HII Q3 2022 Earnings November 3, 2022 Chris Kastner President and Chief Executive Officer Tom Stiehle Executive Vice President and Chief Financial Officer

Cautionary Statement Regarding Forward-looking Statements 2 Statements in this presentation, other than statements of historical fact, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. You can generally identify forward-looking statements by words such as "may," "will," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue," and similar wordsor phrases or the negative of these words or phrases. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, levels of activ ity, performance, or achievements to be materially different from any future results, levels of activ ity, performance, or achievements expressed or implied by these forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable when made, we cannot guarantee future results, levels of activ ity, performance, or achievements. There are a number of important factors that could cause our actual results to differ materially from the results anticipated by our forward-looking statements, which include, but are not limited to: changes in government and customer priorities and requirements (including government budgetary constraints, shifts in defense spending, and changes in customer short-range and long-range plans); our ability to estimate our future contract costs, including increases in costs due to inflation, and perform our contracts effectively; changes in procurement processes and government regulations and our ability to comply with such requirements; our ability to deliver our products and serv ices at an affordable life cycle cost and compete within our markets; natural and environmental disasters and political instability; our ability to execute our strategic plan, including with respect to share repurchases, div idends, capital expenditures, and strategic acquisitions; adverse economic conditions in the United States and globally; health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic, and the impacts of vaccination mandates on our workforce; our ability to attract and retain a qualified workforce; disruptions impacting the global supply, including those attributable to the ongoing COVID-19 pandemic and the ongoing conflict between Russia and Ukraine; our ability to effectively integrate the operations of Alion Science and Technology into our business; changes in key estimates and assumptions regarding our pension and retiree health care costs; security threats, including cyber security threats, and related disruptions; and other risk factors discussed in our filings with the U.S. Securities and Exchange Commission. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business, and we undertake no obligation to update any forward-looking statements. You should not place undue reliance on any forward-looking statements that we may make. This presentation also contains non-GAAP financial measures. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures.

3 HII Q3 2022 Highlights • Revenues were ~$2.6 billion in the quarter • Diluted EPS was $3.44 in the quarter • Total backlog of ~$47 billion Ingalls Shipbuilding • Awarded a design engineering contract for the next-generation guided-missile destroyer • Authenticated the keel of guided-missile destroyer Jeremiah Dent on (DDG 129) • Awarded a contract to begin combat systems availability for the Zumwalt -class destroyer, Lyndon B. Johnson (DDG 1002) • Began fabrication of amphibious t ransport dock Pittsburgh (LPD 31) Newport News Shipbuilding • Turned over the 1,000th compartment of aircraft carrier John F. Kennedy (CVN 79) • Achieved pressure hull complete on Virginia-class submarine Massachuset t s (SSN 798) • Celebrated the ceremonial keel laying of aircraft carrier Ent erprise (CVN 80) Mission Technologies • Awarded a task order to provide spectrum assessments across technical, policy and strategy areas for the DoD Chief Information Officer • Awarded a $826 million task order to provide Decisive Mission Actions and Technology Services (DMATS) to the DoD • Awarded a $127 million task order to support the Defense Security Cooperation Agency (DSCA) to perform research, development, test and evaluation of emerging technologies San Antonio-class amphibious transport dock Fort Lauderdale (LPD 28) departed Ingalls Shipbuilding in July, following delivery earlier in the year Newport News Shipbuilding achieved pressure hull complete on Virginia-class submarine Massachusetts (SSN 798)

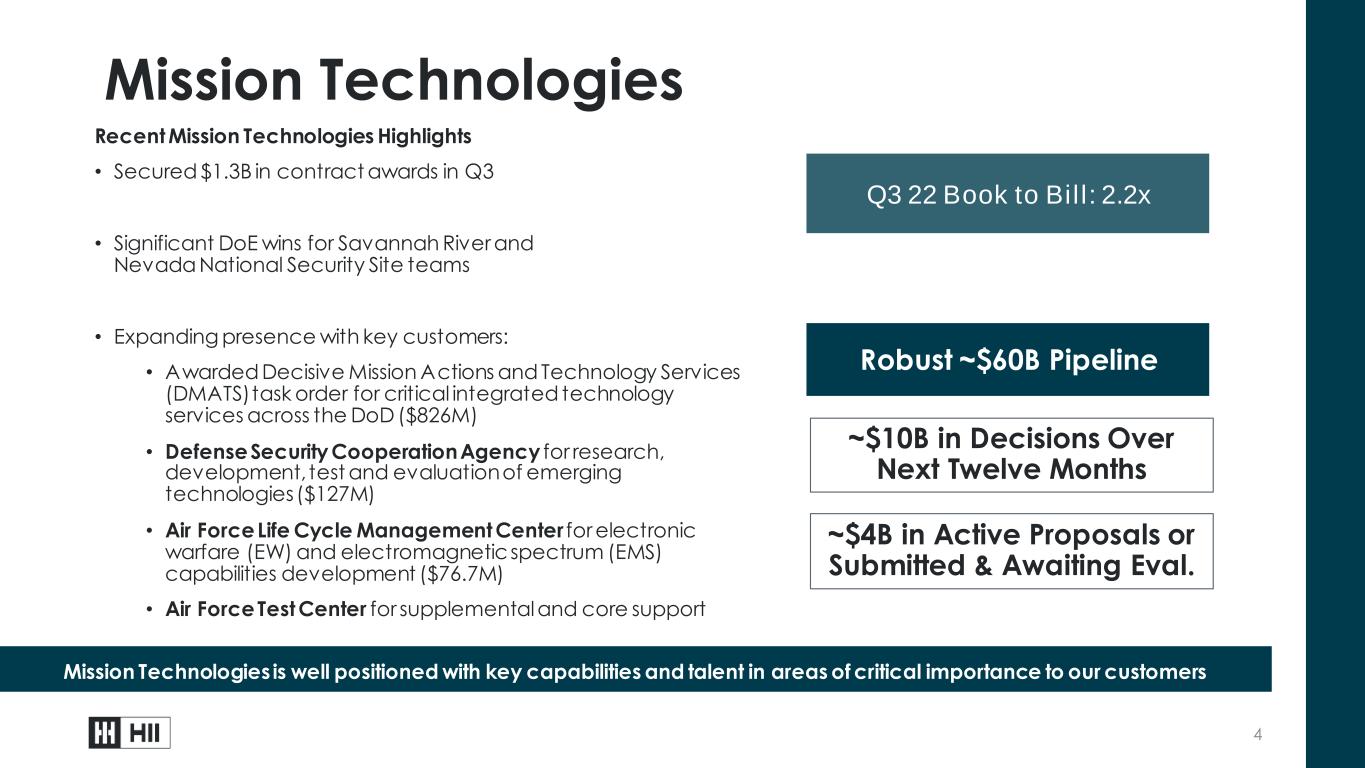

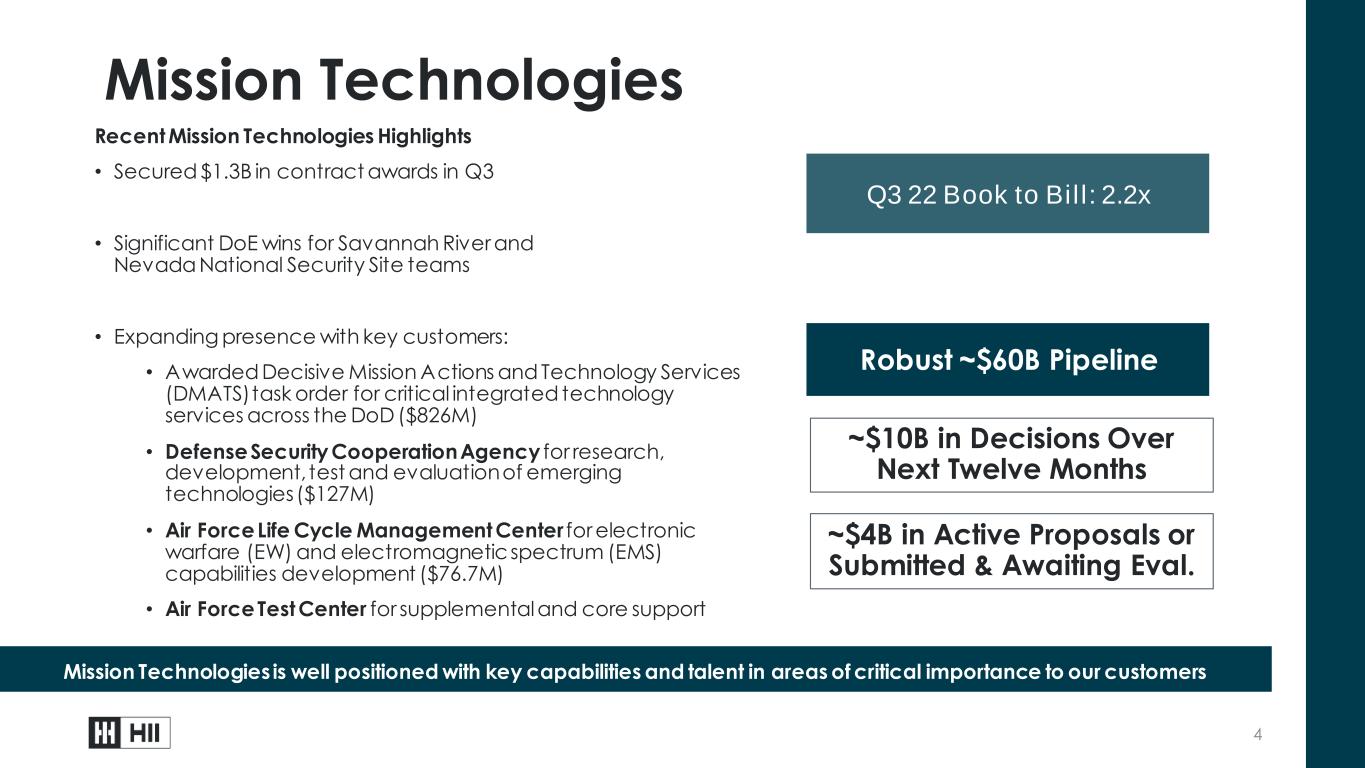

Q3 22 Book to Bill: 2.2x Recent Mission Technologies Highlights • Secured $1.3B in contract awards in Q3 • Significant DoE wins for Savannah River and Nevada National Security Site teams • Expanding presence with key customers: • Awarded Decisive Mission Actions and Technology Services (DMATS) task order for critical integrated technology services across the DoD ($826M) • Defense Security Cooperation Agency for research, development, test and evaluation of emerging technologies ($127M) • Air Force Life Cycle Management Center for electronic warfare (EW) and electromagnetic spectrum (EMS) capabilities development ($76.7M) • Air Force Test Center for supplemental and core support 4 Mission Technologies is well positioned with key capabilities and talent in areas of critical importance to our customers Mission Technologies Robust ~$60B Pipeline ~$10B in Decisions Over Next Twelve Months ~$4B in Active Proposals or Submitted & Awaiting Eval.

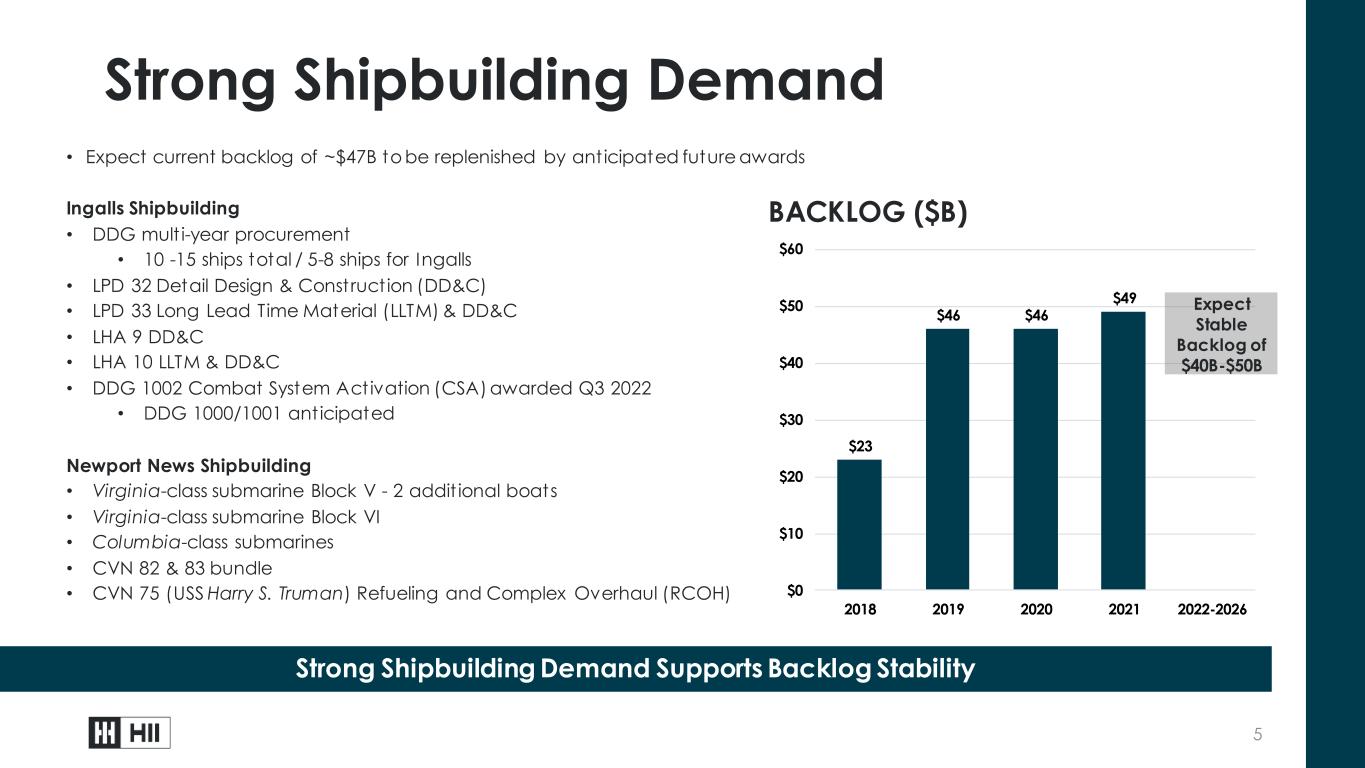

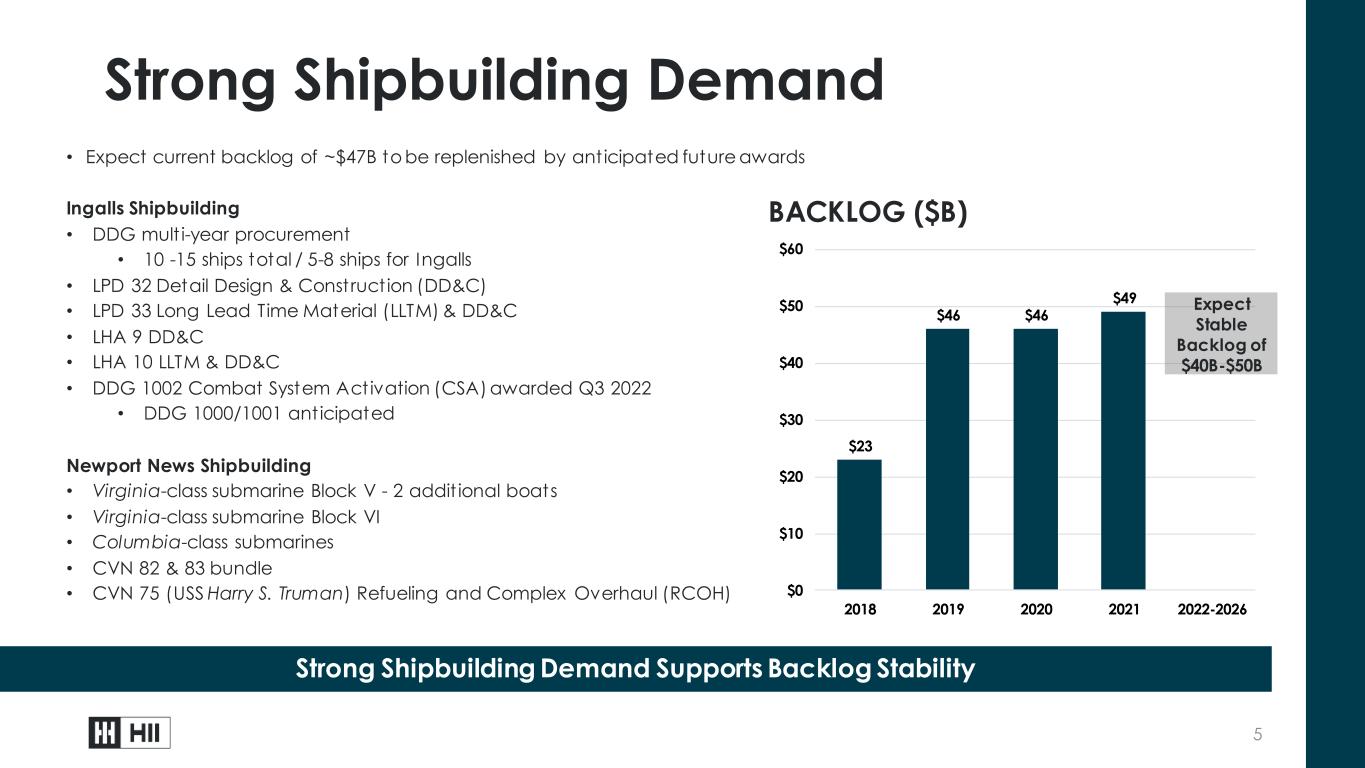

$23 $46 $46 $49 $0 $10 $20 $30 $40 $50 $60 2018 2019 2020 2021 2022-2026 • Expect current backlog of ~$47B to be replenished by anticipated future awards Ingalls Shipbuilding • DDG mult i-year procurement • 10 -15 ships total / 5-8 ships for Ingalls • LPD 32 Detail Design & Construct ion (DD&C) • LPD 33 Long Lead Time Material (LLTM) & DD&C • LHA 9 DD&C • LHA 10 LLTM & DD&C • DDG 1002 Combat System Activation (CSA) awarded Q3 2022 • DDG 1000/1001 anticipated Newport News Shipbuilding • Virginia-class submarine Block V - 2 addit ional boats • Virginia-class submarine Block VI • Columbia-class submarines • CVN 82 & 83 bundle • CVN 75 (USS Harry S. Truman) Refueling and Complex Overhaul (RCOH) 5 Strong Shipbuilding Demand Supports Backlog Stability Strong Shipbuilding Demand BACKLOG ($B) Expect Stable Backlog of $40B-$50B

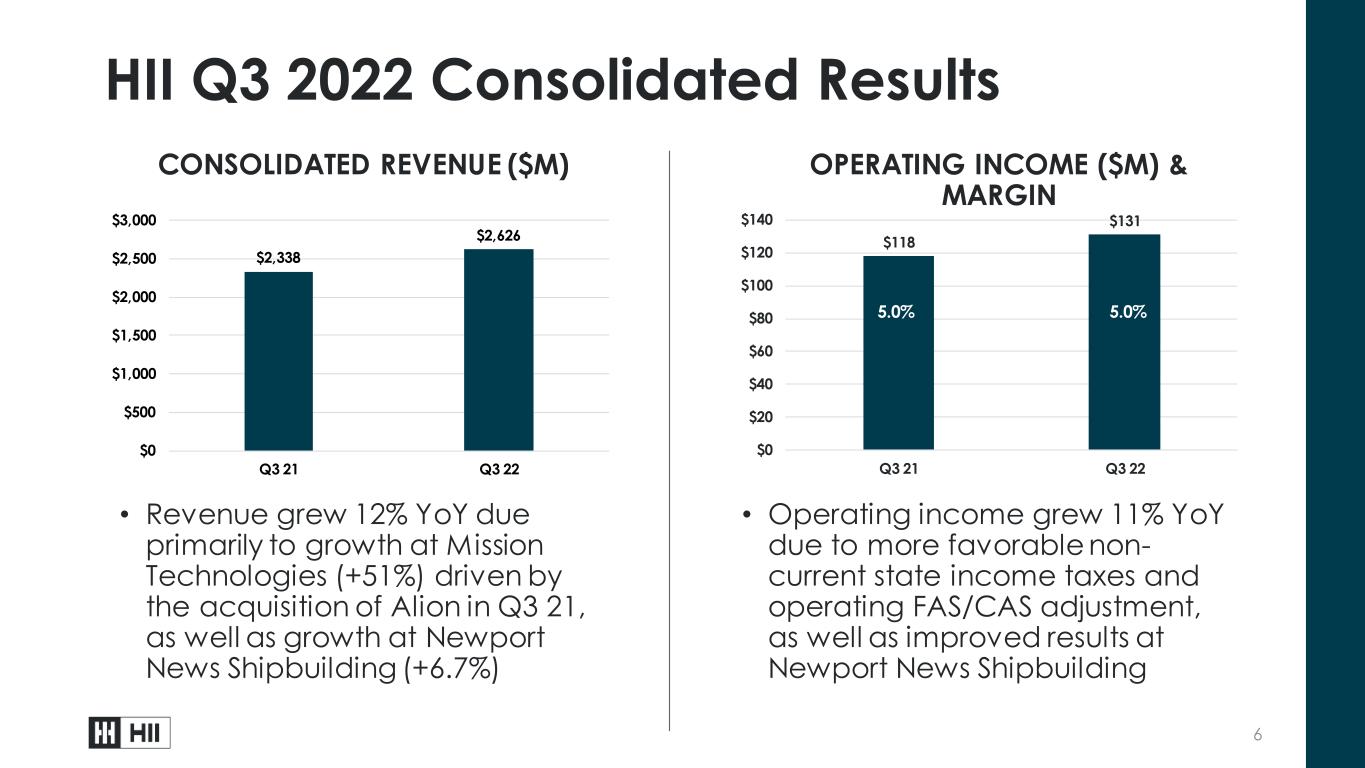

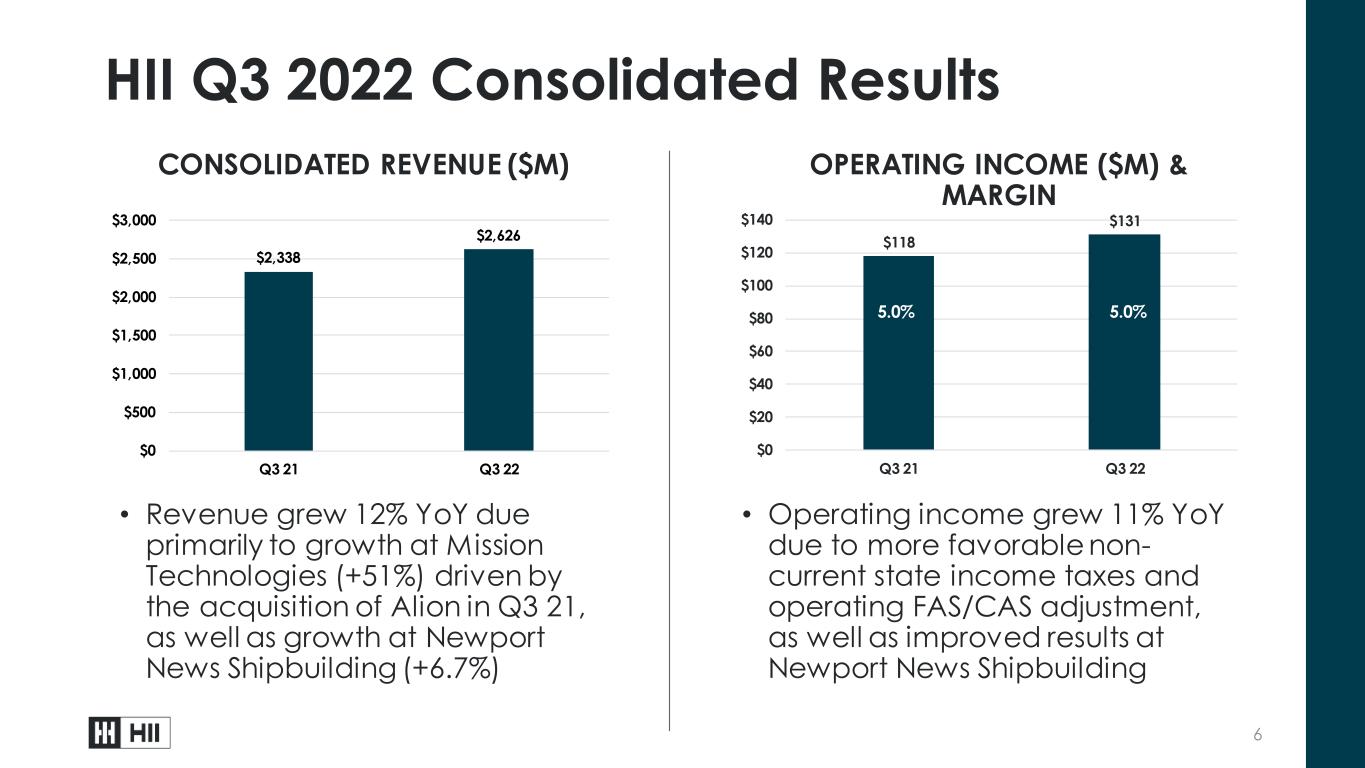

6 HII Q3 2022 Consolidated Results • Revenue grew 12% YoY due primarily to growth at Mission Technologies (+51%) driven by the acquisition of Alion in Q3 21, as well as growth at Newport News Shipbuilding (+6.7%) $2,338 $2,626 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 Q3 21 Q3 22 CONSOLIDATED REVENUE ($M) OPERATING INCOME ($M) & MARGIN $118 $131 $0 $20 $40 $60 $80 $100 $120 $140 Q3 21 Q3 22 5.0% 5.0% • Operating income grew 11% YoY due to more favorable non- current state income taxes and operating FAS/CAS adjustment, as well as improved results at Newport News Shipbuilding

7 HII Q3 2022 Segment Results YoY Revenue - NSC & LPD + DDG Operating Income - DDG risk retirement (prior year incentive) + LPD risk retirement Newport News Shipbuilding Ingalls Shipbuilding Mission Technologies REVENUE ($M) SEGMENT OPERATING INCOME ($M) & MARGIN1 REVENUE ($M) Revenue + Sub & carrier fleet support + Columbia-class submarine program + RCOH of USS John C. Stennis (CVN 74) Operating Income + Columbia-class incentives - VCS risk retirement REVENUE ($M) Revenue + Acquisition of Alion in Q3 21 (closed 8/19/21) Operating Margin - ~$24M of PI amortization related to Alion acquisition $628 $623 $0 $200 $400 $600 $800 Q3 21 Q3 22 $1,354 $1,445 $0 $500 $1,000 $1,500 $2,000 Q3 21 Q3 22 $394 $595 $0 $200 $400 $600 $800 Q3 21 Q3 22 $62 $50 $0 $20 $40 $60 $80 Q3 21 Q3 22 $88 $102 $0 $50 $100 $150 Q3 21 Q3 22 $13 $14 $0 $5 $10 $15 Q3 21 Q3 22 1 Non-GAAP measures. See appendix for definitions and reconciliations. 9.9% 8.0% 6.5% 7.1% 3.3% 2.4% SEGMENT OPERATING INCOME ($M) & MARGIN1 SEGMENT OPERATING INCOME ($M) & MARGIN1

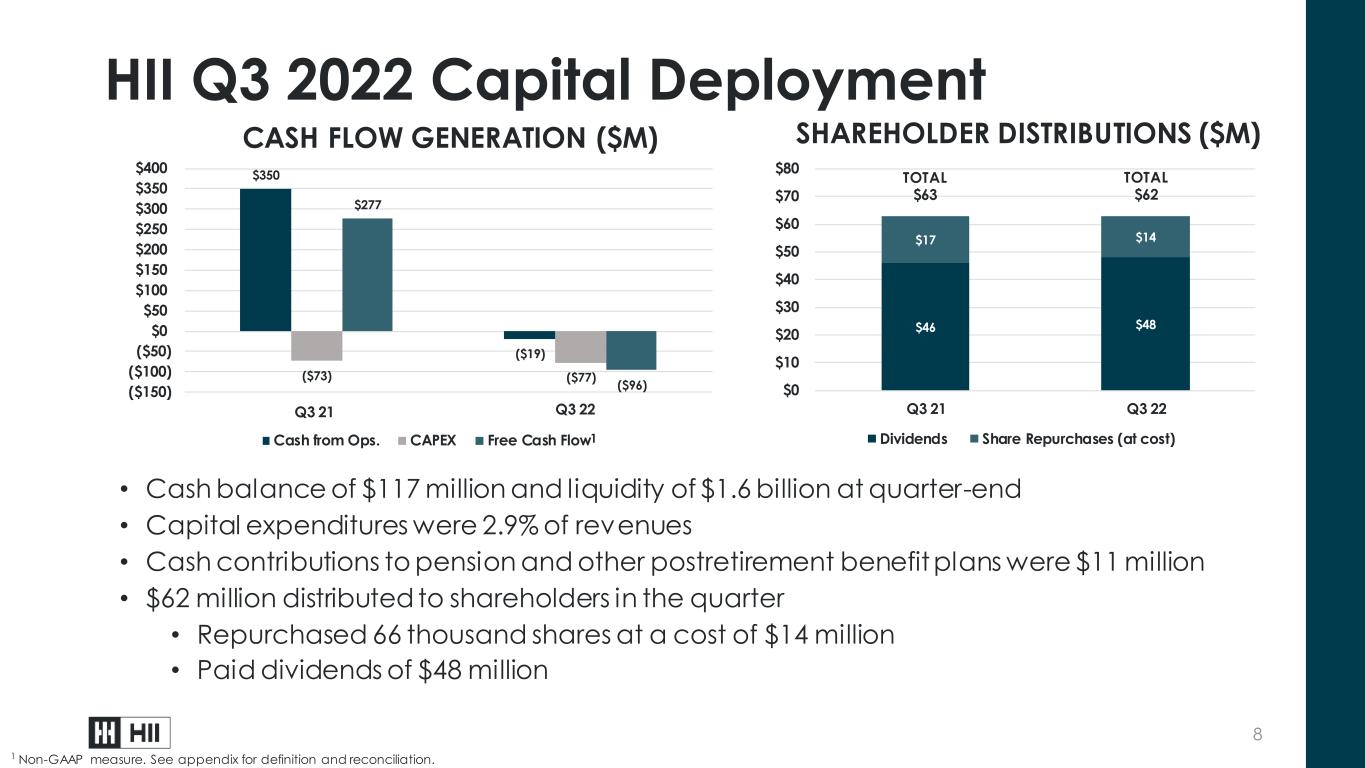

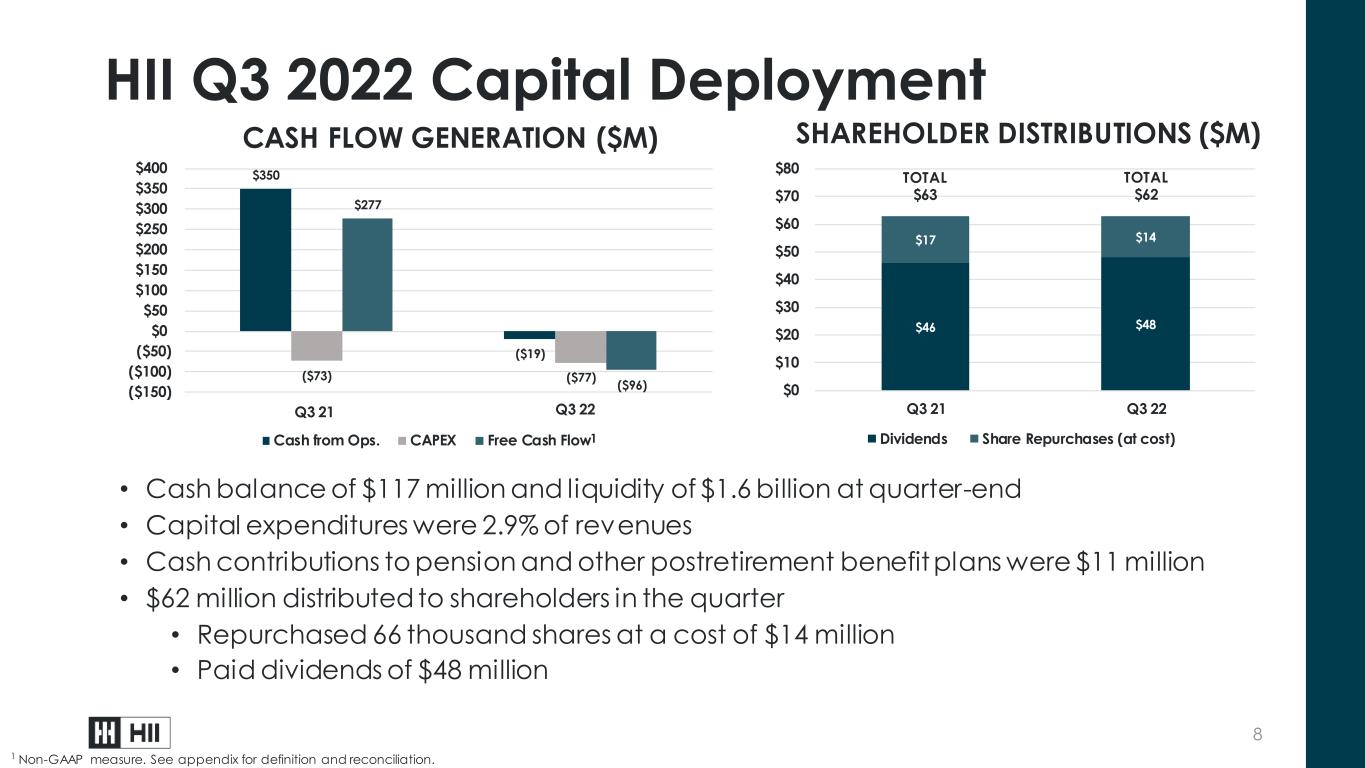

$46 $48 $17 $14 $0 $10 $20 $30 $40 $50 $60 $70 $80 Q3 21 Q3 22 Dividends Share Repurchases (at cost) $350 ($19) ($73) ($77) $277 ($96) ($150) ($100) ($50) $0 $50 $100 $150 $200 $250 $300 $350 $400 Cash from Ops. CAPEX Free Cash Flow 8 HII Q3 2022 Capital Deployment • Cash balance of $117 million and liquidity of $1.6 billion at quarter-end • Capital expenditures were 2.9% of revenues • Cash contributions to pension and other postretirement benefit plans were $11 million • $62 million distributed to shareholders in the quarter • Repurchased 66 thousand shares at a cost of $14 million • Paid dividends of $48 million Q3 21 Q3 22 CASH FLOW GENERATION ($M) SHAREHOLDER DISTRIBUTIONS ($M) TOTAL $63 TOTAL $62 1 Non-GAAP measure. See appendix for definition and reconciliation. 1

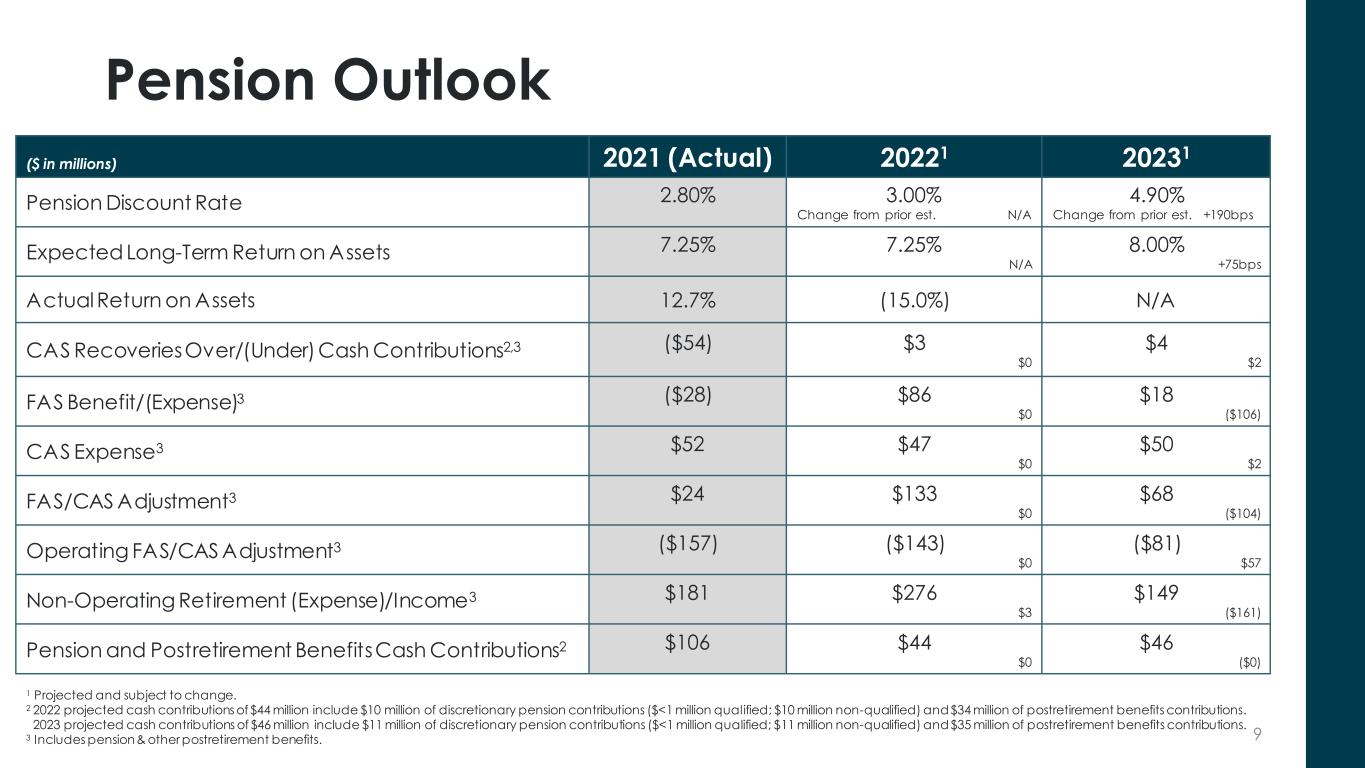

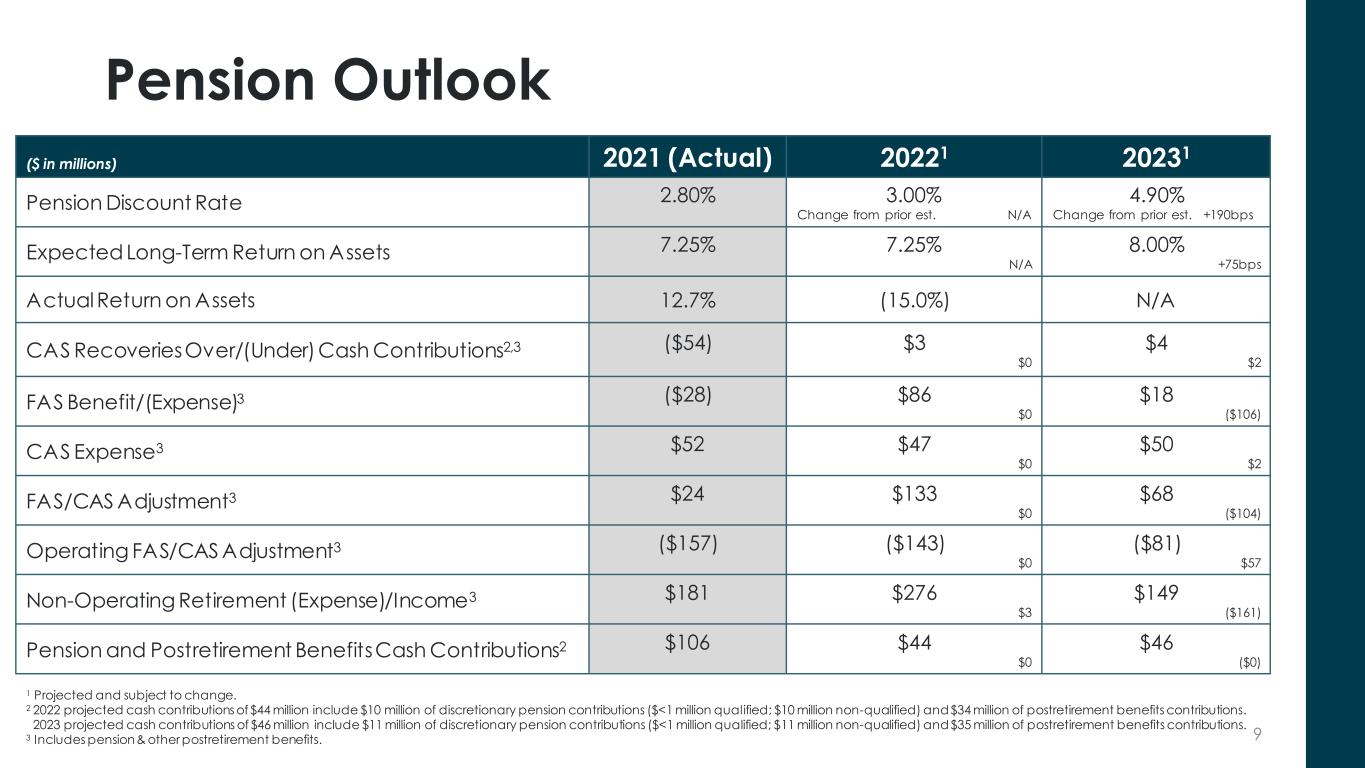

9 Pension Outlook ($ in millions) 2021 (Actual) 20221 20231 Pension Discount Rate 2.80% N 3.00% Change from prior est. N/A 4.90% Change from prior est. +190bps Expected Long-Term Return on Assets 7.25% N 7.25% N/A 8.00% +75bps Actual Return on Assets 12.7% (15.0%) N/A CAS Recoveries Over/(Under) Cash Contributions2,3 ($54) N $3 $0 $4 $2 FAS Benefit/(Expense)3 ($28) N $86 $0 $18 ($106) CAS Expense3 $52 N $47 $0 $50 $2 FAS/CAS Adjustment3 $24 N $133 $0 $68 ($104) Operating FAS/CAS Adjustment3 ($157) N ($143) $0 ($81) $57 Non-Operating Retirement (Expense)/Income3 $181 N $276 $3 $149 ($161) Pension and Postretirement Benefits Cash Contributions2 $106 N $44 $0 $46 ($0) 1 Projected and subject to change. 2 2022 projected cash contributions of $44 million include $10 million of discretionary pension contributions ($<1 million qualified; $10 million non-qualified) and $34 million of postretirement benefits contributions. 2023 projected cash contributions of $46 million include $11 million of discretionary pension contributions ($<1 million qualified; $11 million non-qualified) and $35 million of postretirement benefits contributions. 3 Includes pension & other postretirement benefits.

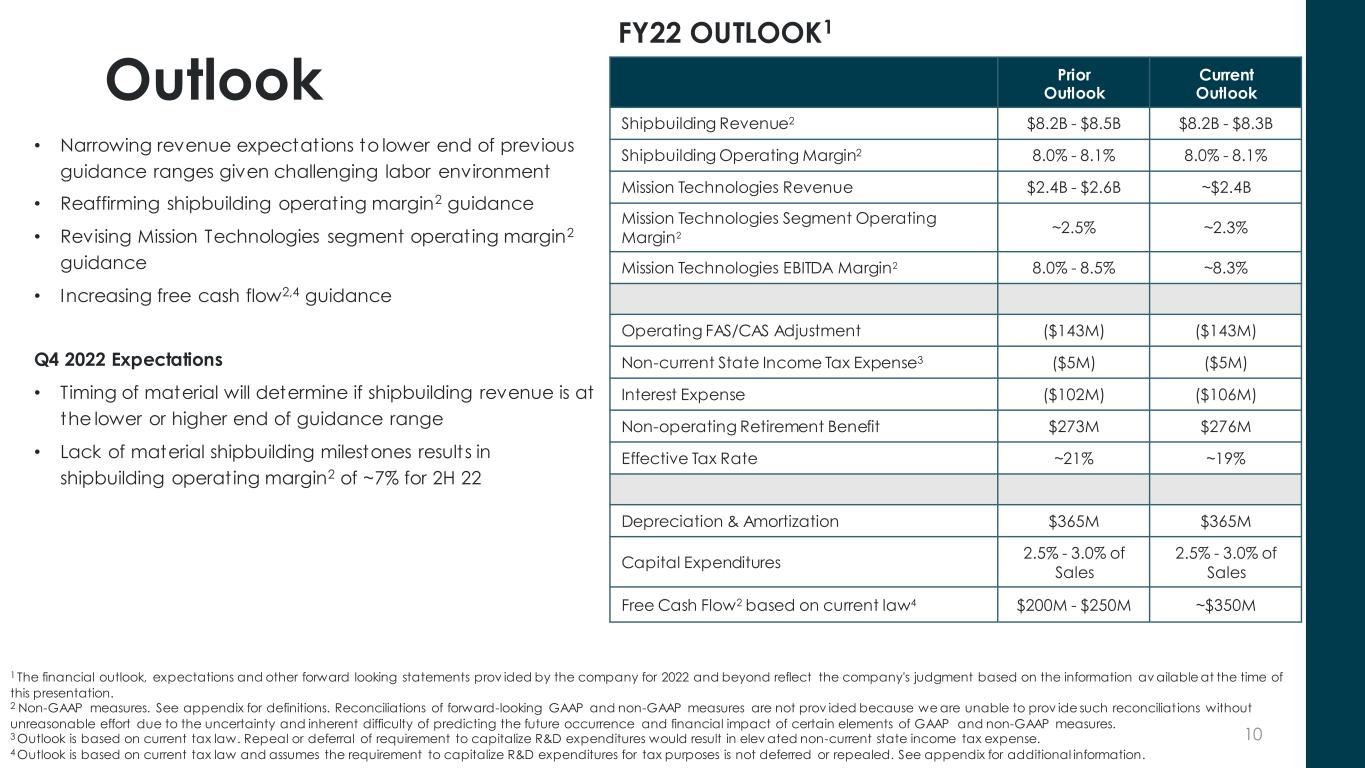

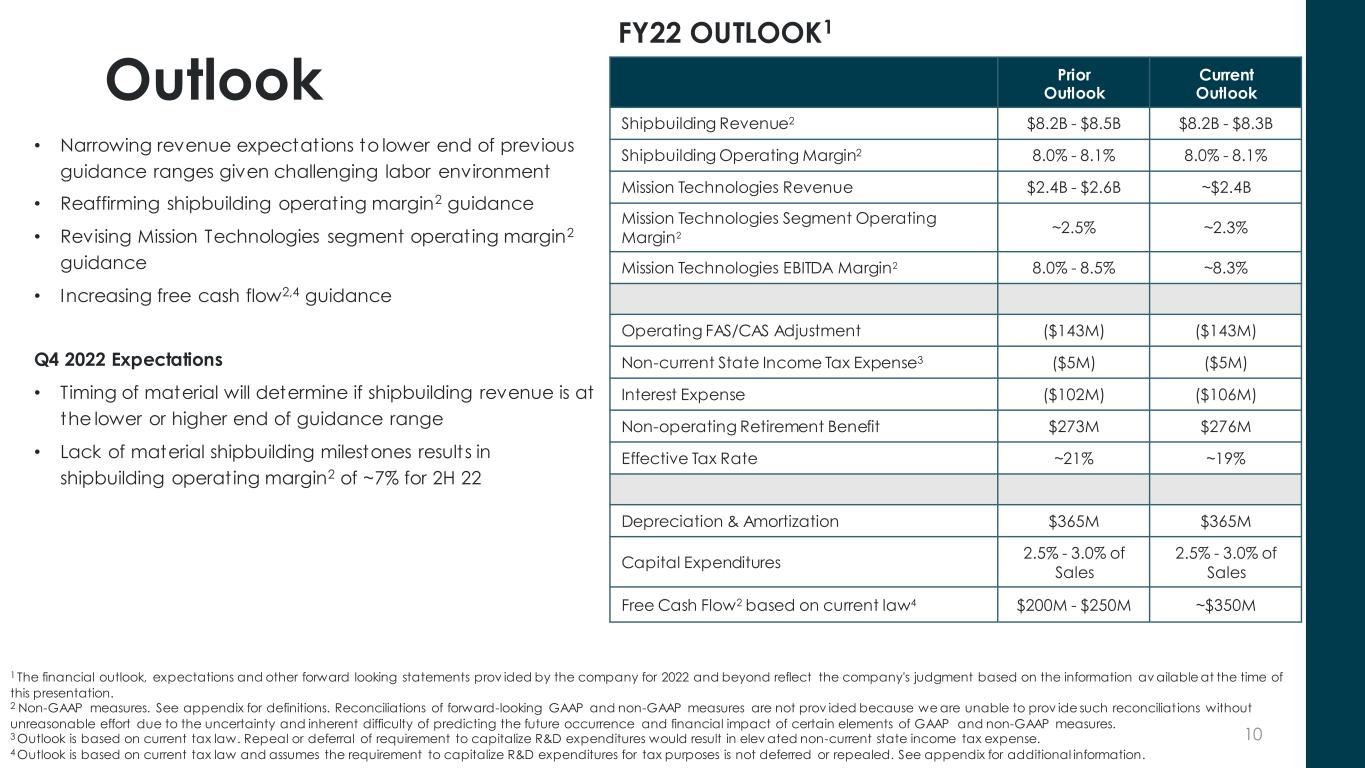

10 Outlook Prior Outlook Current Outlook Shipbuilding Revenue2 $8.2B - $8.5B $8.2B - $8.3B Shipbuilding Operating Margin2 8.0% - 8.1% 8.0% - 8.1% Mission Technologies Revenue $2.4B - $2.6B ~$2.4B Mission Technologies Segment Operating Margin2 ~2.5% ~2.3% Mission Technologies EBITDA Margin2 8.0% - 8.5% ~8.3% Operating FAS/CAS Adjustment ($143M) ($143M) Non-current State Income Tax Expense3 ($5M) ($5M) Interest Expense ($102M) ($106M) Non-operating Retirement Benefit $273M $276M Effective Tax Rate ~21% ~19% Depreciation & Amortization $365M $365M Capital Expenditures 2.5% - 3.0% of Sales 2.5% - 3.0% of Sales Free Cash Flow2 based on current law4 $200M - $250M ~$350M FY22 OUTLOOK1 • Narrowing revenue expectations to lower end of previous guidance ranges given challenging labor environment • Reaffirming shipbuilding operating margin2 guidance • Revising Mission Technologies segment operating margin2 guidance • Increasing free cash flow2,4 guidance Q4 2022 Expectations • Timing of material will determine if shipbuilding revenue is at the lower or higher end of guidance range • Lack of material shipbuilding milestones results in shipbuilding operating margin2 of ~7% for 2H 22 1 The financial outlook, expectations and other forward looking statements prov ided by the company for 2022 and beyond reflect the company's judgment based on the information av ailable at the time of this presentation. 2 Non-GAAP measures. See appendix for definitions. Reconciliations of forward-looking GAAP and non-GAAP measures are not prov ided because we are unable to prov ide such reconciliat ions without unreasonable effort due to the uncertainty and inherent difficulty of predicting the future occurrence and financial impact of certain elements of GAAP and non-GAAP measures. 3 Outlook is based on current tax law. Repeal or deferral of requirement to capitalize R&D expenditures would result in elev ated non-current state income tax expense. 4 Outlook is based on current tax law and assumes the requirement to capitalize R&D expenditures for tax purposes is not deferred or repealed. See appendix for additional information.

11 Free Cash Flow1,2 & Capital Allocation3 FY22 ~$350M FY23 $545M- $595M FY24 $730M- $830M • Committed to investment grade rating; Targeting ≤2x Debt/EBITDA1 by year-end 2024 • Continued dividend growth at low to mid single digit growth rate • Balanced share repurchases; $1.0B authorization remaining through 2024 • Continue to evaluate targeted M&A; No significant capability gaps today • Target ~$300M cash balance • Committed to return substantially all 2022 - 2024 free cash flow1, after planned debt repayment, to shareholders 1 Non-GAAP measure. See appendix for definition. 2 Free cash flow outlook assumes the requirement to capitalize R&D expenditures for tax purposes is not deferred or repealed. See appendix for additional information. 3The financial outlook, expectations and other forward looking statements prov ided by the company for 2022 and beyond reflect the company's judgment based on the information av ailable at the time of this presentation. FREE CASH FLOW1 WALK FY22-24 (assumes Sec. 174 is not deferred or repealed, ~$250M impact FY22-24) COVID-19 repayment impact moves from FY22 to FY23 ~$250M opportunity over FY23-24 if Sec. 174 is repealed

12 Sustainability at HII Ingalls Shipbuilding is testing a fleet of electric vehicles Newport News Shipbuilding converted a steam barge from liquid fuel to natural gas, significantly reducing emissions • Appointed HII’s first Chief Sustainability Officer • Ongoing work to develop program and future reporting • Recognized as one of America’s best large employers • Sustainability program aligned with our core values and our commitment to the communities in which we work Newport News Shipbuilding partnered with Habitat for Humanity to start construction on the 20t h and 21st houses built by shipyard volunteers Mission Technologies employees support arriving service members and families at USO Korea Our first, detailed sustainability report will be published later this month

INVESTMENT THESIS POSITIONED FOR SUCCESS; FOCUSED ON EXECUTION Historic backlog and positioning provide strong visibility Consistent long-term shipbuilding growth profile Reshaped Mission Technologies portfolio to address evolving customer needs in high growth markets 13 Nearing sustainable free cash flow inflection point Commitment to return substantially all free cash flow, after planned debt repayment, to shareholders 2022 - 2024

Appendix 14

Non-GAAP Information 15 We make reference to “segment operating income,” “segment operating margin,” “shipbuilding revenue,” “shipbuilding operating margin,” “Mission Technologies EBITDA margin,” “Debt/EBITDA” and “free cash flow.” We internally manage our operations by reference to segment operating income and segment operating margin, which are not recognized measures under GAAP. When analyzing our operating performance, investors should use segment operating income and segment operating margin in addition to, and not as alternatives for, operating income and operating margin or any other performance measure presented in accordance with GAAP. They are measures that we use to evaluate our core operating performance. We believe that segment operating income and segment operating margin reflect an additional way of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. We believe these measures are used by investors and are a useful indicator to measure our performance. Because not all companies use identical calculations, our presentation of segment operating income and segment operating margin may not be comparable to similarly titled measures of other companies. Shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin are not measures recognized under GAAP. They are measures that we use to evaluate our core operating performance. We believe that shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin reflect additional ways of viewing aspects of our operations that, when viewed with our GAAP results, provide a more complete understanding of factors and trends affecting our business. When analyzing our operating performance, investors should use shipbuilding revenue, shipbuilding operating margin and Mission Technologies EBITDA margin in addition to, and not as alternatives for, operating income and operating margin or any other performance measure presented in accordance with GAAP. We believe these measures are used by investors and are a useful indicator to measure our performance. Free cash flow is not a measure recognized under GAAP. Free cash flow has limitations as an analytical tool and should not be considered in isolation from, or as a substitute for, net earnings as a measure of our performance or net cash provided or used by operating activities as a measure of our liquidity. We believe free cash flow is an important measure for our investors because it provides them insight into our current and period-to-period performance and our ability to generate cash from continuing operations. We also use free cash flow as a key operating metric in assessing the performance of our business and as a key performance measure in evaluating management performance and determining incentive compensation. Free cash flow may not be comparable to similarly titled measures of other companies. The Debt/EBITDA ratio is not a measure recognized under GAAP. We believe the Debt/EBITDA ratio is useful to management, investors and other users of our financial information in evaluating the total amount of leverage in our capital structure. Reconciliations of forward-looking GAAP and non-GAAP measures are not provided because we are unable to provide such reconciliations without unreasonable effort due to the uncertainty and inherent difficulty of predicting the future occurrence and financial impact of certain elements of GAAP and non-GAAP measures.

Non-GAAP Measures Definitions 16 Debt/EBITDA is defined as gross debt divided by net earnings before interest expense, income taxes, depreciation and amortization. Segment operating income is defined as operating income for the relevant segment(s) before the Operating FAS/CAS Adjustment and non-current state income taxes. Segment operating margin is defined as segment operating income as a percentage of sales and service revenues. Shipbuilding revenue is defined as the combined sales and service revenues from our Newport News Shipbuilding segment and Ingalls Shipbuilding segment. Shipbuilding operating margin is defined as the combined segment operating income of our Newport News Shipbuilding segment and Ingalls Shipbuilding segment as a percentage of shipbuilding revenue. Mission Technologies EBITDA margin is defined as Mission Technologies segment operating income before interest expense, income taxes, depreciation, and amortization as a percentage of Mission Technologies revenues. Free cash flow is defined as net cash provided by (used in) operating activities less capital expenditures net of related grant proceeds. Operating FAS/CAS Adjustment is defined as the difference between the service cost component of our pension and other postretirement expense determined in accordance with GAAP (FAS) and our pension and other postretirement expense under U.S. Cost Accounting Standards (CAS). Non-current state income taxes are defined as deferred state income taxes, which reflect the change in deferred state tax assets and liabilities and the tax expense or benefit associated with changes in state uncertain tax positions in the relevant period. These amounts are recorded within operating income. Current period state income tax expense is charged to contract costs and included in cost of sales and service revenues in segment op erating income. We present financial measures adjusted for the Operating FAS/CAS Adjustment and non-current state income taxes to reflect the company’s performance based upon the pension costs and state tax expense charged to our contracts under CAS. We use these adjusted measures as internal measures of operating performance and for performance-based compensation decisions.

Non-GAAP Reconciliations Segment Operating Income & Segment Operating Margin 17 ($ in millions) 2022 2021 2022 2021 Ingalls revenues 623 628 1,912 1,947 Newport News revenues 1,445 1,354 4,268 4,124 Mission Technologies revenues 595 394 1,785 890 Intersegment eliminations (37) (38) (101) (114) Sales and Service Revenues 2,626 2,338 7,864 6,847 Operating Income 131 118 460 393 Operating FAS/CAS Adjustment 36 41 108 118 Non-current state income taxes (1) 4 (1) 12 Segment Operating Income 166 163 567 523 As a percentage of sales and service revenues 6.3 % 7.0 % 7.2 % 7.6 % Ingalls segment operating income 50 62 242 233 As a percentage of Ingalls revenues 8.0 % 9.9 % 12.7 % 12.0 % Newport News segment operating income 102 88 277 257 As a percentage of Newport News revenues 7.1 % 6.5 % 6.5 % 6.2 % Mission Technologies operating income 14 13 48 33 As a percentage of Mission Technologies revenues 2.4 % 3.3 % 2.7 % 3.7 % Three Months Ended September 30 September 30 Nine Months Ended

Non-GAAP Reconciliations Shipbuilding Revenues & Operating Margin 18 ($ in millions) 2022 2021 2022 2021 Sales and service revenues 2,626 2,338 7,864 6,847 Mission Technologies (595) (394) (1,785) (890) Intersegment eliminations 37 38 101 114 Shipbuilding Revenues 2,068 1,982 6,180 6,071 Operating Income 131 118 460 393 Operating FAS/CAS Adjustment 36 41 108 118 Non-current state income taxes (1) 4 (1) 12 Segment Operating Income 166 163 567 523 Mission Technologies (14) (13) (48) (33) Shipbuilding Operating Income 152 150 519 490 As a percentage of Shipbuilding Revenues 7.4 % 7.6 % 8.4 % 8.1 % Three Months Ended September 30 September 30 Nine Months Ended

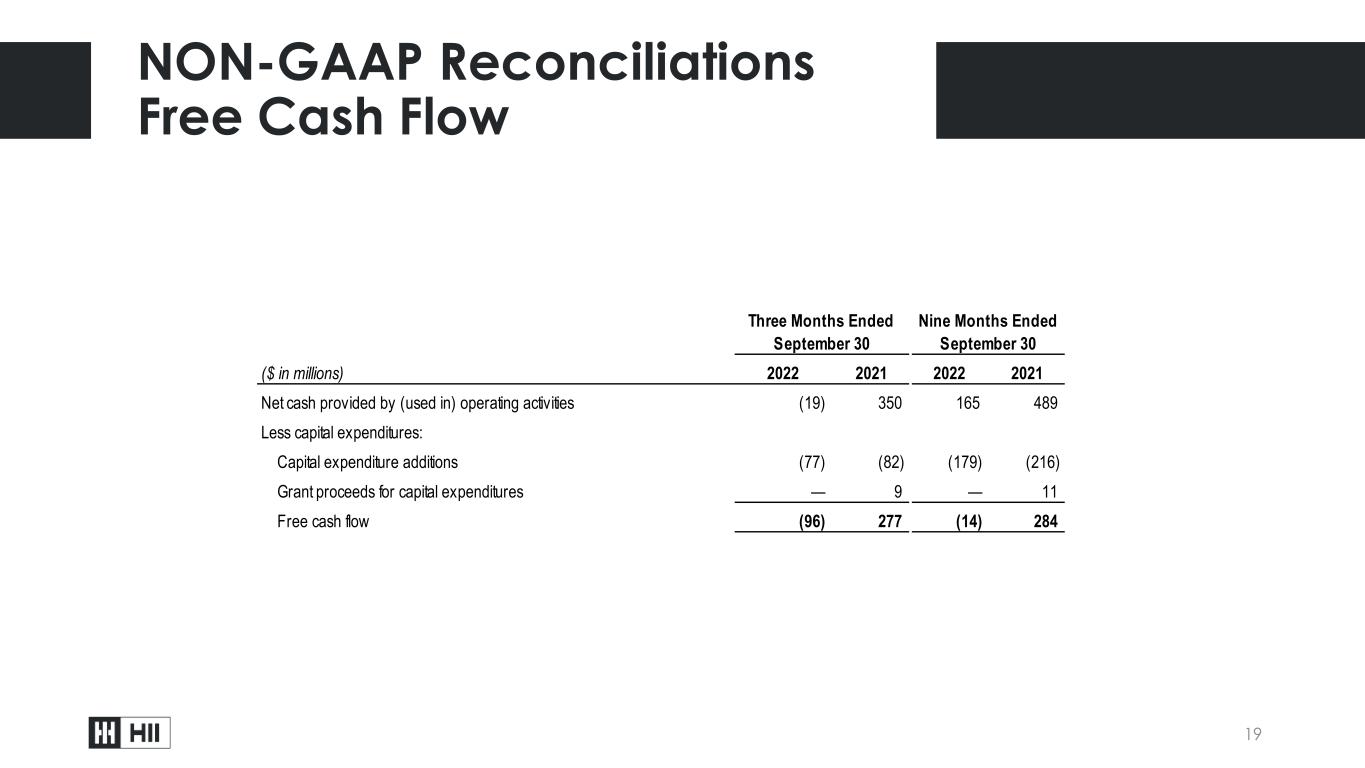

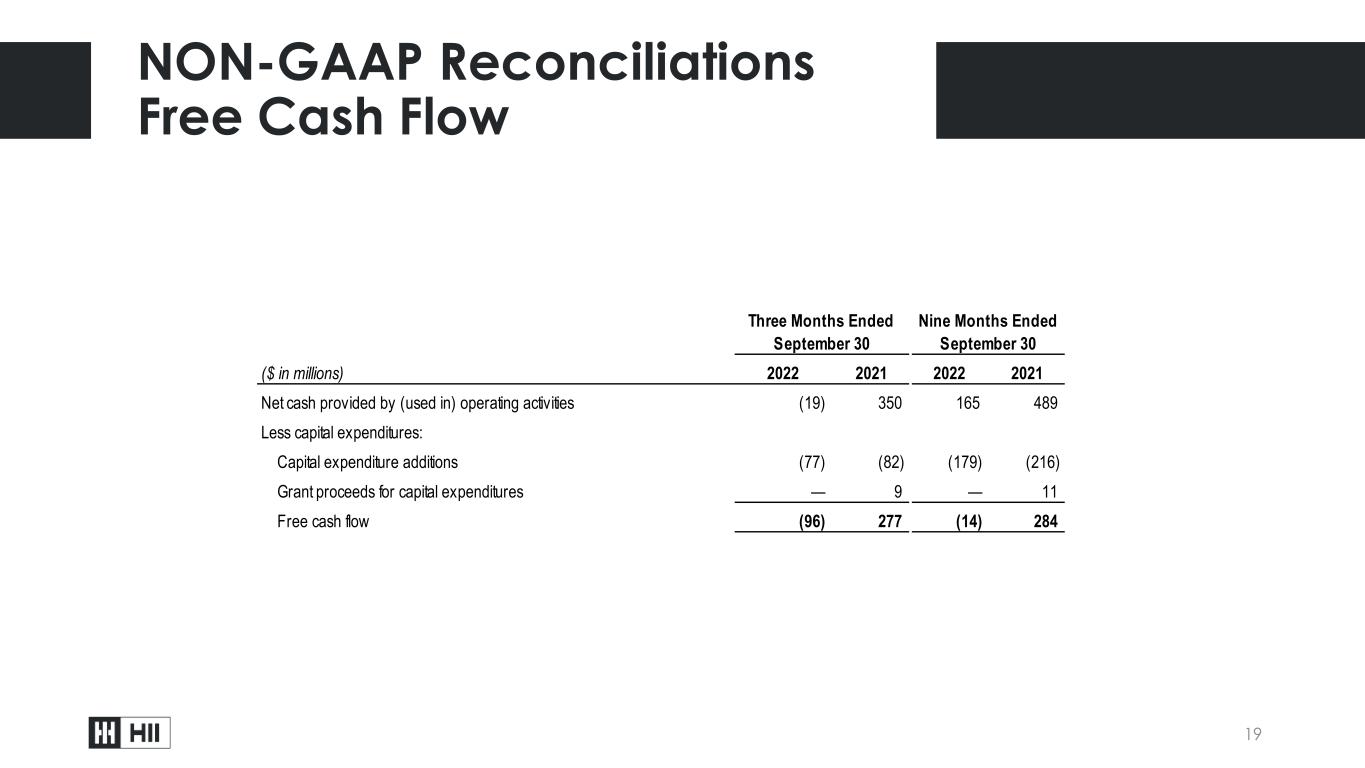

NON-GAAP Reconciliations Free Cash Flow 19 ($ in millions) 2022 2021 2022 2021 Net cash provided by (used in) operating activities (19) 350 165 489 Less capital expenditures: Capital expenditure additions (77) (82) (179) (216) Grant proceeds for capital expenditures — 9 — 11 Free cash flow (96) 277 (14) 284 Three Months Ended September 30 Nine Months Ended September 30

20 Non-GAAP Reconciliations Mission Technologies EBITDA Margin (in millions) 2022 2021 2022 2021 Mission Technologies sales and service revenues 595 394 1,785 890 Mission Technologies segment operating income 14 13 48 33 Mission Technologies depreciation expense 3 2 8 4 Mission Technologies amortization expense 30 16 90 32 Mission Technologies state tax expense 3 (1) 9 5 Mission Technologies EBITDA 50 30 155 74 Mission Technologies EBITDA margin 8.4 % 7.6 % 8.7 % 8.3 % Nine Months Ended September 30September 30 Three Months Ended

21