UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

x Preliminary Information Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

o Definitive Information Statement

SOTON HOLDINGS GROUP, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

o Fee paid previously with preliminary materials.

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

SOTON HOLDINGS GROUP, INC.

180 Madison Ave, Suite 1702

New York, NY 10016

December ___, 2011

To: The Holders of the Common Stock of Soton Holdings Group, Inc.

Re: Action by Written Consent in Lieu of Meeting of Stockholders

This Information Statement is furnished by the Board of Directors of Soton Holdings Group, Inc., a Nevada corporation (the “Company”), to holders of record of the Company’s common stock, $0.001 par value per share, at the close of business on December 16, 2011. The purpose of this Information Statement is to inform the Company’s stockholders of a certain actions taken by the written consent of the holders of a majority of the Company’s common stock, dated as of December 16, 2011. This Information Statement shall be considered the notice required under Section 78.370 of the Nevada Revised Statutes. This Information Statement provides notice that the Board of Directors has recommended, and holders of a majority of the voting power of our outstanding common stock have voted, to approve the following items:

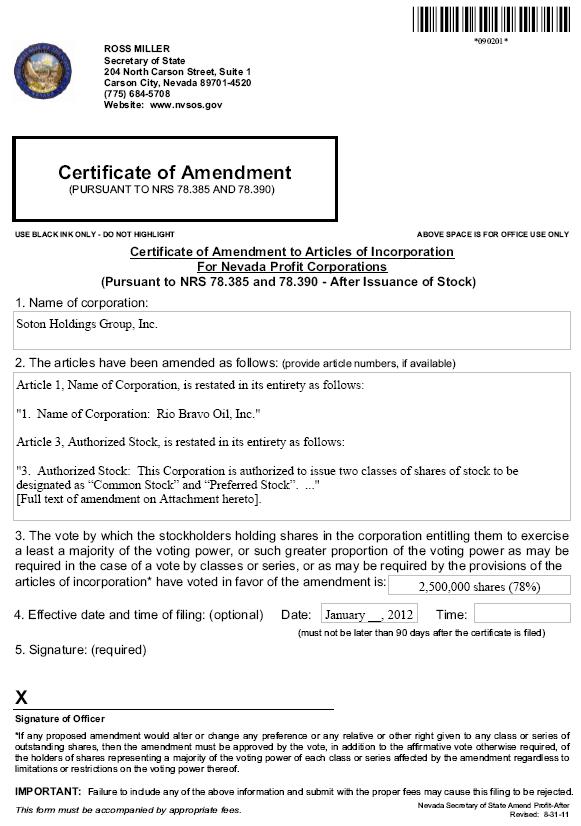

| 1. | To approve an amendment to the Company’s Articles of Incorporation to (a) change the name of the Company from Soton Holdings Group, Inc. to “Rio Bravo Oil, Inc.”, (b) increase the authorized common stock from 75,000,000 shares, par value $0.001, to 120,000,000 shares, par value $0.001, and (c) create a class of preferred stock, consisting of 30,000,000 shares, par value $0.001, the rights, privileges, and preferences of which may be set by the Company’s Board of Directors without further shareholder approval. |

| 2. | Grant the Board of Directors the authority to amend the Company’s Articles of Incorporation in the future for the purpose of effectuating a forward stock split at a ratio between 2-for-1 and 35-for-1 without further approval by the shareholders. |

The above actions taken by the Company’s stockholders will become effective on or about January __, 2012 and are more fully described in the Information Statement accompanying this Notice.

Under the rules of the Securities and Exchange Commission, the above actions cannot become effective until at least 20 days after the accompanying Information Statement has been distributed to the stockholders of the Company.

This is not a notice of a special meeting of stockholders and no stockholder meeting will be held to consider any matter that will be described herein.

By Order of the Board of Directors

Paul Vassilakos, President

December __, 2011

New York, NY

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

INFORMATION STATEMENT

INFORMATION STATEMENT PURSUANT TO SECTION 14C OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

THIS IS NOT A NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS AND NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN. THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT HAVE BEEN APPROVED BY HOLDERS OF A MAJORITY OF OUR COMMON STOCK. WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY. THERE ARE NO DISSENTERS’ RIGHTS WITH RESPECT TO THE ACTIONS DESCRIBED IN THIS INFORMATION STATEMENT.

INTRODUCTION

This Information Statement is being mailed or otherwise furnished to the holders of common stock, $0.001 par value per share (the “Common Stock”) of Soton Holdings Group, Inc., a Nevada corporation (the “Company”) by the Board of Directors to notify them about a certain action that the holders of a majority of the Company’s outstanding Common Stock have taken by written consent, in lieu of a special meeting of the stockholders. The action was taken on December 16, 2011.

Copies of this Information Statement are first being sent on or before December [__], 2011 to the holders of record on December 16, 2011 of the outstanding shares of the Company’s Common Stock.

General Information

Stockholders of the Company owning a majority of the Company’s outstanding Common Stock have approved the following action (the “Action”) by written consent dated December 16, 2011, in lieu of a special meeting of the stockholders:

| 1. | To approve an amendment to the Company’s Articles of Incorporation to (a) change the name of the Company from Soton Holdings Group, Inc. to “Rio Bravo Oil, Inc.”, (b) increase the authorized common stock from 75,000,000 shares, par value $0.001, to 120,000,000 shares, par value $0.001, and (c) create a class of preferred stock, consisting of 30,000,000 shares, par value $0.001, the rights, privileges, and preferences of which may be set by the Company’s Board of Directors without further shareholder approval. |

| 2. | Grant the Board of Directors the authority to amend the Company’s Articles of Incorporation in the future for the purpose of effectuating a forward stock split at a ratio between 2-for-1 and 35-for-1 without further approval by the shareholders. |

The Company has asked brokers and other custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of the common stock held of record by such persons and will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenters’ Right of Appraisal

No dissenters’ or appraisal rights under the Nevada Revised Statutes (“NRS”) are afforded to the Company’s stockholders as a result of the approval of the Action.

The vote which was required to approve the above Actions was the affirmative vote of the holders of a majority of the Company’s voting stock. Each holder of Common Stock is entitled to one (1) vote for each share of Common Stock held.

The record date for purposes of determining the number of outstanding shares of voting stock of the Company, and for determining stockholders entitled to vote, was the close of business on December 16, 2011 (the “Record Date”). As of the Record Date, the Common Stock was the Company’s only issued and outstanding class of voting stock. As of the Record Date, the Company had outstanding 3,175,000 shares of Common Stock. Holders of the Common Stock have no preemptive rights. All outstanding shares are fully paid and nonassessable. The transfer agent for the Common Stock is Island Stock Transfer, 15500 Roosevelt Boulevard, Suite 301, Clearwater, Florida 33760, telephone no.: (727) 289-0069.

Vote Obtained - Section 78.320 Nevada Revised Statutes

NRS 78.320 provides that the written consent of the holders of the outstanding shares of voting stock, having not less than the minimum number of votes which would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted for such a meeting.

In order to eliminate the costs and management time involved in soliciting and obtaining proxies to approve the Action and in order to effectuate the Action as early as possible in order to accomplish the purposes of the Company as hereafter described, the Board of Directors of the Company voted to utilize, and did in fact obtain, the written consent of the holders of a majority of the voting power of the Company. The consenting shareholders own in the aggregate approximately 78% of the outstanding voting stock.

Pursuant to NRS 78.370, the Company is required to provide prompt notice of the taking of the corporate action without a meeting to the stockholders of record who have not consented in writing to such action. This Information Statement is intended to provide such notice.

ACTION ONE

AMENDMENT TO THE COMPANY’S

ARTICLES OF INCORPORATION TO CHANGE

THE NAME OF THE COMPANY, INCREASE THE

AUTHORIZED COMMON STOCK, AND AUTHORIZE PREFERRED STOCK

Name Change

General

On December 16, 2011, the Board of Directors of the Company approved, declared it advisable and in the Company’s best interest, and directed that there be submitted to the holders of a majority of the Company’s common stock for approval, the prospective amendment to the Company’s First Articles of the Company’s Articles of Incorporation to change the name of the Company to Rio Bravo Oil, Inc. (the “Name Change Amendment”). On December 16, 2011, stockholders of the Company owning a majority of the Company’s outstanding voting stock (the “Majority Stockholders”) approved the Name Change Amendment by written consent, in lieu of a special meeting of the stockholders.

The Board of Directors of the Company and the Majority Stockholders believe that it is advisable and in the Company’s best interests to authorize and approve the Name Change Amendment in order to more accurately reflect changes in the Company’s business focus. While the Company is still currently in the wine bottle distribution business it plans to transition into the oil and gas business. Although the Company does not currently have any agreements in place to effect this new business plan, management of the Company believes the name “Rio Bravo Oil, Inc.” will more accurately reflect the Company’s proposed business going forward.

The Name Change Amendment, a copy of which is attached to this Information Statement as Exhibit A, will be filed with the Nevada Secretary of State with an expected effective date of January [__], 2012.

Increase the Authorized Common Stock

General

On December 16, 2011, the Board of Directors of the Company approved, declared it advisable and in the Company’s best interest and directed that there be submitted to the holders of a majority of the Company’s voting stock for approval, the prospective amendment to the Third Article of the Company’s Articles of Incorporation to increase the authorized common stock from 75,000,000 shares, par value $0.001, to 120,000,000 shares, par value $0.001 (the “Increase in Authorized Amendment”). On December 16, 2011, the Majority Stockholders approved the Increase in Authorized Amendment by written consent, in lieu of a special meeting of the stockholders.

Reasons for the Increase in Authorized Amendment

Currently, the Company is authorized to issue 75,000,000 shares of Common Stock. Of the 75,000,000 shares of Common Stock authorized, as of the Record Date, there were 3,175,000 shares of Common Stock issued and outstanding and no shares of Common Stock reserved for issuance upon the exercise of outstanding options, including, without limitation, the benefit plans of the Company. Consequently, the Company has approximately 71,875,000 shares of Common Stock available for general corporate purposes. As noted above, the Company intends to shift its business focus to the oil and gas industry and intends to effect this new business strategy by acquiring existing oil and gas leases and interests. The Company plans on using shares of its common stock as at least a portion of the acquisition price paid for the oil and gas interests it plans on acquiring. Additionally, as noted below, the Company’s Board of Directors are being granted authority to effect a forward stock split in the range of not less than 2-for-1 nor more than 35-for-1, which was approved by a majority of the Company’s shareholders, which, if implemented, could take the Company’s number of outstanding shares of common stock from 3,175,000 to up to 111,125,000.

As a general matter, the Board of Directors does not believe the currently available number of unissued shares of Common Stock is an adequate number of shares to assure that there will be sufficient shares available for issuance in connection with possible future acquisitions, equity and equity-based financings, possible future awards under employee benefit plans, stock dividends, stock splits, and other corporate purposes. Therefore, the Board of Directors and Majority Stockholders approved the increase in authorized shares of Common Stock as a means of providing the Company with the flexibility to act with respect to the issuance of Common Stock or securities exercisable for, or convertible into, Common Stock in circumstances which they believe will advance the interests of the Company and its stockholders without the delay of seeking an amendment to the Certificate of Incorporation at that time.

The Board of Directors is considering, and will continue to consider, various financing options, including the issuance of Common Stock or securities convertible into Common Stock from time to time to raise additional capital necessary to support future growth of the Company. As a result of the Increase in Authorized Amendment, the Board of Directors will have more flexibility to pursue opportunities to engage in possible future capital market transactions involving Common Stock or securities convertible into Common Stock, including, without limitation, public offerings or private placements of such Common Stock or securities convertible into Common Stock.

In addition, the Company’s growth strategy may include the pursuit of selective acquisitions to execute its business plan. The Company could also use the additional Common Stock for potential strategic transactions, including, among other things, acquisitions, spin-offs, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and investments.

Creation of a Class of Preferred Stock

General

On December 16, 2011, the Board of Directors of the Company approved, declared it advisable and in the Company’s best interest and directed that there be submitted to the holders of a majority of the Company’s voting stock for approval, the prospective amendment to the Third Article of the Company’s Articles of Incorporation to create a class of preferred stock, consisting of 30,000,000 shares, par value $0.001, the rights, privileges and preferences of which may be set by the Board of Directors without further shareholder approval (the “Creation of Preferred Stock Amendment”). On December 16, 2011, the Majority Stockholders approved the Creation of Preferred Stock Amendment by written consent, in lieu of a special meeting of the stockholders.

Reasons for the Creation of Preferred Stock Amendment

Currently, the Company is not authorized to issue preferred stock. Even after giving effect to the Increase in Authorized Amendment, the Board of Directors does not believe the available number of unissued shares of Common Stock is an adequate number of shares to assure that there will be sufficient shares available for issuance in connection with possible future acquisitions, equity and equity-based financings, possible future awards under employee benefit plans, stock dividends, stock splits, and other corporate purposes. Therefore, the Board of Directors and Majority Stockholders approved, in addition to the Increase in Authorized Amendment, the creation of a class of preferred stock as a means of providing the Company with the flexibility to act with respect to the issuance preferred stock in circumstances which they believe will advance the interests of the Company and its stockholders without the delay of seeking an amendment to the Certificate of Incorporation at that time.

If the Board of Directors elects to utilize preferred stock, it will approve a Certificate of Designations identifying the series (i.e. Series A, Series B., etc.) and setting forth the exact terms thereof. The terms of any series of preferred stock and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

The Board of Directors is considering, and will continue to consider, various financing options, including the issuance of Common Stock or securities convertible into Common Stock from time to time to raise additional capital necessary to support future growth of the Company. As a result of the Creation of Preferred Stock Amendment, the Board of Directors will have more flexibility to pursue opportunities to engage in possible future capital market transactions involving Common Stock or securities convertible into Common Stock, including, without limitation, public offerings or private placements of such Common Stock or securities convertible into Common Stock.

In addition, the Company’s growth strategy may include the pursuit of selective acquisitions to execute its business plan. The Company could also use the newly created preferred stock for potential strategic transactions, including, among other things, acquisitions, spin-offs, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and investments.

Additional Information

Ability of the Board to Issue Stock; Certain Issuances Requiring Shareholder Approval

The additional shares of Common Stock authorized by the Increase in Authorized Amendment, and the shares of preferred stock authorized by the Creation of Preferred Stock Amendment, may be issued for any proper purpose from time to time upon authorization by the Board of Directors, without further approval by the stockholders unless required by applicable law, rule or regulation, including, without limitation, rules of any trading market that the Company’s Common Stock may trade on at that time. Shares may be issued for such consideration as the Board of Directors may determine and as may be permitted by applicable law.

Interest of the Directors and Officers of the Company in the Increase in Authorized Amendment and the Creation of Preferred Stock Amendment

The current officers and directors of the Company and the officers and directors of the Company when the Increase in Authorized Amendment and the Creation of Preferred Stock Amendment were approved by the Board of Directors do not have any substantial interest, direct or indirect, in the approval of the amendments, other than as stockholders of the Company.

Effects of the Increase in Authorized Amendment and the Creation of Preferred Stock Amendment

Neither the increase in authorized shares of Common Stock, nor the creation of a series of preferred stock, was approved as a means of preventing or dissuading a change in control or takeover of the Company. However, use of these shares for such a purpose is possible. Authorized but unissued or unreserved shares of either common or preferred stock, for example, could be issued in an effort to dilute the stock ownership and voting power of persons seeking to obtain control of the Company or could be issued to purchasers who would support the Board of Directors in opposing a takeover proposal. In addition, they may have the effect of discouraging a challenge for control or make it less likely that such a challenge, if attempted, would be successful. The Board of Directors and executive officers of the Company have no knowledge of any current effort to obtain control of the Company or to accumulate large amounts of Common Stock.

The holders of Common Stock are not entitled to preemptive rights with respect to the issuance of additional Common Stock or securities convertible into or exercisable for Common Stock. Accordingly, the issuance of additional shares of Common Stock or such other securities might dilute the ownership and voting rights of stockholders.

The holders of Common Stock will not realize any dilution in their percentage of ownership of our company or their voting rights as a result of the amendments. However, issuances of significant numbers of additional shares of preferred stock or common stock in the future (i) will dilute stockholders’ percentage ownership of our company and (ii) if such shares are issued at prices below what current stockholders paid for their shares, may dilute the value of current stockholders’ shares.

Neither the Increase in Authorized Amendment, nor the Creation of Preferred Stock Amendment, changes the terms of the Common Stock. The additional Common Stock for which authorization is sought will have the same voting rights and liquidation rights, the same rights to dividends and distributions and will be identical in all other respects to the Common Stock now authorized.

The Increase in Authorized Amendment and the Creation of Preferred Stock Amendment are contained in the Certificate of Amendment attached to this Information Statement as Exhibit A and will be filed with the Nevada Secretary of State with an expected effective date of January [__], 2012.

ACTION TWO

PROSPECTIVE FORWARD STOCK SPLIT

General

On December 16, 2011, the Board of Directors of the Company approved, declared it advisable and in the Company’s best interest, and directed that there be submitted to the holders of a majority of the Company’s common stock for approval, to grant authority to the Board of Directors to effect a forward split of the Company’s Common Stock if the Board of Directors, in its sole discretion, deems it in the best interests of the Company (the “Forward Stock Split”). The exact ratio of the Forward Stock Split shall be determined by the Board at a later time and at anytime until the next meeting of the Company’s shareholders which are entitled to vote on such actions and shall be limited to a range of not less than 2-for-1 nor more than 35-for-1 (each a “Forward Ratio”). In the event the Board of Directors effects a Forward Split, the total number of shares of common stock authorized at that time will remain unchanged. On December 16, 2011, the Majority Stockholders approved the Forward Stock Split by written consent, in lieu of a special meeting of the stockholders.

Effects of Forward Split

Following the effectiveness, if any, of a Forward Split, current shareholders shall be issued more shares of Common Stock, with such number of shares dependent on the Forward Ratio approved by the Board of Directors. For example, if the Board approves of a 30-for-1 Forward Split, a shareholder owning 100 shares of Common Stock prior to such Forward Split would hold 3,000 shares of Common Stock following such Forward Split. THE HIGHER THE FORWARD RATIO (30-FOR-1 BEING HIGHER THAN 20-FOR-1 FOR EXAMPLE), THE GREATER THE INCREASE OF RELATED SHARES EACH EXISTING SHAREHOLDER, POST FORWARD SPLIT, WILL EXPERIENCE.

In deciding whether to implement the Forward Split and in determining the Forward Ratio to be used, the Board of Directors will consider, among other things, (i) the potential impact and anticipated benefits for the Company, (ii) the market price of the Common Stock at such time, (iii) the number of shares that will be outstanding after the Forward Split, (iv) the shareholders’ equity at such time, (v) the shares of Common Stock available for issuance in the future, (vi) the liquidity of the Common Stock in the market, and (vii) the nature of the Company’s operations. The Board of Directors shall maintain the right to elect not to proceed with the Forward Split if it determines, in its sole discretion, that this proposal is no longer in the best interests of the Company.

Purposes of the Forward Split

The Board of Directors believes that the Company’s outstanding shares may need to be increased in order to increase the number of outstanding shares of the Company’s Common Stock (as further described below) and facilitate higher levels of individual stock ownership where individual investors may not be able to afford or be amenable to higher stock prices. In the event the Board of Directors elects to effect a Forward Split, it is intention of the Company (i) to allow for additional shares to be available for issuance for general corporate purposes, including, but not limited to, public or private offerings, conversions of convertible securities, issuance of options pursuant to employee stock option plans, acquisition transactions and other general corporate purposes, and (ii) to allow for a potential increase the shareholders’ value by increasing the marketability and liquidity of the Common Stock.

The purpose of seeking shareholder approval of a range of exchange ratios (rather than a fixed exchange ratio) is to provide the Board of Directors with the flexibility to achieve the desired results of the Forward Split. Following the approval of this corporate action, the Board of Directors will effect a Forward Split only upon the Board’s determination that a Forward Split would be in the best interests of the Company at that time. If the Board of Directors were to effect a Forward Split, the Board would set the timing for such a split and select the specific ratio as set forth herein. No further action on the part of shareholders will be required to either implement or abandon the Forward Split. If the Board of Directors determines to implement the Forward Split, we would communicate to the public, prior to the effective date of the Forward Split, additional details regarding the Forward Split, including the Forward Ratio the Board selects. If the Board of Directors does not implement the Forward Split by December 31, 2015, the authority granted in this proposal to implement the Forward Split will terminate.

Common Stock

After the effective date of the Forward Split, each of the Company common stockholders will own more shares of the Company’s Common Stock, but the per-share value of these shares may decrease proportionately. The Forward Split would not change the number of authorized shares of Common Stock designated by the Company’s Articles of Incorporation, as amended. Following the Effective Date of a Forward Split and the above amendments to the Company’s Articles of Incorporation, it will have authorized 150,000,000 shares of stock authorized, including 120,000,000 shares of Common Stock and 30,000,000 shares of Preferred Stock. Thus, following a Forward Split, because the number of issued and outstanding shares of Common Stock would increase, the number of shares remaining available for issuance under the Company’s Articles of Incorporation would effectively decrease.

All outstanding options and warrants to purchase shares of the Company’s Common Stock, including any held by the Company’s officers and directors, would be adjusted as a result of the Forward Split. In particular, the number of shares issuable upon the exercise of each instrument would be increased, and the exercise price per share, if applicable, would be decreased, in accordance with the terms of each instrument and based on the Forward Ratio.

The below charts outline the capital structure following the increase in the Company’s authorized stock as described in Corporate Action No. 1 herein and prior to and immediately following a possible Forward Split, with several different possible Forward Ratios accounted for (but not all). Note the number of shares disclosed as “Issued and Outstanding” in the below charts account for the number of shares issued and outstanding as of the Record Date.

| | Number of shares of Common Stock before 2:1 Forward Split | Number of shares of Common Stock after 2:1 Forward Split |

| Authorized | 120,000,000 | 120,000,000 |

| Issued and Outstanding | 3,175,000 | 6,350,000 |

| Reserved for Issuance | 0 | 0 |

| Authorized but Unissued | 116,825,000 | 113,650,000 |

| | Number of shares of Common Stock before 10:1 Forward Split | Number of shares of Common Stock after 10:1 Forward Split |

| Authorized | 120,000,000 | 120,000,000 |

| Issued and Outstanding | 3,175,000 | 31,750,000 |

| Reserved for Issuance | 0 | 0 |

| Authorized but Unissued | 116,825,000 | 88,250,000 |

| | Number of shares of Common Stock before 20:1 Forward Split | Number of shares of Common Stock after 20:1 Forward Split |

| Authorized | 120,000,000 | 120,000,000 |

| Issued and Outstanding | 3,175,000 | 63,500,000 |

| Reserved for Issuance | 0 | 0 |

| Authorized but Unissued | 116,825,000 | 56,550,000 |

| | Number of shares of Common Stock before 30:1 Forward Split | Number of shares of Common Stock after 30:1 Forward Split |

| Authorized | 120,000,000 | 120,000,000 |

| Issued and Outstanding | 3,175,000 | 95,250,000 |

| Reserved for Issuance | 0 | 0 |

| Authorized but Unissued | 116,825,000 | 24,750,000 |

| | Number of shares of Common Stock before 35:1 Forward Split | Number of shares of Common Stock after 35:1 Forward Split |

| Authorized | 120,000,000 | 120,000,000 |

| Issued and Outstanding | 3,175,000 | 111,125,000 |

| Reserved for Issuance | 0 | 0 |

| Authorized but Unissued | 116,825,000 | 8,875,000 |

Fractional Shares

No fractional shares of the Company’s Common Stock will be issued as a result of the Forward Split since the approved Forward Ratios would not result in any fractional shares.

Potential Risks of a Forward Split

The effect of any Forward Split on the market price for the Company’s Common Stock cannot be predicted, and the performance history of similar stock splits for companies in like circumstances is varied. There can be no assurance that the Company’s Common Stock will continue to trade at least in proportion to the increase in the number of outstanding shares resulting from the Forward Split or that the market price of the post-split Common Stock can be maintained. The market price of the Company’s Common Stock will also be based on its financial performance, market conditions, the market perception of its future prospects and the Company’s industry as a whole, as well as other factors, many of which are unrelated to the number of shares outstanding.

No Dissenters Rights

In connection with the approval of the Forward Split, shareholders of the Company will not have a right to dissent and obtain payment for their shares under the Nevada Revised Statutes, the Articles of Incorporation or Bylaws.

Accounting Matters

The Forward Split will not affect the par value of the Company’s Common Stock. As a result, on the effective date of any Forward Split approved by the Company’s Board of Directors, the stated capital on the Company’s balance sheet attributable to Common Stock would be reduced from then current amount by a fraction that equals the Forward Split Ratio, and the additional paid-in capital account would be credited with the amount by which the stated capital is reduced. The per share net income or loss and net book value per share will be decreased because there will be more shares issued and outstanding.

Decrease of Shares of Common Stock Available for Future Issuance

As a result of any Forward Split, there will be an increase in the number of shares of Common Stock issued and outstanding and an associated decrease in the number of authorized shares that would be unissued and available for future issuance after any Forward Split. After any Forward Split the shares of Company’s common stock available to be used for any proper corporate purpose approved by the Board of Directors, including, among other purposes, future financing transactions and acquisitions, would be decreased. However, the Company does not currently have any agreements, written or otherwise, to issue the additional authorized shares of Common Stock for any purpose, including future financing transactions and acquisitions.

Potential Anti-Takeover Effects of a Forward Split

The implementation of a Forward Split would have the effect of decreasing the proportion of unissued authorized shares to issued shares. Under certain circumstances this may have an anti-takeover effect. By having less unissued shares there would be less shares available for purchase in a hostile takeover attempt, which could delay or prevent a change of control or changes in or removal of the Board of Directors. For example, without further stockholder approval, the Board of Directors could issue and sell shares, thereby preventing the purchase of those shares by a person seeking to effect a change in the composition of our Board of Directors or to propose or complete a tender offer or business combination involving us and potentially strategically placing shares with purchasers who would oppose such a change in the Board of Directors or such a transaction.

In addition, the Nevada General Corporation Law prohibits certain mergers, consolidations, sales of assets or similar transactions between a corporation on the one hand and another company which is, or is an affiliate of, a beneficial holder of 15% or more of that corporation’s voting power (defined as an “Interested Stockholder”) for three years after the acquisition of the voting power, unless the acquisition of the voting power was approved beforehand by the corporation’s board of directors or the transaction is approved by a majority of such corporation’s shareholders (excluding the Interested Stockholder). These provisions prohibiting Interested Stockholder transactions could also preserve management’s control of the Company.

Although a decreased proportion of unissued authorized shares to issued shares could, under certain circumstances, have a potential anti-takeover effect, any authorized Forward Split hereunder is not in response to any effort of which we are aware to accumulate the shares of our Common Stock or obtain control of the Company. There are no plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

Tax Consequences to Common Shareholders

The following discussion sets forth the material United States federal income tax consequences that the Company’s management believes will apply with respect to the Company and the shareholders of the Company who are United States holders at the effective time of the Forward Split. This discussion does not address the tax consequences of transactions effectuated prior to or after the Forward Split, including, without limitation, the tax consequences of the exercise of options, warrants or similar rights to purchase stock. For this purpose, a United States holder is a shareholder that is: (i) a citizen or resident of the United States, (ii) a domestic corporation, (iii) an estate whose income is subject to United States federal income tax regardless of its source, or (iv) a trust if a United States court can exercise primary supervision over the trust’s administration and one or more United States persons are authorized to control all substantial decisions of the trust. This discussion does not describe all of the tax consequences that may be relevant to a holder in light of his particular circumstances or to holders subject to special rules (such as dealers in securities, financial institutions, insurance companies, tax-exempt organizations, foreign individuals and entities and persons who acquired their Common Stock as compensation). In addition, this summary is limited to shareholders who hold their Common Stock as capital assets. This discussion also does not address any tax consequences arising under the laws of any state, local, or foreign jurisdiction. Accordingly, each shareholder is strongly urged to consult with a tax adviser to determine the particular federal, state, local or foreign income or other tax consequences to such shareholder related to any Forward Split.

No gain or loss should be recognized by a shareholder upon his or her exchange of pre-Forward Split shares for post-Forward Split shares except for those associated with any additional shares the shareholder receives due to any forward split threshold. The aggregate tax basis of the post-Forward Split shares received in the Forward Split will be the same as the shareholder’s aggregate tax basis in the pre-Forward Split shares. The shareholder’s holding period for the post-Forward Split shares will include the period during which the shareholder held the pre-Forward Split shares surrendered in the Forward Split.

THIS SUMMARY IS NOT INTENDED AS TAX ADVICE TO ANY PARTICULAR PERSON. IN PARTICULAR, AND WITHOUT LIMITING THE FOREGOING, THIS SUMMARY ASSUMES THAT THE SHARES OF COMMON STOCK ARE HELD AS “CAPITAL ASSETS” AS DEFINED IN THE CODE, AND DOES NOT CONSIDER THE FEDERAL INCOME TAX CONSEQUENCES TO THE COMPANY’S STOCKHOLDERS IN LIGHT OF THEIR INDIVIDUAL INVESTMENT CIRCUMSTANCES OR TO HOLDERS WHO MAY BE SUBJECT TO SPECIAL TREATMENT UNDER THE FEDERAL INCOME TAX LAWS (SUCH AS DEALERS IN SECURITIES, INSURANCE COMPANIES, FOREIGN INDIVIDUALS AND ENTITIES, FINANCIAL INSTITUTIONS AND TAX EXEMPT ENTITIES). IN ADDITION, THIS SUMMARY DOES NOT ADDRESS ANY CONSEQUENCES OF ANY FORWARD SPLIT UNDER ANY STATE, LOCAL OR FOREIGN TAX LAWS. THE STATE AND LOCAL TAX CONSEQUENCES OF ANY FORWARD SPLIT MAY VARY AS TO EACH STOCKHOLDER DEPENDING ON THE STATE IN WHICH SUCH STOCKHOLDER RESIDES.

AS A RESULT, IT IS THE RESPONSIBILITY OF EACH STOCKHOLDER TO OBTAIN AND RELY ON ADVICE FROM HIS, HER OR ITS TAX ADVISOR AS TO, BUT NOT LIMITED TO, THE FOLLOWING: (A) THE EFFECT ON HIS, HER OR ITS TAX SITUATION OF ANY FORWARD SPLIT, INCLUDING, BUT NOT LIMITED TO, THE APPLICATION AND EFFECT OF STATE, LOCAL AND FOREIGN INCOME AND OTHER TAX LAWS; (B) THE EFFECT OF POSSIBLE FUTURE LEGISLATION OR REGULATIONS; AND (C) THE REPORTING OF INFORMATION REQUIRED IN CONNECTION WITH ANY FORWARD SPLIT ON HIS, HER OR ITS OWN TAX RETURNS. IT WILL BE THE RESPONSIBILITY OF EACH STOCKHOLDER TO PREPARE AND FILE ALL APPROPRIATE FEDERAL, STATE, LOCAL, AND, IF APPLICABLE, FOREIGN TAX RETURNS.

Tax Consequences for the Company

The Company should not recognize any gain or loss as a result of the Forward Split.

Share Certificates

In the event the Board of Directors affects any Forward Split, the Company will provide further information to its shareholders regarding their share certificates.

OTHER INFORMATION

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, certain information with respect to the Company’s equity securities owned of record or beneficially by (i) each Officer and Director of the Company; (ii) each person who owns beneficially more than 5% of each class of the Company’s outstanding equity securities; and (iii) all Directors and Executive Officers as a group.

| Title of Class | | Name and Address of Beneficial Owner (2) | | Nature of Beneficial Ownership | | Amount | | Percent of Class (1) |

Common Stock | | Paul Vassilakos (3) | | Chief Executive Officer, Chief Financial Officer, Director | | 2,500,000 (4) | | 78.7% |

| Common Stock | | Miles Leahy (3) | | Secretary, Director | | 0 | | 0% |

Common Stock | | All Directors and Officers As a Group (2 persons) | | | | 2,500,000 (4) | | 78.7% |

| | (1) | Based on 3,175,000 shares outstanding as of December 16, 2011. Shares of common stock subject to options or warrants currently exercisable, or exercisable within 60 days, are deemed outstanding for purposes of computing the percentage of the person holding such options or warrants, but are not deemed outstanding for the purposes of computing the percentage of any other person. |

| | (2) | Unless indicated otherwise, the address of the shareholder is c/o Soton Holdings Group, Inc., 180 Madison Avenue, Suite 1702, New York, NY 10016. |

| | (3) | Indicates an officer and/or director of the Company |

| | (4) | All shares held in the name of Petrina Advisors, Inc., an entity controlled by Mr. Vassilakos. |

The Company is not aware of any person who owns of record, or is known to own beneficially, five percent or more of the outstanding securities of any class of the issuer, other than as set forth above. There are no classes of stock other than common stock issued or outstanding.

On October 17, 2011, the Company’s two largest holders of its common stock, as well as its two officers and directors, Ms. Mariya Kokho and Mr. Vasiliy Ignatenko, entered into a Agreement to Purchase Common Stock (the “Agreement”) with Petrina Advisors, Inc., a New York corporation (“Petrina”), under which Petrina agreed to purchase an aggregate of 2,500,000 shares of the Company’s common stock from Ms. Kokho and Mr. Ignatenko in exchange for $16,000. These shares represent approximately 79% of the Company’s outstanding common stock. The transaction closed November 22, 2011.

Identification of Officers and Directors

Our directors and executive officers, and their respective ages, positions and offices, are as follows:

| Name | Age | Position |

| | | |

| Paul Vassilakos | 35 | Chief Executive Officer, Chief Financial Officer, and a Director |

| | | |

| Miles Leahy | 29 | Secretary and a Director |

Mr. Paul Vassilakos, the President of Petrina Advisors, Inc., the holder of approximately 79% of our outstanding common stock, replaced Ms. Kokho as our Chief Executive Officer and Chief Financial Officer, and was appointed to serve on our Board of Directors. Mr. Vassilakos was former President, Former Chief Executive Officer and Former Interim Acting Chief Financial Officer and former Chairman of Red Mountain Resources, Inc. from February 2011 March 2011. Mr. Vassilakos has served as a director of Red Mountain Resources, Inc. since October 2011. Mr. Vassilakos has been the assistant treasurer of Cullen Agricultural Holding Corp. (“CAH”) since October 2009. CAH is a development stage agricultural company which was formed in connection with the business combination between Triplecrown Acquisition Corp. and Cullen Agricultural Technologies, Inc. ("Cullen Agritech") in October 2009. At CAH, Mr. Vassilakos is responsible for business development, maintenance of financial accounts and public company reporting. Prior to CAH's formation, Mr. Vassilakos assisted Triplecrown Acquisition Corp. with the completion of its initial public offering and later the business combination with Cullen Agritech. In July 2007, Mr. Vassilakos founded Petrina Advisors, Inc. (“Petrina”), a privately held advisory firm formed to provide investment banking services for public and privately held companies, and has served as its President since its formation. Petrina’s clients have primarily consisted of companies which collectively held over one billion dollars in trust, with the aim of completing reverse mergers with privately held companies. Mr. Vassilakos also founded and, since December 2006, serves as the vice president of, Petrina Properties Ltd., a privately held real estate holding company. In July 2007, Mr. Vassilakos was engaged as a consultant to assist Endeavor Acquisition Corp. with its business combination with American Apparel Inc., a California based retail apparel company, which was completed in December 2007. From February 2002 through June 2007, Mr. Vassilakos served as Vice President of Elmsford Furniture Corp., a privately held furniture retailer in the New York area. From July 2000 through January 2002, Mr. Vassilakos was an Associate within the Greek Coverage Group of Citigroup’s UK Investment Banking Division. During this time, Mr. Vassilakos assisted with the execution of M&A transactions, securitizations, as well as debt and equity offerings for some of Greece’s largest publicly traded companies, including OTE and Antenna TV. From July 1998 through July 2000, Mr. Vassilakos was an Analyst within the Industrial Group of Salomon Smith Barney’s New York Investment Banking Division. During this time, Mr. Vassilakos assisted with the execution of M&A transactions, as well as debt and equity offerings for large U.S. publicly-traded industrial companies, including Alcoa, Inc. and Cyprus Amax. From February 1996 through June 1998, Mr. Vassilakos was a Registered Securities Representative at Paine Webber CSC - DJS Securities Ltd, during which time he provided securities brokerage services to private clients. Mr. Vassilakos received a BS in finance from the Leonard N. Stern Undergraduate School of Business in 1998 and was a licensed Registered Securities Representative (Series 7 and 63) from February 1996 through February 2002.

Mr. Miles Leahy replaced Mr. Ignatenko as our Secretary, and was appointed to serve on our Board of Directors. Mr. Miles Leahy has been Managing Director of Nucopia Partners Limited (“Nucopia”) since January, 2011. Nucopia is a London based corporate finance boutique focused on small cap transactions globally in both private and public markets with a particular focus on U.S. publicly-listed companies. At Nucopia, Mr. Leahy is focused on corporate advisory services, capital raising and structuring on behalf of private investors and private and public companies. Prior to Nucopia, from January 2010 to September 2010 Mr. Leahy served as acting Director of Business Development of Cullen Agricultural Holding Corp. (“CAH”), a publicly-listed company based in the United States where he was responsible for business development and corporate strategy. Prior to CAH's formation, Mr. Leahy assisted Triplecrown Acquisition Corp. with the completion of its initial public offering and later the business combination with CAH. From March, 2008 to December, 2009, Mr. Leahy acted as a consultant to Victory Acquisition Corp and Triplecrown Acquisition Corp., two special purpose acquisition companies listed on the American Stock Exchange with a combined USD $880mn under management where he was focused on deal origination and structuring. From March 2006 to March 2008 Mr. Leahy was a member of Ernst & Young’s London-based financial services corporate finance team focused on M&A advisory work. Mr. Leahy received a Bachelor of Science (BS) degree from Imperial College, University of London.

All of our officers and other personnel are independent contractors and will continue to be until we have sufficient time and resources to hire them as employees. We do not currently have any written agreements with any of our officers or directors.

Description of Securities

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001. As of the Record Date, there were 3,175,000 shares of our common stock issued and outstanding, held by approximately 6 shareholders of record.

Common Stock. Each shareholder of our common stock is entitled to a pro rata share of cash distributions made to shareholders, including dividend payments. The holders of our common stock are entitled to one vote for each share of record on all matters to be voted on by shareholders. There is no cumulative voting with respect to the election of our directors or any other matter. Therefore, the holders of more than 50% of the shares voted for the election of those directors can elect all of the directors. The holders of our common stock are entitled to receive dividends when and if declared by our Board of Directors from funds legally available therefore. Cash dividends are at the sole discretion of our Board of Directors. In the event of our liquidation, dissolution or winding up, the holders of common stock are entitled to share ratably in all assets remaining available for distribution to them after payment of our liabilities and after provision has been made for each class of stock, if any, having any preference in relation to our common stock. Holders of shares of our common stock have no conversion, preemptive or other subscription rights, and there are no redemption provisions applicable to our common stock.

Preferred Stock. We are not authorized to issue preferred stock.

Dividend Policy. We have never issued any dividends and do not expect to pay any stock dividend or any cash dividends on our common stock in the foreseeable future. We currently intend to retain our earnings, if any, for use in our business. Any dividends declared on our common stock in the future will be at the discretion of our Board of Directors and subject to any restrictions that may be imposed by our lenders.

Stock Option Plan. We have not approved any stock option plans.

Transfer Agent. The transfer agent for our common stock is Island Stock Transfer, 15500 Roosevelt Boulevard, Suite 301, Clearwater, Florida 33760, telephone no.: (727) 289-0069.

Transactions with Related Persons, Promoters and Certain Control Persons

None of the following parties has, since the Company’s date of incorporation, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect the Company, except as indicated:

· Any of the Company’s directors or officers;

· Any person proposed as a nominee for election as a director;

· Any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to the Company’s outstanding shares of common stock;

· Any relative or spouse of any of the foregoing persons who has the same house as such person;

· Immediate family members of directors, director nominees, executive officers and owners of 5% or more of the Company’s common stock.

On June 9, 2010, Ms. Mariya Kokho, one of our former officers and directors, advanced funds to the Company in the amount of $349. These funds were repaid to Ms. Kokho in connection with the transaction with Petrina Advisors, Inc. referenced herein.

On June 21, 2010, the Company issued a total of 2,500,000 shares of restricted common stock to Ms. Kokho for payment of $2,500.

On June 30, 2010, Ms. Kokho sold 500,000 restricted shares of the Company’s common stock to Mr. Vasiliy Ignatenko in consideration for $500 cash.

Compliance with Section 16(a) of the Securities Exchange Act of 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, directors and greater than ten percent shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

During the most recent fiscal year, to the Company’s knowledge, the following delinquencies occurred:

Name | No. of Late Reports | No. of Transactions Reported Late | No. of Failures to File |

| Paul Vassilakos | 0 | 0 | 0 |

| Miles Leahy | 0 | 0 | 0 |

Board Meetings and Committees

During the 2012 fiscal year to date and during the Company’s fiscal year ended September 30, 2011, the Board of Directors met on a regular basis and took written action on numerous other occasions. All the members of the Board attended the meetings. The written actions were by unanimous consent.

Code of Ethics

We have not adopted a written code of ethics, primarily because we believe and understand that our officers and directors adhere to and follow ethical standards without the necessity of a written policy.

Audit Committee

The Company does not currently have an audit committee.

Compensation Committee

The Company does not currently have a compensation committee.

Executive Compensation

The following tables set forth certain information about compensation paid, earned or accrued for services by (i) the Company’s Chief Executive Officer and (ii) all other executive officers who earned in excess of $100,000 in the period from our fiscal years September 30, 2011 and 2010 (“Named Executive Officers”):

Name and Principal Position | Year | | Salary ($) | | | Bonus ($) | | | Stock Awards ($) | | | Option Awards ($) | | | Non-Equity Incentive Plan Compensation ($) | | | Nonqualified Deferred Compensation ($) | | | All Other Compensation ($) | | | Total ($) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Paul Vassilakos | 2011 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| CEO, CFO | 2010 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Miles Leahy | 2011 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Secretary | 2010 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Mariya Kokho | 2011 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Former CEO, CFO, Treasurer, CAO | 2010 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vasiliy Ignatenko | 2011 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| Former Secretary | 2010 | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

Employment Contracts

We currently do not have written employment agreements with our executive officers.

The following table sets forth director compensation as of for fiscal year ended September 30, 2011:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Total ($) |

| | | | | | | | |

| Paul Vassilakos | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

| | | | | | | | |

| Miles Leahy | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

| | | | | | | | |

| Mariya Kokho (1) | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

| | | | | | | | |

| Vasiliy Ignatenko (1) | -0- | -0- | -0- | -0- | -0- | -0- | -0- |

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information concerning outstanding stock awards held by the Named Executive Officers for our fiscal year ended September 30, 2011:

| | Option Awards | Stock Awards |

Name | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) |

| | | | | | | | | | |

| Paul Vassilakos | -0- | -0- | -0- | N/A | N/A | -0- | -0- | -0- | -0- |

| | | | | | | | | | |

| Miles Leahy | -0- | -0- | -0- | N/A | N/A | -0- | -0- | -0- | -0- |

| | | | | | | | | | |

| Mariya Kokho (1) | -0- | -0- | -0- | N/A | N/A | -0- | -0- | -0- | -0- |

| | | | | | | | | | |

| Vasiliy Ignatenko (1) | -0- | -0- | -0- | N/A | N/A | -0- | -0- | -0- | -0- |

By order of the Board of Directors

_________________________________

Paul Vassilakos, Chief Executive Officer

December ___, 2011

New York, NY

CERTIFICATE OF AMENDMENT

ATTACHMENT TO

CERTIFICATE OF AMENDMENT TO

ARTICLES OF INCORPORATION

OF

SOTON HOLDINGS GROUP, INC.

3. This Corporation is authorized to issue two classes of shares of stock to be designated as “Common Stock” and “Preferred Stock”. The total number of shares of Common Stock which this Corporation is authorized to issue is One Hundred Twenty Million (120,000,000) shares, par value $0.001. The total number of shares of Preferred Stock which this Corporation is authorized to issue is Twenty Million (30,000,000) shares, par value $0.001.

The shares of Preferred Stock may be issued from time to time in one or more series. The Board of Directors of the Corporation (the “Board of Directors”) is expressly authorized to provide for the issue of all or any of the shares of the Preferred Stock in one or more series, and to fix the number of shares and to determine or alter for each such series, such voting powers, full or limited, or no voting powers, and such designations, preferences, and relative, participating, optional, or other rights and such qualifications, limitations, or restrictions thereof, as shall be stated and expressed in the resolution or resolutions adopted by the Board of Directors providing for the issue of such shares (a “Preferred Stock Designation”) and as may be permitted by the Nevada Revised Statutes. The Board of Directors is also expressly authorized to increase or decrease (but not below the number of shares of such series then outstanding) the number of shares of any series subsequent to the issue of shares of that series. In case the number of shares of any such series shall be so decreased, the shares constituting such decrease shall resume the status that they had prior to the adoption of the resolution originally fixing the number of shares of such series.