April 25, 2023 Q1 2023 – Supplemental Information 1 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitations) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by external circumstances outside the Company's direct control, such as adverse events impacting the financial services industry. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Quarterly Highlights 3

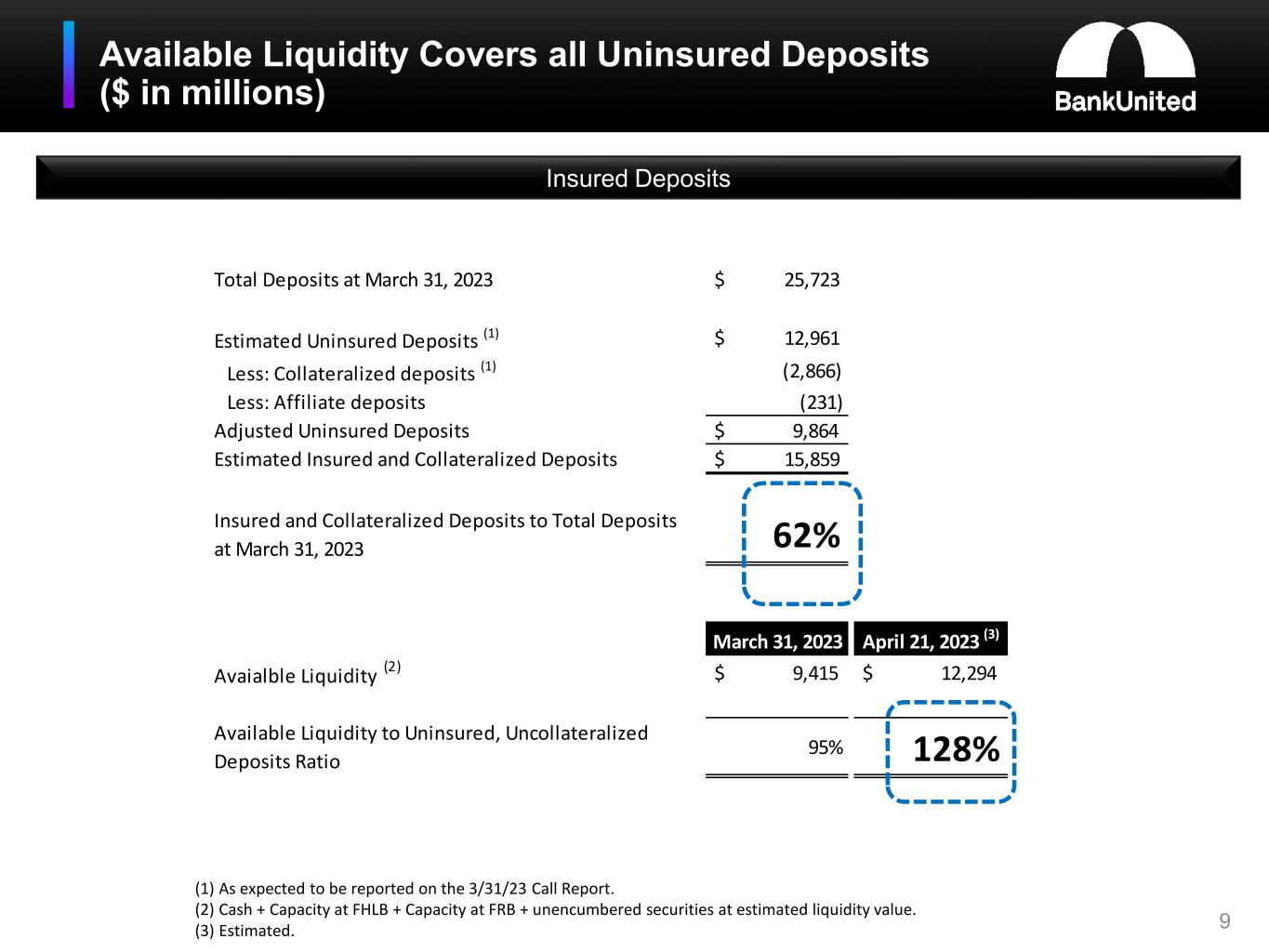

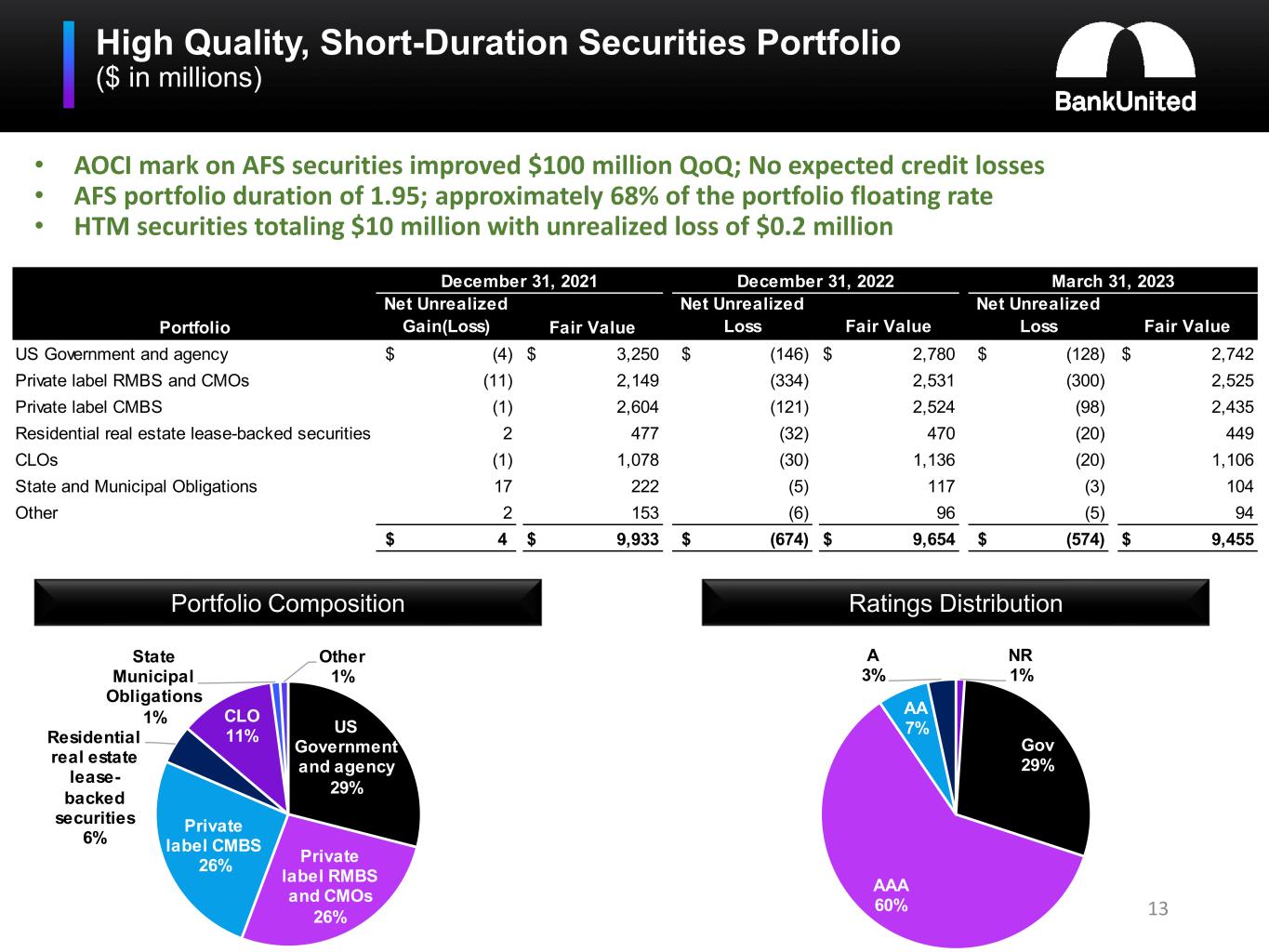

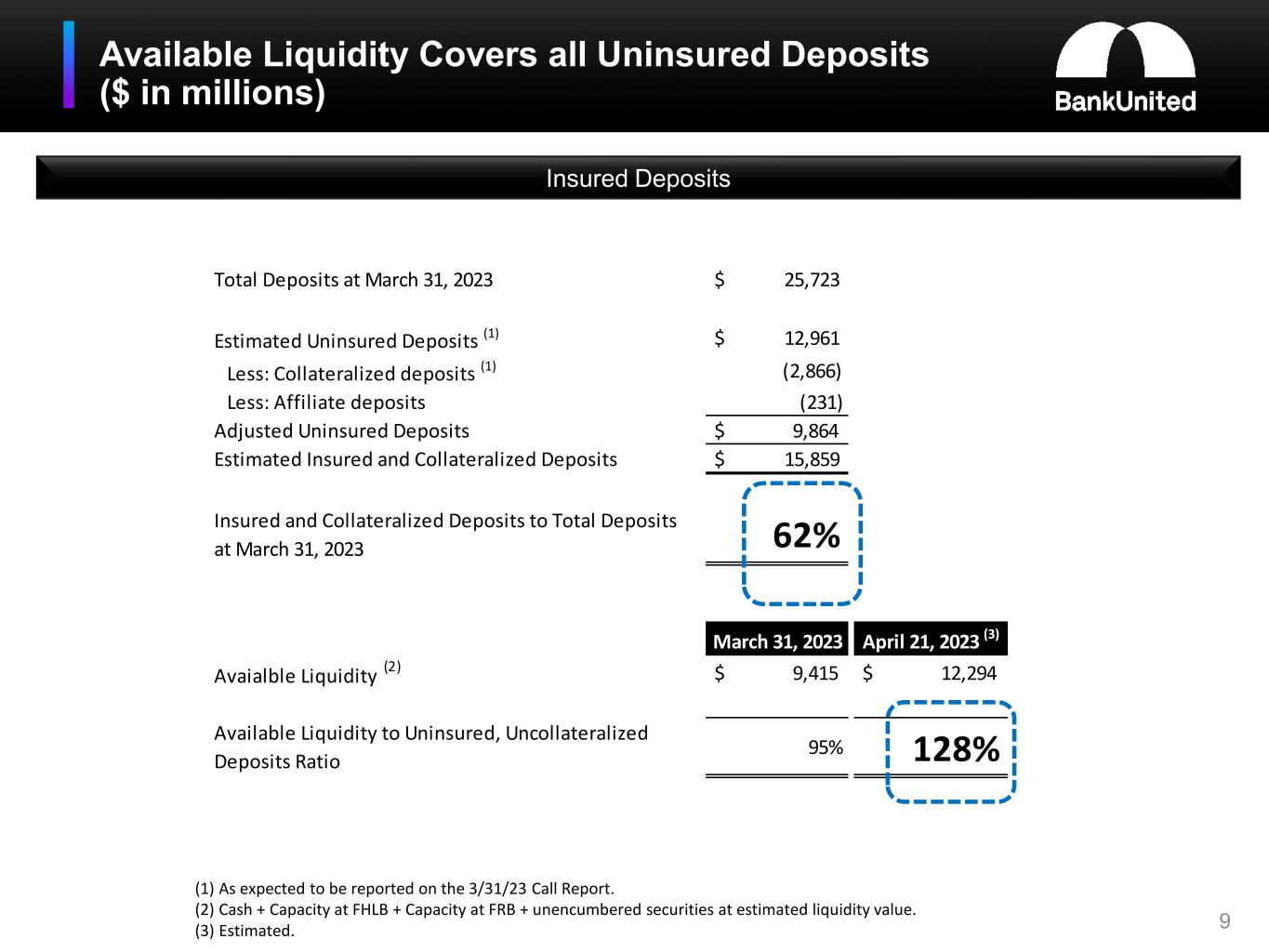

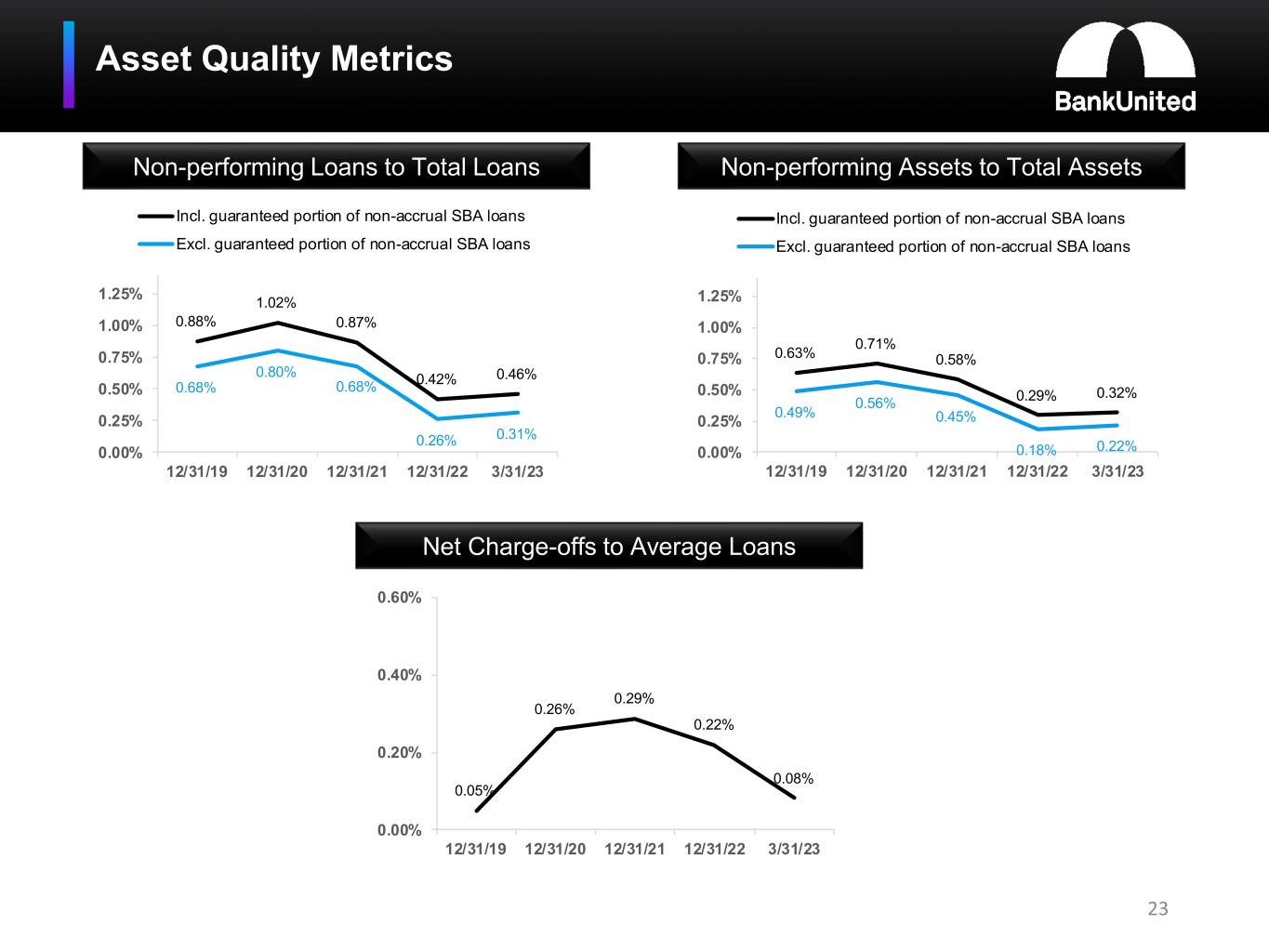

Topics of Current Interest 4 Strong Liquidity Position Securities Portfolio Asset Quality Robust Capital Base • Same day available liquidity of $12.3 billion at April 21 • Available liquidity to uninsured, uncollateralized deposits ratio of 128% at April 21 • Pre-tax unrealized loss on AFS securities improved by $100 million during the quarter to 5.7% of amortized cost • HTM securities totaled only $10 million at March 31; de-minimis unrealized loss • AFS portfolio duration of 1.95 at March 31 • NPA ratio of 0.32% at March 31; 0.22% excluding guaranteed portion of non-accrual SBA loans • Annualized net charge-off rate of 0.08% • High quality CRE portfolio; wtd average DSCR 1.92; wtd average LTV 56.8%; 60% Florida • Total CRE exposure reduced/de-risked by $1.8 billion or 24% since pre-pandemic • CET1 ratios of 10.8% at the holding company and 12.5% at the bank • Pro-forma CET1 at the holding company of 9.4% including AOCI • Repurchased $55 million of common stock in Q1; repurchases have been paused • Book value and tangible book value per share grew to $33.34 and $32.30 (1) (1) Tangible book value per share is a non-GAAP financial measure. See section entitled “Non-GAAP Financial Measures” on page 29. Deposits • Deposits declined by $1.8 billion for the quarter – $1.9 billion of outflows week of March 13 from an isolated group of larger clients • Deposit flows quickly stabilized; successfully protected core deposit relationships amidst deposit pressure – majority of core deposit base remained stable throughout • 62% of our deposits are insured or collateralized at March 31 • Non-interest bearing DDA consistent at 29% of total deposits

Highlights from First Quarter Earnings 5 (1) Includes guaranteed portion of non-accrual SBA loans. (2) Annualized for the period ended March 31, 2023; Q4 2022 value is for fiscal 2022. ($ in millions, except per share data) Q1 23 Q4 22 Change Key Highlights Net Interest Income $228 $243 ($15) Provision for Credit Losses $20 $40 ($20) Deterioration in economic forecast and specific reserves Total Non-interest Income $17 $27 ($10) Q1 2023 includes $13 million loss on preferred equity investments Total Non-interest Expense $153 $148 $5 Net Income $53 $64 ($11) EPS $0.70 $0.82 ($0.12) Period-end Loans $24,893 $24,886 $7 Residential runoff offset by net growth in commercial segments Period-end Non-interest DDA $7,367 $8,038 ($671) Period-end Deposits $25,723 $27,509 ($1,786) CET1 10.8% 11.0% (0.2%) Total Capital 12.6% 12.7% (0.1%) Yield on Loans 5.10% 4.72% 0.38% Yield on Securities 4.95% 4.33% 0.62% Cost of Deposits 2.05% 1.42% 0.63% Higher cost funding related to DDA outflows and elevated liquidity Net Interest Margin 2.62% 2.81% (0.19%) Non-performing Assets to Total Assets (1) 0.32% 0.29% 0.03% Allowance for Credit Losses to Total Loans 0.64% 0.59% 0.05% Net Charge-offs to Average Loans(2) 0.08% 0.22% (0.14%)

Deposits, Liquidity and Interest Rate Risk 6

Primary Strategic Focus - Deposit Base Transformation ($ in millions) 7 Quarterly Cost of Deposits 0.94% 1.52% 1.48% 0.43% 0.19% 1.42% 2.05% Non-interest bearing as % of Total Deposits 14.0% 15.4% 17.6% 25.5% 30.5% 29.2% 28.6% Spot Average Annual Percentage Yield (“APY”) At December 31, 2019 At December 31, 2020 At December 31, 2021 At December 31, 2022 At March 31, 2023 Target Federal Funds Rate Upper Limit 1.75% 0.25% 0.25% 4.50% 5.00% Total non-maturity deposits 1.11% 0.29% 0.14% 1.83% 2.00% Total interest-bearing deposits 1.71% 0.48% 0.23% 2.66% 3.11% Total deposits 1.42% 0.36% 0.16% 1.92% 2.27% Target Federal Funds Rate Upper Limit less Spot APY of Total Deposits 0.33% (0.11%) 0.09% 2.58% 2.73% $6,335 $6,820 $7,347 $4,807 $3,384 $4,268 $5,250 $10,715 $11,262 $10,622 $12,660 $13,369 $13,061 $10,601 $1,758 $1,771 $2,131 $3,020 $3,709 $2,142 $2,505 $3,071 $3,621 $4,295 $7,009 $8,976 $8,038 $7,367 $21,879 $23,474 $24,395 $27,496 $29,438 $27,509 $25,723 12/31/17 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 Non-interest Demand Interest Demand Money Market / Savings Time

Deposit Flows Have Stabilized ($ in millions) 8 • Deposit flows prior to March 10 consistent with industry trends and historical patterns • Late quarter deposit flows normalized after an initial week of volatility • $1.9 billion of outflows during the week of 3/13/23 attributed to a small number of larger institutional customers • Deposit flows since 3/31/23 have been within the range of normal daily operational activity Deposits at 12/31/22 Deposits at 03/31/23 12/31/2022 – 3/10/2023 Week of 3/13/2023 Week of 3/20/2023 Week of 3/27/2023 Deposit Portfolio Characteristics: • No VC or crypto- related business • 61% commercial or municipal • Over 80% of commercial deposits considered relationship deposits • Diverse deposit book by industry sector; largest segment title solutions at $2 billion – no other sectors exceeding $1 billion • Over 85% of title segment deposits in operating accounts • Title segment includes over 8,000 accounts across approx. 950 relationships; segment grew over $100mm in March • Deposits in the ICS program increased from $94 million at 3/13 to $574 million at 4/21

Available Liquidity Covers all Uninsured Deposits ($ in millions) 9 Insured Deposits (1) As expected to be reported on the 3/31/23 Call Report. (2) Cash + Capacity at FHLB + Capacity at FRB + unencumbered securities at estimated liquidity value. (3) Estimated. Total Deposits at March 31, 2023 $ 25,723 Estimated Uninsured Deposits (1) $ 12,961 Less: Collateralized deposits (1) (2,866) Less: Affiliate deposits (231) Adjusted Uninsured Deposits $ 9,864 Estimated Insured and Collateralized Deposits $ 15,859 Insured and Collateralized Deposits to Total Deposits at March 31, 2023 62% March 31, 2023 April 21, 2023 (3) Avaialble Liquidity (2) $ 9,415 $ 12,294 Available Liquidity to Uninsured, Uncollateralized Deposits Ratio 95% 128%

Liquidity is Strong and Stable ($ in millions) 10 Cash $887 Cash $1,001 FHLB Capacity $2,919 FHLB Capacity $3,019 Capacity at the Fed $4,568 Capacity at the Fed $7,433 Unencumbered Securities $1,041 Unencumbered Securities, $841 $9,415 $12,294 3/31/2023 4/21/2023 Same Day Available LiquiditySwift, prudent actions to maximize available liquidity and stabilize deposit flows: • Monetized securities and loan collateral by pledging to FHLB and Fed • Increased cash on balance sheet • Increased deposits in insured ICS program • Frequent communication with funding sources and counterparties • Equipped bankers with enhanced communication tools Available liquidity sources: • Cash • Secured funding (FHLB, BTFP, discount window) • FDIC insured wholesale and municipal deposits • Deposit campaigns • Securities and residential loan paydowns

11 We take limited interest rate risk Simulated percentage change in economic value of equity and net interest income compared to the base case as of 3/31/2023: • Modeling assumes a static balance sheet and parallel shocks of the indicated magnitude • Benchmark indices are floored at zero • Base case assumes the consensus forward curve

Investment Portfolio 12

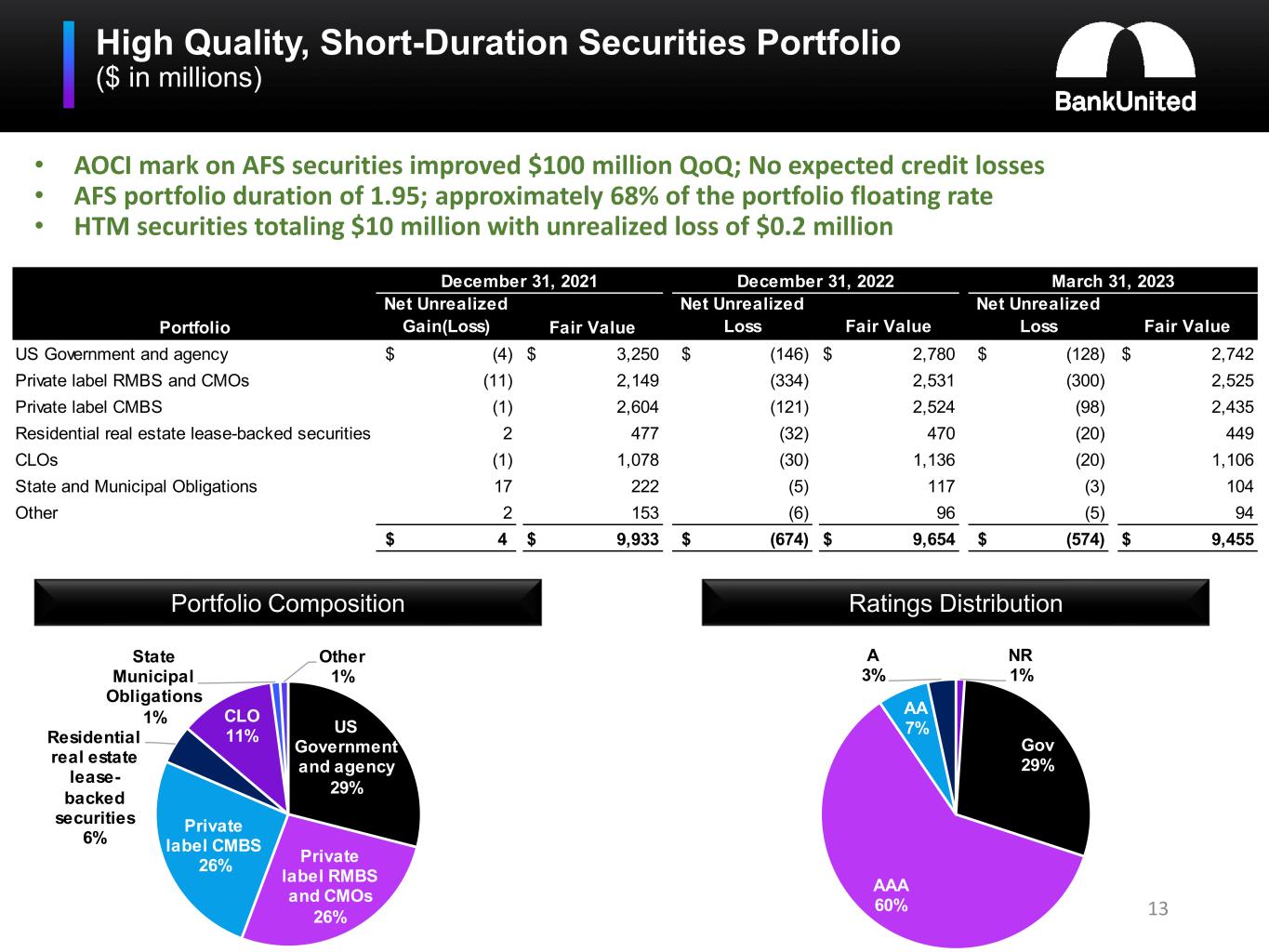

13 High Quality, Short-Duration Securities Portfolio ($ in millions) ($ in thousands) Portfolio Composition Ratings Distribution • AOCI mark on AFS securities improved $100 million QoQ; No expected credit losses • AFS portfolio duration of 1.95; approximately 68% of the portfolio floating rate • HTM securities totaling $10 million with unrealized loss of $0.2 million US Government and agency 29% Private label RMBS and CMOs 26% Private label CMBS 26% Residential real estate lease- backed securities 6% CLO 11% State Municipal Obligations 1% Other 1% NR 1% Gov 29% AAA 60% AA 7% A 3% Portfolio Net Unrealized Gain(Loss) Fair Value Net Unrealized Loss Fair Value Net Unrealized Loss Fair Value US Government and agency (4)$ 3,250$ (146)$ 2,780$ (128)$ 2,742$ Private label RMBS and CMOs (11) 2,149 (334) 2,531 (300) 2,525 Private label CMBS (1) 2,604 (121) 2,524 (98) 2,435 Residential real estate lease-backed securities 2 477 (32) 470 (20) 449 CLOs (1) 1,078 (30) 1,136 (20) 1,106 State and Municipal Obligations 17 222 (5) 117 (3) 104 Other 2 153 (6) 96 (5) 94 4$ 9,933$ (674)$ 9,654$ (574)$ 9,455$ December 31, 2021 December 31, 2022 March 31, 2023

14 Strong credit enhancement levels Private Label RMBS Private Label CMBS CLOs AAA 94% AA 1% A 5% AAA 85% AA 11% A 4% AAA 80% AA 17% A 3% Rating Min Max Avg AAA 3.0 99.8 17.6 2.3 AA 19.1 33.5 24.3 5.3 A 22.9 25.8 23.6 5.4 Wtd. Avg. 4.2 95.4 17.9 2.5 Subordination Wtd. Avg. Stress Scenario Loss Rating Min Max Avg AAA 30.0 98.1 44.7 6.4 AA 29.3 95.0 39.5 7.3 A 25.1 69.9 39.4 8.6 Wtd. Avg. 29.7 96.6 43.9 6.6 Subordination Wtd. Avg. Stress Scenario Loss Rating Min Max Avg AAA 41.4 60.2 46.5 10.4 AA 31.0 38.1 34.8 9.2 A 27.3 31.5 28.9 9.2 Wtd. Avg. 39.2 55.5 43.9 10.1 Subordination Wtd. Avg. Stress Scenario Loss High Quality, Short-Duration Securities Portfolio At March 31, 2023

Loans and the Allowance for Credit Losses 15

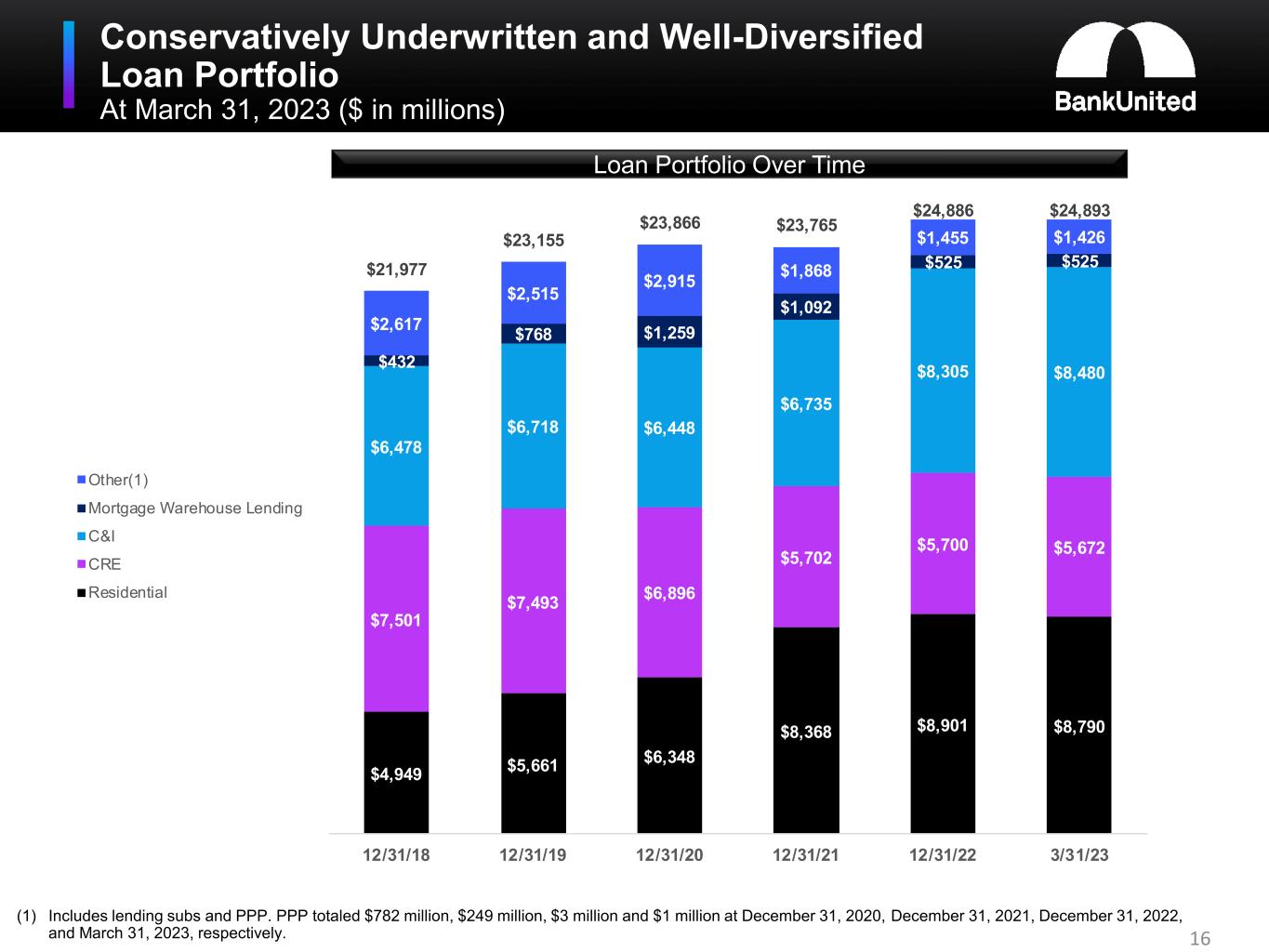

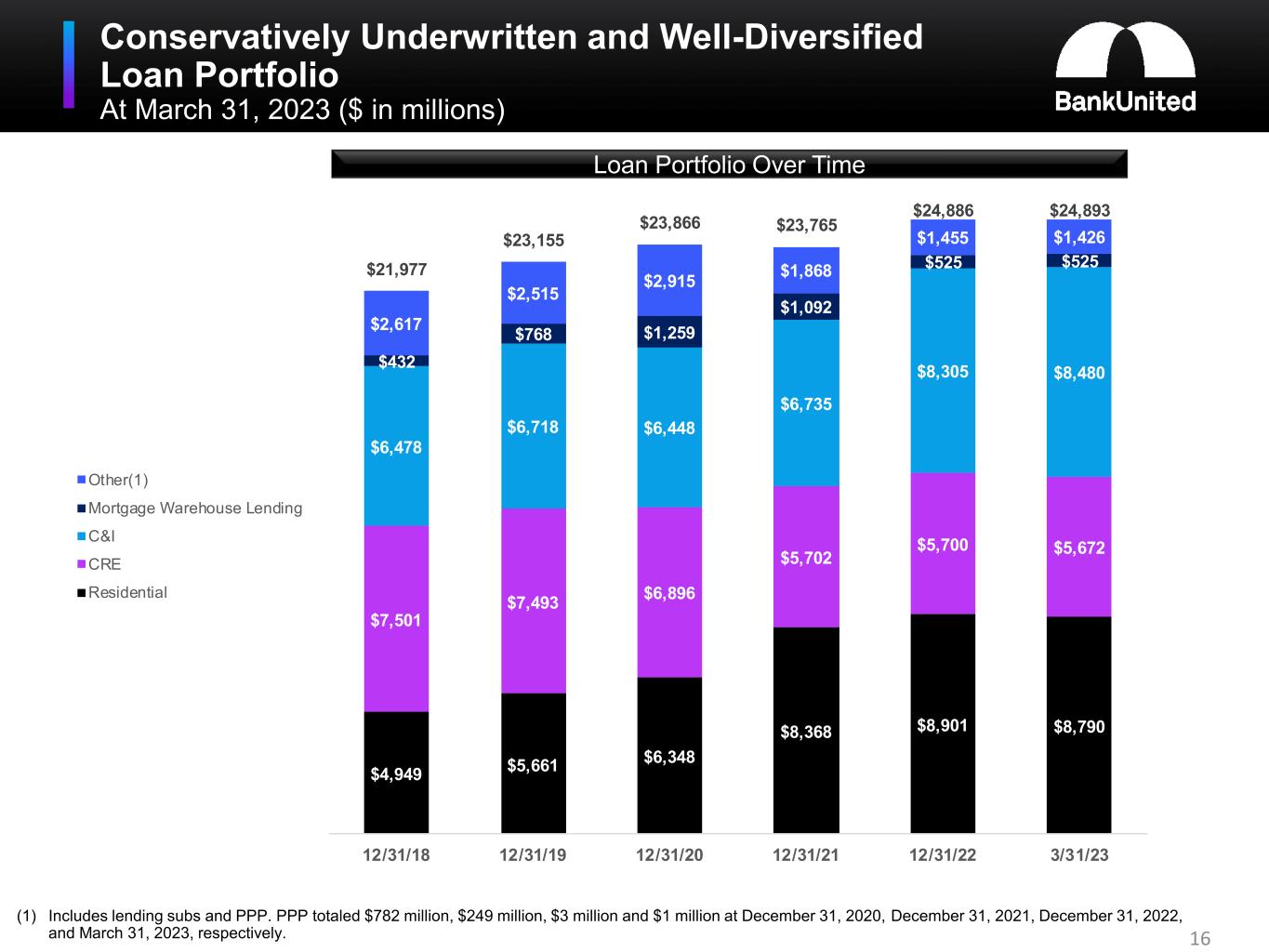

Conservatively Underwritten and Well-Diversified Loan Portfolio At March 31, 2023 ($ in millions) 16 Loan Portfolio Over Time (1) Includes lending subs and PPP. PPP totaled $782 million, $249 million, $3 million and $1 million at December 31, 2020, December 31, 2021, December 31, 2022, and March 31, 2023, respectively. $4,949 $5,661 $6,348 $8,368 $8,901 $8,790 $7,501 $7,493 $6,896 $5,702 $5,700 $5,672 $6,478 $6,718 $6,448 $6,735 $8,305 $8,480 $432 $768 $1,259 $1,092 $525 $525 $2,617 $2,515 $2,915 $1,868 $1,455 $1,426 $21,977 $23,155 $23,866 $23,765 $24,886 $24,893 12/31/18 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 Other(1) Mortgage Warehouse Lending C&I CRE Residential

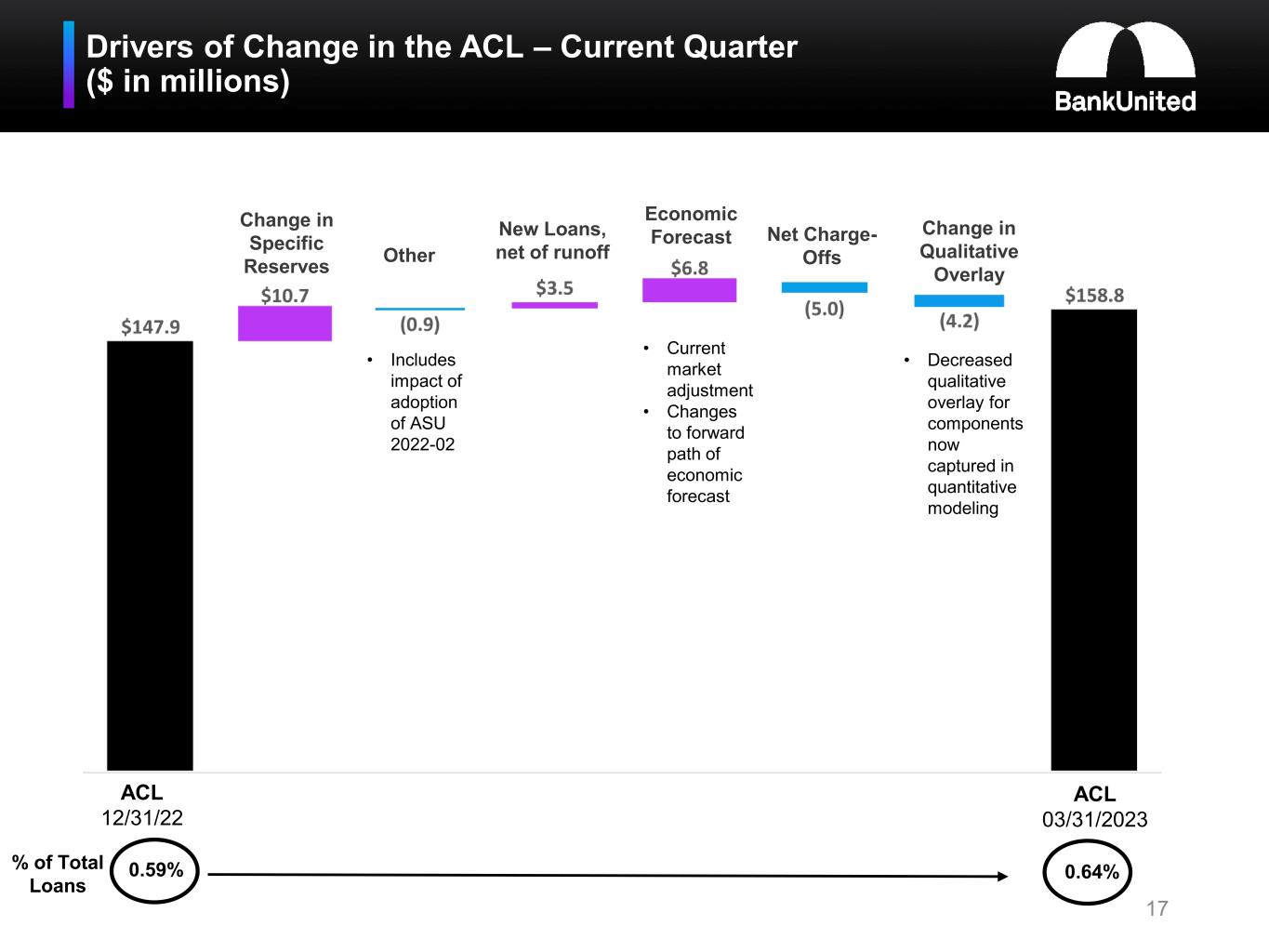

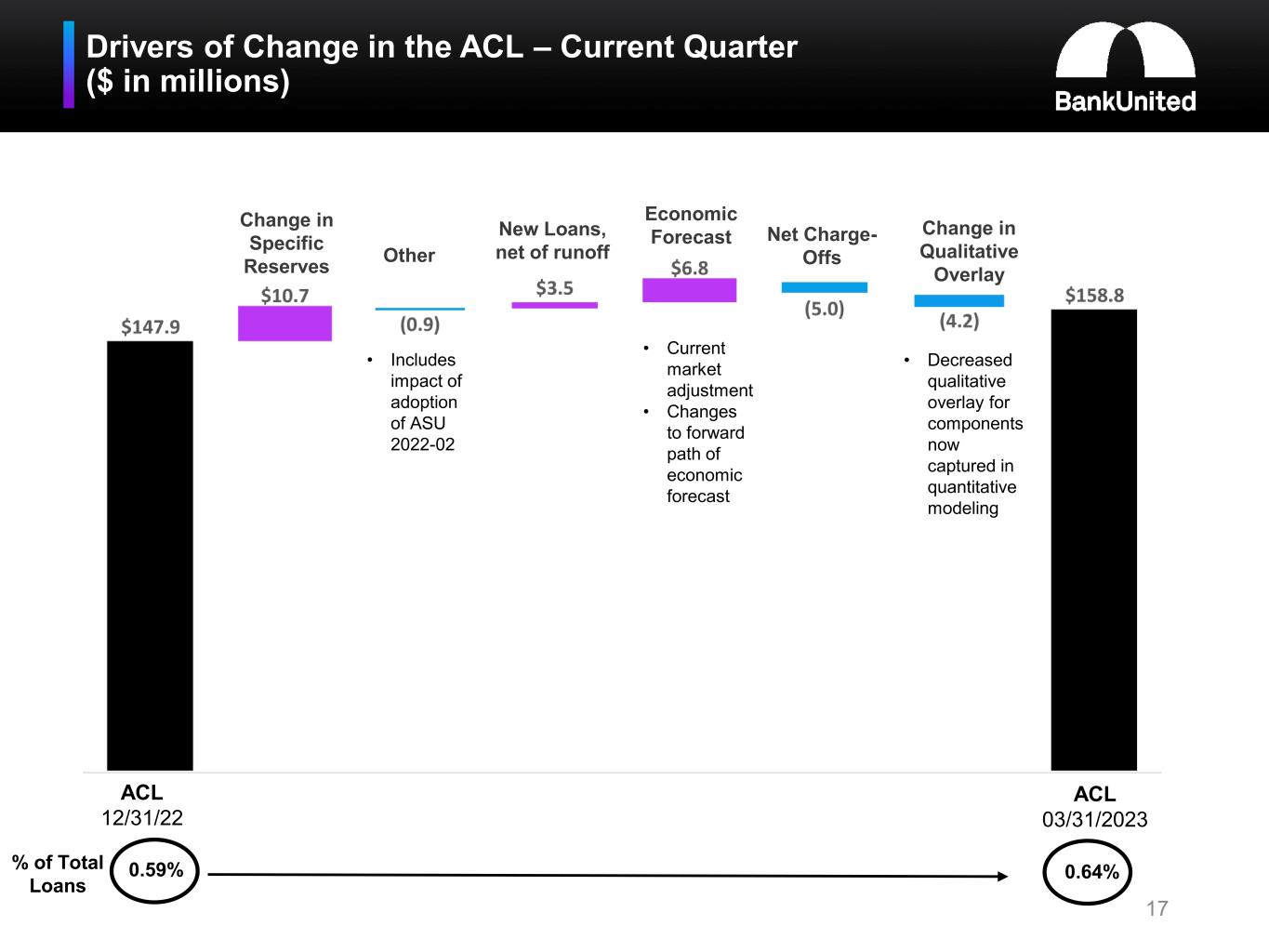

Drivers of Change in the ACL – Current Quarter ($ in millions) 17 ACL 12/31/22 ACL 03/31/2023 Other Economic Forecast Net Charge- Offs Change in Qualitative Overlay % of Total Loans 0.59% 0.64% • Current market adjustment • Changes to forward path of economic forecast • Decreased qualitative overlay for components now captured in quantitative modeling Change in Specific Reserves New Loans, net of runoff • Includes impact of adoption of ASU 2022-02

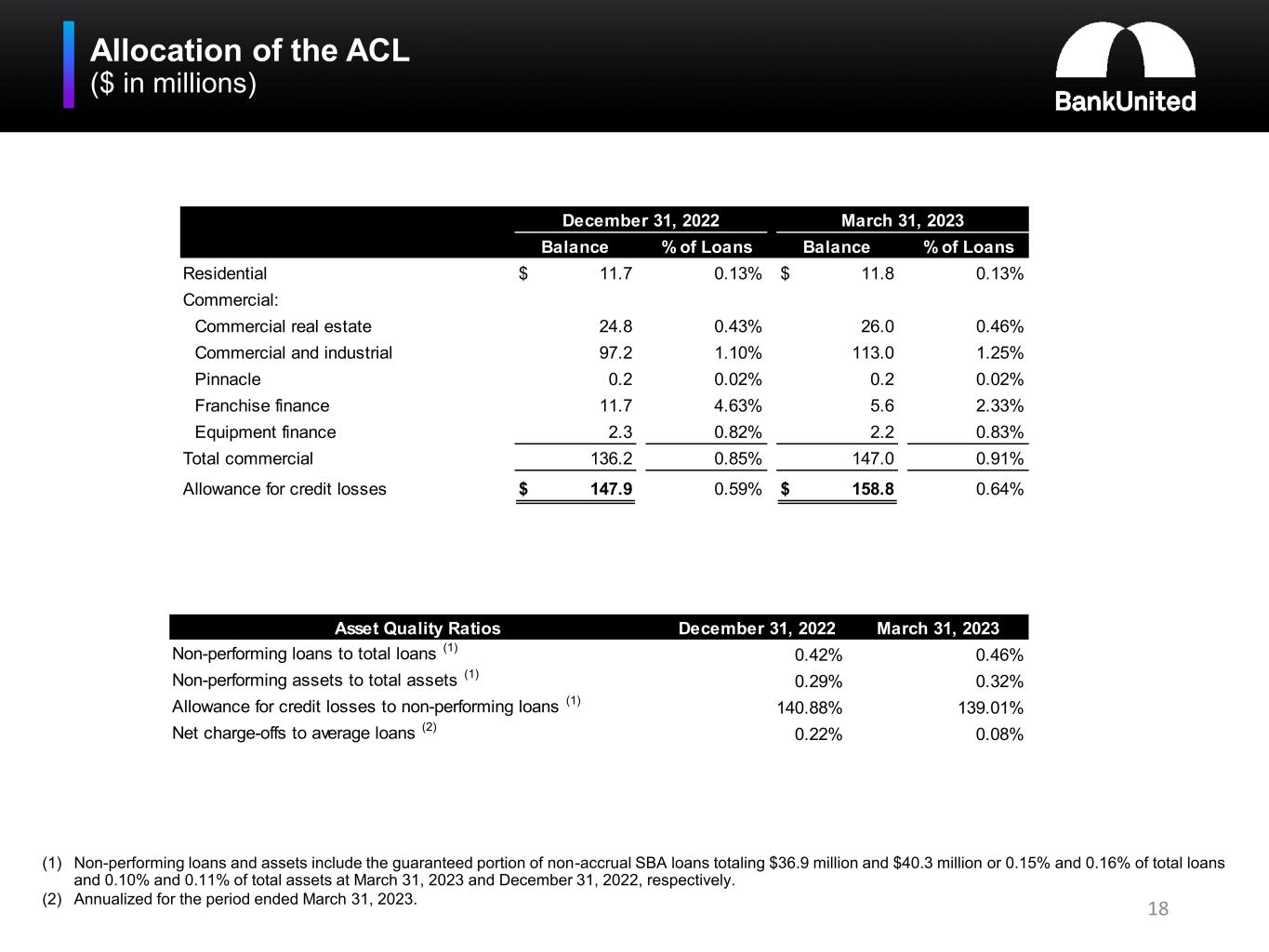

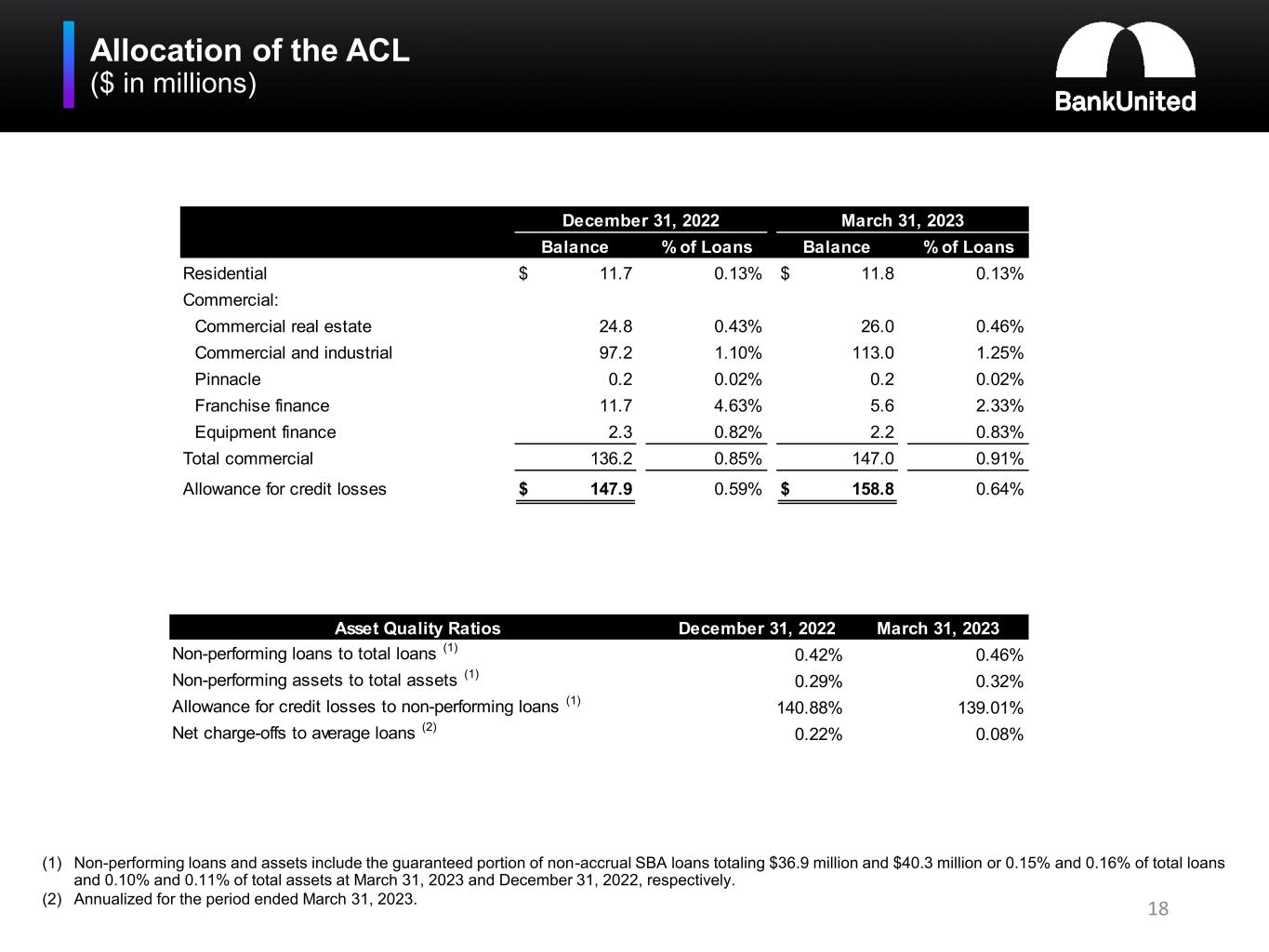

Allocation of the ACL ($ in millions) 18 (1) Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $36.9 million and $40.3 million or 0.15% and 0.16% of total loans and 0.10% and 0.11% of total assets at March 31, 2023 and December 31, 2022, respectively. (2) Annualized for the period ended March 31, 2023. Balance % of Loans Balance % of Loans Residential 11.7$ 0.13% 11.8$ 0.13% Commercial: Commercial real estate 24.8 0.43% 26.0 0.46% Commercial and industrial 97.2 1.10% 113.0 1.25% Pinnacle 0.2 0.02% 0.2 0.02% Franchise finance 11.7 4.63% 5.6 2.33% Equipment finance 2.3 0.82% 2.2 0.83% Total commercial 136.2 0.85% 147.0 0.91% Allowance for credit losses 147.9$ 0.59% 158.8$ 0.64% December 31, 2022 March 31, 2023 Asset Quality Ratios December 31, 2022 March 31, 2023 Non-performing loans to total loans (1) 0.42% 0.46% Non-performing assets to total assets (1) 0.29% 0.32% Allowance for credit losses to non-performing loans (1) 140.88% 139.01% Net charge-offs to average loans (2) 0.22% 0.08%

19 Granular, Diversified Commercial & Industrial Portfolio At March 31, 2023 (1) Includes $1.9 billion of owner-occupied real estate ($ in millions) Industry Balance(1) % of Portfolio Finance and Insurance 1,844$ 21.8% Manufacturing 729 8.6% Educational Services 710 8.4% Information 671 7.9% Wholesale Trade 634 7.5% Utilities 568 6.7% Real Estate and Rental and Leasing 496 5.8% Health Care and Social Assistance 478 5.6% Transportation and Warehousing 375 4.4% Construction 358 4.2% Retail Trade 313 3.7% Professional, Scientific, and Technical Services 277 3.3% Other Services (except Public Administration) 231 2.7% Public Administration 221 2.6% Arts, Entertainment, and Recreation 177 2.1% Administrative and Support and Waste Management 170 2.0% Accommodation and Food Services 160 1.9% Other 69 0.8% 8,481$ 100.0%

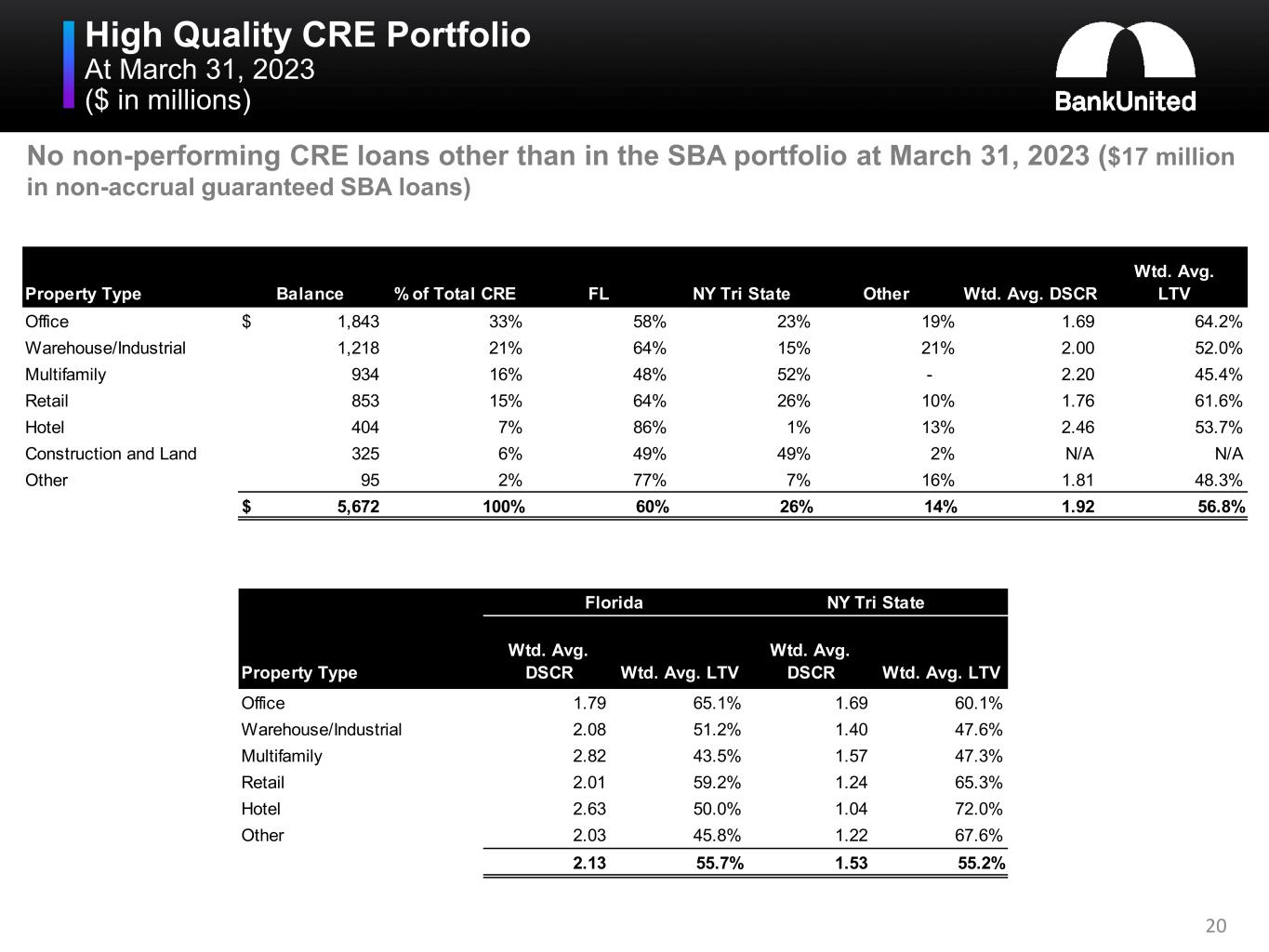

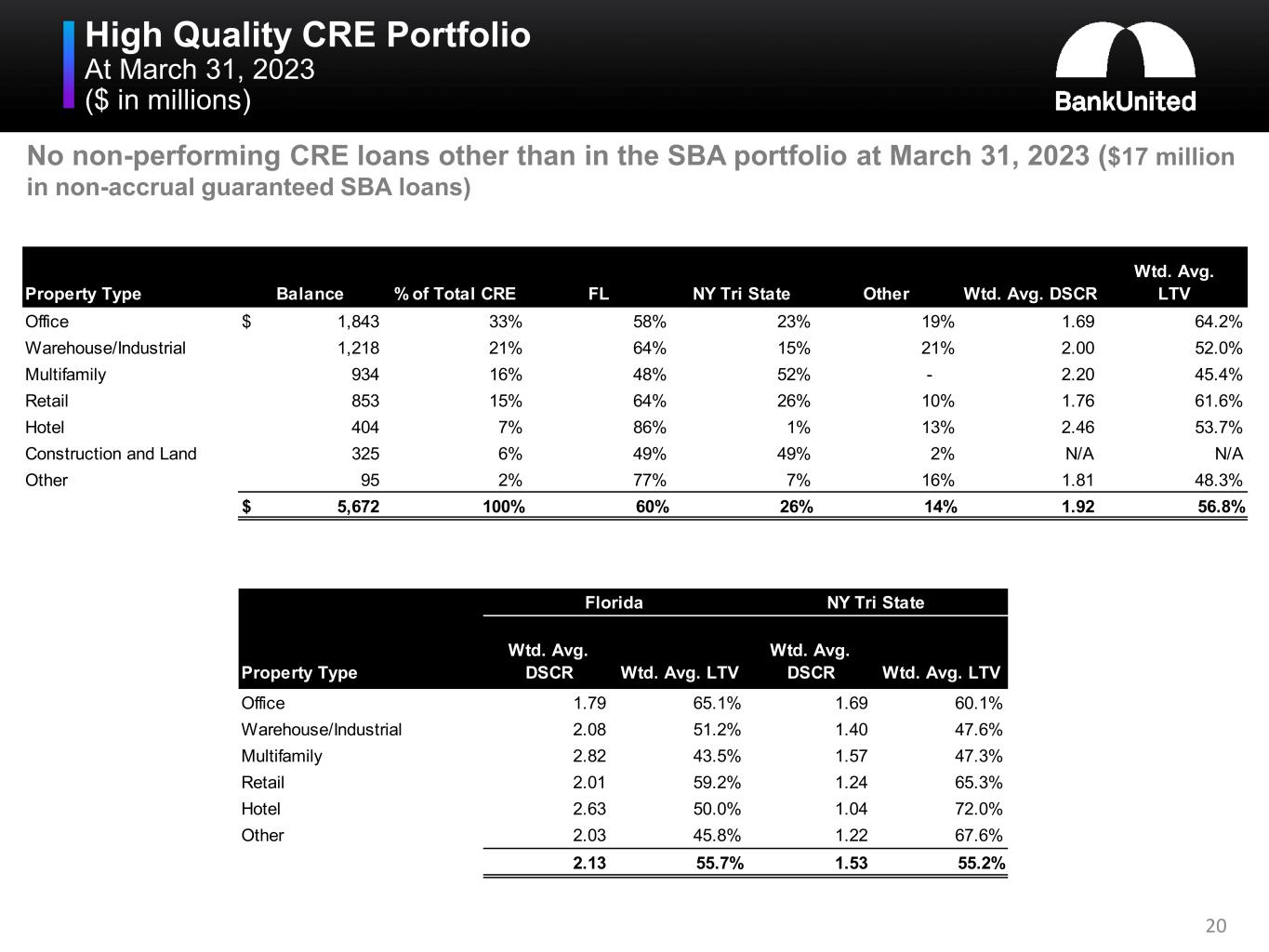

20 High Quality CRE Portfolio At March 31, 2023 ($ in millions) No non-performing CRE loans other than in the SBA portfolio at March 31, 2023 ($17 million in non-accrual guaranteed SBA loans) Property Type Wtd. Avg. DSCR Wtd. Avg. LTV Wtd. Avg. DSCR Wtd. Avg. LTV Office 1.79 65.1% 1.69 60.1% Warehouse/Industrial 2.08 51.2% 1.40 47.6% Multifamily 2.82 43.5% 1.57 47.3% Retail 2.01 59.2% 1.24 65.3% Hotel 2.63 50.0% 1.04 72.0% Other 2.03 45.8% 1.22 67.6% 2.13 55.7% 1.53 55.2% Florida NY Tri State Property Type Balance % of Total CRE FL NY Tri State Other Wtd. Avg. DSCR Wtd. Avg. LTV Office 1,843$ 33% 58% 23% 19% 1.69 64.2% Warehouse/Industrial 1,218 21% 64% 15% 21% 2.00 52.0% Multifamily 934 16% 48% 52% - 2.20 45.4% Retail 853 15% 64% 26% 10% 1.76 61.6% Hotel 404 7% 86% 1% 13% 2.46 53.7% Construction and Land 325 6% 49% 49% 2% N/A N/A Other 95 2% 77% 7% 16% 1.81 48.3% 5,672$ 100% 60% 26% 14% 1.92 56.8%

21 High Quality CRE Portfolio ($ in millions) Manageable Maturity Risk: Just 8% of Total CRE portfolio are Fixed or Swapped and maturing in next 12 months Office Portfolio Characteristics: • 58% total exposure Florida, 9% Manhattan • Florida exposure over 90% suburban, approx 60% Class A or medical office • New York exposure approx 35 - 40% Manhattan, remainder Long Island, boroughs and surrounding areas; approx 40% Class A or medical • Rent rollover in next 12 months a little over 10% of the portfolio • De-minimis delinquent or non-performing loans ($300k 30 days delinquent) • 5 year cumulative net charge-offs of $2 million Property Type Maturing in the Next 12 Months % Maturing in the Next 12 Months Fixed Rate Floating Rate Swapped Fixed Rate to Borrower as a % of Total Portfolio Floating Rate Not Swapped Office 344$ 19% 122$ 74$ 11% 148$ Warehouse/Industrial 105 9% 46 - 4% 59 Multifamily 159 17% 79 - 8% 80 Retail 159 19% 114 8 14% 37 Hotel 28 7% 3 - 1% 25 Construction and Land 38 12% 2 - 1% 36 Other 12 13% - 12 13% - 845$ 15% 366$ 94$ 8% 385$

22 CRE Portfolio – Stress Testing Results At December 31, 2022 ($ in millions) • 12/31/2022 CRE portfolio losses modeled using the Moody's S4 recessionary scenario • Total expected losses of $97 million, or 1.7% of total CRE • Moody's S4 Recessionary Scenario: recession > 1 year with decline in real GDP over 4%; Unemployment ~ 9%; Inverted yield curve through 2023; CRE prices decline by 30% • Continue to be significantly above 6.5% "Well Capitalized" threshold if modeled S4 scenario losses were incurred across the entire loan portfolio. Estimated stressed CET1 at the bank of 11.9% and at the holding company of 10.5% at 12/31/22; implied 3/31/23 CET 1 of 12.0% at bank and 10.3% at holdco 2.28% 0.13% 1.35% 1.03% 5.31% 2.76% 0.95% 1.70% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Office Industrial Multifamily Retail Hotel Construction and Land Other Total Moody's S4 Scenario Expected Losses in S4 Scenario $42.8 $1.6 $12.7 $8.9 $21.6 $8.1 $0.9 $96.6

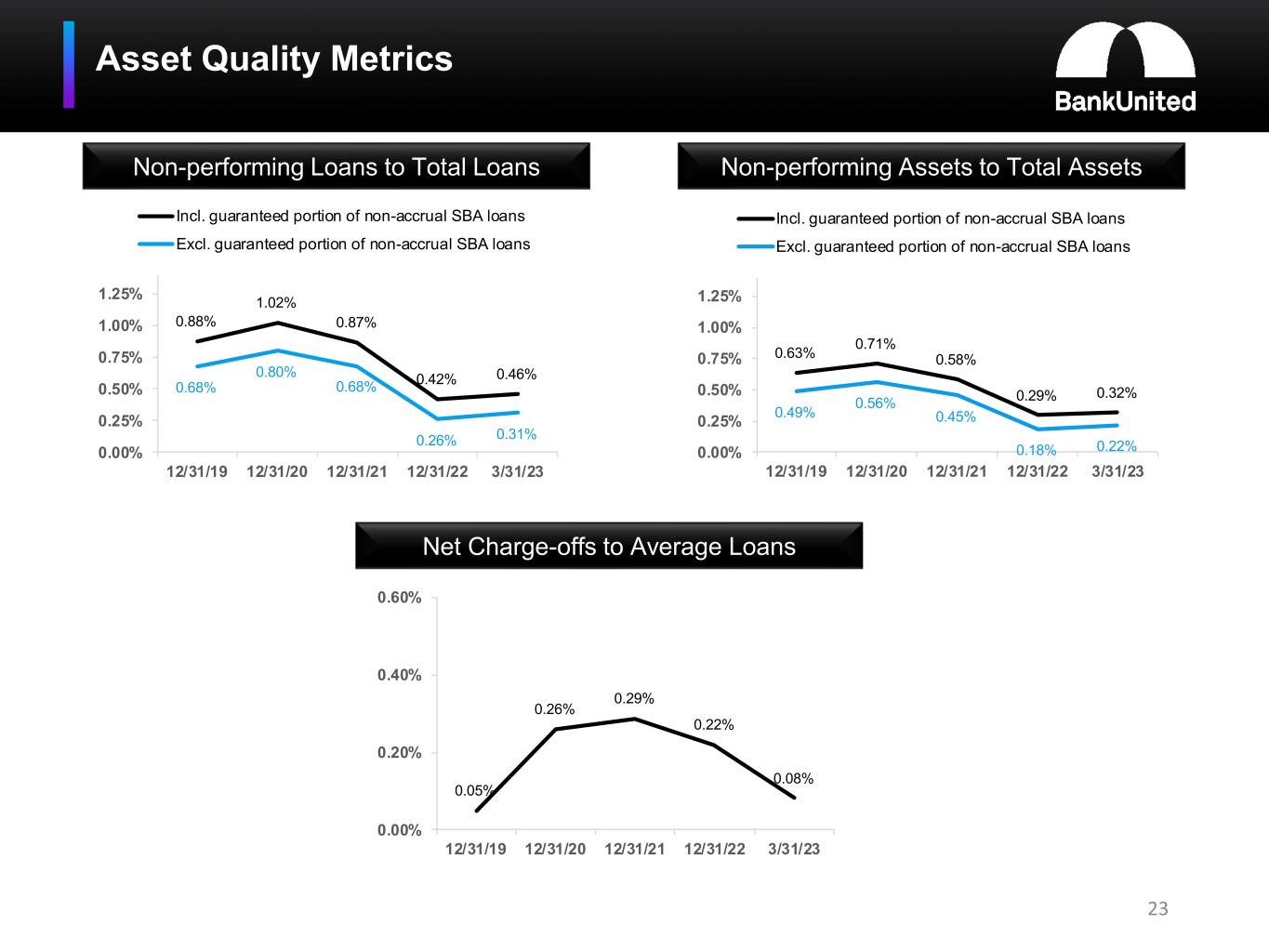

Asset Quality Metrics Non-performing Loans to Total Loans Non-performing Assets to Total Assets Net Charge-offs to Average Loans 23 0.88% 1.02% 0.87% 0.42% 0.46% 0.68% 0.80% 0.68% 0.26% 0.31% 0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.63% 0.71% 0.58% 0.29% 0.32% 0.49% 0.56% 0.45% 0.18% 0.22%0.00% 0.25% 0.50% 0.75% 1.00% 1.25% 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 0.05% 0.26% 0.29% 0.22% 0.08% 0.00% 0.20% 0.40% 0.60% 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23

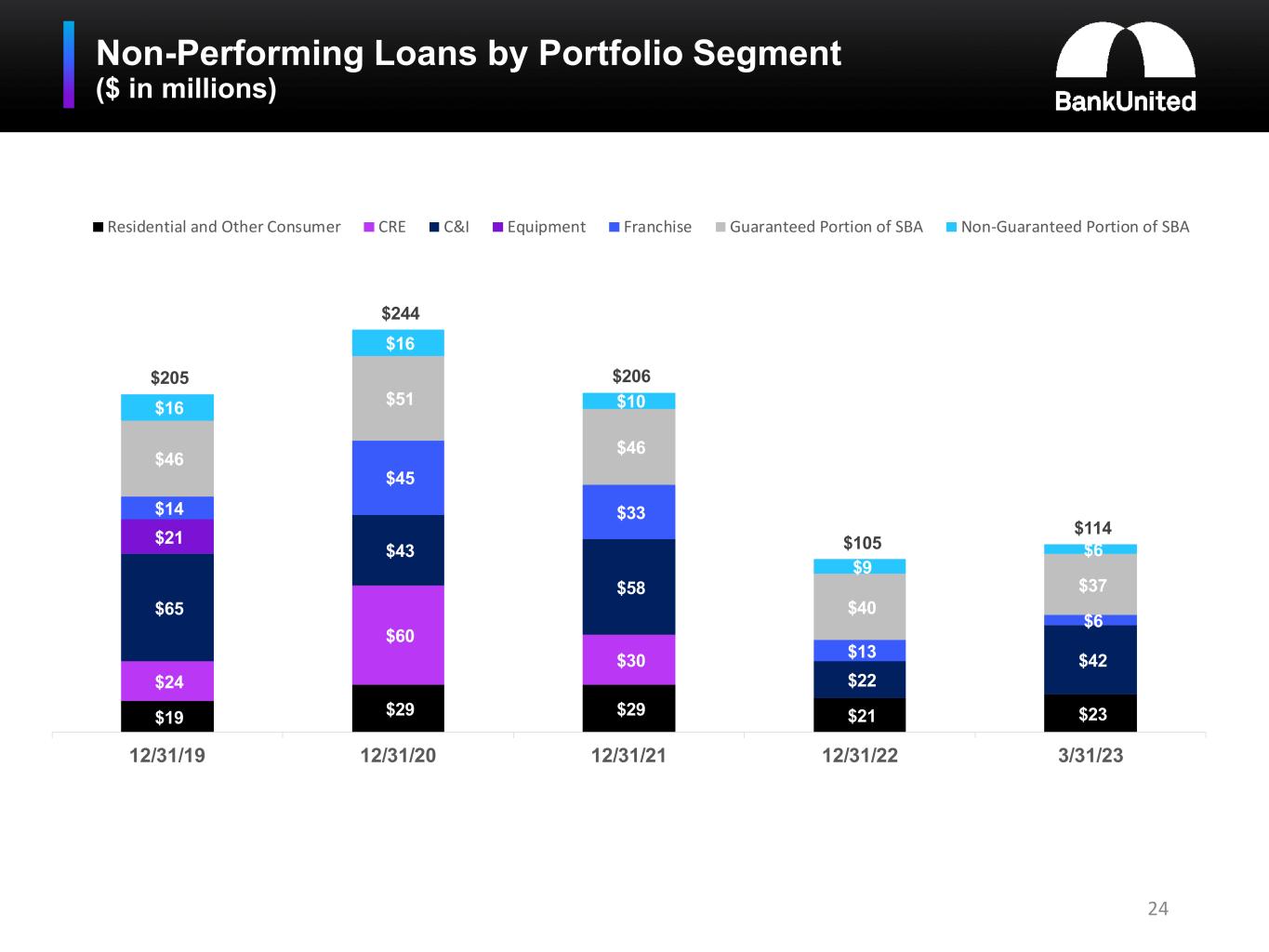

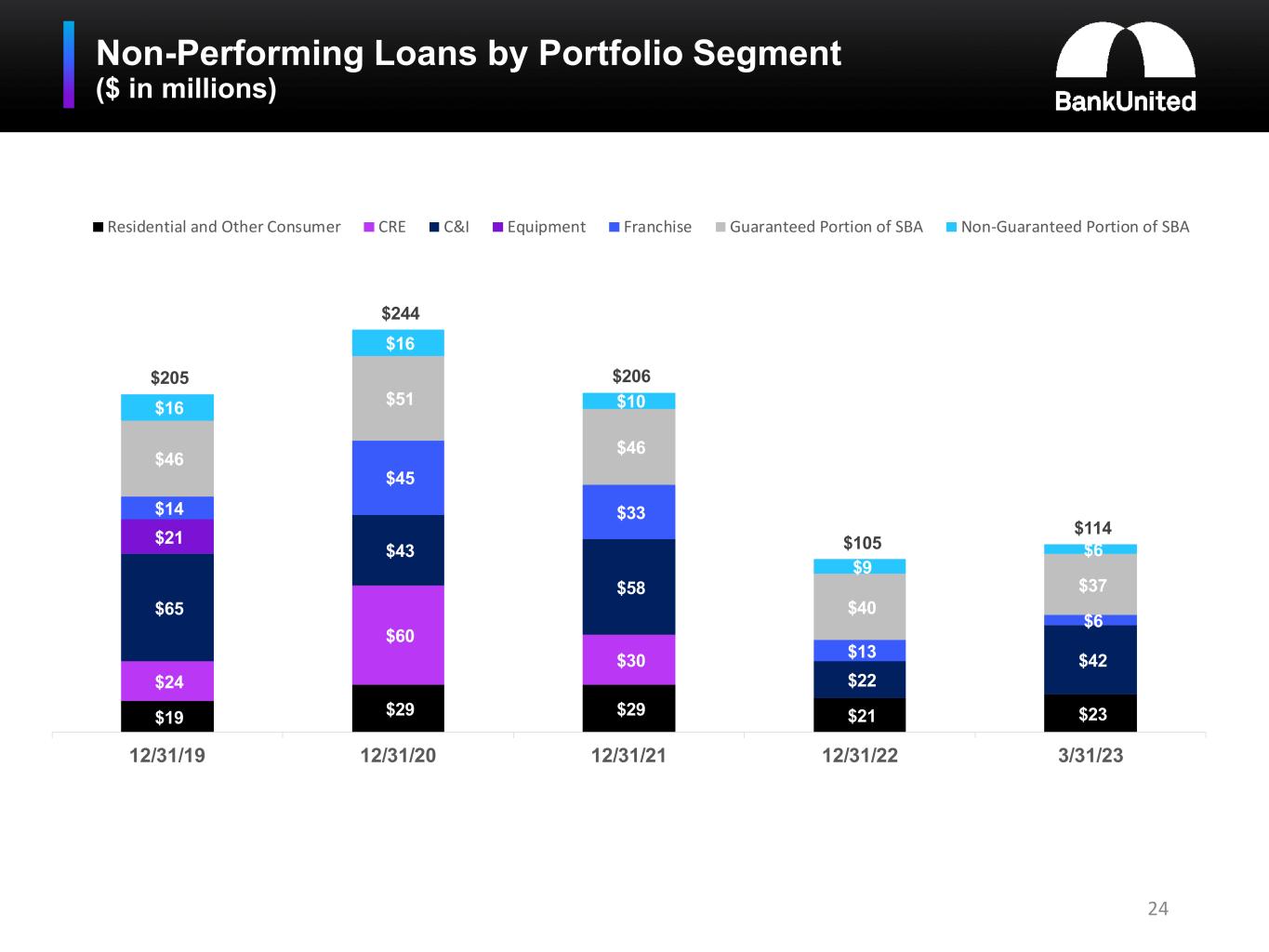

Non-Performing Loans by Portfolio Segment ($ in millions) 24 $19 $29 $29 $21 $23 $24 $60 $30 $65 $43 $58 $22 $42 $21 $14 $45 $33 $13 $6 $205 $244 $206 $105 $114 $16 $16 $10 $9 $6 $46 $51 $46 $40 $37 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 Residential and Other Consumer CRE C&I Equipment Franchise Guaranteed Portion of SBA Non-Guaranteed Portion of SBA

Criticized and Classified Loans ($ in millions) Commercial Real Estate (1) Commercial & Industrial (1) (1) Excludes SBA $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 25 $180 $39 $80 $91 $2 $20 Multifamily Hotel Retail Office Construction & Land SBA Criticized and Classified CRE by Property Type at March 31, 2023 Over $50mm of multi-family criticized/classified paid off or expected to pay off in April

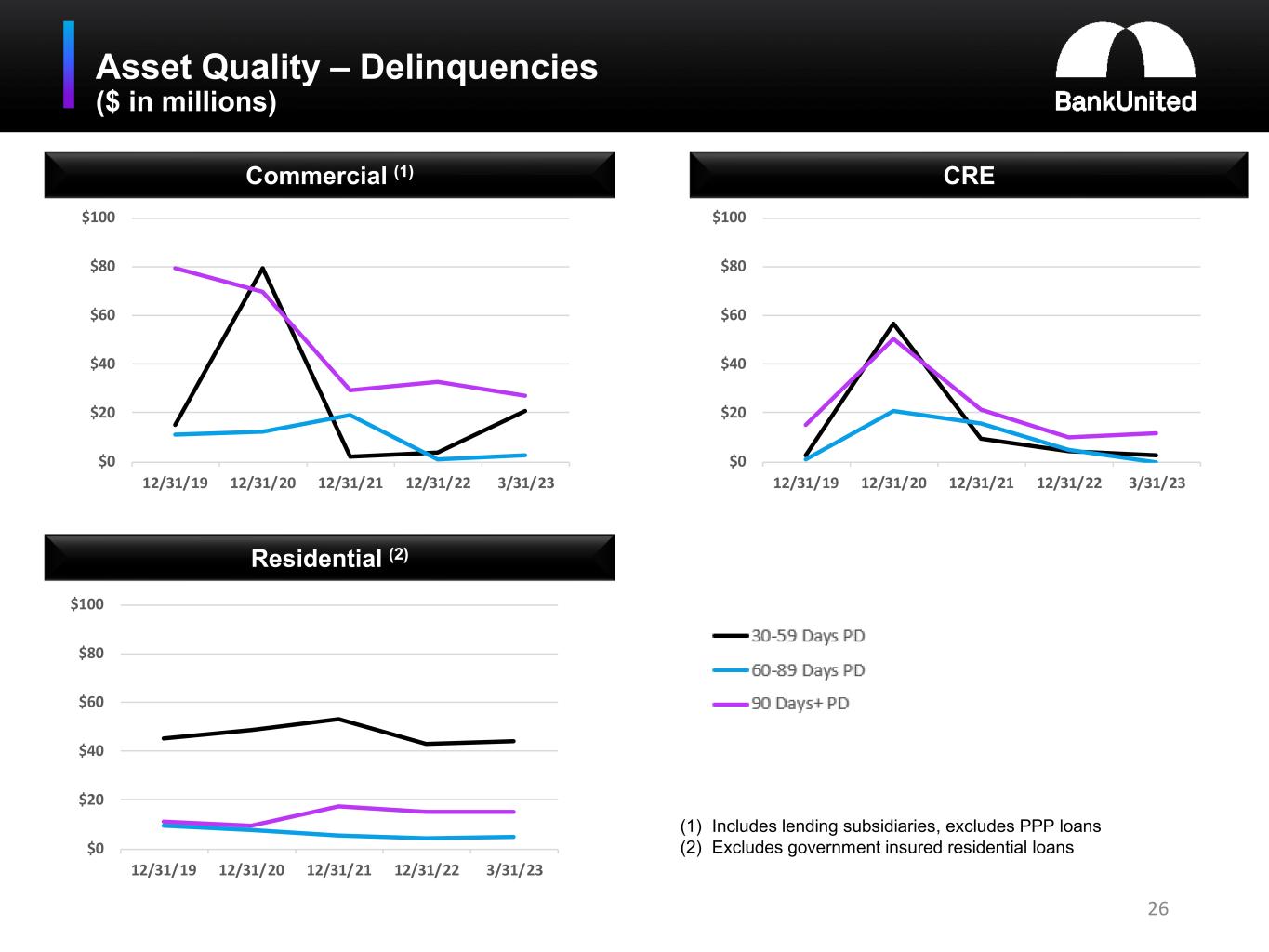

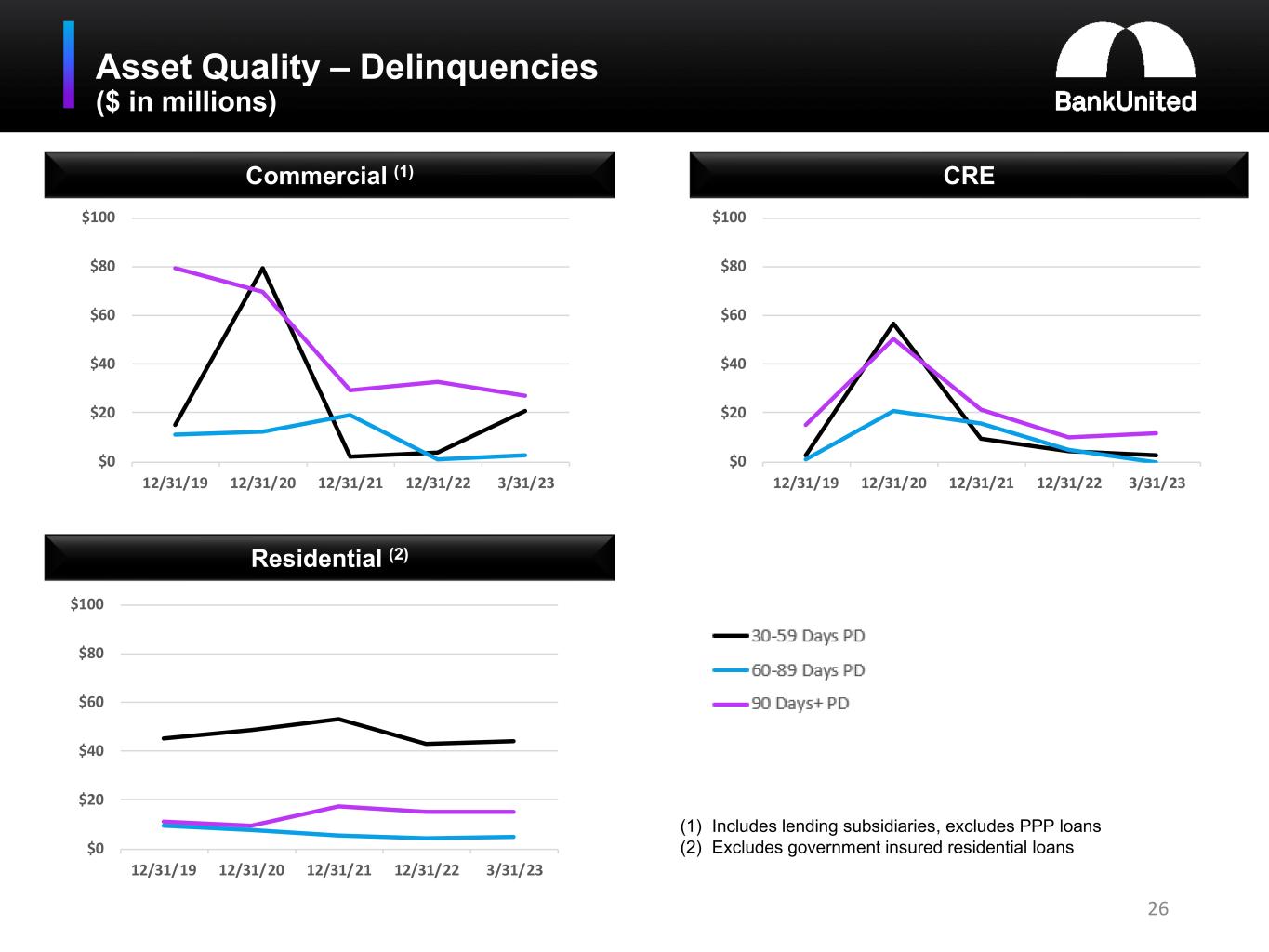

Asset Quality – Delinquencies ($ in millions) Commercial (1) CRE Residential (2) (1) Includes lending subsidiaries, excludes PPP loans (2) Excludes government insured residential loans 26 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23 $0 $20 $40 $60 $80 $100 12/31/19 12/31/20 12/31/21 12/31/22 3/31/23

Residential Portfolio Overview At March 31, 2023 High quality residential portfolio consists primarily of high FICO, low LTV, prime jumbo mortgages with de- minimis charge-offs since inception as well as government insured loans FICO Distribution(1) Breakdown by LTV(1) Breakdown by Vintage(1) (1) Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination. 27 Prior 20% 2019 4% 2020 13% 2021 44% 2022 17% 2023 2% 60% or less 35% 61% - 70% 26% 71% - 80% 38% More than 80% 1% <720 or NA 10% 720-759 16% >759 74% Residential Loan Product Type 30 Yr Fixed 31% 15 & 20 Year Fixed 13% 10/1 ARM 12% 5/1 & 7/1 ARM 24% Formerly Covered 1% Govt Insured 19%

Non-GAAP Financial Measures 28

29 Non-GAAP Financial Measures Tangible book value per common share is a non-GAAP financial measure. Management believes this measure is relevant to understanding the capital position and performance of the Company. Disclosure of this non-GAAP financial measure also provides a meaningful basis for comparison to other financial institutions as it is a metric commonly used in the banking industry. The following table reconciles the non-GAAP financial measurement of tangible book value per common share to the comparable GAAP financial measurement of book value per common share at March 31, 2023 (in thousands except share and per share data): Total stockholders’ equity (GAAP) Less: goodwill Tangible stockholders’ equity (non-GAAP) Common shares issued and outstanding Book value per common share (GAAP) Tangible book value per common share (non-GAAP) March 31, 2023 Total stockholders’ equity (GAAP) 2,481,394$ Less: goodwill 77,637 Tangible stockholders’ equity (non-GAAP) 2,403,757$ Common shares issued and outstanding 74,423,365 Book value per common share (GAAP) 33.34$ Tangible book value per common shar (n n-GAAP) 32.30$