Exhibit 99.1

ADISSIDENTISTRYINGTOTAKECONTROLOFYOURCOMPANY.

DON’TLETTHATHAPPEN. CHOOSEPROVENPERFORMANCE,

NOTVAGUEPROMISESANDANUNCERTAINFUTURE.

| | | | | | |

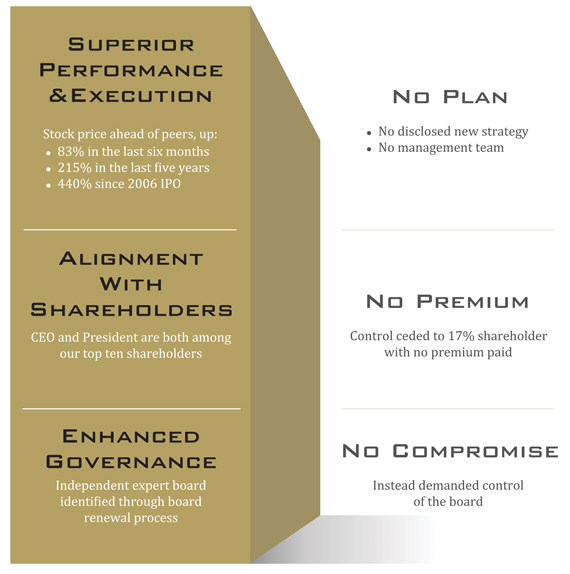

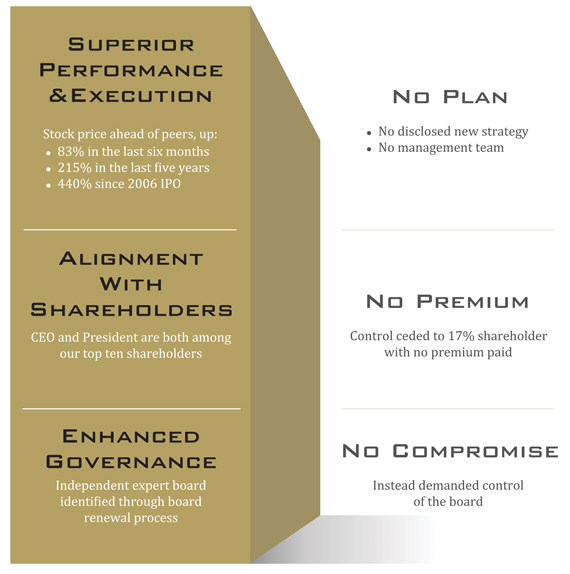

| | A vote for the Timmins Gold | | With Sentry’s dissident | | |

| | Nominees gets you: | | nominees you get: | | |

| | | | |

| | VOTE FORTHE TIMMINS GOLD NOMINEESONTHE WHITE FORMOF PROXY TODAY | | |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

Letter to Shareholders

June 23, 2014

Dear Fellow Shareholder:

You have an important choice to make about the future of your company, one that could significantly impact the value of your investment in Timmins Gold.

At the shareholders meeting on July 31, we urge you to elect the Timmins Gold Nominees to lead your Company’s future growth. REJECT thedissident nominees. They have no strategy and no management team. They offer only an uncertain future.

The seven Timmins Gold Nominees, of whom six are independent, have more than 170 years of combined mining and related business experience. The Timmins Gold Nominees have proven track records and the expertise and skills to meet the needs of your Company.

Each of the Timmins Gold Nominees shares our commitment to building long-term value for all shareholders. If elected, they intend to continue to evaluate and execute on the Company’s proven business strategy that has provided a 440% shareholder return since the initial public offering in 2006 and has increased year-over-year production by 154% since 2010.

The Timmins Gold Nominees include four new experienced and independent nominees who will bring unequalled technical, operational, financial and market expertise to our Board. These are the very best candidates identified through a rigorous Board renewal process undertaken by the Special Committee of independent directors formed to oversee the Company’s response to the dissident campaign by Sentry Investments Inc.

As part of the Board renewal process, the Special Committee:

| | — | | took into account Sentry’s expressed concerns; |

| | — | | engaged an independent legal advisor and Korn Ferry International, the leading international executive search firm; |

| | — | | received input from some of the Company’s largest shareholders; and |

| | — | | received input from RBC Capital Markets, which Timmins Gold has engaged as its financial advisor. |

The Board and the new nominees believe that the Board renewal process achieves many of the objectives sought by the dissident that are also of benefit to all shareholders. Moreover, the renewed Board will preserve the knowledge and experience of Timmins Gold’s operational and corporate management as well as the trust of local communities, if the Timmins Gold Nominees are elected. This knowledge, experience and trust will be lost if a dissident board is elected.

Your vote FOR the Timmins Gold Nominees is a vote:

FOR continued superior execution on a strategy that delivers results

The choice is clear. VOTE FOR theTimmins Gold Nominees, an expert, independent board who will oversee a management team with proven operating results. A vote for the Timmins Gold

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 1 |

Nominees is a vote for continued superior execution on our strategy that has already delivered a 440% shareholder return since the initial public offering in 2006.

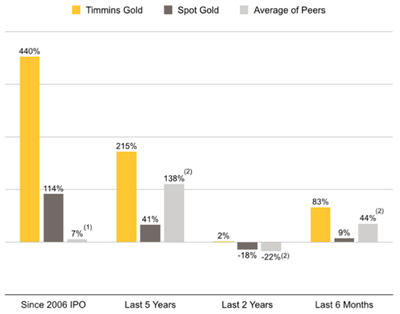

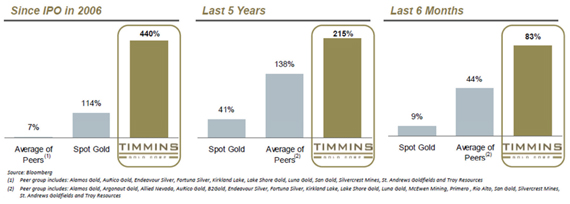

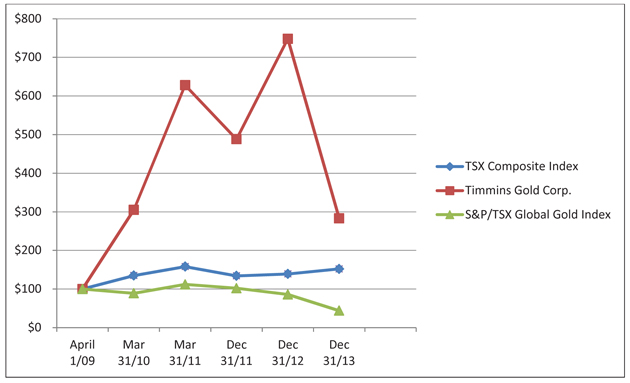

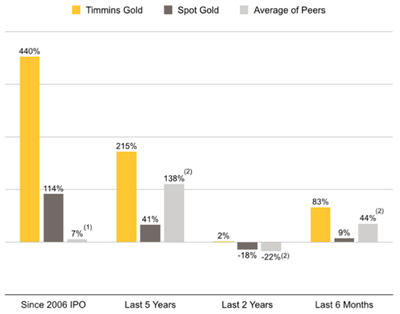

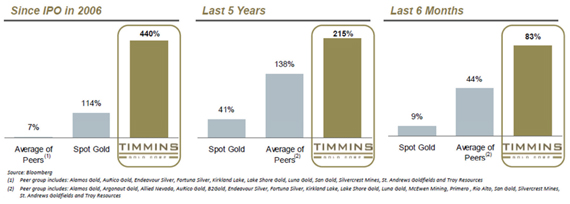

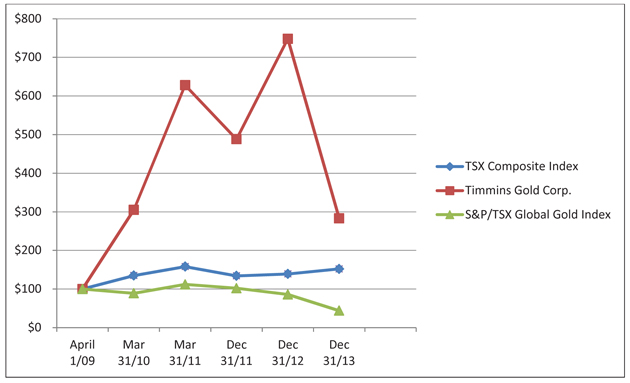

Under the leadership of our Board and management team, Timmins Gold has flourished and continues to generate significant cash flow despite challenging economic conditions and weak gold prices. Your Company has consistently outperformed its peers and the change in the spot price of gold as shown below:

| | (1) | Alamos Gold Inc., AuRico Gold Inc., Endeavour Silver Corp, Fortuna Silver Mines Inc., Kirkland Lake Gold Inc., Lake Shore Gold Corp, Luna Gold Corp, San Gold Corporation, Silvercrest Mines Inc., St. Andrews Goldfields Ltd., Troy Resources Limited. |

| | (2) | Alamos Gold Inc., Argonaut Gold Inc., Allied Nevada Gold Corp, AuRico Gold Inc., B2Gold Corp, Endeavour Silver Corp, Fortuna Silver Mines Inc., Kirkland Lake Gold Inc., Lake Shore Gold Corp, Luna Gold Corp, McEwen Mining Inc., Primero Mining Corp, Rio Alto Mining Limited, San Gold Corporation, Silvercrest Mines Inc., St. Andrews Goldfields Ltd., Troy Resources Limited. |

Your Company has also won the confidence of the investment community. Of the 14 investment banks that actively publish research on Timmins Gold, nine have given us superior ratings recommendations (buy or outperform). Here is a sampling of the positive comments from analyst reports after our first quarter results announcement on April 29, 2014:

| | — | | “This was another solid, free cash flow positive quarter for Timmins” (TD Securities Inc.) |

| | — | | “Smooth operations, well-cashed balance sheet” (Cowen and Co.) |

| | — | | Timmins Gold is“one of the few companies producing positive free cash flow at current gold prices” (Dundee Capital Markets) |

| | — | | “Timmins is a solid operating group doing what it said it was going to do, exceeding expectations the first part of the year and operating in a very safe part of the world” (GMP Securities L.P.) |

Moreover, Timmins Gold has initiated a strategic review process. While the Company will continue to execute on its strategy that has delivered superior shareholder returns, the strategic review process will enable the Company to:

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 2 |

| | — | | conduct a critical analysis of the Company’s existing strategy, business plan, market valuation, and capital structure; |

| | — | | review and identify key market and industry trends, opportunities and challenges; |

| | — | | explore and evaluate various alternatives to enhance shareholder value which may be available to the Company. |

The strategic review process will be overseen by the Special Committee of independent directors, which will be re-constituted with independent members of the new Board of Directors following the election.

FOR a management team whose interests are aligned with all shareholders’ interests

We believe a key reason for our continued success is the strong alignment of interests between management and our shareholders. Our CEO and our President are among our top ten shareholders, with a significant combined ownership of 3.3% of the issued and outstanding shares. Accordingly, the interests of management are fully aligned with those of all shareholders and their decisions are made with a view to building long-term shareholder value.

FOR an enhanced, independent Board that is responsive to shareholders

Corporate governance is important to us, which is why developing the Company’s approach to corporate governance is a continual process that is built into our Board mandate. Prior to this year, through a continual and measured Board renewal process, we added four new independent directors in the past three and a half years, including a new independent director as recently as December 2013.

As discussed in more detail in the accompanying management information circular, for this year’s election we identified and recruited four new, independent Timmins Gold Nominees through our Board renewal process. They, along with the three nominees who are already directors, are all highly qualified candidates, with the most appropriate experience, expertise and skills, to lead and oversee your Company’s continued growth.

Each of the Timmins Gold Nominees brings a track record in the successful development, operating and oversight of mining companies and/or technical, financial and capital markets expertise. Only one of our nominees, our CEO Mr. Bragagnolo, is part of our executive team. All of the other six nominees are independent. See the accompanying management information circular for additional biographical information on the Timmins Gold Nominees.

The Board renewal process was undertaken, in part, in response to feedback from our shareholders. While Sentry and its dissident nominees declined our invitation to participate, the Board renewal has taken Sentry’s expressed concerns into account.

WITHHOLD your vote from the dissident nominees

The intentions of the dissident, Sentry, are unclear and the future with a dissident board is uncertain.

| — | | No articulated business plan, strategy or management team – The dissident has provided no plan to improve upon the Company’s already strong performance or create additional shareholder value. Despite its criticisms of management, Sentry has not proposed a new management team. |

| — | | No compromise and false assertions – While the Company has been open to engaging in constructive dialogue with a view to addressing Sentry’s concerns, including a proposal to add Sentry nominees to the Board, Sentry has refused to engage in meaningful dialogue. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 3 |

| | Sentry also falsely asserted, among other things, that the Board has rebuffed potential acquirers. |

| — | | Control with no premium paid – If elected, Sentry’s six dissident nominees will represent 86% of the Board. This means that Sentry, with 17% of the shares, will have effective control of the Board and, indirectly, of your Company, and will have paid no premium for such control. |

| — | | Refusal to have nominees assessed – We invited the dissident nominees to participate in the Board renewal process so that the independent Special Committee, with assistance from Korn Ferry International, could evaluate the dissident nominees’ suitability along with all other candidates. Sentry refused to have its dissident nominees participate in the process. |

With your Company’s track record of superior performance, a proven strategy and management team that has delivered strong shareholder returns and, if the Timmins Gold Nominees are elected, an enhanced, independent Board, we do not believe that Sentry has made a compelling case for a change of control of the Board. Please seeReasons to Reject Sentry’s Dissident Nominees in the accompanying management information circular for more information.

The choice is clear, vote your WHITE form of proxy TODAY

It is very important for you toVOTE TODAY to protect the value of your investment in your Company. VoteFOR the Timmins Gold Nominees on theWHITE form of proxy and disregard the materials you receive from Sentry.

You are invested in a company that has delivered a 440% shareholder return since its initial public offering, under the leadership of a Board and management team with a proven track record of superior execution on a proven strategy and whose interests are aligned with those of all shareholders.

Sentry, a 17% shareholder, is attempting to take effective control of your Company without paying a premium for such control. Sentry has not offered a compelling case for change or articulated a clear strategy for the Company that would create greater shareholder value.

Act now to protect the value of your investment in Timmins Gold. Support the continuation of Timmins Gold’s sound and successful business strategy. Please use theWHITE form of proxy today to voteFOR the Timmins Gold Nominees.

We appreciate your continued support.

On behalf of the Board of Directors,

“Paula Rogers”

Paula Rogers

Chair of the Independent Special Committee

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 4 |

Reasons to Vote FOR the Timmins Gold Nominees

| 1. | Strong share price performance. Since the initial public offering in 2006, Timmins Gold has delivered a 440% shareholder return. If you had invested C$1,000 in Timmins Gold shares at the IPO price of C$0.35, your investment would be worth C$5,400 as of June 20, 2014. |

Your Company has consistently outperformed its peers and the change in the spot price of gold as shown below:

| 2. | Strong operational performance. Despite a challenging period of persistently low commodity prices, Timmins Gold has, among other accomplishments: |

| | — | | brought the San Francisco gold mine into production on time and on budget; |

| | — | | consistently grown production year-over-year, and by 154% since starting production in 2010; |

| | — | | grown reserves by 168%, measured and indicated resources by 161%, and inferred resources by 27 times (all net of depletion) since 2008; |

| | — | | increased crusher throughput by 140% over three years; |

| | — | | maintained flat cash costs since 2012; |

| | — | | established and grown a 100% local Mexican operating team, and earned local recognition for its commitment to social responsibility; |

| | — | | maintained a strong balance sheet; |

| | — | | posted significant positive free cash flow for the past three quarters, in a challenging gold price environment; and |

| | — | | carried out an extensive regional prospecting campaign and developed an exploration plan with the potential for two new mines, each of similar scale to the San Francisco gold mine. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 5 |

| 3. | Proven Board, management team and strategy. Timmins Gold’s Board and management team has overseen the development and successful execution of the Company’s strategy, recent growth and profitability. Timmins Gold’s success has been driven by operational excellence and a track record of continuous improvement. Timmins Gold is moving forward with positive momentum, a strong balance sheet and a clear focus on increasing production and containing or reducing costs. |

Timmins Gold has also recently embarked on a forward exploration plan with the potential for two new mines each of similar scale to its San Francisco gold mine. The Board believes that shareholders will be best served by the continued execution of this strategy, guided by a Board and management team who are experienced in the industry, familiar with Timmins Gold’s unique challenges and opportunities, and committed to the best long-term interests of all shareholders.

The Company has also recently initiated a strategic review process to, among other things, conduct a critical analysis of its strategy, identify market trends and opportunities, and explore and evaluate available value-enhancing alternatives. The strategic review process will be overseen by the Special Committee of independent directors, which will be re-constituted with independent members of the new Board of Directors following the election.

Through years of personal engagements and careful relationship-building efforts, Timmins Gold and its management team have won the trust of local communities around its San Francisco mine in Mexico. Timmins Gold believes that such trust is essential for successful mine operations.

Timmins Gold’s social and environmental programs have earned the Company the “Socially Responsible Business Distinction” award (2011 Distintivo Empresa Socialmente Responsable), which affirms Timmins Gold’s position as a leader in corporate social responsibility and environmental practices. Timmins Gold is recognized as a company that goes beyond mere legal and regulatory compliance and that shows a true commitment and respect to the environment and surrounding community.

The renewed Board will preserve the knowledge and experience of Timmins Gold’s operational and corporate management as well as the trust of local communities, if the Timmins Gold Nominees are elected. This knowledge, experience and trust will be lost if a dissident board is elected.

| 4. | Enhanced governance with independent Board and adoption of majority voting policy. As a group, the seven Timmins Gold Nominees have more than 170 years of relevant business experience. They have proven track records and the expertise and skills to meet the evolving needs of the Company as it continues to execute on its proven strategy. Individually, each of the Timmins Gold Nominees brings: industry knowledge, impeccable reputations for integrity, independent judgment and a commitment to building long-term shareholder value. |

The seven Timmins Gold Nominees include co-founder and CEO Bruce Bragagnolo and six independent nominees, including two who are already members of the Board and four who have been recruited as new nominees this year. The four new independent nominees will bring unequalled technical, operational, financial and market expertise to our Board. They are the very best candidates identified through a rigorous Board renewal process undertaken by the Special Committee with assistance from Korn Ferry International, the leading international executive search firm, and with input from some of the Company’s largest shareholders. If elected, these four new independent nominees and two continuing independent nominees will represent 86% of the new enhanced Board (six of seven directors).

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 6 |

Summaries of the backgrounds for the six independent Timmins Gold Nominees are as follows:

| | — | | George Brack, 52, has spent 29 years in the mining industry and in mining-focused investment banking. From 2000 to 2009 he was a mining-focused investment banker, serving successively as President and CEO of Macquarie North America and Managing Director, Industry Head, Mining with Scotia Capital Inc. Among other things, as an investment banker he advised clients on the sale of public companies and projects involving five gold mining assets in Mexico. From 1995 to 1999 he was Vice-President, Corporate Development for one of Canada’s largest gold miners, Placer Dome Inc. He is currently a director of several companies including Silver Wheaton Corp. and Capstone Mining Corp. He served as chair of the special committee of the boards of both Red Back Mining Inc. in 2010 and Aurizon Mines Ltd. in 2013 when they were acquired for $7.2 billion and $796 million, respectively. He has an MBA degree from York University, a Bachelor of Applied Science degree in Geological Engineering from the University of Toronto and has earned the Chartered Financial Analyst designation. He is a new Timmins Gold Nominee. |

| | — | | Bryan Coates, 56, has spent 30 years in the mining industry. He currently serves as President of Osisko Gold Royalties Ltd. and previously was VP Finance and Chief Financial Officer for Osisko Mining Corp. from 2007 until it was acquired earlier this month for $3.9 billion. Osisko developed and operated the Canadian Malartic mine, the largest gold mine in Quebec, and also conducted exploration work in Mexico. Before Osisko he served as VP Finance and Chief Financial Officer for IAMGOLD Corp. and Cambior Inc. Mr. Coates is a director of Golden Queen Mining Co. He has a Bachelor of Commerce degree from Laurentian University, and has earned the Chartered Accountant designation. He is a new Timmins Gold Nominee. |

| | — | | Stephen Lang, 58, a mining engineer, has spent more than 32 years in the mining industry. He is currently chair of Centerra Gold Inc., one of the largest gold miners in Asia. From 2008 to 2012, prior to becoming chair, he was Centerra’s President and CEO. His prior experience includes serving as Executive VP and Chief Operating Officer of Stillwater Mining Co., and managing large mines for Barrick Gold Corp and Kinross Gold Corp. He has recently become a director of both Allied Nevada Gold Corp. and International Tower Hill Mines Ltd. For International Tower Hill he also serves as chair. He has a Master of Science degree and a Bachelor of Science degree from the University of Missouri-Rolla. He is a new Timmins Gold Nominee. |

| | — | | Luc Lessard, 50, a mining engineer, has spent more than 25 years designing, constructing and operating mining projects. He currently serves as Senior VP and Chief Operating Officer of Canadian Malartic Partnership and previously was Senior Vice President and Chief Operating Officer of Osisko Mining Corp. from 2011 until it was acquired earlier this month for $3.9 billion. He was Osisko’s VP, Engineering and Construction from 2007 to 2011, during which time he was directly responsible for the design and construction of the Canadian Malartic gold mine. He previously served as VP Engineering and Construction for IAMGOLD Corp. and as General Manager, Projects for Cambior Inc. during which time he was responsible for the construction of the Rosebel gold mine in Suriname. He has a Bachelor of Applied Science degree from Universite du Laval, a College Degree in Mining Technologies from College de la Region de l’Amiante, and he has earned the Professional Engineer designation from the Canadian Council of Professional Engineers. Mr. Lessard is a director of Nighthawk Gold Corp. He is a new Timmins Gold Nominee. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 7 |

| | — | | Paula Rogers, 45, joined the Board in 2011. She is a Chartered Professional Accountant and brings over 20 years of experience working for Canadian-based international public companies in the areas of treasury, mergers and acquisitions, financial reporting and tax. She has extensive experience in the mining industry in both director and officer roles. Ms. Rogers is currently the CFO of Castle Peak Mining Ltd. and director and chair of the Audit Committee of Athabasca Uranium Inc. She has served as Vice-President, Treasurer of Goldcorp Inc., Treasurer of Wheaton River Minerals Ltd. and Treasurer of Silver Wheaton Corp. She has worked on several significant transactions including the spin-out of Silver Wheaton from Wheaton River Minerals and Goldcorp’s acquisition of the Canadian assets of Placer Dome from Barrick Gold. She holds a Bachelor of Commerce degree from the University of British Columbia. |

| | — | | Jose Vizquerra Benavides, 34, joined the Board in 2013. Mr. Vizquerra is currently President, CEO and a director of Oban Mining Co. and has more than ten years of experience in mining. From 2008 until 2011 Mr. Vizquerra was the head of project evaluations with Compania de Minas Buenaventura of Lima, Peru, and from 2005 until 2008 he was a geologist with Goldcorp. Mr. Vizquerra is fluent in both Spanish and English. Mr. Vizquerra holds a Master of Science degree in Mineral Exploration from Queen’s University and a Bachelor of Civil Engineering degree from the Peruvian University of Applied Science. He has earned the Certified Professional Geologist designation from the American Institute of Professional Geologists. |

See alsoElection of Directors in the accompanying management information circular for additional biographical information on the Timmins Gold Nominees.

While part of the Board’s mandate is to continually review and assess its composition against the evolving needs of the Company, the independent Special Committee was formed and specifically tasked to undertake a special Board renewal process for the annual meeting, partly in response to the dissident action launched by Sentry and to feedback from other shareholders. As part of the process, the Special Committee:

| | — | | retained leading international executive search firm Korn Ferry International to assist it in identifying qualified candidates; |

| | — | | engaged with and considered input on Board composition from shareholders and advisors; |

| | — | | considered the appropriate mix of skills, perspectives, experience, expertise and independence to oversee Timmins Gold’s future growth; and |

| | — | | invited the dissident nominees to participate in the process so that the Special Committee, with Korn Ferry International’s assistance, could evaluate the dissident nominees’ suitability along with all other candidates. Sentry and the dissident nominees rejected this invitation. |

In line with best governance practices, the Board has adopted a majority voting policy with respect to the election of directors. Pursuant to the policy, in an uncontested election where a director nominee is not elected by at least a majority (50% + 1 vote) of the votes cast with regard to his or her election, such director must immediately tender his or her resignation to the Board, which resignation must be accepted within 90 days following the shareholders’ meeting absent exceptional circumstances.

| 5. | Measured pursuit of growth opportunities that deliver shareholder value. The Timmins Gold Board has and continues to actively pursue both organic and strategic growth opportunities. The soundness and effectiveness of Timmins Gold’s measured growth strategy is evidenced, among other things, by the 440% stock price appreciation since the 2006 IPO. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 8 |

As part of its mandate to provide strategic oversight, the Board continually evaluates available value-enhancing opportunities and has established stringent return thresholds to prioritize the focus on delivering shareholder value. Timmins Gold has engaged RBC Capital Markets as its financial advisor to assist in the assessment of value-enhancing opportunities.

Reasons to Reject Sentry’s Dissident Nominees

| 1. | No articulated business plan, strategy or management team. Sentry has provided no information about how it will improve upon the Company’s already strong performance or create additional shareholder value. It is unclear what Sentry’s intentions are with the future strategic direction of your Company. Despite its criticisms of “inadequate strategic plan”, “mismanagement of assets” and “lack of management accountability”, Sentry has not proposed any new plan or strategy for the Company, nor has it proposed a new management team for the Company. |

| 2. | No compromise and false assertions. While the Company has been open to engaging in constructive dialogue with a view to addressing Sentry’s concerns, including a proposal to add Sentry nominees to the Board, Sentry has refused to engage in meaningful dialogue and launched an unprovoked proxy contest by announcing its dissident nominees on June 2, 2014. |

In its announcement, Sentry also alleged that the Board “ignored requests made by significant shareholders to allow for comprehensive due diligence to be conducted by potential acquirers” and in so doing, “rebuffed” such potential acquirers with “superior growth prospects, stronger financial positions, superior technical skills and superior operating performance”. Timmins Gold has repeatedly told Sentry that these assertions are false.

Around the same time, through the shareholder and investment community engagement which was part of the Board renewal process, the Board became aware of further false assertions circulating in the financial markets. These further false assertions were along the lines of Sentry’s June 2 announcement, but embellished with additional unsupported details.

The unwritten and unfounded embellishments suggest that:

| | — | | management failed to present to the Board a $3.00 per share takeover offer from a purported bidder; and |

| | — | | Timmins Gold signed confidentiality agreements with potential suitors and then refused to provide such suitors with relevant information. |

Any of this information, had the events occurred, would have been subject to a confidentiality agreement and therefore not known to any party other than Timmins Gold and the purported bidder or potential suitors.

While Timmins Gold does not typically respond to any false assertions, it is important to correct the record in advance of the shareholder vote. In its news release of June 6, 2014 Timmins Gold advised that:

| | — | | a potential suitor at one time put forward an indicative non-binding proposal to acquire Timmins Gold and management immediately brought the proposal to the Board’s attention and the potential suitor was granted exclusivity and afforded the opportunity to undertake due diligence, but ultimately declined to make a binding acquisition offer; and |

| | — | | as part of its normal course operations, Timmins Gold has provided numerous potential partners with relevant information under confidentiality agreements and has provided access for site visits to its San Francisco gold mine. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 9 |

Timmins Gold is concerned that the negative image of the Company painted by such false assertions may deter interested third parties from approaching the Company in the future. Timmins Gold states emphatically, once and for all, it never received a $3.00 per share binding offer, or any other binding offer to acquire the Company.

| 3. | Control with no premium paid. If elected, Sentry’s six dissident nominees will represent 86% of the Board, which means that Sentry, a 17% shareholder, will have effective control of the Board and, indirectly, of your Company without having paid a premium for such control. A central goal and feature of the Canadian capital markets is the protection of shareholders, by ensuring that they are consulted and compensated for ceding control (e.g., through the takeover bid regime). Sentry’s attempt to take control of the Board (and effective control of your Company) through a proxy contest, circumvents such protection and deprives shareholders of the right to be fairly compensated for ceding control to another investor. |

| 4. | Refusal to have nominees assessed. Despite the Special Committee’s invitation to have the dissident nominees participate in the formal Board renewal process so that their suitability to serve as a director could be properly assessed along with all other candidates under consideration, Sentry refused to have its dissident nominees participate in the process. Nonetheless, the Special Committee considered each of the dissident nominees based on the limited information available in Sentry’s solicitation documents. |

Conclusion

Sentry has failed to make a compelling case for its proposed change of control and it has offered no premium for such control. Its future intentions for the Company are unclear.

Timmins Gold has delivered a 440% shareholder return since its initial public offering and has consistently outperformed its peers, under the leadership of a Board and management team with a proven track record of superior execution on a proven strategy.

The choice is clear. VOTE FOR theTimmins Gold Nominees, an expert, independent board who will oversee a management team with proven operating results. REJECT thedissident nominees. They have no strategy and no management team. They offer only an uncertain future.

Act now to protect the value of your investment in Timmins Gold. Vote the WHITE proxy today FOR the Timmins Gold Nominees and support the continuation of Timmins Gold’s sound and successful business strategy.

VOTE FOR THE TIMMINS GOLD NOMINEES.

VOTE THE WHITE FORM OF PROXY TODAY.

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 10 |

SHAREHOLDERS CAN SUPPORT TIMMINS GOLD BY VOTING THE WHITE

FORM OF PROXY FOR THE TIMMINS GOLD NOMINEES TODAY

PROXIES MUST BE RECEIVED NO LATER THAN

10:00 a.m. (VANCOUVER TIME) ON JULY 29, 2014

In order to ensure that your proxy is received in time for Timmins Gold’s annual general and special meeting of shareholders to be held on July 31, 2014, we recommend that you vote in the following ways as soon as possible.

REGISTERED SHAREHOLDERS

If you are a registered shareholder (your share certificate is registered in your name), you can use one of the following options to register your vote:

| | — | | Internet: Go to www.investorvote.com and follow the instructions. You will need your control number, which is located on your WHITE proxy form. |

| | — | | Telephone: Call 1-866-732-vote (1-866-732-8683) (toll-free in North America) from a touch-tone phone and follow the voice instructions. You will need your account number and Proxy access number which are noted on your WHITE proxy form. If you vote by telephone, you cannot appoint anyone other than the appointees named on your WHITE proxy form as your proxyholder. |

| | — | | Fax: Complete, sign and date your WHITE proxy form and send it by fax at 1-866-249-7775, (toll-free in North America) or (416) 263-9524 (outside North America). |

| | — | | Mail: Complete, sign and date your WHITE proxy form and return it in the envelope provided. |

NON-REGISTERED SHAREHOLDERS

If you are a non-registered shareholder (your shares are held by a bank, broker or other intermediary), vote by following the instructions below and located on the voting instruction form provided by your bank or broker.

| | — | | Internet: visit www.proxyvote.com and enter your 12 digit control number located on the enclosed WHITE voting instruction form; or |

| | — | | Telephone: call the number listed on your WHITE voting instruction form and provide your 12 digit control number located therein; or |

| | — | | Fax: complete, date and sign the WHITE voting instruction form and fax it to the number listed therein, if applicable. |

| | | | |

| | YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT 1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM | | 11 |

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the “Meeting”) of shareholders of Timmins Gold Corp. (the “Company”) will be held in the Ballroom at the Vancouver Club at 915 West Hastings Street, Vancouver, British Columbia, Canada V6C 1C6 at 10:00 a.m. (Vancouver time) on Thursday, July 31, 2014 for the following purposes:

| | (a) | to receive the audited financial statements of the Company for the financial year ended December 31, 2013 and accompanying report of the auditor; |

| | (b) | to set the number of directors of the Company at seven; |

| | (c) | to elect the directors of the Company to hold office for the ensuing year; |

| | (d) | to appoint Deloitte LLP, Chartered Accountants, as the auditor of the Company for the ensuing year and to authorize the directors to fix their remuneration; |

| | (e) | to approve the Advance Notice Policy of the Company; and |

| | (f) | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

The details of all matters proposed to be put before shareholders at the Meeting are set forth in the management information circular accompanying this Notice of Meeting. At the Meeting, shareholders will be asked to approve each of the foregoing items.

The directors of the Company have fixed June 17, 2014 as the record date for the Meeting (the “Record Date”). Only shareholders of record at the close of business on the Record Date are entitled to vote at the Meeting or any adjournment thereof.

If you are a registered shareholder of the Company and unable to attend the Meeting in person, please exercise your right to vote by completing and returning the accompanying form of proxy and deposit it with Computershare Investor Services Inc. Proxies must be completed, dated and signed and returned to Computershare Investor Services Inc., at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 by 10:00 a.m. (Vancouver time) on July 29, 2014, or if the Meeting is adjourned or postponed, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the date to which the Meeting is adjourned or postponed. Telephone voting can be completed at 1-866-732-vote (1-866-732-8683), voting by fax can be sent to 1-866-249-7775 or 416-263-9524 and Internet voting can be completed at www.investorvote.com.

Late proxies may be accepted or rejected by the Chair of the meeting at his or her discretion and the Chair of the meeting is under no obligation to accept or reject any particular late proxy. The Chair of the meeting may waive or extend the proxy cut-off without notice.

If you are a non-registered shareholder, please follow the instructions from your bank, broker or other financial intermediary for instructions on how to vote your shares.

DATED at Vancouver, British Columbia June 23, 2014.

TIMMINS GOLD CORP.

“Barry Fraser”

Chairman

MANAGEMENT INFORMATION CIRCULAR

(all information as at June 23, 2014 unless otherwise noted)

PERSONS MAKING THE SOLICITATION

This Management Information Circular (the “Circular”) is furnished in connection with the solicitation of proxies being made by the management of Timmins Gold Corp. (the “Company”) for use at the Annual and Special Meeting of the Company’s shareholders (the “Meeting”) to be held on July 31, 2014 at the time and place and for the purposes set forth in the accompanying Notice of Meeting. The Company has retained the services of Laurel Hill Advisory Group (“Laurel Hill”) for the solicitation of proxies in Canada and the United States for a fee of approximately $135,000 plus disbursements and other expenses. While it is expected that the solicitation will be made primarily by mail, proxies may be solicited personally or by telephone by directors, officers and employees of the Company. All costs of this solicitation will be borne by the Company.

APPOINTMENT AND REVOCATION OF PROXIES

The individuals named in the accompanying form of proxy (the “Proxy”) are directors or officers of the Company.A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO ATTEND AND ACT FOR THE SHAREHOLDER AND ON THE SHAREHOLDER’S BEHALF AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY INSERTING SUCH PERSON’S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY AND STRIKING OUT THE TWO PRINTED NAMES, OR BY COMPLETING ANOTHER FORM OF PROXY. A Proxy will not be valid unless the completed, dated and signed Proxy is received by Computershare Investor Services Inc., at 8th Floor, 100 University Avenue, Toronto, Ontario, M5J 2Y1 by 10:00 a.m. (Vancouver time) on July 29, 2014 or if the Meeting is adjourned or postponed, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the date to which the Meeting is adjourned or postponed. Telephone voting can be completed at 1-866-732-vote (1-866-732-8683), voting by fax can be sent to 1-866-249-7775 or 416-263-9524 and Internet voting can be completed atwww.investorvote.com.

Late proxies may be accepted or rejected by the Chair of the meeting at his or her discretion and the Chair of the meeting is under no obligation to accept or reject any particular late proxy. The Chair of the meeting may waive or extend the proxy cut-off without notice.

A shareholder who has given a Proxy may revoke it by an instrument in writing executed by the shareholder or by the shareholder’s attorney authorized in writing or, if the shareholder is a corporation, by a duly authorized officer or attorney of the corporation, and delivered either to the registered office of the Company, at Suite 1900, 570 Granville Street, Vancouver, British Columbia, Canada, V6C 3P1, at any time up to and including the last business day preceding the day of the Meeting or any adjournment of it or to the Chair of the Meeting on the day of the Meeting or any adjournment of it. A revocation of a Proxy does not affect any matter on which a vote has been taken prior to the revocation.

If you are a non-registered shareholder, please follow the instructions from your bank, broker or other financial intermediary for instructions on how to revoke your voting instructions.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 2 -

EXERCISE OF DISCRETION

If the instructions in a Proxy are certain, the shares represented thereby will be voted on any poll by the persons named in the Proxy and, where a choice with respect to any matter to be acted upon has been specified in the Proxy, the shares represented thereby will, on a poll, be voted or withheld from voting in accordance with the specifications so made.If you do not provide instructions in your Proxy, the persons named in the enclosed Proxy will vote your Common Shares FOR the matters to be acted on at the Meeting.

The persons named in the enclosed Proxy will have discretionary authority with respect to any amendments or variations of these matters or any other matters properly brought before the Meeting or any adjournment or postponement thereof, in each instance, to the extent permitted by law, whether or not the amendment or other item of business that comes before the Meeting is routine or contested. The persons named in the enclosed Proxy will vote on such matters in accordance with their best judgment. At the time of the printing of this Circular, the management of the Company knows of no such amendment, variation or other matter which may be presented to the Meeting.

NON-REGISTERED HOLDERS

All references to shareholders in this Circular and the accompanying Proxy and Notice of Meeting are to shareholders of record unless specifically stated otherwise.

ONLY REGISTERED SHAREHOLDERS OR DULY APPOINTED PROXYHOLDERS ARE PERMITTED TO VOTE AT THE MEETING. SHAREHOLDERS WHO DO NOT HOLD THEIR SHARES IN THEIR OWN NAME (REFERRED TO HEREIN AS “NON-REGISTERED HOLDERS”) ARE ADVISED THAT ONLY PROXIES FROM SHAREHOLDERS OF RECORD CAN BE RECOGNIZED AND VOTED AT THE MEETING.

Non-Registered Holders are registered either: (a) in the name of an intermediary that the Non-Registered Holder deals with in respect of the Common Shares, such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of registered plans; or (b) in the name of a depository (such as CDS Clearing and Depository Services Inc.) of which the intermediary is a participant.

In accordance with applicable Canadian securities laws, the Company will be distributing copies of the Meeting materials to the depository and intermediaries for further distribution to Non-Registered Holders. Intermediaries are required to forward the Meeting materials to Non-Registered Holders and receive voting instructions from them unless a Non-Registered Holder has waived the right to receive the Meeting materials. Intermediaries often use service companies to forward the Meeting materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive the Meeting materials will either:

| | (a) | be given a voting instruction form which must be completed and signed by the Non-Registered Holder in accordance with the directions set out on the voting instruction form (which may, in some cases, permit the completion of the voting instruction form by telephone or via the Internet); or |

| | (b) | less typically, be given a Proxy which has already been signed by the intermediary which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder, but which is otherwise uncompleted. In this case, the Non-Registered Holder who wishes to submit the Proxy should otherwise properly complete and deposit it with Computershare Investor Services Inc. |

In either case, the purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares which they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 3 -

Registered Holder should strike out the names of the persons named in the Proxy or voting instruction form and insert the name of the Non-Registered Holder (or such other person) in the blank space provided.In either case, Non-Registered Holders should carefully follow the instructions of their intermediaries and their intermediaries’ service companies.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as disclosed herein, since the commencement of the Company’s last completed financial year, no informed person of the Company, proposed director of the Company, or any associate or affiliate of any informed person or proposed director, has any material interest, direct or indirect in any transaction or any proposed transaction which has materially affected or would materially affect the Company or any of its subsidiaries.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE ACTED UPON

Except as disclosed herein, and except for transactions carried out in the ordinary course of business of the Company or its subsidiaries, no Person or Company has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors or the appointment of auditors. For the purpose of this paragraph, “Person” or “Company” shall include: (a) each person who has been a director or executive officer of the Company at any time since the commencement of the Company’s last financial year; (b) each proposed nominee for election as a director of the Company; and (c) each associate or affiliate of any of the persons or companies listed in paragraphs (a) or (b).

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at the date hereof, the Company has issued and outstanding 163,379,045 fully paid and non-assessable common shares without par value (“Common Shares”), each share carrying the right to one vote.

Any holder of Common Shares of record at the close of business on June 17, 2014 who either personally attends the Meeting or who has completed and delivered a Proxy in the manner specified, subject to the provisions described above, shall be entitled to vote or to have such shareholder’s shares voted at the Meeting.

To the best of the knowledge of the directors and executive officers of the Company, there are no persons who, or corporations which, beneficially own, or control or direct, directly or indirectly, voting shares carrying 10% or more of the voting rights attached to any class of voting shares of the Company other than:

| | | | |

Name of Shareholder | | Number of Shares held | | Percentage of Issued Shares |

Sentry Investments Inc. 130 King Street West, Suite 2850 Toronto, Ontario, M5X 1A4 | | 27,767,900(1) | | 17.0% |

Van Eck Associates Corporation 335 Madison Avenue, 19th Floor New York, NY 10017 USA | | 24,424,818(2) | | 14.9% |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 4 -

| | (1) | According to a report filed under National Instrument 62-103 on SEDAR on June 10, 2014 by Sentry Investments Inc. (“Sentry”). Sentry exercises control over but not ownership of the Common Shares and is at arms’ length to the Company. |

| | (2) | According to a report filed under National Instrument 62-103 on SEDAR on March 6, 2014 by Van Eck Associates Corporation (“Van Eck”). Van Eck exercises control over but not ownership of the Common Shares and is at arms’ length to the Company. |

FINANCIAL STATEMENTS

The audited consolidated financial statements of the Company for the years ended December 31, 2013 and 2012, and the auditors’ report thereon (the “Statements”) and the Management Discussion and Analysis for the years ended December 31, 2013 and 2012 (the “MD&A”) are available upon request from the Company. The Statements and MD&A are available on the Company’s website atwww.timminsgold.com and on the System for Electronic Document Analysis and Retrieval (SEDAR) at www.sedar.com and on the United States Securities and Exchange Commission website atwww.sec.gov. The Statements will be placed before the Meeting for consideration by the shareholders.

APPOINTMENT AND REMUNERATION OF AUDITOR

Shareholders will be asked at the Meeting to approve the appointment of Deloitte LLP, Chartered Accountants, of 2800 – 1055 Dunsmuir Street, Vancouver, BC, as auditor of the Company to hold office until the next annual general meeting of the shareholders at a remuneration to be fixed by the directors. Deloitte LLP was first appointed as the Company’s auditor on November 29, 2007.In the absence of instructions to the contrary, a properly executed and returned Proxy will be voted FOR the auditor nominee herein listed.

NUMBER OF DIRECTORS

The Special Committee of the Board of Directors of the Company (the “Board”), completed a thorough Board renewal process. The Special Committee determined that the Board could benefit from the appointment of new independent candidates identified through the Board renewal process. For more information on the Board renewal process, see “Corporate Governance - Nomination of Directors” below.

On the Special Committee’s unanimous recommendation, the Board approved seven individuals as nominees for the election of directors at the Meeting. As a consequence, the Board is seeking approval for a decrease in the size of the Board from its current eight members to seven members.

Shareholders will be asked at the Meeting to approve an ordinary resolution that the number of directors elected be set at seven (7) for the ensuing year, subject to the articles of the Company and the provisions of theBusiness Corporations Act (British Columbia).The Board recommends a vote “FOR” the approval of the resolution setting the number of directors at seven. In the absence of instructions to the contrary, a properly executed and returned Proxy will be voted FOR the approval of the resolution setting the number of directors at seven.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 5 -

ELECTION OF DIRECTORS

The directors of the Company are elected at each annual general meeting and hold office until the next annual general meeting or until their successors are appointed.

Each of the persons named in the following table are proposed for nomination for election as a director of the Company.The Board recommends a vote “FOR” each of the nominees listed below. In the absence of instructions to the contrary, a properly executed and returned Proxy will be voted FOR the director nominees herein listed.

The nominees for election as a director of the Company include four new independent nominees, each of whom has held senior executive positions in major mining companies. These candidates were identified as a result of a Board renewal process undertaken by the Special Committee of the Board directors, with assistance from a reputable international executive search firm and input from some of the Company’s largest shareholders.

Information concerning such persons, as furnished by the individual nominees, is as follows:

| | |

Name and Profile | | Principal Occupation and Biography |

George Brack | | PRINCIPAL OCCUPATION: Corporate Director |

MBA, CFA, B.A.Sc., Geological Engineering Age: 52 Residence: Vancouver, British Columbia, Canada Common Shares: Nil. Director Nominee Independent | | BIOGRAPHY: Mr. Brack has spent 29 years in the mining industry and in mining-focused investment banking. From 2000 to 2009 he was a mining-focused investment banker, serving successively as President and CEO of Macquarie North America and Managing Director, Industry Head Mining with Scotia Capital Inc. As an investment banker he advised clients on the sale of public companies and projects involving five gold mining assets in Mexico. From 1995 to 1999 he was Vice President, Corporate Development for one of Canada’s largest gold miners, Placer Dome Inc. He served as chair of the special committee of the Boards of both Red Back Mining Inc. in 2010 and Aurizon Mines Ltd. in 2013 when they were acquired for $7.2 billion and $796 million, respectively. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Silver Wheaton Corp. (TSX) - Capstone Mining Corp. (TSX) - Alexco Resource Corp. (TSX) - Geologix Explorations Inc. (TSX) - Newstrike Capital Inc. (TSXV) |

| | CURRENT COMMITTEE MEMBERSHIPS: Not applicable |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 6 -

| | |

Name and Profile | | Principal Occupation and Biography |

Bruce Bragagnolo | | PRINCIPAL OCCUPATION: CEO of the Company |

LLB Age: 57 Residence: Vancouver, British Columbia, Canada Common Shares: 2,761,000 Director since March 17, 2005 Non-independent | | BIOGRAPHY: Mr. Bragagnolo is the CEO and co-founder of the Company. As CEO he oversees the strategic vision, administration and finance of the Company. He has over 27 years of experience in the natural resource sector both as a lawyer and a director. Mr. Bragagnolo has been responsible for structuring and raising over 100 million dollars in equity and debt for the Company and overseeing the growth of the Company as it transitioned from junior developer to gold producer. As CEO he has guided the Company to industry leading financial metrics. His business, legal and transactional background provides a direct benefit to the Board. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: None |

| | CURRENT COMMITTEE MEMBERSHIPS: None |

| | |

| | |

| | |

| | |

| | |

| | |

Bryan Coates | | PRINCIPAL OCCUPATION: President of Osisko Gold Royalties Ltd. |

B.Com (Honours), CPA, CA Age: 56 Residence: Saint-Lambert, Quebec, Canada Common Shares: Nil Director Nominee Independent | | BIOGRAPHY: Mr. Coates has spent 30 years in the mining industry. He was most recently the Vice President Finance and Chief Financial Officer for Osisko Mining Corp. from 2007 until it was acquired earlier this month for $3.9 billion. Osisko developed and operated the Canadian Malartic gold mine, the largest such mine in Quebec, and also conducted exploration work in Mexico. Prior to Osisko, Mr. Coates served as Vice President of Finance and Chief Financial Officer for IAMGOLD Corp. and Cambior Inc. and has previously sat on the board of directors of various mining companies. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Golden Queen Mining Company (TSX) |

| | CURRENT COMMITTEE MEMBERSHIPS: Not applicable |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 7 -

| | |

Name and Profile | | Principal Occupation and Biography |

Stephen Lang | | PRINCIPAL OCCUPATION: Corporate Director |

M.Sc. M.Eng, Mining Engineering Age: 58 Residence: Columbia, Missouri, USA Common Shares: Nil Director Nominee Independent | | BIOGRAPHY: Mr. Lang has over 32 years of experience in the mining industry. He served as President and CEO of Centerra Gold Inc. from 2008 to 2012, having joined Centerra in 2007 as Chief Operating Officer. Between 2003 and 2007, Mr. Lang served as Executive Vice President and Chief Operating Officer of Stillwater Mining Company. Prior to joining Stillwater, he was employed with Barrick Gold Corporation as Vice President and General Manager of Barrick Gold’s Goldstrike/Meikle operation from 2001 to 2003. Prior to this he served as Vice President of Engineering and Project Development of Rio Algom, Limited in Santiago, Chile from 1999 to 2001. From 1996 to 1999, he served as Vice President and General Manager of Kinross Gold Corporation/Amax Gold Corporation’s Fort Knox Mine in Fairbanks, Alaska. From 1981 to 1996, he held various positions with Santa Fe Pacific Gold Minerals Corporation, including General Manager of the Twin Creeks Mine in Golconda, Nevada. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Centerra Gold Inc. (TSX) - Allied Nevada Gold Corp. (TSX; NYSE-MKT) - International Tower Hill Mines Ltd. (TSX; NYSE-MKT) |

| | CURRENT COMMITTEE MEMBERSHIPS: Not applicable |

| |

| |

| |

Luc Lessard | | PRINCIPAL OCCUPATION: Senior Vice President and COO of Canadian Malartic Partnership |

B.A.Sc., P.Eng. Age: 50 Residence: Montreal, Quebec, Canada Common Shares: Nil Director Nominee Independent | | BIOGRAPHY: Mr. Lessard has spent more than 25 years in the mining industry. Mr. Lessard was Senior Vice President and Chief Operating Officer of Osisko from 2011 until it was acquired earlier this month for $3.9 billion. He was Osisko’s VP, Engineering and Construction from 2007 to 2011, during which time he was directly responsible for the design and construction of the Canadian Malartic gold mine. He previously served as VP Engineering and Construction for IAMGOLD Corp. and as General Manager, Projects for Cambior Inc. during which time he was responsible for the construction of the Rosebel gold mine in Suriname. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Nighthawk Gold Corp. (TSXV) |

| | CURRENT COMMITTEE MEMBERSHIPS: Not applicable |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 8 -

| | |

Name and Profile | | Principal Occupation and Biography |

Paula Rogers  B.Com, CPA, CA Age: 45 Residence: Vancouver, British Columbia, Canada Common Shares: 12,500 Director since August 3, 2011 Independent | | PRINCIPAL OCCUPATION: CFO of Castle Peak Mining Ltd. |

| | BIOGRAPHY: Ms. Rogers is a Chartered Professional Accountant and brings over 20 years of experience working for Canadian-based international public companies in the areas of treasury, mergers and acquisitions, financial reporting and tax. She has extensive experience in the mining industry in both director and officer roles. Ms. Rogers is currently the Chief Financial Officer of Castle Peak Mining Ltd. and Director and Chair of the Audit Committee of Athabasca Uranium Inc. She has served as Vice President, Treasurer of Goldcorp Inc., Treasurer of Wheaton River Minerals Ltd. and Treasurer of Silver Wheaton Corp. She has worked on several significant transactions including the spin-out of Silver Wheaton from Wheaton River Minerals and Goldcorp’s acquisition of the Canadian assets of Placer Dome from Barrick Gold. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Athabasca Uranium Inc. (TSXV) |

| | CURRENT COMMITTEE MEMBERSHIPS: Audit Committee Compensation Committee Special Committee |

| | |

| | |

| | |

| | |

Jose Alberto Vizquerra Benavides  M.Sc., Mineral Exploration, B. Eng., CPG Age: 34 Residence: Toronto, Ontario, Canada Common Shares: 15,000 Director since November 27, 2013 Independent | | PRINCIPAL OCCUPATION: President and CEO of Oban Mining Co. |

| | BIOGRAPHY: Mr. Vizquerra has more than ten years of experience in mining. Prior to his current roles as President, CEO and director of Oban Mining Co., Mr. Vizquerra was the head of project evaluations with Compania de Minas Buenaventura of Lima, Peru and from 2008 until 2011, and a geologist with Goldcorp. from 2005 until 2008. Mr. Vizquerra is fluent in both Spanish and English. |

| | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: - Oban Mining Co. (TSX) |

| | CURRENT COMMITTEE MEMBERSHIPS: Corporate Governance and Nominating Committee Compensation Committee Special Committee |

| | |

| | |

| | |

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 9 -

Corporate Cease Trade Orders or Bankruptcies

No proposed director of the Company is, as of the date hereof or was within 10 years before the date hereof, a director, chief executive officer or chief financial officer of any company (including the Company) that:

| | (a) | was subject to a cease trade order, an order similar to a cease trade order or an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued while the director or executive officer was acting in the capacity as director, chief executive officer or chief financial officer; or |

| | (b) | was subject to a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, that was issued after the director or executive officer ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

No proposed director of the Company:

| | (a) | is, as of the date hereof or was within 10 years before the date hereof, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | (b) | has, within 10 years before the date hereof, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

Penalties or Sanctions

No proposed director of the Company has been subject to:

| | (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. |

The foregoing, not being within the knowledge of the Company, has been furnished by the respective directors.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 10 -

OTHER BUSINESS

Approval of Advance Notice Policy

On April 3, 2014, the Board adopted an advance notice policy with immediate effect (the “Advance Notice Policy”). Since the Company adopted its Advance Notice Policy, Institutional Shareholder Services (“ISS”) has provided further guidance on its policy considerations in connection with the approval of such advance notice policies. As a result, the Board has approved an amendment to the Policy and is presenting to shareholders the amended policy for approval. If approved, the amended policy will be effective as the Advance Notice Policy of the Company as at and from the date of the Meeting. A copy of the Advance Notice Policy to be approved at the Meeting is attached to this Circular as Schedule A. A blackline copy of the amended Advance Notice Policy is available from the Company on request.

Purpose of the Advance Notice Policy

The directors of the Company are committed to: (i) facilitating an orderly and efficient annual general or, where the need arises, special meeting, process; (ii) ensuring that all shareholders receive adequate notice of the director nominations and sufficient information with respect to all nominees; and (iii) allowing shareholders to register an informed vote having been afforded reasonable time for appropriate deliberation.

The purpose of the Advance Notice Policy is to provide shareholders, directors and management of the Company with a clear framework for nominating directors. The Advance Notice Policy fixes a deadline by which holders of record of Common Shares must submit director nominations to the Company prior to any annual or special meeting of shareholders and sets forth the information that a shareholder must include in the notice to the Company for notice to be in proper written form in order for any director nominee to be eligible for election at any annual or special meeting of shareholders.

Terms of the Advance Notice Policy

The following information is intended as a brief description of the Advance Notice Policy and is qualified in its entirety by the full text of the Advance Notice Policy, a copy of which is attached as Schedule A.

The Advance Notice Policy provides that advance notice to the Company must be made in circumstances where nominations of persons for election to the board of directors are made by shareholders of the Company other than pursuant to: (i) a “proposal” made in accordance with Division 7 of theBusiness Corporations Act (British Columbia) (the “Act”); or (ii) a requisition of the shareholders made in accordance with section 167 of the Act.

Among other things, the Advance Notice Policy fixes a deadline by which holders of record of common shares of the Company must submit director nominations to the Secretary of the Company prior to any annual or special meeting of shareholders and sets forth the specific information that a shareholder must include in the written notice to the Secretary of the Company for an effective nomination to occur. No person will be eligible for election as a director of the Company unless nominated in accordance with the provisions of the Advance Notice Policy.

In the case of an annual meeting of shareholders, notice to the Company must be made not less than 30 nor more than 65 days prior to the date of the annual meeting; provide however, that in the event that the annual meeting is to be held on a date that is less than 50 days after the date on which the first public announcement of the date of the annual meeting was made, notice must be made not later than the close of business on the 10th day following such public announcement.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 11 -

In the case of a special meeting of shareholders (which is not also an annual meeting), notice to the Company must be made not later than the close of business on the 15th day following the day on which the first public announcement of the date of the special meeting was made.

The Board of Directors of the Company may, in its sole discretion, waive any requirement of the Advance Notice Policy.

Approval of Advance Notice Policy by Shareholders

If the Advance Notice Policy is approved at the Meeting, the Advance Notice Policy will be effective and in full force and effect in accordance with its terms and conditions beyond the termination of the Meeting. Thereafter, the Advance Notice Policy will be subject to review by the Board of Directors of the Company and will be updated to the extent needed to reflect changes required by securities regulatory agencies or stock exchanges, or so as to meet industry standards.

If the Advance Notice Policy is not approved at the Meeting, the Advance Notice Policy will terminate and be of no further force or effect from and after the termination of the Meeting.

At the Meeting, the shareholders will be asked to approve the following by ordinary resolution (the “Advance Notice Policy Resolution”):

“BE IT RESOLVED, as an ordinary resolution of the Shareholders of the Company, that:

| 1. | The Company’s Advance Notice Policy (the “Advance Notice Policy”), as further described in the Circular dated June 23, 2014, be and is hereby ratified, confirmed and approved; |

| 2. | The Board of Directors of the Company be authorized in its absolute discretion to administer the Advance Notice Policy and amend or modify the Advance Notice Policy in accordance with its terms and conditions to the extent needed to reflect changes required by securities regulatory agencies or stock exchanges, so as to meet industry standards, or as otherwise determined to be in the best interests of the Company and its shareholders; and |

| 3. | Any one director or officer of the Company be and is hereby authorized and directed to do all such acts and things and to execute and deliver, under the corporate seal of the Company or otherwise, all such deeds, documents, instruments and assurances as in his or her opinion may be necessary or desirable to give effect to the foregoing resolutions.” |

The Board recommends a vote “FOR” the approval of the Advance Notice Policy Resolution. In the absence of a contrary instruction, a properly executed and returned Proxy will be voted FOR the approval of the Advance Notice Policy Resolution.

Other Matters

Management of the Company knows of no other matter to come before the Meeting other than those referred to in the Notice of Meeting accompanying this Circular. However, if any other matter properly comes before the Meeting, it is the intention of the persons named in the Proxy accompanying this Circular to vote the same in accordance with their best judgment of such matters.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 12 -

EXECUTIVE COMPENSATION

For the purposes of this Circular, named executive officers of the Company means the following individuals (the “NEOs”):

| (a) | Our chief executive officer (“CEO”); |

| (b) | Our chief financial officer (“CFO”); |

| (c) | each of the three most highly compensated executive officers of the Company, including any of its subsidiaries, or the three most highly compensated individuals acting in a similar capacity, other than the CEO and CFO, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000, as determined in accordance with subsection 1.3(6) of Form 51-102F6Statement of Executive Compensation, for that financial year; and |

| (d) | each individual who would be an NEO under paragraph (c) but for the fact that the individual was neither an executive officer of the Company or its subsidiaries, nor acting in a similar capacity, at the end of that financial year. |

During the most recently completed financial year the Company had six NEOs: Arturo Bonillas, Bruce Bragagnolo, Darren Prins, Miguel Bonilla, Alexander Tsakumis and Taj Singh. Their positions within the Company are set out in the “Summary Compensation Table” below.

Compensation Discussion and Analysis

Board Compensation Committee Report on Executive Compensation

The Company’s executive compensation program is administered by the Compensation Committee of the Board. The Compensation Committee is comprised of three independent members of the Board: Barry Fraser (since November 2011), Paula Rogers (since November 2011) and Jose Vizquerra (since April 2014). Ms. Rogers serves as the Chair of the Compensation Committee. The Compensation Committee has a written mandate which was approved by the Board on June 17, 2010. The Compensation Committee’s primary responsibility is to review and make recommendations for the remuneration of executive officers and directors of the Company.

The Compensation Committee reviews position descriptions as they are developed, evaluates the performance of the Company’s senior executive officers and directors and reviews the design and competitiveness of the Company’s compensation arrangements.

During the years ended December 31, 2012 and December 31, 2013, the Compensation Committee engaged an independent human resources consultant, PM Search Partners (“PM Search”), to provide compensation analysis and recommendations for executives, directors and committee members for consideration by the Compensation Committee. Among other consulting services provided, PM Search also assisted in developing compensation metrics for the CEO and the President.

During the year ended December 31, 2013, the Compensation Committee also engaged independent human resources consultants Roger Gurr & Associates (“RGA”) to assist the Compensation Committee with compensation matters throughout the year and, in particular, in establishing the 2013 compensation packages for each of the CEO, President and CFO. The Compensation Committee made its recommendations to the Board for the year ended December 31, 2013 based on the advice of the independent consultants as well as other factors.

YOUR VOTE IS EXTREMELY IMPORTANT. PLEASE SUBMIT YOUR VOTE TODAY.

FOR ASSISTANCE WITH VOTING, PLEASE CONTACT LAUREL HILL ADVISORY GROUP TOLL FREE AT

1-877-452-7184 (416-304-0211 COLLECT) OR BY EMAIL AT ASSISTANCE@LAURELHILL.COM.

- 13 -

Executive Compensation Program

The Company’s executive compensation program is based on a pay-for-performance philosophy. It is designed to encourage, compensate and reward executives on the basis of individual and corporate performance, both in the short and the long-term. The salaries for the year ended December 31, 2013 and annual incentive bonuses paid to the executive officers of the Company were set on the recommendations of the independent consultants, peer group review and survey information.

Compensation for the NEOs, as well as for executive officers as a whole, is designed to consist of a base salary, short-term incentive awards in the form of an annual bonus and a longer term incentive award in the form of stock options. The Compensation Committee reviews and recommends base salary levels to the Board based on a number of factors in order to enable the Company to attract, motivate and retain high quality executives who are critical to the Company’s long-term success. Annual incentive compensation is linked to achievement of individual and annual corporate objectives, thereby aligning interests of the executives with those of the Company’s shareholders. Long-term equity incentive compensation is provided to align the interests of executives with the longer term interests of shareholders.