Building Bridges in Medical Dermatology Investor Presentati May 2020 NYSE American: TMBR

Safe Harbor Statement Certain statements contained in this PowerPoint presentation describing Timber’s technology and development program, including, without limitation, statements containing the words “expects,” “anticipates,” “believes,” and words of similar import, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995.These forward-looking statements are subject to various risks and uncertainties that could cause actual future results and events to differ materially from those currently anticipated. Potential investors are cautioned not to place undue reliance on these forward-looking statements. 2 NYSE American: TMBR

3 Introducing Timber Pharmaceuticals, Inc. Timber Pharmaceuticals is building an orphan dermatology company that focuses on mitigating the cost, risk, and time of drug development by leveraging the Orphan Drug pathway for conditions with no FDA Approved treatments. The company’s investigational therapies utilize proven mechanisms-of-action backed by decades of clinical experience and well-established CMC (chemistry, manufacturing and control) and safety profiles. Timber is initially focused on developing non-systemic treatments for rare dermatologic diseases including congenital ichthyosis (CI), facial angiofibromas in tuberous sclerosis complex (TSC), and localized scleroderma. NYSE American: TMBR

4 Investment Highlights Timber is positioned to become a leading Dermatology company with a focus on orphan diseases, led by a management team with a proven track record in development and commercialization High potential, late stage, low risk multi-product candidate pipeline Proven clinical Proof of Concept (POC) Enrolling patients in two Phase 2b studies with two different product candidates Recently completed equity raise of $25 million to fund company through multiple key clinical development milestones Closed reverse merger with NYSE American listed company on May 18, 2020 NYSE American: TMBR

Leadership Team Strong Balance between Entrepreneurial Acumen and Proven Operational Leadership Michael Derby, MS, MBA, Executive Chairman • • • Pharma entrepreneur with several successful exits Managing Partner of TardiMed Sciences Founder of Norphan Pharmaceuticals, rare neurology drug development, sold to Marathon Pharma (2013), subsequently sold to PTC Therapeutics (2017) Co-Founder & CEO of Castle Creek Pharmaceuticals, rare dermatology drug development, raised >$120 million across three rounds of financing from leading investors • John Koconis, MBA, CEO • Seasoned Pharmaceutical executive with over 25 years experience leading successful teams in global markets and having launched multiple market leading products in Dermatology President & CEO of LEO Pharma (US), established a market leading Dermatology company with focus on Psoriasis and AK Global Lead for Dermatology and Respiratory Disease at Sanofi Genzyme, led the Global launch of Dupilumab in AD EVP & CCO at Castle Creek Pharmaceuticals, built a rare/orphan dermatology company with a focus on EBS • • • 5 NYSE American: TMBR

Zach Rome, Chief Operating Officer Joseph Lucchese, CFO • • Dermatology inventor and entrepreneur Co-founder and President at Patagonia Pharmaceuticals, >$11 million in funding from founders and strategic partner Advanced lead development candidate from concept to Phase 2B clinical studies and was the Recipient of FDA Orphan Products Grant Partner at TardiMed Sciences • Chief Financial Officer of Timber Pharmaceuticals as well as a Partner at TardiMed Sciences. Founding member and Managing Director of Oncology Partners Managing Director at BlueStone Capital Partners, headed the Private Placement desk. Portfolio Manager and Chief Financial Officer of the MicroCap Fund, a NASDAQ-listed private equity fund that invested in early stage companies in the healthcare and information technology sectors. Began career as a member of Chase Manhattan Bank’s Merchant Banking Group, part of the team that financed highly leveraged transactions and managed the bank’s private equity portfolio. • • • • • • Amir Tavakkol, PhD, EVP and CSO • Senior executive and a passionate leader with strong management skills with over 25 years of drug development and medical affairs experience in large pharma/biotech, consumer healthcare and academia Nationally and internationally recognized industry drug-development expert in nail, skin and hair fungal diseases, with significant experience in pre-clinical research, phase 1 – 4 clinical research in retinoids, dermatosis, and cutaneous antioxidant products. Head of Dermatology Clinical Research at Schering-Plough leading the simultaneous approval of phase 3 programs by FDA, EMEA, PMDA, and Health Canada for topical antifungal drug tavaborole, Head of Antifungal Product Development at Merck; CDO at Viamet where he led drug development efforts for Viamet’s portfolio of antifungal drugs EVP & CDO at Castle Creek Pharmaceuticals where he focused on drug development for rare skin diseases including EBS and CI among others. • • • • 6 NYSE American: TMBR

World Class Clinical Clinical Advisors Advisors and Partners Partners • Peter Elias, MD – Professor, Dept of Dermatology, University of California, San Francisco (UCSF) Keith Choate, MD, PhD – Professor of Dermatology, Pathology, and Genetics, Yale University Joyce Teng, MD – Professor and Director of Pediatric Dermatology, Stanford University Development partner on TMB-002 (Pascomer®) program • • 7 NYSE American: TMBR

• Timber’s strategy focuses on attempting to mitigate the cost, risk, and time of drug development while retaining earnings potential Timber Business Model • Identify compounds with broad and proven mechanisms across many dermatologic conditions. Differentiate the drug product and create a barrier to entry strategy Pursue orphan indications and then seek to expand to additional indications • • • Orphan Drugs • Focus on orphan conditions for which there are no current FDA approved treatments Smaller and less costly trials with greater flexibility from FDA Potential to receive valuable priority review voucher from FDA Orphan Drug Exclusivity: 7 years in U.S., 10 years in E.U. • • • • Leverage the 505(b)(2) pathway • • • Straight to Phase 2 studies Fewer requirements from FDA Safety and efficacy already established 8 NYSE American: TMBR

Strategically Building Pipeline in Rare Dermatologic Disease 9 NYSE American: TMBR

Life Cycle Management All products have potential follow-on indications in significant dermatology markets Scars 10 NYSE American: TMBR Sebaceous Hyperplasia Hypertrophic/Keloid Port Wine Stains Severe Acne Scarring Alopecia Darier ’s Disease Sturge-Weber Syndrome TMB-003 TMB-002 TMB-001

Barriers Entry to • • • Orphan exclusivity – 7 years in U.S., 10 years in E.U. Patents pending globally Trade secrets in formulation/manufacturing • Cytotoxic, requires containment, photolabile, prone to oxidation, temperature sensitivities, stability challenges, etc. dosing, and other methods of • Priority date of March 2018 11 NYSE American: TMBR TMB-001 TMB-002 TMB-003 •WO 2017/074982 A1 – initial family is formulation based, with expansion planned around dosing, PK, and other methods of use •Pending in the US, Australia, Canada, China, EPO, Japan, Mexico, and South Korea • Priority date of October 2015 • FTO complete •US 2013/0225631 A1 – method of use applications licensed from AFT, with expansion planned around formulation and other methods of use • Pending in the US •Priority date of March 2013 • FTO complete •WO 2019/173215 A1 and WO 2019/173219 – Two method of use families (cutaneous fibrosis and pigmentation disorders) with expansion planned around formulation, PK, use • Pending with the PCT •Landscape search complete

TMB-001for Congenital Ichthyosis A rare disorder of keratinization affecting ~ 80,000 people in the U.S. (>1.5 million globally) Prevalence • X-Linked Ichthyosis has a prevalence of 1:2,000-1:6,000 males • Lamellar Ichthyosis has a prevalence of 1:100,000-200,000 Quality of life is significantly affected • Skin inflammation and fragility, pruritus, fissuring and cracking of thickened skin, ectropion, anhidrosis, and in some severe cases, an increased susceptibility to infection • In Lamellar Ichthyosis, almost the whole body can be covered and be severe No FDA Approved treatments 12 NYSE American: TMBR X-Linked Ichthyosis Unmet Need: An efficacious and safe treatment that can be used long term to cover a large body surface area. Lamellar Ichthyosis

TMB-001Topical Isotretinoin in CI Proprietary topical formulation minimizing systemic absorption and allowing for chronic treatment Isotretinoin is widely viewed as the most effective therapy for several skin conditions, including ichthyosis, but it is only available orally, where high dose, chronic oral therapy cannot be tolerated due to systemic toxicity Development Stage: • • Phase 2B study in CI is currently enrolling Phase Ib/2a POC study in CI completed in 2018 with positive data on clinically meaningful endpoints and no systemic absorption TMB-001 utilizes proprietary IPEG™ delivery system to target isotretinoin delivery to the epidermis and dermis, minimize systemic absorption and remove irritating excipients 2018 FDA Orphan Products Grant Recipient • Awarded $1.5 Million from the FDA to run the Phase 2A and Phase 2B Clinical Trials We believe we have Strong Market Protection, with Orphan exclusivity granted (7 years in U.S., 10 years in E.U.) and additional patents pending 13 NYSE American: TMBR

TMB-001Clinical Trial Results Phase Ib/IIa study of TMB-001 in Congenital Ichthyosis TMB-001 (0.1%) Percent of Subject Achieving 2-point reduction on Day 57 Vehicle 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1 Baseline 2 Day 57 TMB-001 (0.1%) TMB-001 (0.1%) IGA Scaling Active 0.1% Vehicle 3 Day 84 14 NYSE American: TMBR Primary measure was change in IGA and Scaling relative to baseline at Day 57

TMB-001Topical Isotretinoin in CI Commercial Opportunity • • Dermatologists already familiar with oral Accutane® / Isotretinoin Payor landscape based on key findings from reimbursement analysis: • Formulary access will be swift and a formality due to orphan status and TMB-001 positioned as only FDA approved therapy for the indication Pharmacy Tier status is anticipated to be that of the Specialty Tier, possibly Tier-4 Method of delivery to patient - mail order via specialty pharmacy or retail specialty pharmacy Likelihood of product substitution is deemed very low Payor adoption under orphan drug policies will be widespread Available topical generic comparators have a price point of $1,723.40 - $3,902.10 per month when factoring for expected usage within this patient population • • • • • • FIRST Patient Advocacy Organization • Will facilitate building of awareness and coordination amongst KOL’s 15 NYSE American: TMBR

TMB-001 Phase 2B Study Design (CONTROL Study) Treatment of Congenital Ichthyosis decrease in VIIS scaling score • PRO (itch, DLQI) • Multi-center global trial (US and Australia) 16 NYSE American: TMBR Title A Vehicle Controlled Study to Evaluate Safety and Efficacy of Topical TMB-001 for Primary Objective Proportion of subjects with VIIS treatment success, defined as 50% or greater Secondary Objectives • IGA decrease in disease severity by at least 2 grades Study Design • Randomized, Parallel, Double-Blind, Vehicle Controlled Study • Evaluating the Safety and Efficacy of Two Concentrations of Topical TMB-001 Study Population Moderate to Severe X-linked and Lamellar Ichthyosis 9 years and older Patient Number 45 Therapy Twice Daily Application Time Schedule 12 weeks

TMB-002Topical Rapamycin Leading the Competition (Pascomer®) Compounded topical rapamycin is disadvantageous for many reasons • • • Not approved by regulators May provides inconsistent quality, homogeneity and potency Expensive and unreimbursed for patients (>$30K-$50K per annual course of therapy for 1% strength) Topical rapamycin products in development are behind Timber •Japanese product (Nobelpharma) is approved solely in Japan at a lower strength (0.2%), has only 12 months of stability at refrigerated conditions, and would require significant additional clinical work in Western populations to gain approval in U.S. and Europe •Aucta Pharma is running a smaller Phase 2 study. Management believes that TMB-002 is further along in the process. 17 NYSE American: TMBR

TMB-002 for Facial Angiofibromas in Tuberous Sclerosis TSC is a multisystem genetic disorder affecting approximately 50,000 people in the US TSC is caused by the unregulated activation of the mammalian target of rapamycin (mTOR) pathway, resulting in the growth of hamartomas in multiple organs Prevalence Complex • • 40,000-50,000 People suffer from TSC in the US 75% of these have Facial Angiofibromas Rapamycin is a well-known inhibitor of inflammatory signaling in TSC, including in FAs, but only available as an oral agent, associated with significant systemic toxicity No FDA Approved Topical Formulation of Rapamycin 18 NYSE American: TMBR Unmet Need: FDA Approved, GMP Quality Topical Rapamycin Formulation to treat Facial Angiofibromas with a significantly better safety profile

TMB-002Topical Rapamycin (Pascomer®) Potentially the First Commercially Available, High-Quality Topical Formulation of Rapamycin with Broad Access Proprietary topical formulation of rapamycin (1.0%, 0.5%, and 0.1%) Development Stage • Efficacy of topical rapamycin demonstrated in multiple well controlled studies and dozens of published case reports Robust Phase 2B study (one of two pivotal studies required for registration) in FAs in TSC underway; Enrolling 120 subjects across 17 sites • Additional 5% strength assessed in preclinical toxicity studies • Utilizes trade secret lipid crystalline vehicle system designed to improve stability and delivery of unstable APIs • Compounded formulations that are sometimes currently used lack consistent quality, potency, and homogeneity Other topical rapamycin formulations have short shelf lives and require refrigeration Pascomer has demonstrated room temperature stability for 0.5%, 1.0%, and 5.0% formulations • We believe we have Strong Market Protection, with Orphan exclusivity granted (7 years in U.S., 10 years in E.U.) and with additional patents pending • 19 NYSE American: TMBR

TMB-002Topical Rapamycin (Pascomer®) Commercial Opportunity Dermatologists already familiar with rapamycin and its potential in TSC • Defined target group (64 U.S. specialist clinics) can be reached with a small salesforce Payor landscape based on key findings from reimbursement analysis: • All payors interviewed expected to cover Pascomer on their commercial and Medicare plans at the tested price points ($10-$30K/year) Medicare plans will cover Pascomer on the specialty tier with a simple Prior Authorization Contracting is not expected to play a role in this category due to low disease prevalence • • Robust life cycle management possibilities • Follow-on indications may include Sturge-Weber Syndrome and port-wine stains (PWS) all conditions in which topical rapamycin has already demonstrated clinical benefit Tuberous Sclerosis Alliance Patient Organization • Will facilitate building of awareness and coordination amongst KOL’s 20 NYSE American: TMBR

TMB-002 (Pascomer®) Phase 2B Study Design Tuberous Sclerosis Complex two grades from baseline • Percentage improvement in FA, as assessed by the participant or parent/caregiver • Efficacy and Safety of Two Concentrations of TMB-002 21 NYSE American: TMBR Title Dose-Ranging Efficacy and Safety Study of Topical Rapamycin Cream for Facial Angiofibromas Associated With Primary Objective Proportion of subjects with IGA treatment success defined as clear or almost clear with an improvement of at least Secondary Objectives • Time from the first dose to IGA success •Change in IGA from baseline •Change in the Facial Angiofibroma Severity Index (FASI) from baseline •Percentage improvement in FA, as assessed by the clinician •Change in FA on a 5-point scale, as assessed by the participant or parent/caregiver Study Design •Phase 2/3, Multi-Center, Double-Blind, Placebo-Controlled, Randomized, Parallel-Group, Dose-Response Comparison • Multi-center global trial (US, Europe, Australia, NZ) Study Population Patients aged 6 – 65 with FA severity score of 2 or 3 on the IGA Patient Number 120 Therapy Once Daily Application Time Schedule 26 weeks

TMB-003Locally Delivered Highly Selective ET-A inhibitor Sitaxsentan Sitaxsentan was a highly selective (6,500:1) ET-A receptor antagonist previously on the market in the EU, Canada and Australia as an oral treatment for PAH, but voluntarily withdrawn from global market in 2010 due to risks of liver toxicity • Demonstrated benefit in cutaneous scleroderma symptoms in multiple case reports TMB-003 • Locally delivered formulations of Sitaxsentan in development • Systemic safety concerns addressed via topical / subcutaneous / intralesional administration • We believe we have strong market protection based on: • • No prior art contemplation of local administration Method of use patents pending for conditions of cutaneous fibrosis and hyperpigmentation Orphan exclusivity • 22 NYSE American: TMBR Role of Et-A Inhibition Endothelin-1 is a potent and long-lasting vasoconstrictor and profibrotic known to play a role in skin fibrosis •Endothelin-1 acts through two receptors, ET-A and ET-B, known to have broadly opposing functions •Hypothesized that selectively antagonizing ET-A may lead to more effective reductions in collagen production Endothelin Receptor Antagonists are a class of drugs currently on the market (in oral form) for the treatment of Pulmonary Arterial Hypertension (PAH) •A review of the literature showed no difference in endothelin selectivity in PAH, however in the subset of PAH patients with connective tissue disease, selective ET-A inhibition was beneficial

Localized Scleroderma Rare connective tissue disorder affecting approximately 90,000 people in the US Localized Scleroderma is a rare, autoimmune connective tissue disorder (CTD) characterized by inflammation and thickening of the skin from excessive collagen deposition. It is more common in children, with about 90,000 people in the U.S. affected Quality of life can be significantly affected •Disfiguring •Can cover joints and cause pain, affect movement / mobility, etc. No FDA Approved treatments for any cutaneous symptoms in scleroderma •Off-label therapies have significant side effects and rarely lead to benefit •Bosentan (Tracleer®), a non-selective endothelin receptor antagonist, is approved in Europe to reduce digital ulcers in patients with systemic scleroderma 23 NYSE American: TMBR

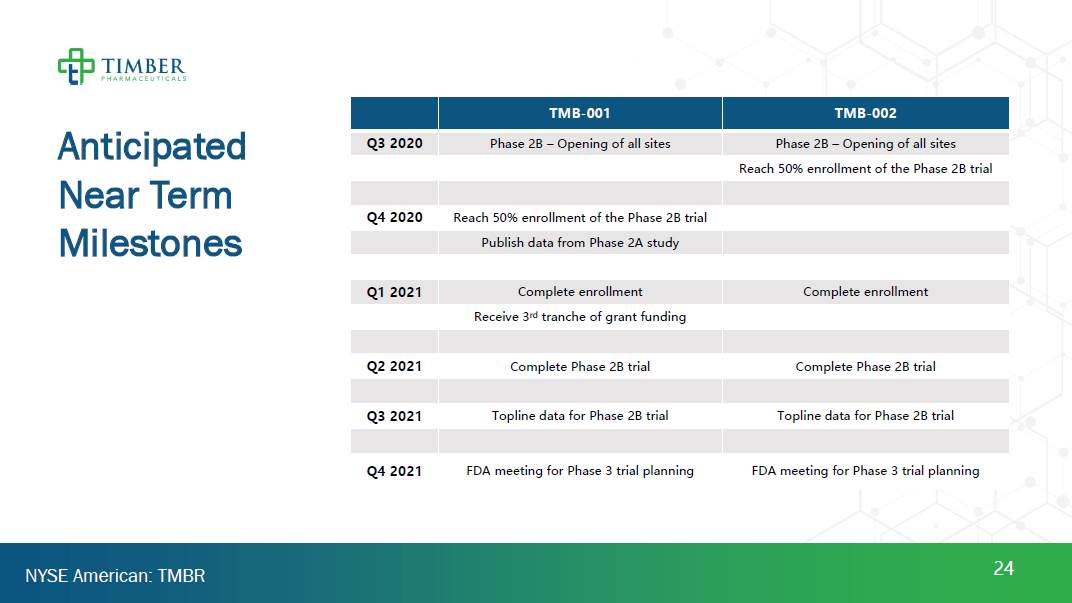

Anticipated Near Term Milestones 24 NYSE American: TMBR TMB-001 TMB-002 TMD-003 Q3 2020 Phase 2B – Opening of all sites Phase 2B – Opening of all sites Reach 50% enrollment Q4 2020 Reach 50% enrollment Formulation milestone Publish data from Phase 2A study Q1 2021 Complete enrollment Complete enrollment Receive 3rd tranche of grant funding Q2 2021 Complete Phase 2B trial Complete Phase 2B trial Q3 2021 Topline data for Phase 2B trial Topline data for Phase 2B trial Q4 2021 FDA meeting for Phase 3 trial planning FDA meeting for Phase 3 trial planning

25 Financial and Capitalization Highlights As a result of the merger, Timber Pharmaceuticals LLC became a wholly owned subsidiary of BioPharmX Corporation, which changed its name to Timber Pharmaceuticals, Inc. Upon closing of the merger, Timber received $20 million of funding from certain institutional investors in exchange for common shares and warrants. In addition, a $5 million bridge note issued by Timber LLC was converted into common shares and warrants on the same terms as the new funding. Timber believes that proceeds from this financing will be sufficient to fund its operating expenses and capital expenditure requirements into the fourth quarter of calendar year 2021. Immediately after the merger, financing, and giving effect to a 12:1 reverse stock split, the combined entity had: NYSE American: TMBR

26 Topical Isotretinoin for Congenital Ichthyosis Topical Rapamycin for Facial Angiofibromas in Tuberous Sclerosis Complex Locally Delivered Endothelin-A Antagonist for Localized Scleroderma Recently acquired Topical Minocycline programs Label expansion opportunities for all programs Track record of success, including founding and build-up of Castle Creek Pharma, raising >$120 million in capital Deep experience in dermatology and rare disease High unmet needs with large market potential All programs qualify for Orphan Drug status No approved treatments for indications Potential to receive valuable priority review voucher from FDA Clinical proof of concept established in two assets Proven MOA’s with decades of clinical experience Well-known CMC and safety profiles Portfolio of orphan indications Additional broad dermatology indications under exploration Market expansion potential in broader dermatology indications Rare, High Need Medical Dermatology Large Market Potential Multiple Shots on Goal De-Risked Portfolio Management Expertise Key Takeaways NYSE American: TMBR

Building Bridges in Medical Dermatology Thank You For additional Investor Information please contact: John Koconis CEO jkoconis@timberpharma.com Stephanie Prince PCG Advisory sprince@pcgadvisory.com (646) 762-4518 www.timberpharma.com