- CNFR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Conifer (CNFR) DEF 14ADefinitive proxy

Filed: 12 Apr 23, 12:03pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ |

| Preliminary Proxy Statement |

☐ |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

| Definitive Proxy Statement |

☐ |

| Definitive Additional Materials |

☐ |

| Soliciting Material Under §240.12 |

CONIFER HOLDINGS, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check all boxes that apply):

☒ |

| No fee required. |

|

|

|

☐ |

| Fees paid previously with preliminary materials. |

|

|

|

☐ |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

CONIFER HOLDINGS, INC.

3001 West Big Beaver Road, Suite 200

Troy, Michigan 48084

(248) 559‑0840

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

You are cordially invited to attend the 2023 Annual Meeting of Shareholders (the “Annual Meeting”) of Conifer Holdings, Inc., which will be held virtually on Wednesday, May 17, 2023 at 10:00 a.m. (Eastern Time). The virtual Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/CNFR2023, where you will be able to listen to the meeting live, submit questions and vote online. We believe that a virtual shareholder meeting provides greater access to those who may want to attend, and therefore have chosen a virtual meeting over an in-person meeting.

We have elected to deliver our proxy materials to our shareholders over the Internet in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). We believe that this delivery process reduces our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our shareholders’ timely access to this important information. On or about April 12, 2023, we will send a proxy statement, annual report, and proxy card to our shareholders. The proxy card also provides instructions on how to vote by telephone or through the Internet.

The matters to be acted upon are as follows:

The Record Date for the Annual Meeting was March 20, 2023. Only shareholders of record at the close of business on that date are entitled to vote at the Annual Meeting. The proxy materials were mailed only to those shareholders. Our Board of Directors unanimously recommends that you vote FOR the election of each director nominee, and FOR Proposal 2.

This proxy statement and our annual report can be accessed directly at the following Internet address: www.virtualshareholdermeeting.com/CNFR2023. You will be asked to enter the control number located on your proxy card.

YOUR VOTE IS IMPORTANT. Whether or not you plan to participate in the virtual Annual Meeting, we urge you to submit your vote via: telephone; Internet; or request, sign and return a proxy card.

| By Order of the Board of Directors, |

| Nicholas Petcoff |

| Director & Co-Chief Executive Officer |

Troy, Michigan

Dated: April 12, 2023

TABLE OF CONTENTS

|

| Page |

| 1 | |

| 4 | |

| 4 | |

| 5 | |

| 6 | |

| 6 | |

| 7 | |

| 7 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 10 | |

| 10 | |

| 11 | |

| 12 | |

| 13 | |

PROPOSAL NO. 2 - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| 14 |

| 17 | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| 18 |

| 19 | |

| 20 | |

| 20 | |

| 20 | |

| 21 | |

| 21 | |

| 21 | |

| 23 | |

| 26 | |

| 27 | |

Shareholder Proposals to be Presented at Next Annual Meeting |

| 27 |

| 27 | |

| 28 |

CONIFER HOLDINGS, INC.

PROXY STATEMENT

FOR 2023 ANNUAL MEETING OF SHAREHOLDERS

To Be Held at 10:00 a.m. Eastern Time on Wednesday, May 17, 2023

INFORMATION ABOUT SOLICITATION AND VOTING

The accompanying proxy is solicited on behalf of the Board of Directors of Conifer Holdings, Inc. (the “Company” or “Conifer”) for use at the Company’s 2023 Annual Meeting of Shareholders (“Annual Meeting”) to be held virtually on May 17, 2023, at 10:00 a.m. (Eastern Time), and any adjournment or postponement thereof. The virtual Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/CNFR2023, where you will be able to listen to the meeting live, submit questions and vote online. The proxy statement and our annual report is first being mailed on or about April 12, 2023 to all shareholders entitled to vote at the Annual Meeting.

The information provided in the question and answer format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in the proxy statement are inactive textual references only and do not represent an active link.

QUESTIONS AND ANSWERS

A proxy is a procedure which enables you, as a shareholder, to authorize someone else to cast your vote for you. The Board of Directors of the Company is soliciting your proxy, and asking you to authorize James Petcoff, Executive Chairman and Co-Chief Executive Officer, Nicholas Petcoff, Co-Chief Executive Officer and Director, or Brian Roney, President of the Company, to cast your vote at the 2023 Annual Meeting. You may, of course, cast your vote via telephone, the Internet, by proxy or abstain from voting, if you so choose. The term proxy is also used to refer to the person who is authorized by you to vote for you.

A proxy statement is the document the United States Securities and Exchange Commission (the “SEC”) requires be provided to you in order to explain the matters on which you are asked to vote. A proxy card is the form by which you may authorize someone else, and in this case, James Petcoff, Nicholas Petcoff and Brian Roney to cast your vote for you. The proxy statement and proxy card with respect to the Company’s 2023 Annual Meeting were made available on or about April 12, 2023 to all shareholders entitled to vote at the Annual Meeting.

Only holders of shares of the Company’s common stock at the close of business on March 20, 2023 (the “Record Date”) are entitled to vote on proposals presented at the Annual Meeting. Each shareholder of record has one vote for each share of common stock on each matter presented for a vote.

1

Some banks, brokers, and other record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one proxy statement and 2022 annual report on Form 10-K may have been sent to multiple shareholders in your household. We will promptly deliver a separate copy of these documents to you if you contact us at the address set forth on the Notice of Annual Meeting of Shareholders on the first page of this proxy statement. If you want to receive separate copies of our proxy statements and annual reports on Form 10-K in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker, or other record holder.

Shareholders are asked to vote upon:

The Board of Directors recommends a vote FOR the election of each director nominee and FOR Proposal 2.

You can vote by telephone, the Internet or by proxy. To vote by proxy, complete, sign, date and return the proxy card in the included envelope. If you returned your signed proxy card to the Company before the Annual Meeting, the persons named as proxies on the card will vote your shares as you direct. Shares represented by proxies which are marked “ABSTAIN” on Proposals 2 will not be counted in determining whether the requisite vote has been received for such proposal. IF YOU WISH TO VOTE IN THE MANNER THE BOARD OF DIRECTORS RECOMMENDS, IT IS NOT NECESSARY TO SPECIFY YOUR CHOICE ON THE INTERNET OR THE PROXY CARD. SIMPLY SIGN ONLINE OR SIGN, DATE AND RETURN THE PROXY CARD IN THE INCLUDED ENVELOPE. You may revoke a proxy at any time before the proxy is voted by:

Yes, your vote is confidential. Only the inspector of elections and certain employees associated with processing proxy cards and counting the votes have access to your proxy card. All comments received will be forwarded to management on an anonymous basis unless you request that your name be disclosed.

2

There were 12,215,849 shares of the Company’s common stock outstanding on the Record Date, March 20, 2023. A simple majority of the outstanding shares entitled to be cast, or 6,107,925 shares, present or represented by proxy, constitutes a quorum. A quorum must exist to conduct business at the Annual Meeting. Abstentions and broker non-votes are counted as votes present for purposes of determining whether there is a quorum. A broker non-vote is a proxy a broker submits that does not indicate a vote for the proposal, because the broker does not have discretionary voting authority and the broker did not receive instructions as to how to vote on the proposal.

The nominees receiving the most votes for the open board positions available, whether or not a majority, will be elected as directors. If a quorum is present, the affirmative vote by the holders of a majority of the votes cast on the Internet, by telephone, or by proxy is required to approve Proposal 2. Abstentions and broker non-votes are not votes cast. Therefore, an abstention and a broker non-vote will have no effect on Proposal 2.

The Company will vote properly executed proxies it receives prior to the Annual Meeting in the way you direct. If you do not specify instructions, the shares represented by proxies will be voted FOR the nominees for director and FOR the approval of Proposal 2. No other proposals are currently scheduled to be presented at the meeting.

The Company pays the cost of preparing and printing the proxy materials. The Company will solicit proxies by electronic mail, but also may solicit proxies personally and by telephone, facsimile or other means. Officers and regular employees of the Company and its subsidiaries also may solicit proxies, but will receive no additional compensation for doing so, nor will their efforts result in more than a minimal cost to the Company.

The Company maintains a corporate website, www.cnfrh.com, where the Company makes available, free of charge, copies of its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after they are filed. In addition, the Company maintains the charters of its Nominating and Corporate Governance Committee, the Compensation Committee, the Audit Committee, and the Finance and Investment Committee of the Board of Directors on its website, as well as the Company’s Code of Business Conduct and Ethics Policy, and Insider Trading Policy and Whistleblower Policy. The names of shareholders of record entitled to vote at the Annual Meeting will be available to shareholders upon request for any purpose reasonably relevant to the meeting. Printed copies of the above are available, free of charge, to any shareholder who requests this information.

All shareholder proposals to be considered for inclusion in next year’s proxy statement under SEC Rule 14a-8 or otherwise must be submitted in writing to the Secretary of the Company at the address shown on the Notice of Annual Meeting of Shareholders on the first page of this booklet by December 14, 2023.

The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

3

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

The following table sets forth the names, ages as of the Record Date of March 20, 2023, and certain other information for each of the members of our Board of Directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing members of our Board of Directors:

|

| Class |

| Age |

|

| Position |

| Director |

| Current |

| Expiration |

| ||

Directors with Terms expiring at the Annual Meeting / Nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Timothy Lamothe (3) |

| II |

|

| 67 |

|

| Director |

| 2020 |

| 2023 |

|

| — |

|

Isolde O'Hanlon (1) (2) |

| II |

|

| 64 |

|

| Director |

| 2017 |

| 2023 |

|

| — |

|

Nicholas Petcoff |

| II |

|

| 41 |

|

| Director, Co-CEO |

| 2009 |

| 2023 |

|

| — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||

James Petcoff |

| III |

|

| 67 |

|

| Director, Executive Chairman, and Co-CEO |

| 2009 |

| 2024 |

|

| — |

|

Jeffrey Hakala (2) (3) |

| III |

|

| 49 |

|

| Director |

| 2018 |

| 2024 |

|

| — |

|

John Melstrom (1) |

| I |

|

| 82 |

|

| Director |

| 2019 |

| 2025 |

|

| — |

|

Joseph Sarafa (2) (3) |

| I |

|

| 68 |

|

| Director |

| 2012 |

| 2025 |

|

| — |

|

R. Jamison Williams, Jr. (1) |

| I |

|

| 81 |

|

| Director |

| 2009 |

| 2025 |

|

| — |

|

Gerald Hakala |

| I |

|

| 51 |

|

| Director |

| 2022 |

| 2025 |

|

| — |

|

Nominees for Director

Timothy Lamothe has more than 39 years’ experience in the reinsurance industry, with particular expertise in the development and implementation of marketing programs throughout the United States. He attended Hofstra University MBA Program in 1980 and received his MBA in Business Administration & Finance from Sacred Heart University in Bridgeport, CT in 1984. His Undergraduate work was at St Michael’s College in Winooski, VT in 1977. Most recently (from 2001-2019), Mr. Lamothe served as Senior Vice President for Swiss Reinsurance, where he was responsible for direct marketing to over 25 states. His career also includes senior level marketing positions at PXRE Reinsurance Company, General Re/National Reinsurance Corporation, AIG, and Liberty Mutual Insurance Company. Mr. Lamothe was elected to the Conifer Holdings, Inc. Board of Directors in 2020. His expertise in engaging independent agent channels and marketing specialty insurance programs is invaluable as Conifer continues to expand its commercial and personal lines businesses.

Isolde O'Hanlon has more than 35 years of financial institutions banking experience; including 25 years focused exclusively on the insurance, reinsurance and brokerage/distribution sectors. Ms. O’Hanlon Received her AB in Economics from Smith College in 1981. Most recently Ms. O’Hanlon served as a Managing Director on the Insurance Investment Banking team at BMO Capital Markets. Prior to that she worked at Fox-Pitt Kelton and the Macquarie Group, after spending 23 years with JP Morgan. Ms. O’Hanlon was elected to the Conifer Holdings, Inc. Board of Directors in 2017. With more than 25 years of experience in the Insurance Investment Banking field, her expertise serving small to mid-cap Insurance clients in strategic advisory and capital raising is an invaluable addition to the Board.

Nicholas Petcoff is Co-Chief Executive Officer and a Director of Conifer Holdings, Inc., Nick Petcoff oversees the Company's Commercial Lines Underwriting, Reinsurance, Claims and Information Technology. Mr. Petcoff is also Director and President of Conifer Insurance Company and President of White Pine Insurance Company, both wholly owned subsidiaries

4

of Conifer Holdings, Inc. He has been with the Company since 2009 and has more than 18 years of experience in the insurance industry. Mr. Petcoff’s distinctive skillset in the areas of Underwriting, Claims and Treaty Reinsurance equips him to direct the Company’s overall strategy, growing the business while enabling the Company to conceptualize and deftly respond to market needs.

Continuing Directors

James Petcoff is Executive Chairman & Co-Chief Executive Officer of Conifer Holdings, Inc. Mr. Petcoff is responsible for establishing the overall direction and materializing the strategy of the Company. Mr. Petcoff and Mr. Nicholas Petcoff founded the Company in 2009. He has over 35 years of insurance industry experience, including founding North Pointe Insurance Company in 1986, taking it public in 2005 and facilitating the sale to QBE Holdings Inc. in 2008. Mr. Petcoff has a B.A. from Michigan State University, a M.B.A. from University of Detroit and a J.D. from University of Detroit School of Law. Mr. Petcoff's extensive executive leadership and public company expertise provides irreplaceable direction for the continued growth of the Company.

Jeffrey Hakala is the Chief Executive Officer and Co-Chief Investment Officer of Clarkston Capital Partners, LLC, an investment management firm with offices in Rochester, Michigan, Bloomfield Hills, Michigan, and Scottsdale, Arizona. Prior to Mr. Hakala co-founding Clarkston Capital Partners in 2007, he served as a portfolio manager for multiple investment management firms and worked in public accounting. Mr. Hakala was elected to the Conifer Holdings, Inc. Board of Directors in 2018. In addition, Mr. Hakala also serves as a Director and member of the Audit Committee of Waterford Bancorp, Inc. Mr. Hakala holds a B.A. in accounting and M.B.A. from Michigan State University and is both a Chartered Financial Analyst and a registered Certified Public Accountant. Mr. Hakala’s over 25 years of experience in portfolio investment management and public accounting brings inimitable investment strategy and financial expertise to the Board.

John Melstrom is a founder and Partner Emeritus of Fenner, Melstrom and Dooling, a Birmingham, Michigan C.P.A. firm. With over 50 years as a practicing C.P.A. and a serial entrepreneur, Mr. Melstrom has broad knowledge and experience in multiple businesses and has served in various capacities as owner, advisor, counselor or director. Throughout his career, Mr. Melstrom has served, often in the leadership role of Chairman or Vice Chairman, on multiple boards and has been active in his community by serving on various civic and charitable boards. Mr. Melstrom was elected to the Board of Directors of Conifer Holdings, Inc. in 2019. Mr. Melstrom received his Bachelor of Science degree in accounting from Michigan State University in 1963 and is a practicing Certified Public Accountant licensed in the State of Michigan.

Joseph Sarafa has over 30 years of experience as a practicing attorney and is the co-owner of a property management and development company in Michigan. Since 2010, Mr. Sarafa has been a partner with the firm Moothart & Sarafa, PLC. Mr. Sarafa was elected to the Conifer Holdings, Inc. Board of Directors in 2012 and named the Chair of the Nominating and Corporate Governance Committee in 2015. Mr. Sarafa is very involved in the community, serving multiple businesses and charitable organizations in various capacities over the years and currently serves on multiple boards in an array of industries. Mr. Sarafa has a B.S. from the University of Michigan and a J.D. from the University of Detroit - School of Law. He was admitted to the State Bar of Michigan in 1983. His legal experience and years of providing counsel to a broad range of industries brings important expertise in the areas of governance, compliance, and regulatory issues to the Board.

Richard Jamison Williams, Jr. is a founder and Chairman of Williams, Williams, Rattner & Plunkett, P.C. and has over 50 years of experience as a practicing attorney specializing in business law. Mr. Williams was elected to the Conifer Holdings, Inc. Board of Directors in 2009. He is a Director of a number of companies, including Penske Corporation, Clarke Power Services and Green Optics. Mr. Williams’ civic responsibilities include serving on the Boards of Trustees of Cranbrook Educational Community, Detroit Symphony Orchestra and Beaumont Hospital. Mr. Williams brings extensive experience in a wide variety of transactions, and his legal judgment and experience strengthens our Board in its consideration of various governance and strategic issues.

5

Gerald Hakala is Co-Chief Investment Officer of Clarkston Capital Partners, LLC, an investment management firm with offices in Rochester, Michigan, Bloomfield Hills, Michigan, and Scottsdale, Arizona. Prior to Mr. Hakala co-founding Clarkston Capital Partners in 2007, he held finance, accounting and portfolio management positions with various companies.

Mr. Hakala was appointed to the Conifer Holdings, Inc. Board of Directors in 2022, and is the brother of Mr. Jeffrey Hakala. Mr. Hakala holds a B.B.A. from the University of Michigan Ross School of Business and M.B.A. from Michigan State University and is a Chartered Financial Analyst. Mr. Hakala’s more than 23 years of finance, accounting and portfolio management experience brings inimitable investment strategy and financial expertise to the Board.

Former Directors

Andrew Petcoff is President of Sycamore Specialty Underwriters, LLC, a Michigan insurance agency. Conifer Holdings, Inc. owns 50% of Sycamore Specialty Underwriters, LLC. Effective December 31, 2022, Andrew Petcoff resigned from the Company's Board of Directors. Mr. Petcoff's resignation was not the result of any dispute or disagreement with the Company or the Company's Board of Directors on any matter relating to the operations, policies or practices of the Company.

Staggered Board

Our articles of incorporation and restated bylaws provide for a classified board of directors consisting of three classes of directors, each serving staggered three-year terms. Our directors are divided among the three classes as follows:

Directors in a particular class will be elected for three-year terms at the Annual Meeting of Shareholders in the year in which their terms expire. As a result, only one class of directors will be elected at each annual meeting of our shareholders, with the other classes continuing for the remainder of their respective three-year terms. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation or removal.

Our articles of incorporation and restated bylaws provide that our Board of Directors or our shareholders may fill vacant directorships. Any additional directorships resulting from an increase in the authorized number of directors would be distributed among the three classes so that, as nearly as possible, each class would consist of an equal number of the authorized number of directors.

Director Independence

Our Board of Directors determines the independence of our directors by applying the applicable rules, regulations and listing standards of the Nasdaq Global Select Market (“Nasdaq”) and applicable rules and regulations promulgated by the SEC. The applicable rules, regulations and listing standards of Nasdaq provide that a director is independent only if the Board of Directors affirmatively determines that the director does not have a relationship with the Company which, in the opinion of the Board of Directors, would interfere with the exercise of his or her independent judgment in carrying out the responsibilities of a director. They also specify various relationships that preclude a determination of director independence. Such relationships may include employment, commercial, accounting, family and other business, professional and personal relationships.

Applying these standards, our Board of Directors annually reviews the independence of our directors, taking into account all relevant facts and circumstances. In its most recent review, our Board of Directors considered, among other things, the relationships that each non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

6

As a result of this review, our Board of Directors determined that Messrs. Jeffrey Hakala, Gerald Hakala, Lamothe, Williams, Jr., Sarafa, Melstrom, and Ms. O'Hanlon representing seven of our nine directors, are “independent directors” as defined under the applicable rules, regulations and listing standards of Nasdaq and applicable rules and regulations promulgated by the SEC. All members of our Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee must be independent directors under the applicable rules, regulations and listing standards of Nasdaq. Members of the Audit Committee also must satisfy a separate SEC independence requirement, which provides that (i) they may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company other than their directors’ compensation, and (ii) they may not be an affiliated person of the Company.

Board Leadership Structure

Our Corporate Governance Guidelines provide that our Board of Directors may choose its chairperson in any way that it considers to be in the best interests of our Company. Our Nominating and Corporate Governance Committee periodically considers the leadership structure of our Board of Directors, including the separation of the chairperson and chief executive officer roles and makes such recommendations to our Board of Directors with respect thereto as our Nominating and Corporate Governance Committee deems appropriate.

Currently, our Board of Directors believes that it is in the best interest of our Company and our shareholders for our Co-Chief Executive Officer, James Petcoff, to serve as both Co-Chief Executive Officer and Executive Chairman given his knowledge of our Company and industry and his strategic vision. Our Board of Directors believes that its majority of independent members and active oversight of management is maintained effectively through this leadership structure, the composition of our Board of Directors and sound corporate governance policies and practices.

Board's Role in Risk Oversight

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the Company faces, while our Board of Directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

Our Board of Directors believes that open communication between management and our Board of Directors is essential for effective risk management and oversight. Our Board of Directors meets with members of the senior management team at quarterly meetings of our Board of Directors (as well as such other times as they deemed appropriate), where, among other topics, they discuss risks facing the Company.

While our Board of Directors is ultimately responsible for risk oversight, our board committees assist our Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. Our Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our Audit Committee reviews our major financial risk exposures and the steps management has taken to monitor and control these exposures. Our Audit Committee also monitors certain key risks on a regular basis throughout the fiscal year, such as risk associated with internal control over financial reporting and liquidity risk. Our Nominating and Corporate Governance Committee assists our Board of Directors in fulfilling its oversight responsibilities with respect to the management of risk associated with board organization, membership and structure, and corporate governance. Our Compensation Committee assesses risks created by the incentives inherent in our compensation policies. Finally, our full Board of Directors reviews strategic and operational risk and the Company's Enterprise Risk Management initiatives in the context of reports from the management team, receives reports on all significant committee activities at each regular meeting, and evaluates the risks inherent in significant transactions.

7

Board Meetings and Committees

During our fiscal year ended December 31, 2022, our Board of Directors held eight meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board of Directors held during the period for which he/she has been a director and (ii) the total number of meetings held by all committees of our Board of Directors on which he/she served during the periods that he/she served.

Although we do not have a formal policy regarding attendance by members of our Board of Directors at annual meetings of shareholders, we encourage, but do not require, our directors to attend. All board members were in attendance at the 2022 Annual Meeting.

Our Board of Directors has established three standing committees to assist it in fulfilling its responsibilities in compliance with SEC and Nasdaq rules and regulations. These committees include the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each committee operates under a separate charter adopted by our Board of Directors. Committee charters are available under the “Governance” tab on the Company’s website at www.cnfrh.com. Committee members are appointed by the Board of Directors annually and serve until their resignation or until otherwise determined by the Board. Details and the function of each committee are described below.

Audit Committee

The Audit Committee assists our Board of Directors in fulfilling its oversight responsibilities relating to:

In so doing, the Audit Committee is responsible for maintaining free and open communication between the committee, the independent registered public accounting firm and our management. In this role, the Audit Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of our Company and has the power to retain outside counsel or other experts for this purpose. The Audit Committee has direct responsibility for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The Audit Committee meets in executive session with both the internal auditor and the independent registered public accounting firm periodically. The Audit Committee in conjunction with the head of the Internal Audit and Corporate Counsel, oversees the administration of the Company's whistleblower hotline to include oversight over the investigative process initiated as a result of any report that is received by the Company. The Audit Committee is responsible for approving all transactions with related persons. The Audit Committee periodically reviews and approves or ratifies a summary of transactions with related persons as prepared by management. To the extent any new transactions may arise during the course of the year, management discusses such transactions with the Audit Committee.

Currently, the Audit Committee members are Isolde O'Hanlon (Chairperson), John Melstrom, and Richard Jamison Williams, Jr. Our Board of Directors has determined that each member of the Audit Committee meets the requirements for independence under the applicable rules, regulations and listing standards of Nasdaq and applicable rules and regulations promulgated by the SEC. The Audit Committee met seven times in 2022. The Audit Committee Report is set forth later in this proxy statement. Isolde O’Hanlon has the requisite attributes of a financial expert and such attributes were acquired through relevant education and experience for purposes of service on the Audit Committee and in accordance with the rules and regulations of the Nasdaq Stock Market and the applicable securities laws of the Securities and Exchange Commission.

8

Compensation Committee

The Compensation Committee assists our Board of Directors with reviewing the performance of our management in achieving corporate goals and objectives and assuring that our executives are compensated effectively in a manner consistent with our strategy, competitive practice and the requirements of applicable regulatory bodies. Toward that end, the Compensation Committee, among other responsibilities, makes recommendations to our Board of Directors regarding director and executive officer compensation, equity‑based compensation plans and executive benefit plans. The Compensation Committee also administers the Company’s incentive plans.

The Compensation Committee met four times in 2022. All members of the Compensation Committee satisfy the independence requirements established by the Nasdaq. The Compensation Committee members are Jeffrey Hakala (Chairperson), Isolde O’Hanlon, and Joseph Sarafa.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, among other things:

The members of the Nominating and Corporate Governance Committee are Joseph Sarafa (Chairperson), Jeffrey Hakala, and Timothy Lamothe. The Nominating and Corporate Governance Committee met four times in 2022. The Nominating and Corporate Governance Committee recommended to the Board, and the Board approved the nomination of Timothy Lamothe, Isolde O'Hanlon, and Nicholas Petcoff as directors with terms expiring in 2026.

9

Board Diversity

The following Board Diversity Matrix presents our Board diversity statistics in accordance with Nasdaq Rule 5606, as self-disclosed by our directors.

Board Diversity Matrix (As of April 12, 2023) | ||||

Total Number of Directors | 10 | |||

| Female | Male | Non-Binary | Did Not Disclose Gender |

Part I: Gender Identity |

| |||

Directors | 1 | 9 | 0 | 0 |

Part II: Demographic Background |

| |||

African American or Black | 0 | 0 | 0 | 0 |

Alaskan Native or Native American | 0 | 0 | 0 | 0 |

Asian | 0 | 0 | 0 | 0 |

Hispanic or Latinx | 0 | 0 | 0 | 0 |

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

White | 1 | 9 | 0 | 0 |

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

LGBTQ+ | 0 | |||

Did Not disclose Demographic Background | 0 | |||

Code of Business Conduct and Ethics

We have a Code of Conduct and Ethics applicable to our directors, officers and employees that complies with the requirements of applicable rules and regulations of the SEC and Nasdaq. This code is designed to deter wrongdoing and to promote:

Our Code of Business Conduct and Ethics is available on the governance portion of our website at www.cnfrh.com.

Hedging

Pursuant to the terms of our Insider Trading Policy, we prohibit all directors, officers, and employees from engaging in hedging transactions including hedging or monetization transactions, such as zero-cost collars and forward sale contracts with respect to our securities.

Any shareholder may communicate directly with the Board of Directors, or with any one or more individual members of the Board. A shareholder wishing to do so should address the communication to “Board of Directors” or to one or more individual members of the Board and submit the communication to the Company at the address of the Company noted on the first page of this Notice of Meeting and Proxy Statement. All such communications received by the Company and addressed to

10

the Board of Directors will be forwarded to the Chairman of the Board, or to the individual member or members of the Board, if addressed to them.

All of these communications will be reviewed by our Secretary to filter out communications that are not appropriate, specifically, spam or communications offering to buy or sell products or services. The Secretary will forward all remaining communications to the appropriate directors.

Nomination to the Board of Directors

Candidates for nomination to our Board of Directors are selected by our Board of Directors based on the recommendation of the Nominating and Corporate Governance Committee in accordance with the committee’s charter, our bylaws, our Corporate Governance Guidelines, and the criteria adopted by our Board of Directors regarding director candidate qualifications. In recommending candidates for nomination, the Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, shareholders and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate and, in addition, the Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

Additional information regarding the process for properly submitting shareholder nominations for candidates for membership on our Board of Directors is set forth below under “Shareholder Proposals to Be Presented at Next Annual Meeting.”

Director Qualifications

With the goal of developing a diverse, experienced and highly qualified board of directors, the Nominating and Corporate Governance Committee is responsible for developing and recommending to our Board of Directors the desired qualifications, expertise and characteristics of members of our Board of Directors, including qualifications that the Committee believes must be met by a committee-recommended nominee for membership on our Board of Directors and specific qualities or skills that the Committee believes are necessary for one or more of the members of our Board of Directors to possess.

Since the identification, evaluation and selection of qualified directors is a complex and subjective process that requires consideration of many intangible factors, and will be significantly influenced by the particular needs of our Board of Directors from time to time, our Board of Directors has not adopted a specific set of minimum qualifications, qualities or skills that are necessary for a nominee to possess, other than those that are necessary to meet U.S. legal, regulatory and Nasdaq listing requirements and the provisions of our bylaws, Corporate Governance Guidelines, and charters of the board committees. When considering nominees, our Nominating and Corporate Governance Committee may take into consideration many factors including, among other things, a candidate’s independence, integrity, skills, financial and other expertise, breadth of experience, and knowledge about our business or industry and ability to devote adequate time and effort to responsibilities of our Board of Directors in the context of its existing composition. Through the nomination process, the Nominating and Corporate Governance Committee seeks to promote board membership that reflects a diversity of business experience, expertise, viewpoints, personal backgrounds and other characteristics that are expected to contribute to our Board of Directors’ overall effectiveness. The brief biographical description of each director set forth in “Information about the Nominees and the Incumbent Directors” includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

11

Director Compensation

Our non-employee directors received the following compensation in 2022.

Name |

| Fees Earned or Paid in Cash |

| |

|

| 2022 |

| |

Joseph Sarafa |

| $ | 20,000 |

|

R. Jamison Williams, Jr. |

|

| 20,000 |

|

Isolde O'Hanlon |

|

| 20,000 |

|

Jeffrey Hakala |

|

| 20,000 |

|

John Melstrom |

|

| 20,000 |

|

Timothy Lamothe (elected in 2020) |

|

| 20,000 |

|

Gerald Hakala (appointed in 2022) |

|

| 5,000 |

|

Andrew Petcoff (resigned in 2022) |

|

| — |

|

Total Fees |

| $ | 125,000 |

|

12

PROPOSAL NO. 1

THE ELECTION OF THREE DIRECTORS

The Company’s Board of Directors is divided into three classes with each class of directors elected to a staggered three-year term of office. At each annual meeting of shareholders, the shareholders elect one class of directors for a three-year term to succeed the class of directors whose term of office expires at that meeting. Each director's term continues until the election and qualification of his or her successor, or such director's earlier death, resignation, or removal.

This year you are voting on three candidates for director. The Company’s Board of Directors, acting upon the recommendation of its Nominating and Corporate Governance Committee, has nominated Timothy Lamothe, Isolde O'Hanlon, and Nicholas Petcoff as directors with terms expiring in 2026. Each nominee has consented to his or her nomination and has agreed to serve as a director, if elected.

If any nominee is unable to stand for election, the Company may vote the shares to elect a substitute nominee, who is nominated by the Board, or the number of directors to be elected at the Annual Meeting may be reduced.

Vote Required

The three nominees receiving the largest number of votes, whether or not a majority, will be elected for a three-year term ending at the Annual Meeting of Shareholders in 2026.

The Company’s Board recommends a vote FOR each of the nominees.

13

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed Plante & Moran, PLLC ("Plante"), an independent registered public accounting firm, to audit our consolidated financial statements for our fiscal year ending December 31, 2023. During our fiscal year ended December 31, 2022, Plante served as our independent registered public accounting firm.

Notwithstanding the appointment of Plante and even if our shareholders ratify the appointment, our Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our Audit Committee believes that such a change would be in the best interests of our Company and our shareholders. At the Annual Meeting, our shareholders are being asked to ratify the appointment of Plante as our independent registered public accounting firm for our fiscal year ending December 31, 2023. Our Audit Committee is submitting the appointment of Plante to our shareholders because we value our shareholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Representatives of Plante will be present at the Annual Meeting, and will be available to respond to appropriate questions from our shareholders.

If our shareholders do not ratify the appointment of Plante, our Board of Directors may reconsider the appointment.

Change in Independent Registered Public Accounting Firm

As reported on the Company’s Current Report on Form 8-K, dated June 3, 2022, the Audit Committee engaged Plante on June 1, 2022 as the Company’s independent registered public accounting firm for the Company’s fiscal year ending December 31, 2022 and dismissed Deloitte & Touche LLP (“Deloitte”), the Company’s prior independent registered public accounting firm.

During the Company’s two most recent fiscal years ended December 31, 2021 and December 31, 2020 and during the subsequent interim period from January 1, 2022 through June 1, 2022, (i) there were no disagreements with Deloitte on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures that, if not resolved to Deloitte’s satisfaction, would have caused Deloitte to make reference to the subject matter of the disagreement in connection with its reports and (ii) there were no “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K.

During the Company’s two most recent fiscal years ended December 31, 2021 and December 31, 2020, and for the subsequent interim period through June 1, 2022, neither the Company nor anyone on its behalf consulted Plante regarding (i) the application of accounting principles to a specified transaction, either completed or proposed; or on the type of audit opinion that might be rendered on the consolidated financial statements of the Company, and neither a written report nor oral advice was provided to the Company that Plante concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement as defined in Item 304(a)(1)(iv) of Regulation S-K or a reportable event as described in Item 304(a)(1)(v) of Regulation S-K.

The Company requested that Deloitte furnish a letter addressed to the SEC stating whether it agrees with the above statements. Deloitte has furnished the letter confirming its agreement with the above statements. A copy of Plante’s letter, dated June 3, 2022, is filed as Exhibit 16 to the Company’s Form 8-K dated June 3, 2022.

14

Fees Paid to the Independent Registered Public Accounting Firm

On June 1, 2022, the Company engaged Plante & Moran, PLLC as its new independent registered public accounting firm. The following table presents fees incurred for professional audit services and other services rendered to our Company by Plante & Moran, PLLC and Deloitte & Touche LLP for the year ended December 31, 2022, in thousands. For the year ended December 31, 2021, the table shows professional audit services and other services rendered by Deloitte & Touche LLP, in thousands.

|

| 2022 |

|

| 2021 |

|

| ||

Audit Fees (1) |

| $ | 617 |

|

| $ | 520 |

|

|

Audit-Related Fees (2) |

|

| 38 |

|

|

| 13 |

|

|

Total Fees |

| $ | 655 |

|

| $ | 533 |

|

|

(1) Audit Fees consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our Annual Report on Form 10-K and services that are normally provided by the independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years. The 2022 audit fees also included $85,000 of professional services related to the Company's sale of its Security & Alarm business in the fourth quarter of 2022. The 2022 audit fees also included $61,000 of professional services related to the Company's loss portfolio transfer that was entered into during the fourth quarter of 2022.

The 2021 Audit Fees also include $75,000 of professional service fees related to the Company’s Venture Transaction that occurred in the second quarter of 2021 and $9,000 of professional service fees related to the Department of Insurance and Financial Services’ (DIFS) triennial exam of the Company.

(2) Audit-Related Fees consist of fees for professional services for the actuarial certification. For the 2022 actuarial certification, the Company used EVP Advisor, Inc. For the 2021 and 2020 actuarial certifications, the Company used Deloitte & Touche LLP.

Auditor Independence

In our fiscal year ended December 31, 2022, there were no other professional services provided by Plante, other than those listed above, that would have required our Audit Committee to consider their compatibility with maintaining the independence of Plante.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our Audit Committee is required to pre-approve all audit and non-audit services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair the public accountants’ independence. All services provided by Plante & Moran, PLLC for our fiscal year ended December 31, 2022, were pre-approved by our Audit Committee. All services provided by Deloitte & Touche LLP for our fiscal years ended December 31, 2021 and 2020 were pre-approved by our Audit Committee.

15

Vote Required

The ratification of the appointment of Plante as our independent registered public accounting firm requires the affirmative vote of a majority vote of the votes cast by Internet, by proxy or by telephone and entitled to vote thereon. Abstentions and broker non-votes will have no effect on the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF PLANTE & MORAN, PLLC.

16

REPORT OF THE AUDIT COMMITTEE

The information contained in the following report of our Audit Committee is not considered to be “soliciting material,” “filed” or incorporated by reference in any past or future filing by us under the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that we specifically incorporate it by reference.

The Audit Committee has reviewed and discussed with our management and Plante & Moran, PLLC our audited financial statements for the year ended December 31, 2022. The Audit Committee has also discussed with Plante & Moran, PLLC the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") and the SEC.

The Audit Committee has received and reviewed the written disclosures and the letter from Plante & Moran, PLLC required by applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with Plante & Moran, PLLC its independence from Conifer.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors and the Board of Directors approved that the audited financial statements be included in our annual report on Form 10-K for the year ended December 31, 2022 for filing with the Securities and Exchange Commission.

Submitted by the Audit Committee

Isolde O'Hanlon

John Melstrom

Richard Jamison Williams, Jr.

17

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 20, 2023 for:

We have determined beneficial ownership in accordance with the rules of the SEC, and thus it represents sole or shared voting or investment power with respect to our securities. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares that they beneficially owned, subject to community property laws where applicable.

We have based our calculation of the percentage of beneficial ownership on 12,215,849 shares of our common stock outstanding as of March 20, 2023. There are authorized shares of our common stock that will be issued in the future pursuant to restricted stock units ("RSU") and stock option awards. RSU and stock options are subject to vesting conditions. The table below reflects only outstanding shares relating to fully vested RSUs and exercised stock options as of 60 days following March 20, 2023.

Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Conifer Holdings, Inc., 3001 West Big Beaver Road, Suite 200, Troy, MI 48084. The information provided in the table is based on our records, information filed with the SEC and information provided to us, except where otherwise noted.

Name of Beneficial Owner |

| Number of |

|

| Percentage |

| ||

Named Executive Officers and Directors: |

|

|

|

|

|

| ||

James Petcoff (1) |

|

| 3,796,968 |

|

|

| 30.8 | % |

Brian Roney (4) |

|

| 575,232 |

|

|

| 4.7 | % |

Nicholas Petcoff (1) (5) |

|

| 360,314 |

|

|

| 2.9 | % |

Harold Meloche (6) |

|

| 59,267 |

|

| * |

| |

Timothy Lamothe |

|

| 17,351 |

|

| * |

| |

Joseph Sarafa |

|

| 250,000 |

|

|

| 2.1 | % |

R. Jamison Williams, Jr. |

|

| 440,752 |

|

|

| 3.6 | % |

Isolde O'Hanlon |

|

| 5,000 |

|

| * |

| |

John Melstrom |

|

| 25,000 |

|

| * |

| |

Jeffrey Hakala (2) |

|

| 1,753,895 |

|

|

| 14.3 | % |

Gerald Hakala (2) |

|

| 1,753,895 |

|

|

| 14.3 | % |

All named executive officers and directors as a |

|

| 8,677,360 |

|

|

| 70.7 | % |

|

|

|

|

|

|

| ||

Other Beneficial Owners |

|

|

|

|

|

| ||

Clarkston Ventures, LLC (3) |

|

| 3,635,769 |

|

|

| 29.7 | % |

(1) James Petcoff, Nicholas Petcoff and Andrew Petcoff entered into a voting agreement on August 8, 2022 that permits James Petcoff to vote all of the Issuer's shared owned by James Petcoff, Nicholas Petcoff and Andrew Petcoff.

(2) The shares are held directly by Clarkston Ventures, LLC (“CV”) and indirectly by Jeffrey Hakala and Gerald Hakala, who are both Co-Chief Investment Officers of CV. Jeffry Hakala and Gerald Hakala disclaim beneficial ownership in the shares held by CV except to the extent of their pecuniary ownership therein.

(3) Based solely on information contained in the Form 4 filed with the SEC on August 12, 2022 by CV. The address of CV is 81 West Long Lake Road, Bloomfield Hills, MI, 48304.

(4) Includes 65,000 shares underlying outstanding stock options.

(5) Includes 85,000 shares underlying outstanding stock options.

(6) Includes 8,000 shares underlying outstanding stock options and 2,000 shares underlying restricted stock units.

(7) Includes 158,000 shares underlying outstanding stock options and 2,000 shares underlying restricted stock units.

18

OTHER EXECUTIVE OFFICERS

Brian Roney, 58, is the President of Conifer Holdings, Inc. Mr. Roney oversees the Company's finance and investor relations functions, as well as general operations. He has been with the Company since 2010 and has over 24 years of experience in the insurance industry. Mr. Roney has a B.A. from the University of Notre Dame and a M.B.A. from the University of Detroit. Mr. Roney has more than 34 years of financial services experience and spent 10 years in the securities industry as a principal with a broker-dealer, where he specialized in public and private offerings and held FINRA (NASD) Series 7, 24 and 63 licenses. Mr. Roney's prior experience with multiple publicly traded insurance companies brings vital public company expertise to the executive leadership team.

Harold Meloche, 61, is the Chief Financial Officer and Treasurer of Conifer Holdings, Inc. Mr. Meloche has primary responsibility over accounting and financial reporting. Mr. Meloche has been with the Company since 2013 and has over 29 years of experience in the insurance industry. Mr. Meloche is a registered Certified Public Accountant and his analytical expertise bears considerable value to the Company’s financial leadership team.

19

EXECUTIVE COMPENSATION

Summary Compensation Table for Fiscal Year 2022 and 2021

The following table shows the compensation earned by James Petcoff, Brian Roney and Nicholas Petcoff (collectively, the "named executive officers") for the years ended December 31, 2022, and 2021.

Name and Principal Position |

| Year |

| Salary |

|

| Option Awards |

|

| All Other |

|

| Total |

| ||||

James Petcoff |

| 2022 |

|

| 600,000 |

|

|

| — |

|

|

| 12,200 |

|

|

| 612,200 |

|

Co-Chief Executive Officer and Executive Chairman of the Board of Directors of the Corporation |

| 2021 |

|

| 550,000 |

|

|

| — |

|

|

| 11,200 |

|

|

| 561,200 |

|

Nicholas Petcoff |

| 2022 |

|

| 425,000 |

|

|

| 354,303 |

|

|

| 12,200 |

|

|

| 791,503 |

|

Co-Chief Executive Officer and Director of the Corporation |

| 2021 |

|

| 425,000 |

|

|

| — |

|

|

| 11,200 |

|

|

| 436,200 |

|

Brian Roney |

| 2022 |

|

| 425,000 |

|

|

| 257,233 |

|

|

| 12,200 |

|

|

| 694,433 |

|

President of the Corporation |

| 2021 |

|

| 425,000 |

|

|

| — |

|

|

| 11,200 |

|

|

| 436,200 |

|

(1) In accordance with SEC rules, in the case of time-based equity awards, this column reflects the aggregate grant date fair value of such equity awards, as computed in accordance with FASB ASC Topic 718, which is consistent with the estimate of aggregate compensation cost to be recognized over the service period determined as of the grant date under FASB ASC Topic 718. Assumptions used in the calculation of these amounts are included in the notes to our financial statements included in our Annual Report on Form 10‑K for the year ended December 31, 2022. These amounts do not reflect the actual economic value that will be realized by our named executive officers upon the vesting of such equity awards or the sale of the common stock underlying such awards.

(2) Other compensation for James Petcoff consisted of $12,200 and $11,200 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2022 and 2021. Other compensation for Nicholas Petcoff consisted of $12,200 and $11,200 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2022 and 2021. Other compensation for Brian Roney consisted of $12,200 and $11,200 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2022 and 2021.

Narrative Disclosure to Summary Compensation Table

Base Salary

Our Compensation Committee determines the base salaries for each of our named executive officers, as referenced above. Generally, we aim to set executive base salaries near the middle range of the salaries that we have observed for executives in similar positions with similar responsibilities. We pay our named executive officers an annual base salary in cash. Base salaries are reviewed annually by the Compensation Committee and, when appropriate, make recommendations to the Board for approval of the compensation of our named executive officers.

Bonus

Our Compensation Committee historically has not utilized a strict formula in its determination of the annual bonus paid to each of our named executive officers. Rather, the Compensation Committee, with input from our Co-Chief Executive Officer, James Petcoff, has taken into account individual performance, Company performance, and market conditions in its determination of the annual bonus paid to each of our named executive officers. Beginning in 2017, the Compensation Committee evaluates executive bonuses primarily in accordance with a formula taking into account the Company's annual return on equity. Under the plan, executives may be eligible to be paid a bonus equal to a percentage of their base salary, with the applicable percentage increasing as the Company's annual return on equity (defined as pre-tax, post-bonus net income, as a percentage of the Company's total shareholders' equity as of the beginning of the year) increases. For Mr. James Petcoff, the applicable percentage would be 30% of base salary at a 3% annual return on equity and would increase to a maximum of 200%

20

of base salary at an annual return on equity in excess of 17%. For Mr. Nicholas Petcoff and Mr. Roney, the applicable percentage would be 20% of base salary at a 3% annual return on equity and would increase to a maximum of 125% of base salary at an annual return on equity in excess of 17%. In addition, the Compensation Committee may take into account individual performance, Company performance, and market conditions in its determination of annual bonuses to be paid to named executive officers if the Company's annual return on equity for any annual period is less than 3%.

Equity Awards Granted to our Named Executive Officers

On March 8, 2022, the Company issued options to purchase 630,000 shares of the Company's common stock to two of our named executive officers. The value of the options are $612,000 and will vest over a five-year period.

Outstanding Equity Awards at 2022 Year-End

The following table lists all outstanding equity awards held by our Named Executive Officers as of December 31, 2022.

| Option Awards |

| ||||||||||

Name | Number of securities underlying unexercised options exercisable (#) |

| Number of |

| Option |

| Option |

| ||||

James Petcoff |

| — |

|

| — |

|

| — |

|

| — |

|

Nicholas Petcoff (1) |

| 12,000 |

|

| 18,000 |

| $ | 3.81 |

| 6/30/2030 |

| |

Brian Roney (1) |

| 12,000 |

|

| 18,000 |

| $ | 3.81 |

| 6/30/2030 |

| |

Nicholas Petcoff (2) |

| — |

|

| 365,000 |

| $ | 4.53 |

| 3/8/2032 |

| |

Brian Roney (2) |

| — |

|

| 265,000 |

| $ | 4.53 |

| 3/8/2032 |

| |

(1) 30,000 options were granted on June 30, 2020 to Mr. Nicholas Petcoff and Mr. Roney, respectively. These options vest in five equal annual installments beginning on the first anniversary of the date of grant.

(2) 365,000 and 265,000 options were granted on March 8, 2022 to Mr. Nicholas Petcoff and Mr. Roney, respectively. These options vest in five equal annual installments beginning on the first anniversary of the date of grant.

Severance and Change in Control Benefits

The Company is party to employment agreements (the “Employment Agreements”) with each of our NEOs. The Employment Agreements are the same except for the individuals' titles and annual base salaries, which are $600,000 for Mr. James Petcoff, $425,000 Mr. Nicholas Petcoff, and $425,000 for Mr. Brian Roney.

The initial term for each of the Employment Agreements ended on March 13, 2018 for Mr. James Petcoff, Mr. Nicholas Petcoff, and Mr. Brian Roney. All of the aforementioned Employment Agreements have an unlimited one-year automatic extension unless the Employee gives written notice of non-extension not less than 30 days prior to the expiration of the term or the Company gives written notice of non-extension prior to the expiration of the term. The Employment Agreements provide for an annual base salary, participation in the annual bonus plan, participation in any long-term incentive plan made generally available to senior executive officers of the Company and other fringe benefits and perquisites as are generally made available to the Company’s executives.

If any of the executives’ employment is terminated for cause, the executive will receive the accrued and unpaid portion of base salary. If any of the executives’ employment is terminated due to death or permanent disability, the executive (or his legal representative or beneficiary) will receive the accrued and unpaid portion of base salary and any earned but not yet paid incentive awards for already completed years or award cycles. If any of the executives’ employment is terminated without cause or if he terminates his employment for good reason (assuming the change of control provisions below do not apply), the executive will receive the accrued and unpaid portion of base salary, any earned but not yet paid incentive awards for already completed years or award cycles, plus one times his annual base salary. In addition, any unvested equity awards will immediately vest. If any of the executives’ employment is terminated without cause (other than due to death or permanent

21

disability) or he terminates such employment for good reason, in each case within 24 months after a change of control, the executive will receive the accrued and unpaid portion of base salary, any earned but not yet paid incentive awards for already completed years or award cycles and 2.99 times the sum of (i) his annual base salary and (ii) the greater of his annual target bonus or his average bonus for the prior three years. In addition, any unvested equity awards will immediately vest.

The employment agreements also provide for confidentiality and non-solicitation provisions, the latter for one year after termination of employment.

Chief Executive Officer Pay Ratio

As a “smaller reporting company”, we are not required to provide information relating to the ratio of total compensation of our Chief Executive Officer to the median of the annual total compensation of all of our employees, as required by the Investor Protection and Securities Reform Act of 2010, which is part of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth certain information as of December 31, 2022 concerning our equity compensation plans:

Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

| Weighted-average exercise price of outstanding options, warrants and rights (b) |

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(c) |

| |||

Equity compensation plans approved by security holders |

| 892,000 |

| $ | 4.32 |

|

| 18,572 |

|

Equity compensation plans not approved by security holders |

| — |

|

| — |

|

| — |

|

Total |

| 892,000 |

| $ | 4.32 |

|

| 18,572 |

|

22

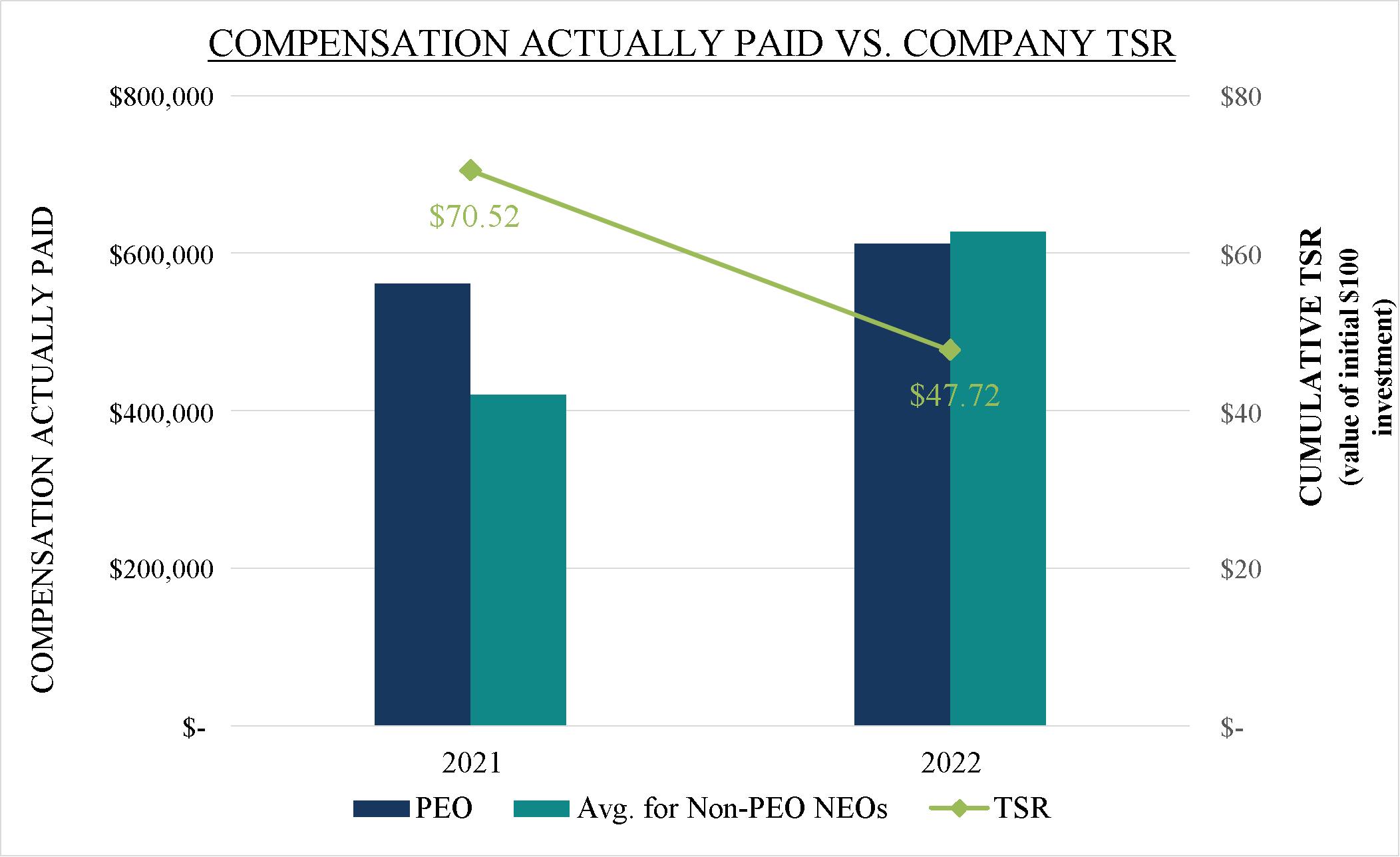

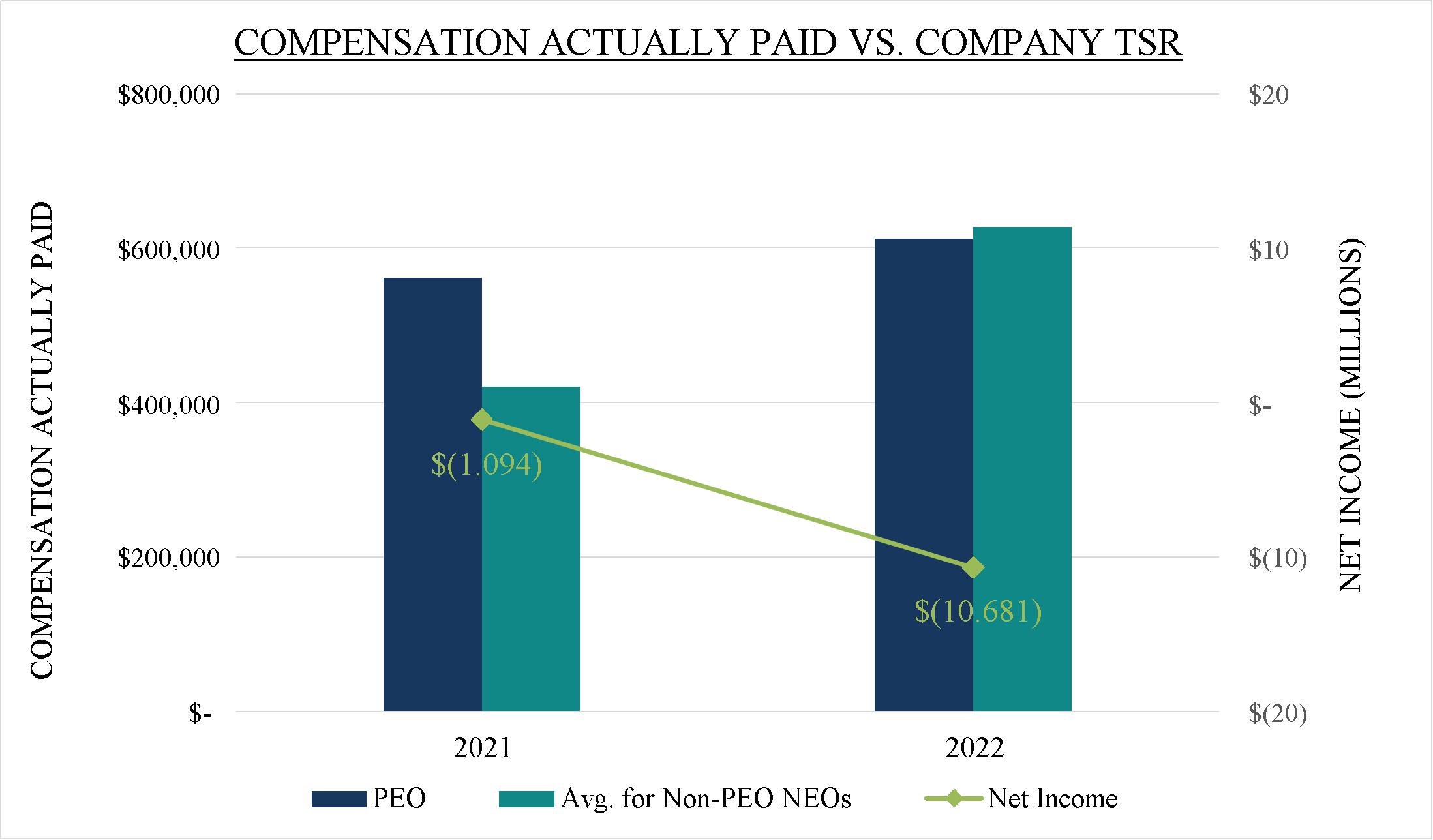

PAY VERSUS PERFORMANCE

We are providing the following information about the relationship between executive compensation actually paid (CAP) and certain financial performance of the Company as required by SEC rules. Please see “Executive Compensation” for discussion of our compensation philosophy.

Year | Summary Compensation Table Total for PEO1 | Compensation Actually Paid to PEO2 | Average Summary Compensation Table Total for Non-PEO NEOs3 | Average Compensation Actually Paid to Non-PEO NEOs4 | Value of Initial Fixed $100 Investment Based On: | Net Loss (in thousands) |

Total Shareholder Return | ||||||

2022 | $612,200 | $612,200 | $742,968 | $627,442 | $47.72 | $(10,681) |

2021 | $561,200 | $561,200 | $436,200 | $419,684 | $70.52 | $(1,094) |

1 Reflects the amount reported in the “Total” column of the Summary Compensation Table for Mr. James Petcoff for each corresponding year. See “Executive Compensation – Summary Compensation Table for Fiscal Year 2022”.

2 Amounts reported reflect CAP for Mr. James Petcoff, as computed in accordance with Item 402(v) of Regulation S-K for each corresponding year. No adjustments were reported as Mr. James Petcoff does not have any equity awards outstanding.

Year | Reported Summary Compensation Table Total for PEO | Reported Value of Equity Awards(a) | Compensation Actually Paid to PEO |

2022 | $612,200 | 0 | $612,200 |

2021 | $561,200 | 0 | $561,200 |

3 Reflects the average amount reported in the “Total” column of the Summary Compensation Table for our other NEOs as a group (excluding Mr. James Petcoff) for each corresponding year. The names of each of the other NEOs included for the purposes of calculating the average amounts in each applicable year are Mr. Nick Petcoff and Mr. Brian Roney for each of 2022 and 2021.

4 Amounts reported reflect CAP for the other NEOs as a group (excluding Mr. James Petcoff), as computed in accordance with Item 402(v) of Regulation S-K for each corresponding year. The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; and (iii) for awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value. The valuation assumptions used to calculate fair values did not materially differ from those disclosed at the time of grant. The amounts deducted or added in calculating the equity award adjustments are as follows:

Year | Average Reported Summary Compensation Table Total for Non-PEO NEOs | Average Reported Value of Equity Awards | Average Equity Award Adjustments(a) | Average Compensation Actually Paid to Non-PEO NEOs |

2022 | $742,968 | $305,768 | $190,242 | $627,442 |

2021 | $436,200 | 0 | $(16,516) | $419,684 |

23

Year | Average Year End Fair Value of Equity Awards Granted in the Year and Outstanding and Unvested at Year End | Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards | Year over Year Average Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year | Total Average Equity Award Adjustments |

2022

| $197,932 | $(5,363) | $(2,327) | $190,242 |

2021

| 0 | $(15,104) | $(1,412) | $(16,516) |

Analysis of the Information Presented in the Pay versus Performance Table

In accordance with Item 402(v) of Regulation S-K, the Company is providing the following descriptions of the relationships between information presented in the Pay versus Performance table.

24

25

Policies and Procedures for Related Person Transactions

Our related person transaction policy states that our executive officers, directors and principal shareholders, including their immediate family members, are not permitted to enter into a related person transaction with us without the consent of our Audit Committee, or the disinterested members of Board of Directors. Any request for us to enter into a transaction with an executive officer, director, principal shareholder or any of such persons’ immediate family members, in which the amount involved exceeds $120,000, will be required to be presented to our Audit Committee for review, consideration and approval. All of our directors, executive officers and employees are required to report to our Audit Committee any such related person transaction. In approving or rejecting the proposed transaction, our Audit Committee will take into account, among other factors it deems appropriate, whether the proposed related person transaction is on terms no less favorable than terms generally available to an unaffiliated third‑party under the same or similar circumstances, the extent of the related person’s interest in the transaction and, if applicable, the impact on a director’s independence. Under the policy, if we should discover related person transactions that have not been approved, our Audit Committee will be notified and will determine the appropriate action, including ratification, rescission or amendment of the transaction.

Other Family Relationships

The Company employs Nicholas Petcoff as Co-Chief Executive Officer and Director. Nicholas Petcoff is the son of James Petcoff, the Company's Executive Chairman and Co-Chief Executive Officer. Details of Nicholas Petcoff's role and background can be found in the "Information about the Nominees and the Incumbent Directors" section and details of compensation can be found in the "Executive Compensation" section of this proxy statement.

The Company employed Andrew Petcoff as Director, Senior Vice President of Personal Lines, and President of Sycamore Insurance Agency. Andrew Petcoff resigned from the Company's Board of Directors on December 31, 2022. Andrew Petcoff resigned from the Company on June 30, 2021, as a result of the sale of certain business line segments from Sycamore Insurance Agency, Inc., to Venture Agency Holdings, Inc. He is the son of James Petcoff, the Company's Executive Chairman and Co-Chief Executive Officer.

Andrew Petcoff earned $187,500 in base salary compensation for his services during 2021. He did not receive a bonus in 2021 from the Company. Andrew Petcoff received $7,500 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2021.

The Company employed B. Matthew Petcoff, the brother of the Executive Chairman and Co-Chief Executive Officer, James Petcoff, as the President of Blue Spruce Underwriters, a business unit and DBA of Sycamore Insurance Agency. B. Matthew Petcoff resigned from the Company on June 30, 2021, as a result of the sale of certain business line segments from Sycamore Insurance Agency, Inc., to Venture Agency Holdings, Inc. B. Matthew Petcoff earned $120,000 in base salary compensation for his services during 2021. B. Matthew Petcoff received $4,800 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2021. B. Matthew Petcoff did not receive a bonus in 2021.

The Company employed Hilary Petcoff as its Vice President of Enterprise Risk Management. Hilary Petcoff resigned from the Company on June 30, 2021, as a result of the sale of certain business line segments from Sycamore Insurance Agency, Inc., to Venture Agency Holdings, Inc. She is the daughter of the Company's Executive Chairman and Co-Chief Executive Officer, James Petcoff.

Hilary Petcoff earned $66,500 in base salary compensation for her services during 2021. Hilary Petcoff received $2,660 of employer matches on contributions to the Company's 401(k) employee benefit plan in 2021. Hilary Petcoff did not receive a bonus from the Company in 2021.

On August 10, 2022, the Company issued $5.0 million of common equity through a private placement of 2,500,000 shares priced at $2.00 per share. Clarkston Ventures, LLC purchased 1,500,000 shares; James Petcoff purchased 750,000 shares; Nicholas Petcoff purchased 100,000 shares; Brian Roney purchased 100,000 shares; and Joseph Sarafa purchased 50,000 shares.

26

ADDITIONAL INFORMATION

Our bylaws provide that, for shareholder nominations to the board or other proposals to be considered at an annual meeting, the shareholder must give timely notice thereof in writing to the Secretary at 3001 West Big Beaver Road, Suite 200, Troy, MI 48084, Attn: Secretary.

To be timely for the 2024 Annual Shareholder’s Meeting, a shareholder’s notice must be delivered to, or mailed and received by, our Secretary at our principal executive offices not earlier than 5:00 p.m. Eastern Time on November 19, 2023, and not later than 5:00 p.m. Eastern Time on January 18, 2024. A shareholder’s notice to the Secretary must set forth each matter the shareholder proposes to bring before the Annual Meeting and the information required by our bylaws.

Shareholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act and intended to be presented at our 2024 Annual Meeting must be received by the Secretary no later than December 14, 2023 in order to be considered for inclusion in our proxy materials for that annual meeting.

Available Information

This proxy statement and our annual report are posted on our website at http://www.cnfrh.com and are available from the SEC at its website at www.sec.gov. You may also obtain without charge, upon written request, a copy of Conifer’s annual report on Form 10-K for the year ending December 31, 2022, including the financial statements and list of exhibits, and any exhibit specifically requested.