FS ENERGY & POWER FUND 2019 Global High Yield & Leveraged Finance Conference FEBRUARY 25, 2019

TABLE OF CONTENTS 2 1 KEY CREDIT HIGHLIGHTS 3 2 FS / EIG PARTNERSHIP OVERVIEW 6 3 PORTFOLIO UPDATE 8

3 3 KEY CREDIT HIGHLIGHTS

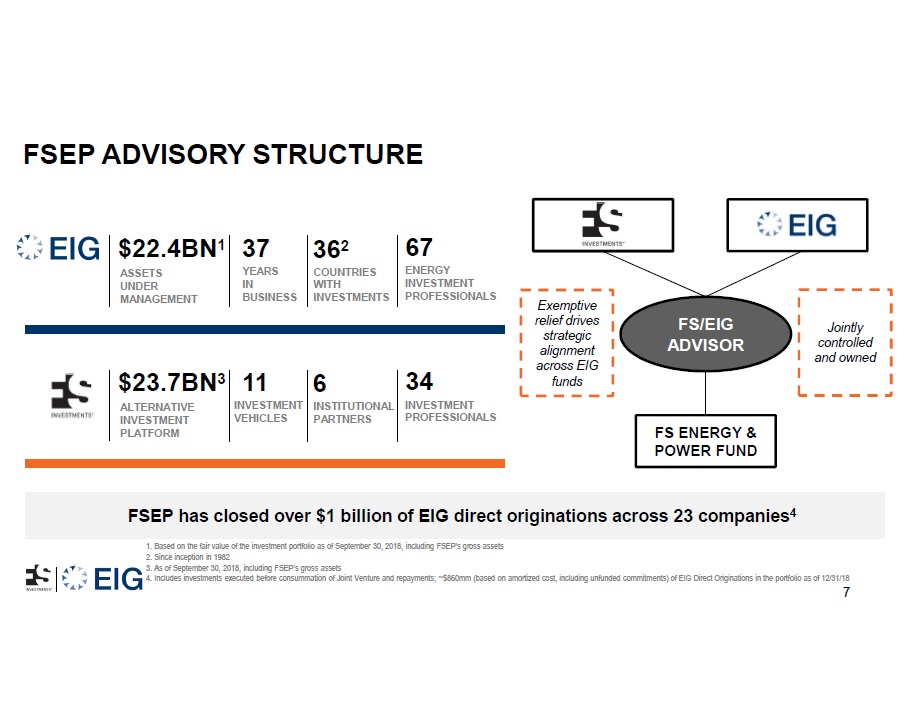

4 • 37 year track record of investing in the energy industry • Extensive asset management experience developed by managing investments through multiple commodity cycles • Focus on downside protection, evidenced by strong recovery rates in work - out scenarios SUPPORTED BY EIG’S SUCCESSFUL INVESTMENT TRACK RECORD • Strong LTVs provide significant collateral cushion to investors • Well diversified across energy sectors, including upstream, midstream, power, and renewables SIGNIFICANT FOCUS ON DOWNSIDE PROTECTION • Strong track record of managing corporate liability structure conservatively and through commodity cycles • Targeting conservative leverage (debt / equity) of 0.50x with a long range target in the 0.50x – 0.65x range • Quarterly redemptions are capped at the amount of shareholder dividends reinvested to reduce risks of forced selling CONSERVATIVE LEVERAGE PROFILE • Close to $68tn is expected to be spent on energy infrastructure globally through 2040 1 • EIG’s extensive sourcing capability allows for expansion of investment opportunities and diversification of existing portfoli o • Technical expertise allows EIG to quickly and thoroughly assess the attractiveness of potential energy investments ATTRACTIVE MARKET OPPORTUNITY • EIG’s scale and industry expertise allow it to function as a solution provider and negotiate investment terms • FS and EIG manage $23.7bn 2 and $22.4bn 3 in assets, respectively • Over 100 investment professionals between both firms (67 4 at EIG and 34 at FS, 14 engineers at EIG) SCALED PLATFORM 1. IEA World Energy Outlook 2015 - 2040 2. As of September 30, 2018, including FSEP’s gross assets 3. Based on the fair value of the investment portfolio as of September 30, 2018, including FSEP’s gross assets 4. 67 aggregate investment professionals, 7 of whom are also engineers KEY CREDIT HIGHLIGHTS

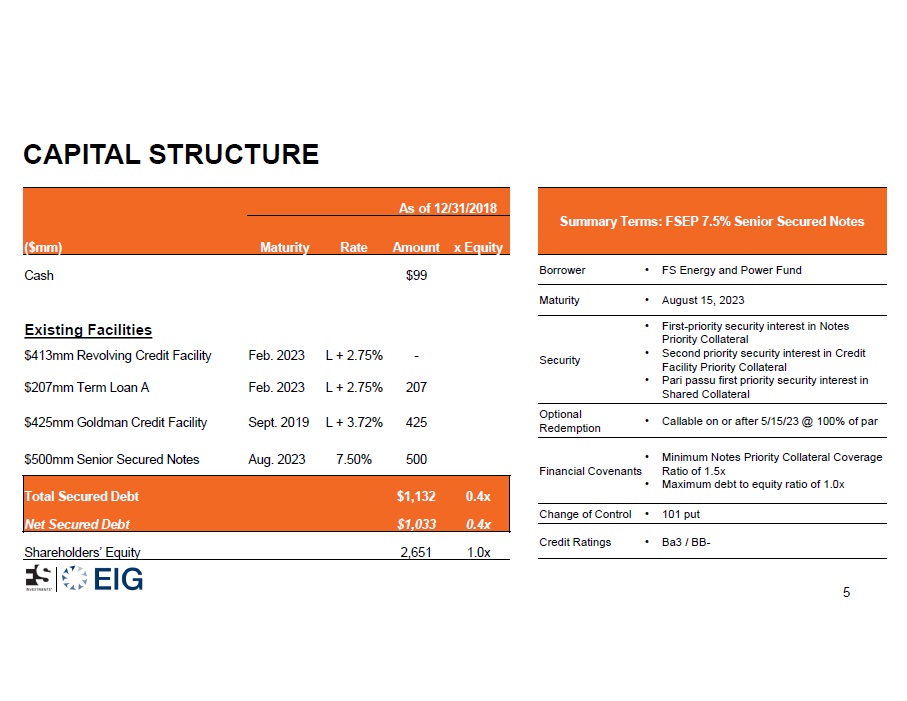

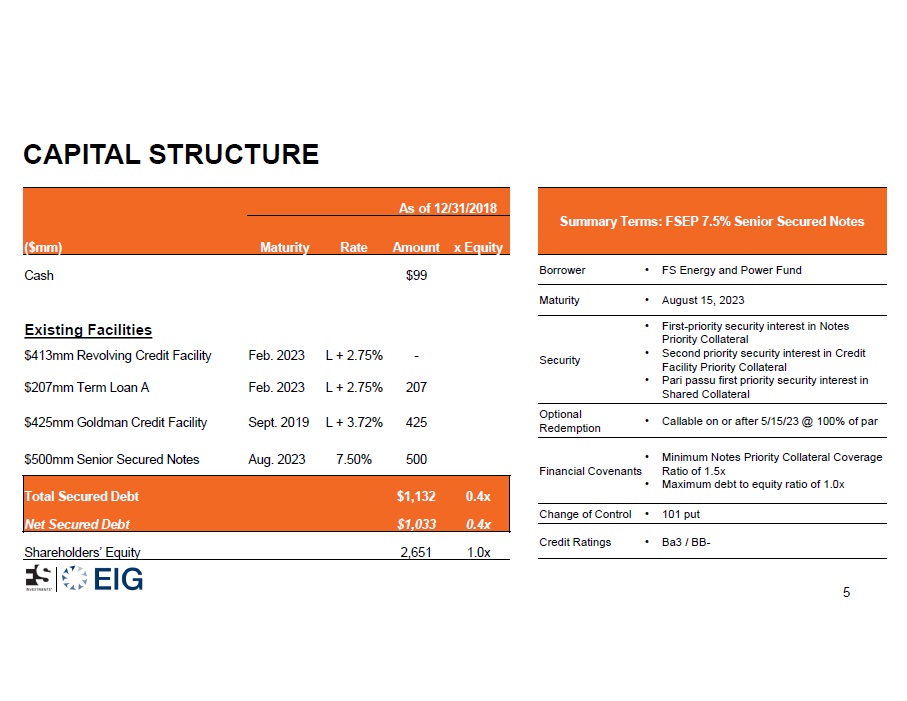

CAPITAL STRUCTURE 5 As of 12/31/2018 ($mm) Maturity Rate Amount x Equity Cash $99 Existing Facilities $413mm Revolving Credit Facility Feb. 2023 L + 2.75% - $207mm Term Loan A Feb. 2023 L + 2.75% 207 $425mm Goldman Credit Facility Sept. 2019 L + 3.72% 425 $500mm Senior Secured Notes Aug. 2023 7.50% 500 Total Secured Debt $1,132 0.4x Net Secured Debt $1,033 0.4x Shareholders’ Equity 2,651 1.0x Summary Terms: FSEP 7.5% Senior Secured Notes Borrower • FS Energy and Power Fund Maturity • August 15, 2023 Security • First - priority security interest in Notes Priority Collateral • Second priority security interest in Credit Facility Priority Collateral • Pari passu first priority security interest in Shared Collateral Optional Redemption • Callable on or after 5/15/23 @ 100% of par Financial Covenants • Minimum Notes Priority Collateral Coverage Ratio of 1.5x • Maximum debt to equity ratio of 1.0x Change of Control • 101 put Credit Ratings • Ba3 / BB -

FS / EIG PARTNERSHIP OVERVIEW 6 6

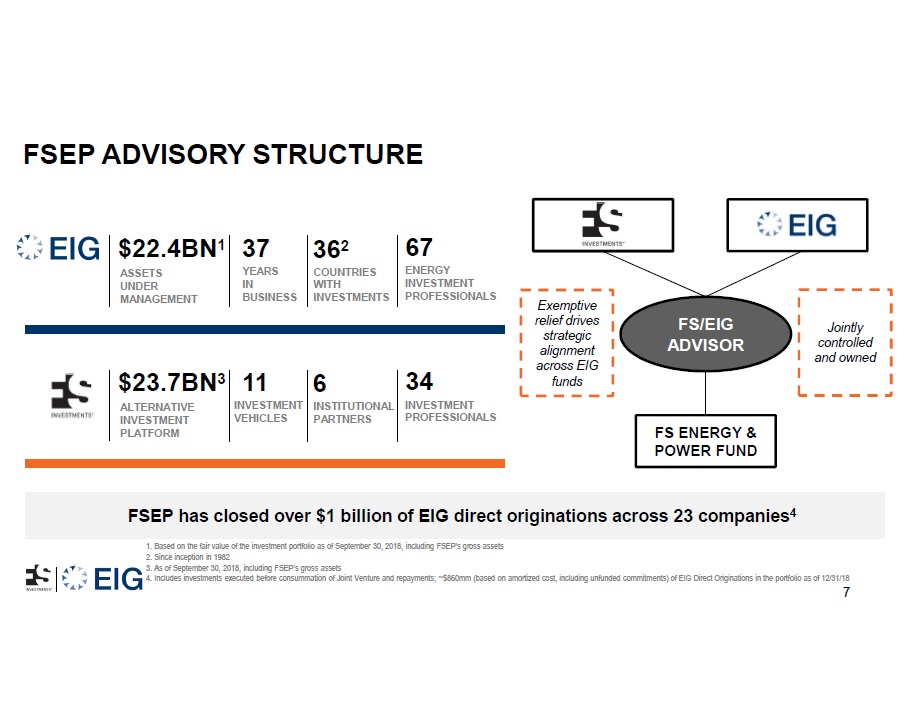

7 1. Based on the fair value of the investment portfolio as of September 30, 2018, including FSEP’s gross assets 2. Since inception in 1982 3. As of September 30, 2018, including FSEP’s gross assets 4. Includes investments executed before consummation of Joint Venture and repayments; ~$860mm (based on amortized cost, inclu din g unfunded commitments) of EIG Direct Originations in the portfolio as of 12/31/18 $22.4BN 1 ASSETS UNDER MANAGEMENT 37 YEARS IN BUSINESS 67 ENERGY INVESTMENT PROFESSIONALS 36 2 COUNTRIES WITH INVESTMENTS $23.7BN 3 ALTERNATIVE INVESTMENT PLATFORM 11 INVESTMENT VEHICLES 34 INVESTMENT PROFESSIONALS 6 INSTITUTIONAL PARTNERS FSEP has closed over $1 billion of EIG direct originations across 23 companies 4 FS ENERGY & POWER FUND FS/EIG ADVISOR Exemptive relief drives strategic alignment across EIG funds Jointly controlled and owned FSEP ADVISORY STRUCTURE

PORTFOLIO UPDATE 8 8

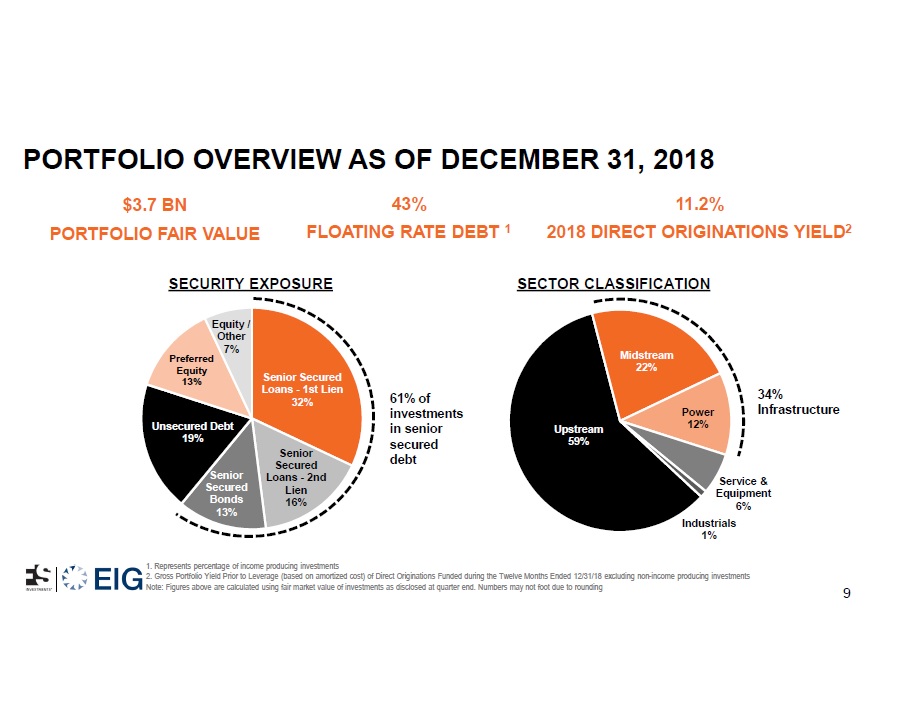

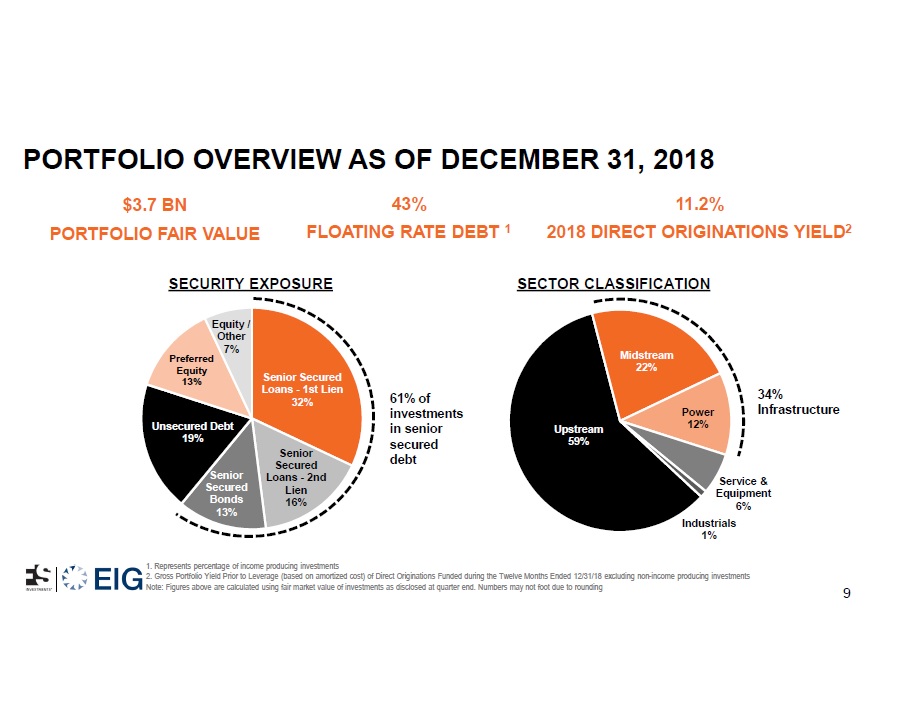

9 1. Represents percentage of income producing investments 2. Gross Portfolio Yield Prior to Leverage (based on amortized cost) of Direct Originations Funded during the Twelve Months E nde d 12/31/18 excluding non - income producing investments Note: Figures above are calculated using fair market value of investments as disclosed at quarter end. Numbers may not foot d ue to rounding Upstream 59% Midstream 22% Power 12% Service & Equipment 6% Industrials 1% Senior Secured Loans - 1st Lien 32% Senior Secured Loans - 2nd Lien 16% Senior Secured Bonds 13% Unsecured Debt 19% Preferred Equity 13% Equity / Other 7% 61 % of investments in senior secured debt PORTFOLIO OVERVIEW AS OF DECEMBER 31, 2018 43% FLOATING RATE DEBT 1 $3.7 BN PORTFOLIO FAIR VALUE 11.2 % 2018 DIRECT ORIGINATIONS YIELD 2 SECURITY EXPOSURE SECTOR CLASSIFICATION 34 % Infrastructure

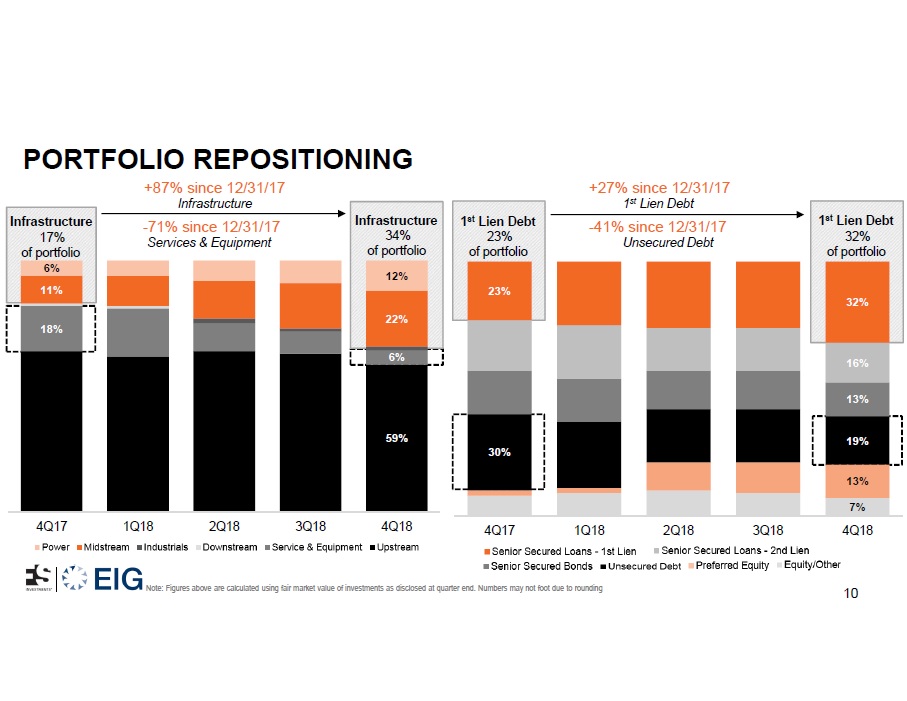

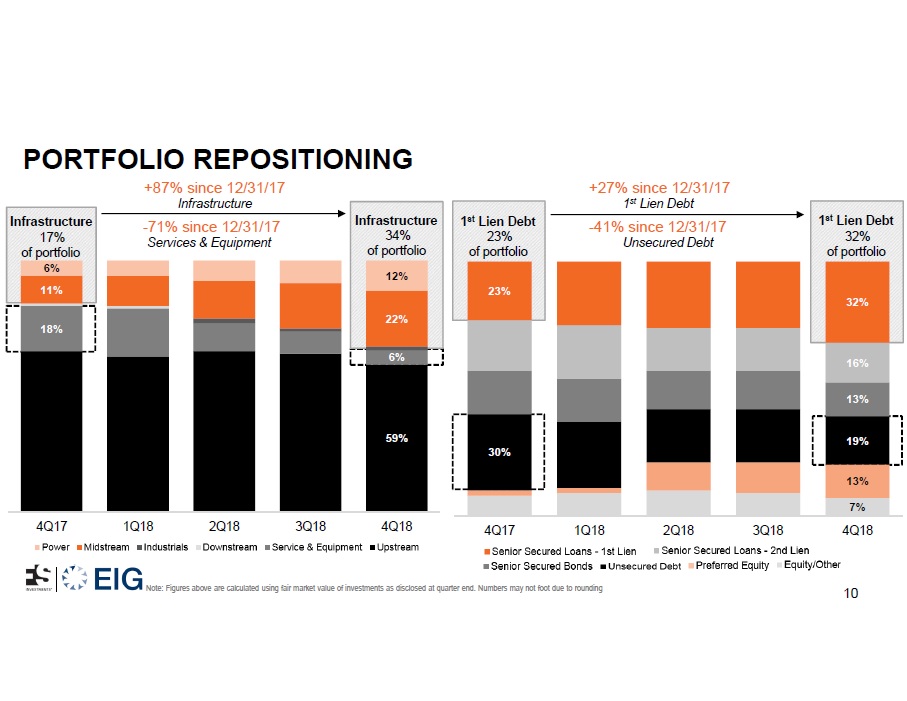

Infrastructure 10 Note: Figures above are calculated using fair market value of investments as disclosed at quarter end. Numbers may not foot d ue to rounding 59% 18% 6% 11% 22% 6% 12% 4Q17 1Q18 2Q18 3Q18 4Q18 Upstream Service & Equipment Downstream Industrials Midstream Power 7% 13% 30% 19% 13% 16% 23% 32% 4Q17 1Q18 2Q18 3Q18 4Q18 +87% since 12/31/17 Infrastructure +27% since 12/31/17 1 st Lien Debt - 41% since 12/31/17 Unsecured Debt of portfolio 17% Infrastructure of portfolio 34% 1 st Lien Debt of portfolio 23% 1 st Lien Debt of portfolio 32% - 71% since 12/31/17 Services & Equipment PORTFOLIO REPOSITIONING

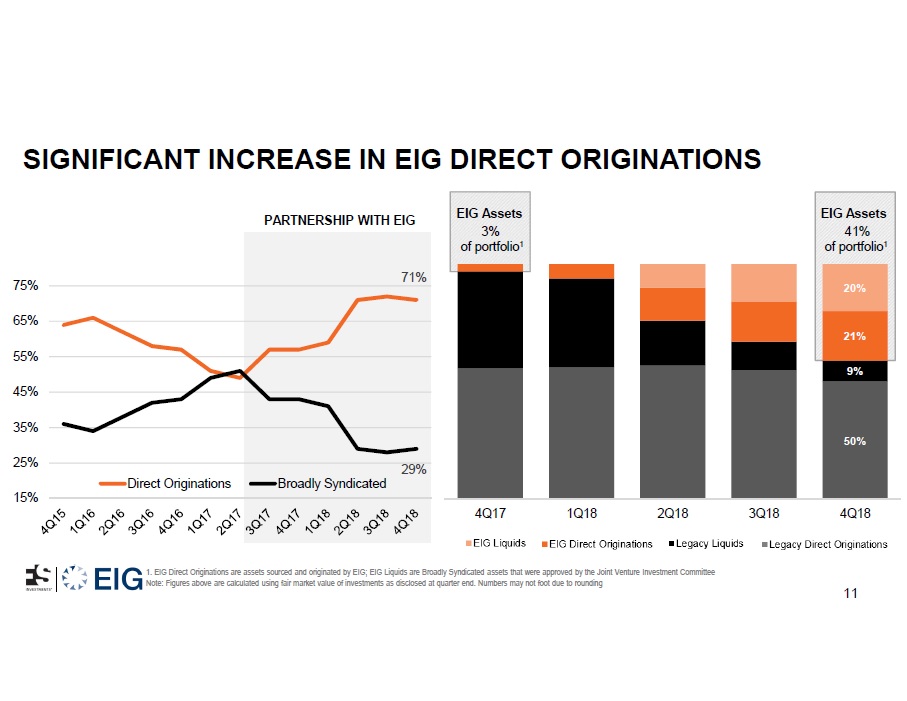

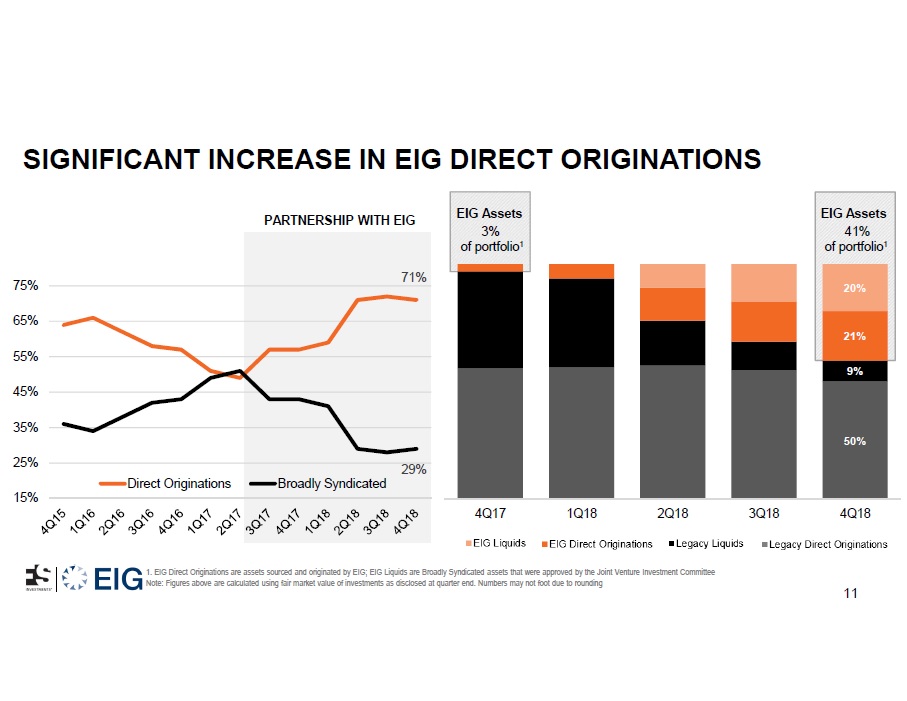

11 1. EIG Direct Originations are assets sourced and originated by EIG; EIG Liquids are Broadly Syndicated assets that were appr ove d by the Joint Venture Investment Committee Note: Figures above are calculated using fair market value of investments as disclosed at quarter end. Numbers may not foot d ue to rounding 71% 29% 15% 25% 35% 45% 55% 65% 75% Direct Originations Broadly Syndicated PARTNERSHIP WITH EIG 50% 9% 21% 20% 4Q17 1Q18 2Q18 3Q18 4Q18 Legacy Direct Originations Legacy Liquids EIG Direct Originations EIG Liquids of portfolio 1 EIG Assets 3 % of portfolio 1 EIG Assets 41 % SIGNIFICANT INCREASE IN EIG DIRECT ORIGINATIONS

12 Note: Asset review summary is for illustrative purposes only. Past performance is not a guarantee of future results • Midstream sector • Blue Racer operates an integrated Appalachian Basin midstream “super system” that comprises gas gathering, processing, fractionation, and transportation • Total EIG commitment of $ 300 mm across FSEP and other EIG - managed accounts ($516mm total facility size) • FSEP commitment of $90mm PORTFOLIO COMPANY / PROJECT TRANSACTION SUMMARY • Upstream sector • Volumetric Production Payment (“VPP”) issued by the parent company of Cox Oil Offshore • Total EIG commitment of approximately $375mm across FSEP and other EIG - managed accounts • FSEP commitment of $100mm Segreto Power Holdings • Power sector • Covert is a 2004 vintage natural gas - fired combined cycle generating facility selling power and capacity in PJM • Total EIG commitment of $ 317 mm across FSEP and other EIG - managed accounts • FSEP commitment of $70mm SUCCESSFULLY - CLOSED RECENT INVESTMENTS

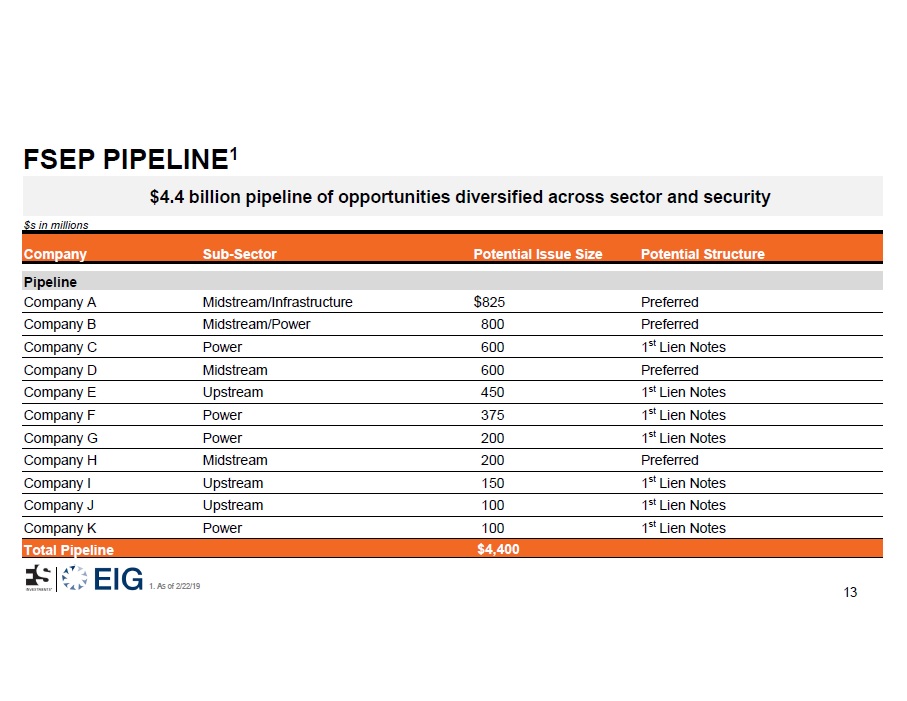

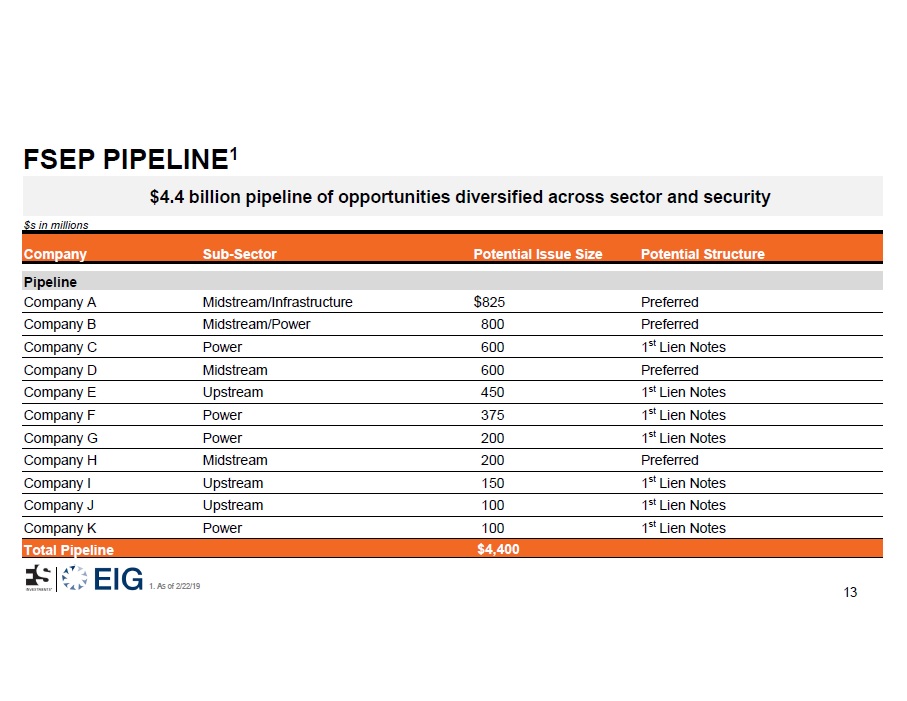

1. As of 2/22/19 13 Company Sub - Sector Potential Issue Size Potential Structure Pipeline Company A Midstream/Infrastructure $ 825 Preferred Company B Midstream/Power 800 Preferred Company C Power 600 1 st Lien Notes Company D Midstream 600 Preferred Company E Upstream 450 1 st Lien Notes Company F Power 375 1 st Lien Notes Company G Power 200 1 st Lien Notes Company H Midstream 200 Preferred Company I Upstream 150 1 st Lien Notes Company J Upstream 100 1 st Lien Notes Company K Power 100 1 st Lien Notes Total Pipeline $4,400 $4.4 billion pipeline of opportunities diversified across sector and security $s in millions FSEP PIPELINE 1

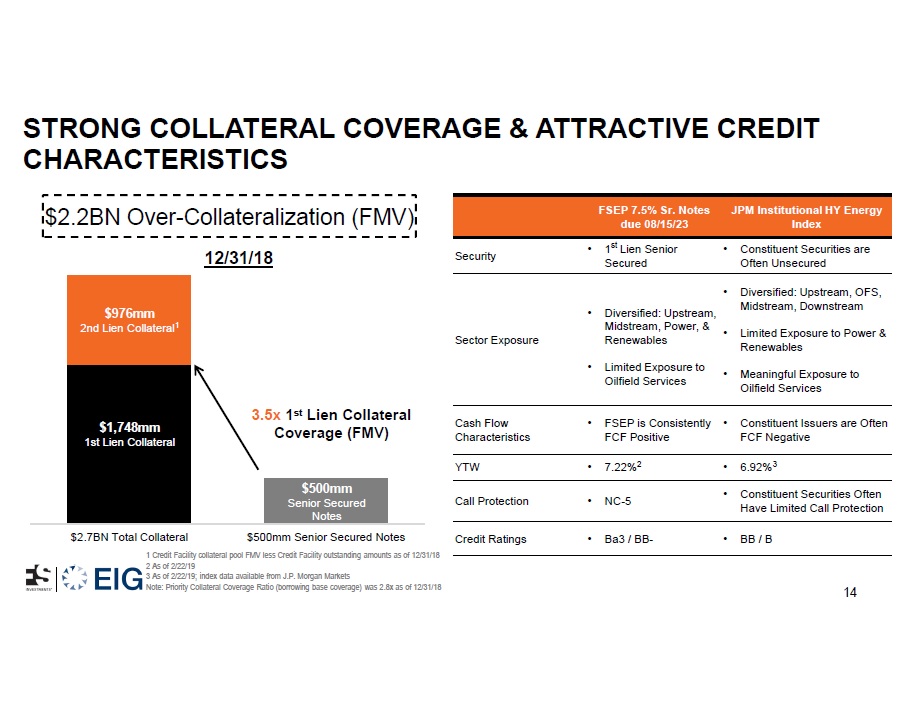

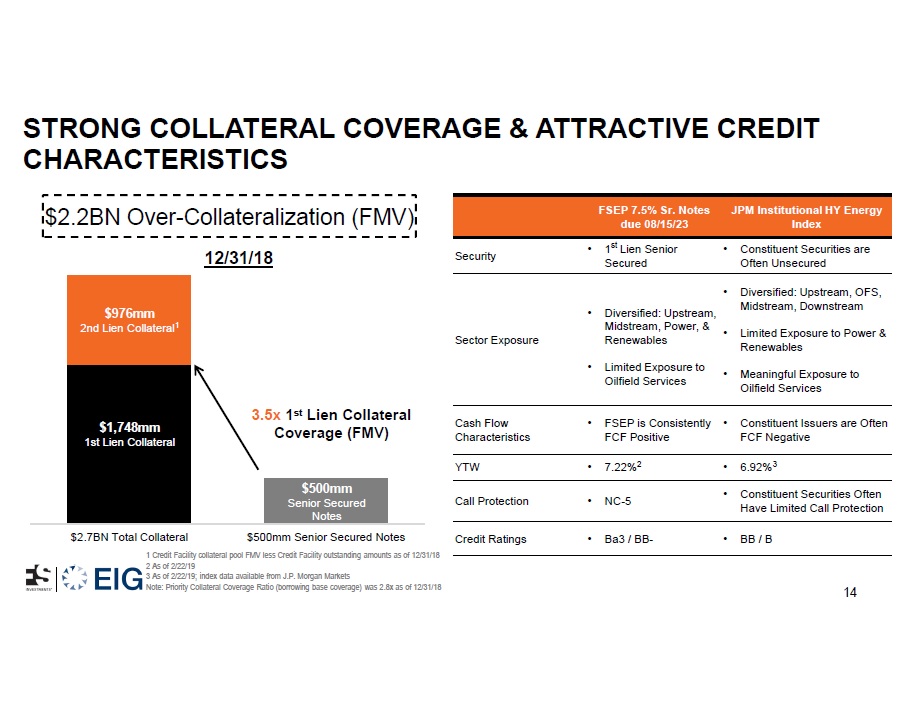

$2.7BN Total Collateral $500mm Senior Secured Notes 1 Credit Facility collateral pool FMV less Credit Facility outstanding amounts as of 12/31/18 2 As of 2/22/19 3 As of 2/22/19; index data available from J.P. Morgan Markets Note: Priority Collateral Coverage Ratio (borrowing base coverage) was 2.8x as of 12/31/18 3.5x 1 st Lien Collateral Coverage (FMV) $500mm Senior Secured Notes $1,748mm 1st Lien Collateral 12/31/18 $500 Senior Secured Notes $1,430 1st Lien collateral 14 FSEP 7.5% Sr. Notes due 08/15/23 JPM Institutional HY Energy Index Security • 1 st Lien Senior Secured • Constituent Securities are Often Unsecured Sector Exposure • Diversified: Upstream, Midstream, Power, & Renewables • Limited Exposure to Oilfield Services • Diversified: Upstream, OFS, Midstream, Downstream • Limited Exposure to Power & Renewables • Meaningful Exposure to Oilfield Services Cash Flow Characteristics • FSEP is Consistently FCF Positive • Constituent Issuers are Often FCF Negative YTW • 7.22% 2 • 6.92% 3 Call Protection • NC - 5 • Constituent Securities Often Have Limited Call Protection Credit Ratings • Ba3 / BB - • BB / B $976mm 2nd Lien Collateral 1 $2.2BN Over - Collateralization (FMV) STRONG COLLATERAL COVERAGE & ATTRACTIVE CREDIT CHARACTERISTICS

IMPORTANT DISCLOSURES 15 This presentation (this “Presentation”) is being furnished to you on a confidential basis for due diligence purposes only and ma y not be reproduced and may not be used for any other purpose. This Presentation does not constitute an offer to sell or a solicitation of an offer to buy the securities of any fund (each, a “F und ” and, collectively, the “Funds”) sponsored by FS Investments (“FS Investments”). An offering is made only by a prospectus filed with the U.S. Securities and Exchange Commission, as may be supplemented or am end ed from time to time (as so supplemented and amended, a “Prospectus”), which should be read in its entirety. A Prospectus will be delivered to prospective investors prior to any sal e o f securities of a Fund. Each Prospectus contains additional information about the investment objectives, terms and conditions of an investment in the applicable Fund and also contains tax information and cer tai n risks and conflicts of interest disclosures that are important to any investment decision regarding the applicable Fund. No person has been authorized to make any statement concerning any Fund ot her than as set forth in this Presentation, and any such statements, if made, may not be relied upon. This Presentation contains highly confidential information regarding FS Investments’ Funds and suc h Funds’ strategies and organization. Your acceptance of this Presentation constitutes your agreement to: (i) keep confidential all the information contained in this Presentation, as well as any information derived by you from the information contained in this Presentation (collectively, “Confidential Information”) and not disclose any such Confidential Information to any other perso n; (ii) not use any of the Confidential Information for any purpose other than to complete a due diligence review of the Funds; (iii) not use the Confidential Information for purposes of trading any security ; ( iv) not copy this Presentation without the prior written consent of FS Investments; and (v) promptly return this Presentation and any copies hereof to FS Investments upon FS Investments’ request, in each case sub ject to the confidentiality provisions more fully set forth in any written agreement between the recipient and FS Investments. An investment in any Fund involves a high degree of risk and may be considered speculative. The Funds may lack diversificatio n, thereby increasing the risk of loss. The Funds’ performance may be volatile. As a result, an investor could lose all or a substantial amount of his or her investment. Each Fund’s Prospectus co nta ins descriptions of certain of the risks associated with an investment in the Fund. In addition, the Funds’ fees and expenses may offset their profits. With the exception of FS Investment Corporation, th ere is no secondary market for securities of any Fund and no secondary market for the securities of any other Fund is expected to develop prior to the occurrence of a liquidity event for such Fund. With the exception of FS Investment Corporation, each of the Funds has implemented a share repurchase program, but only a limited number of shares are eligible for repurchase. In addition, any such repurchases may be at a discount to the offering price in effect on the date of repurchase. In making an investment decision, investors must rely on their own examination of the applicable Fund and the terms of such Fund ’s offering. You should not construe the contents of this Presentation as legal, tax, investment or other advice. No offer to purchase securities of any Fund will be accepted prior to the receipt by the off ere e of all appropriate documentation, including a Prospectus. Values in this presentation have been rounded. Fair value is determined by each Fund’s board of directors or trustees, as app lic able.

IMPORTANT DISCLOSURES (CONTINUED) 16 Any selected case studies included herein are for informational purposes only and do not constitute investment advice or reco mme ndations of past investments. All rights to the trademarks and/or logos, if any, listed herein belong to their respective owners and FS Investments' use thereof does not imply any affiliation with, or end orsement by, the owners of these trademarks and/or logos. Any projections, forecasts and estimates contained herein are based upon certain assumptions that the Funds consider reasonab le. Projections are necessarily speculative in nature, and it can be expected that some or all of the assumptions underlying the projections will not materialize or will vary significantly from actual re sul ts. The inclusion of projections herein should not be regarded as a representation or guarantee regarding the reliability, accuracy or completeness of the information contained herein and the Funds are under no obl igation to update or keep current such information. Unless otherwise indicated, the information provided herein is based on matters as they exist as of the date of preparation of this Presentation and not as of any future date. Recipients of this Presentation are encouraged to contact representatives of the Funds to discuss the procedures and methodologies used to make the projections and other information p rov ided herein. The terms of the Funds’ offerings, the information regarding the Funds’ investment strategies and the risks related to the Funds included herein are not intended to be complete or final and are qualified in their entirety by reference to the applicable Fund’s Prospectus (a copy of which will be furnished to investors upon request and must be received and reviewed by all investors prior to investi ng) , and other reports filed with the SEC before investing. In the event that the descriptions or terms described herein are inconsistent with or contrary to the descriptions in or terms set forth in the app lic able Fund’s Prospectus, the Prospectus shall control. All information contained herein concerning the Funds is subject to revision and completion. Certain information contained herein has been obtained fro m p ublished and non - published sources prepared by other parties, which in certain cases has not been updated through the date hereof. While such information is believed to be reliable for the purpose s u sed herein, FS Investments does not assume responsibility for the accuracy or completeness of such information and such information has not been independently verified by FS Investments. The use of this Presentation in certain jurisdictions may be restricted by law. The Funds mentioned in this Presentation may not be eligible for sale in some states or countries, and may not be suitable for all types of investors; their value and the income they produce may fluctuate and/or be adversely affected by exchange rates, int ere st rates and other factors. Prospective investors should inform themselves as to the legal requirements and tax consequences of an investment in the Funds within the countries of their citizenship, resid enc e, domicile and place of business. This Presentation is for information purposes only and does not constitute a financial promotion, investment advice or an ind uce ment or incitement to participate in any product, offering or investment. It does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any inve stm ent, nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract. No representation, warranty or undertaking, express or implied, is given as to the accuracy or co mpleteness of the information or opinions contained in this Presentation by FS Investments, its members or employees and no liability is accepted by such persons for the accuracy or completeness of any su ch information or opinions. IN MAKING AN INVESTMENT DECISION, INVESTORS MUST RELY SOLELY ON THEIR OWN EXAMINATION OF THE APPLICABLE FUND AND THE TERMS OF TH E APPLICABLE FUND’S PROSPECTUS, INCLUDING THE MERITS AND RISKS INVOLVED, AND NOT ON ANY INFORMATION OR REPRESENTATION MADE OR ALLEGED TO HAVE BEE N M ADE HEREIN OR OTHERWISE. CAPITALIZED TERMS USED IN THIS PRESENTATION WITHOUT DEFINITION ARE DEFINED IN THE APPLICABLE FUND’S PROSPECTUS. For more information regarding the risks associated with the Funds, see the section of the applicable Fund’s Prospectus entit led “Risk Factors” or “Types of Investment and Related Risks,” as applicable, and other reports filed with the SEC before investing.