UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 21, 2014

| Thompson Designs, Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada | 000-54871 | 59-3843182 | ||

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1098 Hamilton Court Menlo Park, CA 94025 | ||

| (Address of Principal Executive Offices) |

Tel. (650) 889-5020

Fax (650) 900-4130

Registrant’s telephone number, including area code

3315 East Russell Road, Ste. A-4 129

Las Vegas, Nevada 89120

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

| Item No. | Description of Item | Page No. | ||

| Item 1.01 | Entry Into a Material Definitive Agreement | 3 | ||

| Item 2.01 | Completion of Acquisition or Disposition of Assets | 4 | ||

| Item 3.02 | Unregistered Sales of Equity Securities | 18 | ||

| Item 4.01 | Changes in Registrant’s Certifying Accountant | 18 | ||

| Item 5.01 | Changes in Control of Registrant | 19 | ||

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | 19 | ||

| Item 5.03 | Amendment of Articles of Incorporation or Bylaws; Change in Fiscal Year | 19 | ||

| Item 5.06 | Change in Shell Company Status | 20 | ||

| Item 9.01 | Financial Statements and Exhibits | 20 |

EXPLANATORY NOTE

This Current Report on Form 8-K is being filed by Thompson Designs, Inc. We are reporting the acquisition of a new business and providing a description of this business and its audited financial statements below.

| ● | The “Company,” “we,” “us,” or “our,” are references to the combined business of Thompson Designs, Inc. (“Thompson Designs”) and its subsidiary, BPMX. |

| ● | “BPMX” refers to BioPharmX Inc., a Delaware corporation, and our direct, wholly owned subsidiary. |

| “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States. | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended. |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

Share Exchange Agreement

On January 23, 2014, Thompson Designs, BPMX and stockholders of BPMX who collectively own 100% of BPMX (the “BPMX Stockholders”) entered into and consummated transactions pursuant to a Share Exchange Agreement (the “Share Exchange Agreement,” such transaction referred to as the “Share Exchange Transaction”), whereby the Company issued to the BPMX Stockholders an aggregate of 7,025,000 shares of its common stock, par value $0.001 (“Common Stock”), in exchange for 100% of the equity interests of BPMX held by the BPMX Stockholders. The shares of our Common Stock received by the BPMX Stockholders in the Share Exchange Transaction constitute approximately 77.8% of our issued and outstanding Common Stock giving effect to the issuance of shares pursuant to the Share Exchange Agreement. As a result of the Share Exchange Transaction, BPMX became a subsidiary of the Company.

The Share Exchange Agreement contains representations and warranties by us, BPMX and the BPMX Stockholders, which are customary for transactions of this type, such as, (1) with respect to the Company: organization, good standing and qualification to do business; capitalization; subsidiaries; authorization and validity of the transaction and transaction documents; consents being obtained or not required to consummate the transaction; no conflict or violation of Articles of Incorporation and By-laws, (2) with respect to BPMX: authorization; capitalization; and, title to BPMX’s common stock being exchanged, and (3) with respect to BPMX Stockholders: authorization; no conflict or violation of law; investment purpose; accredited investor status; reliance on exemption on the Company’s Common Stock to be exchanged; and, transfer or resale pursuant to the Securities Act.

3

On January 23, 2014, we completed the acquisition of BPMX pursuant to the Share Exchange Agreement. The acquisition was accounted for as a reverse merger and recapitalization effected by a share exchange. BPMX is considered the acquirer for accounting and financial reporting purposes. The assets and liabilities of the acquired entity have been brought forward at their book value and no goodwill has been recognized.

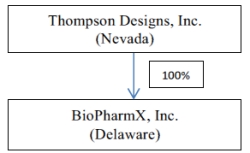

OUR CORPORATE STRUCTURE

The following diagram sets forth the structure of the Company as of the date of this Report:

Organizational History of Thompson Designs, Inc.

Thompson Designs, Inc. was incorporated in Nevada on August 30, 2010. The business plan of the Company was originally to design and build custom signs for residential and commercial properties. Immediately after the completion of the Share Exchange Transaction, the Company discontinued its custom signs business and changed its business plan to development of novel delivery mechanisms and routes of administration for known drugs and tissues.

Organizational History of BioPharmX Inc.

BioPharmX Inc. was incorporated on August 18, 2011 in Delaware and is a development-stage biotechnology company focusing on development of novel delivery mechanisms and routes of administration for known drugs and tissues.

OUR BUSINESS

Overview

BioPharmX, Inc. (“BPMX”) is a Silicon Valley-based company, which seeks to provide innovative products through unique, proprietary platform technologies for pharmaceutical and over-the-counter (“OTC”) applications in the fast growing health and wellness markets, including women’s health, dermatology, and otolaryngology (ears, nose & throat).

BPMX is primarily a research & development (“R&D”) company focusing on the development of novel delivery mechanisms and novel routes of administration for known drugs and tissues. BPMX has expertise in formulation development, intellectual property generation, clinical trial execution, and regulatory strategy definition. BPMX’s business model is to outsource much of its manufacturing and commercialization activities in order to maintain its focus on technology sourcing, acquisitions, and partner development to create new products to address unmet needs in well-defined, multi-billion dollar markets.

Our Products

BPMX’s product pipeline includes products in three categories: prescription products, OTC products, and dietary supplements. Products will be delivered as oral, topical, inhalant, and/or injectable forms depending on the platform technology being applied and the anatomical target.

Prescription products in development include:

| ● | molecular iodine (I2) pill for the treatment of breast pain associated with fibrocystic breast disease, a woman’s health condition; |

| ● | topical antibiotics for acne and cutaneous bacterial infection; and, |

| ● | injectable filler for wrinkle reduction and volume enhancement |

In addition to OTC versions of some of our prescription products, our OTC product pipeline also includes a series of medicated bandages, nasal sprays and other products based on BPMX platform technologies.

Our supplement product pipeline includes BPMX’s breast health pill. Our initial product will be a dietary supplement distributed under the brand name VI2OLET™. The VI2OLET breast health pill is a women’s dietary supplement designed to promote breast health. The VI2OLET breast health pill includes patented technology that provides a stable solid oral dosage of molecular iodine as a safe and reliable supplement to promote breast health. Taken once a day, the VI2OLET breast health pill is intended to provide a new health measure for women to promote and enjoy a healthier life.

4

Our Market Opportunity

Our strategy begins with obtaining patented, platform technologies through in-house development, joint development, exclusive licensing, or acquisition. BPMX then develops these platform technologies into product lines and tests these products in clinical trials. BPMX frequently develops products with a bifurcated market penetration strategy, including a high-dosage, prescription version and an OTC low-dosage version. Identifying such technologies requires a strong knowledge of the markets served through technology assessment and evaluation of sell-side and buy-side opportunities through relationships with major pharmaceutical companies. By design, BPMX’s innovative products are formulated to address both market pathways and to address unmet needs in well-defined, multi-billion dollar markets. BPMX makes decisions on a product-by-product basis regarding IP licensing of its technologies or direct commercialization of its products for both pharmaceutical and OTC distribution and sales.

Strategic Partnerships/Alliances

We have existing strategic partnerships with two private companies based in the United States. We have a collaboration and licensing agreement with Iogen, LLC (“Iogen”), a biotechnology company with molecular iodine technology. Our iodine dietary supplement product and the development of our molecular iodine prescription product build upon this licensed technology. Under the agreement, BPMX received an exclusive worldwide perpetual irrevocable license to Iogen’s patented technology relating to an oral iodine pill. In consideration of the license granted under the agreement, BPMX agreed to pay to Iogen a non-refundable license issue fee of $150,000. In addition, BPMX also agreed to pay to Iogen 30% of net profit associated with direct commercialization of the product or 30% of net royalties received from any sublicensee. For other products developed and commercialized by BPMX, including the prescription iodine drug, BPMX agreed to pay to Iogen a royalty of 3% of net sales for the first 12 months of commercialization and 2% of net sales thereafter.

We also have a collaboration and supply agreement with NuTech Medical, Inc. (“NuTech”). This agreement describes the collaboration between BPMX and NuTech to develop products in the field of dermatology. Products developed under this agreement are exclusively owned by BPMX and licensed to Nutech for use in their field. In exchange for an exclusive license to Nutech’s IP in the field of dermatology, BPMX will pay to NuTech a royalty of 3% of net sales on Product sold in the field of dermatology. In exchange for granting Nutech an exclusive license to BioPharmX IP and IP developed in collaboration with NuTech in their field, BioPharmX shall receive from Nutech a royalty of 3% net sales on Products sold in their field.

Customers

Customers for our products and services include:

| ● | Pharmaceutical companies |

| ● | Dermatology and aesthetics practices |

| ● | Retail customers via retail sales channels and/or physician offices |

Suppliers

The Company has relationships with a number of suppliers for small quantities of materials to accomplish its research and development (“R&D”) objectives. In addition, the Company has relationships with contract manufacturers to supply and package its iodine dietary supplement pills for finished goods distribution. Our agreement with NuTech specifies that NuTech will supply materials for our dermatological products and associated R&D.

Manufacturing

The Company utilizes contract manufacturers to produce its products for commercial distribution. There is no plan to establish in-house manufacturing capabilities for large-scale production.

Marketing and Sales

The BPMX team has expertise in the commercialization of consumer products with channels such as drug (Walgreens, CVS), wholesale (Costco, Sam’s Club), department store (Nordstrom, Target) and specialty retail (GNC, Sephora). With years of combined experience branding and launching products both in the U.S. and Europe, the team has a deep understanding of channel strategies that include branded, private label, and licensed product strategies. BPMX plans to commercialize products in the pipeline of health and wellness markets, including women’s health, dermatology, and otolaryngology (ears, nose & throat) into various channels, beginning with our VI2OLET breast health pill.

5

BPMX has contracted with outsourced sales representatives with broad retail and pharmaceutical sales coverage and expertise. In addition, the company is leveraging outside marketing and advertising agencies to gain product awareness.

Competitive Environment

Our competitors, typically large pharmaceutical companies, vary from product to product. In the area of women’s health, many companies sell iodine supplements, mostly based on delivering iodine with iodide salts. We believe our competitive advantage is our licensed proprietary formulation, which delivers molecular iodine in a stable manner. In the areas of dermatology and aesthetics, market leaders include Valeant Pharmaceutical and Allergen.

High competitive barriers to entry include:

| ● | Imitation by competitors would require reverse engineering efforts |

| ● | Many products require time-consuming regulatory and clinical hurdles |

| ● | Exclusive partner agreements and licensing arrangements |

Technology and Intellectual Property

The Company has three proprietary platform technologies which can be used in various combinations for product development in both the prescription and OTC markets:

| ● | Iodine-based products |

| ● | Drug delivery technologies |

| ● | Injectable filler formulations |

Patents

Patent protection is an important aspect of our product portfolio development. BPMX actively develops intellectual property in-house and has several patents pending. BPMX has exclusively licensed patents for technologies related to molecular iodine.

BioPharmX Inc.

BPMX holds four U.S. provisional patent applications related to drug delivery technologies and iodine-based products.

Iogen, LLC

On March 1, 2013, BPMX entered into a collaboration and license agreement with Iogen to license certain patents, patent applications, formulations and know-how relating to molecular iodine formulations used to manufacture an oral pill based on Iogen technology. Below is a list of the U.S. patents and patent applications licensed by BPMX from Iogen.

| Title | Patent Number | |

| Treatment of iodine deficiency diseases | US 5,589,198 | |

| Methods and pharmaceutical compositions for oral delivery of molecular iodine | US 5,885,592 | |

| Stabilized oral pharmaceutical composition containing iodide and iodate and method | US 6,248,335 | |

| Non-staining topical iodine composition and method | US 6,432,426 | |

| Method for the eradication of pathogens including S. Aureus and antibiotic resistant microbes from the upper respiratory tract of mammals and for inhibiting the activation of immune cells | US 8,303,994 |

| Title | Patent Application Number | |

| Methods for inhibiting the activation of immune cells | US 2013-0039997 A1 |

6

Trademarks

BPMX has applied for trademark protection for its “BIOPHARMX” and “VI2OLET” trademarks in the U.S. and intends to apply for trademark protection in key markets outside the U.S.

Our Growth Strategy

BPMX has focused this past year on key milestones to growth, including (1) preparing for submission of an Investigational New Drug application for Phase III clinical trials for the molecular iodine pill to obtain U.S. Food and Drug Administration (FDA) approval, (2) developing commercialization plans for the low dosage version under the brand name VI2OLET, and (3) advancing the pre-clinical development and testing for the topical acne product. The required capital to grow and expand product development will depend on the company’s ability to utilize the capital markets, once publicly traded on the over-the-counter (“OTCBB”) exchange with plans to list on the NASDAQ or NYSE exchange.

Future sources of revenue are expected to include partner license fees, contracted development payments, and royalties, along with direct commercialization proceeds. Product costs of goods sold include all outsourced manufacturing costs, partner royalties, and sourcing expenses, as well as partner funded clinical trial costs associated with contracted development payments. Operating expenses include direct personnel costs, direct commercialization, and directly funded clinical costs along with associated overhead expenses.

Our overall strategy is to identify early-stage scientific research projects being done by outside individuals and organizations and develop that research into commercially viable products for prescription, OTC, and dietary supplement use within the health and wellness, dermatology, and otolaryngology markets.

Research and Development

Our core competency is providing the link between concept and commercialization through focused, practical product development based on innovative research. We employ highly-qualified scientists and consultants specializing in our various product development areas. More than 50% of our research staff have earned a Ph.D. degree and have previous experience at dynamic, high-growth companies.

As a Silicon Valley-based company, we are located in a region with many strong biotech and pharmaceutical companies, which have drawn a high caliber of scientists and scientific support staff to the region. We believe this will enable the Company to grow our product development and consultant staff. The Company’s location also provides convenient access to local formulation resources and pre-clinical test facilities.

The Company spent $31,000 and $4,000 on its research and development during the fiscal years ended December 31, 2012 and 2011, respectively. The Company spent $401,000 and $222,000 on its research and development during the nine and three months ended September 30, 2013, respectively.

Significant Accomplishments

The Company is currently preparing an IND application to enter Phase III clinical trials for the molecular iodine pill prescription product. Previously completed Phase I & II clinical trial results of over 1,500 study subjects, available through our license agreement with Iogen, will be leveraged to pursue a Phase III study that is carefully planned to achieve the most efficient and effective results towards obtaining the necessary approval.

Government Regulation

We intend to sell our products in the U.S. and foreign markets. Many of these markets are highly regulated for the distribution of drug products. Our products fall into the following key regulatory categories within the U.S.: prescription drugs, over-the-counter drugs, medical devices, and dietary supplements. Several of our products may require demonstration of safety and efficacy before being permitted to be sold. We anticipate that the majority of our products will take 3-5 years to conduct clinical studies and regulatory review before they can be sold.

7

Insurance

The Company maintains standard corporate liability insurance and plans to have standard product liability insurance prior to product launch.

Employees

The Company has 6 full-time employees as of January 24, 2014. Our employees have business and technical expertise in pharmaceutical, biological sciences, medical devices, and consumer product development, and possess extensive experience in ex-vivo/in-vitro design, preclinical and clinical development, and intellectual property generation. Quality and regulatory expertise includes knowledge of medical directives, U.S. FDA guidance for drugs and medical devices and ICH & IEC guidelines for the U.S., Canada and the European Union. The Company also utilizes consultants to provide additional expertise in niche or highly technical areas.

BPMX considers its employee relations to be good, and to date has not experienced a work stoppage due to a labor dispute. None of BPMX’s employees are represented by a labor union.

DESCRIPTION OF PROPERTY

Our principal executive office and laboratory is located at 1098 Hamilton Court, Menlo Park, California 94025, where the company occupies 10,800 sq. ft. of R&D and administration facilities that are nearby to external formulation, clinical and pre-clinical testing facilities. The lease has a term of 39 months. The monthly base rent for the facilities is $23,220 through November 30, 2014, $23,916 through November 30, 2015, and $24,634 through November 30, 2016. This excludes monthly operating expenses initially estimated at $3,261. The initial security deposit under the lease is $150,000 which is to be reduced to $50,000 after BPMX has received at least $6 million in new funding.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

PLAN OF OPERATIONS

This Current Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These include statements about our expectations, beliefs, intentions or strategies for the future, which we indicate by words or phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,” “management believes” and similar language. Except for the historical information contained herein, the matters discussed in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere in this Current Report are forward-looking statements that involve risks and uncertainties. The cautionary language in this Current Report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from those projected. Except as may be required by law, we undertake no obligation to update any forward-looking statement to reflect events after the date of this Current Report on Form 8-K.

Plan of Operations

The Company plans to implement operations and reach its goals and objectives by hiring talented people to play key roles throughout the organization. The Company strives to hire employees with long term successful track records. It seeks to identify and hire the best talent for each open position. The Company will initiate a strong branding and marketing campaign for its first commercialized product, branded VI2OLET. While a portion of the funds that the Company intends to raise through sale of the Company's securities to finance its operations will be put into marketing, branding, and sales activities along with operational support activities, the majority of funds will be used for advancing research and development activities for new products in the pre-clinical pipeline and launching Phase III clinical studies for the molecular iodine prescription product.

Results of Operations

Nine Months ended September 30, 2013

Revenue

From August 18, 2011 through September 30, 2013, the Company has not had any revenues. The Company is in the research and development stage, but projects its molecular iodine prescription product will be released in 2014.

8

Research and Development Expenses

Research and development expenses for the nine months ended September 30, 2013, consisted primarily of compensation and benefits in the amount of $318,000 and laboratory supplies of $40,000. Research and development expenses for the period from August 18, 2011 (date of inception) through December 31, 2012 consisted of $22,000 of compensation and benefits and $5,000 in laboratory supplies. The Company has 12 full and part time employees and consultants in research and development as of September 30, 2013. The Company plans to convert some of the consultants to employees in 2014.

Sales and Marketing Expenses

Sales and marketing expenses for the nine months ended September 30, 2013, consisted primarily of compensation and benefits in the amount of $37,000 and the cost of developing marketing strategy and material in the amount of $28,000. Sales and marketing expenses for the period from August 18, 2011 (date of inception) through December 31, 2012 consisted of $7,000 primarily for the development of the company website and logo. The Company currently has no employees in sales and marketing and plans to continue to use outside consultants for this work, some of whom the Company may hire in 2014.

General and Administrative Expenses

General and administrative expenses for the nine months ended September 30, 2013, consisted primarily of compensation and benefits in the amount of $162,000, professional fees totaling $67,000 to the Company’s legal counsel and auditors, travel expense of $47,000, as well as other general and administrative expenses totaling $10,000. General and administrative expenses for the period from August 18, 2011 (date of inception) through December 31, 2012 consisted primarily of $26,000 in compensation and benefits.

Loss from Operations

Loss from operations for the nine months ended September 30, 2013 was $780,000. The loss was primarily attributable to spending on research and development with no current revenue. Loss from operations for period from August 18, 2011 (date of inception) through December 31, 2012, was $90,000.

Net Loss

Net loss for the nine months ended September 30, 2013 was $822,000. Net loss for the period from August 18, 2011 (date of inception) through December 31, 2012, was $95,000.

Inflation did not have a material impact on the Company’s operations for either of the periods. Other than the foregoing, management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

Fiscal Years Ended December 31, 2012 and 2011

Revenue

From August 18, 2011 through December 31, 2012, the Company has not had any revenues. The Company is in the research and development stage, but currently plans to have its molecular iodine prescription product to market in 2014.

Research and Development Expenses

Research and development expenses for the fiscal years ended December 31, 2012 and 2011, consisted primarily of compensation and benefits in the amount of $21,000 and $1,000, respectively. Research and development expenses for period from inception through December 31, 2012 consisted of $22,000 of compensation and benefits and $5,000 in laboratory supplies. The Company had 5 part-time consultants in research and development on December 31, 2012.

Sales and Marketing Expenses

Sales and marketing expenses for the fiscal years ended December 31, 2012 and 2011, consisted primarily of advertising and promotion in the amount of $7,000 and $150 for the cost of developing the Company’s website and logo. Sales and marketing expenses for the period from inception through December 31, 2012 consisted of $7,000 primarily for the development of the company website and logo. The Company currently has no employees in sales and marketing and uses outside consultants for this work.

9

General and Administrative Expenses

General and administrative expenses for the fiscal years ended December 31, 2012 and 2011, consisted primarily of compensation and benefits in the amount of $26,000 and zero, respectively. General and administrative expenses for the period from August 18, 2011 (date of inception) through December 31, 2012 primarily consisted of $26,000 in compensation and benefits.

Loss from Operations

Loss from operations for the fiscal years ended December 31, 2012 and 2011 was $83,000 and $7,000, respectively. The loss from operations was primarily attributable to spending on research and development with no current revenue. Loss from operations for the period from August 18, 2011 (date of inception) through December 31, 2012, was $90,000.

Net Loss

Net loss for the fiscal years ended December 31, 2012 and 2011 was $88,000 an $7,000, respectively. Net loss for the period from inception through December 31, 2012, was $95,000.

Inflation did not have a material impact on the Company’s operations for either of the periods. Other than the foregoing, management knows of no trends, demands, or uncertainties that are reasonably likely to have a material impact on the Company’s results of operations.

In January 2013, BPMX issued to an accredited investor 6% secured convertible notes in the aggregate principal amount of $500,000. The notes are secured by all the assets of BPMX pursuant to the Security Agreement dated January 3, 2014, by and between BPMX and the collateral agent, and rank senior to any other indebtedness of BPMX. The notes are automatically convertible into the shares of common stock of the Company, contingent on the completion of the reverse acquisition of the Company by BPMX and closing of a financing in the amount of at least $2,000,000 at a conversion price per share equal to 80% of the per share offering price of such financing. The investor has the right to receive at the closing of the reverse acquisition warrants to purchase shares of common stock of the Company equal to 100% of the shares of common stock underlying the respective notes.

Between September 2012 and January 2014, the Company issued 6% unsecured convertible notes to investors in the aggregate principal amount of $1,220,000. These notes have a maturity date three years from the date of issuance, with principal and interest payable at maturity. The notes are automatically convertible into the securities of the Company sold in an offering that takes place after the completion of the reverse acquisition of the Company by BPMX, contingent on the completion of the reverse acquisition and closing of such financing at a conversion price per share equal to 80% of the per share offering price of such financing.

The following table summarizes total current assets, liabilities and working capital at September 30, 2013.

September 30, 2013 | ||||

| Current Assets | $ | 166,540 | ||

| Current Liabilities | $ | 498,756 | ||

| Working Capital Deficit | $ | (332,216 | ) | |

At September 30, 2013, we had a working capital deficit of $332,000.

Net cash used for operating activities for the nine months ended September 30, 2013 was $670,000. Cash used in operating activities was primarily due to net loss for the nine months ended September 30, 2013 of $822,000 which was partially offset by changes in operating assets and liabilities of $76,000, non-cash interest expense of $42,000 and stock-based compensation of $28,000. Cash used in investing activities was primarily for acquisition of intellectual property and acquisition of fixed assets.

Net cash obtained through all financing activities for the nine months ended September 30, 2013 was $630,000. This consisted of primarily $630,000 in proceeds from issuing convertible notes payable.

Going Concern

As reflected in the accompanying financial statements, the Company has a net loss and net cash used in operations of $822,000 and $670,000, respectively, for the nine months ended September 30, 2013 and a deficit accumulated during the development stage of $917,000 as of September 30, 2013.

The ability of the Company to continue its operations is dependent on Management's plans, which include the raising of capital through debt and/or equity markets with some additional funding from other traditional financing sources, including term notes, until such time that funds provided by operations are sufficient to fund working capital requirements. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s existence.

10

The Company may require additional funding to finance the growth of its current and expected future operations as well as to achieve its strategic objectives. The Company believes its current available cash along with anticipated revenues may be insufficient to meet its cash needs for the near future if it does not receive the anticipated additional funding. There can be no assurance that financing will be available in amounts or terms acceptable to the Company, if at all. In that event, the Company would be required to change its growth strategy and seek funding on that basis, if at all.

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should the Company be unable to continue as a going concern.

In response to the above, management will:

| ● | seek additional third party debt and/or equity financing; |

| ● | continue with the implementation of the business plan; |

| ● | seek to generate revenue through commercialization of the technology. |

To date, all of our funding has been generated from private investments. During the next twelve months, we anticipate raising funding to continue expansion; however, as of this writing, we only have sufficient funds to proceed with basic company operations only. We do not have sufficient funds to fully implement our business plan until such time that we are able to raise additional funding, to which there is no guarantee. If we do not obtain the funds necessary for us to continue our business activities we may need to curtail or cease our operations until such time as we have sufficient funds.

Recent Accounting Pronouncements

There are no recent accounting pronouncements that are expected to have a material impact on the Company’s financial statements.

Critical Accounting Policies

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States (“GAAP”). GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expense amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

Our significant accounting policies are summarized in Note 3 of our audited financial statements. While all these significant accounting policies impact our financial condition and results of operations, we view certain of these policies as critical. Policies determined to be critical are those policies that have the most significant impact on our financial statements and require management to use a greater degree of judgment and estimates. Actual results may differ from those estimates. Our management believes that given current facts and circumstances, it is unlikely that applying any other reasonable judgments or estimate methodologies would cause effect on our results of operations, financial position or liquidity for the periods presented in this report.

11

We believe the following critical accounting policies and procedures, among others, affect our more significant judgments and estimates used in the preparation of our financial statements:

Stock-based compensation

The Company accounts for stock-based employee compensation arrangements which requires the recognition of compensation expense, using a fair-value based method for costs related to all employee share-based payments, including stock options. The Company estimates the fair value of share-based payment awards on the date of grant using an option pricing model. All option grants have been expensed on a straight-line basis over their vesting period. Equity instruments issued to nonemployees are recorded at their fair value on the measurement date and are subject to periodic adjustment as the underlying equity instruments vest.

For the period August 18, 2011 (date of inception) to December 31, 2012 stock-based compensation amounted to $9,000. For the nine months ended September 30, 2013, stock-based compensation was $28,000.

Off Balance Sheet Arrangements:

We do not have any off-balance sheet arrangements, financings, or other relationships with unconsolidated entities or other persons, also known as “special purpose entities” (SPEs).

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

Directors and Executive Officers

In connection with the change in control of the Company described in Item 5.01 of this report, effective on January 21, 2014, we appointed Mr. James Pekarsky as our Chairman, Chief Executive Officer and Chief Financial Officer, and Ms. Anja Krammer as our Director and President. Ms. Kade Thompson resigned as our officer at the same time.

The following table sets forth certain information as of the Effective Date concerning our directors and executive officers. All directors hold office until the next annual meeting of stockholders or until their respective successors are elected, except in the case of death, resignation or removal:

| Name | Age | Position | ||

| James R. Pekarsky | 54 | Chief Executive Officer, Chief Financial Officer, and Chairman of the Board of Directors | ||

| Anja Krammer | 46 | President and Director |

James R. Pekarsky, age 54, is a seasoned executive who brings extensive financial and operational experience from public and private high technology and medical research companies. His background includes substantial international business experience, strategic planning, acquisitions, venture capital, bank fund raising and IPOs. Since 2008, Mr. Pekarsky has been a consultant serving as Chief Financial Officer and Chief Operating Officer to several private and public companies. Most recently, he served as Chief Financial Officer of Solar Power, Inc. (OTC Markets: SOPW) from November 2011 to August 2013. Additionally, Mr. Pekarsky served as Chief Financial Officer of MoSys, Inc., (NASDAQ: MOSY), from January 2006 to November 2007 and Virage Logic (NASDAQ:VIRL) from May 1999 to November 2003, where he led the company’s IPO. Other public companies include Mentor Graphics (NASDAQ:MENT) and Bio-Rad Laboratories (NYSE:BIO), where Mr. Pekarsky held General Manager positions based in Europe for 5 years. Mr. Pekarsky holds a B.S. in Accounting from Indiana University of Pennsylvania and an M.B.A. in Finance from Golden Gate University. We believe that Mr. Pekarsky’s credentials and extensive experience as an executive officer of publicly traded companies position him well as a member of our board of directors.

Anja Krammer, age 46, is a veteran marketing executive with over 20 years of experience in guiding healthcare and consumer enterprises in product development, sales/marketing management and commercialization strategies. Her industry background includes pharmaceuticals, medical devices, technology, and consumer products. Her therapeutic area experience includes dermatology (aesthetic/cosmetic and therapeutic drugs), cardiovascular, diabetes, consumer health, gastroenterology, and orthopedics. Ms. Krammer has served as President of BioPharmX since August 2011. Ms. Krammer previously served as Chief Marketing Officer/Founder of MBI, Inc., a management consulting firm from 2008 to 2013. Prior to joining MBI Consulting, Ms. Krammer was Vice President Global Marketing from April 2006 to August 2008 for Reliant Technologies, a venture backed startup in aesthetic medicine. From April 2004 to April 2006, Ms. Krammer served as Sr. Director of Strategic Marketing for Medtronic Corporation (NYSE: MDT). From December 2000 to September 2001, Ms. Krammer was Vice President, Solutions Marketing for Getronics Corporation (AMS: GTN), a global IT services company. From April 1999 to December 2000, Ms. Krammer served as Vice President, Indirect Channel Sales and Worldwide Industry Partnership Marketing, Itronix Division, Acterna Corporation (NASDAQ: ACTR), an optical communications company. Prior roles included, serving as Director of Worldwide Marketing and Communications Tektronix Corporation in its Color Printing and Imaging Division (NYSE: TEK) from October 1997 to April 1999. From October 1995 to October 1997, Ms. Krammer was Director of Worldwide Sales and Marketing with KeyTronic Corporation (Nasdaq: KTCC), a computer equipment manufacturer. Ms. Krammer holds a BAIS degree with a focus on Marketing/Management from University of South Carolina and an International Trade Certificate from the Sorbonne, University of Paris. We believe that Ms. Krammer's qualifications and her extensive experience as an officer of publicly traded technology companies provide a unique perspective for our Board.

12

Committees

We do not have a standing nominating, compensation or audit committee. Rather, our full board of directors performs the functions of these committees. We do not believe it is necessary for our board of directors to appoint such committees because the volume of matters that come before our board of directors for consideration permits the directors to give sufficient time and attention to such matters to be involved in all decision making. Additionally, because our Common Stock is not listed for trading or quotation on a national securities exchange, we are not required to have such committees.

Audit Committee Financial Expert

The board of directors has determined that Mr. James Pekarsky is our Audit Committee financial expert, as defined under Item 407(d)(5)(i) of Regulation S-K.

Director Independence

Our securities are not listed on a national securities exchange or in an inter-dealer quotation system which has requirements that directors be independent. No member of the Company’s board of directors qualifies as an independent director pursuant to the definition of “independent director” under the Rules of NASDAQ, Marketplace Rule 5605(a)(2). We do not have majority of independent directors.

Code of Ethics

We do not have a code of ethics but intend to adopt one in the near future that applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer and principal accounting officer. The new code will address, among other things, honesty and ethical conduct, conflicts of interest, compliance with laws, regulations and policies, including disclosure requirements under the federal securities laws, confidentiality, trading on inside information, and reporting of violations of the code.

Meetings of the Board of Directors

During the Company’s fiscal year ended September 30, 2013, the board of directors did not meet on any occasion, but rather transacted business by unanimous written consent.

Board Leadership Structure and Role in Risk Oversight

Our Board recognizes that the leadership structure and combination or separation of the president and chairman roles is driven by the needs of the Company at any point in time. Currently, Mr. James Pekarsky serves as the Chief Executive Officer of the Company and the Chairman of our Board, and Ms. Anja Krammer serves as the President of the Company. We have no policy requiring the combination or separation of leadership roles and our governing documents do not mandate a particular structure. This has allowed, and will continue to allow, our Board the flexibility to establish the most appropriate structure for our company at any given time.

Immediately following the consummation of the Share Exchange Transaction, the size of our management team will be increased in order to manage our expanded operations, risks and resources.

13

Summary Compensation

The following is a summary of the compensation we paid to our executive officers, for the two fiscal years ended September 30, 2013 and 2012, and compensation paid by BPMX for the fiscal years ended December 31, 2012 and 2011. BPMX was organized on August 18, 2011.

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | All Other Compensation ($) | Totals ($) | ||||||||||||||||||

James R. Pekarsky(1) CEO, CFO, Chairman of the Company; CEO and Director of BPMX | FY2012 FY2011 | - | - | - | - | - | - | ||||||||||||||||||

Anja Krammer(2) President and Director of the Company; President and Director of BPMX | FY2012 FY2011 | - | - | - | - | - | - | ||||||||||||||||||

Kade Thompson CEO, CFO, Director of the Company | FY2013 FY2012 | - | - | - | - | - | - | ||||||||||||||||||

_____________________

| (1) | Mr. Pekarsky was appointed as our Chief Executive Officer, Chief Financial Officer and Chairman on January 21, 2014. Mr. Pekarsky has been the Chief Executive Officer and Director of BPMX since its inception. |

| (2) | Ms. Krammer was appointed as our Director and President on January 21, 2014. Ms. Krammer has been the President and Director of BPMX since its inception. |

| (3) | Ms. Thompson resigned as our Sole Director, Chief Executive Officer, Chief Financial Officer, President, Treasurer and Secretary on January 21, 2014. |

Employment Agreements

On January 21, 2014, the Company and James Pekarsky entered into an Employment Agreement, where Mr. Pekarsky was employed as Chief Executive Officer and Chairman of the Board of the Company for a term of four years with a one-year automatic renewal term. Mr. Pekarsky is entitled to the compensation consisting of $250,000 per year for base salary and an annual bonus if performance targets are met at the discretion of the board of directors.

On January 21, 2014, the Company and Anja Krammer entered into an Employment Agreement, where Ms. Krammer was employed as President and Director of the Company for a term of four years with a one-year automatic renewal term. Ms. Krammer is entitled to the compensation consisting of $250,000 per year for base salary and an annual bonus if performance targets are met at the discretion of the board of directors.

For the fiscal year ended September 30, 2013, none of the members of our board of directors received compensation for service as a director. We do not currently have an established policy to provide compensation to members of our board of directors for their services in that capacity.

14

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDPENDENCE

Transactions with related persons

Our policy is that a contract or transaction either between the Company and a director, or between a director and another company in which he is financially interested is not necessarily void or void-able if the relationship or interest is disclosed or known to the board of directors and the stockholders are entitled to vote on the issue, or if it is fair and reasonable to our company.

On September 17, 2010, the Company issued 7,000,000 shares of common stock to Kade Thompson, its President, CEO, CFO, and sole Director, in consideration for $7,000 at a price of $0.001 per share. On December 21, 2012, the Company borrowed $3,000 from Ms. Thompson, under the terms of a Promissory Note due December 21, 2014. The note bears interest of 5% per annum payable at maturity.

On January 21, 2014, Ms. Thompson sold to BPMX 7,000,000 shares of the Company’s common stock representing approximately 77.8% of the then issued and outstanding shares of common stock and cancelled the 5% promissory note pursuant to a Stock Purchase Agreement dated as of the same date.

Since inception of BPMX, the founding executives of the company have made advances to cover short-term operating expenses. These advances are non-interest bearing. As of September 30, 2013 and December 31, 2012, related party payables of BPMX were $139,000 and $17,000, respectively.

Except for the above transactions or as otherwise set forth in this report or in any reports filed by the Company with the SEC, the Company was not a party to any transaction (where the amount involved exceeded the lesser of $120,000 or 1% of the average of our assets for the last two fiscal years) in which a Director, executive officer, holder of more than five percent of our common stock, or any member of the immediate family of any such person have or will have a direct or indirect material interest and no such transactions are currently proposed. The Company is currently not a subsidiary of any company.

The Company’s Board conducts an appropriate review of and oversees all related party transactions on a continuing basis and reviews potential conflict of interest situations where appropriate. The Board has not adopted formal standards to apply when it reviews, approves or ratifies any related party transaction. However, the Board believes that the related party transactions are fair and reasonable to the Company and on terms comparable to those reasonably expected to be agreed to with independent third parties for the same goods and/or services at the time they are authorized by the Board.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding shares of common stock as of January 23, 2014 immediately following the closing of the Share Exchange Transaction and cancellation of the 7,000,000 shares purchased by BPMX from Kade Thompson, and by the officers and directors, individually and as a group. Except as otherwise indicated, all shares are owned directly and the shareholders listed possess sole voting and investment power with respect to the shares shown. The address for each officer and director is 1098 Hamilton Court, Menlo Park, California 94025.

Name Officers and Directors | Office | Shares Beneficially Owned(1) | Percent of Class(2) | |||||||

| James Pekarsky | Chairman and CEO | 2,500,000 | 27.7 | % | ||||||

| Anja Krammer | Director and President | 2,500,000 | 27.7 | % | ||||||

| All officers and directors as a group (2 persons named above) | 5,000,000 | 55.4 | % | |||||||

| 5% Securities Holders | ||||||||||

Kin Chan 1098 Hamilton Court Menlo Park, California 94025 | 1,200,000 | 13.3 | % | |||||||

Kevin Mszanowski 211 Solana Drive Los Altos, California 94022 | 825,000 | 9.1 | % | |||||||

_______________

| (1) | Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. |

| (2) | Based on 9,025,000 shares of the Company’s common stock issued and outstanding. |

15

DESCRIPTION OF SECURITIES

General

Our authorized capital stock consists of 90,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing fifty percent (50%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash). Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

As of the date of this report, there were 9,025,000 shares of common stock issued and outstanding.

Preferred Stock

Our board of directors may become authorized to authorize preferred shares of stock and to divide the authorized shares of our preferred stock into one or more series, each of which must be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our articles of incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including, but not limited to, the following:

| 1. | The number of shares constituting that series and the distinctive designation of that series, which may be by distinguishing number, letter or title; |

| 2. | The dividend rate on the shares of that series, whether dividends will be cumulative, and if so, from which date(s), and the relative rights of priority, if any, of payment of dividends on shares of that series; |

| 3. | Whether that series will have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights; |

| 4. | Whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the board of directors determines; |

| 5. | Whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption, including the date or date upon or after which they are redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates; |

| 6. | Whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund; |

| 7. | The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights of priority, if any, of payment of shares of that series; |

| 8. | Any other relative rights, preferences and limitations of that series |

Options

As of January 24, 2014 there are outstanding options to purchase 2,606,000 shares of the Company’s common stock issued under the 2014 Equity Incentive Plan. The options generally vest 25% annually and expire ten years from the date of grant.

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON

EQUITY AND RELATED STOCKHOLDER MATTERS

While there is no established public trading market for our Common Stock, our Common Stock is quoted on the OTC Markets OTCQB, under the symbol “TPND.” Except for one quotation dated February 14, 2013 of $0.15, there have been no reported quotations for our common stock for the two most recent fiscal years and for the interim period ended September 30, 2013 for which financial statements are included in this report.

The market price of our Common Stock is subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our Common Stock, regardless of our actual or projected performance.

Holders

As of January 23, 2014, we had 9,025,000 shares of our common stock par value, $0.001 issued and outstanding. There were approximately 28 beneficial owners of our common stock.

16

The Transfer Agent for our capital stock is Empire Stock Transfer, located at 1859 Whitney Mesa Dr., Henderson, Nevada 89014.

Penny Stock Regulations

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be an equity security that has a market price of less than $5.00 per share. Our Common Stock, when and if a trading market develops, may fall within the definition of penny stock and be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors (generally those with assets in excess of $1 million, or annual incomes exceeding $200,000 individually, or $300,000, together with their spouse).

For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s prior written consent to the transaction. Additionally, for any transaction, other than exempt transactions, involving a penny stock, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the Securities and Exchange Commission relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market-maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell our Common Stock and may affect the ability of investors to sell their Common Stock in the secondary market.

Dividend Policy

We have not paid any cash dividends to our shareholders. Any future determination as to the declaration and payment of dividends on shares of our Common Stock will be made at the discretion of our board of directors out of funds legally available for such purpose. We are under no contractual obligations or restrictions to declare or pay dividends on our shares of Common Stock. In addition, we currently have no plans to pay such dividends.

Equity Incentive Plan Information

On January 23, 2014, the Company adopted the 2014 Equity Incentive Plan (the “Plan”) which permits the Company to grant stock options to directors, officers or employees of the Company or others to purchase shares of common stock of the Company through awards of incentive and nonqualified stock options (“Option”), stock (Restricted Stock or Unrestricted Stock) and stock appreciation rights (“SARs”). 2,700,000 shares of the Company’s common stock have been authorized and reserved for the Plan, subject to an adjustment for an increase or decrease of the Company’s issued and outstanding Common Stock resulting from a stock split, change of the number of shares issued and outstanding without receipt of consideration by the Company or as the Plan administrator may determine in its discretion, provided that in no event shall the total number of shares of common stock authorized under the plan exceed 30% of the issued and outstanding shares of the Company’s common stock.

17

LEGAL PROCEEDINGS

There are no material proceedings to which any director or officer, or any associate of any such director or officer, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. No director or executive officer has been a director or executive officer of any business which has filed a bankruptcy petition or had a bankruptcy petition filed against it during the past ten years. No director or executive officer has been convicted of a criminal offense or is the subject of a pending criminal proceeding during the past ten years. No director or executive officer has been the subject of any order, judgment or decree of any court permanently or temporarily enjoining, barring, suspending or otherwise limiting his involvement in any type of business, securities or banking activities during the past ten years. No director or officer has been found by a court to have violated a federal or state securities or commodities law during the past ten years.

In addition, there are no material proceedings to which any affiliate of our Company, or any owner of record or beneficially of more than five percent of any class of voting securities of our Company, is a party that is adverse to our Company or any of our subsidiaries or has a material interest adverse to our Company or any of our subsidiaries. Currently there are no legal proceedings pending or threatened against us. We are not currently involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations.

There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our Company or any of our subsidiaries, threatened against or affecting our Company, our common stock, any of our subsidiaries or of our Company’s or our Company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

However, from time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

RECENT SALES OF UNREGISTERED SECURITIES

Reference is made to Item 3.02 of this Current Report on Form 8-K for a description of recent sales of unregistered securities, which is hereby incorporated by reference.

INDEMNIFICATION OF OFFICERS AND DIRECTORS

Our by-laws provide for the indemnification of our directors, officers, employees, and agents, under certain circumstances, against attorney's fees and other expenses incurred by them in any litigation to which they become a party arising from their association with or activities on our behalf. We will also bear the expenses of such litigation for any of our directors, officers, employees, or agents, upon such persons promise to repay us therefore if it is ultimately determined that any such person shall not have been entitled to indemnification. This indemnification policy could result in substantial expenditures by us, which it may be unable to recoup.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore unenforceable.

At the present time, there is no pending litigation or proceeding involving a director, officer, employee or other agent of ours in which indemnification would be required or permitted. We are not aware of any threatened litigation or proceeding which may result in a claim for such indemnification.

Please refer to Item 1.01 - “Entry into a Material Definitive Agreement” for a description of the unregistered sales of equity securities as a result of the Share Exchange Transaction, which is incorporated in its entirety into this Item 3.03.

The issuances of these securities were exempt from registration under the Securities Act pursuant to Section 4(2) of the Securities Act, Regulation D and Regulation S promulgated thereunder.

Item 4.01 Changes in Registrant’s Certifying Accountant

Previous Independent Accountants

On January 23, 2014, we dismissed Silberstein Ungar, PLLC (“SUPLLC”), as our independent accountant. The reports of SUPLLC, on our financial statements for the past two fiscal years contained no adverse opinion or a disclaimer of opinion and were not modified; however, the reports were qualified as to the uncertainty of our ability to continue as a going concern due to our dependence on a successful execution of our plan of operations and ability to raise additional financing, lack of our generation of revenues, and our stockholders’ deficit and negative working capital. The decision to change independent accountants was approved by our board of directors on January 23, 2014.

18

During our two most recent fiscal years and through the date of this report, we have had no disagreements with SUPLLC, on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of SUPLLC, would have caused it to make reference to the subject matter of such disagreements in its report on our financial statements for such periods.

During our two most recent fiscal years and through the date of this report on Form 8-K, there have been no reportable events as defined under Item 304(a)(1)(v) of Regulation S-K adopted by the SEC.

We provided SUPLLC, with a copy of this disclosure before its filing with the SEC. We requested that SUPLLC, provide us with a letter addressed to the SEC stating whether or not it agrees with the above statements, and we received a letter from SUPLLC, stating that it does agree with the above statements. A copy of such letter, dated as of January 27, 2014 is filed as Exhibit 16.1 to this report.

New Independent Registered Public Accounting Firm

Our board of directors appointed Burr Pilger Mayer, Inc. (“BPM”) as our new independent registered public accounting firm on January 23, 2014, which appointment was accepted by BPM effective as of January 24, 2014. During the two most recent fiscal years and through the date of our engagement, we did not consult with BPM regarding either (1) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on our financial statements, or (2) any matter that was either the subject of a disagreement or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

On January 21, 2014, Ms. Kade Thompson, a majority shareholder of the Company, entered into a Securities Purchase Agreement (the “Purchase Agreement,” such transaction, the “Purchase Transaction”) with BPMX, pursuant to which Ms. Thompson sold to BPMX 7,000,000 shares of common stock of the Company (the “Control Shares”) for an aggregate amount of $20,000.

On January 23, 2014, the Company entered into and consummated the transactions contemplated by the Share Exchange Agreement with BPMX and its shareholders whereby the Company purchased from the shareholders of BPMX all issued and outstanding shares of BPMX’s common stock in consideration of the issuance of 7,025,000 shares of common stock of the Company. Following the issuance of such shares, the Control Shares have been cancelled by BPMX.

The Purchase Transaction and the Share Exchange Transaction resulted in (i) a change in control of the Company with the shareholders of BPMX owning approximately 77.8% of the then issued and outstanding shares of common stock of the Company, and (ii) appointment of certain nominees of the shareholders of BPMX as directors and officers of the Company and resignation of Ms. Thompson as director, chief executive officer, chief financial officer, secretary and treasurer of the Company.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

On January 21, 2014, Kade Thompson, our former Chief Executive Officer, President and Director, resigned from each of his positions as a director and officer of the Company.

Also, on January 21, 2014, (i) James Pekarsky was appointed as the Chief Executive Officer, Chief Financial Officer, Treasurer, Director and Chairman of the Company, and (ii) Anja Krammer was appointed as the President, Secretary and Director of the Company.

On January 23, 2014, the Company adopted the accounting acquirer’s fiscal year end of December 31 as a result of the Share Exchange Transaction consummated on January 23, 2014. The Share Exchange Transaction is accounted for as a reverse merger and recapitalization with the acquired company, BPMX, becoming the acquirer in this transaction.

19

As a result of the Share Exchange Transaction as described in Items 1.01 and 2.01, which description is incorporated by reference in this Item 5.06 of this report, the Company ceased being a shell company as such term is defined in Rule 12b-2 under the Exchange Act.

(a) Financial Statements of Business Acquired.The financial statements of BPMX are appended to this Current Report beginning on page F-1, and unaudited proforma financial statements of the Company are appended to this report beginning on page F-28.

(d) Exhibits. The following exhibits are filed with this report:

| Description | ||

| 2.1 | Form of Share Exchange Agreement dated January 23, 2014 by and among the Company, BioPharmX Inc. and BioPharmX Stockholders. | |

| 4.1 | Form of Notes issued pursuant to the Stock Purchase Agreement dated January 3, 2014. | |

| 4.2 | Form of Warrant issuable pursuant to the Stock Purchase Agreement dated January 3, 2014. | |

| 10.1 | Form of Stock Purchase Agreement dated January 23, 2014 by and between Kade Thompson and BioPharmX Inc. | |

| 10.2 | Form of Employment Agreement dated January 23, 2014 by and between James Pekarsky and the Company. | |

| 10.3 | Form of Employment Agreement dated January 23, 2014 by and between Anja Krammer and the Company. | |

| 10.4 | Amended and Restated Collaboration and License Agreement dated as of March 1, 2013 by and between BioPharmX Inc. and Iogen LLC. | |

| 10.5 | Collaboration and Supply Agreement dated as of October 22, 2013 by and between BioPharmX Inc. and Nutech Medical, Inc. | |

| 10.6 | Lease Agreement dated August 23, 2013 by and between Prologis, L.P. and BioPharmX Inc. | |

| 10.7 | 2014 Equity Incentive Plan. | |

| 10.8 | Form of Securities Purchase Agreement dated January 3, 2014 by and between BPMX and the investor. | |

| 10.9 | Form of Amendment to the Securities Purchase Agreement dated January 3, 2014. | |

| 10.10 | Form of Security Agreement dated January 3, 2014 by and between BPMX and the collateral agent. | |

| 16.1 | Letter of Silberstein Ungar, PLLC to the SEC dated January 23, 2014. | |

| 21.1 | List of Subsidiaries. |

20

BioPharmX Inc.

Index to Financial Statements

| Page | ||||

| Unaudited Condensed Financial Statements as of September 30, 2013 | ||||

| Condensed Balance Sheets (Unaudited) | F-2 | |||

| Condensed Statements of Operations and Comprehensive Loss (Unaudited) | F-3 | |||

| Condensed Statements of Cash Flows (Unaudited) | F-4 | |||

| Notes to Condensed Financial Statements (Unaudited) | F-5 - F-12 | |||

| Financial Statements as of December 31, 2012 and 2011 | ||||

| Report of Independent Registered Public Accounting Firm | F-13 | |||

| Balance Sheets | F-14 | |||

Statements of Operations and Comprehensive Loss | F-15 | |||

| Statement of Stockholders’ Deficit | F-16 | |||

| Statements of Cash Flows | F-17 | |||

| Notes to Consolidated Financial Statements | F-18 - F-27 | |||

| Unaudited Proforma Financial Statements of the Company | F-28 | |||

| Proforma Balance Sheet (Unaudited) | F-29 | |||

| Proforma Statement of Operations (Unaudited) | F-30 | |||

| Notes to Proforma Financial Statements (Unaudited) | F-31 | |||

F-1

BIOPHARMX, INC. | ||||||||

| (a development stage enterprise) | ||||||||

UNAUDITED CONDENSED BALANCE SHEETS | ||||||||

| as of September 30, 2013 and December 31, 2012 | ||||||||

| ____________ | ||||||||

September 30, 2013 | December 31, 2012 | |||||||

ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 24,059 | $ | 137,850 | ||||

| Prepaid expenses and other current assets | 142,481 | 1,927 | ||||||

| Total current assets | 166,540 | 139,777 | ||||||

| Property and equipment, net | 29,972 | 12,194 | ||||||

| Intangible assets, net | 150,000 | - | ||||||

| Other assets | 50,000 | - | ||||||

| Total assets | $ | 396,512 | $ | 151,971 | ||||

LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued expenses | $ | 259,476 | $ | 16,115 | ||||

| Related party payables | 139,280 | 16,530 | ||||||

| Convertible notes, short-term | 100,000 | - | ||||||

| Total current liabilities | 498,756 | 32,645 | ||||||

| Convertible notes payable | 590,207 | 162,628 | ||||||

| Other long-term liabilities | 20,717 | 2,566 | ||||||

| Total liabilities | 1,109,680 | 197,839 | ||||||

| Commitments and contingencies (Note 8) | ||||||||

| Stockholders' deficit: | ||||||||

Common stock, $0.0001 par value; 10,000,000 shares authorized; 7,025,000 and 7,400,000 shares issued and outstanding at September 30, 2013 and December 31, 2012, respectively | 703 | 740 | ||||||

| Additional paid-in capital | 202,813 | 48,487 | ||||||

| Deficit accumulated during the development stage | (916,684 | ) | (95,095 | ) | ||||

| Total stockholders' deficit | (713,168 | ) | (45,868 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 396,512 | $ | 151,971 | ||||

F-2

BIOPHARMX, INC. | ||||||||||||||||||||

| (a development stage enterprise) | ||||||||||||||||||||

UNAUDITED CONDENSED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS | ||||||||||||||||||||

| for thethree and nine months ended September 30, 2013 and 2012 and, cumulatively, | ||||||||||||||||||||

| for the period from August 18, 2011 (date of inception) to September 30, 2013 | ||||||||||||||||||||

| ____________ | ||||||||||||||||||||

Three months ended September 30, | Nine months ended September 30, | Cumulative for the period from August 18, 2011 (date of inception) to | ||||||||||||||||||

| 2013 | 2012 | 2013 | 2012 | September 30, 2013 | ||||||||||||||||

| Operating expenses: | ||||||||||||||||||||

| Research and development | $ | 221,653 | $ | 1,154 | $ | 400,726 | $ | 3,499 | $ | 435,477 | ||||||||||

| Sales and marketing | 44,725 | 250 | 72,728 | 550 | 82,011 | |||||||||||||||

| General and administrative | 162,877 | 4,082 | 306,406 | 7,247 | 352,272 | |||||||||||||||

| Total operating expenses | 429,255 | 5,486 | 779,860 | 11,296 | 869,760 | |||||||||||||||

| Loss from operations | (429,255 | ) | (5,486 | ) | (779,860 | ) | (11,296 | ) | (869,760 | ) | ||||||||||

| Interest expense | (22,210 | ) | - | (41,729 | ) | - | (46,924 | ) | ||||||||||||

| Net and comprehensive loss | $ | (451,465 | ) | $ | (5,486 | ) | $ | (821,589 | ) | $ | (11,296 | ) | $ | (916,684 | ) | |||||

F-3

| (a development stage enterprise) | ||||||||||||

UNAUDITED CONDENSED STATEMENTS OF CASH FLOWS | ||||||||||||

| for the nine months ended September 30, 2013 and 2012 and, cumulatively, | ||||||||||||

| for the period from August 18, 2011 (date of inception) to September 30, 2013 | ||||||||||||

| ____________ | ||||||||||||

Nine months ended September 30, | Cumulative for the period from August 18, 2011 (date of inception) to | |||||||||||

| 2013 | 2012 | September 30, 2013 | ||||||||||

| Cash flows from operating activities: | ||||||||||||

| Net loss | $ | (821,589 | ) | $ | (11,296 | ) | $ | (916,684 | ) | |||

| Adjustments to reconcile net loss to net cash from | ||||||||||||

| operating activities: | ||||||||||||

| Stock-based compensation expense | 28,308 | 5,145 | 37,165 | |||||||||

| Depreciation expense | 6,251 | - | 6,871 | |||||||||

| Noncash interest expense | 41,729 | - | 46,923 | |||||||||

| Changes in assets and liabilities: | ||||||||||||

| Prepaid expenses and other assets | (190,554 | ) | - | (192,481 | ) | |||||||

| Accounts payable and accrued expenses | 143,361 | (2,207 | ) | 159,476 | ||||||||

| Related party payables | 122,750 | 8,880 | 139,280 | |||||||||

| Net cash provided by (used in) operating activities | (669,744 | ) | 522 | (719,450 | ) | |||||||

| Cash flows from investing activities: | ||||||||||||

| Purchases of property and equipment | (24,029 | ) | (1,631 | ) | (36,843 | ) | ||||||