Annual Shareholder Meeting May 17, 2023 NASDAQ: CNFR Fulfilling the Unique Needs of �Specialty Insurance Markets as �a Long-Term Partner

Safe Harbor Statement This presentation contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to management. These forward-looking statements include, without limitation, statements regarding our industry, business strategy, plans, goals and expectations concerning our market position, product expansion, future operations, margins, profitability, future efficiencies, and other financial and operating information. When used in this discussion, the words “may,” “believes,” “intends,” “seeks,” “anticipates,” “plans,” “estimates,” “expects,” “should,” “assumes,” “continues,” “potential,” “could,” “will,” “future” and the negative of these or similar terms and phrases are intended to identify forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, inherent risks and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this presentation. Our actual future results may be materially different from what we expect due to factors largely outside our control, including the occurrence of severe weather conditions and other catastrophes, the cyclical nature of the insurance industry, future actions by regulators, our ability to obtain reinsurance coverage at reasonable rates and the effects of competition. These and other risks and uncertainties associated with our business are described under the heading “Risk Factors” in our most recently filed Annual Report on Form 10-K and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, which should be read in conjunction with this presentation. The company and subsidiaries operate in a dynamic business environment, and therefore the risks identified are not meant to be exhaustive. Risk factors change and new risks emerge frequently. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

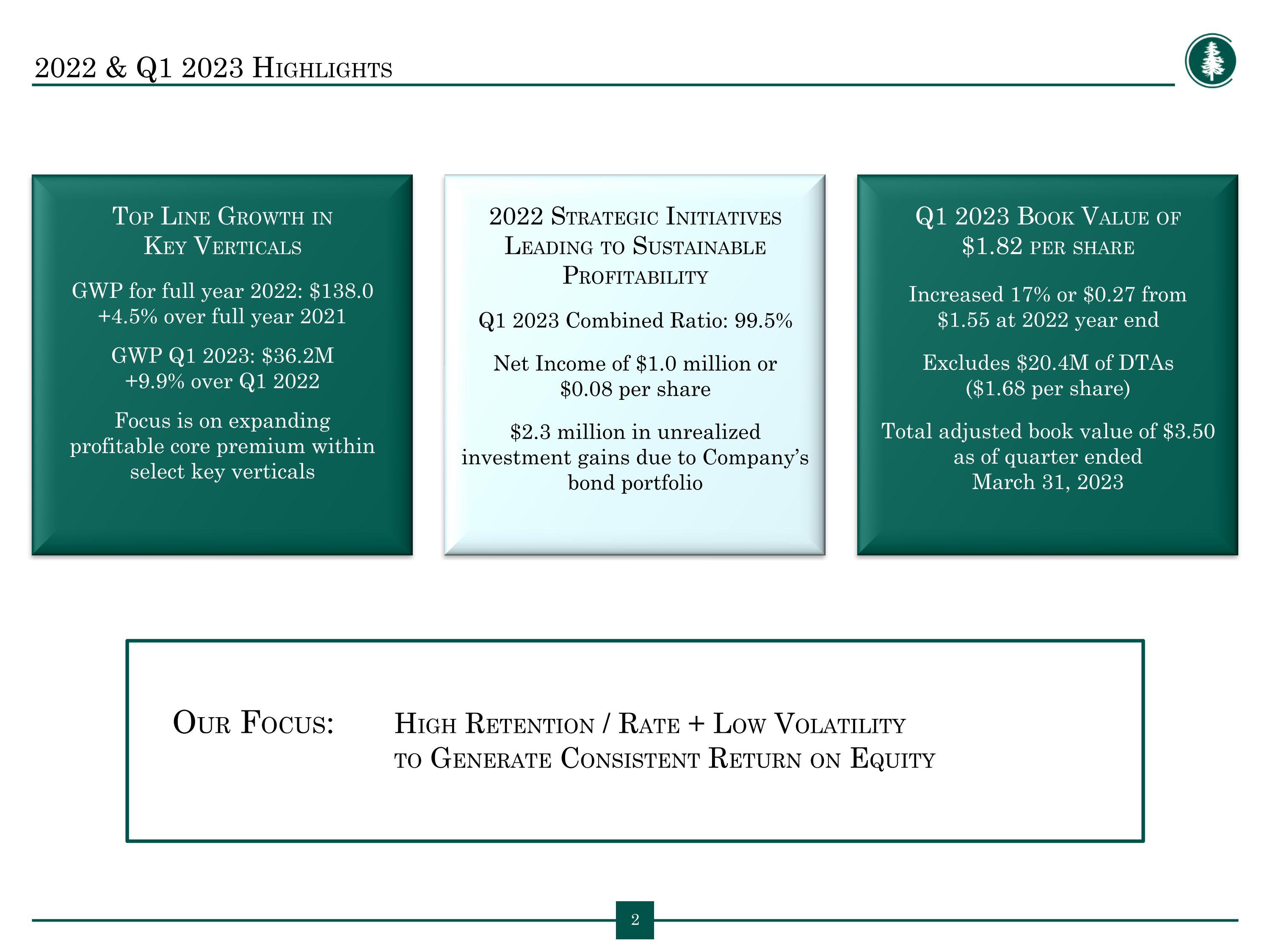

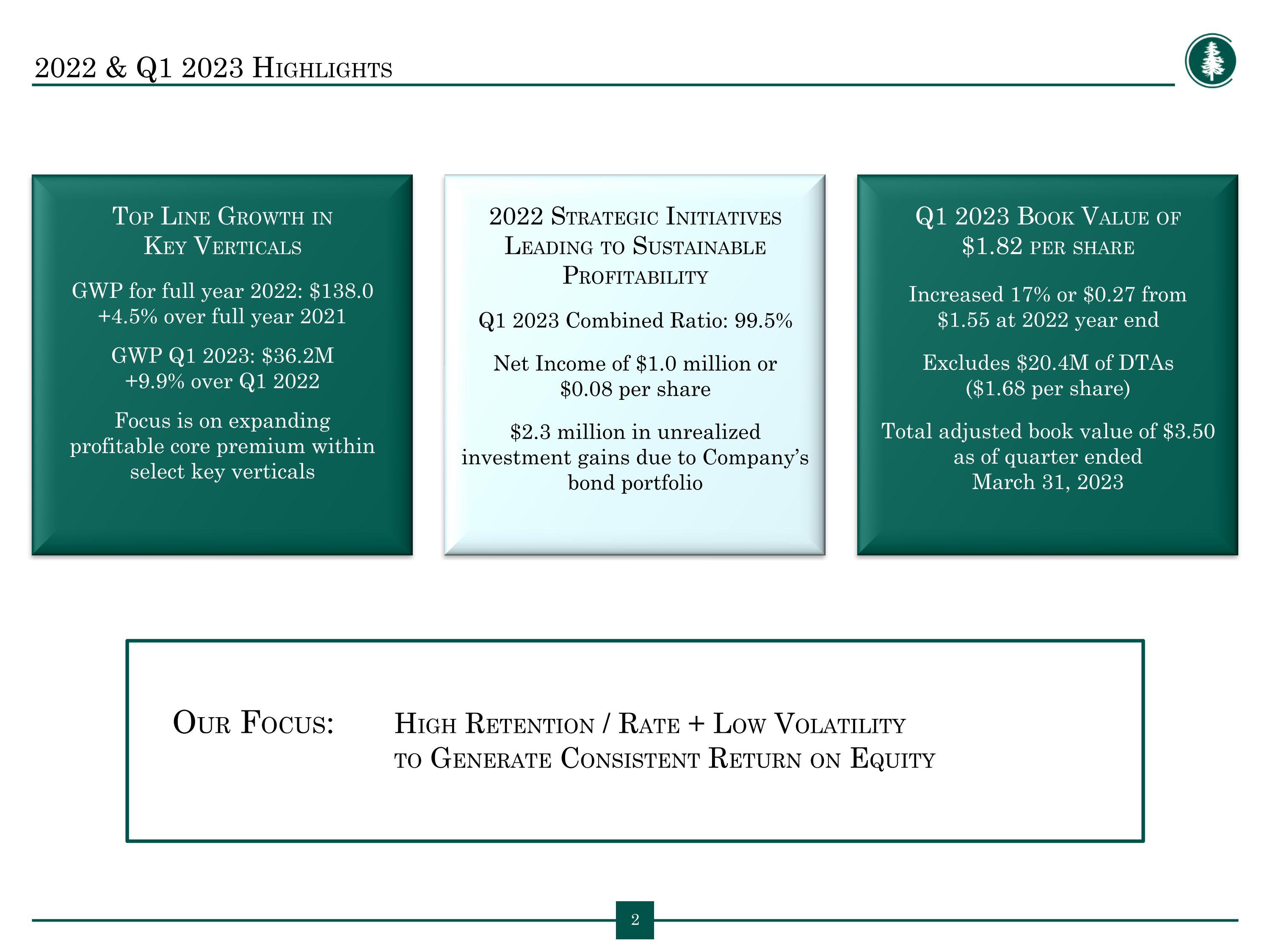

2022 & Q1 2023 Highlights Top Line Growth in�Key Verticals GWP for full year 2022: $138.0�+4.5% over full year 2021 GWP Q1 2023: $36.2M�+9.9% over Q1 2022 Focus is on expanding �profitable core premium within �select key verticals 2022 Strategic Initiatives Leading to Sustainable Profitability Q1 2023 Combined Ratio: 99.5% Net Income of $1.0 million or �$0.08 per share $2.3 million in unrealized investment gains due to Company’s bond portfolio Q1 2023 Book Value of �$1.82 per share Increased 17% or $0.27 from �$1.55 at 2022 year end Excludes $20.4M of DTAs �($1.68 per share) Total adjusted book value of $3.50 as of quarter ended March 31, 2023 Our Focus: High Retention / Rate + Low Volatility �to Generate Consistent Return on Equity

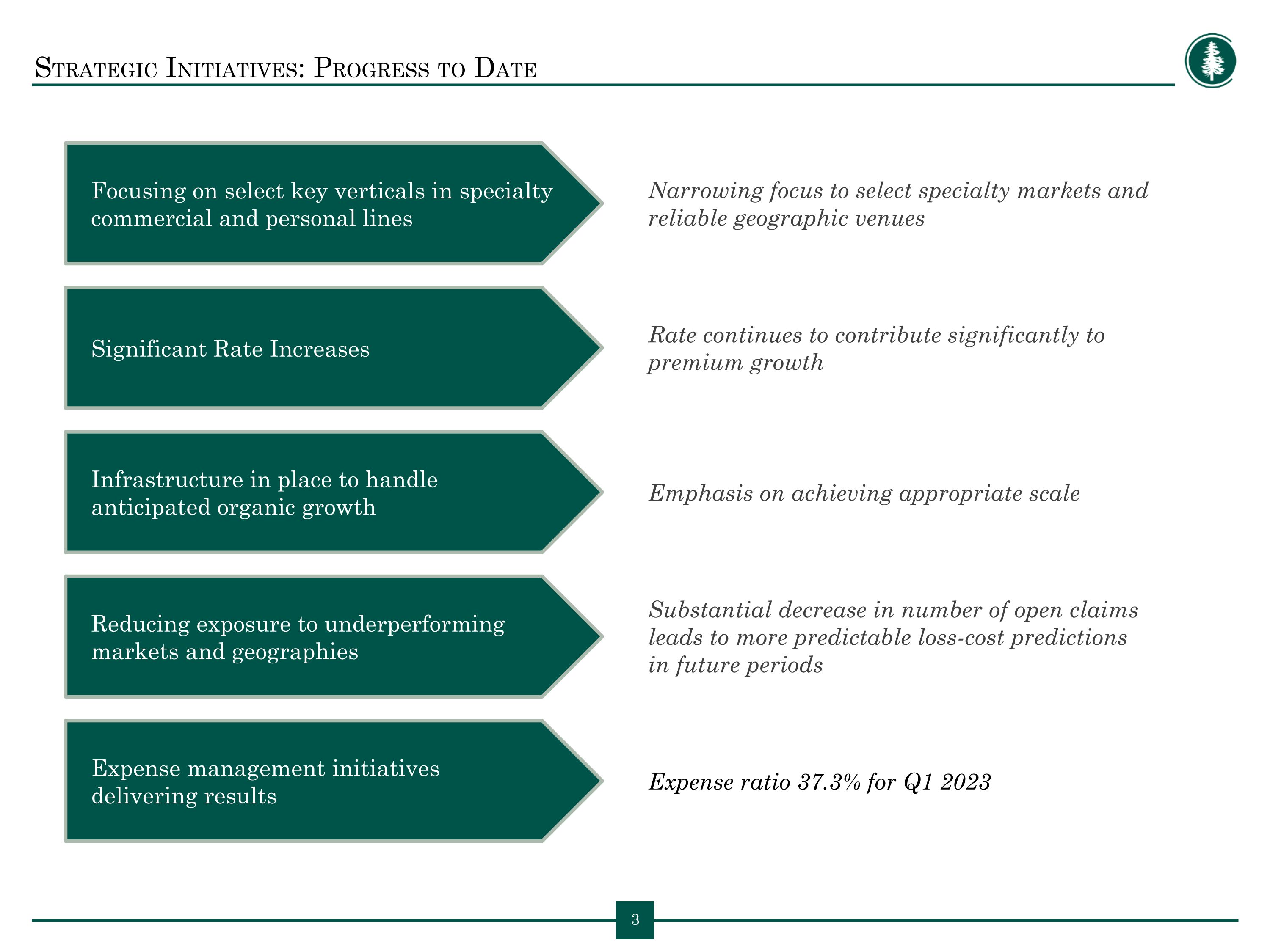

Strategic Initiatives: Progress to Date Focusing on select key verticals in specialty commercial and personal lines Narrowing focus to select specialty markets and reliable geographic venues Significant Rate Increases Rate continues to contribute significantly to premium growth Infrastructure in place to handle anticipated organic growth Emphasis on achieving appropriate scale Reducing exposure to underperforming markets and geographies Substantial decrease in number of open claims leads to more predictable loss-cost predictions �in future periods Expense management initiatives �delivering results Expense ratio 37.3% for Q1 2023

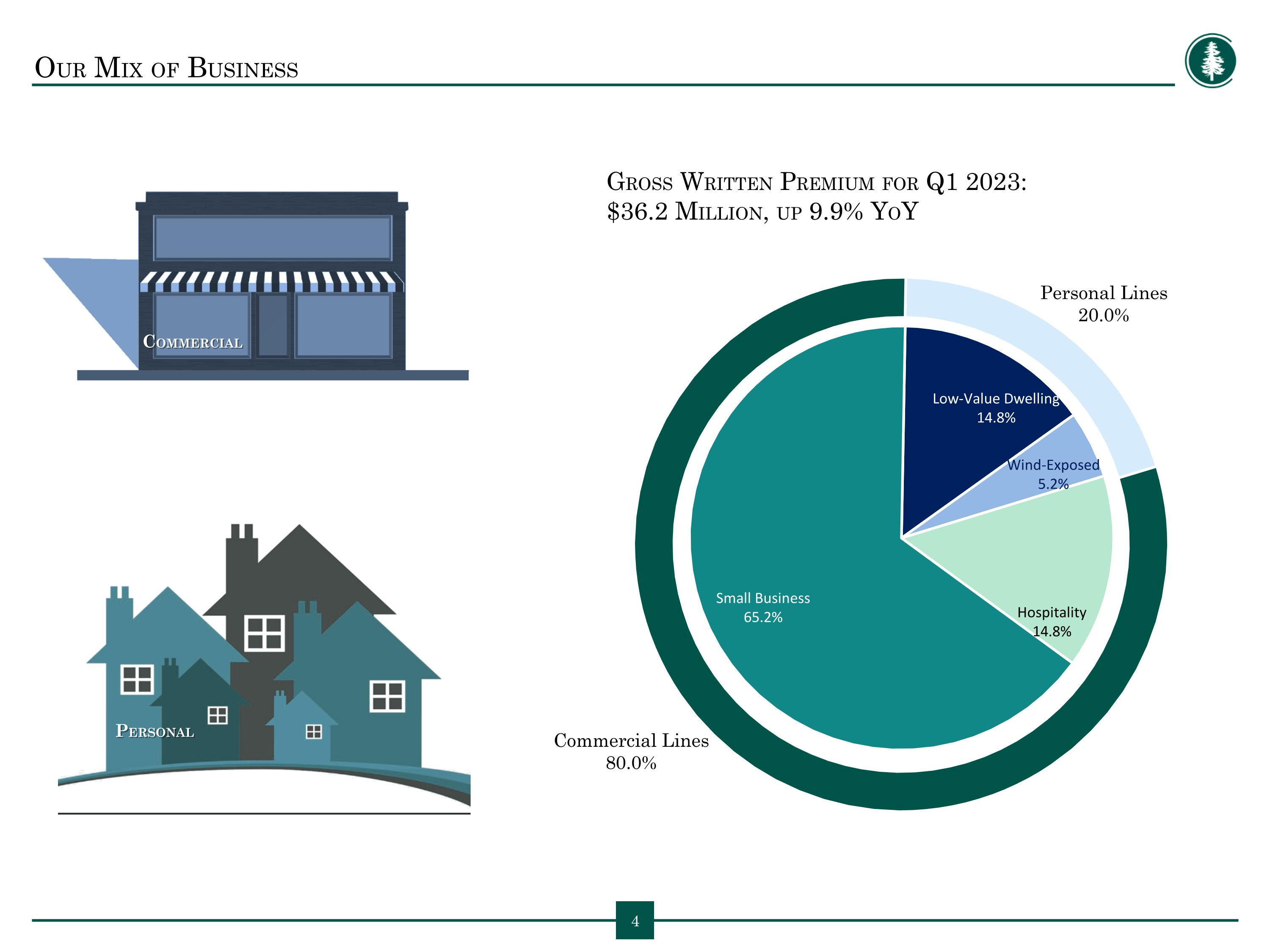

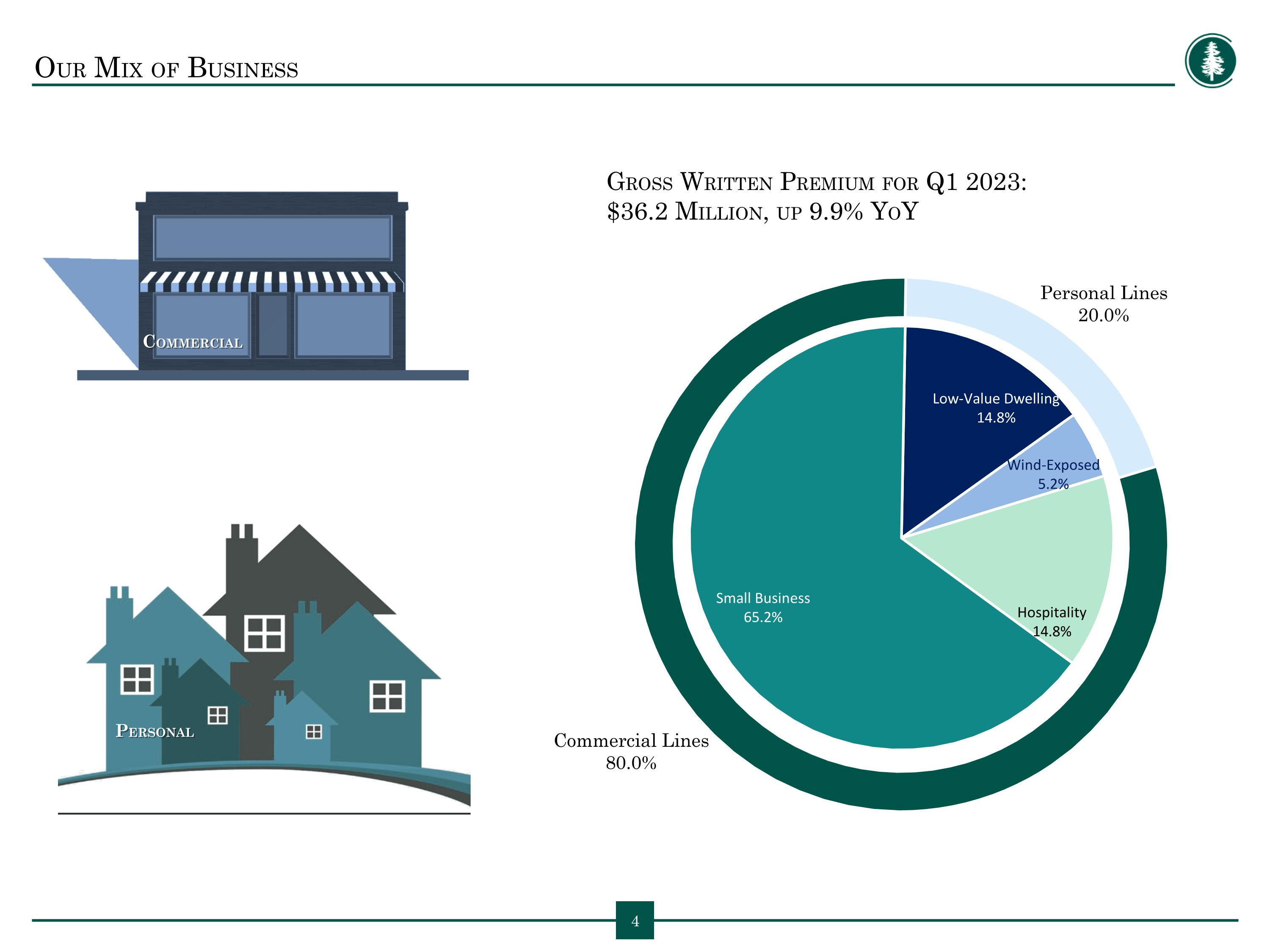

Our Mix of Business Commercial Personal Gross Written Premium for Q1 2023: �$36.2 Million, up 9.9% YoY

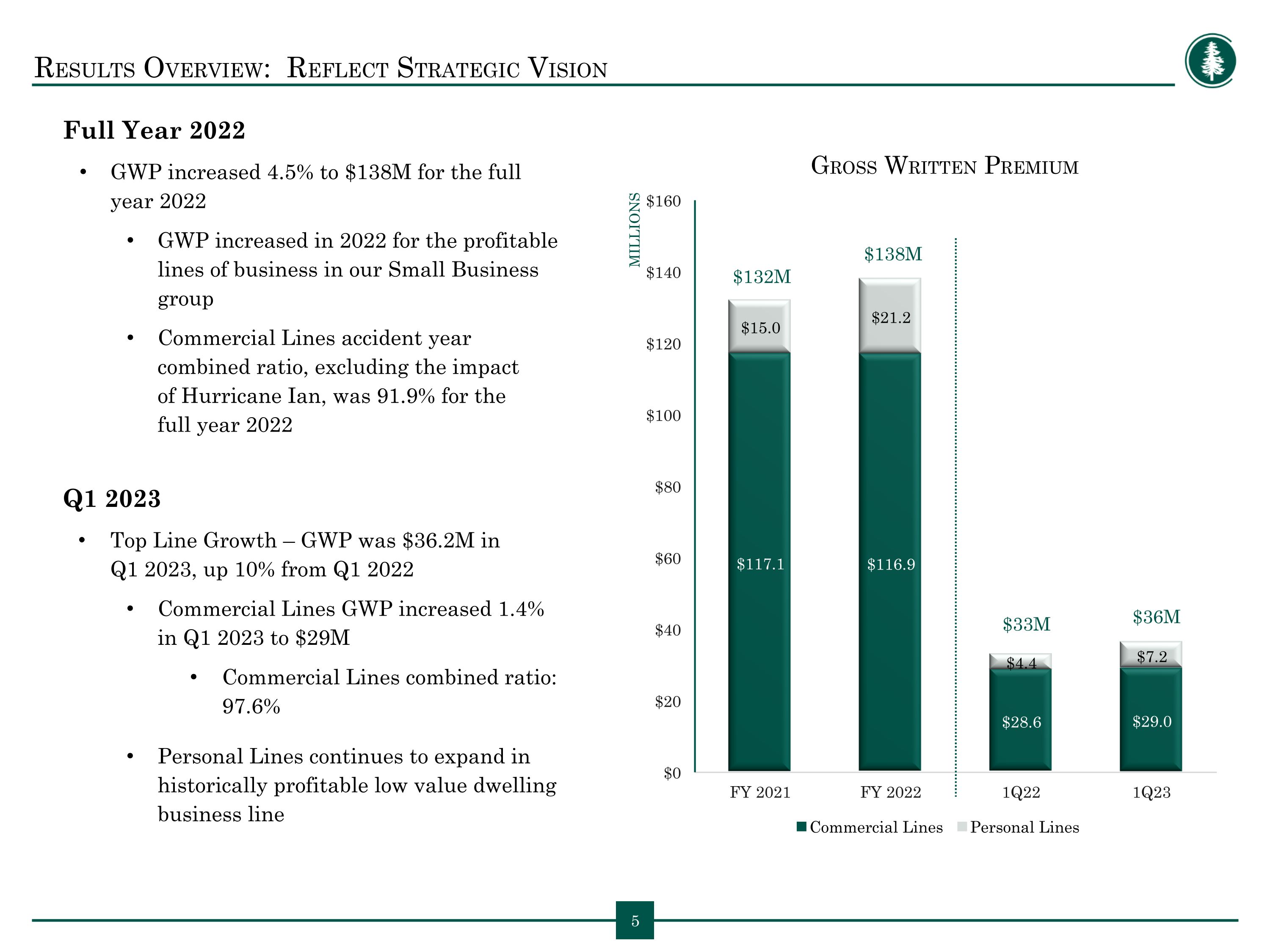

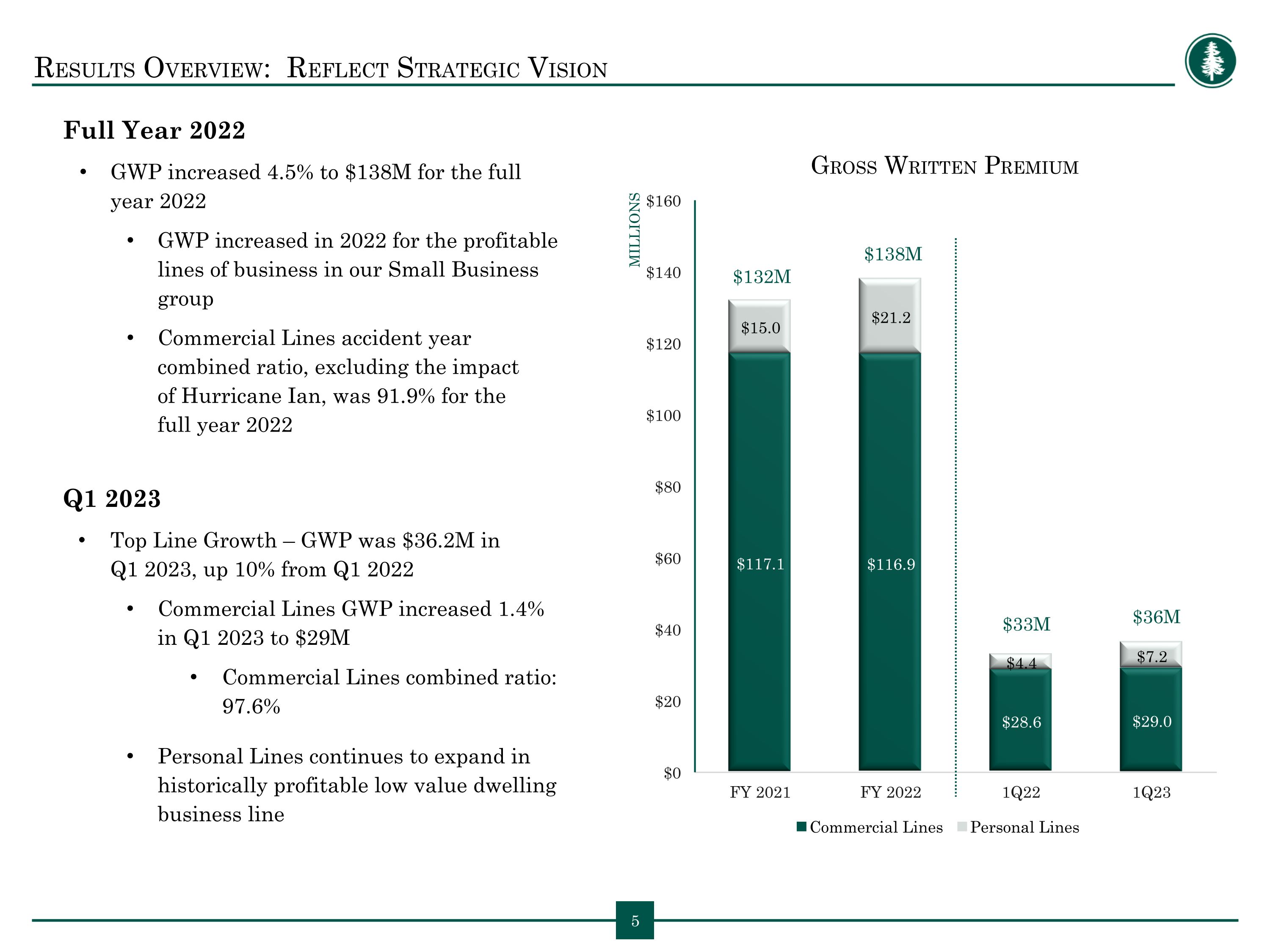

Results Overview: Reflect Strategic Vision Full Year 2022 GWP increased 4.5% to $138M for the full year 2022 GWP increased in 2022 for the profitable lines of business in our Small Business group Commercial Lines accident year combined ratio, excluding the impact �of Hurricane Ian, was 91.9% for the �full year 2022 Q1 2023 Top Line Growth – GWP was $36.2M in �Q1 2023, up 10% from Q1 2022 Commercial Lines GWP increased 1.4% in Q1 2023 to $29M Commercial Lines combined ratio: 97.6% Personal Lines continues to expand in historically profitable low value dwelling business line $132M $138M MILLIONS Gross Written Premium $33M $36M

Commercial Lines Focus: Disciplined, Quality Underwriting Focus on classes where we have deep underwriting knowledge and experience Partner with retail and select wholesale agencies and retain �underwriting authority in-house: Underwriting teams have established strong relationships �with retail and wholesale specialists in these lines of business. With agents who specialize in our unique classes, we remain �closer to our insureds and underwrite a stronger account / �risk profile. A hallmark of our success has always been tight agent relationships that generate high account retention: Commercial retention in the quarter was over 90%. High account retention allows us to selectively grow market share where we see the best pricing and profitability. Leverage ability to write on E&S and admitted paper for rate and form flexibility: Our markets continue firming, and we are seeing rate increases in our specialty markets. Increasing rate, especially Excess & Surplus lines. Maintain low limits as much as possible: vast majority of property TIV is under $1M Also, we are seeing opportunities for additional market share movement in our space Continuing to emphasize specialty business, our premium mix remains firmly dedicated to Commercial Lines �with 80.0% Specialty Commercial and 20.0% Personal Lines for Q1 2023.

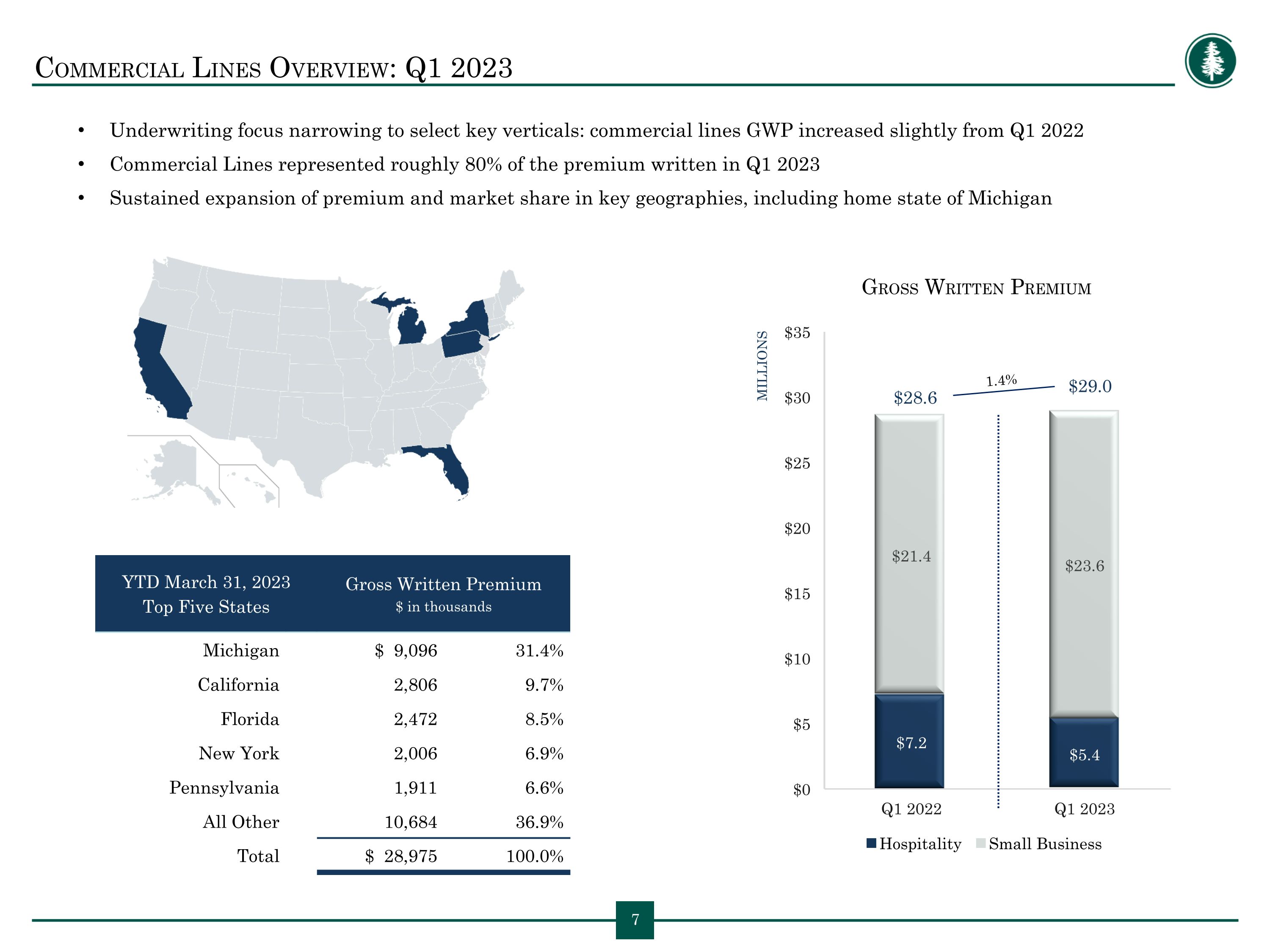

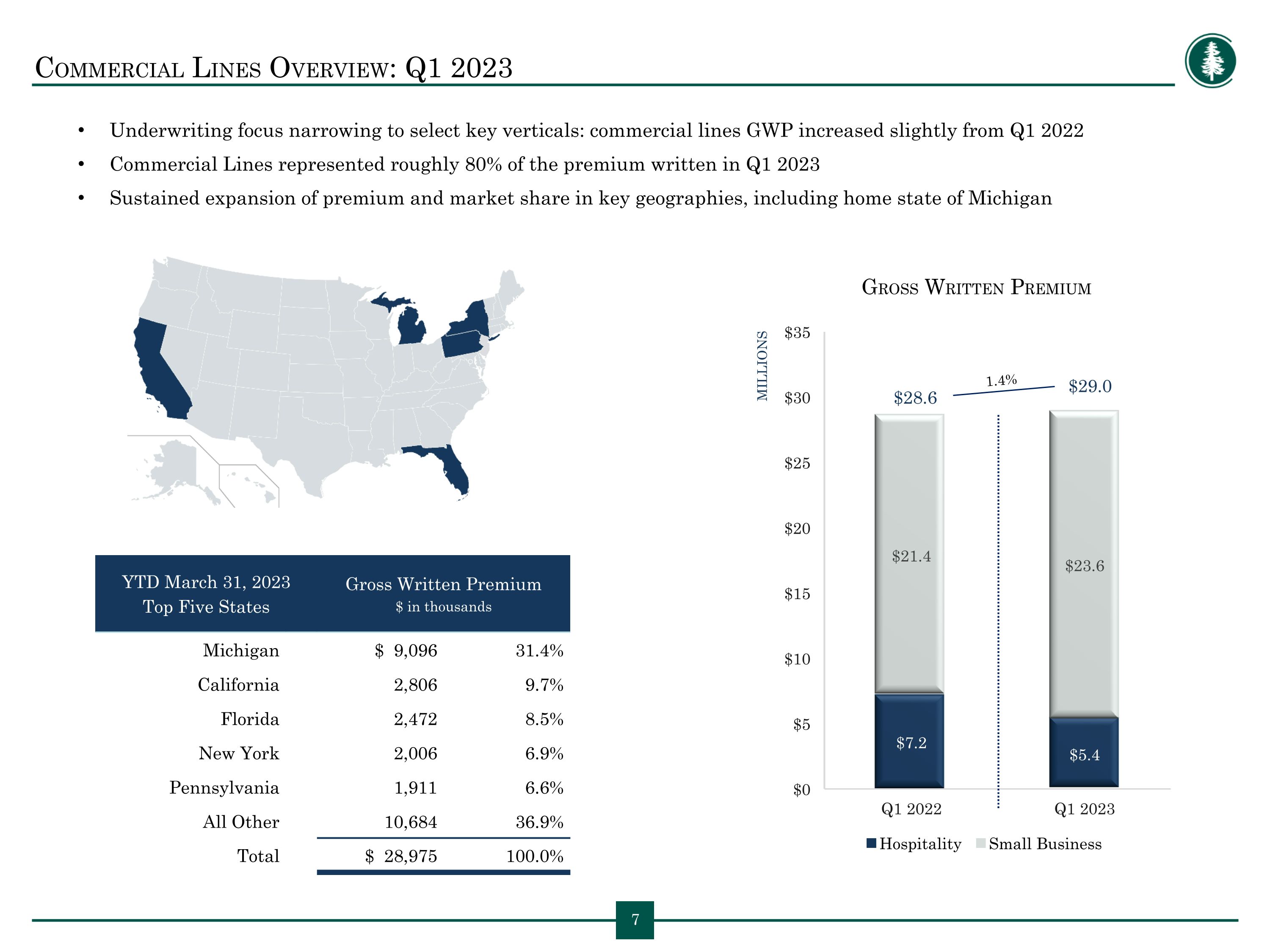

Commercial Lines Overview: Q1 2023 Underwriting focus narrowing to select key verticals: commercial lines GWP increased slightly from Q1 2022 Commercial Lines represented roughly 80% of the premium written in Q1 2023 Sustained expansion of premium and market share in key geographies, including home state of Michigan $28.6 $29.0 MILLIONS 1.4% Gross Written Premium YTD March 31, 2023 Top Five States Gross Written Premium $ in thousands Michigan $ 9,096 31.4% California 2,806 9.7% Florida 2,472 8.5% New York 2,006 6.9% Pennsylvania 1,911 6.6% All Other 10,684 36.9% Total $ 28,975 100.0%

Personal Lines Focus: Niche Specialty Homeowners Products Underwriting teams have established strong relationships with retail and wholesale specialists in �low value dwelling markets Leverage ability to write on E&S and admitted paper, where possible, for rate and form flexibility Utilize technology to appropriately price our property risks Maintain competitive advantage in ease of use for �agency portal and submission/bind process Cloud-based agency portal system with strong �data mining and predictive outcome capabilities Maintain rate and underwriting discipline �regardless of market cycles

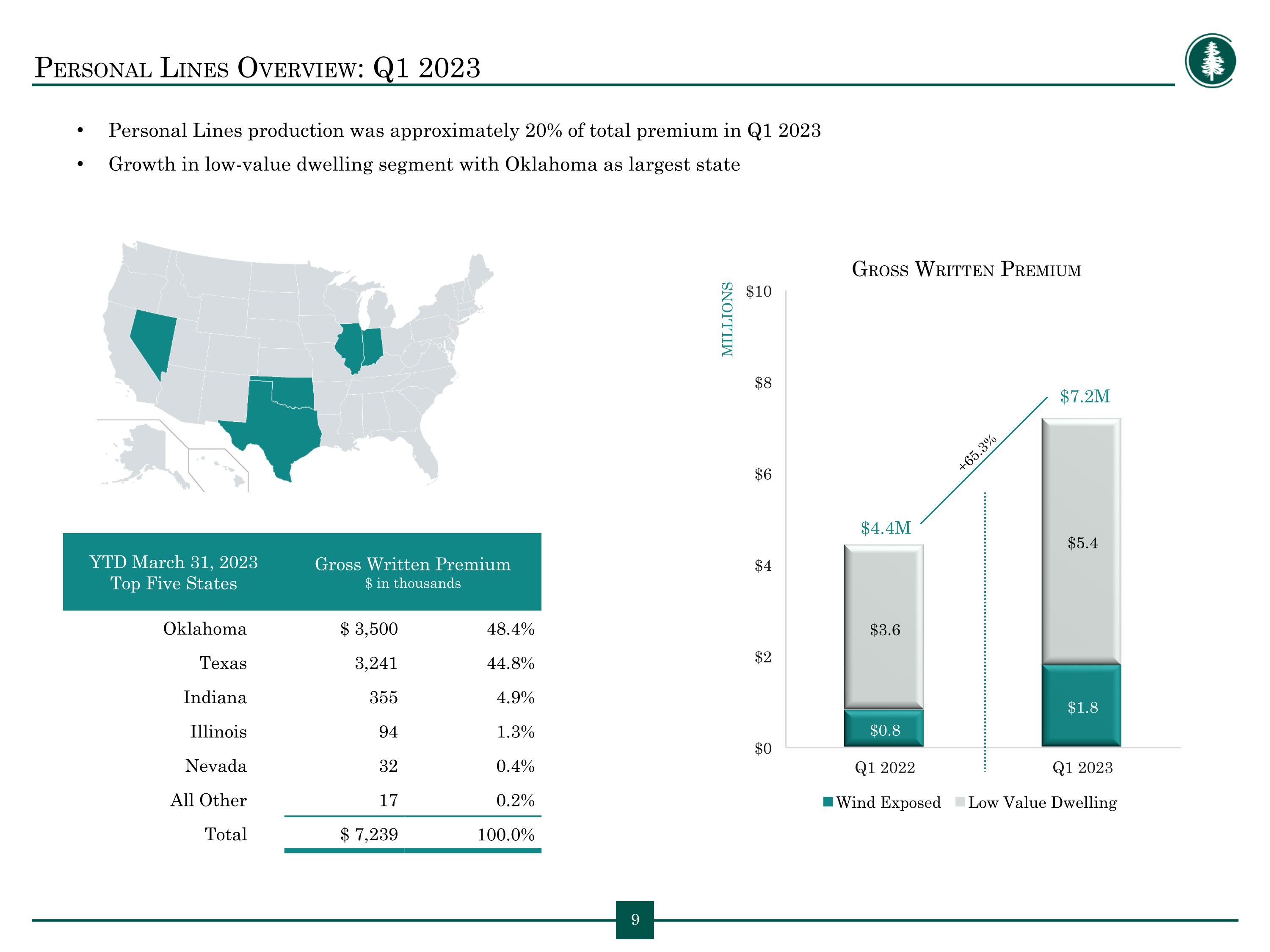

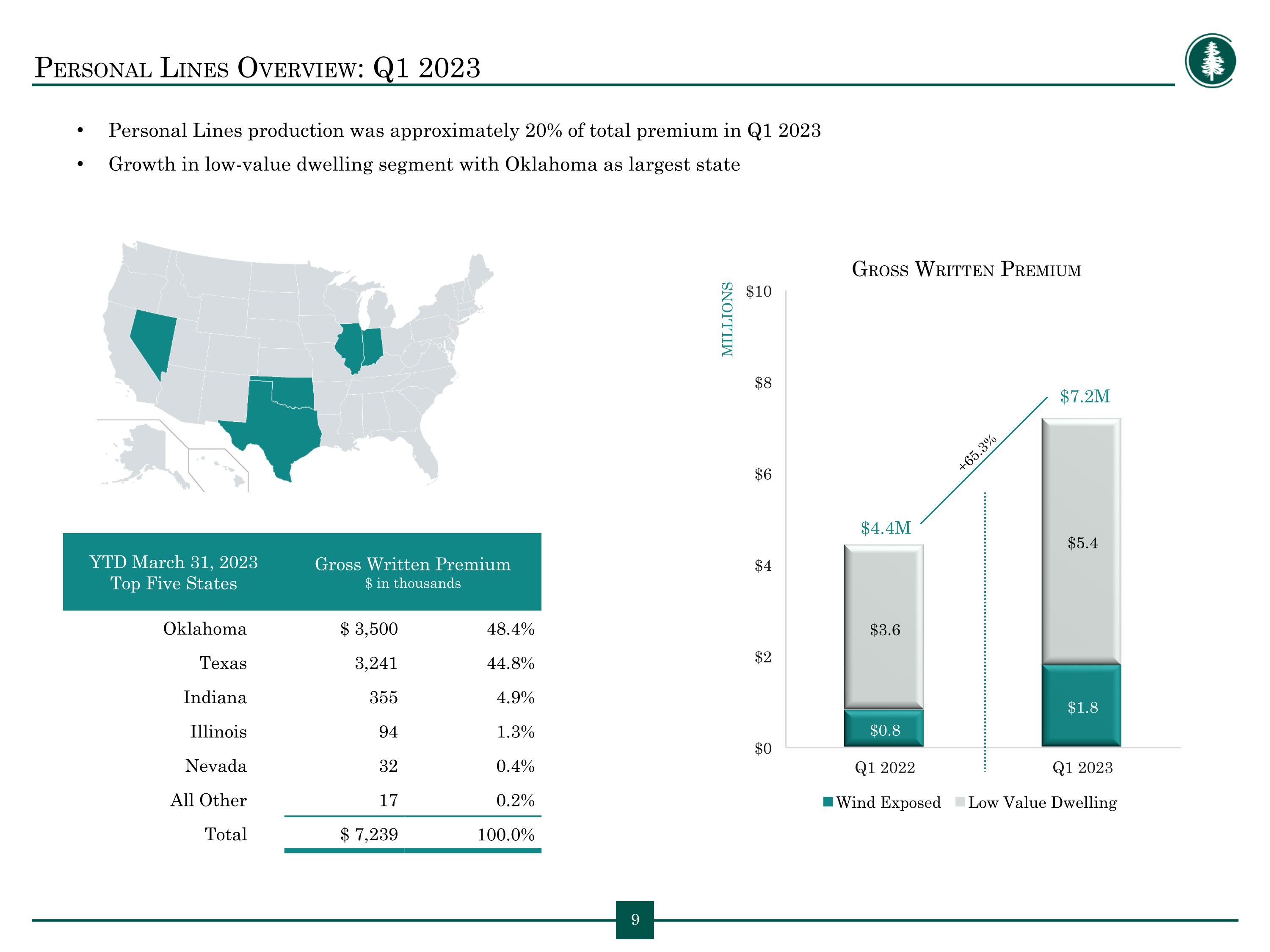

Personal Lines Overview: Q1 2023 Personal Lines production was approximately 20% of total premium in Q1 2023 Growth in low-value dwelling segment with Oklahoma as largest state $4.4M $7.2M MILLIONS Gross Written Premium +65.3% YTD March 31, 2023 Top Five States Gross Written Premium $ in thousands Oklahoma $ 3,500 48.4% Texas 3,241 44.8% Indiana 355 4.9% Illinois 94 1.3% Nevada 32 0.4% All Other 17 0.2% Total $ 7,239 100.0%

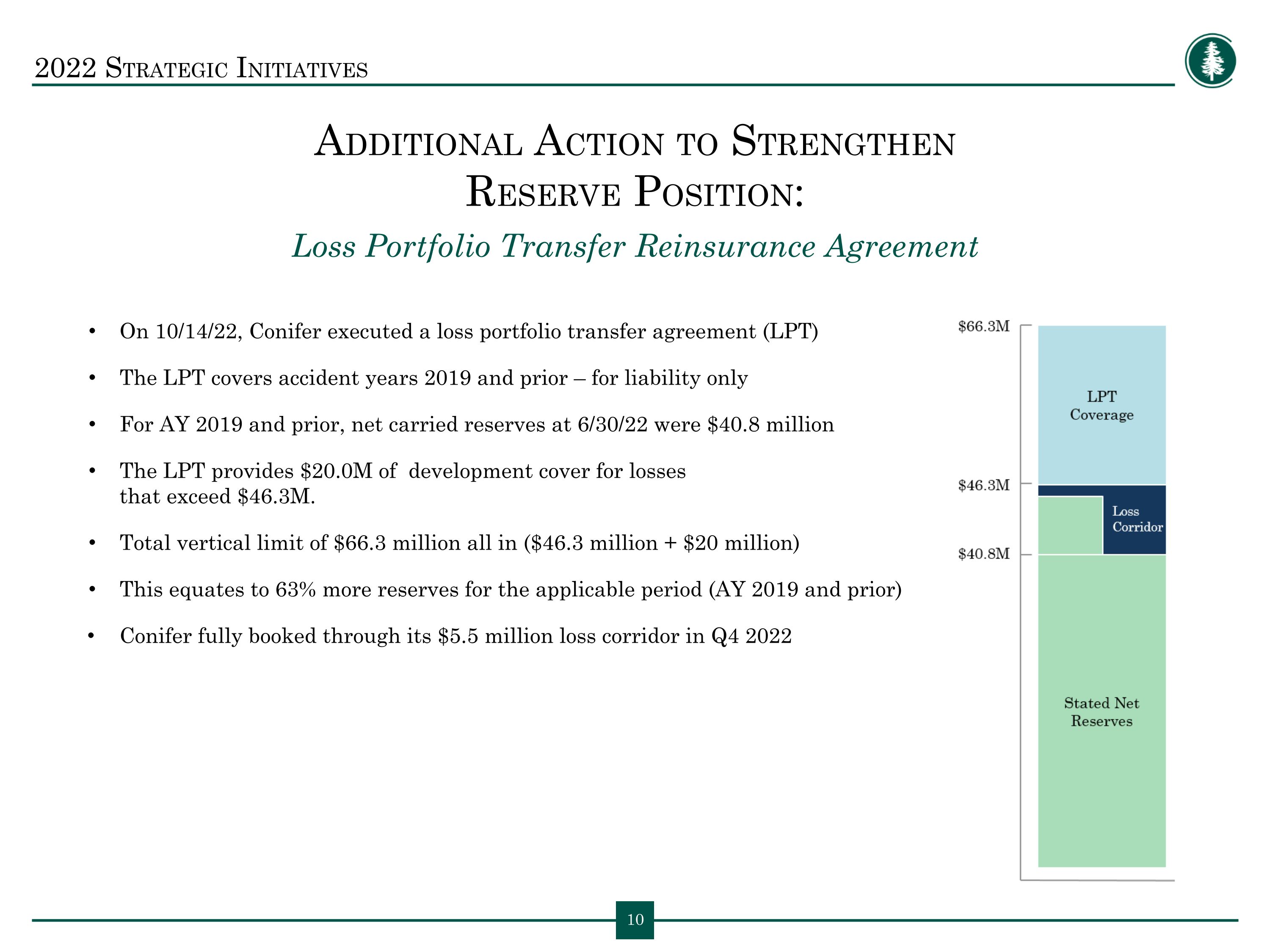

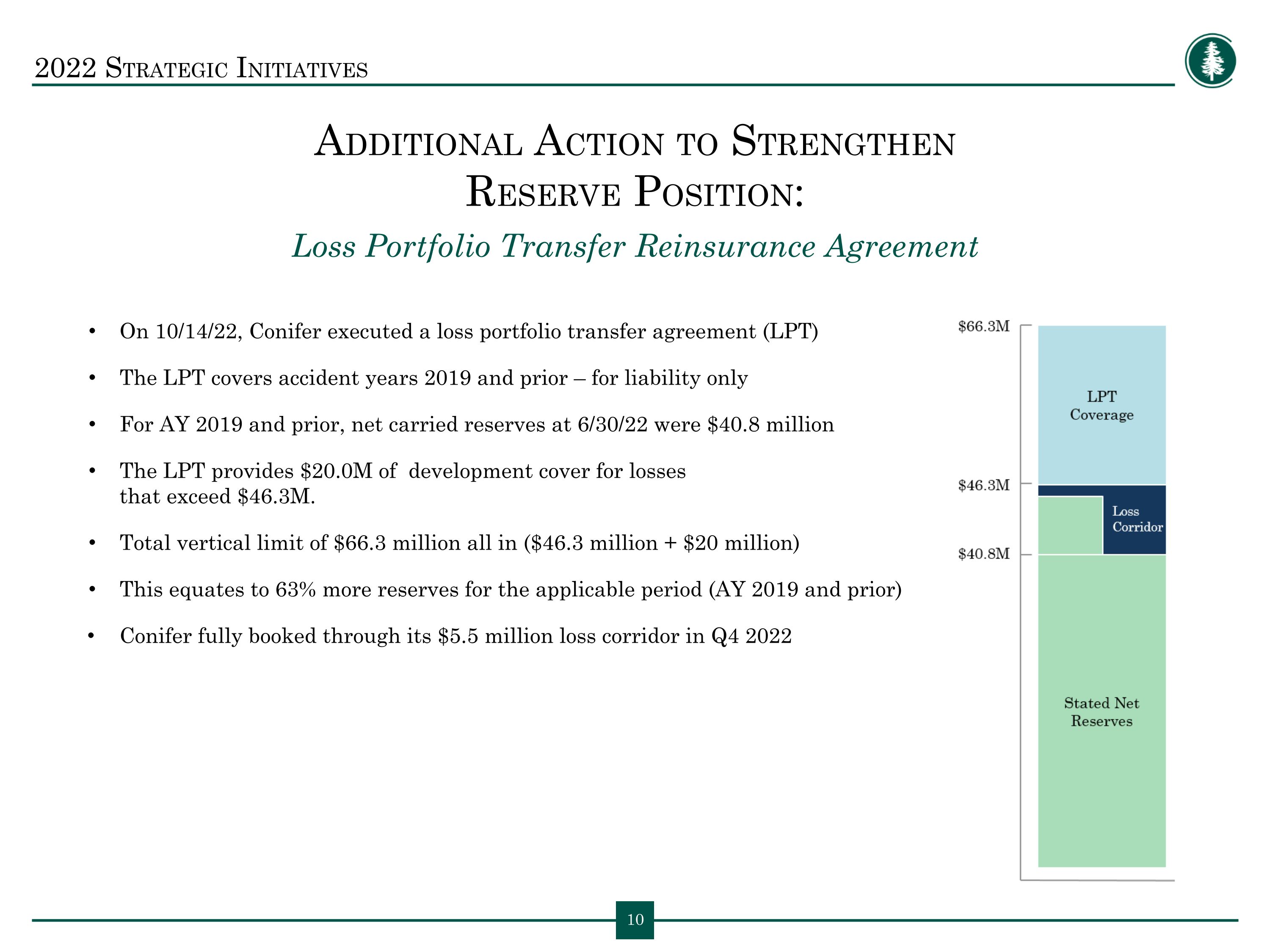

2022 Strategic Initiatives On 10/14/22, Conifer executed a loss portfolio transfer agreement (LPT) The LPT covers accident years 2019 and prior – for liability only For AY 2019 and prior, net carried reserves at 6/30/22 were $40.8 million The LPT provides $20.0M of development cover for losses �that exceed $46.3M. Total vertical limit of $66.3 million all in ($46.3 million + $20 million) This equates to 63% more reserves for the applicable period (AY 2019 and prior) Conifer fully booked through its $5.5 million loss corridor in Q4 2022 Additional Action to Strengthen �Reserve Position: Loss Portfolio Transfer Reinsurance Agreement

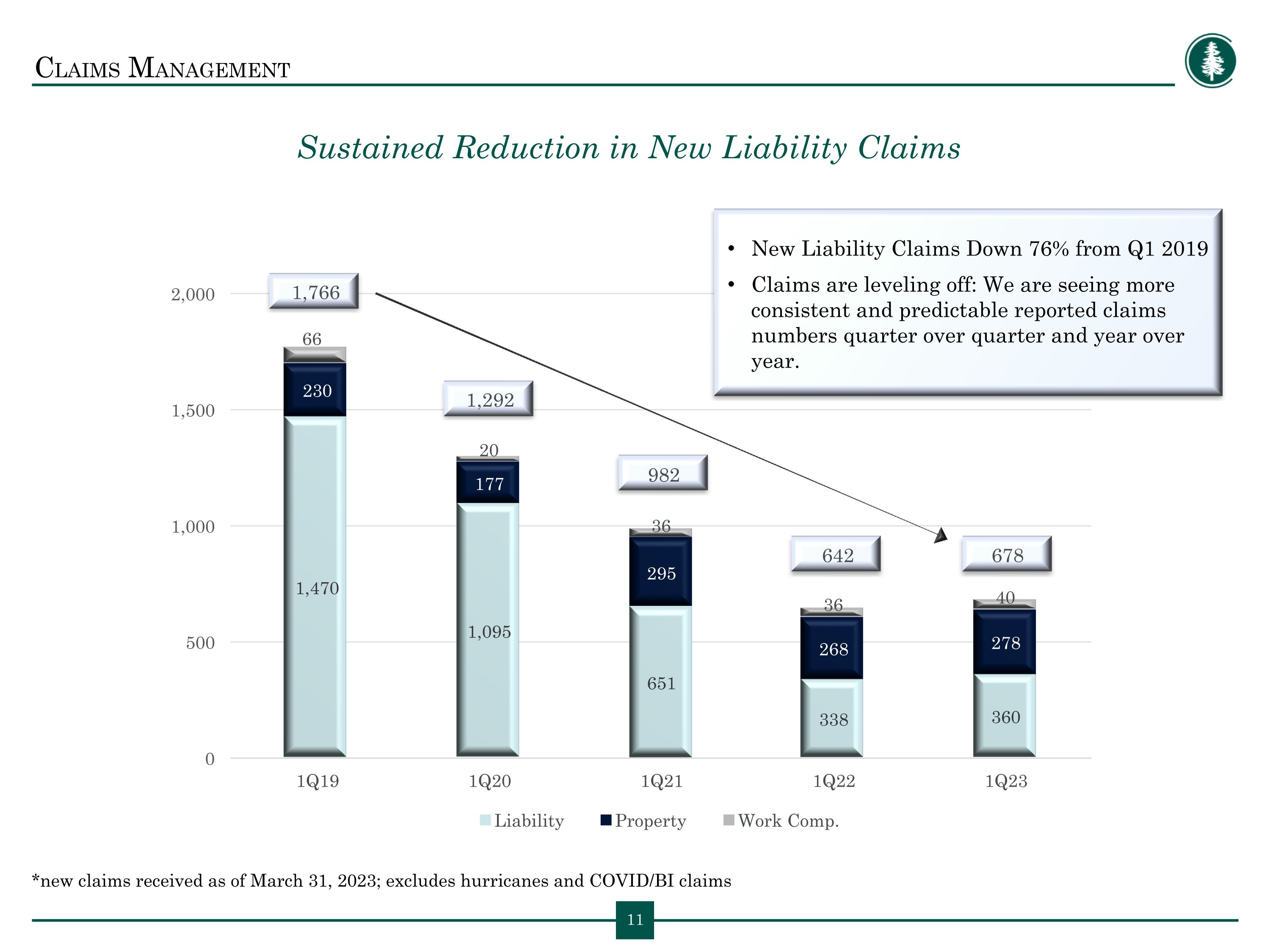

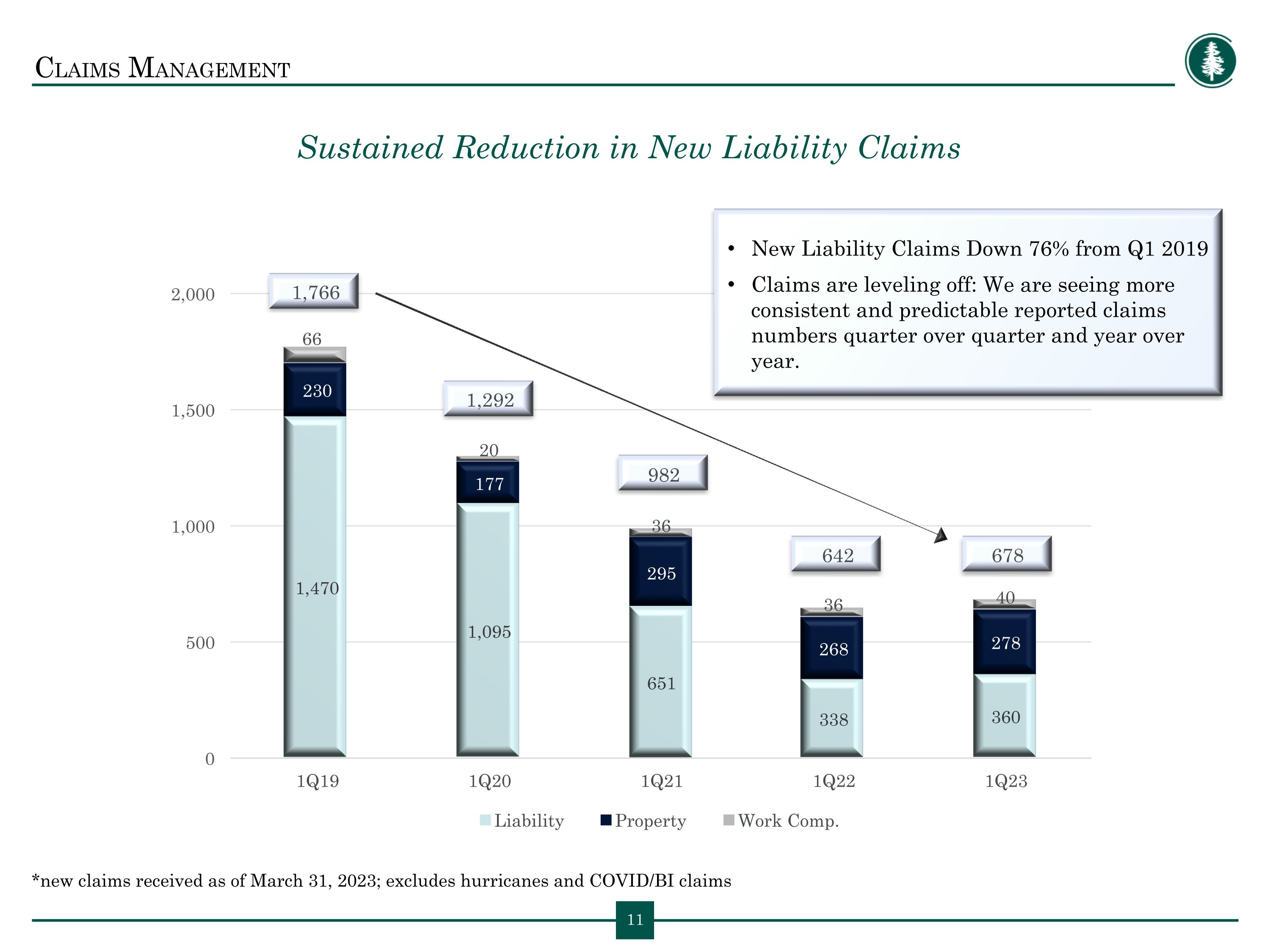

Claims Management Sustained Reduction in New Liability Claims 1,766 1,292 New Liability Claims Down 76% from Q1 2019 Claims are leveling off: We are seeing more consistent and predictable reported claims numbers quarter over quarter and year over year. 982 642 *new claims received as of March 31, 2023; excludes hurricanes and COVID/BI claims 678

Claims Management Open Claim Counts Continue to Decrease As of March 31, 2023, �total open claim volume is down 39% from 2019. All Accident Years – Open Claims as of March 31st: 2019 2020 2021 2022 2023 Commercial Auto 247 232 262 276 215 Commercial Liability 2,073 1,584 1,372 1,144 1,146 Commercial Property 142 272 89 87 75 Homeowners Liability 14 9 7 18 15 Homeowners Property 100 41 53 58 111 Liquor Liability 137 106 92 79 74 Realtors E&O 44 41 30 40 56 Workers’ Compensation 274 164 160 146 161 Total 3,031 2,449 2,065 1,848 1,853 89% Decrease from Q1 2019

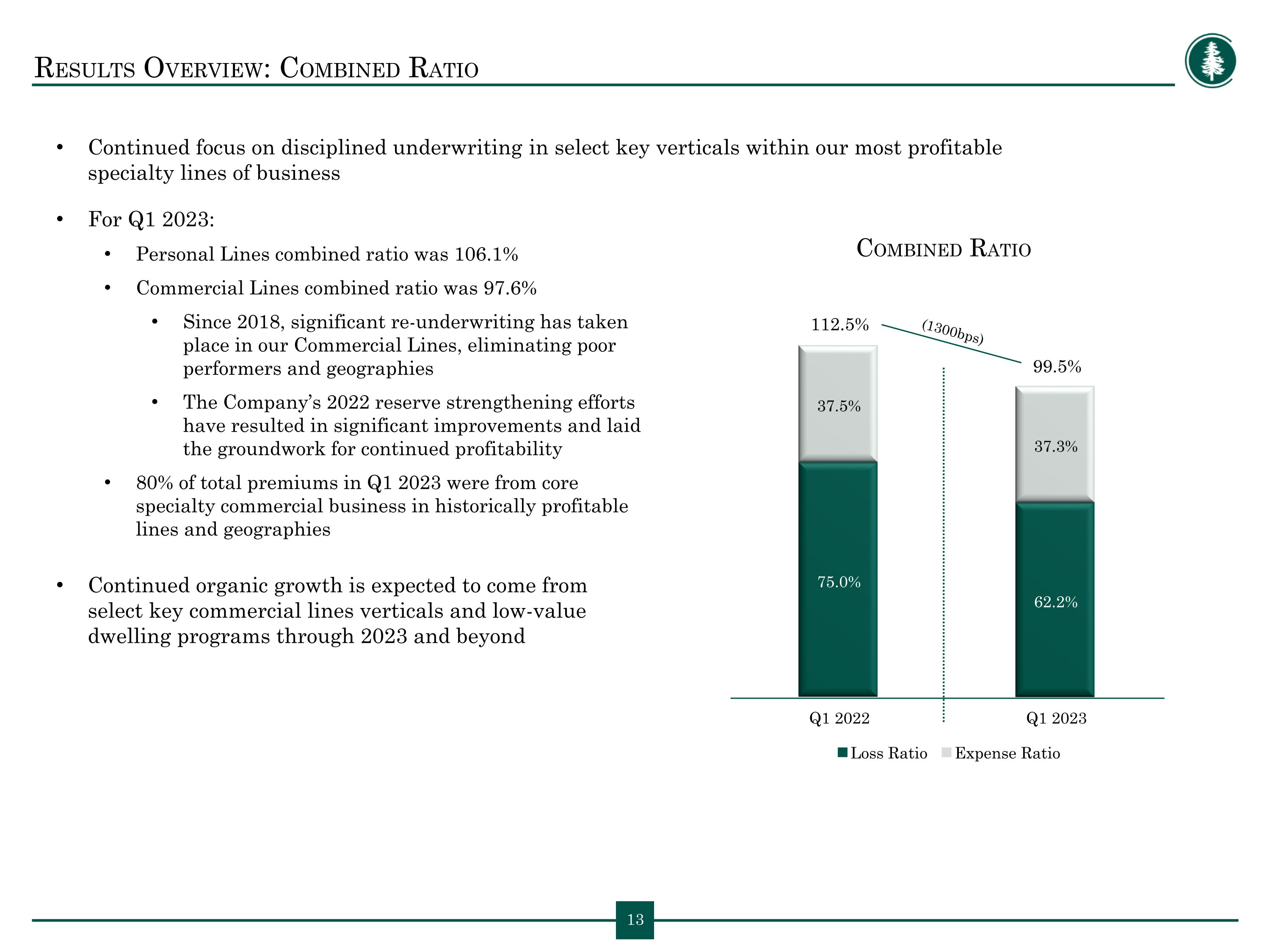

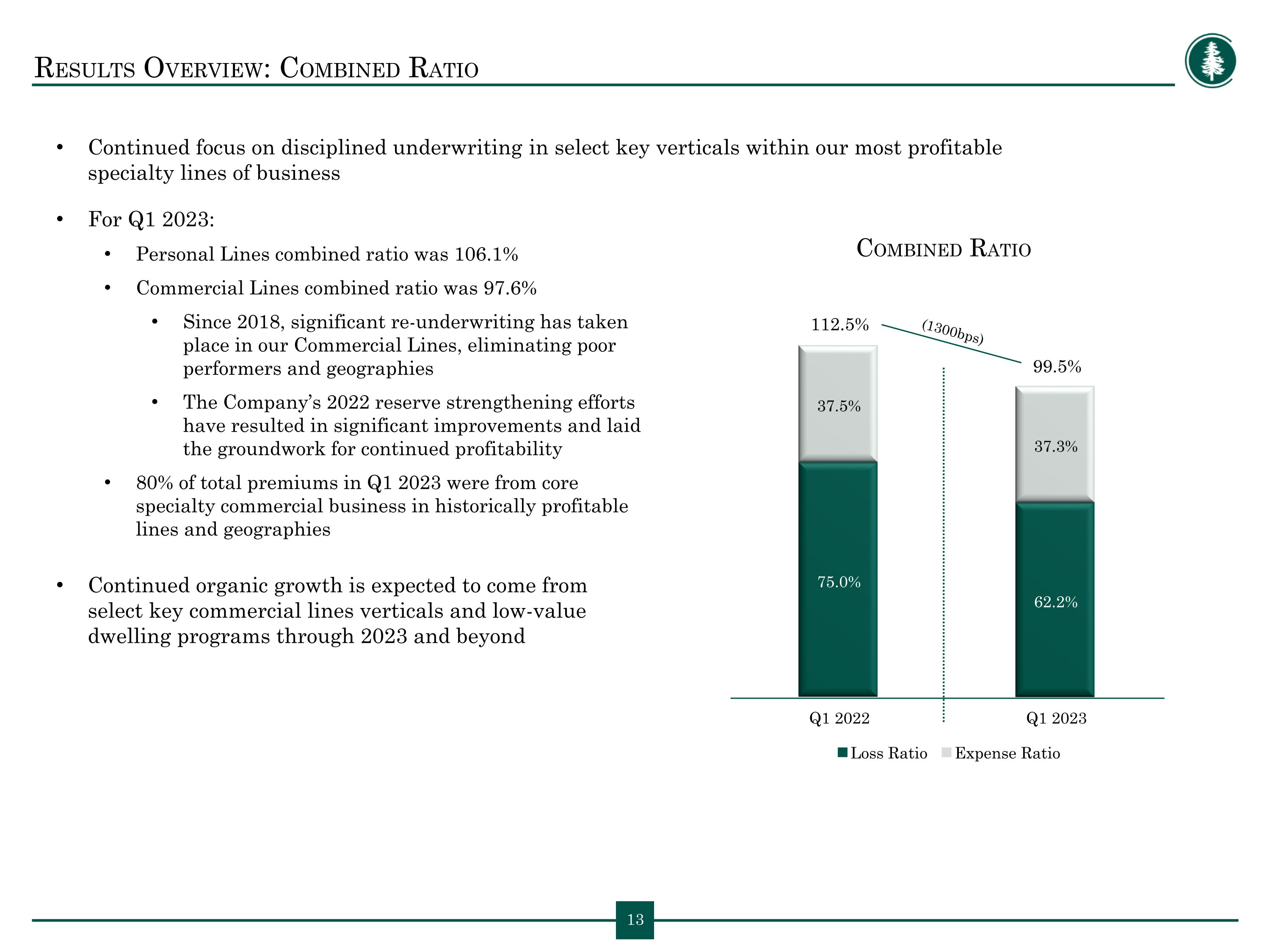

Results Overview: Combined Ratio Continued focus on disciplined underwriting in select key verticals within our most profitable �specialty lines of business For Q1 2023: Personal Lines combined ratio was 106.1% Commercial Lines combined ratio was 97.6% Since 2018, significant re-underwriting has taken �place in our Commercial Lines, eliminating poor �performers and geographies The Company’s 2022 reserve strengthening efforts �have resulted in significant improvements and laid�the groundwork for continued profitability 80% of total premiums in Q1 2023 were from core �specialty commercial business in historically profitable �lines and geographies Continued organic growth is expected to come from �select key commercial lines verticals and low-value �dwelling programs through 2023 and beyond 112.5% 99.5% Combined Ratio (1300bps)

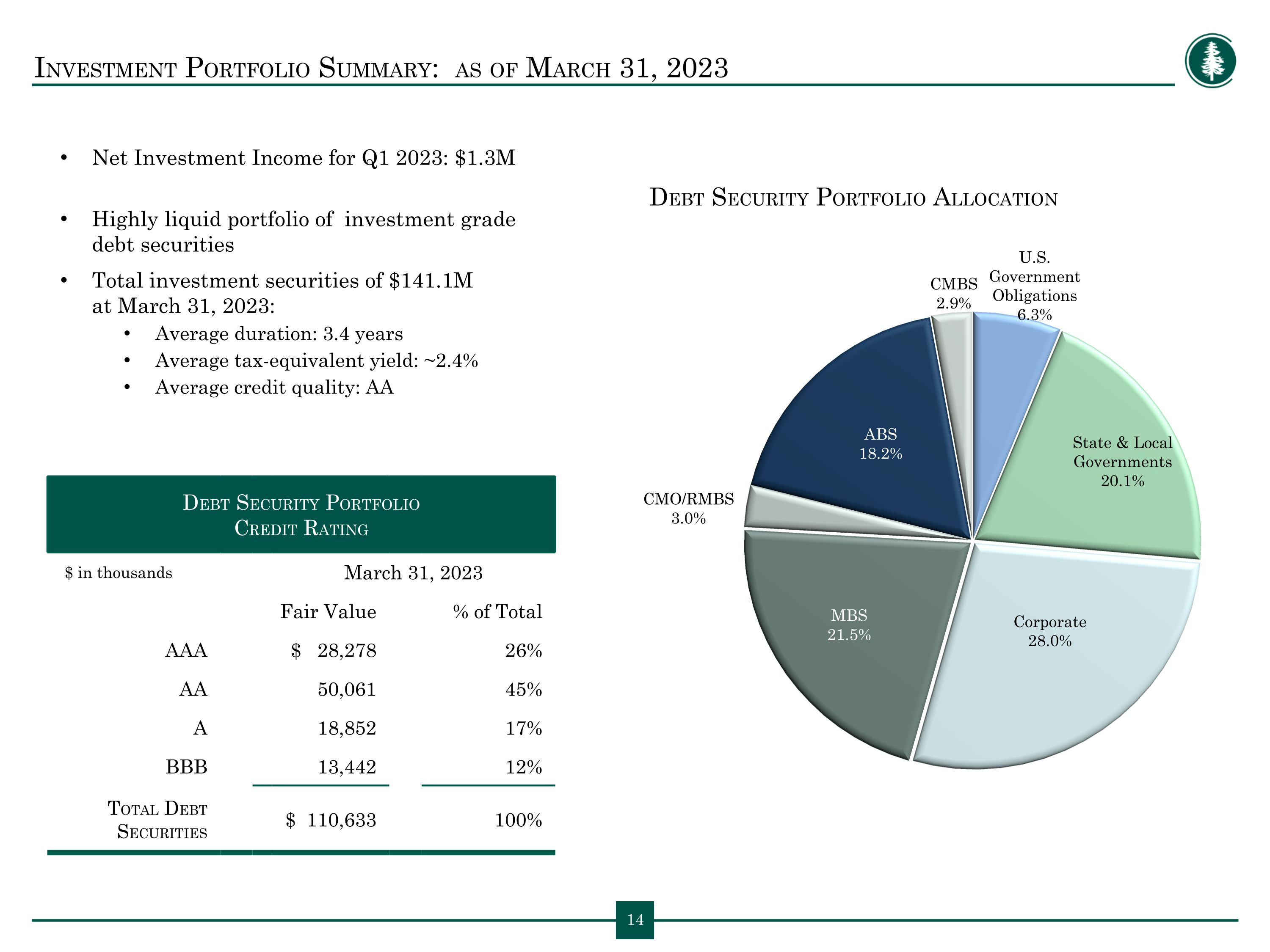

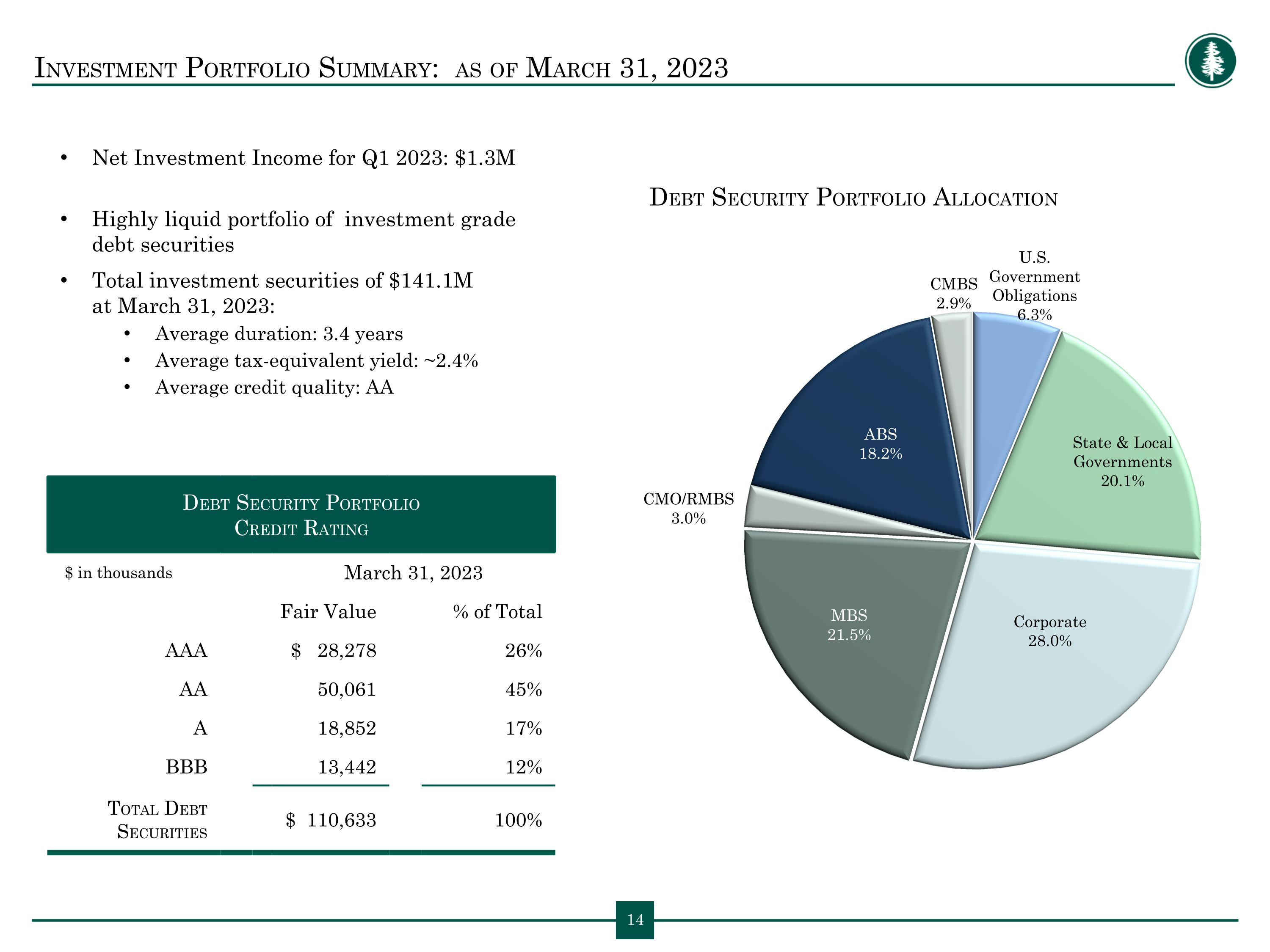

Investment Portfolio Summary: as of March 31, 2023 Net Investment Income for Q1 2023: $1.3M Highly liquid portfolio of investment grade �debt securities Total investment securities of $141.1M �at March 31, 2023: Average duration: 3.4 years Average tax-equivalent yield: ~2.4% Average credit quality: AA Debt Security Portfolio �Credit Rating $ in thousands March 31, 2023 Fair Value % of Total AAA $ 28,278 26% AA 50,061 45% A 18,852 17% BBB 13,442 12% Total Debt �Securities $ 110,633 100% Debt Security Portfolio Allocation

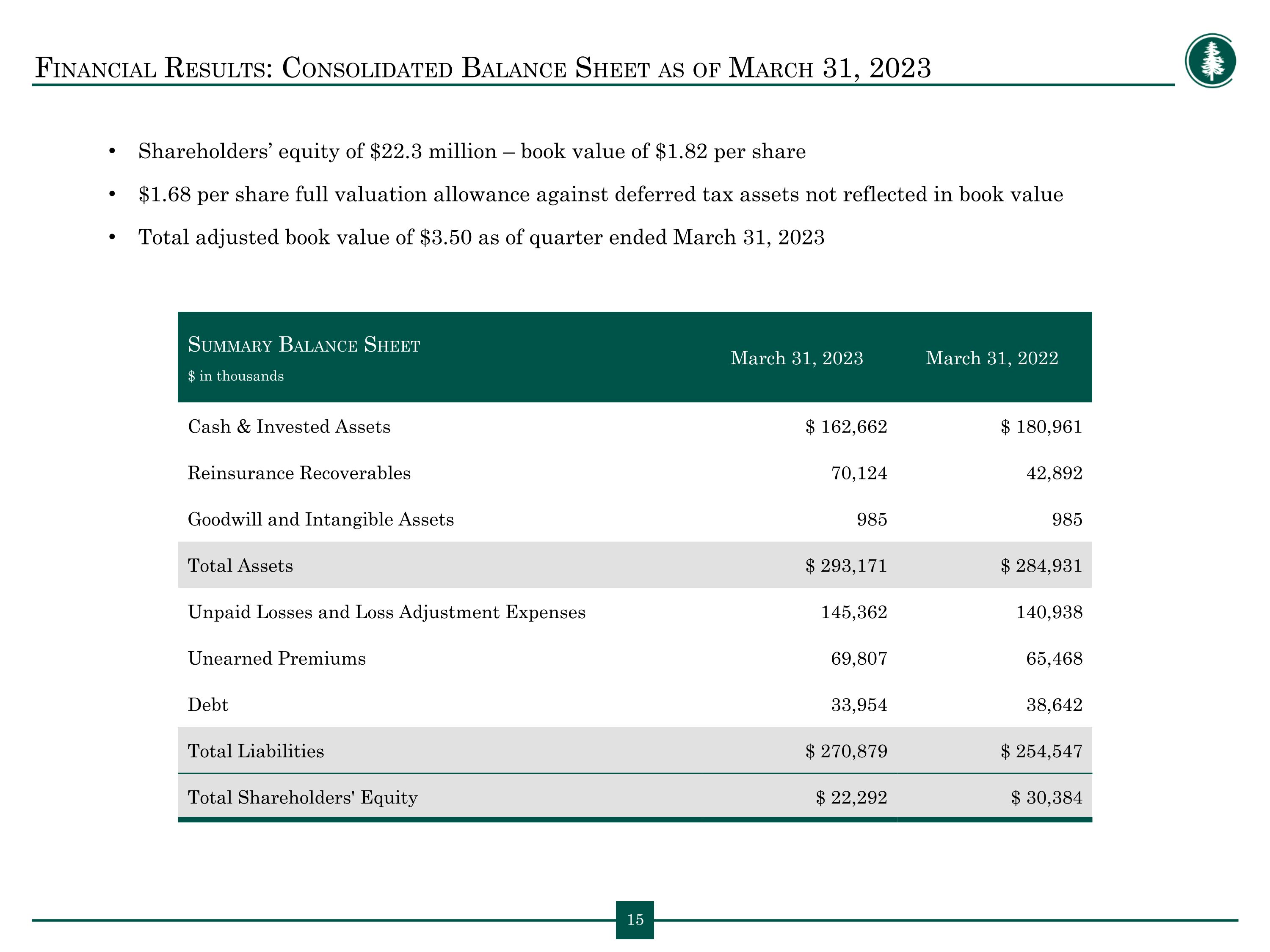

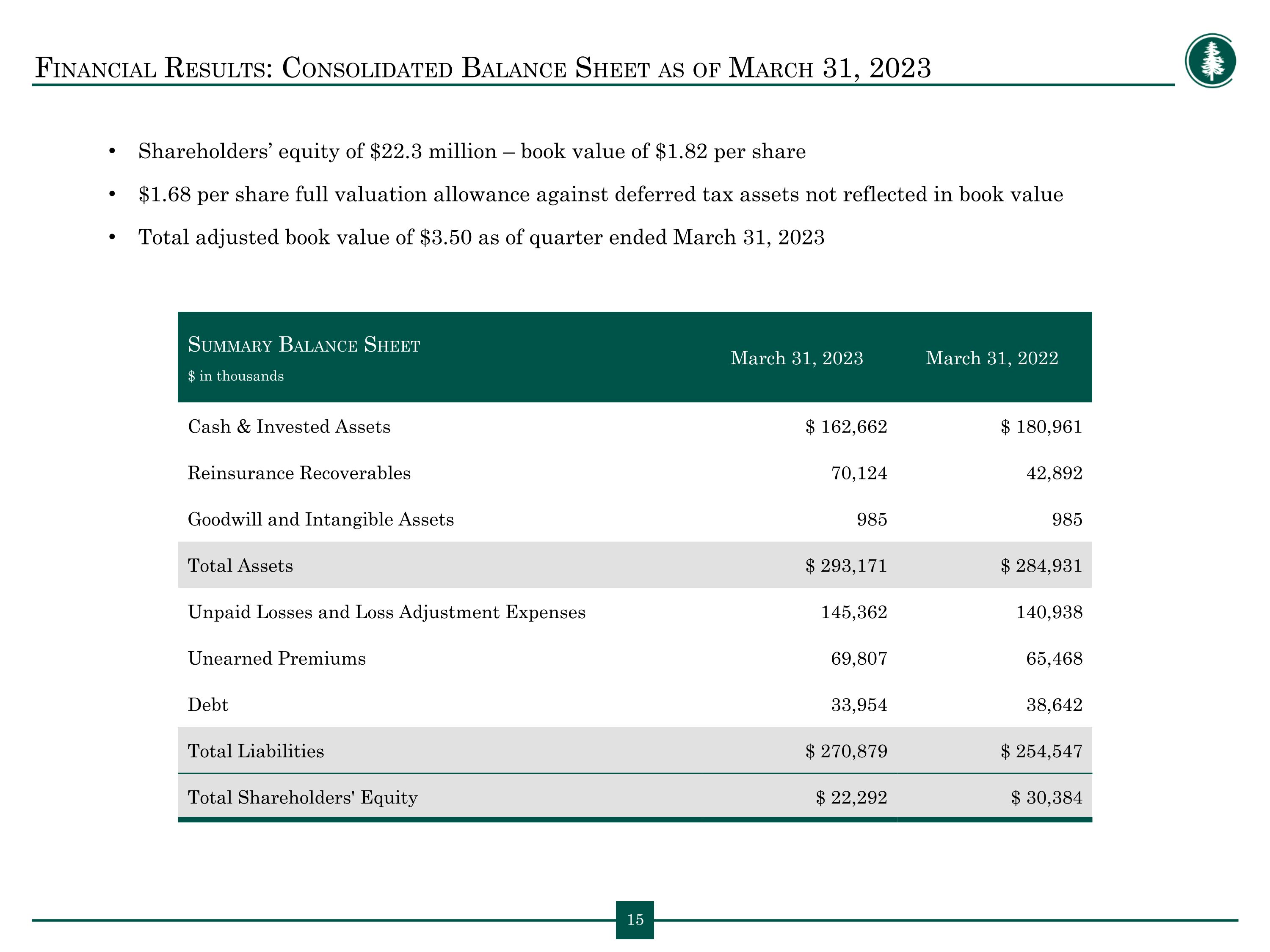

Financial Results: Consolidated Balance Sheet as of March 31, 2023 Shareholders’ equity of $22.3 million – book value of $1.82 per share $1.68 per share full valuation allowance against deferred tax assets not reflected in book value Total adjusted book value of $3.50 as of quarter ended March 31, 2023 Summary Balance Sheet $ in thousands March 31, 2023 March 31, 2022 Cash & Invested Assets $ 162,662 $ 180,961 Reinsurance Recoverables 70,124 42,892 Goodwill and Intangible Assets 985 985 Total Assets $ 293,171 $ 284,931 Unpaid Losses and Loss Adjustment Expenses 145,362 140,938 Unearned Premiums 69,807 65,468 Debt 33,954 38,642 Total Liabilities $ 270,879 $ 254,547 Total Shareholders' Equity $ 22,292 $ 30,384

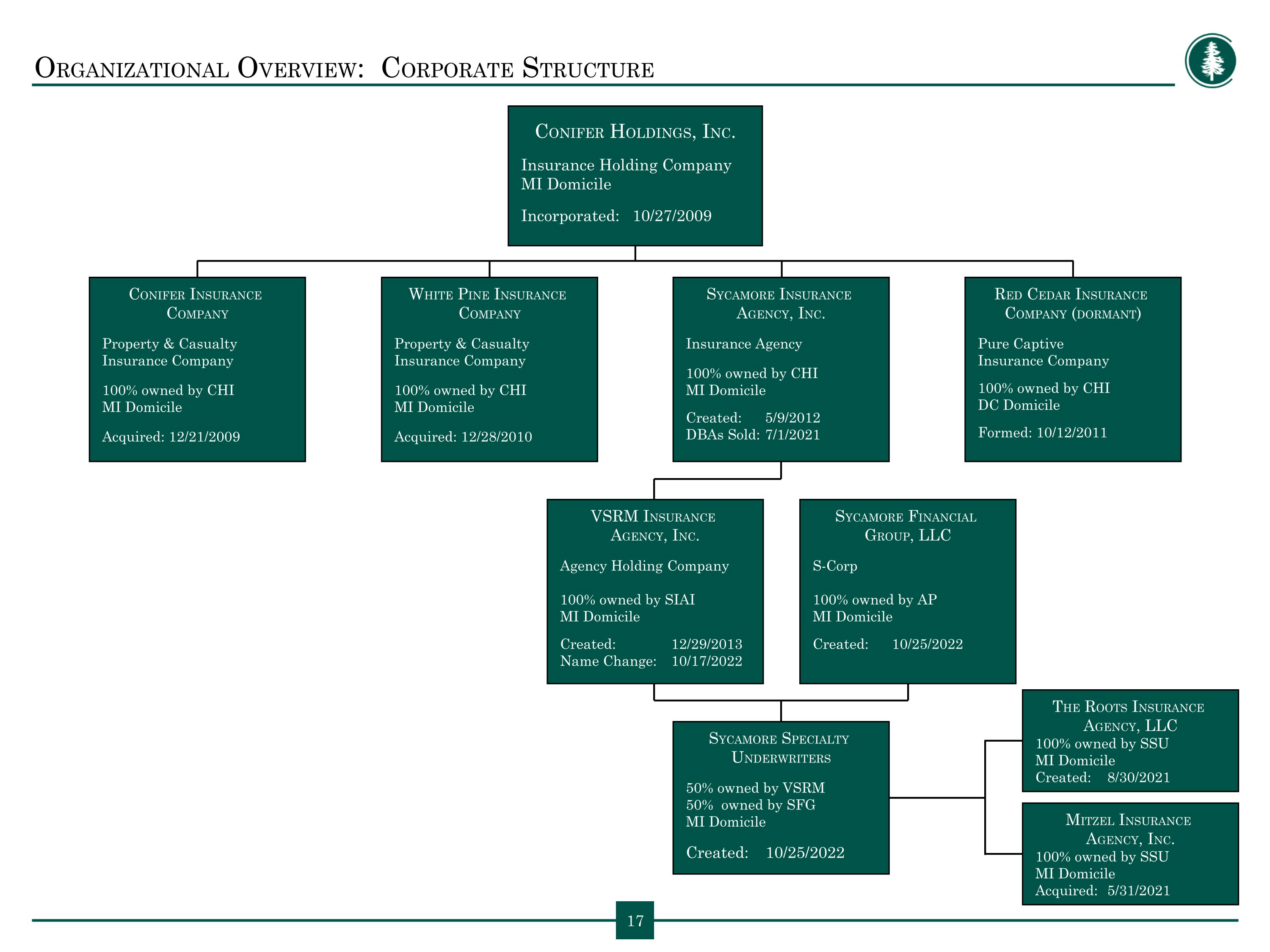

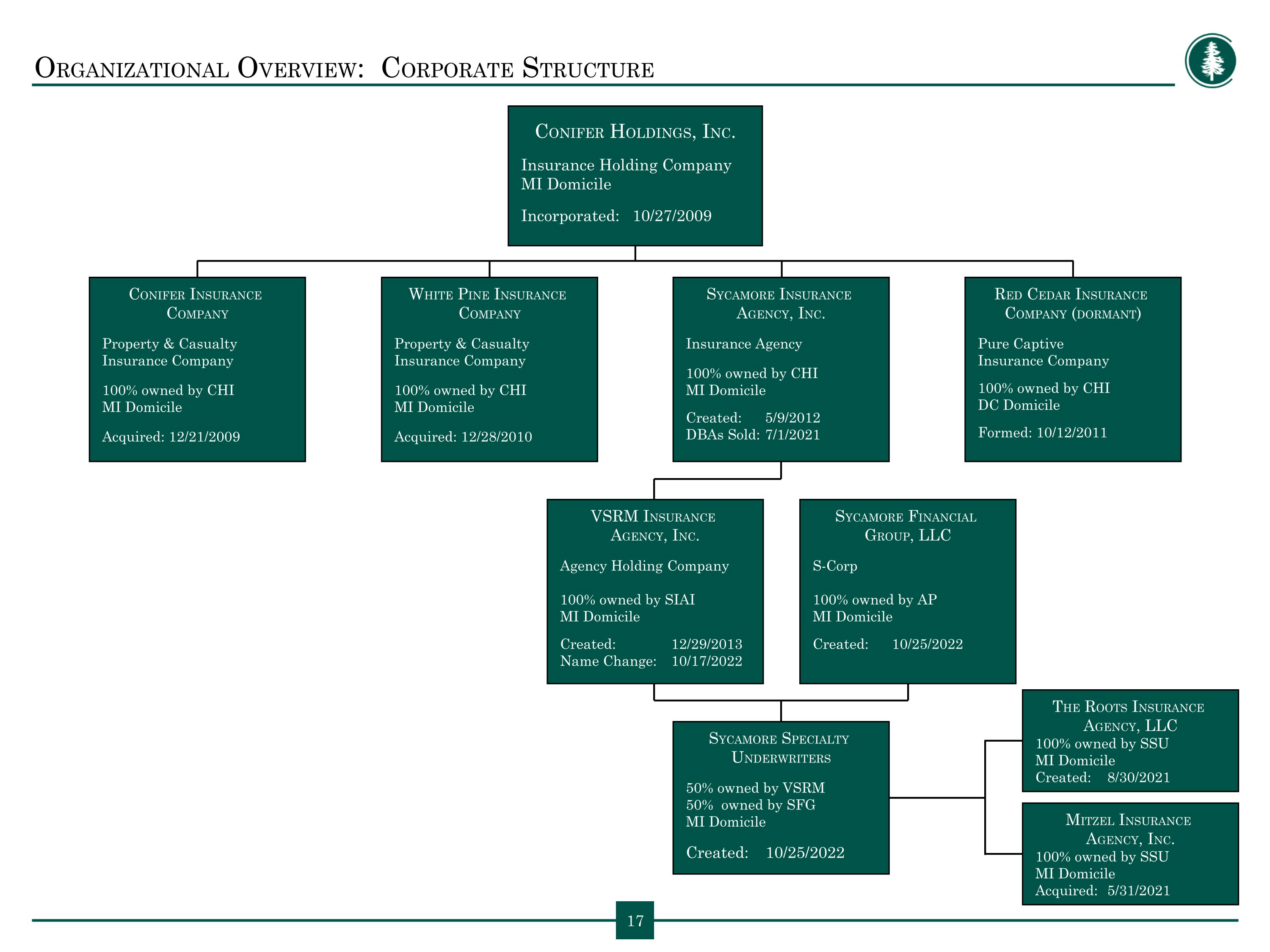

Organizational Overview: Corporate Structure 17 Sycamore Specialty �Underwriters 50% owned by VSRM 50% owned by SFG MI Domicile Created: 10/25/2022 Conifer Holdings, Inc. Insurance Holding Company MI Domicile Incorporated: 10/27/2009 Sycamore Insurance �Agency, Inc. Insurance Agency 100% owned by CHI MI Domicile Created: 5/9/2012 DBAs Sold: 7/1/2021 Conifer Insurance Company Property & Casualty Insurance Company 100% owned by CHI MI Domicile Acquired: 12/21/2009 Red Cedar Insurance �Company (dormant) Pure Captive �Insurance Company 100% owned by CHI DC Domicile Formed: 10/12/2011 White Pine Insurance Company Property & Casualty Insurance Company 100% owned by CHI MI Domicile Acquired: 12/28/2010 Sycamore Financial �Group, LLC S-Corp 100% owned by AP MI Domicile Created: 10/25/2022 VSRM Insurance �Agency, Inc. Agency Holding Company 100% owned by SIAI MI Domicile Created: 12/29/2013 Name Change: 10/17/2022 Mitzel Insurance �Agency, Inc. 100% owned by SSU MI Domicile Acquired: 5/31/2021 The Roots Insurance �Agency, LLC 100% owned by SSU MI Domicile Created: 8/30/2021

Corporate Overview: Our Companies Conifer Holdings, Inc. provides niche market insurance programs through Conifer Insurance Company and White Pine Insurance Company, on both an admitted and E&S basis. Program Portfolio Hospitality Liquor Liability Security Guards, Alarm Contractors & �Private Investigators Workers’ Compensation Cannabis Specialty Homeowners Conifer Insurance Company Founded in 2009 Licensed & Admitted in 4 States �(MI, IL, IN, SD) E&S in 49 States (Exc. NY) White Pine Insurance Company Founded in 2010 Licensed & Admitted in 44 States & DC

Organizational Overview: Board of Directors James G. Petcoff | Executive Chairman, co-CEO & Founder As Executive Chairman & Co-Chief Executive Officer of Conifer Holdings, Inc., Jim Petcoff is responsible for establishing the overall direction and materializing the strategy of the Company. Mr. Petcoff and Mr. Nicholas Petcoff founded the Company in 2009. He has over 35 years of insurance industry experience, including founding North Pointe Insurance Company in 1986, taking it public in 2005 and facilitating the sale to QBE Holdings Inc. in 2008. �Mr. Petcoff has a B.A. from Michigan State University, a M.B.A. from University of Detroit and a J.D. from University of Detroit School �of Law. Mr. Petcoff's extensive executive leadership and public company expertise provides irreplaceable direction for the continued growth of �the Company. Nicholas J. Petcoff | Director & co-CEO As Director & Co-Chief Executive Officer of Conifer Holdings, Inc., Nick Petcoff oversees the Company's Commercial Lines Underwriting, Reinsurance, Claims and Information Technology. Mr. Petcoff is also Director and President of Conifer Insurance Company and President of White Pine Insurance Company, both wholly owned subsidiaries of Conifer Holdings, Inc. He has been with the Company since 2009 and has more than 17 years of experience in the insurance industry. Mr. Petcoff’s distinctive skillset in the areas of Underwriting, Claims and Treaty Reinsurance equips him to direct the Company’s overall strategy, growing the business while enabling the Company to conceptualize and deftly respond to market needs. Gerald W. Hakala| Director Jerry Hakala is co-Chief Investment Officer of Clarkston Capital Partners, LLC, an investment management firm with offices in Rochester, Michigan, Bloomfield Hills, Michigan, and Scottsdale, Arizona. Prior to Mr. Hakala co-founding Clarkton Capital Partners in 2007, he held finance, accounting and portfolio management positions with various companies. Mr. Hakala was elected to the Conifer Holdings, Inc. Board of Directors in 2022. Mr. Hakala holds a B.B.A. from the University of Michigan Ross School of Business and M.B.A. from Michigan State University and is a Chartered Financial Analyst. Mr. Hakala’s more than 23 years of finance, accounting and portfolio management experience brings inimitable investment strategy and financial expertise to the Board.

Organizational Overview: Board of Directors (continued) 20 Jeffrey A. Hakala | Director Jeff Hakala is the Chief Executive Officer and co-Chief Investment Officer of Clarkston Capital Partners, LLC, an investment management firm with offices in Rochester, Michigan, Bloomfield Hills, Michigan, and Scottsdale, Arizona. Prior to Mr. Hakala co-founding Clarkton Capital Partners in 2007, he served as a portfolio manager for multiple investment management firms and worked in public accounting. Mr. Hakala was elected to the Conifer Holdings, Inc. Board of Directors in 2018. In addition, Mr. Hakala also serves as a Director and member of the Audit Committee of Waterford Bancorp, Inc. Mr. Hakala holds a B.A. in accounting and M.B.A. from Michigan State University and is both a Chartered Financial Analyst and a registered Certified Public Accountant. Mr. Hakala’s over 25 years of experience in portfolio investment management and public accounting brings inimitable investment strategy and financial expertise to the Board. Timothy M. Lamothe | Director Tim Lamothe has more than 38 years’ experience in the reinsurance industry, with particular expertise in the development and implementation of marketing programs throughout the United States. He attended Hofstra University MBA Program in 1980 and received his MBA in Business Administration & Finance from Sacred Heart University in Bridgeport, CT in 1984. His Undergraduate work was at St Michael’s College in Winooski, VT in 1977. Most recently (from 2001-2019), Mr. Lamothe served as Senior Vice President for Swiss Reinsurance, where he was responsible for direct marketing to over 25 states. His career also includes senior level marketing positions at PXRE Reinsurance Company, General Re/National Reinsurance Corporation, AIG, and Liberty Mutual Insurance Company. Mr. Lamothe was elected to the Conifer Holdings, Inc. Board of Directors in 2020. His expertise in engaging independent agent channels and marketing specialty insurance programs will prove invaluable as Conifer continues to expand its commercial and personal lines businesses. John W. Melstrom | Director John W. Melstrom is a founder and Partner Emeritus of Fenner, Melstrom and Dooling, a Birmingham, Michigan C.P.A. firm. With over 50 years as a practicing C.P.A. and a serial entrepreneur, Mr. Melstrom has broad knowledge and experience in multiple businesses and has served in various capacities as owner, advisor, counselor or director. Throughout his career, Mr. Melstrom has served, often in the leadership role of Chairman or Vice Chairman, on multiple boards both public and private and has been active in his community by serving on various civic and charitable boards. Mr. Melstrom was elected to the Board of Directors of Conifer Holdings, Inc. in 2019. Mr. Melstrom received his Bachelor of Science degree in accounting from Michigan State University in 1963 and is a practicing Certified Public Accountant licensed in the State of Michigan.

Organizational Overview: Board of Directors (continued) 21 Isolde G. O’Hanlon | Director Isolde O’Hanlon has more than 35 years of financial institutions banking experience; including 25 years focused exclusively on the insurance, reinsurance and brokerage/distribution sectors. Ms. O’Hanlon Received her AB in Economics from Smith College in 1981. Most recently Ms. O’Hanlon served as a Managing Director on the Insurance Investment Banking team at BMO Capital Markets. Prior to that she worked at Fox-Pitt Kelton and the Macquarie Group, after spending 23 years with JP Morgan. Ms. O’Hanlon was elected to the Conifer Holdings, Inc. Board of Directors in 2017. With more than 25 years of experience in the Insurance Investment Banking field, her expertise serving small to mid-cap Insurance clients in strategic advisory and capital raising is an invaluable addition to the Board. Joseph D. Sarafa | Director Joe Sarafa has over 30 years of experience as a practicing attorney and is the co-owner of a property management and development company in Michigan. Since 2010, Mr. Sarafa has been a partner with the firm Moothart & Sarafa, PLC. Mr. Sarafa was elected to the Conifer Holdings, Inc. Board of Directors in 2012 and named the Chair of the Nominating and Corporate Governance Committee in 2015. Mr. Sarafa is very involved in the community, serving multiple businesses and charitable organizations in various capacities over the years and currently serves on multiple boards in an array of industries. Mr. Sarafa has a B.S. from the University of Michigan and a J.D. from the University of Detroit - School of Law. He was admitted to the State Bar of Michigan in 1983. His legal experience and years of providing counsel to a broad range of industries brings important expertise in the areas of governance, compliance, and regulatory issues to the Board. Richard Jamison Williams, Jr. | Director Rick Williams is a founder and Chairman of Williams, Williams, Rattner & Plunkett, P.C. and has over 50 years of experience as a practicing attorney specializing in business law. Mr. Williams was elected to the Conifer Holdings, Inc. Board of Directors in 2009. He is a Director of a number of companies, including Penske Corporation, Clarke Power Services and Green Optics. Mr. Williams’ civic responsibilities include serving on the Boards of Trustees of Cranbrook Educational Community, Detroit Symphony Orchestra and Beaumont Hospital. Mr. Williams brings extensive experience in a wide variety of transactions, and his legal judgment and experience strengthens our Board in its consideration of various governance and strategic issues.

Organizational Overview: Executive Management 22 James G. Petcoff | Executive Chairman, co-CEO & Founder As Executive Chairman & co-Chief Executive Officer of Conifer Holdings, Inc., Jim Petcoff is responsible for establishing the overall direction and materializing the strategy of the Company. He and Mr. Nicholas Petcoff founded the Company in 2009. Mr. Petcoff has more than 35 years of insurance industry experience, including founding North Pointe Insurance Company in 1986, taking it public in 2005 and facilitating the sale to QBE Holdings Inc. in 2008. Mr. Petcoff has a B.A. from Michigan State University, a M.B.A. from University of Detroit and a J.D. from University of Detroit School of Law. Mr. Petcoff's extensive executive leadership and public company expertise provides irreplaceable direction for the continued growth of the Company. Nicholas Petcoff | co-CEO & Director As Director & Co-Chief Executive Officer of Conifer Holdings, Inc., Nick Petcoff oversees the Company's Commercial Lines Underwriting, Reinsurance, Claims, Corporate Legal and Information Technology. He co-founded the Company in 2009 and has more than 17 years of experience in the insurance industry. Mr. Petcoff is also Director and President of Conifer Insurance Company and President of White Pine Insurance Company, both wholly owned subsidiaries of Conifer Holdings, Inc. Mr. Petcoff’s distinctive skillset in the areas of Underwriting, Claims and Treaty Reinsurance equips him to direct the Company’s overall strategy, growing the business while enabling the Company to conceptualize and deftly respond to market needs. Brian Roney | President As President of Conifer Holdings, Inc., Brian Roney oversees the Company's finance and investor relations functions, as well as general operations. He has been with the Company since 2010 and has over 20 years of experience in the insurance industry. Mr. Roney has a B.A. from the University of Notre Dame and a M.B.A. from the University of Detroit. Mr. Roney has more than 34 years of financial services experience and spent 10 years in the securities industry as a principal with a broker-dealer, where he specialized in public and private offerings and held FINRA (NASD) Series 7, 24 and 63 licenses. Mr. Roney's prior experience with multiple publicly traded insurance companies brings vital public company expertise to the executive leadership team. Harold Meloche | Chief Financial Officer & Treasurer As Chief Financial Officer and Treasurer of Conifer Holdings, Inc., Harold Meloche has primary responsibility over accounting and financial reporting. Mr. Meloche has been with the Company since 2013 and has over 28 years of experience in the insurance industry. Mr. Meloche is a registered Certified Public Accountant and his analytical expertise bears considerable value to the Company’s financial leadership team.