UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material under §240.14a-12 |

FS ENERGY AND POWER FUND

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

EIG Global Energy Partners

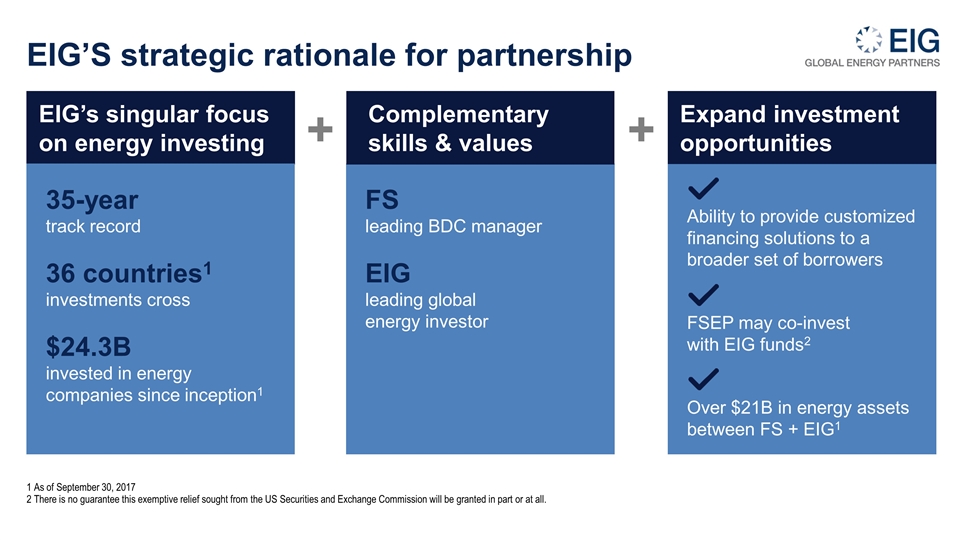

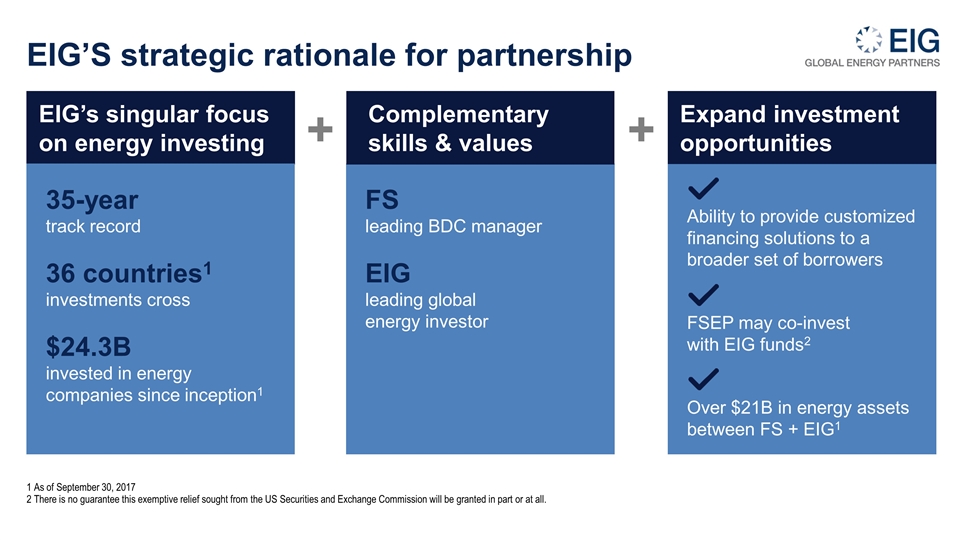

EIG’S strategic rationale for partnership 1 As of September 30, 2017 2 There is no guarantee this exemptive relief sought from the US Securities and Exchange Commission will be granted in part or at all. EIG’s singular focus on energy investing 35-year track record 36 countries1 investments cross $24.3B invested in energy companies since inception1 FS leading BDC manager EIG leading global energy investor Complementary skills & values + Expand investment opportunities + Ability to provide customized financing solutions to a broader set of borrowers FSEP may co-invest with EIG funds2 Over $21B in energy assets between FS + EIG1

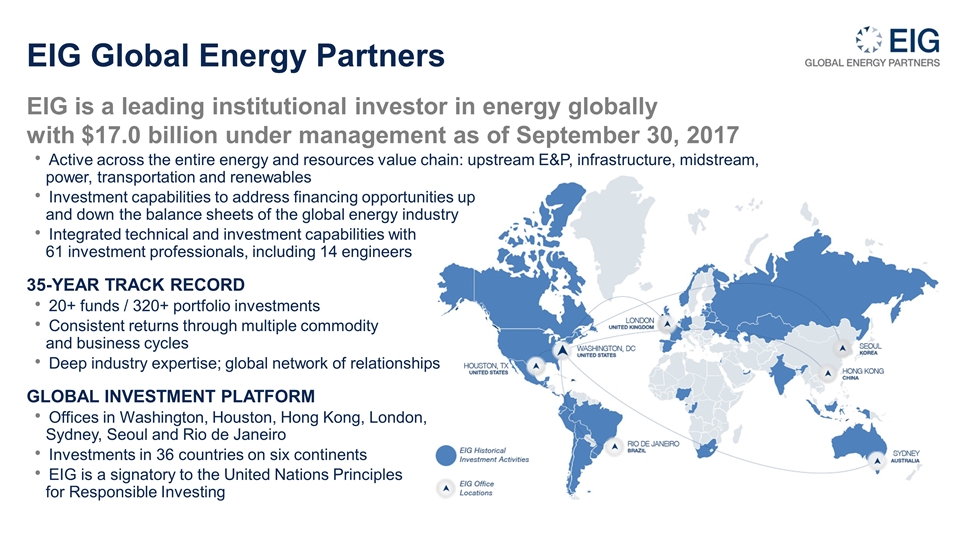

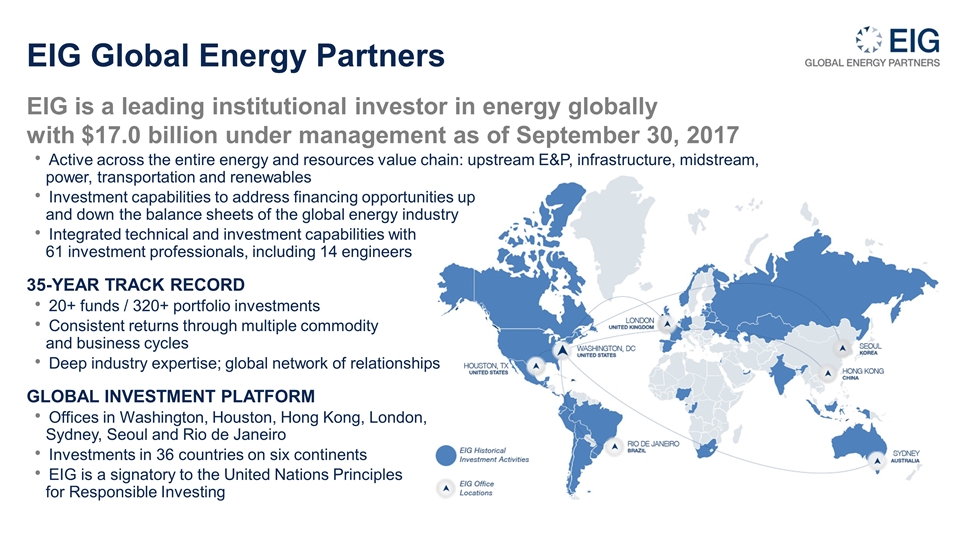

EIG Global Energy Partners EIG is a leading institutional investor in energy globally with $17.0 billion under management as of September 30, 2017 Active across the entire energy and resources value chain: upstream E&P, infrastructure, midstream, power, transportation and renewables Investment capabilities to address financing opportunities up and down the balance sheets of the global energy industry Integrated technical and investment capabilities with 61 investment professionals, including 14 engineers 35-year track record 20+ funds / 320+ portfolio investments Consistent returns through multiple commodity and business cycles Deep industry expertise; global network of relationships Global Investment Platform Offices in Washington, Houston, Hong Kong, London, Sydney, Seoul and Rio de Janeiro Investments in 36 countries on six continents EIG is a signatory to the United Nations Principles for Responsible Investing

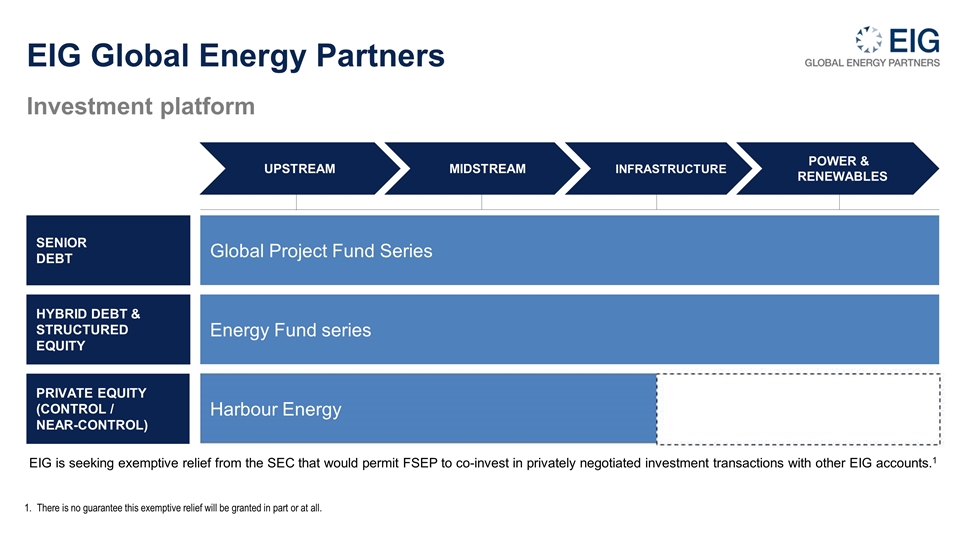

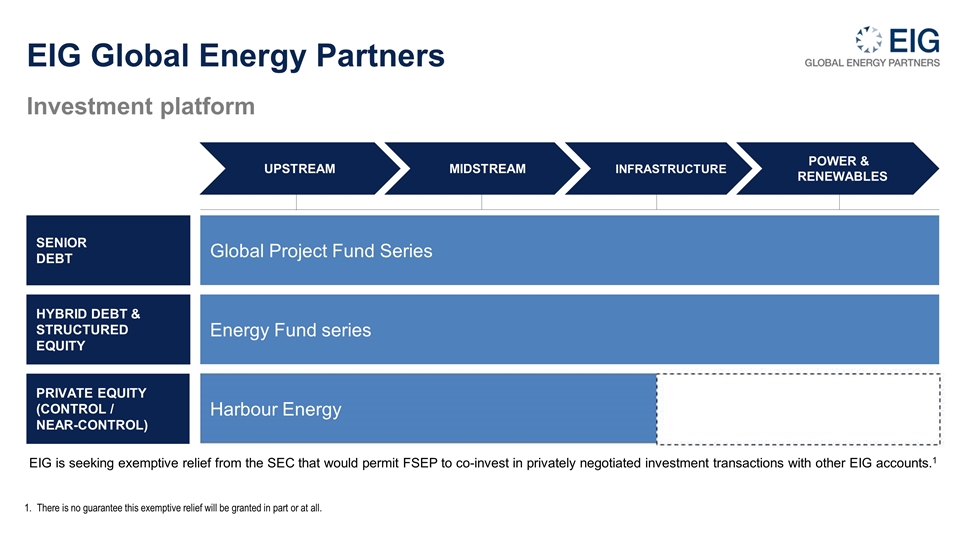

EIG Global Energy Partners Investment platform There is no guarantee this exemptive relief will be granted in part or at all. Senior Debt Hybrid Debt & Structured Equity Private Equity (Control / Near-Control) Global Project Fund Series Energy Fund series Harbour Energy Upstream Midstream Infrastructure Power & Renewables EIG is seeking exemptive relief from the SEC that would permit FSEP to co-invest in privately negotiated investment transactions with other EIG accounts.1

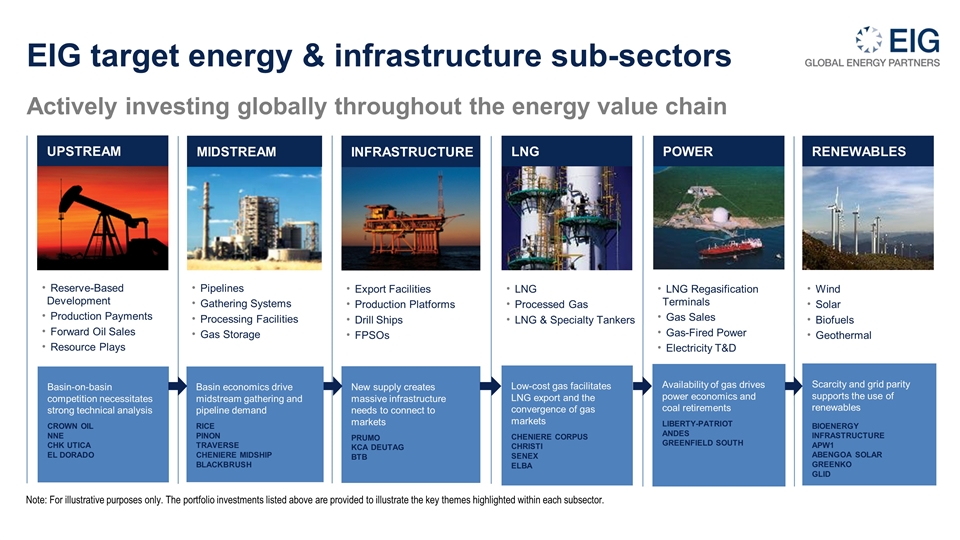

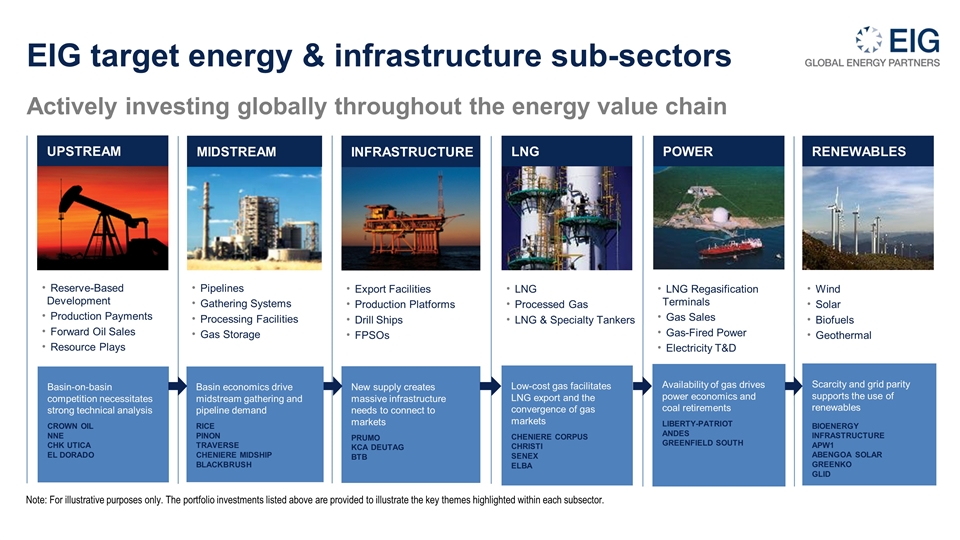

Reserve-Based Development Production Payments Forward Oil Sales Resource Plays Pipelines Gathering Systems Processing Facilities Gas Storage LNG Processed Gas LNG & Specialty Tankers LNG Regasification Terminals Gas Sales Gas-Fired Power Electricity T&D Wind Solar Biofuels Geothermal UPSTREAM INFRASTRUCTURE MIDSTREAM RENEWABLES Export Facilities Production Platforms Drill Ships FPSOs LNG POWER Note: For illustrative purposes only. The portfolio investments listed above are provided to illustrate the key themes highlighted within each subsector. EIG target energy & infrastructure sub-sectors Actively investing globally throughout the energy value chain Basin economics drive midstream gathering and pipeline demand Rice Pinon Traverse Cheniere Midship Blackbrush New supply creates massive infrastructure needs to connect to markets Prumo KCA Deutag BTB Low-cost gas facilitates LNG export and the convergence of gas markets Cheniere corpus christi SENEX ELBA Availability of gas drives power economics and coal retirements Liberty-Patriot Andes Greenfield South Scarcity and grid parity supports the use of renewables BIOENERGY INFRASTRUCTURE APW1 ABENGOA SOLAR GREENKO GLID Basin-on-basin competition necessitates strong technical analysis Crown Oil NNE CHK Utica El dorado

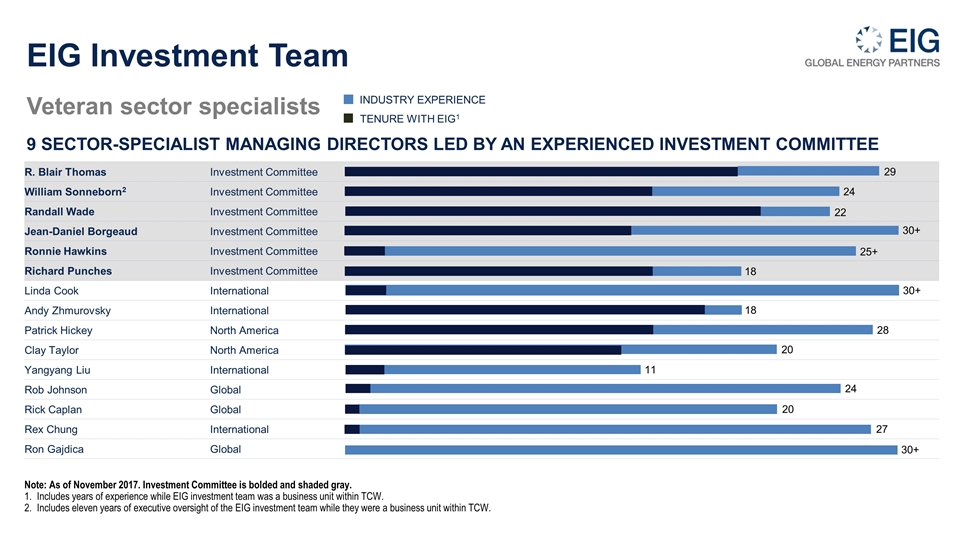

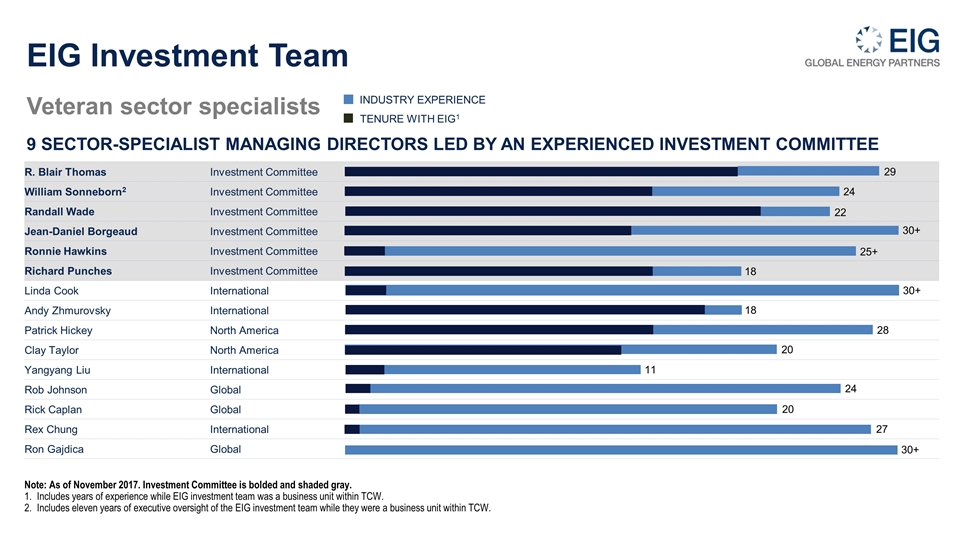

Veteran sector specialists 9 sector-specialist Managing Directors led by an experienced Investment Committee R. Blair Thomas Investment Committee William Sonneborn2 Investment Committee Randall Wade Investment Committee Jean-Daniel Borgeaud Investment Committee Ronnie Hawkins Investment Committee Richard Punches Investment Committee Linda Cook International Andy Zhmurovsky International Patrick Hickey North America Clay Taylor North America Yangyang Liu International Rob Johnson Global Rick Caplan Global Rex Chung International Ron Gajdica Global INDUSTRY EXPERIENCE TENURE WITH EIG1 22 30+ 20 29 24 18 28 25+ 11 18 30+ 20 30+ 24 27 EIG Investment Team Note: As of November 2017. Investment Committee is bolded and shaded gray. Includes years of experience while EIG investment team was a business unit within TCW. Includes eleven years of executive oversight of the EIG investment team while they were a business unit within TCW.

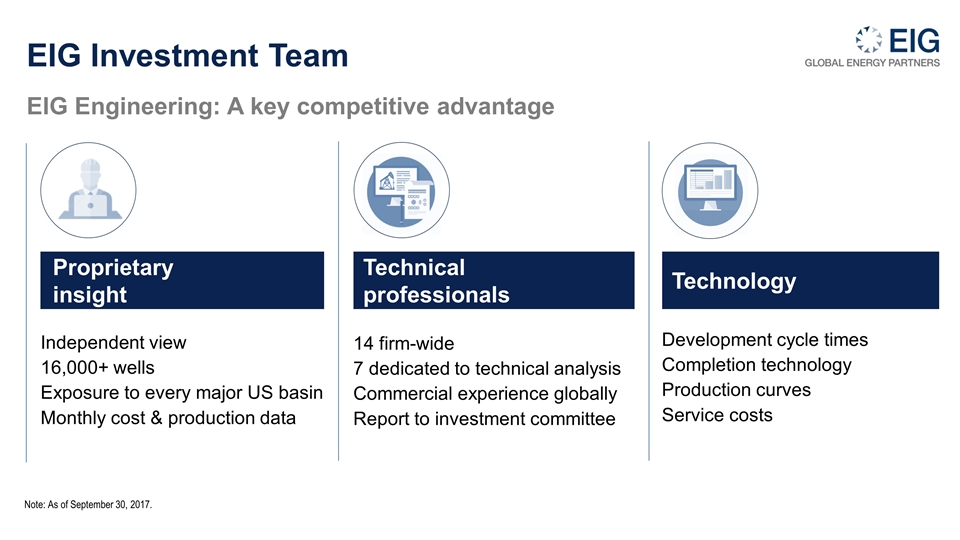

Technology Technical professionals EIG Investment Team EIG Engineering: A key competitive advantage Note: As of September 30, 2017. Proprietary insight Independent view 16,000+ wells Exposure to every major US basin Monthly cost & production data 14 firm-wide 7 dedicated to technical analysis Commercial experience globally Report to investment committee Development cycle times Completion technology Production curves Service costs

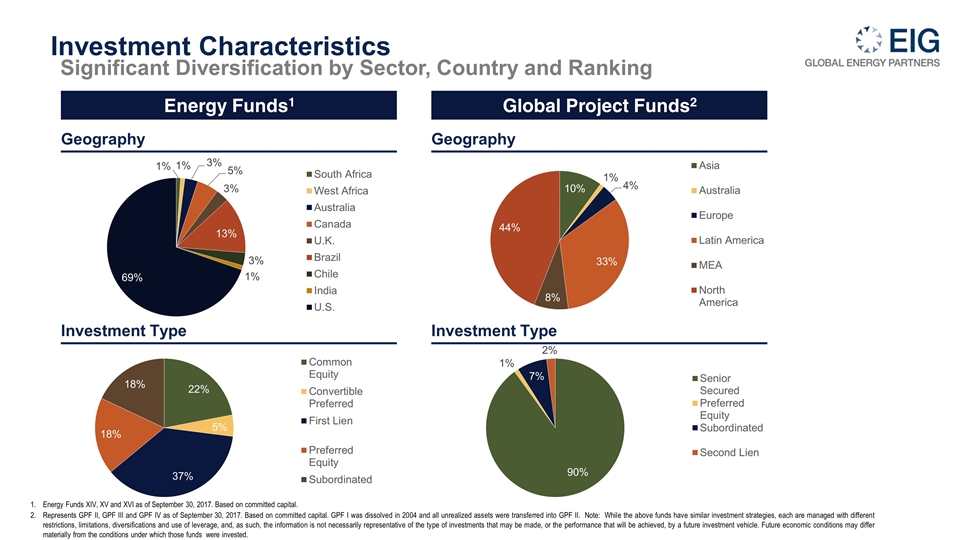

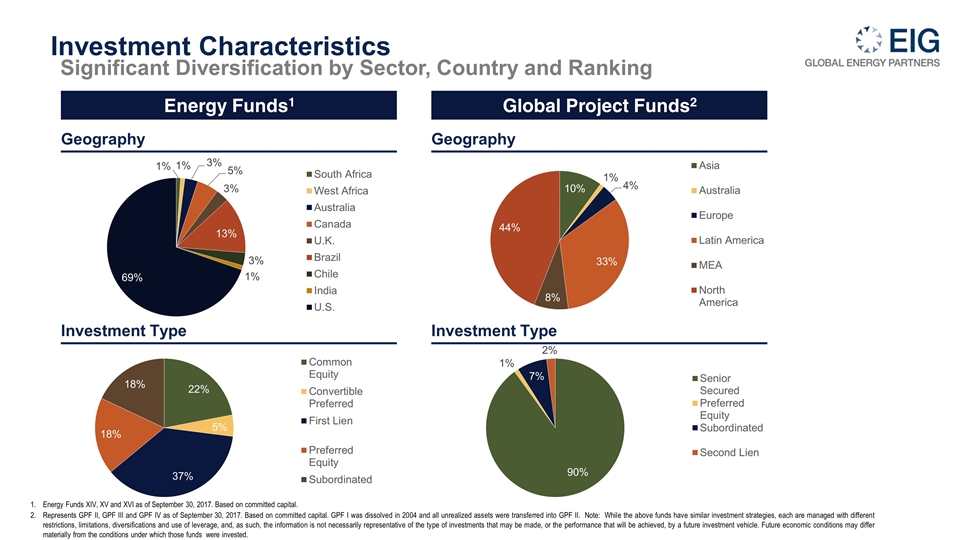

Significant Diversification by Sector, Country and Ranking Investment Characteristics Energy Funds1 Global Project Funds2 Geography Investment Type Geography Investment Type Energy Funds XIV, XV and XVI as of September 30, 2017. Based on committed capital. Represents GPF II, GPF III and GPF IV as of September 30, 2017. Based on committed capital. GPF I was dissolved in 2004 and all unrealized assets were transferred into GPF II. Note: While the above funds have similar investment strategies, each are managed with different restrictions, limitations, diversifications and use of leverage, and, as such, the information is not necessarily representative of the type of investments that may be made, or the performance that will be achieved, by a future investment vehicle. Future economic conditions may differ materially from the conditions under which those funds were invested.

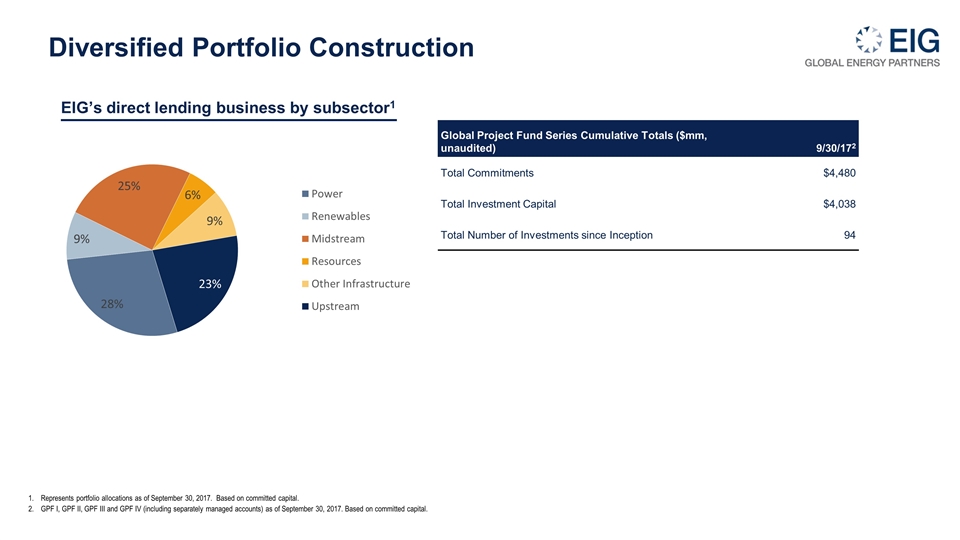

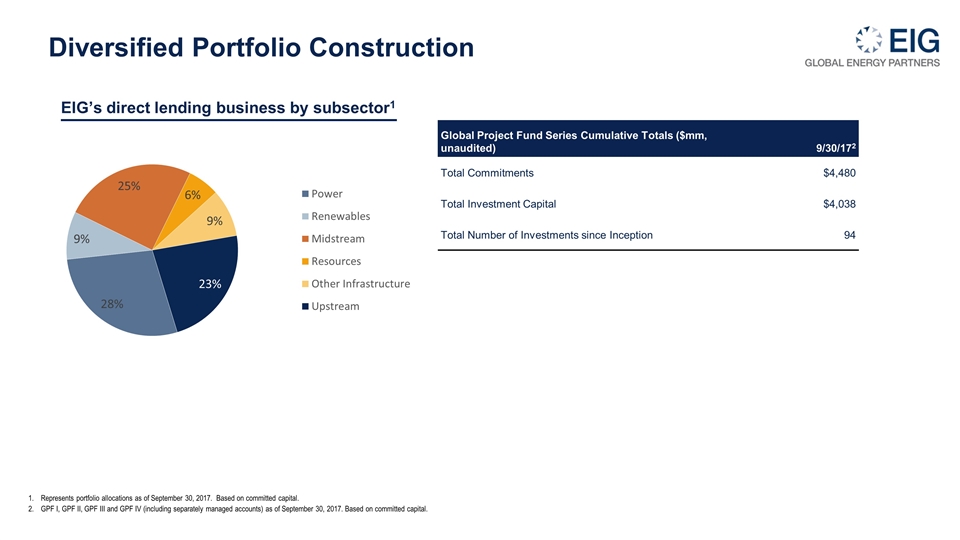

Diversified Portfolio Construction EIG’s direct lending business by subsector1 Global Project Fund Series Cumulative Totals ($mm, unaudited) 9/30/172 Total Commitments $4,480 Total Investment Capital $4,038 Total Number of Investments since Inception 94 Represents portfolio allocations as of September 30, 2017. Based on committed capital. GPF I, GPF II, GPF III and GPF IV (including separately managed accounts) as of September 30, 2017. Based on committed capital.

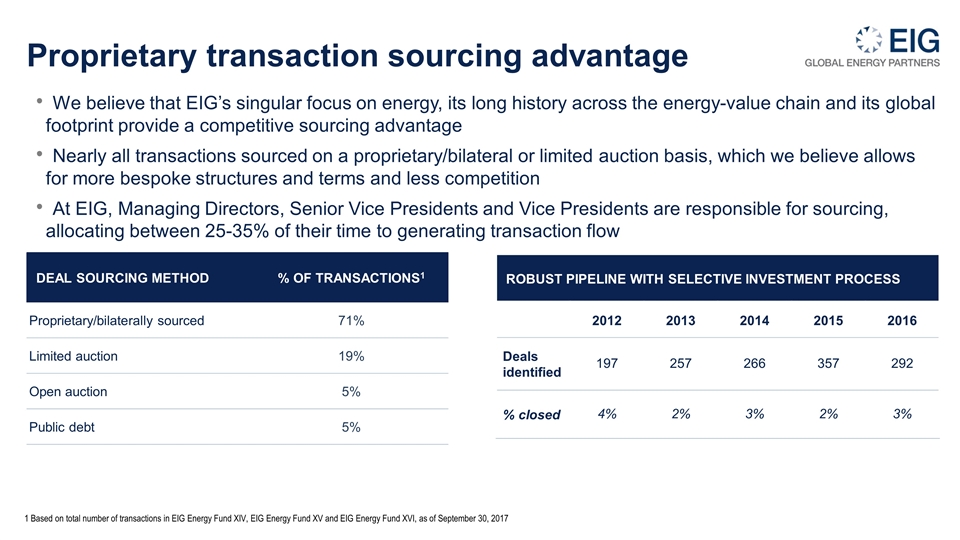

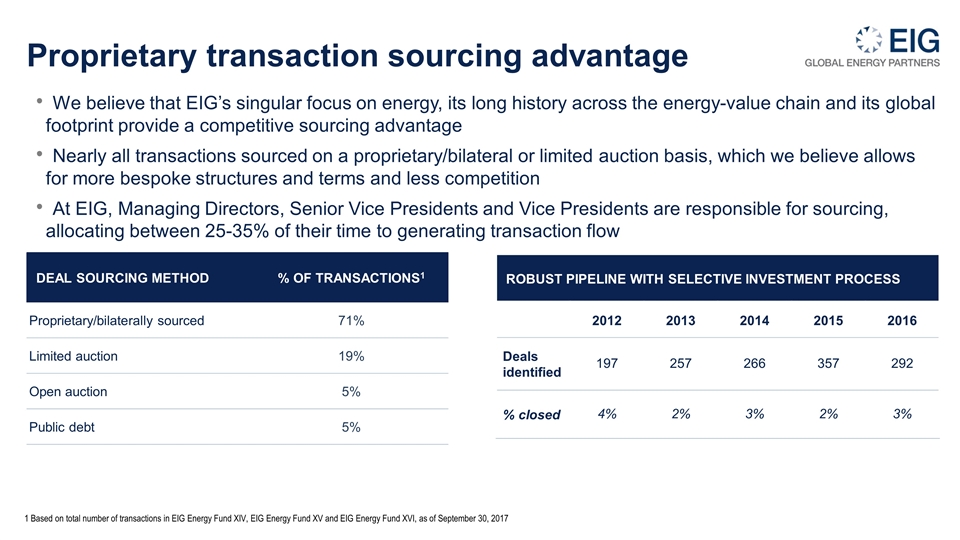

DEAL SOURCING METHOD % OF TRANSACTIONS1 Proprietary/bilaterally sourced 71% Limited auction 19% Open auction 5% Public debt 5% ROBUST PIPELINE WITH SELECTIVE INVESTMENT PROCESS 2012 2013 2014 2015 2016 Deals identified 197 257 266 357 292 % closed 4% 2% 3% 2% 3% Proprietary transaction sourcing advantage We believe that EIG’s singular focus on energy, its long history across the energy-value chain and its global footprint provide a competitive sourcing advantage Nearly all transactions sourced on a proprietary/bilateral or limited auction basis, which we believe allows for more bespoke structures and terms and less competition At EIG, Managing Directors, Senior Vice Presidents and Vice Presidents are responsible for sourcing, allocating between 25-35% of their time to generating transaction flow 1 Based on total number of transactions in EIG Energy Fund XIV, EIG Energy Fund XV and EIG Energy Fund XVI, as of September 30, 2017

Significant focus on downside protection Contributing factors resulting in high level of recoveries on defaulted investments Expertise in highly negotiated documentation (covenants, control rights, hedging, prepayment protection, etc.) Structural covenants to protect position in the senior level of the capital structure (ability to exercise remedies) Real asset orientation rather than general corporate purpose funding Lending inside of asset values Active portfolio management There can be no assurance that any investment made by FSEP will achieve its objective or avoid substantial losses.

Disclosures The information contained herein (the “Presentation”) is highly confidential and is being provided to you at your request for informational purposes only and is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any investment vehicle managed by EIG Global Energy Partners or its affiliates (together with such affiliates, EIG and FS Energy and Power Fund (“FSEP”)). Forward-Looking Statements This Presentation may contain certain “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future performance or operations of FSEP. Words such as “believes,” “expects,” “projects,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy, risks associated with possible disruption of EIG or FSEP’s operations or the economy generally due to terrorism or natural disasters, future changes in laws or regulations and conditions in FSEP’s or EIG’s operating area, the failure of FSEP’s shareholders to approve the Proposal (as defined below), the failure or inability to obtain the exemptive relief from the Securities and Exchange Commission (the “SEC”) and the failure to consummate the transactions contemplated by the master agreement between FS Investments and EIG. Some of these factors are enumerated in the filings FSEP makes with the SEC and are contained in the Proxy Statement. The inclusion of forward-looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication. Except as required by the federal securities laws, FSEP undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Additional Information and Where to Find It This Presentation relates to proposed new investment advisory agreements for FSEP (collectively, the “Proposal”). In connection with the Proposal, FSEP has filed relevant materials with the SEC, including a proxy statement on Schedule 14A (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. FSEP is mailing the definitive Proxy Statement and a proxy card to each shareholder entitled to vote at the shareholder meeting relating to such matters. Shareholders OF FSEP ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), AND ANY OTHER RELEVANT DOCUMENTS THAT FSEP WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSAL. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC's web site, http://www.sec.gov and from FS Investments’ website at www.fsinvestments.com. Participants in the Solicitation FSEP and its trustees, executive officers and certain other members of management and employees, including employees of FS Investments, EIG and their respective affiliates, may be deemed to be participants in the solicitation of proxies from the shareholders of FSEP in connection with the Proposal. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of FSEP’s shareholders in connection with the Proposal are contained in the Proxy Statement. The Proxy Statement and other proxy solicitation documents may be obtained free of charge from the sources indicated above.

End notes Pipeline Investments. Any investment pipeline information presented herein is for informational purposes only and is intended to illustrate EIG’s sourcing experience and the profile and types of investments previously pursued by EIG. It should not be assumed that investments made in the future will be comparable in quality or performance to the investments described herein. EIG Credit Platform is inclusive of EIG Global Private Debt Fund, two separately managed commitments including an Insurance Company Separately Managed Account commitment, and Triloma EIG Energy Income Funds. Harbour Energy is an energy investment vehicle formed to pursue control or near-control investments in high-quality upstream and midstream energy assets globally.