PROSPECTUS

Contango ORE, Inc.

$100,000,000

Common Stock

Preferred Stock

Warrants

Subscription Rights

Units

and

415,000 Shares of Common Stock Offered

by the Selling Stockholder

We may, from time to time in one or more offerings, offer and sell up to $100,000,000 in the aggregate of common stock, preferred stock, warrants to purchase common stock or preferred stock, subscription rights, or any combination of the foregoing, either individually or as units comprised of one or more of the other securities.

In addition, the selling stockholder named herein may offer and sell up to an aggregate of 415,000 shares of our common stock from time to time in one or more offerings. We will not receive any of the proceeds from the sale of our common stock by the selling stockholder.

The common stock, the preferred stock, the warrants, the subscription rights and the units collectively are referred to in this prospectus as the "securities".

We may offer and sell these securities from time to time in amounts, at prices and on terms to be determined by market conditions and other factors at the time of our offerings. We or the selling stockholder may offer and sell these securities on a continuous or delayed basis through agents, through underwriters or dealers or directly to one or more purchasers, including existing stockholders. This prospectus provides you with a general description of these securities and the general manner in which we will offer the securities. Each time we sell securities, we will provide a prospectus supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus.

Our common stock is traded on the OTCQB Tier of the OTC Markets Group Inc. under the symbol “CTGO”. The last reported sales price of our common stock on the OTCQB on October 26, 2021 was $20.20 per share.

INVESTING IN OUR SECURITIES INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE RISK FACTORS DESCRIBED UNDER “RISK FACTORS” ON PAGE 5 OF THIS PROSPECTUS AND IN THE APPLICABLE PROSPECTUS SUPPLEMENT OR ANY OF THE DOCUMENTS WE INCORPORATE BY REFERENCE BEFORE YOU MAKE AN INVESTMENT IN OUR SECURITIES.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus may not be used without a prospectus supplement.

The date of this prospectus is November 12, 2021.

TABLE OF CONTENTS

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, we may, over time, offer and sell the securities described in this prospectus in one or more offerings or resales up to an aggregate amount of $100,000,000. In addition, under this shelf process, the selling stockholder to be named in a supplement to this prospectus may, from time to time, sell up to 415,000 shares of common stock, as described in this prospectus, in one or more offerings.

This prospectus provides you with a general description of the securities we and the selling stockholder may offer. Each time we or the selling stockholder sells any of the securities described herein, we or the selling stockholder may provide a prospectus supplement that will contain specific information about the terms of that offering and may include a discussion of any risk factors or other special considerations that apply to those securities. The prospectus supplement may also add to, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement, you should rely on the information in the applicable prospectus supplement. Please carefully read this prospectus, any applicable prospectus supplement and any free-writing prospectus that we authorize to be distributed to you and any information incorporated by reference into the foregoing, together with additional information described under the heading “Where You Can Find More Information” before buying any of the securities offered under this prospectus.

You should rely only on the information contained in this prospectus and in any relevant prospectus supplement or free writing prospectus, including any information incorporated herein or therein by reference. Neither we nor the selling stockholder have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should not assume that the information in this prospectus, any accompanying prospectus supplement, any free writing prospectus or any document incorporated by reference is accurate as of any date other than the date on its front cover. Our business, financial condition, results of operations and prospects may have changed since the date indicated on the front cover of such documents. Neither this prospectus nor any prospectus supplement or free writing prospectus constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate, nor does this prospectus or a prospectus supplement or free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

NOTICE REGARDING MINERAL DISCLOSURE

(Industry Guide 7 vs. Regulation S-K 1300 et. seq.)

In October 2018, the Securities and Exchange Commission (the “SEC”) adopted amendments to its current disclosure rules to modernize the mineral property disclosure requirements for mining registrants. The amendments include the adoption of a new subpart 1300 of Regulation S-K, which will govern disclosure for mining registrants (the “SEC Mining Modernization Rules”). The SEC Mining Modernization Rules replace the historical property disclosure requirements for mining registrants that were included in the SEC’s Industry Guide 7 and better align disclosure with international industry and regulatory practices, including the Canadian National Instrument 43-101—Standards of Disclosure for Mineral Projects. The Company must comply with the SEC Mining Modernization Rules as of the Company’s fiscal year beginning on or after January 1, 2021, which began on July 1, 2021.

The Technical Report summary for the Peak Gold JV Property (as defined below) has been prepared in accordance with the SEC Mining Modernization Rules and is included as Exhibit 96.1 to the registration statement that contains this prospectus.

These disclosures differ in material respects from the requirements set forth in Industry Guide 7, which remains applicable to U.S. companies subject to the reporting and disclosure requirements of the SEC that have not early adopted the SEC Mining Modernization Rules. These standards differ significantly from the disclosure requirements of Industry Guide 7 in that mineral resource information contained herein may not be comparable to similar information disclosed by U.S. companies that have not early adopted the SEC Mining Modernization Rules.

The financial statements, notes thereto and audits for the fiscal years ended June 30, 2020 and 2021, all of which are contained in the documents incorporated by reference into this prospectus, were prepared in compliance with Industry Guide 7. The accounting and definitions used in the notes to the financial statements for the Company’s fiscal years ending June 30, 2020 and 2021 were prepared in compliance with Industry Guide 7 since the SEC Mining Modernization Rules were not applicable during these periods. However, since there are disclosures made in this prospectus that are made to be current when the Company's prospectus is effective and since the effective date of the prospectus will be after June 30, 2021, the disclosure made in certain Items that is not solely based on an historical presentation for periods prior to July 1, 2021 has been made in compliance with the SEC Mining Modernization Rules. Additionally, we anticipate disclosures to be made in prospectus supplements will be made in compliance with the SEC Mining Modernization Rules.

The Company has no known reserves as defined under Industry Guide 7 or the SEC Mining Modernization Rules. There are significant differences in the definitions and in the disclosure required under the SEC Mining Modernization Rules and under Industry Guide 7. Under Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Industry Guide 7 does not define and the SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve.

Therefore, the reader should be aware that the notes to the financial statements were prepared in compliance with Industry Guide 7, and the balance of this prospectus was prepared (and we anticipate prospectus supplements will be prepared) in compliance with the SEC Mining Modernization Rules. Therefore, those terms that have specific definitions in the SEC Mining Modernization Rules have those meanings ascribed to them by the regulation.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in or incorporated by reference into this prospectus may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934, as amended. The words and phrases “should be”, “will be”, “believe”, “expect”, “anticipate”, “estimate”, “forecast”, “goal” and similar expressions identify forward-looking statements and express expectations about future events. These include such matters as:

| | • | The Company’s financial position; |

| | • | Business strategy, including outsourcing; |

| | • | Meeting the Company’s forecasts and budgets; |

| | • | Anticipated capital expenditures and the availability of future financing; |

| | • | Prices of gold and associated minerals; |

| | • | Timing and amount of future discoveries (if any) and production of natural resources on the Peak Gold JV Property and the Company's other properties; |

| | • | Operating costs and other expenses; |

| | • | Cash flow and anticipated liquidity; |

| | • | The Company’s ability to fund its business with current cash reserves based on currently planned activities; |

| | • | Prospect development; |

| | • | Operating and legal risks; and |

| | • | New governmental laws and regulations. |

Although the Company believes the expectations reflected in such forward-looking statements are reasonable, such expectations may not occur. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from future results expressed or implied by the forward-looking statements. These factors include among others:

| | • | Ability to raise capital to fund capital expenditures; |

| | • | Ability to retain or maintain our relative ownership interest in the Peak Gold JV; |

| | • | Ability to influence management of the Peak Gold JV; |

| | • | Ability to realize the anticipated benefits of the Kinross Transactions, including ability to process ore mined from the Peak Gold JV Property at the existing Fort Knox mining and milling complex; |

| | • | Disruption from the Kinross Transactions and transition of the Peak Gold JV's management to Kinross, including as it relates to maintenance of business and operational relationships, potential delays or changes in plans with respect to exploration or development projects or capital expenditures; |

| | • | Operational constraints and delays; |

| | • | The risks associated with exploring in the mining industry; |

| | • | The timing and successful discovery of natural resources; |

| | • | Availability of capital and the ability to repay indebtedness when due; |

| | • | Declines and variations in the price of gold and associated minerals; |

| | • | Availability of operating equipment; |

| | • | Operating hazards attendant to the mining industry; |

| | • | The ability to consummate acquisitions and the effects of acquisitions on our business; |

| | • | Weather; |

| | • | The ability to find and retain skilled personnel; |

| | • | Restrictions on mining activities; |

| | • | Legislation that may regulate mining activities; |

| | • | Changes in applicable tax rates and other regulatory changes; |

| | • | Impact of new and potential legislative and regulatory changes (including commitments to international agreements) on mining operating and safety standards; |

| | • | Uncertainties of any estimates and projections relating to any future production, costs and expenses (including changes in the cost of fuel, power, materials and supplies); |

| | • | Timely and full receipt of sale proceeds from the sale of any of our mined products (if any); |

| | • | Stock price and interest rate volatility; |

| | • | Federal and state regulatory developments and approvals; |

| | • | Availability and cost of material and equipment; |

| | • | Actions or inactions of third parties; |

| | • | Potential mechanical failure or under-performance of facilities and equipment; |

| | • | Environmental and regulatory, health and safety risks; |

| | • | Strength and financial resources of competitors; |

| | • | Worldwide economic conditions; |

| | • | Impact of pandemics, such as the worldwide COVID-19 outbreak, which could impact the Company’s or the Peak Gold JV’s exploration schedule and operating activities and result in reduced demand for mined minerals; |

| | • | Expanded rigorous monitoring and testing requirements; |

| | • | Ability to obtain insurance coverage on commercially reasonable terms; |

| | • | Competition generally and the increasing competitive nature of the mining industry; |

| | • | Risk related to title to properties; and |

| | • | Ability to consummate strategic transactions. |

Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in the forward-looking statements contained herein. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. All forward-looking statements contained in or incorporated by reference into this prospectus are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that we or persons acting on our behalf may issue. See the information under the heading “Risk Factors” in this prospectus for some of the important factors that could affect the Company’s financial performance or could cause actual results to differ materially from estimates contained in forward-looking statements.

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference herein. Because this is only a summary, it does not contain all of the information that you should consider before investing in our securities. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements,” and all other information included or incorporated by reference into this prospectus.

Unless the context requires otherwise or unless stated otherwise, references in this prospectus to the “Company,” “Contango ORE,” “Contango,” “CORE,” “we,” “our” and “us” refer to Contango ORE, Inc. and its subsidiaries on a consolidated basis.

Our Company

Contango ORE engages in exploration for gold ore and associated minerals in Alaska. The Company conducts its operations through three primary means:

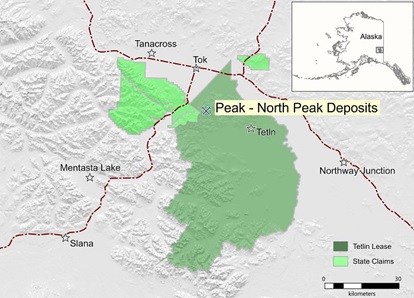

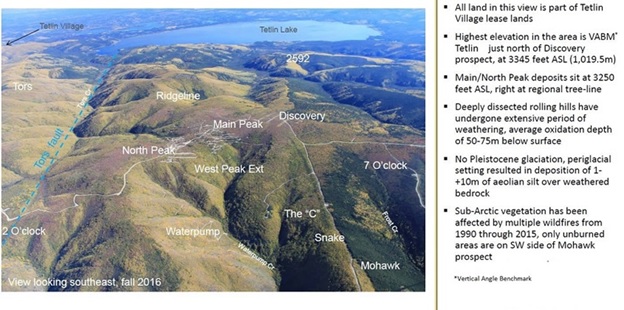

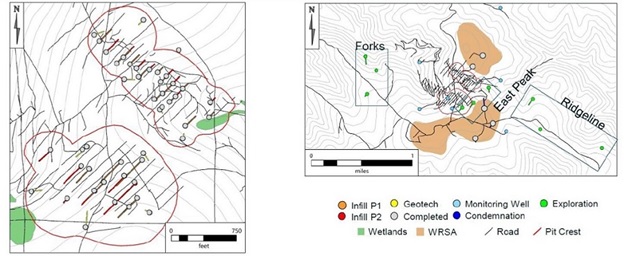

| ● | a 30.0% membership interest in Peak Gold, LLC (the “Peak Gold JV”), which leases approximately 675,000 acres from the Tetlin Tribal Council and holds approximately 13,000 additional acres of State of Alaska mining claims (such combined acreage, the “Peak Gold JV Property”) for exploration and development, including in connection with the Peak Gold JV's plan to mine ore from the Peak and North Peak deposits within the Peak Gold JV Property (the “Manh Choh Project”); |

| ● | its wholly-owned subsidiary, Alaska Gold Torrent, LLC, an Alaska limited liability company (“AGT”), which leases the mineral rights to approximately 8,600 acres of State of Alaska and patented mining claims for exploration from Alaska Hard Rock, Inc., located in three former producing gold mines located on the patented claims in the Willow Mining District about 75 miles north of Anchorage, Alaska (the “Lucky Shot Property”); and |

| ● | its wholly-owned subsidiary, Contango Minerals Alaska, LLC (“Contango Minerals”), which separately owns the mineral rights to approximately 215,800 acres of State of Alaska mining claims for exploration, including (i) approximately 139,100 acres located immediately northwest of the Peak Gold JV Property (the “Eagle/Hona Property”), (ii) approximately 14,800 acres located northeast of the Peak Gold JV Property (the “Triple Z Property”), (iii) approximately 52,700 acres of new property in the Richardson district of Alaska staked by the Company in the first quarter of 2021 (the “Shamrock Property”) and (iv) approximately 9,200 acres located to the north and east of the Lucky Shot Property (the “Willow Property” and, together with the Shamrock Property, the Eagle/Hona Property and the Triple Z Property, collectively the “Minerals Property”) |

The Lucky Shot Property and the Minerals Property are collectively referred to in this prospectus as the “Contango Properties”.

Properties

From 2009 until September 2020, the Company’s primary focus was on the exploration for minerals near Tok, Alaska pursuant to a mineral lease with the Native Village of Tetlin, governed by the Tetlin Tribal Council (the “Tetlin Lease”). The Tetlin Lease covers mineral rights to an estimated 675,000 acres of land in the Tintina Gold Belt. All work conducted by the Company during that period was directed to support exploration of these lands to increase our understanding of the characteristics of, and potential economics of, any mineralization discovered. In addition to the Tetlin Lease, the Peak Gold JV also held additional acres of State of Alaska mining claims peripheral to the Tetlin Lease. The Company's interest in the Peak Gold JV is held by its wholly-owned subsidiary, CORE Alaska, LLC.

In connection with the Kinross Transactions in 2020 (discussed below), the Lucky Shot Transaction in 2021 (discussed below), and through other activities during and after that time, the Company has acquired to date, through its wholly-owned subsidiaries Contango Minerals and AGT, the rights to approximately 224,400 acres of mining claims for exploration that combined make up the Contango Properties.

In April 2021, the Company obtained a Technical Report Summary for the Manh Choh Project prepared by John Sims, C.P.G., and Sims Resources LLC (collectively, “Sims”) as of December 31, 2020 (the “Technical Report”). The Technical Report was prepared in accordance with the requirements of the Modernization of Property Disclosures for Mining Registrants set forth in subpart 1300 of Regulation S-K (the “SEC Mining Modernization Rules”). The Technical Report estimates mineral resources in the following amounts and categories on the Peak Gold JV Property as of December 31, 2020 (both on a 100% basis and a 30% basis attributed to the Company's ownership interest in the Peak Gold JV):

Summary of Mineral Resources as of December 31, 2020

(Peak Gold JV's 100% Ownership)

| Category | Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | Grade (g/t Ag) | Contained Metal (000 oz Ag) | Grade

(g/t AuEq) | Contained Metal

(000 oz AuEq) |

| Measured | 473 | 6.4 | 97 | 16.7 | 254 | 6.6 | 101 |

| Indicated | 8,728 | 4.0 | 1,111 | 14.1 | 3,945 | 4.2 | 1,168 |

Total Measured + Indicated | 9,201 | 4.1 | 1,208 | 14.2 | 4,199 | 4.3 | 1,267 |

| | | | | | | | |

| Inferred | 1,344 | 2.7 | 116 | 16.1 | 694 | 2.9 | 126 |

Summary of Mineral Resources as of December 31, 2020

(Contango's 30% Attributable Ownership)

| Category | Tonnage (000 t) | Grade (g/t Au) | Contained Metal (000 oz Au) | Grade (g/t Ag) | Contained Metal (000 oz Ag) | Grade

(g/t AuEq) | Contained Metal

(000 oz AuEq) |

| Measured | 142 | 6.4 | 29 | 16.7 | 76 | 6.6 | 30 |

| Indicated | 2,618 | 4.0 | 333 | 14.1 | 1,183 | 4.2 | 350 |

Total Measured + Indicated | 2,760 | 4.1 | 362 | 14.2 | 1,260 | 4.3 | 380 |

| | | | | | | | |

| Inferred | 403 | 2.7 | 35 | 16.1 | 208 | 2.9 | 38 |

Notes:

| 1. | The definitions for Mineral Resources in the SEC Mining Modernization Rules were followed for Mineral Resources. |

| 2. | The point of reference for the Mineral Resources is in situ. |

| 3. | Mineral Resources are estimated at a cut-off value of US$28 NSR/t and US$30 NSR/t. |

| 4. | Mineral Resources are estimated using a long-term gold price of US$1,400 per ounce Au, and US$20 per ounce Ag. |

| 5. | Metallurgical recoveries were 90% Au and 52% Ag for the Main+West Zone and 94% Au and 60% Ag for the North Zone. |

| 6. | Silver equivalents are reported using a ratio of 70 oz silver per 1 oz gold. |

| 7. | Bulk density is 2.75 t/m3. |

| 8. | Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

| 9. | Numbers may not add due to rounding. |

The above tables are qualified in their entirety by the Technical Report, and should be read in conjunction with the Technical Report, as well as the warnings and disclaimers set forth in the section entitled “Notice Regarding Mineral Disclosure”.

The Company has not obtained a technical report on the Contango Properties, and therefore no disclosure is contained herein regarding mineral resources on the Contango Properties at this time. The Lucky Shot Property has historically produced minerals; however, the Company did not participate in those production operations, and has not verified historical production figures or future production viability, or obtained a technical report on those properties.

To date, no proven or probable mineral reserves have been established at the Peak Gold JV Property or any of the Contango Properties.

Recent Developments

Acquisition of Lucky Shot Property

On August 24, 2021 the Company completed the purchase of all outstanding membership interests (the “Interests”) of AGT from CRH Funding II PTE. LTD, a Singapore private limited corporation (“CRH”) (the “Lucky Shot Transaction”). AGT holds rights to the Lucky Shot Property. The Company agreed to purchase the Interests for a total purchase price of up to $30 million. The purchase price includes an initial payment at closing of $5 million in cash and a promissory note in the original principal amount of $6.25 million, payable by the Company to CRH (the “Promissory Note”), with a maturity date of February 28, 2022 (the “Maturity Date”). The Promissory Note is secured by the Interests. If the Company completes the offering contemplated by this prospectus and obtains a listing of its shares on the NYSE American prior to the Maturity Date, the Company will pay the Promissory Note through the issuance to CRH of shares of the Company's common stock. The common stock will be valued at the per share price in this offering, if available, or (y) the per share price representing a 10% discount to the 30-day volume-weighted average share price as of the Maturity Date. If the public offering is not completed or the Company's common stock is not listed on the NYSE American on or before the Maturity Date, the Company will pay the Promissory Note in cash.

In addition to the cash at closing and the Promissory Note, the Company will be obligated to pay CRH additional consideration if production on the Lucky Shot Property meets two separate milestone payment thresholds. If the first threshold of (1) an aggregate “mineral resource” equal to 500,000 ounces of gold or (2) production and receipt by the Company of an aggregate of 30,000 ounces of gold (including any silver based on a 1:65 gold:silver ratio) is met, then the Company will pay CRH $5 million in cash and $3.75 million in newly issued shares of CORE common stock. If the second threshold of (1) an aggregate “mineral resource” equal to 1,000,000 ounces of gold or (2) production and receipt by the Company of an aggregate of 60,000 ounces of gold (including any silver based on a 1:65 gold:silver ratio) is met, then the Company will pay CRH $5 million in cash and $5 million in newly issued shares of CORE common stock. If payable, the additional share consideration will be issued based on the 30-day volume weighted average price for each of the thirty trading days immediately prior to the satisfaction of the relevant production goal.

The Company also agreed to make $10,000,000 in expenditures during the 36-month period following closing toward the existence, location, quantity, quality or commercial value of mineral deposits in, under and upon the Lucky Shot Property.

Willow Claims

In the third fiscal quarter of 2021, the Company determined that there was available acreage on lands owned by the State of Alaska to the north and east of the existing patented and State of Alaska mining claims that make up the Lucky Shot Property, and expanded its claims block by the acquisition of an additional 72 State of Alaska mining claims covering approximately 9,200 acres.

Hiring of Mine Manager

On August 16, 2021, the Company hired Chris Kennedy, who has prior experience in underground mine operations management, to serve as the Company's Mine General Manager. In his role, Mr. Kennedy will manage the Company's underground exploration and development program on the Lucky Shot Property.

Amendment No. 1 to Rights Agreement

On September 21, 2021, the Board of Directors of the Company approved an amendment to the Company’s Rights Agreement dated as of September 23, 2020, between the Company and Computershare Trust Company, N.A., as Rights Agent (as amended, the “Rights Plan”), extending the Rights Plan by an additional year to September 22, 2022.

Corporate Information

Contango ORE, Inc. was formed on September 1, 2010 as a Delaware corporation for the purpose of engaging in the exploration in the State of Alaska for gold ore and associated minerals.

On January 8, 2015, the Company's wholly owned subsidiary, CORE Alaska, LLC (“CORE Alaska”), and a subsidiary of Royal Gold, Inc. (“Royal Gold”) formed Peak Gold, LLC (the “Peak Gold JV”). On September 30, 2020, CORE Alaska sold a 30.0% membership interest (the “CORE JV Interest”) in the Peak Gold JV to KG Mining (Alaska), Inc. (“KG Mining”), an indirect wholly-owned subsidiary of Kinross Gold Corporation (“Kinross”). The sale is referred to as the “CORE Transactions”.

Concurrently with the CORE Transactions, KG Mining, in a separate transaction, acquired 100% of the equity of Royal Alaska, LLC from Royal Gold, which held Royal Gold's 40.0% membership interest in the Peak Gold JV (the “Royal Gold Transactions” and, together with the CORE Transactions, the “Kinross Transactions”). After the consummation of the Kinross Transactions, CORE Alaska retained a 30.0% membership interest in the Peak Gold JV. KG Mining now holds a 70.0% membership interest in the Peak Gold JV and Kinross serves as the manager and operator of the Peak Gold JV.

Our principal executive offices are located at 3700 Buffalo Speedway, Suite 925, Houston, Texas 77098. Our telephone number is (713) 877-1311 and our website address is www.contangoore.com. Information contained on our website does not constitute a part of this prospectus.

An investment in our securities involves a significant degree of risk. Before you invest in our securities, you should carefully consider the risk factors included in, or incorporated by reference into, this prospectus, as updated by our subsequent filings under the Exchange Act, and those risk factors that may be included in any applicable prospectus supplement, together with all of the other information included in this prospectus, any prospectus supplement and the documents we incorporate by reference, in evaluating an investment in our securities. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, cash flows and results of operations. If that occurs, the trading price of our securities could decline materially and you could lose all or part of your investment. The risks described in the Annual Report are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and/or operating results. Past financial and operational performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. Please also read carefully the section above entitled “Cautionary Statement Regarding Forward-Looking Statements”.

Risks Related to our Industry

Exploration activities involve a high degree of risk, and exploratory drilling activities may not be successful.

The Company’s future success will largely depend on the success of the exploration drilling programs on the Contango Properties and the Peak Gold JV Property. Participation in exploration drilling activities involves numerous risks, including the significant risk that no commercially marketable minerals will be discovered. The mining of minerals and the manufacture of mineral products involves numerous hazards, including:

| ● | Ground or slope failures; |

| ● | Pressure or irregularities in formations affecting ore or wall rock characteristics; |

| ● | Equipment failures or accidents; |

| ● | Adverse weather conditions; |

| ● | Compliance with governmental requirements and laws, present and future; |

| ● | Shortages or delays in the availability and delivery of equipment; and |

| ● | Lack of adequate infrastructure, including access to roads, electricity and available housing. |

Poor results from the Company’s or the Peak Gold JV’s drilling activities would materially and adversely affect the Company’s future cash flows and results of operations.

Underground mining operations are subject to unique risks.

While we are not currently conducting mining operations at the Lucky Shot Property, if we begin mining operations on the Lucky Shot Property in the future, such operations will involve underground mining activities. The exploration for minerals, mine construction and mining operations in an underground mine involve a high level of risk and are often affected by hazards outside of our control. Some of these risks include, but are not limited to, underground fires or floods, fall-of-ground accidents, seismic activity and unexpected geological formations or conditions including noxious fumes or gases. The occurrence of one or more of these events in connection with our exploration, mine construction, or production activities may result in the death of, or personal injury to, our employees, other personnel or third parties, the loss of mining equipment, damage to or destruction of mineral properties or production facilities, monetary losses, deferral or unanticipated fluctuations in production, environmental damage and potential legal liabilities, all of which may adversely affect our reputation, business, prospects, results of operations and financial condition.

The Contango Properties and the Peak Gold JV Property are located in the remote regions of Alaska and exploration activities may be limited by weather and limited access and existing infrastructure.

The Company and the Peak Gold JV are currently focused on the exploration of properties in the State of Alaska. The arctic climate limits many exploration and mining activities during certain seasons. In addition, the remote location of the properties may limit access and increase exploration expense. Higher costs associated with exploration activities and limitation on the annual periods in which the Company and the Peak Gold JV can carry on exploration activities might increase the costs and time associated with our planned exploration activities and could negatively affect the value of the Contango Properties, the Peak Gold JV Property and the Company’s securities.

The probability that an individual prospect will contain commercial grade reserves is extremely remote.

The probability of finding economic mineral reserves on the Contango Properties or the Peak Gold JV Property is extremely small. It is common to spend millions of dollars on an exploration prospect and complete many phases of exploration and still not obtain mineral reserves that can be economically exploited. Therefore, the possibility that the Contango Properties or the Peak Gold JV Property will contain commercial mineral reserves and that the Company will recover funds spent on exploration is extremely remote.

Competition in the mineral exploration industry is intense, and the Company is smaller and has a much more limited operating history than most of its competitors.

The Company will compete with a broad range of mining companies with far greater resources in their exploration activities. Several mining companies concentrate drilling efforts on one type of mineral and thus may enjoy economies of scale and other efficiencies. However, the Company’s and the Peak Gold JV's drilling strategies currently include exploring for gold ore as well as associated minerals. As a result, the Company may not be able to compete effectively with such companies.

Most competitors have substantially greater financial resources than the Company. These competitors may be able to evaluate, bid for and purchase a greater number of properties and prospects than the Company can. In addition, most competitors have been operating for a much longer time than the Company has and have substantially larger staffs. Processing of gold and associated minerals requires complex and sophisticated processing technologies. The Company has no experience in the minerals processing industry.

Because of the Company’s limited operating history, the Company has limited insight into trends that may emerge and affect its business. The Company may make errors in predicting and reacting to relevant business trends and will be subject to the risks, uncertainties and difficulties frequently encountered by early-stage companies.

The mining industry is historically a cyclical industry and market fluctuations in the prices of minerals beyond the Company's and the Peak Gold JV's control could adversely affect the Company’s and Peak Gold JV’s business.

Prices for minerals tend to fluctuate significantly in response to factors beyond the Company’s control. These factors include:

| ● | U.S. and global economic conditions; |

| ● | Domestic and foreign tax policy; |

| ● | The cost of exploring for, producing and processing gold; |

| ● | Available transportation capacity; and |

| ● | The overall supply and demand for gold. |

Changes in gold prices would directly affect revenues and may reduce the amount of funds available to reinvest in exploration activities. Reductions in gold prices not only reduce revenues and profits, but could also reduce the quantities of resources that are commercially recoverable. Declining metal prices may also impact the operations of the Peak Gold JV by requiring a reassessment of the commercial feasibility of any of its mining work.

Because the Company’s and Peak Gold JV’s sole source of revenue will be the sale of gold and associated minerals, if their exploration efforts are successful, changes in demand for, and the market price of, gold and associated minerals could significantly affect the Company’s and the Peak Gold JV’s profitability. The value and price of the Company’s common stock may therefore be significantly affected by declines in the prices of gold minerals and products.

Gold prices fluctuate widely and are affected by numerous factors beyond the Company’s control such as interest rates, exchange rates, inflation or deflation, fluctuation in the relative value of the United States dollar against foreign currencies on the world market, global and regional supply and demand for gold, and the political and economic conditions of gold producing countries throughout the world. The Company and the Peak Gold JV do not have any programs to hedge against fluctuating commodity prices, and as such are highly exposed to those fluctuations.

An increase in the global supply of gold and associated minerals may adversely affect the Company’s and the Peak Gold JV’s business.

The pricing and demand for gold and associated minerals is affected by a number of factors beyond the Company’s or the Peak Gold JV's control, including global economic conditions and the global supply and demand for gold and associated minerals and products. Increases in the amount of gold and associated minerals sold by competitors of the Company and the Peak Gold JV may result in price reductions and/or reduced margins, and the Company and the Peak Gold JV may not be able to compete effectively against current and future competitors.

Concentrating capital investment in the State of Alaska increases exposure to risk.

The Company and the Peak Gold JV have focused their capital investments in exploring for gold and associated mineral prospects on the Contango Properties and the Peak Gold JV Property in the State of Alaska. However, the exploration prospects in Alaska may not lead to any revenues, or the Company or the Peak Gold JV may not be able to drill for mineral deposits at anticipated costs due to financing, environmental and other regulatory or operating uncertainties. Because of this concentration in a limited geographic area, the success and profitability of our operations may be disproportionately exposed to regional factors relative to competitors that have more geographically dispersed operations.

The Company and the Peak Gold JV are subject to complex laws and regulations, including environmental regulations that can adversely affect the cost, manner or feasibility of doing business.

The Company’s and the Peak Gold JV’s exploratory mining operations are subject to numerous federal, tribal, state and local laws and regulations governing the operations, discharge, emission, or release of materials into the environment and the protection of the environment and human health and safety, including the Federal Clean Water Act (“CWA”), Clean Air Act (“CAA”), Endangered Species Act, Safe Drinking Water Act, Migratory Bird Treaty Act, National Environmental Policy Act, Resource Conservation and Recovery Act (“RCRA”), and Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”). Federal initiatives are often also administered and enforced through state agencies or tribal authorities operating under parallel state or tribal statutes and regulations. Failure to comply with such rules and regulations could result in substantial penalties or construction or operational delays or requirements to cease production and have an adverse effect on both the Company and the Peak Gold JV. These laws and regulations may, among other things:

| ● | Require that the Company and/or the Peak Gold JV obtain permits before commencing mining work and to comply with ongoing permit requirements; |

| ● | Restrict the substances that can be released into the environment in connection with mining work and require remediation of substances that are released; |

| ● | Impose obligations to reclaim land in order to minimize long term effects of land disturbance; and |

| ● | Limit or prohibit mining work on protected areas. |

Under these laws and regulations, the Company and/or the Peak Gold JV could be liable for personal injury and clean-up costs and other environmental and property damages, as well as administrative, civil and criminal penalties. The Company and the Peak Gold JV maintain limited insurance coverage for sudden and accidental environmental damages. Accordingly, the Company and the Peak Gold JV may be subject to liability, or it may be required to cease production from properties in the event of environmental damages. Compliance with environmental laws and regulations and future changes in these laws and regulations may require significant capital outlays, cause material changes or delays in the Company’s and the Peak Gold JV’s current and planned operations and future activities and reduce the profitability of operations. It is possible that future changes in these laws or regulations could increase operating costs or require capital expenditures in order to remain in compliance. Any such changes could have an adverse effect on the Company’s and the Peak Gold JV’s business, financial condition and results of operations.

The Company and the Peak Gold JV are subject to the Federal Mine Safety and Health Act of 1977 and regulations promulgated thereto, which impose stringent health and safety standards on numerous aspects of their operations.

The Company’s and the Peak Gold JV’s exploration and mining work in Alaska is subject to the Federal Mine Safety and Health Act of 1977, which imposes stringent health and safety standards on numerous aspects of mineral extraction and processing operations, including the training of personnel, operating procedures, operating equipment and other matters, and the costs associated with compliance with such laws and regulations can be substantial. The Company’s and the Peak Gold JV’s failure to comply with these standards could have a material adverse effect on their business, financial condition or otherwise impose significant restrictions on their ability to conduct mining work.

The Company or the Peak Gold JV may be unable to obtain, maintain or renew permits necessary for the exploration, development or operation of any mining activities, which could have a material adverse effect on its business, financial condition or results of operation.

The Company and the Peak Gold JV must obtain a number of permits that impose strict conditions, requirements and obligations relating to various environmental and health and safety matters in connection with their current and future operations. To obtain certain permits, the Company and the Peak Gold JV may be required to conduct environmental studies, collect and present data to governmental authorities and the general public pertaining to the potential impact of its current and future operations upon the environment and take steps to avoid or mitigate the impact. The permitting rules are complex and have tended to become more stringent over time. Accordingly, permits required for mining work may not be issued, maintained or renewed in a timely fashion or at all, or may be conditioned upon restrictions which may impede its ability to operate efficiently. Furthermore, the issuance or renewal of permits can be opposed by adverse persons before governmental authorities, resulting in significant delays and possibly denial of the permits. The failure to obtain certain permits or the adoption of more stringent permitting requirements could have a material adverse effect on its business, its plans of operation, and properties in that the Company or the Peak Gold JV may not be able to proceed with their exploration, development or mining programs.

Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business.

A number of governments or governmental bodies have introduced or are contemplating regulatory changes in response to various climate change interest groups and the potential impact of climate change. Legislation and increased regulation regarding climate change could impose significant costs on us and the Peak Gold JV, including costs related to increased energy requirements, capital equipment, environmental monitoring and reporting and other costs to comply with such regulations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Given the emotion, political significance and uncertainty around the impact of climate change and how it should be dealt with, we cannot predict how legislation and regulation will affect our or the Peak Gold JV's financial condition, operating performance and ability to compete. Furthermore, even without such regulation, increased awareness and any adverse publicity in the global marketplace about potential impacts on climate change by us or other companies in our industry could harm our reputation. The potential physical impacts of climate change on our and the Peak Gold JV's operations are highly uncertain, and would be particular to the geographic circumstances in areas in which we operate. These may include changes in rainfall and storm patterns and intensities, water shortages, changing sea levels and changing temperatures. These impacts may adversely impact the cost, production and financial performance of our operations and the operations of the Peak Gold JV.

Opposition to our operations and those of the Peak Gold JV from local stakeholders or non-governmental organizations could have a material adverse effect on us.

There is an increasing level of public concern relating to the effect of mining production on its surroundings, communities, and environment. Local communities and non-governmental organizations (“NGOs”), some of which oppose resource development, are often vocal critics of the mining industry. While we and the Peak Gold JV seek to operate in a socially responsible manner, opposition to extractive industries or our operations specifically or adverse publicity generated by local communities or NGOs related to extractive industries, or our operations specifically, could have an adverse effect on our reputation and financial condition or our relationships with the communities in which we operate. As a result of such opposition or adverse publicity, we or the Peak Gold JV may be unable to obtain permits necessary for our operations or to continue operations as planned or at all.

We face risks related to health epidemics and other outbreaks, including the recent spread of COVID-19 novel coronavirus, or fear of such an event.

Our business could be adversely affected by a widespread outbreak of contagious disease, including the outbreak of the 2019 novel strain of coronavirus, causing a contagious respiratory disease known as COVID-19, which was declared a pandemic by the World Health Organization on March 11, 2020. Through June 30, 2021, the spread of this virus and government responses have caused business disruption and are adversely affecting many industries. The spread of COVID-19 has also caused significant volatility in U.S. and international debt and equity markets. There is significant uncertainty around the breadth and duration of business disruptions related to COVID-19, as well as its impact on the U.S. economy and consumer confidence. If a significant portion of our workforce or the Peak Gold JV’s workforce becomes unable to work or travel to our operations or the Peak Gold JV’s operations, due to illness or state or federal government restrictions (including travel restrictions and “shelter-in-place” and similar orders restricting certain activities that may be issued or extended by authorities), we or the Peak Gold JV may be forced to reduce or suspend operations at one or more properties, which could reduce exploration activities and development projects and impact liquidity and financial results. To the extent the COVID-19 pandemic adversely affects our business and financial results, it may also have the effect of heightening many of the other risks described in this “Risk Factors” section, including, but not limited to, risks related to commodity prices and commodity markets, commodity price fluctuations, our ability to raise additional capital, information systems and cyber security and risks relating to operations, impacts of governmental regulations, availability of infrastructure and employees, and challenging global financial conditions.

The Company and the Peak Gold JV are monitoring the situation and taking reasonable steps to keep our business premises, properties, vendors and employees in a safe environment and are constantly monitoring the impact of COVID-19. The extent to which COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted, including new information which may emerge concerning the severity of COVID-19 and the actions taken to contain it or treat its impact. While we have not seen a significant impact to our results from COVID-19 to date, if the virus continues to cause significant negative impacts to economic conditions or impacts the Peak Gold JV’s ability to continue exploration work, our results of operations, financial condition and liquidity could be adversely impacted.

Our insurance will not cover all of the potential risks associated with mining operations.

Our business, and the business of the Peak Gold JV, is subject to a number of risks and hazards generally, including adverse environmental conditions, environmental or industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena, such as inclement weather conditions, floods, hurricanes and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to our properties or the property of others, delays in construction or mining, monetary losses, and possible legal liability.

Although we and the Peak Gold JV maintain insurance to protect against certain risks in such amounts as we or the Peak Gold JV, as applicable, consider reasonable, such insurance will not cover all the potential risks associated with a mining company’s operations. We and the Peak Gold JV may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as loss of title to mineral property, environmental pollution, or other hazards as a result of exploration and production, is not generally available to us or to other companies in the mining industry on acceptable terms. We or the Peak Gold JV might also become subject to liability for pollution or other hazards which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect on our financial performance and results of operations.

Risks Related to our and the Peak Gold JV's Business

We may not be able to grow successfully through future acquisitions or successfully manage future growth.

We may actively pursue the acquisition of exploration, development and production assets consistent with our growth strategy. From time to time, we may also acquire securities of or other interests in companies with respect to which we may enter into acquisitions or other transactions. Acquisition transactions involve inherent risks, including but not limited to:

| ● | accurately assessing the value, strengths, weaknesses, contingent and other liabilities, and potential profitability of acquisition; |

| ● | diversion of management’s attention from existing business; |

| ● | integrating the acquired business or property; |

| ● | decline in the value of acquired properties or companies; and |

| ● | unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying the acquisition. |

We may not be able to identify attractive acquisition opportunities or successfully acquire identified targets or successfully integrate assets or companies we acquire. Furthermore, competition for acquisition opportunities may escalate, increasing our cost of making acquisitions or causing us to refrain from making acquisitions. We may also be limited in our ability to generate capital or incur indebtedness in connection with or to fund future acquisitions.

Our inability to make acquisitions of properties or companies or to realize the anticipated benefits of any acquisition of properties or companies could have a material adverse effect on our financial condition.

Our business depends on the continued contributions made by Rick Van Nieuwenhuyse, as our key executive officer, the loss of who may result in a severe impediment to our business.

Our success is dependent upon the continued contributions made by our President and Chief Executive Officer, Rick Van Nieuwenhuyse. We rely on his extensive experience in the mining industry when we are developing new products and services. The Company has no “Key Man” insurance to cover the resulting losses in the event that any of our officers or directors should die or resign.

If Mr. Nieuwenhuyse cannot serve the Company or is no longer willing to do so, the Company may not be able to find alternatives in a timely manner or at all. This would likely result in a severe damage to our business operations and would have an adverse material impact on our financial position and operational results. To continue as a viable operation, the Company may have to recruit and train replacement personnel at a higher cost. Additionally, if Mr. Nieuwenhuyse joins our competitors or develops similar businesses that are in competition with the Company or the Peak Gold JV, our business may also be negatively impacted.

Our future success depends on our ability to attract and retain qualified long-term management, administrative, geology, and database management personnel. We have a great need for qualified talent, but we may not be successful in attracting, hiring, developing, and retaining the talent required for our success.

The Company is dependent upon information technology systems, which are subject to disruption, cyber-attacks, damage, failure and risks associated with implementation and integration.

The Company is dependent upon information technology systems in the conduct of its operations. Our information technology systems are subject to disruption, damage or failure from a variety of sources, including computer viruses, security breaches, cyber-attacks, natural disasters, extreme weather events and defects in design. Cybersecurity incidents, in particular, are evolving and include, malicious software, attempts to gain unauthorized access to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise protected information and the corruption of data. The Company believes that it has implemented appropriate measures to mitigate potential risks. However, given the unpredictability of the timing, nature and scope of information technology disruptions, the Company could be subject to manipulation or improper use of its systems and networks or financial losses from remedial actions, any of which could have a material adverse effect on its financial condition and results of operations. The Company faces increased cybersecurity risks due to the COVID-19 pandemic. For example, a portion of the Company’s workforce is working remotely to facilitate social distancing, and these employees may transmit data using unsecured internet connections despite training advising of those risks. In addition, our employees may experience increased phishing and malware attacks and socially engineered cyberattacks which, in some cases, attempt to use the circumstances of the COVID-19 pandemic to gain unauthorized access to the Company’s information technology systems.

The Company’s ability to successfully execute its business plan is dependent on its ability to obtain adequate financing.

The Company’s business plan, which includes drilling and developing the Contango Properties and funding its proportionate share of the Peak Gold JV’s exploration prospects, will require substantial capital expenditures. The Company’s ability to raise capital will depend on many factors, including the status of various capital and industry markets at the time it seeks such capital. Accordingly, the Company cannot be certain that financing will be available to us on acceptable terms, if at all. In the event additional capital resources are unavailable, the Company may be unable to fund expenditures to explore and develop the Contango Properties in which case the Contango Properties may never produce revenues, or may not produce sufficient revenues to become profitable which would have an adverse effect on the Company’s financial condition. Additionally, the Company may not be able to fund its proportionate share of the expenditures of the Peak Gold JV for exploration and development activities, which could force the Company to sell all or some portion of its interest in the Peak Gold JV in an untimely fashion or on less than favorable terms.

The Company has no revenue to date from the Contango Properties or from the Peak Gold JV, which may negatively impact the Company’s ability to achieve its business objectives.

To date, the Company and the Peak Gold JV have conducted only exploration activities and to date none of the properties have any proven or probable reserves as defined by the SEC Mining Modernization Rules. The Company’s ability to become profitable will be dependent on the receipt of revenues from the extraction of minerals greater than operational expenses. The Company, and after its formation, the Peak Gold JV, have carried on their business of exploring the Peak Gold JV Property at a loss since inception and the Company expects that the Peak Gold JV will continue to incur losses unless and until such time as one of the properties enters into commercial production and generates sufficient revenues to fund its continuing operations. Similarly, the Company expects to incur expenditures relating to the Contango Properties to drill on the Triple-Z target and continue its exploration efforts on its earlier stage Eagle/Hona projects, as well as the recently acquired Shamrock and Lucky Shot projects. The Company expects to be able to drill on the Triple-Z target once the State of Alaska has received conveyance from the federal government of these state-selected lands – a process that is on-going in Alaska. The amounts and timing of expenditures will depend on the progress of ongoing exploration, the results of consultants’ analysis and recommendations, the rate at which operating losses are incurred, and other factors, many of which are beyond the Company’s control. Whether any mineral deposits discovered would be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, market prices for the minerals, and governmental regulations. If the Company or the Peak Gold JV cannot discover commercially viable deposits or commence actual mining operations, the Company and the Peak Gold JV may never generate revenues and may never become profitable.

The Company’s continued viability depends on the exploration, permitting, development and operation of the Peak Gold JV Property and the Contango Properties.

The Peak Gold JV Property and the Contango Properties are all currently in the exploration stage. The Company’s continued viability is based upon the Peak Gold JV and the Company performing appropriate exploratory and engineering work, site assessments and evaluation, and the permitting and construction of mine and processing facilities in a reasonable time frame.

Neither the Contango Properties nor the Peak Gold JV Property has any proven or probable reserves and the Company and the Peak Gold JV may never identify any commercially exploitable mineralization.

Neither the Contango Properties nor the Peak Gold JV Property has any proven or probable reserves as defined by the SEC Mining Modernization Rules. To date, the Company and the Peak Gold JV have only engaged in exploration activities on such properties. Accordingly, the Company does not have sufficient information upon which to assess the ultimate success of their exploration efforts. There is no assurance that either the Company or the Peak Gold JV may ever locate any mineral reserves. Additionally, even if the Company or the Peak Gold JV finds minerals in sufficient quantities to warrant recovery, such recovery may not be economically profitable. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. Unusual or unexpected geologic formations and the inability to obtain suitable or adequate machinery, equipment or labor are risks involved in the conduct of exploration programs. If either the Company or the Peak Gold JV does not establish reserves, it might be required to curtail or suspend operations, in which case the market value of the Company’s common stock will decline, and you might lose all of your investment.

The Company relies on the accuracy of the estimates in reports provided to the Company by the Peak Gold JV’s Manager and outside consultants and engineers.

The Company has limited in-house mineral engineering capability, and therefore relies on the accuracy of reports provided to it by the Peak Gold JV’s manager and independent third-party consultants. If those reports prove to be inaccurate, the Company’s financial reports could have material misstatements. Further, the Company will use the reports of such independent consultants in its financial planning. If the reports prove to be inaccurate, we may also make misjudgments in our financial planning and forecasts.

The Company and the Peak Gold JV have no assurance of title to their properties.

The Company, through its wholly-owned subsidiaries, Contango Minerals and AGT, owns the mineral rights to approximately 224,400 acres of State of Alaska unpatented mining claims for gold ore exploration, and the Peak Gold JV holds approximately 13,000 acres of State of Alaska unpatented mining claims in addition to the Tetlin Lease (described below). Unpatented mining claims are unique property interests in that they are subject to the paramount title of the State of Alaska and the rights of third parties to the use of the surface within their boundaries, and are generally considered to be subject to greater title risk than other real property interests. The rights to deposits of minerals lying within the boundaries of the unpatented state claims are subject to Alaska Statues 38.05.185 - 38.05.280, and are governed by Alaska Administrative Code 11 AAC 86.100 - 86.600. The validity of all State of Alaska unpatented mining claims is dependent upon inherent uncertainties and conditions.

The Peak Gold JV leases approximately 675,000 acres for exploration and development pursuant to a mineral lease (the “Tetlin Lease”) with the Native Village of Tetlin whose governmental entity is the Tetlin Tribal Council (“Tetlin Tribal Council”). The Company retained title lawyers to conduct a preliminary examination of title to the mineral interest prior to executing the Tetlin Lease. The Peak Gold JV conducted a title examination prior to the assignment of the Tetlin Lease to the Peak Gold JV and performed certain curative title work. In addition, in connection with the assignment of the Tetlin Lease from the Company to the Peak Gold JV, the Company and the Native Village of Tetlin entered into an Estoppel and Agreement and a Stability Agreement, which were approved by the Tetlin Tribal Council and the Native Village of Tetlin members and renewed on September 29, 2020 in connection with the CORE Transactions described in “Summary – Corporate Information” (the “Tetlin Agreements”). The Tetlin Agreements approved the assignment of the Tetlin Lease to the Peak Gold JV and, among other things, confirmed the validity and effectiveness of the Tetlin Lease.

We cannot provide assurance that title to our properties will not be challenged. We or the Peak Gold JV, as applicable, may not have, or may not be able to obtain, all necessary surface rights to develop a property. Title insurance is generally not available for mineral properties and our and the Peak Gold JV's ability to ensure that we or the Peak Gold JV, as applicable, have obtained a secure claim to individual mining properties may be severely constrained. Our and the Peak Gold JV's mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. In addition, our ability to continue to explore and develop the property may be subject to agreements with other third parties including agreements with native corporations and first nations groups.

A deficiency in title or claims by a third party may not be curable. It does happen, from time to time, that the title to a property is defective, having been obtained in error from a person who is not the rightful owner of the mineral interest desired. In these circumstances, the Company or the Peak Gold JV, as applicable, might not be able to proceed with exploration of its properties or might incur costs to remedy a defect. This could result in our not being compensated for our prior expenditures relating to the property. It might also happen, from time to time, that the Company or the Peak Gold JV might elect to proceed with mining work despite any such deficiency or claim.

The Tetlin Lease was executed with a Native American tribe for the exploration of gold ore and associated minerals. The enforcement of contractual rights against Native American tribes with sovereign powers may be difficult.

Federally recognized Native American tribes are independent governments with sovereign powers, except as those powers may have been limited by treaty or the United States Congress. Such tribes maintain their own governmental systems and often their own judicial systems and have the right to tax, and to require licenses and to impose other forms of regulation (including regarding workers’ safety and the environment) and regulatory fees, on persons and businesses operating on their lands. As sovereign nations, federally recognized Native American tribes are generally subject only to federal regulation. States do not have the authority to regulate them, unless such authority has been specifically granted by Congress, and state laws generally do not directly apply to them and to activities taking place on their lands, unless they have a specific agreement or compact with the state or Federal government allowing for the application of state law. The Tetlin Lease provides that it will be governed by applicable federal law and the law of the State of Alaska. The Company and the Tetlin Tribal Council entered into a Stability Agreement, dated October 2, 2014, that was assigned by the Company to the Peak Gold JV and reaffirmed on September 29, 2020 in connection with the CORE Transactions described in “Summary – Corporate Information”. However, no assurance may be given that the choice of law clause in the Tetlin Lease or the agreements with the Tetlin Tribal Council in the Stability Agreement will be enforceable.

Federally recognized Native American tribes also generally enjoy sovereign immunity from lawsuit similar to that of the states and the United States federal government. In order to sue a Native American tribe (or an agency or instrumentality of a Native American tribe), the Native American tribe must have effectively waived its sovereign immunity with respect to the matter in dispute. Moreover, even if a Native American tribe effectively waives its sovereign immunity, there exists an issue as to the forum in which a lawsuit can be brought against the tribe. Federal courts are courts of limited jurisdiction and generally do not have jurisdiction to hear civil cases relating to matters concerning Native American lands or the internal affairs of Native American governments. Federal courts may have jurisdiction if a federal question is raised by the lawsuit, which is unlikely in a typical contract dispute. Diversity of citizenship, another common basis for federal court jurisdiction, is not generally present in a suit against a tribe because a Native American tribe is not considered a citizen of any state. Accordingly, in most commercial disputes with tribes, the jurisdiction of the federal courts, may be difficult or impossible to obtain. The Tetlin Lease contains a provision in which the Tetlin Tribal Council expressly waives its sovereign immunity to the limited extent necessary to permit judicial review in the courts in Alaska of certain issues affecting the Tetlin Lease, and the Stability Agreement contains, among other things, agreement that any disputes under the Tetlin Lease will be submitted to the jurisdiction of the federal and state courts.

Risks Related to our interest in the Peak Gold JV

The Company is dependent up on a third party manager of the Peak Gold JV who has discretion regarding its operation and the use and allocation of funds for further exploration of the Peak Gold JV Property.

Kinross is the manager of the Peak Gold JV and has appointed two of the three designates to the Management Committee of the Peak Gold JV (the “Management Committee”). The Company has appointed one designate to the Management Committee. Kinross has a 70.0% membership interest in the Peak Gold JV, in accordance with the Amended and Restated Limited Liability Company Agreement of the Peak Gold JV (the “Peak Gold JV LLCA”), and, therefore, will continue to have the right to appoint two designates to the Management Committee with the Company appointing one designate. The affirmative vote of a majority of designates will determine most decisions of the Management Committee, including the approval of programs and budgets and the expenditure of the Peak Gold JV’s investments, which will include the level of expenditures. As a result, Kinross has discretion regarding the use and allocation of funds for further exploration of the Peak Gold JV Property. The Company has limited ability to influence the decision of Kinross in its capacity as manager, or as the party controlling the majority of the Management Committee.

There can be no assurance that the Company will be capable of raising additional funding required to continue development of the Peak Gold JV Property and meet its funding obligations under the Peak Gold JV LLCA.

Pursuant to the terms of the Peak Gold JV LLCA, the Company and Kinross, through their respective wholly-owned subsidiaries, are required to jointly fund the operations of the Peak Gold JV in proportion to their respective membership interests in that company. If a member elects not to contribute to an approved program and budget or contributes less than its proportionate membership interest, its percentage membership interest will be reduced. The Company’s ability to contribute funds sufficient to retain its membership interests in the Peak Gold JV may be limited. To date, neither the Company nor the Peak Gold JV has generated any revenue from mineral sales or operations. In the future, the Peak Gold JV may generate revenue from a combination of mineral sales and other payments resulting from any commercially recoverable minerals from the Peak Gold JV Property. The Peak Gold JV currently does not have any recurring source of revenue, and its only source of cash inflows are contributions received from Kinross and the Company. The Company currently does not have any recurring source of revenue. As a result, the Company’s ability to contribute funds to the Peak Gold JV and retain its membership interest will depend on its ability to raise capital. The ability of the Company to arrange financing in the future will depend, in part, on the prevailing capital market conditions and the exploration results achieved at the Peak Gold JV Property, as well as the market price of metals. The Company cannot be certain that financing will be available to the Company on acceptable terms, if at all. If the Company were unable to fund its contributions to the approved programs and budgets for the Peak Gold JV, its membership interest in the Peak Gold JV would be diluted.

Further financing by the Company may include issuances of equity, instruments convertible into equity (such as warrants) or various forms of debt. The Company has issued common stock and other instruments convertible into equity in the past and cannot predict the size or price of any future issuances of common stock or other instruments convertible into equity, and the effect, if any, that such future issuances and sales will have on the market price of the Company’s securities. Any additional issuances of common stock or securities convertible into, or exercisable or exchangeable for, common stock may ultimately result in dilution to the holders of common stock, dilution in any future earnings per share of the Company and may have a material adverse effect upon the market price of the common stock of the Company.

There can be no assurance that Kinross will fund the Peak Gold JV to continue exploration work.

Pursuant to the Peak Gold JV LLCA, there is no requirement that Kinross contribute any future amounts to the Peak Gold JV to continue exploration work, and the Company will have limited funds to continue exploration of the Peak Gold JV Property, if Kinross fails to contribute additional amounts to the Peak Gold JV.

The Company’s interest in the Peak Gold JV may be reduced.

Pursuant to the terms of the Peak Gold JV LLCA, the Company and Kinross, through their respective wholly-owned subsidiaries, are required to jointly fund the joint venture operations in proportion to their membership interests in the Peak Gold JV. If a member elects not to contribute to an approved program and budget or contributes less than its proportionate membership interest, its percentage membership interest will be reduced. Going forward, the Company’s ability to contribute funds sufficient to maintain the current level of its membership interests in the Peak Gold JV may be limited. On December 10, 2020, the Management Committee approved a total budget of $18.0 million for the calendar year 2021 to undertake in-fill drilling, engineering and environmental studies necessary to complete a feasibility-level study, additional exploration, community relations, and to prepare the project for formal permitting. On June 22, 2021, the Management Committee voted to increase the exploration budget by $0.2 million for interpretation of archive drilling, adopting oriented core and geological consulting. The Company would need to fund its share of the budget, approximately $5.5 million, to maintain its current level of interest in the Peak Gold JV. If the Company elects not to, or is unable to contribute its proportionate share of the approved exploration budget, its interest in the Peak Gold JV will be reduced.

Kinross has far greater financial resources than the Company.

Kinross is a large gold producer with a diverse global portfolio and extensive operating experience in Alaska, with a market capitalization of approximately $7.9 billion as of October 20, 2021. Because of its vastly superior financial resources, Kinross may adopt budgets and work programs for the Peak Gold JV that the Company will be unable to fund in the time frame required, and its interest in the Peak Gold JV may be substantially diluted.

The Peak Gold JV LLCA restricts the Company’s right to transfer or encumber its interests in the Peak Gold JV.

The Peak Gold JV LLCA contains certain limitations on transferring or encumbering interests in the Peak Gold JV including any transfer that would cause termination of the Peak Gold JV as a partnership for Federal income tax purposes except none of the restrictions limit the transfer of any capital stock of the Company.

The appointment of Kinross as manager of the Peak Gold JV does not provide assurance that further exploration efforts will be successful.

The appointment of Kinross as manager of the Peak Gold JV does not provide assurance that further exploration of the Peak Gold JV Property will be successful, any additional resource will be discovered or a commercial deposit of gold ore and associated minerals will be located. The results of any further exploration work will be assayed and analyzed to determine if additional work should be performed and additional funds expended.