ANNUAL INFORMATION FORM

Year ended December 31, 2015

March 30, 2016

TABLE OF CONTENTS

| FORWARD-LOOKING STATEMENTS | 1 |

| MINERAL RESERVE AND RESOURCE ESTIMATES | 2 |

| CURRENCY AND EXCHANGE RATES | 3 |

| CORPORATE STRUCTURE | 3 |

| GENERAL DEVELOPMENT OF THE BUSINESS | 4 |

| Risk Factors | 9 |

| Mineral Properties | 21 |

| San Francisco Property | 21 |

| Caballo Blanco Project | 37 |

Ana Paula Project | 57 |

| DIVIDENDS | 70 |

| CAPITAL STRUCTURE | 70 |

| MARKET FOR SECURITIES | 70 |

| ESCROWED SECURITIES | 71 |

| DIRECTORS AND OFFICERS | 72 |

| Director and Officer Information | 72 |

| Shareholdings of Directors and Officers | 73 |

| Corporate Cease Trade Orders or Bankruptcies | 73 |

| Penalties or Sanctions | 74 |

| Conflicts of Interest | 74 |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 75 |

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 75 |

| REGISTRAR AND TRANSFER AGENT | 76 |

| MATERIAL CONTRACTS | 76 |

| TECHNICAL INFORMATION | 76 |

| INTEREST OF EXPERTS | 76 |

| AUDIT COMMITTEE INFORMATION | 77 |

| ADDITIONAL INFORMATION | 79 |

- i -

Unless otherwise stated or the context requires otherwise, references in this Annual Information Form (“AIF”) to the “Company”, “Timmins”, “we”, “us” or “our” refer to Timmins Gold Corp. and its subsidiaries on a consolidated basis.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this AIF may constitute “forward-looking statements” or “forward-looking information” (collectively,“forward-looking statements”) and are made pursuant to the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 and Canadian securities laws. Forward-looking statements are statements which relate to future events. Such statements include estimates, forecasts and statements with respect to project development risks and estimated future production and cash costs, future trends, plans, strategies, objectives and expectations, including with respect to costs, capital requirements, availability of financing, production, exploration and reserves and resources, projected production at the Company’s San Francisco Property, Ana Paula Project and Caballo Blanco Project, including estimated internal rate of return and projected production, exploitation activities and potential, and future operations. Information inferred from the interpretation of drilling results and information concerning mineral resource estimates may also be deemed to be forward-looking statements, as it constitutes a prediction of what might be found to be present when, and if, a project is actually developed. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans, “anticipates”, believes”, “estimates”, “predicts”, “potential”, or “continue” or the negative of these terms or other comparable terminology. All statements and information other than statements of historical fact may be forward-looking statements.

These forward-looking statements are based on a number of assumptions, including: the successful completion of development projects, planned expansions or other projects within the timelines anticipated and at anticipated production levels; the accuracy of reserve and resource, grade, mine life, cash cost, net present value and internal rate of return estimates and other assumptions, projections and estimates made in the technical reports for the San Francisco Property, the Ana Paula Project and the Caballo Blanco Project; that mineral resources can be developed as planned; interest and exchange rates; that required financing and permits will be obtained; general economic conditions; that labor disputes, flooding, ground instability, fire, failure of plant, equipment or processes to operate as anticipated and other risks of the mining industry will not be encountered; the price of gold, silver and other metals; competitive conditions in the mining industry; title to mineral properties; and changes in laws, rules and regulations applicable to the Company.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to differ materially from those anticipated in such forward-looking statements. The Company believes the expectations reflected in such forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and readers are cautioned not to place undue reliance on forward-looking statements due to the inherent uncertainty thereof. Some of the risks and other factors which could cause actual results to differ materially from those expressed in the forward-looking statements contained in this AIF include, but are not limited to: changes in market conditions; actual results being materially different than reserve and resource, grade, mine life, net present value, internal rate of return and cash cost estimates and the other projections and estimates made in the technical reports for the San Francisco Property, the Ana Paula Project and the Caballo Blanco Project; variations in grade or recovery rates; risks relating to international operations; fluctuations in gold, silver and other metal prices and currency exchange rates; failure to obtain required financing; inability to successfully complete development projects, planned expansions or other projects within the timelines anticipated; natural disasters; adverse changes to general economic conditions or applicable laws, rules and regulations; changes in project parameters; the possibility of project cost overruns or unanticipated costs and expenses; labor disputes, flooding, ground instability, fire and other risks of the mining industry; failure of plant, equipment or processes to operate as anticipated; the risk of an undiscovered defect in title or other adverse claim; the risk that results of exploration activities will be different than anticipated; and other factors contained in the section entitled “Risk Factors” in this AIF.

1

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in the forward-looking statements, you are cautioned that this list is not exhaustive and there may be other factors that the Company has not identified. Furthermore, the Company undertakes no obligation to update or revise any forward-looking statements included in this AIF if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

MINERAL RESERVE AND RESOURCE ESTIMATES

The Company is subject to the reporting requirements of the applicable Canadian securities laws, and as a result reports mineral reserves and resources according to Canadian standards. Canadian reporting requirements for disclosure of mineral properties are governed by National Instrument 43-101Standards of Disclosure for Mineral Projects (“NI 43-101”). The definitions of NI 43-101 are adopted from those given by the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”). U.S. reporting requirements are governed by Industry Guide 7 (“Guide 7”) of the Securities and Exchange Commission (the “Commission”). These reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but embody different approaches and definitions. For example, under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. In particular, we report “resources” in accordance with NI 43-101. While the terms “Mineral Resource,” “Measured Mineral Resource,” “Indicated Mineral Resource” and “Inferred Mineral Resource” are recognized and required by Canadian regulations, they are not defined terms under standards of the Commission and generally, U.S. companies are not permitted to report resources in documents filed with the Commission. As such, certain information contained in this AIF concerning descriptions of mineralization and resources under Canadian standards is not comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the Commission. In addition, an Inferred Mineral Resource has a great amount of uncertainty as to its existence and as to its economic and legal feasibility, and you cannot assume that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. You are cautioned not to assume that all or any part of Measured or Indicated Resources will ever be converted into Mineral Reserves, and not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable. In addition, the definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” under CIM standards differ in certain respects from the standards of the Commission.

2

CURRENCY AND EXCHANGE RATES

All dollar amounts in this AIF are expressed in United States dollars, unless otherwise indicated. References in this AIF to “dollars” or “$” are to United States dollars. References in this AIF to “C$” are to Canadian dollars. The following table sets forth the value of the Canadian dollar expressed in United States dollars on December 31 of each year and the average, high and low exchange rates during the year indicated based on the noon rate of exchange as reported by the Bank of Canada:

| Canadian Dollars into | 2015 | 2014 | 2013 |

| United States Dollars | | | |

| | | | |

| Closing | 0.7225 | 0.8620 | 0.9402 |

| | | | |

| Average | 0.7820 | 0.8985 | 0.9701 |

| | | | |

| High | 0.8527 | 0.9422 | 1.0164 |

| | | | |

| Low | 0.7148 | 0.8589 | 0.9348 |

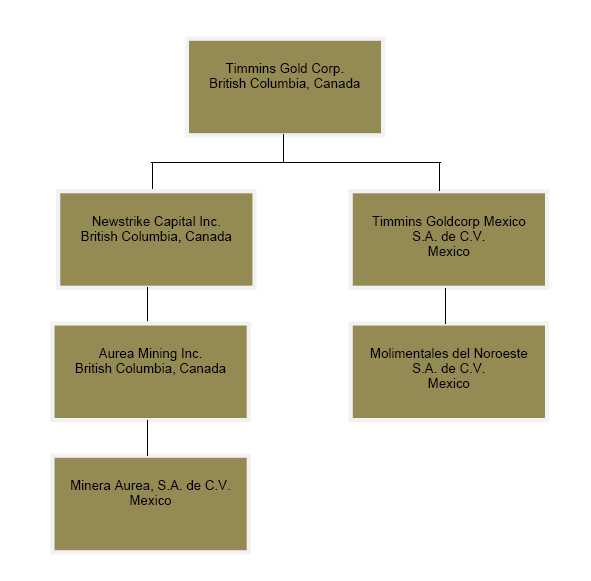

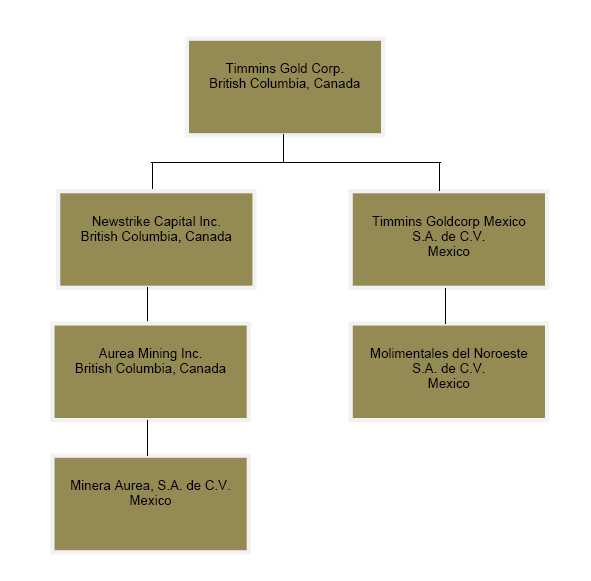

CORPORATE STRUCTURE

Timmins Gold Corp. was incorporated pursuant to theBusiness Corporations Act (British Columbia) on March 17, 2005.

The Company’s head office and its registered and records office are located at Suite 1900 – 570 Granville Street, Vancouver, British Columbia, V6C 3P1. The Company’s head office in Mexico is located at Blvd. Solidaridad #335 A, Local 3, Col Las Palmas, Hermosillo, Sonora, Mexico, 83270. The Company also maintains a field office at the San Francisco Property (as defined under “General Development of the Business – Overview” below), near Estacion Llano, Sonora.

The Company has five subsidiaries: Timmins Goldcorp Mexico, S.A. de C.V. (“Timmins Mexico”), Molimentales del Noroeste, S.A. de C.V. (“Molimentales”), Newstrike Capital Inc. (“Newstrike”), Aurea Mining Inc. (“Aurea”) and Minera Aurea, S.A. de C.V. (“Minera”). All subsidiaries are wholly owned except for nominal shareholders holding one share in each of the Mexican subsidiaries. Timmins Mexico was incorporated pursuant to the laws of Mexico on March 23, 2005 and is the entity through which the Company conducts its Mexican operations. Molimentales was acquired on March 20, 2007, and was incorporated pursuant to the laws of Mexico for the principal purpose of holding the mineral concessions and infrastructure that constitute the San Francisco open pit gold mine. Molimentales is also the entity that acquired the Caballo Blanco project in Veracruz in December 2014. In February 2015 the Company acquired all of the outstanding shares of Newstrike. Newstrike was incorporated pursuant to theBusiness Corporations Act (Alberta) on November 7, 2000 under the name “Erez Inc.”. The name was changed to MCS Global Corp. on June 20, 2003. On April 21, 2006 MCS Global Corp. continued to British Columbia under theBusiness Corporations Act (British Columbia) and subsequently changed its name to “Newstrike Capital Inc.” on May 5, 2006. In 2008 Newstrike, acquired all of the outstanding shares of Aurea. Aurea was incorporated pursuant to theBusiness Corporations Act (British Columbia). Aurea holds all but one of the outstanding shares of Minera which was incorporated pursuant to the laws of Mexico on March 22, 2004. Minera owns the Ana Paula gold project in Guerrero, Mexico.

3

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

The Company is a publicly traded gold producer engaged in the operation, development, exploration and acquisition of resource properties, primarily in Mexico. The Company owns and operates the San Francisco open pit gold mine (the “San Francisco Mine”), which together with the associated La Chicharra open pit gold mine, and additional exploration claims in and around the mines (collectively, the “San Francisco Property”) consists of approximately 53,380 hectares (“ha”) of surface area in the state of Sonora, Mexico. In addition, on December 24, 2014 the Company completed the acquisition of the Caballo Blanco project in Veracruz State, Mexico the (“Caballo Blanco Project”) and on May 26, 2015, the Company completed the acquisition of Newstrike, owner of the Ana Paula property in the state of Guerrero, Mexico (the “Ana Paula Project”). The Company’s goal is to become a Mexican-focused intermediate gold producer.

4

Locations of the Company’s Assets

Three Year History

During 2012 and 2013, the Company completed approximately 220,000 meters (“m”) of exploration drilling at the San Francisco Property. In November 2013, the Company announced a new reserve and resource update.

On February 11, 2014, the Company closed a bought deal offering of 18,920,000 common shares of the Company (including 2,250,000 common shares issued pursuant to the partial exercise of the underwriters’ over-allotment option), at a price of C$1.50 per common share for aggregate gross proceeds of C$28,380,000. The common shares were issued in a public offering in certain provinces of Canada pursuant to a short form prospectus dated February 4, 2014 filed with certain Canadian securities regulators, and were underwritten by a syndicate of underwriters led by RBC Dominion Securities Inc. and including BMO Nesbitt Burns Inc., TD Securities Inc., GMP Securities L.P., National Bank Financial Inc., Scotia Capital Inc. and PI Financial Corp.

During 2014, the Company carried out an exploration drilling program adjacent to and below the San Francisco pit and also completed a regional program. The Company completed approximately 2,100 m in 20 diamond drill (core) holes evaluating the area immediately south of the current pit. The drilling was designed to evaluate whether the orogenic nature of the deposit may provide the potential for the discovery of high grade feeders. Previous drill results combined with this follow-up work done in 2014 indicated the potential for high grade structures proximal to and down dip of the existing pit.

5

The Company also completed approximately 9,000 m of drilling in 73 reverse circulation (“RC”) holes at various locations throughout the pit. These holes were designed to provide additional information to support operations and also to test areas where prior positive drill results warranted follow-up drilling. Results identified that there was potential for improvements in grade adjacent to existing operations.

In 2014, the Company also completed a regional drill program on the North Trend, a cluster of high priority targets 2-8 kilometers (“km”) north of the San Francisco Property. The program consisted of approximately 25,000 m in a combination of core, RC and rotary air blast drilling on the North Trend identified by previous prospecting and exploration. The drill program met its objective of identifying potential deposits similar to San Francisco or La Chicharra that could act as a satellite pit to the existing operations. Follow-up work on these targets is being planned.

In 2015, the Company also commenced drifting into the underground veins parallel to the south wall of the San Francisco pit. The drift was part of a pilot phase designed to test the mining and processing of the underground ore. Previous drilling had delineated three mineralized veins near the south wall of the San Francisco pit located within 50 to 100 m of the current south pit wall. The pilot phase involved drifting 90 m into the south wall of the pit to access the veins followed by 200 m of lateral drifting to extract a bulk sample of ore. The pilot phase allowed the Company to test ground conditions, mining costs, grade and metallurgical recovery of the underground ore. The program was put on hold in Q3 of 2015 due to the depressed gold price. It did provide very good insight and the Company would like to continue in evaluation of the underground potential at the San Francisco Property.

While the Company has in the past primarily focused on the San Francisco Property, it has recently expanded into other regions in Mexico, including Veracruz and Guerrero. In December 2014, the Company announced that it had entered into an Asset Purchase Agreement (the “Asset Purchase Agreement”) dated December 17, 2014 among Goldgroup Mining Inc. (“Goldgroup”), Candymin S.A. de C.V., Minera Cardel S.A. de C.V. (each subsidiaries of Goldgroup) and Molimentales to purchase 100% of the Caballo Blanco Project, for total consideration of $10.0 million in cash and 16,065,000 common shares of the Company. The Company has also agreed to pay to Goldgroup a contingent payment of an additional $5.0 million when Caballo Blanco receives its environmental permit or the Company undergoes a change of control within the next five years. The contingent payment can be paid at the Company’s option in cash or common shares.The Caballo Blanco Project is subject to two Net Smelter Royalties (“NSR”) in favour of third parties, for 0.5% and 1.5%, respectively. See “Mineral Properties - Caballo Blanco Project” below.

On May 26, 2015, the Company completed a plan of arrangement (“Arrangement”) with Newstrike, owner of the Ana Paula Project, pursuant to which the Company acquired all of the issued and outstanding common shares of Newstrike by way of a court approved plan of arrangement. Under the terms of the Arrangement, Newstrike shareholders received 0.9 (“Exchange Ratio”) of a common share and C$0.0001 in cash for each Newstrike common share (a “Newstrike Share”), representing the equivalent of C$1.15 per Newstrike Share and a premium of 20% based on the closing prices of the common shares on the TSX and the Newstrike Shares on the TSX Venture Exchange (“TSX-V”) on February 13, 2015, and C$1.20 per Newstrike Share and a premium of 22.4% based on the 20-day volume-weighted-average-price of the common shares on the TSX and the Newstrike Shares on the TSX-V as of February 13, 2015. In addition, each outstanding option to purchase a Newstrike Share will be exchanged for an option to purchase a common share, based upon the Exchange Ratio.

Upon completion of the Arrangement, the Company is owned approximately 63% by shareholders of the Company and 37% by Newstrike shareholders (based on the number of Newstrike shares outstanding as of the date of the arrangement agreement dated February 16, 2015). See “Mineral Properties – Ana Paula Project” below.

In July 2015, the Company commenced a drill program at its Ana Paula Project which was designed to confirm previous drilling, obtain metallurgical samples and carry out select infill drilling. The program consisted of 2,000 m in ten core holes. The results from the confirmation drilling were consistent with those from previous programs. Additionally, the infill drilling results were very encouraging, as they continue to display Ana Paula’s high-grade gold mineralization and allowed for a greater understanding of the deposit. Metallurgical testing will be part of a Feasibility Study which the Company is scheduling for completion in the second half of 2016. In addition, approximately 1,400 m of infill drilling was conducted in seven holes at the Ana Paula deposit with the goal of increasing the confidence of the block model via a reduction in the kriging interpolation distance, and to confirm the approximate dimensions of the high grade breccia zone.

6

On August 7, 2015, the Company filed a Form 51-102F4 Business Acquisition Report in respect of the Arrangement that is available under the Company’s profile on SEDAR atwww.sedar.com.

On October 6, 2015 the Company’s employment agreement with Bruce Bragagnolo was terminated. Mr. Bragagnolo resigned as a director of the Company and was replaced by Mark Backens as Interim CEO.

On November 2, 2015, the Company acquired the complete process plant and select auxiliary equipment (“Plant”) used by Goldcorp Inc. (“Goldcorp”) in the operation of its El Sauzal Mine in Chihuahua, Mexico (“PlantAcquisition”). The El Sauzal Mine was operational until December 2014 when Goldcorp began its closure. The Plant was acquired by the Company for future use at the Ana Paula Project.

The total purchase price of C$8.0 million consists of the following:

| | a. | C$1.0 million in cash paid on closing; |

| | | |

| | b. | C$3.0 million which was satisfied by the issuance of 10 million shares in the capital of the Company at a price of C$0.30 per share on closing; and |

| | | |

| | c. | C$4.0 million in cash payable to Goldcorp one year from closing. |

The closing of the Plant Acquisition was subject to, among other things, the completion of a C$6.0 million investment by Goldcorp in the Company by way of a non-brokered private placement of 20 million units of the Company ("Private Placement") at a price of C$0.30 per unit. Each unit consisted of one share and one half of a Warrant, each whole Warrant being exercisable for a term of 24 months into a common share of the Company at a price of C$0.35 per share. The Warrants are subject to an accelerated exercise period of 10 days if the Company's closing share price meets or exceeds C$0.60 per share for 20 consecutive trading days. As a result of the Plant Acquisition and Private Placement, Goldcorp holds approximately 9.9% of the Company’s issued and outstanding common shares on an undiluted basis. During the fourth quarter of 2015 the demobilization of the El Sauzal Mine began and approximately 15% of the total demobilization was complete by December 31, 2015.

On November 2, 2015, the Company announced that, assuming the gold price retained in its current range over the next year, open pit operations would cease in the second half of 2016, at which point the Mine would be placed on care and maintenance. Heap leach operations would continue through early 2017. Full operations could then resume if and when gold prices returned to higher levels. The focus of the 2016 mine-out is to mine the highest margin ounces to accelerate free cash flow during the year.

On December 31, 2015, the Company announced that it had agreed to an extension to January 31, 2016 of its existing $10.2 million credit facility with Sprott Resource Lending Partnership (“Sprott”), as administrative agent for Sprott and Morgan Stanley Capital Group Inc. In consideration of the extension, the Company paid a fee to Sprott as administrative agent in the amount of $150,000. On January 26, 2016 the credit facility was amended to replace Morgan Stanley Capital Group Inc. with Goldcorp (together with Sprott the “Lenders”) and to extend the maturity date to June 30, 2016. Interest is payable monthly at the rate of 12% per annum. In consideration of the re-financing the Company will pay a $408,901 bonus to the Lenders, in cash or shares at the option of each Lender, in relation to its proportion of the credit facility, on the earlier of the repayment and June 30, 2016. The facility was originally entered into in 2011 for C$18.0 million. In 2014, the Company paid C$5.0 million on the facility and redenominated the remaining C$13.0 million to $10.20 million.

7

Gold Sales

The Company delivers gold and silver in doré form to an internationally respected precious metal refinery in North America where the doré may, at the Company’s option, be converted into London Good Delivery metal, or alternatively, be sold to the refiner. Gold is delivered to the refinery by armoured, insured carriers. If the metal is returned to the Company, it is then sold to international bullion dealers.

Metal Revenues

In 2015, the Company sold 93,196 gold ounces at an average realized gold price of $1,172 per ounce, compared to sales of 121,441 gold ounces at an average realized gold price of $1,269 per ounce during 2014. This represents a decrease of 23.3% in gold ounces sold and a decrease of 7.6% in realized gold price over 2014.

Total metal revenues from mining operations in 2015 were $109.2 million, compared to $154.1 million during 2014. The average London PM Fix price in 2015 was $1,160 per gold ounce, compared to $1,266 per gold ounce during 2014. This represents an 8.4% decrease in 2015 compared to 2014 and was also a contributing factor to the decrease in metal revenues over fiscal 2014.

Employees

As of December 31, 2015, the Company had sevenfull-time employees or contractors at its Vancouver, Canada head office and one full-time employee in Toronto, Canada. In addition, the Company had 17 full-time employees at its office in Hermosillo, Mexico, five full-time employees at the Caballo Blanco Project and 66 full-time employees at the Ana Paula Project. All mining activities at the San Francisco Property are carried out by a mining contractor. As of December 31, 2015, the contractor provided 292 skilled mining personnel to the Company.

Competitive Conditions

The precious metal mineral exploration and mining business is a competitive business. The Company competes with numerous other companies and individuals in the search for and the acquisition of attractive precious metal mineral properties. The ability of the Company to acquire precious metal mineral properties in the future will depend not only on its ability to develop its present properties, but also on its ability to select and acquire suitable producing properties or prospects for precious metal development or mineral exploration. In addition, the Company also competes with its competitors over sourcing raw materials and supplies used in connection with its mining operations, as well as for skilled experienced workers. See the following “Risk Factors:

| • | “The Company’s operations are dependent on the accessibility and reliability of existing localinfrastructure, and its exploration activities are dependent upon adequate infrastructure being available inthe future.” |

| | |

| • | “If the Company is unable to hire, train, deploy and manage qualified personnel in a timely manner,particularly in Mexico, its ability to manage and grow its business will be hampered.” |

| | |

| • | “The Company is in a highly competitive industry with many large competitors, and it expects thatcompetition may intensify in the future.” |

Foreign Operations

The Company currently owns, among other interests, 100% of the San Francisco Property in Sonora, Mexico, 100% of the Ana Paula Project in Guerrero, Mexico and 100% of the Caballo Blanco Project in Veracruz, Mexico. The Company’s operations are exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties include but are not limited to: terrorism and hostage taking, expropriation or nationalization without adequate compensation, difficulties enforcing judgements obtained in Canadian or United States courts against assets located outside of those jurisdictions, high rates of inflation, changes to royalty and tax regimes, substantial fluctuations in currency exchange rates, volatile local political and economic developments, difficulty understanding and complying with the regulatory and legal framework respecting the ownership and maintenance of mineral properties, mines and mining operations, reduced variability of fuel price as a component of cost structure, and difficulty obtaining key equipment and components for equipment.

8

The Company’s business is subject to a variety of federal, state, provincial and local laws and regulations in Mexico and Canada. Mexican regulators have broad authority to shut down and/or levy fines against facilities that do not comply with regulations or standards. The costs associated with compliance with these laws and regulations are substantial and possible future laws and regulations, changes to existing laws and regulations or more stringent enforcement of current laws and regulations by governmental authorities could cause additional expense, capital expenditures, restrictions on or suspensions of the Company’s operations and delays in the development of its properties.

The Company is required to obtain and renew governmental permits and licenses for its operations and expansion or for the development, construction and commencement of new operations. The Company may not be able to obtain or renew permits or licenses that are necessary to its operations. Unexpected delays, costs or other challenges could delay the development of or impede the operation of a mine or the Company’s ability to carry out mining activities.

See the following “Risk Factors”:

| • | “The Company is subject to particular risks associated with doing business in Mexico, any of which couldresult in additional costs to the Company and cause its operating results to suffer.” |

| | |

| • | “The Company’s business is subject to various governmental regulations and compliance with theseregulations may cause the Company to incur significant expenses. If the Company fails to maintaincompliance with applicable regulations, it may be forced to pay fines, be subject to civil penalties or beforced to temporarily halt or cease operations.” |

| | |

| • | “The Company may be unable to obtain or renew required government permits, or may only be able to doso at significant expense, which may harm its operating results.” |

RISK FACTORS

Risk Factors Relating to the Company’s Business

The Company may not be able to generate sufficient cash to service all of its indebtedness, and may be forced to take other actions to satisfy its obligations under such indebtedness, which may not be successful.

The Company’s ability to make scheduled payments on or refinance its debt obligations depends on its financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond the Company’s control. The Company may be unable to maintain a level of cash flow from operating activities sufficient to permit it to pay the principal, premium, if any, and interest on its indebtedness.

If the Company’s cash flows and capital resources are insufficient to fund its debt service obligations, the Company could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures or to dispose of material assets or operations, seek additional debt or equity capital or restructure or refinance its indebtedness. The Company may not be able to effect any such alternative measures on commercially reasonable terms or at all and, even if successful, those alternatives may not allow it to meet its scheduled debt service obligations.

9

The Company may not be able to refinance, extend or repay its substantial indebtedness owed to its senior secured lender, which would have a material adverse affect on the Company’s financial condition and ability to continue as a going concern.

As of December 31, 2015, the Company owed its senior secured lender $10.2 million (Senior Debt Amount), payable on June 30, 2016. If the Company is unable to raise sufficient capital to repay this obligation at maturity and it is otherwise unable to extend the maturity date or refinance this obligation, it would be in default. The Company cannot provide any assurances that it will be able to raise the necessary amount of capital to repay this obligation or that it will be able to extend the maturity date or otherwise refinance this obligation. Upon a default of the Senior Debt Amount, the Company’s senior secured lender would have the right to exercise its rights and remedies to collect, which would include foreclosing on the Company’s assets. Accordingly, a default would have a material adverse effect on the Company’s business and, if the Company’s senior secured lender exercises its rights and remedies, the Company would likely be forced to seek bankruptcy protection.

The Company’s revenue is derived primarily from the sale of gold, and therefore decreases in the price of gold may cause the Company’s revenue to decrease substantially.

The majority of the Company’s revenue is derived from the sale of gold, and therefore fluctuations in the price of gold represent one of the most significant factors affecting the Company’s operations and profitability. To a lesser extent, the Company also generates revenue from other by-product or co-product metals, such as silver. The price of gold and other commodities has fluctuated widely in recent years and is affected by numerous factors beyond the Company’s control, including:

| • | levels of supply and demand; |

| | |

| • | global or regional consumptive patterns; |

| | |

| • | sales by government holders; |

| | |

| • | metal stock levels maintained by producers and others; |

| | |

| • | increased production due to new mine developments and improved mining and production methods; |

| | |

| • | speculative activities; |

| | |

| • | inventory carrying costs; |

| | |

| • | availability and costs of metal substitutes; |

| | |

| • | international economic and political conditions; |

| | |

| • | interest rates; |

| | |

| • | currency values; and |

| | |

| • | inflation or deflation. |

The market price of gold and other metals may decline from current levels. Declining market prices for gold or other metals could materially adversely affect the Company’s operations and profitability. Further, a decline in the market price of gold may also require the Company to write-down its mineral reserves or resources, which would have a material adverse effect on its earnings and profitability.

10

The Company operates in a highly competitive industry with many large competitors, and it expects that competition may intensify in the future.

The gold mining industry is intensely competitive, and the Company competes with other companies that have greater financial and human resources and technical facilities. Competition is primarily for mineral-rich properties which can be developed and produced economically; the technical expertise to find, develop, and produce such properties; the labor and equipment to operate such properties; and the capital to finance the development of such properties. Many of the Company’s competitors not only explore for and mine precious metals, but conduct refining and marketing operations on a worldwide basis and have far greater financial and technical resources than the Company. Such competition may result in the Company being unable to acquire desired properties, recruit or retain qualified employees or acquire the capital necessary to fund its operations and develop its properties, which could have an adverse effect on results.

The Company is subject to particular risks associated with doing business in Mexico, any of which could result in additional costs to the Company and cause its operating results to suffer.

The Company’s only operating mine and all of its exploration and development properties are located in Mexico. In the past, Mexico has been subject to a number of risks and uncertainties, including:

| • | terrorism and hostage taking; |

| | |

| • | expropriation or nationalization without adequate compensation; |

| | |

| • | difficulties enforcing judgments obtained in Canadian or United States courts against assets located outside of those jurisdictions; |

| | |

| • | high rates of inflation; |

| | |

| • | changes to royalty and tax regimes; |

| | |

| • | substantial fluctuations in currency exchange rates; |

| | |

| • | volatile local political and economic developments; |

| | |

| • | difficulty understanding and complying with the regulatory and legal framework respecting the ownership and maintenance of mineral properties, mines and mining operations; |

| | |

| • | as the price of fuel is set by the federal government the fuel component of cost structure is not necessarily determined by market forces; and |

| | |

| • | difficulty obtaining key equipment and components for equipment. |

Criminal activities in the State of Guerrero, where the Company’s Ana Paula Project is located, or the perception that criminal activities are likely, may disrupt operations, hamper the ability to hire and keep qualified personnel and impair access to sources of capital. Risks associated with conducting business in the region include risks related to personnel safety and asset security. Risks may include, but are not limited to: kidnappings of employees and contractors, exposure of employees and contractors to local crime related activity and disturbances, exposure of employees and contractors to drug trade activity, and damage or theft including future gold shipments, if any. These risks could result in serious adverse consequences including personal injuries or death, property damage or theft, limiting or disrupting operations, restricting the movement of funds, impairing contractual rights and causing the Company to shut down operations, all of which may expose the Company to costs as well as potential liability. Such events could have a material adverse effect on the Company’s cash flows, earnings, results of operations and financial condition and make it more difficult for the Company to obtain required financing. Although the Company intends to develop procedures regarding these risks, due to the unpredictable nature of criminal activities, there is no assurance that the Company’s efforts will effectively mitigate risks and safeguard personnel and the Company property effectively.

11

Any of these factors, among others, may cause changes in the existing business or regulatory environment in Mexico with respect to mineral exploration and mining activities, which could result in additional costs to the Company and thereby cause its operating results to suffer. In addition, the enforcement by the Company of its legal rights to exploit its properties may not be recognized by the government of Mexico or by its court system. These risks, along with any variation from the current regulatory, economic and political climate may limit or disrupt the Company’s operations, restrict the movement of funds or result in the deprivation of contractual rights. The Company obtains insurance coverage to partially mitigate risk; however, there is no assurance that adequate insurance will be available to cover all risks or if insurance coverage is available the cost of coverage might be prohibitive.

The Company’s business is subject to various governmental regulations, and compliance with these regulations may cause the Company to incur significant expenses. If the Company fails to maintain compliance with applicable regulations, it may be forced to pay fines, be subject to civil penalties or be forced to temporarily halt or cease operations.

The Company’s business is subject to a variety of federal, state, provincial and local laws and regulations in Mexico and Canada, including:

| • | environmental protection; |

| | |

| • | management and use of toxic substances and explosives; |

| | |

| • | management of natural resources; |

| | |

| • | exploration, development, production and post-closure reclamation of mines; |

| | |

| • | imports and exports; |

| | |

| • | price controls or production restrictions; |

| | |

| • | taxation; |

| | |

| • | mining royalties; |

| | |

| • | labor standards and occupational health and safety, including mine safety; and |

| | |

| • | historical and cultural preservation. |

The Company’s activities relating to the San Francisco Property are subject to, among other things, regulations promulgated by SEMARNAT, Mexico’s environmental protection agency; DGM, the Mexican Department of Economy—Director General of Mines; and the regulations of CONAGUA, the Comisión Nacional del Agua with respect to water rights. Mexican regulators have broad authority to shut down or levy fines against facilities that do not comply with regulations or standards.

The costs associated with compliance with these laws and regulations are substantial and possible future laws and regulations, changes to existing laws and regulations or more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of the Company’s operations and delays in the development of its properties. Moreover, these laws and regulations may allow governmental authorities and private parties to bring lawsuits based upon damages to property and injury to persons resulting from the environmental, health and safety impacts of the Company’s past and current operations, or possibly even those actions of parties from whom the Company acquired its properties, and could lead to the imposition of substantial fines, penalties or other civil or criminal sanctions. It is difficult to strictly comply with all regulations imposed on the Company, and even with the application of considerable care the Company may inadvertently fail to comply with certain laws. Such events can lead to fines, penalties, loss, reduction or expropriation of entitlements, the imposition of additional local or foreign parties as joint venture partners and other material negative impacts on the Company.

12

If the Company is unable to hire, train, deploy and manage qualified personnel in a timely manner, particularly in Mexico, its ability to manage and grow its business will be impaired.

Recruiting and retaining qualified personnel is critical to the Company’s success. The Company is dependent on the services of key executives including our President and Interim Chief Executive Officer and other highly skilled and experienced executives and personnel focused on managing the Company’s interests. The number of persons skilled in acquisition, exploration and development of mining properties is limited and competition for such persons is intense. As the Company’s business activity grows, the Company will require additional key financial, administrative and mining personnel as well as additional operations staff, particularly in Mexico. The Company may not be successful in attracting, training and retaining qualified personnel as competition for persons with these skill sets increases. If the Company is not successful in attracting, training and retaining qualified personnel, the efficiency of its operations could be impaired, which could have an adverse impact on its future cash flows, earnings, results of operations and financial condition.

It may be particularly difficult to find or hire qualified personnel in the mining industry who are situated in Mexico, to obtain all of the necessary services or expertise in Mexico, or to conduct operations on the Company’s projects at reasonable rates. If qualified personnel cannot be obtained in Mexico, the Company may need to obtain those services outside of Mexico, which will require work permits and compliance with applicable laws and could result in delays and higher costs to the Company.

The Company may be unable to obtain or renew required government permits, or may only be able to do so at significant expense, which may harm its operating results.

In the ordinary course of business, the Company is required to obtain and renew governmental permits and licenses for the operation and expansion of existing operations or for the development, construction and commencement of new operations. Obtaining or renewing the necessary governmental permits and licenses is a complex and time-consuming process, often involving public hearings and costly undertakings on the Company’s part.

The duration and success of the Company’s efforts to obtain and renew permits and licenses are contingent upon many variables not within its control, including the interpretation of applicable requirements implemented by the permitting authority. The Company may not be able to obtain or renew permits or licenses that are necessary to its operations, or the cost to obtain or renew permits or licenses may exceed what the Company believes it can recover from a given property once in production. Any unexpected delays or costs associated with the permitting and licensing process, including challenges to the terms of such permits or licenses, whether successful or unsuccessful, could delay the development or impede the operation of a mine, which could adversely impact the Company’s operations and profitability.

The Company plans to apply for certain permits relating to the Caballo Blanco Project, which the project’s prior owners were unable to obtain in the past. If the Company is unable to obtain such permits, it may be unable to complete the development of the Caballo Blanco Project, which would have an adverse impact on the Company’s future cash flows, earnings, results of operations and financial condition.

In order for the Company to carry out its mining activities, its exploitation licenses must be kept current. There is no guarantee that the Company’s exploitation licenses will be extended or that new exploitation licenses will be granted. In addition, such exploitation licenses could be changed and applications to renew existing licenses may not be approved. The Company may also be required to contribute to the cost of providing the required infrastructure to facilitate the development of its properties, and will also be required to obtain and comply with permits and licenses that may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies, abandonment and restoration plans and financial assurances. The Company may not be able to comply with any such conditions.

13

Failure to discover new reserves, maintain or enhance existing reserves or develop new operations could negatively affect the Company’s future results and financial condition.

The long-term operation of the Company’s business and its profitability is dependent, in part, on the cost and success of its exploration and development programs. Most of the Company’s properties are in the exploration and development stages and only the San Francisco Property has mineralization considered a mineral reserve pursuant to CIM standards. Mineral exploration and development involves a high degree of risk and few properties that are explored are ultimately developed into producing mines. The Company’s mineral exploration and development programs may not result in any discoveries of bodies of commercially viable mineralization, and even if commercial quantities of mineralization are discovered, the Company may not be able to bring the mineral property into commercial production. Development of the Company’s mineral properties will follow only upon obtaining satisfactory exploration results. Discovery of mineral deposits is dependent upon a number of factors, not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit once discovered is also dependent upon a number of factors, some of which are the particular attributes of the deposit (such as size, grade and proximity to infrastructure), metal prices, permitting, anticipated capital and operating costs and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals and environmental protection. Most of the above factors are beyond the Company’s control. As a result, the Company’s acquisition, exploration and development programs may not yield new reserves to replace or expand current reserves. Unsuccessful exploration or development programs could have a material adverse affect on the Company’s operations and profitability.

In addition, the Company’s ability to sustain its present levels of gold production is dependent upon the identification of additional reserves at the Mine. If the Company is unable to develop new ore bodies, it may not be able to sustain or increase present production levels. Reduced production would have a material and adverse affect on future cash flows, results of operations and financial condition.

The Company is subject to various operating risks and hazards associated with its exploration and mining operations, any of which could cause it to incur substantial expenses or affect the economic feasibility of its projects. The Company may be unable to insure against such risks, or to insure against such risks at a reasonable cost.

The ownership, operation and development of a mine or mineral property involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These risks include:

| | • | environmental hazards; |

| | | |

| | • | industrial accidents, explosions and third party accidents; |

| | | |

| | • | the encountering of unusual or unexpected geological formations; |

| | | |

| | • | ground falls, rock bursts, cave-ins and seismic activity including earthquakes; |

| | | |

| | • | fires and flooding; |

| | | |

| • | metallurgical and other processing problems, including the availability and costs of processing and refining facilities; |

| | | |

| | • | availability of economic sources of power; |

| | | |

| | • | variations in grade, deposit size, density and other geological problems; |

| | | |

| | • | unanticipated adverse geotechnical conditions; |

| | | |

| | • | incorrect data on which engineering assumptions are made; |

14

| | • | mechanical equipment performance problems; |

| | | |

| | • | unavailability or significant changes in the cost of materials and equipment including fuel; |

| | | |

| | • | labor force disruptions; |

| | | |

| | • | title claims, including aboriginal land claims; |

| | | |

| | • | unanticipated transportation costs; and |

| | | |

| | • | periodic interruptions due to inclement or hazardous weather conditions. |

These occurrences could result in:

| | • | environmental damage and liabilities; |

| | | |

| | • | work stoppages, delayed production and resultant losses; |

| | | |

| | • | increased production costs; |

| | | |

| | • | damage to, or destruction of, mineral properties or production facilities and resultant losses; |

| | | |

| | • | asset write downs; |

| | | |

| | • | monetary losses; |

| | | |

| • | claims for compensation of loss of life and/or damages in connection with accidents that occur on company property, and punitive awards in connection with those claims; and |

| | | |

| | • | other liabilities. |

These factors, among others, may cause anticipated capital and operating costs, production and economic returns, or other estimates to differ significantly from the Company’s actual capital and operating costs. It is not always possible to fully insure against such risks and the Company may decide not to insure against such risks due to high premiums or for other reasons. Should any such uninsured liabilities arise, they could adversely impact the Company’s profitability.

The Company’s operations are dependent on the accessibility and reliability of existing local infrastructure, and its exploration activities are dependent upon adequate infrastructure being available in the future.

Mining, processing, development and exploration activities depend, to some degree, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay exploitation or development of the Company’s projects. If adequate infrastructure is not available in a timely manner, the exploitation or development of the Company’s projects may not be commenced or completed on a timely basis, if at all. In addition, the resulting operations may not achieve the anticipated production volume, or the construction costs and ongoing operating costs associated with the exploitation and/or development of the Company’s advanced projects will be higher than anticipated. In addition, unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Company’s operations and profitability.

The Company is subject to extensive environmental regulation, and any failure of compliance could result in fines or government sanctions, civil liabilities and damage to its reputation.

All phases of the Company’s operations are subject to environmental laws and regulations. These laws and regulations set certain standards regarding health and environmental quality, and provide for penalties and other liabilities for violations, as well as obligations to rehabilitate current and former properties in certain circumstances. Furthermore, operating permits could be temporarily withdrawn where there is evidence of serious breaches of health and safety, or even permanently, in the case of extreme breaches. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous owners of acquired properties or noncompliance with environmental laws. In addition, environmental legislation in Mexico is generally evolving in a manner which will require stricter standards and will be subject to increased enforcement, fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. Such changes in environmental regulation, if any, may adversely impact the Company’s operations and profitability.

15

Land reclamation requirements may be burdensome.

Land reclamation requirements are generally imposed on companies with mining operations in order to minimize the long term effects of land disturbance, and the Company is subject to such requirements at its mineral properties. Reclamation obligations include requirements to:

| | • | control dispersion of potentially harmful effluents; and |

| | | |

| | • | reasonably re-establish pre-disturbance land forms and vegetation. |

In order to carry out reclamation obligations arising from exploration and development activities, the Company must allocate financial resources that might otherwise be spent on further exploration and development programs. If the Company is required to carry out unanticipated reclamation work, its financial position could be adversely affected.

The Company’s production and exploration depend on its ownership of, or control over, the properties on which it operates, and maintaining existing property rights or obtaining new rights is a highly competitive and costly process.

The Company’s ability to carry out successful mining activities will depend in part on its ability to obtain tenure to its properties to the satisfaction of international lending institutions. The issue of any such licenses must be in accordance with Mexican law and, in particular, relevant mining legislation. The validity of mining or exploration titles or claims or rights, which constitute most of the Company’s property holdings, can be uncertain and may be contested. The Company has used reasonable commercial efforts to investigate its title or claims to its various properties and, to its knowledge, except where it has otherwise identified, those titles or claims to material properties are in good standing. However, the Company has not conducted surveys of all the claims in which it holds direct or indirect interests and therefore, the precise area and location of such claims may be in doubt. The Company’s properties may also be subject to prior unregistered liens, agreements or transfers, native land claims or undetected title defects. The Mexican government may revoke or significantly alter the conditions of the applicable exploration and mining titles or claims, and such exploration and mining titles or claims may be challenged or impugned by third parties, which could materially impact the Company’s rights to its various properties or interests. In addition, the Company has recently formalized its interests in the Caballo Blanco Project and related properties acquired pursuant to the Asset Purchase Agreement. Title insurance is generally not available for mining properties, and the Company’s ability to ensure that it has obtained secure claims to individual mineral properties or mining concessions may be severely constrained.

Mines have limited lives and, as a result, the Company continually seeks to replace and expand reserves through the acquisition of new properties. In addition, there is a limited supply of desirable mineral lands available in areas where the Company would consider conducting exploration, development and/or production activities. Because the Company faces strong competition for new properties from other mining companies, some of which have greater financial resources than it does, the Company may be unable to acquire attractive new mining properties on terms that it considers acceptable. Competition in the mining business for limited sources of capital could adversely impact the Company’s ability to acquire and develop suitable mines, developmental projects or properties having significant exploration potential. As a result, the Company’s acquisition, exploration and development programs may not yield new mineral reserves to replace or expand current mineral reserves.

16

The process of estimating mineral reserves and resources is subject to inherent uncertainties, and reported reserves and resources may not accurately reflect the economic viability of the Company’s properties.

There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources. Until mineral reserves or mineral resources are actually mined and processed, the quantity of mineral and reserve grades must be considered as estimates only. Levels of metals indicated by such mineral reserves or mineral resources may not be produced, and the Company may not receive the price assumed in determining its reserves. These estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While the Company believes that the reserve and resource estimates included in this MD&A are well established and reflect management’s best estimates, by their nature reserve and resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences that may ultimately prove unreliable.

Furthermore, fluctuations in the market price of metals, as well as increased capital or production costs or reduced recovery rates may render ore reserves uneconomic and may ultimately result in a reduction of reserves. The extent to which resources may ultimately be reclassified as proven or probable reserves is dependent upon the demonstration of their profitable recovery. The evaluation of reserves or resources is always influenced by economic and technological factors, which may change over time. Resource estimates may not ultimately be reclassified as proven or probable reserves. If the Company’s reserve or resource figures are inaccurate or are reduced in the future, this could have an adverse affect on its future cash flows, earnings, results of operations and financial condition.

In estimating its reserves and resources, the Company relies on laboratory-based recovery models to project estimated recoveries by ore type at optimal crush sizes. Actual gold recoveries in a commercial heap leach operation may exceed or fall short of projected laboratory test results. In addition, the grade of mineralization ultimately mined may differ from the one indicated by the drilling results and the difference may be material. Production can be affected by such factors as permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations, inaccurate or incorrect geological, metallurgical or engineering work and work interruptions, among other things. Short term factors, such as the need for an orderly development of deposits or the processing of new or different grades, may have an adverse effect on mining operations or the results of those operations. Minerals recovered in small scale laboratory tests may not be duplicated in large scale tests under on-site conditions or in production-scale operations. Material changes in proven and probable reserves or resources, grades, waste-to-ore ratios or recovery rates may affect the economic viability of projects. The estimated proven and probable reserves and resources the Company discloses should not be interpreted as assurances of mine life or of the profitability of future operations.

The Company has engaged expert independent technical consultants to advise it on, among other things, mineral reserves and resources and project engineering at the Mine. The Company believes these experts are competent and that they have and will carry out their work in accordance with internationally recognized industry standards. If, however, the work conducted and to be conducted by these experts is ultimately found to be incorrect or inadequate in any material respect, the Company may experience delays and increased costs.

The process of estimating future mine production and related costs are subject to inherent uncertainties, and actual results may differ materially from such estimates.

The Company periodically prepares estimates of future mine production and future production costs for the Mine. There can be no assurance that the Company will achieve these production estimates. These production estimates are dependent on, among other things, the accuracy of underlying mineral reserve estimates; the accuracy of assumptions regarding ore grades and recovery rates, ground conditions and physical characteristics of ores; equipment and mechanical availability; labor availability; facilities and infrastructure; having sufficient materials and supplies on hand; and the accuracy of estimated rates and costs of mining and processing. Failure to achieve production estimates could have a material and adverse effect on any or all of the Company’s future cash flows, results of operations and financial condition.

17

The Company’s actual production and costs may vary from its estimates for a variety of reasons, including actual ore mined varying from estimates of grade, tonnage, dilution and metallurgical and other characteristics; short-term operating factors, such as the need for sequential development of ore bodies and the processing of new or different ore grades from those planned; and the risks and hazards associated with mining described throughout these “Risk Factors Relating to the Company’s Business”. In addition, metal recoveries in small scale laboratory tests may not be duplicated in larger scale tests under on-site conditions or during production, and known and experienced recoveries may not continue. Costs of production may also be affected by changing stripping ratios, ore grade metallurgy, labor costs, costs of supplies and services (such as, for example, fuel and power), general inflationary pressures and currency exchange rates. Failure to achieve cost estimates could have a material and adverse effect on any or all of the Company’s future cash flows, results of operations and financial condition.

The expansion and development of the Company’s mining properties is uncertain and subject to risk.

The development of the Company’s properties that are found to be economically feasible will require the expansion and improvement of existing mining operations, as well as the construction and operation of additional mines, processing plants and related infrastructure. As a result, the Company is subject to all of the risks associated with establishing and expanding mining operations and business enterprises including:

| • | the timing and cost, which will be considerable, of the construction of additional mining and processing facilities; |

| | | |

| | • | the availability and costs of skilled labor, power, water, transportation and mining equipment; |

| | | |

| | • | the availability and cost of appropriate smelting and/or refining arrangements; |

| | | |

| • | the need to obtain necessary environmental and other governmental approvals, permits and licenses, and the timing of those approvals, permits and licenses; and |

| | | |

| | • | the availability of funds to finance construction and development activities. |

It is not unusual in new mining operations to experience unexpected problems and delays during the construction and development of a mine. In addition, delays in the commencement or expansion of mineral production often occur and, once commenced or expanded, the production of a mine may not meet expectations or estimates set forth in feasibility or other studies. Accordingly, the Company may not be able to successfully develop and expand mining operations or profitably produce precious metals at its exploration or development-stage properties.

The Company’s results may be negatively affected by currency exchange rate fluctuations.

Fluctuations in currency exchange rates, particularly the weakening or strengthening of the U.S. dollar (being the currency in which the Company’s products are sold) against the Mexican peso (being the currency in which the majority of the Company’s capital and operating costs are incurred), could have a significant impact on the Company’s results of operations. The Company does not currently have a formal policy of actively managing such currency fluctuations, and therefore, such fluctuations may have a significant impact on its financial results in any given period.

Some of the Company’s directors and officers have interests that may be different than the Company’s interests.

Some of the Company’s directors and officers are engaged and will continue to be engaged in the search for additional business opportunities on behalf of other companies, and situations may arise where these directors and officers will be in direct competition with the Company. Conflicts, if any, will be dealt with in accordance with the relevant provisions of theBusiness Corporations Act (British Columbia). Some of the Company’s directors and officers are or may become directors or officers of other companies engaged in other business ventures. In order to avoid potential conflicts of interest which may arise between the directors’ and officers’ duties to the Company and their duties to other companies, the Company’s directors and officers have agreed to the following:

18

| • | participation in other business ventures will be allocated on the basis of prudent business judgment and the relative financial abilities and needs of the companies to participate; |

| | | |

| | • | no commissions or other extraordinary consideration will be paid to such directors and officers; and |

| | | |

| • | business opportunities arising through other companies in which such directors and officers are involved will not be offered to the Company except on the same or better terms than the basis on which they are offered to third party participants. |

In addition, the Company’s Corporate Governance and Nominating Committee has developed, and its board of directors has adopted, guidelines which require all directors to disclose all conflicts of interest and potential conflicts of interest to the Company.

The Company’s inability to access additional capital could have a negative impact on its growth strategy.

The Company currently has limited financial resources and operating income, and adequate funding may not be available to further its exploration and development projects. The Company may need to raise additional capital to fund its operations, and such capital may not be available on commercially acceptable terms, if at all. If the Company is unable to obtain additional capital on commercially acceptable terms, the Company may be forced to reduce or curtail its operations or its anticipated exploration activities. Although the Company has been successful in the past in financing its activities through the sale of equity securities, it may not be able to obtain sufficient financing in the future. The Company’s ability to arrange additional financing in the future will depend, in part, on the prevailing capital market conditions as well as the business performance of the Company.

The Company may experience problems integrating new acquisitions and other problems associated with strategic transactions.

Strategic transactions, including acquisitions or dispositions of assets, could involve numerous risks, including:

| | • | potential disruption of the Company’s ongoing business and distraction of management; |

| | | |

| | • | difficulty integrating acquired businesses or segregating assets to be disposed of; |

| | | |

| • | exposure to unknown and/or contingent or other liabilities, including litigation arising in connection with the acquisition, disposition and/or against any businesses the Company may acquire, and |

| | | |

| | • | changing the Company’s business profile in ways that could have unintended consequences. |

The Company’s success at completing acquisitions will depend on a number of factors, including, but not limited to, identifying acquisitions that fit its strategy, negotiating acceptable terms with the seller of the business or property to be acquired and obtaining approval from regulatory authorities in the jurisdictions of the business or property to be acquired. Any positive effect on the Company’s results from its acquisitions, including the Caballo Blanco Project acquisition, and the acquisition of Newstrike, will depend on a variety of factors, including, but not limited to, assimilating the operations of an acquired business or property in a timely and efficient manner, the ability to achieve identified and anticipated operating and financial synergies, the decline in value of acquired properties, companies or securities, maintaining the Company’s financial and strategic focus while integrating the acquired business or property, managing the potential loss of the Company’s key employees or key employees of any business acquired, implementing uniform standards, controls, procedures and policies at the acquired business, as appropriate, and conducting and managing operations in a new operating environment. In addition, the financing of any significant acquisition may result in changes in its capital structure, including the incurrence of additional indebtedness. Conversely, any material disposition could reduce its indebtedness or require the amendment or refinancing of a portion of its outstanding indebtedness. The Company may not be successful in addressing these risks or any other problems encountered in connection with any strategic transactions.

19

The Company may from time to time become subject to legal proceedings.

The Company may from time to time, become involved in various claims, legal proceedings, regulatory investigations, and complaints arising in the ordinary course of business. The Company cannot reasonably predict the likelihood or outcome of these actions, should they arise. If it is unable to resolve any such disputes favorably, it may have a material adverse impact on the Company’s financial performance, cash flow and results of operations. In particular, see “Legal Proceedings and Regulatory Actions”.

The Company faces risks and uncertainties related to the repatriation of funds from its foreign subsidiaries.

The Company expects to generate cash flow and profits at its foreign subsidiaries, and it will need to repatriate funds from those subsidiaries to service its indebtedness or fulfill its business plans, in particular in relation to ongoing expenditures at its exploration and development assets. The Company may not be able to repatriate funds, or may incur tax payments or other costs when doing so, as a result of a change in applicable law or tax requirements at local subsidiary levels or at the parent level, which costs could be substantial.

Risk Factors Relating to the Company’s Common Shares

The Company does not intend to pay dividends for the foreseeable future.

The Company has never declared or paid any cash dividends on the Company’s common shares and does not intend to pay any cash dividends in the foreseeable future. The Company anticipates that it will retain all of its future earnings for use in the development of its business and for general corporate purposes. Any determination to pay dividends in the future will be at the discretion of the Company’s board of directors. In addition, from time to time the Company may enter into agreements that restrict its ability to pay dividends.

The price of the Company’s common shares may be volatile.

The trading price of the Company’s common shares has been and may continue to be subject to material fluctuations and may increase or decrease in response to a number of events and factors, including:

| • | changes in the market price of the commodities the Company sells and purchases, particularly gold and silver; |

| | | |

| • | current events affecting the economic situation and exchange rates in Canada, the United States, Mexico and internationally; |

| | | |

| | • | changes in financial estimates and recommendations by securities analysts; |

| | | |

| | • | acquisitions and financings; |

| | | |

| | • | quarterly variations in operating results; |

| | | |

| | • | the operating and share price performance of other companies that investors may deem comparable; |

| | | |

| • | the issuance of additional equity securities by the Company or the perception that such issuance may occur; and |

| | | |

| | • | purchases or sales of blocks of the Company’s common shares. |

Part of this volatility may also be attributable to the current state of the stock market, in which wide price swings are common. This volatility may adversely affect the prices of the Company’s common shares regardless of the Company’s operating performance and could cause the market price of the Company’s common shares to decline.

20

The Company may not be able to maintain compliance with the continued listing requirements of NYSE MKT.

The Company’s common stock is listed on the NYSE MKT. In order to maintain that listing, the Company must satisfy minimum financial and other requirements including, without limitation, a requirement that the Company’s closing bid price be at least $0.20 per share. If the Company fails to continue to meet all applicable continued listing requirements for the NYSE MKT in the future and the NYSE MKT determines to delist the Company’s common stock, the delisting could adversely affect the market liquidity of the Company’s common stock, the Company’s ability to obtain financing to repay debt and fund the Company’s operations.

If securities analysts or industry analysts downgrade the Company’s common shares, publish negative research or reports, or do not publish reports about the Company’s business, the price of and trading volume of the Company’s common shares could decline.

The trading market for the Company’s common shares will be influenced by the research and reports that industry or securities analysts publish about the Company, its business and its market. If one or more analysts adversely change their recommendation regarding the Company’s common shares or its competitors’ securities, the price of the Company’s common shares would likely decline. If one or more analysts cease covering or fail to regularly publish reports about the Company, it could lose visibility in the financial markets, which in turn could cause its share price or trading volume to decline. In addition, the Company’s common shares price could be adversely affected by negative stories written or broadcast about it.

Holders of the Company’s common shares may experience dilution when outstanding options are exercised, or as a result of additional securities offerings which may reduce the Company’s earnings per share.

There are a number of outstanding options pursuant to which additional common shares of the Company may be issued in the future. Exercise of such options may result in dilution to the Company shareholders. In addition, if the Company raises additional funds to finance its activities, through the sale of equity securities, shareholders may have their investment diluted. If the Company issues additional common shares, shareholders’ percentage ownership of the Company will decrease and shareholders may experience dilution in the Company’s earnings per share. Moreover, as the Company’s intention to issue any additional equity securities becomes publicly known, the common share price may be materially and adversely affected.

MINERAL PROPERTIES

San Francisco Property