Conifer Holdings, Inc.Page 7

May 11, 2022

Adjusted Operating Income (Loss)

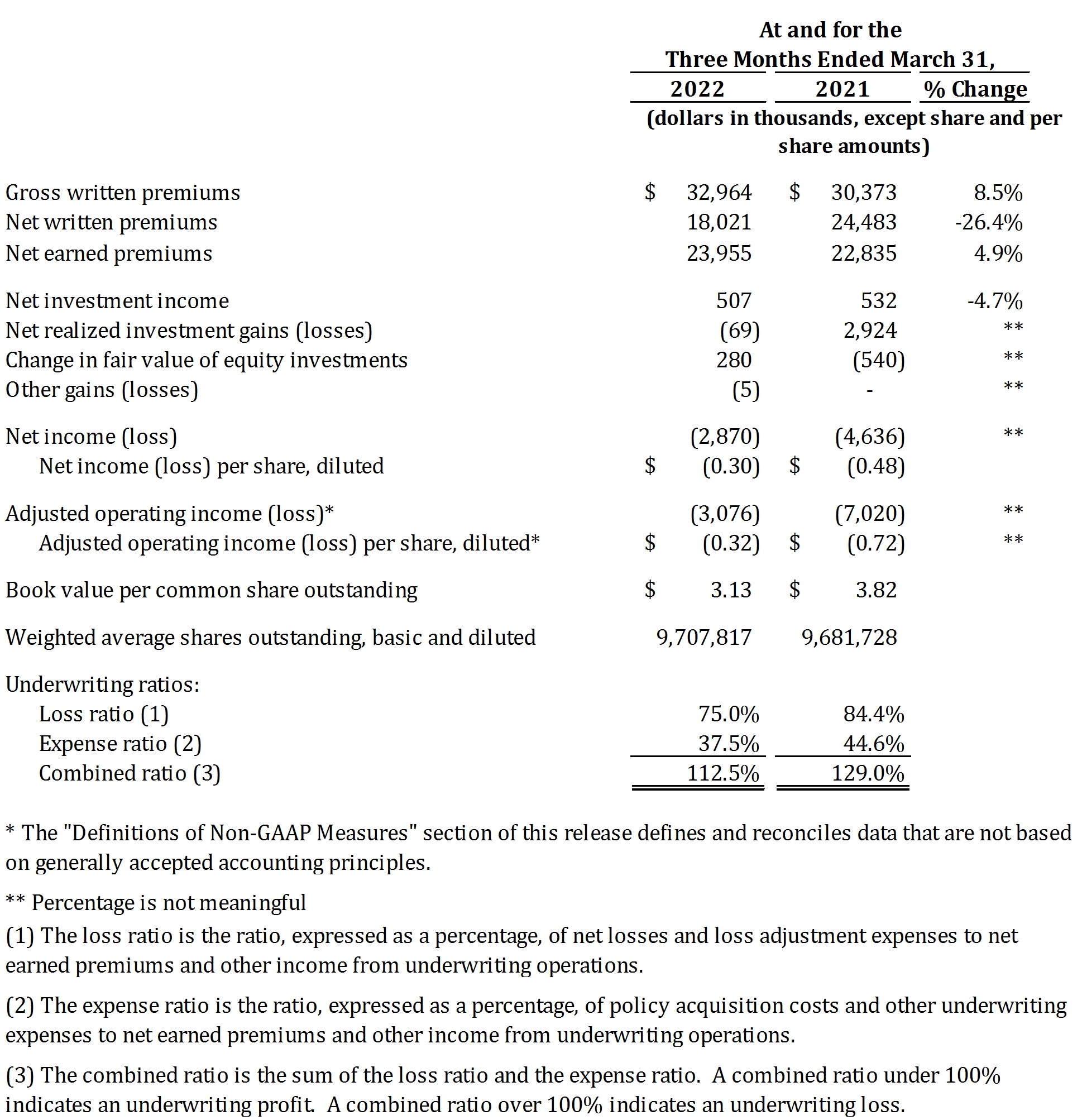

In the first quarter of 2022, the Company reported an adjusted operating loss of $3.1 million, or $0.32 per share, compared to an adjusted operating loss of $7.0 million, or $0.72 per share, for the same period in 2021. See Definitions of Non-GAAP Measures.

Earnings Conference Call with Accompanying Slide Presentation

The Company will hold a conference call/webcast on Thursday, May 12, 2022 at 8:30 a.m. ET to discuss results for the first quarter ended March 31, 2022.

Investors, analysts, employees and the general public are invited to listen to the conference call via:

Webcast:On the Event Calendar at IR.CNFRH.com

Conference Call:844-868-8843 (domestic) or 412-317-6589 (international)

The webcast will be archived on the Conifer Holdings website and available for replay for at least one year.

About the Company

Conifer Holdings, Inc. is a specialty insurance holding company, offering customized coverage solutions tailored to the needs of our insureds. Nationwide, Conifer markets largely through independent agents, and is traded on the NASDAQ exchange under the symbol “CNFR”. Additional information is available on the Company’s website at www.CNFRH.com.

Definitions of Non-GAAP Measures

Conifer prepares its public financial statements in conformity with accounting principles generally accepted in the United States of America (GAAP). Statutory data is prepared in accordance with statutory accounting rules as defined by the National Association of Insurance Commissioners' (NAIC) Accounting Practices and Procedures Manual, and therefore is not reconciled to GAAP data.

We believe that investors’ understanding of Conifer’s performance is enhanced by our disclosure of adjusted operating income. Our method for calculating this measure may differ from that used by other companies and therefore comparability may be limited. We define adjusted operating income (loss), a non-GAAP measure, as net income (loss) excluding after-tax net realized investment gains and losses, excluding the tax effect of changes in unrealized gains and losses, excluding the after-tax change in fair value of equity securities. We use adjusted operating income as an internal performance measure in the management of our operations because we believe it gives our management and other users of our financial information useful insight into our results of operations and our underlying business performance.