Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| x | Definitive Proxy Statement | |

| ¨ | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |

CytomX Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 10, 2016

AT 3 P.M. PACIFIC TIME

Dear Stockholder:

You are cordially invited to attend the 2016 Annual Meeting of Stockholders of CytomX Therapeutics, Inc., a Delaware corporation. The 2016 Annual Meeting of Stockholders will be held on June 10, 2016, at 3 p.m., Pacific Time, at the San Francisco Airport Marriott Waterfront, 1800 Old Bayshore Highway, Burlingame, CA 94010, for the following purposes:

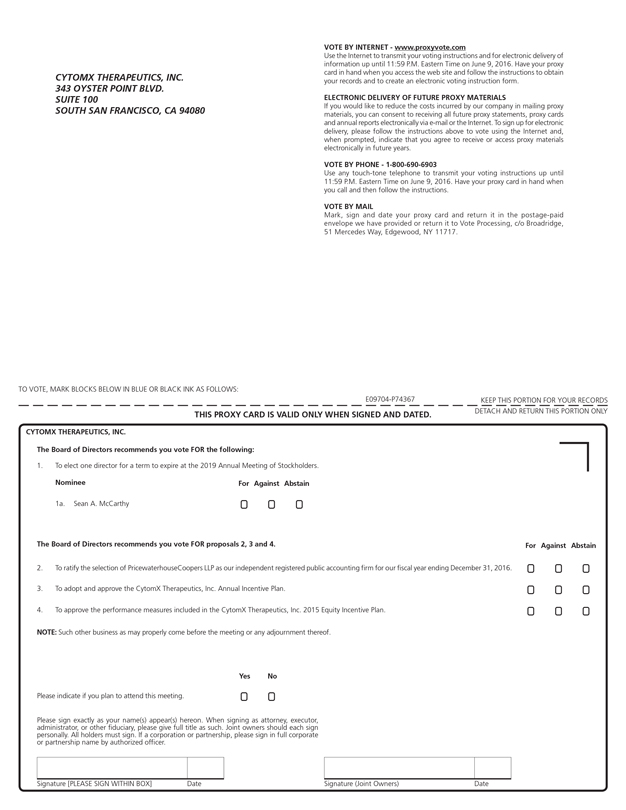

| 1. | To elect one director with term to expire at the 2019 Annual Meeting of Stockholders; |

| 2. | To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016; |

| 3. | To adopt and approve the CytomX Therapeutics, Inc. Annual Incentive Plan; |

| 4. | To approve the performance measures included in the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan; and |

| 5. | To conduct any other business properly brought before the 2016 Annual Meeting of Stockholders. |

These items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders. The record date for the 2016 Annual Meeting of Stockholders is April 12, 2016. Only stockholders of record at the close of business on that date are entitled to notice of, and to vote at, the 2016 Annual Meeting of Stockholders or any adjournment thereof.

Your vote is very important. Whether or not you attend the 2016 Annual Meeting of Stockholders in person, it is important that your shares be represented. You may vote your proxy on the Internet, by phone or by mail in accordance with the instructions in the Notice of Availability of Proxy Materials.

On behalf of the board of directors, thank you for your participation in this important annual process.

| By Order of the Board of Directors |

/s/ Cynthia J. Ladd |

Cynthia J. Ladd Senior Vice President and General Counsel |

South San Francisco, California

April 28, 2016

You are cordially invited to attend the annual meeting in person. Whether or not you expect to attend the annual meeting, please vote on the Internet, by phone or by mail as instructed in the notice of availability of proxy materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the annual meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the annual meeting, you must obtain a proxy issued in your name from that record holder.

Table of Contents

Table of Contents

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 10, 2016

AT 3 P.M. PACIFIC TIME

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING PROCEDURES

Why am I receiving these materials?

We sent you a Notice of Availability of Proxy Materials because the board of directors of CytomX Therapeutics, Inc. is soliciting your proxy to vote at our 2016 Annual Meeting of Stockholders to be held on June 10, 2016 at 3 p.m., Pacific Time, at the San Francisco Airport Marriott Waterfront, 1800 Old Bayshore Highway, Burlingame, CA 94010. We invite you to attend the annual meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may vote by proxy over the Internet or by phone by following the instructions provided in the notice or, if you request printed copies of the proxy materials by mail, you may vote by mail.

The notice is being sent or made available on or about April 28, 2016 to all stockholders of record entitled to vote at the annual meeting.

As used in this proxy statement, “CytomX,” the “Company,” “we” or “us” refer to CytomX Therapeutics, Inc., a Delaware corporation.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on April 12, 2016 will be entitled to vote at the annual meeting. On this record date, there were 36,085,809 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on April 12, 2016, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. The notice will be sent to you by mail directly by us. As a stockholder of record, you may vote in person at the annual meeting or vote by proxy. Whether or not you plan to attend the annual meeting, we urge you to vote on the Internet or by phone as instructed in the notice or by proxy by mail by requesting a paper copy of the proxy materials as instructed in the notice to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on April 12, 2016, your shares were held in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and the notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent

1

Table of Contents

on how to vote the shares in your account. Your brokerage firm, bank or other agent will not be able to vote in the election of directors unless they have your voting instructions, so it is very important that you indicate your voting instructions to the institution holding your shares.

You are also invited to attend the annual meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the annual meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

There are four matters scheduled for a vote:

| • | Proposal 1: To elect one director with term to expire at the 2019 Annual Meeting of Stockholders. |

| • | Proposal 2: To ratify the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016. |

| • | Proposal 3: To adopt and approve the CytomX Therapeutics, Inc. Annual Incentive Plan. |

| • | Proposal 4: To approve the performance measures in the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan. |

How are proxy materials distributed?

Under rules adopted by the Securities and Exchange Commission (“SEC”), we are sending the notice to our stockholders of record and beneficial owners as of April 12, 2016. Stockholders will have the ability to access the proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, on the Internet atwww.proxyvote.com or to request a printed or electronic set of the proxy materials at no charge. Instructions on how to access the proxy materials over the Internet and how to request a printed copy may be found on the notice.

In addition, any stockholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to stockholders and will reduce the impact of annual meetings on the environment. A stockholder who chooses to receive future proxy materials by email will receive an email prior to next year’s annual meeting with instructions containing a link to those materials and a link to the proxy voting website. A stockholder’s election to receive proxy materials by email will remain in effect until the stockholder terminates it.

How do I vote?

You may either vote “For” or “Against” or abstain from voting with respect to the nominee to the board of directors. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record as of April 12, 2016, you may vote in person at the annual meeting, vote by proxy over the Internet or by phone by following the instructions provided in the notice or, if you request printed copies of the proxy materials by mail, you may vote by mail. If your proxy is properly executed in time to be voted at the annual meeting, the shares represented by the proxy will be voted in accordance with the instructions you provide. Whether or not you plan to attend the annual meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the annual meeting and vote in person if you have already voted by proxy.

| 1. | To vote in person, come to the annual meeting and we will give you a ballot when you arrive. |

2

Table of Contents

| 2. | To vote on the Internet, go towww.proxyvote.com to complete an electronic proxy card. You will be asked to provide the 12-digit control number from the notice and follow the instructions. Your vote must be received by 11:59 p.m., Eastern Time, on June 9, 2016 to be counted. |

| 3. | To vote by phone, request a paper or email copy of the proxy materials by following the instructions on the notice and call the number provided with the proxy materials to transmit your voting instructions. Your vote must be received by 11:59 p.m., Eastern Time, on June 9, 2016 to be counted. |

| 4. | To vote by mail, request a paper copy of the proxy materials by following the instructions on the notice and complete, sign and date the proxy card enclosed with the paper copy of the proxy materials and return it promptly in the envelope provided. If you return your signed proxy card to us before the annual meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a notice and voting instructions from that organization rather than from us. Simply follow the instructions to ensure that your vote is counted. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with the notice, or contact your broker, bank or other agent.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 12, 2016.

What is the quorum requirement?

A quorum of stockholders is necessary to take any action at the meeting, other than to adjourn the meeting. The presence, in person or by proxy duly authorized, of the holders of a majority of the outstanding shares of stock entitled to vote will constitute a quorum. On April 12, 2016, there were 36,085,809 shares outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote in person at the annual meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the chairman of the annual meeting or a majority of the votes present at the annual meeting may adjourn the annual meeting to another date.

What if I return a proxy card but do not make specific choices?

If you are a stockholder of record and you return a proxy card without marking any voting selections, your shares will be voted:

| 1. | Proposal 1: “For” election of one nominee for director. |

| 2. | Proposal 2: “For” the ratification of the audit committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016. |

| 3. | Proposal 3: “For” the adoption and approval of the CytomX Therapeutics, Inc. Annual Incentive Plan. |

| 4. | Proposal 4: “For” the approval of the performance measures included in the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan. |

3

Table of Contents

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, your shares are held by your broker, bank or other agent as your nominee, or in “street name,” and you will need to obtain a proxy form from the organization that holds your shares and follow the instructions included on that form regarding how to instruct the organization to vote your shares. If you do not give instructions to your broker, bank or other agent, it can vote your shares with respect to “discretionary” items but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may vote your shares held in street name on such proposals. Non-discretionary items are proposals considered non-routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may not vote your shares held in street name on such proposals and the shares will be treated as broker non-votes. Proposals 1, 3 and 4 are matters considered non-routine under the applicable rules. If you do not give your broker specific instructions, the broker may not vote your shares on Proposals 1, 3 and 4 and your shares will constitute broker non-votes which will be counted for purposes of determining whether a quorum exists but will not affect the outcome of these proposals. Proposal 2 involves a matter we believe to be routine and thus if you do not give instructions to your broker, the broker may vote your shares in its discretion on Proposal 2 and therefore no broker non-votes are expected to exist in connection with Proposal 2.

How are votes counted?

Votes will be counted by the inspector of election appointed for the annual meeting, who will count, with respect to Proposals 1, 2, 3 and 4, “For” votes, “Against” votes and abstentions, and with respect to Proposal 1, 3 and 4, broker non-votes.

Who will serve as inspector of elections?

A representative of Broadridge Financial Solutions, Inc. will serve as the inspector of elections.

How many votes are needed to approve each proposal?

| • | For Proposal 1 electing one member of the board of directors, the director must receive a “For” vote from a majority of the votes cast either in person or by proxy at the annual meeting and entitled to vote on the election of directors. A majority of votes cast shall mean that the number of shares voted “For” the director’s election exceeds fifty percent of the number of votes cast with respect to that director’s election, with votes cast including votes “Against” in each case and excluding abstentions and broker non-votes with respect to that director’s election. |

| • | For Proposal 2 ratifying the audit committee’s selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2016, the proposal must receive a “For” vote from the majority of the votes cast either in person or by proxy at the annual meeting and entitled to vote on the proposal, with votes cast including votes “Against” and excluding abstentions. |

| • | For Proposal 3 adopting and approving the CytomX Therapeutics, Inc. Annual Incentive Plan, the proposal must receive a “For” vote from the majority of the votes cast either in person or by proxy at the annual meeting and entitled to vote on the proposal, with votes cast including votes “Against” and excluding abstentions and broker non-votes with respect to the proposal. |

| • | For Proposal 4 approving the performance measures included in the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan, the proposal must receive a “For” vote from the majority of the votes cast either in person or by proxy at the annual meeting and entitled to vote on the proposal, with votes cast including votes “Against” and excluding abstentions and broker non-votes with respect to the proposal. |

4

Table of Contents

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to the notice and the proxy materials, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. We will not pay our directors and employees any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding the notice and any other proxy materials to beneficial owners.

What does it mean if I receive more than one notice?

If you receive more than one notice, your shares are registered in more than one name or are registered in different accounts. Please vote by proxy according to each notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Yes, you can revoke your proxy at any time before the final vote at the annual meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

| 1. | A duly executed proxy card with a later date or time than the previously submitted proxy; |

| 2. | A written notice that you are revoking your proxy to our Secretary, care of CytomX Therapeutics, Inc., at 343 Oyster Point Blvd., Suite 100, South San Francisco, CA 94080; or |

| 3. | A later-dated vote on the Internet or by phone or a ballot cast in person at the annual meeting (simply attending the annual meeting will not, by itself, revoke your proxy). |

If you are a beneficial owner, you may revoke your proxy by submitting new instructions to your broker, bank or other agent, or if you have received a proxy from your broker, bank or other agent giving you the right to vote your shares at the annual meeting, by attending the meeting and voting in person.

When are stockholder proposals due for next year’s annual meeting?

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in our 2017 proxy statement. Any such proposal must be submitted in writing by December 29, 2016, to our Secretary, care of CytomX Therapeutics, Inc., at 343 Oyster Point Blvd., Suite 100, South San Francisco, CA 94080, our current principal executive offices address, if such proposal is submitted to us before December 1, 2016, or 151 Oyster Point Boulevard, Suite 400, South San Francisco, CA 94080, our new principal executive offices address, if such proposal is submitted to us on or after December 1, 2016, the date around which we currently expect to move into the new offices. If we change the date of our 2017 Annual Meeting of Stockholders by more than 30 days from the date of the previous year’s annual meeting, the deadline shall be a reasonable time before we begin to print and send our proxy materials. Stockholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities laws and our bylaws. The submission of a stockholder proposal does not guarantee that it will be included in our proxy statement.

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that if you wish to submit a proposal that is not to be included in next year’s proxy statement or nominate a director, a timely written notice of a stockholder proposal must be delivered to, or mailed and received by, our Secretary, care of CytomX Therapeutics, Inc., at 151 Oyster Point Boulevard, Suite 400, South San Francisco, CA 94080, no earlier than February 10, 2017 and no later than the close of business on March 13, 2017, which notice must contain the information specified in our bylaws. If we change the date of our 2017 Annual Meeting of Stockholders by more than 30 days before, or more than 60 days after, the one-year

5

Table of Contents

anniversary of the 2016 Annual Meeting of Stockholders, then the written notice of a stockholder proposal that is not intended to be included in our proxy statement must be delivered, or mailed and received, not later than the 90th day prior to our 2017 Annual Meeting of Stockholders or, if later, the 10th day following the day on which certain public disclosure as described in our bylaws of the meeting date is made.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders who have the same address may receive only one copy of the notice, unless one or more of these stockholders notifies us that they wish to receive individual copies of the notice and, if requested, other proxy materials. This process potentially means extra convenience for stockholders and cost savings for companies.

If you are a beneficial owner of our common stock, once you receive notice from your broker, bank or other agent that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive separate notices or other proxy materials, please notify your broker, bank or other agent, direct your written request to CytomX Therapeutics, Inc., Secretary, at 343 Oyster Point Blvd., Suite 100, South San Francisco, CA 94080 or contact our Secretary at (650) 515-3185. Stockholders who currently receive multiple copies of the notice or other proxy materials at their address and would like to request householding of their communications should contact their broker, bank or other agent.

How can I find out the results of the voting at the annual meeting?

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in a Current Report on Form 8-K filed with the SEC within four business days following the annual meeting.

6

Table of Contents

ELECTION OF DIRECTOR

Our board of directors currently consists of seven directors and is divided into three classes, designated as Class I, Class II and Class III. Under our amended and restated certificate of incorporation, our board of directors is authorized to assign its members in office to each class. Each class has a term of three years. There are currently two directors in Class I, Sean A. McCarthy, D. Phil. and Elaine V. Jones, Ph.D., whose term of office expires upon the election of directors at the 2016 Annual Meeting of Stockholders. Dr. McCarthy, one of the current directors in Class I, has been nominated for election at the 2016 Annual Meeting of Stockholders. Dr. Jones will not stand for re-election at the 2016 Annual Meeting of Stockholders. Dr. Jones has decided not to stand for re-election in order to focus on her other business interests.

Any vacancies on our board of directors resulting from death, resignation, disqualification, removal or other causes, and any newly created directorships resulting from any increase in the number of directors, shall be filled by the affirmative vote of a majority of the directors then in office, even though less than a quorum of the board of directors. Any director elected to fill a vacancy shall hold office for the remainder of the unexpired term in which the vacancy occurred or newly created directorship was created and until such director’s successor shall have been elected and qualified.

Directors are elected by a majority of the votes cast at the annual meeting and entitled to vote on the election of directors. A majority of votes cast shall mean that the number of shares voted “For” a director’s election exceeds fifty percent of the number of votes cast with respect to that director’s election, with votes cast including votes “Against” in each case and excluding abstentions and broker non-votes with respect to that director’s election. Shares represented by executed proxies will be voted for the election of the two nominees named below, unless the “Against” or “Abstain” voting selection has been marked on the proxy card.

If Dr. McCarthy becomes unavailable for election as a result of an unexpected occurrence, shares that would otherwise be voted for him will be voted for the election of a substitute nominee proposed by the nominating and corporate governance committee and nominated by the board of directors. Dr. McCarthy has agreed to serve if elected. Our management has no reason to believe that Dr. McCarthy will be unable to serve. If elected at the annual meeting, Dr. McCarthy will serve until the earliest of the 2019 Annual Meeting of Stockholders, his successor is elected and qualified or his death, resignation or removal.

The following is a brief biography of Dr. McCarthy, the nominee for director, and a discussion of his specific experience, qualifications, attributes or skills that led the nominating and corporate governance committee of the board of directors to recommend that Dr. McCarthy as a nominee for director, as of the date of this proxy statement.

Name | Position | Age | ||||

Sean A. McCarthy, D. Phil. | President and Chief Executive Officer, Director | 49 | ||||

Sean A. McCarthy, D. Phil.

Dr. McCarthy has served as a member of our board of directors and our president and chief executive officer since August 2011. Previously, Dr. McCarthy served as our chief business officer from December 2010 to August 2011. From April 2006 to December 2010, he was a transactional partner at Pappas Ventures, a venture capital firm, where he helped drive investments in therapeutic, medical device and molecular diagnostic companies. Prior to Pappas Ventures, Dr. McCarthy was the vice president of business development at SGX Pharmaceuticals, Inc., where he spearheaded a wide range of strategic collaborations with major pharmaceutical companies, and served on the management team that led to the initial public offering of the company in 2006, before the Company’s ultimate acquisition by Eli Lilly and Company. Prior to SGX Pharmaceuticals, Inc.,

7

Table of Contents

Dr. McCarthy was associate director of program management at Millennium Pharmaceuticals, Inc., where he managed therapeutic protein programs and a research team that invented novel genomic techniques for the identification of therapeutic proteins. Dr. McCarthy is an author on multiple peer reviewed scientific publications and patent applications. Dr. McCarthy received his B.Sc. in biochemistry and pharmacology at King’s College, University of London, his D. Phil. in cancer biology from St. John’s College, University of Oxford and his M.B.A. from the Rady School at the University of California, San Diego. Dr. McCarthy currently serves on the board of directors of the California Life Sciences Association. The nominating and corporate governance committee believes that Dr. McCarthy’s experience serving as our chief executive officer, combined with his experience in the biopharmaceutical and the venture capital industries, provide him with the qualifications and skills to serve as a member of our board of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF THE NAMED NOMINEE.

8

Table of Contents

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The audit committee of our board of directors has selected PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2016 and has further directed that management submit the selection of our independent registered public accounting firm for ratification by the stockholders at the annual meeting. PricewaterhouseCoopers LLP has audited our financial statements for the fiscal years ended December 31, 2015 and 2014. Representatives of PricewaterhouseCoopers LLP are expected to be present at the annual meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm. However, the audit committee is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee will reconsider whether or not to retain PricewaterhouseCoopers LLP. Even if the selection is ratified, the audit committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the committee determines that such a change would be in our best interests and our stockholders’ best interest.

The affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy at the annual meeting and cast on this proposal will be required to ratify the selection of PricewaterhouseCoopers LLP for our fiscal year ending December 31, 2016. Abstentions will not be counted as votes cast on this proposal. No broker non-votes are expected to exist in connection with this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 2.

9

Table of Contents

APPROVAL OF THE CYTOMX THERAPEUTICS, INC. ANNUAL INCENTIVE PLAN

At the annual meeting, our stockholders will be asked to approve the CytomX Therapeutics, Inc. Annual Incentive Plan (the “Bonus Plan”) under which officers and other employees of the Company would be eligible to receive incentive payments based on the achievement of objective performance goals for performance periods commencing after June 10, 2016. The Bonus Plan was approved by the board of directors on April 15, 2016, subject to stockholder approval. If the Bonus Plan is approved by our stockholders at the annual meeting, it is intended that the Bonus Plan will qualify for exemption under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), which would generally allow awards granted under the Bonus Plan to be tax deductible by us, assuming other applicable regulatory requirements are satisfied.

The Bonus Plan will allow the Compensation Committee to utilize specified financial or individual measures (as more fully described below) when determining awards under the Bonus Plan. Section 162(m) limits the deduction for federal income tax purposes of compensation for the chief executive officer and certain other most highly compensated executive officers as of the last day of a company’s taxable year (collectively, the “162(m) covered employees”) to $1 million per year, unless such compensation qualifies as “performance-based compensation” under Section 162(m). Various requirements must be satisfied in order for compensation paid to the 162(m) covered employees to qualify as performance-based compensation within the meaning of Section 162(m). One such requirement is that the compensation must be paid based upon the attainment of performance measures established by a committee of board members, or a subcommittee thereof, meeting the definition of “outside director” as defined in Section 162(m). In addition, the measures established by such a committee must be based upon performance measures, the material terms of which are approved by the stockholders.

We are accordingly requesting the stockholders to approve the Bonus Plan in accordance with Section 162(m). If stockholders do not approve the Bonus Plan in accordance with Section 162(m), then the compensation committee will re-evaluate the compensation program in order to continue to provide compensation to attract, retain and motivate its executive officers.

The following is a description of the Bonus Plan. This description is qualified in its entirety by reference to the Bonus Plan, a copy of which has been included as Appendix A to this proxy statement.

Description of the Bonus Plan

The purpose of the Bonus Plan is to retain and motivate officers and other employees of the Company who are designated by the compensation committee to participate in the Bonus Plan for a specified performance period commencing after June 10, 2016 (a “Performance Period”) by providing such designated officers and employees with the opportunity to earn incentive payments based upon the extent to which specified performance goals have been achieved or exceeded for that Performance Period. The Bonus Plan will be administered by the compensation committee, which is comprised solely of independent directors.

All officers and other employees of the Company and its subsidiaries are eligible to be designated as participants in the Bonus Plan. The compensation committee, in its discretion, will designate the eligible employees who will participate in the Bonus Plan for a specified Performance Period, and will do so not later than 90 days after the beginning of the Performance Period or, if earlier, not later than the date on which 25% of the Performance Period has been completed (the “Applicable Period”). As of April 12, 2016, approximately 65 officers and other employees would have been eligible to participate in the Bonus Plan; however, it is anticipated that only our executive officers (currently, five individuals) will be eligible to receive awards under the Bonus Plan.

10

Table of Contents

Under the Bonus Plan, payment of awards to participating employees is subject to the attainment of specific performance goals and other terms and conditions established by the compensation committee during the Applicable Period for each Performance Period. A participant may receive an award under the Bonus Plan based upon achievement of a performance goal or goals using one or more objective corporate-wide or subsidiary, division, operating unit or individual measures. With respect to bonuses payable to persons who are, or are expected to be, employed as the chief executive officer or certain of the other most highly compensated executive officers of the Company as of the last day of the Company’s taxable year (“162(m) Covered Employees”) and to the extent necessary for an award to be qualified performance-based compensation under Section 162(m) of the Code, the applicable performance goals shall be based exclusively on one or more of the following objective corporate-wide or subsidiary, division, operating unit or individual measures: the attainment by a share of a specified fair market value for a specified period of time; earnings per share; return to stockholders (including dividends); return on assets; return on equity; earnings of the Company before or after taxes and/or interest; revenues; expenses; market share; cash flow or cost reduction goals; interest expense; return on investment; return on investment capital; return on operating costs; economic value created; operating margin; gross margin; the achievement of annual operating profit plans; net income; earnings before interest, depreciation and/or amortization; operating earnings after interest expense and before incentives, and/or extraordinary or special items; operating earnings; net cash provided by operations; and strategic business criteria, consisting of one or more objectives based on meeting specified market penetration, geographic business expansion goals, cost targets, days sales outstanding goals, customer satisfaction, reductions in errors and omissions, reductions in lost business, management of employment practices and employee benefits, supervision of litigation and information technology, quality and quality audit scores, productivity, efficiency, and goals relating to acquisitions or divestitures, or any combination of the foregoing. Each such goal may be expressed on an absolute or relative basis and may include comparisons based on current internal targets, the past performance of the Company (including the performance of one or more subsidiaries, divisions, or operating units) or the past or current performance of other companies (or a combination of such past and current performance). In the case of earnings-based measures, in addition to the ratios specifically enumerated above, performance goals may include comparisons relating to capital (including, but not limited to, the cost of capital), stockholders’ equity, shares outstanding, assets or net assets, or any combination thereof. The applicable performance measures may be applied on a pre- or post-tax basis and may be adjusted in accordance with Section 162(m) of the Code to include or exclude objectively determinable components of any performance measure, including, without limitation, special charges such as restructuring or impairment charges, debt refinancing costs, extraordinary or noncash items, unusual, nonrecurring or one-time events affecting the Company or its financial statements or changes in law or accounting principles. With respect to participants who are not “covered employees” within the meaning of Section 162(m) of the Code and who, in the Committee’s judgment, are not likely to be covered employees at any time during the applicable Performance Period, the performance goals established for the Performance Period may consist of any objective or subjective corporate-wide or subsidiary, division, operating unit or individual measures, whether or not listed herein.

If the relevant performance goals are attained during the Performance Period, a participant will be eligible to receive a cash award. Performance goal targets are expressed in terms of an objective formula or standard which may be based on an employee’s base salary, or a multiple thereof, at the time or immediately before the performance goals for such Performance Period were established. In all cases, the compensation committee has the sole and absolute discretion to reduce the amount of any payment under the Bonus Plan that would otherwise be made to any participant or to decide that no payment shall be made. No participant will receive a payment under the Bonus Plan with respect to any Performance Period having a value in excess of $3,000,000, which maximum amount will be proportionally adjusted with respect to Performance Periods that are less than or more than one year in durations.

Determination of the performance compensation awarded to each participant is to be made at a time determined by the compensation committee after the last day of each Performance Period following a certification by the compensation committee that the applicable performance goals were satisfied. During the Applicable Period, the compensation committee will establish terms regarding the timing of payment of awards.

11

Table of Contents

The compensation committee may delegate its responsibilities under the Bonus Plan to our chief executive officer or such other executive officer of the Company as it deems appropriate, except that the compensation committee may not delegate its responsibilities with respect to bonuses payable to 162(m) Covered Employees. No compensation will be paid under the Bonus Plan to 162(m) Covered Employees if the Bonus Plan is not approved by stockholders. If approved, the Bonus Plan will be effective for Performance Periods commencing June 10, 2016. The board of directors may terminate the Bonus Plan at any time.

New Plan Benefits

The value of the performance-based awards granted under the Bonus Plan is subject to performance objectives established by the compensation committee and is, therefore, not determinable. Please see the “2015 Summary Compensation Table” for the value of payouts received under the Company’s annual bonus plan by each of our named executive officers for performance in 2015.

The affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy at the annual meeting and cast on this proposal will be required to approve the CytomX Therapeutics, Inc. Annual Incentive Plan. Abstentions and broker non-votes will not be counted as votes cast on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 3.

12

Table of Contents

APPROVAL OF THE PERFORMANCE MEASURES INCLUDED IN THE CYTOMX THERAPEUTICS, INC. 2015 EQUITY INCENTIVE PLAN

At the annual meeting, our stockholders will be asked to approve the material terms of the performance measures used for performance-based awards granted under the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan (the “2015 Plan”), in accordance with Section 162(m) of the Code. The 2015 Plan was approved by the board of directors on September 17, 2015, and by our stockholders on October 2, 2015. Stockholders are being asked to approve the performance measures under the 2015 Plan so that certain compensation paid under the 2015 Plan may qualify as performance-based compensation under Section 162(m), assuming other applicable conditions are satisfied. Stockholders are not being asked to approve an increase in the number of shares available under the 2015 Plan or any amendment to the 2015 Plan.

As discussed in Proposal 3, Section 162(m) limits the deduction for federal income tax purposes of compensation for 162(m) covered employees to $1 million per year, unless such compensation qualifies as “performance-based compensation” under Section 162(m). Various requirements must be satisfied in order for compensation paid to the 162(m) covered employees to qualify as performance-based compensation within the meaning of Section 162(m). One such requirement is that the compensation must be paid based upon the attainment of performance measures established by a committee of board members meeting the definition of “outside director” used for purposes of Section 162(m). In addition, the performance measures established by such a committee, which in our case would be the compensation committee, must be based upon performance measures, the material terms of which are approved by stockholders. Following our IPO, that stockholder approval must be obtained no later than the first regularly scheduled meeting of stockholders that occurs after the close of the third calendar year following the calendar year in which the Company became a publicly-held corporation.

We are accordingly requesting the stockholders to approve the material terms of the performance measures for the 2015 Plan in accordance with Section 162(m).

The following is a description of the material terms of the performance measures and certain other material terms of the 2015 Plan. This description is qualified in its entirety by reference to the 2015 Plan, a copy of which has been included as Appendix B to this proxy statement.

Material Terms of the Performance Measures

Eligible Participants

All officers, non-employee directors, employees, consultants, agents and independent contractors, and persons expected to become officers, non-employee directors, employees, consultants, agents and independent contractors of the Company or any of our subsidiaries are eligible to receive awards under the 2015 Plan. The compensation committee of our board will determine the participants under the 2015 Plan. As of April 12, 2016, approximately five executive officers, 60 other employees and seven non-employee directors were eligible to participate in the 2015 Plan.

Award Limits

To the extent necessary for an award to be qualified performance—based compensation under Section 162(m), (i) the maximum number of shares of Company common stock with respect to which options and share appreciation rights, or a combination thereof, may be granted during any fiscal year of the Company to any person is 1,417,867, subject to adjustment in the event of a stock split, stock dividend, recapitalization,

13

Table of Contents

reorganization, merger, spin-off or other similar change or event, (ii) the maximum number of shares of Company common stock with respect to which restricted shares or restricted share units subject to performance measures or performance units denominated in shares of Company common stock that may be granted during any fiscal year of the Company to any person is 1,417,867, subject to adjustment in the event of a stock split, stock dividend, recapitalization, reorganization, merger, spin-off or other similar change or event, and (iii) the maximum amount that may be earned by any person during any fiscal year of the Company with respect to performance units denominated in cash is $3,000,000; provided, however, that each of the per person limits set forth in this sentence will be multiplied by two for awards granted to participants in the year such participants’ employment with the Company commences.

Performance Measures

To the extent an award is intended to qualify as performance-based compensation under Section 162(m), the performance measures to be used under the 2015 Plan will be one or more of the following corporate-wide or subsidiary, division, operating unit or individual measures: the attainment by a share of common stock of the Company of a specified fair market value for a specified period of time; earnings per share; return to stockholders (including dividends); return on assets; return on equity; earnings of the Company before or after taxes and/or interest; revenues; expenses; market share; cash flow or cost reduction goals; interest expense; return on investment; return on investment capital; return on operating costs; economic value created; operating margin; gross margin; the achievement of annual operating profit plans; net income; earnings before interest, depreciation and/or amortization; operating earnings after interest expense and before incentives, and/or extraordinary or special items; operating earnings; net cash provided by operations; and strategic business criteria, consisting of one or more objectives based on meeting specified market penetration, geographic business expansion goals, cost targets, days sales outstanding goals, customer satisfaction, reductions in errors and omissions, reductions in lost business, management of employment practices and employee benefits, supervision of litigation and information technology, quality and quality audit scores, productivity, efficiency, and goals relating to acquisitions or divestitures, or any combination of the foregoing. Each such goal may be expressed on an absolute or relative basis and may include comparisons based on current internal targets, the past performance of the Company (including the performance of one or more subsidiaries, divisions, or operating units) or the past or current performance of other companies (or a combination of such past and current performance). In the case of earnings-based measures, in addition to the ratios specifically enumerated above, performance goals may include comparisons relating to capital (including, but not limited to, the cost of capital), stockholders’ equity, shares outstanding, assets or net assets, or any combination thereof. The applicable performance measures may be applied on a pre- or post-tax basis and may be adjusted in accordance with Section 162(m) to include or exclude objectively determinable components of any performance measure, including, without limitation, special charges such as restructuring or impairment charges, debt refinancing costs, extraordinary or noncash items, unusual nonrecurring or one-time events affecting the Company or its financial statements or changes in law or accounting principles. With respect to participants who are not 162(m) covered employees and who are not expected to be 162(m) covered employees at any time during the applicable performance period, the performance goals may include any objective or subjective corporate-wide or subsidiary, division, operating unit or individual measures, whether or not listed above.

Summary Description of the 2015 Plan

Under the 2015 Plan, the Company may grant: nonqualified options; incentive stock options; share appreciation rights; bonus shares; restricted shares; restricted share units; and performance units. The purposes of the 2015 Plan are (i) to align the interests of the Company’s stockholders and the recipients of awards under the 2015 Plan by increasing the proprietary interest of such recipients in the Company’s growth and success, (ii) to advance the interests of the Company by attracting and retaining non-employee directors, officers, employees and other service providers and (iii) to motivate such persons to act in the long-term best interests of the Company and its stockholders.

14

Table of Contents

Administration

The compensation committee will interpret, construe and administer the 2015 Plan. The compensation committee’s interpretation, construction and administration of the 2015 Plan and all of its determinations thereunder will be final, conclusive and binding on all persons. The compensation committee will have the authority to determine the participants in the 2015 Plan, the form, amount and timing of any awards, the performance goals, if any, and all other terms and conditions pertaining to any award. The compensation committee may take any action such that (i) any outstanding options and share appreciation rights become exercisable in part or in full, (ii) all or any portion of a restriction period on any restricted shares or restricted share units will lapse, (iii) all or a portion of any performance period applicable to any outstanding award will lapse and (iv) any performance measures applicable to any outstanding award will be deemed satisfied at the target level or any other level.

The compensation committee may delegate some or all of its powers and authority to the board of directors, the chief executive officer and president or other executive officer as the compensation committee deems appropriate, subject to Section 162(m) and Section 16 of the Exchange Act, except that the compensation committee may not delegate its responsibilities with respect to awards granted to 162(m) covered employees.

Available Shares

The 2015 Plan initially reserved 2,444,735 shares of common stock for issuance of awards under the 2015 Plan, subject to adjustment for stock splits and other similar changes in capitalization. The number of available shares will be reduced by the aggregate number of shares that become subject to outstanding awards granted under the 2015 Plan. As of the first day of each calendar year beginning on or after January 1, 2016, the number of shares available for all awards under the 2015 Plan, other than incentive stock options, will automatically increase by 4% of the number of shares that are issued and outstanding as of that date, unless the compensation committee approves an increase of a lesser percentage. To the extent that shares subject to an outstanding award granted under the 2015 Plan are not issued or delivered by reason of the expiration, termination, cancellation or forfeiture of such award or by reason of the settlement of an award in cash, then those shares will again be available under the 2015 Plan. Shares subject to an award under the 2015 Plan may not be made available for issuance under the 2015 Plan if such shares are: (i) shares that were subject to a share-settled share appreciation right and were not issued upon the net settlement or net exercise of such share appreciation right, (ii) shares used to pay the exercise price of an option, (iii) shares delivered to or withheld by the Company to pay withholding taxes related to an award under the 2015 Plan, or (iv) shares repurchased on the open market with the proceeds of an option exercise. On April 12, 2016, the closing sales price per share of Company common stock as reported on The NASDAQ Global Select Market was $13.15.

Effective Date, Termination and Amendment

The 2015 Plan became effective on October 6, 2015 and will terminate on the September 17, 2025, unless earlier terminated by the board of directors. The board of directors may amend the 2015 Plan at any time, subject to stockholder approval if required by applicable law, rule or regulation, including Section 162(m), or any rule of the NASDAQ. No amendment may materially impair the rights of a holder of an outstanding award without the consent of such holder.

Change in Control

In the event of a change in control, the board of directors may, in its discretion, (i) provide that (a) some or all outstanding options and share appreciation rights will immediately become exercisable in full or in part, (b) the restriction period applicable to some or all outstanding share awards will lapse in full or in part, (c) the performance period applicable to some or all outstanding awards will lapse in full or in part, and (d) the performance measures applicable to some or all outstanding awards will be deemed to be satisfied at the target or

any other level, (ii) require that shares of stock of the Company resulting from such change in control, or a parent

15

Table of Contents

corporation thereof, be substituted for some or all of our shares subject to an outstanding award, and/or (iii) require outstanding awards, in whole or in part, to be surrendered by the holder, and to be immediately cancelled, and to provide for the holder to receive (a) a cash payment in an amount equal to (1) in the case of an option or share appreciation right, the number of our shares then subject to the portion of such option or share appreciation right surrendered, whether vested or unvested, multiplied by the excess, if any, of the fair market value of a share of our common stock as of the date of the change in control, over the purchase price or base price per share of our common stock subject to such option or share appreciation right, (2) in the case of a share award, the number of shares of our common stock then subject to the portion of such award surrendered, whether vested or unvested, multiplied by the fair market value of a share of our common stock as of the date of the change in control, and (3) in the case of a performance unit award, the value of the performance units then subject to the portion of such award surrendered, whether vested or unvested; (b) shares of capital stock of the Company resulting from such change in control, or a parent corporation thereof, having a fair market value not less than the amounts determined under clause (iii)(a) above; or (c) a combination of the payment of cash pursuant to clause (iii)(a) above and the issuance of shares pursuant to clause (iii)(b) above.

Under the 2015 Plan, a change in control is generally defined as: (i) a person’s or entity’s acquisition, other than from us, of beneficial ownership of 50% or more of either our then outstanding shares or the combined voting power of our then outstanding voting securities, but excluding certain acquisitions by the Company, its subsidiaries or employee benefit plans, or by a corporation in which our shareholders hold a majority interest; (ii) a reorganization, merger or consolidation of the Company if our shareholders do not thereafter beneficially own more than 50% of the outstanding shares or combined voting power of the resulting company; (iii) an unapproved change in the composition of a majority of our board; or (iv) a complete liquidation or dissolution of the Company or of the sale or other disposition of all or substantially all of our assets; but excluding, in any case, the initial public offering or any bona fide primary or secondary public offering following the occurrence of the initial public offering.

Tax Matters

In general, a participant will not recognize taxable income at the time an option is granted. Upon exercise of a non-qualified option, a participant will recognize compensation, taxable as ordinary income, equal to the excess of the fair market value of the shares of common stock purchased over their exercise price. In the case of “incentive stock options,” within the meaning of Section 422 of the Code, a participant will not recognize ordinary income at the time of exercise (except for purposes of the alternative minimum tax), and if the participant observes certain holding period requirements, then when the shares are sold, the entire gain over the exercise price will be taxable at capital gains rates. If the participant does not observe the holding period requirements, then when the shares are sold, the participant generally will recognize compensation, taxable as ordinary income, equal to the excess of the fair market value of the shares at the time of exercise (or, if less, the amount realized on the sale of the shares) over the exercise price. A participant has no taxable income at the time share appreciation rights are granted, but will recognize compensation taxable as ordinary income upon exercise in an amount equal to the fair market value of any shares of common stock delivered and the amount of any cash paid by the Company. A participant who is granted restricted shares, including shares subject to performance conditions, generally will not recognize taxable income at the time the restricted shares are granted, but will recognize compensation taxable as ordinary income at the time the restrictions constituting a substantial risk of forfeiture lapse in an amount equal to the excess of the fair market value of the shares of common stock at such time over the amount, if any, paid for such shares. However, a participant instead may elect to recognize compensation taxable as ordinary income on the date the restricted shares are granted in an amount equal to the fair market value of the shares on that date over the amount, if any, paid for such shares. If such election is made, any subsequent gain upon disposition of the shares will be taxable at capital gains rates. The taxation of other share-based awards will depend on how such awards are structured. Generally, a participant who is granted an award of restricted share units, including restricted share units subject to performance conditions, or some other performance unit will not recognize taxable income at the time such award is granted. When the restrictions applicable to the award lapse, and the shares of common stock subject to the restricted share units or other award

16

Table of Contents

are transferred (or any amount of cash is paid) to the participant, the participant will recognize compensation taxable as ordinary income in an amount equal to the fair market value of the shares of common stock on the date of transfer and the amount of any cash paid by the Company.

Subject to the Section 162(m) deduction limitation described above, the Company may deduct, as a compensation expense, the amount of ordinary income recognized by a participant in connection with the 2015 Plan at the time such ordinary income is recognized by that participant.

New Plan Benefits

The number of performance-based awards granted under the 2015 Plan in any year is subject to the compensation committee’s discretion and is, therefore, not determinable.

The affirmative vote of the holders of a majority of the shares of our common stock present in person or represented by proxy at the annual meeting and cast on this proposal will be required to approve the performance measures included in the CytomX Therapeutics, Inc. 2015 Equity Incentive Plan. Abstentions and broker non-votes will not be counted as votes cast on this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 4

17

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the ownership of our common stock as of March 31, 2016, by: (i) each director; (ii) each of our named executive officers; (iii) all of our executive officers and directors as a group; and (iv) all those known by us to be beneficial owners of more than five percent of our common stock.

| Beneficial Ownership** | ||||||||

Beneficial Owner | Number of Shares | Percent of Total | ||||||

Third Rock Ventures, L.P.(1) | 8,670,348 | 24.03 | % | |||||

FMR LLC(2) | 5,403,643 | 14.97 | % | |||||

Canaan IX L.P.(3) | 4,884,755 | 13.54 | % | |||||

Pfizer Inc.(4) | 2,017,604 | 5.59 | % | |||||

CytomX Therapeutics Holdings, LLC(5) | 2,252,976 | 6.24 | % | |||||

Roche Finance Ltd(6) | 1,903,579 | 5.28 | % | |||||

Sean A. McCarthy, D. Phil.(7) | 869,324 | 2.36 | % | |||||

Neil Exter | — | — | ||||||

Frederick W. Gluck(8) | 249,115 | * | % | |||||

Hoyoung Huh, M.D., Ph.D.(9) | 359,993 | 0.99 | % | |||||

Elaine V. Jones, Ph.D. | — | — | ||||||

Timothy M. Shannon, M.D. | — | — | ||||||

Matthew P. Young(10) | 26,895 | * | % | |||||

Robert C. Goeltz II(11) | 86,560 | * | % | |||||

Rachel W. Humphrey, M.D.(12) | 54,624 | * | % | |||||

W. Michael Kavanaugh, M.D.(13) | 104,603 | * | % | |||||

All executive officers and directors as a group (11 persons)(14) | 1,762,998 | 4.70 | % | |||||

| * | Denotes ownership percentage less than one percent. |

| ** | This table is based upon information supplied by officers, directors and principal stockholders and Forms 3, Forms 4 and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table, we believe that each of the stockholders named in the table has sole voting and dispositive power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 36,085,809 shares outstanding on March 31, 2016, adjusted as required by rules promulgated by the SEC. |

| (1) | Based solely on the Schedule 13G filed with the SEC on February 10, 2016, by Third Rock Ventures, L.P. (“TRV”), Third Rock Ventures GP, L.P. (“TRV GP”), the sole general partner of TRV, TRV GP, LLC (“TRV GP LLC”), the sole general partner of TRV GP, and Mark Levin (“Levin”), Kevin P. Starr (“Starr”) and Robert I. Tepper (“Tepper”), each a managing member of TRV GP LLC. TRV owns 8,670,348 shares of our common stock. Each of TRV GP, TRV GP LLC, Levin, Starr and Tepper may be deemed to beneficially own the shares held by TRV. Neil Exter, a member of our board of directors, is a partner of Third Rock Ventures. Mr. Exter does not have voting or investment power over any of the shares purchased by Third Rock Ventures, L.P. The address of TRV LP is 29 Newbury Street, Suite 401, Boston, Massachusetts 02116. |

| (2) | Based solely on the Schedule 13G/A (Amendment No. 1) filed with the SEC on February 12, 2016, by FMR LLC, a Delaware limited liability company, and Abigail P. Johnson. 5,403,643 shares of our common stock are beneficially owned, or may be deemed to be beneficially owned, by FMR LLC, certain of its subsidiaries and affiliates, and other companies. Abigail P. Johnson is a Director, the Vice Chairman, the Chief Executive Officer and the President of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ |

18

Table of Contents

| voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act (“Fidelity Funds”) advised by Fidelity Management & Research Company, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. The address of the principal place of business of FMR LLC and Abigail P. Johnson is 245 Summer Street, Boston, Massachusetts 02210. |

| (3) | Based solely on the Schedule 13G filed with the SEC on February 11, 2016, by Canaan IX L.P. and Canaan Partners IX LLC. Canaan IX L.P. owns 4,884,755 shares of our common stock. Canaan Partners IX LLC is the general partner of Canaan IX L.P. and may be deemed to beneficially own the shares held by Canaan IX L.P. Timothy M. Shannon, M.D. is a non-managing member of Canaan Partners IX LLC, the general partner of Canaan IX L.P., and a member of our board of directors. Dr. Shannon does not have beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of any shares held by Canaan IX L.P. The address of Canaan IX L.P. and Canaan Partners IX LLC is 285 Riverside Avenue, Suite 250, Westport, Connecticut 06880. |

| (4) | Based solely on the Schedule 13G filed with the SEC on October 21, 2015 by Pfizer Inc. 2,017,604 shares of our common stock are beneficially owned by Pfizer Inc. The business address for Pfizer Inc. is 235 East 42nd Street, New York, New York 10017. |

| (5) | Based solely on the Form S-1 (Amendment No. 5) filed with the SEC on October 6, 2015 by the Company. Consists of 2,252,976 shares of our common stock held by CytomX Therapeutics Holdings, LLC. Alan J. Heeger and Gary Wilcox are the managing members of CytomX Therapeutics Holdings, LLC and may be deemed to share voting and investment power over the shares held by CytomX Therapeutics Holdings, LLC. Each of them disclaims beneficial ownership of such shares, except to the extent of their proportionate pecuniary interest therein, if any. The address of CytomX Therapeutics Holdings, LLC is 1421 State Street, Suite B, Santa Barbara, California 93101. |

| (6) | Based solely on the Form S-1 (Amendment No. 5) filed with the SEC on October 6, 2015 by the Company. Consists of 1,903,579 shares of our common stock held by Roche Finance Ltd. Roche Finance Ltd exercises voting and investment control over the shares held by it. Roche Finance Ltd is wholly-owned by Roche Holding Ltd. Roche Holding Ltd’s American Depository Receipt is cross-listed on OTCQX International Premier under the symbol RHHBY. Roche Holding Ltd’s non-voting equity securities and its voting shares are both listed on SIX Swiss Exchange. The address of Roche Finance Ltd is Grenzacherstrasse 122, 4070 Basel, Switzerland. |

| (7) | Consists of (a) 158,737 shares of our common stock held in the McCarthy Family Trust dated August 9, 2001, Sean A. McCarthy and Jeanette J. McCarthy, as Trustees and (b) 710,587 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (8) | Consists of (a) 155,991 shares of our common stock, 5,000 of which are held by Richlin Partners, LLC, an entity owned by the spouse of Frederick W. Gluck and 3,200 of which are held by the spouse of Frederick W. Gluck and (b) 93,124 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (9) | Consists of 359,993 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (10) | Consists of 26,895 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (11) | Consists of 86,560 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (12) | Consists of 54,624 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (13) | Consists of (a) 13,917 shares of our common stock and (b) 90,686 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

| (14) | Consists of (a) 331,645 shares of our common stock and (b) 1,431,353 shares of our common stock issuable upon exercise of stock options exercisable within 60 days of March 31, 2016. |

19

Table of Contents

Section 16(A) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who beneficially own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent beneficial owners are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on our review of Forms 3, 4 and 5, and any amendments thereto, furnished to us or written representations that no Form 5 was required, we believe that during the fiscal year ended December 31, 2015, all filing requirements applicable to our executive officers and directors under the Exchange Act were met in a timely manner

20

Table of Contents

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Policies and Procedures for Related Party Transactions

We have adopted a written related party transactions policy, which sets forth the policies and procedures for the review and approval or ratification of related party transactions. The policy covers, with certain exceptions set forth in Item 404 of Regulation S-K promulgated under the Exchange Act, any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we were or are to be a participant, where the amount involved exceeds $120,000 and a related party had, has or will have a direct or indirect material interest, including indebtedness, guarantees of indebtedness and employment by us of a related party.

A related party transaction reviewed under the policy will be considered approved or ratified if it is authorized by the audit committee of our board of directors or the chairperson of the audit committee in accordance with the standards set forth in the policy after full disclosure of the related party’s interests in the transaction. As appropriate for the circumstances, the audit committee or the chairperson of the audit committee, as applicable, shall review and consider:

| • | the related party’s interest in the transaction; |

| • | the approximate dollar value of the amount involved in the related party transaction; |

| • | the approximate dollar value of the amount of the related party’s interest in the transaction without regard to the amount of any profit or loss; |

| • | whether the transaction was undertaken in our ordinary course of business; |

| • | whether the transaction with the related party is proposed to be, or was, entered into on terms no less favorable to us than terms that could have been reached with an unrelated third party; |

| • | the purpose and the potential benefits of the related party transaction to us; |

| • | required public disclosure, if any; and |

| • | any other information regarding the related party transaction or the related party in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

Certain Related Party Transactions

We describe below transactions and series of similar transactions since January 1, 2015, to which we were a party or will be a party, in which (i) the amounts involved exceeded or will exceed $120,000 and (ii) any of our directors, executive officers, holders of more than five percent of our capital stock or any member of their immediate family had or will have a direct or indirect material interest, other than compensation arrangements with directors and executive officers, which are described where required in the sections titled “Director Compensation” and “Executive Compensation,” respectively, in this proxy statement.

21

Table of Contents

Participation in the initial public offering

Certain holders of more than five percent of our capital stock and their affiliated entities and one of our directors purchased shares of our common stock in the initial public offering of our common stock, which closed on October 14, 2015 (the “IPO”), from the underwriters for payment in excess of $120,000 as summarized in the following table. The underwriters received the same underwriting discount from the sale of the shares of our common stock to these holders as they did from other shares of our common stock sold to the public in the IPO.

Participants | Number of Shares of Common Stock Purchased | Aggregate Purchase Price ($) | ||||||

Entities affiliated with Fidelity Management & Research Company | 2,777,500 | 33,330,000 | ||||||

Pfizer Inc. | 416,666 | 4,999,992 | ||||||

Frederick W. Gluck(1) | 15,000 | 180,000 | ||||||

| (1) | Consists of (a) 10,000 shares of our common stock purchased by Frederick W. Gluck and (b) 5,000 shares of our common stock purchased by Richlin Partners, LLC, an entity owned by the spouse of Frederick W. Gluck. |

Issuance of preferred stock in 2015

In February 2015 and May 2015, we issued and sold an aggregate of 941,842 shares of our Series C preferred stock at a purchase price of $5.309387 per share for an aggregate purchase price of approximately $5.0 million in cash, including (i) 659,209 shares issued to Canaan IX L.P. for an aggregate purchase price of approximately $3.5 million and (iii) 282,633 shares issued to CytomX Therapeutics Holdings, LLC for an aggregate purchase price of approximately $1.5 million.

In June 2015, we issued and sold an aggregate of 7,490,540 shares of our Series D preferred stock at a purchase price of $9.345101 per share for an aggregate purchase price of approximately $70.0 million in cash, including 2,461,177 shares issued to entities affiliated with Fidelity Management & Research Company for an aggregate purchase price of approximately $23.0 million.

Name | Number of Shares of Series C Preferred Stock | Number of Shares of Series D Preferred Stock | ||||||

Entities affiliated with Fidelity Management & Research Company(1) | — | 2,461,177 | ||||||

Canaan IX L.P.(2) | 659,209 | — | ||||||

CytomX Therapeutics Holdings, LLC | 282,633 | — | ||||||

| (1) | Consists of (a) 287,485 shares purchased by Fidelity Select Portfolios: Biotechnology Portfolio, (b) 64,961 shares purchased by Fidelity Advisory Series VII: Fidelity Advisor Biotechnology Fund, (c) 189,110 purchased by Fidelity Growth Company Commingled Pool, (d) 207,739 shares purchased by Fidelity Mt. Vernon Street Trust: Fidelity Series Growth Company Fund, (e) 794,033 shares purchased by Fidelity Mt. Vernon Street Trust: Fidelity Growth Company Fund, (f) 105,499 shares purchased by Fidelity Securities Fund: Fidelity Series Small Cap Opportunities Fund—Healthcare Sub, (g) 27,627 shares purchased by Fidelity Capital Trust: Fidelity Stock Selector Small Cap Fund—Health Care Sub, (h) 2,584 shares purchased by Fidelity Blue Chip Growth Commingled Pool, (i) 137,854 shares purchased by Fidelity Securities Fund: Fidelity Series Blue Chip Growth Fund, (j) 378,621 shares purchased by Fidelity Securities Fund: Fidelity Blue Chip Growth Fund, (k) 4,032 shares purchased by Fidelity OTC Commingled Pool, (l) 244,269 shares purchased by Fidelity Securities Fund: Fidelity OTC Portfolio and (m) 17,363 shares purchased by Pyramis Lifecycle Blue Chip Growth Commingled Pool. |

| (2) | Consists of 659,209 shares of Series C preferred stock purchased by Canaan IX L.P. Timothy M. Shannon, M.D., a member of our board of directors, is a non-managing member of Canaan Partners IX LLC, the general partner of Canaan IX L.P. Dr. Shannon does not have voting or investment power over any of the shares directly held by Canaan IX L.P. |

22