Item 1. Report to Stockholders.

Table of Contents

| Manager Commentary | 1 |

| Fund Summary | |

| Blackstone / GSO Senior Floating Rate Term Fund | 3 |

| Blackstone / GSO Long-Short Credit Income Fund | 5 |

| Blackstone / GSO Strategic Credit Fund | 7 |

| Portfolio of Investments | |

| Blackstone / GSO Senior Floating Rate Term Fund | 9 |

| Blackstone / GSO Long-Short Credit Income Fund | 18 |

| Blackstone / GSO Strategic Credit Fund | 28 |

| Statements of Assets and Liabilities | 40 |

| Statements of Operations | 41 |

| Statements of Changes in Net Assets | 42 |

| Statements of Cash Flows | 43 |

| Financial Highlights | |

| Blackstone / GSO Senior Floating Rate Term Fund | 44 |

| Blackstone / GSO Long-Short Credit Income Fund | 46 |

| Blackstone / GSO Strategic Credit Fund | 48 |

| Notes to Financial Statements | 50 |

| Report of Independent Registered Public Accounting Firm | 62 |

| Summary of Dividend Reinvestment Plan | 63 |

| Additional Information | 64 |

| Privacy Procedures | 65 |

| Trustees & Officers | 67 |

| Blackstone / GSO Funds | Manager Commentary |

| | December 31, 2016 (Unaudited) |

To Our Shareholders:

Surprising political developments did little to discourage the equity and credit markets from reaching new highs and recording the best annual returns in over a half decade. The biggest political story was the U.S. Presidential Election in which businessman Donald Trump defeated a better‐financed and heavily‐favored Hillary Clinton. Similar to the Brexit vote, the market’s initial reaction was negative though the selloff was short lived. Investors quickly judged the incoming administration to be business friendly and markets promptly reversed course. It remains to be seen whether “Trumponomics” will overcome the low‐inflation, low‐growth period the U.S has been stuck in, but deregulation and fiscal expansion should be supportive of growth. The markets are responding in the affirmative; however, the U.S. still faces the headwinds of aging demographics, declining productivity gains and a stronger dollar.

The high yield market recorded its fourth best year (+17.13%) in the past quarter century while the senior loan market registered its fourth best year (+10.16%) in the near‐two‐decade history of the S&P/LSTA Leveraged Loan Index. Performance was driven in part by the rebound in commodity prices and other distressed credits. The energy sector alone contributed over 3.00% to high yield’s 2016 return while bonds rated triple‐C surged 31.46% in 2016, snapping a two‐year losing streak. Senior loans rated below B‐, including defaulted credits, gained 28.68% last year. Energy loans soared 44.91% to lead all sectors, followed closely by the metals & minerals segment, which gained 42.17%. The risk‐on trade clearly rewarded investors in 2016.

Other asset classes produced mixed results last year. Large cap equities (S&P 500) rallied 7.82% over the final six months but trailed high yield for the year (+11.95%). Treasuries retreated during the second half, offsetting the strong start to 2016. The 10‐year Treasury sank 7.51% over the last six months versus the 7.95% gain over the first six months of 2016. Emerging markets were roughly flat during the second half (+0.44%) after submitting the best first‐half performance among major dollar‐denominated assets (+9.40%).

Market returns over the last half of 2016, which saw Treasury yields rise and credit spreads tighten, represented a striking shift from the past few years when Treasury yields and credit spreads often moved in the same direction. Easier monetary policy led to lower yields and tighter credit spreads. While monetary policy assisted markets over the past few years, we are beginning to see signs of global central banks handing off to fiscal policy makers. In general, an expansion in fiscal policy should be negative for rates (i.e. higher rates) and good for equities and credit spreads (i.e. lower spreads). We have seen fiscal‐related talk (e.g. fewer regulation, more spending, lower taxes) in a number of countries including the U.S., the U.K. and Japan. This is not to say that central bank policy is not important anymore, but rather, it will share investor focus within the political realm in 2017 and beyond.

Following the rally, valuations hit two‐year highs in December with high yield spreads dipping below 4.00% and senior loan prices rising over $98 (per $100 of principal) for the first time since September 2014. More importantly for the loan market, at year end, roughly 70% of outstanding loans traded above par and were at risk of repricing due the lack of call protection inherent in the asset class. In fact, January 2017 is shaping up as one of the busiest months on record for senior loan repricing.

Most sell‐side strategists are forecasting for a continuation of the market’s strong performance. The median 2017 total return forecast for senior loans is 5.5% with a couple of strategists expecting lower yet still positive returns. The median for high yield bonds is also 5.5%, but with a wider distribution as one strategist is projecting a slightly negative return this year. Default forecasts are also optimistic with most strategists forecasting lower high yield default rates in 2017 as most of the energy excess restructured in 2015 and 2016.

History supports the strategists’ projections. Annual returns for high yield bonds and senior loans have exhibited some autocorrelation. In other words strong years like 2016 are often followed by solid returns. In fact, historically the high yield and senior loan markets were less likely to produce a negative return following an excellent year than they were when the prior year’s returns are lower. Although the sample size is small, it follows that some investors may either chase returns or feel comfortable that the backdrop is advantageous to taking additional credit risk.

| 2016 Total Returns | |

| US Loans (S&P/LSTA Leveraged Loan Index) | 10.16% |

| US High Yield Bonds (Bloomberg Barclays U.S. High Yield Index) | 17.13% |

| 3‐month Treasury Bills (Bloomberg Barclays U.S. Treasury Bellweathers: 3 Month) | 0.35% |

| 10‐Year Treasuries (Bloomberg Barclays U.S. Treasury Bellweathers: 10 Year) | -0.16% |

| US Aggregate Bonds(Bloomberg Barclays U.S. Aggregate Index) | 2.65% |

| US Investment Grade Bonds (Bloomberg Barclays U.S. Corporate Investment Grade Index) | 6.11% |

| Emerging Markets (Bloomberg Barclays EM USD Aggregate Index) | 9.88% |

US Large Cap Equities (S&P 500® Index) | 11.95% |

Sources: Barclays, Bloomberg, S&P/LCD

Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

| Annual Report | December 31, 2016 | 1 |

| Blackstone / GSO Funds | Manager Commentary |

| December 31, 2016 (Unaudited) |

We enter 2017 with much optimism on the CEO and consumer fronts. CEO confidence hit a 10‐year high at the end of December while consumer confidence hit a 15‐year high. All of this could reignite the “animal spirits” the U.S. economy has sorely missed since the financial crisis. Although this may be good for the economy it also demands increased investor focus in order to distinguish between sustainable trends and those that will fizzle out. This is particularly important as valuations reach multi‐year highs.

At GSO / Blackstone, we value your continued investment and confidence in us and in our family of funds. Additional information about our funds is available on our website at www.blackstone‐gso.com.

Sincerely,

GSO / Blackstone Debt Funds Management LLC

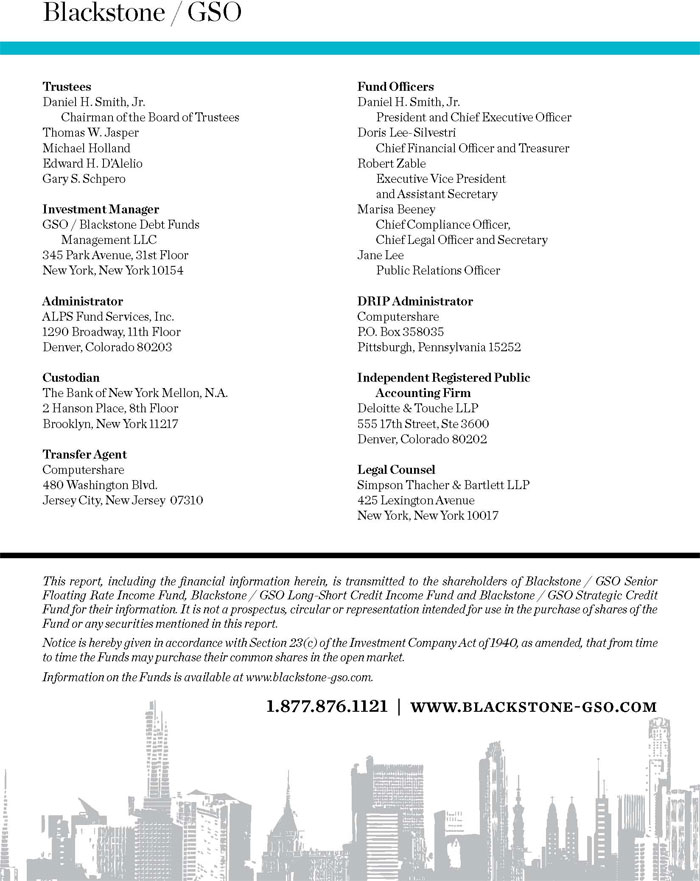

| Blackstone / GSO Senior Floating Rate Term Fund | Fund Summary |

| | December 31, 2016 (Unaudited) |

Fund Overview

Blackstone / GSO Senior Floating Rate Term Fund (“BSL” or herein, the “Fund”) is a closed‐end term fund that trades on the New York Stock Exchange under the symbol “BSL”. BSL’s primary investment objective is to seek high current income, with a secondary objective to seek preservation of capital, consistent with its primary goal of high current income. Under normal market conditions, the fund invests at least 80% of its total assets in senior, secured floating rate loans (“Senior Loans”). BSL may also invest in second‐lien loans and high yield bonds and employs financial leverage, which may increase risk to the fund. The Fund has a limited term, and absent shareholder approval to extend the life of the Fund, the Fund will dissolve on or about May 31, 2020.

Portfolio Management Commentary

Fund Performance

BSL outperformed its key benchmark, the S&P/LSTA Leveraged Loan Index (“S&P LLI”), on a Net Asset Value (“NAV”) per share basis and a share price basis for the periods of six months, one year, three years, five years, and the life of the Fund since inception. The shares of the Fund traded at an average discount to NAV of 3.5% for the twelve months ended December 31, compared to its peer group average discount of 8.3% over the same time.1

NAV Performance Factors2

The Fund’s outperformance relative to its benchmark in 2016 was attributable to its under‐allocation to higher‐rated (BB‐ or above) assets (12.9% vs. 46.7% for the benchmark), which underperformed during the period. By sector, the Fund’s credit selection in industrials, energy, and IT were the strongest contributors to outperformance. Additionally, the Fund’s modest allocation to bonds (3.8%) also contributed positively. By issuer, the largest contributors to performance relative to the benchmark were Sheridan Production Partners, Avaya and Smile Brands, while the largest detractors were Templar Energy, Fairway Group and Concordia.

Portfolio Activity and Positioning

Over the past twelve months, and particularly during the second half of the year, the Fund systematically took advantage of market rallies in order to gradually reduce its bond and higher beta loan allocation, selling duration and paring lower‐rated loan positions, as well as allowing for natural attrition by returning paper during repricing activity. Additionally, in anticipation of increased volatility throughout the fourth quarter, the Fund took steps to increase diversification by participating heavily in the attractive relative value of the primary market, and by reducing concentration in less liquid, higher beta assets. On a sector basis, the Fund reduced its allocation to energy and telecom while increasing exposure to financials, basic materials and technology in the second half of the year.2 The Fund continues to seek to opportunistically take advantage of rallies to pare higher risk names where the portfolio managers believe inadequate levels of compensation are being offered relative to the credit risk. Given the outlook for repricing activity and lack of new issue, we anticipate this dynamic to continue well into the first quarter of 2017.

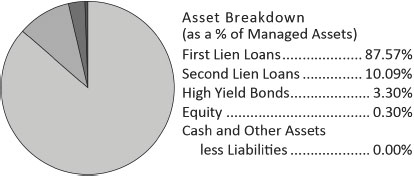

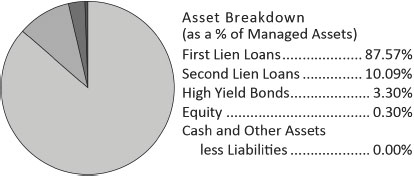

As of December 31, 2016, the Fund held 87.6% of its Managed Assets in Senior Loans, 10.1% in second lien loans, and around 3.3% in high yield bonds. BSL’s investments represented the obligations of 208 companies, with an average position size representing 0.41% of Managed Assets of the Fund. High tech, healthcare and pharmaceuticals, and business services represent the Fund’s top sector weightings.

| 1 | Average discount and peer group per Morningstar. |

| 2 | Industries per the Global Industry Classification Standard. |

| Annual Report | December 31, 2016 | 3 |

| Blackstone / GSO Senior Floating Rate Term Fund | Fund Summary |

December 31, 2016 (Unaudited)

BSL’s Portfolio Composition

| † | The Fund’s Net Cash and Other Assets Less Liabilities includes amounts payable for investments purchased but not yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the amount of cash on hand, and the Fund’s Net Cash and Other Assets Less Liabilities therefore equaled -1.26% of the Fund’s Managed Assets. The Fund uses funds from its leverage program to settle amounts payable for investments purchased, but such funds are not reflected in the Fund’s net cash. |

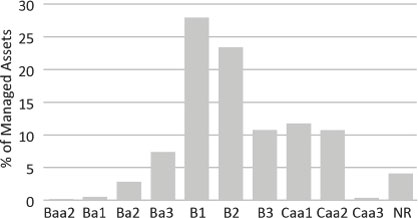

BSL’s Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

| Portfolio Characteristics | |

Weighted Average Loan Spread^ | 4.70% |

| Weighted Average Bond Coupon | 7.92% |

Current Dividend Yield† | 6.44% |

| Weighted Average Days to Reset | 68 |

| Effective Duration* | 0.38 |

| Average Position** | 0.41% |

| Leverage** | 32.82% |

| ^ | Spread over LIBOR inclusive of LIBOR floors. |

| † | Using current dividend rate of $0.097/share and market price/share as of December 31, 2016. |

| * | Loan durations are treated as 3 months because of LIBOR resets, however, the effective rate for loans with LIBOR floors will not change if LIBOR is below the floor. |

| ** | As a percentage of Managed Assets. |

| Top 10 Holdings* | |

| Jeld‐Wen Inc, Senior Secured First Lien Term B‐2 Loan | 1.54% |

| DTI Holdco Inc, Senior Secured First Lien Initial Term Loan | 1.36% |

| Quest Software US Holdings Inc, Senior Secured First Lien Initial Term Loan | 1.34% |

| Aspect Software Inc, Senior Secured First Lien Exit Term Loan | 1.32% |

| Avaya Inc, Senior Secured First Lien Term B‐7 Loan | 1.28% |

| Crossmark Holdings Inc, Senior Secured First Lien Term Loan | 1.14% |

| Surgery Center Holdings Inc, Senior Secured First Lien Initial Term Loan | 1.11% |

| Windstream Services LLC, Senior Secured First Lien New Tranche B‐6 Term Loan | 1.02% |

| Cortes NP Acquisition Corporation, Senior Secured First Lien Initial Term Loan | 1.01% |

| Reynolds Group Holdings Inc, Senior Secured First Lien US Term Loan | 0.98% |

| Top 10 Holdings | 12.10% |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

| Top 5 Industries*^ | |

| High Tech Industries | 13.83% |

| Healthcare and Pharmaceuticals | 13.47% |

| Services ‐ Business | 10.27% |

| Construction and Building | 9.33% |

| Telecommunications | 8.06% |

| Top 5 Industries | 54.96% |

BSL Total Return

| | 3 Month | 6 Month | 1 Year | 3 Year† | 5 Year† | Since Inception† |

| NAV | 4.41% | 9.81% | 18.44% | 4.07% | 5.77% | 5.80% |

| Market Price | 9.74% | 18.41% | 30.70% | 5.76% | 6.85% | 5.49% |

| S&P LLI | 2.26% | 5.41% | 10.16% | 3.58% | 5.12% | 5.05% |

| * | As a percentage of Managed Assets. |

| Blackstone / GSO Long-Short Credit Income Fund | Fund Summary |

December 31, 2016 (Unaudited)

Fund Overview

Blackstone / GSO Long Short Credit Income Fund (“BGX” or herein, the “Fund”) is a closed‐end fund that trades on the New York Stock Exchange under the symbol “BGX”. BGX’s primary investment objective is to provide current income, with a secondary objective of capital appreciation. BGX will take long positions in investments which we believe offer the potential for attractive returns under various economic and interest rate environments. BGX may also take short positions in investments which we believe will under‐perform due to a greater sensitivity to earnings growth of the issuer, default risk or the general level and direction of interest rates. BGX must hold no less than 70% of its Managed Assets in first‐ and second‐lien secured floating rate loans (“Secured Loans”), but may also invest in unsecured loans and high yield bonds.

Portfolio Management Commentary

Fund Performance

BGX outperformed a composite weighting of the S&P LLI and the Barclays High Yield Index (“Barclays HYI”) (70% loans, 30% high yield bonds) on a NAV per share basis for the periods of six months, one year, three years, five years, and the life of the Fund since inception. On a share price basis, the Fund outperformed its benchmark for the periods of six months, one year, three years, and five years, and underperformed its benchmark since inception. The shares of the Fund traded at an average discount to NAV of 10.6% for the twelve months ended December 31, compared to its peer group average discount of 11.0% over the same time.1

NAV Performance Factors2

The Fund’s outperformance relative to its benchmark in 2016 was attributable to both strong credit selection and asset allocation. The Fund’s under‐allocation to higher‐rated (BB‐ or above) assets (13.2% vs. 49.0% for the benchmark) contributed positively as higher‐rated assets generally underperformed during the period. By sector, the Fund’s credit selection in consumer discretionary, industrials and energy were the strongest contributors to outperformance, while the Fund’s strong credit selection within bonds also contributed positively during the period, though partially offset by an underweight allocation to bonds (19.8% vs. 30.0%). By issuer, the largest contributors to performance relative to the benchmark were Scientific Games, Comstock Resources and Coveris, while the largest detractors were Avaya, Concordia and Payless.

Portfolio Activity and Positioning

Over the past twelve months, and particularly during the second half of the year, the Fund systematically took advantage of market rallies in order to gradually reduce its bond and higher beta loan allocation, selling duration and paring lower‐rated loan positions, as well as allowing for natural attrition by returning paper during repricing activity. Additionally, in anticipation of increased volatility throughout the fourth quarter, the Fund took steps to increase diversification by participating heavily in the attractive relative value of the primary market, and by reducing concentration in less liquid, higher beta assets. The Fund reduced its CCC and non‐rated exposure while increasing exposure to BB and B‐rated loans. On a sector basis, the Fund reduced its allocation to consumer discretionary, utilities and energy while increasing exposure to financials, basic materials, industrials and technology.2 The Fund continues to seek to opportunistically take advantage of rallies to pare higher risk names where the portfolio managers believe inadequate levels of compensation are being offered relative to the credit risk. Given the outlook for repricing activity and lack of new issue, we anticipate this dynamic to continue well into the first quarter of 2017.

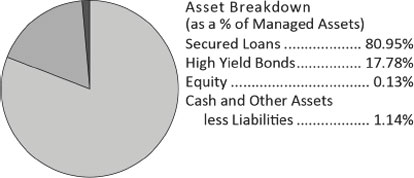

As of December 31, 2016, the Fund held 81.0% of its Managed Assets in Secured Loans and around 17.8% in high yield bonds. BGX’s investments represented the obligations of 221 companies, with an average position size representing 0.38% of Managed Assets of the Fund. Healthcare and pharmaceuticals, high tech, and business services represent the Fund’s top sector weightings.

| 1 | Average discount and peer group per Morningstar. |

| 2 | Industries per the Global Industry Classification Standard. |

| Annual Report | December 31, 2016 | 5 |

| Blackstone / GSO Long-Short Credit Income Fund | Fund Summary |

December 31, 2016 (Unaudited)

BGX’s Portfolio Composition

BGX’s Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

| Portfolio Characteristics | |

| Weighted Average Loan Spread^ | 4.87% |

| Weighted Average Bond Coupon | 7.81% |

Current Dividend Yield† | 7.76% |

| Weighted Average Days to Reset | 63 |

| Effective Duration* | 0.75 |

| Average Position** | 0.38% |

| Long Positions*** | 150.76% |

| Short Positions*** | 0.00% |

| Net Positions*** | 150.76% |

| Leverage** | 34.43% |

| ^ | Spread over LIBOR inclusive of LIBOR floors. |

| † | Using current dividend rate of $0.103/share and market price/share as of December 31, 2016. |

| * | Loan durations are treated as 3 months because of LIBOR resets, however, the effective rate for loans with LIBOR floors will not change if LIBOR is below the floor. |

| ** | As a percentage of Managed Assets. |

| *** | As a percentage of net assets. |

| Top 10 Holdings* | |

| Aspect Software Inc, Senior Secured First Lien Exit Term Loan | 1.25% |

| Scientific Games Corp, Senior Unsecured Bond | 1.08% |

| PriSo Acq Corp / Bldng Pro, Senior Unsecured Bond | 1.06% |

| P F Chang's China Bistro Inc, Senior Unsecured Bond | 1.01% |

| Neff Rental LLC, Senior Secured Second Lien Closing Date Term Loan | 0.97% |

| Sedgwick Claims Management Services Inc, Senior Secured Second Lien Incremental Term Loan | 0.96% |

| Avantor Performance Materials Holdings Inc, Senior Secured First Lien Initial Term Loan | 0.94% |

| Windstream Services LLC, Senior Secured First Lien Delayed Draw Term Loan | 0.93% |

| Windstream Services LLC, Senior Secured First Lien New Tranche B‐6 Term Loan | 0.92% |

| Cortes NP Acquisition Corporation, Senior Secured First Lien Initial Term Loan | 0.92% |

| Top 10 Holdings | 10.04% |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

| Top 5 Industries*^ | |

| Healthcare and Pharmaceuticals | 12.09% |

| High Tech Industries | 11.31% |

| Services ‐ Business | 10.94% |

| Banking, Finance, Insurance and Real Estate | 8.71% |

| Construction and Building | 8.32% |

| Top 5 Industries | 51.37% |

BGX Total Return

| | 3 Month | 6 Month | 1 Year | 3 Year† | 5 Year† | Since Inception† |

| NAV | 4.21% | 10.33% | 21.21% | 4.41% | 6.76% | 5.77% |

| Market Price | 6.69% | 16.96% | 29.89% | 4.59% | 6.70% | 3.86% |

| 70% S&P LLI / 30% Barclays HYI | 2.11% | 6.01% | 12.22% | 4.06% | 5.88% | 5.04% |

| * | As a percentage of Managed Assets. |

| Blackstone / GSO Strategic Credit Fund | Fund Summary |

December 31, 2016 (Unaudited)

Fund Overview

Blackstone / GSO Strategic Credit Fund (“BGB” or herein, the “Fund”) is a closed‐end term fund that trades on the New York Stock Exchange under the symbol “BGB”. BGB’s primary investment objective is to seek high current income, with a secondary objective to seek preservation of capital, consistent with its primary goal of high current income. BGB invests primarily in a diversified portfolios or loans and other fixed income instruments of predominantly US Corporate issuers, including first‐ and second‐lien loans (“Senior Secured Loans”) and high yield corporate bonds of varying maturities. BGB must hold no less than 80% of its Managed Assets in credit investments comprised of corporate fixed income instruments and other investments (including derivatives) with similar economic characteristics. The Fund has a limited term and will dissolve on or about September 15, 2027, absent shareholder approval to extend such term.

Portfolio Management Commentary

Fund Performance

BGB outperformed a composite weighting of the S&P LLI and the Barclays HYI (75% loans, 25% high yield bonds) on a NAV per share basis for the periods of six months, one year, three years, and the life of the Fund since inception. On a share price basis, the Fund outperformed its benchmark for the periods of six months and one year, and underperformed its benchmark for the periods of three years and since inception. The shares of the Fund traded at an average discount to NAV of 10.7% for the twelve months ended December 31, compared to its peer group average discount of 11.0% over the same time.1

NAV Performance Factors2

The Fund’s outperformance relative to its benchmark in 2016 was attributable to both strong credit selection and asset allocation. The Fund’s under‐allocation to higher‐rated (BB‐ or above) assets (13.7% vs. 48.6% for the benchmark) contributed positively as higher‐rated assets generally underperformed during the period. By sector, the Fund’s credit selection in consumer discretionary, industrials, and energy were the strongest contributors to outperformance, while the Fund’s strong credit selection within bonds also contributed positively during the period. By issuer, the largest contributors to performance relative to the benchmark were Scientific Games, Coveris and Aspect Software, while the largest detractors were Templar Energy, Titan Energy and Avaya.

Portfolio Activity and Positioning

Over the past twelve months, and particularly during the second half of the year, the Fund systematically took advantage of market rallies in order to gradually reduce its bond and higher beta loan allocation, selling duration and paring lower‐rated loan positions, as well as allowing for natural attrition by returning paper during repricing activity. Additionally, in anticipation of increased volatility throughout the fourth quarter, the Fund took steps to increase diversification by participating heavily in the attractive relative value of the primary market, and by reducing concentration in less liquid, higher beta assets. The Fund reduced its CCC and non‐rated exposure while increasing exposure to BB and B‐rated loans. On a sector basis, the Fund reduced its allocation to consumer discretionary, utilities and energy while increasing exposure to financials, basic materials, industrials and technology.2 The Fund continues to seek to opportunistically take advantage of rallies to pare higher risk names where the portfolio managers believe inadequate levels of compensation are being offered relative to the credit risk. Given the outlook for repricing activity and lack of new issue, we anticipate this dynamic to continue well into the first quarter of 2017.

As of December 31, 2016, the Fund held 80.9% of its Managed Assets in Senior Secured Loans and around 19.6% in high yield bonds. BGB’s investments represented the obligations of 256 companies, with an average position size representing 0.32% of Managed Assets of the Fund. High tech, healthcare and pharmaceuticals, and business services represent the Fund’s top sector weightings.

1 | Average discount and peer group per Morningstar. |

2 | Industries per the Global Industry Classification Standard. |

| Annual Report | December 31, 2016 | 7 |

| Blackstone / GSO Strategic Credit Fund | Fund Summary |

December 31, 2016 (Unaudited)

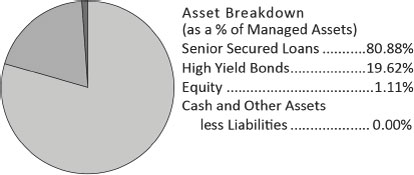

BGB’s Portfolio Composition

| † | The Fund’s Net Cash and Other Assets Less Liabilities includes amounts payable for investments purchased but not yet settled and amounts receivable for investments sold but not yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the amount of cash on hand, and the Fund’s Net Cash and Other Assets Less Liabilities therefore equaled -1.61% of the Fund’s Managed Assets. The Fund uses funds from its leverage program to settle amounts payable for investments purchased, but such funds are not reflected in the Fund’s net cash. |

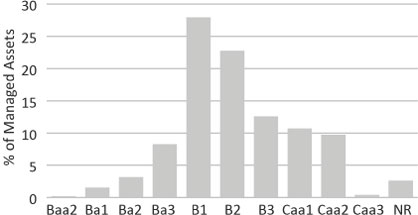

BGB’s Moody’s Rating Distribution**

| ** | For more information on Moody's ratings and descriptions refer to www.moodys.com. |

| Portfolio Characteristics | |

| Weighted Average Loan Spread^ | 4.88% |

| Weighted Average Bond Coupon | 7.85% |

Current Dividend Yield† | 8.21% |

| Weighted Average Days to Reset | 57 |

| Effective Duration* | 0.74 |

| Average Position** | 0.32% |

| Leverage** | 36.01% |

| ^ | Spread over LIBOR inclusive of LIBOR floors. |

| † | Using current dividend rate of $0.105/share and market price/share as of December 31, 2016. |

| * | Loan durations are treated as 3 months because of LIBOR resets, however, the effective rate for loans with LIBOR floors will not change if LIBOR is below the floor. |

| ** | As a percentage of Managed Assets. |

| Top 10 Holdings* | |

| Scientific Games Corp, Senior Unsecured Bond | 1.14% |

| P F Chang's China Bistro Inc, Senior Unsecured Bond | 1.12% |

| PriSo Acq Corp / Bldng Pro, Senior Unsecured Bond | 1.12% |

| Aspect Software Inc, Senior Secured First Lien Exit Term Loan | 1.09% |

| Cortes NP Acquisition Corporation, Senior Secured First Lien Initial Term Loan | 1.03% |

| Fairpoint Communications Inc, Senior Secured Bond | 0.95% |

| TierPoint LLC, Senior Secured First Lien Term B‐1 Loan | 0.93% |

| DTI Holdco Inc, Senior Secured First Lien Initial Term Loan | 0.93% |

| Avantor Performance Materials Holdings Inc, Senior Secured First Lien Initial Term Loan | 0.92% |

| Quest Software US Holdings Inc, Senior Secured First Lien Initial Term Loan | 0.91% |

| Top 10 Holdings | 10.14% |

Portfolio holdings and distributions are subject to change and are not recommendations to buy or sell any security.

| Top 5 Industries*^ | |

| High Tech Industries | 13.98% |

| Healthcare and Pharmaceuticals | 11.37% |

| Services ‐ Business | 9.71% |

| Banking, Finance, Insurance and Real Estate | 9.18% |

| Construction and Building | 8.58% |

| Top 5 Industries | 52.82% |

BGB Total Return

| | 3 Month | 6 Month | 1 Year | 3 Year† | Since Inception† |

| NAV | 4.37% | 9.75% | 21.02% | 4.30% | 5.19% |

| Market Price | 6.22% | 12.47% | 25.71% | 3.65% | 1.88% |

| 75% S&P LLI / 25% Barclays HYI | 2.14% | 5.91% | 11.88% | 3.98% | 4.63% |

| * | As a percentage of Managed Assets. |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

December 31, 2016

| | Principal Amount | | | Value | |

| | | | | | | |

FLOATING RATE LOAN INTERESTS(a) ‐ 145.42% | | | | | | |

| Aerospace and Defense ‐ 2.42% | | | | | | |

Digitalglobe Inc, Senior Secured First Lien Term Loan, L+2.75%, 01/15/2024(b) | | $ | 1,282,932 | | | $ | 1,294,158 | |

| Engility Corporation, Senior Secured First Lien Term B‐2 Loan, 5.811%, 08/14/2023 | | | 746,606 | | | | 759,486 | |

| PRV Aerospace LLC, Senior Secured First Lien Term Loan, 7.000%, 05/09/2018 | | | 3,081,709 | | | | 2,989,258 | |

| WP CPP Holdings LLC, Senior Secured First Lien B‐3 Term Loan, 4.500%, 12/27/2019 | | | 1,476,844 | | | | 1,446,384 | |

| | | | | | | | 6,489,286 | |

| | | | | | | | | |

| Automotive ‐ 2.61% | | | | | | | | |

| American Tire Distributors Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 09/01/2021 | | | 3,172,913 | | | | 3,169,613 | |

| Dealer Tire LLC, Senior Secured First Lien Initial Term Loan, 4.750%, 12/22/2021 | | | 925,562 | | | | 940,602 | |

| Mitchell International Inc, Senior Secured Second Lien Term Loan, 8.500%, 10/11/2021 | | | 2,895,978 | | | | 2,879,326 | |

| | | | | | | | 6,989,541 | |

| | | | | | | | | |

| Banking, Finance, Insurance and Real Estate ‐ 8.89% | | | | | | | | |

| Alliant Holdings Intermediate LLC, Senior Secured First Lien 2016 Term Loan, 5.253%, 08/15/2022 | | | 1,421,429 | | | | 1,437,711 | |

| Alliant Holdings Intermediate LLC, Senior Secured First Lien Initial Term Loan, 4.753%, 08/12/2022 | | | 777,632 | | | | 783,223 | |

| AmWins Group LLC, Senior Secured First Lien New Term Loan, 4.750%, 09/06/2019 | | | 2,612,734 | | | | 2,645,119 | |

| AssuredPartners Inc, Senior Secured First Lien 2016 Refinancing Term Loan, 5.250%, 10/21/2022 | | | 2,447,020 | | | | 2,485,561 | |

| Asurion LLC, Senior Secured First Lien Incremental Tranche B‐5 Term Loan, 4.750%, 11/03/2023 | | | 1,931,758 | | | | 1,961,700 | |

| Asurion LLC, Senior Secured Second Lien Term Loan, 8.500%, 03/03/2021 | | | 1,925,532 | | | | 1,961,039 | |

| Broadstreet Partners Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 11/08/2023 | | | 1,463,415 | | | | 1,481,400 | |

| Confie Seguros Holding II Co, Senior Secured First Lien Term B Loan, 5.750%, 04/13/2022 | | | 665,494 | | | | 669,986 | |

| Cunningham Lindsey US Inc, Senior Secured First Lien Initial Term Loan, 5.028%, 12/10/2019 | | | 3,780,799 | | | | 3,195,720 | |

| Gold Merger Co Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 07/27/2023 | | | 885,355 | | | | 892,367 | |

| MPH Acquisition Holdings LLC, Senior Secured First Lien Initial Term Loan, 5.000%, 06/07/2023 | | | 2,163,063 | | | | 2,204,399 | |

National Financial Partners Corp, Senior Secured First Lien Tranche B Term Loan, L+3.50%, 01/08/2014(b) | | | 782,123 | | | | 790,140 | |

| Solera LLC (Solera Finance Inc), Senior Secured First Lien Dollar Term Loan, 5.750%, 03/03/2023 | | | 1,860,938 | | | | 1,888,851 | |

VF Holding Corp, Senior Secured First Lien Term B‐1 Loan, L+3.25%, 06/30/2023(b) | | | 747,664 | | | | 751,600 | |

| Victory Capital Operating LLC, Senior Secured First Lien Initial Term Loan, 8.500%, 10/29/2021 | | | 673,335 | | | | 684,067 | |

| | | | | | | | 23,832,883 | |

| | | | | | | | | |

| Beverage, Food and Tobacco ‐ 2.76% | | | | | | | | |

| AdvancePierre Foods Inc, Senior Secured First Lien Effective Date Term Loan, 4.000%, 06/02/2023 | | | 708,702 | | | | 721,016 | |

| Americold Realty Operating Partnership LP, Senior Secured First Lien Initial Term Loan, 5.750%, 12/01/2022 | | | 394,059 | | | | 399,233 | |

| Candy Intermediate Holdings Inc, Senior Secured First Lien Initial Term Loan, 5.500%, 06/15/2023 | | | 589,145 | | | | 594,391 | |

| CEC Entertainment Inc, Senior Secured First Lien Term B Loan, 4.000%, 02/15/2021 | | | 1,673,982 | | | | 1,671,195 | |

| Chobani LLC, Senior Secured First Lien Closing Date Term Loan, 5.250%, 10/09/2023 | | | 2,183,288 | | | | 2,218,767 | |

Constellation Brands Canada Inc, Senior Secured First Lien Initial Tranche B‐1 Term Loan, L+3.75%, 11/15/2023(b) | | | 461,538 | | | | 467,453 | |

| Supervalu Inc, Senior Secured First Lien New Term Loan, 5.500%, 03/21/2019 | | | 1,039,638 | | | | 1,049,026 | |

| Winebow Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 07/01/2021 | | | 289,726 | | | | 290,451 | |

| | | | | | | | 7,411,532 | |

| Annual Report | December 31, 2016 | 9 |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

| Capital Equipment ‐ 0.56% | | | | | | |

| Husky Injection Molding Systems Ltd, Senior Secured First Lien Initial Term Loan, 4.250%, 06/30/2021 | | $ | 487,805 | | | $ | 491,412 | |

| Meter Readings Holding LLC, Senior Secured First Lien Initial Term Loan, 6.750%, 08/29/2023 | | | 997,500 | | | | 1,018,697 | |

| | | | | | | | 1,510,109 | |

| | | | | | | | | |

| Chemicals, Plastics and Rubber ‐ 3.03% | | | | | | | | |

| Emerald Performance Materials LLC, Senior Secured First Lien Initial Term Loan, 4.500%, 08/02/2021 | | | 2,971,943 | | | | 2,996,461 | |

| Pinnacle Operating Corporation, Senior Secured First Lien Term B Refinancing Loan, 4.750%, 11/15/2018 | | | 2,632,558 | | | | 2,211,349 | |

| Royal Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.500%, 06/20/2022 | | | 1,319,933 | | | | 1,335,330 | |

Tekni‐Plex Inc, Senior Secured First Lien Tranche B‐1 Loan, L+3.50%, 06/01/2022(b) | | | 851,214 | | | | 856,534 | |

| Tekni‐Plex Inc, Senior Secured Second Lien Initial Term Loan, 8.750%, 06/01/2023 | | | 713,942 | | | | 713,050 | |

| | | | | | | | 8,112,724 | |

| | | | | | | | | |

| Construction and Building ‐ 13.06% | | | | | | | | |

| American Bath Group LLC, Senior Secured First Lien Term Loan, 6.750%, 09/30/2023 | | | 1,813,636 | | | | 1,820,437 | |

| American Bath Group LLC, Senior Secured Second Lien term Loan, 10.750%, 09/30/2024 | | | 250,000 | | | | 241,250 | |

| Builders Firstsource Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 07/29/2022 | | | 3,089,080 | | | | 3,124,219 | |

| C.H.I. Overhead Doors Inc, Senior Secured First Lien Initial Term Loan, 4.500%, 07/29/2022 | | | 2,339,008 | | | | 2,346,809 | |

| Dayton Superior Corporation, Senior Secured First Lien Term Loan, 9.000%, 11/03/2021 | | | 1,555,556 | | | | 1,567,222 | |

| Forterra Finance LLC, Senior Secured First Lien Term Loan 4.500%, 10/25/2023 | | | 2,573,529 | | | | 2,608,272 | |

| GYP Holdings III Corp, Senior Secured First Lien Term Loan 4.500%, 04/01/2021 | | | 1,470,000 | | | | 1,484,700 | |

| HNC Holdings Inc, Senior Secured First Lien Initial Term Loan, 5.500%, 10/05/2023 | | | 1,243,523 | | | | 1,259,074 | |

| IPS Structural Adhesives Holding Inc, Senior Secured First Lien Initial Term Loan, 6.250%, 12/14/2023 | | | 1,839,080 | | | | 1,836,782 | |

IPS Structural Adhesives Holding Inc, Senior Secured Second Lien Initial Term Loan, L+9.50%, 12/14/2024(b) | | | 1,000,000 | | | | 990,000 | |

| Jeld‐Wen Inc, Senior Secured First Lien Term B‐2 Loan, 4.750%, 07/01/2022 | | | 6,055,834 | | | | 6,140,041 | |

| Morsco Inc, Senior Secured First Lien Initial Term Loan, 8.000%, 10/31/2023 | | | 2,000,000 | | | | 2,020,000 | |

| Priso Acquisition Corporation, Senior Secured First Lien Initial Term Loan, 4.500%, 05/09/2022 | | | 1,362,919 | | | | 1,375,697 | |

| SiteOne Landscape Supply LLC, Senior Secured First Lien Tranche B Term Loan, 5.500%, 04/29/2022 | | | 1,429,358 | | | | 1,443,651 | |

| SRS Distribution Inc, Senior Secured First Lien Tranche B‐1 Loan, 5.250%, 08/25/2022 | | | 1,457,873 | | | | 1,482,474 | |

| SRS Distribution Inc, Senior Secured Second Lien 06/16 Term Loan, 9.750%, 02/24/2023 | | | 821,918 | | | | 849,403 | |

| US LBM Holdings LLC, Senior Secured First Lien Initial Term Loan, 6.250%, 08/20/2022 | | | 3,798,077 | | | | 3,773,864 | |

| Wilsonart LLC, Senior Secured First Lien Tranche C Term Loan, 4.500%, 12/19/2023 | | | 659,341 | | | | 666,138 | |

| | | | | | | | 35,030,033 | |

| | | | | | | | | |

| Consumer Goods Durable ‐ 1.94% | | | | | | | | |

| Apex Tool Group LLC, Senior Secured First Lien Term Loan, 4.500%, 01/31/2020 | | | 1,027,913 | | | | 1,021,062 | |

Culligan NewCo Ltd, Senior Secured First Lien Tranche B‐1 Term Loan, L+4.00%, 11/13/2023(b) | | | 1,045,752 | | | | 1,055,885 | |

| Hercules Achievement Inc, Senior Secured First Lien Initial Term Loan, 5.000%, 12/13/2021 | | | 1,837,500 | | | | 1,867,819 | |

| Zodiac Pool Solutions LLC, Senior Secured First Lien Term Loan, 5.500%, 12/14/2023 | | | 1,237,113 | | | | 1,248,717 | |

| | | | | | | | 5,193,483 | |

| | | | | | | | | |

| Consumer Goods Non Durable ‐ 2.70% | | | | | | | | |

| FGI Operating Company LLC, Senior Secured First Lien Term B Loan, 5.500%, 04/19/2019 | | | 2,800,654 | | | | 2,672,286 | |

| Inmar Inc, Senior Secured Second Lien Initial Term Loan, 8.000%, 01/27/2022 | | | 250,000 | | | | 239,688 | |

| Revlon Consumer Products Corporation, Senior Secured First Lien Initial Term B Loan, 4.293%, 09/07/2023 | | | 1,982,609 | | | | 2,006,033 | |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

| Consumer Goods Non Durable (continued) | | | | | | |

| SRAM LLC, Senior Secured First Lien Term Loan, 4.018%, 04/10/2020 | | $ | 2,316,901 | | | $ | 2,308,212 | |

| | | | | | | | 7,226,219 | |

| | | | | | | | | |

| Containers, Packaging and Glass ‐ 6.50% | | | | | | | | |

| Anchor Glass Container Corporation, Senior Secured First Lien Term Loan, 4.250%, 12/07/2023 | | | 246,914 | | | | 249,460 | |

| Berlin Packaging LLC, Senior Secured First Lien Initial Term Loan, 4.500%, 10/01/2021 | | | 3,001,047 | | | | 3,031,283 | |

| Charter Nex US Holdings Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 02/07/2022 | | | 2,418,915 | | | | 2,443,104 | |

| Coveris Holdings SA, Senior Secured First Lien USD Term Loan, 4.500%, 05/08/2019 | | | 1,877,702 | | | | 1,890,997 | |

Flex Acquisition Company Inc, Senior Secured First Lien Initial Term Loan, L+3.25%, 12/29/2023(b) | | | 1,832,461 | | | | 1,851,738 | |

| Flex Acquisition Company Inc, Senior Secured First Lien Interim Initial Term Loan, 8.000%, 12/16/2017 | | | 1,785,714 | | | | 1,787,946 | |

| IBC Capital Limited, Senior Secured Second Lien Term Loan, 8.000%, 09/09/2022 | | | 912,750 | | | | 856,844 | |

| Printpack Holdings Inc, Senior Secured First Lien Term Loan, 5.000%, 07/26/2023 | | | 1,391,860 | | | | 1,406,649 | |

| Reynolds Group Holdings Inc, Senior Secured First Lien US Term Loan, 4.250%, 02/06/2023 | | | 3,855,582 | | | | 3,912,105 | |

| | | | | | | | 17,430,126 | |

| | | | | | | | | |

| Energy, Oil and Gas ‐ 3.90% | | | | | | | | |

| Ascent Resources ‐ Marcellus LLC, Senior Secured First Lien Term Loan, 5.250%, 08/04/2020 | | | 1,481,481 | | | �� | 819,755 | |

| Crestwood Holdings LLC, Senior Secured First Lien Tranche B‐1 Term Loan, 9.000%, 06/19/2019 | | | 2,342,989 | | | | 2,299,058 | |

| Jonah Energy Inc, Senior Secured Second Lien Initial Term Loan, 7.500%, 05/12/2021 | | | 2,000,000 | | | | 1,900,000 | |

| Sheridan Investment Partners I LLC, Senior Secured First Lien Tranche B‐2 Term Loan, 4.449%, 10/01/2019 | | | 2,847,009 | | | | 2,454,121 | |

| Sheridan Production Partners I LLC, Senior Secured First Lien Deferred Principal Term Loan,: | | | | | | | | |

| 0.000%, 01/01/2030 | | | 8,866 | | | | 6,698 | |

| 0.000%, 01/01/2030 | | | 14,516 | | | | 10,967 | |

| 0.000%, 01/01/2030 | | | 109,547 | | | | 82,763 | |

| Sheridan Production Partners I‐A LP, Senior Secured First Lien Tranche B‐2 Term Loan, 4.450%, 10/01/2019 | | | 377,252 | | | | 325,191 | |

| Sheridan Production Partners I‐M LP, Senior Secured First Lien Tranche B‐2 Term Loan, 4.450%, 10/01/2019 | | | 230,428 | | | | 198,629 | |

| Utex Industries Inc, Senior Secured First Lien New Initial Term Loan, 5.000%, 05/24/2021 | | | 1,497,997 | | | | 1,402,500 | |

| W3 Co, Senior Secured First Lien Term Loan, 5.750%, 03/13/2020 | | | 1,152,307 | | | | 969,995 | |

| | | | | | | | 10,469,677 | |

| | | | | | | | | |

| Environmental Industries ‐ 0.87% | | | | | | | | |

| EnergySolutions LLC, Senior Secured First Lien Advance Term Loan, 6.750%, 05/29/2020 | | | 1,734,545 | | | | 1,751,891 | |

| Infiltrator Water Technologies LLC, Senior Secured First Lien Term B‐1 Loan, 4.500%, 05/27/2022 | | | 562,857 | | | | 567,782 | |

| | | | | | | | 2,319,673 | |

| | | | | | | | | |

| Healthcare and Pharmaceuticals ‐ 19.39% | | | | | | | | |

| Albany Molecular Research Inc, Senior Secured First Lien Term Loan, 6.006%, 07/16/2021 | | | 2,319,715 | | | | 2,351,611 | |

| Alvogen Pharma US Inc, Senior Secured First Lien Term Loan, 6.000%, 04/01/2022 | | | 2,707,423 | | | | 2,626,200 | |

| Amneal Pharmaceuticals LLC, Senior Secured First Lien Term B Loan, 4.501%, 11/01/2019 | | | 333,455 | | | | 334,705 | |

| Arbor Pharmaceuticals LLC, Senior Secured First Lien Initial Term Loan, 6.000%, 07/05/2023 | | | 1,693,836 | | | | 1,717,126 | |

| Avantor Performance Materials Holdings Inc, Senior Secured First Lien Initial Term Loan, 6.000%, 06/21/2022 | | | 3,787,360 | | | | 3,863,107 | |

| BioClinica‐Clinverse Holdings Corp, Senior Secured First Lien Initial Term Loan, 5.250%, 10/20/2023 | | | 1,434,783 | | | | 1,437,480 | |

| BioClinica‐Clinverse Holdings Corp, Senior Secured Second Lien Initial Term Loan, 9.250%, 10/04/2024 | | | 1,052,629 | | | | 1,047,365 | |

CHG Healthcare Services Inc, Senior Secured First Lien Term Loan, L+3.75%, 06/07/2023(b) | | | 1,369,413 | | | | 1,387,387 | |

| Annual Report | December 31, 2016 | 11 |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

| Healthcare and Pharmaceuticals (continued) | | | | | | |

| Concordia Healthcare Corp, Senior Secured First Lien Dollar Term Loan, 5.250%, 10/21/2021 | | $ | 2,773,810 | | | $ | 2,179,757 | |

| CT Technologies Intermediate Holdings Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 12/01/2021 | | | 2,227,671 | | | | 2,135,780 | |

| Curo Health Services Holdings Inc, Senior Secured First Lien Term B Loan, 6.500%, 02/07/2022 | | | 1,403,571 | | | | 1,414,681 | |

| Global Healthcare Exchange LLC, Senior Secured First Lien Initial Term Loan, 5.250%, 08/15/2022 | | | 1,889,749 | | | | 1,908,259 | |

| Horizon Pharma Inc, Senior Secured First Lien Term B‐1 Loan, 5.500%, 05/07/2021 | | | 735,294 | | | | 736,445 | |

| inVentiv Group Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 11/09/2023 | | | 1,980,583 | | | | 2,001,448 | |

| Lanai Holdings III Inc, Senior Secured First Lien Initial Term Loan, 5.750%, 08/29/2022 | | | 1,238,532 | | | | 1,236,984 | |

| Mediware Information Systems Inc, Senior Secured First Lien Initial Term Loan, 5.750%, 09/28/2023 | | | 941,038 | | | | 949,272 | |

| National Mentor Holdings Inc, Senior Secured First Lien Initial Tranche B Term Loan, 4.250%, 01/29/2021 | | | 1,058,161 | | | | 1,066,097 | |

| Netsmart Technologies Inc, Senior Secured First Lien Term C‐1 Loan, 5.500%, 04/19/2023 | | | 2,144,397 | | | | 2,155,794 | |

| Onex Carestream Finance LP, Senior Secured First Lien Term Loan, 5.000%, 06/07/2019 | | | 464,796 | | | | 452,788 | |

| Onex Carestream Finance LP, Senior Secured Second Lien Term Loan, 9.500%, 12/09/2019 | | | 2,849,338 | | | | 2,350,704 | |

| Onex Schumacher Finance LP, Senior Secured First Lien Initial Term Loan, 5.000%, 07/29/2022 | | | 1,206,344 | | | | 1,209,359 | |

| Packaging Coordinators Midco Inc, Senior Secured First Lien Initial Term Loan, 5.000%, 06/29/2023 | | | 1,733,434 | | | | 1,739,934 | |

| Pharmaceutical Product Development Inc, Senior Secured First Lien Initial Term Loan, 4.250%, 08/18/2022 | | | 531,983 | | | | 538,633 | |

| Precyse Acquisition Corp, Senior Secured First Lien Initial Term Loan, 6.500%, 10/20/2022 | | | 3,615,263 | | | | 3,669,492 | |

| Press Ganey Holdings Inc, Senior Secured First Lien Term Loan, 4.250%, 10/23/2023 | | | 1,386,139 | | | | 1,396,105 | |

| Press Ganey Holdings Inc, Senior Secured Second Lien Initial Term Loan, 8.250%, 09/30/2024 | | | 909,091 | | | | 927,273 | |

| Surgery Center Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 11/03/2020 | | | 4,388,356 | | | | 4,432,239 | |

| U.S. Renal Care Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 12/30/2022 | | | 3,964,962 | | | | 3,732,021 | |

| Valeant Pharmaceuticals International Inc, Senior Secured First Lien Series D‐2 Tranche B Term Loan, 5.000%, 02/13/2019 | | | 986,081 | | | | 987,067 | |

| | | | | | | | 51,985,113 | |

| | | | | | | | | |

| High Tech Industries ‐ 20.12% | | | | | | | | |

| Ascend Learning LLC, Senior Secured First Lien Term Loan, 5.500%, 07/31/2019 | | | 458,999 | | | | 462,843 | |

| Aspect Software Inc, Senior Secured First Lien Exit Term Loan, 11.278%, 05/25/2020 | | | 5,261,943 | | | | 5,270,704 | |

| BMC Software Finance Inc, Senior Secured First Lien Initial US Term Loan, 5.000%, 09/10/2020 | | | 2,836,206 | | | | 2,838,872 | |

CompuCom Systems Inc, Senior Secured First Lien Term Loan, L+3.25%, 05/11/2020(b) | | | 928,032 | | | | 730,051 | |

| Compuware Corporation, Senior Secured First Lien Tranche B‐2 Term Loan, 6.250%, 12/15/2021 | | | 984,925 | | | | 992,435 | |

| Compuware Corporation, Senior Secured Second Lien Term Loan, 9.250%, 12/15/2022 | | | 3,500,000 | | | | 3,517,500 | |

| Cypress Semiconductor Corp, Senior Secured First Lien 2016 Incremental Term Loan, 6.500%, 07/05/2021 | | | 1,669,014 | | | | 1,710,739 | |

| Epicor Software Corporation, Senior Secured First Lien Term B Loan, 4.750%, 06/01/2022 | | | 2,779,392 | | | | 2,795,276 | |

| Hyland Software Inc, Senior Secured First Lien Term Loan, 4.750%, 07/01/2022 | | | 197,542 | | | | 199,023 | |

| Informatica Corporation, Senior Secured First Lien Dollar Term Loan, 4.500%, 08/05/2022 | | | 2,402,174 | | | | 2,396,420 | |

| Landslide Holdings Inc, Senior Secured First Lien Term Loan, 5.500%, 09/27/2022 | | | 1,715,665 | | | | 1,741,400 | |

| Landslide Holdings Inc, Senior Secured Second Lien Term Loan, 9.500%, 09/27/2023 | | | 1,481,481 | | | | 1,503,704 | |

| MA FinanceCo LLC, Senior Secured First Lien Tranche B‐2 Term Loan, 4.520%, 11/19/2021 | | | 3,459,127 | | | | 3,509,786 | |

| P2 Upstream Acquisition Co, Senior Secured First Lien Term Loan, 5.000%, 10/30/2020 | | | 2,771,429 | | | | 2,643,250 | |

| Peak 10 Inc, Senior Secured First Lien Term Loan, 5.000%, 06/17/2021 | | | 2,659,091 | | | | 2,689,006 | |

| Peak 10 Inc, Senior Secured Second Lien Initial Term Loan, 8.250%, 06/17/2022 | | | 875,000 | | | | 824,687 | |

| Pomeroy Group LLC, Senior Secured First Lien Initial Term Loan, 7.000%, 11/12/2021 | | | 1,496,231 | | | | 1,489,685 | |

| ProQuest LLC, Senior Secured First Lien Initial Term Loan, 5.750%, 10/25/2021 | | | 1,763,940 | | | | 1,780,477 | |

| Quest Software US Holdings Inc, Senior Secured First Lien Initial Term Loan, 7.000%, 10/31/2022 | | | 5,275,362 | | | | 5,354,519 | |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

| High Tech Industries (continued) | | | | | | |

| Riverbed Technology Inc, Senior Secured First Lien Amendment Term Loan, 4.250%, 04/25/2022 | | $ | 776,715 | | | $ | 783,403 | |

| Rocket Software Inc, Senior Secured First Lien Term Loan, 5.250%, 10/13/2023 | | | 2,087,077 | | | | 2,117,517 | |

| SolarWinds Holdings Inc, Senior Secured First Lien 2016 Refinancing Term Loan, 5.500%, 02/03/2023 | | | 820,619 | | | | 832,123 | |

| Sophia LP, Senior Secured First Lien Closing Date Term Loan, 4.750%, 09/30/2022 | | | 1,960,897 | | | | 1,982,350 | |

| Sybil Software LLC, Senior Secured First Lien Initial Dollar Term Loan, 5.000%, 09/30/2022 | | | 1,343,537 | | | | 1,366,841 | |

| Tech Finance & Co SCA, Senior Secured First Lien US Term Loan, 5.000%, 07/13/2020 | | | 999,234 | | | | 1,007,353 | |

| Trader Corporation, Senior Secured First Lien Term Loan, 5.000%, 09/28/2023 | | | 1,351,351 | | | | 1,370,493 | |

| TTM Technologies Inc, Senior Secured First Lien New Term B Loan, 5.006%, 05/31/2021 | | | 1,742,880 | | | | 1,769,023 | |

| Western Digital Corporation, Senior Secured First Lien US Term B‐1 Loan, 4.520%, 05/01/2023 | | | 277,920 | | | | 282,784 | |

| | | | | | | | 53,962,264 | |

| | | | | | | | | |

| Hotels, Gaming and Leisure ‐ 5.49% | | | | | | | | |

| Alpha Topco Limited ‐ Delta 2 (Lux) Sarl, Senior Secured Second Lien Term Loan, 8.068%, 07/29/2022 | | | 3,812,600 | | | | 3,850,726 | |

| Corner Investment Propco LLC, Senior Secured First Lien Term B Loan, 11.000%, 11/04/2019 | | | 1,873,961 | | | | 1,888,016 | |

| Scientific Games International Inc, Senior Secured First Lien B‐2 Term Loan, 6.000%, 10/01/2021 | | | 1,667,696 | | | | 1,691,543 | |

| Scientific Games International Inc, Senior Secured First Lien Initial Term Loan, 6.000%, 10/19/2020 | | | 1,049,924 | | | | 1,065,127 | |

| SMG, Senior Secured First Lien 2014 Term Loan, 4.617%, 02/27/2020 | | | 1,650,431 | | | | 1,645,893 | |

| Travelport Finance (Luxembourg) Sarl, Senior Secured First Lien Term B Loan, 5.000%, 09/02/2021 | | | 2,911,202 | | | | 2,944,870 | |

| UFC Holdings LLC, Senior Secured First Lien Term Loan, 5.000%, 08/18/2023 | | | 1,602,671 | | | | 1,625,910 | |

| | | | | | | | 14,712,085 | |

| | | | | | | | | |

| Media Advertising, Printing and Publishing ‐ 1.33% | | | | | | | | |

| McGraw‐Hill Global Education Holdings LLC, Senior Secured First Lien Term B Loan, 5.000%, 05/04/2022 | | | 852,857 | | | | 855,258 | |

| Vestcom Parent Holdings Inc, Senior Secured First Lien Term Loan, 5.250%, 12/15/2023 | | | 2,713,043 | | | | 2,721,522 | |

| | | | | | | | 3,576,780 | |

| | | | | | | | | |

| Media Broadcasting and Subscription ‐ 1.20% | | | | | | | | |

| Numericable US LLC, Senior Secured First Lien USD TLB‐7 Term Loan, 5.140%, 01/15/2024 | | | 1,253,370 | | | | 1,272,064 | |

| Sable International Finance Ltd, Senior Secured First Lien Term B‐1 Loan, 5.748%, 01/03/2023 | | | 1,473,077 | | | | 1,495,291 | |

| Sable International Finance Ltd, Senior Secured First Lien Term B‐2 Loan, 5.830%, 01/03/2023 | | | 450,000 | | | | 456,786 | |

| | | | | | | | 3,224,141 | |

| | | | | | | | | |

| Metals and Mining ‐ 1.40% | | | | | | | | |

| Fairmount Santrol Inc, Senior Secured First Lien Tranche B‐2 Term Loan, 4.500%, 09/05/2019 | | | 1,656,102 | | | | 1,614,360 | |

| McJunkin Red Man Corporation, Senior Secured First Lien 2013 Term Loan, 5.000%, 11/08/2019 | | | 1,172,252 | | | | 1,181,776 | |

| Murray Energy Corporation, Senior Secured First Lien Term B‐2 Non‐PIK Loan, 8.250%, 04/16/2020 | | | 996,561 | | | | 956,704 | |

| | | | | | | | 3,752,840 | |

| | | | | | | | | |

| Retail ‐ 5.97% | | | | | | | | |

| Albertsons LLC, Senior Secured First Lien Replacement 2016‐1 Term B‐6 Loan, 4.061%, 06/22/2023 | | | 1,483,608 | | | | 1,504,727 | |

| Ascena Retail Group Inc, Senior Secured First Lien Tranche B Term Loan, 5.310%, 08/19/2022 | | | 1,273,484 | | | | 1,245,945 | |

| Annual Report | December 31, 2016 | 13 |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

| | | Principal Amount | | | Value | |

| Retail (continued) | | | | | | |

| Fairway Group Acquisition Company, Senior Secured First Lien First Out Term Loan, 9.000%, 01/03/2020 | | $ | 255,529 | | | $ | 258,084 | |

| Fairway Group Acquisition Company, Senior Secured First Lien Last Out Non‐PIK Term Loan, 10.000%, 01/03/2020 | | | 164,894 | | | | 150,054 | |

| Fairway Group Holdings Corp, Senior Secured First Lien Subordinated Non‐PIK Term Loan, 11.000%, 10/04/2021 | | | 143,606 | | | | 117,757 | |

| Jill Acquisition LLC, Senior Secured First Lien Initial Term Loan, 6.000%, 05/09/2022 | | | 1,022,917 | | | | 1,023,556 | |

| Neiman Marcus Group Ltd LLC, Senior Secured First Lien Other Term Loan, 4.250%, 10/26/2020 | | | 1,265,120 | | | | 1,103,501 | |

| Nine West Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 10/08/2019 | | | 2,145,000 | | | | 1,344,454 | |

| Payless Inc, Senior Secured First Lien Initial Term Loan, 5.000%, 03/11/2021 | | | 1,860,251 | | | | 984,379 | |

| Petco Animal Supplies Inc, Senior Secured First Lien Tranche B‐2 Term Loan, 5.140%, 01/26/2023 | | | 3,657,307 | | | | 3,684,353 | |

| Spencer Gifts LLC, Senior Secured First Lien Term B‐1 Loan, 5.250%, 07/16/2021 | | | 3,819,645 | | | | 3,361,288 | |

Sports Authority (The), Senior Secured First Lien Term B Loan, L+6.00%, 11/16/2017(b) | | | 6,013,320 | | | | 1,225,214 | |

| | | | | | | | 16,003,312 | |

| | | | | | | | | |

| Services ‐ Business ‐ 14.82% | | | | | | | | |

| Advantage Sales & Marketing Inc, Senior Secured Second Lien Initial Term Loan, 7.500%, 07/25/2022 | | | 2,750,000 | | | | 2,693,295 | |

| BarBri Inc (Gemini Holdings Inc), Senior Secured First Lien Term Loan, 4.500%, 07/17/2019 | | | 2,662,751 | | | | 2,576,212 | |

| Crossmark Holdings Inc, Senior Secured First Lien Term Loan, 4.500%, 12/20/2019 | | | 6,056,548 | | | | 4,562,609 | |

| DTI Holdco Inc, Senior Secured First Lien Initial Term Loan, 6.250%, 10/02/2023 | | | 5,499,730 | | | | 5,439,590 | |

| Erie Acquisition Holdings Inc (GCA Services Group Inc), Senior Secured First Lien Term Loan, 6.058%, 03/01/2023 | | | 3,318,425 | | | | 3,368,218 | |

GlobalLogic Holdings Inc, Senior Secured First Lien Closing Date Term Loan, L+4.50%, 06/20/2022(b) | | | 1,980,198 | | | | 1,982,673 | |

Information Resources Inc, Senior Secured First Lien Term B Loan, L+4.25%, 12/20/2023(b) | | | 2,481,390 | | | | 2,503,102 | |

Information Resources Inc, Senior Secured Second Lien Term B Loan, L+8.25%, 12/20/2024(b) | | | 2,000,000 | | | | 1,993,340 | |

| LD Intermediate Holdings Inc, Senior Secured First Lien Initial Term Loan, 6.875%, 12/09/2022 | | | 2,000,000 | | | | 1,860,000 | |

| Sedgwick Claims Management Services Inc, Senior Secured Second Lien Incremental Term Loan, 6.750%, 02/28/2022 | | | 2,075,472 | | | | 2,078,066 | |

| Sedgwick Claims Management Services Inc, Senior Secured Second Lien Initial Term Loan, 6.750%, 02/28/2022 | | | 1,845,960 | | | | 1,849,808 | |

| SurveyMonkey.com LLC, Senior Secured First Lien Term Loan, 6.250%, 02/07/2019 | | | 2,317,273 | | | | 2,349,135 | |

| Transaction Network Services, Senior Secured First Lien Initial Term Loan, 5.000%, 02/14/2020 | | | 1,083,540 | | | | 1,095,394 | |

| Transaction Network Services, Senior Secured Second Lien Initial Term Loan, 9.000%, 08/14/2020 | | | 479,902 | | | | 477,104 | |

| TravelCLICK Inc, Senior Secured First Lien Initial Term Loan, 5.500%, 05/12/2021 | | | 2,201,235 | | | | 2,209,490 | |

| TravelCLICK Inc, Senior Secured Second Lien Initial Term Loan, 8.750%, 11/08/2021 | | | 2,750,000 | | | | 2,705,313 | |

| | | | | | | | 39,743,349 | |

| | | | | | | | | |

| Services ‐ Consumer ‐ 4.89% | | | | | | | | |

| Focus Brands Inc, Senior Secured First Lien Initial Term Loan, 5.000%, 10/05/2023 | | | 1,469,281 | | | | 1,503,567 | |

| Learning Care Group (US) No. 2 Inc, Senior Secured First Lien Term Loan, 5.000%, 05/05/2021 | | | 1,417,593 | | | | 1,431,768 | |

| Nord Anglia Education Finance LLC, Senior Secured First Lien Initial Term Loan, 4.500%, 03/31/2021 | | | 926,916 | | | | 942,271 | |

| NVA Holdings Inc, Senior Secured First Lien Incremental B‐1 Term Loan, 5.500%, 08/14/2021 | | | 347,250 | | | | 348,986 | |

| NVA Holdings Inc, Senior Secured First Lien Term Loan, 4.750%, 08/16/2021 | | | 1,837,490 | | | | 1,852,420 | |

| NVA Holdings Inc, Senior Secured Second Lien Term Loan, 8.000%, 08/14/2022 | | | 1,438,251 | | | | 1,444,249 | |

| Outerwall Inc, Senior Secured First Lien Term B Loan, 5.250%, 09/27/2023 | | | 421,903 | | | | 428,759 | |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

| | | Principal Amount | | | Value | |

| Services ‐ Consumer (continued) | | | | | | |

Prime Security Services Borrower LLC, Senior Secured First Lien 2016‐2 Refinancing Term B‐1 Loan, L+3.25%, 05/02/2022(b) | | $ | 878,361 | | | $ | 892,963 | |

| Red Lobster Management LLC, Senior Secured First Lien Initial Term Loan, 6.250%, 07/28/2021 | | | 854,347 | | | | 866,094 | |

| Renaissance Learning Inc, Senior Secured First Lien Initial Term Loan, 4.500%, 04/09/2021 | | | 1,364,912 | | | | 1,371,450 | |

| Spin Holdco Inc, Senior Secured First Lien Initial Term Loan, 4.250%, 11/14/2019 | | | 2,043,601 | | | | 2,040,495 | |

| | | | | | | | 13,123,022 | |

| | | | | | | | | |

| Telecommunications ‐ 11.10% | | | | | | | | |

| Alorica Inc, Senior Secured First Lien Term B Loan, 5.520%, 06/30/2022 | | | 1,006,244 | | | | 1,018,822 | |

| Avaya Inc, Senior Secured First Lien Term B‐7 Loan, 6.250%, 05/29/2020 | | | 5,836,339 | | | | 5,092,235 | |

| Communications Sales & Leasing Inc, Senior Secured First Lien Term Loan, 4.500%, 10/24/2022 | | | 3,273,344 | | | | 3,324,899 | |

| ConvergeOne Holdings Corporation, Senior Secured First Lien Initial Term Loan, 6.375%, 06/17/2020 | | | 2,478,953 | | | | 2,475,854 | |

| Cortes NP Acquisition Corporation, Senior Secured First Lien Initial Term Loan, 6.000%, 11/30/2023 | | | 3,970,803 | | | | 4,030,365 | |

| Fairpoint Communications Inc, Senior Secured First Lien Term Loan, 7.500%, 02/14/2019 | | | 2,366,126 | | | | 2,396,081 | |

| Greeneden US Holdings II LLC, Senior Secured First Lien Initial Dollar Term Loan, 6.250%, 12/01/2023 | | | 618,557 | | | | 631,123 | |

GTT Communications Inc, Senior Secured First Lien Initial Term Loan, L+4.00%, 12/13/2023(b) | | | 414,508 | | | | 421,590 | |

| LTS Buyer LLC (Light Tower Fiber LLC / Sidera Networks Inc), Senior Secured First Lien Term B Loan, 4.248%, 04/13/2020 | | | 695,446 | | | | 701,096 | |

| Masergy Holdings Inc, Senior Secured First Lien Term B Loan, 5.500%, 12/15/2023 | | | 620,155 | | | | 625,194 | |

Masergy Holdings Inc, Senior Secured Second Lien Initial Term Loan, L+8.50%, 12/16/2024(b) | | | 500,000 | | | | 498,750 | |

| Telesat Canada, Senior Secured First Lien Term B‐3 Loan, 4.500%, 11/17/2023 | | | 1,992,445 | | | | 2,024,185 | |

Windstream Services LLC, Senior Secured First Lien Delayed Draw Term Loan, L+4.00%, 03/29/2021(b) | | | 2,429,907 | | | | 2,442,056 | |

| Windstream Services LLC, Senior Secured First Lien New Tranche B‐6 Term Loan, 4.762%, 03/29/2021 | | | 4,033,610 | | | | 4,072,695 | |

| | | | | | | | 29,754,945 | |

| | | | | | | | | |

| Transportation Cargo ‐ 0.23% | | | | | | | | |

| XPO Logistics Inc, Senior Secured First Lien Refinanced Term Loan, 4.250%, 11/01/2021 | | | 617,624 | | | | 626,647 | |

| | | | | | | | | |

| Transportation Consumer ‐ 1.52% | | | | | | | | |

| Air Medical Group Holdings Inc, Senior Secured First Lien 2016 New Term Loan, 5.000%, 04/28/2022 | | | 481,452 | | | | 490,180 | |

| Lineage Logistics LLC, Senior Secured First Lien Term Loan, 4.500%, 04/07/2021 | | | 3,606,529 | | | | 3,588,496 | |

| | | | | | | | 4,078,676 | |

| | | | | | | | | |

| Utilities Electric ‐ 8.72% | | | | | | | | |

| Chief Power Finance LLC, Senior Secured First Lien Term B Advance Loan, 5.750%, 12/31/2020 | | | 1,618,193 | | | | 1,312,759 | |

Eastern Power LLC, Senior Secured First Lien Term Loan, L+4.00%, 10/02/2021(b) | | | 2,312,395 | | | | 2,336,675 | |

| Exgen Texas Power LLC, Senior Secured First Lien Term Loan, 5.750%, 09/20/2021 | | | 2,231,593 | | | | 1,711,364 | |

| Granite Acquisition Inc, Senior Secured Second Lien Term B Loan, 8.250%, 12/19/2022 | | | 2,030,075 | | | | 1,959,023 | |

| Green Energy Partners / Stonewall LLC, Senior Secured First Lien Term B‐1 Conversion Advance Loan, 6.500%, 11/15/2021 | | | 500,000 | | | | 497,500 | |

| Moxie Patriot LLC, Senior Secured First Lien Construction B‐1 Facility Term Loan, 6.750%, 12/18/2020 | | | 1,450,133 | | | | 1,442,883 | |

| Panda Liberty LLC, Senior Secured First Lien Construction B‐1 Facility Term Loan, 7.500%, 08/21/2020 | | | 3,440,939 | | | | 3,402,228 | |

| Panda Temple Power II LLC, Senior Secured First Lien Construction Term Loan, 7.250%, 04/03/2019 | | | 2,620,800 | | | | 2,437,344 | |

| Annual Report | December 31, 2016 | 15 |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

| | | Principal Amount | | | Value | |

| Utilities Electric (continued) | | | | | | |

| Pike Corporation, Senior Secured First Lien Initial Term Loan, 5.500%, 12/22/2021 | | $ | 1,215,054 | | | $ | 1,222,648 | |

| Sandy Creek Energy Associates LP, Senior Secured First Lien Term Loan, 5.000%, 11/09/2020 | | | 3,060,100 | | | | 2,581,959 | |

| Southeast PowerGen LLC, Senior Secured First Lien Advance Term B Loan, 4.500%, 12/02/2021 | | | 1,979,374 | | | | 1,971,952 | |

| Vistra Operations Company LLC, Senior Secured First Lien 2016 Incremental Term Loan, 4.000%, 12/14/2023 | | | 458,716 | | | | 465,525 | |

| Vistra Operations Company LLC, Senior Secured First Lien Exit Term Loan, 5.000%, 08/04/2023 | | | 1,639,501 | | | | 1,661,667 | |

| Vistra Operations Company LLC, Senior Secured First Lien Initial Term C Loan, 5.000%, 08/04/2023 | | | 373,921 | | | | 378,977 | |

| | | | | | | | 23,382,504 | |

| | | | | | | | | |

| TOTAL FLOATING RATE LOAN INTERESTS (Cost $396,568,117) | | | | | | | 389,940,964 | |

| | | | | | | | | |

| CORPORATE BONDS ‐ 4.91% | | | | | | | | |

| Banking, Finance, Insurance and Real Estate ‐ 0.26% | | | | | | | | |

National Financial Partners Corp, Senior Unsecured Bond, 9.000%, 07/15/2021(c) | | | 650,000 | | | | 688,188 | |

| | | | | | | | | |

| Construction and Building ‐ 0.82% | | | | | | | | |

BMC East LLC, Senior Unsecured Bond, 5.500%, 10/01/2024(c) | | | 1,450,000 | | | | 1,450,000 | |

FBM Finance Inc, Senior Secured Bond, 8.250%, 08/15/2021(c) | | | 710,000 | | | | 752,600 | |

| | | | | | | | 2,202,600 | |

| | | | | | | | | |

| Consumer Goods Durable ‐ 0.07% | | | | | | | | |

Apex Tool Group LLC, Senior Unsecured Bond, 7.000%, 02/01/2021(c) | | | 200,000 | | | | 180,000 | |

| | | | | | | | | |

| Containers, Packaging and Glass ‐ 0.65% | | | | | | | | |

ARD Finance SA, Senior Unsecured Bond, 7.125%, 09/15/2023(c)(d) | | | 600,000 | | | | 594,750 | |

Coveris Holdings SA, Senior Unsecured Bond, 7.875%, 11/01/2019(c) | | | 955,000 | | | | 952,613 | |

Reynolds GRP ISS / Reynold, Senior Unsecured Bond, 7.000%, 07/15/2024(c) | | | 190,000 | | | | 202,231 | |

| | | | | | | | 1,749,594 | |

| | | | | | | | | |

| Energy, Oil and Gas ‐ 0.38% | | | | | | | | |

Comstock Resources Inc, Senior Unsecured Bond, 10.000%, 03/15/2020(d) | | | 1,000,000 | | | | 1,030,000 | |

| | | | | | | | | |

| Healthcare and Pharmaceuticals ‐ 0.67% | | | | | | | | |

InVentiv Group Holdings Inc, Senior Unsecured Bond, 7.500%, 10/01/2024(c) | | | 340,000 | | | | 357,816 | |

Kinetic Concept / KCI USA Inc, Senior Unsecured Bond, 9.625%, 10/01/2021(c) | | | 1,360,000 | | | | 1,445,000 | |

| | | | | | | | 1,802,816 | |

| | | | | | | | | |

| High Tech Industries ‐ 0.46% | | | | | | | | |

| Infor US Inc, Senior Unsecured Bond, 6.500%, 05/16/2022 | | | 750,000 | | | | 783,750 | |

Riverbed Technology Inc, Senior Unsecured Bond, 8.875%, 03/01/2023(c) | | | 430,000 | | | | 457,950 | |

| | | | | | | | 1,241,700 | |

| | | | | | | | | |

| Media Advertising, Printing and Publishing ‐ 0.10% | | | | | | | | |

McGraw‐Hill Global Education, Senior Unsecured Bond, 7.875%, 05/15/2024(c) | | | 270,000 | | | | 273,037 | |

| | | | | | | | | |

| Retail ‐ 0.14% | | | | | | | | |

Nine West Holdings Inc, Senior Unsecured Bond, 8.250%, 03/15/2019(c) | | | 1,800,000 | | | | 360,000 | |

| Blackstone / GSO Senior Floating Rate Term Fund | Portfolio of Investments |

| | | Principal Amount | | | Value | |

| Services ‐ Business ‐ 0.47% | | | | | | |

Infinity ACQ LLC / FI Corp, Senior Unsecured Bond, 7.250%, 08/01/2022(c) | | $ | 1,500,000 | | | $ | 1,271,250 | |

| | | | | | | | | |

| Telecommunications ‐ 0.89% | | | | | | | | |

Avaya Inc, Senior Secured Bond, 7.000%, 04/01/2019(c) | | | 1,000,000 | | | | 880,000 | |

Fairpoint Communications Inc, Senior Secured Bond, 8.750%, 08/15/2019(c) | | | 1,430,000 | | | | 1,494,350 | |

| | | | | | | | 2,374,350 | |

| | | | | | | | | |

| TOTAL CORPORATE BONDS (Cost $13,610,394) | | | | | | | 13,173,535 | |

| | | Shares | | | | | |

| COMMON STOCK ‐ 0.20% | | | | | | | | |

| Energy, Oil and Gas ‐ 0.20% | | | | | | | | |

| TE Holdcorp LLC, Class A | | | 72,786 | | | $ | 532,249 | |

| | | | | | | | | |

| TOTAL COMMON STOCK (Cost $2,919,283) | | | | | | | 532,249 | |

| | | | | | | | | |

| PREFERRED STOCK ‐ 0.26% | | | | | | | | |

| Energy, Oil and Gas ‐ 0.26% | | | | | | | | |

| TE Holdcorp LLC | | | 48,248 | | | | 693,569 | |

| | | | | | | | | |

| TOTAL PREFERRED STOCK (Cost $482,483) | | | | | | | 693,569 | |

| | | | | | | | | |

| RIGHTS AND WARRANTS ‐ 0.01% | | | | | | | | |

| Energy, Oil and Gas ‐ 0.01% | | | | | | | | |

Comstock Resources Inc(e) | | | | | | | | |

| expires 9/6/2018 at $0.01 | | | 3,438 | | | | 33,864 | |

| | | | | | | | | |

| TOTAL RIGHTS AND WARRANTS (Cost $–) | | | | | | | 33,864 | |

| | | | | | | | | |

| Total Investments ‐ 150.80% (Cost $413,580,277) | | | | | | | 404,374,181 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets ‐ (1.95)% | | | | | | | (5,220,693 | ) |

| | | | | | | | | |

| Leverage Facility ‐ (48.85)% | | | | | | | (131,000,000 | ) |

| | | | | | | | | |

| Net Assets ‐ 100.00% | | | | | | $ | 268,153,488 | |

Amounts above are shown as a percentage of net assets as of December 31, 2016.

(a) | The interest rate shown represents the rate at period end. |

(b) | All or a portion of this position has not settled as of December 31, 2016. The interest rate shown represents the stated spread over the London Interbank Offered Rate ("LIBOR" or "L") or the applicable LIBOR floor; the Fund will not accrue interest until the settlement date, at which point LIBOR will be established. |

(c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. Total market value of Rule 144A securities amounts to $11,359,785, which represents approximately 4.24% of net assets as of December 31, 2016. Such securities may normally be sold to qualified institutional buyers in transactions exempt from registration. |

(d) | Option to convert to pay-in-kind security. |

(e) | Non-income producing security. |

| See Notes to Financial Statements. | |

| Annual Report | December 31, 2016 | 17 |

| Blackstone / GSO Long-Short Credit Income Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

FLOATING RATE LOAN INTERESTS(a) ‐ 123.49% | | | | | | |

| Aerospace and Defense ‐ 0.95% | | | | | | |

| Engility Corporation, Senior Secured First Lien Term B‐2 Loan, 5.811%, 08/14/2023 | | $ | 558,444 | | | $ | 568,077 | |

| Jazz Acquisition Inc, Senior Secured Second Lien Term Loan, 7.750%, 06/19/2022 | | | 1,732,833 | | | | 1,470,023 | |

| | | | | | | | 2,038,100 | |

| | | | | | | | | |

| Automotive ‐ 0.98% | | | | | | | | |

| American Tire Distributors Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 09/01/2021 | | | 395,497 | | | | 395,085 | |

| KAR Auction Services Inc, Senior Secured First Lien Tranche B‐3 Term Loan, 4.500%, 03/09/2023 | | | 411,683 | | | | 417,923 | |

| Mitchell International Inc, Senior Secured Second Lien Term Loan, 8.500%, 10/11/2021 | | | 1,294,266 | | | | 1,286,824 | |

| | | | | | | | 2,099,832 | |

| | | | | | | | | |

| Banking, Finance, Insurance and Real Estate ‐ 10.08% | | | | | | | | |

| Alliant Holdings Intermediate LLC, Senior Secured First Lien 2016 Term Loan, 5.253%, 08/15/2022 | | | 1,066,071 | | | | 1,078,283 | |

| AmWins Group LLC, Senior Secured First Lien New Term Loan, 4.750%, 09/06/2019 | | | 1,959,550 | | | | 1,983,839 | |

| Arnhold and S Bleichroeder Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.998%, 12/01/2022 | | | 1,435,500 | | | | 1,451,649 | |

| AssuredPartners Inc, Senior Secured First Lien 2016 Refinancing Term Loan, 5.250%, 10/21/2022 | | | 1,503,084 | | | | 1,526,758 | |

| Asurion LLC, Senior Secured First Lien Incremental Tranche B‐5 Term Loan, 4.750%, 11/03/2023 | | | 2,414,697 | | | | 2,452,125 | |

| Asurion LLC, Senior Secured Second Lien Term Loan, 8.500%, 03/03/2021 | | | 2,050,064 | | | | 2,087,867 | |

| Broadstreet Partners Inc, Senior Secured First Lien Initial Term Loan, 5.250%, 11/08/2023 | | | 1,097,561 | | | | 1,111,050 | |

| Confie Seguros Holding II Co, Senior Secured First Lien Term B Loan, 5.750%, 04/13/2022 | | | 499,120 | | | | 502,489 | |

| Cunningham Lindsey US Inc, Senior Secured First Lien Initial Term Loan, 5.028%, 12/10/2019 | | | 1,763,253 | | | | 1,490,390 | |

| DTZ US Borrower LLC, Senior Secured Second Lien Initial Term Loan, 9.250%, 11/04/2022 | | | 166,512 | | | | 166,998 | |

| EZE Software Group LLC, Senior Secured Second Lien Term Loan, 7.250%, 04/05/2021 | | | 470,905 | | | | 462,271 | |

| Gold Merger Co Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 07/27/2023 | | | 1,705,784 | | | | 1,719,294 | |

| MPH Acquisition Holdings LLC, Senior Secured First Lien Initial Term Loan, 5.000%, 06/07/2023 | | | 1,730,450 | | | | 1,763,519 | |

National Financial Partners Corp, Senior Secured First Lien Tranche B Term Loan, L+3.50%, 01/08/2014(b) | | | 586,592 | | | | 592,605 | |

| Solera LLC (Solera Finance Inc), Senior Secured First Lien Dollar Term Loan, 5.750%, 03/03/2023 | | | 2,186,147 | | | | 2,218,939 | |

VF Holding Corp, Senior Secured First Lien Term B‐1 Loan, L+3.25%, 06/30/2023(b) | | | 560,748 | | | | 563,700 | |

| Victory Capital Operating LLC, Senior Secured First Lien Initial Term Loan, 8.500%, 10/29/2021 | | | 505,001 | | | | 513,051 | |

| | | | | | | | 21,684,827 | |

| | | | | | | | | |

| Beverage, Food and Tobacco ‐ 3.14% | | | | | | | | |

| AdvancePierre Foods Inc, Senior Secured First Lien Effective Date Term Loan, 4.000%, 06/02/2023 | | | 566,962 | | | | 576,813 | |

| Americold Realty Operating Partnership LP, Senior Secured First Lien Initial Term Loan, 5.750%, 12/01/2022 | | | 295,545 | | | | 299,425 | |

Candy Intermediate Holdings Inc, Senior Secured First Lien Initial Term Loan, L+4.50%, 06/15/2023(b) | | | 1,788,257 | | | | 1,804,181 | |

| CEC Entertainment Inc, Senior Secured First Lien Term B Loan, 4.000%, 02/15/2021 | | | 989,822 | | | | 988,174 | |

| Chobani LLC, Senior Secured First Lien Closing Date Term Loan, 5.250%, 10/09/2023 | | | 1,819,407 | | | | 1,848,972 | |

Constellation Brands Canada Inc, Senior Secured First Lien Initial Tranche B‐1 Term Loan, L+3.75%, 11/15/2023(b) | | | 576,923 | | | | 584,316 | |

| Winebow Holdings Inc, Senior Secured Second Lien Initial Term Loan, 8.500%, 12/31/2021 | | | 693,642 | | | | 652,023 | |

| | | | | | | | 6,753,904 | |

| Blackstone / GSO Long-Short Credit Income Fund | Portfolio of Investments |

December 31, 2016

| | | Principal Amount | | | Value | |

| | | | | | | |

| Capital Equipment ‐ 1.25% | | | | | | |

| Diebold Inc, Senior Secured First Lien Dollar Term B Loan, 5.250%, 11/06/2023 | | $ | 797,500 | | | $ | 810,958 | |

| Husky Injection Molding Systems Ltd, Senior Secured First Lien Initial Term Loan, 4.250%, 06/30/2021 | | | 352,293 | | | | 354,899 | |

| Meter Readings Holding LLC, Senior Secured First Lien Initial Term Loan, 6.750%, 08/29/2023 | | | 1,496,250 | | | | 1,528,045 | |

| | | | | | | | 2,693,902 | |

| | | | | | | | | |

| Chemicals, Plastics and Rubber ‐ 2.20% | | | | | | | | |

| Emerald Performance Materials LLC, Senior Secured First Lien Initial Term Loan, 4.500%, 08/02/2021 | | | 699,281 | | | | 705,050 | |

| Emerald Performance Materials LLC, Senior Secured Second Lien Initial Term Loan, 8.750%, 08/01/2022 | | | 1,500,000 | | | | 1,501,875 | |

| Pinnacle Operating Corporation, Senior Secured First Lien Term B Refinancing Loan, 4.750%, 11/15/2018 | | | 2,198,032 | | | | 1,846,347 | |

| Royal Holdings Inc, Senior Secured First Lien Initial Term Loan, 4.500%, 06/20/2022 | | | 209,716 | | | | 212,163 | |

| Tekni‐Plex Inc, Senior Secured Second Lien Initial Term Loan, 8.750%, 06/01/2023 | | | 475,962 | | | | 475,366 | |

| | | | | | | | 4,740,801 | |

| | | | | | | | | |

| Construction and Building ‐ 10.18% | | | | | | | | |

| American Bath Group LLC, Senior Secured First Lien Term Loan, 6.750%, 09/30/2023 | | | 1,360,227 | | | | 1,365,328 | |

| American Bath Group LLC, Senior Secured Second Lien term Loan, 10.750%, 09/30/2024 | | | 150,000 | | | | 144,750 | |

| Builders Firstsource Inc, Senior Secured First Lien Initial Term Loan, 4.750%, 07/29/2022 | | | 775,379 | | | | 784,199 | |

| C.H.I. Overhead Doors Inc, Senior Secured First Lien Initial Term Loan, 4.500%, 07/29/2022 | | | 1,496,222 | | | | 1,501,212 | |

| Dayton Superior Corporation, Senior Secured First Lien Term Loan, 9.000%, 11/03/2021 | | | 1,166,667 | | | | 1,175,417 | |

| Forterra Finance LLC, Senior Secured First Lien Term Loan 4.500%, 10/25/2023 | | | 2,053,676 | | | | 2,081,401 | |

| GYP Holdings III Corp, Senior Secured First Lien Term Loan 4.500%, 04/01/2021 | | | 1,102,500 | | | | 1,113,525 | |

| HNC Holdings Inc, Senior Secured First Lien Initial Term Loan, 5.500%, 10/05/2023 | | | 621,762 | | | | 629,537 | |

| IPS Structural Adhesives Holding Inc, Senior Secured First Lien Initial Term Loan, 6.250%, 12/14/2023 | | | 1,839,080 | | | | 1,836,782 | |

IPS Structural Adhesives Holding Inc, Senior Secured Second Lien Initial Term Loan, L+9.50%, 12/14/2024(b) | | | 750,000 | | | | 742,500 | |

| Jeld‐Wen Inc, Senior Secured First Lien Term B‐2 Loan, 4.750%, 07/01/2022 | | | 2,704,655 | | | | 2,742,263 | |

| Morsco Inc, Senior Secured First Lien Initial Term Loan, 8.000%, 10/31/2023 | | | 1,250,000 | | | | 1,262,500 | |

| SiteOne Landscape Supply LLC, Senior Secured First Lien Tranche B Term Loan, 5.500%, 04/29/2022 | | | 1,044,235 | | | | 1,054,677 | |

| SRS Distribution Inc, Senior Secured First Lien Tranche B‐1 Loan, 5.250%, 08/25/2022 | | | 1,272,423 | | | | 1,293,895 | |

| SRS Distribution Inc, Senior Secured Second Lien 06/16 Term Loan, 9.750%, 02/24/2023 | | | 547,945 | | | | 566,269 | |

| US LBM Holdings LLC, Senior Secured First Lien Initial Term Loan, 6.250%, 08/20/2022 | | | 2,969,943 | | | | 2,951,010 | |

| Wilsonart LLC, Senior Secured First Lien Tranche C Term Loan, 4.500%, 12/19/2023 | | | 659,341 | | | | 666,139 | |

| | | | | | | | 21,911,404 | |

| | | | | | | | | |

| Consumer Goods Durable ‐ 2.50% | | | | | | | | |

| Apex Tool Group LLC, Senior Secured First Lien Term Loan, 4.500%, 01/31/2020 | | | 684,665 | | | | 680,101 | |

Culligan NewCo Ltd, Senior Secured First Lien Tranche B‐1 Term Loan, L+4.00%, 11/13/2023(b) | | | 2,307,190 | | | | 2,329,546 | |

| Hercules Achievement Inc, Senior Secured First Lien Initial Term Loan, 5.000%, 12/13/2021 | | | 1,837,500 | | | | 1,867,819 | |

| Hillman Group Inc (The), Senior Secured First Lien Initial Term Loan, 4.500%, 06/30/2021 | | | 496,183 | | | | 499,803 | |

| | | | | | | | 5,377,269 | |

| | | | | | | | | |

| Consumer Goods Non Durable ‐ 1.92% | | | | | | | | |