Exhibit 10.1

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement is made and entered into this 12th day of December, 2022 (the “Agreement”), by and among Global Foods Group, LLC, duly incorporated or organized under the laws of Delaware ( “GFG” or “Seller”), Point of Care Nano-Technology, Inc., a Nevada corporation publicly traded over the counter in the United States (the “U.S.”) (“PCNT” or “Buyer”), the Seller party listed on the signature page hereto (the “Majority Member”) and, solely with respect to Section 6(d) of the Agreement, Nicholas DeVito (the “Preferred Shareholder”) (collectively, the “Parties” and, individually, a “Party”).

WHEREAS, GFG is engaged in marketing Jaca®, a rare sugar product, and owns assets relating to the marketing, distribution, and acquisition of Jaca, being all the material assets (the “Assets”) of GFG; and

WHEREAS, GFG desires to sell the Assets to Buyer, and Buyer desires to purchase the Assets from GFG (the “Acquisition”), to commercialize the Assets in the U.S. and the rest of the world, in exchange for shares of Buyer’s common stock, $0.0001 par value per share (the “Common Stock”).

NOW, THEREFORE, in consideration of the mutual covenants, terms, and conditions set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

1. Sale of Assets.

| a) | Purchased Assets. Concurrently upon receipt of all of the consideration due at Closing (as defined below) set forth in Section 2 below, Seller shall assign, transfer, convey and deliver to Buyer and Buyer shall accept and purchase all of Seller’s rights, title and interest in, to and under the Assets, existing as of the close of business on the day of the Closing, including, without limitation, all Intellectual Property, documents, know how, contracts, patent and patent applications, Trademarks listed on Schedule 1.a) attached hereto. |

| b) | Excluded Assets. The foregoing notwithstanding, Buyer shall not purchase, and the Seller shall not be deemed to sell, those assets which are listed in the Schedule of Excluded Assets attached hereto and labeled Schedule 1.b). |

| c) | Assumption of Pre-Closing Liabilities. As of the Closing, Buyer shall undertake, assume, and agree to perform, and otherwise pay, satisfy and discharge after the Closing the liability listed in the Schedule of Assumed Liabilities attached hereto as Schedule 1.c) (the “Assumed Liabilities”). |

| d) | Exclusion of Pre-Closing Liabilities. Except as specified on Schedule 1.c), Buyer will not assume nor have any responsibility with respect to any Seller debts, liabilities or obligations which exist at Closing or which are attributable to actions taken by Seller prior to Closing, and Buyer shall not be deemed by anything contained in this Agreement or any other instrument to have assumed or become responsible for any such Seller liabilities, all of which shall remain the responsibility of Seller. Seller agrees to indemnify and hold Buyer harmless against any such liabilities, debts, obligations, claims or damages therefrom (including incidental and consequential damages), costs and expenses. |

GFG and PCNT Asset Purchase Agreement

| e) | Asset Maturity. The Parties understand that the Assets included on Schedule 1.a) do not constitute an operational business and that substantial work is still required to build inventory, perform marketing campaigns, generate revenues, establish distribution, and create billing and accounting systems. |

2. Consideration. In consideration of Seller’s sale, transfer and delivery to Buyer at Closing of the Assets, Buyer shall issue to certain persons to be designated by GFG, such designated persons being equity owners of GFG (the “Seller Designees”), shares of Common Stock, as specified below (the “Purchase Price”). The Purchase Price Shares (as defined below) shall be issued to those Seller Designees and in the denominations listed on Exhibit A attached hereto.

| (a) | At the Closing, PCNT shall issue to the GFG Designees, in the aggregate: |

| i. | 7,000,000 (seven million) restricted shares of the Common Stock valued at $1.00 per share (the “Purchase Price Shares”). |

3. Conditions to Closing. The obligations of each Party to consummate the Acquisition shall be subject to the fulfillment, at or prior to the Closing, of each of the following conditions:

| (a) | Assignment Agreements. Seller shall execute and deliver to Buyer at the Closing such other instruments of assignment and transfer as are reasonably required to affect the transfer to Buyer of all of Seller’s right, title, and interest in and to the Assets in accordance with this Agreement, in form and substance reasonably satisfactory to Buyer. |

| (b) | Representations and Warranties. The representations and warranties of Buyer, Seller and the Majority Member set forth in this Agreement shall be true and correct in all material respects as of the date of this Agreement and as of the Closing Date as though made on and as of the Closing Date, and Buyer and Seller shall each have received a certificate signed by the duly authorized representative of the other to such effect. |

| (c) | Operation in the Ordinary Course. Buyer’s obligations hereunder shall also be subject to and conditioned on Seller continuing to manage and operate the Assets in the ordinary course through the Closing. Without limiting the foregoing and without obtaining the prior consent of Buyer, Seller shall not sell or dispose of any of the Assets other than sales of inventory in the ordinary course of business. |

| (d) | Member Approval by GFG. Seller shall have received appropriate approvals from its members for the sale of all of the Assets to Buyer and Buyer shall have received a certificate signed by the duly authorized representative of Seller to such effect. |

| (e) | Satisfactory Due Diligence. Buyer and Seller shall have completed their due diligence with respect to Seller’s Assets and Buyer’s assets and Common Stock to their satisfaction in their sole discretion. |

| (f) | Fundraising. Seller shall have secured One Million Five Hundred Thousand Dollars ($1,500,000) in funding, before offering fees and expenses, closing prior to or concurrently with the Closing under this Agreement, which funds, net of bona fide offering expenses, shall be included in the Assets itemized on Schedule 1.a) and transferred to the Company upon Closing. |

2 -GFG and PCNT Asset Purchase Agreement

| (g) | Accredited Investor Questionnaires. Each of the Seller Designees shall have delivered to Buyer a completed and signed accredited investor questionnaire. |

| (h) | Board Authorization of Issuance of Shares. Buyer’s board of directors shall have approved the Acquisition and the issuance of the Purchase Price Shares to the Seller Designees. |

| (i) | Buyer Regulatory Filings. Buyer undertakes to timely file all required periodic and current reports with the Securities and Exchange Commission. |

4. Representations and Warranties of Seller and the Majority Member. Seller and the Majority Member, severally and jointly, represent and warrant to, and covenant with Buyer, as of the date hereof, as follows, except as set forth in the disclosure schedules to be delivered by Seller and attached to this Agreement (the “Disclosure Schedules”). The Disclosure Schedules will be arranged for purposes of convenience only, in sections corresponding to the Subsections of this Section 4 and will provide exceptions to the representations and warranties contained in Section 4 whether or not a specific reference to such Disclosure Schedules are included in a representation and warranty contained in this Section 4:

| (a) | Seller is an entity duly organized, validly existing and in good standing under the law of the state or jurisdiction of its organization; |

| (b) | Seller has the full corporate right, power, and authority to enter into this Agreement and to perform the obligations hereunder; |

| (c) | the execution of this Agreement by Seller been duly authorized by all necessary corporate action of the Seller; |

| (d) | Seller is not a participant in any joint venture, partnership or similar arrangement. Except for the Majority Member and the other Seller Designees, no other person owns any right, title or interest in or to any membership interest or other equity interest or owns any security that is exercisable or exchangeable for or convertible into any equity interest in Seller. |

| (e) | the execution of this Agreement, when executed and delivered by Seller, shall constitute the legal, valid, and binding obligation of such entity, enforceable against such entity in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law; |

| (f) | The execution, delivery and performance by Seller of this Agreement does not and will not conflict with, or result in any violation of or default under, any provision of the Certificate of formation, operting agreement or other comparable agreements or constituent instruments of Seller or any ordinance, rule, regulation, judgment, order, decree, agreement, instrument or license applicable to Seller or to any of its properties or assets. No consent, approval, order or authorization of, or registration, declaration or filing with, any court, administrative agency or commission or other governmental authority or instrumentality, domestic or foreign, is required by or with respect to Seller in connection with its execution, delivery or performance of this Agreement; |

3 -GFG and PCNT Asset Purchase Agreement

| (g) | Except for assets disposed of in the ordinary course of business and Excluded Assets, the Assets consist of all assets which are used by Seller and required to operate the seller’s business as presently conducted. The Assets are sufficient for the continued conduct of the seller’s business immediately after the Closing in substantially the same manner as conducted immediately prior to the Closing; |

| (h) | Except for assets disposed of, or to be disposed of in the ordinary course of business, Seller has good and marketable title or a valid leasehold interest in all of the personal property included in the Assets, in each case free and clear of all mortgages, liens, security interests, pledges, charges or encumbrances of any nature whatsoever. All inventory, finished goods, raw materials, work in progress, supplies, and other inventories of the seller’s business (“Inventory”), consists of a quality and quantity usable and salable in the ordinary course of business, except for obsolete, damaged, defective or slow-moving items that have been written off or written down to fair market value or for which adequate reserves have been established. All Inventory is owned by Seller free and clear of all liens and no Inventory is held on a consignment basis. The quantities of each item of Inventory (whether raw materials, work-in-process or finished goods) are not excessive, but are reasonable in the present circumstances of the Business; |

| (i) | Seller does not own any real property; |

| (j) | Seller understands that the Purchase Price Shares have not been, and will not be, registered under the Securities Act of 1933, as amended (the “Securities Act”), or under any state securities laws, and are being offered and sold in reliance upon federal and state exemptions for transactions not involving any public offering. The Purchase Price Shares are being acquired by Seller and Seller Designees for their accounts, for investment purposes and not with a view to the sale or distribution of all or any part of the Securities, nor with any present intention to sell or in any way distribute the same, as those terms are used in the Securities Act. Seller represents that, to its knowledge, Seller Designees have sufficient knowledge and experience in financial matters so as to be capable of evaluating the merits and risks of purchasing the Purchase Price Shares. The Majority Member has reviewed copies of such documents and other information as the Majority Member has deemed necessary in order to make an informed investment decision with respect to its acquisition of the Purchase Price Shares. The Majority Member understands that the Purchase Price Shares may not be sold, transferred or otherwise disposed of without registration under the Securities Act or the availability of an exemption therefrom, and that in the absence of an effective registration statement covering the Purchase Price Shares or an available exemption from registration under the Securities Act, the Securities must be held indefinitely. Further, the Majority Member understands and has the financial capability of assuming the economic risk of an investment in the Purchase Price Shares for an indefinite period of time. The Majority Member has been advised by Buyer that the Majority Member and the other Seller Designees will not be able to dispose of the Purchase Price Shares, or any interest therein, without first complying with the relevant provisions of the Securities Act and any applicable state securities laws. The Majority Member acknowledges that Buyer is under no obligation to register the Purchase Price Shares or to furnish any information or take any other action to assist the undersigned in complying with the terms and conditions of any exemption which might be available under the Securities Act or any state securities laws with respect to sales of the Purchase Price Shares in the future. Seller represents that each of Seller Designees is an “Accredited Investor” as defined in rule 501 (a) of Regulation D under the Securities Act and acknowledges that each of th Seller Designees will be required to provide to Buyer an accredited investor questionnaire as a condition to the closing of the Acquisition; |

4 -GFG and PCNT Asset Purchase Agreement

| (k) | Except at disclosed on Schedule 4(k), Seller has timely filed all tax returns that it was required to file with the appropriate governmental authorities in all jurisdictions in which such returns are required to be filed. All such tax returns accurately and correctly reflect the taxes of Seller for the periods covered thereby and are complete in all material respects. Except as set forth on Schedule 4(k), all taxes owed by Seller, or for which Seller may be liable (whether or not shown on any tax return), have been or will be timely paid. Seller is not currently the beneficiary of any extension of time within which to file any tax return. No claim has ever been made by an authority in a jurisdiction where Seller does not file tax returns that Seller is or may be subject to taxation by that jurisdiction. There are no liens on any of the Assets that arose in connection with any failure (or alleged failure) to pay any tax. |

| (l) | Seller acknowledges that the Purchase Price Shares are not and will not be registered under the Securities Act or any state securities laws, and that the Purchase Price Shares may not be transferred or sold except pursuant to the registration provisions of the Securities Act or pursuant to an applicable exemption therefrom and subject to state securities laws and regulations, as applicable; |

| (m) | no broker, finder or investment banker is entitled to any brokerage, finder's or other fee or commission in connection with the transactions contemplated by this Agreement; |

| (n) | Seller is the sole and exclusive legal and beneficial owner of all right, title and interest in and to the Intellectual Property and the other Assets listed on Schedule 1.a), free and clear of encumbrances, liens, security interests, rights of first refusal, negotiation or offer; |

| (o) | neither the execution, delivery, or performance of this Agreement, nor the consummation of the transactions contemplated hereunder, will result in the loss or impairment of or payment of any additional amounts with respect to, nor require the consent of any other person in respect of, Buyer's right to own or use any of the Assets and Intellectual Property listed on Schedule 1.a); |

| (p) | Seller has not received a notice (written or otherwise) that any of, the rights to the Assets have expired, terminated, or been abandoned, or is expected to expire or terminate or be abandoned, within five (5) years from the date of this Agreement. Seller has not received a written notice of a claim or otherwise has any Knowledge (as defined below) that the Assets rights violate or infringe upon the rights of any Person. All rights to the Assets are enforceable and, to the Knowledge of Seller, there is no existing infringement by another Person of any of the Asset property rights. Seller has taken reasonable security measures to protect the secrecy, confidentiality, and value of all the Assets, except where failure to do so could not, individually or in the aggregate, reasonably be expected to have a material adverse effect; |

| (q) | Seller has not granted and will not grant any licenses or other contingent or non-contingent right, title, or interest under or relating to any of the Assets, and is not or will not be under any obligation, that does or will conflict with or otherwise affect this Agreement, including any of Seller's representations, warranties, or obligations, or Buyer's rights hereunder; |

| (r) | there is no settled, pending or, to its Knowledge, threatened litigation against the Assets; and |

| (a) | alleging the unpatentability, invalidity, misuse, unregistrability, unenforceability, or noninfringement of, or error in any Assets; |

5 -GFG and PCNT Asset Purchase Agreement

| (b) | challenging Seller's right to transfer any Assets, or alleging any adverse right, title, or interest with respect thereto; or |

| (c) | alleging that the practice of any Assets or the making, using, offering to sell, sale, or importation of any product incorporating any of the Assets does or would infringe, misappropriate, or otherwise violate any patent, trade secret, or other intellectual property of any third party. |

5. Representations and Warranties of Buyer. Buyer represents and warrants to, and covenants with Seller and the Majority Member as follows:

| (a) | it is duly organized, validly existing, and in good standing as a corporation in the State of Nevada; |

| (b) | it has the full corporate right, power, and authority to enter into this Agreement and to perform its obligations hereunder; |

| (c) | the execution of this Agreement by its representative whose signature is set forth on the signature page hereto has been duly authorized by all necessary corporate action of the Party; |

| (d) | when executed and delivered by Buyer, this Agreement shall constitute the legal, valid, and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable law; |

| (e) | to the best of Buyer’s Knowledge, there are no material suits, actions, arbitrations, or legal, administrative, or other proceedings, or governmental investigations pending, or threatened, against or affecting it or its business, assets, financial condition, the Shares, its officers, or directors; |

| (f) | the consummation of the transactions contemplated by this Agreement will not result in or constitute a default or an event that, with notice or lapse of time or both, would be a default, breach or violation of any lease agreement, promissory note, commitment, indenture, mortgage, deed of trust, or other agreement, instrument, or arrangement to which Buyer is a party, or by which Buyer is bound; |

| (g) | the authorized capital stock of Buyer consists of 100,000,000 shares of Common Stock and 10,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”). Buyer currently has approximately 940,621 shares of Common Stock outstanding and 1,000 shares of Class A Preferred Stock outstanding as reflected in the October 25, 2022 Securities and Exchange Commission filing 10K; |

| (h) | Buyer is not a party to any option, warrant, purchase right, or other contract or commitment that could require Buyer to sell, issue. transfer, or otherwise dispose of any shares of Common Stock or Preferred Stock (other than pursuant to the terms of this Agreement), and Buyer is neither a party to nor, to Buyer’s Knowledge, does there exist any voting trust, proxy, or other agreement or understanding with respect to the voting of any of Buyer’s capital stock; |

6 -GFG and PCNT Asset Purchase Agreement

| (i) | there does not exist an entity or individual that has any rights of first refusal to purchase any shares of Common Stock or Preferred stock of Buyer; |

| (j) | no broker, finder or investment banker is entitled to any brokerage, finder's or other fee or commission in connection with the transactions contemplated by this Agreement; and |

| (k) | The Purchase Price Shares, when issued, sold and delivered in accordance with the terms and for the consideration set forth in this Agreement, will be validly issued, fully paid and nonassessable and free of restrictions on transfer other than restrictions on transfer under applicable state and federal securities laws and liens or encumbrances created by or imposed by Seller or its members. |

6. Closing. The following matters shall apply to the Closing of the transaction contemplated herein:

| (a) | Time and Place. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated by this Agreement (the “Closing”) shall take place through the exchange of signature pages through electronic mail or otherwise as agreed to by the Parties after all of the conditions to Closing are either waived or satisfied (other than conditions which, by their nature, are to be satisfied by the Closing Date), or at such other time, date or place as Seller and Buyer may mutually agree upon in writing. The date on which the Closing is to occur is hereinafter referred as the “Closing Date.” |

| (b) | Buyer’s Obligations. At the Closing, Buyer shall deliver: |

| (i) | To the Seller Designees, duly executed certificates evidencing the Purchase Price Shares (whereupon the stock ledger and other internal records of Buyer shall be changed to reflect the transfer of the Purchase Price Shares to the recipients thereof) in the names and denominations as set forth on Exhibit A attached hereto; and |

| (ii) | To the Preferred Shareholder, duly executed certificates evidencing 2,000,000 restricted shares of Common Stock (the “Exchange Shares”) in the names and denominations as set forth on Exhibit A attached hereto. |

| (c) | Seller’s Obligations. At the Closing, Seller shall deliver to Buyer: |

| (i) | A certificate certifying all items of Inventory included in the Assets as listed on Schedule 1.a). |

| (ii) | Consents executed by all necessary parties to permit Buyer to assume Seller’s interest in any contracts acquired among the Assets. |

| (iii) | A duly executed Bill of Sale in the form attached hereto as Exhibit B for all Assets listed on Schedule 1.a) attached hereto; |

| (iv) | An Assignment and Assumption Agreement in the form attached hereto as Exhibit C. |

| (v) | Such other documents, instruments or certificates as shall be reasonably requested by Buyer or its counsel. |

7 -GFG and PCNT Asset Purchase Agreement

| (d) | Preferred Shareholder Obligations and Representations. |

| (i) | At the Closing, the Preferred Shareholder shall deliver to the Company for cancellation a certificate (or if held in book entry, a cancellation receipt) evidencing the 1,000 shares of Class A Preferred Stock (the ”Class A Preferred Shares”) of the Company owned by the Preferred Shareholder, along with a duly executed stock power, in exchange for the Exchange Shares. |

| (ii) | The Preferred Shareholder owns of record and beneficially the Class A Preferred Shares, free and clear of all liens, encumbrances, pledges, claims, options, charges and assessments of any nature whatsoever, with full right and lawful authority to transfer the Class A Preferred Shares to the Company. No person has any preemptive rights or rights of first refusal with respect to any of the Class A Preferred Shares. There exists no voting agreement, voting trust, or outstanding proxy with respect to any of the Class A Preferred Shares. There are no outstanding rights, options, warrants, calls, commitments, or any other agreements of any character, whether oral or written, with respect to the Class A Preferred Shares. |

| (iii) | The Preferred Shareholder understand that the Exchange Shares have not been, and will not be, registered under the Securities Act, or under any state securities laws, and are issued in reliance upon federal and state exemptions for transactions not involving any public offering. The Exchange Shares are being acquired by the Preferred Shareholder for investment purposes and not with a view to the sale or distribution of all or any part of the Exchange Shares, nor with any present intention to sell or in any way distribute the same, as those terms are used in the Securities Act. |

| (e) | Allocation of Purchase Price Shares. The Purchase Price Shares shall be allocated and distrbuted pursuant to a schedule to be furnished to Seller by Buyer prior to Closing, or as soon as practicable after Closing, as determined by a revised Exhibit A schedule of all equity shareholders as of the Closing day. |

| (f) | Further Cooperation. From time to time after the Closing, Seller, at Buyer's reasonable request and without further consideration, agrees to execute and deliver or to cause to be executed and delivered such other instruments of transfer as Buyer may reasonably request that are necessary to transfer to Buyer more effectively the right, title and interest in or to the Assets and to take or cause to be taken such further or other action as may reasonably be necessary or appropriate in order to effectuate the transactions contemplated by this Agreement. |

7. Indemnification.

| (a) | Survival of Representations and Warranties. All of the representations and warranties of Buyer, Seller and the Majority Member contained in this Agreement shall survive the Closing and continue in full force and effect for a period of twenty-four (24) months thereafter, provided that the representations and warranties contained in Section 4(g) (title to personal property and 4(k) (taxes) (such representations being referred to herein as the “Fundamental Representations”) shall continue in full force and effect for a period equal to the applicable statute of limitations. The representations and warranties of the Buyer, Seller and Majority Member shall survive the Closing and continue in full force and effect for a period equal to the applicable statute of limitations. This Section 7(a) shall survive so long as any representations, warranties or indemnification obligations of any party survive hereunder. |

8 -GFG and PCNT Asset Purchase Agreement

| (b) | After the Closing, each of the Parties (each as the “Indemnifying Party”) agrees to save, defend and indemnify the other Party(ies) and each of their respective, directors, officers, employees, agents, representatives, successors and assigns (each, an “Indemnified Party”) from and against, and hold each of them harmless from, any and all losses arising out of, based upon, resulting from or incident to: (i) any breach of or material inaccuracy in any representation or warranty made by the Parties set forth in this Agreement; or (ii) any breach of or failure to perform any obligation or covenant that should be performed pursuant to this Agreement. |

| (c) | Notwithstanding anything to the contrary in this Agreement, the Indemnifying Party is not obligated to indemnify hold harmless, or defend an Indemnified Party against any claim (whether direct or indirect) if such claim or corresponding losses arise out of or result from, in whole or in part, an Indemnified Party's: |

| (i) | Gross negligence or more culpable act or omission (including recklessness or willful misconduct); or |

| (ii) | bad faith failure to materially comply with any of its obligations set forth in this Agreement. |

| (d) | Promptly after receipt by any Indemnified Party of notice of any demand, claim or circumstances which would or might give rise to a claim or the commencement of any action, proceeding or investigation in respect of which indemnity may be sought pursuant to this Section 7, such Indemnified Person shall promptly notify the Indemnifying party in writing. |

| (e) | All indemnification obligations for which Seller is liable hereunder may, at the option of Seller, be satisfied by: |

| (i) | return to Buyer of such number of Purchase Price Shares as shall, when valued at the closing price of the Common Stock on the date of return, equal up to the amount for which Seller is liable for such indemnity; and/or |

| (f) | Seller’s indemnification under the provisions of this Section 7 shall be capped at the value of the total Purchase Price Shares issued (the “Indemnification Cap”), which amount may be paid by way of surrender of Purchase Price Shares received by the Seller Designees, each valued as indicated above, to the extent such aggregate value is less than or equal to the Indemnification Cap. |

8. Termination. This Agreement may be terminated at any time prior to the Closing:

| (a) | by the mutual written consent of Seller and Buyer; |

| (b) | by Buyer or Seller if the transactions contemplated by this Agreement are not consummated by February 28, 2023, which date shall be automatically extended for up to an additional 30 days if and as required or as additionally extended by mutual agreement (the “Drop-Dead Date”); |

| (c) | by Buyer, by written notice to Seller if: |

9 -GFG and PCNT Asset Purchase Agreement

| (i) | Buyer is not then in material breach of any provision of this Agreement and there has been a material breach, inaccuracy in or failure to perform any representation, warranty, covenant, or agreement made by Seller pursuant to this Agreement and such breach, inaccuracy or failure cannot be cured by Seller by the Drop-Dead Date; or |

| (ii) | any of the obligations of Seller set forth in Section 3, including, without limitation, Section 3(f), shall not have been fulfilled by the Drop-Dead Date. |

| (d) | by Seller, by written notice to Buyer if: |

| (i) | Seller is not then in material breach of any provision of this Agreement and there has been a material breach, inaccuracy in or failure to perform any representation, warranty, covenant, or agreement made by Buyer pursuant to this Agreement and such breach, inaccuracy or failure cannot be cured by Buyer by the Drop-Dead Date; or |

| (ii) | any of the obligations of Buyer set forth in Section 3 shall not have been fulfilled by the Drop-Dead Date. |

(f) Effect of Termination. In the event of the termination of this Agreement in accordance with this Article, this Agreement shall forthwith become void and there shall be no liability on the part of any Party hereto except that nothing herein shall relieve any Party hereto from liability for any intentional breach of any provision hereof. All Assets including intellectual property, return and/or remain the property of Seller in the event the acquisition is not closed by the Drop Dead Date or if the acquisition is terminated by Buyer.

9. Acquisition Agreement Due Diligence Expenses. Except as otherwise expressly provided herein, all costs and expenses, including, without limitation, fees and disbursements of counsel, financial advisors and accountants, incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the Party incurring such costs and expenses, whether or not the Closing shall have occurred.

10. GFG Company Payables. Following the Closing, up to $35,000 in outstanding payables to Seller’s contractors, service providers and vendors, as itemized on Schedule 1.c) (the “Creditors”), will be allocated from financing monies to satisfy balances due, subject to negotiation with each of the Creditors.

11. Director Roles, Responsibilities and Compensation. Upon and subject to the Closing, Peter Ferrari will be named Chief Executive Officer (“CEO”) and Director and Nick DeVito will be named President, Chief Financial Officer “CFO”), Treasurer, Secretary and Director of the Company. Messrs. Ferrari’s and De Vito’s respective roles and responsibilities shall be commensurate with the generally accepted business practices of CEO and CFO, respectively. Following the Closing, Messrs. Ferrari and De Vito shall each enter into executive employment agreements which, among other things, shall specify total annual compensation for each set initially at $350,000, and a term of employment of three years. In the event of separation from the Company of either or both of Messrs. Ferrari and DeVito for any reason during the term other than for “cause” (as to be defined in the agreements), a severance package for the remainder of the three-year term at the annual compensation rate shall apply. Compensation shall commence on the Closing Date.

10 -GFG and PCNT Asset Purchase Agreement

12. Board of Directors. Both CEO and CFO will be appointed to the Board of Directors of PCNT at Closing. CEO will also have the right to appoint one (1) additional individual to the Board of Directors subject to any required reviews and approvals.13. Name and Stock Symbol Change. By Closing, or within a reasonable time thereafter, the Company’s name will be changed to reflect a corporate name more in alignment with the Global Foods Group brand. At such time, the Company’s stock symbol will also be changed to reflect the same, subject to regulatory requirements.

14. General Provisions

| (a) | Knowledge Definition. As used herein, the word “Knowledge” means the actual or constructive knowledge of any director or officer of Seller or Buyer, as the case may be, after due internal inquiry. |

| (b) | Press Release; Confidentiality. Except as indicated below, the Parties shall keep this Agreement and its terms confidential, but either party may make such disclosures as it reasonably considers as required by applicable law or necessary to raise financing. Seller acknowledges that Buyer is required by federal securities laws to disclose the material terms of this Agreement through the filing with the Securities and Exchange Commission of a Current Report on Form 8-K and that Buyer will attach a copy of this Agreement as an exhibit to such Current Report or as an exhibit to its next Quarterly Report on Form 10-Q. If the transactions contemplated by this Agreement are not consummated for any reason whatsoever, each Party hereto agrees not to disclose any confidential information it may have concerning the affairs of the other Party, except for information which is required by law to be disclosed. Confidential information includes financial records, surveys, reports, plans, proposals financial, information relating to personal contracts, stock ownership, liabilities and litigation. |

| (c) | Entire Agreement. This Agreement and all Exhibits hereto contain the entire understanding and agreement of the Parties with respect to matters addressed herein and supersedes any prior understandings and agreements among them respecting the subject matter of this Agreement. No modification of this Agreement shall be valid unless it is in writing and signed by each of the Parties. |

| (d) | Severability. If one or more of the provisions contained in this Agreement shall for any reason be held to be unenforceable or excessively broad as to time, duration, scope, activity or subject, such provision will be construed, by limiting or reducing it, so as to be enforceable to the extent compatible with the then-applicable law. In the event of any question as to the interpretation of any provision herein, such question shall not be resolved by resort to any rule or maxim which resolves it against the drafting Party. In the event any one or more provisions contained in this Agreement are held by a court or other tribunal to be invalid or unenforceable, the remaining provisions shall continue in full force and effect without being impaired or invalidated in any way. |

| (e) | Governing Law. This Agreement and the rights and obligations of the Parties herein, shall be construed in accordance with the laws of the State of New York without giving effect to any choice or conflict of law or provision or rule. |

| (f) | Specific Performance. The Parties agree that irreparable damage would occur if any provision of this Agreement were not performed in accordance with the terms hereof and that the Parties shall be entitled to specific performance of the terms hereof, in addition to any other remedy to which they are entitled at law or in equity. |

11 -GFG and PCNT Asset Purchase Agreement

| (g) | Assignment. Neither Party may assign its rights and obligations under this Agreement except with the prior written consent of the other, which consent shall not be unreasonably withheld. Any attempt to assign or delegate prior to the Closing without such consent shall be ineffective. |

| (h) | Mediation; Arbitration. |

| (i) | Any dispute, controversy or claim involving the Parties arising out of or relating to this Agreement (a “Dispute”), shall first be submitted to a senior business person of each Party, each with authority to resolve the Dispute. If such persons cannot resolve the Dispute within thirty (30) days after notice of a Dispute, either Party may submit such Dispute to nonbinding mediation in accordance with the Commercial Mediation Procedures of the American Arbitration Association (“AAA”). Such mediation shall be attended on behalf of each Party by a senior business person with authority to resolve the Dispute. Any period of limitations that would otherwise expire between the initiation of a mediation and its conclusion shall be extended until twenty (20) days after the conclusion of the mediation. The costs of mediation shall be shared equally by the parties to the mediation. |

| (ii) | Any Dispute that cannot be resolved for any reason by mediation within sixty (60) days of notice by one Party to the other of the existence of a Dispute (unless the Parties agree in writing to extend that period) shall be finally settled and resolved by a one-person arbitrator panel administered by the American Arbitration Association in accordance with its Commercial Arbitration Rules, and judgment on the award rendered by the arbitrator(s) may be enforced in any court having jurisdiction thereof. The one-person arbitration panel shall be mutually selected by the Parties, or, in the event the Parties cannot agree upon such an arbitrator, then by the American Arbitration Association. Any decision so rendered in arbitration shall be binding and final on all Parties. The seat of arbitration shall be Florida. |

| (i) | Counterparts. This Agreement may be executed in several counterparts, and all so executed, shall constitute one Agreement, binding on the Parties hereto even though all the Parties are not signatories to the original or the same counterpart. |

| (j) | Facsimile and Electronic Mail Transmission. Facsimile or electronic mail transmission of any signed original document, and retransmission of any signed facsimile or electronic mail transmission, shall be the same as transmission of an original. Parties will confirm signatures transmitted by facsimile or electronic mail by signing an original document. |

| (k) | Binding Effect. This Agreement shall be binding upon and inure to the benefit of the Parties, and their respective successors and assigns, subject to the assignment provisions set forth above. |

| (l) | Further Documentation. The Parties recognize that Buyer is a publicly traded company, and as such other documentation may be required to effectuate all the terms of this Agreement. Further, the Parties recognize that at Closing management of Buyer may concurrently change, requiring the filing of various documents with state and/or federal governments setting forth the change in management. The Parties agree to promptly execute any and all future documentation necessary to complete all of the promises and conveyances set forth in this Agreement. |

12 -GFG and PCNT Asset Purchase Agreement

[SIGNATURE PAGE FOLLOWS]

13 -GFG and PCNT Asset Purchase Agreement

IN WITNESS WHEREOF, the Parties have duly executed this Agreement as of the date first written above.

| GLOBAL FOODS GROUP, LLC |

| |

| |

| By: | /s/ Peter Ferrari |

| Name: Peter Ferrari |

By GFG Partner Holdings, LLC Its Manager |

MAJORITY MEMBER GFG Partner Holdings, LLC |

| |

| |

| By: | /s/ Peter Ferrari |

| Name: Peter Ferrari |

Title: Managing Member |

POINT OF CARE NANO-TECHNOLOGY, INC. |

| |

| |

| By: | /s/ Nicholas DeVito |

| Name: Nicholas DeVito |

Title: Chief Executive Officer and Director |

PREFERRED SHAREHOLDER |

| (solely with respect to Section 6(d) of the Agreement) |

| |

| By: | /s/ Nicholas DeVito |

| Nicholas DeVito |

GFG and PCNT Asset Purchase Agreement

SCHEDULE 1.A)

Assets and Intellectual Property Being Purchased by PCNT

the following is a list of the documentation that comprises the assets.

Business Model. Charted paths related, but not limited to; launching in the Direct To Consumer model (DTC) over the Internet en masse to establish Jaca as the dominant brand and GFG as the thought leader, the invention associated with the creation of a Voucher Program to provide Jaca to impoverished communities, the coalitions to be galvanized with healthcare associations/nonprofits such as but not limited to the American Heart Association and the Juvenile Diabetes Research Foundation, the liaisons/marketing partnerships to be forged with sports teams, athletes and other celebrities/influencers, distribution agreements within the grocery, retail and specialty retail spaces, food and beverage company partnerships for the co-creation of products, and, leveraging the existing 501c3 organization (The Foundation For Nutritional Equality) to further the company’s messaging establish barriers to imitation and create competitive advantage. The model is designed and controlled within the Company, it is not easily identifiable and replicated, and, differentiation is created through the know-how and by the innovative design of the Managers which is comprehensively leveraged affecting all revenue streams.

Trademark. The word “Jaca”. The mark consists of standard characters without claim to any particular font style, size or color. Reg. No. 6,853,122.

Software. Electronic Commerce technology framework for the sale and distribution of a Consumer Product Good (Jaca sugar). It is comprised of two (2) interfaces including desktop and mobile versions. Software programs, source code, object code, related applications, data files, associated documentation, flow charts and logic diagrams.

Marketing Assets. The name, “Jaca”; two (2) associated logo designs, slogans, trade styles, trade dress, trade names, iconography, brand book/storyboard.

Product Packaging. Uniquely designed container possessing the commodity, identity of the commodity within the container, net weight, UPC and/or QR codes and other uniquely identifiable information.

Unpatented Invention. Collaborative Replenishment Voucher System (CRVS) for the distribution of Jaca sugar within impoverished communities. The apparatus and mechanism containing initial processes, trade secrets, designs, and, models.

Production Credits. Two (2) signed barter partnerships in place for top tier video production/content output. One agreement with the Production Lead from Meta Elevate (Facebook’s movie production company) and one agreement in place with an internationally renowned television commercial production company in Southeast Asia. Total Value equals $25,000.

Supply Chain Agreements. The Company’s executed Supplier Agreements for Psicose, as well as, Agreements for the co-packing, warehousing, fulfilling and shipping logistical components of the supply chain to facilitate distribution in the marketplace.

Marketing Relationships. Strategic partnerships that exist with Vayner Media, related companies, and affiliates and Leadstacker as best-in-class providers of online marketing services to penetrate the American market with efficiency and economy.

Senior Leadership Council (Board of Advisors). World renowned authorities including; food scientists/inventors, financiers, global retail chain specialists, lobbyists, doctors and nonprofit Board Members that assist in the scaling of the GFG organization.

Health and Wellbeing Lifestyle Modules. Four modules including; 1. Lifestyle Audit, 2. Diet And Fitness Audit/Roadmap, 3. Recognize, Embrace, Channel (“REC”) Analysis, and, 4. Gap Analysis created to be bundled in with the offering of Jaca sugar in order to help people and families identify and map a transition to better health and wellbeing. Modules are comprised of charts, interviews, action plans, goal setting exercises, blueprints, task lists, situation analyses, optimization techniques, suggested routines, and, common mistakes pitfalls. Modules have copyright and potentially process patent value.

All agreements related to JACA, GFG including supply, marketing, production etc. shall be assigned to PCNT at closing.

Inventory. One (1) 25 kg bag of Jaca.

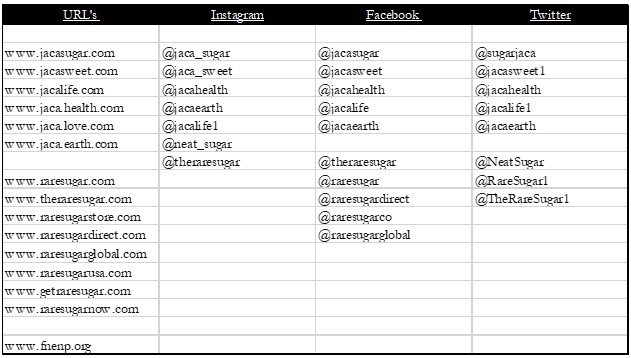

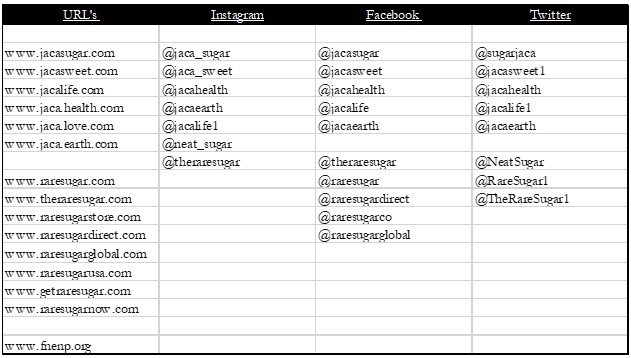

Social Media/Internet Assets.

Content Assets. Social Media. Subject matter encapsulated within trade dress and trade styles across the Facebook, Instagram, Twitter, and, LinkedIn platforms affording “Social Proof”.

Pending Benefit Corporation Status. Unique identifier binding the company to Corporate Social Responsibility (CSR) and Environmental, Social, Governance (ESG) standards. These protocols are a subset of non-financial performance indicators which include ethical, sustainable and corporate government issues such as making sure there are systems in place to ensure accountability and managing the Company’s carbon footprint.

Distribution Agreements. Non Exclusive Agreement with Veteran’s Green Coffee (VGC) as a Distributor for the sale of Global Foods Groups products; whereby, VGC will promote and sell the GFG products to the maximum number of responsible customers.

SCHEDULE 1.B)

Assets and Intellectual Property NOT Being Purchased by PCNT

Office equipment

Office supplies

Office furniture and fixtures

Technology including; computer equipment, peripheral computer equipment such as printers/scanners, and, software

Trade Secrets unrelated to Jaca

SCHEDULE 1.A)

Assumed Liabilities

Outstanding payables to Seller’s contractors, service providers and vendors

| Vayner Company | $22,375.00 |

| VERY Technology (Vayner Affiliate) | $5,000.00 |

| Foundational, LLC | $6,000.00 |