Exhibit 99.2

|

Exhibit 99.2

Acquisition of

Business Property Lending

Investor Conference Call July 2, 2012

BANKING LENDING INVESTING

|

Disclaimer

THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP (“EVERBANK” OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK.

EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF.

CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY BE DERIVED FROM INFORMATION PROVIDED BY THIRD PARTIES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION.

THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO THE FOLLOW RISKS AND UNCERTAINTIES RELATED TO THE ACQUISITION AND THE INTEGRATION OF BUSINESS PROPERTY LENDING INTO EVERBANK FOLLOWING THE CLOSING, INCLUDING BUT NOT LIMITED TO: THE RECEIPT OF REGULATORY AND OTHER APPLICABLE APPROVALS, THE TIMING OF WHICH CANNOT BE PREDICTED AND WHICH MAY NOT BE RECEIVED AT ALL; THE EXPENSES NECESSARY TO COMPLETE THE ACQUISITION AND INTEGRATION OF THE BUSINESS MAY BE SUBSTANTIALLY MORE THAN CURRENTLY ESTIMATED AND MAY TAKE LONGER THAN ANTICIPATED; THE PROJECTED BENEFITS, INCLUDING THE ANTICIPATED DIVERSIFICATION BENEFITS TO EVERBANK’S PRODUCT OFFERING, LOAN PORTFOLIO, ASSET GENERATION AND EARNINGS MAY NOT BE AS SIGNIFICANT OR MAY TAKE LONGER TO ACHIEVE; AND STRATEGIC GROWTH MAY BE MORE DIFFICULT TO ACHIEVE THAN EXPECTED. FOR ADDITIONAL FACTORS THAT COULD MATERIALLY AFFECT OUR FINANCIAL RESULTS AND OUR BUSINESS GENERALLY, PLEASE REFER TO EVERBANK FINANCIAL CORP’S FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING BUT NOT LIMITED TO, THE FACTORS, UNCERTAINTIES AND RISKS DESCRIBED UNDER THE HEADINGS “RISK FACTORS” AND “MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.” THE COMPANY UNDERTAKES NO OBLIGATION TO REVISE THESE STATEMENTS FOLLOWING THE DATE OF THIS PRESENTATION, EXCEPT AS REQUIRED BY LAW.

BANKING LENDING INVESTING 2

|

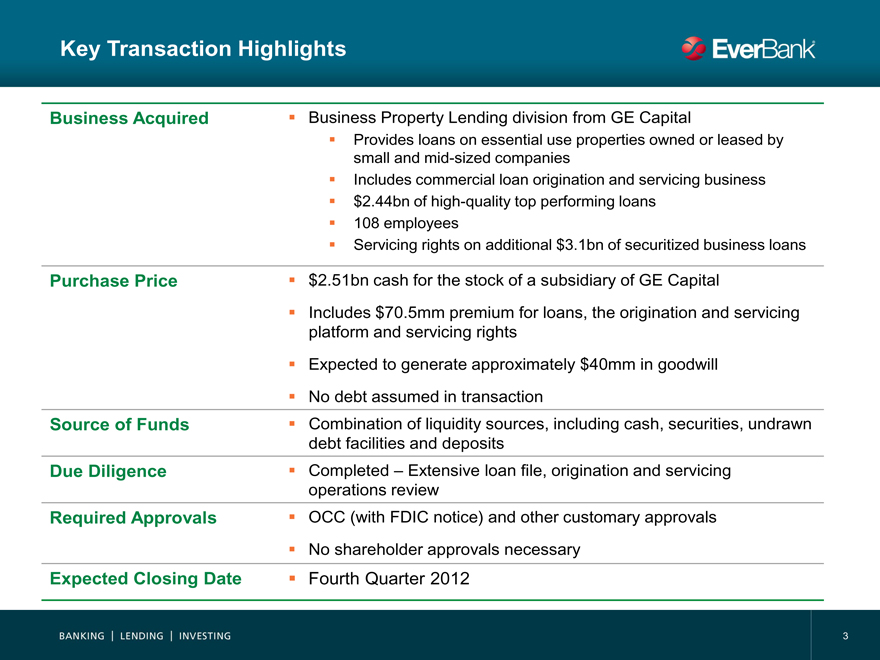

Key Transaction Highlights

Business Acquired

Business Property Lending division from GE Capital

Provides loans on essential use properties owned or leased by small and mid-sized companies Includes commercial loan origination and servicing business $2.44bn of high-quality top performing loans 108 employees Servicing rights on additional $3.1bn of securitized business loans

Purchase Price

$2.51bn cash for the stock of a subsidiary of GE Capital

Includes $70.5mm premium for loans, the origination and servicing platform and servicing rights

Expected to generate approximately $40mm in goodwill

No debt assumed in transaction

Source of Funds

Combination of liquidity sources, including cash, securities, undrawn debt facilities and deposits

Due Diligence

Completed – Extensive loan file, origination and servicing operations review

Required Approvals

OCC (with FDIC notice) and other customary approvals

No shareholder approvals necessary

Expected Closing Date

Fourth Quarter 2012

BANKING LENDING INVESTING 3

|

Transaction Rationale

Strategic Value

Accelerates strategic growth plan

Adds strong commercial asset generation capability

Diversifies balance sheet into high quality business property loans Complements distribution strategy in key markets

Attractive Deal Economics

Immediately accretive to EPS (low double digit %) Accretive to ROE by ~100bps Attractive IRR: ~20% Minimal impact on TBV

Low Risk

High quality loan portfolio

No non-performing loans acquired

Business has demonstrated solid historical credit performance

Turn-key platform

Strong pro forma capital and liquidity

BANKING LENDING INVESTING 4

|

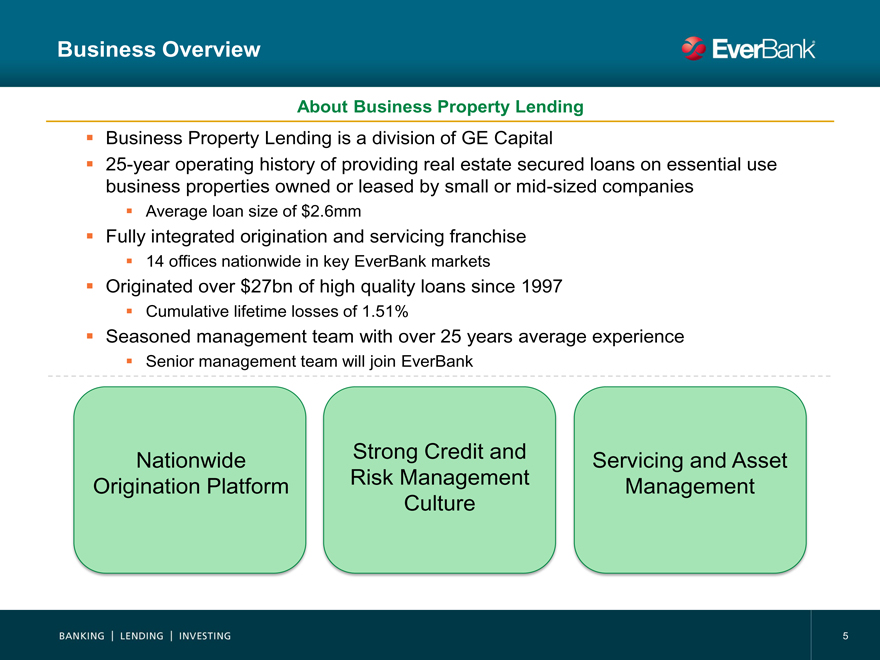

Business Overview

About Business Property Lending

Business Property Lending is a division of GE Capital

25-year operating history of providing real estate secured loans on essential use business properties owned or leased by small or mid-sized companies

Average loan size of $2.6mm

Fully integrated origination and servicing franchise

14 offices nationwide in key EverBank markets

Originated over $27bn of high quality loans since 1997

Cumulative lifetime losses of 1.51%

Seasoned management team with over 25 years average experience

Senior management team will join EverBank

Nationwide

Collateral

Origination Platform

Strong Credit and Risk Management Culture

Servicing and Asset Management

BANKING LENDING INVESTING 5

|

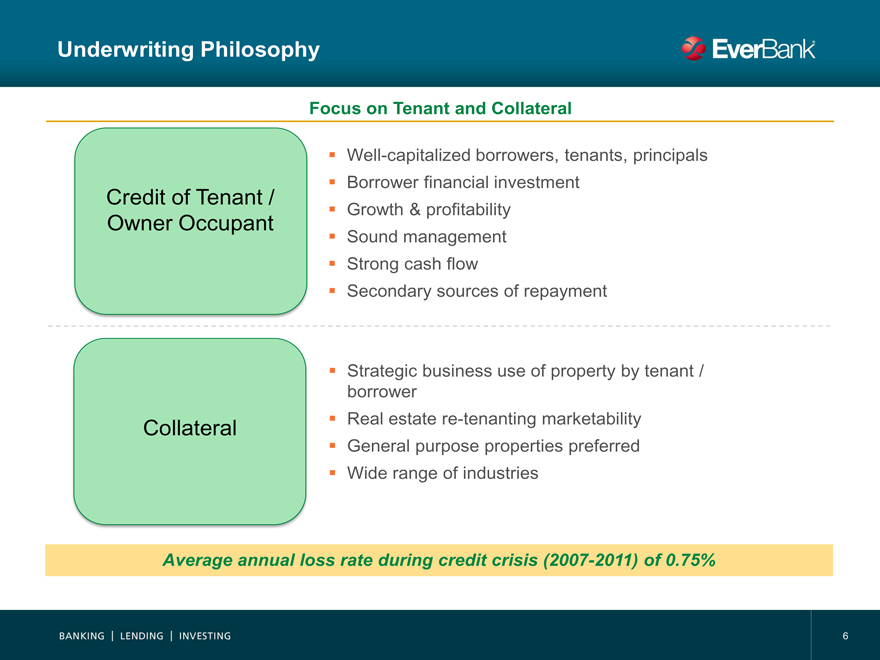

Underwriting Philosophy

Focus on Tenant and Collateral

Credit of Tenant / Owner Occupant

Well-capitalized borrowers, tenants, principals Borrower financial investment Growth & profitability Sound management Strong cash flow Secondary sources of repayment

Collateral

Strategic business use of property by tenant / borrower Real estate re-tenanting marketability General purpose properties preferred Wide range of industries

Average annual loss rate during credit crisis (2007-2011) of 0.75%

BANKING LENDING INVESTING 6

|

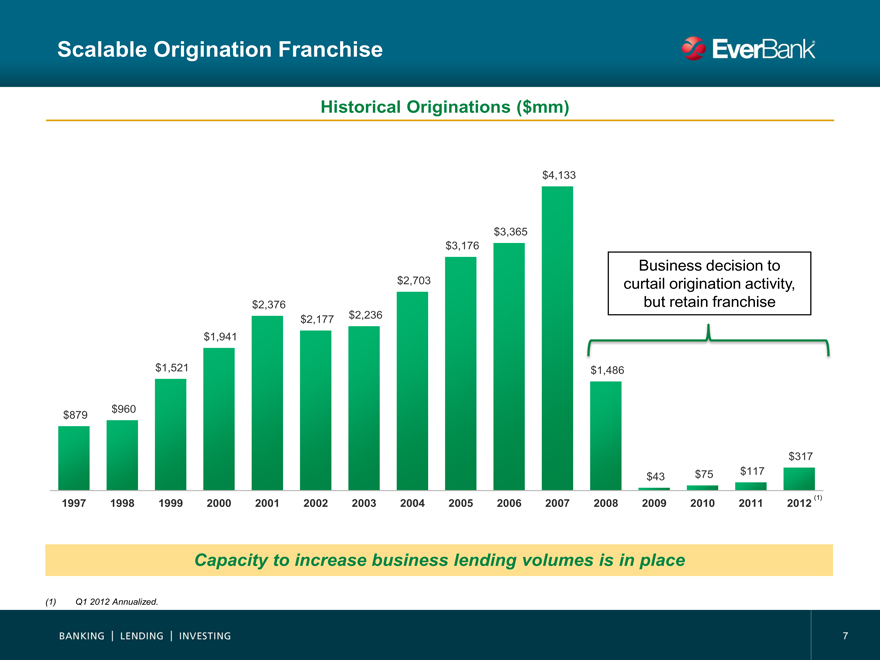

Scalable Origination Franchise

Historical Originations ($mm)

$879

$960

$1,521

$1,941

$2,376

$2,177

$2,236

$2,703

$3,176

$3,365

$4,133

$1,486

$43

$75

$117

$317

(1)

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Business decision to curtail origination activity, but retain franchise

Capacity to increase business lending volumes is in place

(1) Q1 2012 Annualized.

BANKING LENDING INVESTING 7

|

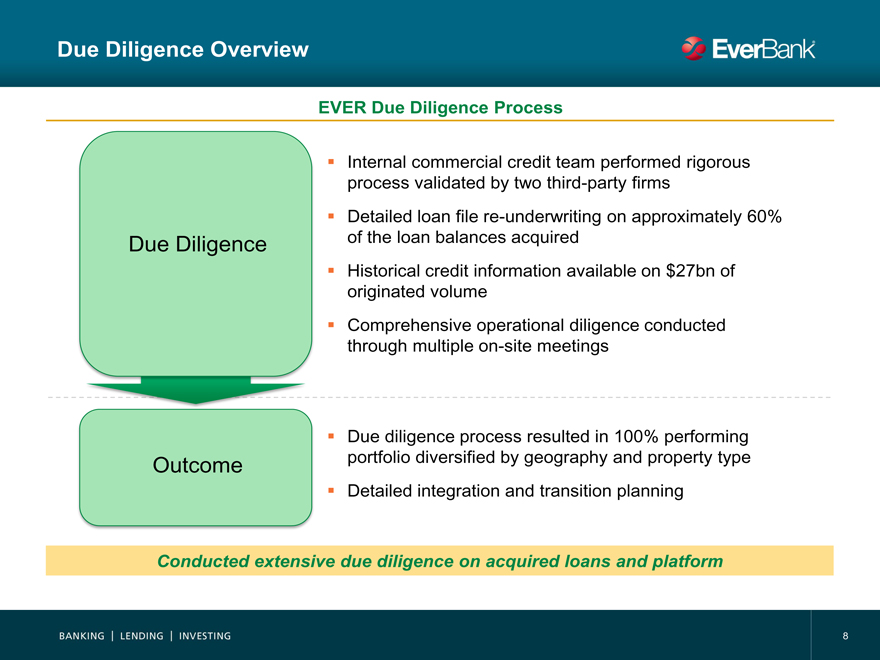

Due Diligence Overview

EVER Due Diligence Process

Due Diligence

Internal commercial credit team performed rigorous process validated by two third-party firms Detailed loan file re-underwriting on approximately 60% of the loan balances acquired Historical credit information available on $27bn of originated volume Comprehensive operational diligence conducted through multiple on-site meetings

Outcome

Due diligence process resulted in 100% performing portfolio diversified by geography and property type Detailed integration and transition planning

Conducted extensive due diligence on acquired loans and platform

BANKING LENDING INVESTING 8

|

Minimal Risk

Business

Cohesive, long-tenured management team of Business Property Lending expected to remain intact Strong, complementary risk management culture Rigorous business and portfolio due diligence 100% performing portfolio Balance sheet and earnings diversification Limited interest rate risk due to expected match funding Strong pro forma capital and liquidity

Conversion

Turn-key platform to remain intact Multi-phased and disciplined approach to business integration Experienced acquirer and integrator of unique transactions

MetLife Warehouse Finance Tygris Commercial Finance Group Bank of Florida

Existing experience in commercial lending and servicing Strong corporate services infrastructure designed to support multiple business lines

BANKING LENDING INVESTING 9

|

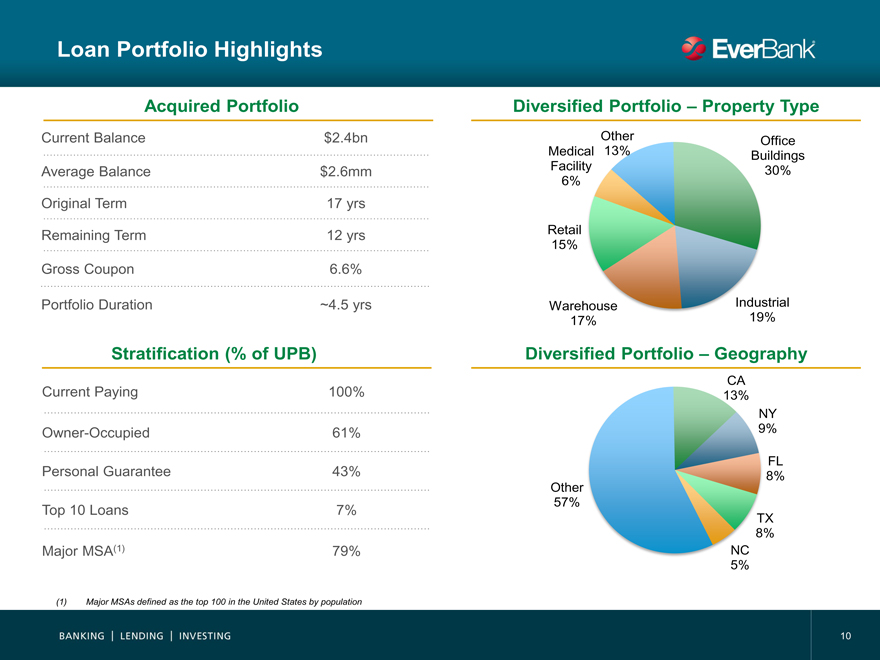

Loan Portfolio Highlights

Acquired Portfolio

Current Balance $2.4bn

Average Balance $2.6mm

Original Term 17 yrs

Remaining Term 12 yrs

Gross Coupon 6.6%

Portfolio Duration ~4.5 yrs

Stratification (% of UPB)

Current Paying 100%

Owner-Occupied 61%

Personal Guarantee 43%

Top 10 Loans 7%

Major MSA(1) 79%

Diversified Portfolio – Property Type

Other 13%

Office Buildings 30%

Industrial 19%

Warehouse 17%

Retail 15%

Medical Facility 6%

Diversified Portfolio – Geography

CA 13%

NY 9%

FL 8%

TX 8%

NC 5%

Other 57%

(1) Major MSAs defined as the top 100 in the United States by population

BANKING LENDING INVESTING 10

|

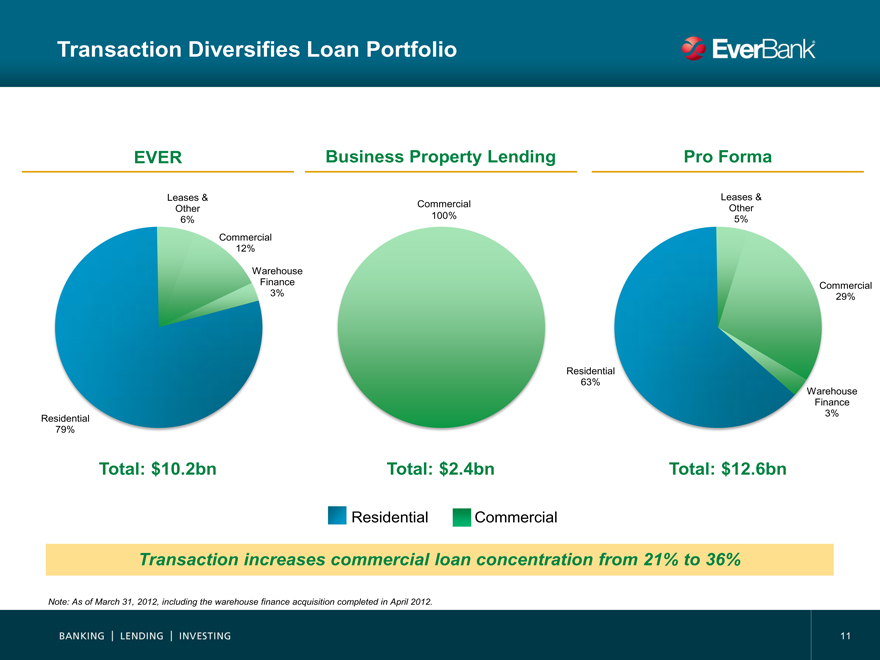

Transaction Diversifies Loan Portfolio

EVER

Leases & Other 6%

Commercial 12%

Warehouse Finance 3%

Residential 79%

Total: $10.2bn

Business Property Lending

Commercial 100%

Total: $2.4bn

Pro Forma

Leases & Other 5%

Commercial 29%

Warehouse Finance 3%

Residential 63%

Total: $12.6bn

Residential

Commercial

Transaction increases commercial loan concentration from 21% to 36%

Note: As of March 31, 2012, including the warehouse finance acquisition completed in April 2012.

BANKING LENDING INVESTING 11

|

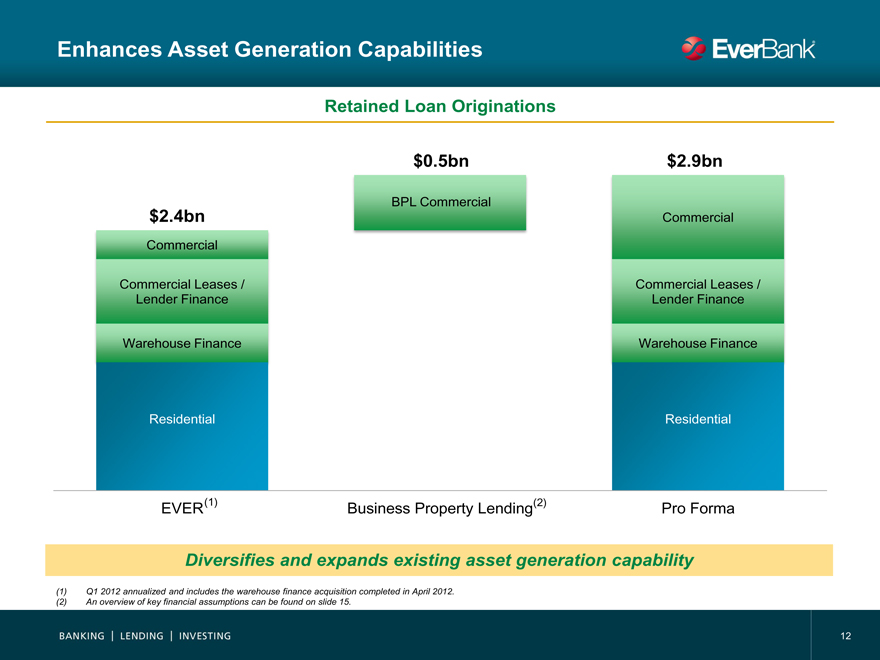

Enhances Asset Generation Capabilities

Retained Loan Originations

$2.4bn

Commercial

Commercial Leases / Lender Finance

Warehouse Finance

Residential

EVER(1)

$0.5bn

BPL Commercial

Business Property Lending(2)

$2.9bn

Commercial

Commercial Leases / Lender Finance

Warehouse Finance

Residential

Pro Forma

Diversifies and expands existing asset generation capability

(1) Q1 2012 annualized and includes the warehouse finance acquisition completed in April 2012. (2) An overview of key financial assumptions can be found on slide 15.

BANKING LENDING INVESTING 12

|

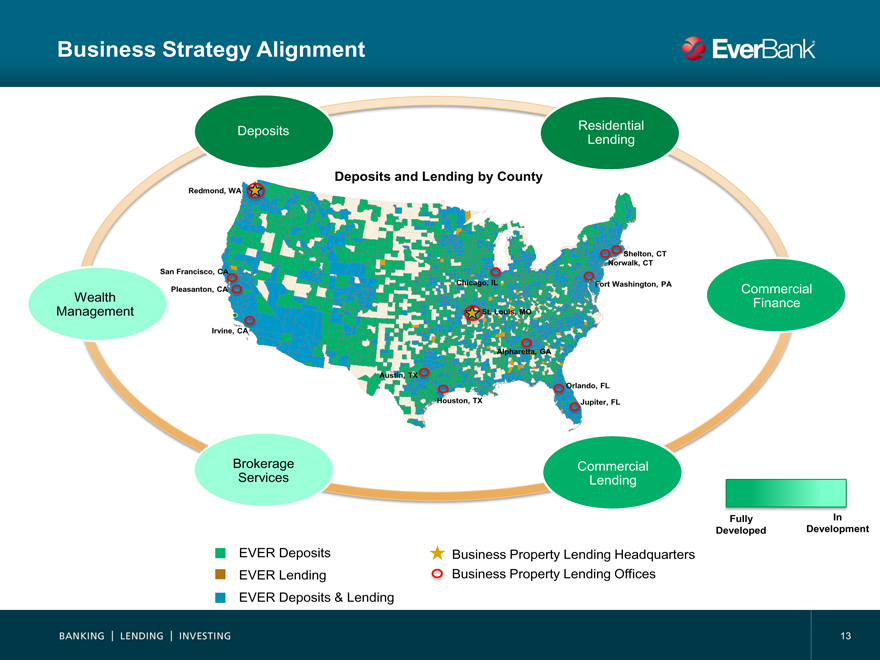

Business Strategy Alignment

Deposits

Residential Lending

Commercial Finance

Commercial Lending

Brokerage Services

Wealth Management

Deposits and Lending by County

Redmond, WA

San Francisco, CA

Pleasanton, CA

Irvine, CA

Austin, TX

Houston, TX

Chicago, IL

St. Louis, MO

Orlando, FL

Jupiter, FL

Fort Washington, PA

Shelton, CT Norwalk, CT

Alpharetta, GA

BANKING LENDING INVESTING 13

|

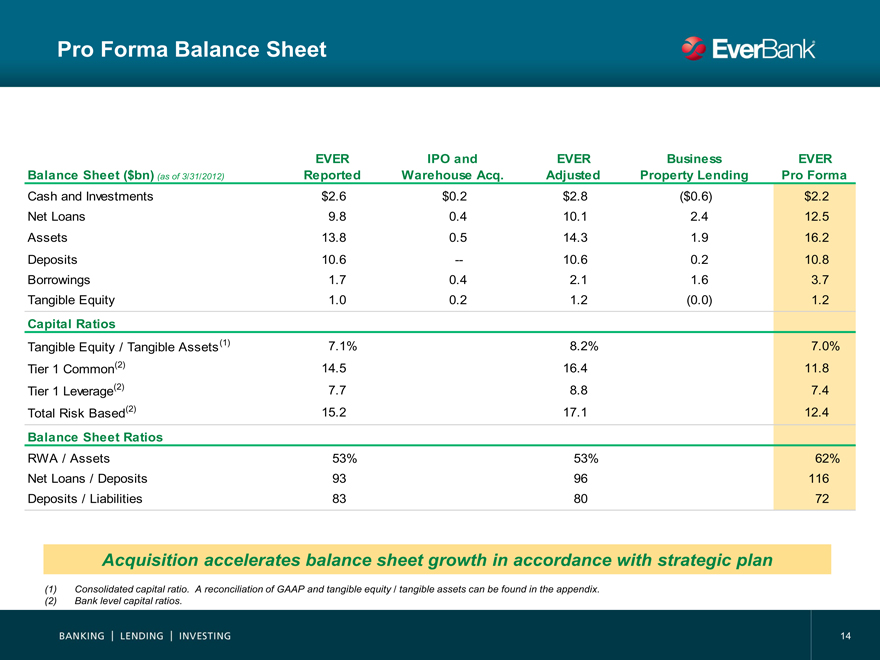

Pro Forma Balance Sheet

EVER IPO and EVER Business EVER

Balance Sheet ($bn) (as of 3/31/2012) Reported Warehouse Acq. Adjusted Property Lending Pro Forma

Cash and Investments $2.6 $0.2 $2.8($0.6) $2.2

Net Loans 9.8 0.4 10.1 2.4 12.5

Assets 13.8 0.5 14.3 1.9 16.2

Deposits 10.6 — 10.6 0.2 10.8

Borrowings 1.7 0.4 2.1 1.6 3.7

Tangible Equity 1.0 0.2 1.2(0.0) 1.2

Capital Ratios

Tangible Equity / Tangible Assets (1) 7.1% 8.2% 7.0%

Tier 1 Common(2) 14.5 16.4 11.8

Tier 1 Leverage(2) 7.7 8.8 7.4

Total Risk Based(2) 15.2 17.1 12.4

Balance Sheet Ratios

RWA / Assets 53% 53% 62%

Net Loans / Deposits 93 96 116

Deposits / Liabilities 83 80 72

Acquisition accelerates balance sheet growth in accordance with strategic plan

(1) Consolidated capital ratio. A reconciliation of GAAP and tangible equity / tangible assets can be found in the appendix. (2) Bank level capital ratios.

BANKING LENDING INVESTING 14

|

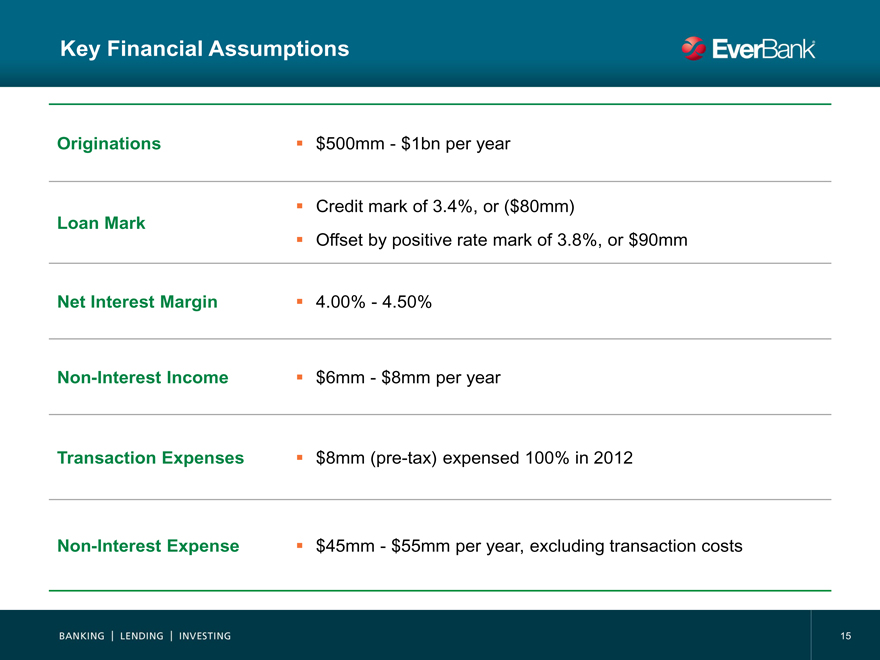

Key Financial Assumptions

Originations

$500mm—$1bn per year

Loan Mark

Credit mark of 3.4%, or ($80mm)

Offset by positive rate mark of 3.8%, or $90mm

Net Interest Margin

4.00%—4.50%

Non-Interest Income

$6mm—$8mm per year

Transaction Expenses

$8mm (pre-tax) expensed 100% in 2012

Non-Interest Expense

$45mm—$55mm per year, excluding transaction costs

BANKING LENDING INVESTING 15

|

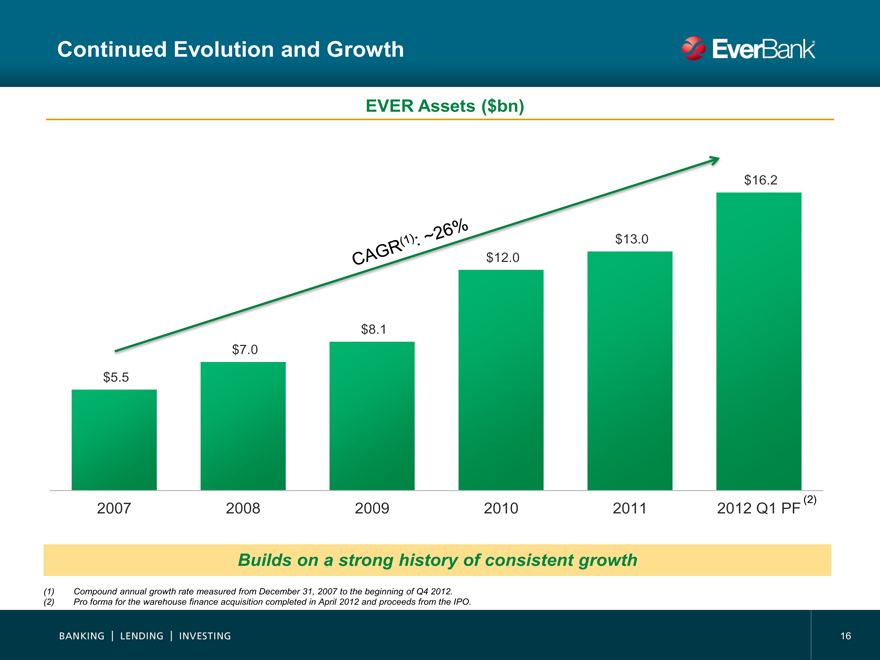

Continued Evolution and Growth

EVER Assets ($bn)

CAGR (1) :~26%

$5.5

$7.0

$8.1

$12.0

$13.0

$16.2

(2)

2007 2008 2009 2010 2011 2012 Q1 PF

Builds on a strong history of consistent growth

(1) Compound annual growth rate measured from December 31, 2007 to the beginning of Q4 2012. (2) Pro forma for the warehouse finance acquisition completed in April 2012 and proceeds from the IPO.

BANKING LENDING INVESTING 16

|

Appendix

BANKING LENDING INVESTING

|

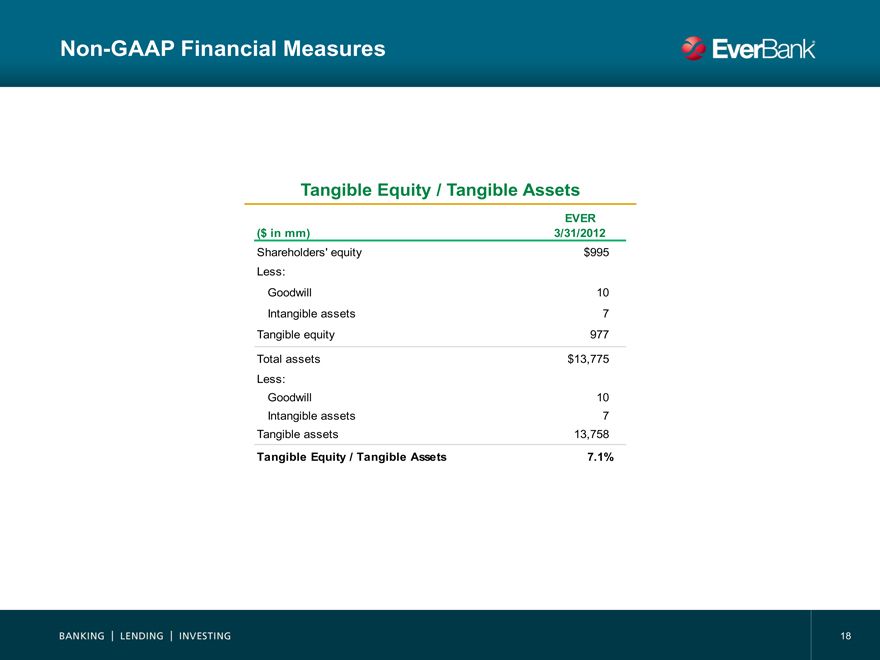

Non-GAAP Financial Measures

Tangible Equity / Tangible Assets

EVER

($ in mm) 3/31/2012

Shareholders’ equity $995

Less:

Goodwill 10

Intangible assets 7

Tangible equity 977

Total assets $13,775

Less:

Goodwill 10

Intangible assets 7

Tangible assets 13,758

Tangible Equity / Tangible Assets 7.1%

BANKING LENDING INVESTING 18