FS Energy and Power Fund 8-K

Exhibit 99.1

FS Energy & Power Fund 1 Q1 portfolio and performance update MAY 1 , 2020

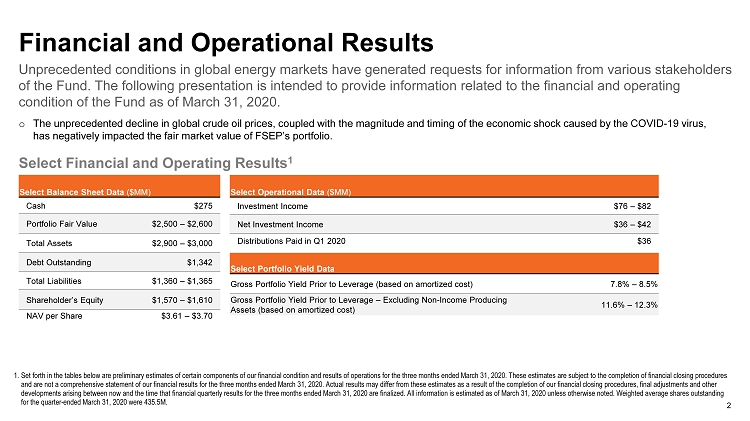

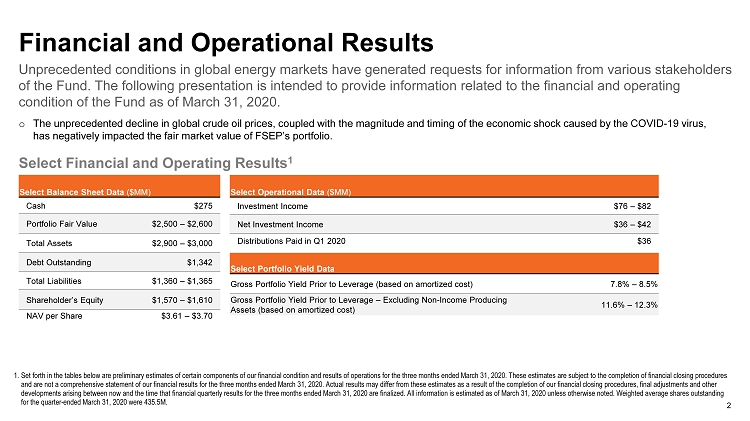

Financial and Operational Results 2 o The unprecedented decline in global crude oil prices, coupled with the magnitude and timing of the economic shock caused by t he COVID - 19 virus, has negatively impacted the fair market value of FSEP’s portfolio. Select Balance Sheet Data ($MM) Cash $275 Portfolio Fair Value $2,500 – $2,600 Total Assets $2,900 – $3,000 Debt Outstanding $1,342 Total Liabilities $1,360 – $1,365 Shareholder’s Equity $1,570 – $1,610 NAV per Share $3.61 – $3.70 Select Operational Data ($MM) Investment Income $76 – $82 Net Investment Income $36 – $42 Distributions Paid in Q1 2020 $36 Select Portfolio Yield Data Gross Portfolio Yield Prior to Leverage (based on amortized cost) 7.8% – 8.5% Gross Portfolio Yield Prior to Leverage – Excluding Non - Income Producing Assets (based on amortized cost) 11.6% – 12.3% Select Financial and Operating Results 1 1. Set forth in the tables below are preliminary estimates of certain components of our financial condition and results of opera tio ns for the three months ended March 31, 2020. These estimates are subject to the completion of financial closing procedures and are not a comprehensive statement of our financial results for the three months ended March 31, 2020. Actual results may dif fer from these estimates as a result of the completion of our financial closing procedures, final adjustments and other developments arising between now and the time that financial quarterly results for the three months ended March 31, 2020 are fin alized. All information is estimated as of March 31, 2020 unless otherwise noted. Weighted average shares outstanding for the quarter - ended March 31, 2020 were 435.5M. Unprecedented conditions in global energy markets have generated requests for information from various stakeholders of the Fund. The following presentation is intended to provide information related to the financial and operating condition of the Fund as of March 31, 2020.

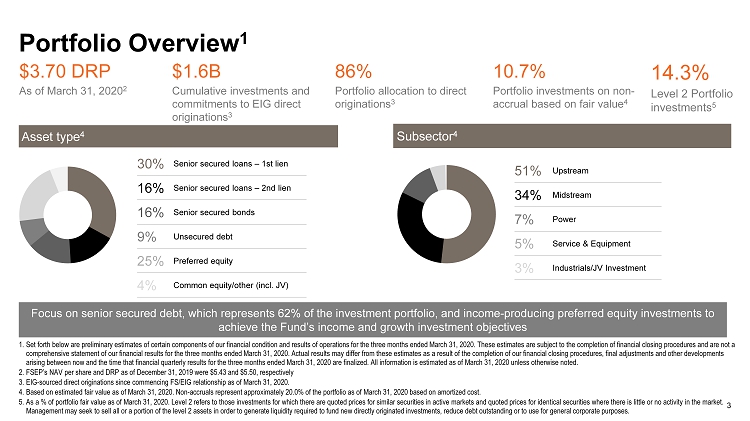

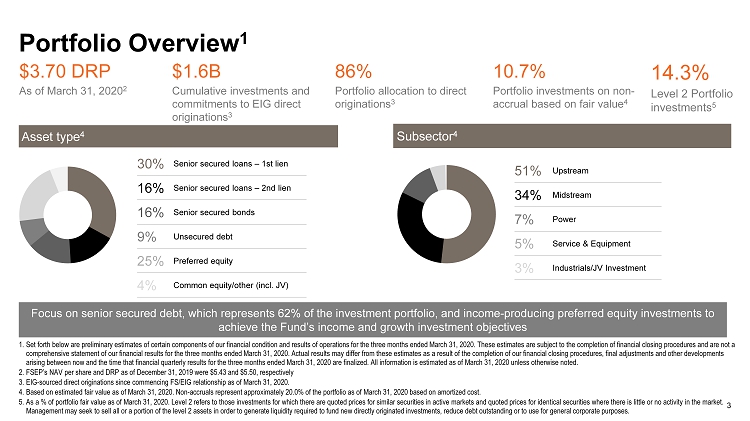

Portfolio Overview 1 3 1. Set forth below are preliminary estimates of certain components of our financial condition and results of operations for the thr ee months ended March 31, 2020. These estimates are subject to the completion of financial closing procedures and are not a comprehensive statement of our financial results for the three months ended March 31, 2020. Actual results may differ from th ese estimates as a result of the completion of our financial closing procedures, final adjustments and other developments arising between now and the time that financial quarterly results for the three months ended March 31, 2020 are finalized. Al l i nformation is estimated as of March 31, 2020 unless otherwise noted. 2. FSEP’s NAV per share and DRP as of December 31, 2019 were $5.43 and $5.50, respectively 3. EIG - sourced direct originations since commencing FS/EIG relationship as of March 31, 2020. 4. Based on estimated fair value as of March 31, 2020. Non - accruals represent approximately 20.0% of the portfolio as of March 31, 2020 based on amortized cost. 5. As a % of portfolio fair value as of March 31, 2020. Level 2 refers to those investments for which there are quoted prices fo r s imilar securities in active markets and quoted prices for identical securities where there is little or no activity in the ma rke t. Management may seek to sell all or a portion of the level 2 assets in order to generate liquidity required to fund new direct ly originated investments, reduce debt outstanding or to use for general corporate purposes. Asset type 4 Subsector 4 30% Senior secured loans – 1st lien 16% Senior secured loans – 2nd lien 16% Senior secured bonds 9% Unsecured debt 25% Preferred equity 4% Common equity/other (incl. JV) 51% Upstream 34% Midstream 7% Power 5% Service & Equipment 3% Industrials/JV Investment $1.6B Cumulative investments and commitments to EIG direct originations 3 86% Portfolio allocation to direct originations 3 10.7% Portfolio investments on non - accrual based on fair value 4 Focus on senior secured debt, which represents 62% of the investment portfolio, and income - producing preferred equity investments to a chieve the Fund’s income and growth investment objectives 14.3% Level 2 Portfolio investments 5 $3.70 DRP As of March 31, 2020 2

4 An investment in FS Energy and Power Fund involves a high degree of risk and may be considered speculative. Investors are adv ise d to read and carefully consider the risk factors and other important information found in FS Energy and Power Fund’s reports filed with the U.S. Securities and Exchange Commission. FSEP is closed to new investors. This presentation is for informational purposes only and does not constitute an offer to sel l n or a solicitation of an offer to buy the securities described herein. CAUTIONARY NOTE REGARDING FORWARD - LOOKING STATEMENTS Certain statements contained in this presentation other than historical information may be considered forward - looking statements . Forward - looking statements include, but are not limited to, statements that relate to future events or FSEP’s future performance or financial condition. Words such as “anticipate,” “believe,” “expect” and “intend” indicate a fo rwa rd - looking statement, although not all forward - looking statements include these words. The forward - looking statements contained in this presentation involve risks and uncertainties. FSEP’s actual results could differ materially from th ose implied or expressed in the forward - looking statements for any reason. Other factors that could cause actual results to differ materially from those implied or expressed in the forward - looking statements include: changes in the ec onomy, risks associated with possible disruption in FSEP’s operations or the economy generally due to terrorism or natural disasters and future changes in laws or regulations and conditions in FSEP’s operating areas; the global ou tbreak of COVID - 19 (more commonly known as the Coronavirus) and the continuing uncertainty surrounding its long - term impact; ongoing disruptions in the oil and gas industry due to the significant decrease in the price of oil; and t he failure from time to time of Saudi Arabia, Russia and other oil producing countries to reach agreements around crude oil production. FSEP has based the forward - looking statements included in this presentation on information available to FSEP on the date of this presentation. Except as required by the federal securities laws, FSEP undertakes no obligation to revise or update any forward - looking statements, whether as a result of new information, future events or otherwise. Shareholders are a dvised to consult any additional disclosures that FSEP has made or may make directly to shareholders or through reports that FSEP has filed or may file with the Securities and Exchange Commission (the “SEC”), including FSEP’s Ann ual Report on Form 10 - K. Provided for illustrative purposes only. Certain statements in this presentation (including those relating to current and fut ure market conditions and trends and other forward looking statements) are based on FS/EIG Advisor’s current expectations, estimates, forecasts and/or opinions. Significant assumptions (generally based on FS/EIG Advisor’s prior simila r i nvestment experience and relevant market data) have been made in preparing these statements and this presentation. Such statements, including the estimates, forecasts, opinions and assumptions on which they are based, involve sig nificant elements of subjective judgment and are subject to numerous uncertainties, not only with respect to the Company, but also uncertainties and changes (including changes in economic, operational, political or other circumstan ces ) and other risks, including, but not limited to, broad trends in business and finance, legislation and regulation, commodity prices and market conditions, all of which are beyond FS/EIG Advisor’s control. While FS/EIG Advisor be lie ves that these assumptions are reasonable, they should not be construed to be indicative of the actual events that will occur. Due to various risks and uncertainties, actual events or results or the actual performance may differ ma terially from those reflected or contemplated in the assumptions, statements and forward looking information herein. FS/EIG Advisor does not make any representation or warranty, express or implied, as to the accuracy or completeness of the in for mation contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information contained herein has been obtained from published and non - publ ished sources. It has not been independently verified by FS/EIG Advisor, and FS/EIG Advisor does not assume responsibility for the accuracy of such information. Except where otherwise indicated herein, the information provided he rein is based on matters as they exist as of the date this presentation has been filed with the SEC and not as of any future date, and will not be updated or otherwise revised to reflect information that subsequently becomes availabl e, or circumstances existing or changes occurring after such date. Furthermore, in certain respects, the information contained herein is incomplete without being supplemented by the accompanying oral presentation and discussion. Disclosures

5 The following are some of the risks an investment in our common shares involves; however, you should carefully consider all o f t he information found in FSEP's Annual Report on Form 10 - K and other reports filed with the SEC: • Because there is no public trading market for our common shares and we are not obligated to effectuate a liquidity event by a sp ecified date, it will be difficult for you to sell your common shares. If you are able to sell your common shares before we complete a liquidity event, it is likely that you will receive less than what you p aid for them. In addition, we have currently suspended our share repurchase program. If we conduct quarterly tender offers for our common shares in the future, only a limited number of our common shar es will be eligible for repurchase. We may suspend or terminate the share repurchase program at any time. • We invest in securities that are rated below investment grade by rating agencies or that would be rated below investment grad e i f they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest a nd repay principal. They may also be difficult to value and illiquid. • An investment strategy focused primarily on privately held companies presents certain challenges, including the lack of avail abl e information about these companies. • Investing in middle market companies involves a number of significant risks, any one of which could have a material adverse e ffe ct on our operating results. • A lack of liquidity in certain of our investments may adversely affect our business. We may be unable to sell our investment s a t favorable prices or at all. • We are subject to financial market risks, including changes in interest rates, which may have a substantial negative impact o n o ur investments. • We have borrowed funds to make investments, which increases the volatility of our investments and may increase the risks of i nve sting in our securities. • Over the last two months, we have elected to sell investments to raise liquidity and satisfy margin obligations under certain of our financing arrangements. Given challenging market conditions, we recorded lower proceeds for these investments relative to where the Fund held the investments on December 31, 2019. In the future, in or der to raise liquidity or otherwise, we may sell additional investments at values that are less than where the Fund held such investments on December 31, 2019. • We expect that the current market conditions may have a lasting and, in some instances, permanent impact on some of our portf oli o companies as they struggle to meet covenant obligations and face insolvency in future periods. Poor performance or insolvency of our portfolio companies could have a material adverse impact on our financial condition and results of operations. • We were out of compliance with covenants relating to our level of shareholders’ equity under certain of our financing arrange men ts as of March 31, 2020. In early April 2020, we obtained waivers from our counterparties to these applicable financing arrangements related to these breaches. In addition, we used $225M of our availa ble cash to repay debt under Gladwyne Funding facility, which repayment occurred subsequent to March 31, 2020. While we currently have sufficient assets to satisfy our outstanding obligations and we are not in breach of any covenants under our various financing arrangements, a persistence or deterioration of the current market environment may lead to such breaches in the future and ma y a dversely impact our ability to satisfy these obligations. Risk factors