NASDAQ: CNFR Fulfilling the Unique Needs of Specialty Insurance Markets as a Long-Term Partner November 11, 2021 Exhibit 99.1

Safe Harbor Statement 2

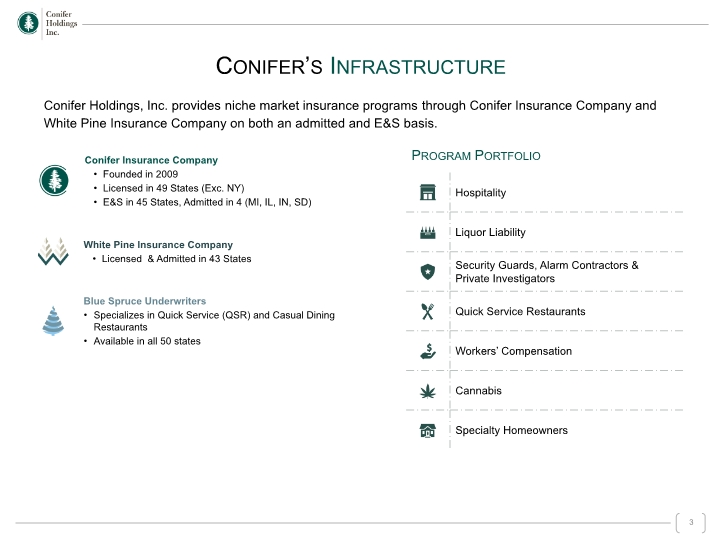

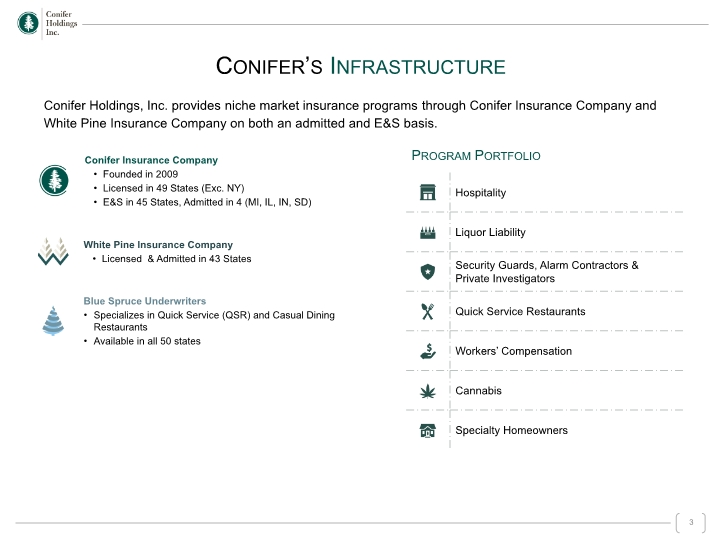

Conifer Holdings, Inc. provides niche market insurance programs through Conifer Insurance Company and White Pine Insurance Company on both an admitted and E&S basis. Conifer’s Infrastructure 3

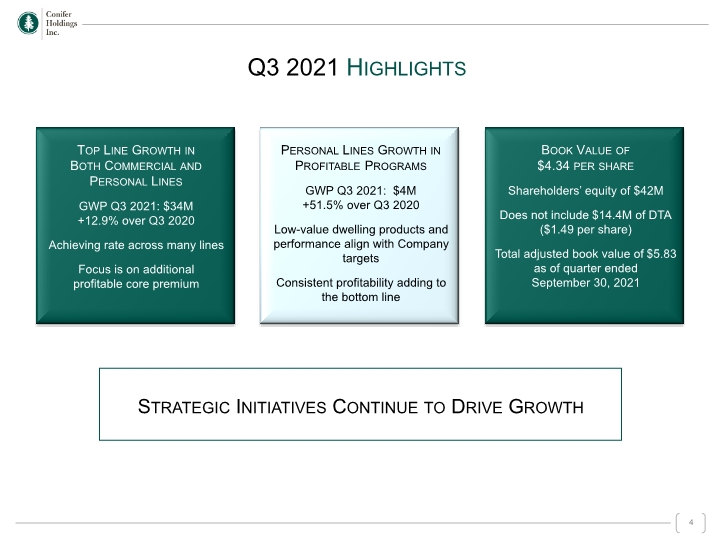

Q3 2021 Highlights Top Line Growth in Both Commercial and Personal Lines GWP Q3 2021: $34M +12.9% over Q3 2020 Achieving rate across many lines Focus is on additional profitable core premium Personal Lines Growth in Profitable Programs GWP Q3 2021: $4M +51.5% over Q3 2020 Low-value dwelling products and performance align with Company targets Consistent profitability adding to the bottom line Book Value of $4.34 per share Shareholders’ equity of $42M Does not include $14.4M of DTA ($1.49 per share) Total adjusted book value of $5.83 as of quarter ended September 30, 2021 Strategic Initiatives Continue to Drive Growth 4

Investment Thesis Focused Expertise in Niche Specialty Insurance Markets Operating Strategy 2 Attractive Entry Point Valuation Based on Operating Trajectory 3 1 5

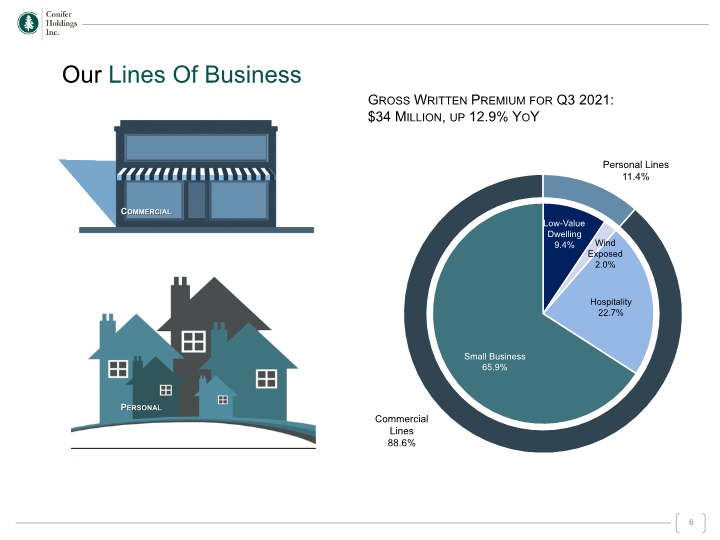

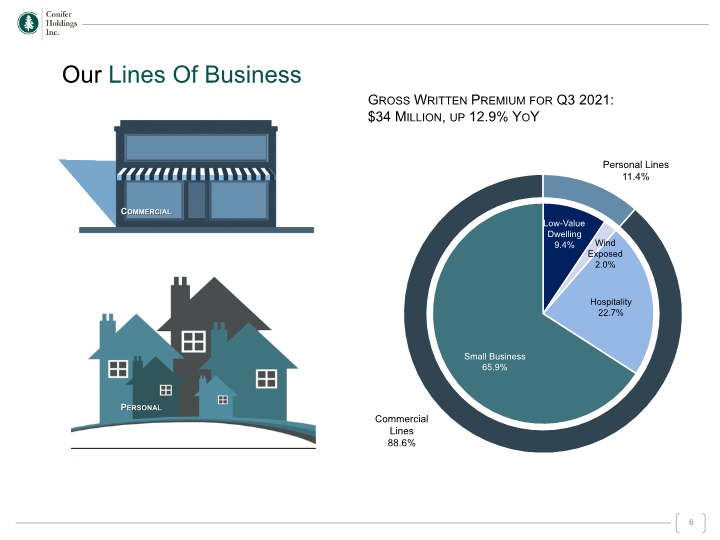

Our Lines Of Business Commercial Personal Gross Written Premium for Q3 2021: $34 Million, up 12.9% YoY 6

Example: Restaurants, Bars and Taverns Conifer has had ties to the Hospitality Industry since the late 1980s, providing coverage and peace of mind for proprietors. Experts in Niche Markets Commercial Lines 7

Focus on classes where we have deep underwriting knowledge and experience Partner with retail and select wholesale agencies and retain underwriting authority in-house: Underwriting teams have established strong relationships with retail and wholesale specialists in these lines of business. With agents who specialize in our unique classes, we remain closer to our insureds and underwrite a stronger account / risk profile overall. A hallmark of our success has always been tight agent relationships that generate high account retention: Commercial retention in the quarter was over 90%. High account retention allows us to selectively grow market share where we see the best pricing and profitability. Leverage ability to write on E&S and admitted paper for rate and form flexibility: Our markets are firming, and we are seeing rate increases in our specialty markets – especially Excess & Surplus lines. In general, this has contributed to higher account retention, and more rate per risk. High single digits generally, low double digits for most classes, and even higher increases for auto insureds. Maintain low limits as much as possible: vast majority of property TIV is under $1M Also, we are seeing select participants exiting and leading to some market share movement in our space Continuing to emphasize specialty business, our premium mix remains firmly dedicated to Commercial Lines with 88.6% Specialty Commercial and 11.4% Personal Lines for Q3 2021. Commercial Lines Focus: Disciplined, Quality Underwriting 8

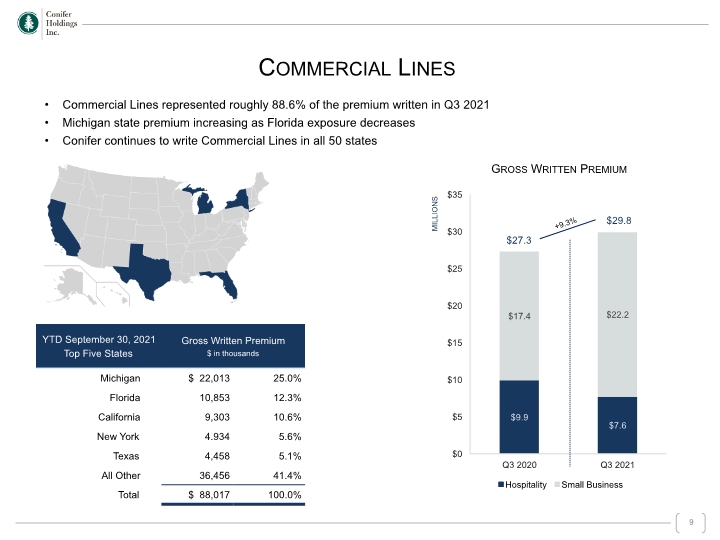

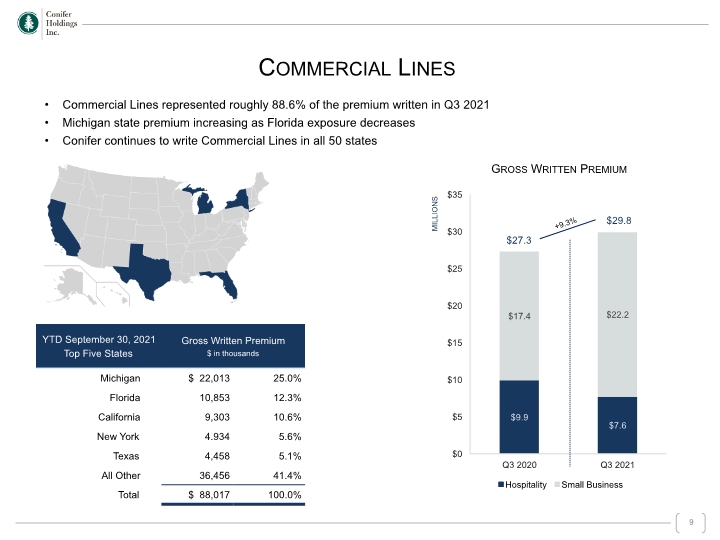

+9.3% Gross Written Premium Commercial Lines represented roughly 88.6% of the premium written in Q3 2021 Michigan state premium increasing as Florida exposure decreases Conifer continues to write Commercial Lines in all 50 states Commercial Lines 9

Low value dwelling focus Underwriting teams have established strong relationships with retail and wholesale specialists in low value dwelling markets Leverage ability to write on E&S and admitted paper, where possible, for rate and form flexibility Utilize technology to appropriately price our property risks – for example, employing satellite imagery software for positive roof selection Improved technology to streamline claims process – for example, text messaging with claimants (including in-app translation capability) Maintain competitive advantage in ease of use for agency portal and submission/bind process Cloud-based agency portal system with strong data mining and predictive outcome capabilities Redesigned insurance company websites with the agent experience in mind Maintain rate and underwriting discipline regardless of market cycles Wind-driven premium has been largely non-renewed, which lowered overall PML by up to 90% 10 Personal Lines Focus: Niche Specialty Homeowners Products

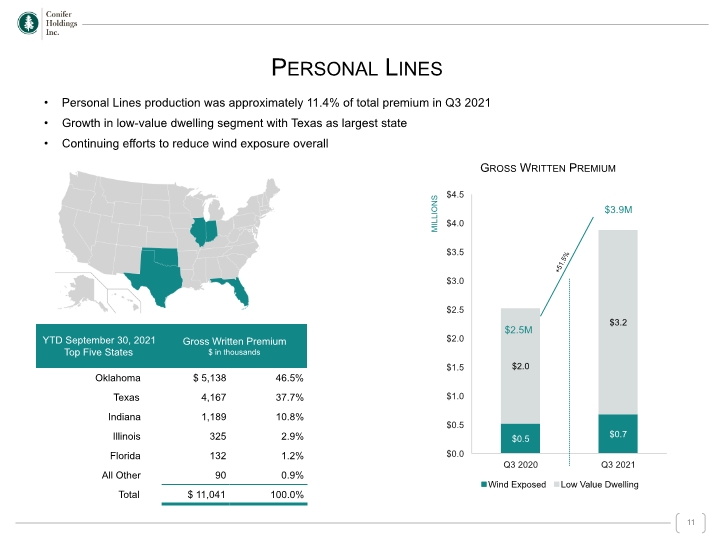

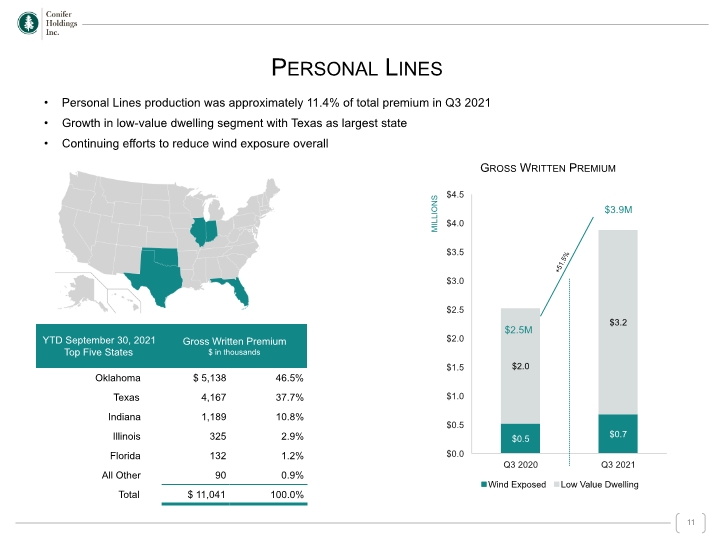

Gross Written Premium Personal Lines production was approximately 11.4% of total premium in Q3 2021 Growth in low-value dwelling segment with Texas as largest state Continuing efforts to reduce wind exposure overall +51.5% Personal Lines 11

Operating Strategy Attractive Entry Point Valuation Based on Operating Trajectory Focused Expertise in Niche Specialty Insurance Markets 2 3 1 Investment Thesis 12

Strategic Initiatives: Progress to Date Writing Specialty Commercial Lines Significant rate increases Infrastructure in place to handle anticipated growth Reducing exposure to underperforming markets (example: exiting select FL commercial lines) Expense management ongoing Focus on Small Commercial Business Experiencing premium growth Achieving appropriate scale Substantial decrease in number of open claims leads to more predictable loss-cost predictions in future periods Expense ratio improvements anticipated 13

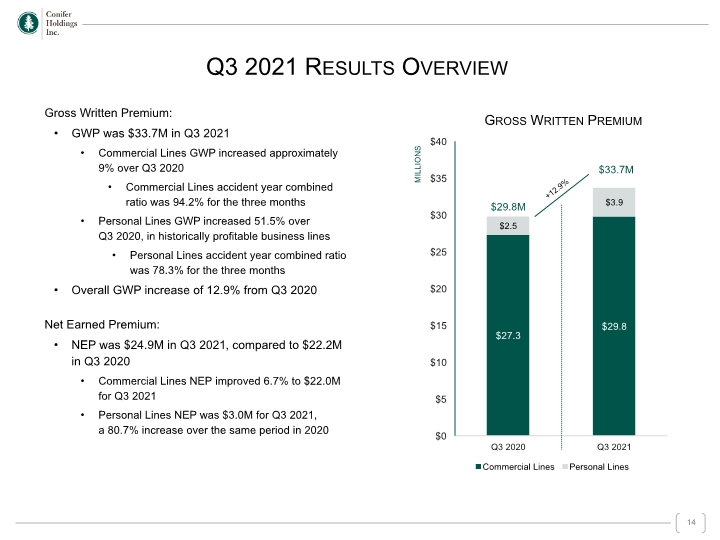

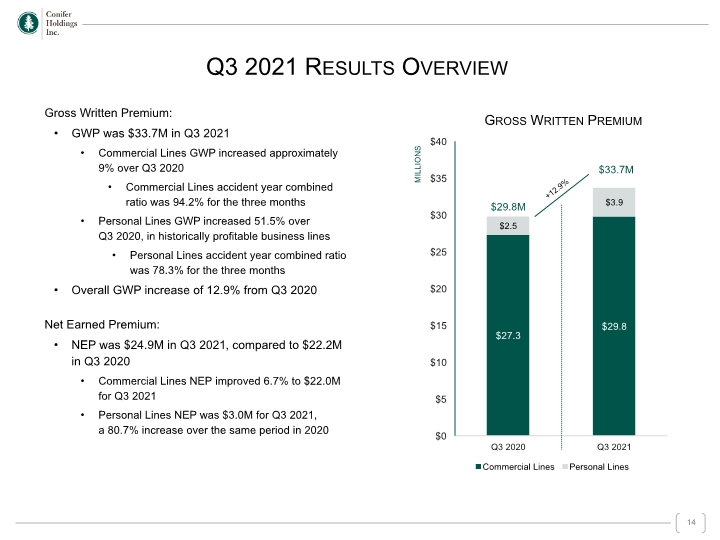

Q3 2021 Results Overview Gross Written Premium: GWP was $33.7M in Q3 2021 Commercial Lines GWP increased approximately 9% over Q3 2020 Commercial Lines accident year combined ratio was 94.2% for the three months Personal Lines GWP increased 51.5% over Q3 2020, in historically profitable business lines Personal Lines accident year combined ratio was 78.3% for the three months Overall GWP increase of 12.9% from Q3 2020 Net Earned Premium: NEP was $24.9M in Q3 2021, compared to $22.2M in Q3 2020 Commercial Lines NEP improved 6.7% to $22.0M for Q3 2021 Personal Lines NEP was $3.0M for Q3 2021, a 80.7% increase over the same period in 2020 Gross Written Premium +12.9% 14

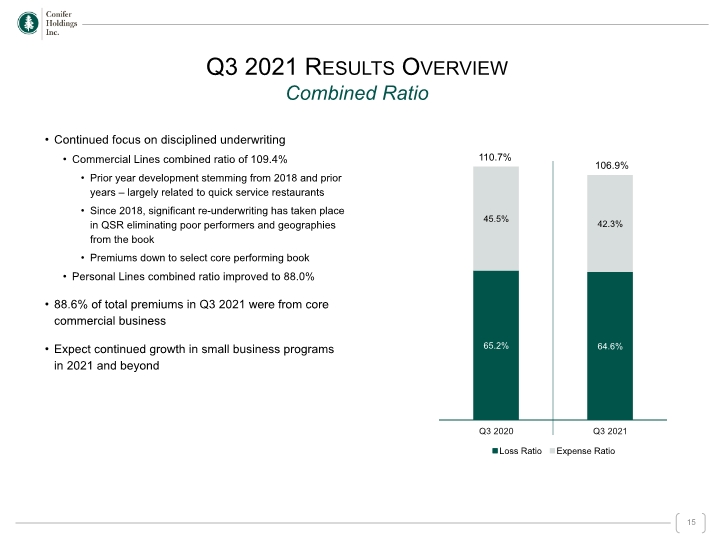

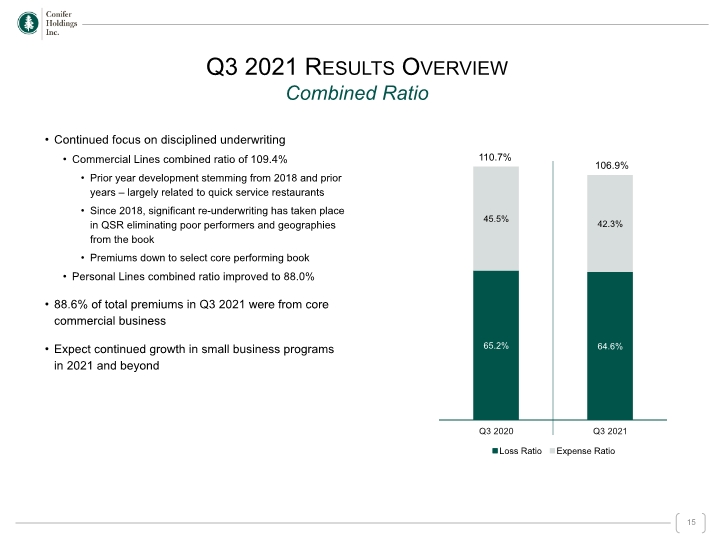

Continued focus on disciplined underwriting Commercial Lines combined ratio of 109.4% Prior year development stemming from 2018 and prior years – largely related to quick service restaurants Since 2018, significant re-underwriting has taken place in QSR eliminating poor performers and geographies from the book Premiums down to select core performing book Personal Lines combined ratio improved to 88.0% 88.6% of total premiums in Q3 2021 were from core commercial business Expect continued growth in small business programs in 2021 and beyond Q3 2021 Results Overview Combined Ratio 110.7% 106.9% 15

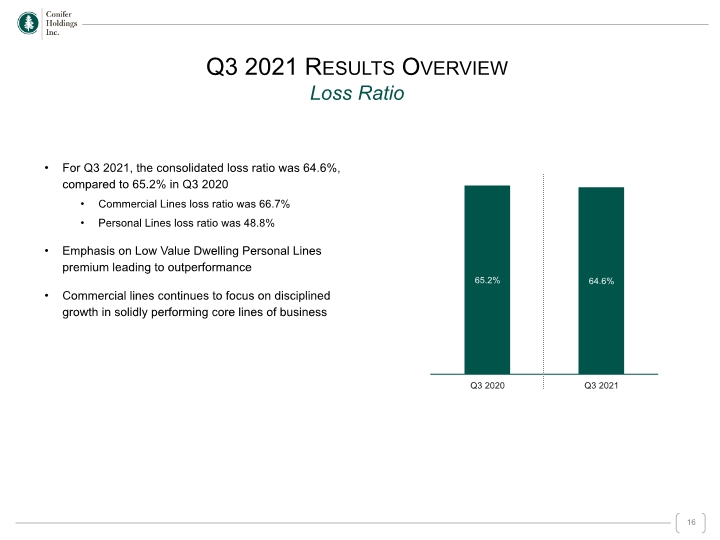

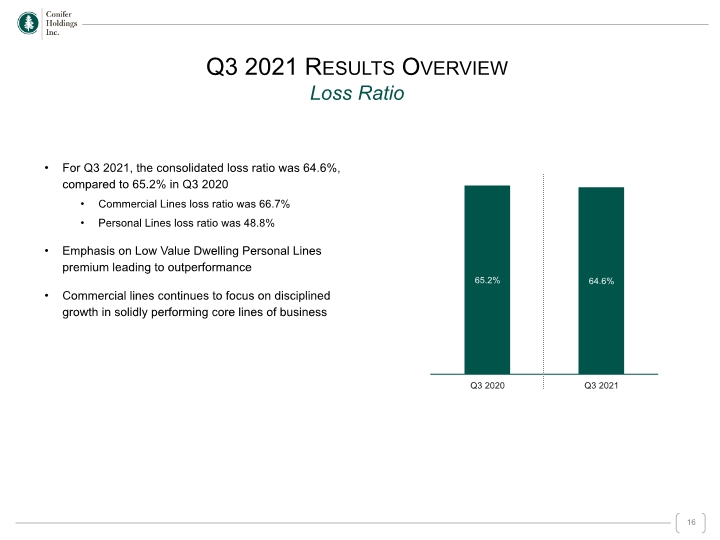

For Q3 2021, the consolidated loss ratio was 64.6%, compared to 65.2% in Q3 2020 Commercial Lines loss ratio was 66.7% Personal Lines loss ratio was 48.8% Emphasis on Low Value Dwelling Personal Lines premium leading to outperformance Commercial lines continues to focus on disciplined growth in solidly performing core lines of business Q3 2021 Results Overview Loss Ratio 16

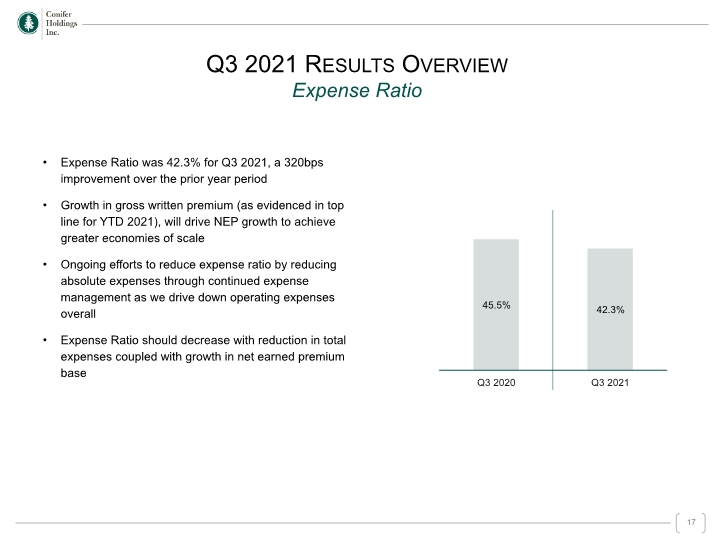

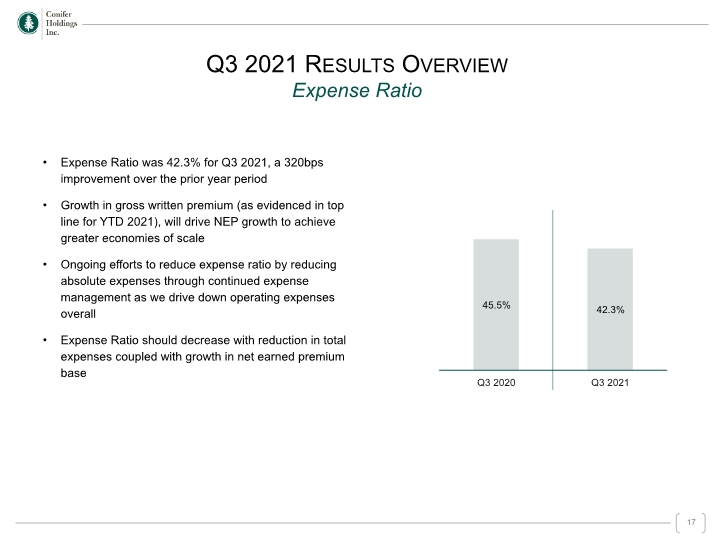

Expense Ratio was 42.3% for Q3 2021, a 320bps improvement over the prior year period Growth in gross written premium (as evidenced in top line for YTD 2021), will drive NEP growth to achieve greater economies of scale Ongoing efforts to reduce expense ratio by reducing absolute expenses through continued expense management as we drive down operating expenses overall Expense Ratio should decrease with reduction in total expenses coupled with growth in net earned premium base Q3 2021 Results Overview Expense Ratio 17

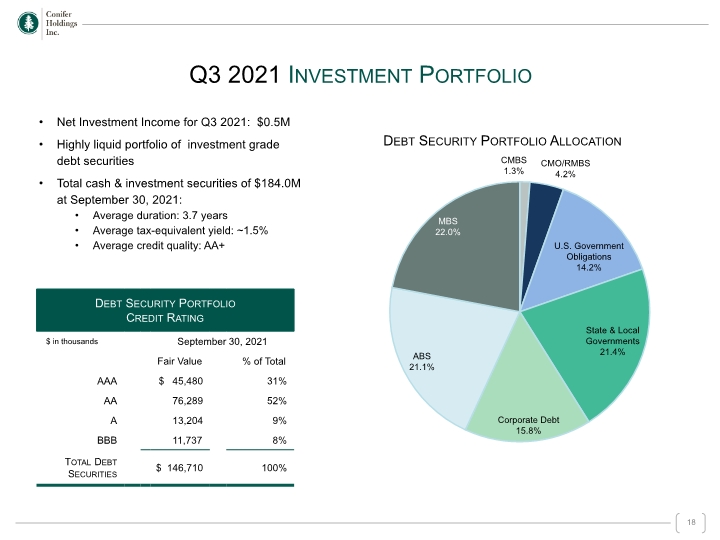

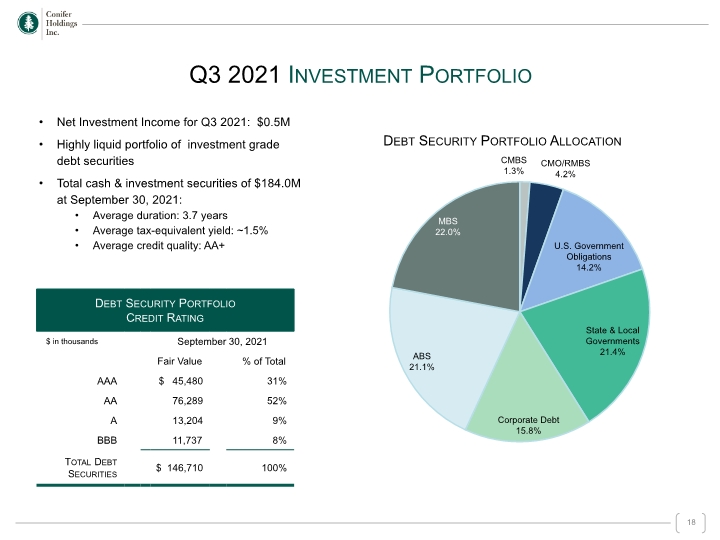

Debt Security Portfolio Allocation Net Investment Income for Q3 2021: $0.5M Highly liquid portfolio of investment grade debt securities Total cash & investment securities of $184.0M at September 30, 2021: Average duration: 3.7 years Average tax-equivalent yield: ~1.5% Average credit quality: AA+ Q3 2021 Investment Portfolio 18

Investment Thesis 19

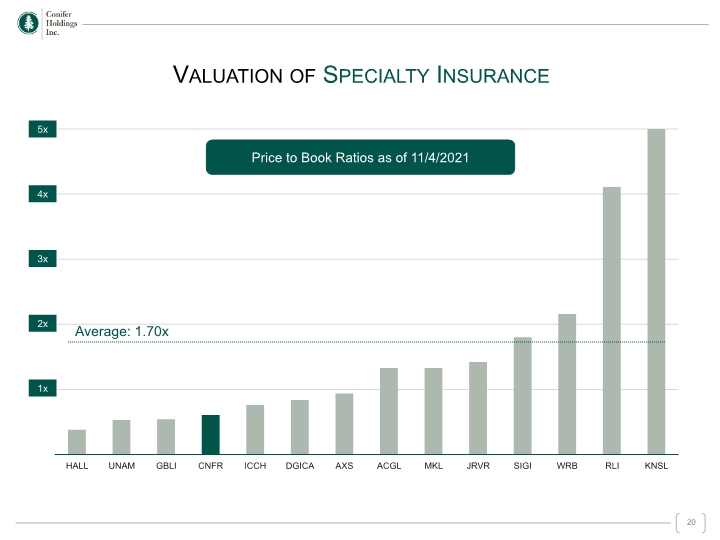

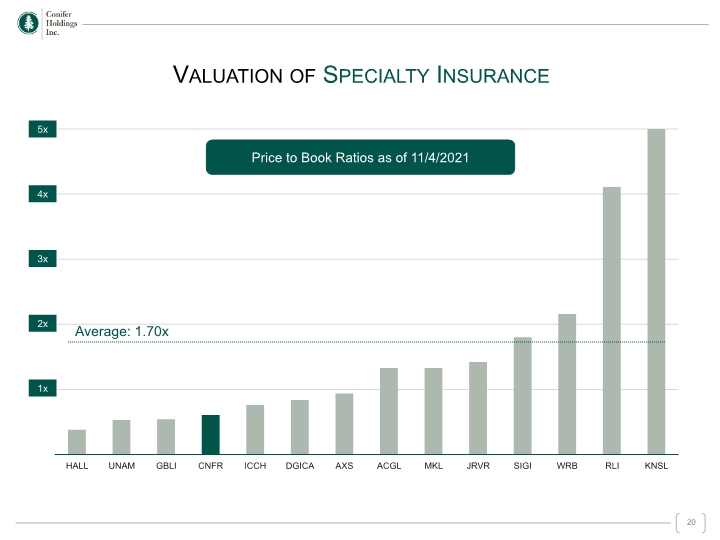

Price to Book Ratios as of 11/4/2021 2x 4x 3x 1x Average: 1.70x Valuation of Specialty Insurance 20 5x

Why Conifer 21

Aligned and Experienced Management Team Insiders own over 64% of outstanding stock 22

Contact: Jessica Gulis (248) 559-0840 ir@cnfrh.com Appendix Income Statement Balance Sheet Summary Financial Information Adjusted Operating EPS 23

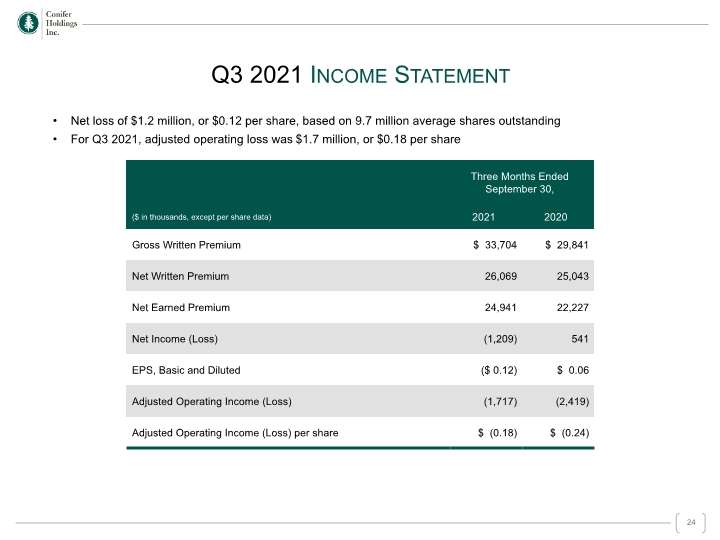

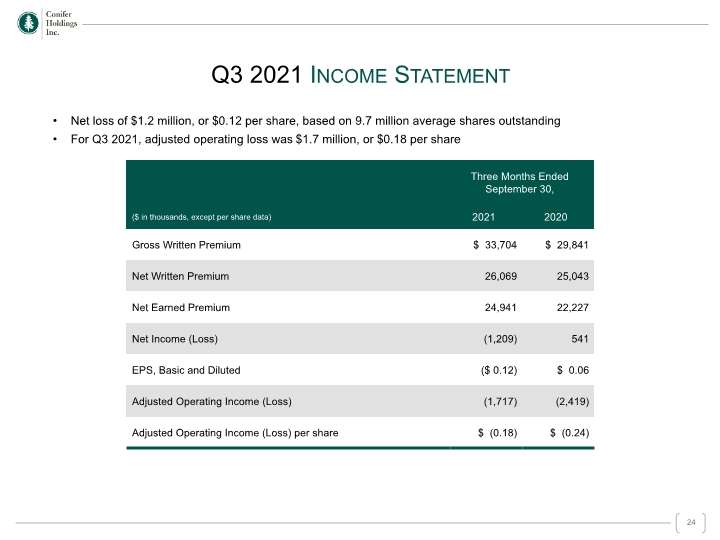

Net loss of $1.2 million, or $0.12 per share, based on 9.7 million average shares outstanding For Q3 2021, adjusted operating loss was $1.7 million, or $0.18 per share Q3 2021 Income Statement 24

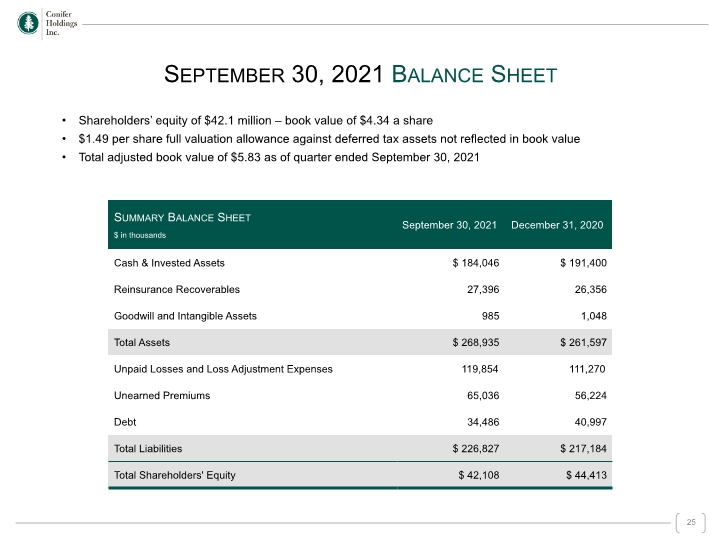

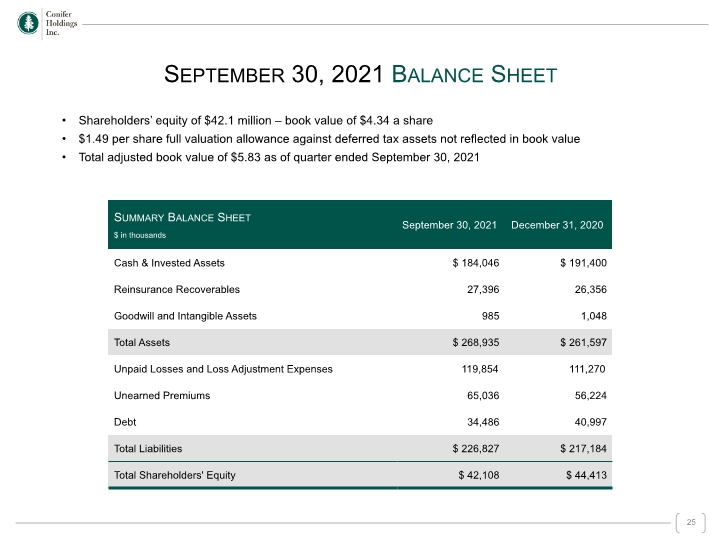

Shareholders’ equity of $42.1 million – book value of $4.34 a share $1.49 per share full valuation allowance against deferred tax assets not reflected in book value Total adjusted book value of $5.83 as of quarter ended September 30, 2021 September 30, 2021 Balance Sheet 25

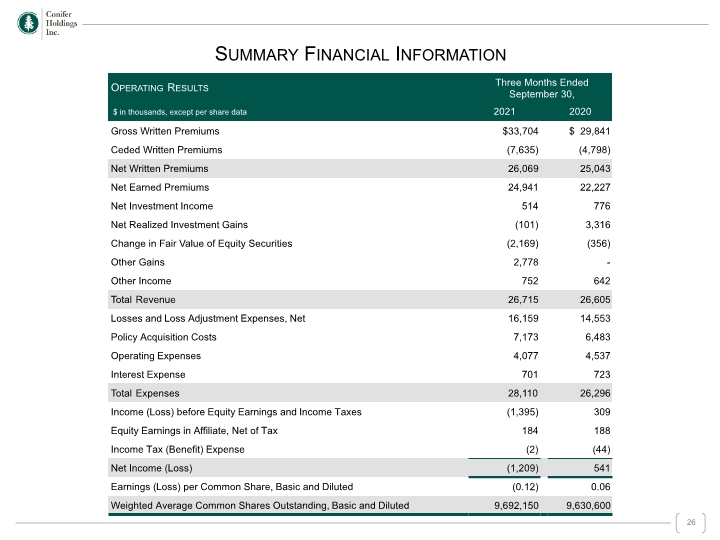

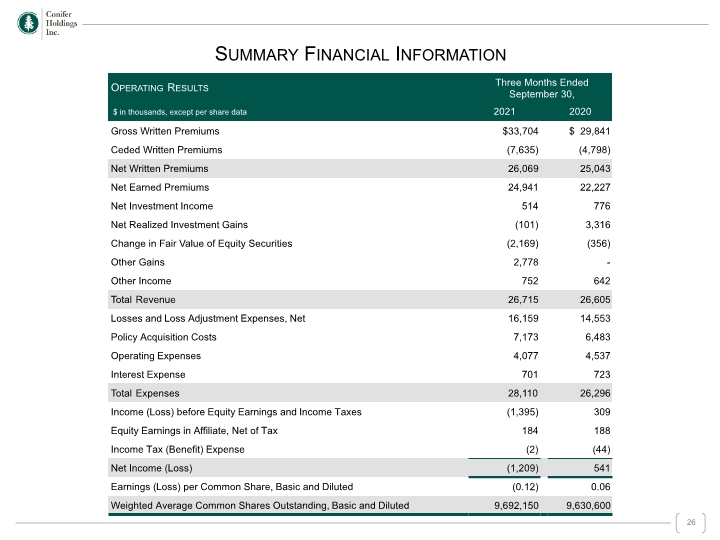

Summary Financial Information 26

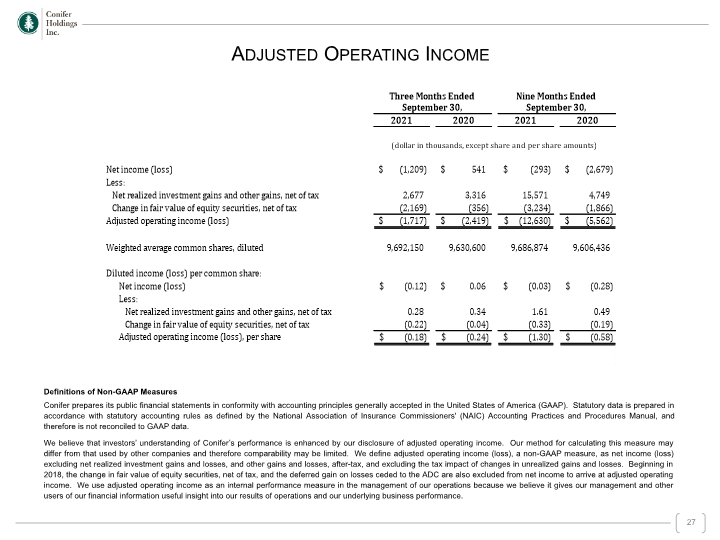

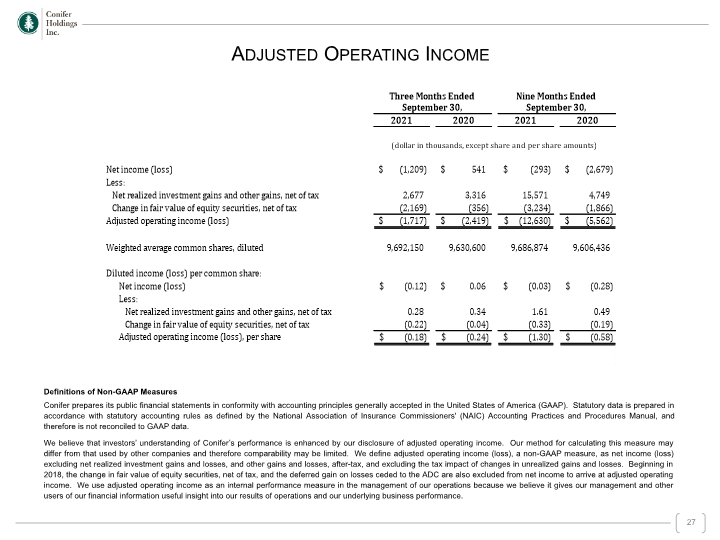

Definitions of Non-GAAP Measures Conifer prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as defined by the National Association of Insurance Commissioners' (NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data. We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of adjusted operating income. Our method for calculating this measure may differ from that used by other companies and therefore comparability may be limited. We define adjusted operating income (loss), a non-GAAP measure, as net income (loss) excluding net realized investment gains and losses, and other gains and losses, after-tax, and excluding the tax impact of changes in unrealized gains and losses. Beginning in 2018, the change in fair value of equity securities, net of tax, and the deferred gain on losses ceded to the ADC are also excluded from net income to arrive at adjusted operating income. We use adjusted operating income as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance. Adjusted Operating Income 27