UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | |

Filed by the Registrant x | Filed by a Party other than the Registrant o |

| | |

| Check the appropriate box: |

| | |

| x | Preliminary Proxy Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| o | Definitive Proxy Statement |

| | |

| o | Definitive Additional Materials |

| | |

| o | Soliciting Material under §240.14a-12 |

HUNTINGTON INGALLS INDUSTRIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

MISSION, VALUES & ETHICS

| | | | | | | | | | | | | | | | | |

| | | | | |

| Mission of Service To deliver the world’s most powerful ships and all-domain solutions in service of the nation, creating the advantage for our customers to protect peace and freedom around the world. |

|

| Values Our mission requires the best of us: the utmost in character and values. Our values are the cornerstones of HII’s culture, driving our day-to-day decision- making and the long-term trust and confidence of our stakeholders. Ultimately, our adherence to our values nourishes and protects the strong, stable, and resilient relationship on which our future growth and success depend. |

|

|

|

|

|

|

|

|

|

|

| INTEGRITY Integrity is at the heart of who we are and what we do. We are each personally accountable for the highest standards of ethics and integrity. |

|

|

|

|

|

|

|

|

|

|

| HII is Committed to Integrity and High Ethical Standards HII’s Ethics & Compliance program provides employees with guidelines for daily work life and defines and describes the values that serve as the foundation for how HII conducts business. HII’s Code of Ethics and Business Conduct is a statement of the Company’s commitment to integrity and high ethical standards and defines the conduct the Company expects of non-employees who act on the Company’s behalf. | | |

| | | |

| | | |

| | | SAFETY We value our employees above all else and will not compromise on maintaining a safe and healthy work environment for them. |

| | | |

| | | |

| | | RESPECT We value people, knowing we must show fairness and equal treatment for all. |

| | | |

| | | |

| | | ENGAGEMENT We are committed to fostering an engaged workforce. Our employees are very involved in what they do and take ownership of their work and work processes. |

| | | |

| | | |

| | | RESPONSIBILITY We keep promises and commitments made to others. We are responsible for ensuring quality is a component of everything we do. We take pride in providing outstanding customer service. |

| | | |

| | | |

| | | PERFORMANCE We are committed to improving our Company performance while upholding our strong values. Superior performance and quality ensure future trust and confidence in our products and services. We promote continuous improvement, innovation and creativity. |

| | | | | |

| |

| LETTER TO OUR STOCKHOLDERS |

| | | | | |

| |

| “The Board and management team are aligned and remain committed to long-term value creation. The team is disciplined and determined in our mission to build and deliver the ships and all-domain solutions that our defense customers and nation urgently need. We understand well the challenges and opportunities ahead and are working with urgency to increase throughput, drive cost efficiency, and partner with our Navy customer on contracting solutions that support our shared mission.” Admiral Kirkland H. Donald, Chairman of the Board |

| |

March 21, 2025

Dear Fellow Stockholders:

On behalf of the Board of Directors and management team of Huntington Ingalls Industries, I would like to invite you to attend the 2025 Annual Meeting of Stockholders. We will hold our Annual Meeting virtually, exclusively by live webcast, on Wednesday, April 30, 2025, at 11:00 a.m., Eastern Daylight Time. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically, and submit your questions prior to and during the meeting.

The accompanying Notice of 2025 Annual Meeting and Proxy Statement describe the matters on which you, as a stockholder, may vote at the Annual Meeting and include details of the business to be conducted at the meeting. If you plan to attend the Annual Meeting virtually via live webcast, you must follow the instructions contained in the Notice and as described under “General Information About the Annual Meeting” in this Proxy Statement.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, I encourage you to vote your shares in advance. Stockholders can submit their votes over the internet at the web address included in the Notice of Internet Availability of Proxy Materials or voting instruction form. If you received a proxy card or voting instruction form, you can submit your votes: over the internet at the web address included in the proxy card or voting instruction form; by telephone through the number included in the proxy card or voting instruction form; or by signing and dating your proxy card and mailing it in the prepaid and addressed envelope.

Thank you for your engagement, interest in, and continued support of HII.

Sincerely,

Admiral Kirkland H. Donald

U.S. Navy (Ret.)

Chairman of the Board

| | | | | |

| |

| NOTICE OF 2025 ANNUAL MEETING OF STOCKHOLDERS |

| | | | | | | | | | | |

| | | |

|

|

|

|

Date and Time Wednesday, April 30, 2025, at 11:00 a.m. Eastern Daylight Time | Place https://meetnow.global/MVQTZRF

There is no physical location for the Annual Meeting. | Record Date Stockholders of record at the close of business on March 6, 2025 are entitled to vote at the Annual Meeting and at any adjournment or postponement thereof. | Huntington Ingalls Industries, Inc. 4101 Washington Avenue Newport News, Virginia 23607 |

| | | | | | | | | | | | | | | | | |

| | | | | |

| Items of Business | |

| | Board Vote Recommendation: | For Further Details | |

| 1. Election of Directors | |  “FOR” each director nominee “FOR” each director nominee | | |

| 2.Advisory Vote to Approve Compensation of Named Executive Officers | |  “FOR” “FOR” | | |

| 3.Ratification of Appointment of Independent Auditor | |  “FOR” “FOR” | | |

| 4.Elimination of Personal Liability of Officers for Monetary Damages for Breach of Certain Fiduciary Duties as Permitted by Delaware Law | |  “FOR” “FOR” | | |

| 5.Amend Restated Certificate of Incorporation to Conform with Special Meeting Bylaw | |  “FOR” “FOR” | | |

| | | | | |

| | |

Stockholders also will act on any other business that may properly come before the Annual Meeting. The 2025 Annual Meeting will be conducted exclusively in virtual meeting format by live webcast. You will be able to attend the Annual Meeting, as well as vote and submit questions during the meeting, by visiting https://meetnow.global/MVQTZRF and entering your control number. You can find additional instructions on how to participate in the Annual Meeting beginning on page 84 of this Proxy Statement. The meeting will begin promptly at 11:00 a.m., Eastern Daylight Time. If you encounter difficulties accessing the virtual meeting, please call the technical support number (888) 724-2416. It is important you vote your shares so they are counted at the Annual Meeting. You can vote your shares: over the internet at the web address included in the Notice of Internet Availability of Proxy Materials and included in the proxy card or voting instruction form (if you received a proxy card or voting instruction form); by telephone through the number included in the proxy card or voting instruction form (if you received a proxy card or voting instruction form); or by signing and dating your proxy card (if you received a proxy card) and mailing it in the prepaid and addressed envelope. If you are a beneficial owner and received a voting instruction form, please follow the instructions provided by your bank or broker to vote your shares. |

|

Tiffany McConnell King

Corporate Vice President,

Associate General Counsel and Secretary March 21, 2025 |

| | | | | |

How to Vote It is important you vote your shares so they are counted at the Annual Meeting. You can vote your shares by using any of the below methods: |

| |

| Internet www.envisionreports.com/HII |

| |

| Telephone (800) 652-VOTE (8683) |

| |

| Mail Mark, sign, date, and promptly mail the enclosed proxy card in the postage-paid envelope |

| |

| QR Code Registered stockholders may vote by scanning the QR code on their proxy card or notice |

| | | | | | | | | | | |

| | | |

| | | |

| | | |

| Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 30, 2025: The Notice of 2025 Annual Meeting and Proxy Statement, the 2025 Annual Report and the form of proxy card are available at www.envisionreports.com/HII. We are making this Proxy Statement and form of proxy card first available on or about March 21, 2025. | |

| | | |

| | | | | |

| |

| 2025 PROXY STATEMENT VOTING ROADMAP |

| | | | | | | | |

|

| | |

ITEM 1 | Election of Directors The Board is asking you to elect, for one-year terms ending in 2025, the 12 nominees for director named herein, each of whom is currently serving as a member of the Board. Detailed information about this proposal can be found beginning on page 10. |

| |

| The Board recommends a vote FOR each director nominee. |

| | |

| | | | | | | | |

|

| | |

ITEM 2 | Advisory Vote to Approve Compensation of Named Executive Officers The Board is asking you to approve, on an advisory basis, the compensation of our named executive officers (“NEOs”) for 2024. Detailed information about this proposal can be found beginning on page 34. |

| | |

| | The Board recommends a vote FOR this proposal. |

| | |

| | | | | | | | |

|

| | |

ITEM 3 | Ratification of Appointment of Independent Auditor The Board is asking you to ratify the selection of Deloitte & Touche LLP as our independent auditor for 2025. Detailed information about this proposal can be found beginning on page 75. |

| |

| The Board recommends a vote FOR this proposal. |

| | |

| | | | | | | | |

|

| | |

ITEM 4 | Elimination of Personal Liability of Officers for Monetary Damages for Breach of Certain Fiduciary Duties as Permitted by Delaware Law The Board is asking you to approve an amendment to our Restated Certificate of Incorporation to provide for the elimination of personal liability of certain officers as permitted by Delaware law. Detailed information about this proposal can be found beginning on page 77. |

| |

| The Board recommends a vote FOR this proposal. |

| | |

| | | | | | | | |

|

| | |

ITEM 5 | Amend Restated Certificate of Incorporation to Conform with Special Meeting Bylaw The Board is asking you to approve an amendment to our Restated Certificate of Incorporation to conform Article Twelfth with the Company’s special meeting bylaw, which provides that a special meeting shall be called by the Board (or an authorized committee thereof) or the Chairperson of the Board following the receipt by the Secretary of written requests to call the meeting from the holders of at least 20% of the voting power of the outstanding capital stock of the Company that have delivered such requests in accordance with the terms of our Restated Bylaws. Detailed information about this proposal can be found beginning on page 79. |

| |

| The Board recommends a vote FOR this proposal. |

| | |

| | | | | |

| 2 | Huntington Ingalls Industries, Inc. |

| | | | | |

| |

| 2025 PROXY STATEMENT SUMMARY |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider. For additional information on these topics, please refer to the discussions contained in this Proxy Statement and in our Annual Report on Form 10-K for the year ended December 31, 2024.

We intend to mail a Notice of Internet Availability of Proxy Materials to Stockholders of record and to make the Notice of 2025 Annual Meeting, the 2024 Annual Report, this Proxy Statement, and accompanying materials available on the internet on or about March 21, 2025.

| | | | | | | | |

| | |

| Performance Highlights | |

| | |

| Huntington Ingalls Industries, Inc. (“HII,” the “Company,” “we,” “us,” or “our”) is a global, all-domain defense partner, building and delivering the world’s most powerful, survivable naval ships and technologies that safeguard America’s seas, sky, land, space, and cyber. While 2024 was a year of challenges, the Company continued to deliver on key operational milestones for the benefit of our stockholders and key stakeholders. We achieved these milestones, while continuing to manage through labor market, supply chain, and inflation-related challenges, primarily associated with ships contracted for prior to the outbreak of the COVID-19 pandemic. | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Ingalls | | | | Newport News | | | | Mission Technologies | |

| | | | | | | | | | |

| Delivered Richard M. McCool Jr. (LPD 29) to U.S. Navy Awarded first amphibious multi-ship procurement contract for $9.6 billion | | | | Delivered Virginia-class fast attack submarine New Jersey (SSN 796) Floated off Massachusetts (SSN 798) | | | | Record revenue of $2.9 billion in 2024 Over $12 billion in total contract value from new and recompete contract awards | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Consolidated revenues of $11.5 billion for 2024 Returned over $368 million to stockholders through dividends and share repurchases |

| | | | | | | | | | |

| | | | | | | | |

| | |

| Corporate Governance Highlights | |

| | |

| We are committed to corporate governance best practices, which we believe promote the long-term interests of stockholders, strengthen accountability of the Board of Directors (the “Board”) and management and build public trust in the Company. Highlights of our corporate governance practices include the items listed below. Board Structure and Governance: Highly qualified, independent Board with all standing committees comprising independent directors, an independent non-executive Chairman, and regular executive sessions without management Stockholder Rights: Annual elections for all directors, majority vote requirements for uncontested elections, and the ability for stockholders to propose their own nominees and call special meetings Stock Ownership: Robust stock ownership guidelines for directors and executives, a clawback policy for performance-based compensation, and a prohibition on hedging or pledging Company stock | |

| | |

2025 PROXY STATEMENT SUMMARY

BOARD NOMINEE HIGHLIGHTS

Director Nominees

The Board is asking you to elect, for one-year terms ending in 2025, the 12 nominees for director named below, each of whom is currently serving as a member of the Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Director Since | | Board Committees |

| Name and Principal Occupation | Age | | A | C | CS | F | GP |

| | | | | | | | | |

| Augustus L. Collins, Chief Executive Officer of MINACT, Inc.  | 67 | 2016 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Leo P. Denault, Former Chairman and Chief Executive Officer of Entergy Corporation  | 65 | 2022 | | CH | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Kirkland H. Donald, Chairman of the Board, Huntington Ingalls Industries, Inc.  | 71 | 2017 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Craig S. Faller, Advisor and Consultant; Retired Admiral, United States Navy  | 63 | 2023 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Victoria D. Harker, Former Executive Vice President and Chief Financial Officer of TEGNA Inc.  | 60 | 2012 | | | CH | | | |

| | | | | | | | | |

| | | | | | | | | |

| Frank R. Jimenez, General Counsel and Corporate Secretary, GE HealthCare Technologies Inc.  | 60 | 2022 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Christopher D. Kastner, President and Chief Executive Officer, Huntington Ingalls Industries, Inc. | 61 | 2022 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Anastasia D. Kelly, Senior Advisor to the Chair and Executive Director of Client Relations of DLA Piper  | 75 | 2011 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Tracy B. McKibben, Founder and Chief Executive Officer of MAC Energy Group Companies  | 55 | 2018 | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Stephanie L. O’Sullivan, Former Principal Deputy Director, Office of the Director of National Intelligence and Independent Business Consultant  | 65 | 2021 | | | | CH | | |

| | | | | | | | | |

| | | | | | | | | |

| Thomas C. Schievelbein, Former Chairman, President and Chief Executive Officer of The Brink’s Company  | 71 | 2011 | | | | | CH | |

| | | | | | | | | |

| | | | | | | | | |

| John K. Welch, Former President and Chief Executive Officer of Centrus Energy Corp.  | 75 | 2015 | | | | | | CH |

| | | | | | | | | |

| | | | | | | | | | | |

CH = Chair | CS = Cybersecurity Committee | | = Independent |

A = Audit Committee | F = Finance Committee | | |

C = Compensation Committee | GP = Governance and Policy Committee | | |

| | | | | |

| 4 | Huntington Ingalls Industries, Inc. |

2025 PROXY STATEMENT SUMMARY

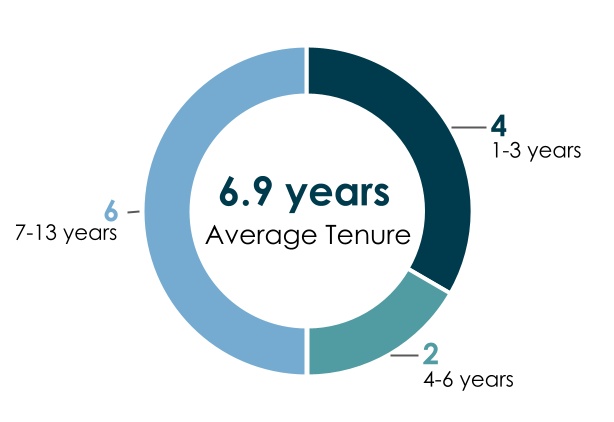

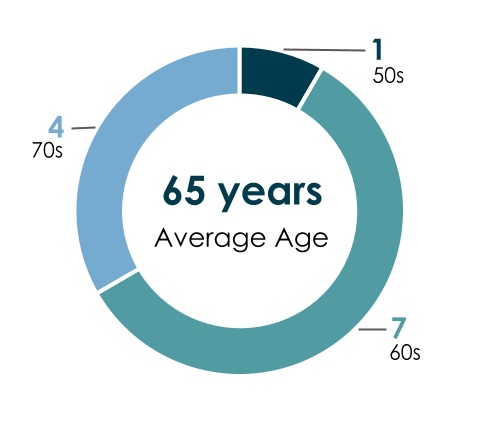

Our Board continues to reflect a highly engaged group of directors with a wide range of backgrounds, skills, experiences, attributes, and perspectives, which continue to evolve. Five of our 12 director nominees have joined the Board in the last four years. The following charts and graphs highlight the current composition of our Board:

| | | | | | | | |

| Chief Executive Leadership and Strategy |

| 8/12 |

| | |

| Chief Financial Officer and Accounting |

| 5/12 |

| | |

| Investment Strategy, Corporate Development, and M&A |

| 7/12 |

| | |

| Shipbuilding and Manufacturing Operations/Leadership |

| 3/12 |

| | |

| Technical Services Executive Leadership |

| 4/12 |

| | |

| Military and Government Relations |

| 9/12 |

| | |

| Corporate Governance |

| 10/12 |

| | | | | | | | |

| Aerospace & Defense Industry Knowledge |

| 8/12 |

| | |

| Compliance, Legal, and Regulatory |

| 6/12 |

| | |

| Nuclear |

| 6/12 |

| | |

| Advanced Technology (Future Warfare) and Innovation |

| 4/12 |

| | |

| Cyber and IT Risk Management |

| 4/12 |

| | |

| Human Resources and Labor Relations |

| 3/12 |

| | |

2025 PROXY STATEMENT SUMMARY

EXECUTIVE COMPENSATION

We have designed our performance-based executive compensation program to attract, motivate, and retain highly qualified executives, incentivize them to achieve business objectives, reward performance, and align the interests of our executives with the interests of our stockholders and other stakeholders.

We have consistently received exceptionally strong stockholder say-on-pay support. The following table sets forth the voting results for our “say-on-pay” proposal for the last five years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Annual Meeting | 2024 | | 2023 | | 2022 | | 2021 | | 2020 |

Votes Cast “FOR” Say-On-Pay Proposal* | | 96% | | | 97% | | | 97% | | | 97% | | | 97% |

* Excludes broker non-votes

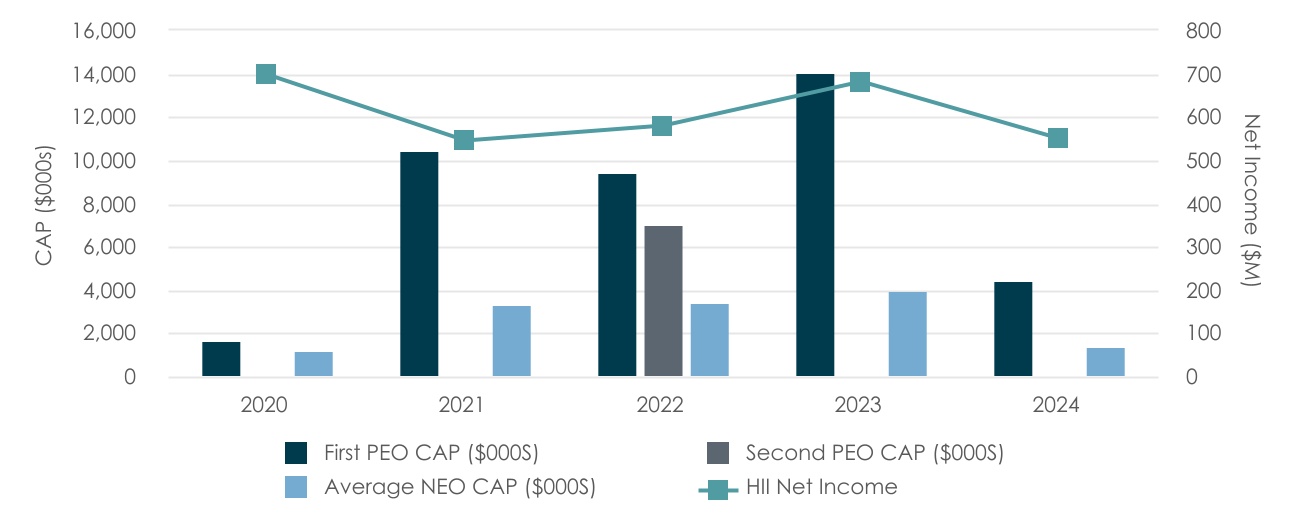

PERFORMANCE-BASED PROGRAM

The fundamental philosophy of our executive compensation program, set by the Compensation Committee of the Board, is pay-for-performance. Our 2024 results were impacted by adverse macroeconomic conditions, including inflationary pressures and labor and supply chain challenges, primarily on our ships contracted prior to the outbreak of the COVID-19 pandemic. We have included below highlights of our financial performance for 2024.

| | | | | |

| 2024 Financial Information | ($ in millions,

except per share data) |

| Contract Awards | 12,127 | |

| Revenues | 11,535 | |

| Operating Income | 535 | |

| Operating Margin | 4.6 | % |

| Segment Operating Income* | 573 | |

| Segment Operating Margin* | 5.0 | % |

| Net Earnings | 550 | |

| Diluted Earnings Per Share | 13.96 | |

| Net Cash Provided by Operating Activities | 393 | |

| Free Cash Flow* | 40 | |

* Non-GAAP financial measures. See Annex A for definitions of these non-GAAP financial measures and reconciliations to comparable GAAP financial measures.

| | | | | |

| 6 | Huntington Ingalls Industries, Inc. |

2025 PROXY STATEMENT SUMMARY

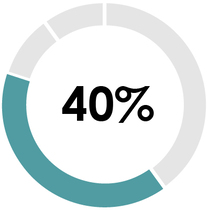

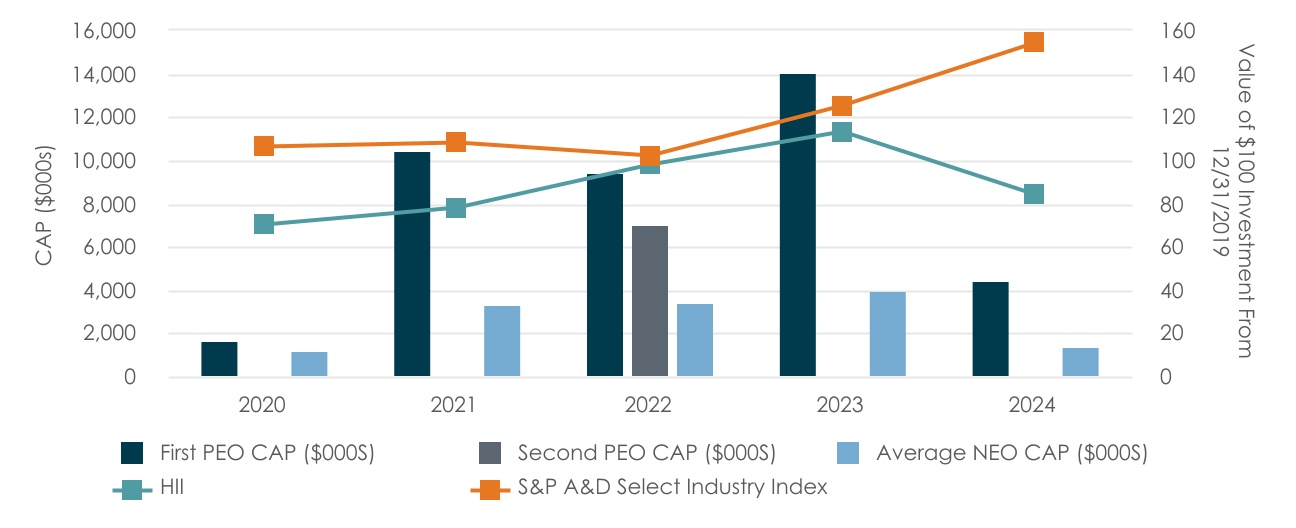

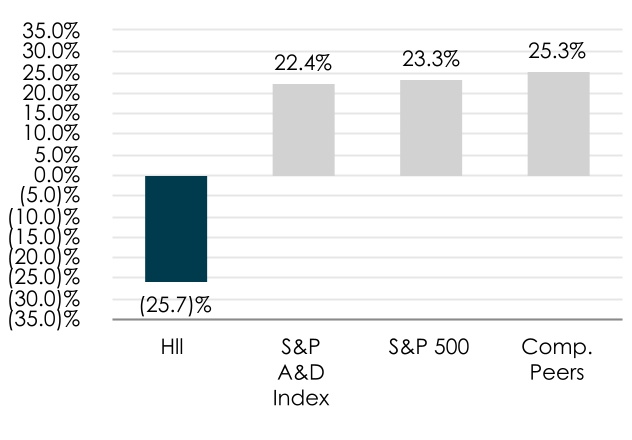

2024 STOCKHOLDER RETURNS

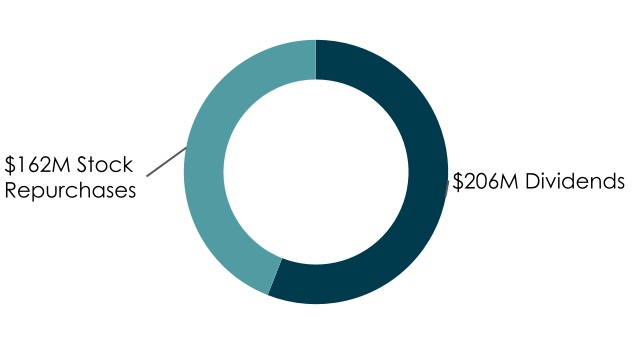

HII’s total stockholder return in 2024 was (25.7)%. We returned $368 million to our stockholders in 2024 through dividends and share repurchases. The following graph and chart show total stockholder return for HII in 2024 compared to benchmark total stockholder returns and total cash returned to stockholders in 2024, respectively.

1-Year Total Stockholder return

Returned $368 Million to Stockholders in 2024

ELEMENTS OF OUR EXECUTIVE COMPENSATION PROGRAM

Our compensation program consisted primarily of the following direct compensation elements:

| | | | | | | | |

| | |

| Base Salary | Annual Incentive Awards | Long-Term Equity-Based Incentive Awards |

| | |

| | |

| Provides a minimum fixed level of compensation. | Generally paid in cash, under our Annual Incentive Plan (“AIP”) to motivate our executives to achieve pre- determined annual financial and operational targets that are aligned with our strategic goals. | Paid in the form of Restricted Performance Rights (“RPSRs”), which promote achievement of pre-determined performance goals over a three-year period that are aligned with long-term stockholder interests, and Restricted Stock Rights (“RSRs”). |

| | |

Our compensation program is designed to balance performance-based compensation over the short- and long-term to incentivize decisions and actions that promote stockholder value and focus our executives on performance that benefits our stockholders and customers, while discouraging inappropriate risk-taking behaviors. A significant portion of the potential compensation of our executives is at risk, and that risk increases with corresponding increases in an executive’s level of responsibility.

2025 PROXY STATEMENT SUMMARY

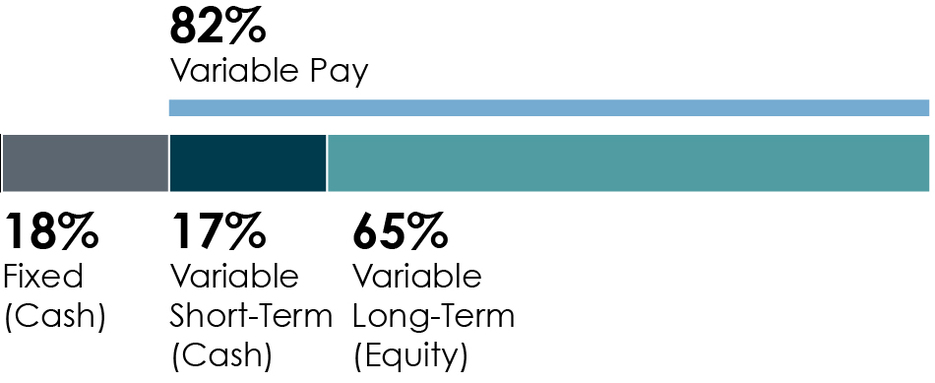

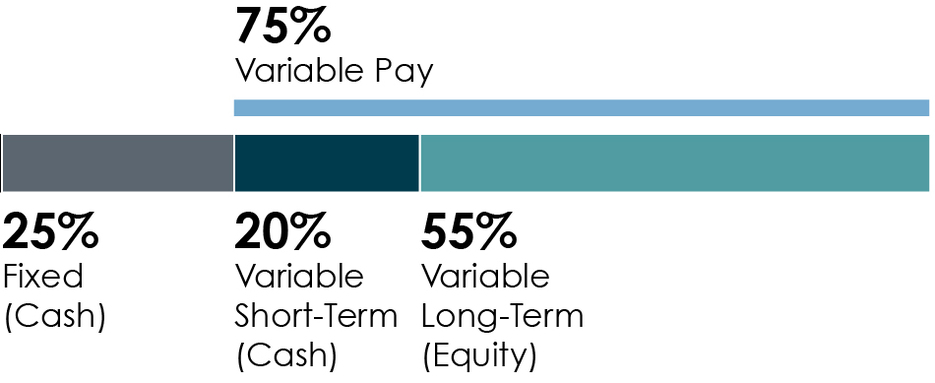

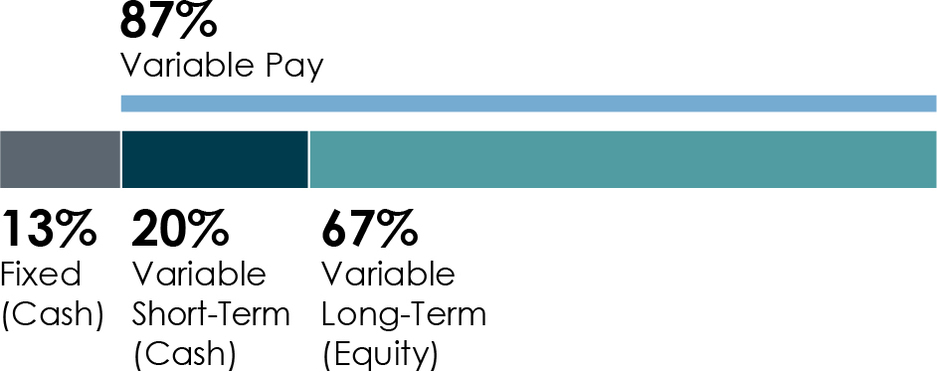

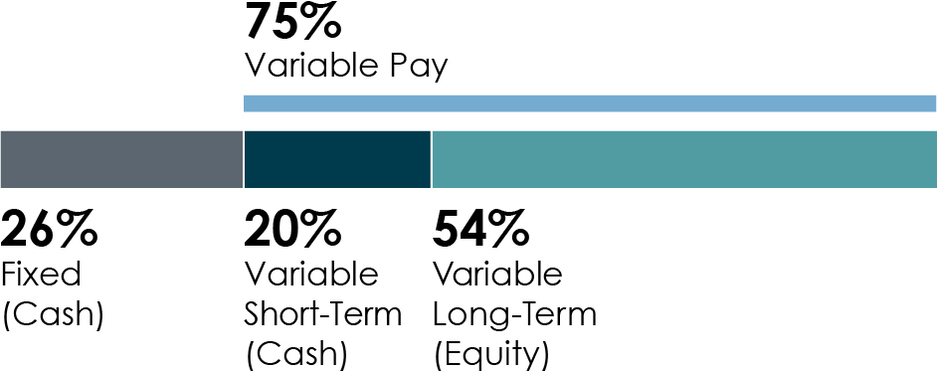

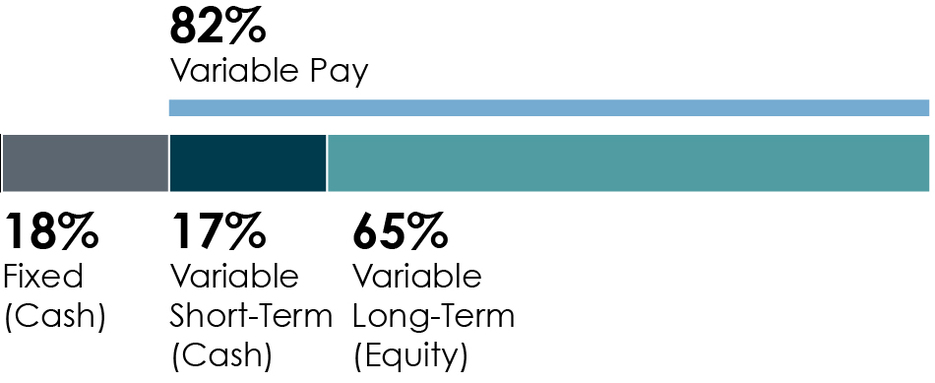

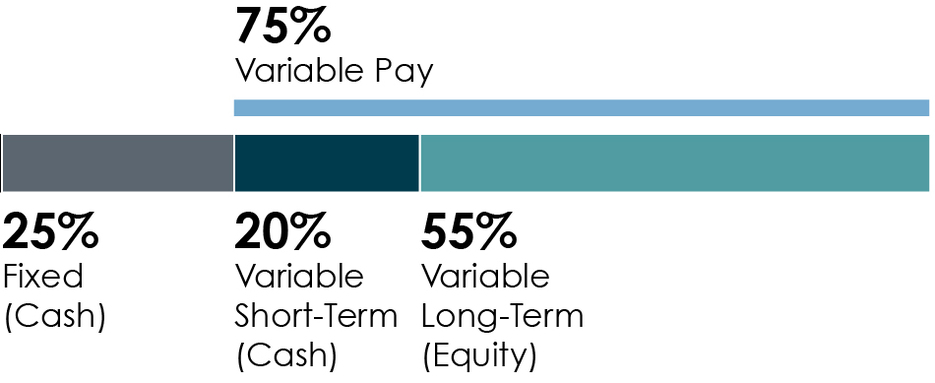

2024 TOTAL DIRECT COMPENSATION MIX

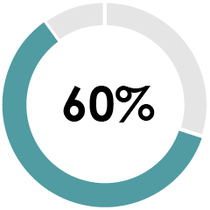

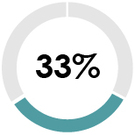

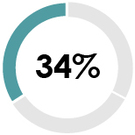

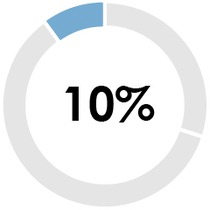

The pay for performance philosophy of our executive compensation program is demonstrated by the compensation mix of our NEOs. Of the three primary elements of total direct compensation, our executive compensation is heavily weighted towards the variable, performance-based elements and long-term and equity-based elements, as reflected in the following charts, which set forth the percentage of total compensation corresponding to each compensation element received by our CEO and by our other NEOs collectively in 2024.

Other NEOs Compensation Mix(2)

(1)Total direct compensation does not include perquisites and other benefits.

(2)Chart reflects average allocation for the NEOs other than our CEO. Total direct compensation does not include perquisites and other benefits.

COMPENSATION BEST PRACTICES

We believe our compensation practices are aligned with and reinforce our pay for performance philosophy and our related executive compensation principles.

| | | | | |

| We Do The Following | We Don’t Do The Following |

| |

Consideration of annual stockholder “say-on-pay” advisory vote on executive compensation. Consideration of annual stockholder “say-on-pay” advisory vote on executive compensation. Pay for performance compensation program heavily weighted toward variable, performance-based elements and toward long-term and equity-based elements. Pay for performance compensation program heavily weighted toward variable, performance-based elements and toward long-term and equity-based elements. Annual assessment of potential risk posed by our compensation programs. Annual assessment of potential risk posed by our compensation programs. Executive compensation “clawback” policy. Executive compensation “clawback” policy. Targeted external compensation benchmarking. Targeted external compensation benchmarking. Independent compensation consultant engaged by Compensation Committee. Independent compensation consultant engaged by Compensation Committee. Executive stock ownership guidelines based upon multiple of executive’s base salary. Executive stock ownership guidelines based upon multiple of executive’s base salary. |  No employment agreements for executives. No employment agreements for executives. No change-in-control agreements for executives or related executive tax gross-up benefits. No change-in-control agreements for executives or related executive tax gross-up benefits. Prohibitions against speculative transactions in our securities, pledging our securities as collateral and hedging transactions involving our securities. Prohibitions against speculative transactions in our securities, pledging our securities as collateral and hedging transactions involving our securities. No dividends or dividend equivalents paid on RPSRs or RSRs prior to vesting. No dividends or dividend equivalents paid on RPSRs or RSRs prior to vesting. |

| |

| | | | | |

| 8 | Huntington Ingalls Industries, Inc. |

We believe stockholder outreach and engagement is a corporate governance best practice. We regularly engage with our stockholders to inform management and the Board on those matters of most importance to our stockholders. This ongoing engagement provides stockholders an opportunity to share their perspectives and helps the Company identify and assess emerging areas of importance that may help shape our governance practices.

We strive for a collaborative approach to stockholder engagement and value the variety of stockholder perspectives we receive. Management and, in some cases, members of the Board actively engage with our stockholders to understand their perspectives on our Company, including our strategy, performance, corporate governance practices, executive compensation program, and sustainability efforts.

During 2024 and early 2025, we offered engagement meetings with the corporate governance teams of our largest stockholders and met with those stockholders that accepted our meeting invitations. These corporate governance engagement efforts, together with our other engagement efforts with institutional stockholders, represented approximately 66% of our total shares outstanding. In March 2024, we also held an Investor Day at the New York Stock Exchange (“NYSE”).

We are committed to understanding the perspectives of our stockholders and responding, as appropriate, giving consideration to their input along with corporate governance trends and best practices.

| | | | | | | | | | | |

| | | |

| | | |

Who We Engaged | | | ~66% of our outstanding shares |

| | | |

| | | |

How We Engaged | | •Proxy Specific Meetings •Investor Conferences •Site Visits and Shipyard Tours | •Annual Meeting •1x1 calls/meetings •Investor Day at NYSE |

| | | |

| | | |

Topics Discussed | | Governance Topics •Stockholder Proposals/Votes •Executive Compensation •Board Composition, Leadership Structure and Oversight | Sustainability Topics •Environmental Goals •Human Rights •Political Spending |

| | | |

| | Financial Topics •Financial Performance •Portfolio Mix •Capital Deployment | Company Strategy •Customer Priorities •Competitive Landscape |

| | |

| | | | | | | | |

|

| | |

PROPOSAL 1 | Election of Directors The Board has nominated 12 individuals for election as directors at the Annual Meeting. Each director nominee is a current HII Board member. |

| | |

| | The Board recommends a vote FOR each of the 12 director nominees. |

| | |

Director Election Process

Our directors are elected to one-year terms in accordance with our Bylaws and Certificate of Incorporation. Each director nominee will hold office until the next annual meeting of stockholders or until his or her earlier death, resignation or removal. They have consented to serve, and we do not know of any reason why they would be unable to serve, if elected. If any nominee is unable to serve as a director, which we do not anticipate, the Board by resolution may reduce the size of the Board or choose a substitute nominee.

Director Qualifications and Experience

We believe the qualifications, skills, experience and attributes of our directors are consistent with our criteria for the selection of directors and that, collectively, our directors have functioned effectively overseeing management of the Company over the last year.

DIRECTOR SKILLS SUMMARY

| | | | | | | | |

| Chief Executive Leadership and Strategy |

| 8/12 |

| | |

| Chief Financial Officer and Accounting |

| 5/12 |

| | |

| Investment Strategy, Corporate Development, and M&A |

| 7/12 |

| | |

| Shipbuilding and Manufacturing Operations/Leadership |

| 3/12 |

| | |

| Technical Services Executive Leadership |

| 4/12 |

| | |

| Military and Government Relations |

| 9/12 |

| | |

| Corporate Governance |

| 10/12 |

| | | | | | | | |

| Aerospace & Defense Industry Knowledge |

| 8/12 |

| | |

| Compliance, Legal, and Regulatory |

| 6/12 |

| | |

| Nuclear |

| 6/12 |

| | |

| Advanced Technology (Future Warfare) and Innovation |

| 4/12 |

| | |

| Cyber and IT Risk Management |

| 4/12 |

| | |

| Human Resources and Labor Relations |

| 3/12 |

| | |

| | | | | |

| 10 | Huntington Ingalls Industries, Inc. |

PROPOSAL 1—ELECTION OF DIRECTORS

DIRECTOR EXPERIENCE AND SKILLS

The Governance and Policy Committee regularly assesses the experience, skills, qualifications, and attributes of Board members relative to the appropriate mix of these qualities the committee believes is necessary to oversee effectively our business and execution of our strategy. While each Board member possesses a broad range of experience and skills, the Board believes each director has particular strategic strengths that he or she brings to the Board. The following table shows the experience, skills, and knowledge constituting the strategic strengths of each of our 12 director nominees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Experience and Skills | | | | | | | | | | | | | |

| Chief Executive Leadership and Strategy Experience as Chief Executive Officer of a public company or Chief Executive Officer of a private organization | | | | | | | | | | | | | |

| Chief Financial Officer and Accounting Experience as Chief Financial Officer of public company or large private organization or private equity executive leadership experience | | | | | | | | | | | | | |

| Investment Strategy, Corporate Development, and M&A Experience in executive leadership of private equity, other strategic investment firm or investment bank; experience in corporate development function; or oversight leadership experience in corporate development and transactional M&A | | | | | | | | | | | | | |

| Shipbuilding and Manufacturing Operations/Leadership Experience in executive leadership of shipyard operations or other manufacturing operations | | | | | | | | | | | | | |

| Technical Services Executive Leadership Experience in executive leadership of technical services business organization or significant technical services leadership or customer experience | | | | | | | | | | | | | |

| Military and Government Relations Experience as Admiral or other significant Naval career experience; significant federal government experience and relationships (e.g., Pentagon, Congress, White House); or significant military leadership role or leadership role in military associations | | | | | | | | | | | | | |

| Corporate Governance Current member of multiple public company boards; experience as public company board chair or public company committee chair; prior member of multiple public company boards; or corporate secretary experience | | | | | | | | | | | | | |

| Aerospace & Defense Industry Knowledge Significant direct Naval industry experience or significant direct general aerospace & defense experience | | | | | | | | | | | | | |

| Compliance, Legal, and Regulatory General Counsel, Chief Legal Officer or Chief Compliance Officer of large business organization or other significant legal or regulatory experience | | | | | | | | | | | | | |

| Nuclear Experience in Navy nuclear executive leadership; executive leadership of Naval nuclear shipyard operations; or oversight of nuclear operations | | | | | | | | | | | | | |

| Advanced Technology (Future Warfare) and Innovation Experience as Chief Technology Officer or equivalent of large aerospace & defense company; Chief Technology Officer or equivalent of other large organization; or engineering/ technology/ innovation functional lead | | | | | | | | | | | | | |

| Cyber and IT Risk Management Experience as Chief Information Officer, Chief Information Security Officer or equivalent operational experience; management experience in cyber operations; or experience on a corporate cyber risk committee | | | | | | | | | | | | | |

| Human Resources and Labor Relations Experience as Chief Human Resources Officer or equivalent of a large business organization or significant human resources or labor relations experience | | | | | | | | | | | | | |

PROPOSAL 1—ELECTION OF DIRECTORS

2025 Director Nominees

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Augustus L. Collins Chief Executive Officer of MINACT, Inc. Director since: November 2016 Age: 67 Committees: Audit, Cybersecurity # of Other Public Company Directorships: 1 | | | | | | | | |

| | General Collins has served as Chief Executive Officer of MINACT, Inc., a business management consulting firm, since September 2016. From January 2012 to August 2016, he was a Major General in the Mississippi National Guard, serving as Adjutant General of both the Mississippi Army National Guard and the Mississippi Air National Guard. From July 2010 to January 2012, General Collins served as Executive Vice President for Strategic Planning of MINACT. From August 2007 to July 2010, he served on Mississippi’s Workers’ Compensation Commission as the commission’s representative of labor. General Collins served more than 35 years in the U.S. Army and Mississippi National Guard, which included command of the 155th Brigade Combat Team of the Mississippi National Guard in Iraq, where he was responsible for security operations in the southern and western provinces. Current Public Company Directorships: General Collins serves on the board of directors of Trustmark Corporation, a bank holding company, and is the chair of its Audit Committee and a member of its Enterprise Risk Committee, Human Resources Committee, and Nominating and Governance Committee. Other Directorships and Memberships: General Collins serves on the board of directors of MINACT, Inc., Trustmark National Bank, Mississippi Power Company, an electric power distribution company, and the Armed Forces Benefits Association. He also serves on the board of the Friends of Mississippi Veterans, a nonprofit entity serving veterans in Mississippi. He is past President of the University of Mississippi Alumni Association. Experience, Qualifications, Attributes, and Skills: We believe General Collins is qualified to serve as a director given his extensive career as a senior military officer with the U.S. Army and Mississippi National Guard and his leadership and business experience as a senior executive and Chief Executive Officer of MINACT, Inc. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Military and Government Relations | | Corporate Governance |

| | | | | | | |

| | | Aerospace & Defense Industry Knowledge | | Human Resources and Labor Relations | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Leo P. Denault Former Chairman and Chief Executive Officer of Entergy Corporation Director since: November 2022 Age: 65 Committees: Audit (Chair), Finance # of Other Public Company Directorships: 1 | | | | | | | | |

| | Mr. Denault served as the Chairman of the Board and Chief Executive Officer of Entergy Corporation from February 2013 to November 2022 and as Executive Chairman of Entergy from November 2022 to February 2023. He served as Executive Vice President and Chief Financial Officer from February 2004 to January 2013 and as Vice President, Corporate Development for Entergy Corporation from March 1999 to February 2004. Prior to that, he was Vice President, Corporate Development for Cinergy Corporation (now Duke Energy), an energy company. Current Public Company Directorships: Mr. Denault currently serves on the board of directors of PG&E Corporation and its subsidiary, Pacific Gas and Electric Company, and is a member of the Audit Committee of both companies and the Finance and Innovation Committee of the PG&E Corporation board. Other Directorships and Memberships: Mr. Denault currently serves on the board of directors of Alpha Generation, a private company that manages critical power infrastructure, and Jobs for America’s Graduates. He also serves as a senior advisor to ArcLight, a leading middle-market infrastructure investor. Experience, Qualifications, Attributes, and Skills: We believe Mr. Denault is qualified to serve as a director based upon his significant business, leadership, and financial experience as Chief Executive Officer and Chief Financial Officer of a Fortune 500 public company. Mr. Denault also possesses extensive business management, financial reporting, and corporate finance experience. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Chief Financial Officer and Accounting | | Investment Strategy, Corporate Development, and M&A |

| | | | | | | |

| | | Corporate Governance | | Compliance, Legal, and Regulatory | | Nuclear |

| | | | | | | | |

| | | | | |

| 12 | Huntington Ingalls Industries, Inc. |

PROPOSAL 1—ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Kirkland H. Donald Chairman of the Board, Huntington Ingalls Industries, Inc. Director since: November 2017 Age: 71 Committees: Compensation, Cybersecurity # of Other Public Company Directorships: 2 | | | | | | | | |

| | Admiral Donald has served as Chairman of the Board of HII since April 2020. Prior to serving as Chairman of the Board, he worked as a business consultant from October 2015. From June 2013 to October 2015, Admiral Donald served as Chief Operating Officer and then President and Chief Executive Officer of Systems Planning and Analysis, Inc., a technical professional services company. Prior to that, Admiral Donald served 37 years in the U.S. Navy, including in his last assignment, as Director, Naval Nuclear Propulsion Program from November 2004 to November 2012. Current Public Company Directorships: Admiral Donald serves on the board of directors of Entergy Corporation and is chair of its Nuclear Committee and a member of its Finance Committee. He also serves on the board of directors of Centrus Energy Corporation, a nuclear energy company, and is a member of its Technology, Competition and Regulatory Committee, Audit and Finance Committee, and Compensation, Nominating and Governance Committee. Other Directorships and Memberships: Admiral Donald currently serves on the boards of directors of Battelle Memorial Institute and the Naval Submarine League. He also is an outside director (on a “proxy” board) of Rolls-Royce North America and Sauer Compressors USA and a CFIUS security monitor for LANXESS Corporation, all of which are suppliers to HII. Experience, Qualifications, Attributes, and Skills: We believe Admiral Donald is qualified to serve as a director based upon his extensive military experience as a senior military officer with the U.S. Navy, including specific experience with naval nuclear programs. He also brings significant business and leadership experience having served on the boards of directors of other public and private companies and his experience serving as a senior operating officer and chief executive officer of a private company that provides services primarily to the U.S. Department of Defense and U.S. Department of Homeland Security. Admiral Donald also has cybersecurity expertise and holds the CERT certificate in cybersecurity oversight from Carnegie Mellon University. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Chief Financial Officer and Accounting | | Technical Services Executive Leadership |

| | | | | | | |

| | | Military and Government Relations | | Corporate Governance | | Aerospace & Defense Industry Knowledge |

| | | | | | | | |

| | | | Compliance, Legal, and Regulatory | | Nuclear | | Advanced Technology (Future Warfare) and Innovation |

| | | | | | | | |

| | | | Cyber and IT Risk Management | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Craig S. Faller Advisor and Consultant; Retired Admiral, United States Navy Director since: 2023 Age: 63 Committees: Audit, Finance

| | | | | | | | |

| | Admiral Faller retired from his position as the Commander of the United States Southern Command in October 2021, where he led U.S. military operations in Latin America and the Caribbean, having served in that position since November 2018. Since his retirement, he has served as an advisor and consultant across many industries. From January 2017 to October 2018, Admiral Faller served as the Senior Military Assistant to the Secretary of Defense, and from June 2014 to January 2017, as Chief of Legislative Affairs for the United States Navy. During his service, Admiral Faller held multiple operational commands, including of two warships and an aircraft carrier strike group, led the Navy’s 5,000 person recruiting organization, and served as Director of Operations for the United States Central Command. He is a nuclear trained surface warfare officer. Other Directorships and Memberships: Admiral Faller serves on the board of directors of Viken Detection and Sigma Defense Systems. He also serves on the International Strategic Advisory Council of Excelerate Energy; as an advisor to Strider Intel; as a trustee of the Center for Naval Analysis; on the Advisory Board of the Penn State Applied Research Laboratory; as a Distinguished Fellow at the Atlantic Council; as a Senior Fellow at the National Defense University; and as a Senior Fellow at Florida International University. He also is Chairman of the Surface Navy Association Board, a non-profit organization that advocates for U.S. Navy Surface Warfare. Experience, Qualifications, Attributes, and Skills: We believe Admiral Faller is qualified to serve as a director given his extensive global and national security experience as a senior military officer in the U.S. Navy. He also possesses significant insight into the legislative and budgetary processes of the U.S. Navy and Department of Defense more broadly given his experience as the Chief of Legislative Affairs for the U.S. Navy. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Technical Services Executive Leadership | | Military and Government Relations | | Aerospace & Defense Industry Knowledge |

| | | | | | | |

| | | Nuclear | | Human Resources and Labor Relations | | |

| | | | | | | | |

PROPOSAL 1—ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Victoria D. Harker Former Executive Vice President and Chief Financial Officer of TEGNA Inc. Director since: August 2012 Age: 60 Committees: Compensation (Chair), Finance # of Other Public Company Directorships: 2 | | | | | | | | |

| | Ms. Harker served as Executive Vice President and Chief Financial Officer of TEGNA Inc., a broadcast and digital media company, from June 2015 to December 2023, and as Chief Financial Officer of Gannett Co., Inc. from July 2012 to June 2015. Prior to that, she served as Chief Financial Officer of The AES Corporation, a multinational power company, from 2006 to 2012 and as President of Global Business Services from 2011 to 2012. Before joining AES, she was the acting Chief Financial Officer and Treasurer of MCI, Inc., a telecommunications company, from November 2002 through January 2006, and Chief Financial Officer of MCI Group, a unit of Worldcom, Inc., a communications company, from 1998 to 2002. Current Public Company Directorships: Ms. Harker serves on the board of directors of Philip Morris International, Inc., where she is a member of its Audit and Risk Committee, and Xylem, Inc. (formerly ITT), a global water infrastructure company, where she serves as Chair of its Audit Committee and is a member of its Nominating and Governance Committee. Prior Public Company Directorships: Ms. Harker served on the board of directors of Stride, Inc., an education company, from 2020 to 2022, and Darden Restaurants, Inc. from 2009 to 2014. Other Directorships and Memberships: Ms. Harker is Vice Chair of the State Council of Higher Education for Virginia, a member of the University of Virginia Health System Board, and a member of the American University Advisory Counsel. Previously she served as a member of the University of Virginia’s Board of Visitors. Experience, Qualifications, Attributes, and Skills: We believe Ms. Harker is qualified to serve as a director based upon the significant experience in business and finance she has accumulated serving as chief financial officer and in other senior management positions with large publicly traded companies, as well as her experience serving on boards and board committees of other publicly traded companies. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Financial Officer and Accounting | | Investment Strategy, Corporate Development, and M&A | | Corporate Governance |

| | | | | | | |

| | | Compliance, Legal, and Regulatory | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Frank R. Jimenez General Counsel and Corporate Secretary of GE HealthCare Technologies Director since: January 2022 Age: 60 Committees: Compensation, Governance and Policy

| | | | | | | | |

| | Mr. Jimenez has served as General Counsel and Corporate Secretary of GE HealthCare Technologies Inc., a medical device manufacturing and pharmaceuticals company, since its spin-off from GE in January 2023, having previously served as General Counsel of GE’s healthcare business from February 2022 until its spin-off. From April 2020 to February 2022, Mr. Jimenez served in various capacities at Raytheon Technologies Corporation (formerly United Technologies Corporation (“UTC”) and now known as RTX), including as Executive Vice President and General Counsel. From January 2015 until its merger with UTC in April 2020, Mr. Jimenez served as Vice President and General Counsel of the Raytheon Company. In prior roles, Mr. Jimenez served as General Counsel of Bunge Limited, ITT Corporation, and ITT spin-off, Xylem Inc. Mr. Jimenez also has extensive government experience, having served as the General Counsel of the Navy, Deputy General Counsel of the U.S. Department of Defense, Principal Deputy General Counsel of the Navy, Chief of Staff at the U.S. Department of Housing and Urban Development, and Deputy Chief of Staff and Acting General Counsel for Florida Governor Jeb Bush. Before entering government service, Mr. Jimenez was a litigation partner at Steel Hector and Davis LLP (now Squire Patton Boggs LLP). He began his legal career with a clerkship in the chambers of Judge Pamela Ann Rymer of the U.S. Court of Appeals for the Ninth Circuit in Pasadena, California. Other Directorships and Memberships: Mr. Jimenez serves on the boards of Equal Justice Works, the Yale Law School Association, the Ann and Robert H. Lurie Children’s Hospital of Chicago and Medical Center, and the Lake Forest Country Day School, as well as the advisory boards of the Columbia University Mailman School of Public Health, the Yale Law School Center for the Study of Corporate Law, the Yale Law School Tsai Leadership Program, and the National Security Institute of the Antonin Scalia Law School at George Mason University. He also serves on the University of Miami President’s Council. Experience, Qualifications, Attributes, and Skills: We believe Mr. Jimenez is qualified to serve as a director based upon his significant leadership experience as a senior legal officer of one of the largest aerospace and defense companies in the United States, as well as the most senior legal officer of four other S&P 500 companies. He also brings extensive government and other public service, including his service as General Counsel of the Navy, our largest customer, and Deputy General Counsel for the Department of Defense. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Investment Strategy, Corporate Development, and M&A | | Military and Government Relations | | Corporate Governance |

| | | | | | | |

| | | Aerospace & Defense Industry Knowledge | | Compliance, Legal, and Regulatory | | |

| | | | | | | | |

| | | | | |

| 14 | Huntington Ingalls Industries, Inc. |

PROPOSAL 1—ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Christopher D. Kastner President and Chief Executive Officer of Huntington Ingalls Industries, Inc. Director since: March 2022 Age: 61

| | | | | | | | |

| | Mr. Kastner has served as President and Chief Executive Officer since March 2022. Prior to becoming CEO, he served as Executive Vice President and Chief Operating Officer from February 2021 to February 2022, and as Executive Vice President and Chief Financial Officer from March 2016 to February 2021. Mr. Kastner served as Corporate Vice President and General Manager, Corporate Development from August 2012 to March 2016, and as Vice President and Chief Financial Officer, Ingalls Shipbuilding, from March 2011 to August 2012. Prior to the spin-off, Mr. Kastner held various positions, including as Vice President, Business Management and Chief Financial Officer, Northrop Grumman Shipbuilding, Gulf Coast, and as Vice President, Contracts and Risk Management, Northrop Grumman Ship Systems. Other Directorships and Memberships: Mr. Kastner serves on the board of directors of New York Life Insurance Co. He is a member of the Aerospace Industries Association and is Vice Chair of the Defense Industry Initiative on Business Ethics and Conduct. Mr. Kastner also is a member of the Business Roundtable Board of Directors and serves as chair of its Education and Workforce Committee. Experience, Qualifications, Attributes, and Skills: We believe Mr. Kastner is qualified to serve as a director based upon his significant leadership, business management, corporate development, strategy and financial expertise from his roles within the Company, including as Chief Operating Officer, Chief Financial Officer and, most recently, CEO. Mr. Kastner brings significant aerospace and defense industry experience from his roles with the Company and Northrop Grumman Corporation prior to the spin-off. He also possesses substantial shipbuilding operational experience from his roles at Ingalls Shipbuilding and predecessor companies. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Chief Financial Officer and Accounting | | Investment Strategy, Corporate Development, and M&A |

| | | | | | | |

| | | Shipbuilding and Manufacturing Operations/Leadership | | Technical Services Executive Leadership | | Aerospace & Defense Industry Knowledge |

| | | | | | | | |

| | | | Nuclear | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Anastasia D. Kelly Senior Advisor to the Chair and Executive Director of Client Relations of DLA Piper Director since: March 2011 Age: 75 Committees: Compensation, Governance and Policy | | | | | | | | |

| | Ms. Kelly has served as Senior Advisor to the Chair and Executive Director of Client Relations of DLA Piper, a law firm, since April 2020. Prior to that, Ms. Kelly served as Managing Partner of DLA Piper Americas from 2018 to 2020, as Co-Managing Partner from 2013 to 2018 and as a partner since 2010. Prior to joining DLA Piper, Ms. Kelly served as Executive Vice President and General Counsel at American International Group, Inc. (“AIG”) from 2006 to 2010, and was named Vice Chairman of AIG in 2009. Prior to joining AIG, Ms. Kelly was general counsel of several companies, including MCI WorldCom, Inc., Sears, Roebuck and Co. and Fannie Mae. Prior Public Company Directorships: Ms. Kelly served on the board of directors of O-I Glass, Inc. (formerly Owens-Illinois, Inc.), one of the leading manufacturers of glass containers, from 1992 until 2022. She was a director of Saxon Capital from 2005 to 2007. Other Directorships and Memberships: Ms. Kelly serves on the boards of numerous philanthropic organizations and serves as a director of George Washington University Medical Faculty Associates. She is also past Chair of Equal Justice Works and a former director of Lawyers for Children America. Experience, Qualifications, Attributes, and Skills: We believe Ms. Kelly is qualified to serve as a director based upon her extensive experience as a senior executive and general counsel of several large, publicly traded companies, her tenure as a director of another public company, and her substantial business and legal experience. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Military and Government Relations | | Corporate Governance | | Compliance, Legal, and Regulatory |

| | | | | | | |

| | | Human Resources and Labor Relations | | | | |

| | | | | | | | |

PROPOSAL 1—ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Tracy B. McKibben Founder & Chief Executive Officer of MAC Energy Group Companies Director since: December 2018 Age: 55 Committees: Cybersecurity, Governance and Policy # of Other Public Company Directorships: 1 | | | | | | | | |

| | Ms. McKibben is the founder and Chief Executive Officer of MAC Energy Group companies that has invested in integrated energy solutions for investments and strategic opportunities across a global platform since 2010. From September 2007 to August 2009, Ms. McKibben served as Managing Director and Head of Environmental Banking Strategy at Citicorp Global Markets. Ms. McKibben has extensive public sector experience, having served as the Director of European Economic Affairs and EU Relations and Acting Senior Director for European Affairs on the National Security Council at the White House from July 2003 to August 2007. Before joining the National Security Council, Ms. McKibben served in various senior advisory roles in the U.S. Department of Commerce. Prior to her work in the public sector, she practiced law at Akin, Gump, Strauss & Feld LLP. Current Public Company Directorships: Ms. McKibben serves on the board of directors of Ecolab Inc., a chemicals company, where she is a member of the Governance Committee and Compensation and Human Capital Management Committee. Other Directorships and Memberships: Ms. McKibben serves on the Board of Directors of United Services Automobile Association, a financial services company, where she serves on the Membership & Technology and Risk & Compliance Committees. She also serves on the Board of Directors of the National Kidney Foundation and the Board of Governors of West Virginia State University. She is a life member of the Council on Foreign Relations, serving on the Membership Committee. Experience, Qualifications, Attributes, and Skills: We believe Ms. McKibben is qualified to serve as a director based on her significant business and leadership experience. She is an international energy and environmental technology expert, with expertise in alternative energy, renewable energy, green technology, water, energy efficiency, and sustainability management. She also has extensive international and public sector experience. Ms. McKibben’s experience serving on the boards of directors of other public companies further complements her qualifications to serve on our Board. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Investment Strategy, Corporate Development, and M&A | | Compliance, Legal, and Regulatory |

| | | | | | | |

| | | Military and Government Relations | | Corporate Governance | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Stephanie L. O’Sullivan Former Principal Deputy Director, Office of the Director of National Intelligence Director since: January 2021 Age: 65 Committees: Cybersecurity (Chair), Finance

| | | | | | | | |

| | Ms. O’Sullivan served as the Principal Deputy Director of the Office of the Director of National Intelligence from February 2011 to January 2017 and has served as an independent business consultant since January 2017. As the Principal Deputy Director of National Intelligence, she assisted the Director of National Intelligence in the management of day-to-day operations of the intelligence community. From December 2009 until February 2011, Ms. O’Sullivan served as the Associate Deputy Director of the Central Intelligence Agency. Prior to that appointment, she held several management positions in the agency’s Directorate of Science and Technology, working to develop and deploy innovative technology in support of intelligence collection and analysis. Other Directorships and Memberships: Ms. O’Sullivan serves on the boards of directors of Centrus, Battelle Memorial Institute, HRL Laboratories (formerly Hughes Research Laboratories) and Accenture Federal Services (proxy board) and on the board of trustees of IQT (In-Q-Tel). She previously served on the boards of The Aerospace Corporation and the CIA Officers Memorial Fund and on various advisory boards at Google, Adobe, Oak Ridge National Laboratory, Noblis, Peraton and Booz Allen Hamilton. Ms. O’Sullivan has been an adjunct faculty member at Georgetown University’s Center for Security and Emerging Technology and continues to support study activities for the Department of Defense, Office of the Director of National Intelligence and the CIA. She was elected a member of the National Academy of Engineering in 2019. Experience, Qualifications, Attributes, and Skills: We believe Ms. O’Sullivan is qualified to serve as a director based upon her extensive national security experience. She brings broad experience in the fields of command, control and intelligence for the U.S. government. In addition, Ms. O’Sullivan is a demonstrated governance professional based upon her experience in the board environment of private organizations. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Technical Services Executive Leadership | | Military and Government Relations |

| | | | | | | |

| | | Corporate Governance | | Aerospace & Defense Industry Knowledge | | Advanced Technology (Future Warfare) and Innovation |

| | | | | | | | |

| | | | Cyber and IT Risk Management | | | | |

| | | | | | | | |

| | | | | |

| 16 | Huntington Ingalls Industries, Inc. |

PROPOSAL 1—ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Thomas C. Schievelbein Former Chairman, President and Chief Executive Officer of The Brink’s Company Director since: March 2011 Age: 71 Committees: Audit, Finance (Chair) | | | | | | | | |

| | Mr. Schievelbein served as Chairman, President and Chief Executive Officer of The Brink’s Company, a security company, from June 2012 until his retirement in May 2016. He served as President of Northrop Grumman Newport News from November 2001 to November 2004 and served as Chief Operating Officer of Newport News Shipbuilding Inc. from 1995 until 2001 and was responsible for the design, construction and maintenance of nuclear-powered aircraft carriers and submarines. His experience includes the Virginia-class submarine program, CVN-76, CVN-77 and CVN-21 aircraft carrier programs, aircraft carrier overhaul and refueling, submarine fleet maintenance, commercial and naval ship repair and business development. Prior Public Company Directorships: Mr. Schievelbein previously served on the board of directors of The Brink’s Company from March 2009 until his retirement in May 2016, serving as Chairman of that board from June 2012. Mr. Schievelbein served on the board of directors of McDermott International Inc., an engineering company, from 2004 to 2012. Other Directorships and Memberships: Mr. Schievelbein is on the board of directors of New York Life Insurance Co., where he serves as lead director. Mr. Schievelbein is a past member of the Secretary of the Navy’s Advisory Panel and was a director of the U.S. Naval Academy Foundation from 2004 through 2012. Experience, Qualifications, Attributes, and Skills: We believe Mr. Schievelbein is qualified to serve as a director based upon his experience as the President and Chief Operating Officer of Northrop Grumman Newport News and Chief Operating Officer of Newport News Shipbuilding Inc., his prior experience as Chairman, President and Chief Executive Officer of a public company and his experience serving as a director of other public companies. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Investment Strategy, Corporate Development, and M&A | | Shipbuilding and Manufacturing Operations/Leadership |

| | | | | | | |

| | | Military and Government Relations | | Corporate Governance | | Aerospace & Defense Industry Knowledge |

| | | | | | | | |

| | | | Nuclear | | Advanced Technology (Future Warfare) and Innovation | | Cyber and IT Risk Management |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

John K. Welch Former President and Chief Executive Officer of Centrus Energy Corp.(formerly USEC Inc.) Director since: February 2015 Age: 75 Committees: Audit, Governance and Policy Committee (Chair)

| | | | | | | | |

| | Mr. Welch served as President and Chief Executive Officer of Centrus Energy Corp. (formerly USEC Inc.) from October 2005 until his retirement in October 2014. He previously was a senior executive with General Dynamics Corporation, retiring from the company in 2003 as Executive Vice President for the Marine Systems Group, which included Bath Iron Works, Electric Boat and National Steel and Shipbuilding Company. During his career with General Dynamics, which began in 1989, Mr. Welch served in various leadership positions at Electric Boat, including as President, Vice President of Programs, with responsibility for new construction, overhaul and repair programs, material acquisition and information technology, and Vice President for Program Development, with responsibility for strategic planning, program and product marketing and high-technology program acquisition and management. Mr. Welch served over seven years on active duty with the U.S. Navy as a nuclear submarine officer and retired from the Naval Reserve. Prior Public Company Directorships: Mr. Welch served on the board of directors of Centrus Energy Corp. and its predecessor, USEC Inc., from 2005 until 2013. Other Directorships and Memberships: Mr. Welch serves on the boards of Novawall Systems Incorporated and is the Chairman of the Board for Ocean Reef Community Association. He also is the retired Chairman of the Board of Battelle Memorial Institute. Experience, Qualifications, Attributes, and Skills: We believe Mr. Welch is qualified to serve as a director based upon his senior executive experience at other public companies in the shipbuilding and energy markets, including one of our primary competitors to our core shipbuilding business. Mr. Welch also brings experience as a director of other public and private companies and not-for-profit entities. |

| | | | | | | |

| | | | | | | |

| | Skills: | | | | |

| | | | | | | |

| | | Chief Executive Leadership and Strategy | | Chief Financial Officer and Accounting | | Investment Strategy, Corporate Development, and M&A |

| | | | | | | |

| | | Shipbuilding and Manufacturing Operations/Leadership | | Military and Government Relations | | Corporate Governance |

| | | | | | | | |

| | | | Aerospace & Defense Industry Knowledge | | Nuclear | | Advanced Technology (Future Warfare) and Innovation |

| | | | | | | | |

| | | | Cyber and IT Risk Management | | | | |

| | | | | | | | |

| | | | | |

| |

| GOVERNANCE OF THE COMPANY |

Overview

We believe robust governance practices are important not only to our stockholders, but to our customers, employees, suppliers, and other stakeholders. Our corporate governance framework is designed to promote the Company’s long-term success, consistent with our values. The following sections provide an overview of our corporate governance framework, the Board’s role in risk oversight, and other key elements of our program.

Board Leadership Structure

The Board believes one of its primary responsibilities is to evaluate and determine from time to time the appropriate Board leadership structure to provide effective oversight of the Company. The Board evaluates, at least annually, the leadership structure, giving consideration to, among other things, the advantages and disadvantages of a combined chief executive officer and chairman role, the need for a strong, independent oversight function, and the overall governance and operating environment. The Board continues to believe it is appropriate and in the best interest of the Company and our stockholders at this time to designate an independent, non-executive Chairman of the Board.

Non-Executive Chairman

Our Bylaws provide that the Board will designate the Chairperson of the Board from among its members. Our Corporate Governance Guidelines provide further that the Board believes it is in the best interests of the Company and its stockholders for the Board to have the flexibility to determine the best director to serve as Chairman. Following the 2024 Annual Meeting, the Board designated Adm. Donald as our non-executive Chairman of the Board. Adm. Donald has served in this role since April 2020.

Our non-executive Chairman has the following responsibilities as set forth under our Corporate Governance Guidelines:

•chair all Board and stockholder meetings, including executive sessions of the independent directors;

•serve as a liaison between the Chief Executive Officer and the independent directors;

•ensure the quality, quantity and timeliness of the flow of information from management to the Board (although management is responsible for the preparation of materials for the Board, the non-executive Chairman may specifically request the inclusion of certain materials);

•prepare the agendas of the Board meetings and assist the Chair of each standing committee with preparation of agendas for the respective committee meetings, taking into account the requests of other Board and committee members;

•set an appropriate schedule for Board meetings to assure there is sufficient time for discussion of all agenda items;

•along with the Chair of the Governance and Policy Committee, interview all Board candidates and make recommendations to the Governance and Policy Committee and the Board;

•have the authority to call meetings of the Board and meetings of the independent directors; and

•if requested by the Chief Executive Officer, be available for consultation and direct communication with stockholders.

| | | | | |

| 18 | Huntington Ingalls Industries, Inc. |

GOVERNANCE OF THE COMPANY

Role of the Board of Directors

We believe the foundation of sound corporate governance is a board of directors whose independence, skills, experience, and judgment enable the Board to oversee management of the Company effectively and provide constructive advice and counsel. In addition to its general oversight role, the Board, together with the standing Board committees, perform a number of important functions for the Company, including those listed below.

STRATEGY, RISK AND PERFORMANCE

•reviewing, approving, and monitoring the Company's long-range business strategies

•reviewing and monitoring the performance of the Company, including the Company’s financial condition

•understanding and assessing the significant enterprise risks to which the Company is subject and overseeing management of those enterprise risks

•reviewing and approving significant corporate transactions and commitments not entered into in the ordinary course

•monitoring and evaluating the performance of the Company and management

HUMAN CAPITAL

•selecting our Chief Executive Officer and electing officers of the Company

•overseeing and evaluating the performance of the Chief Executive Officer and other executive officers

•overseeing succession plans for our Chief Executive Officer and other senior executives

•reviewing and approving executive compensation

GOVERNANCE

•overseeing policies to maintain the integrity of the Company, including the integrity of the Company’s financial statements, compliance with legal requirements, and the Company’s ethics and business conduct standards

•overseeing our sustainability program

•providing advice and counsel to management

•evaluating the effectiveness of the Board and its committees

GOVERNANCE OF THE COMPANY

The Board’s Role in Risk Oversight

As noted above, the Board’s responsibilities include oversight of enterprise risk management, which includes overseeing our system of financial and operational internal controls, our compliance with applicable laws and regulations, data and cybersecurity risks, and our processes for identifying, assessing and mitigating other significant enterprise risks that may affect the Company. To discharge these responsibilities, the Board must understand the significant risks to which the Company is subject. While the Board is charged with mitigating significant enterprise risks that may affect the Company, the Board understands it is neither possible nor prudent to eliminate all risk. Indeed, purposeful, appropriate and managed risk-taking is essential for the Company to be competitive, profitable, and successfully execute its business strategy. The Board in its oversight role seeks to ensure that management is identifying, appropriately managing and mitigating the Company’s significant enterprise risks.

Management has implemented a robust enterprise risk management (“ERM”) program that is designed to identify, assess, manage, and mitigate significant enterprise risks. Our ERM program is managed by an Enterprise Risk Committee, comprised of management from across business units and programmatic and functional disciplines within the Company. The Enterprise Risk Committee is responsible for overseeing the annual enterprise risk assessment process, overseeing development of, and monitoring, enterprise risk mitigation plans, assessing risk correlations, monitoring emerging and evolving risks, and generating data and reports to facilitate management decision-making and the Board’s overall risk oversight function. While the Board and its committees oversee risk management, management is responsible for identifying, assessing, managing, and mitigating risks on a day-to-day basis.

The Board and its committees are responsible for understanding and evaluating the Company's ERM program and its effectiveness. On an annual basis, the Board is briefed by management on the Company’s ERM program, which includes a report on the Company’s annual enterprise risk assessment process, a review of the identified enterprise risks and risk assessments, and assessments of management’s ability to mitigate appropriately the identified enterprise risks. Management also briefs the Board or a Board committee on a periodic basis on individual enterprise risks, which includes a report from management’s risk owner and the related risk mitigation plan. Management seeks to brief the Board on each Tier 1 enterprise risk, which consist of those enterprise risk most likely to significantly impact the Company if they occur, on an annual basis, except those Tier 1 risks that are relatively static (like the risk of hurricane impact and recovery), which generally are briefed on a biennial basis. The Board is updated on an interim basis on any significant changes to the Company’s enterprise risk roster and any other material developments affecting the Company’s ERM program.

The Governance and Policy Committee is responsible for, among other things, (1) developing and recommending to the Board the processes for the Board’s oversight of the Company’s risk management and (2) monitoring the Board’s oversight of risk management. In connection with this responsibility, the Governance and Policy Committee evaluates the enterprise risk roster generated from the Company’s enterprise risk assessment, allocates oversight responsibilities among the full Board and individual standing Board committees, and develops a schedule for briefing enterprise risks among the Board and its committees.

Risks are inherent in the Company’s operations and the pursuit of its strategy, and oversight of risk management is a continuous process. The Board and its committees regularly engage with management in support of a culture of transparency, integrity, and risk awareness. Directors also are encouraged to communicate directly with senior management, which they do on a routine basis.

BOARD AND COMMITTEE OVERSIGHT OF CYBERSECURITY

In response to the increasing risk exposure presented by data and cybersecurity, the Board formed a standing Cybersecurity Committee of the Board in 2019. The Board believes that dedication of a standing committee to cybersecurity facilitates a deeper Board understanding of the Company’s data and cybersecurity risk exposure; the opportunity for Committee members to have a deeper data and cybersecurity knowledge base; and closer Board oversight of the Company’s management and mitigation of data and cybersecurity risks. In addition to the oversight responsibilities described in this section, the Cybersecurity Committee participates with management periodically in a “tabletop” exercise to test the Company’s cybersecurity incident response plan.

| | | | | |

| 20 | Huntington Ingalls Industries, Inc. |

GOVERNANCE OF THE COMPANY

While the full Board has ultimate responsibility for the oversight of risk management, each of our Board committees assists the Board in its oversight of certain enterprise risks. Each committee periodically reports to the Board with respect to its oversight of these enterprise risks.

| | | | | | | | | | | | | | | | | | | | |

Board of Directors The full Board oversees the Company's enterprise risk management processes, and the Board exercises direct oversight of specific enterprise risks not delegated to one of its committees. The committees report to the full Board with updates on their respective areas of designated risk oversight responsibilities. | | | | | | |

| | | Audit Oversees: | | |

| | | |

| | | •System of internal controls •Integrity of financial statements •Financial reporting process •Internal and external audit function •Legal risk | •Compliance program, including Code of Ethics and Business Conduct •Policies and practices relating to corporate sustainability matters relative to environmental stewardship | |

| | | | | |

| | | | | |

| | | | | |

| | | Compensation Oversees: | | |

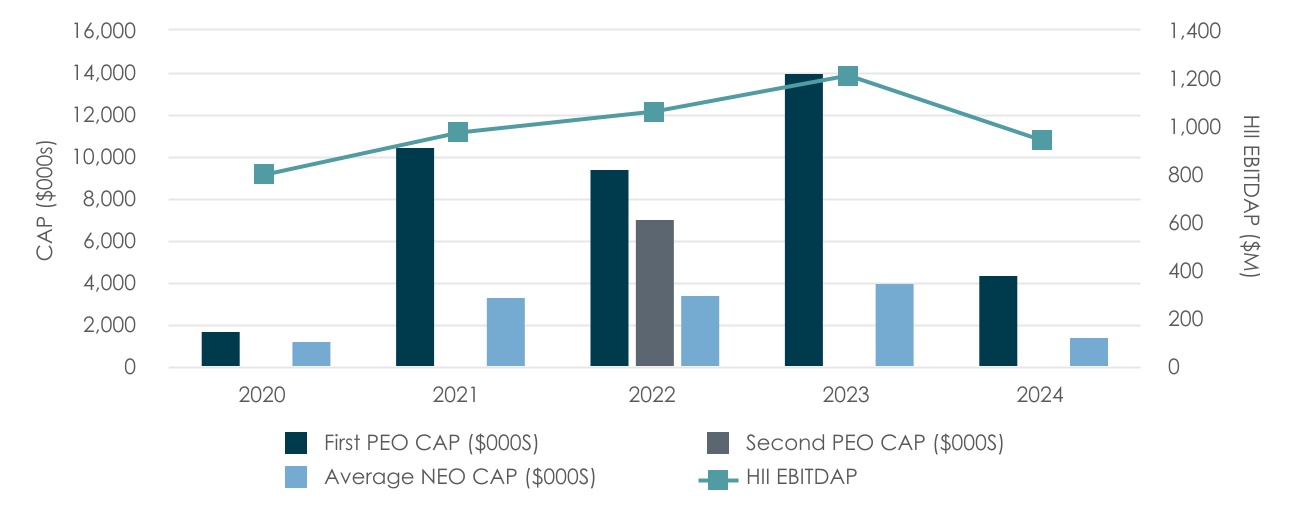

| | | |