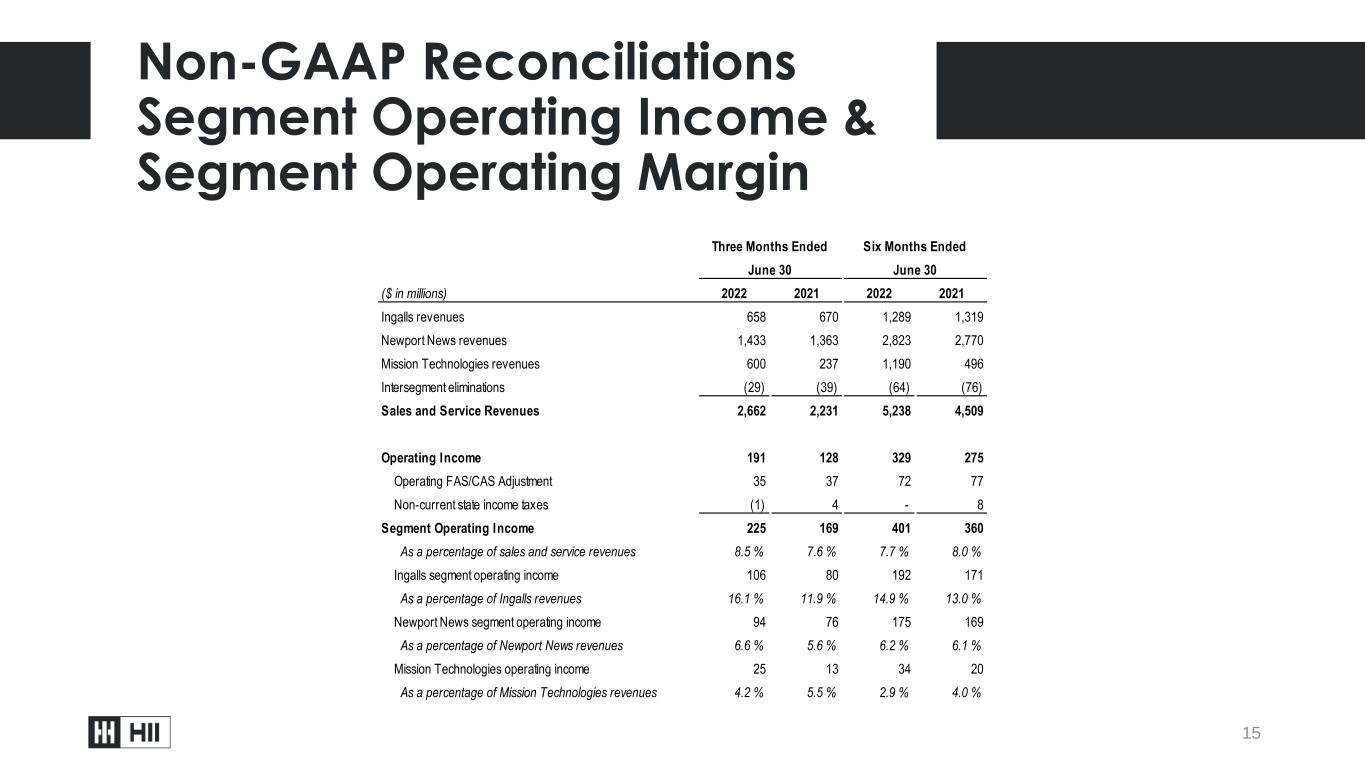

Non-GAAP Reconciliations Segment Operating Income & Segment Operating Margin 15 ($ in millions) 2022 2021 2022 2021 Ingalls revenues 658 670 1,289 1,319 Newport News revenues 1,433 1,363 2,823 2,770 Mission Technologies revenues 600 237 1,190 496 Intersegment eliminations (29) (39) (64) (76) Sales and Service Revenues 2,662 2,231 5,238 4,509 Operating Income 191 128 329 275 Operating FAS/CAS Adjustment 35 37 72 77 Non-current state income taxes (1) 4 - 8 Segment Operating Income 225 169 401 360 As a percentage of sales and service revenues 8.5 % 7.6 % 7.7 % 8.0 % Ingalls segment operating income 106 80 192 171 As a percentage of Ingalls revenues 16.1 % 11.9 % 14.9 % 13.0 % Newport News segment operating income 94 76 175 169 As a percentage of Newport News revenues 6.6 % 5.6 % 6.2 % 6.1 % Mission Technologies operating income 25 13 34 20 As a percentage of Mission Technologies revenues 4.2 % 5.5 % 2.9 % 4.0 % Three Months Ended June 30 June 30 Six Months Ended

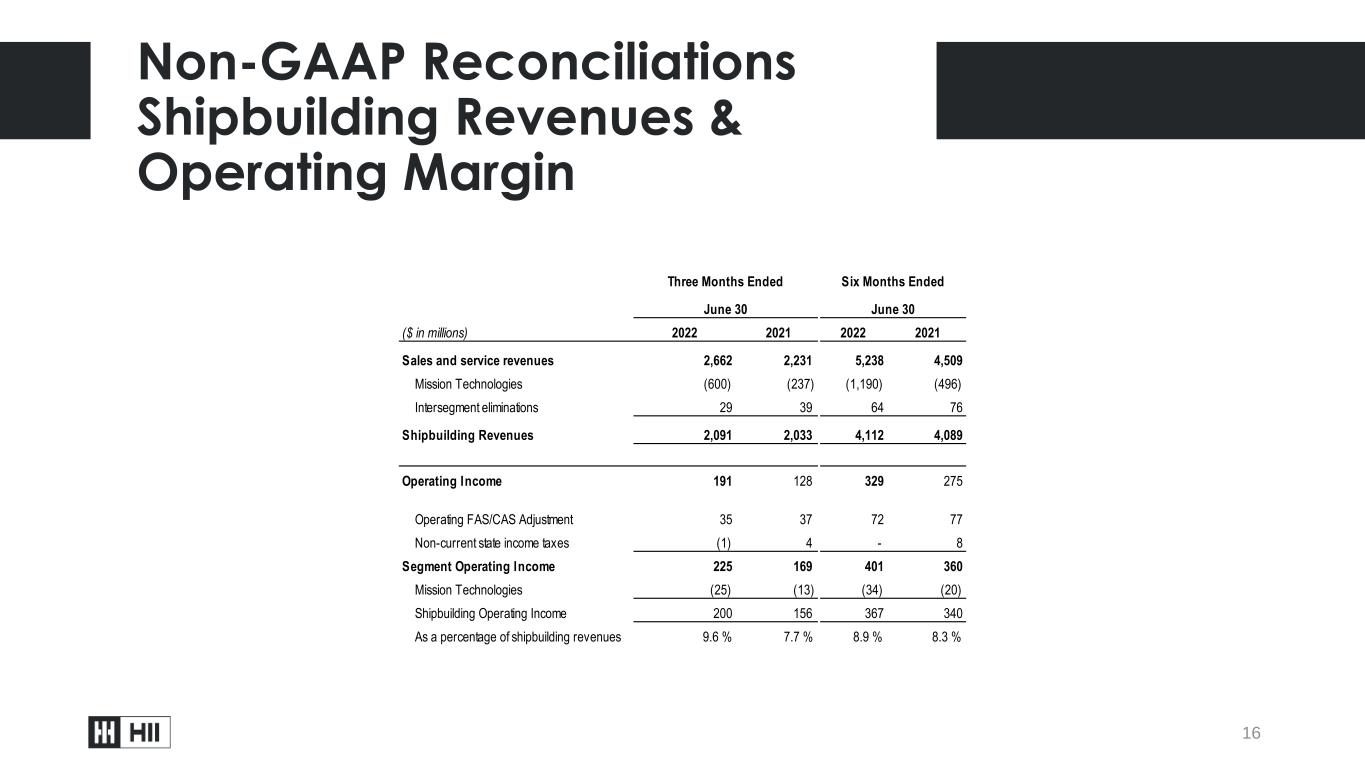

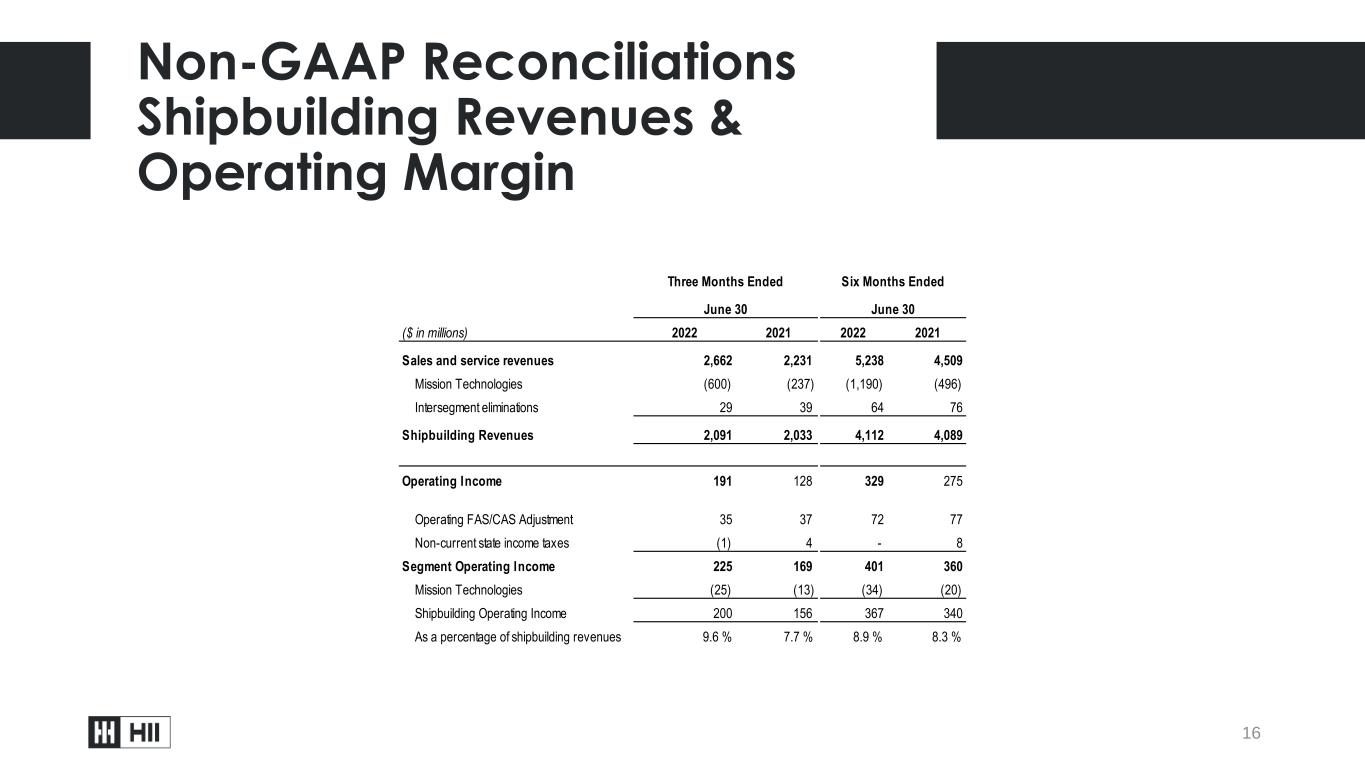

Non-GAAP Reconciliations Shipbuilding Revenues & Operating Margin 16 ($ in millions) 2022 2021 2022 2021 Sales and service revenues 2,662 2,231 5,238 4,509 Mission Technologies (600) (237) (1,190) (496) Intersegment eliminations 29 39 64 76 Shipbuilding Revenues 2,091 2,033 4,112 4,089 Operating Income 191 128 329 275 Operating FAS/CAS Adjustment 35 37 72 77 Non-current state income taxes (1) 4 - 8 Segment Operating Income 225 169 401 360 Mission Technologies (25) (13) (34) (20) Shipbuilding Operating Income 200 156 367 340 As a percentage of shipbuilding revenues 9.6 % 7.7 % 8.9 % 8.3 % Three Months Ended June 30 June 30 Six Months Ended

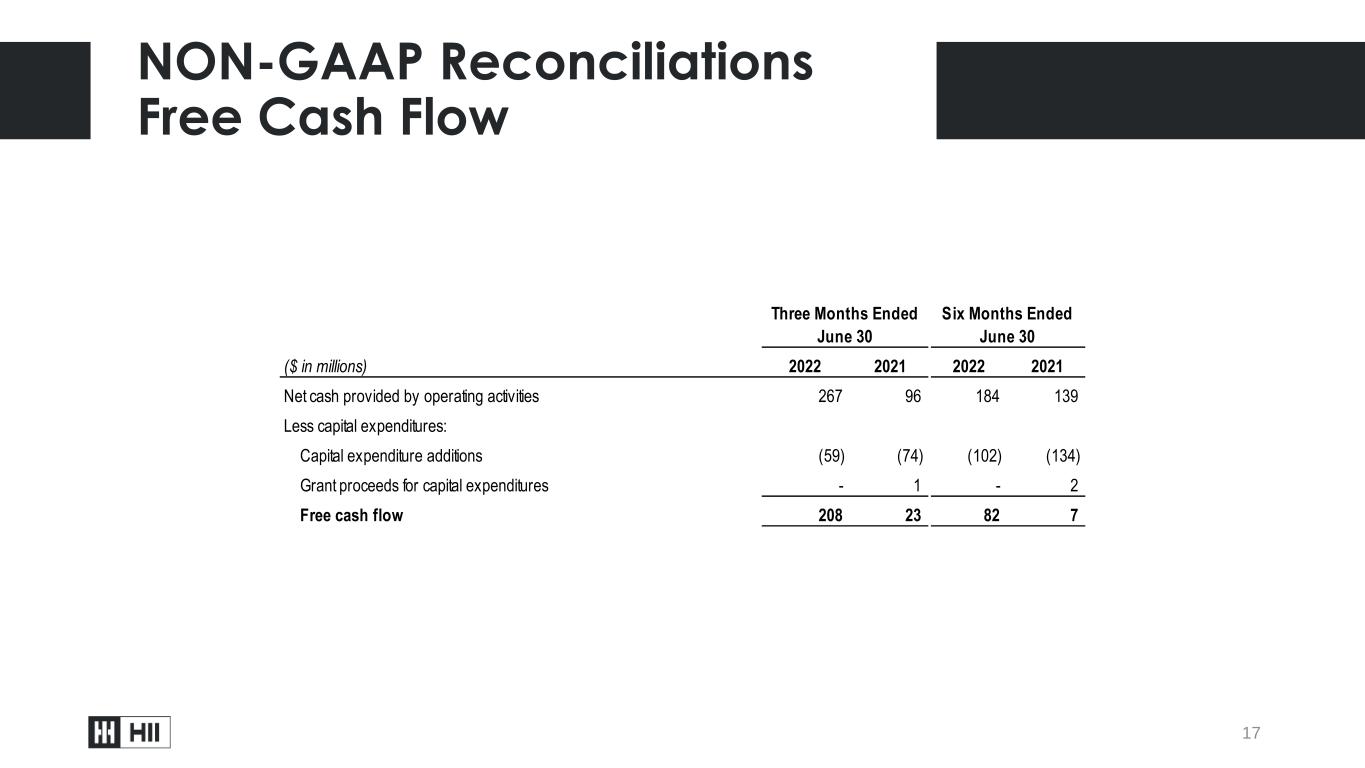

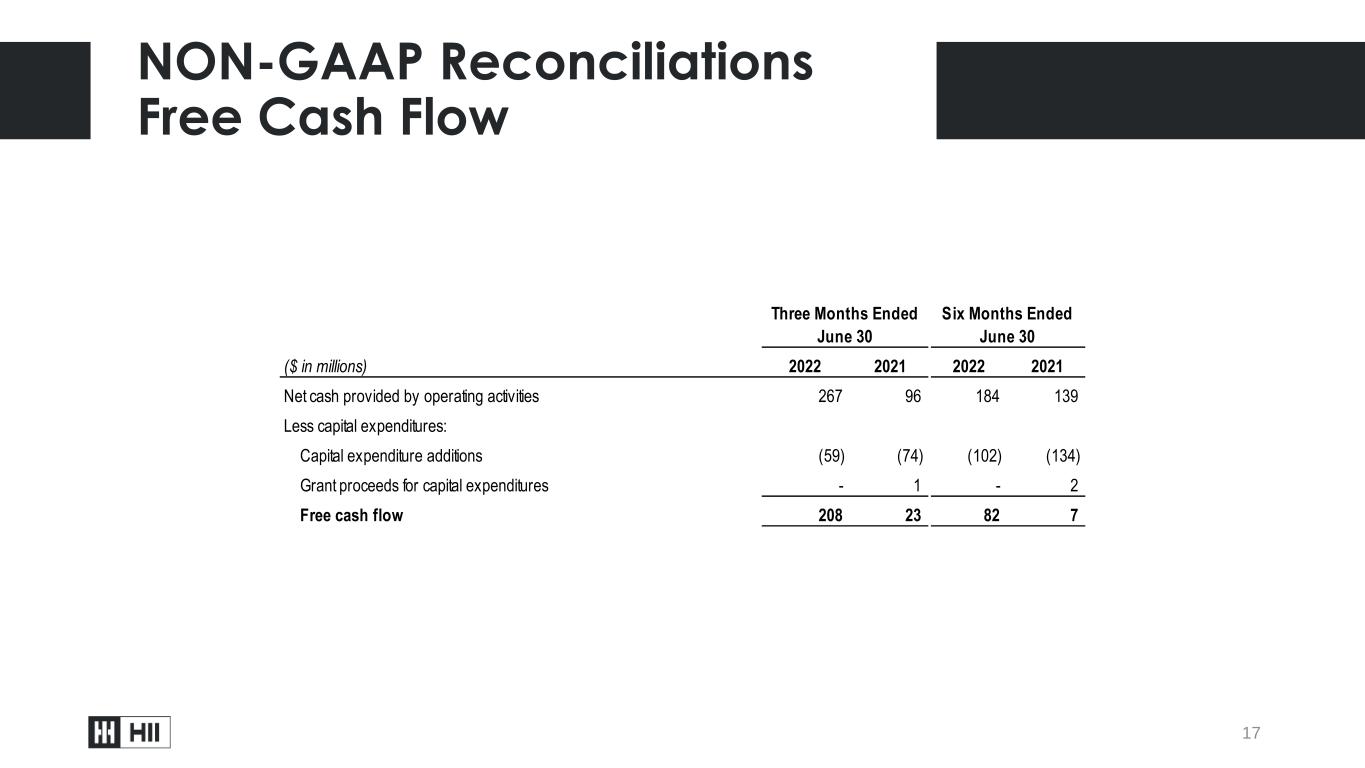

NON-GAAP Reconciliations Free Cash Flow 17 ($ in millions) 2022 2021 2022 2021 Net cash provided by operating activities 267 96 184 139 Less capital expenditures: Capital expenditure additions (59) (74) (102) (134) Grant proceeds for capital expenditures - 1 - 2 Free cash flow 208 23 82 7 Three Months Ended June 30 Six Months Ended June 30

18