January 19, 2023 Q4 2022 – Supplemental Information Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by external circumstances outside the Company's direct control. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Quarterly Highlights

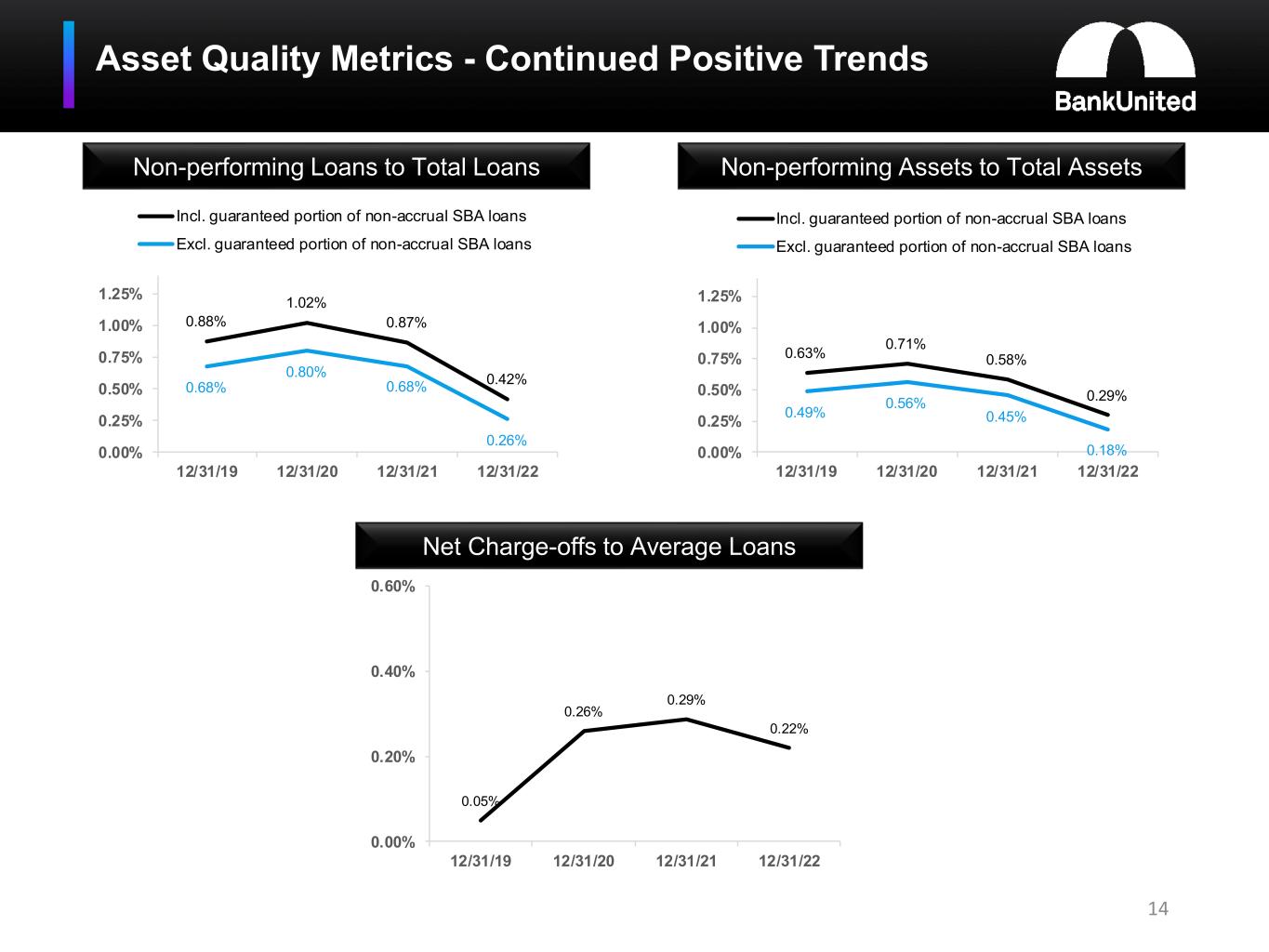

Quarterly Snapshot 4 Operating results Loans and Deposits Asset Quality Capital • Net income for the quarter of $64.2 million and EPS of $0.82 • PPNR of $121.4 million for Q4, compared to $120.8 million in Q3 and $63.8 million in Q4’21(1) • Provision for credit losses of $39.6 million for Q4 - reserve build due to worsening economic forecast and increased likelihood of recession • NIM expanded by 5bps to 2.81% • Loan growth of $619 million • Core C&I and CRE segments grew $722 million • Total deposits increased by $160 million • Average cost of total deposits 1.42% for the quarter, compared to 0.78% in Q3 • NPA ratio of 0.42% at December 31; guaranteed portion of SBA loans included in NPAs was 0.11% of total assets • Net charge-off rate of 0.22% for the year • Criticized/classified assets continued to decline • Total share repurchases of $65 million in Q4; $75 million remaining in current authorization • CET1 ratios of 11.0% at the holding company and 12.4% at the bank at December 31, 2022 • Book value per share and tangible book value per share were $32.19 and $31.16, respectively at December 31(2) (1) PPNR is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 24. (2) Tangible book value per share is a non-GAAP financial measure. See section entitle “Non-GAAP Financial Measures” on page 25.

Highlights from Fourth Quarter Earnings 5 (1) Includes guaranteed portion of non-accrual SBA loans. (2) Annualized for the period ended September 30, 2022. (3) PPNR is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 25. Key Highlights Reserve build due primarily to economic forecast Q4 2021 includes $18 million gain on sale of residential loans Q4 2021 includes $45 million loss on discontinuance of hedges Q4 2021 includes $69 million discrete income tax benefit $722 million growth in core CRE and C&I segments Continued margin expansion in rising rate environment Change From ($ in millions, except per share data) Q4 22 Q3 22 Q4 21 Q3 22 Q4 21 Net Interest Income $243 $236 $206 $7 $37 Provision for Credit Losses $40 $4 $0.2 $36 $39.8 Total Non-interest Income $27 $23 $46 $4 ($19) Total Non-interest Expense $148 $138 $188 $10 ($40) Net Income $64 $88 $125 ($24) ($61) EPS $0.82 $1.12 $1.41 ($0.30) ($0.59) Pre-Provision, Pre-Tax Net Revenue (PPNR)(3) $121.4 $120.8 $63.8 $0.6 $57.6 Period-end Loans $24,886 $24,267 $23,765 $619 $1,121 Period-end Non-interest DDA $8,038 $8,794 $8,976 ($756) ($938) Period-end Deposits $27,509 $27,349 $29,438 $160 ($1,929) CET1 11.0% 11.3% 12.6% (0.3%) (1.6%) Total Capital 12.7% 13.0% 14.3% (0.3%) (1.6%) Yield on Securities 4.33% 3.12% 1.54% 1.21% 2.79% Yield on Loans 4.72% 4.11% 3.50% 0.61% 1.22% Cost of Deposits 1.42% 0.78% 0.19% 0.64% 1.23% Net Interest Margin 2.81% 2.76% 2.44% 0.05% 0.37% Non-performing Assets to Total Assets(1) 0.29% 0.43% 0.58% (0.14%) (0.29%) Allowance for Credit Losses to Total Loans 0.59% 0.54% 0.53% 0.05% 0.06% Net Charge-offs to Average Loans(2) 0.22% 0.16% 0.29% 0.06% (0.07%)

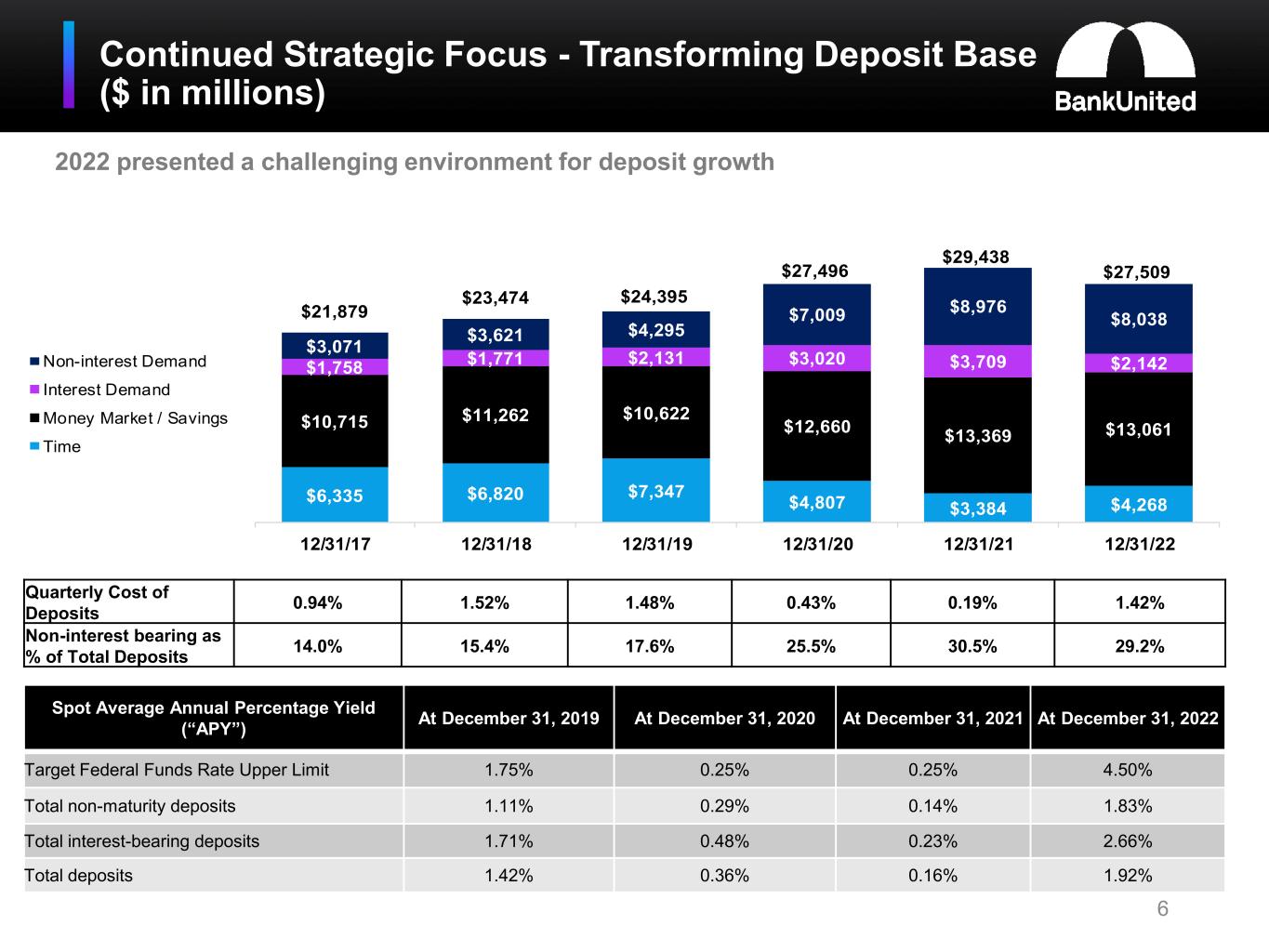

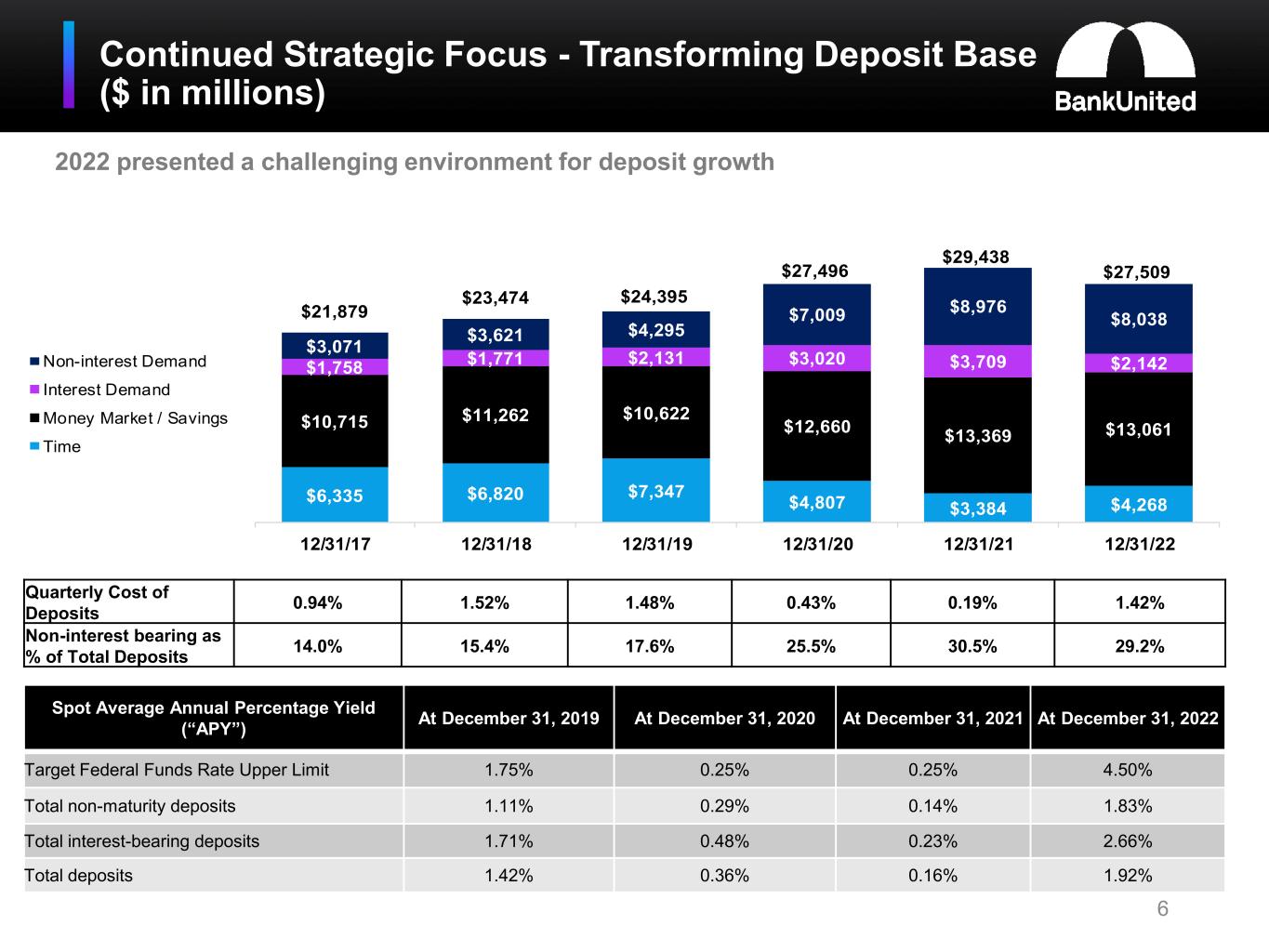

Continued Strategic Focus - Transforming Deposit Base ($ in millions) 6 2022 presented a challenging environment for deposit growth Quarterly Cost of Deposits 0.94% 1.52% 1.48% 0.43% 0.19% 1.42% Non-interest bearing as % of Total Deposits 14.0% 15.4% 17.6% 25.5% 30.5% 29.2% Spot Average Annual Percentage Yield (“APY”) At December 31, 2019 At December 31, 2020 At December 31, 2021 At December 31, 2022 Target Federal Funds Rate Upper Limit 1.75% 0.25% 0.25% 4.50% Total non-maturity deposits 1.11% 0.29% 0.14% 1.83% Total interest-bearing deposits 1.71% 0.48% 0.23% 2.66% Total deposits 1.42% 0.36% 0.16% 1.92% $6,335 $6,820 $7,347 $4,807 $3,384 $4,268 $10,715 $11,262 $10,622 $12,660 $13,369 $13,061 $1,758 $1,771 $2,131 $3,020 $3,709 $2,142 $3,071 $3,621 $4,295 $7,009 $8,976 $8,038$21,879 $23,474 $24,395 $27,496 $29,438 $27,509 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 Non-interest Demand Interest Demand Money Market / Savings Time

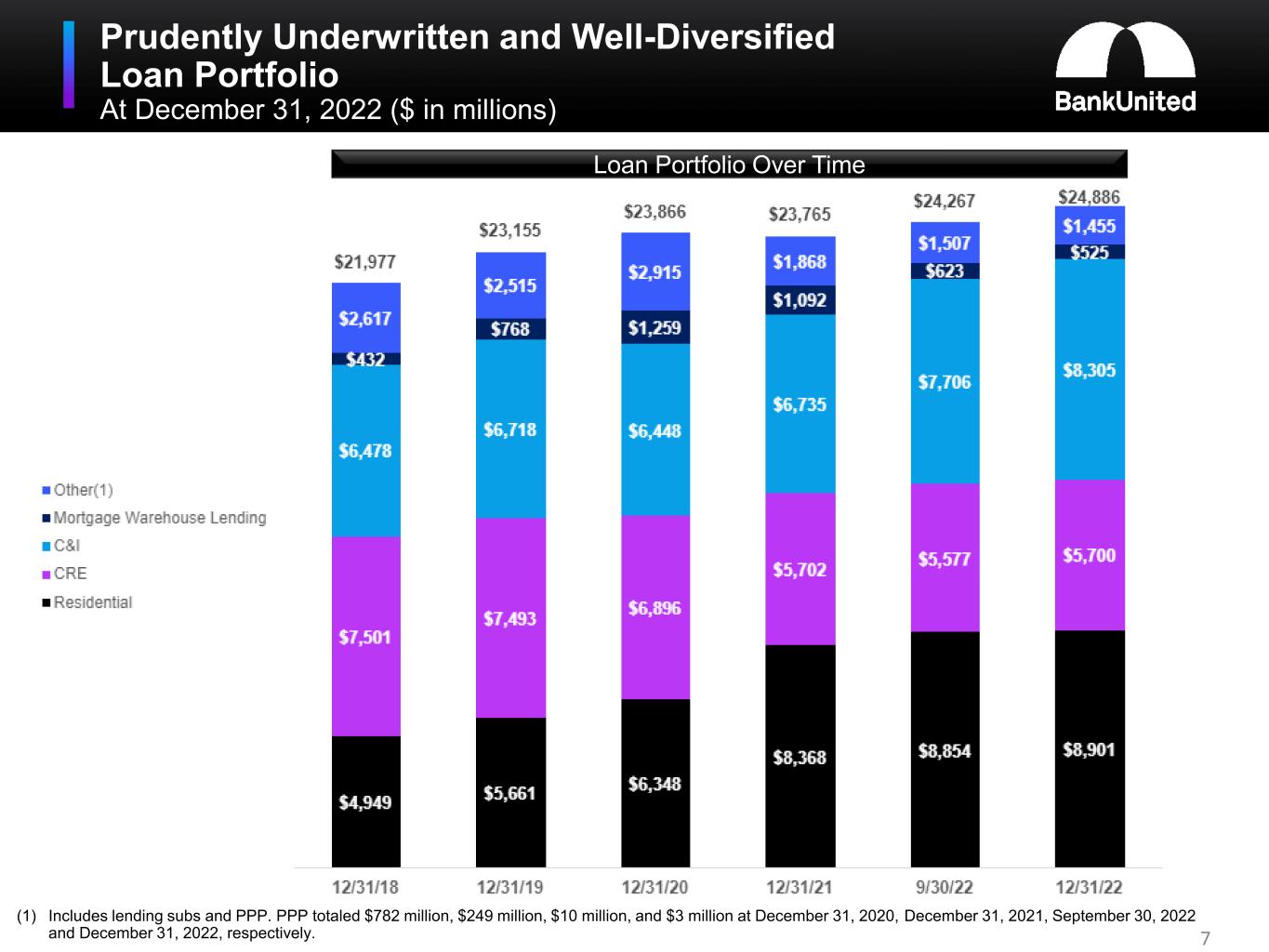

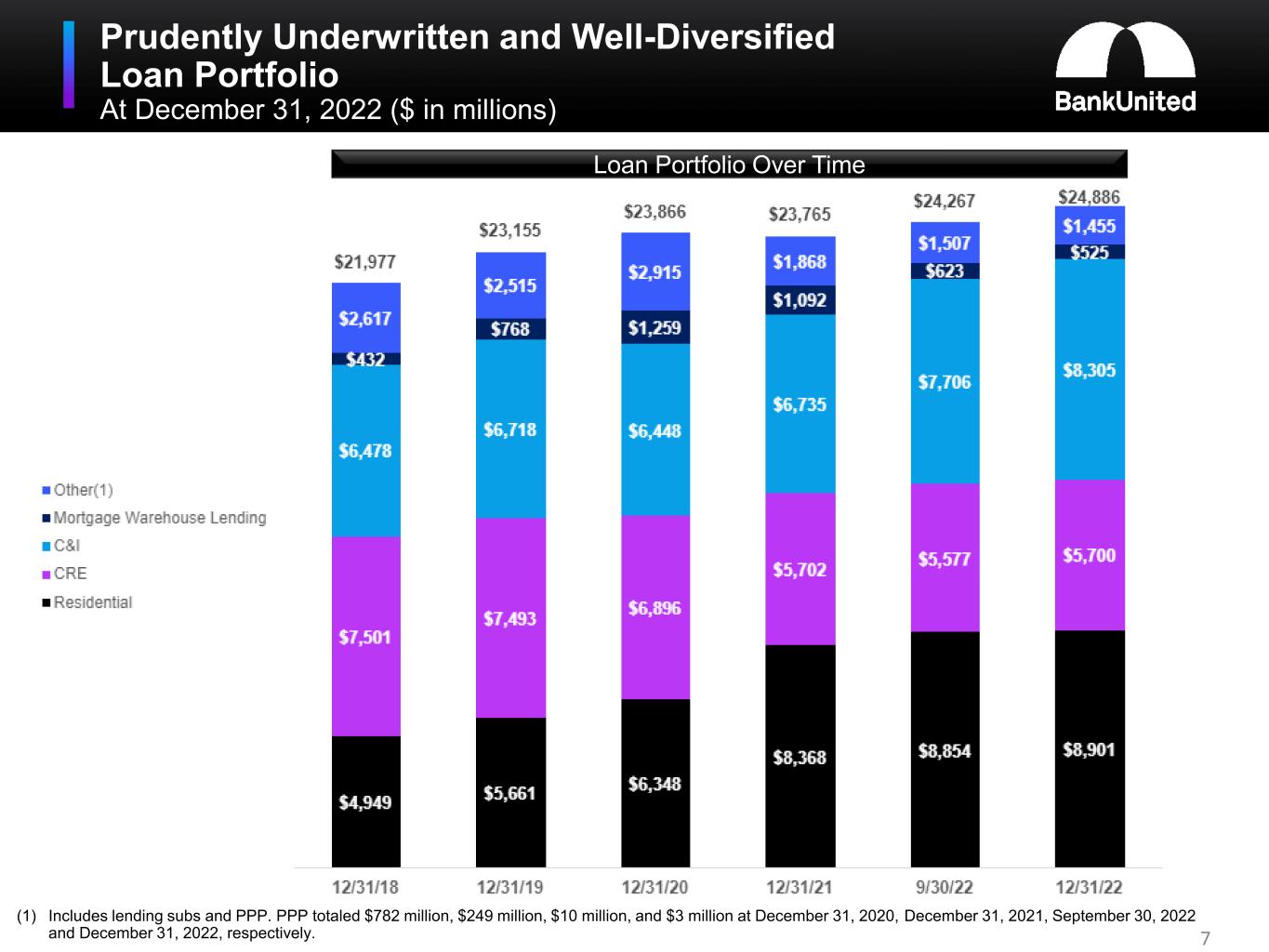

Prudently Underwritten and Well-Diversified Loan Portfolio At December 31, 2022 ($ in millions) 7 Loan Portfolio Over Time (1) Includes lending subs and PPP. PPP totaled $782 million, $249 million, $10 million, and $3 million at December 31, 2020, December 31, 2021, September 30, 2022 and December 31, 2022, respectively.

Allowance for Credit Losses

Drivers of Change in the ACL – Current Quarter 9 ACL 9/30/22 ACL 12/31/22 Assumption Changes Economic Forecast Net Charge- Offs Change in Qualitative Overlay ($ in millions) % of Total Loans 0.54% 0.59% • Portfolio seasoning • Changes in borrower financial condition • Risk rating migration • Current market adjustment • Changes to forward path of economic forecast • Increased qualitative overlay related to economic factors Change in Specific Reserves • Substantially all related to one loan Portfolio Changes • Primarily changes in prepayment speeds New Loans, net of runoff

Allocation of the ACL 10 ($ in millions) (1) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $40.3 million, $41.8 million, and $46.1 million or 0.16%, 0.17%, and 0.19% of total loans and 0.11%, 0.11%, and 0.13% of total assets at December 31, 2022, September 30, 2022, and December 31, 2021, respectively. (2) Annualized for the period ended September 30, 2022. Asset Quality Ratios December 31, 2021 September 30, 2022 December 31, 2022 Non-performing loans to total loans (1) 0.87% 0.64% 0.42% Non-performing assets to total assets (1) 0.58% 0.43% 0.29% Allowance for credit losses to non-performing loans (1) 61.41% 83.54% 140.88% Net charge-offs to average loans (2) 0.29% 0.16% 0.22% Balance % of Loans Balance % of Loans Balance % of Loans Residential and other consumer 9.2$ 0.11% 11.4$ 0.13% 11.7$ 0.13% Commercial: Commercial real estate 28.8 0.51% 24.4 0.44% 24.8 0.43% Commercial and industrial 68.0 0.84% 84.6 1.01% 97.2 1.10% Pinnacle 0.2 0.02% 0.1 0.01% 0.2 0.02% Franchise finance 16.7 4.90% 8.2 3.22% 11.7 4.63% Equipment finance 3.6 1.00% 2.0 0.64% 2.3 0.82% Total commercial 117.3 0.76% 119.3 0.77% 136.2 0.85% Allowance for credit losses 126.5$ 0.53% 130.7$ 0.54% 147.9$ 0.59% December 31, 2021 September 30, 2022 December 31, 2022

Loan Portfolio and Credit

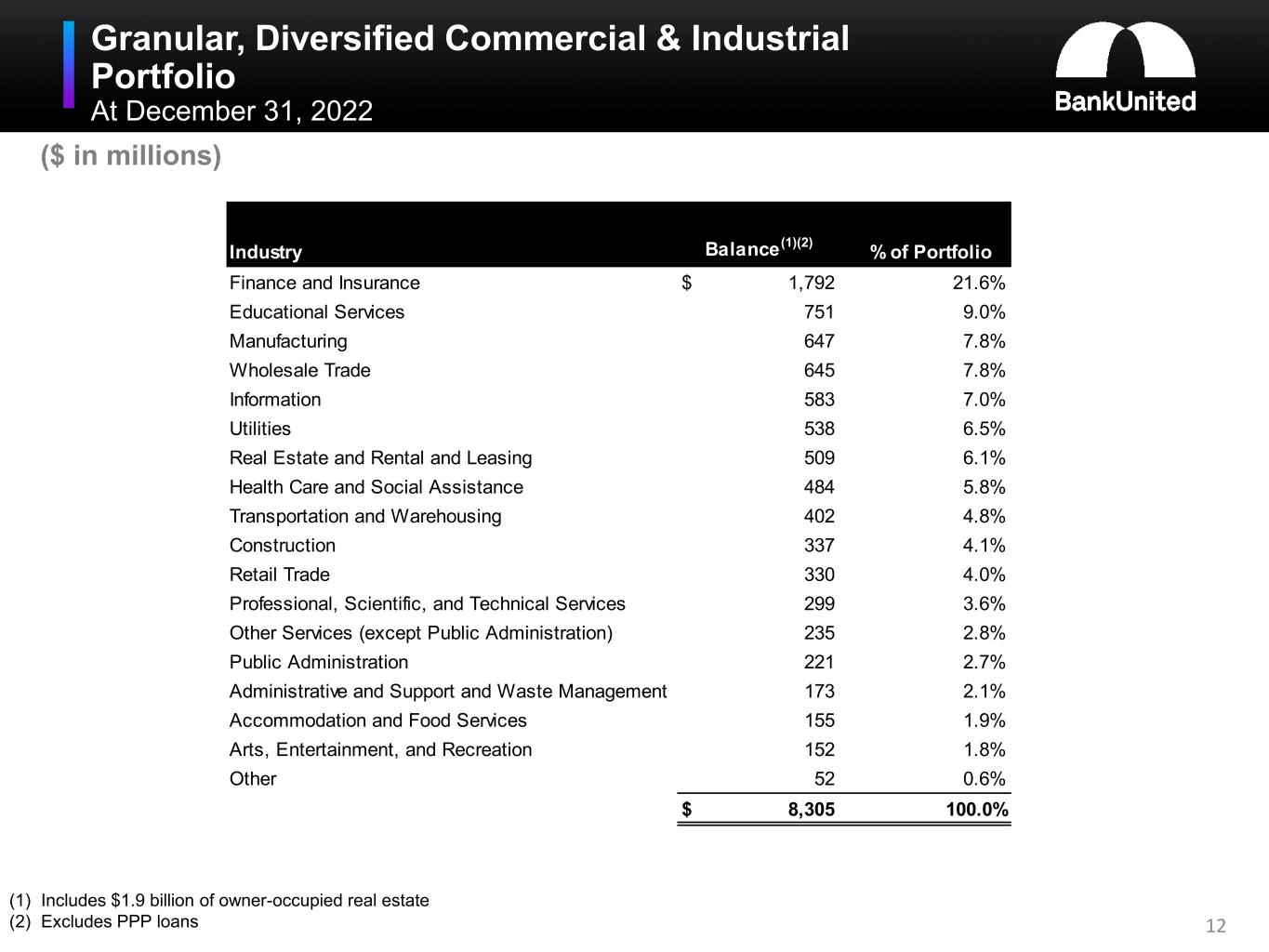

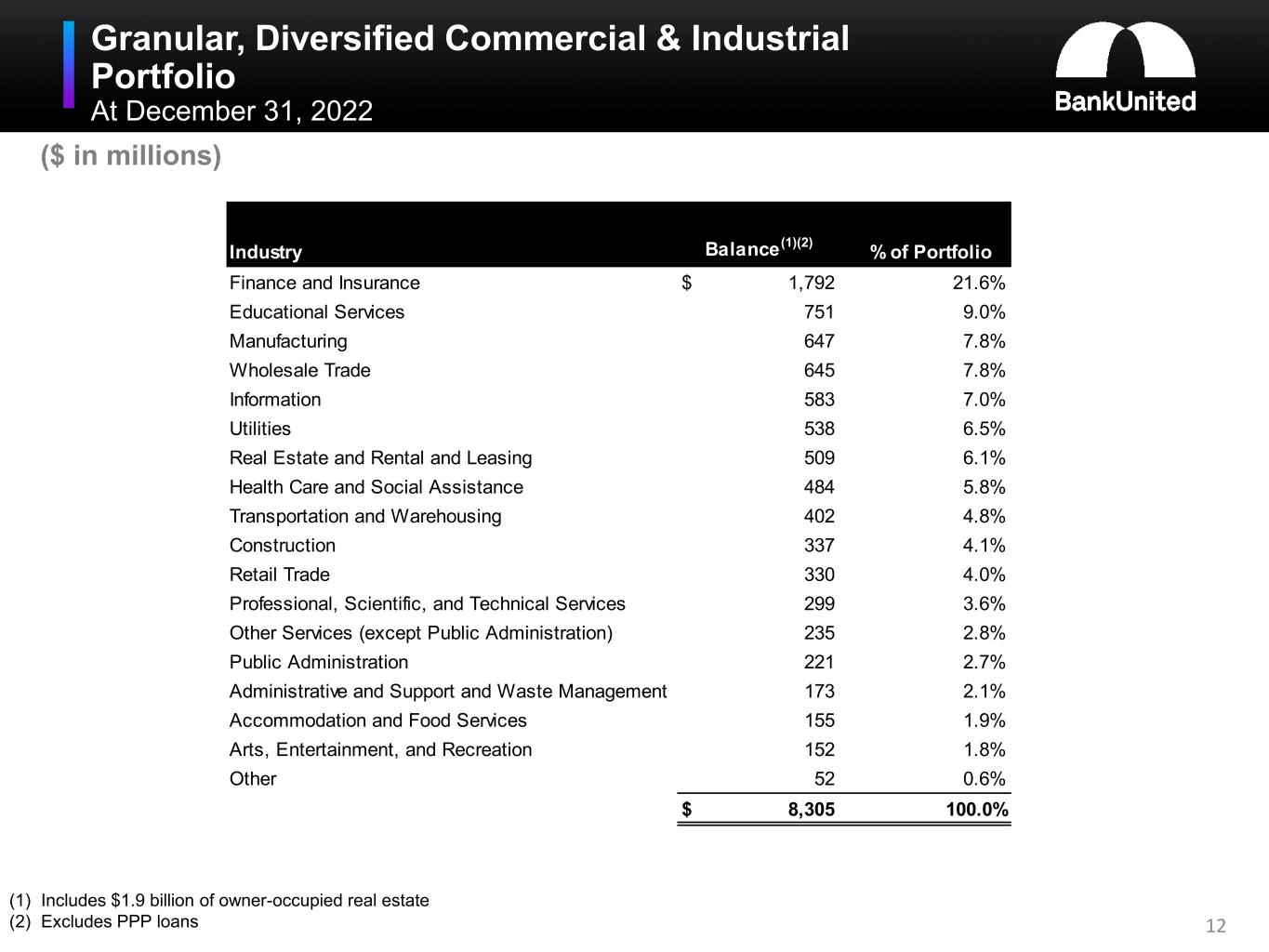

12 Granular, Diversified Commercial & Industrial Portfolio At December 31, 2022 (1) Includes $1.9 billion of owner-occupied real estate (2) Excludes PPP loans ($ in millions) Industry Balance(1)(2) % of Portfolio Finance and Insurance 1,792$ 21.6% Educational Services 751 9.0% Manufacturing 647 7.8% Wholesale Trade 645 7.8% Information 583 7.0% Utilities 538 6.5% Real Estate and Rental and Leasing 509 6.1% Health Care and Social Assistance 484 5.8% Transportation and Warehousing 402 4.8% Construction 337 4.1% Retail Trade 330 4.0% Professional, Scientific, and Technical Services 299 3.6% Other Services (except Public Administration) 235 2.8% Public Administration 221 2.7% Administrative and Support and Waste Management 173 2.1% Accommodation and Food Services 155 1.9% Arts, Entertainment, and Recreation 152 1.8% Other 52 0.6% 8,305$ 100.0%

13 Commercial Real Estate by Property Type At December 31, 2022 ($ in millions) Property Type Balance FL NY Tri State Other Wtd. Avg. DSCR Wtd. Avg. LTV Office 1,875$ 59% 22% 19% 1.75 64.3% Warehouse/Industrial 1,217 62% 18% 20% 2.05 52.6% Multifamily 945 48% 52% - 2.13 45.9% Retail 870 64% 27% 9% 1.88 61.7% Hotel 407 86% 6% 8% 2.13 55.1% Construction and Land 294 49% 49% 2% N/A N/A Other 92 75% 9% 16% 2.45 47.7% 5,700$ 61% 26% 13% 1.95 57.0%

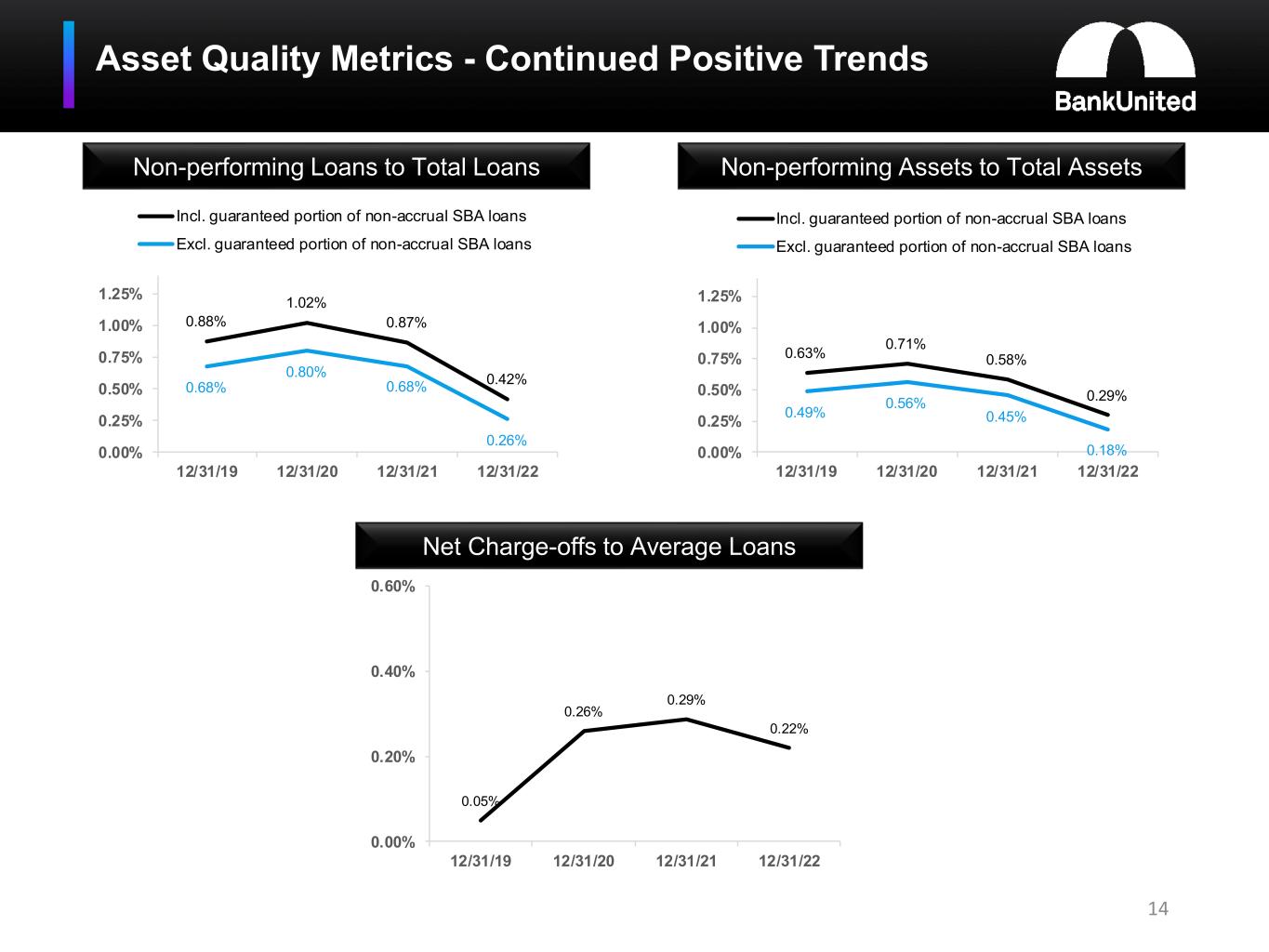

Asset Quality Metrics - Continued Positive Trends Non-performing Loans to Total Loans Non-performing Assets to Total Assets Net Charge-offs to Average Loans 14 0.88% 1.02% 0.87% 0.42% 0.68% 0.80% 0.68% 0.26% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 12/31/20 12/31/21 12/31/22 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.63% 0.71% 0.58% 0.29% 0.49% 0.56% 0.45% 0.18%0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 12/31/20 12/31/21 12/31/22 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.05% 0.26% 0.29% 0.22% 0.00% 0.20% 0.40% 0.60% 12/31/19 12/31/20 12/31/21 12/31/22

Non-Performing Loans by Portfolio Segment ($ in millions) (1) Includes the guaranteed portion of non-accrual SBA loans totaling $40.3 million, $46.1 million, $51.3 million, and $45.7 million at December 31, 2022, 2021, 2020 and 2019, respectively. 15 $19 $29 $29 $21 $24 $60 $30 $65 $43 $58 $22 $21 $14 $45 $33 $13 $62 $67 $56 $49 $205 $244 $206 $105 12/31/19 12/31/20 12/31/21 12/31/22 Residential and Other Consumer CRE C&I Equipment Franchise SBA(1)

Criticized and Classified Loans ($ in millions) Commercial Real Estate Commercial & Industrial (1) Franchise Finance(3) Equipment Finance SBA(2) (1) Substandard non-accruing and doubtful includes $0.6 million, $25.5 million, and $27.8 million of loans rated doubtful at December 31, 2022, September 30, 2022, and December 31, 2021, respectively. (2) Includes the guaranteed portion of non-accrual SBA loans totaling $40.3 million, $41.8 million, $46.1 million, $51.3 million, $45.7 million, at December 31, 2022, September 30, 2022, December 31, 2021, December 31, 2020, and December 31, 2019, respectively. (3) Substandard non-accruing and doubtful includes $7.3 million, $6.6 million, and $20.0 million of loans rated doubtful at September 30 2022, and December 31, 2021, respectively. $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 16 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000

Asset Quality – Delinquencies ($ in millions) Commercial (1) CRE Residential (2) (1) Includes lending subsidiaries, excludes PPP loans (2) Excludes government insured residential loans 17 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 9/30/22 12/31/22 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 9/30/22 12/31/22 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 9/30/22 12/31/22

Residential Portfolio Overview At December 31, 2022 High quality residential portfolio consists primarily of prime jumbo mortgages with de- minimis charge-offs since inception as well as fully government insured assets FICO Distribution(1) Breakdown by LTV(1) Breakdown by Vintage(1) (1) Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination. 18 Prior 19% 2018 3% 2019 4% 2020 13% 2021 44% 2022 17% 60% or less 35% 61% - 70% 26% 71% - 80% 38% More than 80% 1% <720 or NA 9% 720-759 17% >759 74% Residential Loan Product Type 30 Yr Fixed 31% 15 & 20 Year Fixed 13% 10/1 ARM 12% 5/1 & 7/1 ARM 23% Formerly Covered 1% Govt Insured 20%

Investment Portfolio

20 Investment Securities AFS ($ in thousands) Portfolio Composition Ratings Distribution NR 1% Gov 28% AAA 61% AA 7% A 3% US Government and agency 28% Private label RMBS and CMOs 26% Private label CMBS 26% Residential real estate lease- backed securities 6% CLO 12% State Municipal Obligations 1% Other 1% December 31, 2021 September 30, 2022 December 31, 2022 Portfolio Net Unrealized Gain(Loss) Fair Value Net Unrealized Loss Fair Value Net Unrealized Loss Fair Value US Government and agency $(3,939) $3,249,950 $(142,236) $2,774,123 $(145,601) $2,779,885 Private label RMBS and CMOs (10,716) 2,149,420 (306,193) 2,587,586 (333,926) 2,530,663 Private label CMBS (680) 2,604,010 (109,343) 2,583,888 (120,814) 2,524,354 Residential real estate lease-backed securities 2,123 476,968 (27,233) 478,055 (31,753) 470,441 CLOs (931) 1,078,286 (34,541) 1,059,523 (30,375) 1,136,463 State and Municipal Obligations 16,559 222,277 (9,442) 113,524 (5,520) 116,661 Other 1,419 152,510 (6,549) 100,123 (6,218) 95,976 $3,835 $9,933,421 $(635,537) $9,696,822 $(674,207) $9,654,443

21 Investment Securities – Asset Quality of Select Non-Agency Securities At December 31, 2022 Strong credit enhancement levels Private Label RMBS Private Label CMBS CLOs AAA 94% AA 1% A 5% AAA 85% AA 11% A 4% AAA 79% AA 17% A 4% Rating Min Max Avg AAA 3.0 98.2 17.5 2.3 AA 18.9 33.2 24.0 5.3 A 22.1 25.5 23.0 5.4 Wtd. Avg. 4.1 94.0 17.9 2.5 Subordination Wtd. Avg. Stress Scenario Loss Rating Min Max Avg AAA 30.0 98.1 44.3 6.8 AA 29.3 95.8 41.7 7.5 A 25.1 69.5 38.7 8.8 Wtd. Avg. 29.7 96.7 43.8 7.0 Subordination Wtd. Avg. Stress Scenario Loss Rating Min Max Avg AAA 41.4 59.4 45.8 9.9 AA 31.0 40.8 34.7 8.7 A 25.6 29.4 27.0 10.3 Wtd. Avg. 39.1 55.2 43.2 9.7 Subordination Wtd. Avg. Stress Scenario Loss

Recognitions and Rankings 22 Springbuk, October 2022 100 Healthiest Workplaces in America,#3 Superior rating by BauerFinancial consecutively since its inception Newsweek, March 2022 #4 America’s Most Trusted Companies (Banking), Comprehensive Innovation Ranking by Customers for products, conduct, citizenship, workplace and leadership, American Banker, November 2022 #1 Bank Reputation Ranking by Customers, American Banker, November 2022#2 Bank Reputation Ranking by Non- Customers, American Banker, November 2022#9

Non-GAAP Financial Measures

24 Non-GAAP Financial Measures PPNR is a non-GAAP financial measure. Management believes this measure is relevant to understanding the performance of the Company attributable to elements other than the provision for credit losses and the ability of the Company to generate earnings sufficient to cover estimated credit losses, particularly in view of recent volatility of the provision for credit losses. This measure also provides a meaningful basis for comparison to other financial institutions since it is commonly employed and is a measure frequently cited by investors and analysts. The following table reconciles the non-GAAP financial measure of PPNR to the comparable GAAP financial measurement of income before income taxes for the periods indicated (in thousands): December 31, 2022 September 30, 2022 December 31, 2021 Income before income taxes (GAAP) 81,792$ 117,083$ 63,531$ Plus: provision for credit losses 39,608 3,720 246 PPNR (non-GAAP) 121,400$ 120,803$ 63,777$ Three Months Ended

25 Non-GAAP Financial Measures Tangible book value per common share is a non-GAAP financial measure. Management believes this measure is relevant to understanding the capital position and performance of the Company. Disclosure of this non-GAAP financial measure also provides a meaningful basis for comparison to other financial institutions as it is a metric commonly used in the banking industry. The following table reconciles the non-GAAP financial measurement of tangible book value per common share to the comparable GAAP financial measurement of book value per common share at December 31, 2022 (in thousands except share and per share data): Total stockholders’ equity (GAAP) Less: goodwill Tangible stockholders’ equity (non-GAAP) Common shares issued and outstanding Book value per common share (GAAP) Tangible book value per common share (non-GAAP) December 31, 2022 Total stockholders’ equity (GAAP) 2,435,981$ Less: goodwill 77,637 Tangible stockholders’ equity (non-GAAP) 2,358,344$ Common shares issued and outstanding 75,674,587 Book value per common share (GAAP) 32.19$ Tangible book value per common share (non-GAAP) 31.16$