October 22, 2024 Q3 2024 – Supplemental Information 1 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect the current views of BankUnited, Inc. (“BankUnited,” “BKU” or the “Company”) with respect to, among other things, future events and financial performance. The Company generally identifies forward-looking statements by terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” "forecasts" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based on the historical performance of the Company and its subsidiaries or on the Company’s current plans, estimates and expectations. The inclusion of this forward-looking information should not be regarded as a representation by the Company that the future plans, estimates or expectations contemplated by the Company will be achieved. Such forward-looking statements are subject to various risks and uncertainties and assumptions, including (without limitation) those relating to the Company’s operations, financial results, financial condition, business prospects, growth strategy and liquidity, including as impacted by external circumstances outside the Company's direct control, such as but not limited to adverse events or conditions impacting the financial services industry. If one or more of these or other risks or uncertainties materialize, or if the Company’s underlying assumptions prove to be incorrect, the Company’s actual results may vary materially from those indicated in these statements. These factors should not be construed as exhaustive. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements. Information on these factors can be found in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are available at the SEC’s website (www.sec.gov). 2

Quarterly Highlights 3

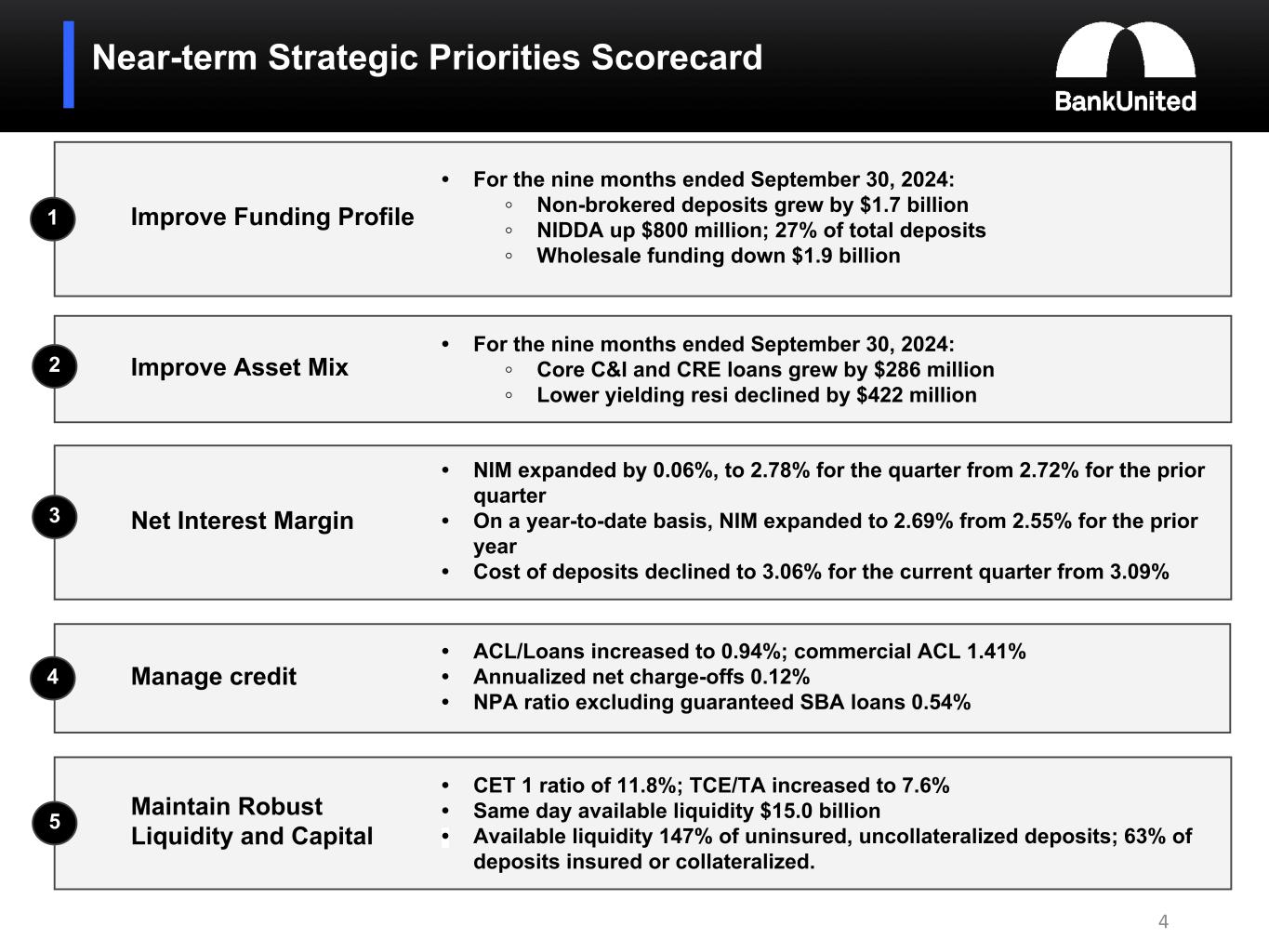

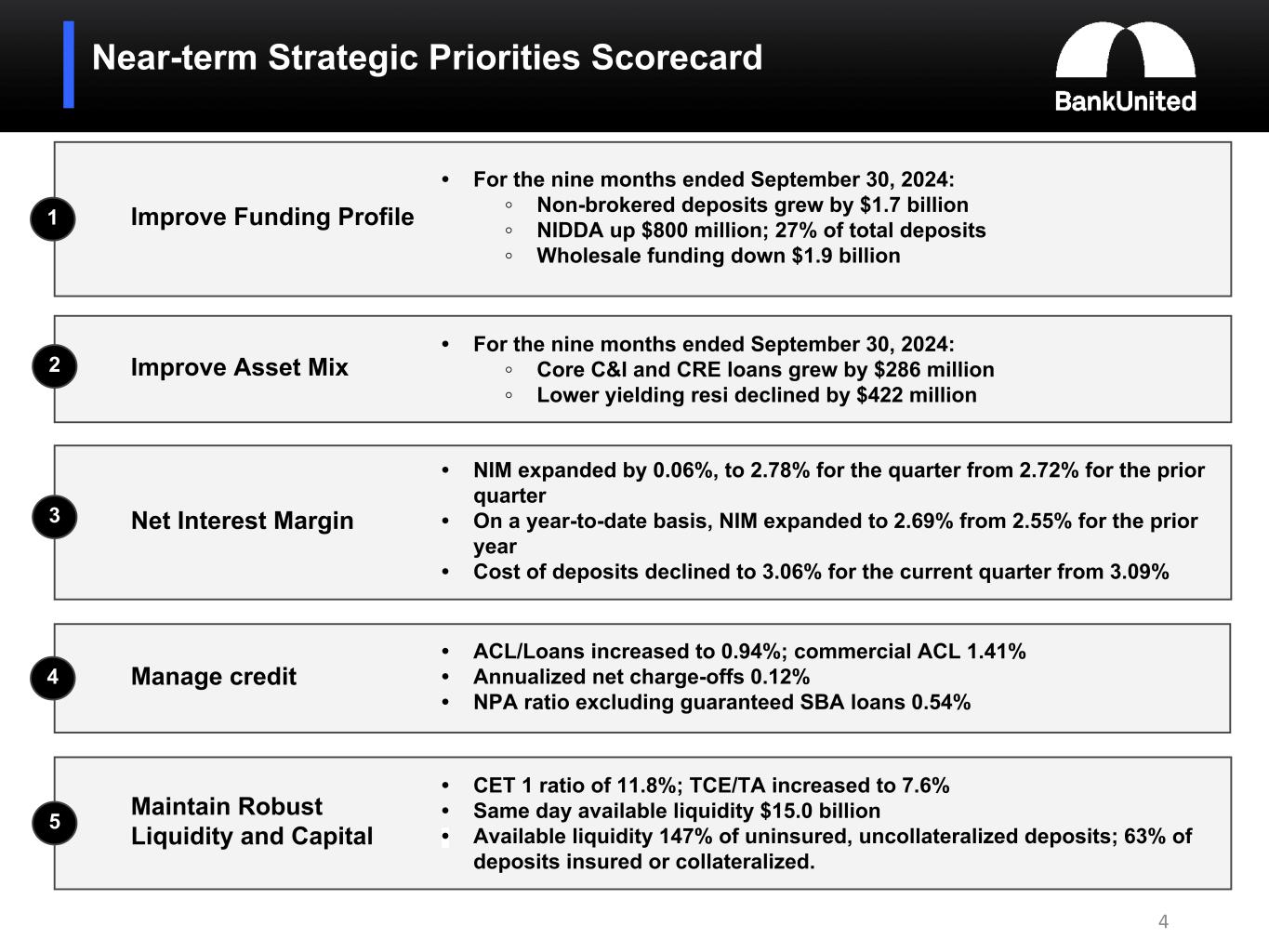

Improve Asset Mix Improve Funding Profile 2 Maintain Robust Liquidity and Capital Net Interest Margin Near-term Strategic Priorities Scorecard 5 3 4 1 • For the nine months ended September 30, 2024: ◦ Non-brokered deposits grew by $1.7 billion ◦ NIDDA up $800 million; 27% of total deposits ◦ Wholesale funding down $1.9 billion • For the nine months ended September 30, 2024: ◦ Core C&I and CRE loans grew by $286 million ◦ Lower yielding resi declined by $422 million • NIM expanded by 0.06%, to 2.78% for the quarter from 2.72% for the prior quarter • On a year-to-date basis, NIM expanded to 2.69% from 2.55% for the prior year • Cost of deposits declined to 3.06% for the current quarter from 3.09% • CET 1 ratio of 11.8%; TCE/TA increased to 7.6% • Same day available liquidity $15.0 billion • Available liquidity 147% of uninsured, uncollateralized deposits; 63% of deposits insured or collateralized. Manage credit • ACL/Loans increased to 0.94%; commercial ACL 1.41% • Annualized net charge-offs 0.12% • NPA ratio excluding guaranteed SBA loans 0.54% 4

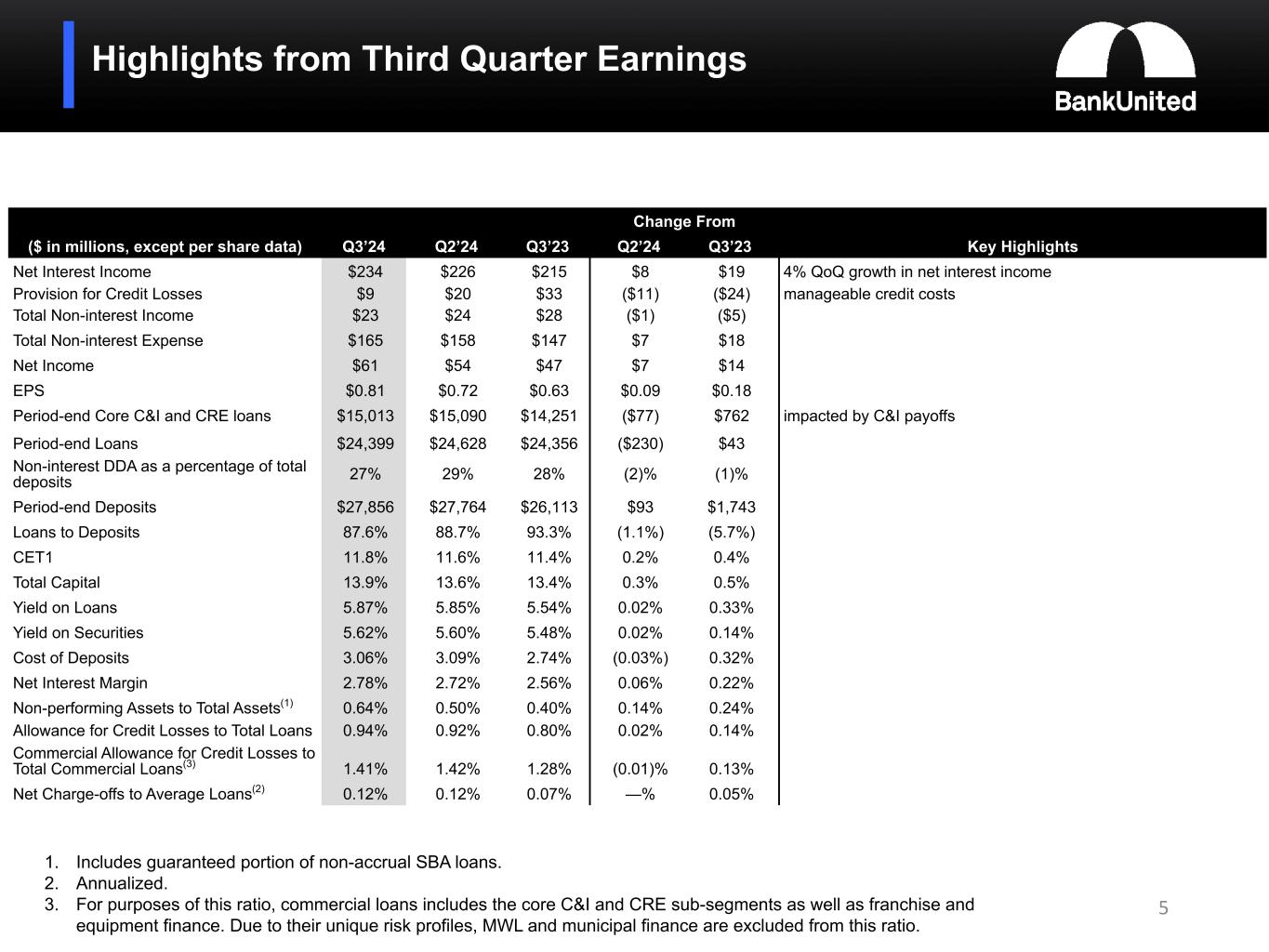

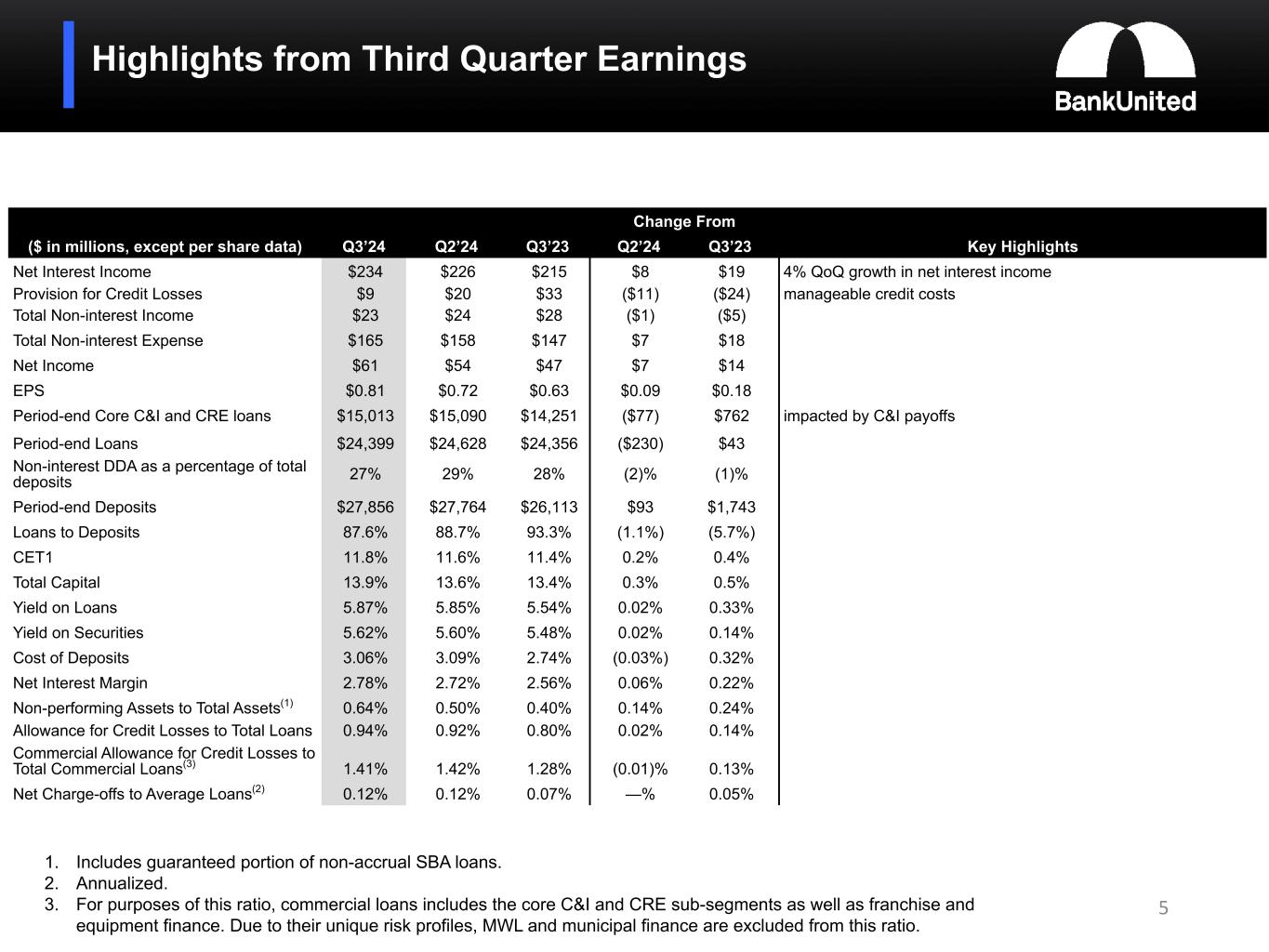

Highlights from Third Quarter Earnings Change From ($ in millions, except per share data) Q3’24 Q2’24 Q3’23 Q2’24 Q3’23 Key Highlights Net Interest Income $234 $226 $215 $8 $19 4% QoQ growth in net interest income Provision for Credit Losses $9 $20 $33 ($11) ($24) manageable credit costs Total Non-interest Income $23 $24 $28 ($1) ($5) Total Non-interest Expense $165 $158 $147 $7 $18 Net Income $61 $54 $47 $7 $14 EPS $0.81 $0.72 $0.63 $0.09 $0.18 Period-end Core C&I and CRE loans $15,013 $15,090 $14,251 ($77) $762 impacted by C&I payoffs Period-end Loans $24,399 $24,628 $24,356 ($230) $43 Non-interest DDA as a percentage of total deposits 27% 29% 28% (2)% (1)% Period-end Deposits $27,856 $27,764 $26,113 $93 $1,743 Loans to Deposits 87.6% 88.7% 93.3% (1.1%) (5.7%) CET1 11.8% 11.6% 11.4% 0.2% 0.4% Total Capital 13.9% 13.6% 13.4% 0.3% 0.5% Yield on Loans 5.87% 5.85% 5.54% 0.02% 0.33% Yield on Securities 5.62% 5.60% 5.48% 0.02% 0.14% Cost of Deposits 3.06% 3.09% 2.74% (0.03%) 0.32% Net Interest Margin 2.78% 2.72% 2.56% 0.06% 0.22% Non-performing Assets to Total Assets(1) 0.64% 0.50% 0.40% 0.14% 0.24% Allowance for Credit Losses to Total Loans 0.94% 0.92% 0.80% 0.02% 0.14% Commercial Allowance for Credit Losses to Total Commercial Loans(3) 1.41% 1.42% 1.28% (0.01)% 0.13% Net Charge-offs to Average Loans(2) 0.12% 0.12% 0.07% —% 0.05% 1. Includes guaranteed portion of non-accrual SBA loans. 2. Annualized. 3. For purposes of this ratio, commercial loans includes the core C&I and CRE sub-segments as well as franchise and equipment finance. Due to their unique risk profiles, MWL and municipal finance are excluded from this ratio. 5

Deposits 6

Deposit Trends ($ in millions) $7,347 $4,807 $3,384 $4,268 $5,164 $4,463 $4,724 $10,622 $12,660 $13,369 $13,061 $11,136 $11,463 $10,325 $2,131 $3,020 $3,709 $2,142 $3,403 $3,773 $5,172 $4,295 $7,009 $8,976 $8,038 $6,835 $8,065 $7,635 $24,395 $27,496 $29,438 $27,509 $26,538 $27,764 $27,856 Non-interest Demand Interest Demand Money Market / Savings Time 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 Quarterly Cost of Deposits 1.48% 0.43% 0.19% 1.42% 2.96% 3.09% 3.06% Non-interest bearing as a % of Total Deposits 17.6% 25.5% 30.5% 29.2% 25.8% 29.1% 27.4% 7

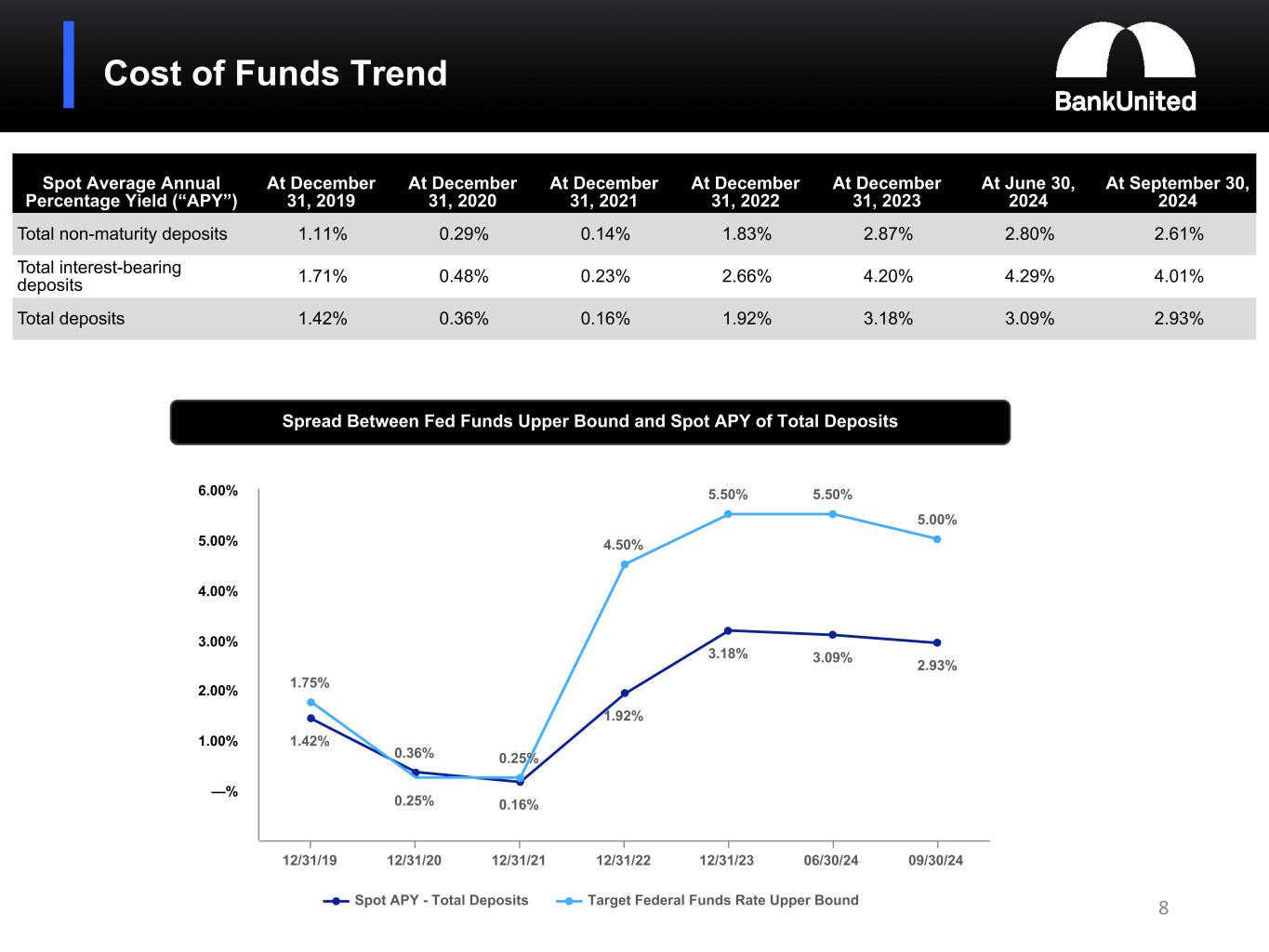

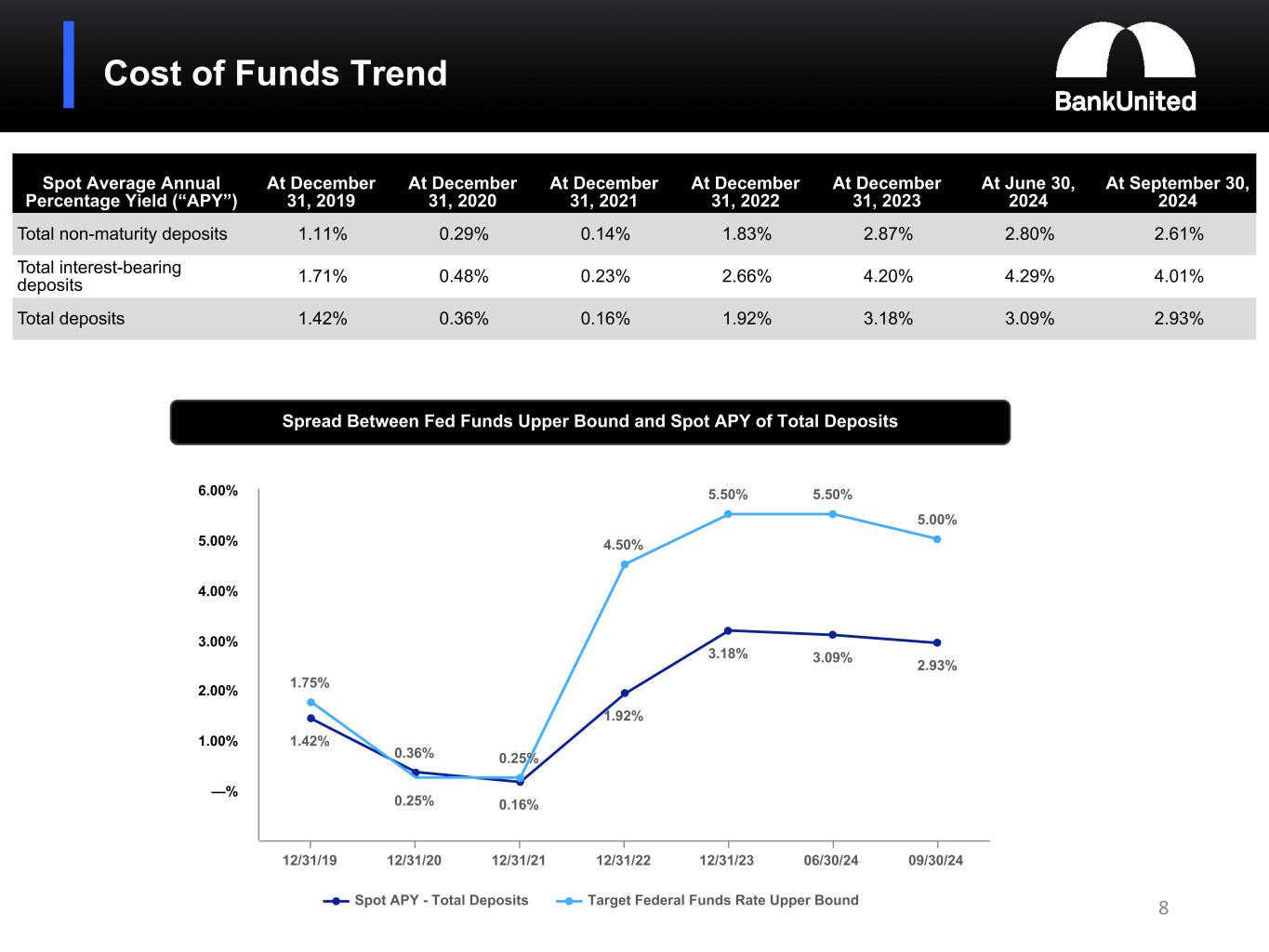

Cost of Funds Trend 8 1.42% 0.36% 0.16% 1.92% 3.18% 3.09% 2.93% 1.75% 0.25% 0.25% 4.50% 5.50% 5.50% 5.00% Spot APY - Total Deposits Target Federal Funds Rate Upper Bound 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 (1.00)% —% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% Spot Average Annual Percentage Yield (“APY”) At December 31, 2019 At December 31, 2020 At December 31, 2021 At December 31, 2022 At December 31, 2023 At June 30, 2024 At September 30, 2024 Total non-maturity deposits 1.11% 0.29% 0.14% 1.83% 2.87% 2.80% 2.61% Total interest-bearing deposits 1.71% 0.48% 0.23% 2.66% 4.20% 4.29% 4.01% Total deposits 1.42% 0.36% 0.16% 1.92% 3.18% 3.09% 2.93% Spread Between Fed Funds Upper Bound and Spot APY of Total Deposits

Loans and the Allowance for Credit Losses 9

10 Prudently Underwritten and Well-Diversified Loan Portfolio At September 30, 2024 ($ in millions) Loan Portfolio Over Time $5,661 $6,348 $8,368 $8,901 $8,209 $7,845 $7,787 $7,493 $6,896 $5,702 $5,700 $5,819 $5,952 $5,987 $6,718 $6,448 $6,735 $8,305 $8,907 $9,136 $9,025 $768 $1,259 $1,092 $525 $433 $539 $572 $2,515 $2,915 $1,868 $1,455 $1,266 $1,156 $1,028$23,155 $23,866 $23,765 $24,886 $24,634 $24,628 $24,399 Other (1) Mortgage Warehouse Lending C&I CRE Residential 12/31/19 12/31/20 12/31/21 12/31/22 12/31/2023 06/30/24 09/30/24 1. Includes Pinnacle municipal finance, franchise and equipment finance, and PPP.

High Quality CRE Portfolio At September 30, 2024 ($ in millions) Property Type Balance % of Total CRE FL NY Tri State Other Wtd. Avg. DSCR Wtd. Avg. LTV Office $ 1,778 30 % 57 % 23 % 20 % 1.56 65.4 % Warehouse/Industrial 1,341 22 % 55 % 9 % 36 % 1.99 48.9 % Multifamily 869 15 % 53 % 47 % — % 1.88 48.4 % Retail 926 16 % 52 % 30 % 18 % 1.68 57.7 % Hotel 488 8 % 78 % 10 % 12 % 1.84 45.6 % Construction and Land 498 8 % 37 % 50 % 13 % NA NA Other 87 1 % 74 % 11 % 15 % 1.91 48.6 % $ 5,987 100 % 56 % 25 % 19 % 1.77 55.3 % 11 Florida NY Tri State Property Type Wtd. Avg. DSCR Wtd. Avg. LTV Wtd. Avg. DSCR Wtd. Avg. LTV Office 1.54 64.8 % 1.65 58.6 % Warehouse/Industrial 2.17 47.7 % 1.98 35.8 % Multifamily 2.31 45.5 % 1.41 51.6 % Retail 1.91 56.4 % 1.43 58.4 % Hotel 1.86 45.5 % 1.88 32.8 % Other 2.08 46.6 % 1.11 64.7 % 1.91 53.8 % 1.55 53.7 % Construction and land includes $85 million of office exposure, $83 million in NY New York rent regulated multi-family exposure $117 million

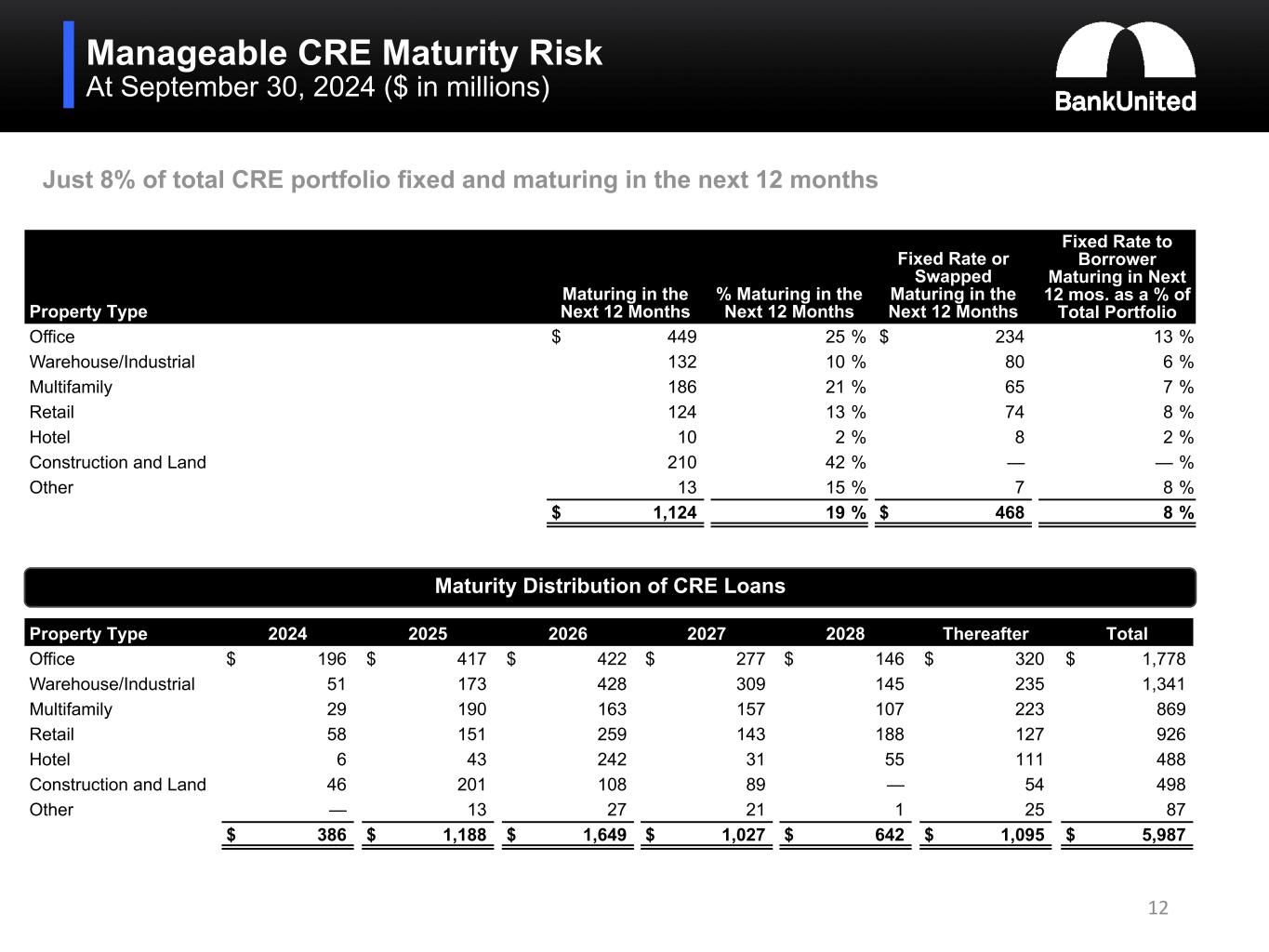

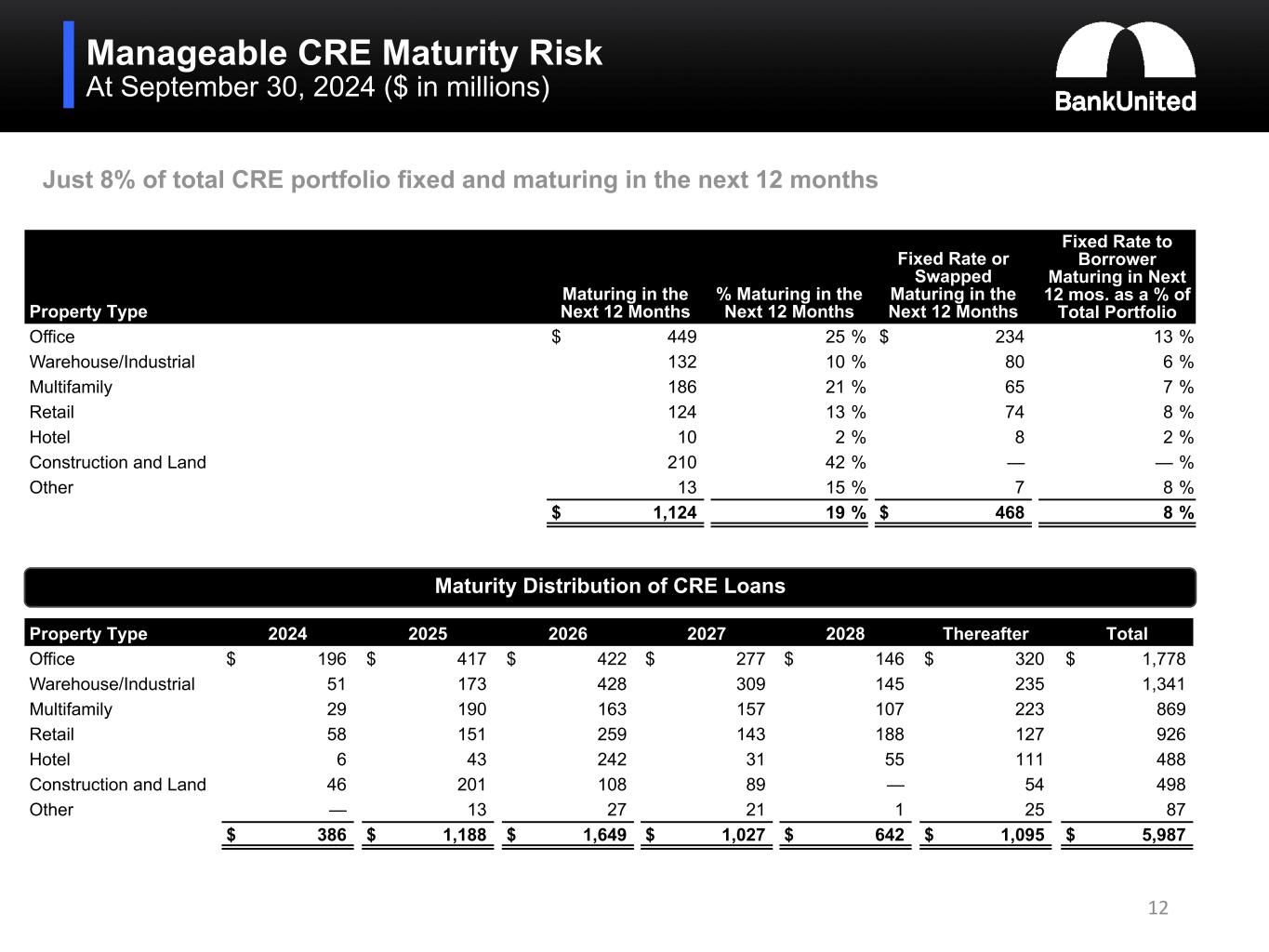

Manageable CRE Maturity Risk At September 30, 2024 ($ in millions) Property Type Maturing in the Next 12 Months % Maturing in the Next 12 Months Fixed Rate or Swapped Maturing in the Next 12 Months Fixed Rate to Borrower Maturing in Next 12 mos. as a % of Total Portfolio Office $ 449 25 % $ 234 13 % Warehouse/Industrial 132 10 % 80 6 % Multifamily 186 21 % 65 7 % Retail 124 13 % 74 8 % Hotel 10 2 % 8 2 % Construction and Land 210 42 % — — % Other 13 15 % 7 8 % $ 1,124 19 % $ 468 8 % 12 Just 8% of total CRE portfolio fixed and maturing in the next 12 months Property Type 2024 2025 2026 2027 2028 Thereafter Total Office $ 196 $ 417 $ 422 $ 277 $ 146 $ 320 $ 1,778 Warehouse/Industrial 51 173 428 309 145 235 1,341 Multifamily 29 190 163 157 107 223 869 Retail 58 151 259 143 188 127 926 Hotel 6 43 242 31 55 111 488 Construction and Land 46 201 108 89 — 54 498 Other — 13 27 21 1 25 87 $ 386 $ 1,188 $ 1,649 $ 1,027 $ 642 $ 1,095 $ 5,987 Maturity Distribution of CRE Loans

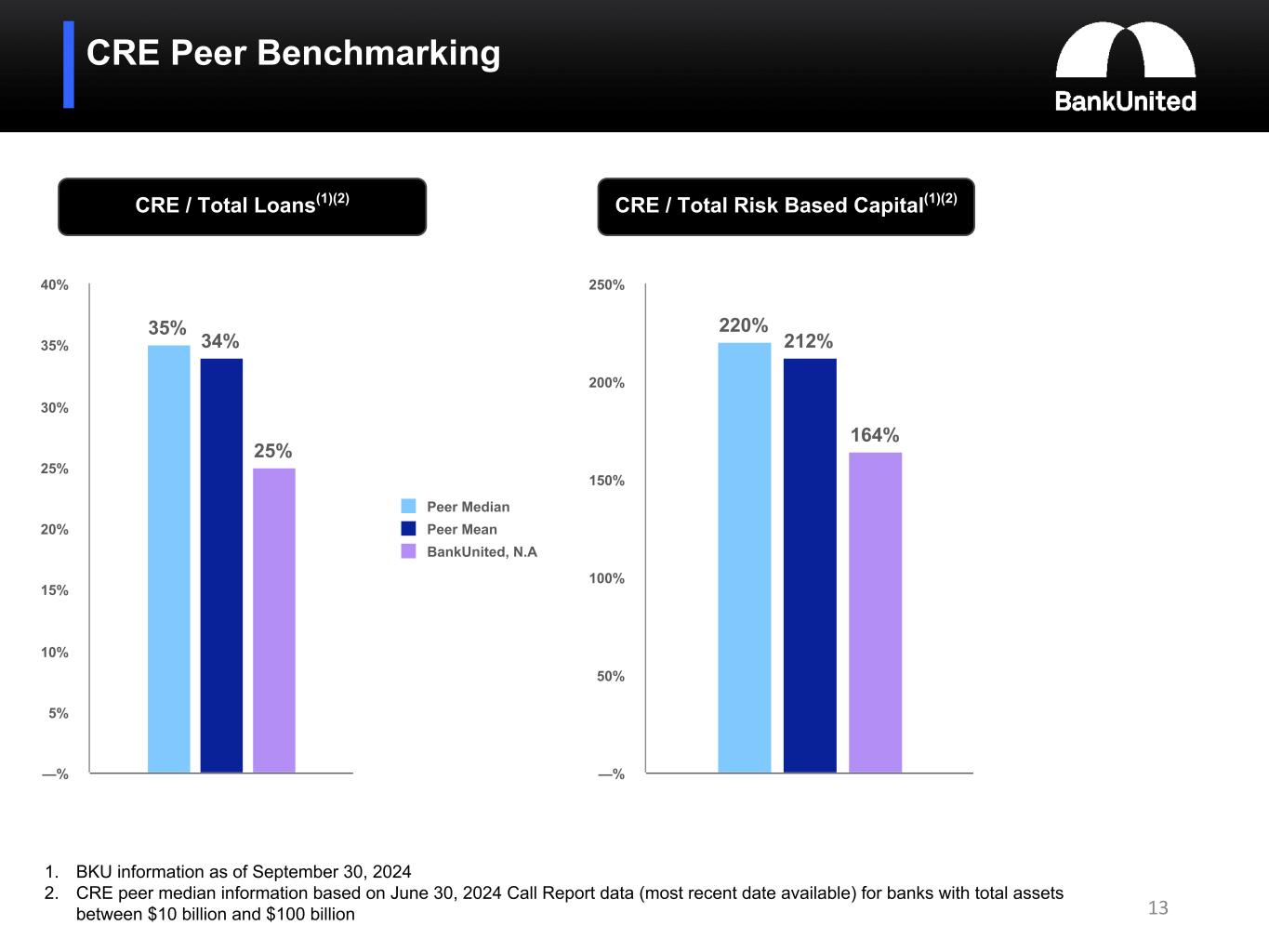

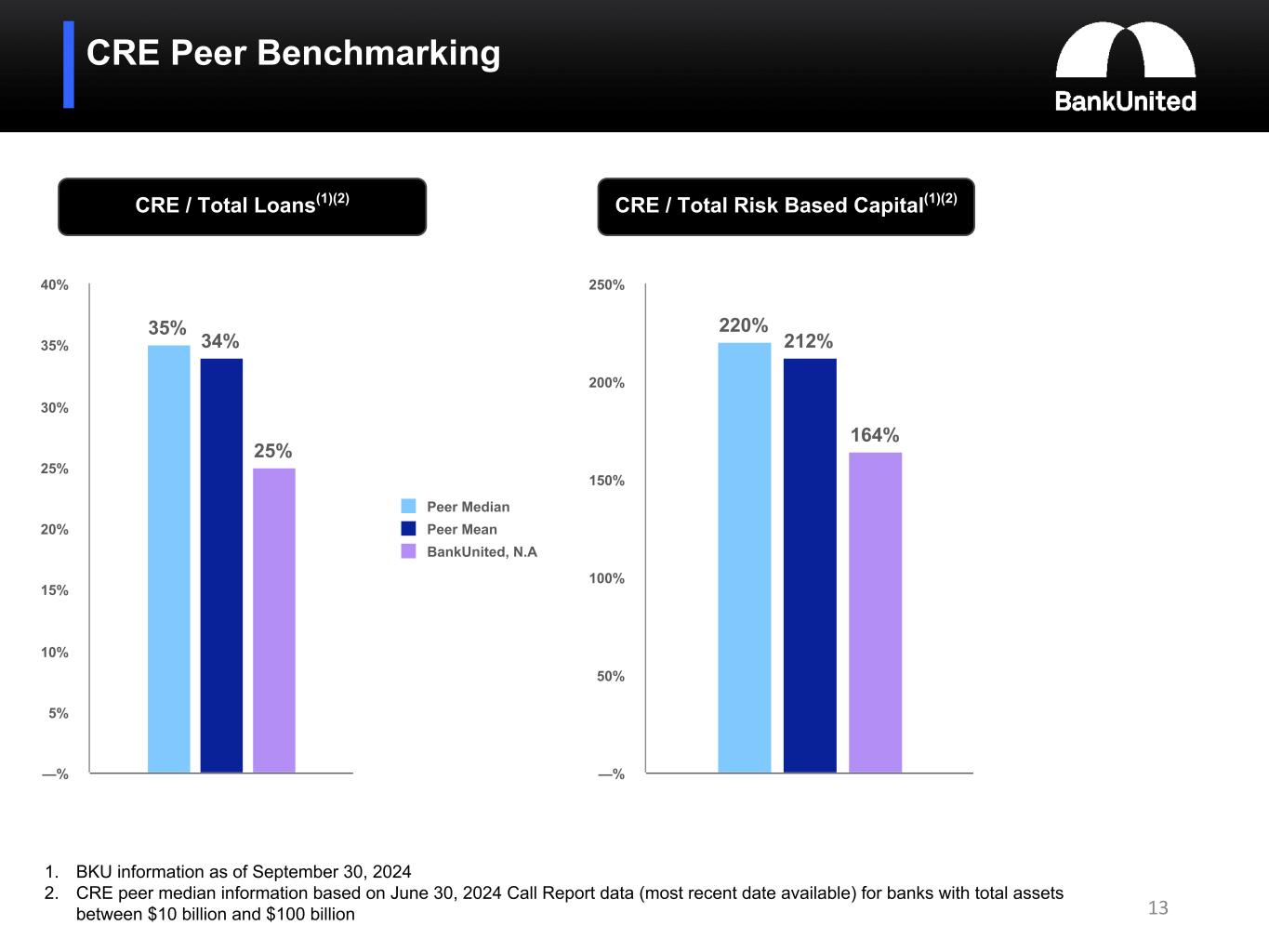

CRE Peer Benchmarking 13 35% 34% 25% Peer Median Peer Mean BankUnited, N.A —% 5% 10% 15% 20% 25% 30% 35% 40% 220% 212% 164% —% 50% 100% 150% 200% 250% 1. BKU information as of September 30, 2024 2. CRE peer median information based on June 30, 2024 Call Report data (most recent date available) for banks with total assets between $10 billion and $100 billion CRE / Total Loans(1)(2) CRE / Total Risk Based Capital(1)(2)

CRE Office Portfolio - Additional Information At September 30, 2024 14 • 20% or $352 million of the total office portfolio is medical office • Rent rollover in next 12 months approximately 11% of the total office portfolio; 12% for FL and 9% in NY Tri State • Manhattan stabilized portfolio has approximately 95% occupancy and rent rollover in the next 12 months of 10% • The Florida portfolio is predominantly suburban 41% 21% 21% 12% 4% 1% Manhattan NY Tri-State Other Long Island Queens Brooklyn Bronx 29% 22%21% 9% 10% 9% Tampa Orlando Boca/Palm Beach Broward Miami-Dade Other NY Tri-State by Sub-Market Florida by Sub-Market

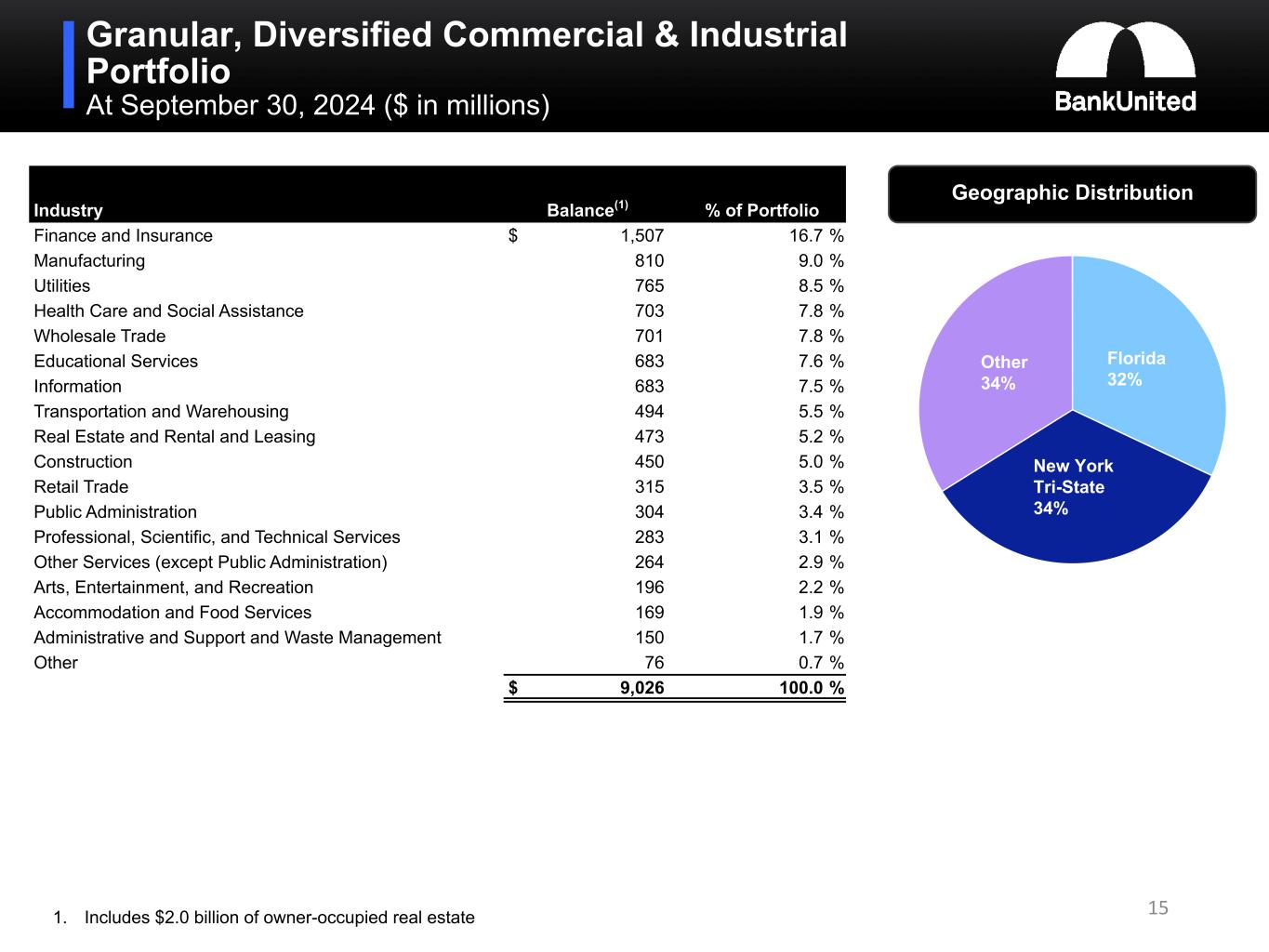

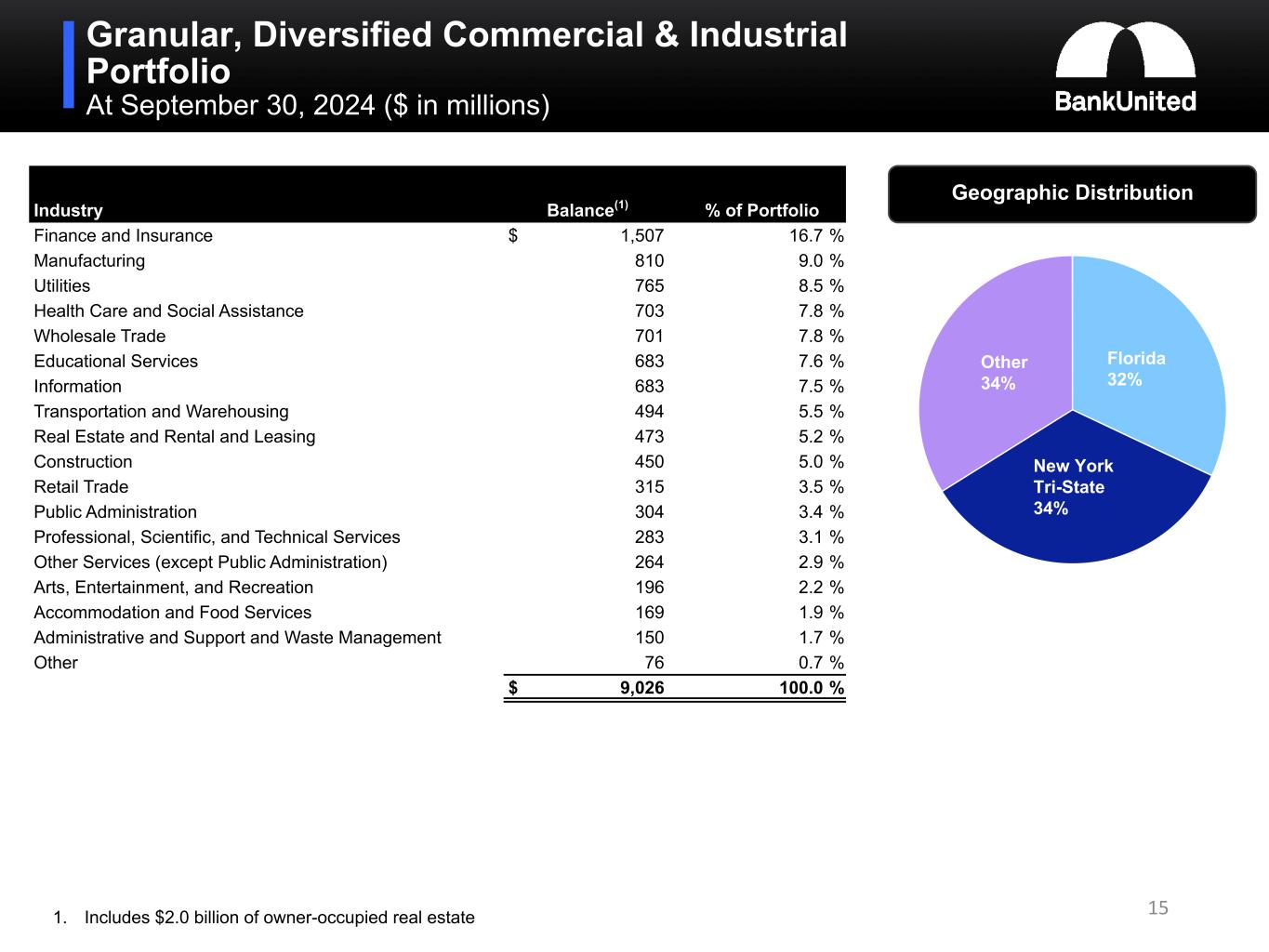

Granular, Diversified Commercial & Industrial Portfolio At September 30, 2024 ($ in millions) Industry Balance(1) % of Portfolio Finance and Insurance $ 1,507 16.7 % Manufacturing 810 9.0 % Utilities 765 8.5 % Health Care and Social Assistance 703 7.8 % Wholesale Trade 701 7.8 % Educational Services 683 7.6 % Information 683 7.5 % Transportation and Warehousing 494 5.5 % Real Estate and Rental and Leasing 473 5.2 % Construction 450 5.0 % Retail Trade 315 3.5 % Public Administration 304 3.4 % Professional, Scientific, and Technical Services 283 3.1 % Other Services (except Public Administration) 264 2.9 % Arts, Entertainment, and Recreation 196 2.2 % Accommodation and Food Services 169 1.9 % Administrative and Support and Waste Management 150 1.7 % Other 76 0.7 % $ 9,026 100.0 % 151. Includes $2.0 billion of owner-occupied real estate Geographic Distribution Florida 32% New York Tri-State 34% Other 34%

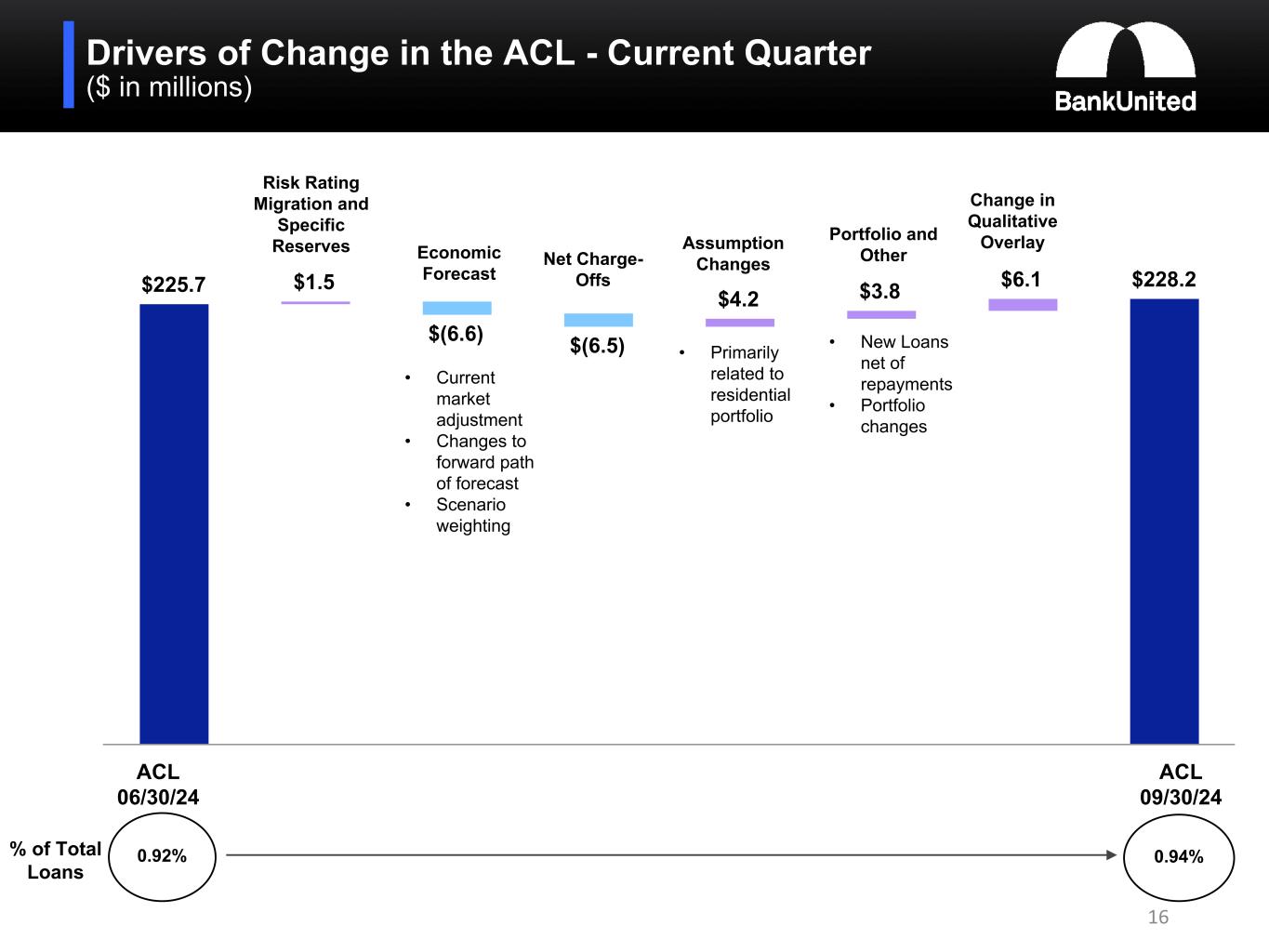

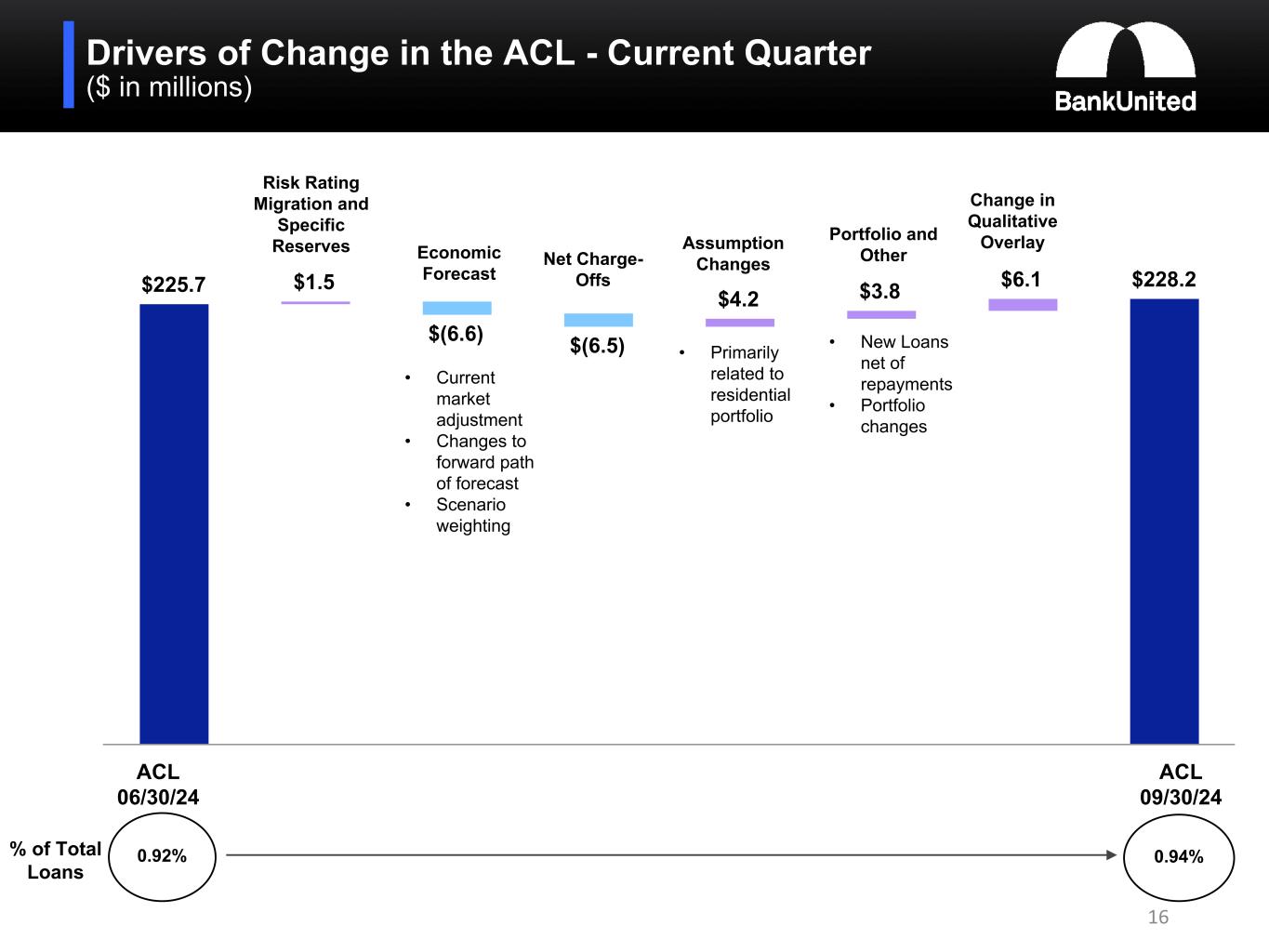

$225.7 $1.5 $(6.6) $(6.5) $4.2 $3.8 $6.1 $228.2 Drivers of Change in the ACL - Current Quarter ($ in millions) Risk Rating Migration and Specific Reserves Economic Forecast Net Charge- Offs ACL 09/30/24 ACL 06/30/24 0.94%0.92%% of Total Loans 16 Change in Qualitative OverlayPortfolio and Other • New Loans net of repayments • Portfolio changes • Current market adjustment • Changes to forward path of forecast • Scenario weighting Assumption Changes • Primarily related to residential portfolio

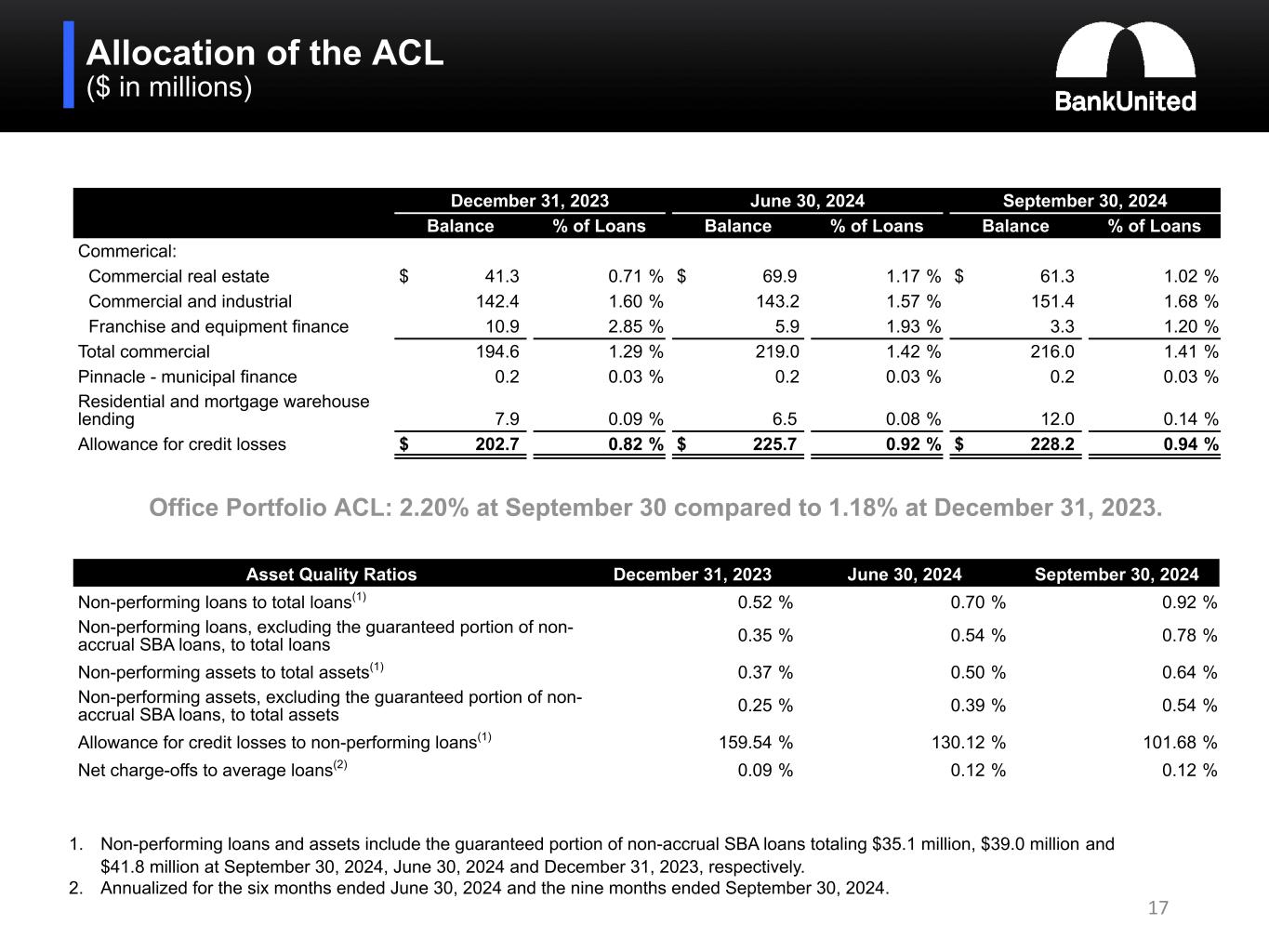

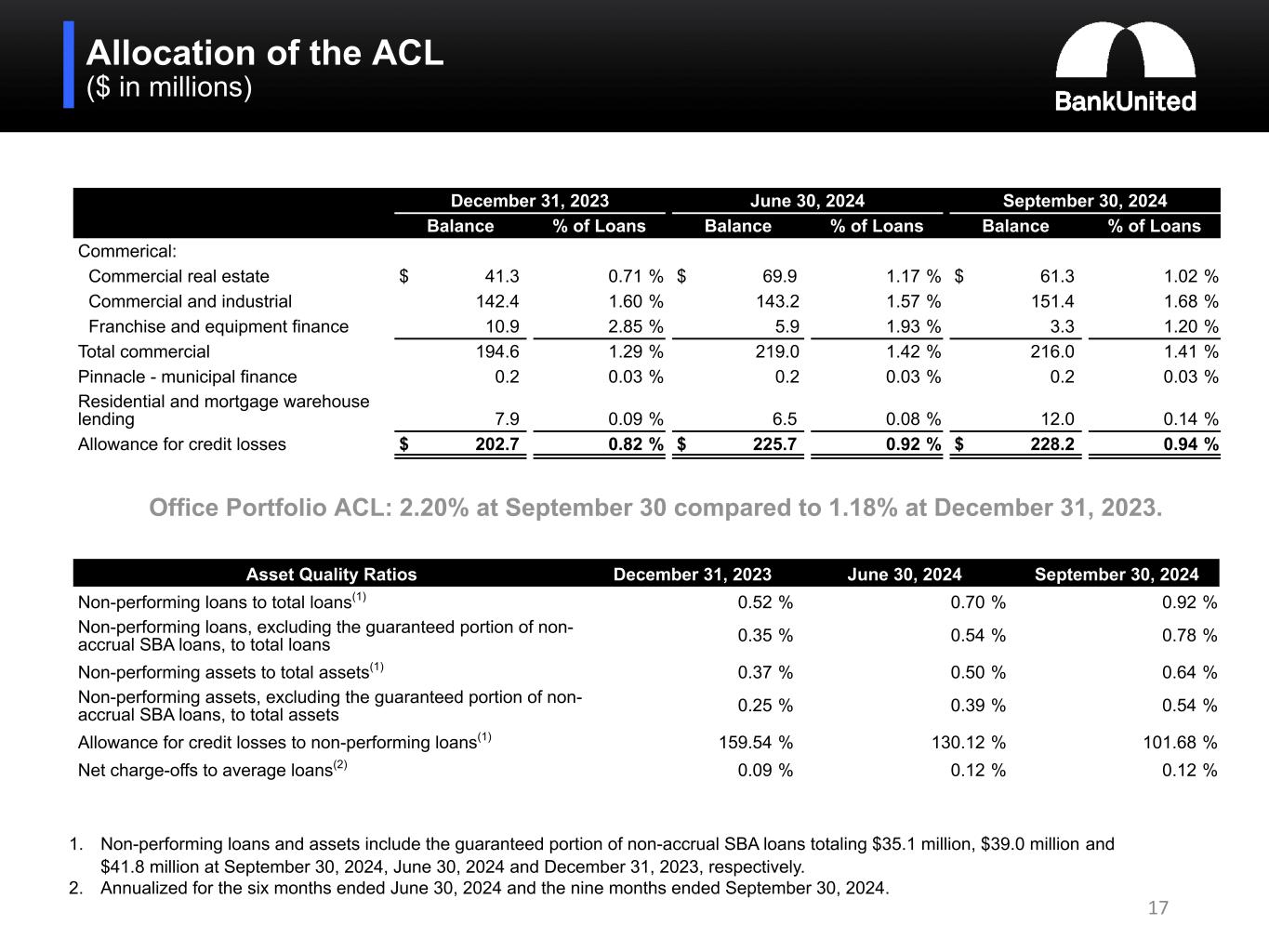

Allocation of the ACL ($ in millions) December 31, 2023 June 30, 2024 September 30, 2024 Balance % of Loans Balance % of Loans Balance % of Loans Commerical: Commercial real estate $ 41.3 0.71 % $ 69.9 1.17 % $ 61.3 1.02 % Commercial and industrial 142.4 1.60 % 143.2 1.57 % 151.4 1.68 % Franchise and equipment finance 10.9 2.85 % 5.9 1.93 % 3.3 1.20 % Total commercial 194.6 1.29 % 219.0 1.42 % 216.0 1.41 % Pinnacle - municipal finance 0.2 0.03 % 0.2 0.03 % 0.2 0.03 % Residential and mortgage warehouse lending 7.9 0.09 % 6.5 0.08 % 12.0 0.14 % Allowance for credit losses $ 202.7 0.82 % $ 225.7 0.92 % $ 228.2 0.94 % Asset Quality Ratios December 31, 2023 June 30, 2024 September 30, 2024 Non-performing loans to total loans(1) 0.52 % 0.70 % 0.92 % Non-performing loans, excluding the guaranteed portion of non- accrual SBA loans, to total loans 0.35 % 0.54 % 0.78 % Non-performing assets to total assets(1) 0.37 % 0.50 % 0.64 % Non-performing assets, excluding the guaranteed portion of non- accrual SBA loans, to total assets 0.25 % 0.39 % 0.54 % Allowance for credit losses to non-performing loans(1) 159.54 % 130.12 % 101.68 % Net charge-offs to average loans(2) 0.09 % 0.12 % 0.12 % 17 1. Non-performing loans and assets include the guaranteed portion of non-accrual SBA loans totaling $35.1 million, $39.0 million and $41.8 million at September 30, 2024, June 30, 2024 and December 31, 2023, respectively. 2. Annualized for the six months ended June 30, 2024 and the nine months ended September 30, 2024. Office Portfolio ACL: 2.20% at September 30 compared to 1.18% at December 31, 2023.

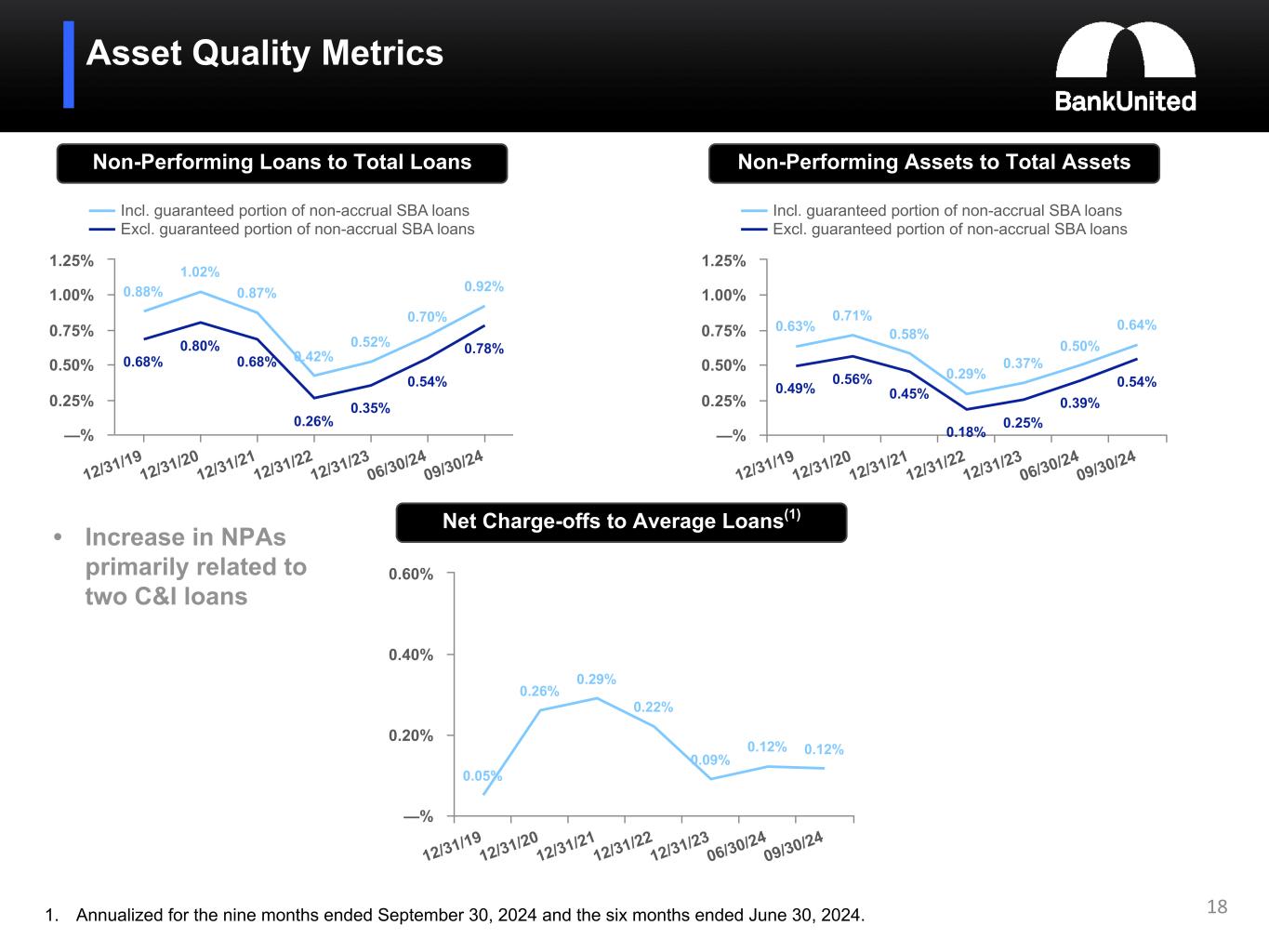

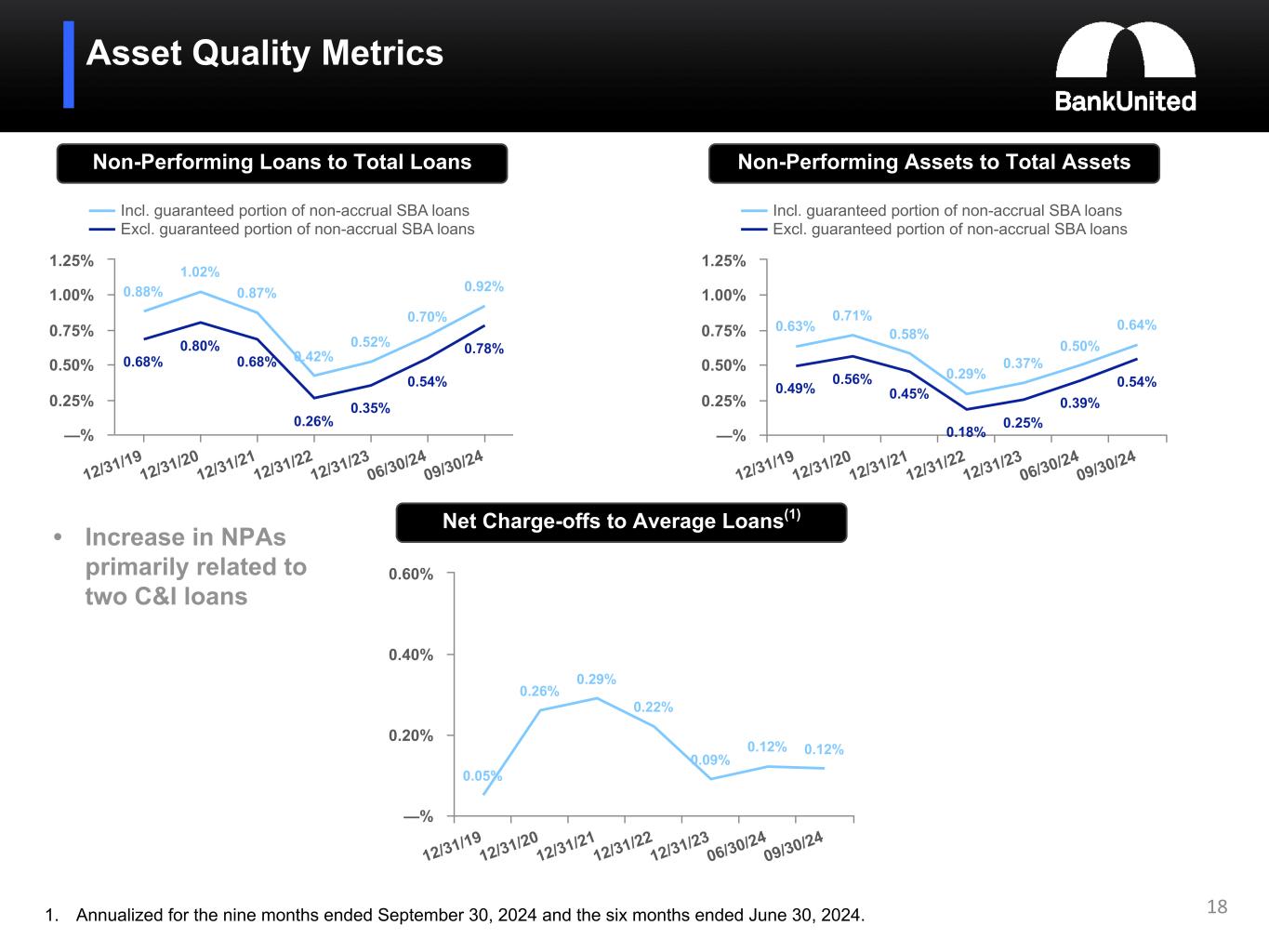

Asset Quality Metrics 18 Non-Performing Loans to Total Loans Non-Performing Assets to Total Assets Net Charge-offs to Average Loans(1) 0.88% 1.02% 0.87% 0.42% 0.52% 0.70% 0.92% 0.68% 0.80% 0.68% 0.26% 0.35% 0.54% 0.78% Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 —% 0.25% 0.50% 0.75% 1.00% 1.25% 0.63% 0.71% 0.58% 0.29% 0.37% 0.50% 0.64% 0.49% 0.56% 0.45% 0.18% 0.25% 0.39% 0.54% Incl. guaranteed portion of non-accrual SBA loans Excl. guaranteed portion of non-accrual SBA loans 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 —% 0.25% 0.50% 0.75% 1.00% 1.25% 0.05% 0.26% 0.29% 0.22% 0.09% 0.12% 0.12% 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 —% 0.20% 0.40% 0.60% 1. Annualized for the nine months ended September 30, 2024 and the six months ended June 30, 2024. • Increase in NPAs primarily related to two C&I loans

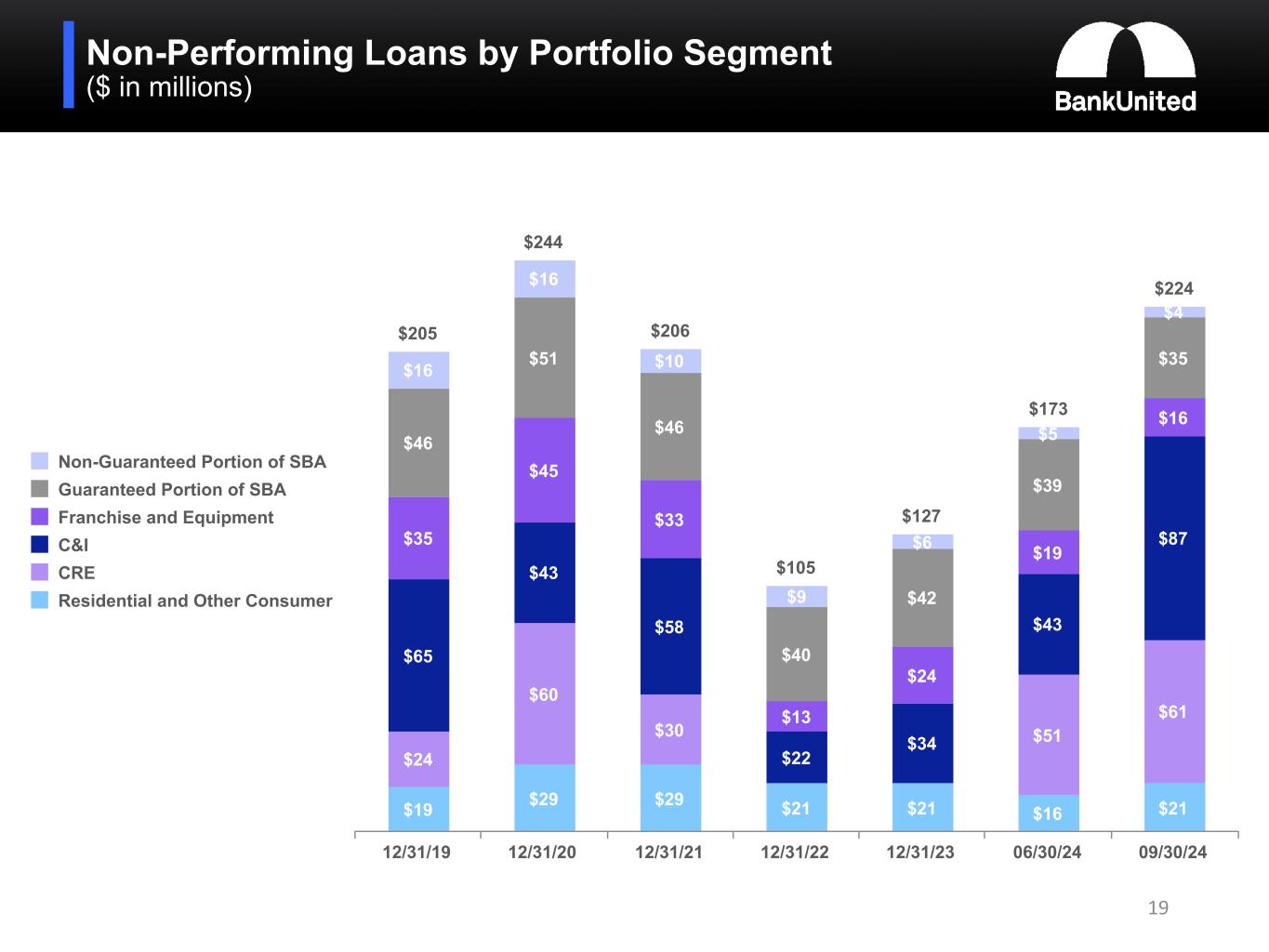

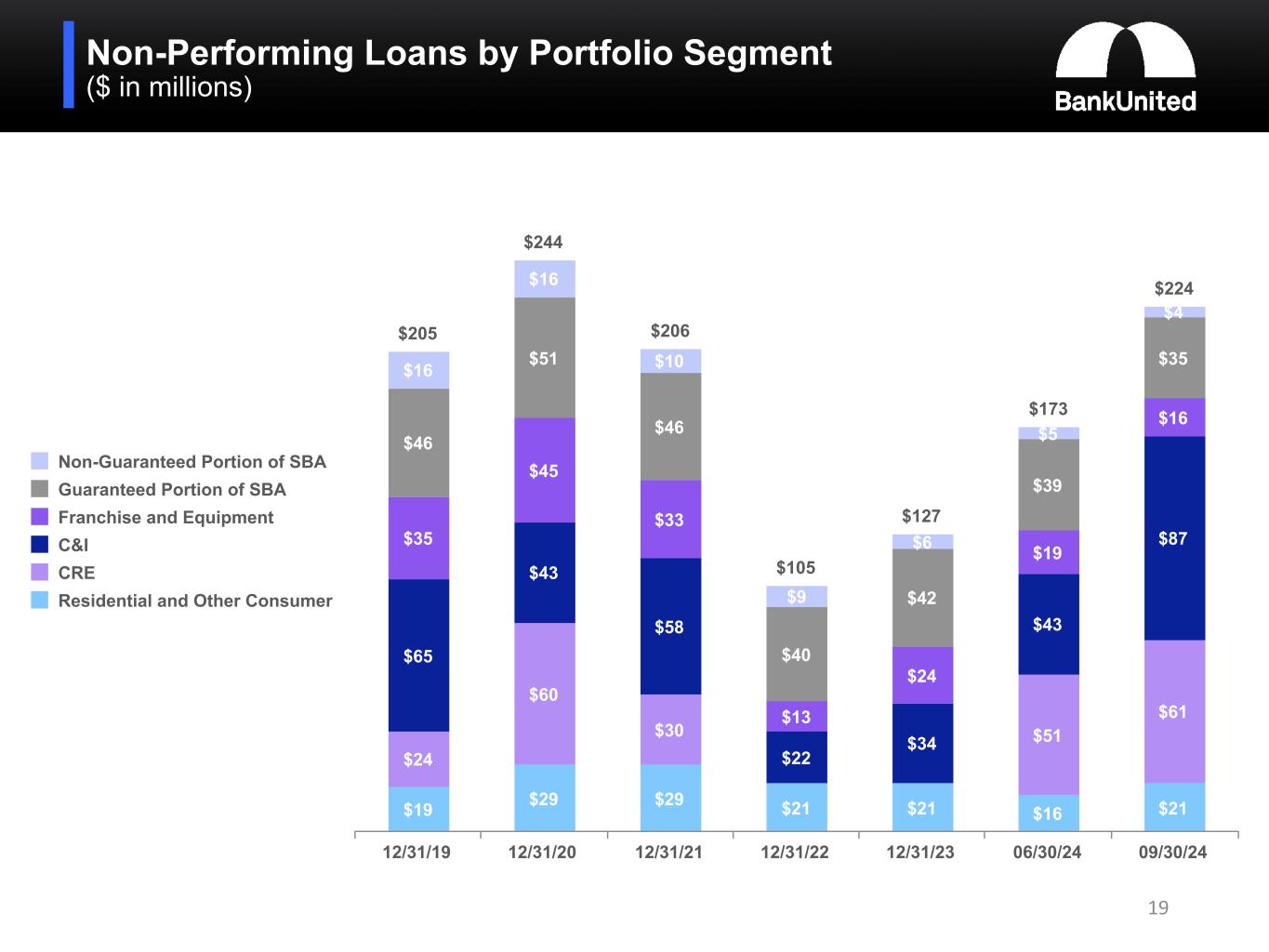

Non-Performing Loans by Portfolio Segment ($ in millions) 19 $205 $244 $206 $105 $127 $173 $224 $19 $29 $29 $21 $21 $16 $21 $24 $60 $30 $51 $61 $65 $43 $58 $22 $34 $43 $87$35 $45 $33 $13 $24 $19 $16 $46 $51 $46 $40 $42 $39 $35$16 $16 $10 $9 $6 $5 $4 Non-Guaranteed Portion of SBA Guaranteed Portion of SBA Franchise and Equipment C&I CRE Residential and Other Consumer 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24

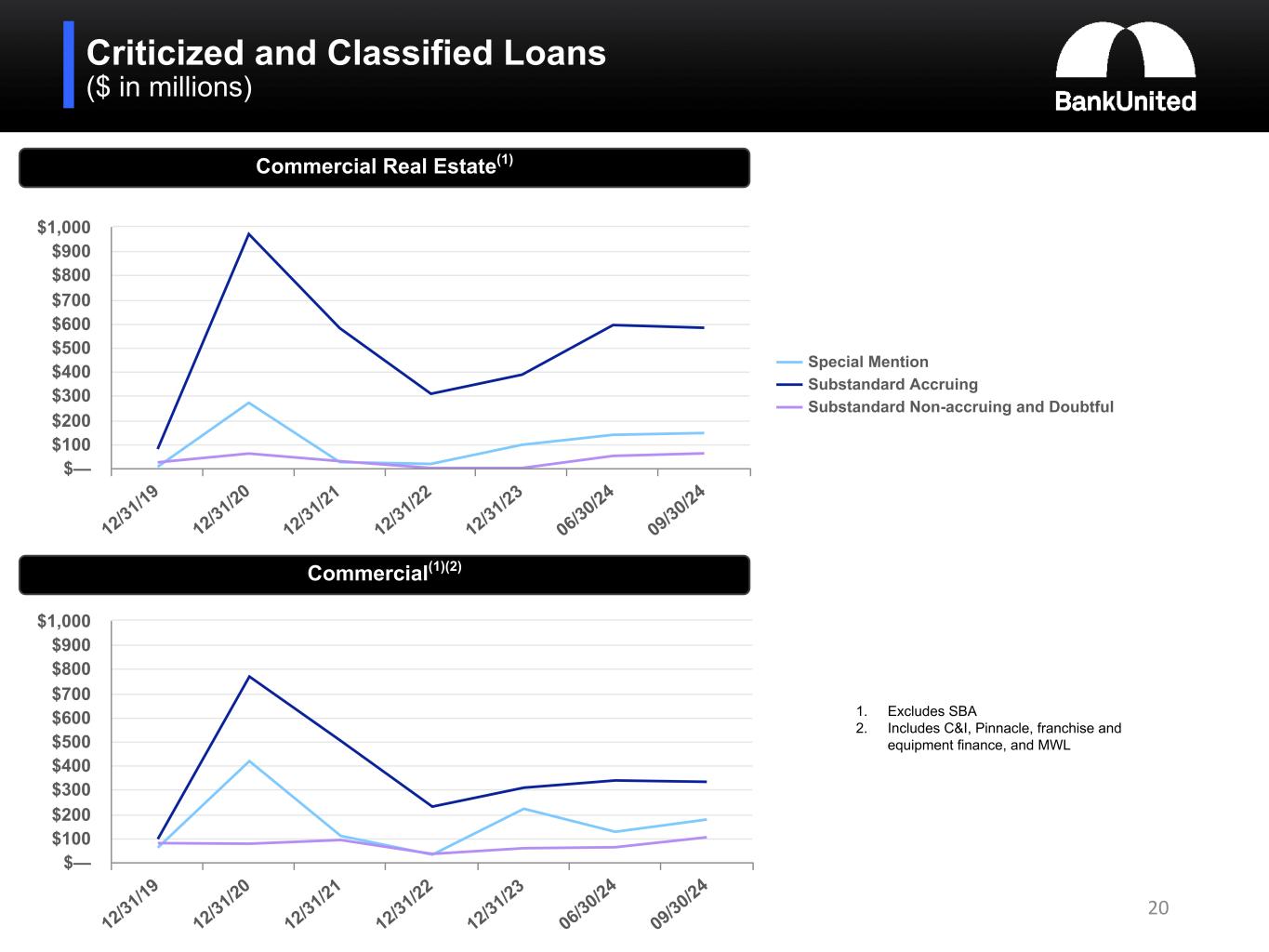

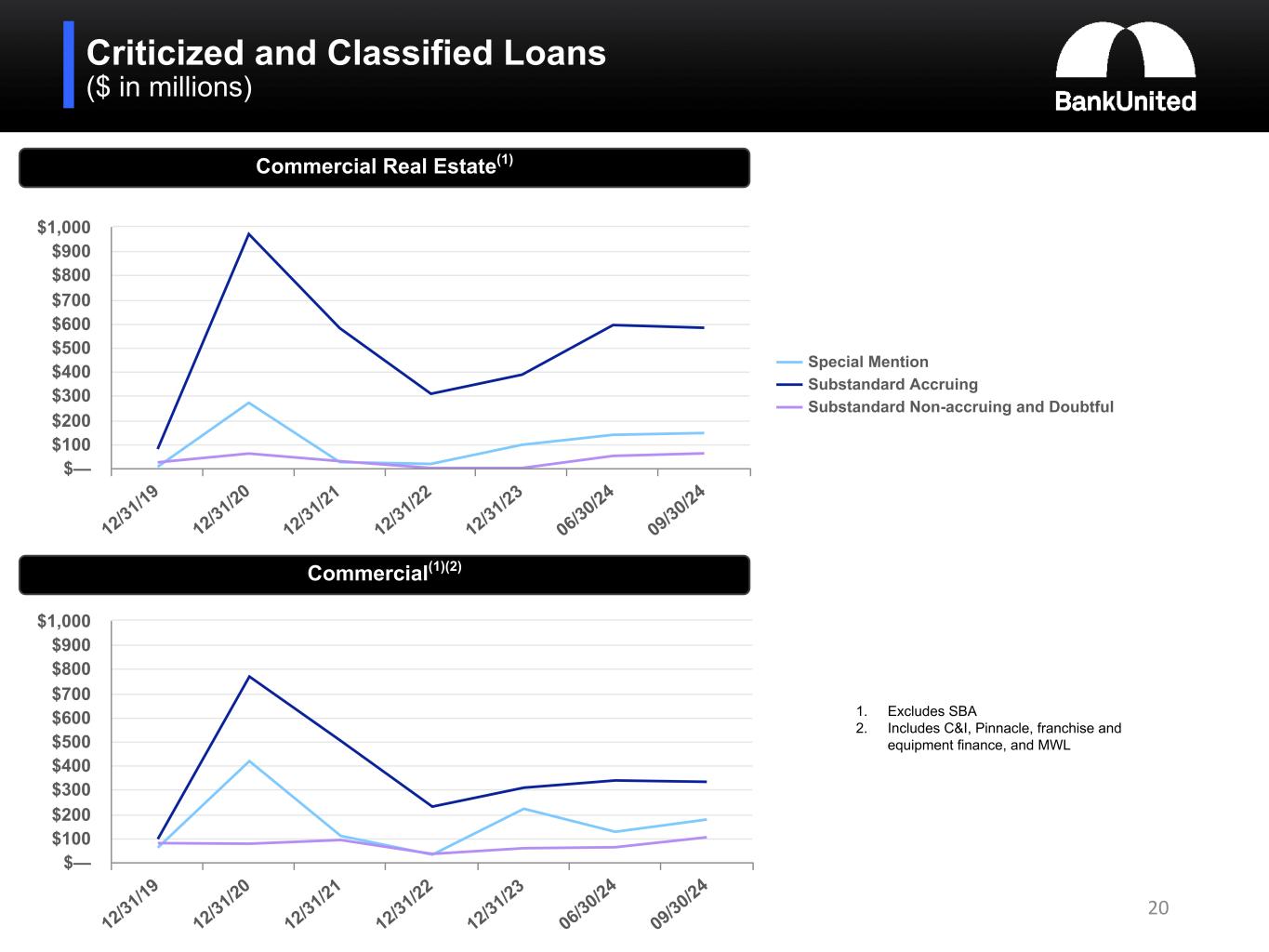

Criticized and Classified Loans ($ in millions) 20 Commercial Real Estate(1) Commercial(1)(2) Special Mention Substandard Accruing Substandard Non-accruing and Doubtful 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 $— $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 $— $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 1. Excludes SBA 2. Includes C&I, Pinnacle, franchise and equipment finance, and MWL

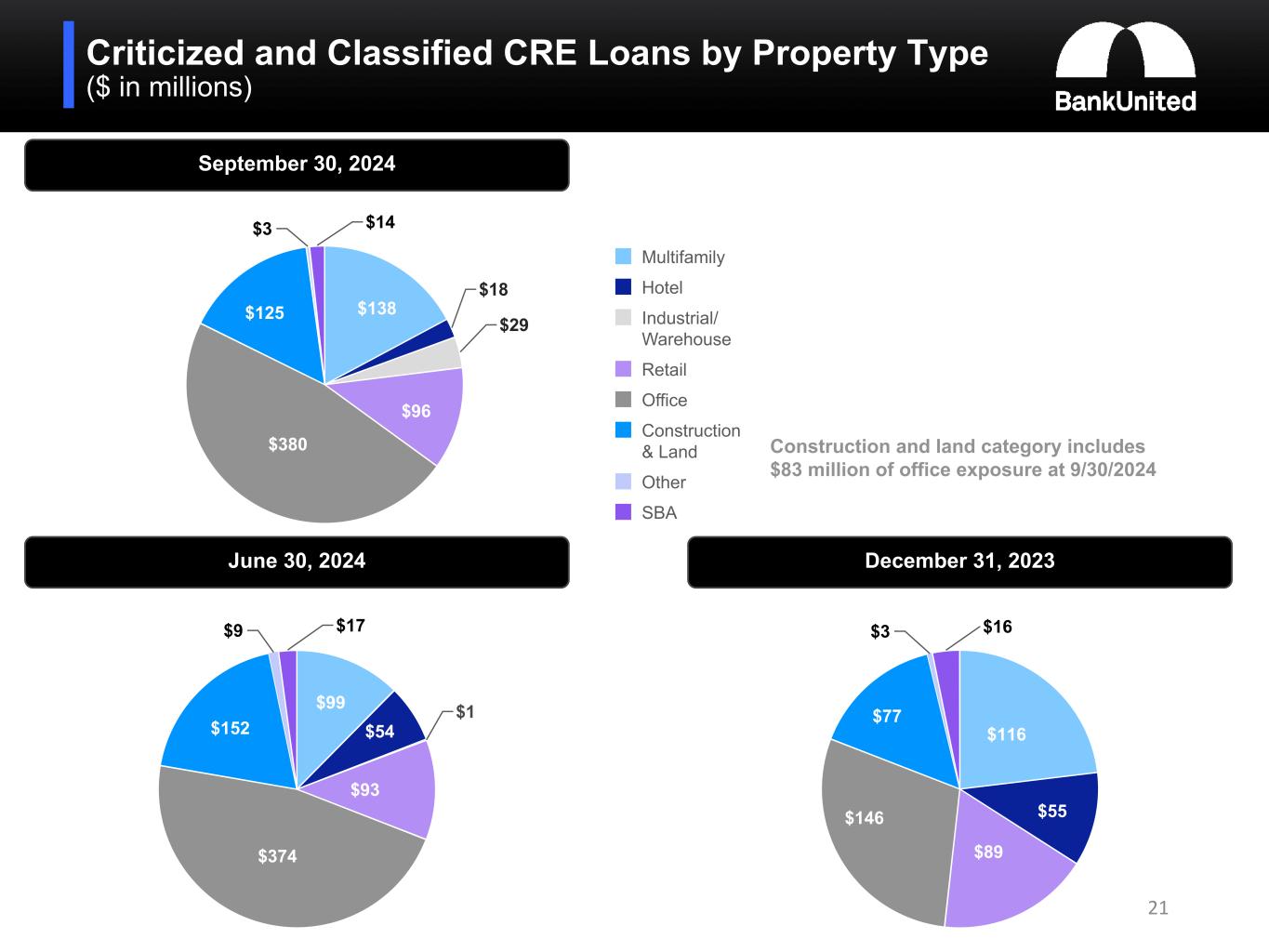

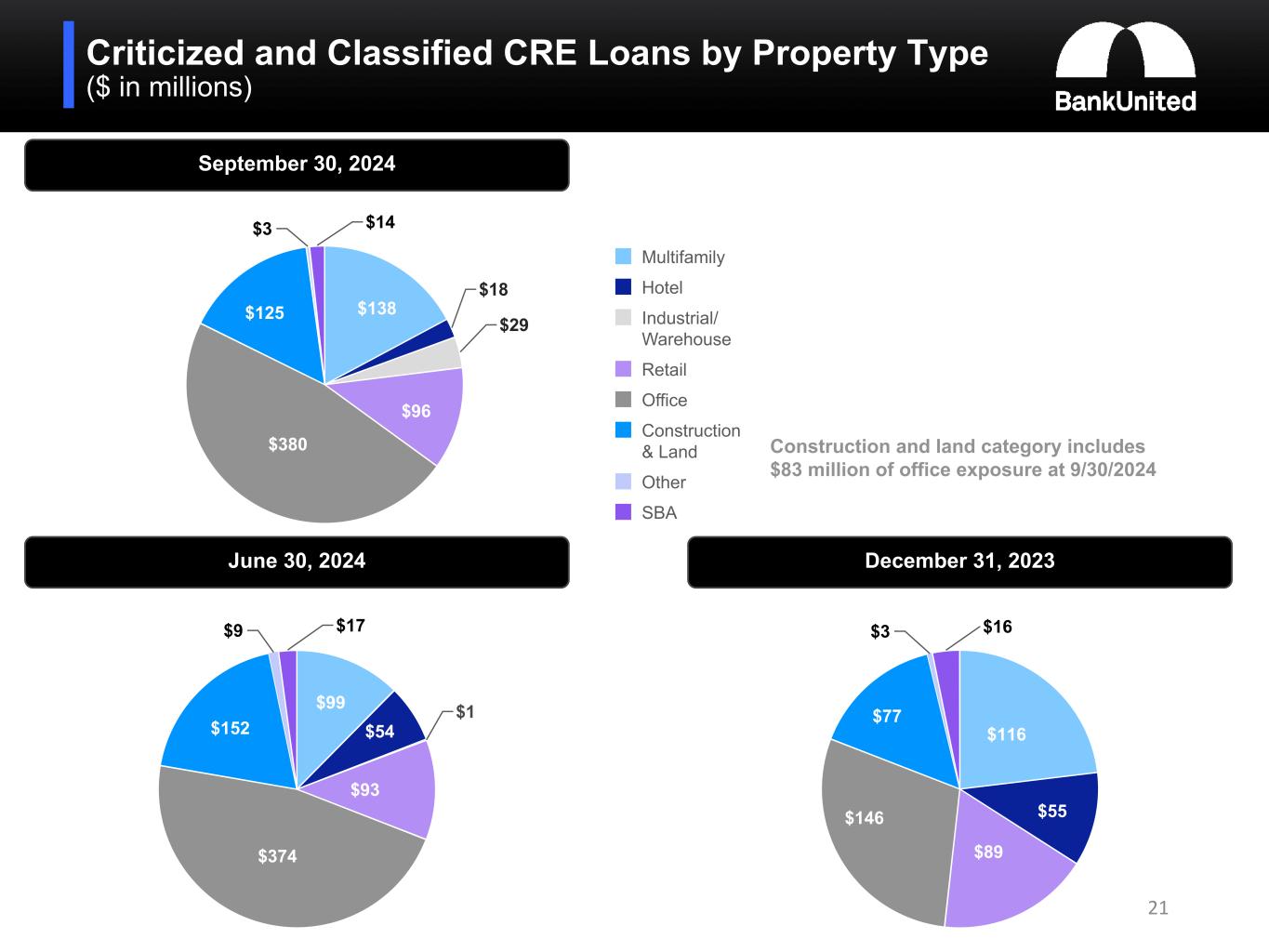

Criticized and Classified CRE Loans by Property Type ($ in millions) 21 June 30, 2024 $99 $54 $1 $93 $374 $152 $9 $17 $116 $55 $89 $146 $77 $3 $16 December 31, 2023 $138 $18 $29 $96 $380 $125 $3 $14 Multifamily Hotel Industrial/ Warehouse Retail Office Construction & Land Other SBA September 30, 2024 Construction and land category includes $83 million of office exposure at 9/30/2024

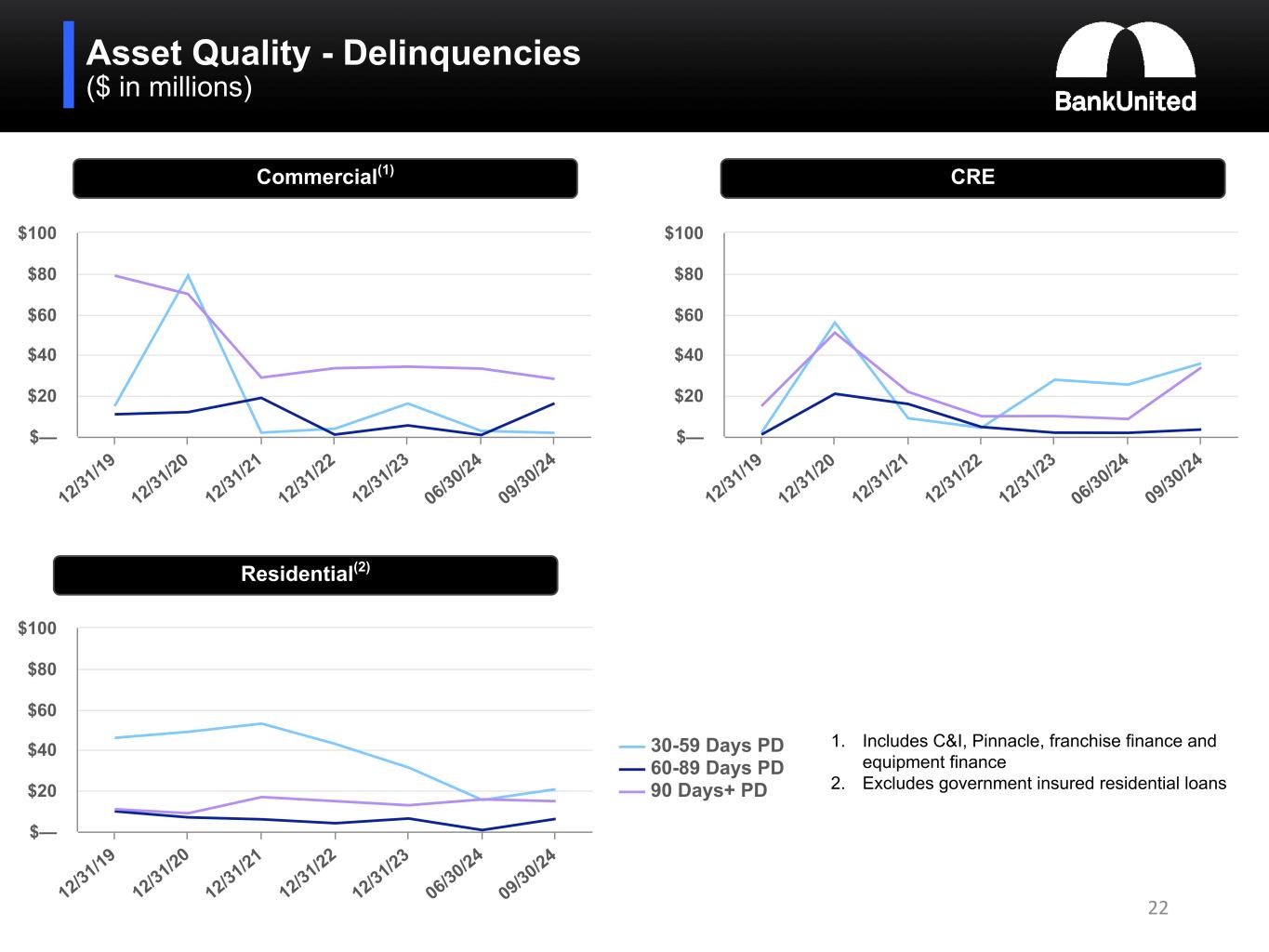

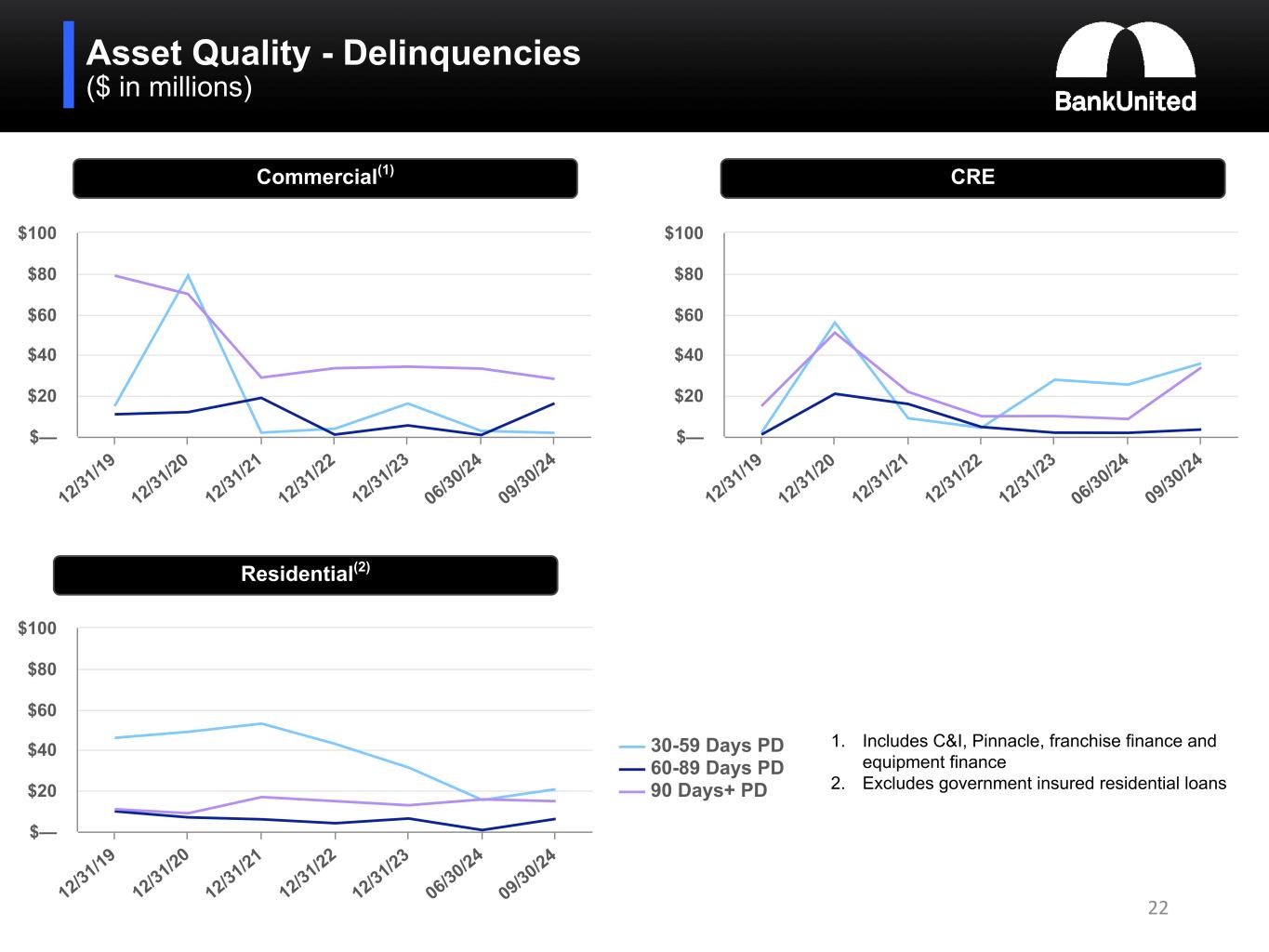

Asset Quality - Delinquencies ($ in millions) 22 Commercial(1) CRE 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 $— $20 $40 $60 $80 $100 Residential(2) 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 $— $20 $40 $60 $80 $100 30-59 Days PD 60-89 Days PD 90 Days+ PD 12/31/19 12/31/20 12/31/21 12/31/22 12/31/23 06/30/24 09/30/24 $— $20 $40 $60 $80 $100 1. Includes C&I, Pinnacle, franchise finance and equipment finance 2. Excludes government insured residential loans

Residential Portfolio Overview At September 30, 2024 23 Residential Loan Product Type FICO Distribution(1) Breakdown by LTV(1) 1. Excludes government insured residential loans. FICOs are refreshed routinely. LTVs are typically based on valuation at origination Prior 21% 2020 12% 2021 42% 2022 16% 2023 6% 2024 3% >759 76% 720-759 14% <720 or NA 10% Breakdown by Vintage(1) 30 Yr Fixed 33% 15 & 20 Year Fixed 12% 10/1 ARM 12% 5/1 & 7/1 ARM 27% Formerly Covered 1% Govt Insured 15% High quality residential portfolio consists primarily of high FICO, low LTV, prime jumbo mortgages with de-minimis charge-offs since inception as well as government insured loans 60% or less 33% 61% - 70% 25% 71% - 80% 40% More than 80% 2%

Stress Testing Results CCAR Severely Adverse Scenario ($ in millions) 24 3.5% 2.6% 0.3% 2.3% Commercial CRE Residential Total —% 1.0% 2.0% 3.0% 4.0% 4.3% 0.6% 2.1% 2.2% 4.0% 2.0% 2.6% CCAR Severely Adverse Scenario Office Industrial Multifamily Retail Hotel Other Total —% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% $327 $150 $23 $500 Lifetime expected losses in the CCAR severely adverse scenario $77 $8 $26 $18 $20 $1 $150 Lifetime expected losses in the CCAR severely adverse scenario 1. Excludes Pinnacle municipal finance and mortgage warehouse lending. 2. Construction loans are included in the chart by their applicable property type. • Bank remains well above well capitalized threshold under hypothetical severe stress CRE Portfolio Stress Test Results(2) Loan Portfolio Stress Test Results(1)(3) 3. Stress testing results based on loan portfolio as of December 31, 2023.

Investment Portfolio 25

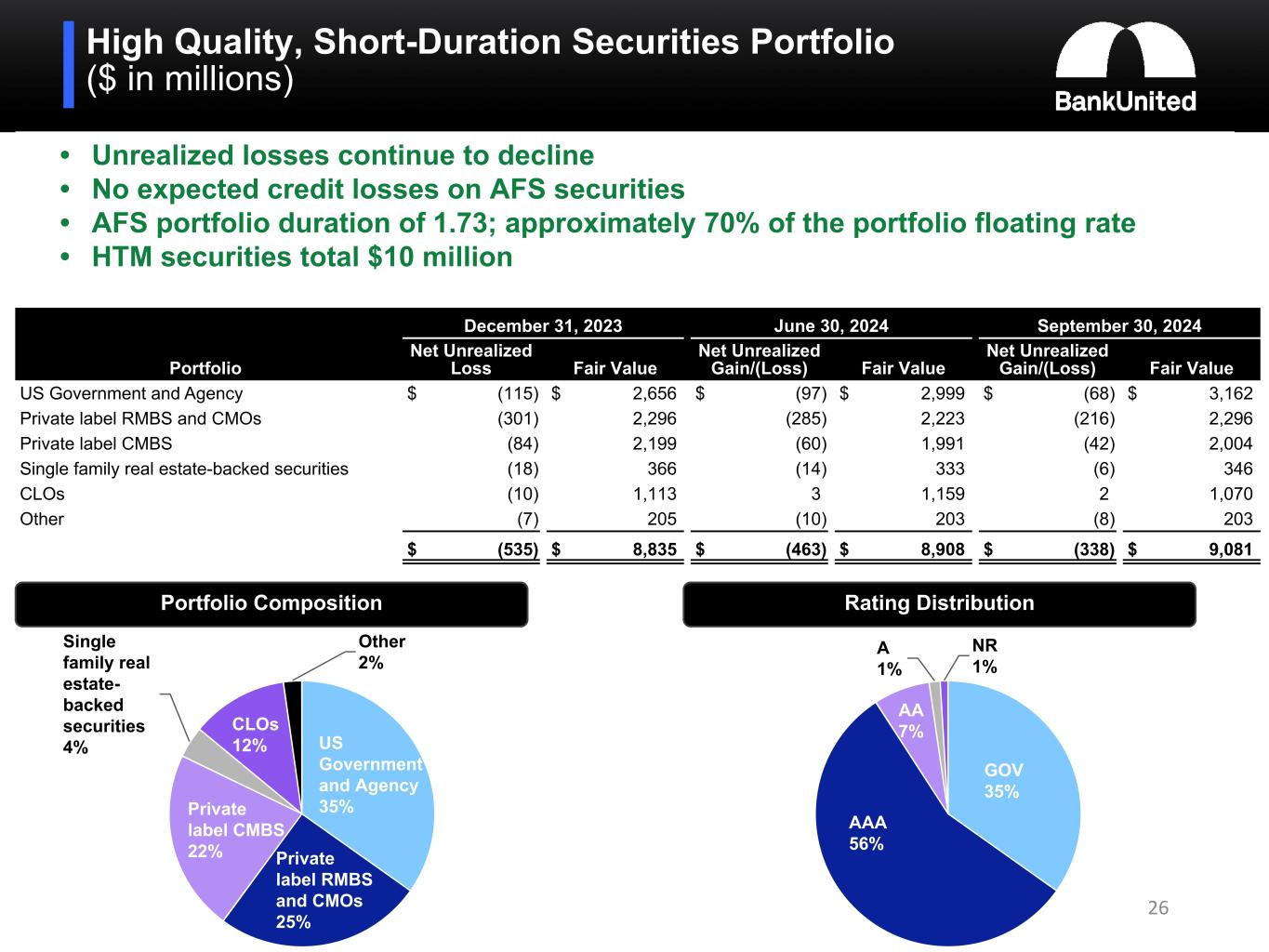

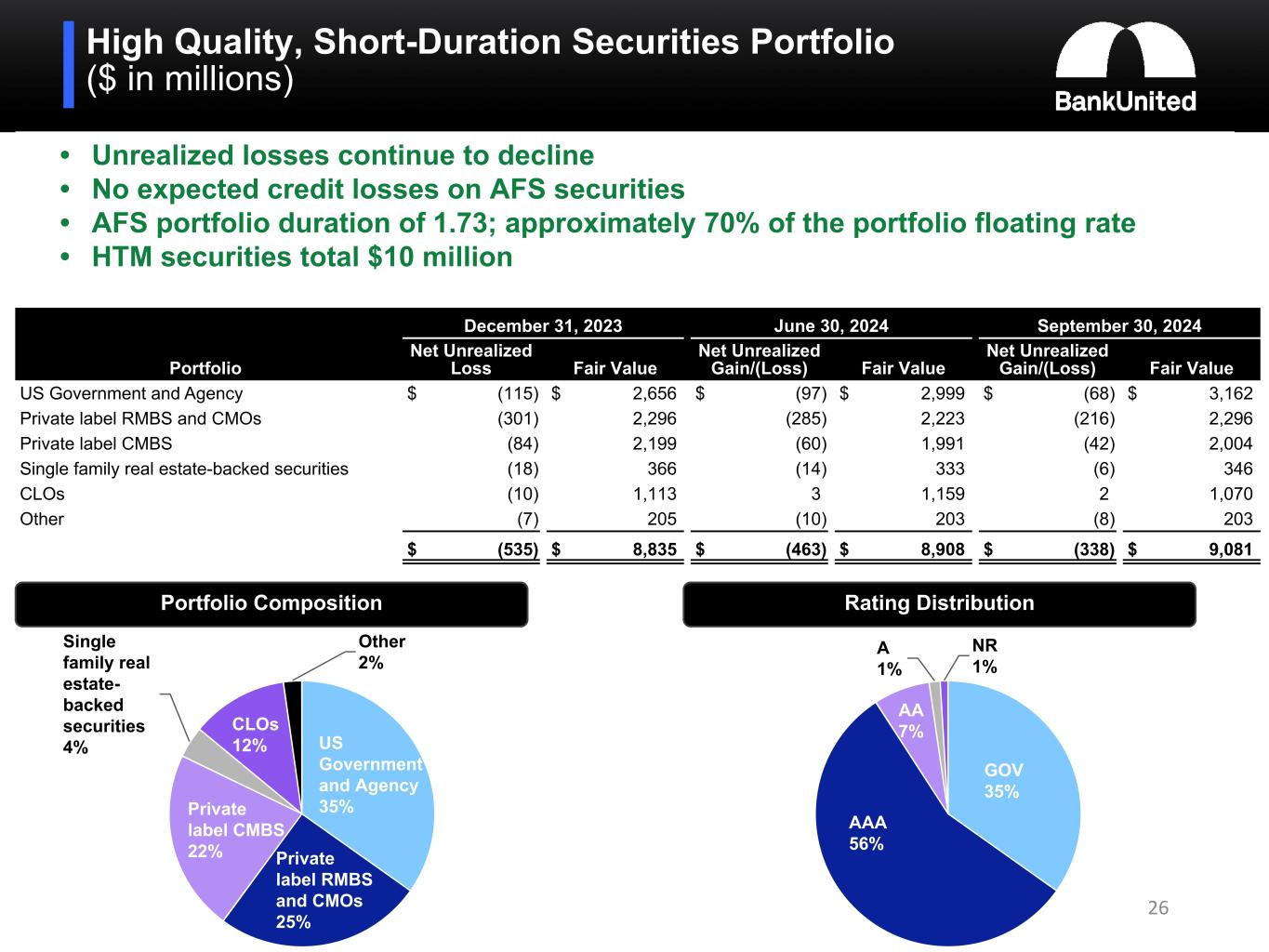

High Quality, Short-Duration Securities Portfolio ($ in millions) December 31, 2023 June 30, 2024 September 30, 2024 Portfolio Net Unrealized Loss Fair Value Net Unrealized Gain/(Loss) Fair Value Net Unrealized Gain/(Loss) Fair Value US Government and Agency $ (115) $ 2,656 $ (97) $ 2,999 $ (68) $ 3,162 Private label RMBS and CMOs (301) 2,296 (285) 2,223 (216) 2,296 Private label CMBS (84) 2,199 (60) 1,991 (42) 2,004 Single family real estate-backed securities (18) 366 (14) 333 (6) 346 CLOs (10) 1,113 3 1,159 2 1,070 Other (7) 205 (10) 203 (8) 203 $ (535) $ 8,835 $ (463) $ 8,908 $ (338) $ 9,081 Portfolio Composition US Government and Agency 35% Private label RMBS and CMOs 25% Private label CMBS 22% Single family real estate- backed securities 4% CLOs 12% Other 2% Rating Distribution GOV 35% AAA 56% AA 7% A 1% NR 1% • Unrealized losses continue to decline • No expected credit losses on AFS securities • AFS portfolio duration of 1.73; approximately 70% of the portfolio floating rate • HTM securities total $10 million 26

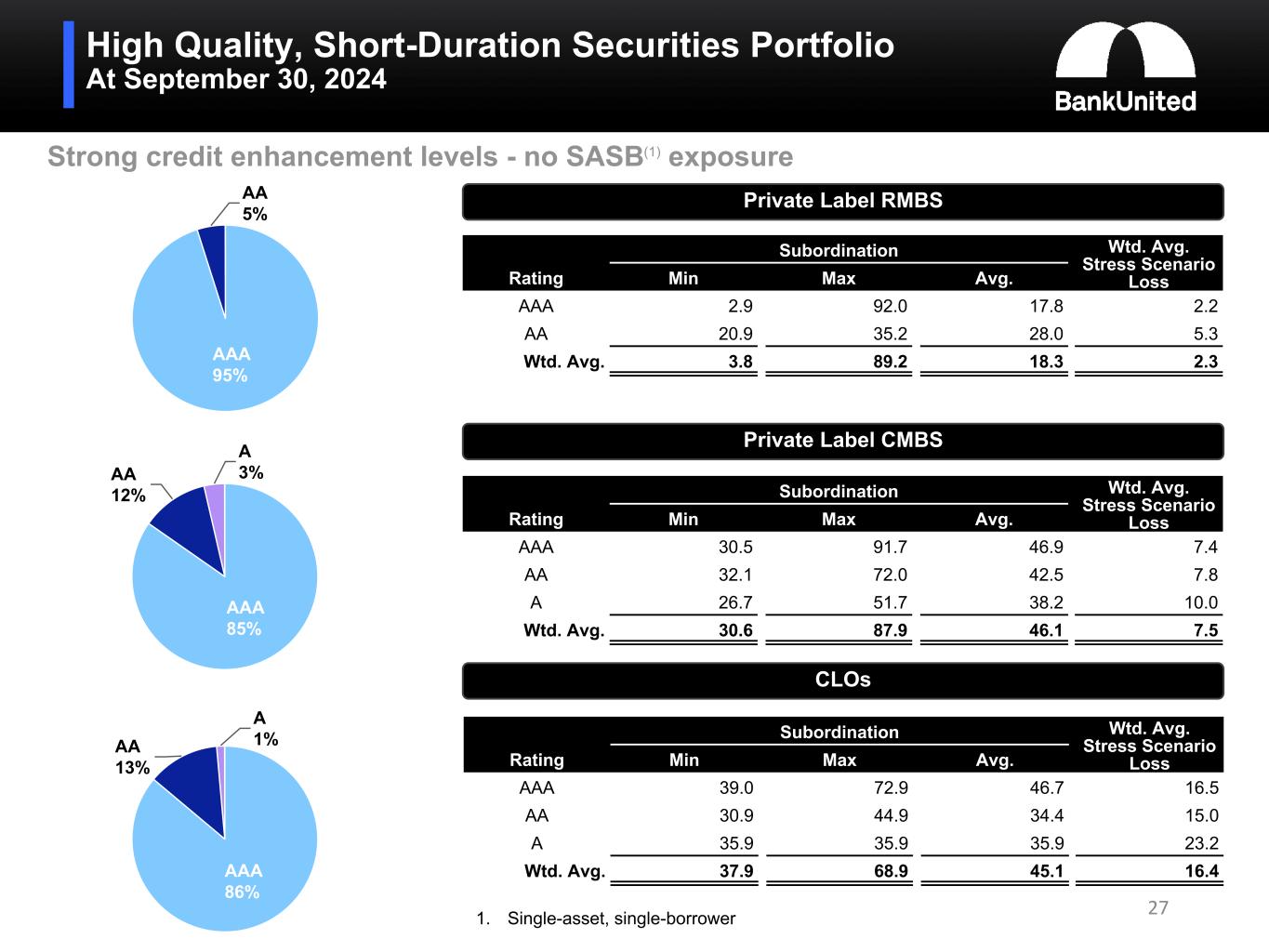

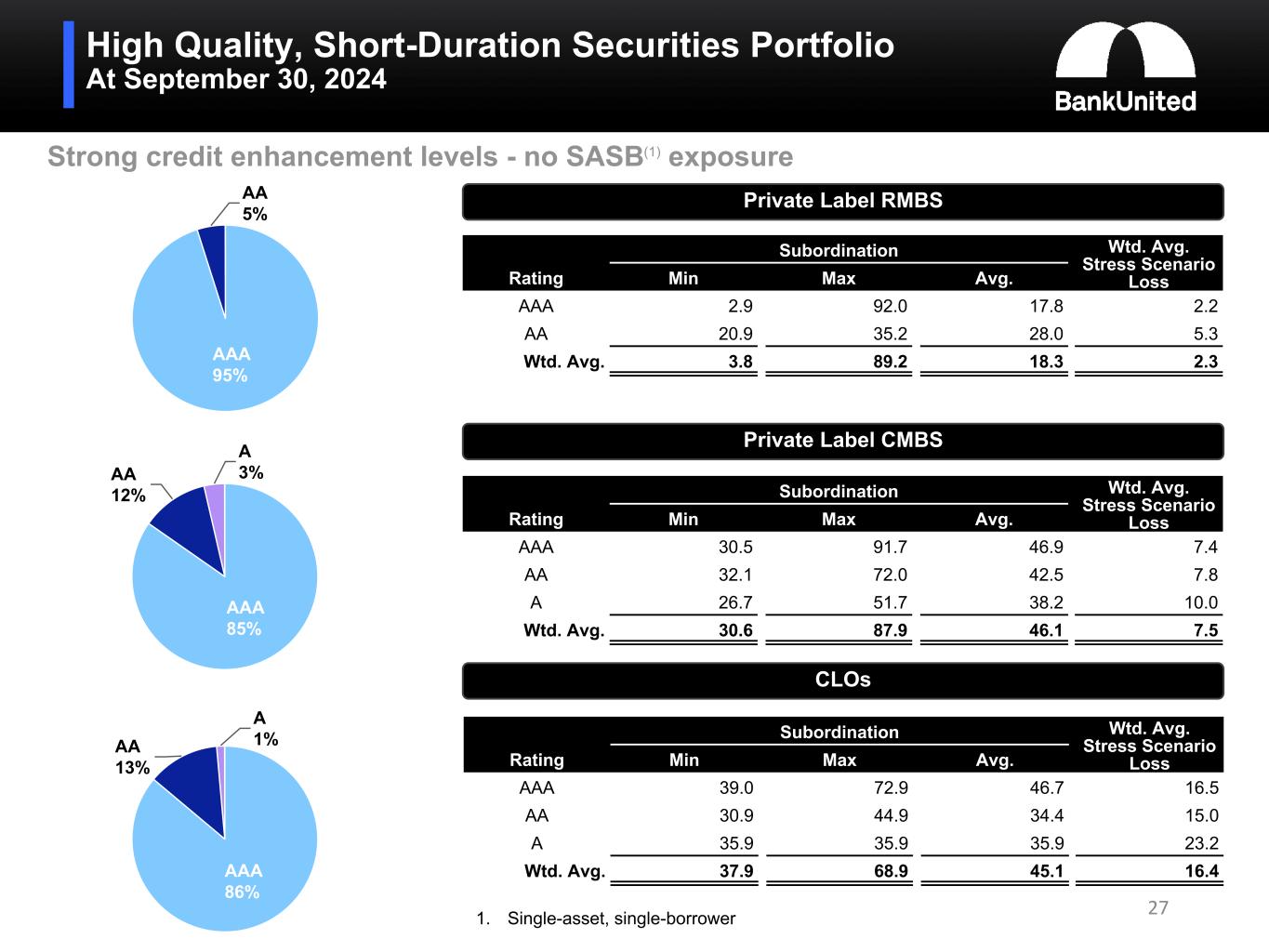

High Quality, Short-Duration Securities Portfolio At September 30, 2024 Strong credit enhancement levels - no SASB(1) exposure Private Label RMBS Subordination Wtd. Avg. Stress Scenario LossRating Min Max Avg. AAA 2.9 92.0 17.8 2.2 AA 20.9 35.2 28.0 5.3 Wtd. Avg. 3.8 89.2 18.3 2.3 Private Label CMBS Subordination Wtd. Avg. Stress Scenario LossRating Min Max Avg. AAA 30.5 91.7 46.9 7.4 AA 32.1 72.0 42.5 7.8 A 26.7 51.7 38.2 10.0 Wtd. Avg. 30.6 87.9 46.1 7.5 CLOs Subordination Wtd. Avg. Stress Scenario LossRating Min Max Avg. AAA 39.0 72.9 46.7 16.5 AA 30.9 44.9 34.4 15.0 A 35.9 35.9 35.9 23.2 Wtd. Avg. 37.9 68.9 45.1 16.4 AAA 95% AA 5% AAA 85% AA 12% A 3% AAA 86% AA 13% A 1% 271. Single-asset, single-borrower