Exhibit 99.3

2nd Quarter Earnings Supplement July 26, 2012

Disclaimer

THIS PRESENTATION HAS BEEN PREPARED BY EVERBANK FINANCIAL CORP (“EVERBANK” OR THE “COMPANY”) SOLELY FOR INFORMATIONAL PURPOSES BASED ON ITS OWN INFORMATION, AS WELL AS INFORMATION FROM PUBLIC SOURCES. THIS PRESENTATION HAS BEEN PREPARED TO ASSIST INTERESTED PARTIES IN MAKING THEIR OWN EVALUATION OF EVERBANK AND DOES NOT PURPORT TO CONTAIN ALL OF THE

INFORMATION THAT MAY BE RELEVANT. IN ALL CASES, INTERESTED PARTIES SHOULD CONDUCT THEIR OWN INVESTIGATION AND ANALYSIS OF EVERBANK AND THE DATA SET FORTH IN THIS PRESENTATION AND OTHER INFORMATION PROVIDED BY OR ON BEHALF OF EVERBANK.

EXCEPT AS OTHERWISE INDICATED, THIS PRESENTATION SPEAKS AS OF THE DATE HEREOF. THE DELIVERY OF THIS PRESENTATION SHALL NOT, UNDER ANY CIRCUMSTANCES, CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY AFTER THE DATE HEREOF.

CERTAIN OF THE INFORMATION CONTAINED HEREIN MAY BE DERIVED FROM INFORMATION PROVIDED BY INDUSTRY SOURCES. EVERBANK BELIEVES THAT SUCH INFORMATION IS ACCURATE AND THAT THE SOURCES FROM WHICH IT HAS BEEN OBTAINED ARE RELIABLE. EVERBANK CANNOT GUARANTEE THE ACCURACY OF SUCH INFORMATION, HOWEVER, AND HAS NOT INDEPENDENTLY VERIFIED SUCH INFORMATION. THIS PRESENTATION MAY CONTAIN CERTAIN FORWARD-LOOKING STATEMENTS AS DEFINED IN THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995. WORDS SUCH AS “OUTLOOK,” “BELIEVES,” “EXPECTS,” “POTENTIAL,” “CONTINUES,” “MAY,” “WILL,” “COULD,” “SHOULD,” “SEEKS,” “APPROXIMATELY,” “PREDICTS,” “INTENDS,” “PLANS,” “ESTIMATES,” “ANTICIPATES” OR THE NEGATIVE VERSION OF THOSE WORDS OR OTHER COMPARABLE WORDS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS BUT ARE NOT THE EXCLUSIVE MEANS OF IDENTIFYING SUCH STATEMENTS. THESE FORWARD-LOOKING STATEMENTS ARE NOT HISTORICAL FACTS, AND ARE BASED ON CURRENT EXPECTATIONS, ESTIMATES AND PROJECTIONS ABOUT THE COMPANY’S INDUSTRY, MANAGEMENT’S BELIEFS AND CERTAIN ASSUMPTIONS MADE BY

MANAGEMENT, MANY OF WHICH, BY THEIR NATURE, ARE INHERENTLY UNCERTAIN AND BEYOND THE COMPANY’S CONTROL. ACCORDINGLY, YOU ARE CAUTIONED THAT ANY SUCH FORWARD-LOOKING STATEMENTS ARE NOT GUARANTEES OF FUTURE PERFORMANCE AND ARE SUBJECT TO CERTAIN RISKS, UNCERTAINTIES AND ASSUMPTIONS THAT ARE DIFFICULT TO PREDICT. ALTHOUGH THE COMPANY BELIEVES THAT THE

EXPECTATIONS REFLECTED IN SUCH FORWARD-LOOKING STATEMENTS ARE REASONABLE AS OF THE DATE MADE, EXPECTATIONS MAY PROVE TO HAVE BEEN MATERIALLY DIFFERENT FROM THE RESULTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. UNLESS OTHERWISE REQUIRED BY LAW, EVERBANK ALSO DISCLAIMS ANY OBLIGATION TO UPDATE ITS VIEW OF ANY SUCH RISKS OR UNCERTAINTIES OR TO ANNOUNCE PUBLICLY THE RESULT OF ANY REVISIONS TO THE FORWARD-LOOKING STATEMENTS MADE IN THIS PRESENTATION. INTERESTED PARTIES SHOULD NOT PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENT AND SHOULD CONSIDER THE UNCERTAINTIES AND RISKS DISCUSSED UNDER ITEM 1A. “RISK FACTORS” OF EVERBANK’S QUARTERLY REPORT ON FORM 10-Q AND IN ANY OF EVERBANK’S

SUBSEQUENT FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION.

2 |

|

Key Highlights – 2Q12

Earnings per share growth

Adjusted EPS of $0.33, up 18% linked quarter (LQ) GAAP EPS of $0.09, up 13% LQ

Increased adjusted ROAE and ROAA

Adjusted ROAE of 13.4%, up 235bps LQ Adjusted ROAA of 1.01%, up 18bps LQ

Stable NIM

Net interest margin was 3.86%, down 11bps LQ Core net interest margin was 3.53%, up 1bp LQ

Strong balance sheet growth

$714mm retained organic asset generation Total loans up $1.1bn, or 11%, LQ to $10.9bn Deposits up $0.3bn, or 2%, LQ to $10.8bn

Solid capital ratios

TCE / TA: 7.8%

Tier 1 leverage (bank): 8.3% Total risk-based (bank): 15.8%

Improved credit quality

Adjusted non-performing assets were 1.46% of total assets, down 17bps LQ Net charge-offs were 0.34% of average loans held for investment, down 31bps LQ

Execution of strategic goals

Closed acquisition of warehouse finance business from MetLife Completed Initial Public Offering

Executed definitive agreements to acquire Business Property Lending from GE Capital

Note: A reconciliation of non-GAAP financial measures can be found in the appendix.

3 |

|

Balance Sheet Overview

End of period loans: $10.9bn, up $1.1bn, or 11%, LQ and $3.3bn, or

44%, YoY

Loans Loans held for sale (HFS) increased $0.6bn, or 26%, and

Loans held for investment (HFI) increased $0.5bn, or 6%, LQ

Securities Securities decreased $53.9mm, or 2%, LQ to $2.2bn

Total deposits increased to $10.8bn, up $250.8mm, or 2%, LQ and

Deposits $867.3mm, or 9%, YoY

Borrowings Balances up $797mm, or 47%, LQ reflecting an increase in FHLB

advances to support recent balance sheet growth

Capital Completed Initial Public Offering in May with net proceeds of ~$198mm

4 |

|

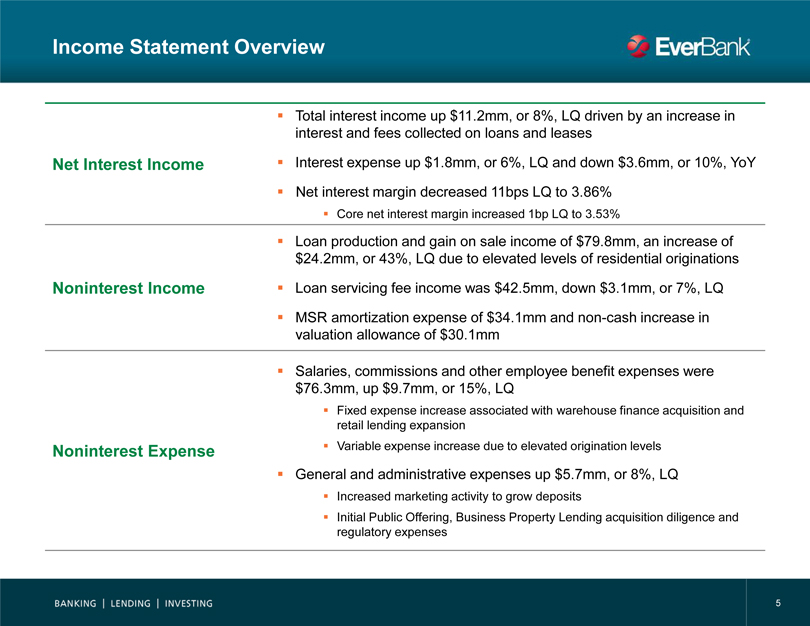

Income Statement Overview

Total interest income up $11.2mm, or 8%, LQ driven by an increase in

interest and fees collected on loans and leases

Net Interest Income Interest expense up $1.8mm, or 6%, LQ and down $3.6mm, or 10%, YoY

Net interest margin decreased 11bps LQ to 3.86%

Core net interest margin increased 1bp LQ to 3.53%

Loan production and gain on sale income of $79.8mm, an increase of

$24.2mm, or 43%, LQ due to elevated levels of residential originations

Noninterest Income Loan servicing fee income was $42.5mm, down $3.1mm, or 7%, LQ

MSR amortization expense of $34.1mm and non-cash increase in

valuation allowance of $30.1mm

Salaries, commissions and other employee benefit expenses were

$76.3mm, up $9.7mm, or 15%, LQ

Fixed expense increase associated with warehouse finance acquisition and retail

lending expansion

Noninterest Expense Variable expense increase due to elevated origination levels

General and administrative expenses up $5.7mm, or 8%, LQ

Increased marketing activity to grow deposits

Initial Public Offering, Business Property Lending acquisition diligence and regulatory

expenses

5 |

|

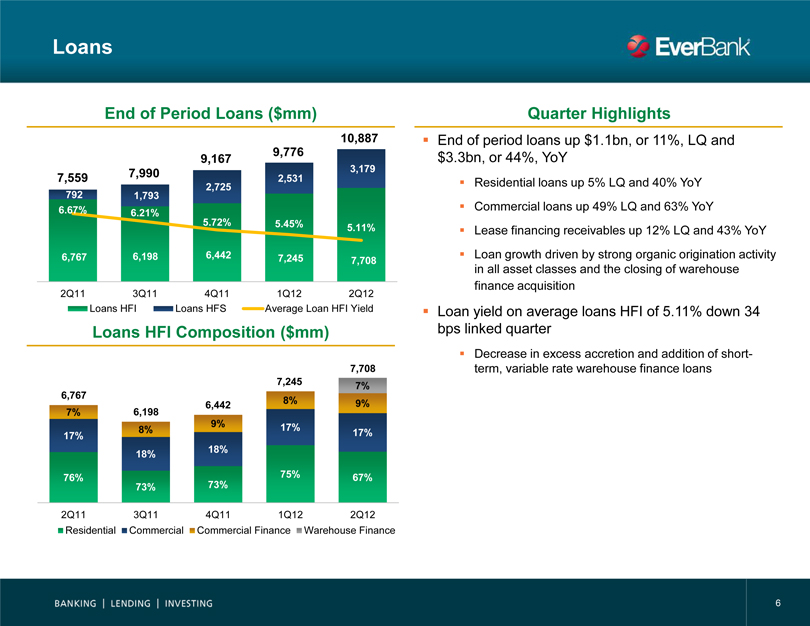

Loans

End of Period Loans ($mm)

10,887

9,167 9,776

7,990 3,179

7,559 2,531

2,725

792 1,793

6.67% 6.21%

5.72% 5.45% 5.11%

6,767 6,198 6,442 7,245 7,708

2Q11 3Q11 4Q11 1Q12 2Q12

Loans HFI Loans HFS Average Loan HFI Yield

Loans HFI Composition ($mm)

7,708

7,245 7%

6,767 6,442 8% 9%

7% 6,198

9% 17%

17% 8% 17%

18% 18%

76% 75% 67%

73% 73%

2Q11 3Q11 4Q11 1Q12 2Q12

Residential Commercial Commercial Finance Warehouse Finance

Quarter Highlights

End of period loans up $1.1bn, or 11%, LQ and $3.3bn, or 44%, YoY

Residential loans up 5% LQ and 40% YoY

Commercial loans up 49% LQ and 63% YoY

Lease financing receivables up 12% LQ and 43% YoY

Loan growth driven by strong organic origination activity in all asset classes and the closing of warehouse finance acquisition

Loan yield on average loans HFI of 5.11% down 34 bps linked quarter

Decrease in excess accretion and addition of short-term, variable rate warehouse finance loans

6 |

|

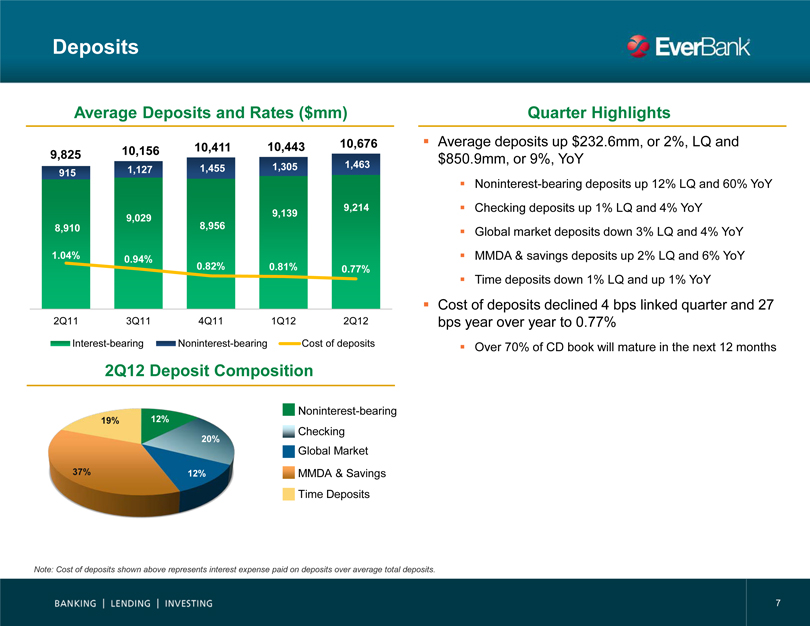

Deposits

Average Deposits and Rates ($mm)

9,825 10,156 10,411 10,443 10,676

915 1,127 1,455 1,305 1,463

9,214

9,029 9,139

8,910 8,956

1.04% 0.94%

0.82% 0.81% 0.77%

2Q11 3Q11 4Q11 1Q12 2Q12

Interest-bearing Noninterest-bearing Cost of deposits

2Q12 Deposit Composition

Noninterest-bearing

19% 12%

Checking

20%

Global Market

37% 12% MMDA & Savings

Time Deposits

Note: Cost of deposits shown above represents interest expense paid on deposits over average total deposits.

Quarter Highlights

Average deposits up $232.6mm, or 2%, LQ and $850.9mm, or 9%, YoY

Noninterest-bearing deposits up 12% LQ and 60% YoY

Checking deposits up 1% LQ and 4% YoY

Global market deposits down 3% LQ and 4% YoY

MMDA & savings deposits up 2% LQ and 6% YoY

Time deposits down 1% LQ and up 1% YoY

Cost of deposits declined 4 bps linked quarter and 27 bps year over year to 0.77%

Over 70% of CD book will mature in the next 12 months

7 |

|

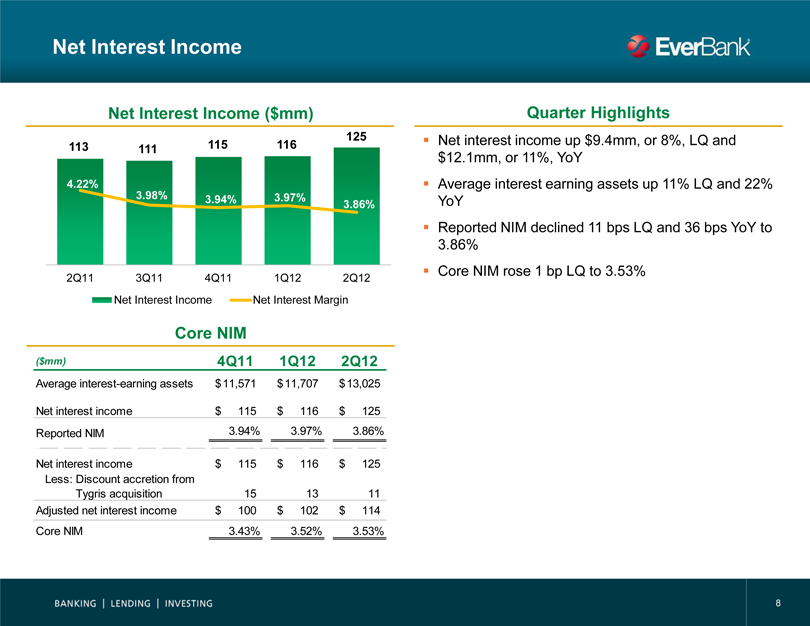

Net Interest Income

Net Interest Income ($mm)

125

113 111 115 116

4.22%

3.98% 3.94% 3.97% 3.86%

2Q11 3Q11 4Q11 1Q12 2Q12

Net Interest Income Net Interest Margin

Core NIM

($mm) 4Q11 1Q12 2Q12

Average interest-earning assets $ 11,571 $ 11,707 $ 13,025

Net interest income $ 115 $ 116 $ 125

Reported NIM 3.94% 3.97% 3.86%

Net interest income $ 115 $ 116 $ 125

Less: Discount accretion from

Tygris acquisition 15 13 11

Adjusted net interest income $ 100 $ 102 $ 114

Core NIM 3.43% 3.52% 3.53%

Quarter Highlights

Net interest income up $9.4mm, or 8%, LQ and $12.1mm, or 11%, YoY

Average interest earning assets up 11% LQ and 22% YoY

Reported NIM declined 11 bps LQ and 36 bps YoY to 3.86%

Core NIM rose 1 bp LQ to 3.53%

8 |

|

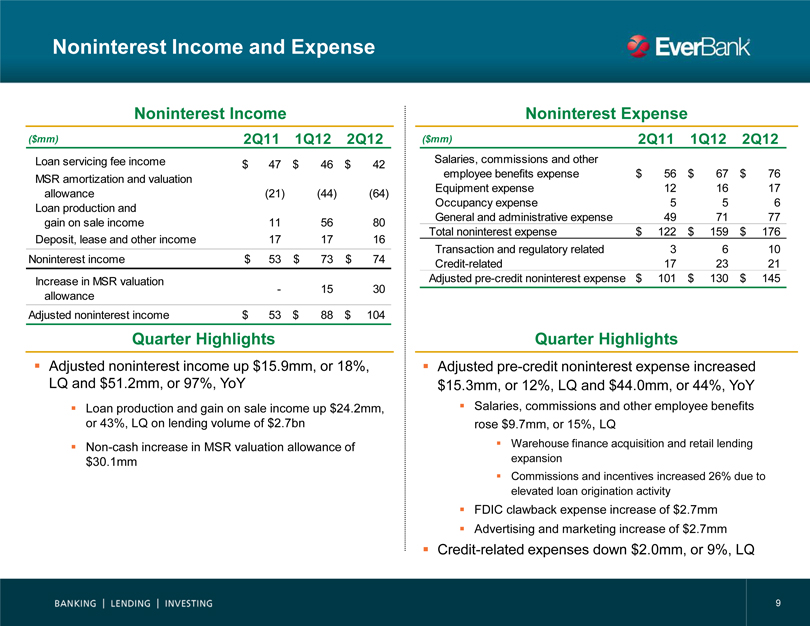

Noninterest Income and Expense

Noninterest Income

($mm) 2Q11 1Q12 2Q12

Loan servicing fee income $ 47 $ 46 $ 42

MSR amortization and valuation

allowance (21) (44) (64)

Loan production and

gain on sale income 11 56 80

Deposit, lease and other income 17 17 16

Noninterest income $ 53 $ 73 $ 74

Increase in MSR valuation

allowance - 15 30

Adjusted noninterest income $ 53 $ 88 $ 104

Quarter Highlights

Adjusted noninterest income up $15.9mm, or 18%,

LQ and $51.2mm, or 97%, YoY

Loan production and gain on sale income up $24.2mm,

or 43%, LQ on lending volume of $2.7bn

Non-cash increase in MSR valuation allowance of

$30.1mm

Noninterest Expense

($mm) 2Q11 1Q12 2Q12

Salaries, commissions and other

employee benefits expense $ 56 $ 67 $ 76

Equipment expense 12 16 17

Occupancy expense 5 5 6

General and administrative expense 49 71 77

Total noninterest expense $ 122 $ 159 $ 176

Transaction and regulatory related 3 6 10

Credit-related 17 23 21

Adjusted pre-credit noninterest expense $ 101 $ 130 $ 145

Quarter Highlights

Adjusted pre-credit noninterest expense increased

$15.3mm, or 12%, LQ and $44.0mm, or 44%, YoY

Salaries, commissions and other employee benefits

rose $9.7mm, or 15%, LQ

Warehouse finance acquisition and retail lending

expansion

Commissions and incentives increased 26% due to

elevated loan origination activity

FDIC clawback expense increase of $2.7mm

Advertising and marketing increase of $2.7mm

Credit-related expenses down $2.0mm, or 9%, LQ

9

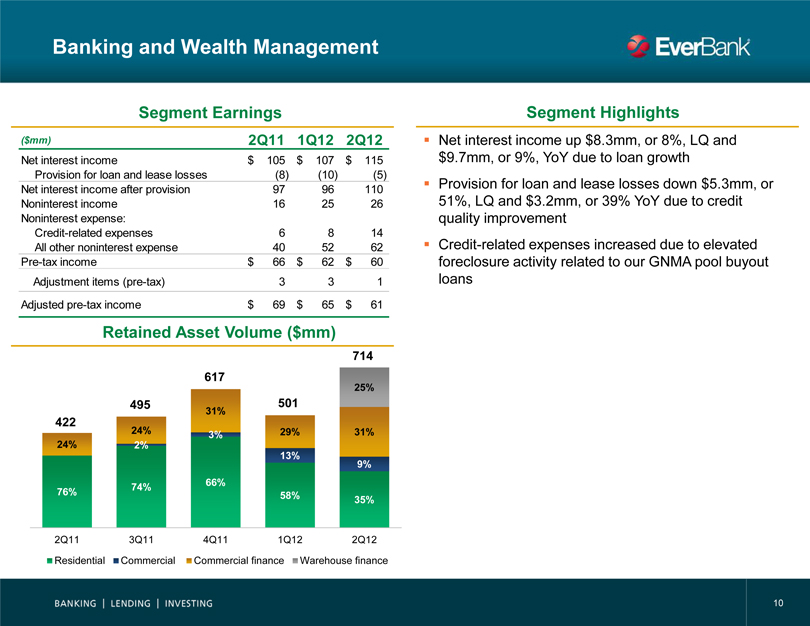

Banking and Wealth Management

Segment Earnings

($mm) 2Q11 1Q12 2Q12

Net interest income $ 105 $ 107 $ 115

Provision for loan and lease losses (8) (10) (5)

Net interest income after provision 97 96 110

Noninterest income 16 25 26

Noninterest expense:

Credit-related expenses 6 8 14

All other noninterest expense 40 52 62

Pre-tax income $ 66 $ 62 $ 60

Adjustment items (pre-tax) 3 3 1

Adjusted pre-tax income $ 69 $ 65 $ 61

Retained Asset Volume ($mm)

714

617

25%

495 501

31%

422

24% 3% 29% 31%

24% 2%

13%

9%

74% 66%

76% 58%

35%

2Q11 3Q11 4Q11 1Q12 2Q12

Residential Commercial Commercial finance Warehouse finance

Segment Highlights

Net interest income up $8.3mm, or 8%, LQ and $9.7mm, or 9%, YoY due to loan growth Provision for loan and lease losses down $5.3mm, or 51%, LQ and $3.2mm, or 39% YoY due to credit quality improvement Credit-related expenses increased due to elevated foreclosure activity related to our GNMA pool buyout loans

10

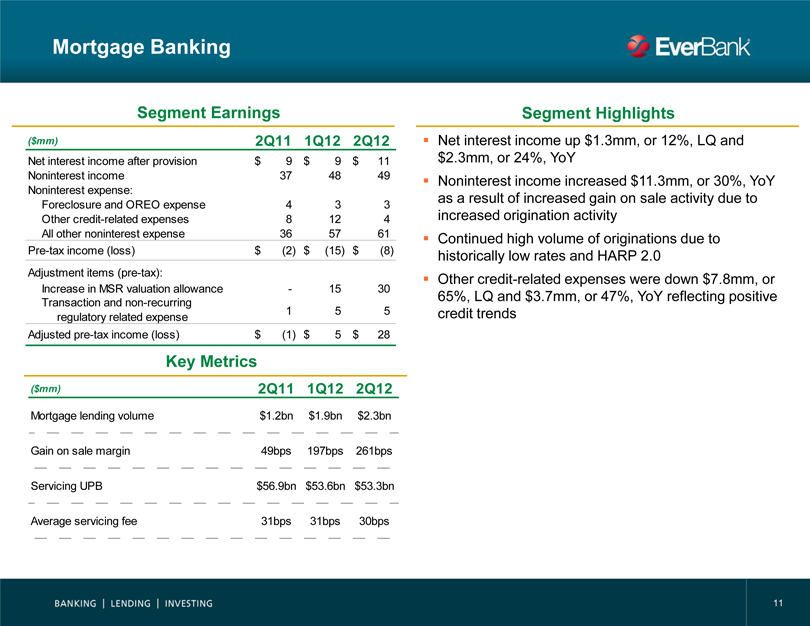

Mortgage Banking

Segment Earnings

($mm) 2Q11 1Q12 2Q12

Net interest income after provision $ 9 $ 9 $ 11

Noninterest income 37 48 49

Noninterest expense:

Foreclosure and OREO expense 4 3 3

Other credit-related expenses 8 12 4

All other noninterest expense 36 57 61

Pre-tax income (loss) $ (2) $ (15) $ (8)

Adjustment items (pre-tax):

Increase in MSR valuation allowance - 15 30

Transaction and non-recurring

regulatory related expense 1 5 5

Adjusted pre-tax income (loss) $ (1) $ 5 $ 28

Key Metrics

($mm) 2Q11 1Q12 2Q12

Mortgage lending volume $1.2bn $1.9bn $2.3bn

Gain on sale margin 49bps 197bps 261bps

Servicing UPB $56.9bn $53.6bn $53.3bn

Average servicing fee 31bps 31bps 30bps

Segment Highlights

Net interest income up $1.3mm, or 12%, LQ and $2.3mm, or 24%, YoY

Noninterest income increased $11.3mm, or 30%, YoY as a result of increased gain on sale activity due to increased origination activity Continued high volume of originations due to historically low rates and HARP 2.0 Other credit-related expenses were down $7.8mm, or 65%, LQ and $3.7mm, or 47%, YoY reflecting positive credit trends

11

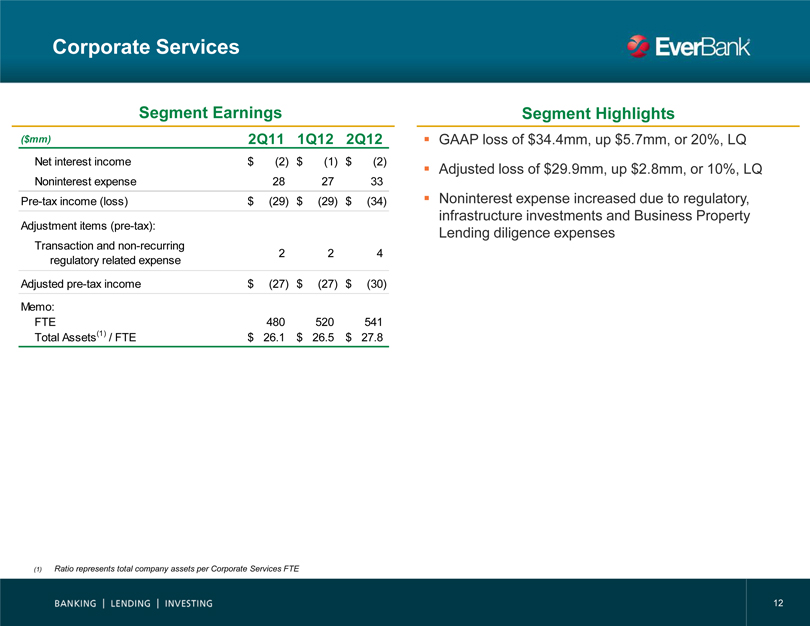

Corporate Services

Segment Earnings

($mm) 2Q11 1Q12 2Q12

Net interest income $ (2) $ (1) $ (2)

Noninterest expense 28 27 33

Pre-tax income (loss) $ (29) $ (29) $ (34)

Adjustment items (pre-tax):

Transaction and non-recurring

regulatory related expense 2 2 4

Adjusted pre-tax income $ (27) $ (27) $ (30)

Memo:

FTE 480 520 541

Total Assets(1) / FTE $ 26.1 $ 26.5 $ 27.8

Segment Highlights

GAAP loss of $34.4mm, up $5.7mm, or 20%, LQ

Adjusted loss of $29.9mm, up $2.8mm, or 10%, LQ

Noninterest expense increased due to regulatory, infrastructure investments and Business Property Lending diligence expenses

(1) Ratio represents total company assets per Corporate Services FTE

12

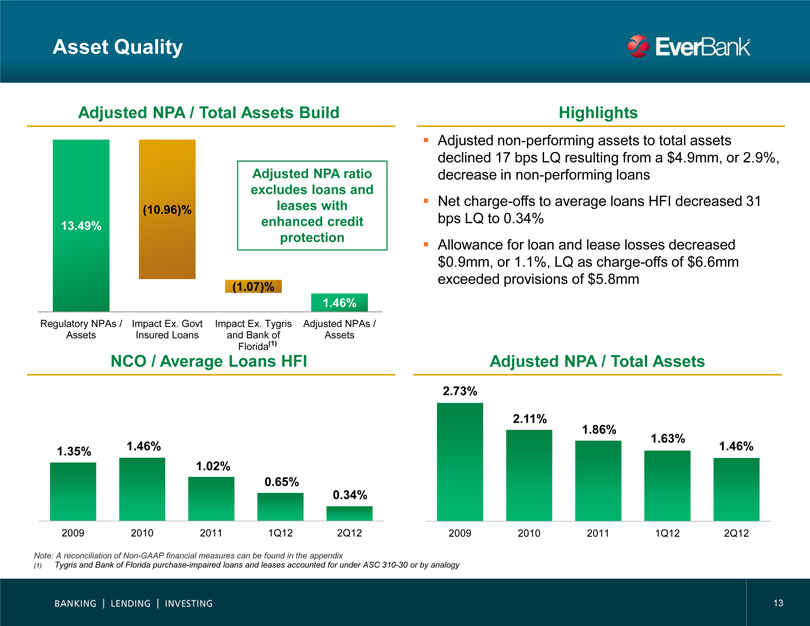

Asset Quality

Adjusted NPA / Total Assets Build

Adjusted NPA ratio

excludes loans and

leases with

enhanced credit

protection

(1.07)% (10.96)% 13.49%

1.46%

Regulatory NPAs / Impact Ex. Govt Impact Ex. Tygris Adjusted NPAs /

Assets Insured Loans and Bank of Assets

Florida(1)

NCO / Average Loans HFI

1.35% 1.46%

1.02%

0.65%

0.34%

2009 2010 2011 1Q12 2Q12

Highlights

Adjusted non-performing assets to total assets declined 17 bps LQ resulting from a $4.9mm, or 2.9%, decrease in non-performing loans Net charge-offs to average loans HFI decreased 31 bps LQ to 0.34% Allowance for loan and lease losses decreased $0.9mm, or 1.1%, LQ as charge-offs of $6.6mm exceeded provisions of $5.8mm

Adjusted NPA / Total Assets

2.73%

2.11%

1.86%

1.63% 1.46%

2009 2010 2011 1Q12 2Q12

Note: A reconciliation of Non-GAAP financial measures can be found in the appendix

(1) |

| Tygris and Bank of Florida purchase-impaired loans and leases accounted for under ASC 310-30 or by analogy |

13

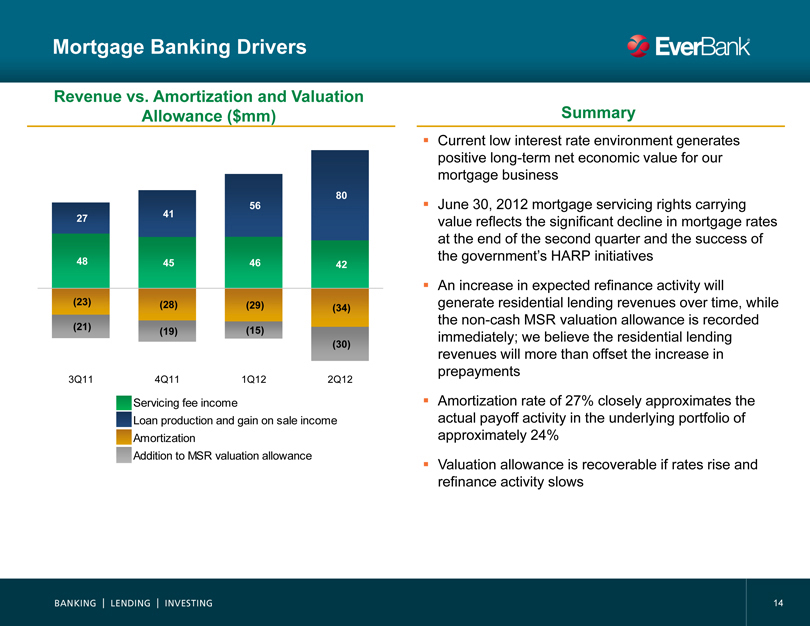

Mortgage Banking Drivers

Revenue vs. Amortization and Valuation

Allowance ($mm)

80

56

27 41

48 45 46 42

(23) |

| (28) (29) (34) |

(21) |

| (19) (15) |

(30) |

|

3Q11 4Q11 1Q12 2Q12

Servicing fee income

Loan production and gain on sale income

Amortization

Addition to MSR valuation allowance

Summary

Current low interest rate environment generates positive long-term net economic value for our mortgage business

June 30, 2012 mortgage servicing rights reflect the significant decline in mortgage rates at the end of the second quarter and the success of the government’s HARP initiatives

Increase in expected refinance activity will generate residential lending profits over time, while the non-cash MSR valuation allowance is recorded immediately

Amortization rate of 27% closely approximates the actual payoff activity in the underlying portfolio of approximately 24%

Valuation allowance is recoverable if rates rise and refinance activity slows

14

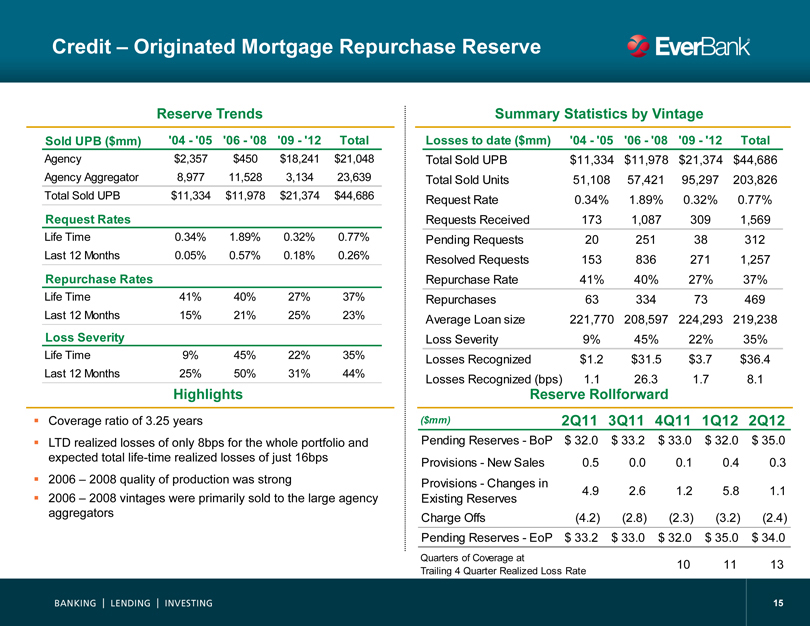

Credit – Originated Mortgage Repurchase Reserve

Reserve Trends

Sold UPB ($mm) ‘04—‘05 ‘06—‘08 ‘09—‘12 Total

Agency $2,357 $450 $18,241 $21,048

Agency Aggregator 8,977 11,528 3,134 23,639

Total Sold UPB $11,334 $11,978 $21,374 $44,686

Request Rates

Life Time 0.34% 1.89% 0.32% 0.77%

Last 12 Months 0.05% 0.57% 0.18% 0.26%

Repurchase Rates

Life Time 41% 40% 27% 37%

Last 12 Months 15% 21% 25% 23%

Loss Severity

Life Time 9% 45% 22% 35%

Last 12 Months 25% 50% 31% 44%

Highlights

Coverage ratio of 3.25 years

LTD realized losses of only 8bps for the whole portfolio and

expected total life-time realized losses of just 16bps

2006 – 2008 quality of production was strong

2006 – 2008 vintages were primarily sold to the large agency

aggregators

Summary Statistics by Vintage

Losses to date ($mm) ‘04—‘05 ‘06—‘08 ‘09—‘12 Total

Total Sold UPB $11,334 $11,978 $21,374 $44,686

Request Rate 0.34% 1.89% 0.32% 0.77%

Requests Received 173 1,087 309 1,569

Pending Requests 20 251 38 312

Resolved Requests 153 836 271 1,257

Repurchase Rate 41% 40% 27% 37%

Repurchase Requests 63 334 73 469

Average Loan size 221,770 208,597 224,293 219,238

Loss Severity 9% 45% 22% 35%

Losses Realized $1.2 $31.5 $3.7 $36.4

Losses Realized (bps) 1.1 26.3 1.7 8.1

Reserve Rollforward

($mm) 2Q11 3Q11 4Q11 1Q12 2Q12

Pending Reserves—BoP $ 32.0 $ 33.2 $ 33.0 $ 32.0 $ 35.0

Provisions—New Sales 0.5 0.0 0.1 0.4 0.3

Provisions—Changes in

Existing Reserves 4.9 2.6 1.2 5.8 1.1

Charge Offs (4.2) (2.8) (2.3) (3.2) (2.4)

Pending Reserves—EoP $ 33.2 $ 33.0 $ 32.0 $ 35.0 $ 34.0

Quarters of Coverage at 10 11 13

Trailing 4 Quarter Realized Loss Rate

15

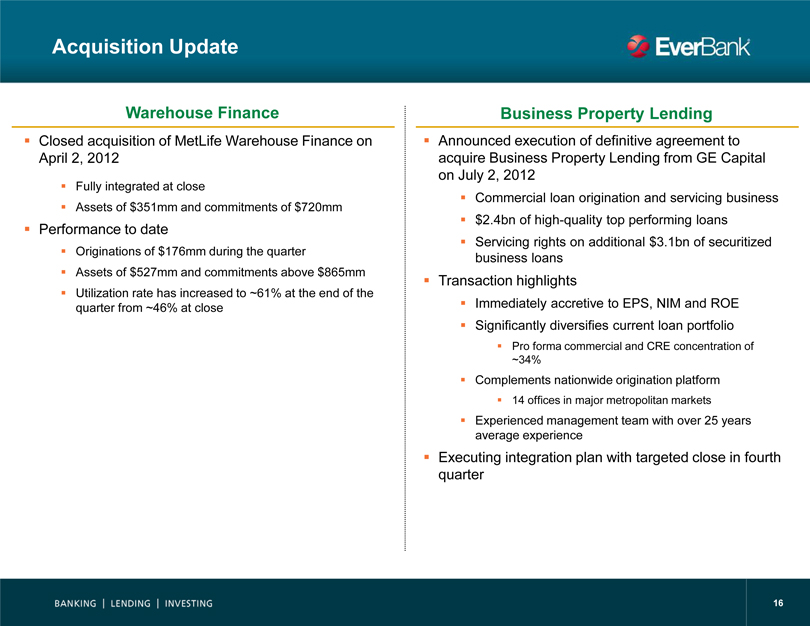

Acquisition Update

Warehouse Finance

Closed acquisition of MetLife Warehouse Finance on April 2, 2012

Fully integrated at close

Assets of $351mm and commitments of $720mm Performance to date Originations of $176mm during the quarter Assets of $527mm and commitments above $865mm Utilization rate has increased to ~61% at the end of the quarter from ~46% at close

Business Property Lending

Announced execution of definitive agreement to acquire Business Property Lending from GE Capital on July 2, 2012 Commercial loan origination and servicing business $2.4bn of high-quality top performing loans Servicing rights on additional $3.1bn of securitized business loans Transaction highlights Immediately accretive to EPS, NIM and ROE

Significantly diversifies current loan portfolio

Pro forma commercial and CRE concentration of ~34% Complements nationwide origination platform 14 offices in major metropolitan markets Experienced management team with over 25 years average experience Executing integration plan with targeted close in fourth quarter

16

Appendix

Non-GAAP Reconciliations

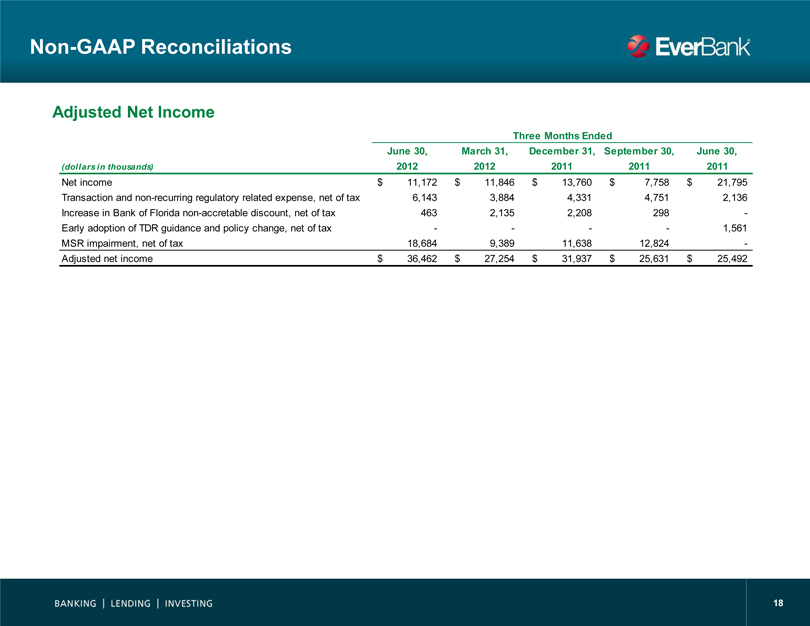

Adjusted Net Income

Three Months Ended

June 30, March 31, December 31, September 30, June 30,

(dollars in thousands) 2012 2012 2011 2011 2011

Net income $ 11,172 $ 11,846 $ 13,760 $ 7,758 $ 21,795

Transaction and non-recurring regulatory related expense, net of tax 6,143 3,884 4,331 4,751 2,136

Increase in Bank of Florida non-accretable discount, net of tax 463 2,135 2,208 298 -

Early adoption of TDR guidance and policy change, net of tax —— — — 1,561

MSR impairment, net of tax 18,684 9,389 11,638 12,824 -

Adjusted net income $ 36,462 $ 27,254 $ 31,937 $ 25,631 $ 25,492

18

Non-GAAP Reconciliations

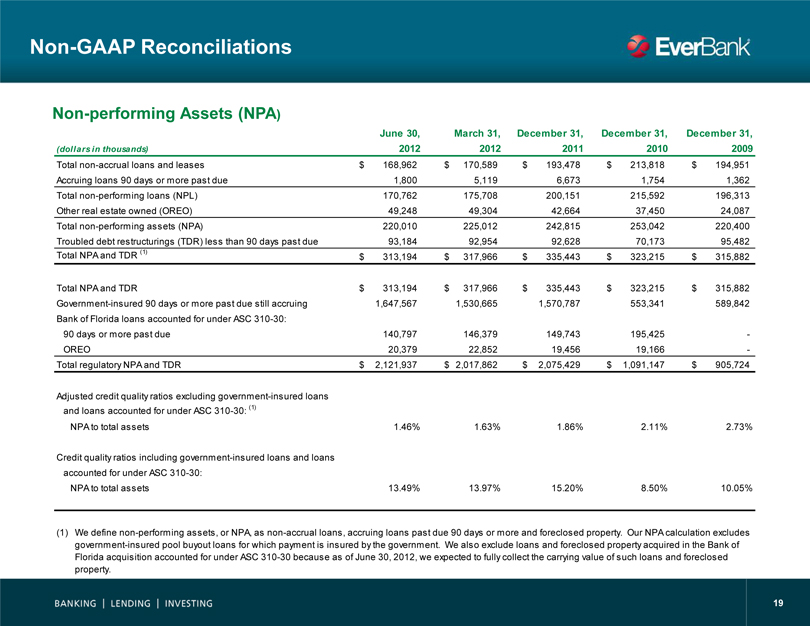

Non-performing Assets (NPA)

June 30, March 31, December 31, December 31, December 31,

(dollars in thousands) 2012 2012 2011 2010 2009

Total non-accrual loans and leases $ 168,962 $ 170,589 $ 193,478 $ 213,818 $ 194,951

Accruing loans 90 days or more past due 1,800 5,119 6,673 1,754 1,362

Total non-performing loans (NPL) 170,762 175,708 200,151 215,592 196,313

Other real estate owned (OREO) 49,248 49,304 42,664 37,450 24,087

Total non-performing assets (NPA) 220,010 225,012 242,815 253,042 220,400

Troubled debt restructurings (TDR) less than 90 days past due 93,184 92,954 92,628 70,173 95,482

Total NPA and TDR (1) $ 313,194 $ 317,966 $ 335,443 $ 323,215 $ 315,882

Total NPA and TDR $ 313,194 $ 317,966 $ 335,443 $ 323,215 $ 315,882

Government-insured 90 days or more past due still accruing 1,647,567 1,530,665 1,570,787 553,341 589,842

Bank of Florida loans accounted for under ASC 310-30:

90 days or more past due 140,797 146,379 149,743 195,425 -

OREO 20,379 22,852 19,456 19,166 -

Total regulatory NPA and TDR $ 2,121,937 $ 2,017,862 $ 2,075,429 $ 1,091,147 $ 905,724

Adjusted credit quality ratios excluding government-insured loans

and loans accounted for under ASC 310-30: (1)

NPA to total assets 1.46% 1.63% 1.86% 2.11% 2.73%

Credit quality ratios including government-insured loans and loans

accounted for under ASC 310-30:

NPA to total assets 13.49% 13.97% 15.20% 8.50% 10.05%

(1) We define non-performing assets, or NPA, as non-accrual loans, accruing loans past due 90 days or more and foreclosed property. Our NPA calculation excludes government-insured pool buyout loans for which payment is insured by the government. We also exclude loans and foreclosed property acquired in the Bank of Florida acquisition accounted for under ASC 310-30 because as of June 30, 2012, we expected to fully collect the carrying value of such loans and foreclosed

property.

19

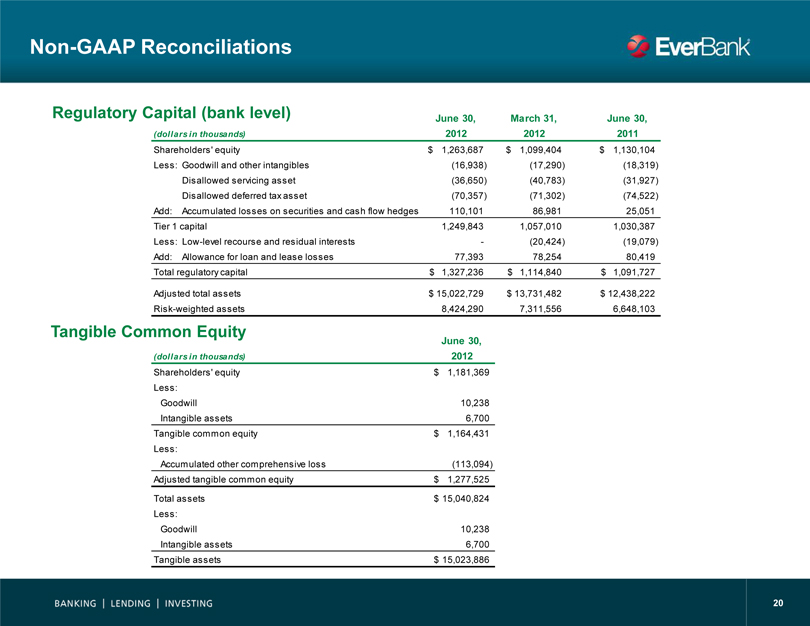

Non-GAAP Reconciliations

Regulatory Capital (bank level) June 30, March 31, June 30,

(dollars in thousands) 2012 2012 2011

Shareholders’ equity $ 1,263,687 $ 1,099,404 $ 1,130,104

Less: Goodwill and other intangibles (16,938) (17,290) (18,319)

Disallowed servicing asset (36,650) (40,783) (31,927)

Disallowed deferred tax asset (70,357) (71,302) (74,522)

Add: Accumulated losses on securities and cash flow hedges 110,101 86,981 25,051

Tier 1 capital 1,249,843 1,057,010 1,030,387

Less: Low-level recourse and residual interests — (20,424) (19,079)

Add: Allowance for loan and lease losses 77,393 78,254 80,419

Total regulatory capital $ 1,327,236 $ 1,114,840 $ 1,091,727

Adjusted total assets $ 15,022,729 $ 13,731,482 $ 12,438,222

Risk-weighted assets 8,424,290 7,311,556 6,648,103

Tangible Common Equity June 30,

(dollars in thousands) 2012

Shareholders’ equity $ 1,181,369

Less:

Goodwill 10,238

Intangible assets 6,700

Tangible common equity $ 1,164,431

Less:

Accumulated other comprehensive loss (113,094)

Adjusted tangible common equity $ 1,277,525

Total assets $ 15,040,824

Less:

Goodwill 10,238

Intangible assets 6,700

Tangible assets $ 15,023,886

20