Exhibit 99.1

Brookfield Residential Properties Inc.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the Annual Meeting of Shareholders of Brookfield Residential Properties Inc. (the “Corporation” or “Brookfield Residential”) will be held at the Hilton McLean Tysons Corner, 7920 Jones Branch Drive, McLean, Virginia, United States on Thursday, May 1, 2014 at 11:00 a.m., EDT, for the following purposes:

| | 1) | to receive the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2013, including the external auditor’s report; |

| | 2) | to elect directors who will serve until the end of the next annual meeting of shareholders; |

| | 3) | to appoint the external auditor who will serve until the end of the next annual meeting of shareholders and authorize the directors to set its remuneration; and |

| | 4) | to hold a non-binding advisory vote on executive compensation. |

We will also consider other business that may properly come before the meeting or any adjournment thereof. You have the right to vote at the Annual Meeting of Shareholders if you were a Brookfield Residential shareholder on March 12, 2014.

Under recent changes to Canadian securities laws, we are no longer required to distribute physical copies of our circular and 2013 annual report (which includes management’s discussion and analysis and consolidated financial statements for the fiscal year ended December 31, 2013) (collectively, the “investor materials”). Instead, we are posting electronic versions of the investor materials on our website for shareholder review – a process known as “Notice and Access”. Electronic copies of the investor materials may be accessed atwww.brookfieldrp.com/notice-and-access andwww.sedar.com. Shareholders are reminded to review our circular prior to voting. For information about the above items to be voted upon, please see the section of our circular titled “PART TWO – BUSINESS OF THE MEETING”.

Please contact us at 855-234-8362 orInvestor.Relations@brookfieldrp.com should you have any questions about Notice and Access or wish to receive paper copies of the investor materials. If you contact us before the meeting, we will mail materials within 3 business days of your request free of charge. We must receive your request prior to 5:00 p.m. EDT on April 16, 2014 to ensure you will receive paper copies in advance of the deadline to submit your vote.

We are mailing our annual report to all shareholders who returned a request form last year asking for a paper copy of the report. All other shareholders have the option of requesting a paper copy as described herein. All shareholders who have signed up for electronic delivery of the investor materials will continue to receive them by email. No shareholder will receive a paper copy of our circular unless they contact us in the manner described above.

Information for Registered Holders

If you are not attending the meeting and wish to vote by proxy, we must receive your vote by 5:00 p.m. EDT on Tuesday, April 29, 2014. You have a number of options to cast your proxy vote:

| • | | Cast your vote on the Internet atwww.cstvotemyproxy.com; |

| • | | Fax your signed proxy to (416) 368-2502 or 1-866-781-3111; |

| • | | Return your signed proxy by mail using the enclosed business reply envelope; |

| • | | Scan and send your signed proxy toproxy@canstockta.com. |

Information for Non-Registered Holders

Non-registered shareholders will have received a voting instruction form with this notice. If you do not wish to attend and vote at the meeting (or have another person attend and vote on your behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form.

| | | | | | |

| | | | | | By Order of the Board of Directors |

| | | |

| Calgary, Canada | | | | | | SHANE D. PEARSON |

| March 27, 2014 | | | | | | Corporate Secretary |

Note: If you are a new shareholder or an existing shareholder who did not elect to receive our 2013 Annual Report, you can view this report on our website atwww.brookfieldrp.comunderInvestors/Financial Reports.If you wish to obtain a printed copy of our 2013 Annual Report, please contact us atinvestorrelations@brookfieldrp.com.

Brookfield Residential Properties Inc.

MANAGEMENT INFORMATION CIRCULAR

TABLE OF CONTENTS

| | | | | | |

| PART ONE – VOTING INFORMATION | | | 1 | |

| | |

| | Who Can Vote | | | 1 | |

| | Notice and Access | | | 2 | |

| | Q & A On Proxy Voting | | | 3 | |

| | Principal Holders of Voting Securities | | | 6 | |

| | Interest of Informed Persons in Material Transactions | | | 6 | |

| |

| PART TWO – BUSINESS OF THE MEETING | | | 7 | |

| |

| PART THREE – STATEMENT OF CORPORATE GOVERNANCE PRACTICES | | | 14 | |

| | |

| | Board of Directors | | | 14 | |

| | Committees of the Board | | | 17 | |

| | Board, Committee and Director Evaluation | | | 19 | |

| | Board and Management Responsibilities | | | 19 | |

| | Communication and Disclosure Policies | | | 20 | |

| | Code of Business Conduct and Ethics | | | 20 | |

| |

| PART FOUR — REPORT ON DIRECTOR COMPENSATION AND EQUITY OWNERSHIP | | | 21 | |

| | |

| | Director Compensation | | | 21 | |

| | Director Share / DSU Ownership Requirements | | | 23 | |

| |

| PART FIVE – REPORT ON EXECUTIVE COMPENSATION | | | 23 | |

| | |

| | Compensation Discussion and Analysis | | | 23 | |

| | Composition and Mandate of the Compensation Committee | | | 24 | |

| | Compensation Philosophy and Objectives | | | 25 | |

| | Benchmark Group | | | 25 | |

| | Compensation Elements | | | 26 | |

| | Incentive and Equity-Based Compensation Employment Policies and Guidelines | | | 30 | |

| | Report on 2013 Compensation | | | 31 | |

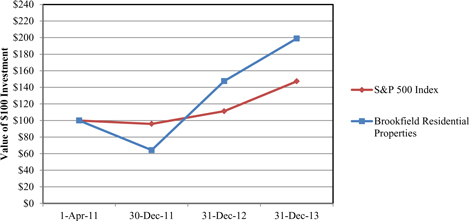

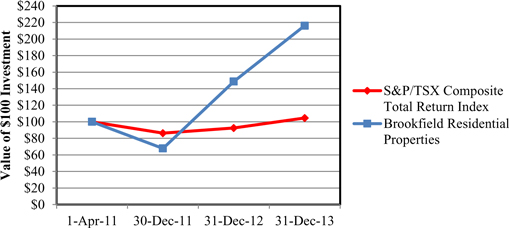

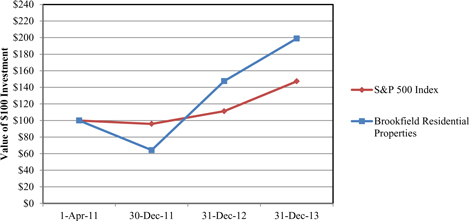

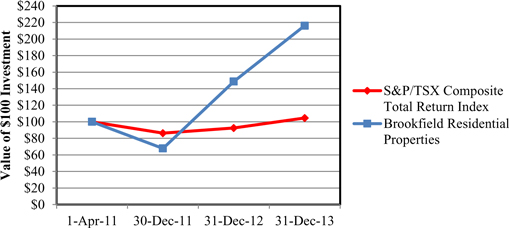

| | Performance Graphs | | | 34 | |

| | Compensation of Named Executive Officers | | | 35 | |

| | Security-Based Compensation Arrangements | | | 39 | |

| | Securities Authorized For Issuance Under Equity Compensation Plans | | | 39 | |

| | Pension and Retirement Benefits | | | 40 | |

| |

| PART SIX — OTHER INFORMATION | | | 40 | |

| | |

| | Indebtedness of Directors and Executive Officers | | | 40 | |

| | Audit Committee | | | 41 | |

| | Directors’ and Officers’ Liability Insurance | | | 41 | |

| | Availability of Disclosure Documents | | | 41 | |

| | Other Business | | | 41 | |

| | Directors’ Approval | | | 41 | |

| |

| APPENDIX A – CHARTER OF THE BOARD OF DIRECTORS | | | A-1 | |

BROOKFIELD RESIDENTIAL PROPERTIES INC.

MANAGEMENT INFORMATION CIRCULAR

PART ONE – VOTING INFORMATION

This Management Information Circular (“Circular”) is provided in connection with the solicitation by the management of Brookfield Residential Properties Inc. (“Brookfield Residential” or the “Corporation”) of proxiesto be used at the Annual Meeting of Shareholders of the Corporation (the “meeting”) referred to in the accompanying Notice of Meeting (the “Notice”) to be held at the Hilton McLean Tysons Corner, 7920 Jones Branch Drive, McLean, Virginia, United States on Thursday, May 1, 2014 at 11:00 a.m., EDT.

The solicitation will be made primarily by sending proxy materials to shareholders by mail and email, and, in relation to the delivery of this Circular, by posting this Circular on our website atwww.brookfieldrp.com and on our SEDAR profile atwww.sedar.com pursuant to Notice and Access – see “Notice and Access” on page 2 of this Circular for further information. Proxies may also be solicited personally or by telephone by regular employees of the Corporation at nominal cost. The cost of solicitation will be borne by the Corporation.

The information in this Circular is given as at March 17, 2014, unless otherwise indicated. As the Corporation operates in U.S. dollars and reports financial results in U.S. dollars, all financial information in this Circular is in U.S. dollars. For comparability, all Canadian dollar amounts in this Circular have been converted to U.S. dollars at the average exchange rate for 2013 of C$1.00 to US$0.9713, unless otherwise indicated.

WHO CAN VOTE

As of March 17, 2014, the Corporation had outstanding 119,031,812 Common Shares and 61,961 8% Convertible Preferred Shares, Series A (the “Preferred Shares”). Each registered holder of Common Shares of record at the close of business onFriday, March 12, 2014, the record date (the “Record Date”) established for the purposes of determining shareholders entitled to receive notice of and to vote at the meeting, will, except as provided below, be entitled to one vote for each Common Share held on all matters to come before the meeting or any adjournment thereof either in person, or by proxy.

Holders of the Preferred Shares are not entitled to receive notice of or to attend any meeting of shareholders of the Corporation and, subject to the articles of the Corporation, as amended, and applicable law, shall not be entitled to vote at any such meeting.

For a description of the procedures to be followed by Non-Registered Shareholders to direct the voting of Common Shares beneficially owned, please refer to the answer to the question “If my Common Shares are not registered in my name but are held in the name of an Intermediary (a bank, trust company, securities dealer, broker, trustee or other), how do I vote my shares?” on page 5 of this Circular.

The election of the Board of Directors of the Corporation (the “Board”) must be approved by a majority of the votes cast by holders of Common Shares who vote in respect of the resolution. See “Election of Directors” on page 7 of this Circular for further information.

The appointment of the external auditor must be approved by a majority of the votes cast by holders of Common Shares who vote in respect of the resolution. See “Appointment of External Auditor” on page 12 of this Circular for further information.

Due to the non-binding advisory nature of the matter to be voted upon in respect of the compensation of the Corporation’s executive officers, there is no minimum vote requirement for the proposal. However, the matter will be considered to have passed with the affirmative vote of a majority of the votes cast by holders of Common Shares that are present or represented and entitled to vote at the meeting.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 1 |

NOTICEAND ACCESS

On November 29, 2012, Canadian Securities Administrators published notice that they were adopting amendments to National Instrument 54-101 – Communications with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and to National Instrument 51-102 – Continuous Disclosure Obligations. These amendments, among other things, provide issuers with the option of using “Notice and Access” to deliver meeting materials electronically by providing shareholders with notice of their availability and access to these materials online. Notice and Access came into force on February 11, 2013 and may be used by issuers in respect of meetings that occur on or after March 1, 2013.

Brookfield Residential has adopted Notice and Access because it reduces printed paper materials. Notice and Access is consistent with the Corporation’s philosophy towards sustainable growth and will reduce costs associated with shareholder meetings. Instead of mailing meeting materials to shareholders, this year Brookfield Residential has posted this Circular on its website,www.brookfieldrp.com, in addition to the System for Electronic Document Analysis and Retrieval (“SEDAR”) atwww.sedar.com. Brookfield Residential has sent the Notice and a form of proxy or voting instruction form (the “Notice Package”) to all shareholders informing them that this Circular is available online and explaining how this Circular may be accessed. Brookfield Residential will not directly send the Notice Package to non-registered shareholders. Instead, the Corporation will pay Intermediaries (as defined on page 3 of this Circular) to forward the Notice Package to all non-registered shareholders. In accordance with NI 54-101, Brookfield Residential set the Record Date at least 40 days before the meeting and also filed a form of notification of the Record Date and the meeting date on SEDAR at least 25 days before the Record Date.

For the meeting, Brookfield is using Notice and Access for both registered and non-registered shareholders. Registered and non-registered shareholders who in 2013 requested a paper copy of the Corporation’s 2013 Annual Report (which includes management’s discussion and analysis and consolidated financial statements for the fiscal year ended December 31, 2013) (the “Annual Report”) will receive a copy of the Annual Report. Registered and non-registered shareholders who have signed up for electronic delivery of this Circular and the Annual Report will continue to receive them by email. Neither registered nor non-registered shareholders will receive a paper copy of this Circular unless they contact the Corporation after it is posted, in which case the Corporation will mail this Circular free of charge within three business days of any request provided the request is made prior to the meeting. We must receive your requestprior to 5:00 p.m., EDT on April 16, 2014 to ensure you will receive paper copies in advance of the deadline to submit your vote.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 2 |

Q & A ON PROXY VOTING

| A: | Holders of Common Shares are voting on the election of the Board, the appointment of the external auditor and authorizing the directors to set its remuneration and the approval, on a non-binding advisory basis, of the compensation of the Corporation’s named executive officers, as such information is disclosed in the Compensation Discussion and Analysis, the compensation tables and the accompanying narrative disclosure in this Circular. Each of the foregoing must be approved by a majority of the votes cast by holders of Common Shares who vote in respect of the resolution; provided, however, that due to the non-binding advisory nature of the matter to be voted upon in respect of the compensation of the Corporation’s executive officers, there is no minimum vote requirement for the proposal. However, the matter will be considered to have passed with the affirmative vote of a majority of the votes cast by holders of Common Shares who vote in respect of the resolution. |

| Q: | Who is entitled to vote? |

| A: | Holders of Common Shares as at the close of business on March 12, 2014 are entitled to vote. Each Common Share entitles the holder to one vote on the items of business identified above. |

| A: | If you are a registered shareholder, you may vote in person at the meeting or you may sign the form of proxy sent to you appointing the named persons or some other person you choose, who need not be a shareholder, to represent you as proxyholder and vote your Common Shares at the meeting. If your Common Shares are held in the name of an intermediary (a bank, trust company, securities dealer, broker, trustee or other) (an “Intermediary”), please refer to the answer to the question “If my Common Shares are not registered in my name but are held in the name of an Intermediary (a bank, trust company, securities dealer, broker, trustee or other), how do I vote my shares?” on page 5 for voting instructions. |

| Q: | What if I plan to attend the meeting and vote in person? |

| A: | If you are a registered shareholder and plan to attend the meeting on May 1, 2014 and wish to vote your shares in person at the meeting, please register with CST Trust Company, Brookfield Residential’s transfer agent, upon your arrival at the meeting. Your vote will be taken and counted at the meeting. If your Common Shares are held in the name of an Intermediary, please refer to the answer to the question “If my Common Shares are not registered in my name but are held in the name of an Intermediary (a bank, trust company, securities dealer, broker, trustee or other), how do I vote my shares?” on page 5 for voting instructions. |

| Q: | Who is soliciting my proxy? |

| A: | The form of proxy sent to you is being solicited by management of Brookfield Residential and the associated costs will be borne by Brookfield Residential. The solicitation will be made primarily by mail and email and, in relation to the delivery of this Circular, by posting this Circular on our website atwww.brookfieldrp.com and on our SEDAR profile atwww.sedar.com pursuant to Notice and Access, but may also be made by telephone or in person by regular employees of the Corporation at nominal cost. |

| Q: | What if I sign the form of proxy sent to me? |

| A: | Signing the form of proxy sent to you gives authority to Robert L. Stelzl or Alan Norris (each of whom is a director of Brookfield Residential), or to another person you have appointed, to vote your Common Shares at the meeting. |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 3 |

| Q: | Can I appoint someone other than these directors to vote my shares? |

| A: | Yes.You have the right to appoint a person or company other than the Brookfield Residential directors named on the form of proxy to be your proxyholder.Write the name of this person (or company), who need not be a shareholder, in the blank space provided in the form of proxy. It is important to ensure that any other person you appoint is attending the meeting and is aware that he, she or it has been appointed to vote your shares. Proxyholders should, upon arrival at the meeting, present themselves to a representative of CST Trust Company. |

| Q: | What do I do with my completed proxy? |

| A: | Return it to Brookfield Residential’s transfer agent, CST Trust Company, in the envelope provided, by fax at (416) 368-2502 or 1-866-781-3111, or by email toproxy@canstockta.com by no later than 5:00 p.m. (Toronto time) onTuesday, April 29, 2014or two days (excluding Saturdays, Sundays and holidays) before the day of the adjourned meeting. |

| Q: | Can I vote by Internet? |

| A: | If you are a registered shareholder, go towww.cstvotemyproxy.com and follow the instructions. You will need your control number (located under your address on the form of proxy) to identify yourself to the system. You must submit your vote by no later than 5:00 p.m. (EDT) onTuesday, April 29, 2014or two days (excluding Saturdays, Sundays and holidays) before the day of the adjourned meeting. |

| Q: | If I change my mind, can I submit another proxy or take back my proxy once I have given it? |

| A: | Yes. If you are a registered shareholder and wish to submit another proxy, you may deliver another properly executed form of proxy bearing a later date and depositing it as described above. If you wish to revoke your proxy, prepare a written statement to this effect. The statement must be signed by you or your attorney as authorized in writing or, if the shareholder is a corporation, under its corporate seal or by an officer or attorney of the corporation duly authorized.This statement must be delivered to the Corporate Secretary of Brookfield Residential at the following address no later than 5:00 p.m. (MDT) on the last business day preceding the date of the meeting, Wednesday, April 30,2014, or any adjournment of the meeting, or to the Chair of the Corporation’s Board of Directors on the day of the meeting, Thursday, May 1, 2014, or the day of the adjourned meeting: |

Shane D. Pearson

Corporate Secretary

Brookfield Residential Properties Inc.

4906 Richard Road SW

Calgary, Alberta T3E 6L1

Fax: (403) 231-8960

A non-registered shareholder may revoke a voting instruction form or a waiver of the right to receive meeting materials and to vote previously given to an Intermediary at any time by written notice to the Intermediary, except that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive materials and to vote that is not received by the Intermediary at least seven days prior to the meeting.

| Q: | How will my shares be voted if I give my proxy? |

| A: | The persons named on the form of proxy must vote for or against or withhold from voting, as applicable, your Common Shares in accordance with your directions and on any ballot that may be called for, or you can let your proxyholder decide for you. In the absence of such directions, proxies received by management will be votedin favour ofthe election of directors of the Board, the appointment of the external auditor and authorizing the directors to set its remuneration and the approval, on a non-binding advisory basis, of the compensation of the Corporation’s named executive officers, as such information is disclosed in the Compensation Discussion and Analysis, the compensation tables and the accompanying narrative disclosure in this Circular. |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 4 |

| Q: | What if amendments are made to these matters or if other matters are brought before the meeting? |

| A: | The persons named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the accompanying Notice and with respect to other matters which may properly come before the meeting. |

As of the date of this Circular, management of Brookfield Residential knows of no such amendment, variation or other matter expected to come before the meeting. If any other matters properly come before the meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment.

| A: | Brookfield Residential’s transfer agent, CST Trust Company, counts and tabulates the proxies. |

| Q: | If I need to contact the transfer agent, how do I reach them? |

| A: | For general shareholder enquiries, you can contact CST Trust Company by mail at: |

CST Trust Company

P.O. Box 700

Station B

Montreal, Quebec H3B 3K3

or by telephone: (416) 682-3860

within Canada and the United States toll-free at 1-800-387-0825;

or by fax: (514) 985-8843 or 1-888-249-6189;

or by email atinquiries@canstockta.com;

website:www.canstockta.com.

| Q: | If my Common Shares are not registered in my name but are held in the name of an Intermediary (a bank, trust company, securities dealer, broker, trustee or other), how do I vote my shares? |

| A: | In many cases, Common Shares of the Corporation which are beneficially owned by a non-registered shareholder (a “Non-Registered Shareholder”) are registered either: |

| | a) | in the name of an Intermediary that the Non-Registered Shareholder deals with in respect of the shares such as, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or |

| | b) | in the name of a depository (such as CDS Clearing and Depository Services Inc.) of which the Intermediary is a participant. |

As required by Canadian securities legislation, you will have received from your Intermediary a voting instruction form for the number of Common Shares you beneficially own.

Voting In Person

Since Brookfield Residential has limited access to the names of its Non-Registered Shareholders, if you attend the meeting Brookfield Residential may have no record of your shareholdings or of your entitlement to vote unless your Intermediary has appointed you as proxyholder. Therefore, if you wish to vote in person at the meeting, insert your name in the space provided on the voting instruction form and return it by following the instructions provided. Do not otherwise complete the form as your vote will be taken at the meeting. Please register with CST Trust Company upon your arrival at the meeting.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 5 |

Directing Your Vote through the Voting Information Form

In accordance with the requirements of NI 54-101 –Communication with Beneficial Owners of Securities of aReporting Issuer, the Corporation has distributed copies of the Notice Package to the depository and to Intermediaries for onward distribution to non-registered shareholders. Intermediaries are required to forward the Notice Package to non-registered shareholders.

Non-registered shareholders who have not opted for electronic delivery will receive a voting instruction form. The purpose of this form is to permit non-registered shareholders to direct the voting of the shares they beneficially own. Non-registered shareholders should follow the procedures set out on the form and contact their Intermediaries promptly if they need assistance.

If a non-registered shareholder does not wish to attend and vote at the meeting in person (or have another person attend and vote on his or her behalf), the voting instruction form must be completed, signed and returned in accordance with the directions on the form. Voting instruction forms in some cases permit the completion of the voting instruction form by telephone or through the Internet. If a non-registered shareholder wishes to attend and vote at the meeting in person (or have another person attend and vote on his or her behalf), the non-registered shareholder must complete, sign and return the voting instruction form in accordance with the directions provided.

Broker Non-Vote

A broker non-vote occurs when an Intermediary holding shares for a Non-Registered Shareholder submits a proxy for the meeting, but does not vote on a particular proposal because that Intermediary does not have discretionary voting power with respect to that “non-routine” proposal and has not received voting instructions from the Non-Registered Shareholder. Each of the election of directors and the non-binding, advisory vote to approve executive compensation is a “non-routine” proposal and so shares for which Intermediaries do not receive voting instructions will not be voted on such matters.

PRINCIPAL HOLDERSOF VOTING SECURITIES

Other than as described below, to the knowledge of the directors and executive officers of the Corporation, no person or company beneficially owns, or controls or directs, directly or indirectly, voting securities of the Corporation carrying more than 10% of the votes attached to any class of outstanding voting securities of the Corporation.

As at March 17, 2014, Brookfield Asset Management Inc. (“Brookfield Asset Management”) beneficially owns, or controls or directs, directly or indirectly, 81,493,112 Common Shares in the capital of the Corporation, representing approximately 68.5% of the outstanding Common Shares of the Corporation. Brookfield Asset Management is an asset management company listed on the New York Stock Exchange, the Toronto Stock Exchange and the NYSE Euronext.

INTERESTOF INFORMED PERSONSIN MATERIAL TRANSACTIONS

Non-Arm’s Length Transactions

Brookfield Residential has a $300 million unsecured revolving credit facility with a subsidiary of Brookfield Asset Management at an interest rate of LIBOR plus 4.5%.

During the year ended December 31, 2013, the Corporation purchased the tax attributes of a subsidiary of Brookfield Asset Management in consideration for a $33 million non-interest bearing promissory note.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 6 |

During the year ended December 31, 2013, the Corporation paid $29 million to a subsidiary of Brookfield Asset Management to acquire 451 lots located in Riverside County, California. The Corporation also entered into profit sharing arrangements with the seller regarding lot sale transactions and net profit from development.

During the year ended December 31, 2013, the Corporation paid $18 million to Brookfield Asset Management for Canadian tax credits.

Additionally, Brookfield Residential has the right to use the names “Brookfield” and “Brookfield Residential” pursuant to a license agreement between Brookfield Office Properties and Brookfield Global Asset Management Limited, a subsidiary of Brookfield Asset Management.

As described above under “Principal Holders of Voting Securities”, Brookfield Asset Management beneficially owns, or controls or directs, directly or indirectly, approximately 68.5% of the outstanding Common Shares of the Corporation. The address of Brookfield Asset Management is Brookfield Place, Suite 300, 181 Bay Street, Toronto, Ontario, M5J 2T3.

PART TWO – BUSINESS OF THE MEETING

We will be addressing four items at the meeting:

| 1. | Receiving the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2013, including the external auditor’s report; |

| 2. | Electing directors who will serve until the end of the next annual meeting of shareholders; |

| 3. | Appointing the external auditor that will serve until the end of the next annual meeting of shareholders and authorizing the directors to set its remuneration; and |

| 4. | Approval, on a non-binding advisory basis, of the compensation of the Corporation’s named executive officers, as such information is disclosed in the Compensation Discussion and Analysis, the compensation tables and the accompanying narrative disclosure in this Circular. |

We will also consider other business that may properly come before the meeting.

As of the date of this Circular, management is not aware of any changes to these items and does not expect any other items to be brought forward at the meeting. If there are changes or new items, you or your proxyholder can vote your shares on these items as you, he, she or it sees fit.

| 1. | RECEIVINGTHE CONSOLIDATED FINANCIAL STATEMENTS |

The annual financial statements of the Corporation for the fiscal year ended December 31, 2013 are included in the Corporation’s 2013 Annual Report. Management will review the Corporation’s consolidated financial results at the meeting and shareholders and proxyholders will be given an opportunity to discuss these results with management. The 2013 Annual Report is available on the Corporation’s website,www.brookfieldrp.com/notice_and_access and on SEDAR atwww.sedar.com.

The Board is comprised of 8 members, all of whom are to be elected at the meeting. The following persons are proposed as nominees for election by the holders of Common Shares:

| | | | | | | | | | | | | | |

| • | | Bruce T. Lehman | | • | | Alan Norris | | • | | Timothy R. Price | | • | | Robert L. Stelzl |

| • | | Patricia M. Newson | | • | | Allan S. Olson | | • | | David M. Sherman | | • | | Michael D. Young |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 7 |

Majority Voting for Directors

The Board has adopted a policy stipulating that, if the total number of Common Shares voted in favour of the election of a director nominee at a shareholders’ meeting represents less than a majority of the total shares voted and withheld for that director, the nominee will submit his or her resignation promptly after the meeting for the Governance and Nominating Committee’s consideration. The Committee will make a recommendation to the Board after reviewing the matter, and the Board’s decision to accept or reject the resignation offer will be disclosed to the public. The policy does not apply in circumstances involving contested director elections.

Voting by Proxy

On any ballot that may be called for in the election of directors, the management representatives designated on the form of proxy to be completed by holders of Common Shares intend to cast the votes in favour of the proposed nominees for election as set forth on pages 8 to 12 of this Circular, unless the shareholder who has given such proxy has directed that such shares be otherwise voted or withheld from voting in the election of directors.

Director Nominees

The Board recommends that the 8 director nominees be elected at the meeting of shareholders on May 1, 2014 to serve as directors of the Corporation until the end of the next annual meeting of shareholders or until their successors are elected or appointed.

All of the proposed nominees were appointed as members of the Board effective May 2, 2013.

We do not expect that any of the director nominees will be unable to serve as a director. If, however, a director nominee tells us before the meeting that he or she will be unable to serve as a director, the management representatives designated in the enclosed form of proxy, unless directed to withhold from voting in the election of directors, reserve the right to vote for other director nominees at their discretion.

The following pages set out additional information about the 8 director nominees, including all major positions and offices currently held in the Corporation by each director nominee, his or her principal occupation or employment, the year in which he or she was first appointed a director of the Corporation, and the approximate number of each class of securities of the Corporation that each director nominee has advised the Corporation are beneficially owned, directly or indirectly, or subject to control or direction by the director nominee as at March 17, 2014.

| | |

Bruce T. Lehman Age: 61 Newport Beach, California, U.S.A. Director since: March 31, 2011 (Independent)(a) | | Mr. Lehman served as a director of Brookfield Homes Corporation from 2002 until March 31, 2011 when he was appointed as a director of the Corporation. During this period, Mr. Lehman invested and held principal positions with Armada, LLC and Summit Land Partners, LLC with a primary focus on residential land investments. He is presently a principal of Armada Real Estate Group, LLC and remains active in real estate investment and development. Previously, Mr. Lehman has also provided independent consulting services, including strategic advice and corporate dispositions in the real estate arena. From 1996 to 2000, Mr. Lehman was President-Merchant Housing Division of Catellus Residential Group, a wholly-owned subsidiary of Catellus Development Corp. (NYSE). Mr. Lehman also held this position with Catellus Residential Group’s predecessor company, Akins Real Estate Group, from 1989 until 2000. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | 9 of 9 | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | |

Audit Committee | | 4 of 4 | | | 100 | % | | | | | | Brookfield Homes Corporation | | 2002 – 2011 |

| | | | | |

Management Resources and Compensation Committee (Chair) | | 4 of 4 | | | 100 | % | | | | | | | | |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/

DSUs Needed to

Meet

Ownership Guidelines

($) (c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 1,529 | | | | 16,765 | | | | 18,294 | | | | 376,674 | | | | — | | | | — | |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 8 |

| | |

Patricia M. Newson Age: 57 Calgary, Alberta, Canada Director since: March 31, 2011 (Independent)(a) | | Ms. Newson was appointed a director of the Corporation on March 31, 2011. In addition to the public companies listed below, Ms. Newson currently serves on the board of directors of the Alberta Electric System Operator, Heritage Gas Limited and Quality Urban Energy Systems of Tomorrow (QUEST). She retired in 2011 from AltaGas Ltd. as President of the Utility Division. Ms. Newson was President and CEO of AltaGas Utility Group Inc. from 2005 to 2009, and Senior Vice President Finance and CFO of AltaGas Income Trust from 1996 to 2006. In addition to the public companies listed below, previous board experience includes Inuvik Gas Ltd. and the Canadian Gas Association. Ms. Newson is a Chartered Accountant. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 9 of 9 | | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | |

Audit Committee (Chair) | | | 4 of 4 | | | | 100 | % | | | | | | Long Run Exploration Ltd. | | 2012 – Present |

| | | | | | | | | | | | | | Pattern Energy Group Inc. | | 2013 – Present |

| | | | | |

| | | | | | | | | | | | | | Guide Exploration Ltd. | | 2011 – 2012 |

| | | | | |

| | | | | | | | | | | | | | Brookfield Asset Management Inc. | | 2008 – 2010 |

| | | | | |

| | | | | | | | | | | | | | AltaGas Utility Group Inc. | | 2005 – 2009 |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | — | | | | 22,647 | | | | 22,647 | | | | 466,302 | | | | — | | | | — | |

| | |

Alan Norris Age: 57 Calgary, Alberta, Canada Director since: March 31, 2011 (Related; Management) (b) | | Mr. Norris was appointed President and Chief Executive Officer and a director of the Corporation on March 31, 2011. Mr. Norris was a director of Brookfield Homes Corporation from 2003 until March 31, 2011. Mr. Norris was President and Chief Executive Officer of BPO Residential, a developer of master-planned communities wholly-owned by Brookfield Office Properties (formerly Brookfield Properties Corporation). Mr. Norris joined BPO Residential in 1983 and assumed increasingly senior positions over the next 11 years until he was appointed President and Chief Executive Officer. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 9 of 9 | | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | |

| | | | | | | | | | | | | | Brookfield Homes Corporation | | 2003 – 2011 |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($) (c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 2,002,294 | (d) | | | 1,250,000 | | | | 3,252,294 | (d) | | | 42,932,733 | (d) | | | — | | | | — | |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 9 |

| | |

Allan S. Olson Age: 72 Spruce Grove, Alberta, Canada Director since: February 13, 2012 (Independent) (a) | | Mr. Olson was appointed as a director of the Corporation on February 13, 2012. Mr. Olson was the founder and majority shareholder and since 1991 has been an executive, and is now Chairman, of First Industries Corporation, a private investment and operating company. Prior to that, he was President and Chief Executive Officer of the Churchill Corporation from 1989 to 1990, and Banister Construction Group from 1990 to 1991 and held various positions at Stuart Olson Construction including President and Chief Executive Officer from 1965 to 1989. Mr. Olson has served as a director of both private and public companies, and most recently was a director of IPSCO Steel Inc. from 1988 until the company was sold in 2007. He was also Chairman of Summit REIT until it was sold in 2006. Mr. Olson is currently a director of ZCL Composites and served as a director of Brookfield Office Properties and its predecessor companies, for more than 15 years, until 2012. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 9 of 9 | | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2012 – Present |

| | | | | |

Audit Committee | | | 4 of 4 | | | | 100 | % | | | | | | Brookfield Office Properties Inc. | | 2005 – 2012 |

| | | | | |

Governance and Nominating Committee | | | 2 of 2 | | | | 100 | % | | | | | | ZCL Composites Inc. | | 2007 – Present |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 10,000 | | | | 6,356 | | | | 16,356 | | | | 336,770 | | | | — | | | | — | |

| | |

Timothy R. Price Age: 71 Toronto, Ontario, Canada Director since: March 31, 2011 (Related)(b) | | Mr. Price was a director of Brookfield Homes Corporation from 2009 until March 31, 2011 when he was appointed as a director of the Corporation. Mr. Price has served as Chairman of Brookfield Funds since 1996 and was also Chairman, Brookfield Financial Corporation until December 31, 2004. Mr. Price was previously a director of Brookfield Homes Corporation from 2004 to 2006. Mr. Price served as a director of Astral Media Inc. from 1978 to 2013. In addition, he has been a director of Canadian Tire Corporation since 2007 and Fairfax Financial Holdings since 2010. Mr. Price also served as a director of Morguard REIT from 2005 to 2008 and currently serves on the board of directors of HSBC Bank Canada. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 8 of 9 | | | | 89 | % | | | 89 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | | | | | | | | | | Brookfield Homes Corporation | | 2009 – 2011 |

| | | | | | | | | | | | | | | | 2004 – 2006 |

| | | | | | | | | | | | | | Canadian Tire Corporation, Limited | | 2007 – Present |

| | | | | | | | | | | | | | Fairfax Financial Holdings Limited | | 2010 – Present |

| | | | | | | | | | | | | | HSBC Bank Canada | | 2007 – Present |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 15,116 | | | | 13,635 | | | | 28,751 | | | | 591,983 | | | | — | | | | — | |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 10 |

| | |

David M. Sherman Age: 56 New York, New York, U.S.A. Director since: March 31, 2011 (Independent)(a) | | Mr. Sherman served as a director of Brookfield Homes Corporation from 2003 until March 31, 2011 when he was appointed as a director of the Corporation. Mr. Sherman is President of Metropolitan Real Estate Equity Management, a wholly owned subsidiary of The Carlyle Group since November 1, 2013, a real estate fund-of-funds manager, a position he has held since the firm’s inception in 2002. From 2002 to 2006, Mr. Sherman also served as an adjunct professor of real estate at Columbia University Graduate School of Business Administration. Mr. Sherman was the Managing Director and head of REIT Equity Research at Salomon Smith Barney, Inc., from 1995 until 2000. Prior to this, Mr. Sherman held various positions in real estate investment banking and finance. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 8 of 9 | | | | 89 | % | | | 91 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | |

Governance and Nominating Committee (Chair) | | | 2 of 2 | | | | 100 | % | | | | | | Brookfield Homes Corporation | | 2003 – 2011 |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($) (c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 6,501 | | | | 76,002 | | | | 82,503 | | | | 1,698,737 | | | | — | | | | — | |

| | |

Robert L. Stelzl Age: 68 Hamilton, Montana, U.S.A. Director since: March 31, 2011 (Independent)(a) | | Mr. Stelzl was appointed a director of the Corporation on March 31, 2011 and including his time with the Corporation’s predecessor, Brookfield Homes Corporation, has since May 2007 served as the Chair of the Corporation. Mr. Stelzl was a director of Brookfield Homes Corporation from 2002 until March 31, 2011. Mr. Stelzl is a private real estate investor and investment manager. In 2003, he retired from Colony Capital, LLC, a large real estate private equity investor, after 14 years as a principal and member of the Investment Committee. Mr. Stelzl currently serves as a director of the Van Eck Family of Mutual Funds in New York. He was previously president of Bren Investment Properties from 1982 to 1989 and has held senior management positions with several international real estate companies including Cadillac Fairview Corporation Limited and Cabot, Cabot & Forbes. He is also a former Chairman of Aman Hotels. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors (Chair) | | | 9 of 9 | | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2005 – Present |

| | | | | | | | | | | | | | Brookfield Office Properties Inc. | | 2011 – Present |

| | | | | |

Management Resources and Compensation Committee | | | 4 of 4 | | | | 100 | % | | | | | | Brookfield Homes Corporation | | 2002 – 2011 |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($) (c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 2,753 | | | | 62,951 | | | | 65,704 | | | | 1,352,845 | | | | — | | | | — | |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 11 |

| | |

Michael D. Young Age: 69 Dallas, Texas, U.S.A. Director since: March 31, 2011 (Independent)(a) | | Mr. Michael D. Young has been a Principal of Quadrant Capital Partners, Inc. since November 2003. From 1994 to October 2003, Mr. Young served as Managing Director and Head of Real Estate Investment Banking for CIBC World Markets. Mr. Young was appointed Global Head of Real Estate for CIBC World Markets in 1997. He has been Trustee of Calloway Real Estate Investment Trust since November 2003. He has been a Director of Brookfield Residential Properties Inc. since March 2011 and was a Director of the company’s predecessor, Brookfield Homes Corporation, from to 2007 to 2011. He has been a trustee of Milestone Apartments REIT since March of 2013. Mr. Young holds a Bachelors degree from the University of Western Ontario. He is also a member of Canada’s Sports Hall of Fame. |

| | | | | | | | | | | | | | | | |

Board/Committee Membership | | 2013 Attendance | | | Total % | | | Public Board Membership During Last Five Years |

Board of Directors | | | 9 of 9 | | | | 100 | % | | | 100 | % | | Brookfield Residential Properties Inc. | | 2011 – Present |

| | | | | |

Management Resources and Compensation Committee | | | 4 of 4 | | | | 100 | % | | | | | | Brookfield Homes Corporation | | 2007 – 2011 |

| | | | | | | | | | | | | | Milestone Apartments REIT | | 2013 – Present |

| | | | | | | | | | | | | | Calloway Real Estate Investment Trust | | 2003 – Present |

| | | | | |

Governance and Nominating Committee | | | 2 of 2 | | | | 100 | % | | | | | | | | |

Number of Shares and Deferred Share Units (DSUs) Beneficially Owned, Controlled or Directed

| | | | | | | | | | | | | | | | | | | | | | | | |

Year | | Common

Shares

(#) | | | DSUs

(#) | | | Total Number

of Shares and

DSUs

(#) | | | Total Value of

Shares and

DSUs

($)(c) | | | Value of Shares/DSUs

Needed to Meet

Ownership Guidelines

($)(c) | | | Date at which

Ownership

Guideline is to

be Met | |

2014 | | | 6,501 | | | | 22,647 | | | | 29,148 | | | | 600,157 | | | | — | | | | — | |

Notes:

| (a) | “Independent” refers to the Board’s determination of whether a director nominee is “independent” under Section 1.2 of the Canadian Securities Administrator’s National Instrument 58-101 – Disclosure of Corporate Governance Practices. |

| (b) | “Related” refers to director nominees who have current or recent interests in or are related to the Corporation or its principal shareholder, Brookfield Asset Management. |

| (c) | Based on the closing price of a Common Share on the TSX on March 17, 2014 of $20.59 (C$22.76 converted into U.S. dollars at the Bloomberg mid-market exchange rate on that day of C$1.00 = US$0.9048). |

| (d) | The number of Common Shares reflects Mr. Norris’ deemed beneficial ownership of 2,000,000 Common Shares held by BRP Holdings Corp. Mr. Norris’pro ratainterest in the Common Shares, based on his percentage ownership in the capital of BRP Holdings Corp., is 1,500,000 Common Shares. The value of the escrowed shares on redemption will be equal to the value of the Common Shares held by BRP Holdings Corp. less the net liabilities and preferred share obligations of BRP Holdings Corp. |

Director Attendance

During 2013, the Board and its Committees held nine meetings in total, which were comprised of five regularly scheduled meetings of the Board, including one meeting to review the Corporation’s annual business plan and long-term strategic plan, and four special meetings to deal with specific items of business; four meetings of the Audit Committee; two meetings of the Governance and Nominating Committee; and four meetings of the Management Resources and Compensation Committee. Director attendance at these meetings is shown in the tables on pages 8 to 12 of this Circular. Private sessions of the independent directors without management present were held after all regularly scheduled quarterly Board meetings.

| 3. | APPOINTMENTOF EXTERNAL AUDITOR |

On recommendation of the Audit Committee, the Board proposes the reappointment of Deloitte LLP as the external auditor of the Corporation. Deloitte LLP is the principal external auditor of the Corporation and has served as the external auditor of the Corporation since being appointed in 2011. Deloitte LLP is independent of the Corporation within the meaning of the Rules of Professional Conduct of the Institute of Chartered Accountants of Alberta. The appointment of the external auditor must be approved by a majority of the votes cast by holders of Common Shares who vote in respect of the resolution.

On any ballot that may be called for in the appointment of the external auditor, the management representatives designated in the enclosed form of proxy intend to vote such shares in favour of reappointing Deloitte LLP, Independent Registered Chartered Accountants, as the external auditor, and authorizing the

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 12 |

directors to set the remuneration to be paid to the external auditor, unless the shareholder has specified in the enclosed form of proxy that the shares represented by such proxy are to be withheld from voting in relation to the appointment of the external auditor.

Principal Accounting Firm Fees and Services

Aggregate fees billed to the Corporation and its subsidiaries for the fiscal year ended December 31, 2013 by Deloitte LLP amounted to approximately $1,698,585. From time to time, Deloitte LLP also provides consultative and other non-audit services to the Corporation and its subsidiaries and affiliates. The Audit Committee has adopted a policy regarding the provision of non-audit services by the external auditor. This policy, which is periodically reviewed and updated, requires Audit Committee pre-approval of permitted audit, audit-related and non-audit services. It also specifies a number of services the provision of which is not permitted by the external auditor, including the use of the external auditor for the preparation of financial information, system design and implementation assignments.

The following table sets forth further information on the fees billed by Deloitte LLP to the Corporation and its consolidated subsidiaries for the fiscal year ended December 31, 2013, expressed in U.S. dollars.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | |

| | | Brookfield

Residential | | | Subsidiaries of

Brookfield

Residential | | | Total | | | Brookfield

Residential | | | Subsidiaries of

Brookfield

Residential | | | Total | |

Audit fees | | $ | 1,018,126 | | | $ | 91,302 | | | $ | 1,109,428 | | | $ | 1,086,906 | | | $ | 87,535 | | | $ | 1,174,441 | |

Audit-related fees | | | 377,576 | | | | 20,000 | | | | 397,576 | | | | 24,135 | | | | — | | | | 24,135 | |

Tax fees | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Other fees | | | 191,581 | | | | — | | | | 191,581 | | | | 125,050 | | | | — | | | | 125,050 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total | | $ | 1,587,283 | | | $ | 111,302 | | | $ | 1,698,585 | | | $ | 1,236,091 | | | $ | 87,535 | | | $ | 1,323,626 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Audit fees include fees for services that would normally be provided by the external auditor in connection with statutory and regulatory filings or engagements, including fees for services necessary to perform an audit or review in accordance with generally accepted auditing standards. This category also includes services that generally only the external auditor reasonably can provide, including comfort letters, statutory audits of public companies, investment funds and financial statements in connection with property-specific and subsidiary financings, attest services, consents and assistance with and review of certain documents filed with securities regulatory authorities.

Audit-related fees are for assurance and related services, such as due diligence services, that traditionally are performed by the external auditor. More specifically, these services include, among others: assistance in connection with Section 404 of the U.S.Sarbanes-Oxley Act of 2002(“Sarbanes-Oxley Act”), employee benefit plan audits, due diligence related to securities filings, securities offerings and mergers and acquisitions, accounting consultations and audits in connection with acquisitions, and attest services that are not required by statute or regulation such as consultation concerning financial accounting and reporting standards.

Tax fees are principally for assistance in tax return preparation and tax advisory services. All other fees include fees for translation, litigation and advisory support services.

The Audit Committee has received representations from Deloitte LLP regarding its independence and has considered the relations described above in arriving at its determination that Deloitte LLP is independent of the Corporation.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 13 |

| 4. | NON-BINDING ADVISORY VOTEON NAMED EXECUTIVE OFFICER COMPENSATION |

The Corporation is seeking an advisory (non-binding) vote on the compensation paid to the Corporation’s named executive officers, as disclosed in this Circular, including the Compensation Discussion and Analysis, compensation tables and narrative discussion. The Board of Directors has determined that it will hold an advisory vote on executive compensation on an annual basis.

This vote, commonly known as a Say-On-Pay proposal, gives holders of Common Shares the opportunity to express their views on the compensation of the Corporation’s named executive officers. This vote is not intended to address any specific item of compensation, but the overall compensation of the named executive officers and the principles, policies and practices described in this Circular. As this is an advisory vote, the result will not be binding on the Corporation, the Board of Directors or the Compensation Committee. However, the Board of Directors and the Compensation Committee value the opinions of Shareholders and intend to take into account the results of the vote when considering future compensation decisions for the named executive officers.

On any ballot that may be called for in the advisory approval of the proposal on named executive officer compensation, the director representatives designated in the enclosed form of proxy intend to vote such shares in favour of a resolution to approve, on a non-binding advisory basis, the compensation of the Corporation’s named executive officers, unless the shareholder has specified in the enclosed form of proxy that the shares represented by such proxy are to be withheld from voting in relation to the approval, on a non-binding advisory basis, of the compensation of the Corporation’s named executive officers.

PART THREE– STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Corporate governance relates to the activities of the Board, the members of which are elected by and are accountable to the shareholders, and takes into account the role of the Corporation’s executive officers who are appointed by the Board and who are charged with the ongoing management of the Corporation. The Board encourages sound corporate governance practices designed to promote the long-term well-being and ongoing development of the Corporation, having always as its ultimate objective the best interests of the Corporation.

The Board is of the view that the Corporation’s corporate governance policies and practices, outlined below, are comprehensive and consistent with the guidelines for corporate governance adopted by Canadian securities administrators. The Board is also of the view that these policies and practices are consistent with the requirements of the New York Stock Exchange and the applicable provisions under the Sarbanes-Oxley Act.

BOARDOF DIRECTORS

Mandate of the Board

Brookfield Residential’s Board oversees the management of the Corporation’s business and affairs directly and through three existing standing committees (the “Committees”). In doing so, the Board acts at all times with a view to the best interests of the Corporation. The responsibilities of the Board and each Committee are set out in written charters, which are reviewed and approved annually. The Board’s Charter is set out in full in Appendix A of this Circular. The written charters for the Committees are posted on the Corporation’s website,www.brookfieldrp.com, underAbout Us/Governance/Committees.

In fulfilling its mandate, the Board is, among other things, responsible for the following:

| • | | overseeing the Corporation’s overall long-term strategic planning process and reviewing and approving its annual business plan; |

| • | | assessing the principal risks of the Corporation’s business and reviewing, approving and monitoring the systems in place to manage these risks; |

| • | | reviewing the major strategic initiatives to determine whether the Corporation’s proposed actions accord with long-term business strategies and shareholder objectives; |

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 14 |

| • | | appointing the Chief Executive Officer, overseeing the selection of other members of senior management and reviewing succession planning; |

| • | | assessing management’s performance against approved business plans; |

| • | | reviewing and approving the reports issued to shareholders, including annual and interim financial statements; |

| • | | promoting the effective operation of the Board; |

| • | | overseeing the Corporation’s compliance with applicable laws and regulations; and |

| • | | safeguarding shareholders’ equity interests through the effective utilization of the Corporation’s capital resources, including issuance of debt and equity securities and setting an appropriate dividend policy. |

Meetings of the Board

The Board meets at least once in each quarter, with additional meetings held to consider specific items of business or as deemed necessary. The Board also meets annually to review the Corporation’s annual business plan, which includes the Corporation’s long-term strategy. In 2013, there were five regularly scheduled meetings, including one meeting to review the Corporation’s annual business plan and long-term strategy, and four special meetings of the Board to review specific items of business. Five regular meetings, including one annual business plan and strategy meeting, are scheduled for 2014. Meeting frequency and agenda items may change depending on the opportunities or risks faced by the Corporation. The agenda for regularly scheduled Board meetings is set by the Chair, with input from the Chief Executive Officer and Chief Financial Officer, prior to circulation to the full Board.

Director Meetings Without Management

Private sessions of the independent directors without management present are held after all regularly scheduled quarterly and, if necessary, special Board meetings, and are chaired by the Chair, who reports back to the Chief Executive Officer on any matters requiring action by management. In 2013, the independent directors held five private sessions. Private sessions of the Committees without management present may also be held after Committee meetings, chaired by the Committee Chair, who reports back to the appropriate executive on any matters requiring action by management.

Size and Composition of the Board

The articles of amendment and the amended and restated by-laws of the Corporation provide that the Board will consist of a minimum of three and a maximum of nine members. The Board currently has 8 directors. The Corporation considers this to be an appropriate number at this time to provide for an effective and efficient Board given the nature of the business and operations of the Corporation.

Independent Directors

The Board has a policy that at least a majority of its directors should be independent directors in order to ensure that the Board’s interests are closely aligned with its shareholders. The following table describes the independence status of the directors proposed as nominees for election at the meeting.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 15 |

| | | | | | | | |

| | | Independence Status of the Nominated Directors | | |

| | | Independent | | Related | | Management | | Reason for Related Status |

| Bruce T. Lehman | | ü | | | | | | |

| | | | |

| Patricia M. Newson | | ü | | | | | | |

| | | | |

| Alan Norris | | | | ü | | ü | | Mr. Norris is President and Chief Executive Officer of the Corporation |

| | | | |

| Allan S. Olson | | ü | | | | | | |

| | | | |

| Timothy R. Price | | | | ü | | | | Mr. Price is Chairman of Brookfield Funds |

| | | | |

| David M. Sherman | | ü | | | | | | |

| | | | |

| Robert L. Stelzl | | ü | | | | | | |

| | | | |

| Michael D. Young | | ü | | | | | | |

The Corporation surveys its directors annually to obtain information necessary to make a determination regarding their independence. Following a review of this information, the Governance and Nominating Committee recommends to the Board a specific determination regarding the directors considered to be independent. On this basis, the Board considers that 6 of the 8 proposed director nominees for election at the 2014 Annual Meeting of Shareholders, comprising 75% of the Board, are independent based on the above criteria. All of the proposed director nominees are incumbent directors. The Board considers that, except for the relationships described next, the 6 independent nominees are also free of any interest in or current or recent relationship with the Corporation’s principal shareholder, Brookfield Asset Management: Robert L. Stelzl also serves as an independent director of Brookfield Office Properties, an affiliate of Brookfield Asset Management and the Corporation; Allan S. Olson was a former independent director of Brookfield Office Properties; and Patricia M. Newson was a former independent director of Brookfield Asset Management.

The other two directors proposed for nomination, Alan Norris and Timothy R. Price, comprising 25% of the Board, are considered to be related directors since they have current or recent interests in or are related to the Corporation or its principal shareholder, Brookfield Asset Management or its affiliates. Mr. Norris is the President and Chief Executive Officer of the Corporation. Mr. Price is Chairman of Brookfield Funds.

Information on each of the 8 proposed nominees for election at the meeting is set out on pages 8 to 12 of this Circular.

Areas of Director Expertise

The Corporation endeavours to ensure that the Board is comprised of directors with the areas of expertise required to ensure effective governance of the Corporation and provide strategic advice to management. Each year, the Corporation surveys the incumbent directors and any additional directors proposed for nomination to identify their areas of expertise. The results of this survey are reviewed by the Governance and Nominating Committee as a basis for identifying additional areas of expertise to be addressed in recruiting new directors.

Interlocking Directorships

There are no interlocking directorships among the Corporation’s directors.

Director Orientation and Education

New directors are provided with information about the Corporation on their election or appointment to the Board. Time is set aside at all regularly scheduled Board meetings for presentations on different areas of the Corporation’s business. Directors are encouraged to suggest topics for discussion or special presentations at regularly scheduled Board meetings and the annual business plan and strategy session. Director dinners are held prior to or immediately following most regularly scheduled Board meetings with senior management present, providing an opportunity for informal discussion and director and management presentations on selected topics of interest.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 16 |

Board Renewal

The Corporation does not have a mandatory age for the retirement of directors. Instead, the Governance and Nominating Committee reviews the composition of the Board on a regular basis in relation to approved director criteria and skill requirements and recommends changes as appropriate to renew the Board.

Director Expectations

The Board has adopted a Charter of Expectations for Directors, which sets out the Corporation’s expectations in regard to personal and professional competencies, share ownership, meeting attendance, conflicts of interest, changes of circumstance and resignation events. Directors are expected to identify in advance any potential conflict of interest regarding a matter coming before the Board or its Committees, bring these to the attention of the Board or Committee Chair and refrain from voting on such matters. Directors are also expected to submit their resignations to the Chair of the Board if they become unable to attend at least 75% of the Board’s regularly scheduled meetings or if they become involved in a legal dispute, regulatory or similar proceedings, take on new responsibilities or experience other changes in personal or professional circumstances that could adversely impact the Corporation or their ability to serve as director. This Charter is reviewed annually and a copy is posted on the Corporation’s website,www.brookfieldrp.com,underAbout Us/Governance.Further information on director share ownership requirements is set out under “Director Share / DSU Ownership Requirements” commencing on page 23 of this Circular.

COMMITTEESOFTHE BOARD

The Board believes that its Committees assist in the effective functioning of the Board and help ensure that the views of independent directors are effectively represented.

The Board has three Committees:

| • | | the Governance and Nominating Committee; and |

| • | | the Management Resources and Compensation Committee (the “Compensation Committee”). |

The responsibilities of these Committees are set out in written charters, which are reviewed and approved annually by the Board of Directors. The Charters of these Committees and the Position Descriptions of the Committee Chairs can be found on the Corporation’s website,www.brookfieldrp.com,underAbout Us/Governance/Committees.It is the Board’s policy that all members of these Committees must be independent directors, as described above. Special committees may be formed from time to time as required to review particular matters or transactions. While the Board retains overall responsibility for corporate governance matters, the Audit Committee, the Governance and Nominating Committee and the Compensation Committee each have specific responsibilities for certain aspects of corporate governance, in addition to their other responsibilities as described below.

Audit Committee

The Audit Committee is responsible for monitoring the Corporation’s systems and procedures for financial reporting, risk management and internal controls and the performance of the Corporation’s external and internal auditors. It is responsible for reviewing certain public disclosure documents prior to their approval by the full Board and release to the public including, among others, the Corporation’s quarterly and annual financial statements and management’s discussion and analysis. The Audit Committee is also responsible for recommending to the Board the firm of chartered accountants to be nominated for appointment as the external auditor, and for approving the assignment of any non-audit work to be performed by the external auditor. The Audit Committee meets regularly in private session with the Corporation’s external and internal auditors, without management present, to discuss and review specific issues as appropriate. The Audit Committee met four times in 2013 and once to date in 2014.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 17 |

In addition to being independent directors as described above, all members of the Audit Committee must meet an additional “independence” test under the Sarbanes-Oxley Act, in that their directors fees must be the only compensation they, or their firms, receive, directly or indirectly, from the Corporation. The Audit Committee has also adopted a requirement that all its members disclose any form of association with a present or former internal or external auditor of the Corporation, in addition to the current requirement to disclose a professional or employment relationship to the Governance and Nominating Committee for a determination as to whether this association affects the independent status of the director.

At March 17, 2014, the Audit Committee was comprised of the following three directors, Patricia M. Newson (Chair), Bruce T. Lehman and Allan S. Olson. All three directors are independent and meet the additional criteria for independence described above. The Board considers that all three members of the Audit Committee are financially literate (within the meaning of the applicable securities laws), as each has the ability to read and understand a set of financial statements that present a breadth and level of complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements.

For more information about the Audit Committee as required by Part 5 of National Instrument 52-110 –Audit Committees,see our Annual Information Form available on SEDAR atwww.sedar.com.

Governance and Nominating Committee

It is the responsibility of the Governance and Nominating Committee, in consultation with the Chair, to assess on an annual basis the size and composition of the Board and its Committees; to review the effectiveness of the Board’s operations and its relationship with management; to assess the performance of the Board, its Committees and individual directors and to review the Corporation’s statement of corporate governance practices.

The Governance and Nominating Committee reviews the performance of the Board, its Committees and the contribution of individual directors on an annual basis. The Board has in place a formal procedure for evaluating the performance of the Board, its Committees and individual directors, consisting of questionnaires and a report from the Chair of the Governance and Nominating Committee.

The Governance and Nominating Committee is responsible for reviewing the credentials of proposed nominees for election or appointment to the Board and for recommending candidates for Board membership, including the candidates proposed to be nominated for the election to the Board at the annual meeting of shareholders. Candidates are assessed in relation to the criteria established by the Board to ensure it has the appropriate mix of talent, quality, skills and other requirements necessary to promote sound governance and Board effectiveness.

The Governance and Nominating Committee reviews, at least once a year, the composition of the Board’s Committees to ensure that Committee membership complies with the relevant governance guidelines and that the work load for its independent directors is balanced. In doing so, the Committee consults with the Chair of the Board and makes recommendations to the Board, which appoints Committee members. The Corporation’s Chief Executive Officer does not participate in this process.

At March 17, 2014, the Governance and Nominating Committee was comprised of the following three directors, David M. Sherman (Chair), Allan S. Olson and Michael D. Young, all of whom are independent directors. The Governance and Nominating Committee met twice in 2013 and once to date in 2014.

Management Resources and Compensation Committee (the “Compensation Committee”)

The Compensation Committee is responsible for reviewing and reporting to the Board on management resource planning including succession planning and proposed senior management appointments, the job descriptions and annual objectives of its senior executives, the form of executive compensation in general, and the levels of compensation of the Chief Executive Officer and other senior executives. The Committee also reviews the performance of senior management against written objectives and reports thereon to the Board. Further, the Committee reviews and recommends the directors’ compensation.

| | |

| Brookfield Residential Properties Inc. | 2014 Management Information Circular | | 18 |

At March 17, 2014, the Compensation Committee was comprised of the following three directors, Bruce T. Lehman (Chair), Robert L. Stelzl and Michael D. Young, all of whom are independent directors. The Compensation Committee met four times in 2013 and once to date in 2014.

BOARD, COMMITTEEAND DIRECTOR EVALUATION

The Board believes that a regular and formal process of evaluation improves the performance of the Board as a whole, its Committees and individual directors. Each year, a survey is sent to directors regarding the effectiveness of the Board and its Committees, inviting comments and suggestions on areas for improvement. The results of this survey are reviewed by the Governance and Nominating Committee, which makes recommendations to the Board as required.

BOARDAND MANAGEMENT RESPONSIBILITIES

Board Positions