PRELIMINARY ECONOMIC ASSESSMENT

CABALLO BLANCO GOLD HEAP LEACH,

VERACRUZ, MEXICO

PREPARED FOR:

Goldgroup Mining Inc.

Suite 2184, 1055 Dunsmuir Street

Vancouver, BC, Canada V7X 1L3

RE-ADDRESSED TO:

Timmins Gold Corp.

Suite 1900 - 570 Granville St

Vancouver, BC, Canada

V6C 3P1

PREPARED BY:

Joseph M. Keane, P.E.

Brent C. Bailey, P.E.

Jim Cuttle, P.Geo.

Gary Giroux, P.Eng.

Stephen Taylor, P.E.

Dino Pilotto, P.Eng.

K D Engineering

7701 N. Business Park Drive

Tucson, Arizona 85743

Document No. Q443-04-028

Project No. 443-04

7 May 2012

(Re-Addressed as of 28 January 2015)

NOTICE TO READER

This technical report was originally prepared for Goldgroup Mining Inc. (“Goldgroup”). It has been re-addressed to Timmins Gold Corp. (“Timmins”). Timmins acquired 100% of the Caballo Blanco Gold Project, which is the subject of this report, from Goldgroup on December 24, 2014 pursuant to an asset purchase agreement. All information in this report is effective May 7, 2012 and the effective date of this report is May 7, 2012.

CERTIFICATE of AUTHOR

This certificate applies to the technical report entitled “Preliminary EconomicAssessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on 28 January, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I, Joseph M. Keane, P.E. do hereby certify that:

| | 1. | I am an Independent Mineral Process Engineering Consultant and contributed to the above referenced Report as an associate of the following organization: |

K D Engineering (now SGS North America Inc.)

7701 N. Business Park Drive

Tucson, Arizona 85743

Telephone: 520-579-8315

Fax: 520-579-3686

E-Mail: Joseph.Keane@sgs.com

| | 2. | I graduated with a degree of Bachelor of Science in Metallurgical Engineering from the Montana School of Mines in 1962. I obtained a Master of Science in Mineral Processing Engineering in 1966 from the Montana College of Mineral Science and Technology. In 1989 I received a Distinguished Alumni Award from that institution. I am a member of the Society for Mining, Metallurgy, and Exploration, Inc. (SME #1682600) and am a registered professional metallurgical engineer in Arizona (#12979) and Nevada #5462). I have worked as a mineral processing engineer for a total of 53 years since my graduation from university. |

| | | |

| | 3. | I have read the definition of "qualified person" set out in National Instrument 43- 101 ("NI 43-101") and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a "qualified person" for the purposes of NI 43-101. |

| | | |

| | 4. | I visited the Caballo Blanco project site in November 2011 for a period of 3 days. |

| | | |

| | 5. | I am responsible for a portion of the report contents, specifically Sections 2, 3, 13, 17, 18, 19, 22 and 23 and also the process portions of Section 1, 21, 24, 25, 26, 27 and 28. |

| Certificate of Author |

| Joseph M. Keane, P.E. |

| | 6. | I am independent of the issuer applying all of the tests in Section 1.5 of National Instrument 43-101. |

| | | |

| | 7. | I have not had prior involvement with the property that is the subject of the Technical Report. |

| | | |

| | 8. | I have read National Instrument 43-101 and Form 43-101F1, and the portions of the Technical Report for which I am responsible have been prepared in compliance with that instrument and form. |

| | | |

| | 9. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the portions of the Technical report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 10th day of February 2015

| | | Joseph M. Keane (Signed and Sealed) |

| | | |

| | | |

| | | |

| Joseph M. Keane, P.E. | | |

| Print Name of Qualified Person | | Seal and Signature of Qualified Person |

CERTIFICATE

This certificate applies to the technical report entitled “Preliminary Economic Assessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I,Brent C. Bailey, hereby certify that:

| 1. | I am a Civil Engineering Consultant specializing in environmental engineering, environmental policy and management, with an address of 6455 S. Yosemite St., Ste 900, Greenwood Village, CO 80111-4954, and I contributed to a report entitled "Preliminary Economic Assessment for Caballo Blanco Gold Heap Leach, Veracruz, Mexico". |

| | | | |

| 2. | Qualifications |

| | | | |

| a. | Education: |

| | | | |

| | i. | Masters of Environmental Policy and Management (M.E.P.M.), University of Denver |

| | | | |

| | ii. | M.S., Civil Engineering (Environmental), University of Utah |

| | | | |

| | iii. | B. S., Civil Engineering, University of Utah |

| | | | |

| | b. | Professional registrations and affiliations: |

| | | | |

| | i. | Registered Professional Engineer – Colorado (No. 22867) |

| | | | |

| | ii. | National Registry of Environmental Professional, Certified Environmental Auditor (No. 9825) |

| | | | |

| | c. | Experience: |

| | | | |

| | i. | Environmental Manager of an underground gold mining operation. |

| | | | |

| | ii. | Consultant - prepared Plans of Operations, Spill Prevention Control and Countermeasure plans, emergency response plans, reclamation and closure plans and cost estimates for mining operations. Additionally, I have conducted environmental audits, International Cyanide Management Institute Cyanide Code audits, and environmental Due Diligence for potential property acquisitions. |

| | | | |

| | iii. | Vice-president of Environmental and Governmental Affairs for a Canadian Gold Mining Company where my activities focused on permitting a mine in southern California and preparing a company environmental auditing program. |

| | | | |

| | iv. | Director of Environmental Affairs with a Canadian Mining Corporation where I conducted mine permitting, prepared Plans of Operations, evaluated baseline study programs, conducted environmental audits and due diligence studies. |

| | | | |

| | v. | I have provided approximately 30 years of environmental services to the mining industry. Approximately 35% of my time has been spent with gold mining operations. This experience includes permitting, evaluation of minerals processing operations, evaluation and development of waste treatment and disposal facilities, and preparation of reclamation and closure programs. |

1

CERTIFICATE

| 3. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| | |

| 4. | I am responsible for Section 20.0 and review of the Technical Report. More specifically, I have reviewed the environmental contributions of the report, Chapter 20.0 – Environmental Studies, Permitting and Social or Community Impact, and although I did not conduct the studies, I believe them to be fair and accurate. ERM was my employer at the time the studies were conducted and I reviewed the related documents. Representatives of ERM have visited the property and prepared the reports as required to accurately and fairly complete the work. |

| | |

| 5. | I have not had prior involvement with the property that is the subject of the Technical Report. |

| | |

| 6. | I am independent of Timmins Gold Corp. as described in section 1.5 of NI 43-101. |

| | |

| 7. | I have read National Instrument 43-101 and Form 43-101F1, and Section 20 of the Technical Report has been prepared in compliance with that instrument and form. |

| | |

| 8. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, Chapter 20 – Environmental Studies, Permitting and Social and Community of the Technical Report for which I am responsible contains all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 10thday of February, 2015.

Brent C. Bailey (Signed and Sealed)

________________________________

Brent C. Bailey,Professional Engineer

2

CERTIFICATE

This certificate applies to the technical report entitled “Preliminary Economic Assessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I, Jim Cuttle, hereby certify that:

| 1. | I am a consulting geologist with an office at 86 Cloudburst Road, Black Tusk Village, Whistler, British Columbia, Canada, V0N 1B1. |

| | |

| 2. | I am a graduate of the University of New Brunswick (1980) with a Bachelor of Science Degree in Geology. I have practiced my geological profession continuously for over 34 years in the capacity of exploration and consulting geologist. I specialize in precious and base metal exploration and have experience in different types of epithermal mineralization similar to mineralization at Caballo Blanco. I remain a registered member in good standing since 1992 of The Association of Professional Engineers and Geoscientists of the Province of British Columbia (#19313). |

| | |

| 3. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43- 101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| | |

| 4. | I last visited the property on January 6, 2012. |

| | |

| 5. | I am responsible for the preparation of Sections 4 through 12 of the Technical Report. |

| | |

| 6. | I am independent of Timmins Gold Corp. as described in section 1.5 of NI 43-101. |

| | |

| 7. | I have previously worked on this property, co-authoring a NI 43-101 report in 2010. |

| | |

| 8. | I have read NI 43-101, and Sections 4 through 12 of the Technical Report for which I am responsible have been prepared in compliance with NI 43-101. |

| | |

| 9. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, Sections 4 through 12 of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 10thday of February, 2015.

Jim F. Cuttle (Signed)

____________________________

Jim F. Cuttle, B.Sc., P.Geo.

CERTIFICATE G.H. Giroux

This certificate applies to the technical report entitled “Preliminary Economic Assessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I, G.H. Giroux, of 982 Broadview Drive, North Vancouver, British Columbia, do hereby certify that:

| • | I am a consulting geological engineer with an office at #1215 - 675 West Hastings Street, Vancouver, British Columbia. |

| • | I am a graduate of the University of British Columbia in 1970 with a B.A. Sc. and in 1984 with a M.A. Sc., both in Geological Engineering. |

| • | I am a member in good standing of the Association of Professional Engineers and Geoscientists of the Province of British Columbia. |

| • | I have practiced my profession continuously since 1970. I have had over 38 years' experience calculating mineral resources. 1 have previously completed resource estimations on a wide variety of precious metal deposits both in B.C. and around the world, including La Colorada, La Jojoba and Livia de Oro, La India and Kisladag. |

| • | I have read the definition of "qualified person" set out in National Instrument 43-101 and certify that by reason of education, experience and affiliation with a professional association, I meet the requirements of a "qualified person" as defined in National Instrument 43-101. |

| • | This report titled "Preliminary Economic Assessment Caballo Blanco Gold Heap Leach,Veracruz, Mexico" readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012, is based on a study of the data and literature available on the La Paila Property. I am responsible for Section 14 on the resource estimations completed in Vancouver during 2012. I have made a site visit the property on Nov. 7 to 9, 2011. |

| • | I have previously worked on this deposit, completing resource estimates in 2010 and Feb. 2012 from which this estimate is taken. |

| • | As of the date of this certificate, to the best of my knowledge, information and belief, the technical report contains all scientific and technical information that is required to be disclosed to make the technical report not misleading. |

| • | I am independent of the issuer applying all of the tests in section 1.5 of National Instrument 43- 101. |

| • | I have read National Instrument 43-101 and Form 43-101F1 and this Technical Report has been prepared in compliance with that instrument and form. |

Dated this 10thday of February, 2015.

G.H. Giroux (Signed and Sealed)

____________________________

G.H. Giroux, P. Eng., MASc.

CERTIFICATE

This certificate applies to the technical report entitled “Preliminary Economic Assessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I, Stephen John Taylor, hereby certify that:

| 1. | I am a civil engineer, at Picacho Associates, LLC, with an address of 522 West State Avenue, Phoenix, Arizona, 85021. |

| | |

| I graduated with a Bachelor's of Science degree in Civil Engineering from the University of the Witwatersrand in 1984, and a Master's of Science in Applied Mathematics from the University of Colorado in 1997. 1 have been employed as an engineer for 27 years. I am a registered Professional Engineer in the State of Arizona (#45940). |

| | |

| 2. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43- 101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| | |

| 3. | I visited the property in November 2011 for 2 days. |

| | |

| 4. | I am responsible for the preparation of Sections 24.1, 24.2, 24.3, 24.4, parts of 26 and Appendices 7, 8 and 9 of the Technical Report. |

| | |

| 5. | I am independent of Timmins Gold Corp. as described in section 1.5 of NI 43-101. |

| | |

| 6. | I have no prior involvement with the property that is the subject of the technical review. |

| | |

| 7. | I have read NI 43-101, and the portions of the Technical Report for which I am responsible have been prepared in compliance with NI 43-101. |

| | |

| 8. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the portions of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 10thday of February, 2015.

Stephen John Taylor (Signed and Sealed)

____________________________

Stephen John Taylor, PE

CERTIFICATE

This certificate applies to the technical report entitled “Preliminary Economic Assessment Caballo Blanco Gold Heap Leach, Veracruz, Mexico” readdressed to Timmins Gold Corp. on January 28, 2015, with an effective date as of May 7, 2012 (the “Technical Report”).

I, Dino Pilotto, hereby certify that:

| 1. | I am a Mine Engineering Lead, at JDS Energy & Mining Inc., with an address of Suite 860, 625 Howe Street, Vancouver BC, Canada. |

| | |

| 2. | I am a graduate of the University of British Columbia with a B.Sc. in Mining and Mineral Process Engineering (1987). I have practiced my profession continuously since June 1987. I have been involved with mining operations, mine engineering and consulting covering a variety of commodities at locations in North America, South America, Africa, and Eastern Europe. |

| | |

| 3. | I am a Professional Mining Engineer (P.Eng. #14782) registered with the Association of Professional Engineers and Geologists of Saskatchewan. I am also a registered Professional Mining Engineer in Alberta and the Northwest Territories. |

| | |

| 4. | I have read the definition of “qualified person” set out in National Instrument 43-101 (“NI 43- 101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “qualified person” for the purposes of NI 43-101. |

| | |

| 5. | I have personally inspected the subject project on November 7, 2011. |

| | |

| 6. | I am the co-author of this report and responsible for the preparation of Sections 15 and 16 and open pit mining aspects of Sections 1, 21, 25, 26 and 27. |

| | |

| 7. | I am independent of Timmins Gold Corp. as described in section 1.5 of NI 43-101. |

| | |

| 8. | I have had no prior involvement with the subject property. |

| | |

| 9. | I have read NI 43-101, and the portions of the Technical Report for which I am responsible have been prepared in compliance with NI 43-101 |

| | |

| 10. | As of the effective date of the Technical Report, to the best of my knowledge, information and belief, the portions of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the Technical Report not misleading. |

Dated this 10thday of February, 2015.

Dino Pilotto (Signed and Sealed)

____________________________

Dino Pilotto, P.Eng.

Mine Engineering Lead

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

TABLE OF CONTENTS

| 1.0 | SUMMARY | 1-1 |

| 2.0 | INTRODUCTION | 2-1 |

| 3.0 | RELIANCE ON OTHER EXPERTS | 3-1 |

| 4.0 | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| 5.0 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES,INFRASTRUCTURE &PHYSIOGRAPHIC | 5-1 |

| 6.0 | HISTORY | 6-1 |

| 7.0 | GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| 8.0 | DEPOSIT TYPES | 8-1 |

| 9.0 | EXPLORATION | 9-1 |

| 10.0 | DRILLING | 10-1 |

| 11.0 | SAMPLE PREPARATION, ANALYSIS AND SECURITY | 11-1 |

| 12.0 | DATA VERIFICATION | 12-1 |

| 13.0 | MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| 14.0 | MINERAL RESOURCE ESTIMATES | 14-1 |

| 15.0 | MINERAL RESERVE ESTIMATES | 15-1 |

| 16.0 | MINING METHODS | 16-1 |

| 17.0 | RECOVERY METHODS | 17-1 |

| 18.0 | PROJECT INFRASTRUCTURE | 18-1 |

| 19.0 | MARKET STUDIES AND CONTRACTS | 19-1 |

| 20.0 | ENVIRONMENTAL STUDIES, PERMITTING ANDSOCIAL OR COMMUNITY IMPACT | 20-1 |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

TABLE OF CONTENTS (Continued)

| 21.0 | CAPITAL AND OPERATING COSTS | 21-1 |

| 22.0 | ECONOMIC ANALYSIS | 22-1 |

| 23.0 | ADJACENT PROPERTIES | 23-1 |

| 24.0 | OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| 25.0 | INTERPRETATION AND CONCLUSIONS | 25-1 |

| 26.0 | RECOMMENDATIONS | 26-1 |

| 27.0 | REFERENCES | 27-1 |

| 28.0 | APPENDICES | 28-1 |

| | Appendix1 | Process Plant Design Criteria |

| | Appendix2 | Process Plant Drawings |

| | Appendix3 | Process Plant Equipment List |

| | Appendix4 | Process Plant Capital Cost Estimate |

| | Appendix5 | Electrical Load Study & Single Line |

| | Appendix6 | Leach Pad, Waste Dumps and Ancillary Facility Drawings |

| Appendix7 | Meteorological Solutions Inc., Precipitation andEvaporation Estimates for Caballo Blanco |

| Appendix8 | Opinion of Probable Costs: Leach Pad, Ponds,and Waste Stockpile Construction |

| | Appendix9 | List of Drill Holes & Semivariograms |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

LIST OF TABLES

| Table 1.1 | NSR Parameters |

| Table 1.2 | Resources Planned to be Extracted in LOM Plan |

| Table 1.3 | LOM Production Schedule |

| Table 1.4 | Total Initial And Future Sustaining Project Costs For Two Stage Crushing Option |

| Table 1.5 | Summary Process Plant Cost - 2-Stage Crushing |

| Table 1.6 | Operating Cost Estimate |

| Table 1.7 | Economic Summary |

| Table 1.8 | Economic Evaluation |

| Table 1.9 | Summary of Key Financial Parameters (Sensitivity to Gold Price) |

| | |

| Table 4.1 | Mineral Claim Details |

| Table 4.2 | The “El Cobre Joint Venture” Boundaries |

| | |

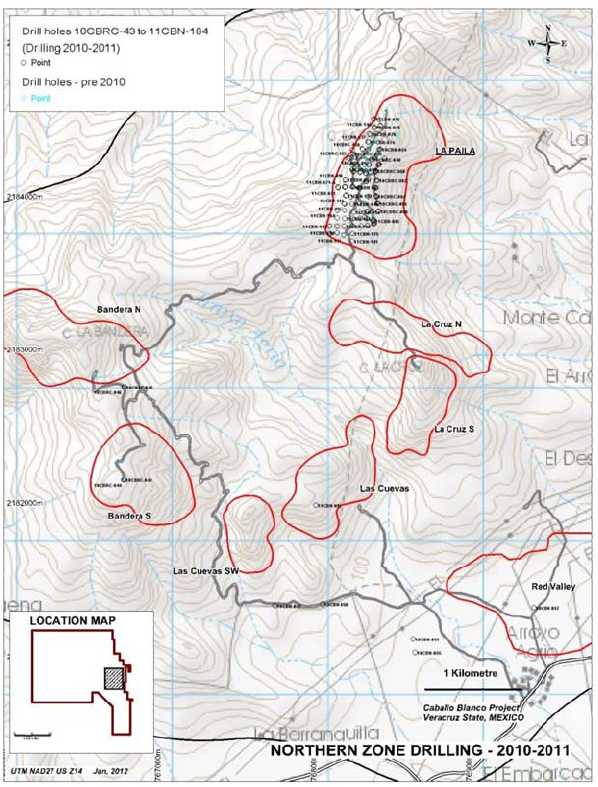

| Table 10.1 | Areas drilled in 2010/2011 by Goldgroup (holes 10CBRC-43 to 11CBN-184) |

| Table 10.2 | Comparison - Reverse Circulation / Diamond drill twinned holes - La Paila area |

| Table 10.3 | All drill collar locations - 2010/2011 (NAD 27 Mex, zone 14) |

| | |

| Table 12.1 | Assay checks by Author, Nov, 2009 |

| | |

| Table 13.1 | Caballo Blanco (La Paila Zone) Preliminary ‘in-house’ Bottle Roll Tests byGoldgroup - 2009 |

| Table 13.2 | Column Leach Test Samples |

| Table 13.3 | Column Leach Test Parameters |

| Table 13.4 | Column Leach Test Results |

| Table 13.5 | Column 1-10 Reaction Equation Parameters |

| Table 13.6 | Operating Parameters |

| | |

| Table 14.1 | Assay statistics for Au and Ag inside and outside Mineralized Solid - La Paila |

| Table 14.2 | Summary of Gold Populations Present in Mineralized Solid |

| Table 14.3 | Cap levels for Gold and Silver - La Paila |

| | |

| Table 14.4 | Assay Statistics for Capped Gold & Silver Inside and Outside Mineralized Solid - LaPaila |

| Table 14.5 | Statistics for Gold & Silver - 5 meter Composites |

| Table 14.6 | Summary of Semivariograms for Gold & Silver |

| Table 14.7 | Summary of Kriging Parameters |

| Table 14.8 | Indicated Resource within the Mineralized Solid - La Paila |

| Table 14.9 | Inferred Resource within the Mineralized Solid - La Paila |

| Table 14.10 | Indicated Resource within Total Blocks |

| Table 14.11 | Inferred Resource within Total Blocks |

| | |

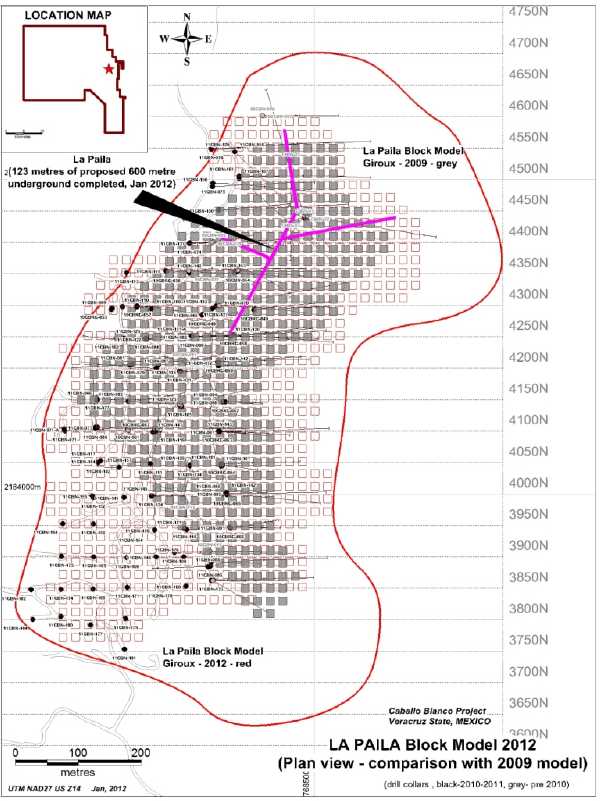

| Table 16.1 | NSR Parameters used in the Whittle Optimization Model |

| Table 16.2 | Cut-off Grade |

| Table 16.3 | Operating Costs and Geotechnical Parameters used for Optimization |

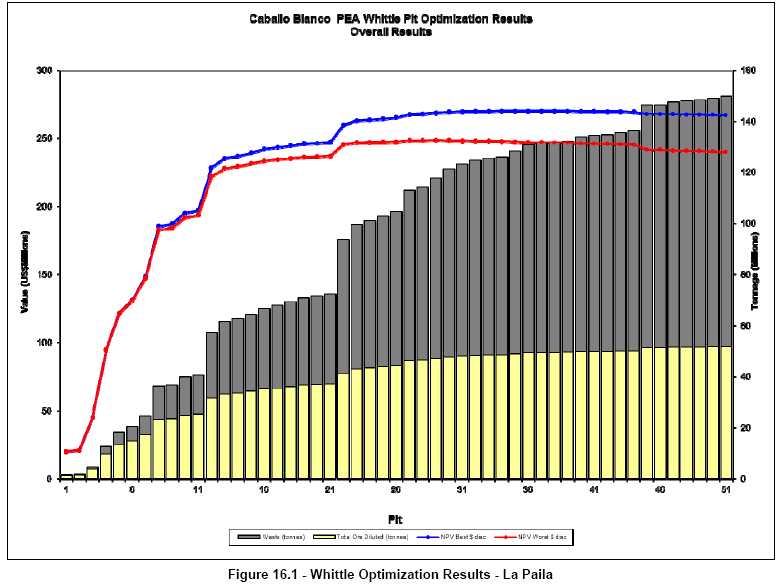

| Table 16.4 | Whittle Optimization Results - La Paila |

| Table 16.5 | Resources Planned to be Extracted in the LOM Plan |

| Table 16.6 | Resources Planned to be Extracted by Classification |

| Table 16.7 | Major Open Pit Mining Equipment |

| Table 16.8 | La Paila Phase Tonnages and Grades |

| Table 16.9 | Proposed LOM Production Schedule |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

LIST OF TABLES (Continued)

| Table 1.1 | Environmental Permits 1 |

| Table 20.2 | Expected Exploration and Mining Operations Environmental Impacts |

| Table 20.3 | Risk Assessment Summary Table |

| Table 20.4 | Mitigation Measures |

| Table 20. 5 | Surrounding Communities |

| Table 20.6 | Development Agreements |

| | |

| Table 21.1 | Process Plant Operating Cost Estimate - Summary |

| Table 21.2 | Operating Cost Estimate Heap Leach Power & Energy |

| Table 21.3 | Operating Cost Estimate - Plant Labor |

| Table 21.4 | Operating Cost Estimate - General Administration Labor |

| Table 21.5 | Operating Cost Estimate - Heap Leach Consumables |

| Table 21.6 | Wear Material Cost Estimates |

| Table 21.7 | Water |

| Table 21.8 | Summary Process Plant Cost - 2 Stage Crushing |

| Table 21.9 | Summary Process Plant Cost - 3 Stage Crushing |

| | |

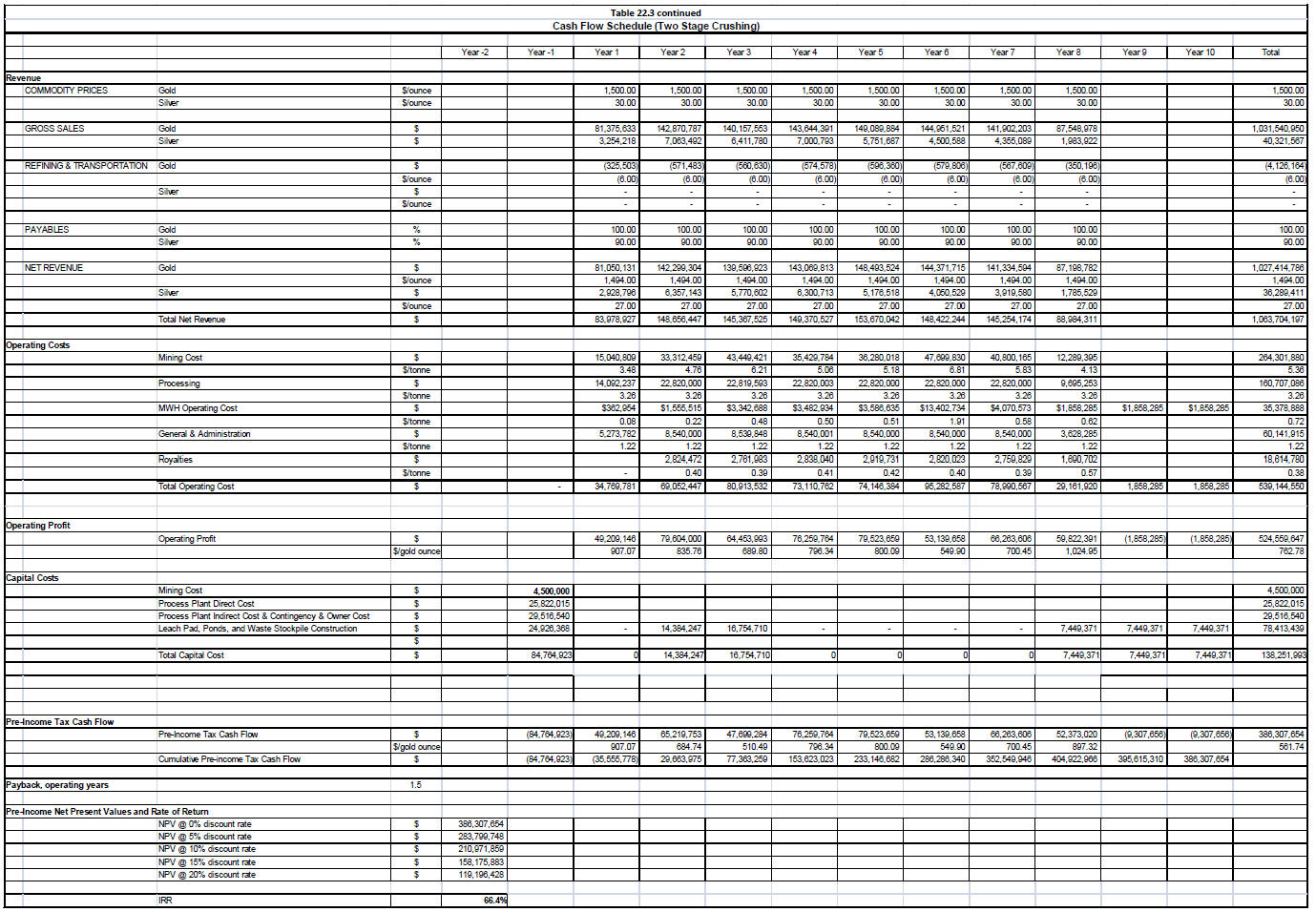

| Table 22.1 | Economic Analysis Summary (Two Stage Crushing) |

| Table 22.2 | Economic Analysis Summary - US$ Pre-Income Tax Cash Flow (Two StageCrushing) |

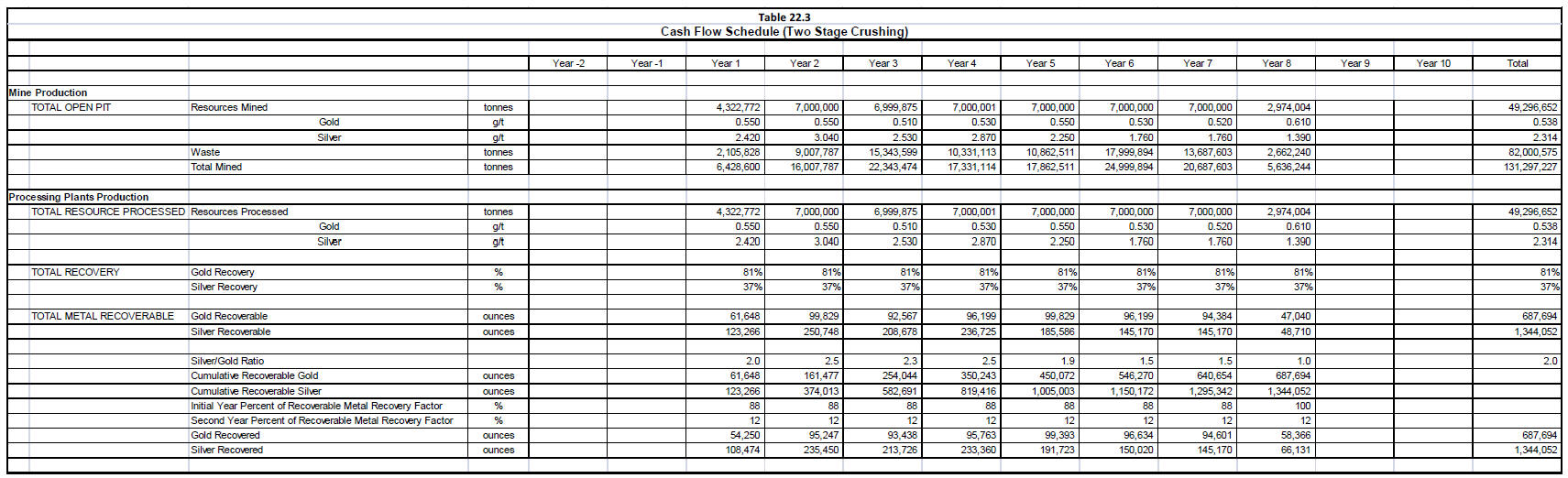

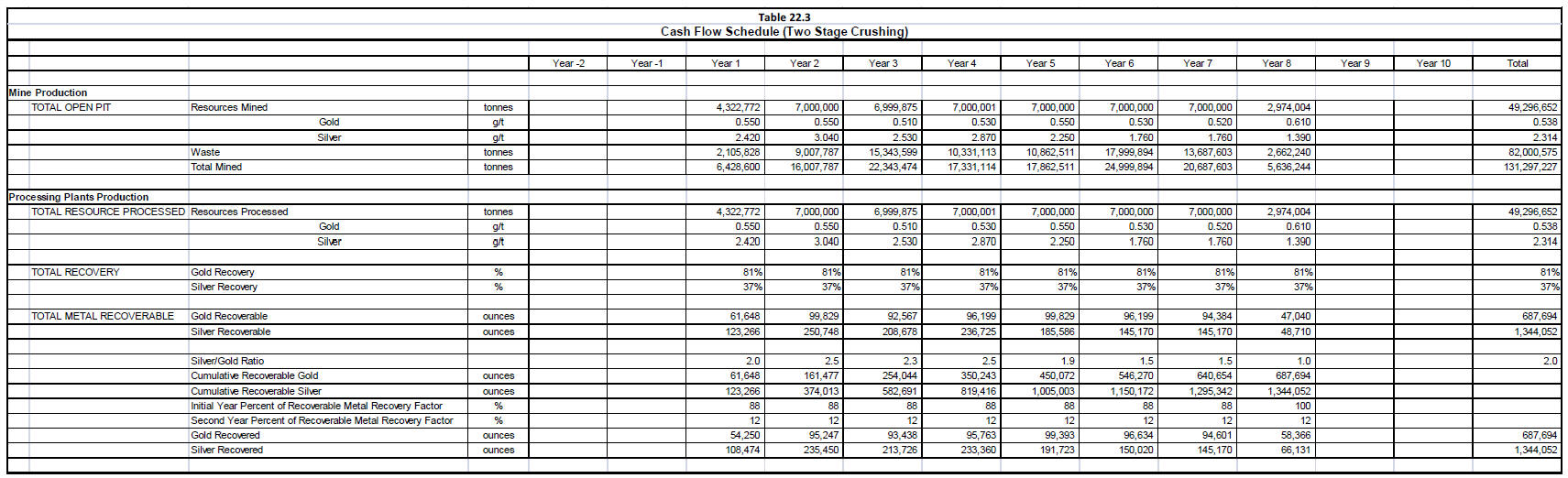

| Table 22.3 | Cash Flow Schedule (Two Stage Crushing) |

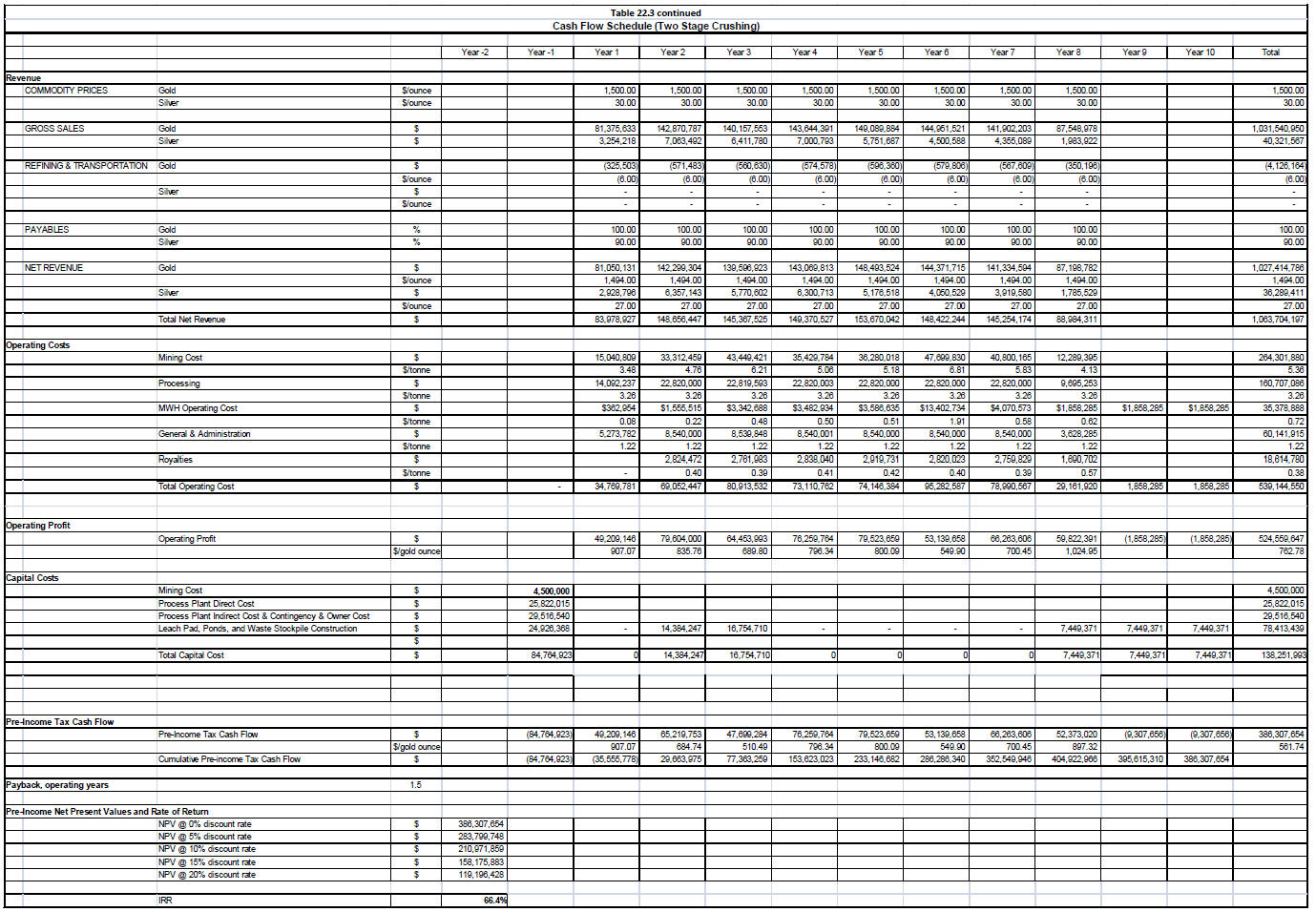

| Table 22.4 | Rate of Return Sensitivity (Two Stage Crushing) |

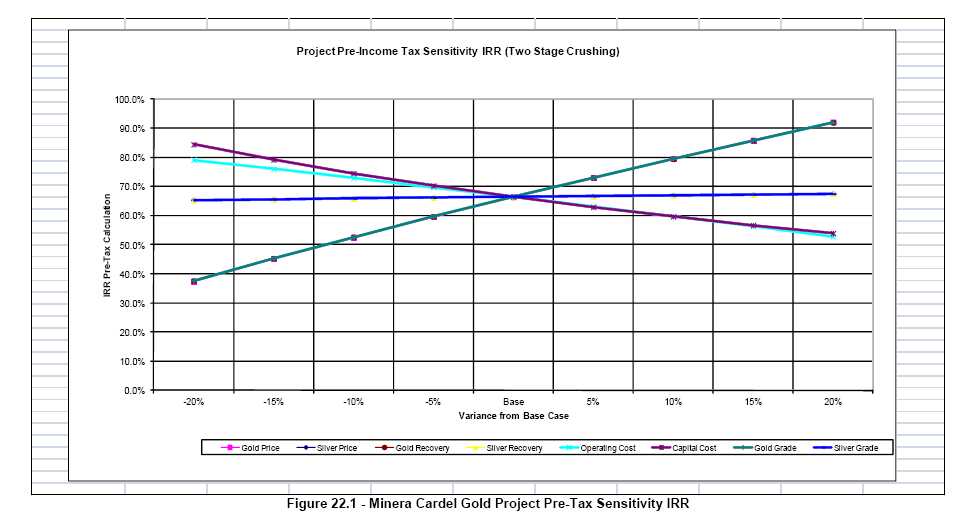

| Table 22.5 | NPV Sensitivity (US$ X 1000) (Two Stage Crushing) |

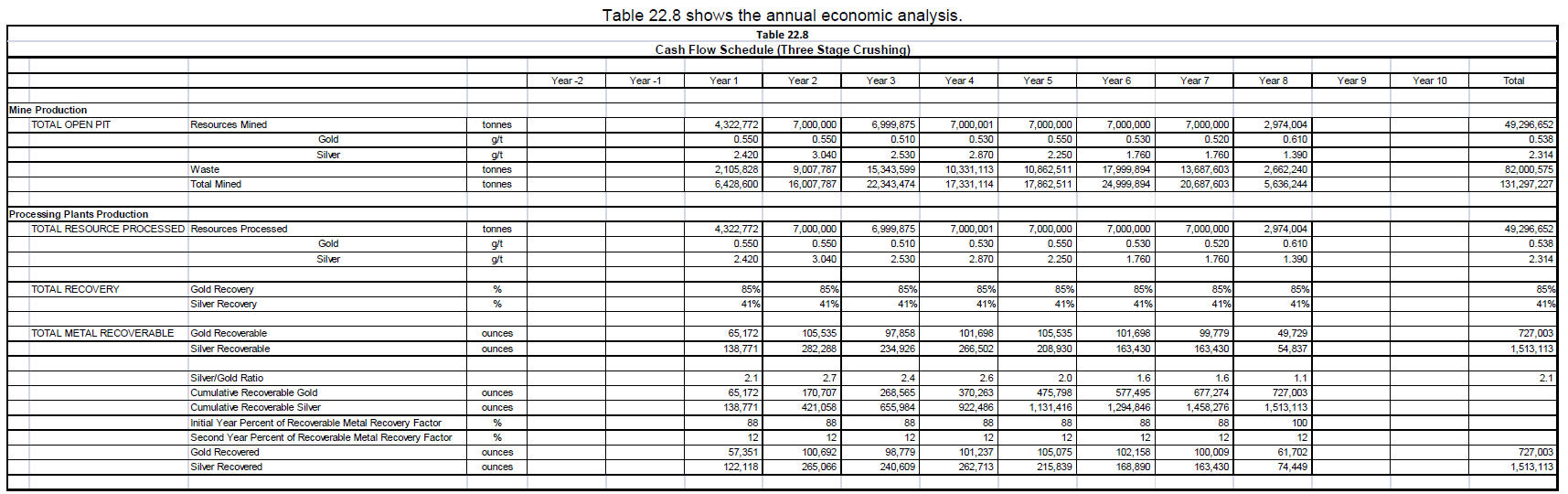

| Table 22.6 | Economic Analysis Summary (Three Stage Crushing) |

| Table 22.7 | Economic Analysis Summary - US$ Pre-Income Tax Cash Flow (Three StageCrushing) |

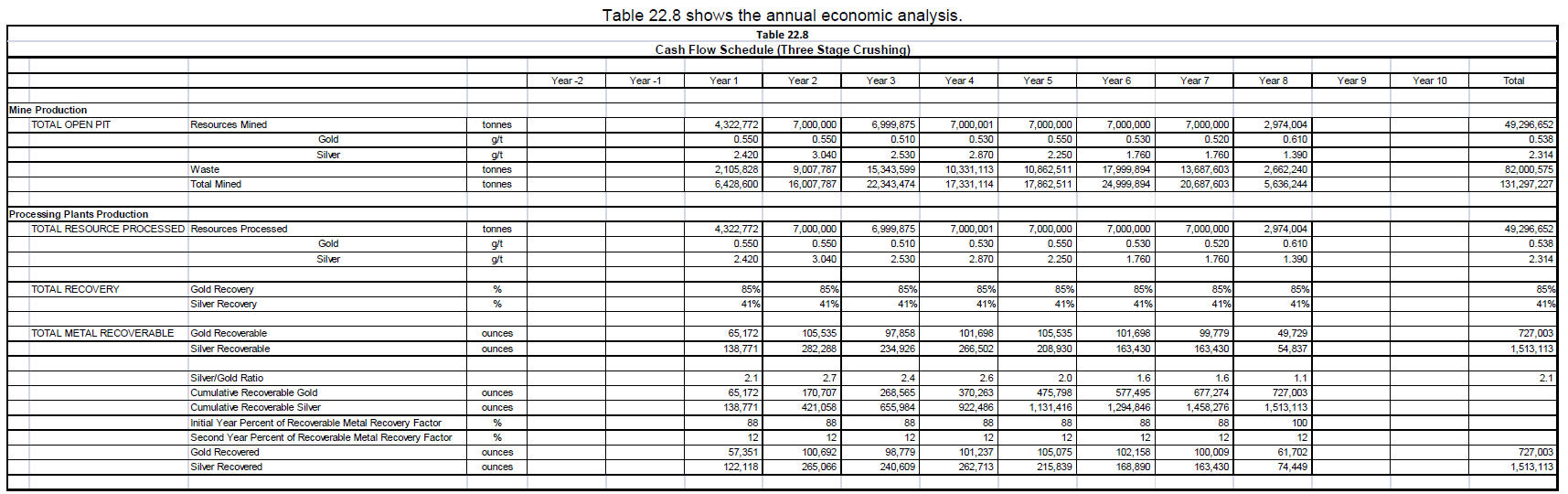

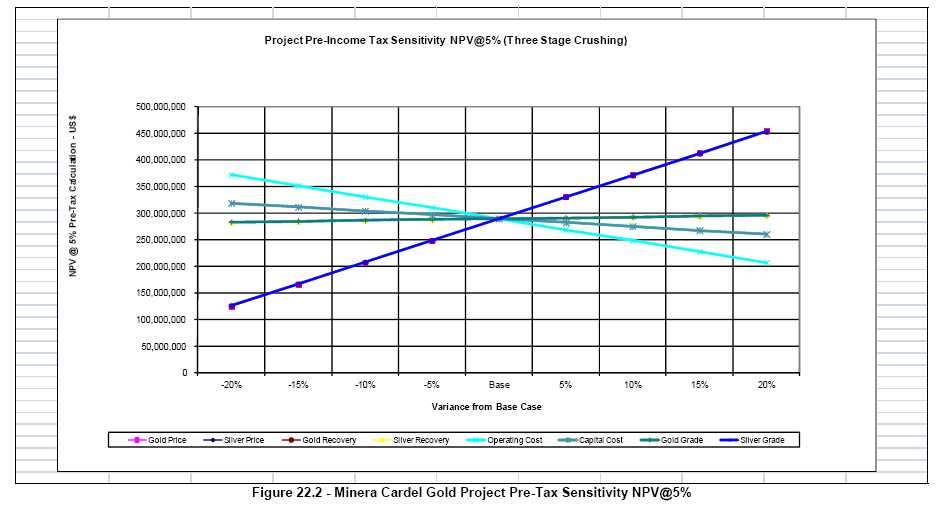

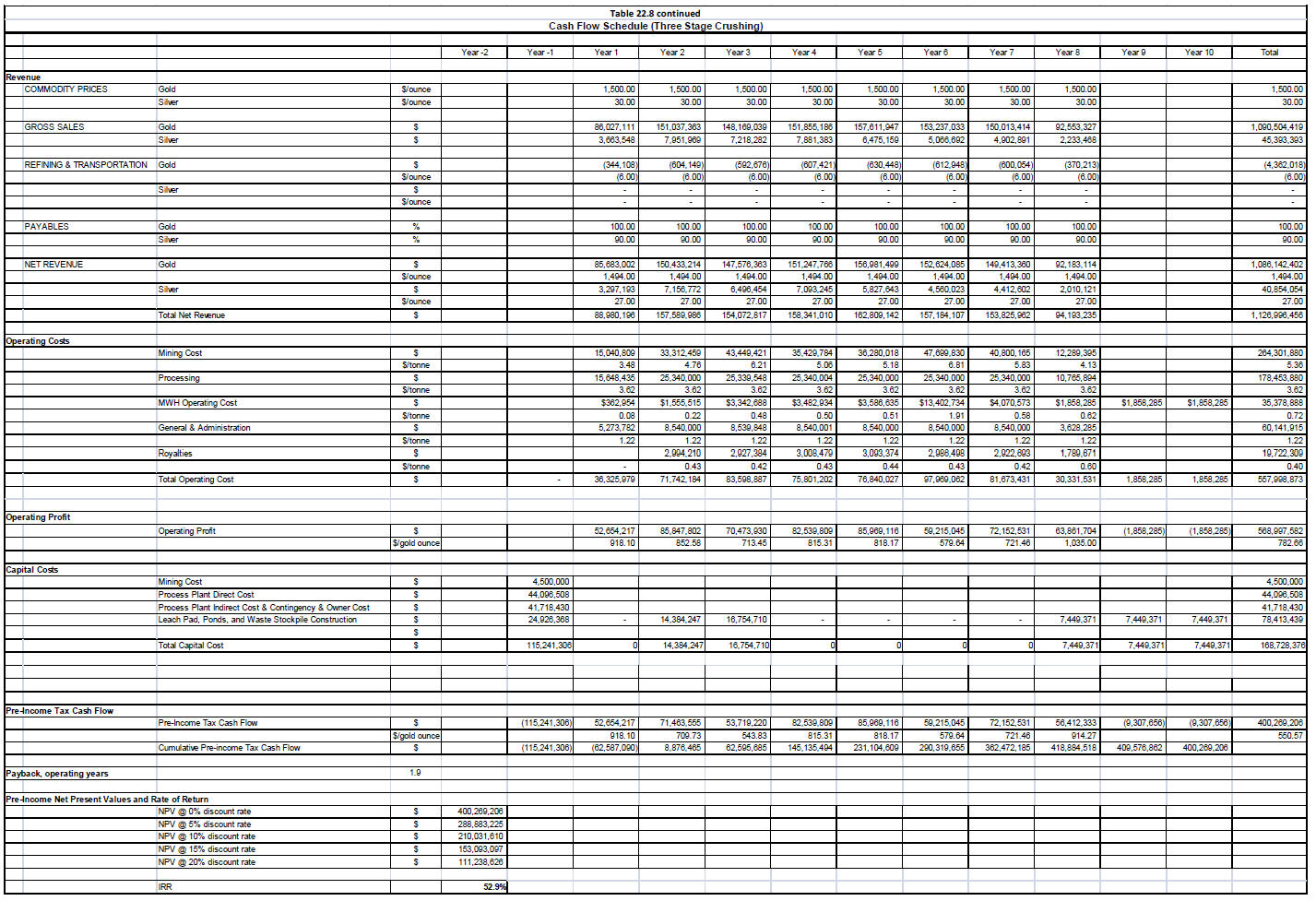

| Table 22.8 | Cash Flow Schedule (Three Stage Crushing) |

| Table 22.9 | Rate of Return Sensitivity (Three Stage Crushing) |

| Table 22.10 | NPV Sensitivity (US$ X 1000) (Three Stage Crushing) |

| | |

| Table 24.1 | Leach Pad Design Criteria used for the Pond Sizing Calculation |

| Table 24.2 | Resource Properties |

| Table 24.3 | Estimated Average Precipitation and Evaporation at Caballo Blanco (per MSI) |

| Table 24.4 | Operation Scenarios Considered in the Water Balance Simulations |

| Table 24.5 | Results of Water Balance Simulations |

| Table 24.6 | Sulfide Waste Stockpile Criteria and Results |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

LIST OF FIGURES

| Figure 4.1 | Country Location Map |

| Figure 4.2 | Veracruz State Location Map |

| Figure 4.3 | Claim Tenure Map |

| | |

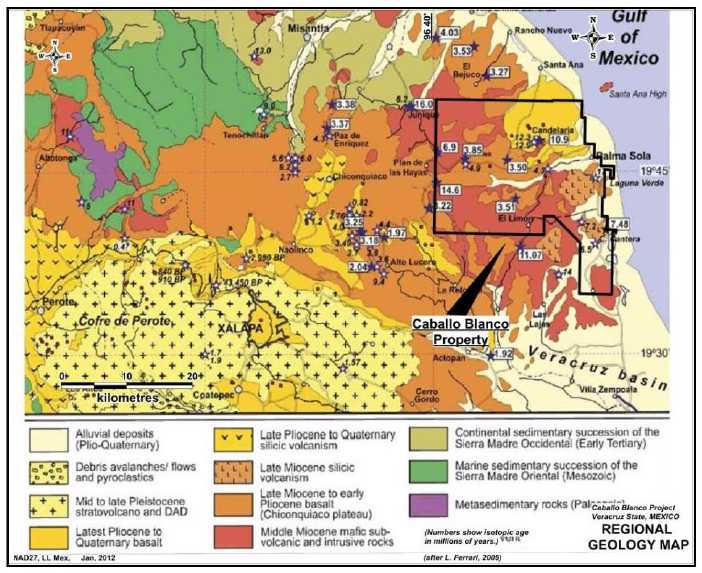

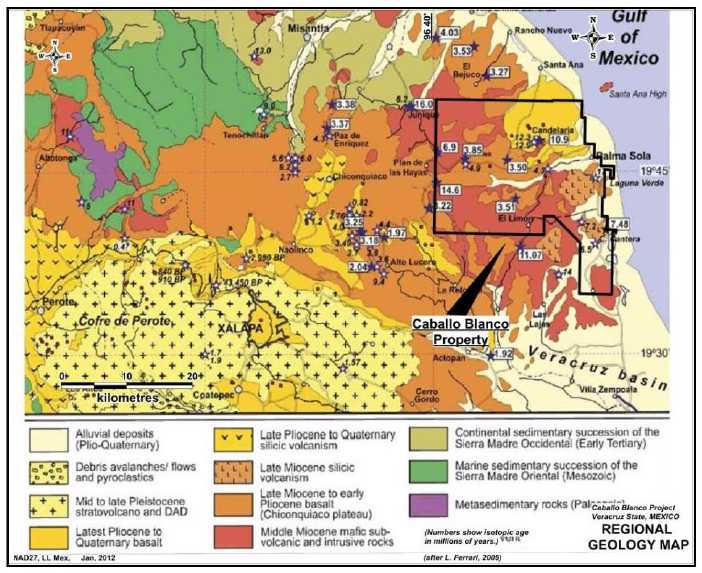

| Figure 7.1 | Regional Geology Map |

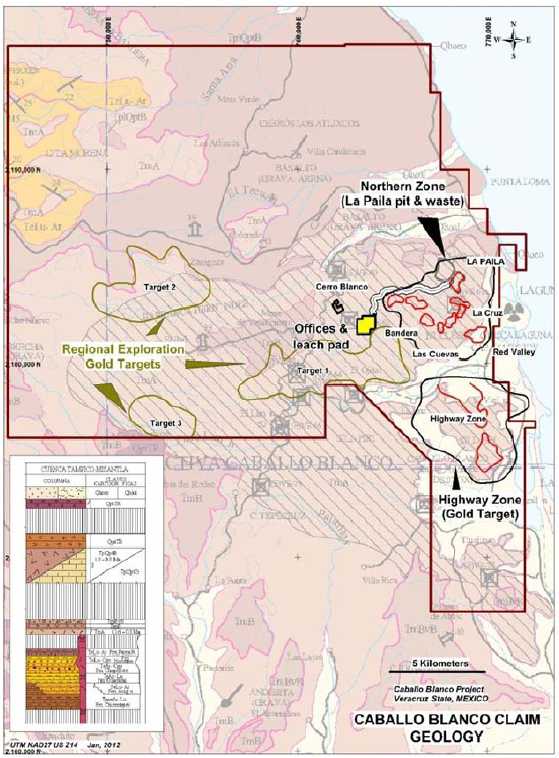

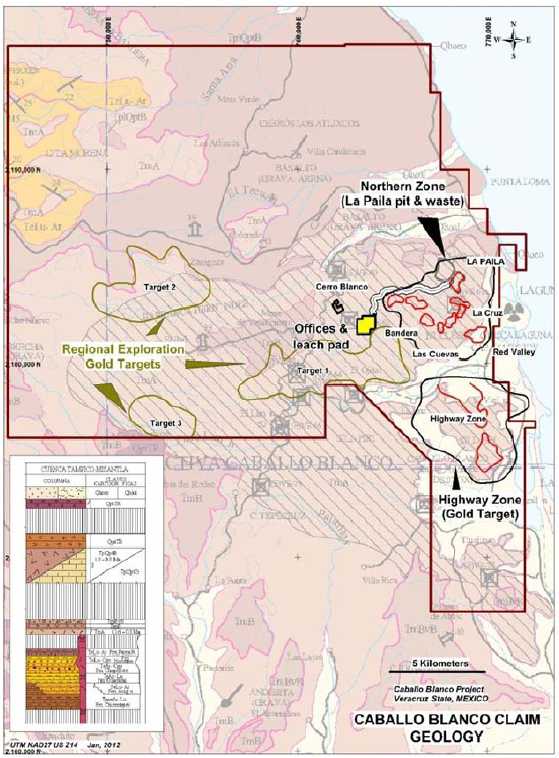

| Figure 7.2 | Property Geology Map |

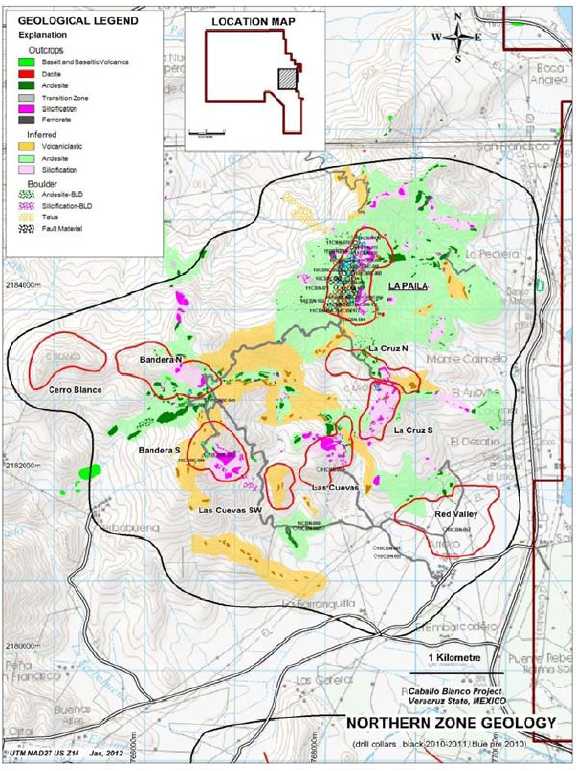

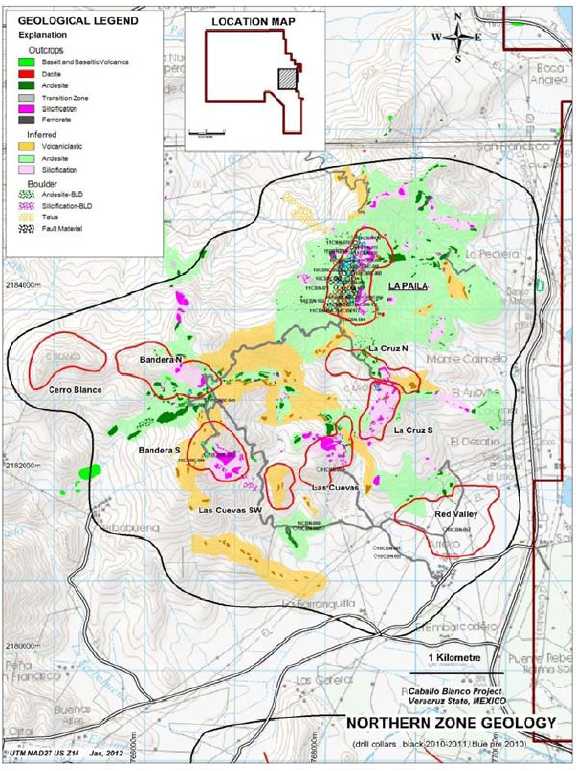

| Figure 7.3 | North Zone Geology Map |

| Figure 7.4 | La Paila Geology Map |

| Figure 8.1 | Typical Alteration of High-Sulphidation Epithermal Deposits |

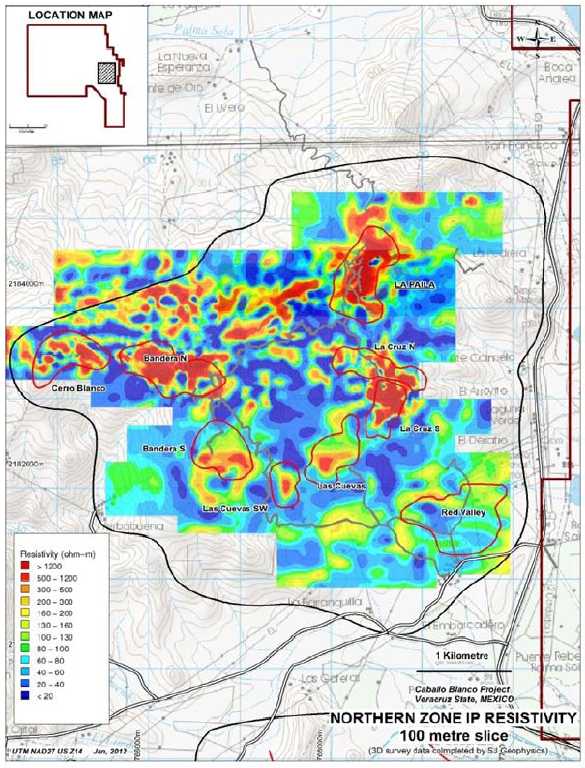

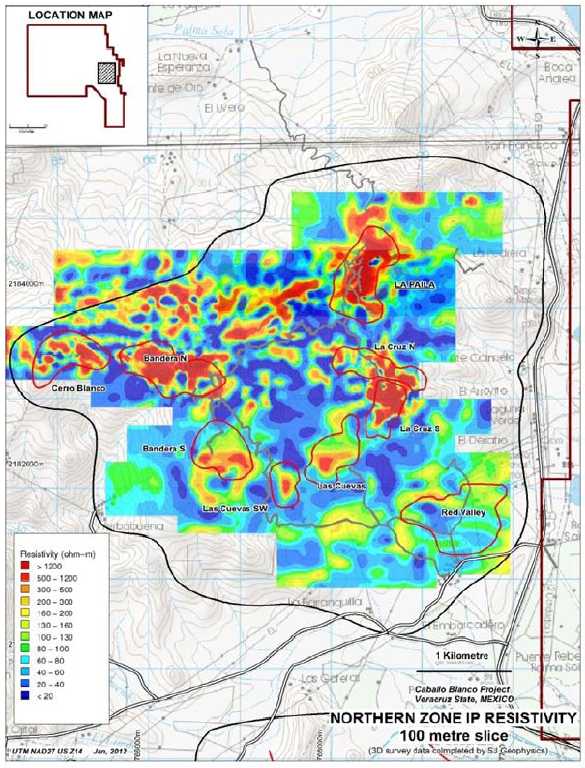

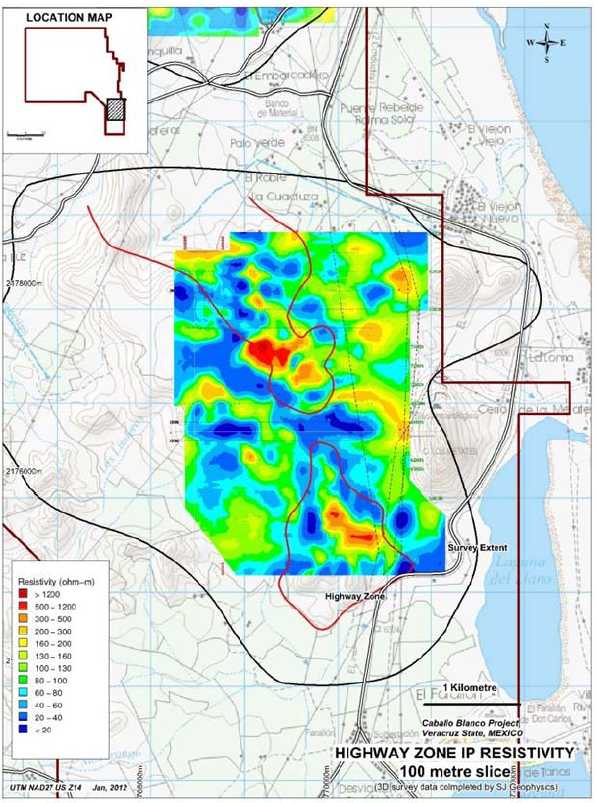

| Figure 9.1 | New Induced Polarization Resistivity Survey - North Zone Area |

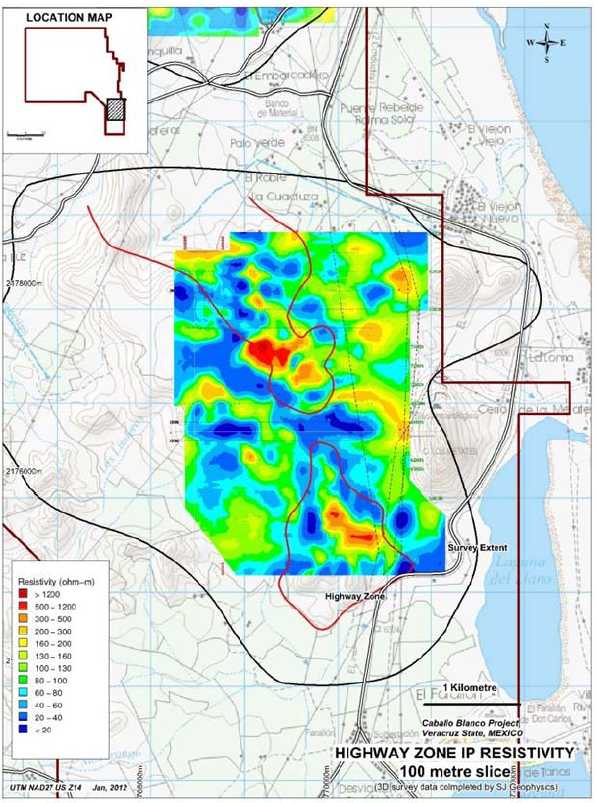

| Figure 9.2 | New Induced Polarization Resistivity - Highway Zone Area |

| | |

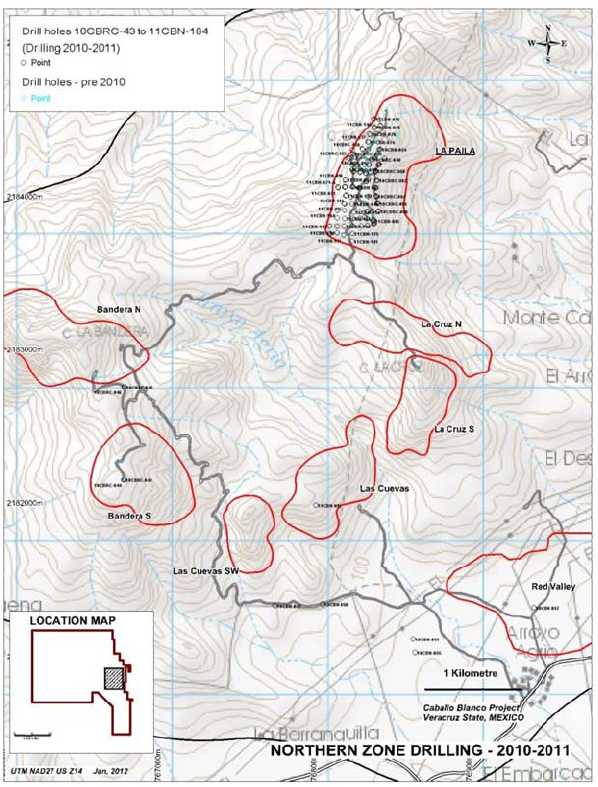

| Figure 10.1 | 2010-2011 Drill Collar Locations by Goldgroup - Northern Zone |

| | |

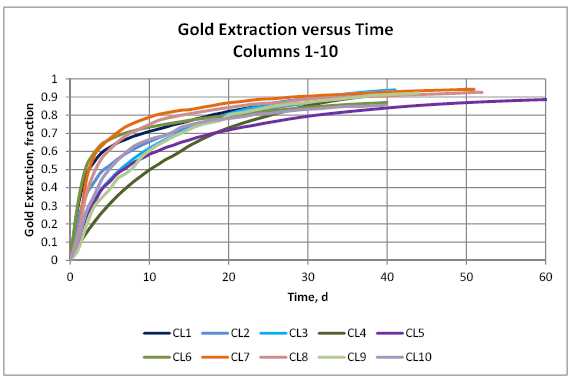

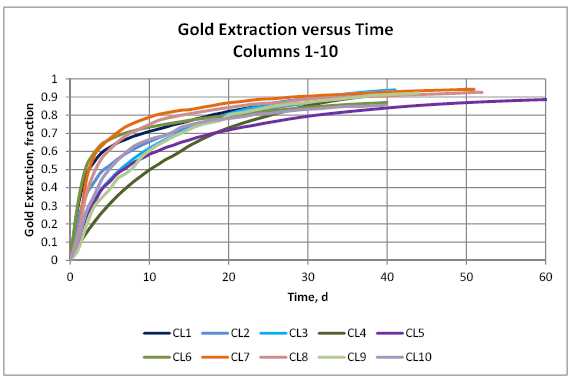

| Figure 13.1 | Column Test Gold Extraction versus Time |

| Figure 13.2 | Modified Leach Curve |

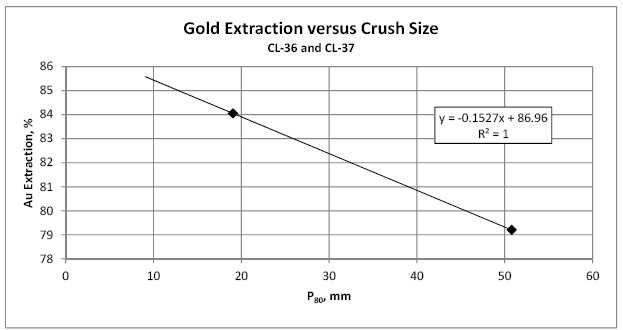

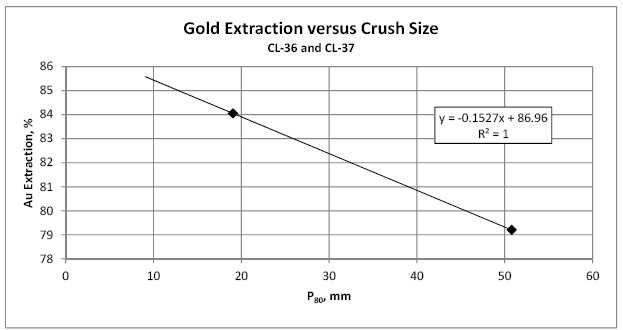

| Figure 13.3 | Gold Extraction versus Crush Size |

| Figure 13.3 | Gold Extraction versus Crush Size |

| | |

| Figure 14.1 | Gold Extraction versus Crush Size |

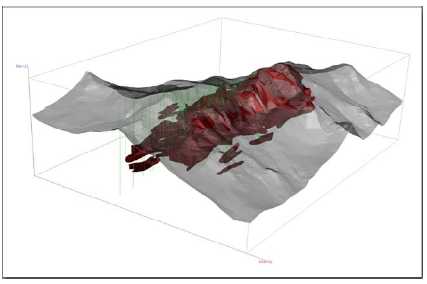

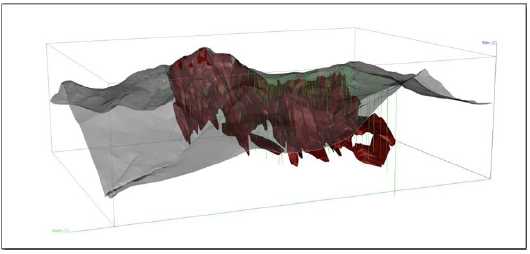

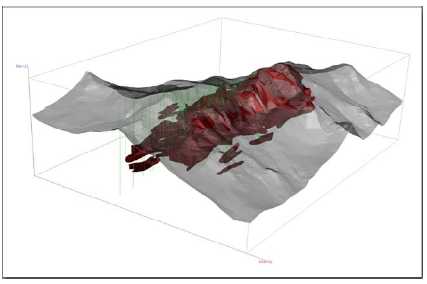

| Figure 14.2 | Isometric View Looking East Showing the Mineralized Solid, Drill Traces andSurface Topography at La Paila |

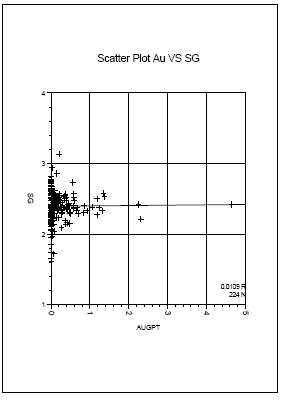

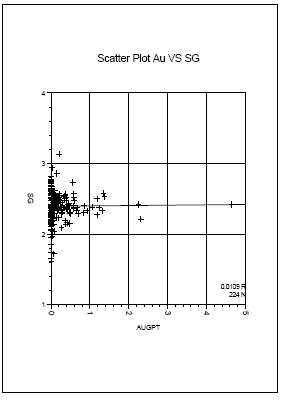

| Figure 14.3 | Scatter Plot Showing Gold versus Specific Gravity |

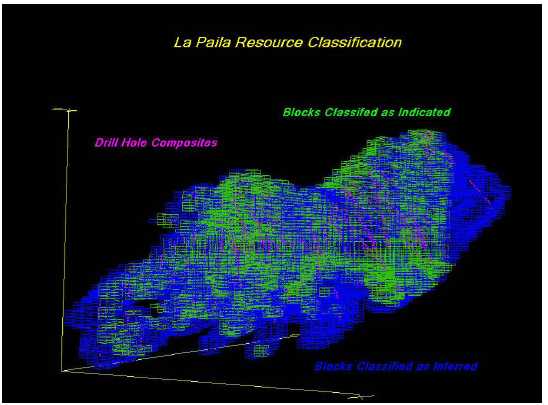

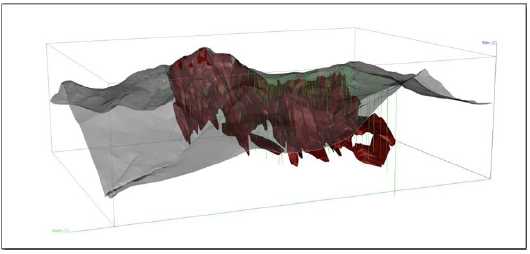

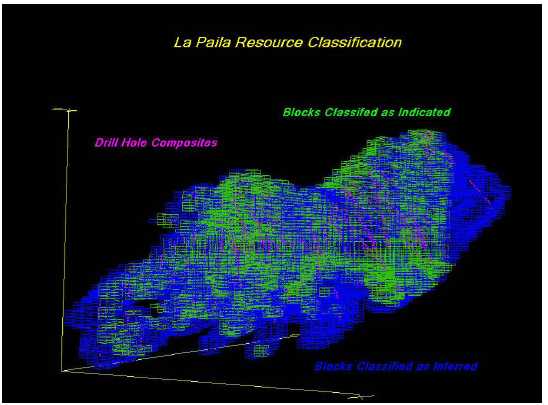

| Figure 14.4 | Isometric View Looking NW Showing Classified Blocks |

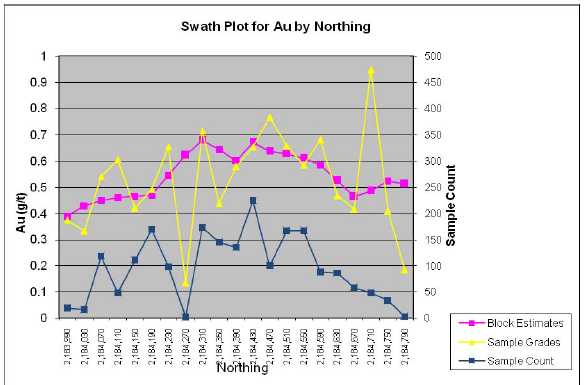

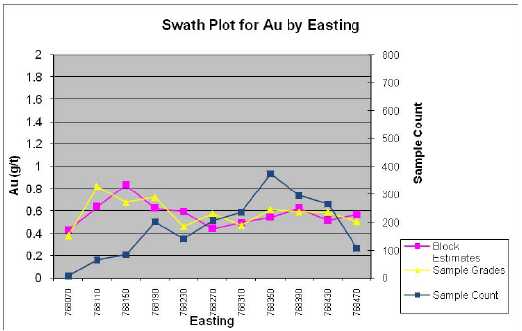

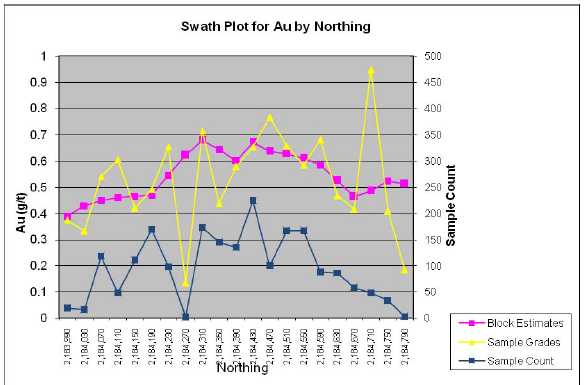

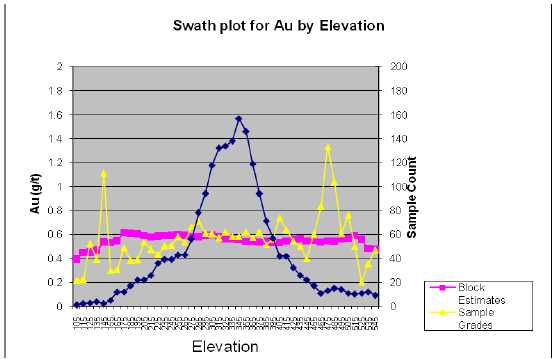

| Figure 14.5 | Swath Plot for Gold by Northing, Slices of 40 meters |

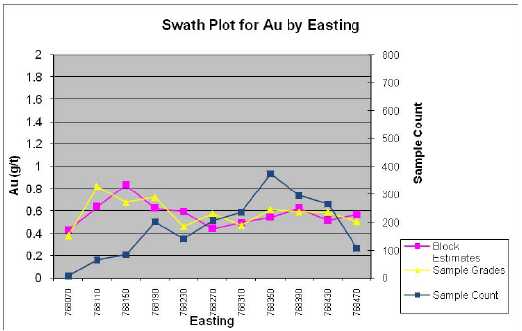

| Figure 14.6 | Swath Plot for Gold by Easting Slices of 40 meters |

| Figure 14.7 | Swath Plot for Gold by Elevation Slices of 10 meters |

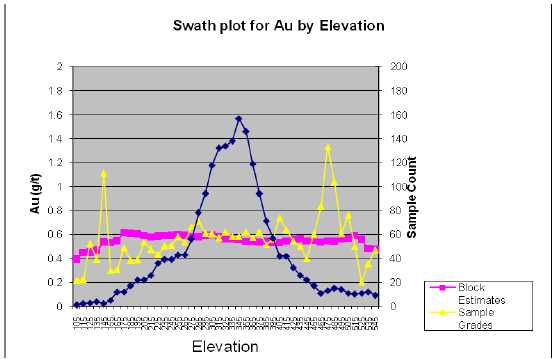

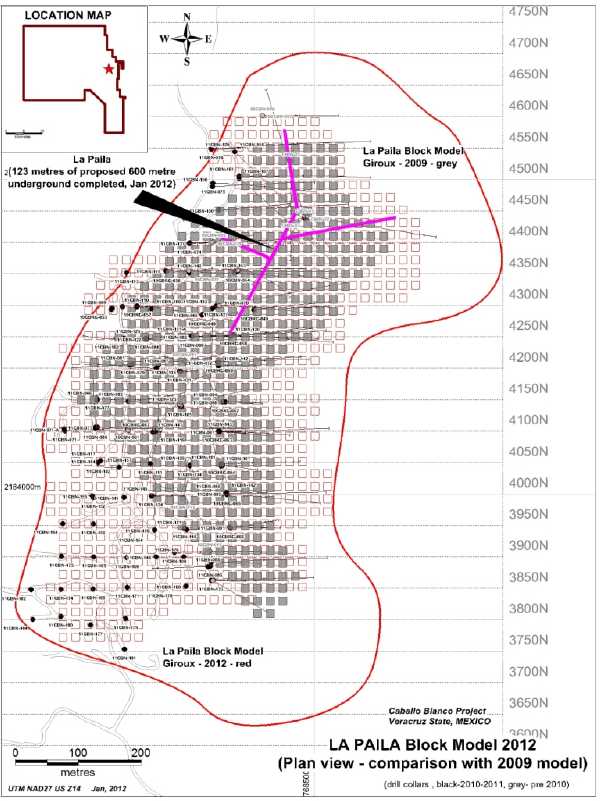

| Figure 14.8 | Block Model Comparison, 2009 to 2012 |

| | |

| Figure 16.1 | Whittle Optimization Results - La Paila |

| Figure 16.2 | Incremental Whittle Value Results - La Paila |

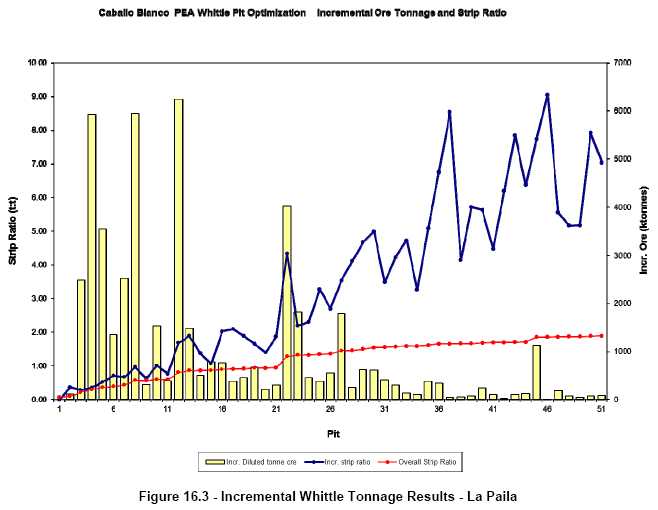

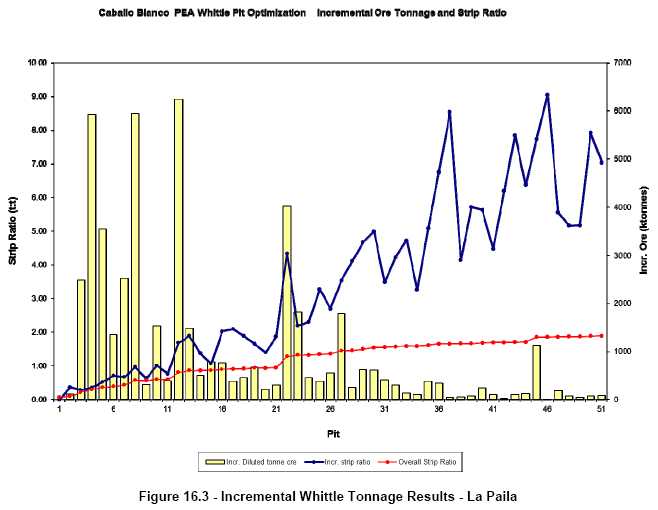

| Figure 16.3 | Incremental Whittle Tonnage Results - La Paila |

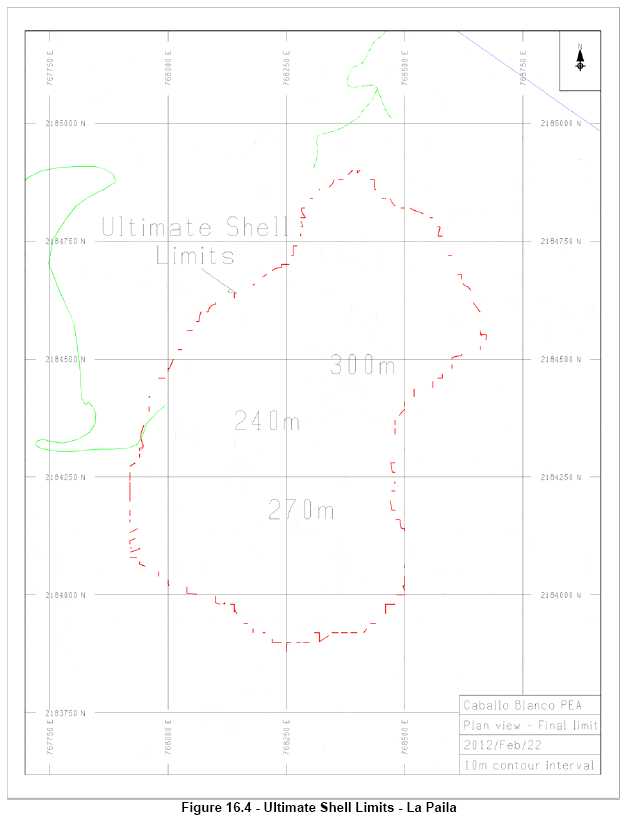

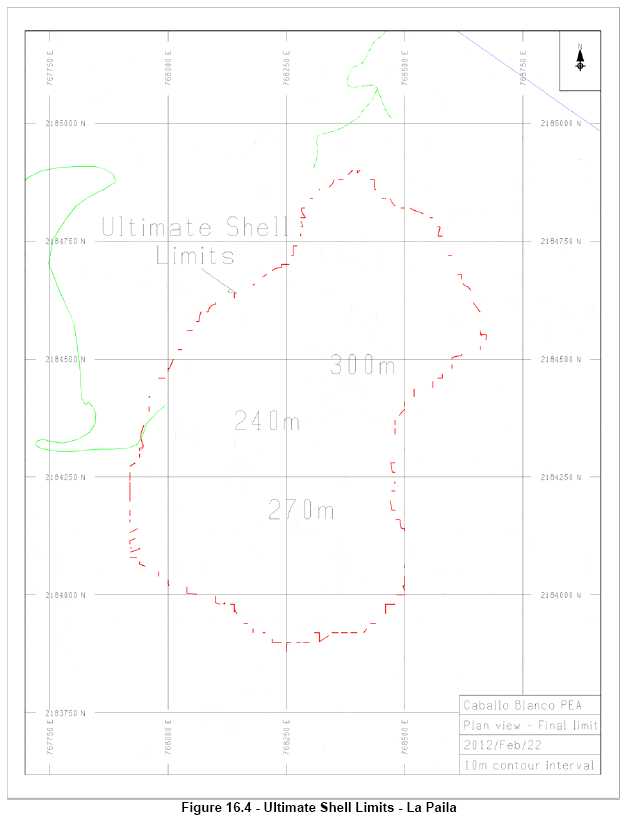

| Figure 16.4 | Ultimate Shell Limits - La Paila |

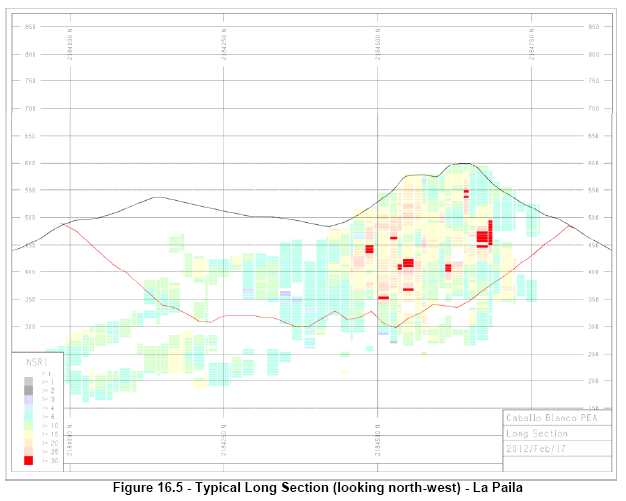

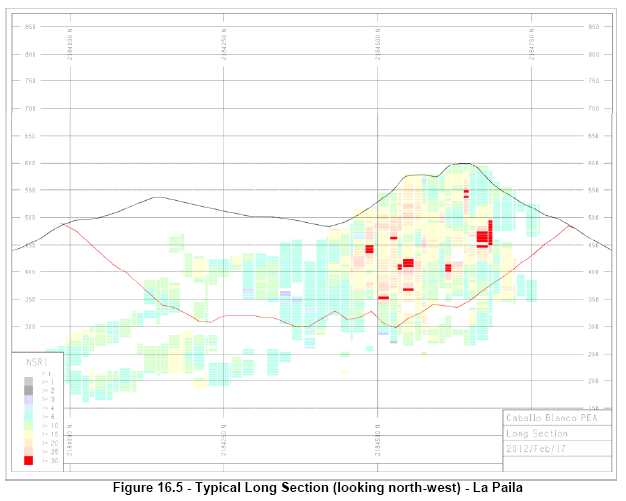

| Figure 16.5 | Typical Long Section (looking north-west) - La Paila |

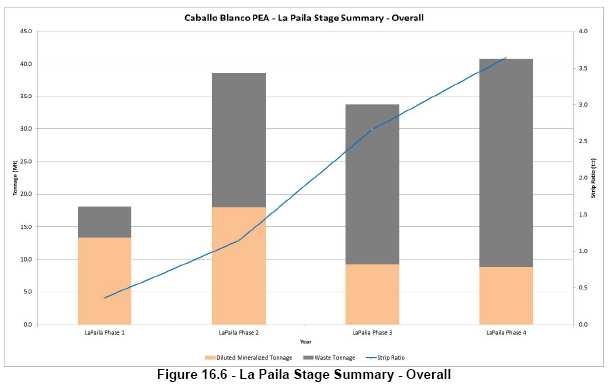

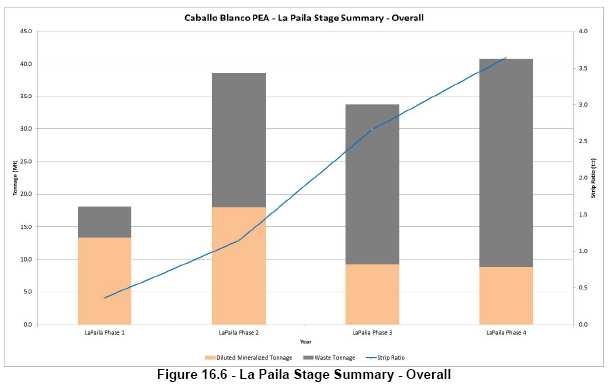

| Figure 16.6 | La Paila Stage Summary - Overall |

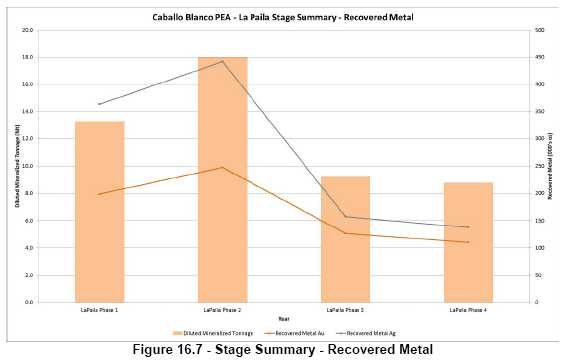

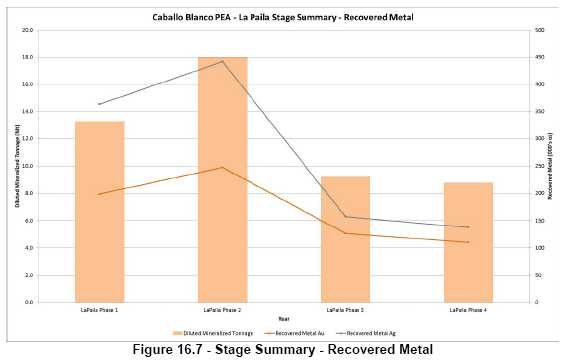

| Figure 16.7 | Stage Summary - Recovered Metal |

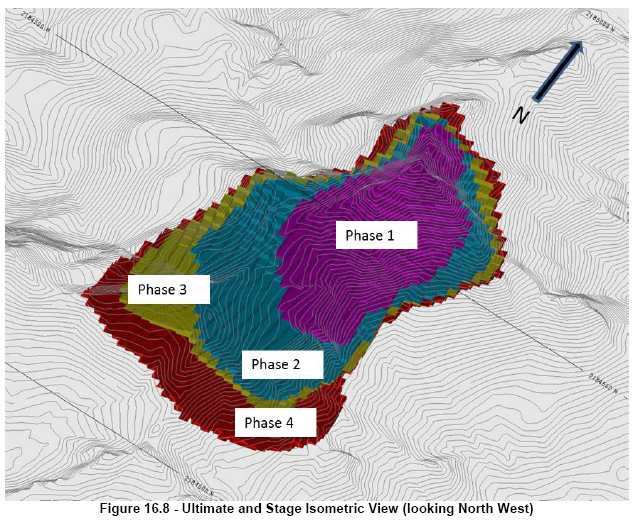

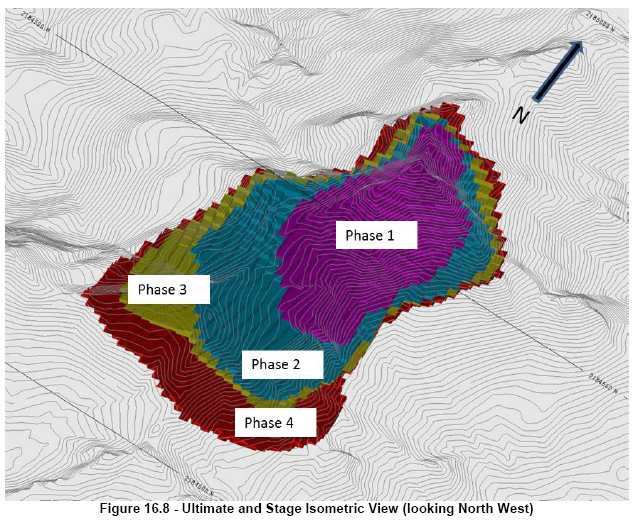

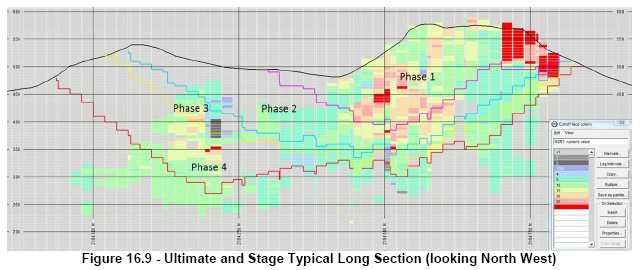

| Figure 16.8 | Ultimate and Stage Isometric View (looking North West) |

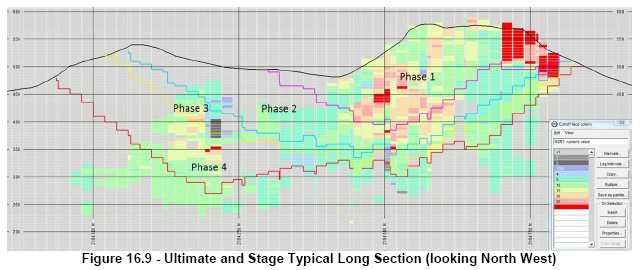

| Figure 16.9 | Ultimate and Stage Typical Long Section (looking North West) |

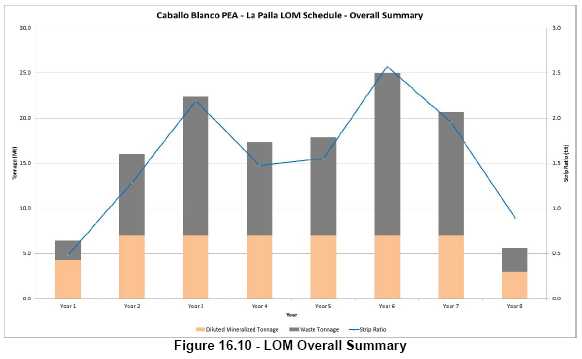

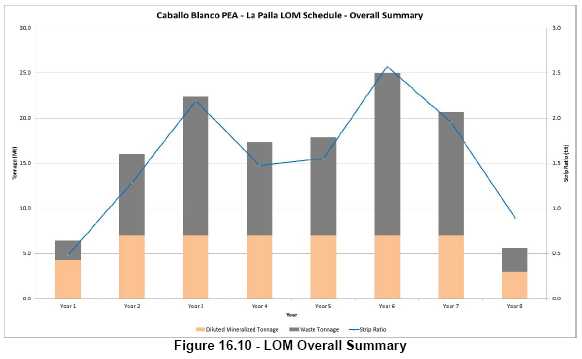

| Figure 16.10 | LOM Overall Summary |

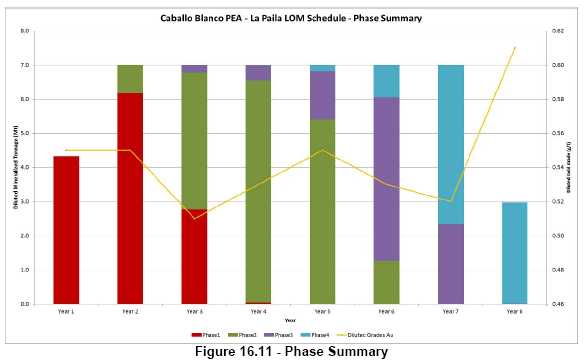

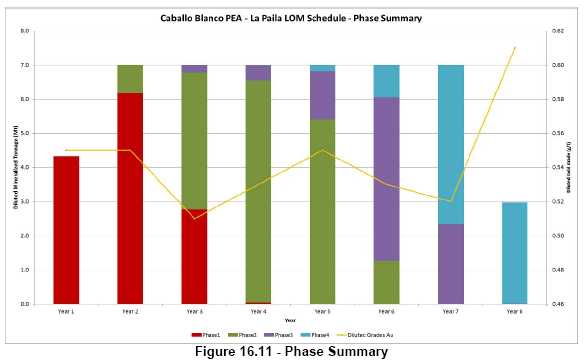

| Figure 16.11 | Phase Summary |

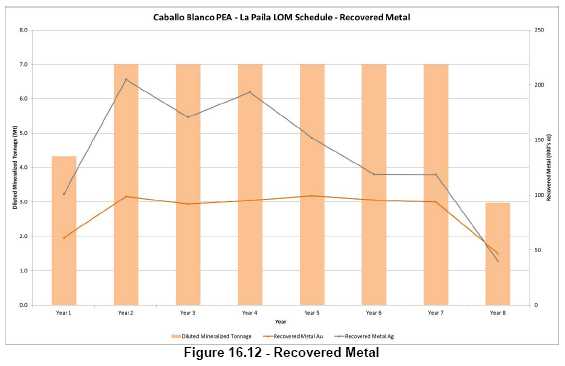

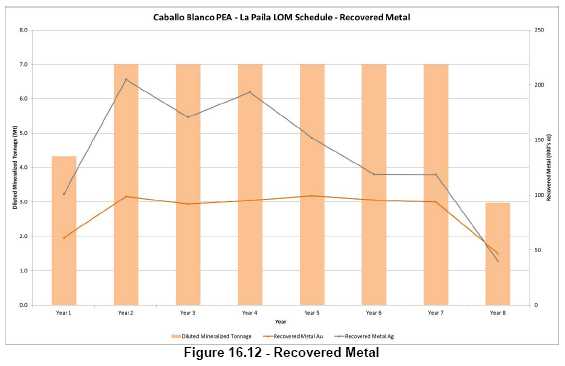

| Figure 16.12 | Recovered Metal |

| | |

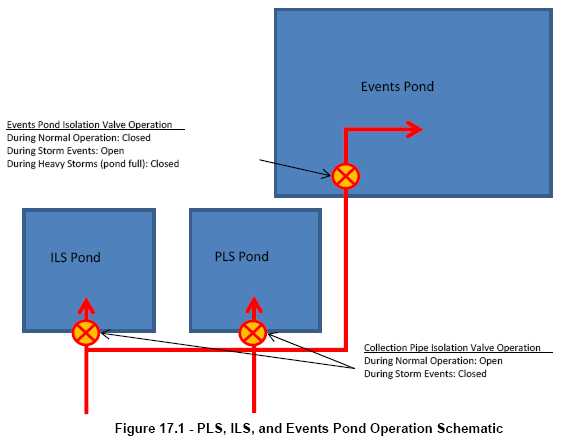

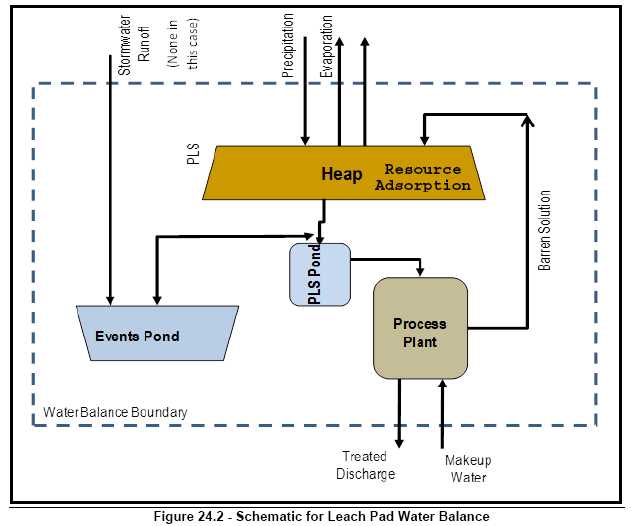

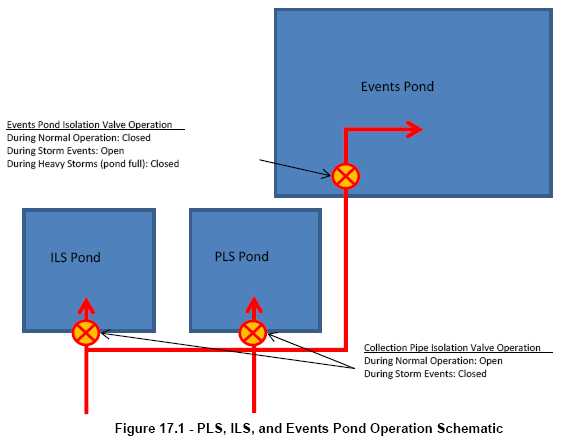

| Figure 17.1 | PLS, ILS, and Events Pond Operation Schematic |

| | |

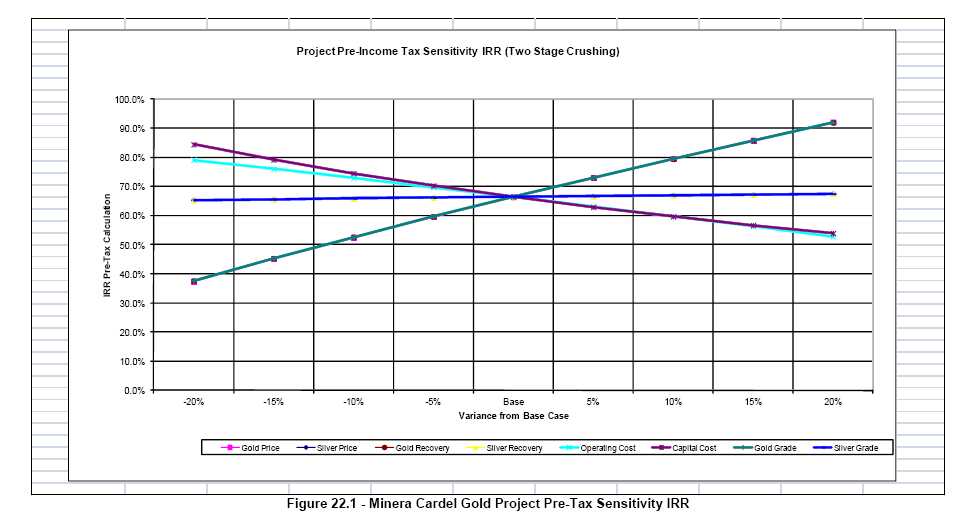

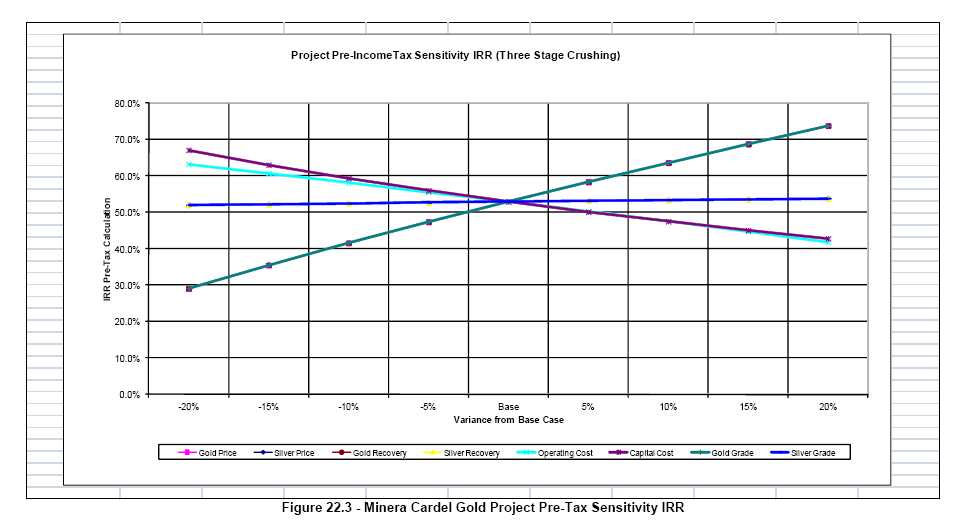

| Figure 22.1 | Minera Cardel Gold Project Pre-Tax Sensitivity IRR |

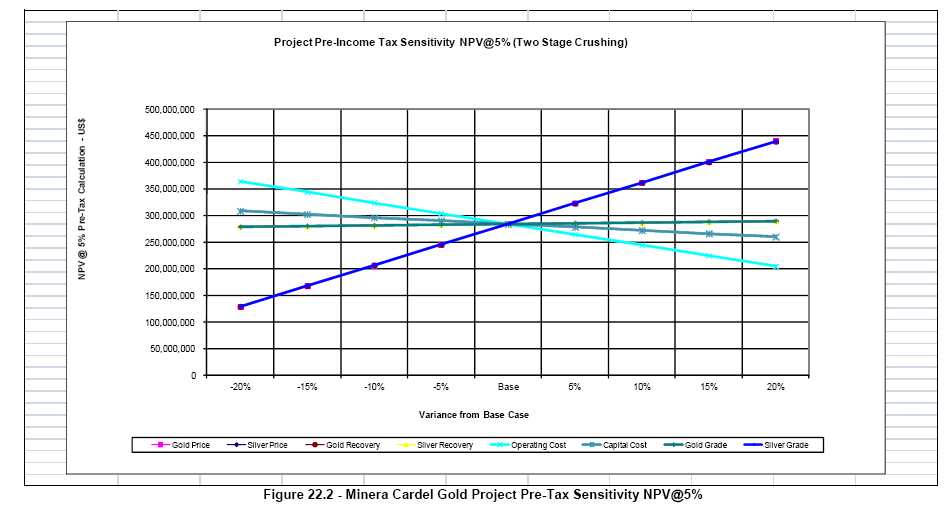

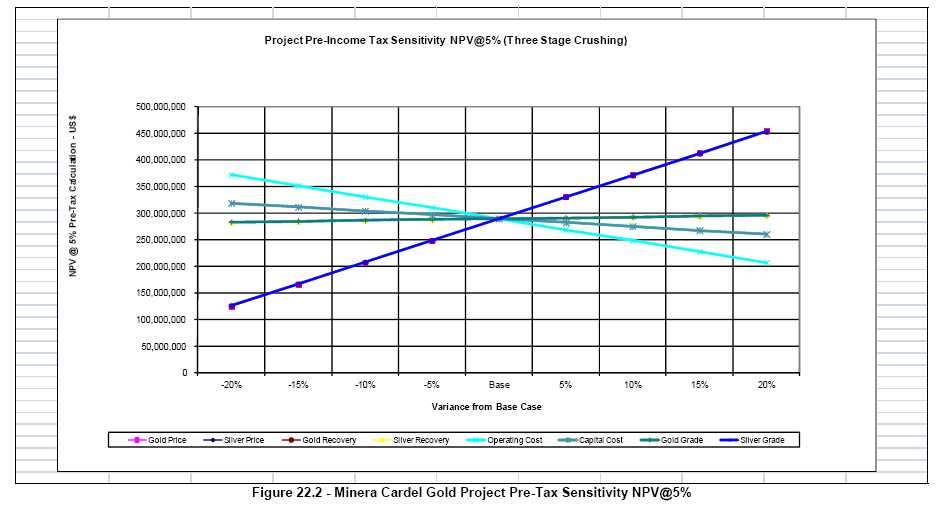

| Figure 22.2 | Minera Cardel Gold Project Pre-Tax Sensitivity NPV@5% |

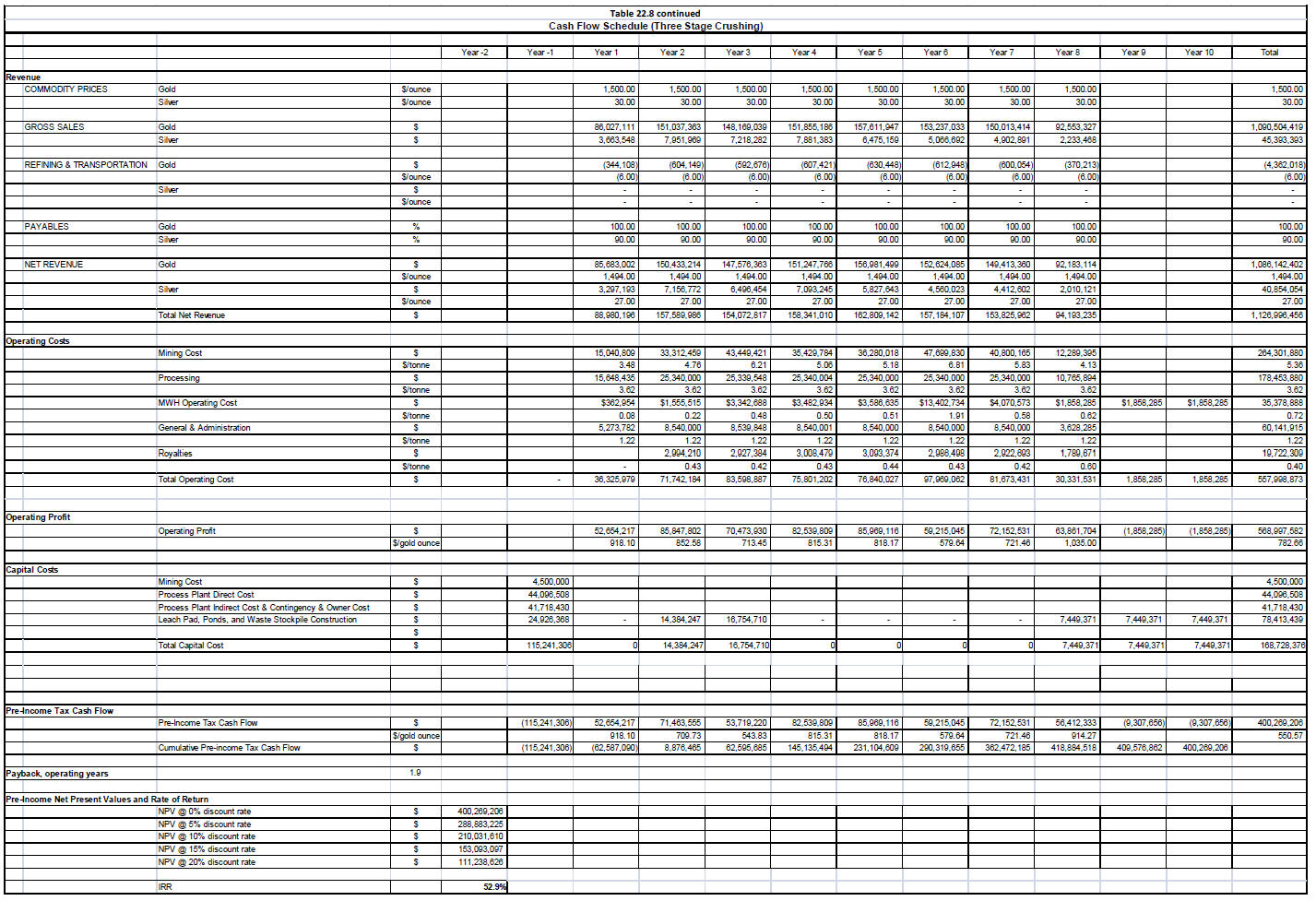

| Figure 22.3 | Minera Cardel Gold Project Pre-Tax Sensitivity IRR |

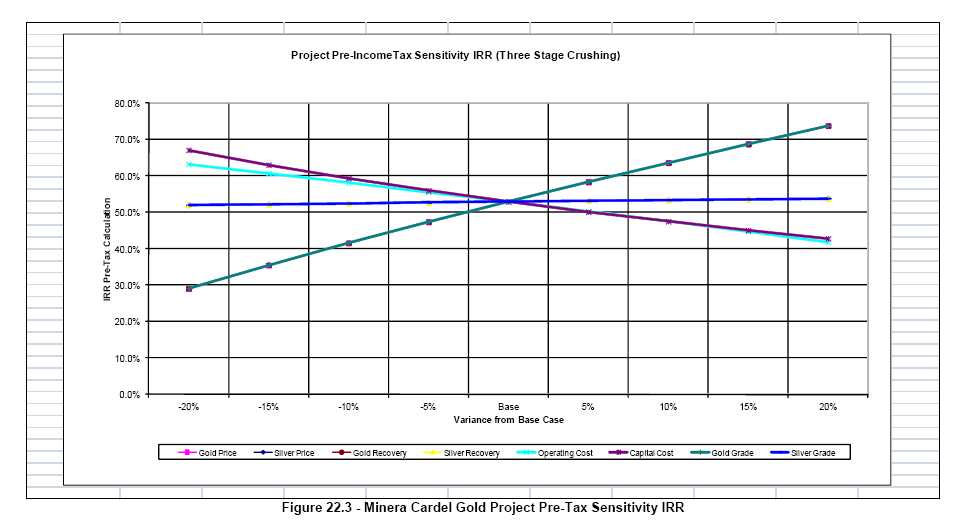

| Figure 22.2 | Minera Cardel Gold Project Pre-Tax Sensitivity NPV@5% |

| | |

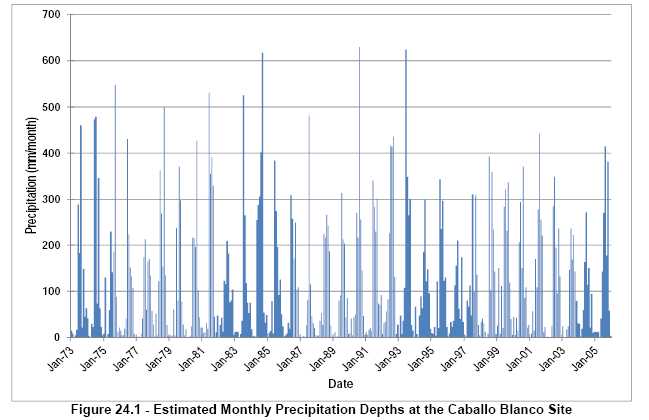

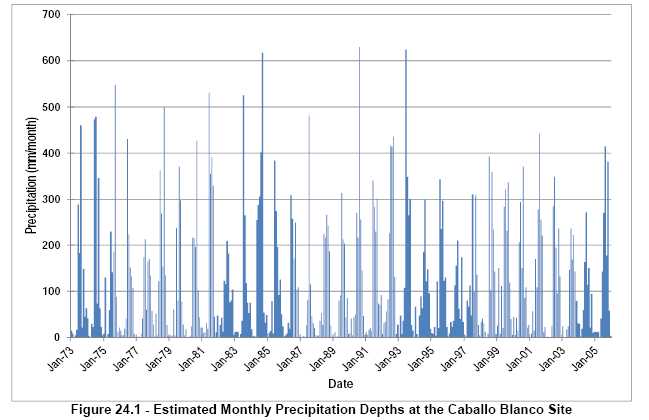

| Figure 24.1 | Estimated Monthly Precipitation Depths at the Caballo Blanco Site |

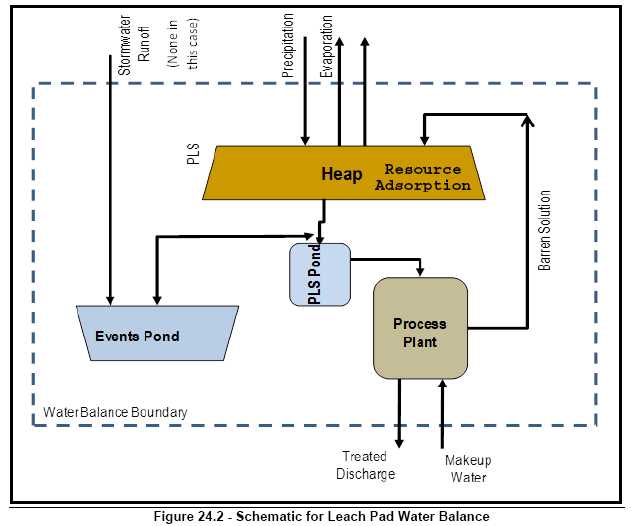

| Figure 24.2 | Schematic for Leach Pad Water Balance |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

LIST OF PHOTOS

| Photo 7.1 | Looking west at La Paila and the broad alteration haloes, Northern Zone |

| Photo 7.2 | Typical ‘vuggy silica’ Alteration with Gold Mineralization - La Paila Area, NorthernZone |

| Photo 7.3 | Alteration Haloes at the Highway Zone |

| | |

| Photo 9.1 | New Underground Development at La Paila - January 2012 |

| | |

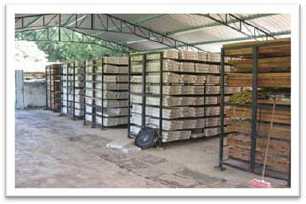

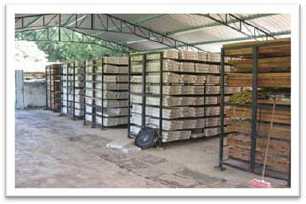

| Photo 12.1 | Core Storage Facilities Near Arroyo Agrio, Caballo Blanco Project - 2009 |

| Photo 12.2 | Typical ‘Cement Carne’ used to Identify Drill Hole Collar Locations, Caballo BlancoProject -2009 |

| Photo 12.3 | Typical ‘Cement Carne’ used to Identify Drill Hole Collar Locations, Caballo BlancoProject - 2012 |

| | |

| Photo 20.1 | Mobile Medical Unit |

| Photo 20.2 | Vermicompost Pile |

| Photo 20.3 | Demonstration Plot |

| Photo 20.4 | Building of a Dam as Part of the “Infrastructure” Program |

| Photo 20.5 | Installation of a Water Well in El Ojital Community |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment |

Glossary

| Alternating Current | AC |

| Amp | A |

| Atomic Absorption | AA |

| Celsius | C |

| Centimeter | cm |

| Day | d |

| Days per year (annum) | dpa |

| Degree | o |

| Dollar | $ |

| Dry metric ton | dmt |

| Gram | g |

| Gram per liter | g/L |

| Grams per ton | gpt |

| Hectare | ha |

| Hertz | Hz |

| Horsepower | hp |

| Hour | h |

| Hours per day | h/d |

| Kilograms | kg |

| Kilometers | km |

| Kilotonne | kt |

| Kilo Watts | kW |

| Kilo Volts | kV |

| Liter | L |

| Life of Mine | LOM |

| Meter | m |

| Meters above sea level | masl |

| Metric ton (tonne) | t |

| Metric ton per day | tpd |

| Metric ton per hour | tph |

| Micrometer | µm |

| Millimeter | mm |

| Million | M |

| Minute (time) | min |

| Ounce | oz |

| Parts per billion | ppb |

| Parts per million | ppm |

| Percent | % |

| Second (time) | s |

| Volt | V |

| Watt | W |

| Year (annum) | a |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-1 |

1.0 SUMMARY

Goldgroup Mining Inc. (Goldgroup) has engaged K D Engine. ring (KDE), an independent engineering firm located in Tucson, Arizona, to prepare a Preliminary Economic Assessment (PEA) of the Caballo Blanco Gold Heap Leach Project. The KDE study was prepared to standards pursuant to Canada’s National Instrument 43-101 (NI 43-101) and was based on the following:

| | • | KDE site visit conducted on 7 November 2011 |

| | | |

| | • | NI 43-101 Technical Report dated February 2012 by Cuttle and Giroux |

| | | |

| • | SRK completed the mining portion of the work including capital and operating costs |

| | | |

| | • | KDE review of metallurgical testing by Goldgroup |

| | | |

| | • | KDE design and estimates for the crushing and gold recovery plant facilities |

| | | |

| • | Heap leach pad, waste dump, and solution pond designs and cost estimates by MWH Americas, Inc. (MWH) |

| | | |

| | • | Environmental and Social Impact scoping study report by ERM. |

| 1.1 | Property Location and Description |

The Caballo Blanco property is located next to the Gulf of Mexico approximately sixty five kilometers by paved road north northwest of the city of Veracruz in the state of Veracruz, Mexico. The property consists of fourteen mineral claims covering an area of 54,732 hectares centered at Longitude 96° 27’ 30” West and Latitude 19° 40’ 44” North.

In October, 2011 Goldgroup completed the acquisition of the remaining 30 percent interest in the Caballo Blanco property held by Almaden Minerals Ltd. (Almaden). Goldgroup currently owns 100 percent of the Caballo Blanco Project.

| 1.2 | Geology and Exploration |

The Caballo Blanco property lies at the eastern end of the Trans Mexican Volcanic Belt and is underlain by sub-aerial basalts, andesites and diorite dykes of Miocene age covered by a sequence of felsic quartz tuffs, andesitic ‘dome’ complexes, volcaniclastics and younger intrusive dacitic plugs. Capping this volcanic package are Pliocene alkaline basalt flows that are commonly well preserved as small flat highland plateaus.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-2 |

A variety of geophysical, geochemical and geological surveys have been extremely useful in identifying drill targets throughout the property; most importantly, airborne magnetics, induced polarization resistivity anomalies, clay alteration haloes identified by TerraSpec® spectrometry, mineralized surface rock geochemistry and detailed geological and structural mapping. These surveys will remain an integral part of any future exploration program at Caballo Blanco.

Two large areas of epithermal gold mineralization have been discovered within the current Caballo Blanco property, referred to as the Northern Zone and Highway Zone. Both are prominent high-sulphidation epithermal gold prospects that occur within extensive areas of clay and silica alteration.

The discovery of gold mineralization at La Paila in the Northern Zone is relatively new for this region of Mexico. The gold is very fine and occurs within a vuggy and brecciated silica alteration of an original andesite host rock in the upper levels of the surrounding epithermal system. The elongate and silicified gold rich mineralization at La Paila likely formed from fluid rising along a north trending fault structure well above a deeper intrusive ‘heat source’. Similar silica and clay alteration zones have been recognized at La Cruz and the Highway Zone that lie along a north-south linear trend over a distance greater than nine kilometers. La Paila, located on the north end of this trend, contains significant gold mineralization with drill intercepts of 2.194 grams per tonne gold over 89.91 meters (08CDN-04) and 0.584 grams per tonne gold over 216.41 meters (07CBN-02).

The basis of this study is the mineral resource estimate by Gary Giroux of Giroux Consultants contained in the NI 43-101 Technical Report compiled by Cuttle and Giroux in February 2012. The resource estimate is based on the constraints of a geological solid surrounding the mineralized sections of a silica breccia. It follows up an initial estimate completed by Cuttle and Giroux, March 2010. The resource estimate is based on 145 diamond drill holes completed since the discovery of the La Paila mineralized zone. The drill hole density is not sufficient to establish any blocks in the measured category and all blocks are considered either indicated or inferred. Below is the resource available if one could mine to the limits of the mineralized solid. It includes no edge dilution. Estimations using a cut-off of 0.2 grams per tonne (g/t) gold can be separated into the following categories for La Paila:

| • | Indicated - 28,890,000 tonnes, 0.62 g/t gold, 2.32 g/t silver or 575,000 ounces gold and 2,150,000 ounces silver |

| | | |

| • | Inferred - 24,020,000 tonnes, 0.54 g/t gold, 2.50 g/t silver or 419,000 ounces gold and 1,930,000 ounces silver |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-3 |

It is proposed that the La Paila deposit is amenable to be developed as an open pit mine. Mining of the deposit is planned to produce a total of 49.3 million tonnes (Mt) of heap leach feed and 81.8 Mt of waste (1.7:1 overall strip ratio) over a seven and a half year mine operating life. The current life of mine (LOM) plan focuses on achieving consistent heap leach feed production rates, mining of higher grade material early in schedule, and balancing grade and strip ratios.

Mine design for the La Paila deposit commenced with the development of a net smelter return (“NSR”) model. The model included estimates of metal prices, exchange rate, mining dilution, leach recovery, smelting and refining payables and costs, freight and marketing costs and royalties (see Table 1.1 below). The NSR model was based on a 20 m x 20 m x 5 m block size.

Table 1.1

NSR Parameters |

| Item | Unit | Assumptions |

| Metal Prices | | |

| Gold | US$/oz | 1,150 |

| Silver | US$/oz | 21.00 |

| Recovery to Doré | | |

| Silver | % | 30% |

| Gold | % | 80% |

| Smelter Payables | | |

| Gold in doré | % | 99.9% |

| Gold deduction in doré | g/t in conc | 0.0% |

| Silver in doré | % | 98.0% |

| Silver deduction in doré | g/t in conc | 0.0% |

| Off-site costs | | |

| Au refining/transportation charge | US$/oz pay Au | 5.50 |

| Ag refining/transportation charge | US$/oz pay Ag | - |

| Other Parameters | | |

| Grade factor | % | 90% |

| Royalties | % | 1.90% |

| Operating Costs | | |

| Waste mining Cost | US$/waste tonne | $1.60 |

| Resource Mining Cost | US$/resource tonne | $2.40 |

| G&A/Sustaining Cost | US$/milled tonne | $080 |

| Heap Leach Processing Cost | US$/milled tonne | $2.24 |

| CostP | | $3.04 |

| Heap Leach Processing rate | t/day leached | 20,000 |

| Pit Slope Angles w/ ramps | overall $ | 40 |

| Heap Leach Processing rate | Mt/yr leached | 7.00 |

| Discount Rate | % | 8% |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-4 |

Gemcom Whittle™ - Strategic Mine Planning™ (“Whittle™”) software was then used to determine the optimal mining shell with an assumed preliminary overall slope angle of 40 degrees. Preliminary phases were selected and preliminary mine planning and scheduling was then conducted on these selected optimal shells. The mineable resources for the La Paila deposit are presented in Table 1.2.

Indicated and inferred resources were used in the LOM plan, with inferred resources representing approximately 40 percent of the material planned to be processed.

Table 1.2

Resources Planned to be Extracted in LOM Plan |

Description |

Unit | Caballo PEA

2012 |

| Diluted Mineralized Tonnage | (Mt) | 49.3 |

| Mine Life | (yrs) | 7.5 |

| Diluted Grades | | |

| Gold | (g/t) | 0.54 |

| Silver | (g/t) | 2.31 |

| Contained Metal | | |

| Gold | (koz) | 854 |

| Silver | (koz) | 3,667 |

| Recovered Metal | | |

| Gold | (koz) | 683 |

| Silver | (koz) | 1,100 |

| Waste Tonnage | (Mt) | 81.8 |

| Total Tonnage | (Mt) | 131.1 |

| Total Material Mined (avg.) | (t/day) | 45,000 |

| Strip Ratio | (t:t) | 1.66 |

The mining sequence was divided into a number of stages designed to maximize grade, reduce pre-stripping requirements in the early years and maintain the heap leach at full production capacity. The LOM mine production schedule is shown in Table 1.3. The mining is envisioned to be undertaken by a mining contractor.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-5 |

Table 1.3

LOM Production Schedule |

| Item | Unit | Total | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 |

| Diluted Mineralized | | | | | | | | | | |

| Tonnage | (Mt) | 49.3 | 4.3 | 7.0 | 7.0 | 7.0 | 7.0 | 7.0 | 7.0 | 3.0 |

| Diluted Grades | | | | | | | | | | |

| Gold | (g/t) | 0.54 | 0.55 | 0.55 | 0.51 | 0.53 | 0.55 | 0.53 | 0.52 | 0.61 |

| Silver | (g/t) | 2.31 | 2.42 | 3.04 | 2.53 | 2.87 | 2.25 | 1.76 | 1.76 | 1.39 |

| Contained Metal | | | | | | | | | | |

| Gold | (koz) | 853 | 76 | 124 | 115 | 119 | 124 | 119 | 117 | 58 |

| Silver | (koz) | 3,664 | 336 | 683 | 569 | 645 | 506 | 396 | 395 | 133 |

| Recovered Metal | | | | | | | | | | |

| Gold | (koz) | 682 | 61 | 99 | 92 | 95 | 99 | 96 | 94 | 47 |

| Silver | (koz) | 1,099 | 101 | 205 | 171 | 193 | 152 | 119 | 119 | 40 |

| Waste Tonnage | (Mt) | 82.0 | 2.1 | 9.0 | 15.3 | 10.3 | 10.9 | 18.0 | 13.7 | 2.7 |

| Total Tonnage | (Mt) | 131.3 | 6.4 | 16.0 | 22.3 | 17.3 | 17.9 | 25.0 | 20.7 | 5.6 |

| Strip Ratio | (t:t) | 1.7 | 0.5 | 1.3 | 2.2 | 1.5 | 1.6 | 2.6 | 2.0 | 0.9 |

| Avg. Material Mined | (t/day) | 45,000 | 18,000 | 44,000 | 61,000 | 47,000 | 49,000 | 68,000 | 57,000 | 15,000 |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. Mineral reserves can only be estimated as a result of an economic evaluation as part of a preliminary feasibility study or a feasibility study of a mineral project. Accordingly, at the present level of development there are no mineral reserves at the Caballo Blanco Project.

| 1.5 | Mineral Processing and Metallurgical Testing |

The calculated gold extraction from each cell under leach, assuming the sample used accurately reflects the resource, is 81 percent. Analysis was based on data provided by Minera Cardel. Extraction curves were calculated from column data where adequate particle distributions were available.

Selection of secondary open-circuit crushing was based on initial run-of-mine (ROM), data provided by Minera Cardel and modeled using Bruno© software. The ROM distribution curve was generated from simulation software.

Material from the La Paila pit is reduced to 80 percent passing 40 mm using a secondary open-circuit crushing system. Haul trucks bring ROM to the primary crushing plant area and direct dump fresh material into a dump hopper. ROM in the hopper is fed to a jaw crusher. The primary crusher product has an 80 percent passing size of 140 mm. Primary crushed material is fed to a conveyor where pebble lime is added from a lime silo. The primary crushed product is fed to a double deck secondary screen. Screen oversize is fed to a secondary cone crusher. The secondary screen undersize and the secondary cone crusher product are combined as the final crushed product reporting to a stockpile. The stockpile has a nominal capacity of 6,700 tonnes.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-6 |

Fine material is loaded into trucks using a front-end loader and hauled to the leach pad where it is stacked in 6 meter lifts forming leach cells. After a cell is filled, a dozer rips the surface to mitigate compaction from the loading process.

The heap leach pad has both barren and intermediate irrigation circuits. Barren solution from the adsorption, desorption, recovery, (ADR), plant is used to irrigate the previously leached material. The drainage from this portion of the heap reports to an intermediate leach solution (ILS) pond. The ILS pond and pumps recirculate the ILS solution to irrigate newly completed fresh cell material. The areas under leach with the fresh barren solution and the ILS are equal, allowing the total flow to be split in half with half the solution reporting to the heap and half reporting to the ADR plant.

The carbon adsorption system consists of one train of five columns in series. Solution flows from each adsorption stage to the next stage by gravity. Carbon is advanced countercurrent to the solution flow by a common carbon advance pump. Barren solution discharging from adsorption is adjusted with cyanide and lime to achieve specified concentrations before reporting to a barren pond or tank.

Loaded carbon is desorbed using the Zadra process. Carbon is first acid washed, rinsed, and then loaded into the Zadra column where gold is stripped from the carbon forming an electrolyte. Carbon is regenerated and returned to the carbon adsorption plant.

The electrolyte solution advances to the refinery where precious metal is recovered. Solutions exiting the electro-winning process report to the barren-solution tank. The electrowon gold is removed batch-wise by high pressure water and the precious metal sludge slurry flows to a pressure filter. The filter cake is dried in a retort to volatilize and recover mercury prior to smelting. The dried cake is fluxed and smelted in an induction furnace and poured into 500 oz doré ingots.

The project area is 65 kilometers northwest of Veracruz in the state of Veracruz Mexico. There is access by paved road to the project area. There is significant electrical infrastructure provided by the nuclear power plant located at Laguna Verde and the project may be able to negotiate accessing this grid at a future date. Communications are well established in terms of phone lines and high speed internet. Water in the area is generally from local wells, there are no major water reservoirs in the area. Well water is the supply method used by the local population

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-7 |

There is good infrastructure surrounding the Caballo Blanco Gold Heap Leach and equipment can be shipped to the ports of Veracruz then trucked to the Caballo Blanco project site.

Community relation issues are currently handled by Goldgroup and a community liaison officer and a good understanding of local issues and sensitivities has been established.

| 1.8 | Environmental and Social Impact. |

The environmental and regulatory framework for mining activities is well defined by Mexican law. Environmental permits have been issued to Minera Cardel for exploration activities, development of an exploration tunnel and use of explosives. A comprehensive Environmental Impact Assessment has been completed and was submitted in December 2011 to SMARNAT (Regulatory Authority) and is currently being evaluated. Part of this submission includes a baseline environmental study, which addressed climatology, land use, hydrology, geology, flora, fauna and landforms. The Environmental Impact Assessment addressed mine waste, heap leach processing, water management, and monitoring programs.

The Environmental Risk Assessment addressed hazardous components such as gasoline, diesel, explosives, sodium cyanide and hydrochloric acid. Minera Cardel has addressed issues related to the ERA and has proposed mitigation measures to meet Mexican Regulatory requirements. Sociological baseline studies were completed and will implement appropriate sociological programs appropriate to the local and regional landscape.

Unless otherwise noted, all costs in this report are in 2012 US dollars.

A summary of the 2-stage crushing, process plant and associated infrastructure capital costs is shown in Table 1.3. The table includes direct costs, indirect costs, and a contingency. These are factored capital cost estimates and are based on equipment costs multiplied by factors to include installation costs. The capital costs estimate does not include sunk costs such as drilling and prior studies undertaken to date.

Capital costs for the project were developed from a mix of first principles, reference projects, and experience. The annual capital costs by major category are shown in Table 1.4. No open pit mining fleet capital costs are included since contract mining is assumed and the contractor will be responsible for supplying an adequate mining fleet.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-8 |

Table 1.4

Total Initial And Future Sustaining Project Costs For Two Stage Crushing Option |

Item | Initial Cost

US$ | Sustaining Cost

US$ | Total

US$ |

| Mining Cost | 4,500,000 | - | 4,500,000 |

| Process Plant Total Cost | 55,338,555 | - | 55,338,555 |

| Leach Pads | 24,926,368 | 31,138,957 | 56,065,325 |

| Closure and Reclamation | | 22,348,113 | 22,348,113 |

| Total Initial and Future Sustaining Project Cost | 84,764,923 | 53,487,070 | 138,251,993 |

The process costs are shown below in more detail.

Table 1.5

Summary Process Plant Cost

2-Stage Crushing |

| Cost

(US$) |

| Plant Direct Costs | |

| Process & Crushing Plant | 17,676,832 |

| Project Infrastructure | 8,145,183 |

| Total Direct & Infrastructure Costs | 25,822,015 |

| Plant Indirect Costs | 9,784,566 |

| Total Direct And Indirect | 35,606,581 |

| 30% Contingency | 10,681,974 |

| Owners Cost | 9,050,000 |

| Total Process Costs | 55,338,555 |

Owner’s costs were included in the estimate and were provided by Minera Cardel. An allowance of US$ 9.05 million dollars includes the following list of items:

| | | | | US$ | |

| | • | Water Source and supply to site | | 1,200,000 | |

| | • | Mine Workshops | | 360,000 | |

| | • | Administration and engineering Offices | | 50,000 | |

| | • | Mobile Equipment | | 1,200,000 | |

| | • | Laboratory Equipment and building Upgrade | | 80,000 | |

| | • | Communications | | 50,000 | |

| | • | Plant Warehouse | | 270,000 | |

| | • | Septic Systems | | 40,000 | |

| | • | Fire Water Distribution System | | 100,000 | |

| | • | Land Cost | | 1,500,000 | |

| | • | Working Capital | | 4,200,000 | |

| | | | | | |

| | | Total Owners Cost | $ | 9,050,000 | |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-9 |

Operating costs for the project are summarized in Table 1.6. All costs are in US dollars. The open pit mining operating costs assume contract mining including drilling/blasting.

Table 1.6

Operating Cost Estimate |

| | Unit | Value |

| Mining Cost | $/tonne | 5.36 |

| Processing | $/tonne | 3.26 |

| Impacted Water | | |

| Treatment/Management | $/tonne | 0.72 |

| General & Administration | $/tonne | 1.22 |

| Royalties | $/tonne | 0.38 |

| Total Operating Cost | $/tonne | 10.94 |

The preliminary economic highlights (base case two stage crushing) are summarized in Table 1.7.

Table 1.7

Economic Summary |

| | Unit | Values |

| Average gold grade | g/t | 0.538 |

| Average annual gold production | oz | 85,962 |

| Life of Mine from production start | Yr | 8 |

| IRR Pre tax | % | 66.4 |

| NPV Pretax (5% discount rate) | $M | 283.8 |

| Payback period from start of production | Yr | 1.5 |

| NPV Pretax (0% discount rate) | $M | 386.3 |

| Initial Capital Cost | $M | 84.8 |

| Total Capital Cost | $M | 138.3 |

| Cash Operating Cost | $/oz | 784.0 |

| Pre-Income Tax Cash Flow | $/oz | 508.97 |

| Metallurgical Recovery, Au | % | 80.7 |

| Total Mined Gold to Leach Pad | Moz | 852,689 |

The financials for the base case mining options are summarized in Table 1.8.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-10 |

Table 1.8

Economic Evaluation |

|

$ x 1000 | $/t

Resource | $/oz

Gold |

| Mine Gate Value of All Resource Net of Transportation and Refining | 1,063,704 | 21.58 | 1,546.77 |

| Mining Operating Cost | (264,302) | (5.36) | (384.33) |

| Processing Cost | (160,707) | (3.26) | (233.69) |

| Impacted Water Treatment/Management | (35,379) | (0.72) | (51.45) |

| General & Administration | (60,142) | (1.22) | (87.45) |

| Royalties | (18,615) | (0.38) | (27.07) |

| Cash Operating Cost | (539,145) | (10.94) | (783.99) |

| Cash Operating Cash Flow | 524,560 | 10.64 | 762.78 |

| Capital Cost including Pre-Production Development | (138,252) | (2.80) | (201.04) |

| Pre-Income Tax Cash Flow | 386,308 | 7.84 | 561.74 |

Metal price scenarios were used in the pre-tax model to evaluate the sensitivity on NPV, IRR, and payback. The results for the base case mining options are shown in Table 1.9.

Table 1.9

Summary of Key Financial Parameters (Sensitivity to Gold Price) |

| Gold Price, $/oz | 1,150 | 1,300 | 1,400 | 1,500 | 1,600 | 1,700 |

| Pre-Tax NPV@ 5%, (000's) | 93,856 | 180,041 | 231,920 | 283,800 | 335,679 | 387,558 |

| IRR, Pre-Taxes | 30.03% | 47.71% | 57.29% | 66.41% | 75.20% | 83.73% |

| Payback, Operating Years | 3.3 | 2.0 | 1.7 | 1.5 | 1.4 | 1.3 |

It is recommended that the project be advanced to the preliminary feasibility study stage, following a definition drilling program that will attempt to convert inferred resources into indicated or measured resources. The cost of the definition drilling program, pre-feasibility study (PFS) and associated field and lab work is estimated to be US$ 4 to US$ 6 million.

The PFS should include the optimization investigations into:

| • | Additional drilling to enhance classification and extension of mineral resources. |

| | | |

| | • | Owner operated mining versus contract mining. |

| | | |

| | • | Leasing vs. Direct Capital Purchase of Owner Fleet. |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 1-11 |

| | • | In pit crushing-conveying versus remotely located crushing plant. |

| | | |

| • | Metallurgical optimization on representative sample to fix design criteria and costs to BFS standards and to enhance silver recovery. |

| | | |

| | • | International ESIA compliance work. |

| | | |

| | • | Plans for project operating and project execution. |

| | | |

| | • | Risk and Opportunity assessments. |

Metallurgical characterization studies on drilled samples and sample composites are also recommended. The minimal estimated cost for additional testwork is US$ 300,000.

Industry standard mining, process design, construction methods and economic evaluation practices have been used to assess the Caballo Blanco Project and there is adequate geological and other pertinent data available to generate a PEA.

Based on current knowledge and assumptions, the results of this study show that the project has positive economics, within preliminary parameters of a PEA, and should be advanced to the next level of study by conducting the work indicated in the recommendations section of this report.

As with almost all mining ventures, there are a large number of risks and opportunities that can affect the outcome of the Caballo Blanco Project. Most of these risks and opportunities are based on uncertainty, such as lack of scientific information such as test results, drill results, etc., or the lack of control over external factors, such as metal prices, exchange rates, and the like.

Subsequent higher-level engineering studies will be required to further refine these risks and opportunities, identify new risks and opportunities and define strategies for risk mitigation or opportunity implementation.

The study has achieved its original objective of providing a preliminary review of the potential economic viability of the Caballo Blanco Project.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 2-1 |

2.0 INTRODUCTION

This Technical Report has been prepared by Mr. Joseph M. Keane, P.E. of K D Engineering (KDE) located in Tucson, Arizona, USA. The report includes details of the updated Mineral Resource Evaluation (MRE) completed for the Caballo Blanco Gold Heap Leach Project and preliminary engineering design information for the proposed mine plan and mineral beneficiation facilities along with capital and operating cost information. The report is written to comply with the requirements of the National Instrument 43-101, “Standards of Disclosure for Mineral Properties”, as part of Goldgroup’s ongoing continuous disclosure obligations regarding the company’s exploration activities and property development.

The following individuals are Qualified Persons (QP’s) as defined by the CIM Definition Standards 22 November 2005 and Section 5.1 of National Instrument 43-101 Standards of Disclosure for Mineral Projects, Form 43-101F1 and Companion Policy 43-101CP.

Mr. Joseph M. Keane, P.E., of K D Engineering has responsibility for the report contents and specifically Sections 2, 3, 13, 17, 18, 19, 22 and 23 and also the process portions of Section 1, 21, 24, 25, 26, 27 and 28. Mr. Keane visited the property November 2011 and is the Qualified Person for matters relating to the design and costs of the processing facility. He has relied upon other experts for specific information in the report as mentioned subsequently.

Mr. Jim Cuttle visited the property 21 May to 24 May 2009 and 6 January 2012 and is the QP for Sections 4 through 12.

Mr. Gary Giroux visited the property 7 to 9 November 2011 and is the QP for Section 14.

Mr. Dino Pilotto from SRK, visited the property in November 2011 and is the qualified person on all matters relating to the mining methods. Mr. Pilotto is responsible for Sections 15 and 16 and the mining portions of Section 1, 21, 25, 26, and 27.

Mr. Stephen Taylor of MWH, visited the property in November 2011, and is the Qualified Person for all matters relating to the leach pad/pond design, portions of Sections 17 and 18 and the geotechnical portions of Section 1, 21, 25, 26 and 27.

Mr. Brent C. Bailey, P.E. from ERM has responsibility for the report contents related to Environmental and Social Impact Assessment. ERM visited the property in January 2012. Mr Bailey has reviewed and certified the contents of Section 20 and portions of 1, 21, 25, 26 and 27 and is the QP for all matters relating to the Environmental and Social Impact Assessment.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 2-2 |

As noted above all Qualified Persons contributed to Sections 1, 21, 25, 26 and 27.

This independent Report has been prepared following resource development activities over the project during 2010 and the first six months of 2011. The following information has been utilized during the preparation of this report. Post-December 2009 technical data, documents, reports and information supplied by Goldgroup, including:

| • | NI 43-101 Technical Report - Caballo Blanco Project and a Resource Estimate at the La Paila Zone, Veracruz State, Mexico, prepared by Cuttle and Giroux, 22 March 2010 |

| | | |

| • | NI 43-101 Technical Report - Caballo Blanco Project Resource Update at the La Paila Zone, prepared by Cuttle and Giroux, 10 February 2012 |

| | | |

| • | Process engineering preliminary designs completed in March 2012 to support this report by KDE. |

| | | |

| • | "Geotechnical Field Investigation for the Leach Pad Design at the Caballo Blanco Project” by GeoQuality, Mexico, dated 4 October 2011, “Monthly Precipitation, Monthly Pan Evaporation, and 100 year/24 hour precipitation Return Period for the Minera Cardel Mine Site Located in the State of Veracruz, Mexico”, by Meteorological Solutions Inc., October 2011. |

| | | |

| • | Preliminary mining leach pad, waste stockpile, water treatment and process capital and operating cost estimates produced by SRK KDE, and MWH. |

| | | |

| | • | Reports and data in the public domain. |

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 3-3 |

3.0 RELIANCE ON OTHER EXPERTS

The authors of this report have obtained and interpreted information concerning Minera Cardel’s Caballo Blanco Project from several sources, including the following experts:

| | • | Mineral Resource estimates - Giroux Consultants |

| | | |

| • | Geophysics - Mexican Geophysical Department - Mexico City and SJ Geophysics - Vancouver, B.C. |

| | | |

| | • | Geological - Richard Sillitoe, 2008 |

| | | |

| | • | Geochemical - Barry Smee and Associates. |

| | | |

| | • | Analytical - ALS Global and Inspectorate Labs, Vancouver, B.C. |

| | | |

| | • | SGM (Servicio Geológico Mexicano) |

| | | |

| | • | Mining Methods - SRK Consulting |

| | | |

| | • | Environmental Studies - ERM, Environmental Resources Management |

| | | |

| | • | Project Infrastructure - MWH |

| | | |

| | • | Metallurgical Processing - K D Engineering |

K D Engineering and the Qualified Persons have followed standard procedures in preparing this report that is based, in part, on details, information, and assumptions provided by others and some by data provide by Minera Cardel. Neither K D Engineering, nor the Qualified Persons, can guarantee the correctness of all information but to the extent of this investigation and within the scope of the assignment, assumptions, conditions, and qualifications, it is believed that this report is substantially correct.

Mineral reserve estimates for the Caballo Blanco deposit are forward-looking statements and may differ from the actual amount of saleable minerals recovered in mining operations. Principle deviation may result from grade variations within the deposit, metallurgical response of the mineralization, market prices, and operating cost levels achieved by the operator.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-1 |

4.0 PROPERTY DESCRIPTION AND LOCATION

The Caballo Blanco Property covers a horizontal surface area of 54,732.4120 hectares (547.32 square kilometers) and is centered next to the Gulf of Mexico at Longitude 96° 27’ 30” W, Latitude 19° 40’ 44” N, or 65 kilometers by paved road north northwest of the city of Veracruz in Veracruz State, Mexico.

As of 7 February 2012 the property comprised fourteen mining claims as described below.

Table 4.1

Mineral Claim Details |

| | CLAIM NAME | TITLE # | RECORDED | HECTARES | COSTS -2011 |

| 1 | Caballo Blanco | 216694 | 17-May-02 | 600 | MXN 75,864.00 |

| 2 | Reduccion Caballo Blanco II | 224414 | 4-May-05 | 504.8125 | MXN 63,828.00 |

| 3 | Caballo Blanco IV | 218176 | 11-Oct-02 | 1,634.00 | MXN 206,603.00 |

| 4 | Reduccion Caballo Blanco VI | 224415 | 4-May-05 | 1,014.17 | MXN 64,136.00 |

| 5 | Caballo Blanco VII | 223282 | 23-Nov-04 | 231.7764 | MXN 14,657.60 |

| 6 | Caballo Blanco VIII (Div) | 223360 | | 48.4557 | MXN 1532.17 |

| 7 | Reyna Negra Fraccion 3 | 221374 | 3-Feb-04 | 1,061.75 | MXN 67,144.00 |

| 8 | Caballo Blanco IX Fraccion 1 (Div) | Pending | Pending | 7,409.07 | MXN 0 |

| 9 | Caballo Blanco IX Fraccion 2 | 234277 | 10-Jun-09 | 663.1832 | MXN 10.080.40 |

| 10 | Caballo Blanco IX Fraccion 3 | 234278 | 10-Jun-09 | 233.395 | MXN 3,457.60 |

| 11 | C.B.2 | 234324 | 12-Jun-09 | 244.0336 | MXN 3,709.40 |

| 12 | C.B.6 | Pending | Pending | 396.29 | MXN0 |

| 13 | C.B.11 | 236991 | 8-Oct-10 | 5,400.00 | MXN 54,864.00 |

| 14 | C.B.12 (Div) | 237441 | 16-Dec-10 | 35,273.78 | MXN 363,158.63 |

| | | | | | |

| TOTALS MXN Pesos ($1Can = 12.78 MXN, Feb 7, 2012) | 54,732.41 | MXN 929,124.80 |

Title to each of the above mineral claims is held by Minera Gavilán S.A. de C.V., a wholly-owned subsidiary of Almaden. Each of the mineral claims is currently in the process of being transferred from Minera Gavilán to Candymin S.A. de C.V., a wholly-owned subsidiary of Goldgroup Mining Inc. in connection with the Goldgroup's acquisition of Almaden's remaining 30 percent interest in the project. As of the date of this report, information obtained from Goldgroup indicates the claims remain in good standing. This claim status was not independently confirmed by the authors.

Under terms of the original Share Purchase Agreement, Goldgroup Resources Inc. (currently Goldgroup Mining Inc.) agreed to buy 100 percent interest in Minera Cardel S.A de C.V., a wholly owned subsidiary of NGEx Resources Incorporated. Minera Cardel S.A. de C.V. holds an option to acquire a 70 percent interest in the Caballo Blanco Project from a subsidiary of Almaden Minerals Ltd. The share purchase agreement called for payments by Goldgroup to NGEx totaling CDN$ 15 million, comprised of staged cash payments totaling CDN$ 6 million and nine million shares of Goldgroup at a deemed price of CDN$ 1.00 per share. NGEx Resources will receive a 1.5 percent net smelter royalty and, upon commercial production, a onetime advance royalty payment in the amount of CDN$ 5 million.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-2 |

Figure 4.1 - Country Location Map(Cuttle, 2012)

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-3 |

Figure 4.2 - Veracruz State Location Map

(modified by Cuttle from Mexican Road Map, Ver 2)

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-4 |

Figure 4.3 - Claim Tenure Map

(Cuttle, 2012)

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-5 |

Pursuant to a memorandum of agreement among Almaden Minerals Ltd., the Company and NGEx Resources Inc. dated 5 February 2010, the area defined in Table 4.2 was transferred to a new entity (the “El Cobre Joint Venture”) owned 60 percent by Almaden Minerals and 40 percent by the Company. The new entity holds a 100 percent interest in the area and is operated by Almaden Minerals.

Table 4.2

The “El Cobre Joint Venture” Boundaries |

| Corner Point | East UTM - Nad 27 | North UTM - Nad 27 |

| 1 | 761525 | 2179000 |

| 2 | 763000 | 2179000 |

| 3 | 767000 | 2175000 |

| 4 | 767000 | 2167172 |

| 5 | 761525 | 2167172 |

In October, 2011 Goldgroup completed the acquisition of the remaining 30 percent interest in the Caballo Blanco Project held by Almaden Minerals Ltd. (Almaden). Goldgroup now owns 100 percent of the Caballo Blanco Project.

The aggregate consideration paid by Goldgroup to Almaden in connection with the transaction consisted of: US$ 2,500,000 in cash; 7,000,000 Goldgroup common shares at closing; the right to receive up to an additional 7,000,000 Goldgroup common shares upon the achievement of certain project milestones (1,000,000 common shares upon commencement of commercial production, 2,000,000 common shares upon measured and indicated resources, including cumulative production, reaching 2,000,000 ounces of gold, 2,000,000 common shares upon measured, indicated and inferred resources, including cumulative production, reaching 5,000,000 ounces of gold and 2,000,000 common shares upon measured, indicated and inferred resources, including cumulative production, reaching 10,000,000 ounces of gold); a 1.5 percent net smelter return royalty; and the transfer of the Company's 40 percent interest in the El Cobre property.

Since the last qualifying report in March, 2010 on Caballo Blanco, Goldgroup has purchased surface rights from eight land owners, signed rental agreements with five land owners and is in the process of buying or leasing four other land parcels. These areas lie within the Northern Zone area including La Paila.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 4-6 |

Originally, NGEx Resources Inc., through its wholly owned subsidiary Minera Cardel S.A de C.V had signed ‘land entry’ agreements with at least five private individuals that claim legal title to surface rights inside the Caballo Blanco claim block. These agreements include a yearly payment for access to their lands as well as additional compensation for any disturbance the company may cause from the Company’s geological surveying, road building and/or drilling activity. Legal rights to these lands have not been verified by the authors however it is understood these agreements remain in good standing for the Goldgroup's ongoing exploration and development work during and beyond 2012. There are no environmental liabilities known to the authors on the Caballo Blanco property.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 5-1 |

5.0 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES,

INFRASTRUCTURE & PHYSIOGRAPHY

Veracruz is a major port and is well connected with daily flights to Mexico City and other national and international destinations. The property is reached by driving north from Veracruz to Villa Rica, using the Pan American Highway which transects the eastern portion of the claim block. From here a network of dirt roads access most of the current areas of interest. New drill roads have been constructed to support recent drill campaigns, particularly in the Northern Zone areas.

The nearest supply center is Cardel, a town of 20,000 located approximately 30 kilometers south of the Caballo Blanco claim block. The town offers an abundant supply of mining personnel. On the northeastern edge of the property sits Mexico’s only nuclear power plant at Laguna Verde. Its location allows easy access to the Mexican electrical power grid. Water is relatively abundant in small creeks at elevations below 200 meters, throughout most of the year.

A well-organized field office and villa style accommodations house a small crew at the coastal community of Villa Rica. Many other villas are currently empty and likely available for rent.

The topography is semi-rugged with elevations from sea level up to 700 meters on the higher mountain tops. The climate is semi-tropical with a distinct rain season from June to November.

The design of the ancillary facilities is based upon information extracted from the prefeasibility economic evaluation, data provided by third party qualified persons and assumptions. The infrastructure required for the Caballo Blanco project includes; site roads (access and haul roads), electrical power, fuel, lubrication storage and dispensing, explosives storage, reagent storage, warehousing, administration offices, water supply, potable water, sewage, power distribution and telecommunications. There will be no on site camp or accommodation as it is expected that workers will be bused to and from site each day.

| 5.3 | Existing Regional Infrastructure |

The project area is 65 kilometers northwest of Veracruz in the state of Veracruz Mexico. There is excellent access by paved road to the project area, in addition there is significant electrical infrastructure provided by the nuclear power plant Laguna Verde. Communications are well established in terms of phone lines and high speed internet.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 5-2 |

Water in the area is generally from local wells, there are no major water reservoirs in the area. Well water is the supply method used by the local population.

| K D Engineering | Document No. Q443-04-028 | 7 May 2011 |

| | | |

| KDE FORM No. A263a-7/12/99 | | |

| Minera Cardel Resource Corp. - Caballo Blanco Gold Heap Leach Preliminary Economic Assessment | Page 6-1 |

6.0 HISTORY

The first record of gold in the Caballo Blanco claim area dates back to 1995 when Charlie Warren of Whitehorse, Yukon sampled a small quartz vein outcrop in a road cut along the Pan American Highway. Through his Mexican wife, he staked several mineral claims to cover what is known today as the Highway Zone.

The property was subsequently optioned to Almaden Minerals Ltd. in 1997 (Minera Gavilán S.A. de C.V.) who staked additional claims to cover the two other areas known as the Central Grid Zone and Northern Zone. Almaden completed a variety of geophysical, geochemical and geological surveys and drilled 17 reverse circulation drill holes in the Central Grid Zone ‘porphyry’ target.

In 2001, Almaden optioned the property to Noranda who drilled nine core holes in the Highway and Central Grid zones and returned the property to Almaden later that year. Results were not encouraging.

In December, 2002, Almaden signed a joint-venture agreement with Comaplex Minerals Corp. proposing to spend US$ 2 million over four years to explore the Caballo Blanco claims. Comaplex carried out a variety of geological work throughout the property, targeting the Central Grid Zone, the Highway Zone and the Northern Zone. From 2004 through 2006 Comaplex drilled ten core holes, and in 2005 discovered wide low grade gold mineralization in drill hole CB05-03 at La Paila in the Northern Zone. Comaplex completed the required expenditures of the joint venture agreement and went on to earn a 60 percent interest in the property. In February 2007, Almaden purchased Comaplex Minerals Corp’s 60 percent interest for a cash payment of US$ 1.25 million.

In April 2007 Almaden optioned Caballo Blanco to Canadian Gold Hunter Corp. of Vancouver, B.C who in turn completed a variety of surveys and additional drilling in the Northern Zone and Central Grid areas under its Mexican subsidiary, Mineral Cardel S.A de C.V. From 2007 to 2009, 42 core holes were drilled, with at least 30 holes targeting the new gold area at La Paila discovered by Comaplex in 2005.

In September 2009, Canadian Gold Hunter Corp changed its name to NGEx Resources Inc. and later in November signed a ‘share purchase agreement’ allowing Goldgroup Resources to earn a 70 percent interest in the Caballo Blanco Project.

Pursuant to a memorandum of agreement among Almaden Minerals Ltd., the Company and NGEx Resources Inc. dated 5 February 2010, the area defined in Section 4.0, Table 4.2 was transferred to a new entity (the “El Cobre Joint Venture”) owned 60 percent by Almaden Minerals and 40 percent by the Company.